Filed by Weyerhaeuser Company

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Plum Creek Timber Company, Inc.

Commission File No.: 001-10239

The following fact sheet was made available to certain Weyerhaeuser employees on November 9, 2015:

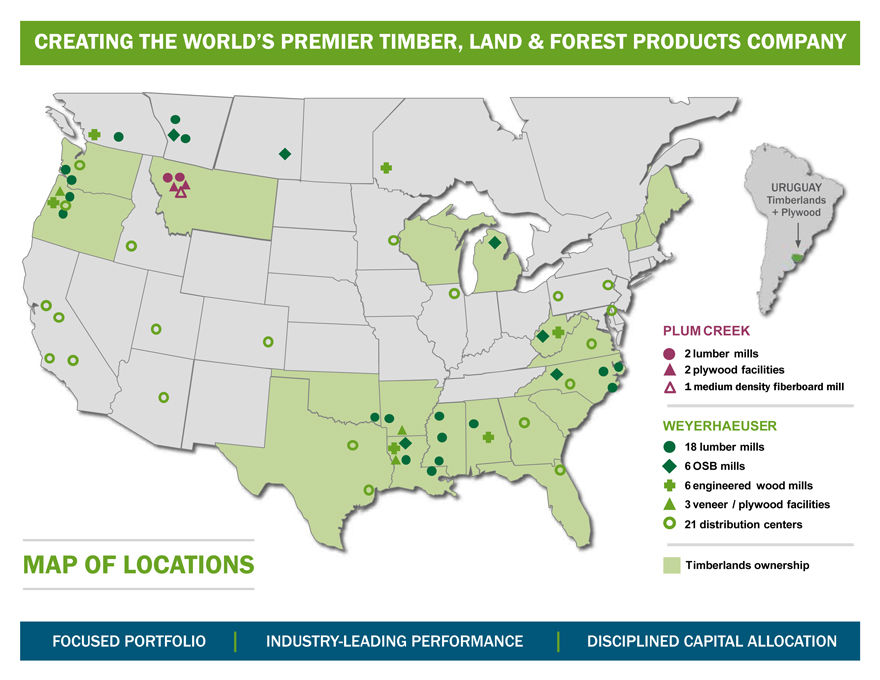

WY + PCL = A WINNING COMBINATION MERGER FACTS NAME: Weyerhaeuser (NYSE: WY) All-stock transaction: PCL shareholders will receive 1.6 WY shares for each PCL share owned Creates $23 billion timber REIT Timing: Late Q1 or early Q2 2016 HEADQUARTERS Seattle, WA FINANCIAL BENEFITS $$2.5 $100 FAD $1.24 BILLION MILLION ACCRETION DIVIDEND post-closing Total annual in first full year per common share repurchase cost synergies (per share) share (annual) DIVERSE & PRODUCTIVE TIMBERLANDS Largest private timberland owner in U.S. 22% 3.0 million acres Pacific Northwest 20% 2.6 million acres Northern Region 56% 7.3 million acres Southern Region 13.2 MILLION ACRES TOTAL* SOUTHERN REGION Highly productive Southern Yellow Pine forests Primarily serves the U.S. housing market PACIFIC NORTHWEST High-value softwood saw logs, mostly Douglas fir Primarily serves West Coast housing and Asian export markets NORTHERN REGION Mixed hardwoods High-value hardwood sawlog & pulpwood markets Inland West softwood sawlogs URUGUAY Fast-growing eucalyptus and pine 2% 323,000 acres Uruguay *Acreage based on pro forma ownership as of 9-30-15 BEST-IN-CLASS TEAM NON-EXECUTIVE CHAIRMAN: Rick R. Holley PRESIDENT & CEO: Doyle R. Simons SENIOR MANAGEMENT TEAM: Rhonda Hunter - SVP, Timberlands Tom Lindquist - EVP, Real Estate, Energy & Natural Resources Adrian Blocker - SVP, Wood Products Russell Hagen - SVP, CFO Devin Stockfish - SVP, General Counsel & Corporate Secretary Denise Merle - SVP, Human Resources Tim Punke - SVP, Corporate Affairs STRONG BALANCE SHEET More than 14K EMPLOYEES Serving customers worldwide LEADING WOOD PRODUCTS MANUFACTURING 20 Lumber Mills 6 OSB Mills 1 Medium Density Fiberboard Mill 5 Plywood/Veneer Mills 6 Engineered Lumber Mills 21 Distribution Centers COMMITTED TO SUSTAINABILITY Together we planted nearly 650 MILLION TREES over the last five years 100% of our timberlands are certified to sustainable forestry standards 2010 2011 2012 2013 2014 CREATING THE WORLD’S PREMIER TIMBER, LAND & FOREST PRODUCTS COMPANY

ii

CREATING THE WORLD’S PREMIER TIMBER, LAND & FOREST PRODUCTS COMPANY URUGUAY Timberlands + Plywood PLUM CREEK 2 lumber mills 2 plywood facilities 1 medium density fiberboard mill WEYERHAEUSER 18 lumber mills 6 OSB mills 6 engineered wood mills 3 veneer / plywood facilities 21 distribution centers Timberlands ownership MAP OF LOCATIONS FOCUSED PORTFOLIO INDUSTRY-LEADING PERFORMANCE DISCIPLINED CAPITAL ALLOCATION

REQUIRED LEGAL LANGUAGE The following legal language is required on all company communication related to this transaction. FORWARD-LOOKING STATEMENTS This communication contains statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, with respect to Weyerhaeuser’s future results and performance, the expected benefits of the proposed transaction such as efficiencies, cost savings and growth potential and the expected timing of the completion of the transaction, all of which are subject to risks and uncertainties. Factors listed below, as well as other factors, may cause actual results to differ significantly from these forward-looking statements. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. If any of the events occur, there is no guarantee what effect they will have on company operations or financial condition. Weyerhaeuser will not update these forward-looking statements after the date of this communication. Some forward-looking statements discuss Weyerhaeuser’s and Plum Creek’s plans, strategies, expectations and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” “approximately,” “anticipates,” “estimates,” and “plans.” In addition, these words may use the positive or negative or other variations of those and similar words. Major risks, uncertainties and assumptions that affect Weyerhaeuser’s and Plum Creek’s businesses and may cause actual results to differ materially from those expressed or implied in these forward-looking statements, including, without limitation, the failure to receive, on a timely basis or otherwise, the required approval of Weyerhaeuser’s shareholders or Plum Creek’s stockholders with respect to the proposed transaction; the risk that any of the conditions to closing of the proposed transaction may not be satisfied; the risk that the businesses of Weyerhaeuser and Plum Creek will not be integrated successfully; the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, and strength of the U.S. dollar; market demand for our products, which is related to the strength of the various U.S. business segments and U.S. and international economic conditions; performance of our manufacturing operations, including maintenance requirements; the level of competition from domestic and foreign producers; the successful execution of internal performance plans, including restructurings and cost reduction initiatives; raw material prices; energy prices; the effect of weather; the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters; transportation availability and costs; federal tax policies; the effect of forestry, land use, environmental and other governmental regulations; legal proceedings; performance of pension fund investments and related derivatives; the effect of timing of retirements and changes in the market price of company stock on charges for stock-based compensation; changes in accounting principles; and other factors described in Weyerhaeuser’s and Plum Creek’s filings with the SEC, including the “Risk Factors” section in Weyerhaeuser’s and Plum Creek’s respective annual reports on Form 10-K for the year ended December 31, 2014. NO OFFER OR SOLICITATION This communication is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. ADDITIONAL INFORMATION AND WHERE TO FIND IT The proposed transaction involving Weyerhaeuser and Plum Creek will be submitted to Weyerhaeuser’s shareholders and Plum Creek’s stockholders for their consideration. In connection with the proposed transaction, Weyerhaeuser intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to Weyerhaeuser’s common shares to be issued in the proposed transaction and a joint proxy statement for Weyerhaeuser’s shareholders and Plum Creek’s stockholders (the “Joint Proxy Statement”) and each of Weyerhaeuser and Plum Creek will mail the Joint Proxy Statement to their respective shareholders or stockholders, as applicable, and file other documents regarding the proposed transaction with the SEC. SECURITY HOLDERS ARE URGED AND ADVISED TO READ ALL RELEVANT MATERIALS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT, CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. The Registration Statement, the Joint Proxy Statement and other relevant materials (when they become available) and any other documents filed or furnished by Weyerhaeuser or Plum Creek with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement from Weyerhaeuser upon written request to Weyerhaeuser Company, 33663 Weyerhaeuser Way South, Federal Way, Washington 98003, Attention: Director, Investor Relations, or by calling (253) 924-2058, or from Plum Creek upon written request to Plum Creek, 601 Union Street, Suite 3100, Seattle Washington 98101, Attention: Investor Relations, or by calling (800) 858-5347. PARTICIPANTS IN THE SOLICITATION Weyerhaeuser, Plum Creek, their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Weyerhaeuser’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Shareholders, which was filed with the SEC on April 1, 2015, and information about Plum Creek’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2015. These documents are available free of charge from the sources indicated above, and from Weyerhaeuser by going to its investor relations page on its corporate web site at www.weyerhaeuser.com and from Plum Creek by going to its investor relations page on its corporate web site at www.plumcreek.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the Registration Statement, the Joint Proxy Statement and other relevant materials Weyerhaeuser and Plum Creek intend to file with the SEC.