SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| | ¨ | | Preliminary Proxy Statement |

| | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | x | | Definitive Proxy Statement |

| | ¨ | | Definitive Additional Materials |

| | ¨ | | Soliciting Material Under Rule 14a-12 |

Saflink Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

777 108th Avenue NE, Suite 2100

Bellevue, Washington 98004

April 30, 2003

Dear Stockholder:

This year’s annual meeting of stockholders will be held on Thursday, June 5, 2003, at 10:00 a.m. local time, at the Bellevue Hyatt Hotel, 900 Bellevue Way NE, Bellevue, Washington. You are cordially invited to attend.

At the annual meeting, you will be asked to (i) elect five directors to our Board of Directors, and (ii) consider and vote on the ratification of the appointment of KPMG LLP as our independent auditors for 2003.

The Notice of Annual Meeting of Stockholders and a proxy statement, which describe the formal business to be conducted at the meeting, follow this letter.

It is important that you use this opportunity to take part in the affairs of SAFLINK by voting on the business to come before this meeting. After reading the proxy statement, please promptly mark, sign, date and return the enclosed proxy card in the prepaid envelope to assure that your shares will be represented. Regardless of the number of shares you own, your careful consideration of, and vote on, the matters before our stockholders is important.

The Board of Directors unanimously recommends that you voteFOR the election of the nominated directors, andFOR the ratification of KPMG LLP as SAFLINK’s independent auditors for 2003.

A copy of our Annual Report to Stockholders is also enclosed for your information. At the annual meeting we will review our activities over the past year and our plans for the future. The Board of Directors and management look forward to seeing you at the annual meeting.

Sincerely yours,

GLENN L. ARGENBRIGHT

President and

Chief Executive Officer

777 108th Avenue NE, Suite 2100

Bellevue, Washington 98004

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on June 5, 2003

TO THE STOCKHOLDERS OF SAFLINK CORPORATION:

Notice is hereby given that the Annual Meeting of the Stockholders of SAFLINK Corporation, a Delaware corporation, will be held on Thursday, June 5, 2003, at 10:00 a.m. local time, at the Bellevue Hyatt Hotel, 900 Bellevue Way NE, Bellevue, Washington, for the following purposes:

1. To elect five members of the Board of Directors to hold office for a one-year term and until their respective successors are elected and qualified.

2. To ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2003.

3. To transact such other business as may properly come before the annual meeting.

Stockholders of record at the close of business on April 14, 2003 are entitled to notice of, and to vote at, this meeting and any adjournment or postponement. For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 777 108th Avenue NE, Suite 2100, Bellevue, Washington 98004.

By order of the Board of Directors,

Ann M. Alexander

Secretary

Bellevue, Washington

April30, 2003

IMPORTANT: PLEASE FILL IN, DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE ANNUAL MEETING. IF YOU ATTEND THE MEETING, YOU MAY CHOOSE TO VOTE IN PERSON EVEN IF YOU HAVE PREVIOUSLY SENT IN YOUR PROXY CARD.

TABLE OF CONTENTS

777 108th Avenue NE, Suite 2100

Bellevue, WA 98004

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To be held on June 5, 2003

The accompanying proxy is solicited by the Board of Directors of SAFLINK Corporation, a Delaware corporation, for use at its annual meeting of stockholders to be held on June 5, 2003, or any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This proxy statement and the enclosed proxy are being mailed to stockholders on or about May 2, 2003.

SOLICITATION AND VOTING

Voting Securities. Only stockholders of record as of the close of business on April 14, 2003, will be entitled to vote at the meeting and any adjournment thereof. As of that time, we had 25,781,933 shares of common stock outstanding, all of which are entitled to vote with respect to all matters to be acted upon at the annual meeting. Each stockholder of record as of that date is entitled to one vote for each share of common stock held by him or her. Our Bylaws provide that a majority of all of the shares of the stock entitled to vote, whether present in person or represented by proxy, shall constitute a quorum for the transaction of business at the meeting. Votes for and against, abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum.

Broker Non-Votes. A broker non-vote occurs when a broker submits a proxy card with respect to shares held in a fiduciary capacity (typically referred to as being held in “street name”) but declines to vote on a particular matter because the broker has not received voting instructions from the beneficial owner. Under the rules that govern brokers who are voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Routine matters include the election of directors, increases in authorized common stock for general corporate purposes and ratification of auditors.

Solicitation of Proxies. We will bear the cost of soliciting proxies. In addition to soliciting stockholders by mail through our employees, we will request banks, brokers and other custodians, nominees and fiduciaries to solicit customers for whom they hold our stock and will reimburse them for their reasonable, out-of-pocket costs. We may use the services of our officers, directors and others to solicit proxies, personally or by telephone, without additional compensation.

Voting of Proxies. All valid proxies received before the meeting will be exercised. All shares represented by a proxy will be voted, and where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If no choice is indicated on the proxy, the shares will be voted in favor of the proposal. A stockholder giving a proxy has the power to revoke his or her proxy at any time before it is exercised by delivering to the Secretary of SAFLINK a written instrument revoking the proxy or a duly executed proxy with a later date, or by attending the meeting and voting in person.

1

PROPOSAL NO. 1

ELECTION OF DIRECTORS

We currently have a Board of Directors consisting of five directors, who will serve until the annual meeting of stockholders to be held in 2003, and until their respective successors are duly elected and qualified. At each annual meeting of stockholders, directors are elected for a term of one year to succeed those directors whose terms expire at the annual meeting dates.

The terms of our current directors will expire on the date of the upcoming annual meeting. Accordingly, five persons are to be elected to serve as members of the Board of Directors at the meeting. Management’s nominees for election by the stockholders to those five positions are the current members of the Board of Directors, Glenn L. Argenbright, Frank M. Devine, Terry N. Miller, Steven M. Oyer, and Robert M. Smibert. If elected, the nominees will serve as directors until our annual meeting of stockholders in 2004 and until their successors are elected and qualified. If any of the nominees declines to serve or becomes unavailable for any reason, or if a vacancy occurs before the election (although we know of no reason to anticipate that this will occur), the proxies may be voted for such substitute nominees as we may designate.

Vote Required and Board of Directors’ Recommendation

If a quorum is present and voting, the five nominees for director receiving the highest number of votes will be elected as directors. Abstentions and broker non-votes have no effect on the vote.

The Board of Directors unanimously recommends a vote “FOR” the nominees named above.

The following table sets forth, for our current directors, including the nominees to be elected at the 2003 annual meeting of stockholders, information with respect to their ages and background.

Name

| | Position With SAFLINK

| | Age

| | Director Since

|

Glenn L. Argenbright | | Director, President and Chief Executive Officer | | 37 | | 2001 |

Frank M. Devine | | Director | | 60 | | 1997 |

Terry N. Miller | | Director | | 47 | | 2003 |

Steven M. Oyer | | Director | | 47 | | 2001 |

Robert M. Smibert | | Director | | 40 | | 2001 |

Glenn L. Argenbright has served as a director of SAFLINK since February 2001. Mr. Argenbright was appointed Interim Chairman of the Board, President and Chief Executive Officer in June 2001, with such appointments being made permanent by our Board of Directors in December 2001. From November 1999 to December 2000, Mr. Argenbright served as the President and Chief Executive Officer of Jotter Technologies, Inc., a firm whose assets were purchased by us in 2000. From May 1998 to November 1999, Mr. Argenbright served as the President and Chairman of the Board of Spotlight Interactive, Inc., a Web-incubator and venture capital firm. From February 1999 to August 1999, while working for Spotlight, Mr. Argenbright served as a director of and consultant to Today’s Communications Inc., a provider and aggregator of Web content. From May 1998 to February 1999, Mr. Argenbright was a director and Executive Vice President of Intelligent Communications, Inc., a company providing high-speed Internet access over satellite. From April 1997 to April 1998, Mr. Argenbright was a director, President and Chief Executive Officer of Internet Extra Corporation, a Web hosting company which owned and operated certain Web properties. From September 1997 to February 1998, Mr. Argenbright served as President and director of Internet Extra Media Placement (which later changed its name to Mediaplex), an online advertising subsidiary of Internet Extra. From January 1995 to April 1997, Mr. Argenbright served as President of FTM Marketing, a Los Angeles based marketing and promotions agency. Mr. Argenbright has also served on the boards of directors of Internet Presence Providers, Internet Extra, Cardzoo!,

2

ProCheer, and AIR, Inc., and currently serves on the boards of directors of Red Cyclone and StarInsider. Mr. Argenbright received a BA from the University of California at San Diego and a JD from the University of San Diego.

Frank M. Devine has served as a director of SAFLINK since June 1997. Mr. Devine also serves as a business consultant for various entities. Mr. Devine founded Bachmann-Devine, Incorporated, a venture capital firm, and co-founded Shapiro, Devine & Craparo, Inc., a manufacturers’ agency serving the retail industry. Mr. Devine also serves on the boards of directors of these companies. Since December 1994, Mr. Devine has served as a member of the board of directors of Salton, Inc., a publicly owned company that markets and sells electrical appliances to the retail trade under various brand names. Mr. Devine received a BS from Iowa State University.

Terry N. Miller has served as a director of SAFLINK since April 2003. Since May of 2001, Mr. Miller has been Managing Partner of CRM Group LLC, a consulting practice concentrating on customer acquisition and retention services. From April of 1996 to January of 2001, Mr. Miller served in various executive positions for a number of Paul Allen funded companies, including Executive Vice President of Mercata.com from September 1998 to January 2001; Vice President of Sales of Supercede Inc. from June of 1997 to August of 1998, and as Vice President of Direct Sales of Click2Learn.com (formerly Asymetrix Corporation) from April of 1996 to May of 1997. Mr. Miller earned a BA in Journalism from the University of Minnesota.

Steven M. Oyer has served as a director of SAFLINK since December 2001. Mr. Oyer served as our Interim Chief Financial Officer from June 2001 until December 2001. Since October 2001, Mr. Oyer has been Vice President of Standard and Poor’s Investment Services, responsible for global business development. In 2000 and 2001, Mr. Oyer was a principal and Chief Financial Officer of Spotlight Interactive, Inc., a Web-incubator and venture capital firm. From October 1995 to November 2000, Mr. Oyer served as the Vice President Regional Director for Murray Johnstone International Ltd., a Scottish investment firm, where he was responsible for the sale and marketing of international investment management services and private equity in North America.

Robert M. Smibert has served as a director of SAFLINK since February 2001. Mr. Smibert served as our Chief Technology Officer from December 2000 until June 2001. Mr. Smibert, a co-founder of Jotter Technologies, Inc., served as the Chief Technology Officer of that entity from December 1997 until we acquired that company’s assets in 2000. Mr. Smibert also co-founded MindQuake Creations, a web boutique company, and served as its Chief Technology Officer from February 1997 to October 1998. From July 1997 to October 1998, Mr. Smibert was the Information Technology Manager of RedCell Canada, a Canadian battery company. From June 1996 to July 1997, Mr. Smibert owned and served as President of Virgin Technologies, Inc., a software design, development and consulting company.

Board Meetings and Committees

The Board of Directors held eight meetings during the fiscal year ended December 31, 2002. The Board of Directors has an Audit Committee and a Compensation Committee. It does not have a nominating committee or a committee performing the functions of a nominating committee. During the last fiscal year, no director attended fewer than 75% of the total number of meetings of the Board and all of the committees of the Board on which such director served held during that period.

Steven M. Oyer served as the sole member of the Audit Committee during fiscal 2002. Frank M. Devine and Robert M. Smibert were appointed to the Audit Committee in April 2003. Upon Terry N. Miller’s appointment to the Board of Directors, Mr. Smibert resigned his appointment to the Audit Committee, and Mr. Miller was subsequently appointed to that committee. The functions of the Audit Committee include retaining our independent auditors, reviewing their independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our auditors, overseeing their audit work, reviewing and pre-approving any non-audit services that may be performed by them, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party

3

transactions. The Audit Committee did not meet separately from meetings of the Board of Directors during the fiscal year ended December 31, 2002. For additional information concerning the Audit Committee, see“Report of the Audit Committee” and the“Charter of the Audit Committee of the Board of Directors” annexed to this proxy statement.

The members of the Compensation Committee during fiscal 2002 were Frank M. Devine and Robert M. Smibert. The Compensation Committee makes recommendations to the Board of Directors on compensation for our executive officers and other key employees, administers our stock incentive plans and reviews management’s recommendations for stock option grants and other compensation plans or practices. The Compensation Committee did not meet separately from meetings of the Board of Directors during the fiscal year ended December 31, 2002. For additional information about the Compensation Committee, see“Report of the Compensation Committee on Executive Compensation”.

4

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has selected KPMG LLP as independent auditors to audit our consolidated financial statements for the fiscal year ending December 31, 2003. KPMG LLP has acted in such capacity since its appointment in fiscal year 2000. A representative of KPMG LLP is expected to be present at the annual meeting, with the opportunity to make a statement if the representative desires to do so, and is expected to be available to respond to appropriate questions.

Audit and Related Fees

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for 2001 and 2002, and fees billed for other services rendered by KPMG LLP.

| | | 2001

| | 2002

|

Audit Fees | | $ | 109,530 | | $ | 100,800 |

Audit related fees(1) | | $ | 124,579 | | $ | 120,987 |

| | |

|

| |

|

|

| | | $ | 234,109 | | $ | 221,787 |

Audit and audit related fees | | | | | | |

Tax fees(2) | | $ | 20,000 | | $ | 13,000 |

All other fees | | | 0 | | | 0 |

| | |

|

| |

|

|

Total fees | | $ | 254,109 | | $ | 234,787 |

| | |

|

| |

|

|

| (1) | | Audit Related Fees consisted principally of acquisition and other audits, services related to registration statements, financing transactions, issuance of consents, and consultations in connection with accounting and financial reporting matters. |

| (2) | | Tax fees consisted of fees for tax consultation and tax compliance services. |

Annual Independence Discussions

The Audit Committee has determined that the provision by KPMG LLP of non-audit services to SAFLINK Corporation is compatible with KPMG LLP maintaining its independence.

Vote Required and Board of Directors’ Recommendation

Approval of this proposal requires the affirmative vote of a majority of the votes cast affirmatively or negatively on the proposal at the annual meeting of stockholders, as well as the presence of a quorum representing a majority of all outstanding shares of our common stock, either in person or by proxy. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will not have any effect on the outcome of the proposal.

Stockholder ratification of the selection of KPMG LLP as our independent auditors is not required by our Bylaws or otherwise. We are submitting the selection of KPMG LLP to you for ratification as a matter of good corporate practice. In the event the stockholders fail to ratify the selection, the Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, the Board of Directors, in its discretion, may direct the appointment of a different independent auditing firm at any time during the year if the Board of Directors determines that such a change would be in our best interest and the best interest of the stockholders.

The Board of Directors unanimously recommends a vote “FOR” the ratification of KPMG LLP as SAFLINK’s independent auditors for the fiscal year ending December 31, 2003.

5

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 20, 2003, certain information with respect to the beneficial ownership of our common stock by (i) each stockholder known by us to be the beneficial owner of more than 5% of our common stock, (ii) each director and director-nominee, (iii) each executive officer named in the Summary Compensation Table below, and (iv) all of our directors and executive officers as a group.

Name of Beneficial Owner(1)

| | Number of Shares of Common Stock

| | Number of Shares Underlying Convertible Securities(2)

| | Total Number of Shares Beneficially Owned(3)

| | Percent of Common Stock(4)

| |

DMG Advisors LLC (5) One Sound Shore Drive, Ste 202 Greenwich, CT 06830 | | 7,108,945 | | — | | 7,108,945 | | 27.76 | % |

SDS Merchant Fund, L.P. (6) One Sound Shore Drive Greenwich, CT 06830 | | 5,894,989 | | 430,442 | | 6,325,431 | | 24.29 | % |

Palo Alto Investors, LLC (7) 470 University Avenue Palo Alto, CA 94301 | | 276,197 | | 1,568,575 | | 1,844,772 | | 6.79 | % |

Ann M. Alexander | | — | | 110,594 | | 110,594 | | * | |

Glenn L. Argenbright | | — | | 212,511 | | 212,511 | | * | |

Frank M. Devine | | — | | 257,091 | | 257,091 | | * | |

Walter G. Hamilton | | — | | 128,650 | | 128,650 | | * | |

Gregory C. Jensen | | — | | 134,792 | | 134,792 | | * | |

Terry N. Miller | | — | | 3,000 | | 3,000 | | * | |

Steven M. Oyer | | — | | 120,726 | | 120,726 | | * | |

Robert M. Smibert (8) | | 616,160 | | 132,868 | | 749,028 | | 2.91 | % |

Directors and executive officers

as a group (10 persons) | | 616,160 | | 1,160,947 | | 1,777,107 | | 6.64 | % |

Former Officer Joshua M. Grantz (9) | | 120,286 | | 159,286 | | 279,572 | | 1.08 | % |

| (1) | | Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of our common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table. |

| (2) | | Under the rules of the Securities and Exchange Commission, a person is deemed to be the beneficial owner of shares that can be acquired by such person within 60 days after March 20, 2003, upon the exercise of options or warrants or upon conversion of securities convertible into common stock. |

| (3) | | Represents the aggregate number of shares beneficially owned by each stockholder. |

| (4) | | Calculated on the basis of 25,612,558 shares of common stock outstanding as of March 20, 2003, provided that any additional shares of common stock that a stockholder has the right to acquire within 60 days after March 20, 2003 are deemed to be outstanding for the purpose of calculating that stockholder’s percentage beneficial ownership. |

| (5) | | Based on a Schedule 13G filed by DMG Advisors LLC, DMG Legacy International Ltd., and DMG Legacy Institutional Fund LLC with the SEC on February 18, 2003. DMG Advisors is the managing member of each of the following, and has shared power to vote and shared dispositive power with respect to 3,607,987 shares held by DMG Legacy International Ltd., 3,025,466 shares held by DMG Legacy Institutional Fund, and 475,492 shares held by DMG Legacy Fund. |

| (6) | | Based on a Schedule 13D filed by SDS Merchant Fund, L.P. with the SEC on February 18, 2003. SDS Capital Partners, L.L.C. is the sole general partner of SDS Merchant Fund and has shared power to vote and dispositive power with respect to all of the shares reported. Steven Derby is the sole managing member of SDS Capital Partners and has shared power to vote and dispositive power with respect to all of the shares reported. SDS Management, LLC, an affiliate of SDS Merchant Fund, L.P., has acted as an adviser to S.A.C. Capital Associates, LLC. Based on a Schedule 13G filed by S.A.C. Capital Advisors, LLC; S.A.C. Capital Management, LLC; and Steven A. Cohen with the SEC on December 31, 2002, S.A.C. Capital Associates, LLC, an Anguillan limited liability company owns 657,144 shares of common stock. Pursuant to investment agreements, each of SAC Capital Advisors and SAC Capital Management share |

6

| | investment and voting power with respect to the securities held by SAC Capital Associates. Mr. Cohen is the President and Chief Executive Officer of SAC Capital Advisors, the Managing Member of which is a corporation wholly owned by Mr. Cohen. Mr. Cohen is also the owner, directly and through a wholly-owned subsidiary, of all of the membership interests of SAC Capital Management. Mr. Cohen disclaims beneficial ownership of the securities held by SAC Capital Associates. SDS Management, LLC, an affiliate of SDS Merchant Fund, L.P., has acted as an adviser to S.A.C. Capital Associates, LLC. |

| (7) | | Based on a Schedule 13D filed by Palo Alto Investors, LLC and Micro Cap Partners, L.P. with the SEC on April 24, 2003. Includes 1,159,105 shares owned by Micro Cap Partners, L.P. Palo Alto Investors is an investment advisor registered with the SEC and is the general partner of and investment advisor to Micro Cap Partners and other investment limited partnerships. The sole manager of Palo Alto Investors, LLC is Palo Alto Investors Corporation. William Leland Edwards is the President and controlling shareholder of Palo Alto Investors Corporation and the principal member of Palo Alto Investors. Palo Alto Investors LLC is the general partner of Micro Cap Partners, L.P. pursuant to an Agreement of Limited Partnership that grants Palo Alto Investors LLC the authority among other things, to invest the funds of Micro Cap Partners, L.P., to vote and dispose of the shares of SAFLINK common stock held by Micro Cap Partners, L.P. Micro Cap Partners L.P. disclaims beneficial ownership of any shares held by Palo Alto Investors LLC. |

| (8) | | Includes 616,160 shares held by Jotter Technologies, Inc. Robert M. Smibert, jointly with his spouse, owns 25% of Jotter’s common stock and serves as Jotter’s Managing Director. Mr. Smibert disclaims beneficial ownership of the shares of our common stock owned by Jotter, except to the extent of his pecuniary interest in such shares. |

| (9) | | Mr. Grantz’s employment was terminated effective as of March 14, 2003, pursuant to the terms of a Confidential Separation Agreement and General Release of Claims. Pursuant to the terms of our 2000 Stock Incentive Plan, all of his vested but unexercised options were accelerated upon his date of termination. See“Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

Executive Officers

Our executive officers are generally elected annually at the meeting of our Board of Directors held in conjunction with the annual meeting of stockholders. The following are our executive officers and their ages as of March 20, 2003:

Name

| | Office

| | Age

| | Position Since

|

Glenn L. Argenbright | | President and Chief Executive Officer | | 37 | | 2001 |

Ann M. Alexander | | Chief Operating Officer and Corporate Secretary | | 56 | | 2001 |

Todd S. Dewey | | Senior Vice President of Sales and Marketing(1) | | 44 | | 2003 |

Jon C. Engman | | Chief Financial Officer(2) | | 39 | | 2002 |

Walter G. Hamilton | | Vice President of Business Development | | 59 | | 2000 |

Gregory C. Jensen | | Chief Technology Officer | | 35 | | 2000 |

| (1) | | Mr. Dewey was appointed Senior Vice President of Sales and Marketing in March 2003, following the termination of Joshua M. Grantz, who previously served as Vice President of Sales. |

| (2) | | Mr. Engman was appointed Chief Financial Officer in April 2002. |

The following sets forth the business experience, principal occupations and employment of each of our current executive officers who do not serve on the board (see above for such information with respect to Mr. Argenbright):

Ann M. Alexander joined SAFLINK in October 2000 as Vice President of Operations and was appointed Corporate Secretary in June 2001 and then Chief Operating Officer in August 2001. Ms. Alexander was Director of Operations at vJungle.com from November 1999 to March 2000 and Director of Operations and Support at Continuex from October 1998 to June 1999. From May 1997 to September 1998, she was Regional Human Resource Manager with Starbucks Coffee Company and Project Manager in Customer Operations at AT&T Wireless Service from May 1996 to April 1997. Ms. Alexander was also a principal in TMR, Inc., a Washington corporation providing consulting on human resources and organizational change management. From August 1987 to May 1995, she was a Senior Manager of Customer Account Services at US West NewVector Group, Inc. Ms. Alexander received a MA in Organizational Design and Effectiveness from the Fielding Institute, Santa Barbara, California.

Todd S. Dewey joined SAFLINK in March 2003 as Senior Vice President of Sales and Marketing. From June 2002 to March 2003, he was Vice President of Global Sales for People Support, Inc., a supplier of customer care, sales and marketing solutions to Fortune 500 companies. From June 2001 to June 2002, Mr. Dewey was employed by Xelus, Inc. as Vice President of Sales, Western Americas. Before joining Xelus, he served as

7

Director of Sales, Western Americas for Matrixone, Inc., from February 2000 to June 2001. From December 1992 to February 2000, Mr. Dewey served in various management positions for J.D. Edwards & Co., including Branch Manager and Senior Account Executive. Mr. Dewey earned a BS in Business Management and Product Marketing from Cornell University.

Jon C. Engman joined SAFLINK in April 2002 as Chief Financial Officer. Mr. Engman served as a consultant to SAFLINK from February 2002 to April 2002. From September 2000 to April 2001, Mr. Engman served as Interim Chief Financial Officer for two companies (iAsiaWorks and ReFlex Communications) in the respective portfolios of the Sprout Group and Enterprise Partners. From 1996 through September 2000, Mr. Engman served in various management positions for a number of Paul Allen funded companies, including as Vice President Finance & Administration at Mercata.com from September 1998 through August 2000; Vice President of Finance & Operations of Supercede, Inc. from July 1997 to August 1998; and as Corporate Controller of Click2Learn.com (formerly Asymetrix, Inc.) from October 1996 to June 1997. From 1990 to 1996, Mr. Engman was Corporate Controller of Captaris (formerly AVT Corporation). Mr. Engman earned his BA in Business Administration, with a concentration in accounting, from the University of Washington.

Walter G. Hamilton joined SAFLINK in December 1995 as Director of Business Development. Mr. Hamilton served as Vice President of Sales and Marketing from August 1999 through August 2000. In September, 2000, Mr. Hamilton was appointed Vice President of Business Development. Prior to joining SAFLINK, Mr. Hamilton was employed by Unisys Corporation and its successor, Loral Corporation, for 34 years. He served as Director of Business Development for the worldwide postal automation business segment, after holding various sales management and product management related assignments with both domestic and international responsibilities. Mr. Hamilton received a BS in Business Administration from the University of Southern Mississippi.

Gregory C. Jensen joined SAFLINK in August 1992 and has served as Chief Systems Engineer, Director of Technical Services, Vice President of Engineering, and is currently Chief Technology Officer. The Board appointed him as a corporate officer of SAFLINK in March 2000. Prior to joining SAFLINK, Mr. Jensen was a member of the Technical Staff of TRW, Inc., involved in the research and development of image processing, signal processing, high volume data storage, and high bandwidth data communication technologies. Mr. Jensen received a BS in Electrical Engineering from California Institute of Technology.

8

EXECUTIVE COMPENSATION AND OTHER MATTERS

Executive Compensation

The following table sets forth information concerning the compensation of our chief executive officer and our four other most highly compensated executive officers, during the fiscal years ended December 31, 2000, 2001 and 2002.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | Long Term Compensation

| | | |

| | | Annual Compensation

| | Awards

| | | |

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | | Other Annual Compensation

| | Shares Underlying Options

| | All Other Compensation

| |

Glenn L. Argenbright(1) President and Chief Executive Officer | | 2002 2001 2000 | | $

| 204,283

58,846

— | | $ | — 5,000 — | (2) | | $ | — — — | | 217,665 44,287 — | | $ | — — — | |

|

Ann M. Alexander Chief Operating Officer and Secretary | | 2002 2001 2000 | | | 159,443 145,000 27,885 | | | — — — | | | | — — — | | 246,000 38,572 14,286 | | | — — 11,400 | (3) |

|

Joshua M. Grantz(4) Vice President of Sales | | 2002 2001 2000 | | | 120,840 18,462 — | | | — 4,000 — | (5) | | | — — — | | 231,000 30,000 — | | | — — — | |

|

Walter G. Hamilton Vice President of Business Development | | 2002 2001 2000 | | | 154,619 145,000 145,000 | | | — — — | | | | — — — | | 231,000 38,572 7,207 | | | — — 25,261 | (6) |

|

Gregory C. Jensen Vice President of Engineering | | 2002 2001 2000 | | | 151,327 150,000 135,808 | | | — — — | | | | — — — | | 231,000 38,572 7,112 | | | — — — | |

| (1) | | Mr. Argenbright was appointed Interim President and Chief Executive Officer in June 2001, with such appointment being made permanent by our Board of Directors in December 2001. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

| (2) | | Mr. Argenbright received this bonus pursuant to signing of his Employment Agreement. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

| (3) | | Represents compensation for consulting services prior to October 2000, when Ms. Alexander was appointed as Vice President of Operations. |

| (4) | | Mr. Grantz’s employment was terminated effective as of March 14, 2003, pursuant to the terms of a Confidential Separation Agreement and General Release of Claims. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

| (5) | | Represents a signing bonus paid to Mr. Grantz. |

| (6) | | Represents reimbursement of relocation expenses paid to Mr. Hamilton. |

9

Stock Options Granted in Fiscal 2002

The following table provides information concerning grants of options to purchase shares of our common stock made during the fiscal year ended December 31, 2002, to the persons named in the Summary Compensation Table:

OPTION GRANTS IN LAST FISCAL YEAR

| | | Individual Grants

| | | | |

Name

| | Number of Shares Underlying Options Granted(2)

| | | % of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price Per Share(3)

| | Expiration Date

| | Potential Realized Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1)

|

| | | | | | 5%

| | 10%

|

Glenn L. Argenbright | | 217,665 | | | 5.5 | % | | $ | 1.07 | | 2/11/2012 | | $ | 146,471 | | $ | 371,185 |

Ann M. Alexander | | 246,000 | | | 6.3 | % | | | 1.07 | | 2/11/2012 | | | 165,538 | | | 419,505 |

Joshua M. Grantz | | 231,000 | (4) | | 5.9 | % | | | 1.07 | | 2/11/2012 | | | 155,443 | | | 393,925 |

Walter G. Hamilton | | 231,000 | | | 5.9 | % | | | 1.07 | | 2/11/2012 | | | 155,443 | | | 393,925 |

Gregory C. Jensen | | 231,000 | | | 5.9 | % | | | 1.07 | | 2/11/2012 | | | 155,443 | | | 393,925 |

| (1) | | Potential gains are net of exercise price, but before taxes associated with exercise. These amounts represent certain assumed rates of appreciation only, based on SEC rules, and therefore are not intended to forecast possible future appreciation, if any, in our stock price. Actual gains, if any, on stock option exercises are dependent on the future performance of our common stock, overall market conditions and the option holders’ continued employment through the vesting period. The amounts reflected in this table may not necessarily be achieved. |

| (2) | | All options were granted pursuant to the 2000 Stock Incentive Plan. Options granted under the 2000 Stock Incentive Plan generally become vested on a monthly basis over a 36-month period, but are not exercisable until optionee has been employed with us for nine months, and they remain exercisable subject to the optionee’s continuous employment with us. Under the 2000 Stock Incentive Plan, the Board retains discretion to modify the terms, including the prices, of outstanding options. |

| (3) | | All options were granted at market value on the date of grant. |

| (4) | | Mr. Grantz’s employment was terminated effective as of March 14, 2003, pursuant to the terms of a Confidential Separation Agreement and General Release of Claims. Pursuant to the terms of our 2000 Stock Incentive Plan, all of his vested but unexercised options were accelerated upon his date of termination.See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

10

Option Exercises and Fiscal 2002 Year-End Values

The following table provides information concerning exercises of options to purchase shares of our common stock during the fiscal year ended December 31, 2002, and unexercised options held as of December 31, 2002, by the persons named in the Summary Compensation Table.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END VALUES

| | | | | | | Number of Shares Underlying Unexercised Options at Fiscal Year End

| | Value of Unexercised In-the- Money Options at Fiscal Year End (1)

|

Name

| | Shares Acquired on Exercise

| | Value Realized

| | Exercisable(2)

| | Unexercisable

| | Exercisable (2)

| | Unexercisable

|

Glenn L. Argenbright(3) | | — | | $ | — | | 114,264 | | 147,688 | | $ | 327,783 | | $ | 440,976 |

Ann M. Alexander(4) | | 25,000 | | | 37,290 | | 72,142 | | 201,716 | | | 183,604 | | | 602,731 |

Joshua M. Grantz (5) | | — | | | — | | 75,832 | | 185,168 | | | 227,846 | | | 563,974 |

Walter G. Hamilton(6) | | 20,000 | | | 58,800 | | 89,879 | | 188,523 | | | 186,203 | | | 568,932 |

Gregory C. Jensen(7) | | — | | | — | | 96,957 | | 188,492 | | | 248,603 | | | 568,932 |

| (1) | | Based on a market value of $4.19, the last reported sale of our common stock on the OTC Bulletin Board on December 31, 2002. |

| (2) | | Except as described in footnotes below, all options were granted pursuant to the 2000 Stock Incentive Plan. Options granted under the 2000 Stock Incentive Plan generally become vested on a monthly basis over a 36-month period, but are not exercisable until optionee has been employed with us for nine months, and they remain exercisable subject to the optionee’s continuous employment with us. Under the 2000 Stock Incentive Plan, the Board retains discretion to modify the terms, including the prices, of outstanding options. |

| (3) | | Includes 5,714 exercisable and 2,858 unexercisable options granted under the 1992 Stock Incentive Plan. |

| (4) | | Includes 9,524 exercisable and 4,762 unexercisable options granted under the 1992 Stock Incentive Plan. |

| (5) | | Mr. Grantz’s employment was terminated effective as of March 14, 2003, pursuant to the terms of a Confidential Separation Agreement and General Release of Claims. Pursuant to the terms of our 2000 Stock Incentive Plan, all of his vested but unexercised options were accelerated upon his date of termination. See “Employment Contracts and Termination of Employment and Change-in-Control Arrangements.” |

| (6) | | Includes 24,760 exercisable and 2,402 unexercisable options granted under the 1992 Stock Incentive Plan. |

| (7) | | Includes 13,029 exercisable and 2,371 unexercisable options granted under the 1992 Plan. |

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

In June 2001, we entered into an Employment Agreement with Glenn L. Argenbright, our President and Chief Executive Officer. The agreement provided for the payment to Mr. Argenbright of an initial $100,000 minimum base annual salary, a $5,000 signing bonus, and a $100,000 bonus based on the achievement of certain objectives. Pursuant to the agreement, Mr. Argenbright was granted an option under the 2000 Stock Incentive Plan to purchase 35,715 shares of our common stock, vesting in three equal increments on an annual basis. In the event of a sale, change of control or merger, or a termination of Mr. Argenbright’s employment with us, his options will fully vest and become immediately exercisable. Mr. Argenbright is also entitled to receive the equivalent of three months’ base salary if his employment with us is terminated for any reason other than cause or if the Board of Directors appoints someone else to the position of Chief Executive Officer. On February 11, 2002, the Board of Directors approved certain modifications to Mr. Argenbright’s compensation, including an increase in his base salary to $175,000 effective as of January 1, 2002, an option under the 2000 Stock Incentive Plan to purchase 217,665 shares of our common stock at an exercise price of $1.07 per share, a salary advance of $20,000, and certain potential cash bonuses tied to our performance and targeted revenue objectives. In December 2002, upon the recommendation of the Compensation Committee, our Board of Directors approved an increase in Mr. Argenbright’s base annual compensation to $216,000, which increase provided for an initial lump

11

sum payment of $27,460. In February 2003, upon the recommendation of the Compensation Committee, the Board of Directors approved certain additional modifications to Mr. Argenbright’s compensation, including a $12,000 increase in Mr. Argenbright’s annual base compensation to $228,000, and a non-qualified stock option grant to Mr. Argenbright to purchase 436,120 shares of our common stock, pursuant to the terms of our 2000 Stock Incentive Plan, at an exercise price of $4.00 per share.

On April 14, 2000, we entered into an Employment Agreement with Walter G. Hamilton, our Vice President of Business Development. The agreement provided for the payment to Mr. Hamilton of an initial annual salary of $145,000. In accordance with the terms of the agreement, Mr. Hamilton’s employment with us is “at will” and he may terminated at anytime with or without cause.

On April 14, 2000, we entered into an Employment Agreement with Gregory C. Jensen, our Chief Technology Officer. The agreement provided for the payment to Mr. Jensen of an initial annual salary of $138,000. In accordance with the terms of the agreement, Mr. Jensen’s employment with us is “at will” and he may terminated at anytime with or without cause.

On October 16, 2000, we entered into an Employment Agreement with Ann M. Alexander, our Chief Operating Officer. The agreement provides for the payment to Ms. Alexander of an initial annual salary of $145,000. Pursuant to the agreement, Ms. Alexander was also granted an option to purchase 14,286 shares of our common stock. In accordance with the terms of the agreement, Ms. Alexander’s employment with us is “at will” and she may terminated at anytime with or without cause.

On October 29, 2001, we entered into an Employment Agreement with Joshua M. Grantz, our former Vice President of Sales. The agreement provided for the payment to Mr. Grantz of an initial annual salary of $120,000. Pursuant to the agreement, Mr. Grantz was also granted an option to purchase 30,000 shares of our common stock. Mr. Grantz’s employment was terminated effective as of March 14, 2003, pursuant to the terms of a Confidential Separation Agreement and General Release of Claims. Pursuant to the terms of our 2000 Stock Incentive Plan, all of his vested but unexercised options were accelerated upon his date of termination.

On April 30, 2002, we entered into an Employment Agreement with Jon C. Engman, our Chief Financial Officer. The agreement provides for the payment to Mr. Engman of an initial annual salary of $140,000. Pursuant to the agreement, Mr. Engman was also granted an option to purchase 182,000 shares of our common stock. In accordance with the terms of the agreement, Mr. Engman’s employment with us is “at will” and he may terminated at anytime with or without cause.

On March 5, 2003, we entered into an Employment Agreement with Todd S. Dewey, our Senior Vice President of Sales & Marketing. The agreement provides for the payment to Mr. Dewey of an initial annual salary of $190,000. Pursuant to the agreement, Mr. Dewey was also granted an option to purchase 125,000 shares of our common stock. In accordance with the terms of the agreement, Mr. Dewey’s employment with us is “at will” and he may terminated at anytime with or without cause.

In addition to the employment arrangements described above, on October 31, 2002, we entered into Retention Agreements with each of Ann M. Alexander, our Chief Operating Officer; Jon C. Engman, our Chief Financial Officer; Gregory C. Jensen, our Chief Technology Officer; and Walter G. Hamilton, our Vice President of Business Development. These Retention Agreements provide as follows: If the employee is terminated as a result of an involuntary termination(as defined in the Retention Agreements), then he/she shall be entitled to receive the compensation, accrued but unused vacation and benefits earned through the date of termination of employment; and severance payments equal to four months salary, payable in accordance with our standard payroll practices. However, if the employee is terminated as a result of an involuntary termination within two months prior to, upon or within twelve months following a change of control, then he/she will be entitled to receive the following: (a) the compensation, accrued but unused vacation and benefits earned through the date of termination; (b) severance payments equal to four months salary, payable in a lump sum within thirty days of the date of termination; (c) vesting of 100% of any unvested options as of the date of termination; (d) for a period of

12

up to twelve months after the date of termination, reimbursement of any COBRA premiums paid by the employee for continued group health insurance coverage of employee and his/her dependents; and (e) the employee will be entitled to receive the laptop or other portable computer device used by the employee, if any, as of the date of termination.

Equity Compensation Plan Information

We currently maintain two compensation plans that provide for the issuance of our common stock to officers and other employees, directors and consultants. These consist of our 1992 Stock Incentive Plan and our 2000 Stock Incentive Plan, each of which has been approved by stockholders. The following table sets forth information regarding outstanding options and shares reserved for future issuance under the foregoing plans as of December 31, 2002:

Plan Category

| | Number of shares to be issued upon exercise of outstanding options, warrants and rights (a)

| | Weighted-average exercise price of outstanding options, warrants and rights (b)

| | Number of shares remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) (c)

|

Equity compensation plans approved by stockholders(1) | | 5,089,826 | | $ | 1.77 | | 2,698,271 |

Total | | 5,089,826 | | | | | 2,698,271 |

| (1) | | Includes 2,698,271 shares that are reserved for issuance under the 2000 Stock Incentive Plan. The shares that are reserved for issuance under the 2000 Stock Incentive Plan are subject to automatic increase on January 1 of each during the term of the 2000 Stock Incentive Plan; the number of shares that may be optioned and sold under the plan is increased such that the maximum number of shares available to be optioned and sold under the plan is equal to the lesser of (i) 15,000,000 shares of our common stock or (ii) 20% of the number of shares of our common stock (on an as converted basis) outstanding on the immediately preceding December 31. On December 31, 2002, there were 22,942,286 shares of common stock outstanding (on an as converted basis). There are no shares available for grant under the 1992 Stock Incentive Plan. |

Compensation of Directors

Each of our non-employee directors is reimbursed for reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors. Non-employee directors receive fees of $1,000 for each board meeting attended in person, and fees of $500 for each board meeting attended telephonically.

13

Upon election to the Board of Directors, each new non-employee director receives an option to purchase an aggregate number of shares of our common stock under our 2000 Stock Incentive Plan determined by the formula: X = (3,000)(12-Y); where X = the aggregate number of shares issuable upon exercise of such option, and Y = the number of full months elapsed since the most recent annual meeting of our stockholders; at an exercise price equal to the fair market value on the date of grant, which grant will become exercisable in equal monthly installments over the period defined as (12-Y) following the date of grant if such individual is still serving as a director at such time.

Each non-employee director also receives an option to purchase 36,000 shares of our common stock under the 2000 plan on the date of our annual meeting of stockholders, at an exercise price equal to the fair market value on such date, which grant becomes exercisable in twelve equal monthly installments following the date of grant if such person is still serving as a director at such time.

From 1996 through 1998, Frank M. Devine was granted options to purchase a total of 47,382 shares of our common stock under our 1992 Stock Incentive Plan in connection with his service as a director. Mr. Devine was granted a fully vested option to purchase 11,429 shares of our common stock on May 21, 2001, as an incentive to continue as a member of the Board of Directors following completion of a financing and the subsequent management changes. Mr. Devine’s option grant was made under the 2000 plan. In addition, on February 11, 2002, Mr. Devine was granted a fully vested option under the 2000 plan to purchase 65,412 shares of our common stock at an exercise price of $1.07 per share. In connection with the establishment of the compensation for non-employee directors described above, on April 30, 2002, Mr. Devine, Steven M. Oyer and Robert M. Smibert were each granted fully vested options under the 2000 plan to purchase 100,000 shares of our common stock at an exercise price of $1.25 per share. In addition, on April 30, 2002, Mr. Smibert was granted a fully vested option under the 2000 plan to purchase 50,000 shares of our common stock at an exercise price of $1.25 per share.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

Frank M. Devine and Robert M. Smibert served on the Compensation Committee of the Board of Directors for the past fiscal year. Mr. Devine is the Chairman of the Compensation Committee. During fiscal 2002, the full Board, including Glenn L. Argenbright, our President and Chief Executive Officer, deliberated on compensation decisions.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Certain Relationships and Related Transactions

Glenn L. Argenbright, our President, Chief Executive Officer and Chairman of the Board, served as President and Chief Executive Officer of Jotter Industries, Inc. from December 1999 until June 2001. Robert M. Smibert, a director, jointly with his spouse owns approximately 25% of Jotter’s common stock.

Mr. Argenbright purchased 32 shares of Series E preferred stock and a Series A warrant to purchase 4,572 shares of our common stock June 2001 for an aggregate purchase price of $6,400. Margaret Argenbright, Mr. Argenbright’s mother, purchased 50 shares of our Series E preferred stock and a Series A warrant to purchase 7,143 shares of common stock in June 2001 for an aggregate purchase price of $10,000. Messrs. Argenbright and Oyer were both directors of Spotlight Interactive, Inc., which purchased 375 shares of our Series E preferred stock and a Series A warrant to purchase 53,572 shares of our common stock in June 2001 for an aggregate purchase price of $75,000. In addition, Ken Wilton, Chairman of the Board of Jotter Industries, Inc., purchased 135 shares of our Series E preferred stock and a Series A warrant to purchase 19,286 shares of our common stock in June 2001 for an aggregate purchase price of $27,000.

14

In January 2002, we issued 238,588 shares to Jotter Technologies Inc. pursuant to our agreement to issue these shares in exchange for cancellation of the convertible long-term note payable issued to Jotter as partial consideration for the intellectual property and fixed assets acquired from that entity in December 2000, for which we received stockholder approval.

On February 11, 2002, the Board of Directors approved certain modifications to Mr. Argenbright’s compensation, including an increase in his base salary to $175,000 effective as of January 1, 2002, an option under the 2000 Stock Incentive Plan to purchase 217,665 shares of our common stock at an exercise price of $1.07 per share, a salary advance of $20,000, and certain potential cash bonuses tied to our performance and targeted revenue objectives. In December 2002, upon the recommendation of the Compensation Committee, our Board of Directors approved an increase in Mr. Argenbright’s base annual compensation to $216,000, which increase provided for an initial lump sum payment of $27,460. In February 2003, upon the recommendation of the Compensation Committee, the Board of Directors approved certain additional modifications to Mr. Argenbright’s compensation, including a $12,000 increase in Mr. Argenbright’s annual base compensation to $228,000, and a non-qualified stock option grant to Mr. Argenbright to purchase 436,120 shares of our common stock, pursuant to the terms of our 2000 Stock Incentive Plan, at an exercise price of $4.00 per share.

DMG Advisors LLC, a holder of more than 5% of our common stock, together with its affiliated entities, purchased 3,333,334 shares of common stock and warrants to purchase 1,666,668 shares of common stock in June 2002 for an aggregate purchase price of approximately $5 million.

SDS Merchant Fund, LP, a holder of more than 5% of our common stock purchased 717,404 shares of common stock and warrants to purchase 358,702 shares of common stock in November 2002 for an aggregate purchase price of approximately $1.8 million.

In addition to the employment arrangements described above, on October 31, 2002, we entered into Retention Agreements with each of Ann M. Alexander, our Chief Operating Officer; Jon C. Engman, our Chief Financial Officer; Gregory C. Jensen, our Chief Technology Officer; and Walter G. Hamilton, our Vice President of Business Development. These Retention Agreements provide as follows: If the employee is terminated as a result of an involuntary termination (as defined in the Retention Agreements), then he/she shall be entitled to receive the compensation, accrued but unused vacation and benefits earned through the date of termination of employment; and severance payments equal to four months salary, payable in accordance with our standard payroll practices. However, if the employee is terminated as a result of an involuntary termination within two months prior to, upon or within twelve months following a change of control, then he/she will be entitled to receive the following: (a) the compensation, accrued but unused vacation and benefits earned through the date of termination; (b) severance payments equal to four months salary, payable in a lump sum within thirty days of the date of termination; (c) vesting of 100% of any unvested options as of the date of termination; (d) for a period of up to twelve months after the date of termination, reimbursement of any COBRA premiums paid by the employee for continued group health insurance coverage of employee and his/her dependents; and (e) the employee will be entitled to receive the laptop or other portable computer device used by the employee, if any, as of the date of termination.

15

On March 13, 2003, the receiver for Alex Jones, Ltd., an alleged creditor of Jotter Technologies, Inc., filed a civil complaint in United States District Court of Utah against Jotter Technologies and us. The complaint alleges breach of contract and judgment on a promissory note against Jotter in connection with a promissory note executed by Jotter and delivered to Alex Jones, Ltd., and unjust enrichment, fraudulent conveyance and declaratory judgment against all parties in connection with our purchase of substantially all of the intellectual property and fixed assets of Jotter in December 2000. The complaint seeks relief from Jotter in the amount of $800,000 in principal and approximately $163,333 in interest on the promissory note, including attorneys’ fees and costs. The complaint also seeks unspecified monetary and equitable relief against Jotter and us. We believe that Jotter has the obligation to indemnify us for any claims or losses in connection with the asset purchase pursuant to the terms of the asset purchase agreement between Jotter and us, and we have demanded such indemnification from Jotter.

On March 14, 2003, we entered into a Confidential Separation Agreement and General Release of Claims with Joshua M. Grantz, our former Vice President of Sales. Pursuant to the terms of our 2000 Stock Incentive Plan, all of his vested but unexercised options were accelerated upon his date of termination. Immediately prior to the date of his termination, Mr. Grantz held unvested options to purchase 164,251 shares of our common stock.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of such forms furnished to us and written representations from certain reporting persons, we believe that all filing requirements applicable to our executive officers, directors and greater-than-10% stockholders were complied with, except that Todd S. Dewey, our Vice President of Sales, filed one late report with respect to one transaction, DMG Advisors LLC filed one late report with respect to one transaction, and Palo Alto Investors, LLC filed one late report with respect to one transaction.

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors is comprised of non-employee members of our Board of Directors. The members of the Compensation Committee during fiscal 2002 were Frank M. Devine and Robert M. Smibert. The Compensation Committee sets the salary and bonus earned by the Chief Executive Officer, reviews and approves salary and bonus criteria for other executive officers, and approves stock option grants to executive officers.

The goals of our executive officer compensation policies are to attract, retain and reward executive officers who contribute to our success, to align executive officer compensation with our performance and to motivate executive officers to achieve our business objectives. We use salary, bonus compensation, option grants, SARs, performance share awards and restricted stock awards to attain these goals.

We strongly believe that equity ownership by executive officers provides incentives to build stockholder value and aligns the interests of executive officers with those of the stockholders, and therefore we make periodic grants of stock options under our stock incentive plans. The size of an option grant to an executive officer has generally been determined with reference to competitive practice, the responsibilities and expected future contributions of the executive officer, previous grants to that officer, as well as recruitment and retention considerations.

16

Mr. Argenbright was appointed as Interim President and Chief Executive Officer in June 2001, with such appointment being made permanent in December 2001. Mr. Argenbright’s compensation was established considering his contacts and experience in our industry and with our potential customers and suppliers, as well as our cash flow position and prospects for raising additional cash. Following the appointment as our President and Chief Executive Officer in December 2001, Mr. Argenbright’s compensation remained as set in June 2001. On February 11, 2002, based on the recommendation of the Compensation Committee, the Board of Directors approved certain modifications to Mr. Argenbright’s compensation, including an increase in his base salary to $175,000 effective as of January 1, 2002, an option under the 2000 Stock Incentive Plan to purchase 217,665 shares of our common stock at an exercise price of $1.07 per share, a salary advance of $20,000, and certain potential cash bonuses tied to our performance and targeted revenue objectives. In December 2002, upon the recommendation of the Compensation Committee, our Board of Directors approved an increase in Mr. Argenbright’s base annual compensation to $216,000, which increase provided for an initial lump sum payment of $27,460. In February 2003, upon the recommendation of the Compensation Committee, the Board of Directors approved certain additional modifications to Mr. Argenbright’s compensation, including a $12,000 increase in Mr. Argenbright’s annual base compensation to $228,000, and a non-qualified stock option grant to Mr. Argenbright to purchase 436,120 shares of our common stock, pursuant to the terms of our 2000 Stock Incentive Plan, at an exercise price of $4.00 per share.

We have considered the provisions of Section 162(m) of the Internal Revenue Code and related Treasury Department regulations which restrict deductibility of executive compensation paid to our chief executive officer and each of the four other most highly compensated executive officers holding office at the end of any year to the extent such compensation exceeds $1,000,000 for any of such officers in any year and does not qualify for an exception under the statute or regulations. Income from options granted under our 2000 Stock Incentive Plan would generally qualify for an exemption from these restrictions so long as the options are granted by a committee whose members are non-employee directors. We expect that the Compensation Committee will generally be comprised of non-employee directors, and that to the extent such committee is not so constituted for any period of time, the options granted during such period will not be likely to result in compensation exceeding $1,000,000 in any year. The committee does not believe that in general other components of our compensation will be likely to exceed $1,000,000 for any executive officer in the foreseeable future and therefore concluded that no further action with respect to qualifying such compensation for deductibility was necessary at this time. In the future, the committee will continue to evaluate the advisability of qualifying its executive compensation for deductibility of such compensation. The committee’s policy is to qualify its executive compensation for deductibility under applicable tax laws as practicable.

COMPENSATION COMMITTEE

Frank M. Devine

Robert M. Smibert

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees our financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including internal control systems. KPMG LLP is responsible for performing an independent audit of our consolidated financial statements in accordance with auditing standards generally accepted in the United States and to issue a report on its audit.

The Audit Committee currently consists of three directors, two of whom, in the judgment of the Board, are “independent directors.” The Board of Directors determined that exceptional circumstances existed such that in order for us to comply with NASD Rules, it was in the best interests of SAFLINK and its stockholders to appoint to the Audit Committee a director who was not independent within the meaning of NASD Rule 4200(a)(14). Although Steven M. Oyer was not an independent director within the meaning of NASD Rule 4200(a)(14) by virtue of his having been employed by the Company within the past three years, the Board determined that, pursuant to the exception to Audit Committee composition requirements set forth in NASD Rule 4350(d)(2)(B), membership on the Audit Committee by Mr. Oyer was in the best interests of the Company and its stockholders, given Mr. Oyer’s industry expertise, financial literacy, financial oversight experience and knowledge of the Company, and that Mr. Oyer’s independent judgment would not be adversely affected by his having been employed by the Company within the past three years.

The functions of the committee include retaining our independent auditors, reviewing their independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our auditors, overseeing their audit work, reviewing and pre-approving any non-audit service that may be performed by them, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party transactions. The committee acts pursuant to a written charter that has been adopted by the Board of Directors. A copy of this charter is attached to this proxy statement as Appendix A. In fulfilling its oversight responsibilities, the committee received and discussed our audited financial statements in the Annual Report with management, including a discussion of the quality of the accounting principles and policies, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The committee has discussed and reviewed with our independent auditors, who are responsible for auditing our financial statements and expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, all matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). The committee has met with KPMG LLP, with and without management present, to discuss the overall scope of KPMG LLP’s audit, the results of its examinations, its evaluations of our internal controls and the overall quality of our financial reporting.

The Audit Committee has received from our auditors a formal written statement describing all relationships between the auditors and us that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), discussed with the auditors any relationships that may impact their objectivity and independence, and satisfied itself as to the auditors’ independence.

Based on the review and discussions referred to above, the committee recommended to the Board of Directors that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

AUDIT COMMITTEE

Frank M. Devine

Terry N. Miller

Steven M. Oyer

18

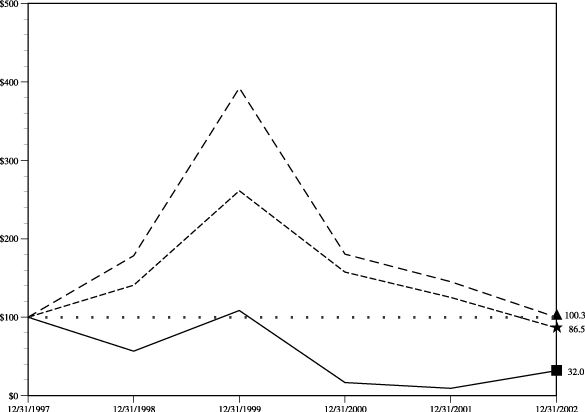

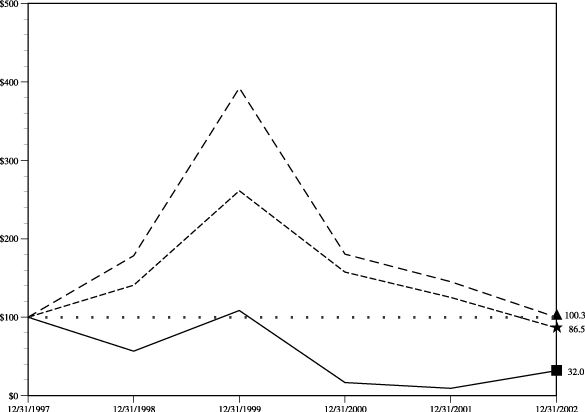

COMPARISON OF STOCKHOLDER RETURN

Set forth below is a line graph comparing the annual percentage change in the cumulative total return on our common stock with the cumulative total returns of the CRSP Total Return Index for the Nasdaq Stock Market and the Nasdaq Computer and Data Processing Stocks Index for the period commencing December 31, 1997.(1)

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

SAFLINK CORPORATION

|

Symbol

| | | | CRSP Total Returns Index for:

| | 12/1997

| | 12/1998

| | 12/1999

| | 12/2000

| | 12/2001

| | 12/2002

|

| | ¨ | | SAFLINK CORP | | 100.0 | | 56.8 | | 108.6 | | 16.7 | | 9.5 | | 32.0 |

– – – – – – – – – | | « | | Nasdaq Stock Market (US Companies) | | 100.0 | | 141.0 | | 261.5 | | 157.8 | | 125.2 | | 86.5 |

— — — — — | | < | | Nasdaq Computer and Data Processing Stocks SIC 7370-7379 US & Foreign | | 100.0 | | 178.4 | | 392.4 | | 180.6 | | 145.4 | | 100.3 |

Notes: A.The lines represent monthly index levels derived from compounded daily returns that include all dividends. B.The indexes are reweighted daily, using the market capitalization on the previous trading day. C.If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. D.The index level for all series was set to $100.0 on 12/31/1997. | | |

19

| (1) | | Assumes that $100 was invested on December 31, 1997 in our common stock and each index, and that all dividends have been reinvested. No cash dividends have been declared on our common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns. |

| (2) | | Our common stock is currently traded on the Nasdaq Small Cap Market under the symbol “SFLK”. From April 27, 1993 through May 31, 2001, our common stock was traded on the Nasdaq Small Cap Market. From August 9, 2001 through April 24, 2003, our common stock was traded on the OTC Bulletin Board. The above chart reflects the range of high and low closing prices reported on the Nasdaq Small Cap Market and the OTC Bulletin Board for the period indicated, adjusted to reflect a one-for-six reverse split effected in 1998 and a one-for-seven reverse split effected in 2001. |

STOCKHOLDER PROPOSALS TO BE PRESENTED

AT NEXT ANNUAL MEETING

Stockholder proposals may be included in our proxy materials for an annual meeting so long as they are provided to us on a timely basis and satisfy the other conditions set forth in applicable SEC rules. For a stockholder proposal to be included our proxy materials for the annual meeting to be held in 2004, the proposal must be received at our principal executive offices, addressed to the Secretary, no later than 120 calendar days in advance of the one year anniversary of the date our proxy statement was released to stockholders in connection with the previous year’s annual meeting of stockholders. Stockholder business that is not intended for inclusion in our proxy materials may be brought before the annual meeting so long as we receive timely notice of the proposal, addressed to the Secretary at our principal executive offices. To be timely, notice of stockholder business must be received by our Secretary no later than the close of business on the 10th day following the day on which the date of the annual meeting is publicly announced. A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual or special meeting (i) a brief description of the business desired to be brought before the annual meeting, (ii) the name and address of the stockholder proposing such business and of the beneficial owner, if any, on whose behalf the business is being brought, (iii) the class and number of shares of our common stock which are beneficially owned by the stockholder and such other beneficial owner, and (iv) any material interest of the stockholder and such other beneficial owner in such business.

TRANSACTION OF OTHER BUSINESS

At the date of this proxy statement, the Board of Directors knows of no other business that will be conducted at the 2003 annual meeting other than as described in this proxy statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

By order of the Board of Directors

Ann M. Alexander

Secretary

April30, 2003

20

Appendix A

SAFLINK CORPORATION

CHARTER OF THE AUDIT COMMITTEE OF THE

BOARD OF DIRECTORS

I. STATEMENT OF POLICY

This Charter specifies the scope of the responsibilities of the Audit Committee (the “Committee”) of the Board of Directors (the “Board”) of SAFLINK Corporation (the “Company”) and the manner in which those responsibilities shall be performed, including its structure, processes and membership requirements.

The primary purpose of the Committee is to assist the Board in fulfilling its oversight responsibilities by reviewing and reporting to the Board on the integrity of the financial reports and other financial information provided by the Company to its stockholders or to any governmental body or the public, and on the Company’s compliance with legal and regulatory requirements. The Committee shall also review the qualifications, independence and performance, and approve the terms of engagement, of the Company’s independent auditor, review the performance of the Committee’s internal audit function, and prepare any reports required of the Committee under rules of the Securities and Exchange Commission. Consistent with these functions, the Committee should encourage continuous improvement of, and should foster adherence to, the Company’s financial policies, procedures and practices at all levels. The Committee’s primary duties and responsibilities are to:

| | · | | retain the independent auditor, evaluate their independence, qualifications and performance, and approve the terms of engagement for audit service and non-audit services; |

| | · | | review with management and the independent auditor, as appropriate, the Company’s financial reports and other financial information provided by the Company to its stockholders or to any governmental body or the public, and the Company’s compliance with legal and regulatory requirements, including the Company’s internal controls; |

| | · | | regularly communicate with the independent auditor, and financial and senior management and report to the Board as required or appropriate; |

| | · | | establish and observe complaint procedures regarding accounting, internal auditing controls or auditing matters; and |

| | · | | prepare the Audit Committee report required by the Securities and Exchange Commission. |

The Company shall provide appropriate funding, as determined by the Committee, to permit the Company to perform its duties under this Charter and to compensate its advisors. The Committee, at its discretion, has the authority to initiate special investigations, and, if appropriate, hire special legal, accounting or other outside advisors or experts to assist the Committee, to fulfill its duties under this Charter. The Committee may also perform such other activities consistent with this Charter, the Company’s Bylaws and governing law as the Committee or the Board deems necessary or appropriate.

A-1

II. ORGANIZATION AND MEMBERSHIP REQUIREMENTS

The Committee shall be comprised of three or more directors, selected by the Board, each of whom shall satisfy the independence and experience requirements of The Nasdaq Stock Market, Inc. In addition, the Committee shall not include any member who:

| | · | | accepts any consulting, advisory, or other compensatory fee from the Company, other than in his or her capacity as a member of the Committee, the Board, or any other committee of the Board, or |

| | · | | is an affiliated person of the Company or any subsidiary of the Company. |

Each member of the Committee must be able to read and understand fundamental financial statements, including a balance sheet, income statement, and cash flow statement. In addition, at least one member shall be a financial expert, as determined in accordance with the rules and regulations of the Securities and Exchange Commission and the rules of The Nasdaq Stock Market, Inc., including having past employment experience in finance or accounting, professional certification in accounting, or other comparable experience or background resulting in the individual being financially sophisticated, including being or having been a chief financial, or other senior officer with financial oversight responsibilities of a public company. In addition, no Committee member should simultaneously serve on the audit committee of more than three public companies.

The members of the Committee shall be appointed by the Board and shall serve until their successors are duly elected and qualified or their earlier resignation or removal. Any member of the Committee may be replaced by the Board. Unless a chairman is elected by the full Board, the members of the Committee may designate a chairman by majority vote of the full Committee membership.

III. MEETINGS