Exhibit 99.2

Foot Locker - Internal Use Only Fourth Quarter 2021 Earnings Results February 25, 2022

Foot Locker - Internal Use Only 2 Disclosure Regarding Forward - Looking Statements This presentation contains “forward - looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amen ded, and Section 21E of the Exchange Act, as amended. The words “believe,” “expect,” “anticipate,” “plan,” “predict,” “intend,” “seek,” “foresee,” “should,” “would,” “could,” “attempt ,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “likely,” “guidance,” “goal,” “model,” “target,” “budget” and other similar expressions are intended to identify forw ard - looking statements, which are generally not historical in nature. Statements may be forward looking even in the absence of these particular words. Examples of forward - looking statements include, but are not limited to, statements regarding our financial position, business strategy, and other plans and objectives for our future operations, and generation of free cash flow . These forward - looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward - looking statements contained in this pr esentation are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judg men t based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain an d involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed descriptio n o f the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q. We do not intend to publicly u pdate or revise any forward - looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward - looki ng statements attributable to us, or persons acting on our behalf. Management cautions you that the forward - looking statements contained herein are not guarantees of future performance, and we ca nnot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from th ose anticipated or implied in the forward - looking statements herein include, but are not limited to a change in the relationship with any of our key suppliers or the unavailability of premium products at competitive prices; a ch ange in negotiated volume discounts, cooperative advertising, and markdown allowances with any of our key suppliers, or the ability to cancel orders an d r eturn excess or unneeded merchandise; our ability to fund our planned capital investments; the impact of volatility in the financial markets or other global economic factors; difficulties in appropriately allocating capital and resources among our strategic opportunities; our ability to realize the expected benefits from recent acquisitions; business opportunities and expansion; i nve stments; expenses; dividends; share repurchases; liquidity; cash flow from operations; use of cash and cash requirements; borrowing capacity and use of proceeds; repatriation of cash to the Unite d S tates; supply chain issues, including delays in merchandise receipts and increasing cost pressure caused by higher oceanic shipping and freight costs; labor shortages; expectations rega rdi ng increased wages; inflation; consumer spending levels; the effect of governmental assistance programs; social unrest; the direct and indirect effects of all variants of the coronavirus pa ndemic (COVID - 19) on our business, including any adverse effects of the U.S. government’s COVID - 19 vaccine mandates; expectations regarding increasing global taxes; the impact of government regula tion, including changes in law; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of wea ther; increased competition; the financial impact of accounting regulations and critical accounting policies; credit risk relating to the risk of loss as a result of non - performance by our cou nterparties ; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward - looking statements attributabl e to us are expressly qualified in their entirety by this cautionary statement. A forward - looking statement is neither a prediction nor a guarantee of future events or circumstances, and those futu re events or circumstances may not occur. You should not place undue reliance on forward - looking statements, which speak to our views only as of the date of this presentation.

Foot Locker - Internal Use Only 3 OUR MISSION: To fuel a shared passion for self - expression OUR VISION: To create unrivaled experiences for our consumers OUR POSITION: To be at the heart of the sport and sneaker communities

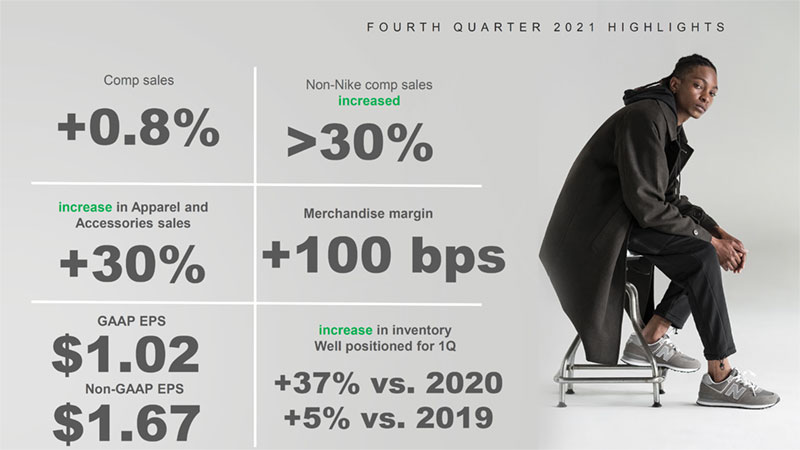

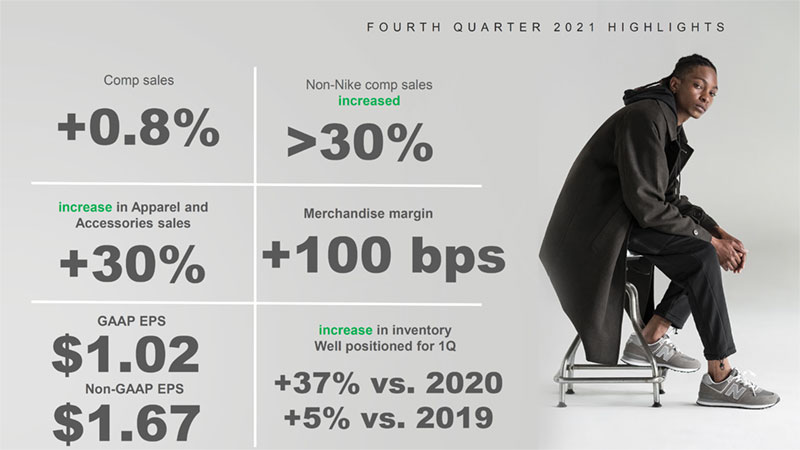

Foot Locker - Internal Use Only +30% increase in Apparel and Accessories sales $1.02 GAAP EPS +37% vs. 2020 +5% vs. 2019 increase in inventory Well positioned for 1Q FOURTH QUARTER 2021 HIGHLIGHTS +0.8% Comp sales +100 bps Merchandise margin $1.67 Non - GAAP EPS >30% Non - Nike comp sales increased

Foot Locker - Internal Use Only SALES DETAILS Store Traffic ~25% ASP Down high - singles Units Up high - singles Footwear Down mid - singles Apparel Up ~30% Accessories Up >35% 4Q SALES DETAIL Up high - teens Down high - singles Flattish NOVEMBER DECEMBER JANUARY

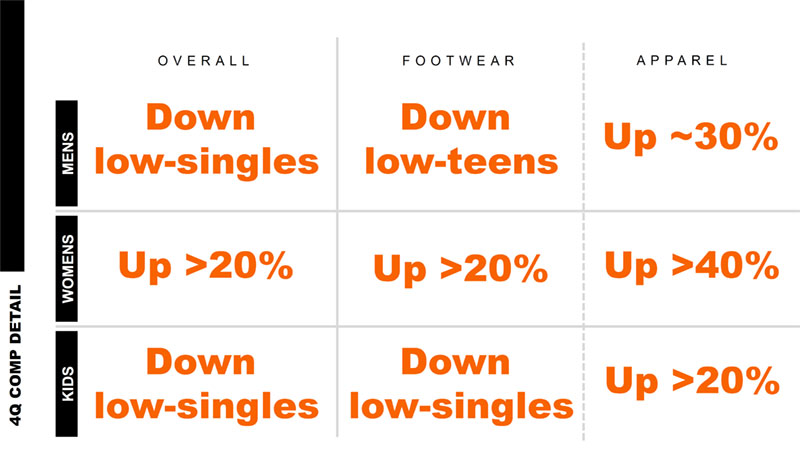

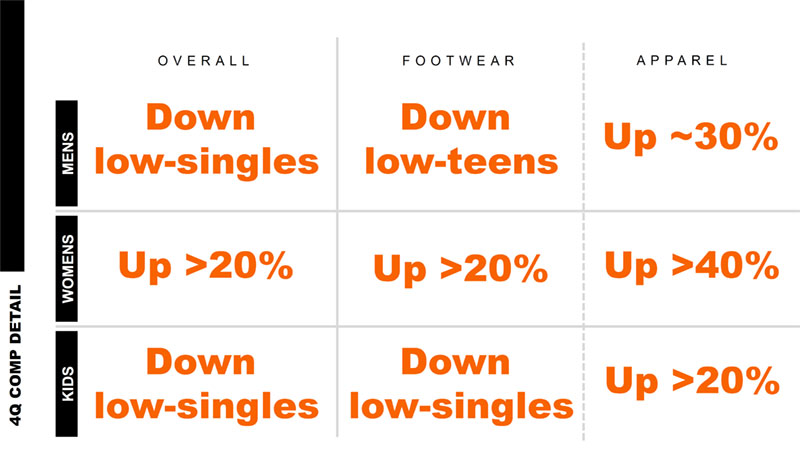

Foot Locker - Internal Use Only MENS WOMENS KIDS OVERALL Down low - singles Up >20% Down low - teens Up >20% Down low - singles Up ~30% Up >40% Up >20% 4Q COMP DETAIL APPAREL FOOTWEAR Down low - singles

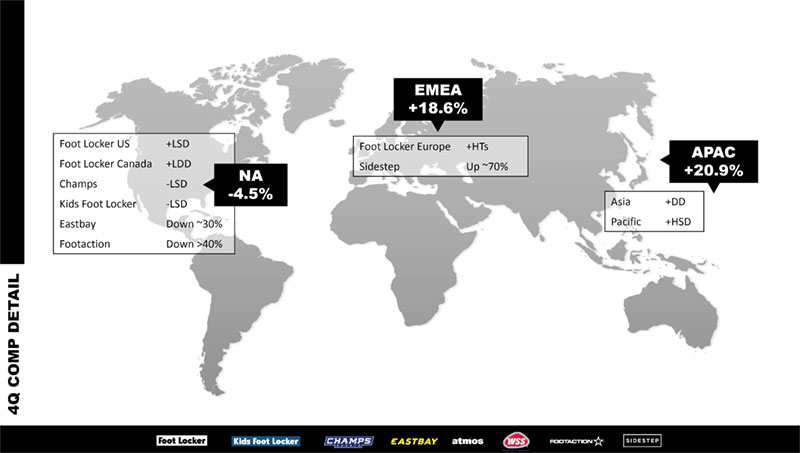

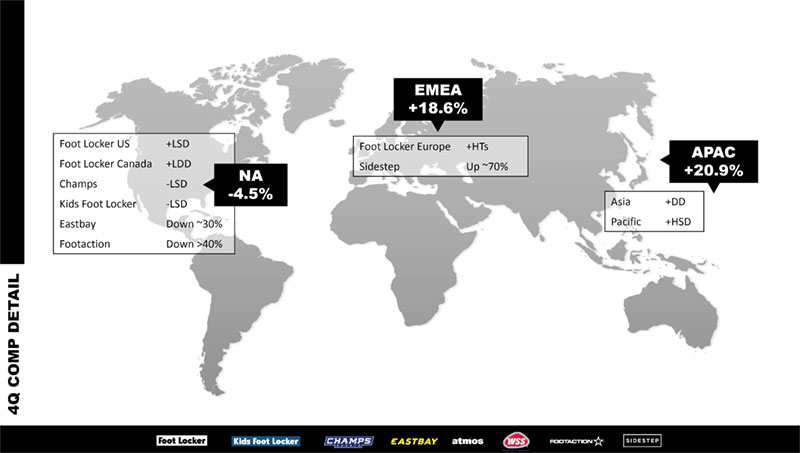

Foot Locker - Internal Use Only GLOBAL SALES BY REGION APAC +20.9% 4Q COMP DETAIL EMEA +18.6% Foot Locker US +LSD Foot Locker Canada +LDD Champs - LSD Kids Foot Locker - LSD Eastbay Down ~30% Footaction Down >40% NA - 4.5% Foot Locker Europe +HTs Sidestep Up ~70% Asia +DD Pacific +HSD

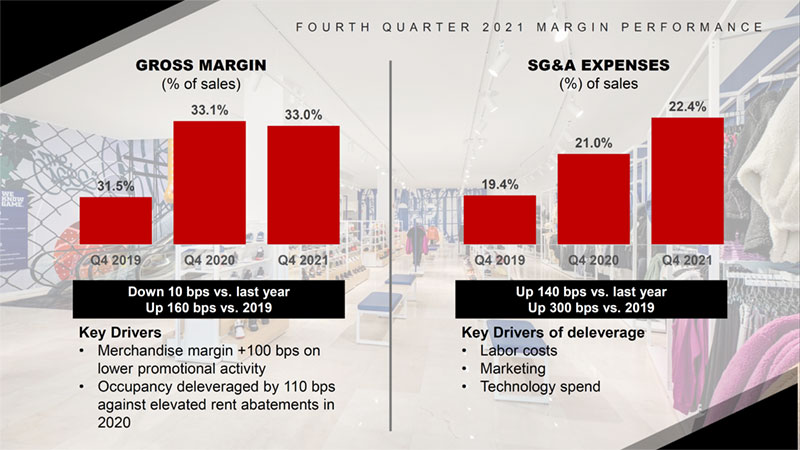

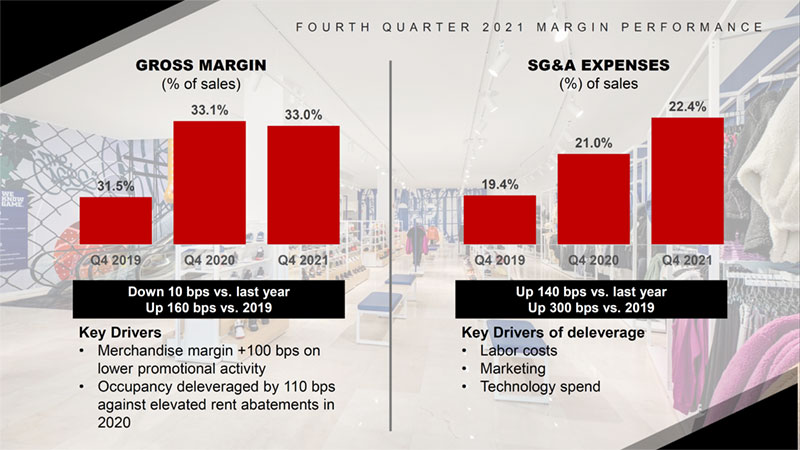

Foot Locker - Internal Use Only GROSS MARGIN (% of sales) Key Drivers • Merchandise margin +100 bps on lower promotional activity • Occupancy deleveraged by 110 bps against elevated rent abatements in 2020 SG&A EXPENSES (%) of sales Down 10 bps vs. last year Up 160 bps vs. 2019 19.4% 21.0% 22.4% Q4 2019 Q4 2020 Q4 2021 31.5% 33.1% 33.0% Q4 2019 Q4 2020 Q4 2021 FOURTH QUARTER 2021 MARGIN PERFORMANCE Up 140 bps vs. last year Up 300 bps vs. 2019 Key Drivers of deleverage • Labor costs • Marketing • Technology spend

Foot Locker - Internal Use Only WSS + ATMOS ACCELERATING GROWTH • Growing revenue from ~$650M in 2022 to ~$1Bn by 2024 • Doubling the store fleet to serve growing Hispanic population • 100% off - mall Real Estate strategy drives occupancy leverage • Growing revenue from ~$220M in 2022 to ~$300M by 2024 • Establishes footprint in critical Japanese sneaker market • Digitally led, globally recognized controlled brand Sales Growth Profile* ~20% Gross Margin 32 - 33% EBIT Margin 11 - 14% EBIT $ CAGR * ~40% Sales Growth Profile* ~15% Gross Margin 32 - 33% EBIT Margin 16 - 18% EBIT $ CAGR * ~20% • CAGR fiscal 2022 through fiscal 2024

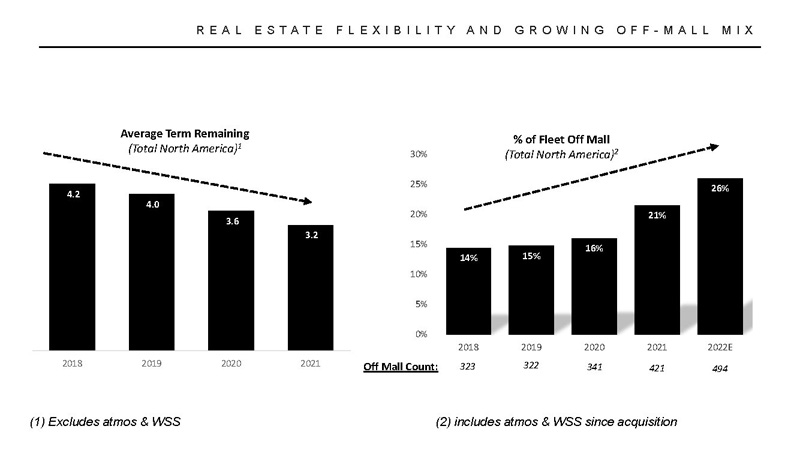

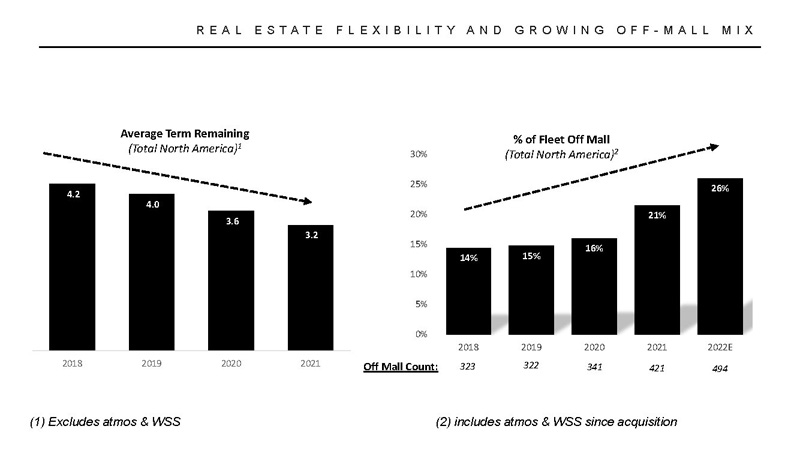

Foot Locker - Internal Use Only 4.2 4.0 3.6 3.2 2018 2019 2020 2021 Average Term Remaining (Total North America) 1 (1) Excludes atmos & WSS REAL ESTATE FLEXIBILITY AND GROWING OFF - MALL MIX 323 322 341 421 494 14% 15% 16% 21% 26% 0% 5% 10% 15% 20% 25% 30% 2018 2019 2020 2021 2022E % of Fleet Off Mall (Total North America) 2 Off Mall Count: (2) includes atmos & WSS since acquisition

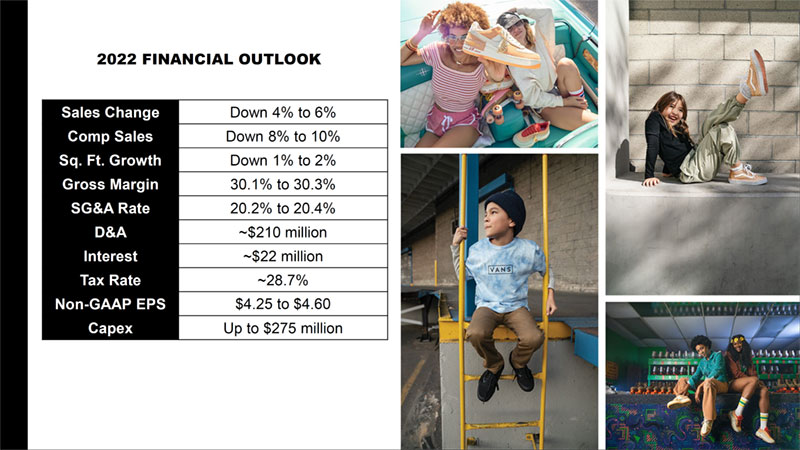

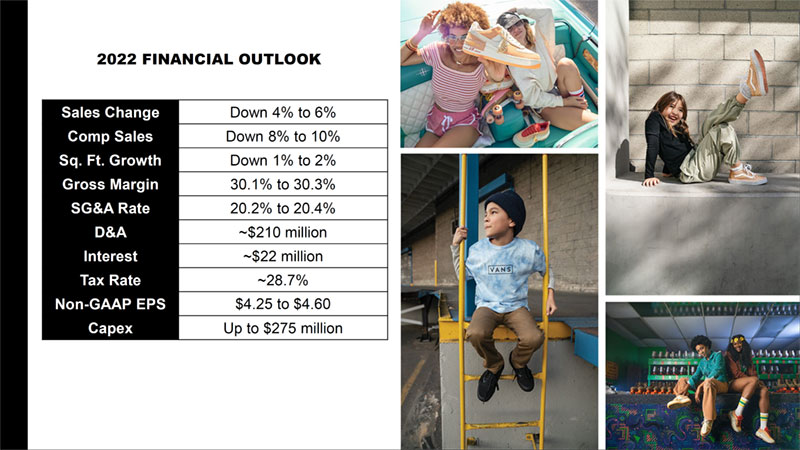

Foot Locker - Internal Use Only Sales Change Down 4% to 6% Comp Sales Down 8% to 10% Sq. Ft. Growth Down 1% to 2% Gross Margin 30.1% to 30.3% SG&A Rate 20.2% to 20.4% D&A ~$210 million Interest ~$22 million Tax Rate ~28.7% Non - GAAP EPS $4.25 to $4.60 Capex Up to $275 million 2022 FINANCIAL OUTLOOK