- HGBL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Heritage Global (HGBL) DEF 14ADefinitive proxy

Filed: 28 Apr 23, 4:15pm

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_____________________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

HERITAGE GLOBAL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

April 28, 2023

San Diego, California

Dear Shareholders:

I am pleased to invite you to attend Heritage Global Inc.’s 2023 Annual Meeting of Shareholders on June 14, 2023 at 9:00 a.m. (Pacific Time). This year’s Annual Meeting will be a virtual meeting of shareholders held via a live audio webcast at www.virtualshareholdermeeting.com/HGBL2023. For more information on how to register and attend this year’s Annual Meeting, please refer to the Information About the Annual Meeting of Shareholders and Voting section which begins on page 1 of the enclosed proxy statement.

The Notice of Annual Meeting and Proxy Statement that follows describes those matters to be voted on at the meeting. Your proxy card and our 2022 annual report are also enclosed.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we recommend that you vote your shares through the enclosed proxy card, by internet or by telephone, to ensure your shares are represented at the Annual Meeting.

| By Order of the Board of Directors, |

|

|

|

|

|

|

| Ross Dove |

| President and Chief Executive Officer |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 28, 2023

San Diego, California

The Annual Meeting of Shareholders (the “Annual Meeting”) of Heritage Global Inc., which we refer to as the “Company,” will be held on June 14, 2023 at 9:00 a.m. (Pacific Time). This year’s Annual Meeting will be a virtual meeting of shareholders held via a live audio webcast at www.virtualshareholdermeeting.com/HGBL2023. No physical meeting will be held. For more information on how to register and attend this year’s Annual Meeting, please refer to the Information About the Annual Meeting of Shareholders and Voting section that begins on page 1 of the enclosed Proxy Statement. The Annual Meeting will be held for the following purposes:

Only shareholders of record, as shown by the transfer books of the Company, at the close of business on April 17, 2023 are entitled to notice of, and to vote at, the Annual Meeting of Shareholders. The Company will make a list of shareholders available electronically on the virtual meeting website during the Annual Meeting for those attending the meeting.

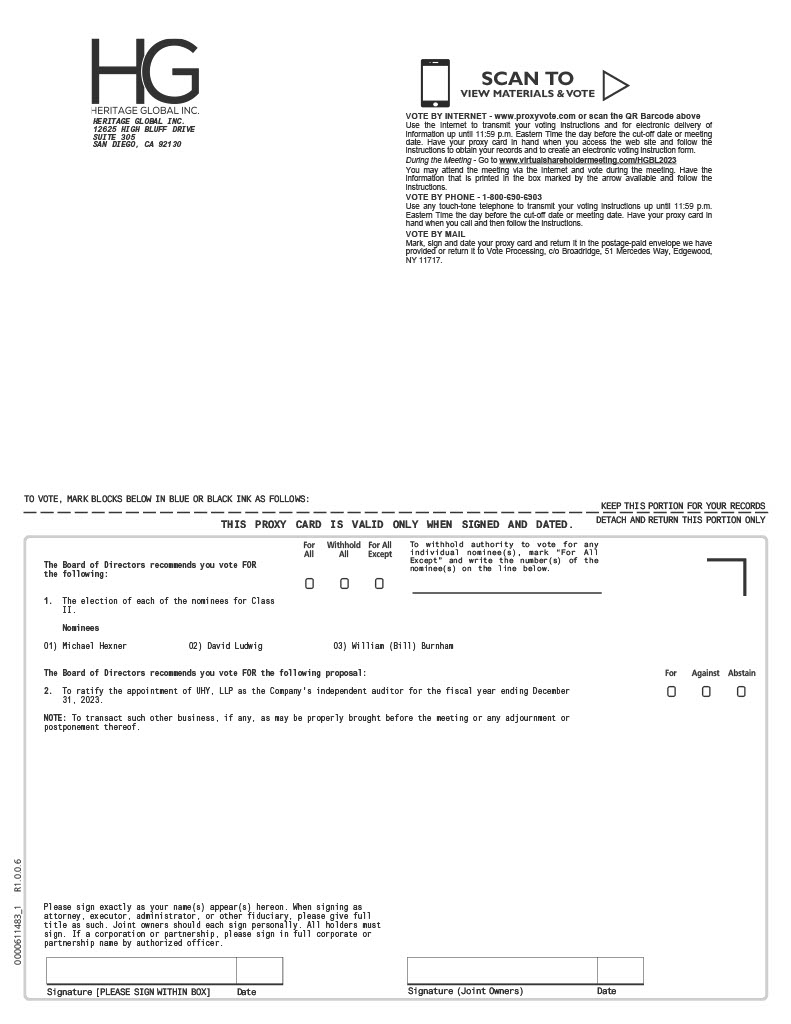

You are requested to vote on these proposals whether or not you plan to attend the annual meeting. If you do not attend and vote, you can vote in one of three ways: (i) complete, sign and date the enclosed proxy card and return it promptly in the envelope provided; (ii) vote by internet pursuant to the instructions on the enclosed proxy card; or (iii) vote by telephone pursuant to the instructions on the enclosed proxy card. Your vote is important and very much appreciated. If you later desire to revoke your proxy for any reason, you may do so in the manner described in the attached Proxy Statement. For further information regarding the individuals nominated as directors, the proposals being voted upon, use of the proxy and other related matters, you are urged to read the enclosed Proxy Statement.

| By Order of the Board of Directors, |

|

|

|

|

|

|

| Ross Dove |

| President and Chief Executive Officer |

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

12625 High Bluff Drive, Suite 305

San Diego, California 92130

PROXY STATEMENT

INFORMATION ABOUT THE ANNUAL MEETING OF

SHAREHOLDERS AND VOTING

Why Did You Send Me This Proxy Statement?

We sent you this Proxy Statement and the enclosed proxy card because the Board of Directors of Heritage Global Inc., which we refer to as “Heritage Global,” “we,” “us,” “our” or the “Company,” is soliciting your proxy to vote at the 2023 Annual Meeting of Shareholders (the “Annual Meeting”). A copy of our 2022 Annual Report to Shareholders (with Form 10-K for the year ended December 31, 2022) accompanies this Proxy Statement.

We are furnishing proxy materials to our shareholders primarily via the Internet, under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), instead of mailing printed copies of those materials to each shareholder. On or about April 28, 2023, we began mailing to our shareholders a Notice of Internet Availability of Proxy Materials (the “Proxy Notice”) containing instructions on how to access our proxy materials, including our Proxy Statement and our 2022 Annual Report to Shareholders. The Proxy Notice also instructs you on how to access your proxy card electronically to vote via the Internet or by telephone. The Proxy Notice is not a form for exercising your voting rights as a shareholder; the Proxy Notice merely presents an overview of our collective proxy materials. We encourage you to review our full proxy materials before voting on the proposals set forth herein.

Our proxy materials may be amended or supplemented in accordance with applicable law. This process is designed to expedite the shareholders’ receipt of proxy materials, lower the cost of the Annual Meeting and help conserve natural resources. Shareholders who would prefer to continue to receive printed proxy materials should follow the instructions included in the Proxy Notice.

This Proxy Statement summarizes the information you need to vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. You may simply vote in accordance with the instructions contained in this Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 14, 2023: THIS PROXY STATEMENT, THE FORM OF PROXY CARD AND THE ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022 ARE AVAILABLE, FREE OF CHARGE, AT WWW.PROXYVOTE.COM.

How Can I Attend the Annual Meeting?

Our Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by a live audio webcast. You are entitled to participate in the Annual Meeting only if you are a shareholder of record as of the close of business on April 17, 2023, the record date, or hold a valid proxy for the Annual Meeting. No physical in-person meeting will be held.

You do not have to register in advance to attend the virtual meeting. To attend and participate in the virtual meeting, please visit www.virtualshareholdermeeting.com/HGBL2023 and enter the 16-digit control number included on your proxy card. Whether or not you plan to attend the virtual annual meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described under “Voting and Other Information” below. During the meeting, you may submit questions, vote, and examine our shareholder list.

4

The online meeting will begin promptly at 9:00 a.m. (Pacific Time) on June 14, 2023. We encourage shareholders to log in to the website and access the webcast early, beginning approximately 15 minutes before the Annual Meeting’s 9:00 a.m. start time, to ensure you can hear the streaming audio before the Annual Meeting starts. If you experience technical difficulties, please contact the technical support telephone number posted on the virtual meeting website, www.virtualshareholdermeeting.com/HGBL2023. The virtual meeting platform is fully supported across browsers and devices running the most updated version of applicable software and plug-ins. Please ensure that you have a strong internet connection wherever you intend to participate in the meeting.

A link to a replay of the Annual Meeting will be available on the Investors Relations section of our website (www.hginc.com) under “Shareholder Meetings” approximately 24 hours after the meeting ends and will remain available on our website for one month following the meeting.

Can I Ask Questions at the Virtual Annual Meeting?

Shareholders as of our record date who attend and participate in our virtual Annual Meeting at www.virtualshareholdermeeting.com/HGBL2023 will have an opportunity to submit questions live via the internet during a designated portion of the meeting. Shareholders must have available their 16-digit control number included on their proxy card. Once past the log-in screen, shareholders will be able to submit questions live during the virtual meeting by typing the question into the “Ask a Question” field, and clicking submit. We will answer questions that comply with the meeting rules of conduct during the annual meeting of shareholders, subject to time constraints.

What Proposals Will Be Voted on at the Annual Meeting?

There are two proposals scheduled to be voted on at the Annual Meeting:

Our Board of Directors (the “Board”) recommends that you vote your shares (1) “FOR” each of the nominees of the Board and (2) “FOR” the ratification of the appointment of UHY LLP as our independent auditor for the fiscal year ending December 31, 2023.

VOTING AND OTHER INFORMATION

Who Is Entitled to Vote?

April 17, 2023 is the record date for the Annual Meeting. If you owned shares of our common stock or Series N Preferred Stock at the close of business on April 17, 2023, you are entitled to vote. As of April 17, 2023, we had 37,112,960 shares of common stock and 565 shares of Series N Preferred Stock outstanding and entitled to vote at the Annual Meeting.

How Many Votes Do I Have?

As of April 17, 2023, the following classes of stock were issued and outstanding, and had the voting powers indicated. Each share of common stock is entitled to one vote for each share of common stock held on the record date on all matters to be voted on, and each share of Series N preferred stock is entitled to 40 votes for each share of preferred stock held on the record date on all matters to be voted on, voting together and not as a separate class, on an “as converted” basis.

Class of Stock |

| Shares |

|

| Equivalent |

| ||

Common Stock |

|

| 37,112,960 |

|

|

| 37,112,960 |

|

Series N Preferred Stock |

|

| 565 |

|

|

| 22,600 |

|

Total Votes at Special Meeting of Shareholders |

|

| 37,113,525 |

|

|

| 37,135,560 |

|

5

What Is the Difference Between Holding Shares as a Shareholder of Record and as a Beneficial Owner?

Many of our shareholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Shareholder of Record

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, you are considered, with respect to those shares, the shareholder of record and these proxy materials are being sent to you directly by Heritage Global. As the shareholder of record, you have the right to grant your voting proxy to the proxies listed on the proxy card or to vote online in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner

If your shares are held in a stock brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or other nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares and are also invited to attend the Annual Meeting. However, because you are not the shareholder of record, you may only vote these shares in accordance with materials and instructions provided by your broker or other nominee for voting your shares, which may also allow you to use the internet or a toll free telephone number to vote your shares.

How Do I Vote at the Annual Meeting?

All shareholders may vote at the Annual Meeting by logging into www.virtualshareholdermeeting.com/HGBL2023 and following the instructions provided on the website. If your shares are registered in your name, to vote you will need your 16-digit Control Number provided with your proxy card. If you are a beneficial owner (i.e. your shares are held in the name of your broker or bank), please refer to “How can I attend the Annual Meeting?” above for information on how to register to attend the Annual Meeting in order to vote your shares at the Annual Meeting.

How Do I Vote by Proxy?

If you are a shareholder of record, you can vote by mailing in the enclosed proxy card or you can use one of the alternatives below:

Please refer to the specific instructions set forth on the enclosed proxy card. In addition, please have the validation details, located on the proxy card, available when voting your shares. If you choose to vote your shares by telephone or through the internet, there is no need for you to mail back your proxy card.

If you hold your shares in street name, your broker or other nominee will provide you with materials and instructions for voting your shares, which may allow you to use the internet or a toll free telephone number to vote your shares.

May I Revoke My Proxy?

Yes. If you change your mind after you vote, you may revoke your proxy by following any of the procedures described below. To revoke your proxy:

6

If you hold your shares in street name, your broker or other nominee will provide you with instructions on how to revoke your proxy.

What Votes Need to be Present to Hold the Annual Meeting?

To have a quorum for our Annual Meeting, persons must be present, in person or by proxy, representing a majority of the shares issued and outstanding and entitled to vote at the meeting.

What Vote Is Required to Approve Each Proposal?

Election of Directors | The election of each of the nominees for Class II director requires that the number of votes cast “FOR” such nominee exceed the number of votes cast “AGAINST” such nominee (with abstentions and broker non-votes not counting as votes cast for or against a nominee). |

Ratification of Appointment of Independent Auditor |

The ratification of the appointment of UHY LLP as independent auditor for the fiscal year ending December 31, 2023 requires the affirmative vote of a majority of the votes entitled to be cast by shareholders who are present in person or represented by proxy at the Annual Meeting and entitled to vote. |

How Are Votes Counted?

Proposal No. 1 - Election of Directors

For Proposal No. 1, you may:

Proposal No. 2 - Ratification of Appointment of Independent Auditor

For Proposal No. 2, your vote may be cast “FOR” or “AGAINST” or you may “ABSTAIN.”

How Would My Shares Be Voted if I Do Not Specify How They Should Be Voted?

If you sign your proxy card with no further instructions, your shares will be voted in accordance with the recommendations of the Board. We will appoint one or more inspectors of election to count votes cast at the meeting or by proxy.

As noted above, if your shares are held in a stock brokerage account or by another nominee, your broker or nominee will provide you with materials and instructions for you to use in directing your broker or nominee as to how to vote your shares. New York Stock Exchange (“NYSE”) Rule 452 provides that brokers and other nominees may not exercise their voting discretion on specified non-routine matters without receiving instructions from the beneficial owner of the shares. Because Rule 452 applies specifically to securities brokers, virtually all of whom are governed by NYSE rules, Rule 452 applies to all companies listed on a national stock exchange, including companies (such as the Company) listed on the Nasdaq Stock Market (the “Nasdaq”).

We expect that the ratification of the appointment of UHY LLP as the Company’s independent auditor for the fiscal year ending December 31, 2023 (Proposal No. 2) to be the only proposal that is considered a “routine” matter. Accordingly, if your shares are held through a broker or other nominee, that person will have discretion to vote your shares on Proposal No. 2 if you fail to provide instructions. On the other hand, the election of Class II directors (Proposal No. 1) will be considered a “non-routine” matter. Thus, if you do not give your broker or other nominee specific instructions on how to vote your shares with respect to Proposal No. 1, your broker or other nominee will inform the inspector of election that it does not have the authority to vote on that matter with respect to your

7

shares. This is generally referred to as a “broker non-vote.” A broker non-vote may also occur if your broker or other nominee fails to vote your shares for any reason. Therefore, if you hold your shares through a broker or other nominee, please instruct that person regarding how to vote your shares on at least Proposal No. 1.

What Is the Effect of Broker Non-Votes, Abstentions and Withhold Votes?

With respect to Proposal No. 1, you may vote “FOR” or “AGAINST” each director nominee, or you may “WITHHOLD” from voting with respect to any director nominee. A vote to withhold or a broker non-vote will not affect the outcome of the election, because each director nominee is elected by plurality (more votes than any other nominee for the seat). With respect to Proposal No. 2, abstentions have the same effect as negative votes because, in order to pass, Proposal No. 2 must receive affirmative votes by a majority of the votes present at the meeting and entitled to be cast. Abstentions are shares present and entitled to be cast, but not affirmative votes. We do not expect broker non-votes for Proposal No. 2 (because it is a routine matter), and any broker non-votes would not affect Proposal No. 2, because they are neither entitled to be cast nor affirmative votes.

What Are the Costs of Soliciting These Proxies and Who Will Pay Them?

The Company will pay all the costs of soliciting these proxies. Although we are mailing these proxy materials, our directors and employees may also solicit proxies by telephone, e-mail or other electronic means of communication or in person. We will reimburse our transfer agent and brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you.

Where Can I Find the Voting Results?

We will publish the voting results by filing a Current Report on Form 8-K, which we will file with the SEC within four business days of our Annual Meeting.

Do Directors Attend the Annual Meeting?

Although we do not have a formal policy regarding director attendance at shareholder meetings, we encourage our directors to attend our annual meeting of shareholders and special meetings of shareholders.

Can a Shareholder Communicate Directly with Our Board? If So, How?

Shareholders and other interested parties may contact any member (or all members) of the Board, any Board committee or any chair of any such committee by mail. To communicate with the Board, any individual director or any group or committee of directors, correspondence should be addressed to the Board or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent to the Secretary of Heritage Global at 12625 High Bluff Drive, Suite 305, San Diego, California, 92130.

All communications received as set forth in the preceding paragraph will be opened by an executive officer of the Company for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising or promotions of a product or service, or are not patently offensive material, will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the executive officers will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

8

PROPOSAL NO. 1: ELECTION OF CLASS II DIRECTORS

General

Our Amended and Restated Bylaws (the “Bylaws”) divide our Board into three classes with the terms of office of each class ending in successive years. Our Bylaws empower our Board to fix the exact number of directors and appoint persons to fill any vacancies on the Board until the next election of the class for which such director was chosen.

Following a recommendation from the Corporate Governance Committee, our Board has nominated Michael Hexner, David Ludwig and William Burnham for election as Class II directors of the Company to serve a three-year term to expire at the annual meeting of shareholders in 2026.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF

THESE NOMINEES AS DIRECTORS OF THE COMPANY.

Each of the nominees has consented to being named as a director nominee in this Proxy Statement and has agreed to serve for the three-year term to which he or she has been nominated, if elected. It is the intention of the persons named as proxies, subject to any direction to the contrary, to vote in favor of the candidates nominated by the Board. We know of no reason why any nominee would be unable to serve as a director. If any nominee is unable to serve, your proxy may vote for another nominee proposed by the Board, or the Board may reduce the number of directors to be elected. If any director resigns, dies or is otherwise unable to serve out his term, or if the Board increases the number of directors, the Board may fill the vacancy until the next election of the class for which such director was chosen.

We have set forth below information with respect to the nominees for election as director proposed by the Company and the other directors whose terms of office as directors will continue after the Annual Meeting. There are no arrangements or understandings between any director and any other person pursuant to which any director was or is selected as a director or nominee.

Nominees for Election at this Annual Meeting (To Terms Expiring in 2026)

Michael Hexner, age 70, has served as a Class II director of the Company since August 2016. Mr. Hexner has expertise and extensive experience in executive leadership with businesses at all stages from early to mature and ready for sale. Mr. Hexner co-founded Wheel Works in 1976, and grew the business, as its Chief Executive Officer, to become the largest independent tire chain in the United States. Mr. Hexner was the co-founder of Pacific Leadership Group in 2001, served as the Chairman and Chief Executive Officer of both SmartPillars and DealerFusion, was President of the Northern California Golf Association and Co-Founder and President of Youth on Course. Mr. Hexner currently serves as Chief Operating Officer of LeadLander, special advisor to the Chief Executive Officers of Laboratory Equipment Company, Rondo, True North Alliances and is managing partner for The Lane. Mr. Hexner received a Bachelor of Arts in political philosophy from Williams College, completed the Executive Management Program at The Haas School of Business of the University of California, is a certified FINRA arbitrator and received a master’s degree in negotiation and dispute resolution from Creighton University.

David Ludwig, age 66, was appointed by the Board as a Class II director in March 2021 to fill the vacancy created by the recent resignation of Allan Silber. Mr. Ludwig currently serves as the President of Heritage Global’s Financial Assets division, which comprises the Company’s National Loan Exchange (“NLEX”) and Heritage Global Capital subsidiaries. He joined Heritage Global in 2014 with the Company’s acquisition of NLEX, which he developed from its start as a post-Resolution Trust Corporation (RTC) sales outlet to the nation’s leading broker of charged-off credit card and consumer debt accounts. With more than 25 years of experience in the financial industry, Mr. Ludwig is considered a leading pioneer in the debt sales industry, and has been a featured speaker at many industry conferences. He has also been quoted in numerous publications including the New York Times, LA Times, Collections and Credit Risk, Collector Magazine, and serves as consultant and expert witness within the industry. Since introducing NLEX to financial institutions in the early 1990’s, Mr. Ludwig has supervised the sale of over 5,000 portfolios with face value of $150 billion. Mr. Ludwig holds a Bachelor of Science Degree in Economics from the University of Illinois.

William Burnham, age 52, was appointed by the Board as a Class II director in March 2023. Mr. Burnham has extensive investing and capital markets experience as an institutional investor, venture capitalist and public equity analyst. Mr. Burnham is currently the Managing Member of Inductive Capital LP, a technology focused investment fund which he founded in 2006. Prior to Inductive, Mr. Burnham was a venture capital investor at both SOFTBANK Capital Partners and Mobius Venture Capital, and prior to that a senior equity research analyst at Credit Suisse First

9

Boston, Deutsche Morgan Grenfell, and Piper Jaffray. Over the course of his investment career, Mr. Burnham has served on a numerous public and private company boards in both the United States and Canada. He currently serves as a Director of TrustCloud Inc. and is a Board Advisor to Abine Inc. Prior to his investing career, Mr. Burnham was a Senior Associate at the management consulting firm of Booz, Allen & Hamilton. He attended Washington University where he graduated Summa Cum Laude, Phi Beta Kappa.

Directors With Terms of Office That Will Continue After This Meeting

Directors With Terms Expiring in 2024

Barbara Sinsley, age 60, has served as a Class III director of the Company since she was appointed by the Board in June 2020. Ms. Sinsley specializes in working with technology and fintech platform service providers focused in payments, security, compliance, and data privacy. Ms. Sinsley currently serves as Chief Legal Officer and is on the Board of Directors for meldCX USA Inc., a commercial app building company. Previously, Ms. Sinsley was the General Counsel and Chief Compliance Officer of FactorTrust Inc., a credit reporting agency sold to TransUnion. Ms. Sinsley has worked closely with the CFPB, Federal Trade Commission and state legislatures to craft legislation and solutions for the consumer finance industry and consumers.

Shirley S. Cho, age 49, has served as a Class III director of the Company since December 20, 2021. Ms. Cho has more than twenty years’ experience advising debtors, creditors’ committees, creditors and purchasers. Throughout her career, Ms. Cho has represented some of the largest companies in America to restructure billions of dollars of debt, and has counseled acquirers of assets out of bankruptcy, and committees of unsecured creditors across a variety of industries and asset classes, as well as representing U.S. debtors in cross-border proceedings. Ms. Cho is also experienced in representing foreign creditors, including Fortune Global top 20 companies, and is an expert on U.S. insolvency law in foreign proceedings. Ms. Cho is a partner in the Los Angeles office of Pachulski Stang Ziehl & Jones LLP. Ms. Cho earned a Bachelor of Arts, magna cum laude, from the University of California, Berkeley and a Juris Doctorate from the University of California, Hastings College of Law. Ms. Cho is admitted to practice law in California and New York.

Directors With Terms Expiring in 2025

Samuel L. Shimer, age 59, was appointed as a Class I director in April 2001 and was appointed as Chairman of the Board in March 2020. Mr. Shimer has extensive expertise in mergers and acquisitions, including transactions that occurred while he was an officer of the former parent of the Company, Street Capital, where he was initially employed as a Senior Vice President, Mergers & Acquisitions and Business Development in July 1997. He was appointed Managing Director in February 2000, and he terminated his employment with the Company in February 2004. Mr. Shimer is currently Managing Director of SLC Capital Partners, LLC, a private equity fund management company that he co-founded in 2010. Mr. Shimer additionally serves on the board of two private companies. Mr. Shimer earned a Bachelor of Science in economics from The Wharton School of the University of Pennsylvania, and a Master of Business Administration degree from Harvard Business School.

Kelly Sharpe, age 58, has served as a Class I director of the Company since November 2020. Ms. Sharpe brings over 25 years of extensive financial, operational and senior management experience in both public and private venture backed high growth companies. She also has valuable expertise across several industries including many years in the Industrial Asset and Valuation sector at DoveBid Inc., helping to guide the growth of that company’s revenue 10X in the first three years of operation. Ms. Sharpe started her career in public accounting with KPMG International in the San Francisco Bay Area. She currently serves as President of Exec Xcel Inc., an executive consulting and coaching company. Previously Ms. Sharpe held executive positions as CEO of Sharpe Energy Services in the energy sector, Chief Financial Officer for Openwave Mobility and Chief Financial Officer of Openwave Messaging in the mobile telecommunications Industry, and Chief Financial Officer for Carrier IQ, Inc., a provider of mobile service intelligence solutions to the wireless industry. Ms. Sharpe graduated from Clarkson University in New York with a Bachelor of Science degree in Accounting and Law and holds an AAS degree from the State University of New York - Canton.

Ross Dove, age 70, the Chief Executive Officer and President of the Company, was appointed by the Board as a Class I director in May 2015. Mr. Ross Dove was appointed our Chief Executive Officer in May 2015 and has served as Co-Managing Partner of Heritage Global Partners, Inc., a Company subsidiary (“HGP”) since its founding in October 2009. Together with his brother, Kirk Dove, Mr. Ross Dove joined our company when HGI acquired HGP in February 2012. Mr. Dove began his career in the auction business over thirty years ago, beginning with a small family-owned auction house and helping to expand it into a global firm, DoveBid, which was sold to a third party in 2008. The Messrs. Dove remained as global presidents of the business until September 2009, and then formed HGP

10

in October 2009. During his career, Mr. Dove has been actively involved with advances in the auction industry such as theatre-style auctions, which was a first step in migrating auction events onto the Internet. Mr. Dove has been a member of the National Auctioneers Association since 1985, and a founding member of the Industrial Auctioneers Association. He served as a director of Critical Path from January 2002 to January 2005 and has served on the boards of several venture funded companies. Ross Dove is the brother of Kirk Dove and uncle of Nicholas Dove.

Diversity Matrix

The following table summarizes certain self-identified characteristics of our directors, in accordance with Nasdaq Listing Rules 5605(f) and 5606. Each term used in the table has the meaning given to it in the rule and related instructions.

Heritage Global Inc. Board Diversity Matrix as of April 28, 2023

Board Size: |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total Number of Directors |

|

| 8 |

|

|

|

|

|

|

|

|

|

| |||

Gender Identity: |

| Female |

|

| Male |

|

| Non-Binary |

|

| Did Not |

| ||||

Directors |

|

| 3 |

|

|

| 5 |

|

|

| — |

|

|

| — |

|

Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

| ||||

African American of Black |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Alaskan Native or Native American |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Asian |

|

| 1 |

|

|

| — |

|

|

| — |

|

|

| — |

|

Hispanic or Latinx |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Native Hawaiian or Pacific Islander |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

White |

|

| 2 |

|

|

| 5 |

|

|

| — |

|

|

| — |

|

Two or More Races or Ethnicities |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

LGBTQ+ |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

Did Not Disclose Demographic Background |

|

| — |

|

|

| — |

|

|

| — |

|

|

| — |

|

11

CORPORATE GOVERNANCE

Overview

In General

Our Board has adopted corporate governance policies, including a Code of Conduct (“Code of Conduct”), and charters for each of our Compensation Committee, Audit Committee, and Corporate Governance Committee. The full text of our Code of Conduct and each committee charter is available in the Investor Relations-Corporate Profile & Governance section of our internet website located at www.hginc.com. A copy of the Code of Conduct is also available in print, free of charge, to any shareholder who requests it by writing to Heritage Global Inc., 12625 High Bluff Drive, Suite 305, San Diego, California, 92130. We intend to post amendments to or waivers, if any, from our Code of Conduct at this location on our website, in each case to the extent such amendment or waiver would otherwise require the filing of a Current Report on Form 8-K pursuant to Item 5.05 thereof. Information contained on our website is not a part of this Proxy Statement and the inclusion of our website address in this Proxy Statement is an inactive textual reference only.

In addition, you may request copies of the Code of Conduct and the committee charters by contacting the Company using the following information:

Telephone: (203) 972-9200

E-mail: investorrelations@hginc.com

Other Corporate Governance Highlights

Board of Directors

Our Board oversees our business and monitors the performance of management. The Board is not involved in day-to-day operations. The directors keep themselves informed by discussing matters with the President and Chief Executive Officer, other key executives and our principal external advisors such as legal counsel, outside auditors,

12

investment bankers and other consultants, by reading the reports and other materials that we send them regularly and by participating in Board and committee meetings.

The Board meets quarterly to review the Company’s operating results, annually to review and approve the Company’s strategy and budget, and periodically throughout the year as necessary. Material matters such as acquisitions and dispositions, investments and business initiatives are approved by the full Board. The Board met four times during 2022. All directors attended 100% of the aggregate number of meetings of the Board and committees of the Board of which they were a member held during the year ended December 31, 2022.

While we do not have a formal policy regarding director attendance at shareholder meetings, all then current directors attended our annual meeting of shareholders in 2022.

Director Independence

Our Board has affirmatively determined that each director other than Messrs. Dove and Ludwig are “independent,” as defined by the Nasdaq Stock Market Rules. Under the Nasdaq Stock Market Rules, a director can be independent only if the director does not trigger a categorical bar to independence and our Board affirmatively determines that the director does not have a relationship which, in the opinion of our Board, would interfere with the exercise of independent judgment by the director in carrying out the responsibilities of a director.

Board Leadership Structure

The Board regularly considers the appropriate leadership structure for the Company and has concluded that the Company should maintain flexibility to select our Chairman and Board leadership structure from time to time. Thus, the Company does not have a formal policy with respect to separation of the offices of Chairman of the Board and Chief Executive Officer. The Company’s Restated By-laws permit the Board to choose a Chairman of the Board from among its members, and the position of Chairman of the Board is currently held by Samuel L. Shimer. The directors believe that, at the Company’s current stage, Mr. Shimer’s history with the Company, combined with his knowledge of its operations and strategic goals, make him qualified to serve as Chairman of the Board. In addition, the Board does not believe, based on the Company’s current size and scale of operations, a lead independent director is necessary to effectively oversee the Company’s strategic priorities. The positions of President and Chief Executive Officer of the Company are currently held by Ross Dove. The directors believe that, at the Company’s current stage, Mr. Dove’s in-depth knowledge of the Company’s operations, strategic goals, and expansive industry experience make him qualified to serve as Chief Executive Officer. The Board believes that this governance structure, which separates the Chairman and Chief Executive Officer roles, promotes balance between the Board’s independent authority to oversee our business and the Chief Executive Officer and his management team who manage the business on a day-to-day basis.

Committees of the Board

The Board has established an Audit Committee, a Compensation Committee, and a Corporate Governance Committee. Our Audit Committee, Compensation Committee, and Corporate Governance Committee consist exclusively of members with whom the Board has affirmatively determined qualify as independent directors under the applicable requirements of the Nasdaq Stock Market Rules. All of our committee charters are available on the Investor Relations page of our website, www.hginc.com.

Audit Committee

The Audit Committee is composed entirely of directors with whom the Board has affirmatively determined are independent of the Company and its management as defined by the Nasdaq Stock Market Rules and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The members of the Audit Committee are Kelly Sharpe, Samuel Shimer and William Burnham. Mr. Burnham was appointed to the Audit Committee effective April 1, 2023. Barbara Sinsley resigned from the Audit Committee concurrent with Mr. Burnham's appointment. Ms. Sharpe serves as chair of the Audit Committee.

The Board has also determined that each member of the Audit Committee satisfies the financial literacy requirements of the Nasdaq Stock Market Rules and that Ms. Sharpe is an “audit committee financial expert,” as that term is defined under Item 407(d) of Regulation S-K. In making its determination that Ms. Sharpe qualifies as an “audit committee financial expert,” the Board considered her education and the nature and scope of Ms. Sharpe’s prior experience. The members of the Audit Committee are reviewed at least annually by the Board.

13

The primary purpose of our Audit Committee is to oversee the integrity of our financial statements, our financial reporting process, the independent accountants’ qualifications and independence, the performance of the independent accountants and our compliance with legal and regulatory requirements on behalf of our Board. In particular, our Audit Committee performs the following key functions, among others:

Additional information regarding our Audit Committee and its processes and procedures for the consideration and approval of related person transactions can be found under the heading “Certain Relationships and Related Party Transactions.”

The Audit Committee met four times in 2022.

Compensation Committee

The Compensation Committee is composed entirely of directors who are independent of the Company and its management, as defined by the Nasdaq Stock Market Rules. The members of the Compensation Committee are Samuel Shimer, Shirley Cho and Michael Hexner, with Mr. Hexner serving as chair of the Compensation Committee.

The principal responsibilities of our Compensation Committee are to assist our Board by ensuring that our officers and key executives are compensated in accordance with our total compensation objectives and policies and to develop and implement these objectives and policies. In particular, the Compensation Committee is responsible for the following key functions, among others:

For additional information regarding the committee’s processes and procedures for considering and determining executive compensation, including the role, if any, of executive officers in determining the amount or form of executive compensation, see “Compensation Discussion and Analysis” below.

The Compensation Committee met four times in 2022.

Corporate Governance Committee

The Corporate Governance Committee is composed entirely of directors who are independent of the Company and its management, as defined by the Nasdaq Stock Market Rules. The members of the Corporate Governance Committee are Barbara Sinsley and Michael Hexner. Ms. Sinsley serves as chair of the Corporate Governance Committee.

The purpose of our Corporate Governance Committee is to assist in shaping the corporate governance of the Company, and to exercise general oversight with respect to nominations to, and the governance of, the Board and related federal securities laws matters. The primary responsibilities of the Corporate Governance Committee include:

14

Risk Oversight

Together with the Board’s standing committees, the Board is responsible for ensuring that material risks are identified and managed appropriately. The various committees appointed by the Board have, within their oversight responsibilities, the obligation to assess for, and initiate mitigating actions to, specific areas of risk within their committee expertise. Each committee regularly reports to the Board.

As part of its responsibilities as set forth in its charter, the Audit Committee is responsible for overseeing the quality and integrity of the Company’s financial statements and other financial information, financial reporting process, internal controls, procedures for financial reporting and the internal audit function. In addition, the Audit Committee is in consultation with the Company's outside auditors to assure the Audit Committee has reasonably assessed financial reporting risks generally, as well as those unique to the Company, and to ensure a proper mitigation of potential risks so identified.

The Compensation Committee considers risk in connection with its design of compensation programs for Company executives. Considerations include a periodic review of the Company's compensation plans to assure that individual compensation is structured to incentivize against overall risk.

The Board and its committees regularly review material operational, cybersecurity and compliance risks with senior management, and strive to provide an open avenue of communication among the Company’s independent auditor and management as a means to anticipate, identify and address any potential risk.

Director Nomination Process

The Corporate Governance Committee has responsibility for the director nomination process. The Corporate Governance Committee identifies potential nominees for directors from various sources, including recommendations by management and other Board members. The Corporate Governance Committee then reviews the appropriate skills and characteristics required of Board members in the context of the current composition of the Board. The Corporate Governance Committee considers, among other things, a potential director’s independence and conflicts of interests, character and integrity, financial literacy, education and business experience and available time to devote to Board matters. The Corporate Governance Committee seeks candidates from diverse business and professional backgrounds with outstanding integrity, achievements, judgment and such other skills and experience that would enhance the Board’s ability to serve the long-term interests of our shareholders. In addition, the Corporate Governance Committee has made a concerted effort in recent years to identify female candidates. The Corporate Governance Committee considers diversity as one of a number of factors in identifying nominees for director. The Committee views diversity broadly to include diversity of experience, skills and viewpoint, as well as other diversity concepts such as race, gender and disability. The Corporate Governance Committee’s objective is to assemble a slate of directors that can best fulfill the Company’s goals and promote the interests of shareholders. The Corporate Governance Committee believes these practices have been effective.

The Corporate Governance Committee will consider a shareholder’s recommendation for director, but the Corporate Governance Committee has no obligation to nominate such candidates for election by the Board. Assuming that appropriate biographical and background material is provided for candidates recommended by shareholders, the Corporate Governance Committee will evaluate those candidates by following substantially the same process and applying substantially the same criteria as for candidates recommended by other sources. If a shareholder has a suggestion for candidates for election, the shareholder should mail it to: Secretary, Heritage Global Inc., 12625 High Bluff Drive, Suite 305, San Diego, California, 92130. No person recommended by a shareholder will become a nominee for director and be included in the Company’s Proxy Statement unless the Corporate Governance Committee recommends, and the Board approves, such person.

If a shareholder desires to nominate a person for election as director at a shareholders’ meeting, that shareholder must comply with Article V, Section 8 of the Company’s Restated By-laws as described below under “Shareholder Proposals for the 2024 Annual Meeting of Shareholders.”

15

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

As part of the operations of NLEX, the Company leases office space in Edwardsville, IL that is owned by Mr. Ludwig, Director and President of the Company’s Financial Assets division (which encompasses NLEX). The total amount paid to the related party was approximately $110,000 for both years ended December 31, 2022 and 2021, respectively, and is included in selling, general and administrative expenses in the consolidated statements of income included in our Annual Report on Form 10-K. All of the payments in both 2022 and 2021 were made to Mr. Ludwig.

While the Board currently does not have a written policy with respect to approval of transactions with related parties, it is the policy of the Board to approve any transactions with related persons. Any approvals would be reflected in the minutes of the meeting of the Board at which the Board approved the transaction. We have adopted a written policy, however, on conflicts of interest, which appears in our Code of Conduct. The Code of Conduct states that a “conflict of interest” exists when any relationship, influence or activity of an officer, director or employee might impair, or have the appearance of impairing, his/her ability to make objective and fair decisions when performing his/her job. Under the Code of Conduct, officers, directors and employees are to avoid actual conflicts of interest, but also to avoid the appearance of a conflict. Transactions or relationships that may reasonably be expected to give rise to conflicts of interest are not permitted. Potential, apparent or actual conflicts of interest must be reported to management.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of April 17, 2023 and based on 37,112,960 shares of common stock and 565 shares of Series N preferred stock issued and outstanding, information regarding beneficial ownership of our common stock and Series N Preferred Stock by the following:

Beneficial ownership is determined according to the rules of the SEC. Beneficial ownership means that a person has or shares voting or investment power of a security, and includes shares underlying options and warrants that are currently exercisable or exercisable within sixty (60) days after the measurement date. The information in the table below is based on information supplied by our directors and executive officers and public filings.

16

Except as otherwise indicated, we believe that the beneficial owners of the common stock and Series N Preferred Stock listed below have sole investment and voting power with respect to their shares, except where community property laws may apply. Unless otherwise indicated, we deem shares of common stock subject to options that are exercisable within sixty (60) days of April 17, 2023 to be outstanding and beneficially owned by the person holding the options for the purpose of computing percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the ownership percentage of any other person. We are not aware of any arrangements, including any pledge by any person of securities of the registrant or any of its parents, the operation of which may at a subsequent date result in a change of control of the registrant.

Name and Address of |

| Number of Shares |

|

|

| Percentage of Common Stock |

| |||

Topline Capital Partners, LP |

|

| 3,617,885 |

| (3) |

|

| 9.7 | % | |

Punch & Associates Investment Management, Inc. |

|

| 2,566,530 |

| (4) |

|

| 6.9 | % | |

Ross Dove |

|

| 2,209,098 |

|

|

|

| 6.0 | % | |

David Ludwig |

|

| 1,107,896 |

| (5) |

|

| 3.0 | % | |

Samuel L. Shimer |

|

| 287,500 |

| (6) |

| *% |

| ||

Michael Hexner |

|

| 271,351 |

| (7) |

| *% |

| ||

Nicholas Dove |

|

| 128,665 |

| (8) |

| *% |

| ||

Barbara Sinsley |

|

| 58,800 |

| (9) |

| *% |

| ||

Kelly Sharpe |

|

| 53,300 |

| (10) |

| *% |

| ||

Shirley Cho |

|

| 30,000 |

|

|

| *% |

| ||

William Burnham |

|

| 15,000 |

|

|

| *% |

| ||

All Executive Officers and Directors as a Group (13 people) |

|

| 4,514,673 |

|

|

|

| 12.0 | % | |

____________________ |

| |||||||||

* | % Indicates less than one percent. |

| ||||||||

(1) | Unless otherwise noted, each person or entity named as beneficial owner has sole voting and dispositive power with respect to the shares of stock owned by each of them. Unless otherwise noted, all addresses are c/o Heritage Global Inc. 12625 High Bluff Drive, Suite 305, San Diego, California, 92130. |

| ||||||||

(2) | As to each person or entity named as beneficial owners, that person’s or entity’s percentage of ownership is determined based on the assumption that any options or convertible securities held by such person or entity which are exercisable or convertible within sixty (60) days of April 17, 2023, have been exercised or converted, as the case may be. |

| ||||||||

(3) | Unrelated third party with beneficial ownership greater than 5.0%, based solely upon a Form 4 filed on April 18, 2023 with the SEC by Topline Capital Partners, L.P., which has sole voting power and sole dispositive power with respect to 3,617,885 shares. The address for the reporting person is 2913 3rd Street, Unit 201, Santa Monica, CA 90405. |

| ||||||||

(4) | Unrelated third party with beneficial ownership greater than 5.0%, based solely upon a Schedule 13G/A filed on February 13, 2023 with the SEC by Punch & Associates Investment Management, Inc., which has sole voting power and sole dispositive power with respect to 2,566,530 shares. The address for the reporting person is 7701 France Ave. So., Suite 300, Edina, MN 55345. |

| ||||||||

(5) | Includes 75,000 shares of common stock issuable pursuant to options. Mr. Ludwig’s address is c/o National Loan Exchange Inc., 10 Sunset Hills Professional Center, Floor 1, Edwardsville, IL 62025. |

| ||||||||

(6) | Includes 5,000 shares of common stock issuable pursuant to options. |

| ||||||||

(7) | Includes 62,500 shares of common stock issuable pursuant to options. |

| ||||||||

(8) | Includes 50,000 shares of common stock issuable pursuant to options. |

| ||||||||

(9) | Includes 12,500 shares of common stock issuable pursuant to options. |

| ||||||||

(10) | Includes 12,500 shares of common stock issuable pursuant to options. |

| ||||||||

17

INFORMATION ABOUT OUR EXECUTIVE OFFICERS

The Company’s executive officers as of April 28, 2023, are:

Ross Dove, age 70, currently serves as a Class I director and the Chief Executive Officer and President of the Company. Mr. Ross Dove was appointed our Chief Executive Officer in May 2015 and has served as Co-Managing Partner of Heritage Global Partners, Inc., a Company subsidiary (“HGP”) since its founding in October 2009. Together with his brother, Kirk Dove, Mr. Ross Dove joined our company when HGI acquired HGP in February 2012. Mr. Dove began his career in the auction business over thirty years ago, beginning with a small family-owned auction house and helping to expand it into a global firm, DoveBid, which was sold to a third party in 2008. The Messrs. Dove remained as global presidents of the business until September 2009, and then formed HGP in October 2009. During his career, Mr. Dove has been actively involved with advances in the auction industry such as theatre-style auctions, which was a first step in migrating auction events onto the Internet. Mr. Dove has been a member of the National Auctioneers Association since 1985, and a founding member of the Industrial Auctioneers Association. He served as a director of Critical Path from January 2002 to January 2005 and has served on the boards of several venture funded companies. Ross Dove is the brother of Kirk Dove and uncle of Nicholas Dove.

Brian Cobb, age 39, currently serves as our Chief Financial Officer and has served in such capacity since May 2022. Prior to his appointment, Mr. Cobb served as the Company’s Vice President of Finance and principal financial officer, and held the positions of Corporate Controller and Director of Financial Reporting since starting with the Company in July 2017. Before joining the Company, Mr. Cobb was a manager in the assurance practice of PricewaterhouseCoopers. Mr. Cobb received a Bachelor of Science from the College of Business Administration at California State University San Marcos.

James Sklar, age 57, currently serves as our Executive Vice President, General Counsel, and Secretary and has served in such capacities since May 2015. From June 2013 to May 2015, Mr. Sklar served as the Executive Vice President and General Counsel of Heritage Global Partners, Inc. Mr. Sklar has more than three decades of relevant legal expertise serving leading worldwide asset advisory and auction services firms. Throughout his career, Mr. Sklar has played a key role in establishing relationships with global alliance partners and implementing international contracts as well as expanding the adoption of the auction sale process in North America, Europe, Asia and Latin America. Mr. Sklar is responsible for all of the Company’s legal matters including negotiating global transactional business alliance documents, managing relationships and contracts with worldwide clients and business partners, and providing legal representation for all of the Heritage Global companies. Mr. Sklar received a Bachelor of Science in economics from the Wharton School of the University of Pennsylvania and a Juris Doctorate from Wayne State University Law School.

David Ludwig, age 66, currently serves as a Class II director and as the President of Heritage Global’s Financial Asset division, which comprises the Company’s National Loan Exchange (“NLEX”) and Heritage Global Capital subsidiaries. He joined Heritage Global in 2014, with the Company’s acquisition of NLEX, which he developed from its start as a post-Resolution Trust Corporation (RTC) sales outlet to the nation’s leading broker of charged-off credit card and consumer debt accounts. With more than 25 years of experience in the financial industry, Mr. Ludwig is considered one of the pioneers in the debt sales industry, and has been a featured speaker at many industry conferences. He has also been quoted in numerous publications including the New York Times, LA Times, Collections and Credit Risk, Collector Magazine, and serves as consultant and expert witness within the industry. Since introducing NLEX to financial institutions in the early 1990’s, Mr. Ludwig has supervised the sale of over 5,000 portfolios with face value of $150 billion. Mr. Ludwig holds a Bachelor of Science Degree in Economics from the University of Illinois.

Nicholas Dove, age 33, currently serves as President, Industrial Assets Division of the Company and has served in such capacity since September 2020. From July 2017 to September 2020, Mr. Dove previously served as Executive Vice President of Sales of Heritage Global Partners since August 2017. From July 2012 to July 2017, Mr. Dove served as one of Heritage Global Partners’ Directors of Sales. Mr. Dove is a licensed auctioneer in multiple states, is a member of the Board of Directors of the Industrial Auctioneers Association and graduated Cum Laude from the W.P. Carey School of Business at Arizona State University. Mr. Dove is the son of Kirk Dove and nephew of Ross Dove.

18

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following sections provide an explanation and analysis of our executive compensation program and the material elements of total compensation paid to each of our named executive officers. Included in the discussion is an overview and description of:

In reviewing our executive compensation program, we considered issues pertaining to policies and practices for allocating between long-term and currently paid compensation and those policies for allocating between cash and non-cash compensation. We also considered the determinations for granting awards, performance factors for our company and our named executive officers, and how specific elements of compensation are structured and taken into account in making compensation decisions. Questions related to the benchmarking of total compensation or any material element of compensation, the tax and accounting treatment of particular forms of compensation and the role of executive officers (if any) in the total compensation process also are addressed where appropriate. In addition to the named executive officers discussed below, we have 77 salaried employees as of April 17, 2023.

Named Executive Officers

Our named executive officers for the last completed fiscal year were as follows:

Overview of our Compensation Program and Compensation Philosophy and Objectives

We compensate our executive management through a combination of base salaries and profit-driven incentives. We adhere to the following compensation policies, which are designed to support the achievement of our business strategies:

19

A core principle of our executive compensation program is the belief that compensation paid to executive officers should be closely aligned with our near- and long-term success, while simultaneously giving us the flexibility to recruit and retain the most qualified key executives. Our compensation program is structured so that it is related to our stock performance and other factors, both direct and indirect, which may influence long-term shareholder value and our success.

We utilize each element of executive compensation to ensure proper balance between our short- and long-term success as well as between our financial performance and shareholder return. In this regard, we believe that the executive compensation program for our named executive officers is consistent with our financial performance and the performance of each named executive officer. We have not utilized the services of compensation consultants in determining or recommending executive compensation, but may do so in the future.

Role of the Compensation Committee

Our Compensation Committee oversees and approves all compensation and awards made to our executive officers to the extent their compensation is not determined by preexisting employment agreements. The Compensation Committee reviews the performance and compensation of the executive officers and establishes their compensation accordingly, with consultation from others, including outside third-party consultants, when appropriate.

Elements of Our Named Executive Officer Compensation Program

The compensation we provide to our named executive officers is primarily comprised of three elements consisting of base salary, bonuses and equity incentive grants. We believe that offering these elements of compensation allows us to meet each of the objectives of our compensation philosophy, as well as to remain competitive with the market for acquiring executive talent. We also provide our named executive officers with certain other benefits and perquisites that are discussed below under “Other Compensation.”

Base Salary

Unless specified otherwise in an employment agreement, the base salaries of our named executive officers are evaluated periodically. In evaluating appropriate pay levels and salary increases for such officers, the Compensation Committee uses a subjective analysis considering achievement of our strategic goals, level of responsibility, individual performance, and internal equity and external pay practices. In addition, the Committee considers the scope of the executives’ responsibilities taking into account competitive market compensation for similar positions where available, as well as seniority of the individual, our ability to replace the individual and other primarily judgmental factors deemed relevant by our Board and Compensation Committee. Mr. Ross Dove’s annual base salary increased from $350,000 in 2021 to $407,740 in 2022. Mr. David Ludwig’s annual base salary remained the same at $400,000.

Performance Based Compensation

Performance based awards are designed to focus management attention on key operational goals for the current fiscal year. Our executives may earn performance based compensation based upon achievement of their specific operational goals and achievement by us or our business unit of financial targets. Cash awards are distributed based upon the Company and the individual meeting performance criteria objectives. The final determination for all payments is made by our Compensation Committee based on a subjective analysis of the foregoing elements, except where the award is provided for in an employment agreement or other contractual obligation between the Company and the executive.

We set performance based compensation based on a subjective analysis of certain performance measures in order to maximize and align the interests of our officers with those of our shareholders. Although performance goals are generally standard for determining awards, we have and will consider additional performance rating goals when evaluating the performance based compensation structure of our executive management. In addition, in instances where the employee has responsibility over a specific area, performance goals may be directly tied to the overall performance of that particular area.

For the years 2022 and 2023, Mr. Ross Dove is eligible for a performance based award on the operating income of the Company, not including the amount of such award. Each year, the amount of such award may range from $30,000 (corresponding to operating income of $3,030,000 for such year) to $1,800,000 (corresponding to operating income of $23,750,000 or more for such year). If earned, the award will be paid 75% in cash, and 25% in restricted stock vesting nine months after the date of grant. The foregoing is conditioned upon Mr. Dove’s continued

20

employment in good standing and is expected to constitute Mr. Dove’s entire performance based compensation for this period. In 2022, Mr. Dove earned a cash award of $438,426 and restricted stock valued at of $146,142.

Mr. David Ludwig is eligible to receive a performance incentive under the terms of the Addendum to the Employment Agreements of David and Tom Ludwig (the “Addendum”), effective on June 1, 2018. The Addendum provides that each calendar year NLEX will allocate 30% of its Net Operating Income and 20% of its Principal Net Operating Income for cash incentive awards to the employees of NLEX, including Mr. Ludwig. Such cash incentive awards are allocated among the NLEX employees, including Mr. Ludwig, based on Mr. Ludwig’s recommendation to our Board. In 2022, Mr. Ludwig received cash incentive awards pursuant to this arrangement of $703,462.

In 2022, Mr. Nicholas Dove earned a performance incentive of $908,525, which was calculated as follows: the first $50,000 of HGP’s divisional Net Operating Income, plus 10% of excess divisional Net Operating Income of HGP over $50,000.

As Mr. Ross Dove’s, Mr. David Ludwig’s and Mr. Nicholas Dove’s performance based awards are closely tied to our profitability, we believe the bonus structure does not encourage inappropriate risk-taking on their part

Equity Incentive Grants

In keeping with our philosophy of providing a total compensation package that favors at-risk components of pay, long-term incentives can comprise a significant component of our executives’ total compensation package. These incentives are designed to motivate and reward executives for maximizing shareholder value and encourage the long-term employment of key employees. Our objective is to provide executives with above-average, long-term incentive award opportunities.

We have traditionally used stock options as the predominant form of stock-based compensation. Stock options generally are granted at the prevailing market price on the date of grant and will have value only if our stock price increases. Grants of stock options generally are based upon our performance, the level of the executive’s position, and an evaluation of the executive’s past and expected future performance. We do not time or plan the release of material, non-public information for the purpose of affecting the value of executive compensation.

In 2022, at the Company's 2022 Annual Meeting of Shareholders, the Company's shareholders approved the 2022 Heritage Global Inc. Equity Incentive Plan, which replaced the Heritage Global Inc. 2016 Plan, and authorized the issuance of an aggregate of 3.5 million shares of common stock for awards made after June 8, 2022. On June 1, 2021, the Company granted 40,000 options to purchase common stock to Mr. David Ludwig, which was made in connection with the Addendum. On August 23, 2021, the Company granted 200,000 options to purchase common stock to Mr. Nicholas Dove. See “Grants of Option Awards” below, for details. No other equity incentive grants were made to any of our named executive officers during 2021 or 2022, except for the restricted stock earned by Mr. Ross Dove discussed above.

Other Compensation

In addition to the primary compensation elements discussed above, we provide our named executive officers with the following limited benefits and perquisites (which are described in more detail below in footnotes 2 and 3 to the 2022 Summary Compensation Table): the Company provided for the payment of an automobile allowance to Mr. Ross Dove in the amount of $14,029 for 2022 and 2021, and the Company provided for the payment of club membership dues for Mr. Ludwig in the amount of $8,695 and $10,216 for 2022 and 2021, respectively. We consider these additional benefits to be a part of a named executive officer’s overall compensation. These benefits generally do not impact the level of other compensation paid to our named executive officers, due to the fact that the incremental cost to us of these benefits and perquisites represents a small percentage of each named executive officer’s total compensation package. We believe that these enhanced benefits and perquisites provide our named executive officers with support services that allow them to focus attention on carrying out their responsibilities to us and are synergistic with positively marketing the Company. In addition, we believe that these benefits and perquisites help us to be competitive and retain talented executives. There were no pension or change in control benefits in either 2022 or 2021.

Upon termination of employment by us without cause, Mr. Ross Dove is entitled to 12 months base salary and a pro rata share of the bonus payable in the fiscal year of termination. Any bonus payable is based on the termination date (provided that, as of the termination date, the performance criteria established with respect to the bonus for the fiscal year have been met), subject to certain conditions.

Upon termination of employment by us without cause, Mr. Ludwig is entitled to receipt of his base salary, payable in equal monthly installments, that would have been received through the last day of the term of his

21

employment agreement. Mr. Ludwig does not receive any compensation for his service as a director on our Board because he is employed by the Company.

Say on Pay Analysis

At our 2021 Annual Meeting, we held an annual advisory vote on executive compensation, and approximately 18,858,002 shares were voted in favor of our named executive officer compensation for 2020. The Compensation Committee will continue to consider the results from our past and future advisory votes on named executive officer compensation, as well as periodic feedback from shareholders, when evaluating our compensation program. Furthermore, based on the results of the advisory vote held at our 2021 Annual Meeting on the frequency of advisory votes on executive compensation, we intend to hold an advisory vote to approve our named executive officer compensation at our 2024 Annual Meeting.

Anti-Hedging of Company Stock

The Company maintains an anti-hedging policy in its Code of Conduct. The Company’s policy prohibits directors, officers and employees, with respect to the Company’s stock, from trading on a short-term basis, engaging in short sales, or buying or selling puts or calls. Moreover, all transactions in the Company’s stock by directors and officers must be cleared by the Corporation’s Secretary. The Company believes that it is improper and inappropriate for its directors, officers and employees to engage in short-term or speculative transactions involving the Company’s stock.

Financial Restatements

The Compensation Committee has not adopted a policy with respect to whether we will make retroactive adjustments to any cash or equity-based incentive compensation paid to named executive officers (or others) where the payment was predicated upon the achievement of financial results that were subsequently the subject of a restatement.

Compensation Clawback

On October 26, 2022, the SEC adopted final rules regarding the adoption of “clawback” policies by publicly listed companies in accordance with the requirements of Section 954 of the Dodd-Frank Wall Street Reform and Consumer Protection Act ("the Dodd-Frank Act"). Pursuant to these rules, publicly listed companies will be required to adopt a “clawback” policy providing for the recovery of incentive-based compensation (as defined in these rules) from its current or former executive officers in the event the listed company is required to prepare an accounting restatement as a result of material noncompliance of the company with any financial reporting requirements under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. The Nasdaq has released proposed listing standards implementing these SEC rules, and the Nasdaq is required to adopt final listing standards later this year.

We intend to adopt a clawback policy consistent with the requirements of the SEC rule and the final Nasdaq listing standards, but we may elect to defer adopting such policy until final Nasdaq listing standards have been adopted later this year in order to ensure full compliance with these listing standards, and in any event intend to adopt such policy within the timeframe required under SEC rules. In addition, Section 304 of the Sarbanes-Oxley Act of 2002 requires the recovery of incentive awards in certain circumstances. If we are required to restate our financials due to material noncompliance with any financial reporting requirements as a result of misconduct, Section 304 of the Sarbanes-Oxley Act provides that our CEO and CFO will be required to reimburse us for (1) any bonus or other incentive- or equity-based compensation received during the 12 months following the first public issuance of the non-complying document, and (2) any profits realized from the sale of our securities during such 12 month period. Our omnibus incentive plan also provides that any award made to a participant under the plan will be subject to mandatory repayment by the participant to us to the extent required by (a) any award agreement, (b) any “clawback” or recoupment policy adopted by the company to comply with the requirements of any applicable laws, rules or regulations, including final SEC rules adopted pursuant to Section 954 of the Dodd-Frank Act, or otherwise, or (c) any applicable laws which impose mandatory recoupment, under circumstances set forth in such applicable laws.

22

Compensation of Executive Officers

Summary Compensation Table

The following table provides information regarding the compensation earned by each of our named executive officers for the fiscal years ended December 31, 2022 and 2021.

Name and |

| Year |

| Salary |

|

| Non-Equity Incentive Plan |

|

| Stock |

|

| Option |

|

| All Other |

|

| Total |

| |||||||

Ross Dove |

| 2022 |

|

| 407,740 |

|

|

| 438,426 |

|

|

| 146,142 |

|

|

| — |

|

|

| 14,029 |

| (2) |

| 1,006,337 |

| |

President and Chief |

| 2021 |

|

| 350,000 |

|

|

| 87,500 |

|

|

| — |

|

|

| — |

|

|

| 14,029 |

| (2) |

| 451,529 |

| |

David Ludwig |

| 2022 |

|

| 400,000 |

|

|

| 703,462 |

|

|

| — |

|

|

| — |

|

|

| 8,695 |

| (3) |

| 1,112,157 |

| |

President, Financial |

| 2021 |

|

| 400,000 |

|

|

| 226,286 |

|

|

| — |

|

|

| 78,680 |

|

|

| 10,216 |

| (3) |

| 715,182 |

| |

Nicholas Dove |

| 2022 |

|

| 200,000 |

|

|

| 908,525 |

|

|

| — |

|

|

| — |

|

|

| — |

|

|

| 1,108,525 |

| |

President, Industrial |

| 2021 |

|

| 200,000 |

|

|

| 410,906 |

|

|

| — |

|

|

| 243,900 |

|

|

| — |

|

|

| 854,806 |

| |

____________________ |

| ||||||||||||||||||||||||||

(1) | See “Grants of Option Awards,” below, for details regarding the assumptions made in the valuation of these awards. |

| |||||||||||||||||||||||||

(2) | This amount represents payment for an automobile allowance. |

| |||||||||||||||||||||||||

(3) | This amount represents membership dues paid on behalf of Mr. Ludwig. |

| |||||||||||||||||||||||||

Grant of Option Awards

On August 23, 2021, the Company granted 200,000 options to purchase common stock to Nicholas Dove and 40,000 options to purchase common stock to David Ludwig at an exercise price of $1.78 per share. No other option grants were made to our named executive officers during 2022 and 2021.

23

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth the detail of outstanding equity awards at December 31, 2022.

Name |

| Number of |

|

|

| Number of |

|

| Option |

|

| Option Expiration |

| Equity |

|

|

| Equity Incentive |

| ||||||

David Ludwig |

|

| — |

|

|

|

| — |

|

| N/A |

|