- CRH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

SD Filing

CRH (CRH) SDConflict minerals disclosure

Filed: 28 May 20, 8:16am

Exhibit 1.01

Conflict Minerals Report of CRH public limited company

Pursuant to Rule13p-1 under the Securities Exchange Act of 1934

Section 1: Introduction and Group overview

Section 1.1: Introduction

This is the Conflict Minerals Report of CRH public limited company (herein referred to as “CRH”, the “Group”, “we”, “us”, or “our”) for calendar year 2019 (“Reporting Year 2019”) in accordance with Section 13(p) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule13p-1 thereunder (“Rule13p-1”). Rule13p-1 was adopted by the Securities and Exchange Commission (SEC) to implement reporting and disclosure requirements related to conflict minerals as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Dodd-Frank Act). Conflict minerals are defined by the SEC as columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin, and tungsten (“3TG” or “conflict minerals”). Rule13p-1 imposes certain reporting obligations on SEC registrants whose products contain conflict minerals that are necessary to the functionality or production of their products (such minerals are referred to as “necessary conflict minerals”), excepting conflict minerals that, prior to January 31, 2013, were located “outside of the supply chain” (as defined in Rule13p-1). For products that contain necessary conflict minerals, the registrant must conduct in good faith a reasonable country of origin inquiry (RCOI) designed to determine whether any of the conflict minerals originated in the Democratic Republic of the Congo (DRC) or an adjoining country, collectively defined as the “Covered Countries”. If, based on such inquiry, the registrant knows or has reason to believe that any of the necessary conflict minerals contained in its products originated or may have originated in a Covered Country and knows or has reason to believe that those necessary conflict minerals may not be solely from recycled or scrap sources, the registrant must conduct due diligence in order to determine if the necessary conflict minerals contained in those products did or did not directly or indirectly finance or benefit armed groups in the Covered Countries. Terms used in this report which are not defined herein have the meanings set forth in Form SD.

Section 1.2: Group overview

CRH is the leading building materials business in the world. Our global footprint spans 30 countries, employing c. 80,300 people at over 3,100 operating locations during 2019, serving customers across the breadth of the building materials spectrum. CRH is the largest building materials business in North America, a leading heavyside materials business in Europe and has positions in both Asia and South America. CRH is ranked among sector leaders by leading Environmental, Social and Governance (ESG) rating agencies and is a constituent member of indices including the FTSE4Good Index, the STOXX® Global ESG Leaders Index and the Dow Jones Sustainability Index as well as a long-term participant in CDP (formerly Carbon Disclosure Project). In addition, many of our operating companies have achieved awards for excellence in sustainability. A Fortune 500 company, CRH is a constituent member of the FTSE 100 Index, the EURO STOXX 50 Index and the ISEQ 20. CRH’s American Depositary Shares (ADSs) are listed on the New York Stock Exchange (NYSE).

CRH manufactures and supplies a range of building materials, products and innovative solutions for the construction industry. From primary materials that we extract, process and supply, to products that are highly engineered and high-value-added, CRH is uniquely positioned to address evolving trends in global construction markets. Our products can be found throughout the built environment in a wide range of construction projects from major public infrastructure to commercial buildings and residential structures.

CRH’s Americas Materials and Europe Materials Divisions manufacture and supply a broad range of materials for use in construction projects including aggregates, cement, asphalt, readymixed concrete, concrete products and lime. In certain markets we also provide paving and construction services. The Group’s Building Products Division is a leading manufacturer and supplier of a wide range of high quality, value-added, innovative building products and solutions, spanning multiple construction applications from residential and commercial structures to public spaces and infrastructure. The Group’s Building Products Division brings together related products businesses in Europe, North America and Asia Pacific across four strategic product groups for growth: Architectural Products, Building Envelope, Infrastructure Products and Construction Accessories.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

CRH has identified over the last seven years that a small portion of our product portfolio includes components which contain 3TG and this has minimal impact on our supply chain. Purchases from these suppliers represent approximately 2% (2018: 2%) of CRH’s cost of raw materials and goods for resale. These include:

| • | Certain glazing products: |

| • | Our Building Envelope business is a leading integrated supplier of products specified to close the building envelope, including architectural glass, storefront systems, custom engineered curtain and window wall, architectural windows, doors and skylights. Float glass is used in the manufacture of some of our glazing products. We purchase this float glass from our suppliers and it is made by floating molten glass on a bed of molten metal, typically tin. Trace amounts of tin remain on the surface of the float glass in the oxide form. |

| • | Certain products containing electrical/electronic components: |

| • | Our former Perimeter Protection* business designs, manufactures, installs and services fully integrated outdoor security and detection solutions. This includes fencing, entrance control and perimeter intrusion detection; and |

| • | Our former Shutters & Awnings* business designs, manufactures and supplies roller shutters, awnings, terrace roofs and related products for sun protection and outdoor living; and |

| • | The primary components of these products do not contain 3TG. However, some electrical/electronic elements of these products (e.g. circuit boards, capacitors, solder tags, pcb boards, micro switches or radio controls) may contain minute amounts of the minerals. |

| * | During 2019, CRH completed the divestment of its Perimeter Protection and Shutters & Awnings businesses. This Form SD includes these businesses for the 2019 Reporting Year, except where outlined below, where we have provided certain information excluding these divested businesses. |

Some of the components which are incorporated into our products contain 3TG that are necessary for the functionality or production of those products. Beyond compliance, CRH is committed to responsibly sourcing all its products and raw materials and our objective is to ensure that our direct suppliers are not using 3TG minerals from sources that directly or indirectly finance or benefit armed groups in the Covered Countries.

We have continued to actively engage with our direct suppliers to put in place processes, procedures and systems to develop conflict-free supply chains for CRH. CRH uses the tools provided by the Responsible Minerals Initiative (RMI), an initiative of the Responsible Business Alliance (RBA) and the Globale-Sustainability Initiative (GeSI), to assist in the ongoing engagement with direct suppliers.

Across our Building Envelope, Perimeter Protection and Shutters & Awnings businesses, we have identified a total of 25 suppliers from whom components with minute amounts of the minerals are purchased (“identified suppliers”), with 3 of these identified suppliers being from our Building Envelope business.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Section 2: Due diligence framework

In accordance with Rule13p-1, CRH undertook due diligence measures to determine the source and chain of custody of 3TG in its products, as described in this Form SD, that are necessary to the functionality or production of the products. CRH designed its due diligence measures to be in conformity, in all material respects, with the internationally recognised due diligence framework as set forth in the Organisation for Economic Cooperation and Development (OECD) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Framework”) and the related supplements for gold and for tin, tantalum and tungsten.

Section 3: Due diligence measures undertaken

CRH’s due diligence measures for 2019 included the five steps listed below, consistent with the OECD Framework. Since our filing in respect of 2018:

| • | We continued to maintain our internal management systems used across the Group, specifically the use of our cloud-based Sustainability Reporting Application, as set out in step 1 below; |

| • | We updated and expanded inquiries to ensure we have appropriately identified and assessed the risk relating to the use of 3TG in the Group’s products as outlined in step 2 below; |

| • | We continue to progress our reasonable country of origin inquiries. As part of our 2019 reporting, 15 of our identified suppliers have provided details of their smelters (including all 3 identified suppliers in respect of our Building Envelope business). Our procedures to assess supplier responses and the smelter listings in respect of our Building Envelope business are ongoing; and |

| • | We incorporated our recently acquired businesses into our inquiries and confirmed that no new high risk businesses were identified as part of these inquiries. |

Step 1: Establish company management systems

CRH previously introduced the following measures to establish management systems per step 1 of the OECD Framework:

| • | Established a cross-functional conflict minerals compliance team comprised of senior representatives from our Sustainability, Procurement and Finance functions to direct the overall efforts of the conflict minerals compliance programme; |

| • | Established a Group policy which aims to prevent the use of minerals that directly or indirectly finance or benefit armed groups in the DRC or in adjoining countries. This policy is incorporated into our Supplier Code of Conduct (the “Code”) which is available on www.crh.com. The Code is communicated to all suppliers and states that we expect all suppliers to align and comply with Dodd-Frank’s conflict minerals reporting rules. We are constantly working on integrating the Code into all CRH sourcing materials such as purchase orders, contracts ande-tenders; |

| • | Developed a grievance mechanism to report any policy violation via the confidential hotline service; we strongly encourage any ethical or legal misconduct or violations of the Code to be reported by either the relevant CRH business or the supplier using our ‘hotline’ facility; |

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

| • | Instituted a retention policy for conflict minerals programme documentation in accordance with current corporate retention practices; |

| • | Engaged with suppliers, informed them that CRH is subject to Section 1502 of the Dodd-Frank Act (Section 13(p) of the Exchange Act) and sent our enquiries to them in this regard; |

| • | Work remains ongoing to include provisions regarding products or components that contain conflict minerals in supply contract renewals and new contracts; |

| • | Suppliers who provide products or components that contain conflict minerals are engaged in our surveys and continued discussions regarding the country of origin of these minerals. Further details on this process are set out in step 3 below; |

| • | Developed specific roles for appropriate and specialised personnel within CRH Procurement with responsibility to further drive Corporate Social Responsibility (CSR) and sustainability practices into our procurement processes and systems which will enable greater transparency of information going forward; |

| • | Implemented a bespoke conflict minerals questionnaire through our online Sustainability Reporting Application to carry out the annual Group-wide Supply Chain assessment to determine the use of conflict minerals within CRH; and |

| • | Reviewed our Group Procurement Application to identify all suppliers to the three businesses identified and to determine the actual spend with any identified suppliers. The identified list of suppliers is continuously reviewed and CRH Procurement engaged with those suppliers across our Building Envelope, Perimeter Protection and Shutters & Awnings businesses, who accounted for 100% of spend in this area (2018: approximately 99%). |

Step 2: Identify and assess risks in the supply chain

At the commencement of the Conflict Minerals reporting process, we undertook a Group-wide Supply Chain assessment to determine the use of conflict minerals within CRH. An applicability assessment was completed which involved cross-functional inquiries across the Group. Local management teams conducted reviews to identify the materials, products, parts and suppliers potentially exposed to Rule13p-1’s requirements using both product-centric and supplier-centric approaches. Three business units (which then represented 128 of the Group’s close to 3,400 locations in 2013) indicated the use of 3TG (through the purchase of3TG-containing electrical and electronic components which are incorporated into our products or used in the production process of our products, or through the purchase of float glass with trace amounts of tin in oxide form on the surface).

Since our 2013 reporting year, when we identified 22 suppliers:

| • | as part of our continued applicability assessment an additional 60 new suppliers (2 in 2019) were identified within our Building Products Division; and |

| • | a total of 57 previously identified suppliers no longer supply to the Group (13 in 2019) and so have been excluded from further inquiries. |

resulting in a total of 25 identified suppliers across our businesses in respect of 2019 reporting, of which our Building Envelope business represents 3 suppliers. We are continuing to engage with the suppliers identified and are conducting country of origin inquiries as outlined in step 3 below.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Reporting Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Movement since 2013 | Building Envelope only 2019 | |||||||||||||||||||||||||||

New suppliers | — | — | +14 | +8 | +23 | +13 | +2 | +60 | — | |||||||||||||||||||||||||||

Suppliers no longer supplying | — | -4 | -1 | -5 | -18 | -16 | -13 | -57 | — | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

Total | 22 | 18 | 31 | 34 | 39 | 36 | 25 | +3 | 3 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||

In an effort to continuously improve our conflict minerals due diligence and assessment processes, over the last six years we have updated and expanded our assessment of the risk in relation to 3TG in order to validate our assessment process and confirm our determination of suppliers that are relevant for the conflict minerals due diligence and assessment processes.

Senior management in our divisions have considered the results of our original applicability assessment in the context of any changes in the profile of their products and supplier base since that assessment. The conflict minerals questionnaire, circulated through our online Sustainability Reporting Application, was used to carry out the annual Group-wide Supply Chain assessment to determine the use of conflict minerals within CRH. The results of the assessment concluded that the initial assessment remains appropriate and the businesses identified at that time continue to represent the only businesses using materials/components that contain 3TG. However, as a result of continuous process improvements, along with changes in our supplier base, since our 2013 reporting year we have identified 3 net additional suppliers within those previously identified businesses that provide components containing minute quantities of 3TG.

Step 3: Design and implement a strategy to respond to identified risks

As described in Step 2 above, consistent with reporting year 2018, we expanded our inquiries beyond those initial suppliers judged to be high risk through an update review, whereby senior management in our divisions confirmed that the findings of our previous assessments remain appropriate. In addition, our implemented procedures, designed to confirm that no new high-risk businesses were identified in our recently acquired businesses, continue to be applied.

Our RCOI process includes the following steps to assess whether the necessary 3TG in our products originated from the Covered Countries:

| • | In respect of our 2019 suppliers, we engaged with the 25 suppliers identified to gather the following information: |

| • | A completed Conflict Minerals Reporting Template (CMRT) developed by the RMI; and |

| • | Where available, details of the suppliers’ policies on conflict minerals as well as any other documentation regarding their management systems and due diligence processes on this matter. |

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

| • | Of the 25 identified suppliers, 2 suppliers contacted confirmed their products supplied to CRH do not contain any 3TG and are therefore outside the scope of this review and for future reporting. |

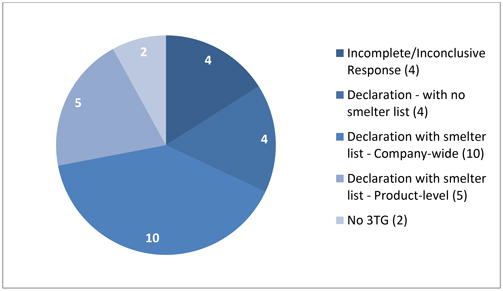

| • | Of the remaining 23 suppliers; |

| • | 15 suppliers have provided details of the smelters who supply their minerals through either a product-level (5) or company-wide (10) declaration; |

| • | 4 suppliers have provided either product-level (2) or company-wide (2) declarations, but have yet to identify the smelters in their supply chain; and |

| • | 4 suppliers have provided responses which appear to be incomplete or inconclusive. |

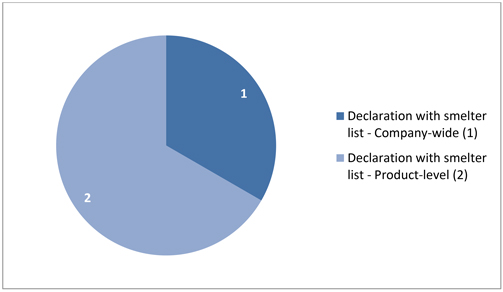

| • | In respect of the 3 suppliers from our Building Envelope business, all suppliers have provided details of the smelters who supply their minerals through either a product-level (2) or company-wide declaration (1). We have assessed their responses and continue to evaluate the reliability of their findings and determine which smelters may be traced to the 3TG used in components of our products, and on this basis, we have not included an individual smelter listing. All 3 of our Building Envelope suppliers have signed our Code. |

Analysis of supplier responses 2019 – including our Shutters & Awnings and Perimeter Protection Businesses:

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Analysis of supplier responses 2019 – Building Envelope Business only:

Our RCOI work is ongoing in this regard:

| • | We continue to experience improved engagement from the majority of suppliers and they demonstrate an understanding of the requirement; |

| • | We have engaged with suppliers to gather all outstanding information/clarifications; |

| • | We have reviewed the RMI CMRT Smelter Reference List and policies received. We continue to develop specific completeness and consistency criteria in order to evaluate our suppliers’ most up to date responses for reliability; |

| • | We continue to engage with suppliers to narrow the list of smelters they identified in their responses to those who potentially source/process the 3TG minerals in the products sold to CRH and to probe any incomplete or inconsistent information in responses received; and |

| • | Because of the many participants in the supply chain of these products, it is a time consuming process to identify all such participants and to ascertain the smelters and country of origin of the minerals. CRH’s RCOI consists of inquiring of direct suppliers and encouraging them to engage with their supply chain to determine the source of the minerals. |

The cross-functional conflict minerals team’s ongoing review of the nature and quality of supplier responses forms a key part of the process of responding to identified risks. Local management report to the team regularly. Update meetings are held periodically during the process, communicating the results of the risk assessment process. Matters discussed include progress on response rates and procedures to evaluate the information received as well as actions to perform follow up inquiries.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Step 4: Carry out independent third-party audit of supply chain due diligence at identified points in the supply chain

In accordance with Rule13p-1 and the SEC’s current guidance, CRH is not required to obtain an independent private sector audit of this Conflict Minerals Report for Reporting Year 2019.

CRH does not directly purchase 3TG. Instead, these minerals are present in a small number of our products through 1) purchase of electrical/electronic components that contain them and are incorporated into our products or used in the production process and 2) the purchase of float glass with trace amounts of tin in oxide form on the surface.

CRH is a downstream consumer of necessary 3TG and is many steps removed from smelters and refiners who provide minerals and ores. CRH does not purchase raw minerals or ores, and does not, to the best of its knowledge, directly purchase from any of the Covered Countries. CRH does not perform or direct audits of smelters and refiners within the supply chain. As a result, CRH’s due diligence measures rely on assessments carried out by its suppliers and cross-industry initiatives such as the RMI led by the RBA and the GeSI to conduct smelter and refiner due diligence. Furthermore, we encourage our suppliers to conduct their own supplier audits in order to identify and monitor risks in their supply chains.

Our work to assess the reliability of supplier representations in this context is ongoing. Section 5 below sets out our ongoing efforts to mitigate risk in this regard.

Step 5: Report on supply chain due diligence

This report and the associated Form SD are available online at www.crh.com.

Section 4: Determination

As a downstream consumer of 3TG, CRH must rely on its direct suppliers to gather information about smelters and refiners in the supply chain. CRH is continuing to engage with our Building Envelope business and its 3 identified suppliers of the products described above. Since our initial reporting for 2013, we have experienced improved engagement from the majority of suppliers, and from assessments of supplier responses to date, we have observed enhanced understanding of the applicable due diligence requirements and progress in our suppliers’ own inquiries. As discussed above, during 2019, CRH completed the divestment of its Perimeter Protection and Shutters & Awnings businesses and these businesses will not form part of our Form SD reporting going forward.

In respect of our Building Envelope business only we have received information from all 3 suppliers (2 product-level, 1 company-wide declarations), all of whom have provided details to us of their smelters and our work to evaluate this information remains ongoing. The suppliers provided a total of 100 unique smelters or refiners (SORs), all of which were included on the CMRT Smelter Reference List. Of these SORs, the RMI has classified 96 as “Conformant,” meaning that the SOR conforms with the RMI’s Responsible Minerals Assurance Process’s (RMAP) assessment protocols, 1 as “Active,” meaning that the SOR participates in the RMAP and has committed to undergo an RMAP assessment, and the remaining 3 are on the CMRT Smelter Reference List but their sourcing policies and practices have not yet been validated.

We lack sufficient assurance regarding the country of origin at this time and CRH is therefore unable to determine where the 3TG identified through certain supplier responses originated. We are continuing to engage with our suppliers and section 5 below sets out our continuous improvement efforts to mitigate risk in this regard.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Section 5: Continuous improvement efforts to mitigate risk

CRH is undertaking the following steps to mitigate any risk that the necessary 3TG used in CRH’s products may benefit armed groups in the Covered Countries:

| • | Continued engagement with the identified suppliers within our Building Envelope business to encourage diligence and resolve in their efforts to identify smelter and country of origin. This includes working with them individually to understand the challenges they face in concluding their inquiries and to narrow the list of smelters they identified to those who potentially source/process the 3TG minerals in the products sold to CRH; |

| • | Continued cross-functional engagement within CRH to build expertise in assessing the reliability of supplier responses and representations on traceability; |

| • | Continued work to include provisions regarding products or components that contain conflict minerals in supply contract renewals and new contracts; |

| • | Continued consideration where necessary of the engagement of additional external experts to perform inquiries/supplier audits to assess identified suppliers’ procedures; and |

| • | Enhancing supplier outreach through the Code and related communications in additional languages. |

Section 6: Independent audit

In accordance with Rule13p-1 and the SEC’s current guidance, CRH is not required to obtain an independent private sector audit of this Conflict Minerals Report for Reporting Year 2019.

Conflict Minerals Report of CRH public limited company

Pursuant to Rule 13p-1 under the Securities Exchange Act of 1934

Forward-Looking Statements

In order to utilise the “Safe Harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, CRH is providing the following cautionary statement.

This Conflict Minerals Report contains certain forward-looking statements with respect to the steps we intend to take to improve the quality of supplier responses in connection with our conflict minerals due diligence efforts. These forward-looking statements may generally, but not always, be identified by the use of words such as “will”, “can”, “intends” or similar expressions.

By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that may or may not occur in the future and reflect the Group’s current expectations and assumptions as to such future events and circumstances that may not prove accurate. A number of factors could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements, certain of which are beyond our control and which include, among other things: our ability to identify additional high-risk suppliers; whether our suppliers respond favourably to our efforts to increase engagement with regards to conflict minerals and our Code; and the feasibility of implementing our planned diligence measures in the next compliance period or at all.