2003 Annual Report

Dynamic Oil & Gas, Inc. is a Canadian-based energy company engaged in the production and exploration of western Canada’s natural gas and oil reserves. We own working interests in producing and early-stage exploration properties located in various areas of southwestern and northeastern British Columbia and central Alberta.

Dynamic’s common shares trade on The Toronto Stock Exchange under the symbol “DOL” and on the NASDAQ under the symbol “DYOLF”

| Abbreviations |

| bbl or bbls | barrel or barrels |

| mcf | thousand cubic feet |

| bbl/d | barrels per day |

| mcf/d | thousand cubic feet per day |

| mbbl | thousand barrels |

| mmcf | million cubic feet |

| bcf | billion cubic feet |

| boe | barrels of oil equivalent (6 mcf = 1 bbl) |

| mmcf/d | million cubic feet per day |

| boe/d | barrels of oil equivalent per day |

| NGL’s | natural gas liquids |

| mboe | thousand barrels of oil equivalent |

[GRAPHIC OMITTED]

Our focus is set firmly on the horizon.

[GRAPHIC OMITTED]

“When you get right down to it, what we do is pretty simple.

All we have to do in our search for fossil fuel is finance it, find it, produce it, process it and get it to our customers.

The difficulty, however, is that Mother Nature has hidden her energy gems in the most rugged and diverse spots on the earth, at various depths and in almost every kind of rock.”

Wayne Babcock, President & CEO

2

2003 Highlights

| | Twelve Months | | Nine Months | | Twelve Months | |

| | Ended | | Ended | | Ended | |

| | December 31, | | December 31, | | March 31, | |

| | 2003 | | 2002 | | 2002 | |

| | | | | | | |

| Daily production | | | | | | |

| Natural gas(mcf/d) | 13,050 | | 14,174 | | 15,107 | |

| Natural gas liquids(bbls/d) | 662 | | 698 | | 631 | |

| Crude oil(bbls/d) | 610 | | 271 | | 76 | |

| All products(boe/d) | 3,447 | | 3,332 | | 3,225 | |

| Total annual production(mboe) | 1,258 | | 916 | | 1,177 | |

| Prices – weighted average | | | | | | |

| Natural gas($/mcf) | 6.56 | | 4.36 | | 3.81 | |

| Natural gas liquids($/bbl) | 27.68 | | 20.90 | | 19.30 | |

| Crude oil($/bbl) | 42.98 | | 41.40 | | 34.33 | |

| Corporate netback($/boe) | 21.86 | | 14.53 | | 12.08 | |

| Reserves – proved plus probable | | | | | | |

| Natural gas(mmcf) | 42,158 | | 37,489 | | 44,740 | |

| Natural gas liquids(mbbls) | 1,393 | | 1,631 | | 1,905 | |

| Crude oil(mbbls) | 800 | | 1,846 | | 553 | |

| Total(mboe) | 9,219 | | 9,725 | | 9,915 | |

| Undeveloped land | | | | | | |

| Net acres | 121,921 | | 110,744 | | 69,162 | |

| Financial($ 000’s, unless otherwise stated) | | | | | | |

| Gross revenues | 46,848 | | 24,123 | | 26,402 | |

| Cash flow from operations(1) | 23,097 | | 10,810 | | 11,337 | |

| Per common share | 1.07 | | 0.53 | | 0.55 | |

| Net earnings (loss) | 4,978 | | 2,004 | | (3,412 | ) |

| Per common share | 0.23 | | 0.10 | | (0.17 | ) |

| Capital expenditures | 31,747 | | 12,578 | | 22,111 | |

| Operation loan | 13,250 | | 11,075 | | 14,750 | |

| Common shares outstanding | | | | | | |

| Basic | 21,393,902 | | 20,357,153 | | 20,365,031 | |

| Diluted | 21,947,801 | | 20,554,231 | | 20,466,543 | |

| (1) | Cash flow from operations = “Cash provided by operating activities” plus “Changes in non-cash working capital affecting operating activities” in the Statements of Cash Flows. Cash flow from operations is a non-GAAP measure that does not have standardized meaning as prescribed by GAAP and is therefore unlikely to be comparable to similar measures presented by other companies. We consider it a key measure as it demonstrates our ability to generate cash flow necessary to fund future growth through capital investment and to repay debt. |

3

President's Message

Last year, my message was about change. In 2002, we made some important structural changes to our Company and the way we do business, including a change to our financial year-end and corporate reserves evaluations. We also increased our staff from 12 employees at end of 2001 to 16 at the end of 2002. And now, that number has risen to 21.

My theme this year is, ‘transition’. This is a transition year for our Company and, in a broader sense, for the world industry. We are beginning to see a transition from reliance on mid-east oil to a western hemisphere strategy involving West Africa and South America as increasingly important players. China, too, is making the transition from a third-world economy to a major consumer with huge awakening demands for fossil energy.

In Canada, this year is a transition year in terms of how we measure our reserves. Now, the majority of our peers in Canada are required to have their oil and gas reserves determined according to a new set of definitions referred to as NI51-101. In the quest for higher confidence that estimated reserves will be recoverable, the new definitions have tended to decrease reported reserve numbers across-the-board. The definitions are now more conservative than those used by US reporting issuers and larger competitors who report their reserves without independent audit.

Dynamic is transitioning for growth. Transitions are not always smooth and this year, we saw a few bumps in the road as St. Albert crude oil production dropped sooner than anticipated, and Cypress natural gas production was delayed by operational and third-party processing issues.

Dynamic is striving for more success in northeastern British Columbia. Our aim is to become less dependent on mature fields like St. Albert and Halkirk in Alberta. The kind of discoveries we've made so far wouldn't have been possible in any of the more mature North American basins. That's why we are here confronting the majors, arm-wrestling over new lands, and building our own transportation and processing infrastructure.

Dynamic has also begun to secure more recognition in the business world. In their “Top 100 Public Companies in British Columbia”, the Sun newspaper group chose Dynamic 19th best company overall and fourth best in terms of employee productivity. For the third consecutive year, I have been nominated by Ernst & Young to compete for 'Entrepreneur of the Year' in the Pacific region of Canada. Aside from being very satisfying honors, these are clear indications that Dynamic is heading in the right direction.

When you get right down to it, what we do is pretty simple. All we have to do in our search for fossil fuel is finance it, find it, produce it, process it and get it to our customers. The difficulty, however, is that Mother Nature has hidden her energy gems in the most rugged and diverse spots on the earth, at various depths and in almost every kind of rock.

4

There's another thing. A good many other folks are trying to do the same thing – mostly they are bigger than we are and have already found the easy stuff. But you know what? These are exactly the things that make it so much fun. The excitement and sense of adventure in what we do, is one of the reasons I've been able to assemble such a dedicated team of explorers and developers and why I believe Dynamic will continue to grow and prosper.

We continue to see uncertainty in global energy markets, not just political uncertainty but uncertainty in reserves as well. Several of the major middle-east producing countries have started to see dwindling reserve-based production. The most recent model calls for worldwide production declines in oil to begin about the year 2008. From then on, it's down hill, because existing and new discoveries will not be able to keep up with production demands.

Today, in North America, we have approximately a seven-year supply of natural gas to meet our current demands. But that cushion is rapidly shrinking. Twenty years ago, we had a fifteen-year supply of forward reserves. We live in a society that is entirely dependent on inexpensive sources of energy – most of us never even think about it when we fill our gas tank (with mostly imported oil) or flick a light switch (from natural gas-fired generators). The next time you do one of these things, I'd like you, as a consumer and a shareholder, to think of Dynamic Oil & Gas and our great team of dedicated individuals.

What does this mean for you as a Dynamic shareholder? Remember Mother Nature – every day we're out searching and exploring for her hidden treasure. I've built a company dedicated to finding new energy in western Canada. Our focus is natural gas – nature's cleanest-burning fossil fuel. Whether natural gas pipelines cross northeast British Columbia or travel up the Gulf Coast, they tie our populations together. When proposed plans go ahead, we'll see a new pipeline connecting the ‘lower forty-eight,’ running through northern British Columbia right up to the Alaska North Slope and the Polar Shelf. That pipeline will open up new opportunities for frontier explorers like Dynamic – and we plan to be ready.

Wayne J. Babcock,

President & Chief Executive Officer

5

[GRAPHIC OMITTED]

Review of Drilling, Land and Properties

We changed our fiscal year end to December 31 from March 31 beginning with December 31, 2002. For discussion purposes, we may refer to the nine-month period ended December 31, 2002 as “Nine-Month Fiscal Transition 2002” and the twelve-month periods ended March 31, 2003 and 2002 as “Fiscal 2003” and “Fiscal 2002,” respectively.

Drilling Activity

| | Fiscal 2003 | | Nine-Month Fiscal Transition 2002 | | Fiscal 2002 | |

| | Gross | | Net | | Gross | | Net | | Gross | | Net | |

| | | | | | | | | | | | | |

| Natural gas | 8 | | 5.3 | | 7 | | 4.3 | | 9 | | 7.5 | |

| Crude oil | 4 | | 3 | | 2 | | 1.5 | | 1 | | 0.7 | |

| Dry | 2 | | 2 | | – | | – | | 4 | | 2.8 | |

| Total | 14 | | 10.3 | | 9 | | 5.8 | | 14 | | 11.0 | |

| Success rate | | | 80 | % | | | 100 | % | | | 75 | % |

During Fiscal 2003, we operated or participated in 14 drilled wells resulting in eight gas wells, four oil wells and two dry wells for an overall success rate of 80%. Of the 12 successful wells, six development wells were drilled at St. Albert, two exploration wells were drilled at Wimborne, one development well at Halkirk, Alberta and three exploration wells were drilled at Cypress/Chowade in British Columbia.

6

Land Holdings (acres)

As at December 31, 2003

| | Developed | | Undeveloped | | Total | | Weighted | |

| Area | Gross | | Net | | Gross | | Net | | Gross | | Net | | Avg WI % | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Alberta | | | | | | | | | | | | | | |

| St. Albert | 9,308 | | 6,060 | | 4,442 | | 3,150 | | 13,750 | | 9,210 | | 67% | |

| Halkirk | 3,840 | | 3,456 | | 2,880 | | 2,880 | | 6,720 | | 6,336 | | 94% | |

| Peavey/Morinville | 6,787 | | 4,921 | | 4,766 | | 2,954 | | 11,553 | | 7,875 | | 68% | |

| Quirk Creek | – | | – | | 6,560 | | 3,280 | | 6,560 | | 3,280 | | 50% | |

| Wimborne | 640 | | 640 | | 9,035 | | 8,555 | | 9,675 | | 9,195 | | 95% | |

| Other | 3,527 | | 2,689 | | 3,340 | | 3,072 | | 6,867 | | 5,761 | | 84% | |

| | 24,102 | | 17,766 | | 31,023 | | 23,891 | | 55,125 | | 41,657 | | 76% | |

| | | | | | | | | | | | | | | |

| British Columbia | | | | | | | | | | | | | | |

| Cypress/Chowade | 5,976 | | 2,564 | | 39,154 | | 12,953 | | 45,130 | | 15,517 | | 34% | |

| Orion | 2,003 | | 1,335 | | 64,611 | | 45,134 | | 66,614 | | 46,469 | | 70% | |

| Fraser Valley | – | | – | | 54,502 | | 18,278 | | 54,502 | | 18,278 | | 34% | |

| | 7,979 | | 3,899 | | 158,267 | | 76,365 | | 166,246 | | 80,264 | | 48% | |

| Total to Dec 31, 2003 | 32,081 | | 21,665 | | 189,290 | | 100,256 | | 221,371 | | 121,921 | | 55% | |

| Total to Dec 31 2002 | 30,170 | | 20,248 | | 161,918 | | 90,496 | | 192,088 | | 110,744 | | 58% | |

| Increase (decrease) | 1,911 | | 1,417 | | 27,372 | | 9,760 | | 29,283 | | 11,177 | | | |

| Increase (decrease) % | 6% | | 7% | | 17% | | 11% | | 15% | | 10% | | | |

Our total land holdings increased during the year by 11,177 net acres (29,283 gross) or 10%. This increase was mainly spread among two key properties, Wimborne, Alberta and Cypress/Chowade in British Columbia. Some of the net increase was offset with minor land reductions at St. Albert, Halkirk and Peavey/Morinville, Alberta. We had significant land reductions at Quirk Creek, Alberta of 2,400 net acres (4,800 gross). Of our total land holdings, 100,256 net acres (189,290 gross) or 82% was undeveloped.

Our weighted average working interest of all our Alberta properties was 76% versus 48% in British Columbia. In total, our weighted average working interests decreased by 3% to 55%.

7

Alberta Properties

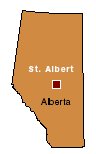

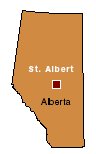

St. Albert/Big Lake

St. Albert is located in central Alberta, northwest of the City of Edmonton and near the City of St. Albert.

Geological Description

The property is comprised of two Devonian-aged reef structures, which are associated with 16, separate Cretaceous-aged natural gas and Devonian-aged crude oil pools stacked in seven productive formations, four are natural gas and three crude oil. For purposes of project identification, we refer to these structures as the “north pool” and the “south pool”. Historically, the property has produced in excess of 22.5 million barrels of crude oil and 109 billion cubic feet of raw natural gas from both pools. They continue to remain prospective for recoverable oil from six established Devonian-aged pools in the Leduc D-3, Nisku D-2 and Wabamun D-1 formations.

Land Holdings

We hold 9,210 net acres (13,750 gross) of various crown and freehold petroleum and natural gas (“P&NG”) leases for a weighted average working interest of 67%.

Seismic

We own a 37.5% working interest in a proprietary 3D seismic database covering 12 square kilometers.

Wells and Facilities

We own a 75% working interest in 17 producing gas wells; from a 44% to 77% working interest in another four; and a 75% working interest in seven producing oil wells. In addition, we own a 75% working interest in one oil battery, one solution gas plant, one sour gas compressor, two sweet gas compressors and a 13 kilometer, 6” sour gas pipeline.

2003 Activities

In the south pool, we drilled three wells targeting remaining Devonian-aged oil reserves. Two of these wells encountered oil pay in the Leduc formation and one well, while unsuccessful in the Leduc formation, was later completed as a Nisku oil well. In the north pool, we drilled one well also targeting remaining Devonian-aged oil reserves. While the well was unsuccessful in the Leduc formation, it was later completed as a Nisku oil well.

We drilled two successful wells targeting remaining natural gas in the Ostracod formation. We were able to minimize surface and environmental impacts by re-entering existing well bores in all of our drilling activity. We addressed declining reservoir pressures in various gas pools by adding third-party owned compression at nearby Villeneuve and Carbondale gas plants.

2004 Outlook

Our budget for the year focuses on continued optimization of the field. All projects are geared toward recovery of remaining crude oil and natural gas reserves from known pools. Our development drilling, re-completions and work-overs will specifically target the Leduc D-3, and Nisku D-2 oil zones, and the Ostracod and Belly River gas zones. Our investment at St. Albert includes numerous wells and facilities. For this reason, we strive to early-inform and consult with the public in the area and work closely with government regulators.

8

| |  |

| | Our budget for 2004 focuses

on continued optimization of our

field at St. Albert/Big Lake. |

9

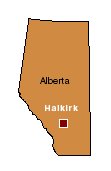

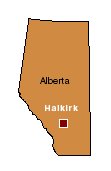

Halkirk

Halkirk is located in central Alberta approximately 168 kilometers northeast of Calgary.

Geological Description

This area is prospective for multiple, sweet natural gas-bearing Cretaceous-aged sandstone reservoirs. The primary target for reserves is the Viking “C” sand with an average net pay thickness of approximately five meters.

Land Holdings

We own 6,336 net acres (6,720 gross) of crown and freehold P&NG leases for a weighted average working interest of 94%.

Wells and Facilities

We own a 100% working interest in five producing gas wells and two standing wells. We also own an 80% before payout working interest and a 48% after payout working interest in three producing gas wells. All of our natural gas production is processed at the Maple Glen Gas Plant under a third-party custom processing agreement.

2003 Activities

We drilled one successful infill Viking gas well and one unsuccessful step-out well. We acquired 320 net acres (100%) of new P&NG rights.

2004 Outlook

Our reserves at Halkirk are based on a 160-acre drainage area. We have identified opportunities to down-space production in the future by drilling additional infill wells to increase reserve allocations and production. No new wells are budgeted.

10

| |  |

| | We own a 100% working interest

in five producing and two standing

natural gas wells at Halkirk. |

11

Wimborne

Wimborne is located in south-central Alberta approximately 112 kilometers northeast of Calgary.

Geological Description

The area is prospective for multiple Cretaceous-aged sandstone reservoirs containing natural gas and natural gas liquids. Additional potential exists for crude oil and natural gas within deeper Mississippian and Devonian carbonate reservoirs.

Land Holdings

We own 9,195 net acres (9,675 gross) of P&NG rights for a weighted average working interest of 95%. Of our total net holdings, 93% is undeveloped.

Seismic

We own a licensed copy of a high quality, 3D seismic database covering 260 square kilometers.

Wells and Facilities

We own a 100% working interest in one standing gas well. The property is in close proximity to existing natural gas pipelines and processing facilities.

2003 Activities

We drilled one successful gas well and one unsuccessful well. We acquired a 100% working interest in approximately ten new sections (6,475 acres) of crown P&NG leases.

2004 Outlook

Our large 3D seismic database is expected to enhance our long-term exploration and development strategy for the area. Through it, we have identified up to six exploration targets on our lands, three of which are planned for drilling this year.

12

| |  |

| | Our large 3D seismic database is

expected to enhance our long-term

exploration and development

strategy for the Wimborne area. |

13

BRITISH COLUMBIA PROPERTIES

Cypress/Chowade

Cypress/Chowade is located in the foothills of northern British Columbia approximately 100 kilometers northwest of Fort St. John.

Geological Description

The area is prospective for multiple, natural gas-bearing Triassic sandstone and carbonate reservoirs and deep Mississippian carbonate reservoirs contained within classic foothill anticlines that trend northwest-southeast through the area.

Land Holdings

We have crown P&NG leases over 15,517 net acres (45,130 gross) for a weighted average working interest of 34%. Of our total net acreage, 83% is undeveloped.

Seismic

We own a licensed copy of a large 2D seismic database and a 100% working interest in 15 kilometers of 2D proprietary seismic data.

Wells and Facilities

We own between 30% - 50% working interests in two producing gas wells and six standing shut-in gas wells. In five of these eight wells, our interest converts from 50% working interest to 30% working interest at payout. All of our fiscal 2003 gas production was processed at Cypress Gas Plant under a third-party custom processing agreement. A major expansion of pipeline and processing facilities is required to develop this area.

2003 Activities

We participated in drilling two successful exploration wells targeting multi-zone natural gas bearing reservoirs of Triassic age. We also participated in one exploration well to test and evaluate the Mississippian-aged Debolt formation. While the well was unsuccessful in the Debolt formation, it was cased as a potential gas well in two Triassic-aged zones. We acquired a weighted average working interest of 33% in 28,350 gross acres, equipped four wells for tie-in and added a field compressor.

2004 Outlook

We plan to drill three exploratory outpost wells and three development wells. We have budgeted to cover our half of the cost to construct a 30 mmcf/d sour gas plant, acid gas injection facilities and a 32 kilometer, 8” diameter sales pipeline to Sikanni. The initial leg of the proposed 8” diameter sales pipeline is scheduled for construction in the first quarter. We plan to have three of our six standing shut-in gas wells on stream in the first quarter and the remaining three wells on stream later in the year. We have seismically identified more than 30 potential exploration and development locations on company-owned lands. We plan to continue an aggressive land acquisition strategy.

14

| |  |

| | We have seismically identified

more than 30 potential exploration

and development locations on

company-interest lands. |

15

Orion

Orion is strategically located between the Sierra and Helmet natural gas fields approximately 56 kilometers west of the Alberta border and 112 kilometers south of the Northwest Territories border. The property is dissected by the Sierra Yoyo Desan Road, which provides year-round access for drilling operations.

A large independent Canadian oil and gas company has referred to the regional Jean Marie carbonate reservoir in this area as ‘The Greater Sierra Gas Play’ and has described the area as the largest gas play discovered in Western Canada. Orion is a part of this area and is a key element in our long-term growth strategy.

Geological Description

The area is prospective for natural gas exploration and development in Cretaceous-aged Bluesky sandstone reservoirs and Mississippian and Devonian-aged Debolt, Jean Marie and Slave Point carbonate reservoirs.

Land Holdings

We hold under lease 46,469 net acres (66,614 gross) for a weighted average working interest of 70%. Approximately 97% of our net holdings are undeveloped.

Wells and Facilities

The property presently has three potential gas wells; one Bluesky and two Jean Marie horizontal wells. All three wells are standing awaiting further evaluation. We own a 100% working interest in the Bluesky and one Jean Marie well, a 15% gross overriding royalty (before payout) and a 50% working interest (after payout) in the other Jean Marie well.

Two major pipeline systems terminate at the edge of our property. To the southwest, the Duke Energy Pipeline System connects to Fort Nelson for delivery to Washington State and to the northeast, the Duke Energy Field Services Pipeline System connects to Tooga Compressor Station for delivery to Alberta.

2003 Activities

We drilled one horizontal well at 100% working interest to test the Jean Marie formation. The well tested gas in the Jean Marie formation at rates below commercial quantities and is being retained as a potential gas well pending further evaluation.

2004 Outlook

We plan to drill two 100% working interest exploration wells; one to test the Slave Point formation and one to test the Bluesky formation. We plan to shoot 90 square kilometers of proprietary 3D seismic.

16

| |  |

| | Orion forms part of

“The Greater Sierra Gas Play”

and is a key element in our

long-term growth strategy. New 3D seismic has defined

multiple drilling targets for 2004. |

17

Fraser Valley

The property is located in the Lower Mainland area of southwest British Columbia near the port city of Vancouver.

Land Holdings

Under a joint venture agreement with Conoco Canada Limited, we continue to hold approximately 18,278 net acres (54,502 gross) of onshore and offshore P&NG rights associated with Permit 802, a validated British Columbia Exploration Permit. Permit 802 is under provincial jurisdiction and includes offshore P&NG rights in the Georgia Basin, located in the Strait of Georgia between the Lower Mainland and Vancouver Island.

2004 Outlook

Presently, areas offshore are subject to a restricted access moratorium for petroleum and natural gas activities, however, discussions are underway between the Provincial and Federal Governments in regards to lifting the moratorium. The Provincial Government has indicated its desire to move forward and the Federal Government is currently conducting a public review to identify environmental and social concerns arising from offshore activities along the Pacific West Coast. A final decision is expected in 2004. We have identified a large structural feature approximately 19 square kilometers in size (the Robert’s Bank Gravity Anomaly) which is supported by government-acquired gravity data and proprietary onshore 2D seismic data. The Geological Survey of Canada has assigned the Georgia Basin a reserve estimate of 6.5 trillion cubic feet of natural gas. A commercial quantity of gas is yet to be discovered in the area. We plan to be inactive in the Fraser Valley in 2004.

Other Non-Core Properties

Peavey/Morinville, Quirk Creek, Alexander, Simonette, Stanmore, and Westlock in Alberta and Elmore and Rapdan in Saskatchewan comprise 16,916 net acres (24,980 gross) with a weighted average working interest of 68%.

2004 Look Ahead

Looking ahead to 2004, we have changed our focus away from Alberta to northeast British Columbia. In Fiscal 2004, we plan to invest $26.1 million or 71% of our total capital budget in northeast British Columbia compared to $9.4 million or 25% of our total capital budget in Alberta.

Our primary strategy is to grow organically through the drill bit by pursuing a fundamentally sound, forward-looking exploration strategy. We believe that northeast British Columbia offers some of the best opportunities in the western Canadian sedimentary basin for long-term sustainable growth. Of our current total net undeveloped land holdings, 76% are located in British Columbia.

British Columbia has become an attractive province for oil and gas investment by implementing several new initiatives: enhancing existing energy policies; streamlining regulations; increasing investments in infrastructure; and implementing new royalty incentives.

18

| |  |

| | The Geological Survey of

Canada has assigned the

Georgia Basin a reserve

estimate of 6.5 trillion cubic

feet of natural gas. |

19

Health, Safety and the Environment

As an upstream oil and gas company we recognize our business and social responsibilities. We are cognizant of the processes and practices we use and the ways in which they may impact the lives of people and the environment.

Managing Health and Safety

Our health and safety program is in effect throughout the organization. It helps to provide and manage a more structured approach to health and safety at the workplace on a daily basis. The program defines and specifies policies, procedures and practices that are to be followed in the prevention of potential adverse health and safety issues affecting employees and the public.

Our goal is to have zero injuries and zero illnesses. We have achieved that mark on a regular basis through the stellar performance of our employees and we will continue to monitor our systems and procedures.

Managing the Environment

We practice sound environmental stewardship. This is clearly stated in our Corporate Health, Safety and Environmental Policy and supported by the implementation of strict practices and procedures. We continuously strive to add or improve our practices and procedures to eliminate or minimize our impact on the environment.

In 2003, we participated with the Canadian Association of Petroleum Producers in a stewardship benchmarking program and will be submitting our first report in the spring of 2004. We will report on a variety of environmental, health, safety, and operational benchmarks that allow us to track our progress from year-to-year compared to our industry peers. This will be a valuable tool to assist us with our environmental performance and the enhancement of our practices and procedures.

Through our newly-developed St. Albert Synergy Group, we are able to receive input from local stakeholders and enhance opportunities for mutual education and communication.

We have monitoring programs in place to self-check operations that affect the environment and we continually maintain and enhance them. Our intention is to have a positive impact on our environment and we conscientiously work towards that objective.

20

[GRAPHIC OMITTED]

We practice sound environmental stewardship.

21

Summary of Reserves

The reserve data set out in the summary table below is based on an independent engineering evaluation of our estimated oil and gas reserves effective January 1, 2004, as conducted by Sproule Associates Limited. This evaluation was prepared in accordance with National Instrument 51-101Standards of Disclosure for Oil and Gas Activities(NI51-101).

Summary of Company Interest Reserves (Before Royalties)

| | Light and | | | | Natural | | Natural Gas | | | |

| | Medium Oil | | Heavy Oil | | Gas(1) | | Liquids | | Total | |

| | (mbbl) | | (mbbl) | | (mmcf) | | (mbbl) | | (mboe) | |

| | | | | | | | | | | |

| Proved | | | | | | | | | | |

| Developed producing | 261 | | 5 | | 18,249 | | 962 | | 4,269 | |

| Developed non-producing | 79 | | – | | 2,710 | | 5 | | 535 | |

| Undeveloped | 158 | | – | | 3,691 | | 20 | | 794 | |

| Total proved | 498 | | 5 | | 24,650 | | 987 | | 5,598 | |

| Probable | 295 | | 1 | | 17,508 | | 406 | | 3,620 | |

| Total proved + probable | | | | | | | | | | |

| Dec. 31, 2003 | 793 | | 6 | | 42,158 | | 1,393 | | 9,218 | |

| Total proved + probable | | | | | | | | | | |

| Dec. 31, 2002 | 1,843 | | 3 | | 37,489 | | 1,631 | | 9,725 | |

| Increase (decrease) | (1,050 | ) | 3 | | 4,669 | | (238 | ) | (507 | ) |

| Increase (decrease) % | (57.0 | )% | 100 | % | 12.5 | % | (14.6 | )% | (5.2 | )% |

(1) Estimates of reserves of natural gas includes solution gas.

Reserves Reconciliation

The following reconciliation shows the changes in our estimated reserves before royalties that occurred during Fiscal 2003. Opening reserves as at January 1, 2003 were evaluated pursuant to the standards in effect at that time entitled,“Guide for Engineers and Geologists Submitting Oil and Gas Reports to Canadian Provincial Securities Administrators”(National Policy 2-B) while closing reserves as at January 1, 2004 were determined pursuant to the definitions of NI51-101. Reserve definitions under these two standards differ and therefore are not directly comparable. For reconciliation purposes, the industry standard is to use ‘proved plus one-half probable’ reserves under National Policy 2-B as roughly equivalent to ‘proved plus probable’ reserves under NI51-101.

Our total estimated proved plus probable reserves are 9,218 mboe as at January 1, 2004, a decrease of 5% from last year. Technical revisions, including adjustments for new reserve definitions under NI51-101 increased proved plus probable reserves by 314 mboe or 3%. Extensions and discoveries through exploration activity added 437 mboe replacing 35% of production.

Compared to Nine-Month Fiscal Transition 2002, proved plus probable reserves of natural gas increased by 4,669 mmcf or 12%, to 42,158 mmcf. This increase was the net result of extensions, discoveries and technical revisions totaling 9,432 mmcf, less Fiscal 2003 production of 4,763 mmcf.

During Fiscal 2003, proved plus probable reserves of light, medium and heavy crude oil declined by 1,047 mmbls or 57%, to 799 mmbls. The main factors contributing to this decrease were Fiscal 2003 production of 223 mbbls and a downward revision of 936 mbbls to previous reserve estimates made on our St. Albert property.

Reconciliation of Company Interest Reserves (Before Royalties)

| | Light, Medium and Heavy Oil | | Natural Gas | | Natural Gas Liquids | | Total | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Proved | | | | | | Proved | | | | | | Proved | | | | | | Proved | |

| | | | | | Plus | | | | | | Plus | | | | | | Plus | | | | | | Plus | |

| | Proved | | Probable | | Probable | | Proved | | Probable | | Probable | | Proved | | Probable | | Probable | | Proved | | Probable | | Probable | |

| | (mbbl) | | (mbbl) | | (mbbl) | | (mmcf) | | (mmcf) | | (mmcf)(2) | | (mbbl) | | (mbbl) | | (mbbl) | | (mboe) | | (mboe) | | (mboe) | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Dec. 31, 2002 | 1,405 | | 441 | (1) | 1,846 | (2) | 31,694 | | 5,795 | (1) | 37,489 | (2) | 1,483 | | 148 | (1) | 1,631 | (2) | 8,170 | | 1,555 | (1) | 9,725 | (2) |

| Extensions | 102 | | 10 | | 112 | | 527 | | 163 | | 690 | | 3 | | – | | 3 | | 193 | | 37 | | 230 | |

| Discoveries | – | | – | | – | | 608 | | 634 | | 1,242 | | – | | – | | – | | 101 | | 106 | | 207 | |

| Revisions | (781 | ) | (155 | ) | (936 | ) | (3,416 | ) | 10,916 | | 7,500 | | (257 | ) | 258 | | 1 | | (1,608 | ) | 1,922 | | 314 | |

| Production | (223 | ) | – | | (223 | ) | (4,763 | ) | – | | (4,763 | ) | (242 | ) | – | | (242 | ) | (1,258 | ) | – | | (1,258 | ) |

| Dec. 31, 2003 | 503 | | 296 | | 799 | | 24,650 | | 17,508 | | 42,158 | | 987 | | 406 | | 1,393 | | 5,598 | | 3,620 | | 9,218 | |

| (1) | Probable figures for December 31, 2002 are equal to 50% of probable reserves reported in our January 1, 2003 reserves report. |

| (2) | Proved plus probable figures for December 31, 2002 represent proved plus 50% probable (established) reserves from our January 1, 2003 reserves report. |

22

Net Present Values of Reserves

Under NI51-101, minimum disclosure requirements for estimated net present values are:

- Proved – using constant prices and costs of the last day of the financial year.

- Proved and probable – using forecasted commodity prices and costs.

In the following two tables, we present Sproule’s estimated net present values effective January 1, 2004. It should not be implicit that the undiscounted and discounted net present values presented represent the fair market values of our reserves, as the use of other assumptions could give rise to different results.

Net Present Value of Company Interest Reserves

Based on constant commodity prices and costs, before income taxes

| ($000’s) | | | | | Discounted at | | | |

| | Undiscounted | | 5% | | 10% | | 15% | | 20% | |

| | | | | | | | | | | |

| Proved | | | | | | | | | | |

| Developed producing | 99,917 | | 83,986 | | 72,958 | | 64,894 | | 58,741 | |

| Developed non-producing | 4,684 | | 3,586 | | 2,756 | | 2,113 | | 1,605 | |

| Undeveloped | 16,445 | | 14,006 | | 12,229 | | 10,867 | | 9,782 | |

| Total proved | 121,046 | | 101,578 | | 87,943 | | 77,874 | | 70,128 | |

| Probable | 76,545 | | 55,502 | | 42,693 | | 34,188 | | 28,173 | |

| Total proved + probable | | | | | | | | | | |

| Dec. 31, 2003 | 197,591 | | 157,080 | | 130,636 | | 112,062 | | 98,301 | |

Based on forecasted commodity prices and costs, before income taxes

| ($000’s) | | | | | Discounted at | | | |

| | Undiscounted | | 5% | | 10% | | 15% | | 20% | |

| | | | | | | | | | | |

| Proved | | | | | | | | | | |

| Developed producing | 72,899 | | 61,982 | | 54,405 | | 48,850 | | 44,600 | |

| Developed non-producing | 1,736 | | 1,047 | | 527 | | 127 | | (187 | ) |

| Undeveloped | 11,294 | | 9,669 | | 8,479 | | 7,562 | | 6,826 | |

| Total proved | 85,929 | | 72,698 | | 63,411 | | 56,539 | | 51,239 | |

| Probable | 51,247 | | 36,699 | | 27,900 | | 22,095 | | 18,012 | |

| Total proved + probable | | | | | | | | | | |

| Dec. 31, 2003 | 137,176 | | 109,397 | | 91,311 | | 78,634 | | 69,251 | |

In the process of estimating our proved and probable reserves on a constant-pricing basis, and their associated net present values, Sproule assumed that our actual December 31, 2003 weighted average commodity prices received and our associated operating costs incurred would remain constant over the life of the reserves. The prices used for natural gas, natural gas liquids and crude oil were $6.18 per mcf, $25.38 per barrel and $39.69 per barrel, respectively.

In the process of estimating our proved and probable reserves on a forecasted-pricing basis, and their associated net present values, Sproule’s commodity price forecasts effective January 1, 2004 were as follows:

Forecast of Commodity Prices

| | | | | Edmonton | | Alberta | | | | | |

| | | WTI Cushing(1) | | Par Price | | AECO-C | | | | Edmonton | |

| Forecast | | Oklahoma | | 40° API | | Spot | | Henry Hub | | Butanes | |

| Year | | ($US/bbl) | | ($Cdn/bbl) | | ($Cdn/MMBTU) | | ($US/MMBtu) | | ($Cdn/bbl) | |

| | | | | | | | | | | | |

| 2004 | | 29.63 | | 37.99 | | 6.04 | | 5.32 | | 31.15 | |

| 2005 | | 26.80 | | 34.24 | | 5.36 | | 4.81 | | 25.52 | |

| 2006 | | 25.76 | | 32.87 | | 4.80 | | 4.39 | | 23.28 | |

| 2007 | | 26.14 | | 33.37 | | 4.91 | | 4.46 | | 23.63 | |

| 2008 | | 26.53 | | 33.87 | | 4.98 | | 4.52 | | 23.98 | |

| 2009 | | 26.93 | | 34.38 | | 5.05 | | 4.59 | | 24.34 | |

| 2010 | | 27.34 | | 34.90 | | 5.14 | | 4.66 | | 24.71 | |

| 2011 | | 27.75 | | 35.43 | | 5.24 | | 4.73 | | 25.08 | |

| 2012 | | 28.16 | | 35.96 | | 5.33 | | 4.80 | | 25.46 | |

| 2013 | | 28.58 | | 36.50 | | 5.43 | | 4.87 | | 25.85 | |

| 2014 | | 29.01 | | 37.05 | | 5.52 | | 4.95 | | 26.24 | |

| 2015 | | 29.45 | | 37.61 | | 5.62 | | 5.02 | | 26.63 | |

Escalation rate of 1.5% thereafter.

| (1) | 40 degrees API, 0.4% sulphur |

Additional information regarding our estimated reserves will be included on exhibit Form 51-101F1 forming part of our Form 20-F, which will be available on SEDAR, EDGAR and our website on or prior to May 19, 2004.

23

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

The following should be read in conjunction with our Financial Statements and the Notes to the Financial Statements included in this Annual Report. The Financial Statements have been prepared in accordance with Canadian generally accepted accounting principles (GAAP). The impact of significant differences between GAAP in Canada and the United States is disclosed in Note 12 to our Financial Statements.

Unless otherwise noted, tabular amounts are in thousands of Canadian dollars, and sales volumes, production volumes and reserves are before royalties. We have presented our working interest before royalties, as we measure our performance on this basis, which is consistent with other Canadian oil and gas companies.

Fiscal 2003 coincides with the calendar year and is the first full year since we changed our fiscal year end to December 31 from March 31. Fiscal 2002, our transition year, covered the period April 1 to December 31, 2002. For ease of reading, we refer throughout this discussion and analysis to the periods reported as follows:

Reported Periods Referred to as

| January 1, 2003 – December 31, 2003 | Fiscal 2003 |

| April 1, 2002 – December 31, 2002 | Nine-Month Fiscal Transition 2002 |

| April 1, 2001 – March 31, 2002 | Fiscal 2002 |

Due to the differing lengths of the reporting periods in this discussion and analysis, results in these periods are not comparable. Accordingly, percentage changes in these results are not meaningful. In the tables in this discussion and analysis, such results are indicated as “n/m”.

Where useful for comparison purposes, annualized numbers relating to Nine-Month Fiscal Transition 2002 are presented by multiplying the nine-month numbers by four-thirds. This method, however, does not reflect actual results for the applicable extrapolated period and as such differs from the results achieved by this calculation.

Due to certain accounting policy changes effected in Fiscal 2003, we have restated prior comparative information in order to conform to the presentation adopted (see Note 3 to our Financial Statements on page 46).

24

Executive Overview

Key Measures for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | |

| | | | Nine-Month | | | |

| | | | Fiscal | | | |

| | Fiscal | | Transition | | Fiscal | |

| | 2003 | | 2002 | | 2002 | |

| | | | | | | |

| Gross revenues | 46,848 | | 24,123 | | 26,402 | |

| Cash flow from operations(1) | 23,097 | | 10,810 | | 11,337 | |

| Cash flow from operations | | | | | | |

| per share ($/share)(1) | 1.08 | | 0.53 | | 0.56 | |

| Net earnings (loss) | 4,978 | | 2,004 | | (3,412 | ) |

| Net earnings (loss) per share ($/share) | 0.23 | | 0.10 | | (0.17 | ) |

| Daily average production (boe/d) | 3,447 | | 3,332 | | 3,225 | |

| Total production(mboe) | 1,258 | | 916 | | 1,177 | |

| Capital expenditures | 31,747 | | 12,578 | | 22,111 | |

| Net debt(2) | 19,313 | | 16,818 | | 13,281 | |

| Net debt to cash flow (times)(3) | 0.8:1 | | 1.6:1 | | 1.2:1 | |

| Net debt to cash flow annualized | | | | | | |

| (times)(4) | 0.8:1 | | 1.2:1 | | 1.2:1 | |

| (1) | Cash flow from operations is a non-GAAP measure that does not have standardized meaning as prescribed by GAAP and therefore may or may not be comparable to similar measures presented by other companies. We consider it a key measure as it demonstrates our ability to generate the cash flow necessary to fund future growth through capital investment and to repay debt. |

| | ($ 000’s) | | | | | | |

| | | | | Nine-Month | | | |

| | | | | Fiscal | | | |

| | | Fiscal | | Transition | | Fiscal | |

| | | 2003 | | 2002 | | 2002 | |

| | | | | | | | |

| | Cash provided by operating activities (GAAP) | 28,294 | | 11,457 | | 9,779 | |

| | Changes in non-cash working capital | | | | | | |

| | affecting operating (GAAP) | (5,197 | ) | (647 | ) | 1,558 | |

| | Cash flow from operations (non-GAAP) | 23,097 | | 10,810 | | 11,337 | |

| | | | | | | | |

| (2) | Net debt is working capital. We have no long-term debt. |

| (3) | Net debt divided by cash flow from operations. |

| (4) | Net debt divided by cash flow from operations annualized. |

Our gross revenues, cash flow from operations and total production were record highs during Fiscal 2003.

Comparisons of our results of Fiscal 2003 versus Nine-Month Fiscal Transition 2002 were significantly affected by the three-month difference in period length. Two other significant factors contributed to the difference in many of our key measures between the two periods – gross revenues were greater in Fiscal 2003 due to a 50% increase in our weighted average price for natural gas and our crude oil sales increased by 125%.

Daily average production of all commodities grew by 3% to 3,447 boe/d. Total production of all products was 1,258 mboe versus 916 mboe. This would have represented a 3% increase, had Nine-Month Fiscal Transition 2002 been annualized at 1,221 mboe.

Our net earnings for Fiscal 2003 were the second highest in corporate history. The main reasons for this were the same key factors that generated higher gross revenues, cash flow from operations and total production outlined above. The impact of these factors on net earnings was lessened, however, by two main areas of expense - amortization and depletion, and exploration expenses which were higher by $5.7 million and $2.4 million, respectively. Amortization and depletion expense reflected: new capital expenditures related to production optimizations and leasehold acquisitions; the effects of transitioning to new reserve definitions (discussed below); and the repurchase of certain gross overriding royalty interests that previously burdened our total current and future corporate production by 3%. Exploration expenses reflected higher costs for seismic data gathering and for the drilling of two unsuccessful wells, compared to none in Nine-Month Fiscal Transition 2002.

Effective January 1, 2004, our reserves were independently determined according to a new standard adopted by Canadian regulatory authorities entitled, “National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities” (NI51-101).The previous standard was entitled,“Guide for Engineers and Geologists Submitting Oil and Gas Reports to Canadian Provincial Securities Administrators” (National Policy 2-B).Reserve definitions under these two standards differ and therefore are not directly comparable. To be more comparable to NI51-101, however, the industry has established for year-over-year reconciliation purposes that January 1, 2003 estimated reserves under National Policy 2-B be restated from “proved plus probable” reserves to “proved plus one-half probable” reserves.

Under NI51-101, proved reserves ‘assigned’ must have at least a 90% certainty that quantities recovered will equal or exceed their ‘estimates’ and proved plus probable reserves must have a minimum of 50% certainty that quantities recovered will equal or exceed their ‘estimates’. Independent engineers are henceforth expected to strive for elimination of downward revisions to proved reserves.

25

During Fiscal 2003, our total proved plus probable ‘assigned’ reserves decreased by 506 mboe or 5%, to 9,218 mboe. We added 294 mboe to proved reserves through extensions and discoveries, however, under NI51-101, revisions decreased by 1,608 mboe. Taking into account annual production, proved reserves decreased by 2,572 mboe or 31%, to 5,598 mboe, 73% of which was natural gas. We added 143 mboe to probable reserves through extensions and discoveries, and 1,922 through revisions. Overall, probable reserves increased by 2,065 mboe or 133%, to 3,620 mboe, 81% of which was natural gas. (For additional disclosure of our estimated reserves and their net present values, see page 22).

Capital Investment by Classification for the Comparative Periods Presented

| ($000’s) | | | | | | |

| | | | Nine-Month | | | |

| | | | Fiscal | | | |

| | Fiscal | | Transition | | Fiscal | |

| | 2003 | | 2002 | | 2002 | |

| | | | | | | |

| Land acquisitions | 5,103 | | 2,568 | | 12,560 | |

| | | | | | | |

| Gross overriding royalty | | | | | | |

| interest acquisition(1) | 9,711 | | – | | – | |

| Drilling, completions and equipping: | | | | | | |

| Exploratory | 5,717 | | 4,914 | | – | |

| Development | 9,460 | | 4,232 | | 7,678 | |

| Facilities and pipelining | 1,448 | | 780 | | 1,757 | |

| Other | 308 | | 84 | | 116 | |

| Total | 31,747 | | 12,578 | | 22,111 | |

| (1) | This amount is comprised of a total payment of $6.5 million paid to the vendors, plus a non-cash adjustment to the carrying value of $3.2 million, as required by Canadian GAAP. The non-cash adjustment represents a future tax liability that is created due to the total payment being part shares and part cash. (See further details in note 7[d] to our Financial Statements). |

Our primary strategy is to build the company through grassroots exploration and development. In particular, we remain committed to natural gas-based projects, as we believe it is a clean, secure and abundant energy source. Our secondary strategy is to target specific acquisitions that we believe will lead to higher returns and future prospects for exploration and development. Throughout 2003, we increased our total capital investment to $31.7 million and advanced our strategies in the following ways:

During Fiscal 2003, we spent $5.1 million on the acquisition of new lands. Our land holdings targeting natural gas increased by 11,177 net acres (29,283 gross). This new acreage was located at Wimborne, Alberta and Cypress/Chowade, British Columbia.

In addition, we repurchased a gross overriding royalty interest that previously burdened our total current and future corporate production from all producing and prospectively-producing properties by 3%;

- We invested $15.2 million in the drilling of 14 gross exploratory and development wells (10.3 net), with an overall success rate of 80%. Of these wells, ten targeted natural gas and four targeted crude oil. Of the ten natural gas wells, two were unsuccessful. Four of the eight successful gas wells were drilled in British Columbia, three at Cypress/Chowade and one at Orion. The remaining four were drilled in Alberta, two at St. Albert, one at Halkirk and one at Wimborne. All four successful crude oil wells were at St. Abert; and

- Our investment in facilities, pipelining and other assets grew by $1.8 million. Half of this capital was incurred at St. Albert to expand infrastructure that supports production optimization of existing reserves, while most of the balance was spent at Cypress/Chowade for new facilities construction.

In order to finance our record-high capital investment program described above, we took certain measures to expand our liquidity and capital resources. We issued 1.1 million common shares from treasury at a deemed price of $5.25 per share, to pay for 85% of the repurchase of the gross overriding royalty interests referred to above and we increased our revolving, demand bank operating loan facility to $25.0 million from $21.0 million. These measures, accompanied by record cash flows and $1.5 million from option exercises allowed us to improve our net debt-to-cash-flow ratio from 1.2:1 to 0.9:1.

Our planned activity for Fiscal 2004 continues to demonstrate the effects of our primary strategy. We have budgeted to invest a record-high $37.1 million on capital expenditures and exploration expenses. The allocation of this budget reflects our changing focus – to invest proportionately more in northeast British Columbia. Seventy-one percent of our investment is budgeted for Cypress/Chowade and Orion, British Columbia. The majority of the remainder is earmarked for St. Albert and Wimborne, Alberta.

We expect a 13% growth in daily average production in Fiscal 2004, subject mostly to timing of regulatory approvals, third-party transportation and processing negotiations, and equipment availability. Based on our forecast of strong commodity prices and supported by our bank loan facility, we expect to meet our 2004 cash requirements.

26

Properties and Capital Investment

We follow the successful efforts method of accounting for our natural gas and crude oil activities. When it is determined that drilling has been unsuccessful in establishing commercial reserves, the costs of drilling are written off and reported as exploration expenses on our Statements of Operations and Retained Earnings (see the section entitled, Exploration Expenses on page 31). All other capital expenditures are reported as natural gas and oil interests on our Balance Sheets.

Fiscal 2003

Capital Investment by Property and Classification(1)

| ($ 000’s) | | | | | | | | | | |

| | | | | | | | | | | |

| | Land and | | | | | | | | | |

| | Gross | | Drilling, | | | | | | | |

| | Overriding | | Completions | | Facilities | | | | | |

| | Royalty | | and | | and | | | | | |

| | Acquisitions | | Equipping | | Pipelining | | Other | | Total | |

| | | | | | | | | | | |

| Alberta | | | | | | | | | | |

| St. Albert | 49 | | 5,951 | | 882 | | – | | 6,882 | |

| Wimborne | 1,694 | | 626 | | – | | – | | 2,320 | |

| Halkirk | – | | 537 | | 27 | | – | | 564 | |

| Peavey/Morinville | – | | 160 | | 44 | | – | | 204 | |

| Other Alberta | – | | 42 | | 1 | | – | | 43 | |

| Total Alberta | 1,743 | | 7,316 | | 954 | | – | | 10,013 | |

| British Columbia | | | | | | | | | | |

| Cypress/Chowade | 2,779 | | 5,689 | | 494 | | – | | 8,962 | |

| Orion | 581 | | 2,172 | | – | | – | | 2,753 | |

| Total British Columbia | 3,360 | | 7,861 | | 494 | | – | | 11,715 | |

| Gross overriding royalty | | | | | | | | | | |

| acquisition and other | 9,711 | | – | | – | | 308 | | 10,019 | |

| Total | 14,814 | | 15,177 | | 1,448 | | 308 | | 31,747 | |

| (1) | For seismic costs, see Exploration Expenses on page 31 of our Management’s Discussion and Analysis. |

Land and Gross Overriding Royalty Acquisitions

During Fiscal 2003, our investment in land increased by $5.1 million in the following areas: $2.8 million at Cypress/Chowade (9,740 net acres); $1.7 million at Wimborne (5,995 net acres); and $0.6 million at Orion (8,545 net acres).

Also during the year, we invested $6.5 million in the repurchase of certain gross overriding royalty interests (“GORR”) that previously burdened our total current and future corporate production by 3%. The carrying value of the repurchase has been adjusted upward by a non-cash amount of $3.2 million, as required by Canadian GAAP. This non-cash adjustment represents a future tax liability that is created due to the total payment being part shares and part cash. The resulting $9.7 million has been allocated to all properties with proved, producing reserves as of July 7, 2003, the effective date of the repurchase. (For further details of the GORR repurchase, see Note 7[d] to our Financial Statements).

Drilling, Completions, Equipping, Facilities and Pipelining

During Fiscal 2003, expenditures incurred on drilling, completions, equipping, facilities and pipelining totaled $16.6 million. These expenditures were split evenly between Alberta and British Columbia, as follows:

Alberta

St. Albert– A total of six wells were drilled, four targeting crude oil and two targeting natural gas. All wells were successful and each was completed in a single zone. Crude oil completions were in the Nisku D-2 and the Leduc D-3 zones, while natural gas completions were in the Ostracod A pool. Upgrades to field compression, salt water injection facilities and our crude oil tank farm were also conducted.

Wimborne– During the year, we drilled our first-ever tests for natural gas at Wimborne. We drilled two Cretaceous wells, one of which was successful and completed as a standing gas well.

Halkirk– Two development wells targeting natural gas in the Viking zone were drilled during the year. One was successful and completed as a producing well.

British Columbia

Cypress/Chowade– During the year, we participated in drilling three natural gas exploration wells, targeting Triassic-aged reservoirs. All three wells were cased and tied-in. A field compressor was also added.

Nine-Month Fiscal Transition 2002

During this period, we invested $12.6 million, $6.2 million or 49% of which was spent on Alberta properties and $6.4 million or 51% on British Columbia properties. Of the amount invested in Alberta, $5.0 million was for land, drilling, completions, equipping and facilities at St. Albert and the balance of $1.2 million was for drilling, completions and equipping at Halkirk. Of the amount invested in British Columbia, $5.0 million was for drilling, completions and equipping at Cypress/Chowade and the balance of $1.2 million was for land acquisitions at Orion.

27

Fiscal 2002

During this period, we invested $22.1 million, $7.3 million of which was spent at St. Albert for drilling, completions and equipping. The balance of $14.8 million was spent mostly to acquire additional working interests at St. Albert.

Financial Results

Cash Flow from Operations and Net Earnings

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Cash flow from operations was $23.1 million versus $10.8 million. In accounting for the difference of $12.3 million between these two results, there are two variance types:

Variances involving revenue

Our variance analysis table on this page shows greater cash flow from operations in Fiscal 2003 mainly due to:

A volume-based variance of $12.7 million that mainly reflects the reporting periods differed in length by three months; and

A price-based variance of $10.0 million that reflects we realized higher weighted average prices in Fiscal 2003 than in Nine-Month Fiscal Transition 2002.

Variances involving cash expenses

The main expense categories that accounted for $10.4 million lesser cash flows from operations, in Fiscal 2003 were:

- Royalties expense – greater by $7.0 million;

- Production costs – greater by $1.5 million;

- General and administrative expenses – greater by $1.6 million; and

- Net interest expense – greater by $0.3 million.

Net earnings were $5.0 million versus $2.0 million. In accounting for the difference of $3.0 million between these two results, the same variances that affected our cash flows from operations referred to above were further affected by the following:

Variances involving non-cash expenses

- Amortization and depletion expense – greater by $5.7 million;

- Exploration expenses – greater by $2.6 million; and

- Future income taxes and various other expenses – greater by $1.0 million.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Cash flow from operations was $10.8 million versus $11.3 million. In accounting for the difference of $0.5 million between these two results, higher weighted average prices realized in all commodities added $3.0 million. Due mainly to the differing

lengths of the reporting periods, cash flow from operations was less by a net of $3.5 million - $5.3 million that related to the smaller volume of sales and $1.8 million that related to greater royalties expense.

Net earnings were $2.0 million versus a deficit of $3.4 million. In accounting for the difference of $5.4 million between these two results, the same variances that affected our cash flows from operations referred to above were further affected by less non-cash net expenses of $6.1 million as follows: $5.7 million that related to less amortization and depletion expense; $3.3 million that related to less exploration expense; and $2.9 million that related to greater future income tax expense.

The cash and non-cash expense variances discussed in this section reflect mainly the differing lengths of the reporting periods to which we refer. Later in this discussion and analysis, we analyze significant increases and decreases to these expense categories as they relate to the production levels of each period.

Revenue

Revenue Variances by Commodity between the Comparative Periods Presented

| ($ 000’s) | | | | | | | | | | | | |

| | Fiscal 2003 vs | | Nine-Month Fiscal | |

| | Nine-Month Fiscal | | Transition 2002 vs | |

| | Transition 2002 | | Fiscal 2002 | |

| | Volume- | | Price- | | | | Volume- | | Price- | | | |

| | based | | based | | Total | | based | | based | | Total | |

| | | | | | | | | | | | | |

| Natural gas | 4,984 | | 8,607 | | 13,591 | | (6,090 | ) | 2,152 | | (3,943 | ) |

| Natural gas liquids | 1,332 | | 1,302 | | 2,634 | | (737 | ) | 307 | | (430 | ) |

| Crude oil | 6,384 | | 116 | | 6,500 | | 1,573 | | 521 | | 2,094 | |

| Total | 12,700 | | 10,025 | | 22,725 | | (5,259 | ) | 2,980 | | (2,279 | ) |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Revenues were $46.8 million versus $24.1 million, a change of $22.7 million. While much of this change is a result of comparing a twelve-month period to a nine-month period, $12.7 million was due to volume-based variances and $10.0 million was due to price-based variances.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Revenues were $24.1 million versus $26.4 million, a downward net change of $2.3 million. While much of this change is a result of comparing a nine-month period to a twelve-month period, a decrease of $5.3 million was due to volume-based variances and an increase of $3.0 million was due to price-based variances.

28

Daily Average Production Rates and Total Production

Daily Average Production Rates by Commodity and Field, and Total Production For the Comparative Periods Presented

| (Units as stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| Daily average production rates | | | | | | | | | | |

| Natural gas(mcf/d) | | | | | | | | | | |

| St. Albert | 9,936 | | (13 | ) | 11,360 | | (6 | ) | 12,101 | |

| Halkirk | 1,188 | | (13 | ) | 1,368 | | 67 | | 822 | |

| Peavey/Morinville | 504 | | (26 | ) | 678 | | (60 | ) | 1,716 | |

| Other Alberta | 666 | | (13 | ) | 768 | | (55 | ) | 468 | |

| Cypress/Chowade, British Columbia | 756 | | – | | – | | – | | – | |

| Total natural gas (mcf/d) | 13,050 | | (8 | ) | 14,174 | | (6 | ) | 15,107 | |

| Total natural gas (boe/d 6:1) | 2,175 | | (8 | ) | 2,363 | | (6 | ) | 2,518 | |

| Natural gas liquids (bbl/d) | | | | | | | | | | |

| St. Albert | 656 | | (5 | ) | 689 | | 10 | | 627 | |

| Other Alberta | 6 | | (33 | ) | 9 | | 125 | | 4 | |

| Total natural gas liquids (bbl/d) | 662 | | (5 | ) | 698 | | 11 | | 631 | |

| Crude oil (bbl/d) | | | | | | | | | | |

| St. Albert | 609 | | 126 | | 270 | | 275 | | 72 | |

| Other, Saskatchewan | 1 | | – | | 1 | | (75 | ) | 4 | |

| Total crude oil (bbl/d) | 610 | | 125 | | 271 | | 257 | | 76 | |

| Total daily average production (boe/d) | 3,447 | | 3 | | 3,332 | | 3 | | 3,225 | |

| Total production all products (mboe) | 1,258 | | n/m | | 916 | | n/m | | 1,177 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Total production of all products was 1,258 mboe versus 916 mboe. This would have represented an increase of 3%, had Nine-Month Fiscal Transition 2002 been annualized at 1,221 mboe.

Our total daily average production of all commodities increased by 115 boe/d or 3%, to 3,447 boe/d. Of this increase, natural gas and natural gas liquids decreased in aggregate by 224 boe/d or 7%, while crude oil increased by 339 boe/d or 125%. The aggregate decrease in natural gas and natural gas liquids was mostly the net result of a decrease due to natural declines in reservoir pressures at St. Albert and an increase due to the start-up of two new wells at Cypress/Chowade. The increase in average daily crude oil production was due to the start up of two new wells in Fiscal 2003 and of one well in late Nine-Month Fiscal Transition 2002. All three crude oil wells were at St. Albert.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Total daily average production of all products increased by a net 107 boe/d or 3%, to 3,332 boe/d. Of this net increase, natural gas and natural gas liquids decreased in aggregate by 88 boe/d or 3%, while crude oil increased by 195 boe/d or 257%. For the most part, the decrease in natural gas and natural gas liquids was due to naturally declining reservoir pressures at St. Albert. The increase in crude oil was due to the start-up of flush production from a new oil well at St. Albert.

Weighted Average Commodity Prices

Weighted Average Commodity Prices for the Comparative Periods Presented

| (Units as stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| | | | | | | | | | | |

| Natural gas ($/mcf) | 6.56 | | 50 | | 4.36 | | 14 | | 3.81 | |

| Natural gas liquids ($/bbl) | 27.68 | | 32 | | 20.90 | | 8 | | 19.30 | |

| Crude oil ($/bbl) | 42.98 | | 4 | | 41.40 | | 21 | | 34.33 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Our weighted average prices of natural gas, natural gas liquids and crude oil increased by 50%, 32% and 4%, respectively.

At the beginning of Fiscal 2003, stronger industry-wide prices for natural gas reflected an extended period of winter cold and lower inventory supplies in North America. Late in the year, natural gas prices again strengthened due to fears of cold weather in the east. During most of Fiscal 2003, industry-wide prices for crude oil were stronger, due in large measure to continuing geo-political uncertainties and tighter North American supplies. Additionally, demand for crude oil in Asia grew and the relative value of the U.S. dollar declined.

Our natural gas liquids were 45% natural gas-based and 55% crude oil-based, therefore, our weighted average price for liquids followed the respective trends mentioned above.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Weighted average prices realized from the sale of all our commodities increased by percentages ranging from 8% to 21%.

29

Hedging

We have no hedge positions, however, by varying our product sales mix of natural gas, natural gas liquids and crude oil, we manage the potential risk of single-product price volatility. Further, we vary our natural gas sales mix between AECO-spot prices and aggregator-based prices (which are, in turn, based on a blend of AECO-spot, long-term and NYMEX contracts).

Royalties, Mineral Taxes and Royalty Credits

Royalites, Mineral Taxes, Royalty Credits and Unit Total Royalties For the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| | | | | | | | | | | |

| Crown | 4,698 | | n/m | | 1,252 | | n/m | | 1,317 | |

| Freehold and overriding | 6,818 | | n/m | | 3,327 | | n/m | | 4,067 | |

| Freehold mineral taxes | 1,346 | | n/m | | 943 | | n/m | | 1,116 | |

| Royalty tax credit (Alberta) | (401 | ) | n/m | | (178 | ) | n/m | | (159 | ) |

| Royalty drilling credit | | | | | | | | | | |

| (British Columbia) | (122 | ) | – | | – | | – | | – | |

| Total royalties | 12,339 | | n/m | | 5,344 | | n/m | | 6,341 | |

| Unit total royalties per boe($) | 9.81 | | 68 | | 5.83 | | 8 | | 5.39 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Total royalties were $12.3 million versus $5.3 million. This would have represented an increase of 73%, had Nine-Month Fiscal Transition 2002 been annualized at $7.1 million.

Unit royalties expense increased by a net $3.98 or 68%, to $9.81 per boe. The main factors causing increases in unit royalties expense were higher commodity prices and heavier-than-average obligations applied to two new St. Albert oil wells. The main factor causing a decrease in unit royalties was the July 7, 2003 repurchase of gross overriding royalty interests that previously burdened our total current and future corporate production by 3% (see Note 7[d] to our Financial Statements on page 50 for further details).

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Total royalties were $5.3 million versus $6.3 million. This would have represented an increase of 13%, had Nine-Month Fiscal Transition 2002 been annualized at $7.1 million.

Unit royalties expense increased by $0.44 or 8% to $5.83 per boe primarily due to royalty obligations associated with production of prior periods and higher commodity prices.

Production Costs

Production Costs and Unit Production Costs for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| | | | | | | | | | | |

| Production costs | 7,011 | | n/m | | 5,470 | | n/m | | 5,846 | |

| Unit production costs per boe ($) | 5.57 | | (7) | | 5.97 | | 20 | | 4.97 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Total production costs were $7.0 million versus $5.5 million. This would have represented a decrease of 4%, had Nine-Month Fiscal Transition 2002 been annualized at $7.3 million.

Unit production costs decreased by a net of $0.40 or 7%, to $5.57 per boe mainly due to the elimination of monthly processing charges for St. Albert facilities acquired at the close of the prior period, pursuant to a sales and leaseback agreement.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Total production costs were $5.5 million versus $5.8 million. This would have represented an increase of 26%, had Nine-Month Fiscal Transition 2002 been annualized at $7.3 million.

Unit production costs increased by $1.00 or 20%, to $5.97 per boe mainly due to higher costs for electricity, facilities maintenance and field compression charges, most of which were at St. Albert.

30

Amortization and Depletion Expense (A&D)

A&D Expense and Unit A&D Expense for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| A&D before the following: | 11,606 | | n/m | | 5,924 | | n/m | | 5,336 | |

| Ceiling test adjustment | 316 | | 29 | | 445 | | (93 | ) | 6,783 | |

| Depletion of asset retirement cost | 99 | | 57 | | 63 | | (7 | ) | 68 | |

| Amortization of deferred items | – | | – | | (109 | ) | 53 | | (230 | ) |

| Total A&D expense | 12,021 | | n/m | | 6,323 | | n/m | | 11,957 | |

| Unit A&D expense per boe ($) | 9.55 | | 38 | | 6.90 | | (32 | ) | 10.16 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Our total A&D expense was $12.0 million versus $6.3 million. This would have represented an increase of 43%, had Nine-Month Fiscal Transition 2002 been annualized at $8.4 million.

Unit A&D expense increased by a net of $2.65 or 38%, to $9.55 per boe due mainly to the following:

An increase of $1.23 per boe due to higher capital-to-reserve ratios. Most of this increase is for recent crude oil discoveries and natural gas optimizations at St. Albert;

An increase of $0.98 per boe due to additional depletion related to the July 7, 2003 repurchase of gross overriding royalty interests that previously burdened our total current and future corporate production by 3% (see Note 7[d] to our Financial Statements on page 50 for further details); and

An increase of $0.55 per boe due to significant growth in our leasehold base.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Our total A&D expense was $6.3 million versus $12.0 million. This would have represented a decrease of 30%, had Nine-Month Fiscal Transition 2002 been annualized at $8.4 million.

Unit A&D expense decreased by a net of $3.26 or 32%, to $6.90 per boe due primarily to a Peavey/Morinville ceiling test adjustment recorded in Fiscal 2002.

Exploration Expenses

Exploration Expenses and Unit Exploration Expenses for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| Drilling(1) | 1,278 | | n/m | | 325 | | n/m | | 3,821 | |

| Seismic data activity | 2,349 | | n/m | | 934 | | n/m | | 649 | |

| Other | 439 | | n/m | | 187 | | n/m | | 176 | |

| Total exploration expenses | 4,066 | | n/m | | 1,446 | | (n/m | | 4,646 | |

| Unit exploration expenses per boe ($) | 3.23 | | 104 | | 1.58 | | (60) | | 3.95 | |

| (1) | We follow the successful efforts method of accounting, whereby costs of drilling an unsuccessful well are expensed when it becomes known the well did not result in a discovery of proved reserves. |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Total exploration expenses were $4.1 million versus $1.4 million. This would have represented an increase of 116%, had Nine-Month Fiscal Transition 2002 been annualized at $1.9 million.

Unit exploration expenses increased by $1.65 or 104%, to $3.23 per boe. While we recognized one unsuccessful drilling attempt at each of Wimborne and Halkirk, there were none in Nine-Month Fiscal Transition 2002. Costs of seismic data also increased due to the gathering of data at Wimborne, Cypress/Chowade and Orion.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Total exploration expenses were $1.4 million versus $4.6 million. This would have represented a decrease of 59%, had Nine-Month Fiscal Transition 2002 been annualized at $1.9 million.

Unit exploration expenses decreased by $2.37 or 60%, to $1.58 per boe. The main reason for this decrease was that all drilling attempts were successful in Nine-Month Fiscal Transition 2002 compared to a total of ten unsuccessful wells in Fiscal 2002, six at Peavey/Morinville, one each at Quirk Creek, Alexander and Orion, and one reentry/workover at St. Albert.

31

Interest Expense – Net

Net Interest Expense and Unit Net Interest Expense for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| Net interest expense | 713 | | n/m | | 453 | | n/m | | 472 | |

| Unit net interest expense per boe ($) | 0.57 | | 16 | | 0.49 | | 23 | | 0.40 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Net interest was $0.7 million versus $0.5 million. This would have represented minimal change, had Nine-Month Fiscal Transition 2002 been annualized at $0.7 million.

The average daily balance of our bank operating facility increased by $1.8 million or 14%, to $14.3 million, and the closing balance was $13.3 million. The effective interest rates were 5.1% in Fiscal 2003 and 5.0% in Nine-Month Fiscal Transition 2002.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

There was no material variance between periods in our net interest expense because our operating loan was used for nine months in both periods at an average balance outstanding of approximately $12.5 million. The effective interest rates in Nine-Month Fiscal Transition 2002 and Fiscal 2002 were 5.0% and 4.7%, respectively.

General and Administrative Expenses (G&A)

G&A Expenses and Unit G&A Expenses for the Comparative Periods Presented

| ($ 000’s unless otherwise stated) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| G&A expenses | 3,415 | | n/m | | 1,839 | | n/m | | 2,347 | |

| Unit G&A expenses per boe ($) | 2.71 | | 35 | | 2.01 | | (4) | | 1.99 | |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Our G&A expenses were $3.4 million versus $1.8 million. This would have represented an increase of 42%, had Nine-Month Fiscal Transition 2002 been annualized at $2.4 million.

Unit G&A expenses increased by a net $0.70 or 35%, to $2.71 per boe. Of this increase, 40% was due to the first-time recognition of stock-based compensation made available to directors and employees under our corporate stock option plan (see Note 3 to our Financial Statements on page 46 for further details). Other increases were mainly attributed to: new staff hires and certain salary adjustments; computer technical and software support; gas marketing advice; and other essential professional services.

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Our G&A expenses were $1.8 million versus $2.3 million. This would have represented an increase of 4%, had Nine-Month Fiscal Transition 2002 been annualized at $2.4 million. Unit G&A expenses remained relatively unchanged between periods.

Income Tax Expense

We use the liability method of tax allocation in accounting for income taxes. Future tax assets and liabilities are determined based on differences between the financial reporting and tax bases of assets and liabilities, and measured using the substantially-enacted rates and laws that will be in effect when the differences are expected to reverse.

Current and Future Income Tax Expenses (Recoveries) for the Comparative Periods Presented

| ($ 000’s) | | | | | | | | | | |

| | | | | | Nine-Month | | | | | |

| | | | | | Fiscal | | | | | |

| | Fiscal | | | | Transition | | | | Fiscal | |

| | 2003 | | % Chg | | 2002 | | % Chg | | 2002 | |

| Current income tax expense | 632 | | n/m | | 207 | | n/m | | 58 | |

| Future income tax expense | 1,579 | | n/m | | 975 | | n/m | | (1,904 | ) |

| Total income tax expense | 2,211 | | n/m | | 1,182 | | n/m | | (1,846 | ) |

Fiscal 2003 vs Nine-Month Fiscal Transition 2002

Total income tax expense increased to $2.2 million from $1.2 million. This increase was consistent with our pre-tax earnings. Our effective tax rate was 30.9%, which was in line with statutory tax rates.

32

Nine-Month Fiscal Transition 2002 vs Fiscal 2002

Total income tax expense increased to $1.2 million from a recovery of $1.8 million. This increase was consistent with our pre-tax earnings. Our effective tax rate was 37.1%, which was in line with statutory tax rates.

Income Tax Pools Available for Deduction Against Future Taxable Income For the Comparative Periods Presented

| ($ 000’s) | | | | | | | | |

| | | | Nine-Month | | | | | |

| | | | Fiscal | | | | Maximum | |

| | Fiscal | | Transition | | Fiscal | | Annual | |

| | 2003 | | 2002 | | 2002 | | Deduction | |

| | | | | | | | | |

| Canadian exploration expense | – | | 1,586 | | – | | 100% | |

| Canadian development expense | 8,893 | | 5,246 | | 3,772 | | 30% | |

| Undepreciated capital costs | 10,934 | | 10,356 | | 10,297 | | 20% –100% | |