- HMN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Horace Mann Educators (HMN) DEF 14ADefinitive proxy

Filed: 13 Apr 06, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

Horace Mann Educators Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

HORACE MANN EDUCATORS CORPORATION

1 Horace Mann Plaza

Springfield, Illinois 62715-0001

ANNUAL MEETING—May 24, 2006

Dear Shareholders:

You are cordially invited to attend the Annual Meeting of your Corporation to be held at 9:00 a.m. Central Daylight Saving Time on Wednesday, May 24, 2006 at the President Abraham Lincoln Hotel and Conference Center, 701 East Adams Street, Springfield, Illinois.

We will present a report on the current affairs of the Corporation at the meeting and Shareholders will have an opportunity for questions and comments.

We request that you sign, date and mail your proxy card whether or not you plan to attend the Annual Meeting.

Prompt return of your proxy card will reduce the cost of further mailings and other follow-up work. You may revoke your voted proxy at any time prior to the meeting or vote in person if you attend the meeting.

We look forward to seeing you at the meeting. If you do not plan to attend and vote by proxy, let us know your thoughts about the Corporation either by letter or by comment on the proxy card.

| Sincerely, | ||||

|  | |||

Joseph J. Melone | Louis G. Lower II | |||

| Chairman of the Board | President and Chief Executive Officer | |||

Springfield, Illinois

April 13, 2006

HORACE MANN EDUCATORS CORPORATION

1 Horace Mann Plaza

Springfield, Illinois 62715-0001

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 24, 2006

| Date: | Wednesday, May 24, 2006 | |

| Time: | 9:00 a.m. Central Daylight Saving Time | |

| Place: | President Abraham Lincoln Hotel and Conference Center 701 East Adams Street Springfield, Illinois | |

| Purpose: | 1. Elect eight Directors. | |

2. Ratify the appointment of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2006. | ||

3. Conduct other business if properly raised. | ||

| Record Date: | March 27, 2006—Shareholders registered in the records of the Company or its agents on that date are entitled to receive notice of and to vote at the meeting. | |

| Mailing Date: | The approximate mailing date of this proxy statement and the accompanying proxy card is April 13, 2006. | |

Your vote is important. Whether or not you plan to attend the Annual Meeting, the Board of Directors urges you to complete, date, sign and return the enclosed proxy card as soon as possible in the enclosed business reply envelope, which requires no postage if mailed in the United States of America. You may revoke your proxy at any time before the vote is taken at the Annual Meeting provided that you comply with the procedures set forth in the Proxy Statement to which this Notice of Annual Meeting of Shareholders is attached. If you attend the Annual Meeting, you may either vote by proxy or revoke your proxy and vote in person.

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Horace Mann Educators Corporation (the “Company”) of proxies from holders of the Company’s common stock, par value $.001 per share (“Common Stock”). The proxies will be voted at the Annual Meeting of Shareholders to be held on Wednesday, May 24, 2006 at 9:00 a.m. Central Daylight Saving Time at the President Abraham Lincoln Hotel and Conference Center, 701 East Adams Street, Springfield, Illinois and through any adjournment or adjournments thereof (the “Annual Meeting”).

The mailing address of the Company is 1 Horace Mann Plaza, Springfield, Illinois 62715-0001 (telephone number (217) 789-2500). This Proxy Statement and the accompanying proxy card are being first transmitted to shareholders of the Company (“Shareholders”) on or about April 13, 2006.

The Board has fixed the close of business on March 27, 2006 as the record date (the “Record Date”) for determining the Shareholders entitled to receive notice of and to vote at the Annual Meeting. At the close of business on the Record Date, an aggregate of 42,996,089 shares of Common Stock were issued and outstanding, each share entitling the holder thereof to one vote on each matter to be voted upon at the Annual Meeting. The presence, in person or by proxy, of the holders of a majority of such outstanding shares is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Proxies will be solicited by mail. The Company, through bankers, brokers or other persons, also intends to make a solicitation of beneficial owners of Common Stock.

At the Annual Meeting, Shareholders will be asked to (1) elect eight Directors to hold office until the next Annual Meeting of Shareholders and until their respective successors have been duly elected and qualified and (2) ratify the appointment of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2006.

Shareholders may also be asked to consider and take action with respect to such other matters as may properly come before the Annual Meeting.

Copies of the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 were mailed to known Shareholders on or about April 13, 2006.

Solicitation and Revocation

Proxies in the form enclosed are solicited by and on behalf of the Board. The persons named in the form of proxy have been designated as proxies by the Board. Such persons are Directors of the Company.

Shares of Common Stock represented at the Annual Meeting by a properly executed and returned proxy will be voted at the Annual Meeting in accordance with the instructions noted thereon, or if no instructions are noted, the proxy will be voted in favor of the proposals set forth in the Notice of Annual Meeting. A submitted proxy is revocable by a Shareholder at any time prior to it being voted provided that such Shareholder gives written notice to the Corporate Secretary at or prior to the Annual Meeting that such Shareholder intends to vote in person or by submitting a subsequently dated proxy. Attendance at the Annual Meeting by a Shareholder who has given a proxy shall not in and of itself constitute a revocation of such proxy.

Proxies will be solicited initially by mail. Further solicitation may be made by officers and other employees of the Company personally, by phone or otherwise, but such persons will not be specifically compensated for such services. Banks, brokers, nominees and other custodians and fiduciaries will be reimbursed for their reasonable out-of-pocket expenses in forwarding soliciting material to their principals, the beneficial owners of Common Stock. The costs of soliciting proxies will be borne by the Company. It is estimated these costs will be nominal.

1

Shareholder Approval

Shareholders are entitled to one vote per share of Common Stock on all matters submitted for consideration at the Annual Meeting. The affirmative vote of a majority of the shares of Common Stock represented in person or by proxy at the Annual Meeting is required for the election of Directors and the ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2006.

Abstentions may not be specified with regard to the election of Directors. On other matters abstentions have the same effect as a vote “against” approval of the matter.

Please note that under the rules of the New York Stock Exchange (“NYSE”) brokers who hold shares of Common Stock in street name for customers have the authority to vote on certain items when they have not received instructions from beneficial owners. With respect to the matters to come before the Annual Meeting, if brokers are not entitled to vote without instructions and therefore cast broker non-votes, that will not affect the outcome of such matters.

Other Matters

Other than the matters set forth above, the Board has not received any Shareholder proposal by the deadline prescribed by the rules of the Securities and Exchange Commission, and otherwise knows of no other matters to be brought before the Annual Meeting. However, should any other matters properly come before the meeting, the persons named in the accompanying Form of Proxy will vote or refrain from voting thereon at their discretion.

Proposal No. 1 Election Of Eight Directors

The By-Laws of the Company provide for the Company to have not less than five nor more than fifteen Directors. The following eight persons currently are serving as Directors of the Company: William W. Abbott, Mary H. Futrell, Stephen J. Hasenmiller, Louis G. Lower II, Joseph J. Melone, Jeffrey L. Morby, Shaun F. O’Malley and Charles A. Parker. The terms of the current Directors expire at the Annual Meeting.

Upon the recommendation of the Nominating & Governance Committee, the Board has nominated Mr. Abbott, Dr. Futrell, Mr. Hasenmiller, Mr. Lower, Mr. Melone, Mr. Morby, Mr. O’Malley and Mr. Parker (the “Board Nominees”) to hold office as Directors. The proxies solicited by and on behalf of the Board will be voted “FOR” the election of the Board Nominees unless such authority is withheld as provided in the proxy. The Company has no reason to believe that any of the foregoing Board Nominees is not available to serve or will not serve if elected, although in the unexpected event that any such Board Nominee should become unavailable to serve as a Director, full discretion is reserved to the persons named as proxies to vote for such other persons as may be nominated. Each Director will serve until the next Annual Meeting of Shareholders and until his or her respective successor is duly elected and qualified.

Board Nominees

The following information, as of March 27, 2006, is provided with respect to each Board Nominee:

William W. Abbott, 74 Chairman of the Compensation Committee; Member of the Executive and Nominating & Governance Committees of the Board | Mr. Abbott has been a Director of the Company since September 1996. He is currently self-employed as a business consultant. In 1989, Mr. Abbott retired after 35 years of service at The Procter & Gamble Company, as a Senior Vice President in charge of worldwide sales and other operations. He currently serves as a member of the Advisory Board of Manco and a member of the Board of Overseers of the Duke Cancer Center. |

2

Mary H. Futrell, 65 Member of the Compensation and Nominating & Governance Committees of the Board | Dr. Futrell has been a Director of the Company since February 2001. She is currently Dean of the Graduate School of Education and Human Development, and Co-Director of the Center for Curriculum, Standards and Technology, The George Washington University, positions she has held for more than 5 years. In addition, Dr. Futrell is Professor, Department of Education Leadership, a position she has held since 1999. Dr. Futrell is also Founding President, Education International and past President, National Education Association and Virginia Education Association. | |

Stephen J. Hasenmiller, 56 Member of the Audit and Investment & Finance Committees of the Board | Mr. Hasenmiller has been a Director of the Company since September 2004. In March 2001, he retired after 24 years of service at The Hartford Financial Services Group, Inc., as a Senior Vice President—Personal Lines. | |

Louis G. Lower II, 60 President and Chief Executive Officer; Member of the Executive and Investment & Finance Committees of the Board | Mr. Lower joined the Company as Director, President and Chief Executive Officer in February 2000. Prior to that, he served as Chief Executive Officer of Allstate Life Insurance Company, a position he held from January 1990 through January 2000. He currently serves as a member of the Boards of Directors of the Illinois Life Insurance Council, Insurance Marketplace Standards Association, NEA Foundation for the Improvement of Education, Abraham Lincoln Presidential Library and Museum, and PMI Mortgage Insurance Co. Mr. Lower has over 30 years of experience in the insurance industry. | |

Joseph J. Melone, 74 Chairman of the Board; Chairman of the Executive and Nominating & Governance Committees; Member of the Compensation Committee of the Board | Mr. Melone has been a Director of the Company since February 2001. Prior to his retirement in 1998, he served as President and Chief Executive Officer of The Equitable Companies Inc. (1996-1998), Chairman and Chief Executive Officer of The Equitable Life Assurance Society (1994-1998) and Chairman and Chief Executive Officer of The Equitable Variable Life Insurance Company (1990-1998). Prior to 1990, Mr. Melone served as President of Prudential Insurance Company. He currently serves as a member of the Boards of Directors of Bysis, Inc. and Foster-Wheeler Corporation. | |

Jeffrey L. Morby, 68 Member of the Audit and Investment & Finance Committees of the Board | Mr. Morby has been a Director of the Company since September 1996. He is currently self-employed as a business consultant and investor. Mr. Morby serves as Managing Director of Amarna Corporation, LLC and makes investments through private subsidiaries and affiliates of Amarna Corporation. Mr. Morby retired on June 30, 1996 as Vice Chairman of Mellon Bank Corporation and Mellon Bank, N.A. Mr. Morby currently serves as a member of the Boards of Directors of Restaurant Insurance Holdings, Inc., Pittsburgh Cultural Trust and the Board of International Advisors of the City of Wuhan, China. He is also Chairman of the Cure Alzheimer’s Fund, a non-profit public charity; Chairman of the Morby Family Charitable Foundation, a private non-profit foundation; a member of the Council of World Wildlife Fund, a non-profit public charity; a member of the Board of Directors of the Pittsburgh City Theater; and Vice President of the Andrew and Velda Morby Educational Foundation, a private non-profit foundation. | |

3

Shaun F. O’Malley, 70 Chairman of the Audit Committee; Member of the Executive and Nominating & Governance Committees of the Board | Mr. O’Malley has been a Director of the Company since September 1996. He is currently the Chairman Emeritus of Price Waterhouse LLP, a title he has held since July 1995. Prior to that, he served as Chairman and Senior Partner of Price Waterhouse LLP. He currently serves as a member of the Boards of Directors of the Finance Company of Pennsylvania, Federal Home Loan Mortgage Corporation (“Freddie Mac”), Polymedix, Inc., and The Philadelphia Contributionship and as a member of the Board of Trustees of the University of Pennsylvania Health System. | |

Charles A. Parker, 71 Chairman of the Investment & Finance Committee; Member of the Audit and Executive Committees of the Board | Mr. Parker has been a Director of the Company since September 1997. He retired in 1995 after 17 years of service at The Continental Corporation, including service as Executive Vice President, Chief Investment Officer and Director. He currently serves as a member of the Boards of Directors of T.C.W. Convertible Fund and T.C.W. Galileo Funds Inc. and as a Governor of the Burridge Center for Research in Security Prices (The Leeds School of Business of the University of Colorado). | |

All of the Board Nominees were elected Directors at the last annual meeting of Shareholders of the Company held on May 26, 2005.

The Board recommends that Shareholders vote FOR the election of these eight nominees as Directors.

Proposal No. 2 Ratification of Independent Registered Public Accounting Firm

The independent registered public accounting firm selected by the Audit Committee of the Board to serve as the Company’s auditors for the year ending December 31, 2006 is KPMG LLP. KPMG LLP served in that capacity for the year ended December 31, 2005. A representative from KPMG LLP is expected to be present at the Annual Meeting. The representative will be given an opportunity to make a statement to Shareholders and is expected to be available to respond to appropriate questions from Shareholders.

The Board recommends that Shareholders vote FOR the ratification of KPMG LLP, an independent registered public accounting firm, as the Company’s auditors for the year ending December 31, 2006.

4

Set forth below is certain information, as of March 27, 2006, with respect to certain executive officers of the Company and its subsidiaries who are not Directors of the Company (“Executive Officers”) (Louis G. Lower II, President and Chief Executive Officer, is discussed above):

Peter H. Heckman, 60 Executive Vice President and Chief Financial Officer | Mr. Heckman joined the Company in April 2000 as Executive Vice President and Chief Financial Officer (“CFO”). Prior to that, he served as Vice President of Allstate Life Insurance Company from 1988 through April 2000, where he held both senior financial and operating positions. Mr. Heckman has over 30 years of experience in the insurance industry. | |

Douglas W. Reynolds, 52 Executive Vice President, Property & Casualty and Information Technology | Mr. Reynolds joined the Company in November 2001 as Executive Vice President, Property and Casualty. In December 2003, he also assumed responsibility for Information Technology. He previously served as Regional Vice President of AIG, Inc., a position he held from February 2000 through November 2001, where he was responsible for all property and casualty business for Southeast Asia and China. Prior to that, he served as Vice President of Allstate Insurance Company (“Allstate”). From November 1976 through January 2000 he held various property and casualty management positions at Allstate, including underwriting, marketing, non-standard auto and mergers and acquisitions, while also leading the start-up of a non-standard auto insurance company. Mr. Reynolds has over 25 years of experience in the insurance industry. | |

Paul D. Andrews, 49 Senior Vice President, Corporate Services | Mr. Andrews joined the Company in July 2001 as Vice President, Client Services. In November 2004, he was appointed to his present position as Senior Vice President, Corporate Services. He previously served as Assistant Vice President of SAFECO Insurance Companies, a position he held from 1998 to 2001, where he was responsible for field operations and personal insurance. Mr. Andrews has over 15 years of experience in the insurance industry. | |

Bret A. Conklin, 42 Senior Vice President and Controller | Mr. Conklin joined the Company as Senior Vice President and Controller in January 2002. Mr. Conklin has over 20 years of experience in the insurance industry, including: serving as Vice President of Kemper Insurance from January 2000 through January 2002, where he was responsible for all corporate financial reporting and accounting operations; serving as Vice President and Controller of the Company from July 1998 through January 2000; being associated with Pekin Insurance from September 1992 through June 1998 and serving as its Vice President and Controller; and seven years of public accounting experience with KPMG Peat Marwick from 1985 to 1992, specializing in its insurance industry practice. | |

Frank D’Ambra III, 52 Senior Vice President, Life & Annuity | Mr. D’Ambra joined the Company in February 2005 as Senior Vice President, Life and Annuity. Prior to joining the Company, he was President of Financial Concepts, a consulting firm he founded in 2002 that focused on helping insurance and investment firms identify and develop market and business opportunities. From 1999 to 2002, he served as Vice President and Director of Marketing and Client Relations with Swiss Re Investors. Mr. D’Ambra has over 25 years of experience in the insurance and financial services industry. | |

5

Dwayne D. Hallman, 43 Senior Vice President, Finance | Mr. Hallman joined the Company in January 2003 as Senior Vice President, Finance. From September 2000 to December 2002, he served as the Chief Financial Officer of Acceptance Insurance Companies, where he was responsible for financial reporting, investor relations, the treasury and investment management functions and property-casualty operations. From July 1995 to August 2000, Mr. Hallman served as Vice President, Finance and Treasurer at Highlands Insurance Group, where he was responsible for financial reporting, treasury, planning and office services. Mr. Hallman has over 20 years of experience in the insurance industry. | |

Robert B. Joyner, 62 Senior Vice President, Marketing | Mr. Joyner joined the Company in March 1971 as an agent. He has held several positions of increasing responsibility within the Company’s marketing operations, including service as Senior Vice President, Marketing effective September 2001. Mr. Joyner has over 35 years of experience in the insurance industry. | |

Ann M. Caparrós, 53 General Counsel, Chief Compliance Officer and Corporate Secretary | Ms. Caparrós joined the Company in March 1994 as Vice President, General Counsel and Corporate Secretary. In October 2000, she also assumed responsibility as Chief Compliance Officer. Ms. Caparrós has over 25 years of experience in the insurance industry. | |

BOARD OF DIRECTORS AND COMMITTEES

There were eight members on the Board as of March 27, 2006. The Board met six times during 2005. No Director of the Company attended fewer than 75% of the Board meetings and the committee meetings to which he or she was appointed and served during 2005. The Chairman of the Board presides over all executive sessions of the Board, including executive sessions of non-management directors, and may be contacted as described in the section “Communications with Directors” or as detailed atwww.horacemann.com under “Investor Relations—Corporate Governance”.

The Company’s Corporate Governance Principles require that the Board consist of a majority of directors who meet the criteria for independence required by the NYSE, as set forth in the NYSE’s Rule 303A.02. Based on the independence requirements of the NYSE and after reviewing any relationships between the Directors and the Company or its management (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company or its management) that could impair, or appear to impair, the Director’s ability to make independent judgments, the Board determined that none of its non-management Directors have a material relationship with the Company, and therefore all of these Directors are independent. The non-management Directors are Mr. Abbott, Dr. Futrell, Mr. Hasenmiller, Mr. Melone, Mr. Morby, Mr. O’Malley and Mr. Parker.

Committees of the Board

The standing committees of the Board consist of the Executive Committee, Compensation Committee, Nominating & Governance Committee, Investment & Finance Committee and Audit Committee. Each standing committee is governed by a charter which defines its role and responsibilities and which is available on the Company’s website atwww.horacemann.com, under “Investor Relations—Corporate Governance”. A printed copy may be obtained by Shareholders upon request, addressed to Investor Relations, Horace Mann Educators Corporation, 1 Horace Mann Plaza, C-120, Springfield, Illinois 62715-0001.

TheExecutive Committee exercises certain powers of the Board during intervals between meetings of the Board and, as requested by the Chief Executive Officer, acts as a sounding board for discussing strategic and operating issues between meetings of the Board. The current members of the Committee are Mr. Melone (Chairman), Mr. Abbott, Mr. Lower, Mr. O’Malley and Mr. Parker. The Executive Committee did not meet during 2005.

6

TheCompensation Committee reviews, approves and recommends the compensation of Officers and Directors of the Company. The current members of the Committee are Mr. Abbott (Chairman), Dr. Futrell and Mr. Melone. The Compensation Committee met five times during 2005. Each of the Committee members is independent under the standards of the NYSE.

TheNominating & Governance Committee oversees succession planning and executive continuity issues relating to the senior management of the Company, including the Chief Executive Officer, and also recommends director nominees to the Board. The Nominating & Governance Committee will consider director nominees recommended by Shareholders. Nominations may be submitted in writing to Ann M. Caparrós, Corporate Secretary, Horace Mann Educators Corporation, 1 Horace Mann Plaza, Springfield, Illinois, 62715-0001 not later than December 31, 2006 in order for such proposal to be considered for inclusion in the Company’s Proxy Statement and proxy relating to the 2007 annual meeting of Shareholders. There are no differences in the evaluation of nominees recommended by Shareholders. The Committee evaluates possible nominees to the Board on the basis of the factors it deems relevant, including the following:

| • | high standards of personal character, conduct and integrity; |

| • | an understanding of the interests of the Company’s Shareholders, customers, employees, suppliers, communities and the general public; |

| • | the intention and ability to act in the interest of all Shareholders; |

| • | a position of leadership and substantial accomplishment in his or her field of endeavor, which may include business, government or academia; |

| • | the ability to understand and exercise sound judgment on issues related to the goals of the Company; |

| • | a willingness and ability to devote the time and effort required to serve effectively on the Board, including preparation for and attendance at Board and committee meetings; |

| • | the absence of interests or affiliations that could give rise to a biased approach to directorship responsibilities and/or a conflict of interest, and the absence of any significant business relationship with the Company except for the employment relationship of an inside director; and |

| • | the needs of the Board, including diversity, age, skills and experience. |

The Nominating & Governance Committee also develops and recommends to the Board corporate governance principles applicable to the Company. The current members of the Committee are Mr. Melone (Chairman), Mr. Abbott, Dr. Futrell and Mr. O’Malley. The Nominating & Governance Committee met four times during 2005. Each of the Committee members is independent under the standards of the NYSE.

TheInvestment & Finance Committee approves investment strategies, monitors the performance of investments made on behalf of the Company and its subsidiaries and oversees issues and decisions relating to the Company’s capital structure. The current members of the Committee are Mr. Parker (Chairman), Mr. Hasenmiller, Mr. Lower and Mr. Morby. The Investment & Finance Committee met four times during 2005.

TheAudit Committee oversees the accounting and financial reporting process, audits of the financial statements and internal operating controls of the Company. It meets with both the Company’s management and the Company’s independent registered public accounting firm. The current members of the Committee are Mr. O’Malley (Chairman), Mr. Hasenmiller, Mr. Morby and Mr. Parker. The Audit Committee met 14 times during 2005. The Board has determined that Mr. O’Malley is a financial expert. In addition, each of the Committee members is independent under the standards of the NYSE.

Report of the Audit Committee of the Board of Directors

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors acting under a written charter, which is provided as Appendix A to this Proxy Statement. The Audit Committee is composed of four Directors, each of whom is independent as defined by the NYSE listing standards. Management has

7

the primary responsibility for the Company’s financial statements and its reporting process, including the Company’s systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Company’s Annual Report on Form 10-K with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee has discussed with our independent registered public accounting firm, which is responsible for expressing an opinion on the conformity of those audited financial statements with United States generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the Audit Committee has received from the independent registered public accounting firm the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and its management, taking into account the potential effect of any non-audit services provided by the independent registered public accounting firm.

The Audit Committee discussed with the Company’s internal auditors and independent registered public accounting firm the overall scope and plans for their respective audits. The Audit Committee meets with the internal auditors and the independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee held 14 meetings during fiscal year 2005.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the Securities and Exchange Commission. The Audit Committee approved the selection of KPMG LLP as the Company’s independent registered public accounting firm.

AUDIT COMMITTEE

SHAUN F. O’MALLEY,Chairman

STEPHEN J. HASENMILLER, JEFFREY L. MORBY and CHARLES A. PARKER, Members

Director Compensation

In 2005, the Company implemented a new Director’s Compensation program for non-employee Directors as shown in the table below.

Compensation Element | Non-Employee Director Compensation Program –Amount | |

Annual Retainer | $25,000 ($75,000 for Board Chairman) | |

Committee Chair Retainer | $4,000 per committee ($7,500 for Audit Committee Chair) | |

Share-based Compensation | • Initial grant of 2,000 restricted stock units upon joining the Board with a one-year vesting period(1)

• Annual grant of 2,000 restricted stock units with a one-year vesting period | |

Board Meeting Fee | $1,500 (in-person or telephonic attendance) | |

Committee Meeting Fee | $1,000 per meeting ($1,500 for Audit Committee members; $2,500 for Audit Committee Chair) | |

Deferred Fees Match | Directors electing to defer cash compensation into common stock equivalent units receive a 25% match in additional common stock equivalent units. | |

| (1) | Non-employee Directors received 2,000 restricted stock units in May 2005 for their pre-2005 service on the Board in addition to the annual grant of 2,000 restricted stock units. |

8

Non-employee Directors are required to hold shares of Common Stock in Horace Mann Educators Corporation (“HMEC”) equal to two times the annual cash retainer. Until non-employee Directors meet this ownership requirement, they must retain all common stock equivalent units and restricted stock units granted as share-based compensation (net of taxes). All non-employee Directors have met the guidelines with the exception of Mr. Hasenmiller, who became a Board member in September 2004 and has five years to meet this requirement.

Employee Directors do not receive compensation for serving on the Board and are subject to separate stock ownership guidelines (see “Executive Compensation—Report of Executive Compensation of the Compensation Committee of the Board of Directors—Stock Ownership Guidelines”).

Communications with Directors

The Company has established various processes to facilitate Shareholder communications with the Board. Communications to non-employee Directors as a group or to the presiding Director individually may be submitted via regular mail addressed to the Board of Directors, c/o General Counsel, Horace Mann Educators Corporation, 1 Horace Mann Plaza, Springfield, Illinois 62715-0001. Additionally, communications may be e-mailed to the Board of Directors, c/o the General Counsel, athmecbofd@horacemann.com. The members of the Board are expected to be present at the Annual Meeting. The following members of the Board attended last year’s annual meeting of Shareholders: Mr. Abbott, Dr. Futrell, Mr. Hasenmiller, Mr. Lower, Mr. Melone, Mr. Morby, Mr. O’Malley and Mr. Parker.

The Company maintains a special advisory board composed of leaders of education associations. The Company meets with the special advisory board on a regular basis. The education association leaders serving on the special advisory board receive a fee of $200 plus expenses for each special advisory board meeting attended. The special advisory board met one time in 2005.

CODE OF ETHICS, CODE OF CONDUCT AND CORPORATE GOVERNANCE PRINCIPLES

The Company has adopted a Code of Ethics and a Code of Conduct applicable to all employees, including the Chief Executive Officer, Chief Financial Officer, Controller and Directors (in their capacity as Directors of the Company). The Company has also adopted Corporate Governance Principles. The Codes and Principles are available on the Company’s website atwww.horacemann.com, under “Investor Relations—Corporate Governance”. A printed copy may be obtained by Shareholders upon written request, addressed to Investor Relations, Horace Mann Educators Corporation, 1 Horace Mann Plaza, C-120, Springfield, Illinois 62715-0001.

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following tables set forth certain information regarding beneficial ownership of shares of Common Stock by each person who is known by the Company to own beneficially more than 5% of the issued and outstanding shares of Common Stock, and by each of the Company’s Directors, the Company’s CEO and the other four highest compensated Executive Officers (collectively the “Named Executive Officers”) and by all Directors and Executive Officers of the Company as a group. Information in the table is as of March 27, 2006, except that the number of shares of Common Stock beneficially owned by the 5% beneficial owners is as of December 31, 2005 based on information reported by such persons to the Securities and Exchange Commission. Except as otherwise indicated, to the Company’s knowledge all shares of Common Stock are beneficially owned and investment and voting power is held solely by the persons named as owners.

Title of Class | Beneficial Owner | Amount of Beneficial Ownership | Percent of Class | ||||

Security Ownership of 5% Beneficial Owners | |||||||

Common Stock | Ariel Capital Management, LLC(1) | 9,194,230 | 21.4 | % | |||

Common Stock | Dimensional Fund Advisors Inc.(2) | 3,361,162 | 7.8 | % | |||

Common Stock | LSV Asset Management(3) | 2,240,890 | 5.2 | % | |||

Security Ownership of Directors and Executive Officers | |||||||

Common Stock | William W. Abbott(4) | 55,364 | * | ||||

Common Stock | Mary H. Futrell(5) | 23,686 | * | ||||

Common Stock | Stephen J. Hasenmiller(6) | 6,900 | * | ||||

Common Stock | Louis G. Lower II(7) | 1,105,126 | 2.5 | % | |||

Common Stock | Joseph J. Melone(8) | 69,460 | * | ||||

Common Stock | Jeffrey L. Morby(9) | 49,580 | * | ||||

Common Stock | Shaun F. O’Malley(10) | 53,098 | * | ||||

Common Stock | Charles A. Parker(11) | 44,954 | * | ||||

Common Stock | Peter H. Heckman(12) | 406,198 | * | ||||

Common Stock | Douglas W. Reynolds(13) | 238,657 | * | ||||

Common Stock | Robert B. Joyner(14) | 82,425 | * | ||||

Common Stock | Frank D’Ambra III(15) | 20,338 | * | ||||

Common Stock | All Directors and Executive Officers as a group (16 persons)(16) | 2,454,983 | 5.4 | % | |||

| * | Less than 1% |

| (1) | Ariel Capital Management, LLC (“Ariel”) has a principal place of business at 200 E. Randolph Drive, Suite 2900, Chicago, IL 60601 and is an investment adviser registered under section 203 of the Investment Advisers Act of 1940. All securities reported are owned by investment advisory clients of Ariel, who have the right to dividends and proceeds of any sale of the subject security. Ariel Fund, a series of Ariel Investment Trust, a registered investment company, owns more than 5% of the subject security. The foregoing is based on Amendment No. 10 to Schedule 13G filed by Ariel in February 2006. |

| (2) | Dimensional Fund Advisors Inc. (“Dimensional”) has a principal place of business at 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 and is an investment adviser registered under section 203 of the Investment Advisers Act of 1940. Dimensional furnishes investment advice to four investment companies and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are the “Funds”. Dimensional possesses investment and/or voting power over the subject securities that are owned by the Funds and may be deemed to be the beneficial owner of the shares held by the Funds. However, all securities reported are owned by the Funds. Dimensional disclaims beneficial ownership of such securities. The foregoing is based on Amendment No. 1 to Schedule 13G filed by Dimensional in February 2006. |

| (3) | LSV Asset Management (“LSV”) has a principal place of business at 1 N. Wacker Drive, Suite 4000, Chicago, IL 60606 and is an investment adviser registered under section 203 of the Investment Advisers Act of 1940. All |

10

securities reported are owned by investment advisory clients of LSV, no one of which to the knowledge of LSV owns more than 5% of the class. The foregoing is based on the Schedule 13G filed by LSV in February 2006. |

| (4) | Includes 30,864 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 17,400 shares of Common Stock that are currently exercisable. |

| (5) | Includes 10,686 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 13,000 shares of Common Stock that are currently exercisable. |

| (6) | Consists entirely of 6,900 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. |

| (7) | Includes options to purchase 1,029,325 shares of Common Stock that are currently exercisable and 56,412 common stock equivalent units held under the Deferred Compensation Plan for Employees. Also includes 9,389 shares of Common Stock that are invested in the Horace Mann Stock Fund of the Horace Mann Supplemental Retirement and Savings Plan (the “401(k) Plan”). |

| (8) | Includes 46,460 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 21,000 shares of Common Stock that are currently exercisable. |

| (9) | Includes 32,180 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 17,400 shares of Common Stock that are currently exercisable. |

| (10) | Includes 35,298 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 17,400 shares of Common Stock that are currently exercisable. |

| (11) | Includes 27,554 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors. Also includes options to purchase 17,400 shares of Common Stock that are currently exercisable. |

| (12) | Includes options to purchase 383,325 shares of Common Stock that are currently exercisable. Also includes 22,873 common stock equivalent units held under the Deferred Compensation Plan for Employees. |

| (13) | Includes options to purchase 222,000 shares of Common Stock that are currently exercisable and 12,492 common stock equivalent units held under the Deferred Compensation Plan for Employees. Also includes 1,166 shares of Common Stock that are invested in the Horace Mann Stock Fund of the 401(k) Plan. |

| (14) | Includes options to purchase 76,213 shares of Common Stock that are currently exercisable. Also includes 5,332 common stock equivalent units held under the Deferred Compensation Plan for Employees. |

| (15) | Consists entirely of options to purchase 20,338 shares of Common Stock that are currently exercisable. |

| (16) | Includes options for the group of Directors and Executive Officers to purchase 2,109,115 shares of Common Stock that are currently exercisable. Also includes 189,942 common stock equivalent units pursuant to the Deferred Equity Compensation Plan for Directors, 119,555 common stock equivalent units pursuant to the Deferred Compensation Plan for Employees and 11,576 shares of Common Stock that are invested in the Horace Mann Stock Fund of the 401(k) Plan. |

Section 16(a) Beneficial Ownership Reporting Compliance

The Company has established procedures by which Executive Officers and Directors provide relevant information regarding transactions in Common Stock to a Company representative and the Company prepares and files the required ownership reports. Based on a review of those reports and other written representations, the Company believes that, with the following exceptions, there was full compliance with the reporting requirements under Section 16(a). In March 2005, the Executive Officers, with the exception of Mr. D’Ambra, acquired common stock equivalent units pursuant to the deferred compensation program, which were reported but not on a timely basis.

Related Party Transactions

The Company does not have any contracts or other transactions with related parties that are required to be reported under the applicable securities laws and regulations.

Ariel Capital Management, Inc., the Company’s largest shareholder with 21.4% of the issued and outstanding shares of Common Stock as of December 31, 2005, is the investment adviser for two of the mutual funds offered to the Company’s annuity customers. In addition, T. Rowe Price Associates, Inc., the Company’s fourth largest shareholder with 4.7% of the issued and outstanding shares of Common Stock as of December 31, 2005, is the investment adviser for three of the mutual funds offered to the Company’s annuity customers.

11

Summary Compensation Table

The following table sets forth all reportable compensation awarded to, earned by, or paid to the Company’s Chief Executive Officer and the other four most highly compensated Executive Officers (the “Named Executive Officers”).

| Annual Compensation | Long-Term Incentives | |||||||||||||||

Name And Principal Position | Year | Salary ($) | Bonus ($) | Cash Incentive ($)(1) | Restricted Stock Units ($)(2) | Stock Options (#) | LTIP Payouts ($) | All Other Compensation ($)(3) | ||||||||

Louis G. Lower II President and Chief Executive Officer | 2005 2004 2003 | 630,006 570,000 600,000 | 482,635 558,900 195,624 | 876,040 0 0 | 553,404 0 0 | 117,300 0 0 | 0 2,130,000 0 | 16,949 16,475 16,064 | ||||||||

Peter H. Heckman Executive Vice President and Chief Financial Officer | 2005 2004 2003 | 366,000 342,000 348,381 | 299,590 219,020 89,673 | 398,200 0 0 | 251,410 0 0 | 53,300 0 0 | 0 810,000 0 | 16,949 16,475 16,064 | ||||||||

Douglas W. Reynolds Executive Vice President— Property & Casualty and Information Technology | 2005 2004 2003 | 342,252 308,757 318,756 | 229,035 288,655 76,163 | 358,380 0 0 | 226,496 0 0 | 48,000 0 0 | 0 600,000 0 | 16,928 16,464 16,053 | ||||||||

Robert B. Joyner Senior Vice President—Marketing | 2005 2004 2003 | 190,425 183,838 162,000 | 81,776 228,755 38,893 | 199,100 0 0 | 126,084 0 0 | 26,650 0 0 | 0 225,000 0 | 19,469 18,810 16,626 | ||||||||

Frank D’Ambra III(4) Senior Vice President—Life & Annuity | 2005 | 197,087 | 105,484 | 159,280 | 100,412 | 21,350 | 0 | 51,449 | ||||||||

| (1) | Represents performance-based cash incentives earned but not yet paid under the Long-term Incentive Plan with respect to 2005 performance (as described in the Compensation Committee Report). The cash incentives for each of Mr. Heckman, Mr. Reynolds and Mr. D’Ambra will be paid in the first quarter of 2007 subject to the continued employment of such officer. The cash incentives for Mr. Lower and Mr. Joyner are fully vested because they have met the qualifications for retirement eligibility and will be paid in the first quarter of 2007. |

| (2) | Represents performance-based Long-term Incentive Plan restricted stock units earned but not yet vested with respect to 2005 performance (as described in the Compensation Committee Report) valued at the December 31, 2005 Common Stock closing price of $18.96. These units are subject to a three-year vesting period starting from December 31, 2005. Restricted stock units accrue dividend equivalents at the same rate as dividends paid to Shareholders. Dividend equivalents are reinvested into restricted stock units. |

12

| (3) | All Other Compensation details: |

Name | Year | Company Contribution to 401(k) Plan | Company Contribution to Money Purchase Pension Plan | Company Contribution to Group Term Life Insurance Premiums | Relocation Expenses | |||||||||

Louis G. Lower II | 2005 | $ | 6,300 | $ | 10,500 | $ | 149 | $ | 0 | |||||

| 2004 | 6,150 | 10,250 | 75 | 0 | ||||||||||

| 2003 | 6,000 | 10,000 | 64 | 0 | ||||||||||

Peter H. Heckman | 2005 | 6,300 | 10,500 | 149 | 0 | |||||||||

| 2004 | 6,150 | 10,250 | 75 | 0 | ||||||||||

| 2003 | 6,000 | 10,000 | 64 | 0 | ||||||||||

Douglas W. Reynolds | 2005 | 6,300 | 10,500 | 128 | 0 | |||||||||

| 2004 | 6,150 | 10,250 | 64 | 0 | ||||||||||

| 2003 | 6,000 | 10,000 | 53 | 0 | ||||||||||

Robert B. Joyner | 2005 | 5,713 | 13,330 | 426 | 0 | |||||||||

| 2004 | 5,515 | 12,869 | 426 | 0 | ||||||||||

| 2003 | 4,860 | 11,340 | 426 | 0 | ||||||||||

Frank D’Ambra III | 2005 | 5,913 | 0 | 78 | 45,458 | |||||||||

| (4) | 2005 bonus for Mr. D’Ambra includes a signing bonus of $50,000. Mr. D’Ambra joined the Company in February 2005. |

Option/SAR Grants in Last Fiscal Year

The following table sets forth information concerning stock option grants in 2005 to each of the Named Executive Officers. No stock appreciation rights were granted.

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | |||||||||||||

Number of Securities Underlying Options | Percent of Total Options Granted to Employees in | Exercise or Base Price | Expiration | |||||||||||

Name | Granted (#) | Fiscal Year | ($/Sh) | Date | 5% ($) | 10% ($) | ||||||||

Louis G. Lower II | 117,300 | (2) | 21.1 | % | 18.76 | 03/09/12 | 897,345 | 2,087,940 | ||||||

Peter H. Heckman | 53,300 | (2) | 9.6 | % | 18.76 | 03/09/12 | 407,745 | 948,740 | ||||||

Douglas W. Reynolds | 48,000 | (2) | 8.6 | % | 18.76 | 03/09/12 | 367,200 | 854,400 | ||||||

Robert B. Joyner | 26,650 | (2) | 4.8 | % | 18.76 | 03/09/12 | 203,873 | 474,370 | ||||||

Frank D’Ambra III | 21,350 30,000 | (2) (3) | 3.8 5.4 | % % | 18.76 19.04 | 03/09/12 03/08/15 | 163,328 359,700 | 380,030 909,900 | ||||||

| (1) | There can be no assurance provided to any executive officer or any other holder of HMEC’s securities that the actual stock price appreciation over the applicable 7-year and 10-year option terms will be the assumed 5% and 10% compounded annual rates or at any other defined level. Unless the market price of the Common Stock appreciates over the option term, no value will be realized from the option grants made to the Named Executive Officers. |

| (2) | The options vest as to 25% of the underlying shares of Common Stock one year after grant, with an additional 25% vesting each additional year after grant. The option term for this grant is seven years. |

| (3) | The options for 25% of the underlying shares of Common Stock were vested at grant, with an additional 25% vesting each year after grant. The option term for this grant is 10 years. |

13

Aggregated Fiscal Year-End Option Values

The following table sets forth information concerning the number of securities underlying unexercised options held by the Named Executive Officers as of December 31, 2005.

| Number of Securities Underlying Unexercised Options at Year End (#) | Value of Unexercised In-the-Money Options at Year End ($) | |||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||

Louis G. Lower II | 1,000,000 | 117,300 | 790,000 | 23,460 | ||||

Peter H. Heckman | 370,000 | 53,300 | 576,600 | 10,660 | ||||

Douglas W. Reynolds | 210,000 | 48,000 | 0 | 9,600 | ||||

Robert B. Joyner | 69,550 | 26,650 | 15,090 | 5,330 | ||||

Frank D’Ambra III | 7,500 | 43,850 | 0 | 4,270 | ||||

Long-term Incentive Plans—Award Opportunities Established in Last Fiscal Year

The following table sets forth information concerning long-term incentive performance-based award opportunities established in 2005, excluding stock options as disclosed in the Option/SAR Grants in Last Fiscal Year table, to each of the Named Executive Officers.

Name | Performance or Other Period Until Maturation or Payout | Nature of Award | Estimated Future Payouts Under Non-Stock Price-Based Plans(1)(2) | |||||||

| Threshold | Target | Maximum | ||||||||

Louis G. Lower II | 2005-2006 | Cash Incentives ($) | 550,000 | 1,100,000 | 2,200,000 | |||||

| Restricted Stock Units (#) | 18,325 | 36,650 | 73,300 | |||||||

Peter H. Heckman | 2005-2006 | Cash Incentives ($) | 250,000 | 500,000 | 1,000,000 | |||||

| Restricted Stock Units (#) | 8,325 | 16,650 | 33,300 | |||||||

Douglas W. Reynolds | 2005-2006 | Cash Incentives ($) | 225,000 | 450,000 | 900,000 | |||||

| Restricted Stock Units (#) | 7,500 | 15,000 | 30,000 | |||||||

Robert B. Joyner | 2005-2006 | Cash Incentives ($) | 125,000 | 250,000 | 500,000 | |||||

| Restricted Stock Units (#) | 4,175 | 8,350 | 16,700 | |||||||

Frank D’Ambra III | 2005-2006 | Cash Incentives ($) | 100,000 | 200,000 | 400,000 | |||||

| Restricted Stock Units (#) | 3,325 | 6,650 | 13,300 | |||||||

| (1) | One-half of the threshold, target and maximum amounts were eligible to be earned for 2005 performance; one-half of the threshold, target and maximum amounts are eligible to be earned for 2006 performance. |

| (2) | Long-term performance awards are comprised of performance-based restricted stock units and cash incentives, which are earned over two one-year performance periods. For the 2005 performance period, awards were earned based upon the achievement of goals related to: |

| • | earnings; |

| • | return on equity; |

| • | growth in the number of agents; and |

| • | growth in the number of auto new business units. |

The dollar values of these awards (which were earned at 159.3% of target) are disclosed in the “Cash Incentive” and “Restricted Stock Units” columns of the Summary Compensation Table. The cash incentives for the 2005 performance period for each of Mr. Heckman, Mr. Reynolds and Mr. D’Ambra will be payable in the first quarter of 2007 subject to the continued employment of such officer. The cash incentives for the 2005 performance period for Mr. Lower and Mr. Joyner are fully vested because they have met the qualifications for retirement

14

eligibility and will be paid in the first quarter of 2007. The restricted stock units for the 2005 performance period are subject to a three-year vesting period starting from December 31, 2005. The restricted stock units are also subject to holding requirements until certain stock ownership guidelines are met.

For the 2006 performance period, awards can be earned based upon the achievement of goals related to:

| • | total shareholder return relative to a peer group of insurance companies; |

| • | growth in the number of agents; and |

| • | growth in the number of auto new business units. |

The restricted stock units for the 2006 performance period are subject to a three-year vesting period starting from the end of the 2006 performance period. The cash incentive awards for the 2006 performance period will be paid in the first quarter of 2007.

Pension and Excess Pension Plans

The following pension table illustrates the total benefits available under the defined benefit pension plans, which were frozen on April 1, 2002.

Years of Covered Service(1)

Covered Remuneration ($) | 20 | 25 | 30 | |||

200,000 | 64,000 | 80,000 | 96,000 | |||

250,000 | 80,000 | 100,000 | 120,000 | |||

300,000 | 96,000 | 120,000 | 144,000 | |||

400,000 | 128,000 | 160,000 | 192,000 | |||

500,000 | 160,000 | 200,000 | 240,000 |

| (1) | Represents the maximum combined benefits payable from all qualified and nonqualified defined benefit pension plans. As of April 1, 2002, all qualified and non-qualified plans were frozen for purposes of eligible compensation and credited service. As of March 31, 2002, Mr. Joyner had 26 years of credited pension service. No other Named Executive Officer, including the CEO, is eligible to participate or is vested in the defined benefit pension plans. |

Compensation for purposes of the defined benefit pension plans included only compensation earned while participating in the defined benefit pension plans. Participants only include those employees hired prior to January 1, 1999. Accruals for credited service and earnings ceased as of March 31, 2002. The CEO’s retirement benefits are not determined pursuant to the defined benefit pension plans described above and are described in the section “Agreements with Key Employees” below.

15

Equity Compensation Plan Information

The following table provides information as of December 31, 2005 regarding outstanding awards and shares remaining available for future issuance under the Company’s equity compensation plans (excluding 401(k) plans, ESOPs, and similar tax-qualified plans):

Equity Compensation Plans | Number of Securities to be Issued Upon Exercise of Outstanding Options (a) | Weighted-Average Exercise Price of Outstanding Options (b) | Number of Securities Remaining Available for (c) | |||||

Plans approved by Shareholders | ||||||||

• Stock Incentive Plans(1) | ||||||||

Stock Options | 4,529,050 | $ | 19.05 | |||||

Restricted Stock Units(2) | 236,781 | — | ||||||

Subtotal | 4,765,831 | — | 1,734,505 | |||||

• Deferred Compensation Plan for Directors(2) | 191,521 | — | 334,111 | (4) | ||||

Subtotal | 4,957,352 | — | 2,068,616 | |||||

Plans not approved by Shareholders | ||||||||

• Deferred Compensation Plan for Employees(2)(3) | 0 | — | 146,218 | (4) | ||||

Total | 4,957,352 | — | 2,214,834 | |||||

| (1) | Includes the 1999 Horace Mann Educators Corporation Incentive Compensation Plan, the 2001 Horace Mann Educators Corporation Incentive Compensation Plan and the Amended and Restated 2002 Horace Mann Educators Corporation Incentive Compensation Plan. |

| (2) | No exercise price is associated with the shares of Common Stock issuable under these rights. |

| (3) | The only non-security holder approved equity plan of the Company is the Horace Mann Educators Corporation Deferred Compensation Plan for Employees (the “DCP”). The DCP permits participants in certain cash incentive programs to defer compensation in the form of common stock equivalent units, which can be settled in cash at the end of the specified deferral period. For purposes of the DCP, common stock equivalent units are valued at 100% of the fair market value of Common Stock on the date of crediting to the participant’s deferral account. Approximately 36 senior executives of the Company are currently eligible to participate in the DCP. The DCP does not reserve a specific number of shares for delivery in settlement of common stock equivalent units but instead provides that shares will be available to the extent needed for such settlements. Further information on the DCP appears in the section “Report on Executive Compensation of the Compensation Committee of the Board of Directors—Deferred Compensation Plan” below. |

| (4) | As of December 31, 2005, the shares of Common Stock available for issuance were valued at $18.96 per share. |

Agreements with Key Employees

Effective February 1, 2000, the Company entered into an employment agreement with Mr. Lower employing him as the Company’s President and Chief Executive Officer. That agreement is an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2005. The term of that agreement expired on December 31, 2000 but is subject to an annual evergreen renewal which extends the agreement an additional year on each September 1, so long as neither Mr. Lower nor the Company, prior to September 1, has notified the other that the agreement will not so extend. Its current expiry date is December 31, 2006. The agreement provides for an annual salary of not less than $500,004 and for Mr. Lower to participate in the Company’s short- and long-term bonus plans. Mr. Lower received a stock grant of 10,000 shares of Common Stock and options to purchase a total of 750,000 shares

16

of Common Stock, which have vested. The Company also agreed to pay annual retirement benefits of $180,000 to Mr. Lower during his lifetime. The agreement contains provisions relating to Mr. Lower’s death, disability or other termination of his employment. In addition, the agreement provides that if, within three years after a Change of Control of the Company, as defined therein, Mr. Lower’s employment with the Company is actually or constructively terminated, Mr. Lower will be paid a lump-sum cash amount equal to the sum of (i) three times the greater of his highest annual cash compensation from the Company or $1,200,000 and (ii) the actuarially determined present value of Mr. Lower’s retirement benefits calculated as if he had been employed by the Company until the date which is three years after the Change in Control. Mr. Lower’s insurance benefits are also continued for three years and there is an excise tax gross-up provision payment sufficient to negate any effect on him of excise and related taxes attributable to the benefits received under the agreement.

The Company entered into a letter of employment with Mr. Heckman, Executive Vice President & Chief Financial Officer, effective April 10, 2000. That agreement is an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2001. Mr. Heckman received a grant of options to purchase a total of 250,000 shares of Common Stock, which have vested.

The Company entered into a letter of employment with Mr. Reynolds, Executive Vice President, Property & Casualty and Information Technology, effective November 12, 2001. That agreement is an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2001. Mr. Reynolds received a grant of options to purchase a total of 150,000 shares of Common Stock, which have vested.

The Company entered into a letter of employment with Mr. D’Ambra, Senior Vice President, Life & Annuity, effective February 1, 2005. That agreement is an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2005. Mr. D’Ambra received a signing bonus of $50,000 and a grant of options to purchase a total of 30,000 shares of Common Stock, of which options to purchase 15,000 shares of Common Stock have vested and options to purchase 7,500 shares of Common Stock will vest on the second and third anniversary of the grant date.

In addition, the Company has entered into agreements with certain key employees, including Mr. Heckman, Mr. Reynolds and Mr. D’Ambra, which provide that if, within three years (two years in the case of Mr. D’Ambra) after a Change in Control of the Company, as defined therein, the employee’s employment with the Company is terminated by the Company without cause or by the employee due to a Constructive Termination, as defined therein, the employee will receive (i) a one-time cash payment, (ii) continued insurance coverage for a specified period, (iii) the present value of such employee’s accrued benefits as of the date of termination under the Company’s nonqualified supplemental pension plan(s) (which amount will be offset against any amount payable under such plan) and (iv) an excise tax gross-up provision payment sufficient to negate the effect on such employee of excise and related taxes attributable to the benefits received by the employee under the agreement. For Mr. Heckman and Mr. Reynolds, the one-time cash payment would be equal to 2.9 times the highest annual cash compensation (salary and bonus) received by the employee in the five preceding years and the specified period during which such employee’s insurance benefits would continue is two (2) years, 11 months. For Mr. D’Ambra, the one-time cash payment would be equal to 1.5 times the sum of his then current annual base salary and the average of the annual cash bonus paid to him in the three preceding years and the specified period during which his insurance benefits would continue is one (1) year, six (6) months.

Report on Executive Compensation of the Compensation Committee of the Board of Directors

The Compensation Committee of the Board of Directors (the “Committee”) designs, implements and administers the Company’s compensation program for Executive Officers, including those named in the Summary Compensation Table. All members of the Committee are independent. The Committee determines all the components of the compensation of the Chief Executive Officer and, in consultation with the CEO, determines the compensation of the remaining Executive Officers and approves and oversees programs applicable to broader groups of management employees. The Committee retains an independent compensation consultant to advise it on compensation practices and conduct research on its behalf. The Committee meets regularly in executive session, either alone or with its independent consultant.

17

Compensation Policies and Practices.The Company’s compensation policies and practices are designed to support the Company’s business strategy by:

| • | Driving the Company’s pay for performance culture |

| • | Providing incentives to deliver sustainable financial results |

| • | Aligning the interests of executives with those of Shareholders |

| • | Enhancing the ability to attract and retain superior executive talent |

Compensation program components include:

| • | Base salary; |

| • | Annual cash incentive; and |

| • | Longer term incentives, including performance-based cash and stock components, which may be subject to performance-based and/or time-based vesting requirements. |

In making compensation decisions with respect to each of these components, the Committee considers the competitive market for executives and compensation levels provided by comparable companies. The Committee regularly uses industry specific compensation surveys that represent competitive opportunities at comparable companies and works with recruiting and compensation consultants. The Committee targets compensation around the median of the competitive market while providing the opportunity for significant additional compensation if warranted by performance. In addition to external competitive factors, the Committee considers internal factors in setting compensation levels, including the individual’s contribution, level of responsibility and internal equity.

The Company’s policies with respect to each of the three key components identified above, as well as other elements of compensation, are set forth below, followed by a discussion of the specific factors considered in determining key elements of fiscal year 2005 executive compensation, including compensation for the Named Executive Officers.

Salary.The Committee seeks to pay salaries that approximate median industry salaries for officers of similar companies in like positions. However, in recruiting new candidates to become Executive Officers, it is sometimes necessary to exceed these guidelines to attract qualified candidates.

Once an Executive Officer’s salary is determined, it is generally reviewed every 15 to 18 months. In that review, the Committee considers where the Executive Officer’s salary stands compared to the salaries of officers of similar companies in like positions and the Executive Officer’s performance of his duties, including the accomplishment of key corporate financial goals, managing personnel and meeting the Company’s ethical standards.

In 2004, several Named Executive Officers voluntarily reduced their salaries by 5% to manage overall costs. Effective January 1, 2005, the Named Executive Officers’ salaries were returned to their pre-2004 levels. In addition, the salaries for the Named Executive Officers were increased during 2005 in accordance with the Company’s regular salary review program as follows:

| • | On January 1, 2005, the President and Chief Executive Officer’s salary was increased from $570,000 to its pre-2004 level of $600,000 and, in April, further increased from $600,000 to $640,008; |

| • | On January 1, 2005, the Executive Vice President & Chief Financial Officer’s salary was increased from $342,000 to its pre-2004 level of $360,000 and, in October, further increased from $360,000 to $384,000; |

| • | On January 1, 2005, the Executive Vice President—Property & Casualty and Information Technology’s salary was increased from $308,750 to its pre-2004 level of $325,000 and, in April, further increased from $325,008 to $348,000; |

| • | In December 2005, the Senior Vice President—Marketing’s salary was increased from $190,000 to $200,004; and |

18

| • | In February 2005, the Senior Vice President—Life & Annuity joined the Company at a salary of $215,004. |

Annual Cash Incentives.Executive Officers’ and other key employees’ annual cash incentive award typically consists of two components: one based on corporate performance and one based on performance of the unit for which the Executive Officer or key employee is responsible. The CEO’s award is based solely on corporate performance. Target annual incentive opportunities for the Named Executive Officers range from 30% - 50% of base salary with the exception of the CEO, whose target opportunity is 60%. Maximum opportunities are set at 200% of target.

In March 2005, the Committee established corporate performance goals for 2005 bonuses based upon measures related to:

| • | net income per share excluding realized investment gains and losses; and |

| • | insurance revenues (premiums) and sales. |

Goals for the business units were based on factors considered most relevant to the specific unit. They included, but were not limited to, profitability, sales and agent staffing.

After the end of the 2005 fiscal year, the Committee determined that corporate performance was achieved at 127.7% of target. Business unit performance achievement (including the corporate component) ranged between 93.8% and 153.8% of target. As a result, the Committee certified the bonus amounts set forth in the Summary Compensation Table.

Long-Term Incentives.In 2005, the Company implemented a new long-term incentive program to focus participants on achieving key operating objectives and creating shareholder value. All Executive Officers as well as other key employees are eligible to participate. The new program consists of Fair Market Value Stock Options, Performance-Based Restricted Stock Units and Performance-Based Cash Incentives weighted as follows:

| • | 25% Fair Market Value Stock Options; |

| • | 25% Performance-Based Restricted Stock Units; and |

| • | 50% Performance-Based Cash Incentives. |

Two years worth of award opportunities were granted in 2005. Additional long-term incentive awards are not expected to be made for the 2006 performance period.

Stock Options under the Long-Term Incentive Program.The Stock Options vest ratably over a four-year period and have a seven-year term. The number of Stock Options awarded to the CEO and the other Named Executive Officers in 2005 for the two year period is set forth in the Summary Compensation Table.

Performance-Based Restricted Stock Units under the Long-Term Incentive Program. Target opportunities for each of the 2005 and 2006 performance periods for the Named Executive Officers, as set forth in the Long-Term Incentive Plans—Award Opportunities Established in Last Fiscal Year table, ranged from approximately 22.5% - 35% of base salary cumulated for the two-year period, with the exception of the CEO, whose target opportunity is approximately 45%. Maximum opportunities were set at 200% of target.

For 2005, restricted stock units were earned based upon the achievement of corporate goals related to the following:

| • | earnings; |

| • | return on equity; |

| • | growth in the number of agents; and |

| • | growth in the number of auto new business units. |

19

For 2006, restricted stock units can be earned based upon the achievement of corporate goals related to the following:

| • | total shareholder return relative to a peer group of insurance companies; |

| • | growth in the number of agents; and |

| • | growth in the number of auto new business units. |

The Committee determined that 2005 performance was achieved at 159.3% of target. The value of the restricted stock units earned by the CEO and the other Named Executive Officers are set forth in the Summary Compensation Table. These restricted stock units are subject to a three-year vesting period from the end of the performance period. In addition, these restricted stock units are subject to holding requirements until certain stock ownership guidelines (described below) are met.

Performance-Based Cash Incentives under the Long-Term Incentive Program.Target opportunities for each of the 2005 and 2006 performance periods for the Named Executive Officers, as set forth in the Long-Term Incentive Plan—Award Opportunities Established in Last Fiscal Year table, ranged from approximately 45% to 70% of base salary, with the exception of the CEO, whose target opportunity is approximately 90%. Maximum opportunities were set at 200% of target. The cash incentive awards are payable in the first quarter of 2007 and, in the case of cash incentive awards for the 2005 performance period, are subject to a one-year vesting period, which vesting period is waived for officers that have met the qualifications for retirement eligibility.

In 2005, the Committee established Performance-Based Cash Incentives for 2005 and 2006 using the same performance criteria as for the restricted stock units described above. As with the restricted stock units, the Committee determined that 2005 performance was achieved at 159.3% of target. The value of the Performance-Based Cash Incentives earned by the CEO and the other Named Executive Officers is set forth in the Summary Compensation Table. An additional one year of vesting is required before the award is paid. In addition, participants are required to defer one-third of their cash payment into Horace Mann common stock units until their stock ownership guidelines (discussed below) are met.

Deferred Compensation Plan.The Company maintains a deferred compensation plan which allows key management employees to defer all or part of their long-term cash incentives and vested restricted stock units into deferred common stock equivalent units that track the performance of the Company’s Common Stock. Common stock equivalent units accrue dividends at the same rate as dividends paid to Shareholders. These dividend equivalents are reinvested into common stock equivalent units.

Perquisites and Other Benefits.The Company does not offer perquisites or executive benefits that exceed $10,000 annually in the aggregate. The Company does offer select key executives membership to a private dining club, as well as airline clubs (lounge facilities).

Employment and Change in Control Agreements. The Company has employment agreements with select key executives which are described in the section “Agreements with Key Employees”. These agreements provide severance protection in change in control and non-change in control situations.

Stock Ownership Guidelines. The Committee has established stock ownership guidelines that require Executive Officers to hold HMEC shares as follows:

Executive Level | Percentage of Base Salary Required to Be Held | |

President & CEO | 500% | |

Other Named Executive Officers | 300% | |

Other Senior Executives | 200% - 300% | |

Other Executives | 100% |

20

The ownership may be achieved by direct ownership or beneficial ownership through a spouse or child. Executives receive credit for restricted stock units, deferred common stock units and shares held in the HMEC Common Stock Investment vehicle in the Company’s 401(k) plan.

As of December 31, 2005, the CEO held HMEC shares valued at 310% of his base salary. As of December 31, 2005, the remaining Named Executive Officers, Mr. Heckman, Mr. Reynolds, Mr. Joyner and Mr. D’Ambra, were at 178%, 155%, 122% and 47% of their base salary, respectively.

CEO Compensation.The CEO’s compensation for 2005 was determined in accordance with the principles discussed above and the following additional factors. Financial performance in 2005 was strong, with the Company exceeding its incentive program goals. The CEO played a central role in the Company’s achievement of substantial improvement in return on equity, earnings per share and book value growth. In addition, the CEO was instrumental in enhancing the company’s financial infrastructure through the issuance of senior debt securities, the execution of an expanded bank line of credit and the continued improvement in the quality of property and casualty new business and in force business, along with the introduction of a more sophisticated property and casualty pricing segmentation model.

Policy with Respect to the Deductibility of Compensation.Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation over $1,000,000 paid for any fiscal year to the corporation’s chief executive officer and four other most highly compensated executive officers as of the end of the fiscal year. However, the statute exempts qualifying performance-based compensation from the deduction limit if certain requirements are met.

The annual and long-term incentive programs are designed to permit full deductibility and the Committee expects all 2005 compensation to be fully deductible. However, the Committee believes that Shareholder interests are best served by not restricting the Committee’s discretion and flexibility in crafting compensation programs, even though such programs may result in certain non-deductible compensation expenses.

COMPENSATION COMMITTEE

WILLIAM W. ABBOTT, Chairman

MARY H. FUTRELL and JOSEPH J. MELONE, Members

NOTE: The Report of the Audit Committee of the Board of Directors, the Report on Executive Compensation of the Compensation Committee of the Board of Directors and the Stock Price Performance Graph shall not be deemed to be incorporated by reference, in whole or in part, by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended, or under the Securities Exchange Act of 1934, as amended.

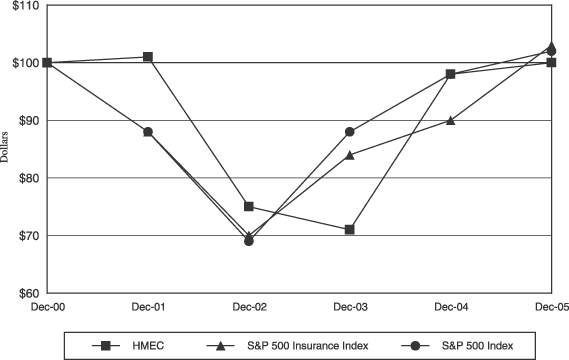

21