Exhibit 99.2

Foot Locker, Inc. THIRD QUARTER 2024 EARNINGS RESULTS

DECEMBER 4, 2024

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This investor presentation includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks,” “continues,” “feels,” “forecasts,” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could,” “may,” “aims,” “intends,” or “projects.” Statements may be forward looking even in the absence of these particular words.

Examples of forward-looking statements include, but are not limited to, statements regarding our financial position, business strategy, and other plans and objectives for our future operations, and generation of free cash flow. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained herein are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate.

We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained herein are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to, a change in the relationship with any of our key suppliers, including access to premium products, volume discounts, cooperative advertising, markdown allowances, or the ability to cancel orders or return merchandise; inventory management; our ability to fund our planned capital investments; a recession, volatility in the financial markets, and other global economic factors, including inflation; difficulties in appropriately allocating capital and resources among our strategic opportunities; our ability to realize the expected benefits from acquisitions; business opportunities and expansion; investments; expenses; dividends; share repurchases; cash management; liquidity; cash flow from operations; our ability to access the credit markets at competitive terms; borrowing capacity under our credit facility; repatriation of cash to the United States; supply chain issues; labor shortages and wage pressures; consumer spending levels and expectations; licensed store arrangements; the effect of certain governmental assistance programs; the success of our marketing and sponsorship arrangements; expectations regarding increasing global taxes and tariffs; the effect of increased government regulation, compliance, and changes in law; the effect of the adverse outcome of any material litigation or government investigation that affects us or our industry generally; the effects of weather; ESG risks, including, but not limited to climate change; increased competition; geopolitical events; the financial effect of accounting regulations and critical accounting policies; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors set forth in the section entitled “Risk Factors” of our most recent Annual Report on Form 10-K and subsequent filings.

All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak to our views only as of the date of this investor presentation. Additional risks and uncertainties that we do not presently know about or that we currently consider to be insignificant may also affect our business operations and financial performance.

Please refer to “Item 1A. Risk Factors” in the Annual Report and subsequent filings for a discussion of certain risks relating to our business and any investment in our securities. Given these risks and uncertainties, you should not rely on forward-looking statements as predictions of actual results. Any or all of the forward-looking statements contained in this investor presentation, or any other public statement made by us, including by our management, may turn out to be incorrect.

We are including this cautionary note to make applicable, and take advantage of, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Non-GAAP Measures – Amounts used in this presentation are on a Non-GAAP basis, a reconciliation is included in the Appendix.

Third Quarter 2024 RESULTS Foot Locker, Inc.

THIRD QUARTER 2024 HIGHLIGHTS

Comp Detail Global FL/KFL +2.8% NA +2.1% EMEA +6.4% APAC (7.3%)

COMP SALES +2.4% Total sales -1.4%

Gross margin +230 bps Reduced Markdown Levels

SG&A rate +210 bps Investments in Technology and Brand-Building

Controlled Inventory Levels Headed into 4Q24 (6.3%) Year-over-year

GAAP EPS ($0.34) Non-GAAP EPS* $0.33

* A reconciliation to GAAP is provided in the Appendix Foot Locker, Inc.

3Q GLOBAL COMP DETAIL

Footwear Up High-Single Digits Up High-Single Digits August

Apparel Down Low- Twenties Down Low-Single Digits September

Accessories Up High-Single Digits Down Low-Single Digits October

Monthly comp percentages include WSS and atmos, however information by family of business excludes those businesses. Foot Locker, Inc.

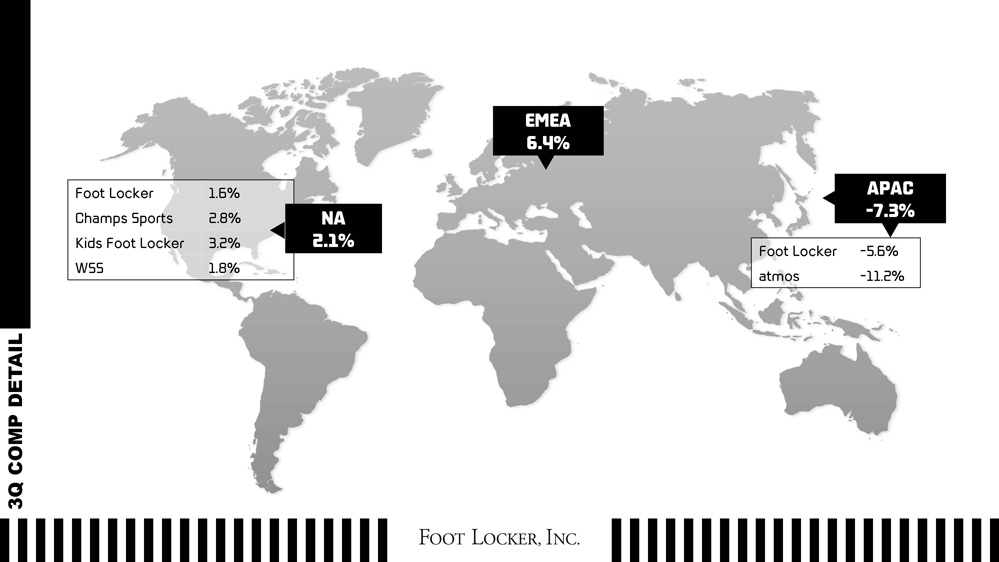

3Q COMP DETAIL

Foot Locker 1.6% Champs Sports 2.8% Kids Foot Locker 3.2% WSS 1.8%

NA 2.1% EMEA 6.4% APAC -7.3%

Foot Locker -5.6% atmos -11.2% Foot Locker, Inc.

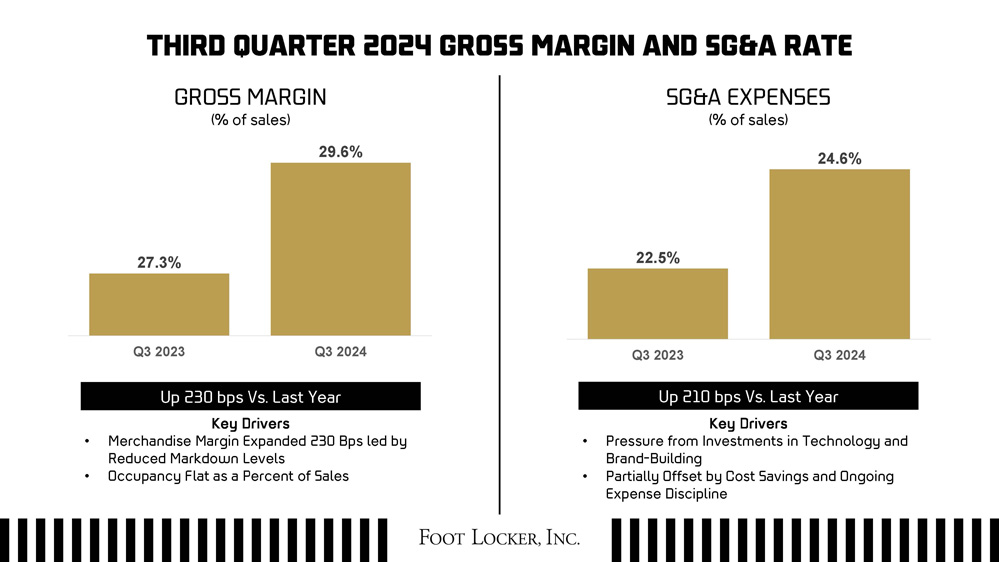

THIRD QUARTER 2024 GROSS MARGIN AND SG&A RATE

GROSS MARGIN (% of sales) 27.3% Q3 2023 29.6% Q3 2024

Up 230 bps Vs. Last Year Key Drivers

• Merchandise Margin Expanded 230 Bps led by Reduced Markdown Levels

• Occupancy Flat as a Percent of Sales

SG&A EXPENSES (% of sales) 22.5% Q3 2023 24.6% Q3 2024

Up 210 bps Vs. Last Year Key Drivers

• Pressure from Investments in Technology and Brand-Building

• Partially Offset by Cost Savings and Ongoing Expense Discipline Foot Locker, Inc.

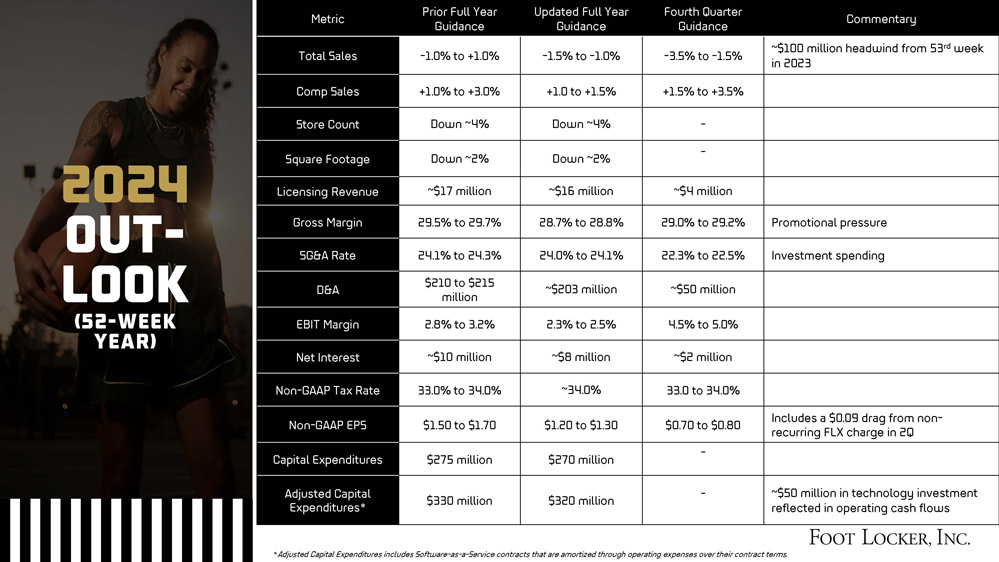

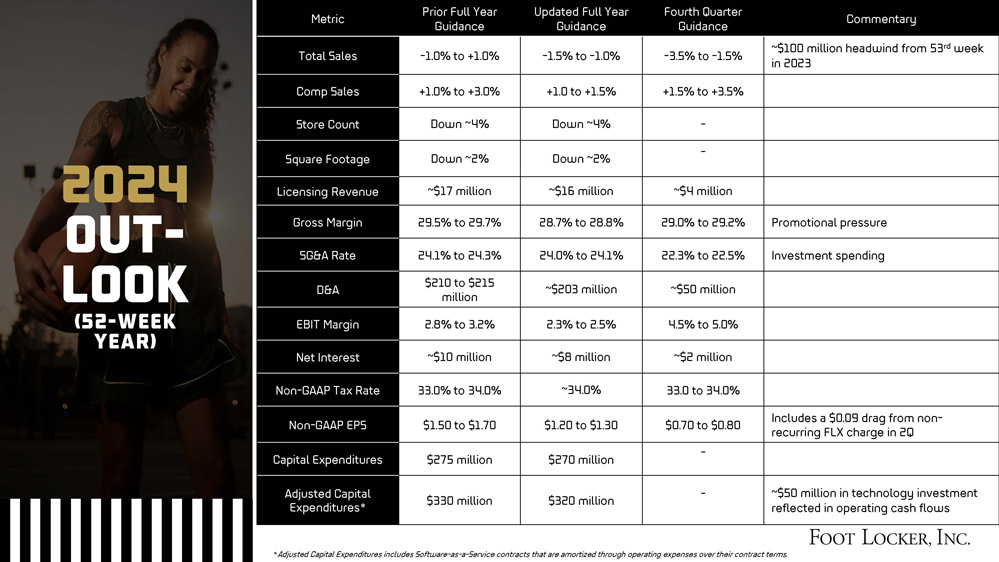

2024 OUT-LOOK (52-WEEK YEAR)

Metric Prior Full Year Guidance Updated Full Year Guidance Fourth Quarter Guidance Commentary

Total Sales -1.0% to +1.0% -1.5% to -1.0% -3.5% to -1.5% ~$100 million headwind from 53rd week in 2023

Comp Sales +1.0% to +3.0% +1.0 to +1.5% +1.5% to +3.5%

Store Count Down ~4% Down ~4% -

Square Footage Down ~2% Down ~2% -

Licensing Revenue ~$17 million ~$16 million ~$4 million

Gross Margin 29.5% to 29.7% 28.7% to 28.8% 29.0% to 29.2% Promotional pressure

SG&A Rate 24.1% to 24.3% 24.0% to 24.1% 22.3% to 22.5% Investment spending

D&A $210 to $215 million ~$203 million ~$50 million

EBIT Margin 2.8% to 3.2% 2.3% to 2.5% 4.5% to 5.0%

Net Interest ~$10 million ~$8 million ~$2 million

Non-GAAP Tax Rate 33.0% to 34.0% ~34.0% 33.0 to 34.0%

Non-GAAP EPS $1.50 to $1.70 $1.20 to $1.30 $0.70 to $0.80 Includes a $0.09 drag from non- recurring FLX charge in 2Q

Capital Expenditures $275 million $270 million -

Adjusted Capital Expenditures* $330 million $320 million - ~$50 million in technology investment reflected in operating cash flows

*Adjusted Capital Expenditures includes Software-as-a-Service contracts that are amortized through operating expenses over their contract terms. Foot Locker, Inc.

Our Lace Up Plan Foot Locker, Inc.

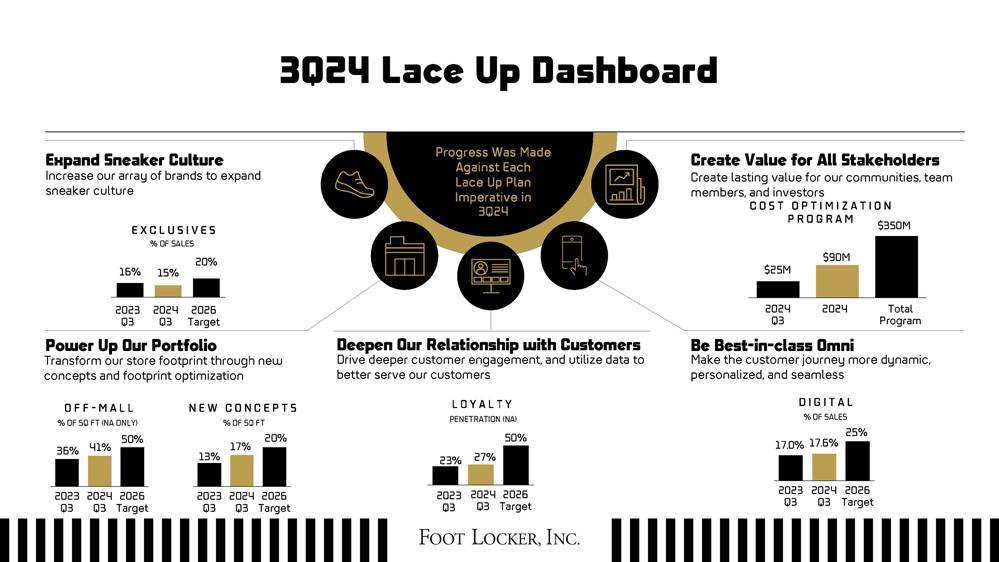

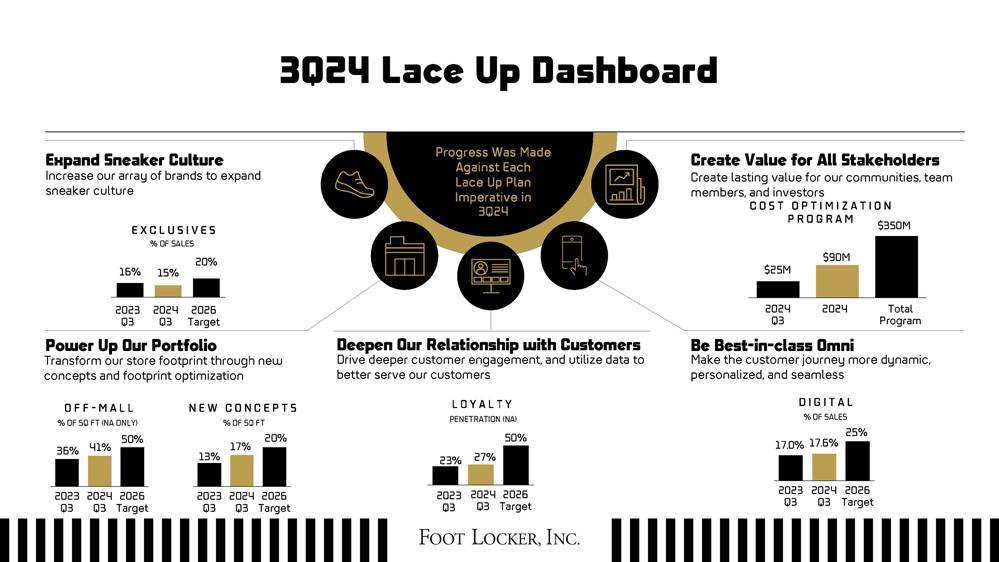

3Q24 Lace Up Dashboard

Expand Sneaker Culture Increase our array of brands to expand sneaker culture

Progress Was Made Against Each Lace Up Plan Imperative in 3Q24

Create Value for All Stakeholders Create lasting value for our communities, team members, and investors

Power Up Our Portfolio Transform our store footprint through new concepts and footprint optimization

Deepen Our Relationship with Customers Drive deeper customer engagement, and utilize data to better serve our customers

Be Best-in-class Omni Make the customer journey more dynamic, personalized, and seamless

EXCLUSIVES % OF sales 16% 2023 Q3 15% 2024 Q3 20% 2026 Target

COST OPTIMIZATION PROGRAM $25M 2024 Q3 $90M 2024 $350M Total Program

OFF - MALL % OF SQ FT (NA ONLY) 36% 2023 Q3 41% 2024 Q3 50% 2026 Target

NEW CONCEPTS % OF SQ FT 13% 2023 Q3 17% 2024 Q3 20% 2026 Target

LOYALTY PENETRATION (NA) 23% 2023 Q3 27% 2024 Q3 50% 2026 Target

DIGITAL % OF SALES 17.0% 2023 Q3 17.6% 2024 Q3 25% 2026 Target Foot Locker, Inc.

MISSION Foot Locker unlocks the “inner sneakerhead” in all of us

VISION To be known as the go-to destination for discovering and buying sneakers globally

Foot Locker Bring the best of sneaker culture to all

Kids Foot Locker Recruit the next generation

Champs Sports Head-to-toe sport style

WSS Celebrate the Hispanic community

atmos Share and celebrate Japanese street and sneaker culture

Our Lace Up Plan

EXPAND SNEAKER CULTURE POWER UP OUR PORTFOLIO DEEPEN OUR RELATIONSHIP WITH CUSTOMERS BE BEST-IN-CLASS OMNI

CREATE VALUE FOR ALL STAKEHOLDERS (CUSTOMERS, Brand partners, Community, Team Members, & INVESTORS) Foot Locker, Inc.

APPENDIX Foot Locker, Inc.

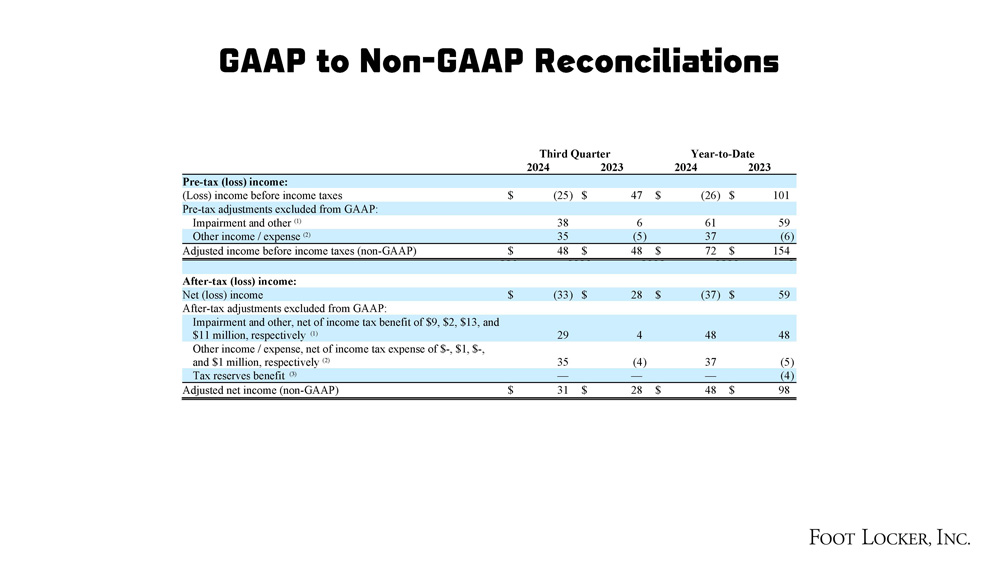

GAAP to Non-GAAP Reconciliations

Third Quarter Year-to-Date

2024 2023 2024 2023

Pre-tax (loss) income:

(Loss) income before income taxes $ (25) $ 47 $ (26) $ 101

Pre-tax adjustments excluded from GAAP:

Impairment and other (1) 38 6 61 59

Other income / expense (2) 35 (5) 37 (6)

Adjusted income before income taxes (non-GAAP) $ 48 $ 48 $ 72 $ 154

After-tax (loss) income:

Net (loss) income $ (33) $ 28 $ (37) $ 59

After-tax adjustments excluded from GAAP:

Impairment and other, net of income tax benefit of $9, $2, $13, and $11 million, respectively (1) 29 4 48 48

Other income / expense, net of income tax expense of $-, $1, $-, and $1 million, respectively (2) 35 (4) 37 (5)

Tax reserves benefit (3) — — — (4)

Adjusted net income (non-GAAP) $ 31 $ 28 $ 48 $ 98 Foot Locker, Inc.

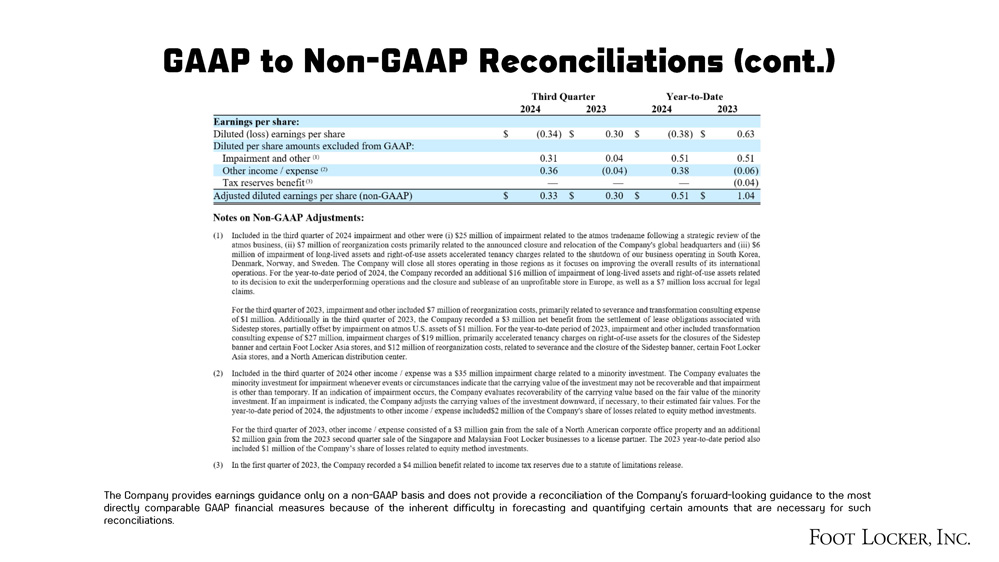

GAAP to Non-GAAP Reconciliations (cont.)

Third Quarter Year-to-Date

2024 2023 2024 2023

Earnings per share: Diluted (loss) earnings per share $ (0.34) $ 0.30 $ (0.38) $ 0.63

Diluted per share amounts excluded from GAAP: Impairment and other (1) 0.31 0.04 0.51 0.51

Other income / expense (2) 0.36 (0.04) 0.38 (0.06)

Tax reserves benefit (3) — — — (0.04)

Adjusted diluted earnings per share (non-GAAP) $ 0.33 $ 0.30 $ 0.51 $ 1.04

Notes on Non-GAAP Adjustments:

(1) Included in the third quarter of 2024 impairment and other were (i) $25 million of impairment related to the atmos tradename following a strategic review of the atmos business, (ii) $7 million of reorganization costs primarily related to the announced closure and relocation of the Company's global headquarters and (iii) $6 million of impairment of long-lived assets and right-of-use assets accelerated tenancy charges related to the shutdown of our business operating in South Korea, Denmark, Norway, and Sweden. The Company will close all stores operating in those regions as it focuses on improving the overall results of its international operations. For the year-to-date period of 2024, the Company recorded an additional $16 million of impairment of long-lived assets and right-of-use assets related to its decision to exit the underperforming operations and the closure and sublease of an unprofitable store in Europe, as well as a $7 million loss accrual for legal claims. For the third quarter of 2023, impairment and other included $7 million of reorganization costs, primarily related to severance and transformation consulting expense of $1 million. Additionally in the third quarter of 2023, the Company recorded a $3 million net benefit from the settlement of lease obligations associated with Sidestep stores, partially offset by impairment on atmos U.S. assets of $1 million. For the year-to-date period of 2023, impairment and other included transformation consulting expense of $27 million, impairment charges of $19 million, primarily accelerated tenancy charges on right-of-use assets for the closures of the Sidestep banner and certain Foot Locker Asia stores, and $12 million of reorganization costs, related to severance and the closure of the Sidestep banner, certain Foot Locker Asia stores, and a North American distribution center.

(2) Included in the third quarter of 2024 other income / expense was a $35 million impairment charge related to a minority investment. The Company evaluates the minority investment for impairment whenever events or circumstances indicate that the carrying value of the investment may not be recoverable and that impairment is other than temporary. If an indication of impairment occurs, the Company evaluates recoverability of the carrying value based on the fair value of the minority investment. If an impairment is indicated, the Company adjusts the carrying values of the investment downward, if necessary, to their estimated fair values. For the year-to-date period of 2024, the adjustments to other income / expense included$2 million of the Company's share of losses related to equity method investments. For the third quarter of 2023, other income / expense consisted of a $3 million gain from the sale of a North American corporate office property and an additional $2 million gain from the 2023 second quarter sale of the Singapore and Malaysian Foot Locker businesses to a license partner. The 2023 year-to-date period also included $1 million of the Company’s share of losses related to equity method investments.

(3) In the first quarter of 2023, the Company recorded a $4 million benefit related to income tax reserves due to a statute of limitations release.

The Company provides earnings guidance only on a non-GAAP basis and does not provide a reconciliation of the Company’s forward-looking guidance to the most directly comparable GAAP financial measures because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Foot Locker, Inc.