| | |

Oppenheimer

Strategic Income Fund |

|

| Prospectus dated January 28, 2009 |

Oppenheimer Strategic Income Fund is a mutual fund that seeks high current income by investing mainly in debt securities in three market sectors: debt securities of foreign governments and companies, U.S. government securities, and lower-rated high-yield securities of U.S. and foreign companies.

|

| This prospectus contains important information about the Fund's objective, investment policies, strategies and risks. It also contains important information about how to buy and sell shares of the Fund and other account features. Please read this prospectus carefully before you invest and keep it for future reference about your account. |

As with all mutual funds, the Securities and Exchange Commission has not approved or disapproved the Fund's securities nor has it determined that this prospectus is accurate or complete. It is a criminal offense to represent otherwise.

|

|

| Oppenheimer Strategic Income Fund |

| Contents |

|

|

| ABOUT THE FUND |

3 | The Fund's Investment Objective and Principal Investment Strategies |

4 | Main Risks of Investing in the Fund |

8 | The Fund's Past Performance |

9 | Fees and Expenses of the Fund |

12 | About the Fund's Investments |

22 | How the Fund is Managed |

|

| ABOUT YOUR ACCOUNT |

23 | About Your Account |

24 | Choosing a Share Class |

31 | The Price of Fund Shares |

33 | How to Buy, Sell and Exchange Shares |

46 | Dividends, Capital Gains and Taxes |

49 | Financial Highlights |

ABOUT THE FUND

The Fund's Investment Objective and Principal Investment Strategies

WHAT IS THE FUND'S INVESTMENT OBJECTIVE? The Fund seeks high current income by investing mainly in debt securities.

THE FUND'S MAIN INVESTMENT STRATEGIES. The Fund invests mainly in debt securities of issuers in three market sectors:

- Foreign governments and companies,

- U.S. Government securities, and

- Lower rated high-yield securities of U.S. and foreign companies (commonly referred to as "junk bonds").

What is a Debt Security? A debt security is a security representing money borrowed by the issuer that must be repaid, specifying the amount of principal, the interest or discount rate, and the time or times at which payments are due.

Under normal market conditions, the Fund invests in each of the three market sectors. However, the Fund is not required to invest in all three sectors at all times, and the amount of its assets in each of the three sectors will vary over time. The Fund can invest up to 100% of its assets in any one sector at any time, if the Fund's portfolio manager believes that the Fund can achieve its objective without undue risk. The Fund's foreign investments may include debt securities of issuers in both developed or emerging markets. The Fund has no requirements regarding the range of maturities of the debt securities it can buy or the market capitalization of the issuers of those securities.

The Fund's investments typically include:

- Foreign and U.S. Government bonds and notes,

- Collateralized mortgage obligations (CMOs),

- Other mortgage-related securities,

- Lower-grade, high-yield domestic and foreign corporate debt obligations,

- Participation interests in loans and investments in loan pools,

The Fund's debt securities may be rated by nationally recognized statistical rating organizations such as Moody's Investors Service ("Moody's") or Standard & Poor's Ratings Services ("Standard &Poor's") or may be unrated. Lower-grade debt securities are those rated below "Baa" by Moody's or below "BBB" by Standard & Poor's or that have comparable ratings from other nationally-recognized rating organizations. Additionally, unrated debt securities may be determined to be comparable to securities rated below investment grade by the Manager. The Fund can buy investment-grade securities, although it normally invests a substantial part of its assets in debt securities below investment-grade, and can do so without limit.

The Fund also uses certain types of derivative instruments for investment purposes or hedging including: options, futures, forward contracts, swaps, certain mortgage-related securities and "structured" notes.

HOW THE PORTFOLIO MANAGER DECIDES WHAT SECURITIES TO BUY OR SELL. In selecting securities, the Fund's portfolio manager analyzes the overall investment opportunities and risks among the three sectors in which the Fund invests. The portfolio manager seeks to build a broadly diversified portfolio to try to moderate the special risks of investing in high-yield debt instruments and foreign securities. The Fund's diversification strategies, with respect to securities in different sectors and securities issued by different companies or governments, are intended to help reduce the volatility of the Fund's share prices while seeking current income. The Fund may try to take advantage of any lack of correlation in the movement of securities prices among the three sectors. The portfolio manager currently focuses on the following factors, which may vary in particular cases and may change over time:

- Securities offering high current income,

- Securities whose market prices tend to move in different directions (to seek overall portfolio diversification), and

- Relative values among the three major market sectors in which the Fund invests.

The Fund may sell securities that the portfolio manager believes are no longer favorable with regard to the above factors.

WHO IS THE FUND DESIGNED FOR? The Fund is designed primarily for investors seeking high current income from a fund that invests in a variety of domestic and foreign debt securities, including government securities and lower-grade debt securities. Those investors should be willing to assume the greater risks of short-term share price fluctuations and the special credit risks that are typical for a fund that invests mainly in lower grade fixed-income securities and foreign securities. The Fund does not seek capital appreciation. Because the Fund's income will fluctuate, it is not designed for investors needing an assured level of current income. The Fund is intended to be a long-term investment, not a short-term trading vehicle. The Fund is not a complete investment program and may not be appropriate for all investors. You should carefully consider your own investment goals and risk tolerance before investing in the Fund.

Main Risks of Investing in the Fund

All investments have some degree of risk. The value of the Fund's shares fluctuates as the value of the Fund's investments changes, and may decline. The value of the Fund's investments may change because of broad changes in the markets in which the Fund invests or from more specific factors like those described below. There is also the risk that poor security selection could cause the Fund to underperform other funds with similar objectives. When you redeem your shares, they may be worth more or less than what you paid for them. These risks mean that you can lose money by investing in the Fund.

MAIN RISKS OF INVESTING IN DEBT SECURITIES. Debt securities (also referred to as "fixed-income securities") may be subject to credit risk, interest rate risk, prepayment risk and extension risk. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. If an issuer fails to pay interest or to repay principal, the Fund's income or share value might be reduced. The extent of this risk varies based on the terms of the particular security and the financial condition of the issuer. Adverse news about an issuer or a downgrade in an issuer's credit rating, for any reason, can reduce the market value of the issuer's securities. The value of debt securities are also subject to change when prevailing interest rates change. When prevailing interest rates fall, the values of already-issued debt securities generally rise. When prevailing interest rates rise, the values of already-issued debt securities generally fall, and they may sell at a discount from their face amount or from the amount the Fund paid for them. Interest rate changes generally have a greater effect on longer-term debt securities than on shorter-term securities. When interest rates fall, the issuers of debt securities may prepay principal more quickly than expected and the Fund may be required to reinvest the proceeds at a lower interest rate. This is referred to as "prepayment risk." When interest rates rise, debt securities may be repaid more slowly than expected and the value of the Fund's holdings may fall sharply. This is referred to as "extension risk." Interest rate changes may have different effects on variable or floating rate securities than they do on securities with fixed interest rates.

Special Risks of Lower-Grade Securities. Lower-grade securities may offer opportunities for larger returns than higher-grade securities but may be subject to wider market fluctuations and greater risk of loss of income and principal than investment-grade securities. While investment-grade securities are subject to risks of non-payment of interest and principal, in general those risks are greater for higher-yielding lower-grade bonds, whether rated or unrated. There also may be less of a market for lower-grade securities and therefore they may be harder to sell at an acceptable price.

Because the Fund can invest without limit in lower-grade securities, the Fund's credit risks are greater than those of funds that buy only investment-grade securities.

FIXED-INCOME MARKET RISKS. Recent developments relating to subprime mortgages have adversely affected fixed-income securities markets in the United States, Europe and elsewhere. The values of many types of debt securities have been reduced, including debt securities that are not related to mortgage loans. These developments have reduced the willingness of some lenders to extend credit and have made it more difficult for borrowers to obtain financing on attractive terms or at all. In addition, broker-dealers and other market participants have been less willing to make a market in some types of debt instruments, which has impacted the liquidity of those instruments. These developments may also have a negative effect on the broader economy. There is a risk that the lack of liquidity or other adverse credit market conditions may hamper the Fund's ability to sell the debt securities in which it invests or to find and purchase suitable debt instruments.

SECTOR ALLOCATION RISK. In allocating investments among its three principal market sectors, the Fund seeks to take advantage of the potential lack of performance correlation between those sectors. There is the risk that the Manager's evaluations regarding the sectors' relative performance may be incorrect and those sectors may all perform in a similar manner under certain market conditions.

RISKS OF FOREIGN INVESTING. While foreign securities may offer special investment opportunities, they are also subject to special risks. Foreign issuers are usually not subject to the same accounting and disclosure requirements as U.S. companies are subject to, which may make it difficult to evaluate a foreign company's operations or financial condition. A change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency and of any income or distributions the Fund may receive on those securities. Additionally, the value of foreign investments may be affected by exchange control regulations, expropriation or nationalization of a company's assets, foreign taxes, higher transaction and other costs, delays in settlement of transactions, changes in economic or monetary policy in the U.S. or abroad, or other political and economic factors.

Foreign Currency Risk. A change in the value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency. If the U.S. dollar rises in value against a foreign currency, a security denominated in that currency will be worth less in U.S. dollars and if the U.S. dollar decreases in value against a foreign currency, a security denominated in that currency will be worth more in U.S. dollars. The dollar value of foreign investments may also be affected by exchange controls.

The Fund can also invest in derivative instruments linked to foreign currencies. The change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of derivatives linked to that foreign currency.

Special Risks of Developing and Emerging Markets. Developing or emerging market countries generally have less developed securities markets or exchanges. Securities of companies in developing or emerging market countries may be more difficult to sell at an acceptable price and their prices may be more volatile than securities of companies in countries with more mature markets. Settlements of trades may be subject to greater delays so that the proceeds of a sale of a security may not be received on a timely basis. The economies of developing or emerging market countries may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. Developing or emerging market countries may have less developed legal and accounting systems, and investments in those countries may be subject to greater risks of government restrictions, including confiscatory taxation, expropriation or nationalization of company assets, restrictions on foreign owner ship of local companies and restrictions on withdrawing assets from the country. Their governments may also be more unstable than the governments of more developed countries. The value of the currency of a developing or emerging market country may fluctuate more than the currencies of countries with more mature markets. Investments in companies in developing or emerging market countries may be considered speculative.

Time-Zone Arbitrage. The Fund may invest in securities of foreign issuers that are traded in U.S. or foreign markets. If the Fund invests a significant amount of its assets in securities traded in foreign markets, it may be exposed to "time-zone arbitrage" attempts by investors seeking to take advantage of differences in the values of foreign securities that might result from events that occur after the close of the foreign securities market on which a security is traded and before the close of the New York Stock Exchange (the "NYSE") that day, when the Fund's net asset value is calculated. If such time-zone arbitrage were successful, it might dilute the interests of other shareholders. However, the Fund's use of "fair value pricing" under certain circumstances, to adjust the closing market prices of foreign securities to reflect what the Manager and the Board believe to be their fair value, may help deter those activities.

RISKS OF DERIVATIVE INVESTMENTS. Derivatives may be volatile and may involve significant risks. Derivative transactions may require the payment of premiums and can increase portfolio turnover. For example, if a call option sold by the Fund were exercised on an investment that had increased in value above the call price, the Fund would be required to sell the investment at the call price and would not be able to realize any additional profit.

Certain derivative investments held by the Fund may be illiquid, making it difficult to close out an unfavorable position. The underlying security or other instrument on which a derivative is based, or the derivative itself, may not perform the way the Manager expects it to. As a result, the Fund could realize little or no income or lose principal from the investment, or a hedge might be unsuccessful. The Fund may also lose money on a derivative investment if the issuer fails to pay the amount due.

For some derivatives, it is possible for the Fund to lose more than the amount invested in the derivative instrument.

_____________________________

There is no assurance that the Fund will achieve its investment objective. Debt securities are subject to credit and interest rate risks that can affect their values and the share prices of the Fund. The values of high-yield debt securities can fluctuate substantially because of interest rate changes and perceptions about the high-yield market among investors. Foreign debt securities can be volatile, and the price of the Fund's shares can go up and down substantially, particularly in emerging markets. The Fund is likely to be more volatile and have more risks than funds that focus on U.S. government securities and investment-grade bonds, but its sector diversification strategy may help make it less volatile than funds that focus solely on investments in high-yield bonds or a single foreign sector, such as emerging markets.

An investment in the Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

The Fund's Past Performance

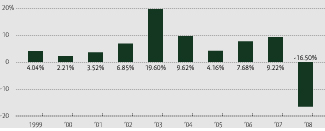

The bar chart and table below show one measure of the risks of investing in the Fund by showing changes in the Fund's performance. The bar chart shows the yearly performance of the Fund's Class A shares for the last 10 calendar years.

For the period from 1/1/08 through 12/31/08, the cumulative return before taxes for Class A shares was -16.50%. Sales charges and taxes are not included in the calculations of return in this bar chart, and if those charges and taxes were included, the returns may be less than those shown. During the period shown in the bar chart, the highest return before taxes for a calendar quarter was 6.55% (2nd qtr 03) and the lowest return before taxes for a calendar quarter was -11.16% (4th qtr 08).

The following table shows the average annual total returns of each class of the Fund's shares before taxes compared to broad-based market indices. After-tax returns are also shown for Class A shares. They are calculated using the highest individual Federal income tax rates in effect during the periods shown and do not reflect the impact of state or local taxes. The after-tax returns are based on certain assumptions mandated by regulation and your actual after-tax returns may differ from those shown, depending on your individual tax situation. After-tax returns will vary for the other share classes and are not relevant to investors who hold their shares through tax-deferred or tax-exempt arrangements (for example, individual retirement accounts, 401(k) plans, 529 plans or tax-exempt institutional investors). The Fund's past investment performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

| Average Annual Total Returns for the periods ended December 31, 2008 | 1 Year | 5 Years | 10 Years

(or life of

class, if less) |

| Class A Shares (inception 10-16-89) | | | |

| Return Before Taxes | (20.47%) | 1.32% | 4.15% |

| Return After Taxes on Distributions | (22.05%) | (0.86%) | 1.49% |

| Return After Taxes on Distributions and Sale of Fund Shares | (13.16%) | (0.04%) | 1.93% |

| Class B Shares (inception 11-30-92) | (21.10%) | 1.22% | 4.19% |

| Class C Shares (inception 5-26-95) | (17.74%) | 1.60% | 3.91% |

| Class N Shares (inception 3-1-01) | (17.40%) | 1.94% | 4.32% |

| Class Y Shares (inception 1-26-98) | (16.12%) | 2.61% | 4.92% |

| Barclays Capital Aggregate Bond Index | 5.24% | 4.65% | 5.63% |

| (reflects no deduction for fees, expenses or taxes) | | | 5.53%* |

| Citigroup World Government Bond Index | 10.89% | 6.05% | 5.90% |

| (reflects no deduction for fees, expenses or taxes) | | | 8.00%* |

* From 2-28-01

The average annual total returns measure the performance of a hypothetical account and assume that all dividends and capital gains distributions have been reinvested in additional shares. The Fund's performance is compared to the performance of the Barclays Capital Aggregate Bond Index (formerly known as the Lehman Brothers Aggregate Bond Index), an unmanaged index of U.S. corporate and government bonds, and the Citigroup World Government Bond Index, an unmanaged index of debt securities of major foreign government bond markets. The index performance includes income reinvestment but does not reflect any transaction costs, fees, expenses or taxes. The calculation of the Fund's performance reflects the following sales charges: for Class A, the current maximum initial sales charge of 4.75%; for Class B, the contingent deferred sales charge of 5% for the "1 Year" period and 2% for the "5 Years" period; and for Class C and Class N, the 1% contingent deferred sales charge for the " 1 Year" period. There is no sales charge for Class Y shares. Because Class B shares convert to Class A shares 72 months after purchase, the Class B "10 Year" performance does not include any contingent deferred sales charge and is based on the Class A performance for the period after 72 months.

Fees and Expenses of the Fund

The following tables are provided to help you understand the fees and expenses you may pay if you buy and hold shares of the Fund. Shareholders pay certain expenses directly, such as sales charges. The Fund pays other expenses for management of its assets, administration, distribution of its shares and other services. Since those expenses are paid from the Fund's assets, all shareholders pay those expenses indirectly.

The numbers below are based on the Fund's expenses during its fiscal year ended September 30, 2008. Expenses may vary in future years.

| Shareholder Fees (charges paid directly from your investment): | | | |

| Class A Shares | Class B Shares | Class C Shares | Class N Shares | Class Y Shares |

| Maximum Sales Charge (Load) on purchases (as % of offering price) | 4.75% | None | None | None | None |

| Maximum Deferred Sales Charge (Load) (as % of the lower of the original offering price or redemption proceeds) | None1 | 5%2 | 1%3 | 1%4 | None |

| Annual Fund Operating Expenses (deducted from Fund assets): (% of average daily net assets) | | |

| Class A

Shares | Class B

Shares | Class C

Shares | Class N

Shares | Class Y

Shares |

| Management Fees | 0.51% | 0.51% | 0.51% | 0.51% | 0.51% |

| Distribution and/or Service (12b-1) Fees | 0.25% | 1.00% | 1.00% | 0.50% | n/a |

| Other Expenses5 | 0.15% | 0.22% | 0.15% | 0.31% | 0.15% |

| Acquired Fund Fees and Expenses6 | 0.02% | 0.02% | 0.02% | 0.02% | 0.02% |

| Total Annual Operating Expenses7 | 0.93% | 1.75% | 1.68% | 1.34% | 0.68% |

1. A Class A contingent deferred sales charge may apply to redemptions of investments of $1 million or more or to certain retirement plan redemptions. See "How to Buy Shares" for details.

2. Applies to redemptions in the first year after purchase. The contingent deferred sales charge gradually declines from 5% to 1% during years one through six and is eliminated after that.

3. Applies to shares redeemed within 12 months of purchase.

4. Applies to shares redeemed within 18 months of a retirement plan's first purchase of Class N shares.

5. "Other expenses" include transfer agent fees, custodial fees, and accounting and legal expenses that the Fund pays. The Transfer Agent has voluntarily undertaken to the Fund to limit the transfer agent fees to 0.35% of average daily net assets per fiscal year for all classes. That undertaking may be amended or withdrawn at any time. For the Fund's fiscal year ended September 30, 2008, the transfer agent fees did not exceed that e xpense limitation. The Fund also receives certain credits from the Fund's custodian that, during the fiscal year, reduced its custodial expenses for all share classes by less than 0.01% of average daily net assets.

6. "Acquired Fund Fees and Expenses" includes fees and expenses incurred indirectly by the Fund with respect to the Fund's investments in Oppenheimer Institutional Money Market Fund, Oppenheimer Master Loan Fund, LLC and Oppenheimer Master Event-Linked Bond Fund, LLC. The calculation of the "Acquired Fund Fees and Expenses" is based on the total annual expense ratios of those funds, without giving effect to any fee waivers or reimbursements. Any material change in the Fund's allocations to Acquired Funds might increase or decrease those expenses.

7. The Manager will voluntarily waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund's investment in Oppenheimer Institutional Money Market Fund, Oppenheimer Master Loan Fund, L LC and Oppenheimer Master Event-Linked Bond Fund, LLC. After all of the above waivers and credits, the actual "Total Annual Operating Expenses", as percentages of average daily net assets were 0.89% for Class A shares, 1.71% for Class B shares, 1.64% for Class C shares, 1.30% for Class N shares and 0.64% for Class Y shares.

EXAMPLES. The following examples are intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The examples assume that you invest $10,000 in a class of shares of the Fund for the time periods indicated and reinvest your dividends and distributions. These examples also assume that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Fund's expenses will vary over time, however, and your actual costs may be higher or lower.

The first example assumes that you redeem all of your shares at the end of the periods. The second example assumes that you keep your shares. Based on these assumptions your expenses would be as follows:

| If shares are redeemed: | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A Shares | $566 | $759 | $967 | $1,569 |

| Class B Shares | $679 | $856 | $1,157 | $1,659* |

| Class C Shares | $272 | $534 | $920 | $2,003 |

| Class N Shares | $237 | $427 | $739 | $1,623 |

| Class Y Shares | $70 | $218 | $380 | $849 |

| If shares are not redeemed: | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A Shares | $566 | $759 | $967 | $1,569 |

| Class B Shares | $179 | $556 | $957 | $1,659* |

| Class C Shares | $172 | $534 | $920 | $2,003 |

| Class N Shares | $137 | $427 | $739 | $1,623 |

| Class Y Shares | $70 | $218 | $380 | $849 |

In the first example, expenses include the initial sales charge for Class A and the applicable Class B, Class C and Class N contingent deferred sales charges. In the second example, the Class A expenses include the sales charge, but Class B, Class C and Class N expenses do not include contingent deferred sales charges. There is no sales charge on Class Y shares.

* Since Class B shares automatically convert to Class A shares 72 months after purchase, the Class B expenses for years 7 through 10 are based on Class A expenses.

In evaluating the Fund's expenses, it is important to remember that mutual funds offer you the opportunity to combine your resources with those of many other investors to obtain professional portfolio management, exposure to a larger number of markets and issuers, reliable custody for investment assets, liquidity, and convenient recordkeeping and reporting services. Funds also offer investment benefits to individuals without the expense and inconvenience of buying and selling individual securities. Because a fund is a pooled investment, however, shareholders may bear certain fund operating costs as a result of the activities of other fund investors. Because some investors may use fund services more than others, or may have smaller accounts or more frequent account activity, those activities may increase the Fund's overall expenses, which are indirectly borne by all of the Fund's shareholders.

About the Fund's Investments

The allocation of the Fund's portfolio among different types of investments will vary over time and the Fund's portfolio might not always include all of the different types of investments described below. The Statement of Additional Information contains more detailed information about the Fund's investment policies and risks.

THE FUND'S PRINCIPAL INVESTMENT POLICIES AND RISKS. The following strategies and types of investments are the ones that the Fund considers to be the most important in seeking to achieve its investment objective and the following risks are those the Fund expects its portfolio to be subject to as a whole.

DEBT SECURITIES. The Fund may invest in debt securities, including: foreign and U.S. Government bonds and notes, collateralized mortgage obligations and other mortgage-related securities, asset-backed securities, participation interests in loans, investments in loan pools, "structured" notes, lower-grade, high-yield domestic and foreign corporate debt obligations, and "zero-coupon" and "stripped" securities.

Debt securities may be subject to the following risks:

- Interest Rate Risk. The values of debt securities usually change when prevailing interest rates change. When interest rates rise, the values of outstanding debt securities generally fall, and those securities may sell at a discount from their face amount. When interest rates fall, the values of already-issued debt securities generally rise. However, when interest rates fall, the Fund's investments in new securities may be at lower yields and may reduce the Fund's income. The values of longer-term debt securities usually change more than the values of shorter-term debt securities when interest rates change.

The Fund may also buy zero-coupon or "stripped" securities, which may be particularly sensitive to interest rate changes. Interest rate changes may have different effects on the values of mortgage-related securities because of prepayment and extension risks.

- Prepayment Risk. Certain fixed-income securities are subject to the risk of unanticipated prepayment. That is the risk that when interest rates fall, borrowers will prepay the loans that underlie these securities more quickly than expected, causing the issuer of the security to repay the principal prior to the security's expected maturity. The Fund may need to reinvest the proceeds at a lower interest rate, reducing its income. Securities subject to prepayment risk generally offer less potential for gains when prevailing interest rates fall. If the Fund buys those securities at a premium, accelerated prepayments on those securities could cause it to lose a portion of its principal investment represented by the premium. The impact of prepayments on the price of a security may be difficult to predict and may increase the security's price volatility. Interest-only and principal-only securities are especially sensitive to interest rate changes, which can affect not only their prices but can also change the income flows and prepayment assumptions about those investments.

- Extension Risk. If interest rates rise rapidly, repayments of principal on certain debt securities may occur at a slower rate than expected and the expected maturity of those securities could lengthen as a result. Those securities generally have a greater potential for loss when prevailing interest rates rise, which could cause their value to fall sharply.

- Credit Risk. Debt securities are also subject to credit risk. Credit risk is the risk that the issuer of a security might not make interest and principal payments on the security as they become due. Securities directly issued by the U.S. Treasury and certain agencies that are backed by the full faith and credit of the U.S. Government have little credit risk, and other U.S. Government securities generally have lower credit risks, while securities issued by private issuers or certain foreign governments generally have greater credit risks. If an issuer fails to pay interest, the Fund's income might be reduced, and if an issuer fails to repay principal, the values of the security might fall. The extent of this risk varies based on the terms of the particular security and the financial condition of the issuer. A downgrade in an issuer's credit rating or other adverse news about an issuer can reduce the market value of that issuer's securities.

Credit Quality. The Fund may invest in securities that are rated or unrated. "Investment grade" securities are rated in one of the top four rating categories by nationally-recognized statistical rating organizations such as Moody's Investors Service or Standard & Poor's Ratings Services. "Lower grade" securities are those that are rated below those categories.

Credit ratings evaluate the expectation that scheduled interest and principal payments will be made in a timely manner. They do not reflect any judgment of market risk. Rating agencies might not always change their credit rating of an issuer in a timely manner to reflect events that could affect the issuer's ability to make timely payments on its obligations. In selecting securities for the Fund's portfolio and evaluating their income potential and credit risk, the Manager does not rely solely on ratings by rating organizations but evaluates business and economic factors affecting issuers as well. The ratings definitions of the principal ratings organizations are included in an Appendix to the Statement of Additional Information.

U.S. Government Securities. The Fund invests in securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities. Some of those securities are directly issued by the U.S. Treasury and are backed by the full faith and credit of the U.S. Government. "Full faith and credit" means that the taxing power of the U.S. Government is pledged to the payment of interest and repayment of principal on a security.

Some securities issued by U.S. Government agencies, such as Government National Mortgage Corporation pass-through mortgage obligations ("Ginnie Maes"), are also backed by the full faith and credit of the U.S. Government. Others are supported by the right of the agency to borrow an amount from the U.S. Government (for example, "Fannie Mae" bonds issued by Federal National Mortgage Corporation and "Freddie Mac" obligations issued by Federal Home Loan Mortgage Corporation). Others are supported only by the credit of the agency (for example obligations issued by the Federal Home Loan Banks). On September 7, 2008, the Federal Housing Finance Agency, a new independent regulatory agency, placed the Federal National Mortgage Corporation and Federal Home Loan Mortgage Corporation into conservatorship and the U.S. Department of Treasury made a commitment to purchase mortgage-backed securities from the companies through December 2009. The U.S. Department of Treasury also entered into a new secured lendin g credit facility with those companies and a Preferred Stock Purchase Agreement. Under those agreements, the Treasury will ensure that each company maintains a positive net worth.

U.S. Treasury Securities. Treasury securities are backed by the full faith and credit of the United States for payment of interest and repayment of principal and have little credit risk. Some of the securities that are issued directly by the U.S. Treasury are: Treasury bills (having maturities of one year or less when issued), Treasury notes (having maturities of from one to ten years when issued), Treasury bonds (having maturities of more than ten years when issued) and Treasury Inflation-Protection Securities ("TIPS"). While U.S. Treasury securities have little credit risk, they are subject to price fluctuations from changes in interest rates prior to their maturity.

Mortgage-Related Government Securities. The Fund can buy interests in pools of residential or commercial mortgages, in the form of collateralized mortgage obligations ("CMOs") and other "pass-through" mortgage securities. They may be issued or guaranteed by the U.S. Government, or its agencies and instrumentalities. CMOs may be issued in different series, each having different interest rates and maturities.

CMOs that are U.S. Government securities have collateral to secure payment of interest and principal. The collateral is either in the form of mortgage pass-through certificates issued or guaranteed by a U.S. agency or instrumentality or mortgage loans insured by a U.S. Government agency. The prices and yields of CMOs are determined, in part, by assumptions about the rate of payments of the underlying mortgages and are subject to prepayment and extension risks.

Private-Issuer Securities. The Fund can also invest in securities issued by private issuers, including mortgage-backed securities.

Mortgage-Related Private Issuer Securities. Primarily these investments include multi-class debt or pass-through certificates secured by mortgage loans, which may be issued by banks, savings and loans, mortgage bankers and other non-governmental issuers. Private-issuer securities may include mortgage-backed securities with respect to both residential and commercial properties.

CMOs and other mortgage-related securities issued by private issuers are not U.S. Government securities. Those securities are subject to greater credit risks than U.S. Government securities. Private issuer securities are subject to the credit risks of the issuers as well as to interest rate risks, although in some cases they may be supported by insurance or guarantees. The prices and yields of private issuer mortgage-related securities are also subject to prepayment and extension risk.

Asset-Backed Securities. Asset-backed securities are fractional interests in pools of loans, other assets or receivables. They are issued by trusts or other special purpose vehicles and are collateralized by the loans, other assets or receivables that make up the pool. The trust or other issuer passes the income from the underlying pool to the investor. Neither the Fund nor the Manager selects the loans or other assets that are included in the pools or the collateral backing those pools. Asset-backed securities are subject to interest rate risk and credit risk. Certain asset-backed securities are subject to prepayment and extension risks.

Forward Rolls. The Fund can enter into "forward roll" transactions (also referred to as "mortgage dollar rolls") with respect to mortgage-related securities. In this type of transaction, the Fund sells a mortgage-related security to a buyer and simultaneously agrees to repurchase a similar security at a later date at a set price. During the period between the sale and the repurchase, the Fund will not be entitled to receive interest and principal payments on the securities that have been sold. The Fund will bear the risk that the market value of the securities might decline below the price at which the Fund is obligated to repurchase them or that the counterparty might default in its obligations.

A substantial portion of the Fund's assets may be subject to forward roll transactions at any given time.

Zero-Coupon Securities. The Fund may invest in convertible "zero-coupon" securities, which pay no interest prior to their maturity date or another specified date in the future but are issued at a discount from their face value. Interest rate changes generally cause greater fluctuations in the prices of zero-coupon securities than in interest-paying securities of the same or similar maturities. The Fund may be required to pay a dividend of the imputed income on a zero-coupon security at a time when it has not actually received the income.

Stripped Securities. "Stripped" securities are the separate income or principal components of a debt security, such as Treasury securities whose coupons have been stripped by a Federal Reserve Bank. Some mortgage related securities may be stripped, with each component having a different proportion of principal or interest payments. One class might receive all the interest payments, all the principal payments or some proportional amount of interest and principal. Interest rate changes may cause greater fluctuations in the prices of stripped securities than in other debt securities of the same or similar maturities. The market for these securities may be limited, making it difficult for the Fund to sell its holdings at an acceptable price. The Fund may be required to pay out the imputed income on a stripped security as a dividend, at a time when it has not actually received the income.

Participation Interest in Loans. These securities represent an undivided fractional interest in a loan obligation of a borrower. They are typically purchased from banks or dealers that have made the loan, or are members of the loan syndicate, and that act as the servicing agent for the interest. The loans may be to foreign or U.S. companies. Participation interests are subject to the credit risk of the servicing agent as well as the credit risk of the borrower. If a fund purchases a participation interest, it may be only able to enforce its rights through the lender. The Fund can also buy interests in trusts and other entities that hold loan obligations. In that case the Fund will be subject to the trust's credit risks as well as the credit risks of the underlying loans.

Investments in Loan Investment Pools. The Fund can also buy interests in trusts and other pooled entities that invest primarily or exclusively in loan obligations, including entities sponsored or advised by the Manager or an affiliate. The loans underlying these investments may include loans to foreign or U.S. borrowers, may be collateralized or uncollateralized and may be rated above or below investment grade or may be unrated. The Manager expects that from time to time investments in loan investment pools may exceed 15% of the Fund's net assets.

These investments are subject to the risk of default by the borrower, interest rate and prepayment risk, as well as credit risks of the pooled entity that holds the loan obligations.

High-Yield, Lower-Grade Debt Securities. The Fund may invest in high-yield, lower-grade, fixed-income securities of U.S. and foreign issuers. Those securities may include, among others: bonds, debentures, notes, preferred stock, loan participation interests, "structured" notes, commercial mortgage-backed securities, and asset-backed securities. There are no limits on the amount of the Fund's assets that can be invested in securities rated below investment grade. The Fund may invest in securities rated as low as "C" or "D" or that are in default at the time the Fund buys them. Those securities are generally considered speculative.

Price Arbitrage. Because the Fund may invest in high yield bonds that may trade infrequently, investors might seek to trade fund shares based on their knowledge or understanding of the value of those securities (this is sometimes referred to as "price arbitrage"). If such price arbitrage were successful, it might interfere with the efficient management of the Fund's portfolio and the Fund may be required to sell securities at disadvantageous times or prices to satisfy the liquidity requirements created by that activity. Successful price arbitrage might also dilute the value of fund shares held by other shareholders.

FOREIGN INVESTMENTS. The Fund can buy a variety of securities issued by foreign governments and companies, as well as "supra-national" entities, such as the World Bank. The Fund's foreign investments primarily include bonds, debentures and notes. The Fund's foreign investments can be denominated in U.S. dollars or in foreign currencies. While foreign securities may offer special investment opportunities, they are also subject to special risks.

DIVERSIFICATION AND CONCENTRATION. The Fund is a diversified fund. It attempts to reduce its exposure to the risks of individual stocks by diversifying its investments across a broad number of different companies. The Fund will not concentrate more than 25% of its total assets in issuers in any one industry. At times, however, the Fund may emphasize investments in some industries more than others.

DERIVATIVE INVESTMENTS. The Fund can invest in a number of different types of "derivative" investments. A derivative is an investment whose value depends on (or is derived from) the value of an underlying security, asset, interest rate, index or currency. Derivatives may allow the Fund to increase or decrease its exposure to certain markets or risks.

The Fund may use derivatives to seek to increase its investment return or for hedging purposes. The Fund is not required to use derivatives in seeking its investment objective or for hedging and might not do so.

Options, futures, forward contracts, swaps, "structured" notes, and certain mortgage-related securities are some of the derivatives that the Fund may use. The Fund may also use other types of derivatives that are consistent with its investment strategies or hedging purposes.

"Structured" Notes. "Structured" notes are specially-designed derivative debt investments. The terms of the instrument may be "structured" by the purchaser and the issuer of the note. Payments of principal or interest on these notes may be linked to the value of an index (such as a currency or securities index), an individual security, or a commodity. The value of these notes will normally rise or fall in response to the changes in the performance of the underlying security, index or commodity.

Structured notes are subject to interest rate risk. Structured notes are also subject to credit risk both with respect to the borrower (referred to as "counter-party" risk) and with respect to the issuer of the underlying investment. If the underlying investment or index does not perform as anticipated, the investment might pay less interest than the stated coupon payment or repay less principal upon maturity. The price of structured notes may be very volatile and they may have a limited trading market, making it difficult to value them or sell them at an acceptable price.

In some cases, the Fund may invest in structured notes that pay an amount based on a multiple of the relative change in value of the asset or reference. This type of note increases the potential for income but at a greater risk of loss than a typical debt security of the same maturity and credit quality.

Credit Default Swaps. A credit default swap enables an investor to buy or sell protection against a credit event, such as an issuer's failure to make timely payments of interest or principal, bankruptcy or restructuring. The terms of the instrument are generally negotiated by the Fund and the swap counterparty. A swap may be embedded within a structured note or other derivative instrument.

Generally, if the Fund buys credit protection using a credit default swap, the Fund will make fixed payments to the counterparty and if a credit event occurs, the Fund will deliver the defaulted bonds underlying the swap to the swap counterparty and the counterparty will pay the Fund par for the bonds. If the Fund sells credit protection using a credit default swap, generally the Fund will receive fixed payments from the counterparty and if a credit event occurs, the Fund will pay the swap counterparty par for the defaulted bonds underlying the swap and the swap counterparty will deliver the bonds to the Fund. If the credit swap is on a basket of securities, the notional value of the swap is reduced by the par amount of the defaulted bonds, and the fixed payments are then made on the reduced notional value.

Credit default swaps are subject to credit risk on the underlying investment and to counterparty credit risk. If the counterparty fails to meet its obligations the Fund may lose money. Credit default swaps are also subject to the risk that the Fund will not properly assess the cost of the underlying investment. If the Fund is selling credit protection, there is a risk that a credit event will occur and that the Fund will have to pay par value on defaulted bonds. If the Fund is buying credit protection, there is a risk that no credit event will occur and the Fund will receive no benefit for the premium paid.

Interest Rate Swaps. In an interest rate swap, the Fund and another party exchange the right to receive interest payments on a security or other reference rate. For example, they might swap the right to receive floating rate payments for the right to receive fixed rate payments. The terms of the instrument are generally negotiated by the Fund and the swap counterparty. An interest rate swap may be embedded within a structured note or other derivative instrument.

Interest rate swaps are subject to interest rate risk and credit risk. An interest rate swap transaction could result in losses if the underlying asset or reference does not perform as anticipated. Interest Rate swaps are also subject to counterparty risk. If the counterparty fails to meet its obligations, the Fund may lose money.

Total Return Swaps. In a total return swap transaction, one party agrees to pay the other party an amount equal to the total return on a defined underlying asset or a non-asset reference during a specified period of time. The underlying asset might be a security or basket of securities or a non-asset reference such as a securities index. In return, the other party would make periodic payments based on a fixed or variable interest rate or on the total return from a different underlying asset or non-asset reference.

Total return swaps could result in losses if the underlying asset or reference does not perform as anticipated. Total return swaps can have the potential for unlimited losses. They are also subject to counterparty risk. If the counterparty fails to meet its obligations, the Fund may lose money.

Hedging. Hedging transactions are intended to reduce the risks of securities in the Fund's portfolio. If the Fund uses a hedging instrument at the wrong time or judges market conditions incorrectly, however, the hedge might be unsuccessful or could reduce the Fund's return or create a loss.

The Fund is not required to use derivatives in seeking its investment objective or for hedging and might not do so.

Risks of Derivative Investments. Derivatives may be volatile and may involve significant risks. Derivative transactions may require the payment of premiums and can increase portfolio turnover. For example, if a call option sold by the Fund were exercised on an investment that had increased in value above the call price, the Fund would be required to sell the investment at the call price and would not be able to realize any additional profit. Certain derivative investments held by the Fund may be illiquid, making it difficult to close out an unfavorable position. The underlying security or other instrument on which a derivative is based, or the derivative itself, may not perform the way the Manager expects it to. As a result, the Fund could realize little or no income or lose principal from the investment, or a hedge might be unsuccessful.

OTHER INVESTMENT STRATEGIES AND RISKS. The Fund can also use the investment techniques and strategies described below. The Fund might not use all of these techniques or strategies or might only use them from time to time.

Common Stock and Other Equity Investments. Equity securities include common stock, preferred stock, rights, warrants and certain debt securities that are convertible into common stock. Equity investments may be exchange-traded or over-the-counter securities. Common stock represents an ownership interest in a company. It ranks below preferred stock and debt securities in claims for dividends and in claims for assets of the issuer in a liquidation or bankruptcy.

Preferred stock has a set dividend rate and ranks ahead of common stocks and behind debt securities in claims for dividends and for assets of the issuer in a liquidation or bankruptcy. The dividends on preferred stock may be cumulative (they remain a liability of the company until paid) or non-cumulative. The fixed dividend rate of preferred stocks may cause their prices to behave more like those of debt securities. When interest rates rise, the value of preferred stock having a fixed dividend rate tends to fall.

A convertible security is one that can be converted into or exchanged for a set amount of common stock of an issuer within a particular period of time at a specified price or according to a price formula. Convertible debt securities pay interest and convertible preferred stocks pay dividends until they mature or are converted, exchanged or redeemed. Convertible securities may provide more income than common stock but they generally provide less income than comparable non-convertible debt securities. Convertible securities are subject to credit and interest rate risk. The credit ratings of convertible securities generally has less impact on the value of the securities than they do for non-convertible debt securities, however.

Risks of Investing in Equity Securities. Stocks and other equity securities fluctuate in price in response to changes in equity markets in general. Equity markets may experience great short-term volatility and may fall sharply at times. Different markets may behave differently from each other and U.S. equity markets may move in the opposite direction from one or more foreign markets.

The prices of equity securities generally do not all move in the same direction at the same time and a variety of factors can affect the price of a particular company's securities. These factors may include: poor earnings reports, a loss of customers, litigation, or changes in government regulations affecting the company or its industry.

When-Issued and Delayed-Delivery Transactions. The Fund may purchase securities on a "when-issued" basis and may purchase or sell such securities on a "delayed-delivery" basis. When-issued and delayed-delivery securities are purchased at a price that is fixed at the time of the transaction, with payment and delivery of the security made at a later date. During the period between purchase and settlement, the Fund makes no payment to the issuer and no interest accrues to the Fund from the investment.

The securities are subject to changes in value from market fluctuations during the period until settlement and the value of the security on the delivery date may be more or less than the Fund paid. The Fund may lose money if the value of the security declines below the purchase price.

Illiquid and Restricted Securities. Investments that do not have an active trading market, or that have legal or contractual limitations on their resale, are generally referred to as "illiquid" securities. Illiquid securities may be difficult to value or to sell promptly at an acceptable price or may require registration under applicable securities laws before they can be sold publicly. Securities that have limitations on their resale are referred to as "restricted securities." Certain restricted securities that are eligible for resale to qualified institutional purchasers may not be regarded as illiquid.

The Fund will not invest more than 15% of its net assets in illiquid securities. The Manager monitors the Fund's holdings of illiquid securities on an ongoing basis to determine whether to sell any of those securities to maintain adequate liquidity.

Loans of Portfolio Securities. The Fund may loan its portfolio securities to brokers, dealers and financial institutions to seek income. The Fund has entered into a securities lending agreement with The Goldman Sachs Trust Company, doing business as Goldman Sachs Agency Lending ("Goldman Sachs") for that purpose. Under the agreement, Goldman Sachs will generally bear the risk that a borrower may default on its obligation to return loaned securities. The Fund, however, will be responsible for the risks associated with the investment of cash collateral, including any collateral invested in an affiliated money market fund. The Fund may lose money on its investment of cash collateral or may fail to earn sufficient income on its investment to meet its obligations to the borrower.

The Fund's portfolio loans must comply with the collateralization and other requirements of the Fund's securities lending agreement, its securities lending procedures and applicable government regulations.

The Fund limits loans of portfolio securities to not more than 25% of its net assets.

Conflicts of Interest. The investment activities of the Manager and its affiliates in regard to other accounts they manage may present conflicts of interest that could disadvantage the Fund and its shareholders. The Manager or its affiliates may provide investment advisory services to other funds and accounts that have investment objectives or strategies that differ from, or are contrary to, those of the Fund. That may result in another fund or account holding investment positions that are adverse to the Fund's investment strategies or activities. Other funds or accounts advised by the Manager or its affiliates may have conflicting interests arising from investment objectives that are similar to those of the Fund. Those funds and accounts may engage in, and compete for, the same types of securities or other investments as the Fund or invest in securities of the same issuers that have different, and possibly conflicting, characteristics. The trading and other investment activities of th ose other funds or accounts may be carried out without regard to the investment activities of the Fund and, as a result, the value of securities held by the Fund or the Fund's investment strategies may be adversely affected. The Fund's investment performance will usually differ from the performance of other accounts advised by the Manager or its affiliates and the Fund may experience losses during periods in which other accounts advised by the Manager or its affiliates achieve gains. The Manager has adopted policies and procedures designed to address potential conflicts of interest identified by the Manager; however, such policies and procedures may also limit the Fund's investment activities and affect its performance.

Investments in Oppenheimer Institutional Money Market Fund. The Fund can invest its free cash balances in Class E shares of Oppenheimer Institutional Money Market Fund, to provide liquidity or for defensive purposes. The Fund invests in Oppenheimer Institutional Money Market Fund, rather than purchasing individual short-term investments, to seek a higher yield than it could obtain on its own. Oppenheimer Institutional Money Market Fund is a registered open-end management investment company, regulated as a money market fund under the Investment Company Act of 1940, as amended, and is part of the Oppenheimer Family of Funds. It invests in a variety of short-term, high-quality, dollar-denominated money market instruments issued by the U.S. Government, domestic and foreign corporations, other financial institutions, and other entities. Those investments may have a higher rate of return than the investments that would be available to the Fund directly. At the time of an investment, the Fund cannot always predict what the yield of the Oppenheimer Institutional Money Market Fund will be because of the wide variety of instruments that fund holds in its portfolio. The return on those investments may, in some cases, be lower than the return that would have been derived from other types of investments that would provide liquidity. As a shareholder, the Fund will be subject to its proportional share of the expenses of Oppenheimer Institutional Money Market Fund's Class E shares, including its advisory fee. However, the Manager will waive a portion of the Fund's advisory fee to the extent of the Fund's share of the advisory fee paid to the Manager by Oppenheimer Institutional Money Market Fund.

Temporary Defensive and Interim Investments. For temporary defensive purposes in times of adverse or unstable market, economic or political conditions, the Fund can invest up to 100% of its assets in investments that may be inconsistent with the Fund's principal investment strategies. Generally, the Fund would invest in shares of Oppenheimer Institutional Money Market Fund or in the types of money market instruments in which Oppenheimer Institutional Money Market Fund invests or in other short-term U.S. Government securities. The Fund might also hold these types of securities as interim investments pending the investment of proceeds from the sale of Fund shares or the sale of Fund portfolio securities or to meet anticipated redemptions of Fund shares. To the extent the Fund invests in these securities, it might not achieve its investment objective.

Portfolio Turnover. A change in the securities held by the Fund is known as "portfolio turnover." The Fund may engage in active and frequent trading to try to achieve its investment objective and may have a portfolio turnover rate of over 100% annually. Increased portfolio turnover may result in higher brokerage fees or other transaction costs, which can reduce performance. If the Fund realizes capital gains when it sells investments, it generally must pay those gains to shareholders, increasing its taxable distributions. The Financial Highlights table at the end of this prospectus shows the Fund's portfolio turnover rates during past fiscal years.

CHANGES TO THE FUND'S INVESTMENT POLICIES. The Fund's fundamental investment policies cannot be changed without the approval of a majority of the Fund's outstanding voting shares; however, the Fund's Board can change non-fundamental policies without a shareholder vote. Significant policy changes will be described in supplements to this prospectus. The Fund's investment objective is a fundamental policy. Other investment restrictions that are fundamental policies are listed in the Fund's Statement of Additional Information. An investment policy is not fundamental unless this prospectus or the Statement of Additional Information states that it is.

PORTFOLIO HOLDINGS

The Fund's portfolio holdings are included in semi-annual and annual reports that are distributed to its shareholders within 60 days after the close of the applicable reporting period. The Fund also discloses its portfolio holdings in its Statements of Investments on Form N-Q, which are public filings that are required to be made with the Securities and Exchange Commission within 60 days after the end of the Fund's first and third fiscal quarters. Therefore, the Fund's portfolio holdings are made publicly available no later than 60 days after the end of each of its fiscal quarters.

A description of the Fund's policies and procedures with respect to the disclosure of its portfolio holdings is available in the Fund's Statement of Additional Information.

How the Fund is Managed

THE MANAGER. OppenheimerFunds, Inc., the Manager, chooses the Fund's investments and handles its day-to-day business. The Manager carries out its duties, subject to the policies established by the Fund's Board of Trustees, under an investment advisory agreement that states the Manager's responsibilities. The agreement sets the fees the Fund pays to the Manager and describes the expenses that the Fund is responsible to pay to conduct its business.

The Manager has been an investment adviser since 1960. The Manager and a subsidiary managed funds with more than 6 million shareholder accounts as of December 31, 2008. The Manager is located at Two World Financial Center, 225 Liberty Street, 11th Floor, New York, New York 10281-1008.

Advisory Fees. Under the Investment Advisory Agreement, the Fund pays the Manager an advisory fee, calculated on the daily net assets of the Fund, at an annual rate that declines on additional assets as the Fund grows: 0.75% of the first $200 million of average annual net assets of the Fund, 0.72% of the next $200 million, 0.69% of the next $200 million, 0.66% of the next $200 million, 0.60% of the next $200 million, 0.50% of the next $4 billion and 0.48% of average annual net assets in excess of $5 billion. The Fund's advisory fee for the period ended September 30, 2008 was 0.51% of average annual net assets for each class of shares.

A discussion regarding the basis for the Board of Trustees' approval of the Fund's investment advisory contract is available in the Fund's Annual Report to shareholders for the period ended September 30, 2008.

Portfolio Managers. The Fund's portfolio is managed by Arthur P. Steinmetz, who has been primarily responsible for the day-to-day management of the Fund's investments since October 1989 and has been sole portfolio manager and Vice President of the Fund since May 2003.

Mr. Steinmetz has been the Director of Fixed Income of the Manager since January 2009, Vice President of the Manager since October 2003 and of HarbourView Asset Management Corporation since March 2000. He is a portfolio manager and an officer of other portfolios in the OppenheimerFunds complex.

The Statement of Additional Information provides additional information about the portfolio manager's compensation, other accounts he manages and his ownership of Fund shares.

ABOUT YOUR ACCOUNT

About Your Account

Where Can You Buy Fund Shares? Oppenheimer funds may be purchased either directly or through a variety of "financial intermediaries" that offer Fund shares to their clients. Financial intermediaries include securities dealers, financial advisors, brokers, banks, trust companies, insurance companies and the sponsors of fund "supermarkets," fee-based advisory or wrap fee programs or college and retirement savings programs.

WHAT CLASSES OF SHARES DOES THE FUND OFFER? The Fund offers investors five different classes of shares. The different classes of shares represent investments in the same portfolio of securities, but the classes are subject to different expenses and will usually have different share prices. When you buy shares, be sure to specify the class of shares you wish to purchase. If you do not choose a class, your investment will be made in Class A shares.

Class A Shares. If you buy Class A shares, you will pay an initial sales charge on investments up to $1 million for regular accounts or lesser amounts for certain retirement plans or if you qualify for certain fee waivers. The amount of the sales charge will vary depending on the amount you invest. The sales charge rates for different investment amounts are listed in "About Class A Shares" below.

Class B Shares. If you buy Class B shares, you will pay no sa les charge at the time of purchase, but you will pay an annual asset-based sales charge (distribution fee) over a period of approximately six years. If you sell your shares within 6 years after buying them, you will normally pay a contingent deferred sales charge. The amount of the contingent deferred sales charge varies depending on how long you own your shares, as described in "About Class B Shares" below.

Class C Shares. If you buy Class C shares, you will pay no sales charge at the time of purchase, but you will pay an ongoing asset-based sales charge. If you sell your shares within 12 months after buying them, you will normally pay a contingent deferred sales charge of 1.0%, as described in "About Class C Shares" below.

Class N Shares. Class N shares are available only through certain retirement plans. If you buy Class N shares, you pay no sales charge at the time of purchase, but you will pay an ongoing asset-base d sales charge. If you sell your shares within 18 months after the retirement plan's first purchase of Class N shares, you may pay a contingent deferred sales charge of 1.0%, as described in "About Class N Shares" below.

Class Y Shares. Class Y shares are offered only to certain institutional investors that have a special agreement with the Distributor and to present or former officers, directors, trustees and employees (and their eligible family members) of the Fund, the Manager and its affiliates, its parent company and the subsidiaries of its parent company, and retirement plans established for the benefit of such individuals. See "About Class Y Shares" below.

Certain sales charge waivers may apply to purchases or redemptions of Class A, Class B, Class C, or Class N shares. More information about those waivers is available in the Fund's Statement of Additional Information, or by clicking on the hyperlink "Sales Charges & Breakpoints" under the heading "Fund Information" on the OppenheimerFunds website at "www.oppenheimerfunds.com."

WHAT IS THE MINIMUM INVESTMENT? In most cases, you can buy Fund shares with a minimum initial investment of $1,000 and make additional investments with as little as $50. The minimum additional investment requirement does not apply to reinvested dividends from the Fund or from other Oppenheimer funds or to omnibus account purchases. A $25 minimum applies to additional investments through an Asset Builder Plan, an Automatic Exchange Plan or a government allotment plan established before November 1, 2002. Reduced initial minimums are available in certain circumstances, including under the following investment plans:

- For most types of retirement accounts that OppenheimerFunds offers, the minimum initial investment is $500.

- For certain retirement accounts that have automatic investments through salary deduction plans, there is no minimum initial investment.

- For an Asset Builder Plan or Automatic Exchange Plan or a government allotment plan, the minimum initial investment is $500.

- For certain fee-based programs that have an agreement with the Distributor, a minimum initial investment of $250 applies.

Minimum Account Balance. A $12 annual "minimum balance fee" is assessed on Fund accounts with a value of less than $500. The fee is automatically deducted from each applicable Fund account annually in September. See the Statement of Additional Information for information about the circumstances under which this fee will not be assessed. Small accounts may be involuntarily redeemed by the Fund if the value has fallen below $500 for reasons other than a decline in the market value of the shares.

Choosing a Share Class

CHOOSING A SHARE CLASS. Once you decide that the Fund is an appropriate investment for you, deciding which class of shares is best suited to your needs depends on a number of factors that you should discuss with your financial advisor. The Fund's operating costs that apply to a share class and the effect of the different types of sales charges on your investment will affect your investment results over time. For example, the net asset value and the dividends of Class B, Class C, and Class N shares will be reduced by additional expenses borne by those classes such as the asset-based sales charge.

Two of the factors to consider are how much you plan to invest and, while future financial needs cannot be predicted with certainty, how long you plan to hold your investment. For example, with larger purchases that qualify for a reduced initial sales charge on Class A shares, the effect of paying an initial sales charge on purchases of Class A shares may be less over time than the effect of the asset-based sales charges on Class B, Class C, or Class N shares. For retirement plans that qualify to purchase Class N shares, Class N will generally be the most advantageous share class. If your goals and objectives change over time and you plan to purchase additional shares, you should re-evaluate each of the factors to see if you should consider a different class of shares.

The discussion below is not intended to be investment advice or a recommendation, because each investor's financial considerations are different. The discussion below assumes that you will purchase only one class of shares and not a combination of shares of different classes. These examples are based on approximations of the effects of current sales charges and expenses projected over time, and do not detail all of the considerations in selecting a class of shares. You should analyze your options carefully with your financial advisor before making that choice.

- Investing for the Shorter Term. While the Fund is meant to be a long-term investment, if you have a relatively short-term investment horizon (that is, if you do not plan to hold your shares for six years or more), you should consider investing in Class C shares. That is because of the effect of the initial sales charge on Class A shares or the Class B contingent deferred sales charge if you redeem within six years.

- Investing for the Longer Term. If you are investing less than $100,000 for the longer term and do not expect to need access to your money for six years or more, Class B shares may be appropriate.

- Amount of Your Investment. Your choice will also depend on how much you plan to invest. For shorter-term investments of less than $100,000, Class C shares might be the appropriate choice because there is no initial sales charge on Class C shares, and the contingent deferred sales charge does not apply to shares you redeem after holding them for one year or more. However, if you plan to invest more than $100,000, and as your investment horizon increases toward six years, Class C shares might not be as advantageous as Class A shares. That is because over time the ongoing asset-based sales charge on Class C shares will have a greater impact on your account than the reduced front-end sales charge available for Class A share purchases of $100,000 or more. If you invest $1 million or more, in most cases Class A shares will be the most advantageous choice, no matter how long you intend to hold your shares.

The Distributor normally will not accept purchase orders from a single investor for more than $100,000 of Class B shares or for $1 million or more of Class C shares. Dealers or other financial intermediaries purchasing shares for their customers in omnibus accounts are responsible for determining the suitability of a particular share class for an investor. Are There Differences in Account Features That Matter to You? Some account features may not be available for all share classes. Other features may not be advisable because of the effect of the contingent deferred sales charge. Therefore, you should carefully review how you plan to use your investment account before deciding which class of shares to buy.

How Do Share Classes Affect Payments to Your Financial Intermediary? The Class B, Class C, and Class N contingent deferred sales charges and asset-based sales charges have the same purpose as the front-end sales charge or contingent deferred sales charge on Class A shares: to compensate the Distributor for concessions and expenses it pays to brokers, dealers and other financial intermediaries for selling Fund shares. Those financial intermediaries may receive different compensation for selling different classes of shares. The Manager or Distributor may also pay dealers or other financial intermediaries additional amounts from their own resources based on the value of Fund shares held by the intermediary for its own account or held for its customers' accounts. For more information about those payments, see "Payments to Financial Intermediaries and Service Providers" below.

ABOUT CLASS A SHARES. Class A shares are sold at their offering price, which is the net asset value of the shares (described below) plus, in most cases, an initial sales charge. The Fund receives the amount of your investment, minus the sales charge, to invest for your account. In some cases, Class A purchases may qualify for a reduced sales charge or a sales charge waiver, as described below or in the Statement of Additional Information.

The Class A sales charge rate varies depending on the amount of your purchase. A portion or all of the sales charge may be retained by the Distributor or paid to your broker, dealer or other financial intermediary as a concession. The current sales charge rates and concessions paid are shown in the table below. There is no initial sales charge on Class A purchases of $1 million or more, but a contingent deferred sales charge (described below) may apply.

| Amount of Purchase | Front-End Sales Charge As a Percentage of Offering Price | Front-End Sales Charge As a Percentage of Net Amount Invested | Concession As a Percentage of Offering Price |

| Less than $50,000 | 4.75% | 4.98% | 4.00% |

| $50,000 or more but less than $100,000 | 4.50% | 4.71% | 3.75% |

| $100,000 or more but less than $250,000 | 3.50% | 3.63% | 2.75% |

| $250,000 or more but less than $500,000 | 2.50% | 2.56% | 2.00% |

| $500,000 or more but less than $1 million | 2.00% | 2.04% | 1.60% |

Due to rounding, the actual sales charge for a particular transaction may be higher or lower than the rates listed above.

Reduced Class A Sales Charges. Under a "Right of Accumulation" or a "Letter of Intent" you may be eligible to buy Class A shares of the Fund at the reduced sales charge rates that would apply to a larger purchase. The Fund reserves the right to modify or to cease offering these programs at any time.

- Right of Accumulation. To qualify for the reduced Class A sales charge that would apply to a larger purchase than you are currently making, you can add the value of shares you or your spouse currently own or other purchases you are currently making to the value of your Class A share purchase of the Fund. You may count Class A, Class B and Class C shares of the Fund and other Oppenheimer funds and Class A, Class B, Class C, Class G and Class H units in adviser sold Section 529 plans, for which the Manager or the Distributor serves as the "Program Manager" or "Program Distributor." In totaling your holdings, you may count shares held in:

° your individual accounts (including IRAs, 403(b) plans and eligible 529 plans),

° your joint accounts with your spouse,

° accounts you or your spouse hold as trustees or custodians on behalf of

your children who are minors.

A fiduciary can apply rights of accumulation to all shares purchased for a trust, estate or other fiduciary account that has multiple accounts (including employee benefit plans for the same employer and Single K plans for the benefit of a sole proprietor).

Your Class A shares of Oppenheimer Money Market Fund, Inc. or Oppenheimer Cash Reserves on which you have not paid a sales charge will not be counted for this purpose.