Exhibit 99.02

SYMC Reports Fourth Quarter 2016 Results – CFO Commentary

May 12, 2016

A reconciliation for all non-GAAP financial measures discussed in this commentary to the most directly comparable GAAP financial measures is included in our financial tables that accompany our earnings press release available on http://investor.symantec.com/investor-relations/events-calendar/.

Q4 Fiscal 2016 Commentary

Revenue was $873 million, down 6% year-over-year in constant currency. Enterprise Security declined 4% and Consumer Security declined 7% in constant currency. The shift in Enterprise Security customer buying preferences resulted in less license revenue during the quarter and more revenue deferred to future periods. This included a faster than expected shift within our product mix to subscription and to ratable contract structures.

Non-GAAP operating income was $214 million and non-GAAP operating margin was 24.5%, down 740 basis points year-over-year in constant currency and below our guidance range.

GAAP operating income was $128 million and GAAP operating margin was 14.7%.

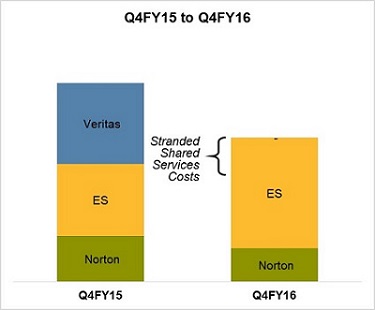

As outlined in the chart below, the sale of the Veritas business resulted in shared services once allocated and used by Veritas that are now being absorbed by the remaining Enterprise Security business. We plan to eliminate these stranded shared services costs as part of our announced restructuring.

Shared Services Spend

Non-GAAP net income was $147 million and non-GAAP EPS was $0.22. GAAP net income was $2.05 billion and GAAP EPS was $3.15.

Our non-GAAP tax rate was 27.5%. During the third quarter of fiscal 2016, the Company adopted a projected long-term non-GAAP tax rate of 27.5% in order to provide better consistency across the interim financial reporting periods by eliminating the effects of stock based compensation, amortization of acquisition related intangibles and restructuring, separation and transition charges. Additionally, the use of a long-term projected non-GAAP tax rate will eliminate the effects of certain discontinued operations accounting policy elections and unique GAAP reporting requirements under discontinued operations as a result of the sale of the information management business. GAAP tax rate was 51.5%.

The Veritas sale closed on January 29, 2016 and the net gain recorded was $3.0 billion. Total U.S. and foreign income taxes and indirect taxes resulting from the sale are approximately $1.0B and are reflected in the net gain described above.

A significant portion of the Veritas sale proceeds are attributable to international tax jurisdictions and the Company does not intend to indefinitely reinvest such earnings. As such, the Company has recorded a one-time non-cash charge of $1.1 billion associated with US taxes on such foreign gain impacts on the Veritas sale. This charge was recorded in continuing operations on the Income Statement.

GAAP and Non-GAAP EPS were calculated using 650 and 656 million fully diluted shares, respectively.

Q4 Fiscal 2016 Segment Results – Enterprise Security

Enterprise Security segment revenue was $467 million, down 4% year-over-year in constant currency.

Enterprise Security excluding Website Security revenue was $377 million, down 5% year-over-year in constant currency.

| ● | Threat protection declined 8% in constant currency. |

| ● | Information protection declined 5% in constant currency. |

| ● | Website Security grew 1% in constant currency. |

| ● | Cybersecurity Services, Consulting and Other grew 9% in constant currency. |

Enterprise Security operating loss was $3 million, driven by lower than expected revenue but partially offset by lower spending.

Q4 Fiscal 2016 Segment Results – Consumer Security

Consumer Security segment revenue was $406 million, down 7% year-over-year in constant currency.

Consumer Security operating income was $217 million.

Discontinued Operations

The Veritas sale closed on January 29, 2016 and the net gain recorded was $3.0 billion.

The results of operations of the information management business will be disclosed as discontinued operations on the income statement.

Cash Flow Statement

Cash flow from operations was $292 million. We made separation payments of $55 million and restructuring payments of $19 million during the March quarter.

Capital expenditures were $47 million. We expect fiscal 2017 capital expenditures to be approximately $200 million.

During the March quarter, we repurchased 47.4 million shares and paid $2.72 billion in dividends. On March 21, 2016, we entered into accelerated stock buyback agreements with Citibank, Merrill Lynch, and Wells Fargo to repurchase $1.0 billion of shares. The Company made an upfront payment of $1.0 billion on March 24, 2016 and received initial shares of 42 million. The shares received are retired in the periods they are delivered, and the up-front payment is accounted for as a reduction to stockholders equity. As part of the accelerated buyback, the company will receive additional shares at the settlement of the ASR.

As previously announced, the Symantec Board declared a special dividend of $4.00 per share, equaling approximately $2.6 billion, which was paid on March 22nd, 2016, out of the earnings and profits of the company, to shareholders of record as of the close of business on March 8th, 2016.

The company intends to return an additional $1.3 billion of cash through share repurchases by March 2017.

Balance Sheet

Cash, cash equivalents and short-term investments at the end of the quarter was $6.0 billion, up $3.8 billion compared to the end of the third quarter of fiscal 2016. The Company has US and foreign income taxes payable on the gain associated with the sale of the Veritas business of approximately $1 billion.

Deferred Revenue at the end of the quarter was $2.6 billion. The deferred revenue balance includes $330 million related to Veritas deferred revenue booked in prior shared contracts.

Debt at of the end of the quarter was $2.2 billion.

| ● | On March 4, 2016, we issued $500M of 2.50% Convertible Senior Notes due April 1, 2021. All the notes were purchased by Silver Lake Partners. The Company incurred approximately $6M in debt issuance costs which will be amortized to interest expense. The conversion option and additional conversion features are not required to be accounted as bifurcated derivatives. The notes are required to be separated into a liability component and equity component as follows: Liability - $471M, Equity - $29M. The difference between the carrying amount of the liability and the principal to be repaid will be recognized as additional interest expense over the life of the instrument (i.e. the $29M). As the investor can redeem the notes on or after the fourth anniversary, the period of amortization for the debt discount and deferred debt issuance costs will be four years. As the Company has the intent and ability, and the past practice of settling the principal amount in cash on conversion, the Company will apply the treasury stock method for EPS. Under the treasury stock method, no numerator or denominator adjustments arise from these components of the Notes because the Notes’ principal and interest are expected to be settled in cash. Instead, the Company need only increase its diluted EPS denominator by the variable number of shares that would be issued upon conversion if it chose to settle the conversion spread obligation with shares. |

| ● | On May 10, 2016, we entered into a credit agreement with a syndicate of lenders that provides for a 3-year term loan facility in an aggregate principal amount of $1.0 billion and a 5-year revolving credit facility in an aggregate principal amount not to exceed $1.0 billion. The credit agreement replaces a prior credit facility which was terminated on May 10, 2016. We have not yet borrowed any funds under the revolving credit facility and borrowed $1.0 billion of loans under the term loan facility which we will use for stock repurchases under the previously approved stock repurchase programs. Payments of the principal amounts of term loans under the credit agreement are due no later than May 10, 2019 and revolving loans under the credit agreement are due no later than May 10, 2021, in each case subject to extension as provided for in the Credit Agreement. We may prepay loans under the credit agreement at any time at its option, without penalty, subject to reimbursement of certain costs in the case of borrowings that bear interest at an adjusted LIBO rate. The revolving loans may be repaid and reborrowed from time to time prior to the revolving loan maturity date. Amounts borrowed under the term loan facility may not be reborrowed once repaid. |

Outlook

The following statements concerning Symantec are forward-looking and actual results could differ materially from current expectations. These statements are subject to risks and uncertainties, including those set forth in Risk Factors in the company’s Annual Report on Form 10-K for the year ended April 3, 2015 and as otherwise discussed in the company’s filings with the Securities and Exchange Commission.

Q1 FY2017

| ● | Our June 2016 quarter guidance assumes an exchange rate of $1.13. |

| ● | We expect revenue for our first fiscal quarter to be between $865 and $895 million. |

| ● | For our Consumer Security segment, we expect revenue to decline year-over-year within the range of (8%) and (5%) in constant currency. |

| ● | We expect revenue for our Enterprise Security segment to decline year-over-year within the range of (4%) and (1%) in constant currency. |

| ● | We expect non-GAAP operating margin to be between 24.5% and 26.5%. |

| ● | We expect third fiscal quarter non-GAAP EPS in the range of 24¢ to 26¢. |

| ● | Our share count of 621 million accounts for the impact of the $1 billion accelerated stock buyback. |

FY2017

| ● | Our fiscal 2017 guidance assumes an exchange rate of $1.13. |

| ● | We expect fiscal 2017 revenue to be between $3,490 and $3,580 million. |

| ● | For our Consumer Security segment, we expect our revenue to decline in a range of between (6%) and (3%) in constant currency. |

| ● | We expect revenue from our Enterprise Security segment to be flat to down (2%) year-over-year in constant currency. |

| ● | We expect non-GAAP operating margin to be between 26.5% and 27.5%, resulting in non-GAAP EPS in the range of $1.06 to $1.10. |

| ● | Our guidance assumes an average share count of 594 million and ending share count of 558 after accounting for a $1.3 billion accelerated stock buyback. |

FY2018

| ● | We expect revenue growth to improve from fiscal 2017 and operating margin to be 33%. |

Use of GAAP and Non-GAAP Financial Information:

Our results of operations have undergone significant change due to the impact of litigation accruals, discontinued operations including the gain on the sale of Veritas, stock-based compensation, restructuring, transition and separation matters, charges related to the amortization of intangible assets, and certain other income and expense items that management considers unrelated to the Company’s core operations. To help our readers understand our past financial performance and our future results, we supplement the financial results that we provide in accordance with generally accepted accounting principles, or GAAP, with non-GAAP financial measures. The method we use to produce non-GAAP results is not computed according to GAAP and may differ from the methods used by other companies. Non-GAAP financial measures are supplemental, should not be considered a substitute for financial information presented in accordance with GAAP and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. Our management team uses these non-GAAP financial measures in assessing Symantec’s operating results, as well as when planning, forecasting and analyzing future periods. Investors are encouraged to review the reconciliation of our non-GAAP financial measures to the comparable GAAP results, which is attached to our quarterly earnings release and which can be found, along with other financial information, on the investor relations page of our website at: http://www.symantec.com/invest.

Reconciliation of Selected GAAP Measures to Non-GAAP Measures:

| SYMANTEC CORPORATION |

Reconciliation of Selected GAAP Measures to Non-GAAP Measures (1) |

| (In millions, except per share data, unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Year-Over-Year |

| | | Three Months Ended | | Non-GAAP Growth Rate |

| | | April 1, 2016 | | April 3, 2015 | | | | | Constant |

| | | GAAP | | Adj | | Non-GAAP | | GAAP | | Adj | | Non-GAAP | | Actual | | Currency (2) |

| Net revenues | | $ | 873 | | | $ | - | | | $ | 873 | | | $ | 899 | | | $ | 30 | | | $ | 929 | | | | -6 | % | | | -6 | % |

| Gross profit: | | $ | 726 | | | $ | 9 | | | $ | 735 | | | $ | 723 | | | $ | 52 | | | $ | 775 | | | | -5 | % | | | -5 | % |

| EDS & NDI contingency | | | | | | | - | | | | | | | | | | | | 30 | | | | | | | | | | | | | |

Unallocated corporate charges (3) | | | | | | | - | | | | | | | | | | | | 10 | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | 3 | | | | | | | | | | | | 3 | | | | | | | | | | | | | |

| Amortization of intangible assets | | | | | | | 6 | | | | | | | | | | | | 9 | | | | | | | | | | | | | |

| Gross margin % | | | 83.2 | % | | | 1.0 | % | | | 84.2 | % | | | 80.4 | % | | | 3.0 | % | | | 83.4 | % | | | 80 bps | | | 50 bps |

| Operating expenses: | | $ | 598 | | | $ | 77 | | | $ | 521 | | | $ | 772 | | | $ | 286 | | | $ | 486 | | | | 7 | % | | | 9 | % |

Unallocated corporate charges (3) | | | | | | | - | | | | | | | | | | | | 159 | | | | | | | | | | | | | |

| Stock-based compensation | | | | | | | 40 | | | | | | | | | | | | 34 | | | | | | | | | | | | | |

| Amortization of intangible assets | | | | | | | 16 | | | | | | | | | | | | 21 | | | | | | | | | | | | | |

| Restructuring, separation, and transition | | | | | | | 20 | | | | | | | | | | | | 72 | | | | | | | | | | | | | |

| Operating expenses as a % of revenue | | | 68.5 | % | | | -8.8 | % | | | 59.7 | % | | | 85.9 | % | | | -33.6 | % | | | 52.3 | % | | | 740 bps | | | 800 bps |

| Operating income (loss) | | $ | 128 | | | $ | 86 | | | $ | 214 | | | $ | (49 | ) | | $ | 338 | | | $ | 289 | | | | -26 | % | | | -28 | % |

| Operating margin % | | | 14.7 | % | | | 9.8 | % | | | 24.5 | % | | | -5.5 | % | | | 36.6 | % | | | 31.1 | % | | | -660 bps | | | -740 bps |

| Net income: | | $ | 2,045 | | | $ | (1,898 | ) | | $ | 147 | | | $ | 176 | | | $ | 27 | | | $ | 203 | | | | -28 | % | | | N/ | A |

| Gross profit adjustment | | | | | | | 9 | | | | | | | | | | | | 52 | | | | | | | | | | | | | |

| Operating expense adjustment | | | | | | | 77 | | | | | | | | | | | | 286 | | | | | | | | | | | | | |

| Income tax effects and adjustments | | | | | | | 1,074 | | | | | | | | | | | | (190 | ) | | | | | | | | | | | | |

| Income from discontinued operations, net of taxes | | | | | | | (3,058 | ) | | | | | | | | | | | (121 | ) | | | | | | | | | | | | |

| Diluted income (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) per share from continuing operations | | $ | (1.56 | ) | | $ | 1.78 | | | $ | 0.22 | | | $ | 0.08 | | | $ | 0.21 | | | $ | 0.29 | | | | | | | | | |

| Income (loss) per share from discontinued operations | | | 4.70 | | | | (4.70 | ) | | | - | | | | 0.17 | | | | (0.17 | ) | | | - | | | | | | | | | |

| Diluted net income per share | | | 3.15 | | | | (2.93 | ) | | | 0.22 | | | | 0.25 | | | | 0.04 | | | | 0.29 | | | | -24 | % | | | N/ | A |

| Diluted weighted-average shares outstanding | | | 650 | | | | 6 | | | | 656 | | | | 693 | | | | - | | | | 693 | | | | -5 | % | | | N/ | A |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) This presentation reflects the discontinued operations associated with the divestiture of our information management business. Please see Appendix A for further information. | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(2) Management refers to growth rates adjusting for currency so that the business results can be viewed without the impact of fluctuations in foreign currency exchange rates. We compare the percentage change in the results from one period to another period in order to provide a framework for assessing how our underlying businesses performed excluding the effect of foreign currency rate fluctuations. To present this information, current and comparative prior period results for entities reporting in currencies other than United States dollars are converted into United States dollars at the actual exchange rates in effect during the respective prior periods. | |

| | |

(3) This item consists of charges previously allocated to our discontinued information management business. Please see Appendix A for further information. | |

Forward Looking Statements:

This commentary contains statements regarding our projected financial and business results and planned cost reductions, which may be considered forward-looking within the meaning of the U.S. federal securities laws, including statements regarding our capital allocation strategy and plans. These statements are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from results expressed or implied in this presentation. Such risk factors include those related to: risks related to general economic conditions; our Company’s leadership transition plan; maintaining customer and partner relationships; the anticipated growth of certain market segments; our sales pipeline and business strategy; the competitive environment in the software industry; changes to operating systems and product strategy by vendors of operating systems; fluctuations in tax rates and currency exchange rates; the timing and market acceptance of new product releases and upgrades; the successful development of new products and integration of acquired businesses; and the degree to which these products and businesses gain market acceptance. Actual results may differ materially from those contained in the forward-looking statements in this presentation. We assume no obligation, and do not intend, to update these forward-looking statements as a result of future events or developments. Additional information concerning these and other risks factors is contained in the Risk Factors section of our Form 10-K for the year ended April 3, 2015.

Any information regarding pre-release of Symantec offerings, future updates or other planned modifications is subject to ongoing evaluation by Symantec and therefore subject to change. This information is provided without warranty of any kind, express or implied. Customers who purchase Symantec offerings should make their purchase decision based upon features that are currently available.

We assume no obligation to update any forward‐looking information contained in this presentation.