Exhibit 99.3

13 Week Cash Flow DIP Budget February 2023

2 Disclaimer Cautionary Note Regarding Projections The cash flow budget, financial projections, prospective financial information or forecasts (collectively, the “Projections”) in cluded in these Cleansing Materials were not prepared with a view towards public disclosure or compliance with the published guidelines of the Securiti es and Exchange Commission (the “SEC”) or the guidelines established by the Public Company Accounting Oversight Board for the presentation an d p reparation of “prospective financial information.” Sorrento Therapeutics, Inc. (the “Company”) generally does not publicly disclose detailed prospective financial information. The Projections were prepared for the internal use of the Company and were provided pursuant to the Confidential ity Agreements for the limited purpose of providing information in connection with the Company’s discussions about a potential financing transaction . T he Projections have been prepared by, and are the responsibility of the Company’s management. The Projections do not purport to present the Compa ny’ s financial condition in accordance with accounting principles generally accepted in the United States. Neither the independent registere d p ublic accounting firm of the Company nor any other independent accountant has audited, reviewed, examined, compiled, or performed any procedures with res pect to the Projections and, accordingly, none has expressed any opinion or any other form of assurance on such information or its achiev abi lity and none assumes any responsibility for the Projections. The inclusion of the Projections should not be regarded as an indication that the Com pan y or any other person considered, or now consider, the Projections to be a reliable prediction of future events, and does not constitute an admissi on or representation by any person that the expectations, beliefs, opinions, and assumptions that underlie such forecasts remain the same as of the date of this Current Report on Form 8 - K, and readers are cautioned not to place undue reliance on the prospective financial information. The estimates and assu mptions underlying the Projections are subject to significant economic and competitive uncertainties and contingencies, which are difficult or i mpo ssible to predict accurately and many of which are beyond the control of the Company and may not prove to be accurate. The Projections also do no t reflect future changes in general business or economic conditions, or any other transaction or event that may occur and that was not anticip ate d at the time this information was prepared. The Projections are not, and should not be regarded as, a representation that any of the expectatio ns contained in, or forming a part of, the Projections will be achieved. The Projections are forward - looking in nature and such information by its nature be comes less predictive with each succeeding day. Accordingly, the Company cannot provide any assurance that the Projections will be realized; actual futu re financial results will vary from such forward - looking information and may vary materially. The above considerations should be taken into account in rev iewing the Cleansing Materials. See “Cautionary Note Concerning Forward - Looking Statements” below.

3 Disclaimer Cautionary Note Concerning Forward - Looking Statements This Current Report on Form 8 - K includes certain statements that are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding the future trading market for the Company’s common stock, the Chapter 11 process and the Chapter 11 Cases . The Company’s actual results or outcomes and the timing of certain events may differ significantly from those discussed in any forward - looking statements . These statements are based on various assumptions and on the current expectations of the Company’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of the Company . These forward - looking statements are subject to a number of risks and uncertainties, including risks associated with the unpredictability of trading markets and whether a market will be established for the Company’s common stock ; the potential adverse impact of the Chapter 11 Cases on the Company’s liquidity and results of operations ; changes in the Company’s ability to meet its financial obligations during the Chapter 11 process and to maintain contracts that are critical to its operations ; the outcome and timing of the Chapter 11 process ; the effect of the Chapter 11 Cases on the Company’s relationships with vendors, regulatory authorities, employees and other third parties ; possible proceedings that may be brought by third parties in connection with the Chapter 11 process ; the timing or amount of any recovery, if any, to the Company’s stakeholders ; objections to the DIP Facility in connection with the Chapter 11 proceedings and the related approvals of the terms and conditions of the DIP Facility; the Company’s ability to comply with the restrictions imposed by the proposed terms and conditions of the DIP Facility ; the expected delisting of the Company’s common stock from Nasdaq and the expected trading of the Company’s common stock on the Pink Open Market ; and those factors discussed in the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2021 and subsequent Quarterly Reports on Form 10 - Q filed with the Securities and Exchange Commission, in each case under the heading “Risk Factors,” and other documents of the Company filed, or to be filed, with the SEC . If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that the Company presently does not know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this document . The Company anticipates that subsequent events and developments will cause its assessments to change . However, while the Company may elect to update these forward - looking statements at some point in the future, the Company specifically disclaims any obligation to do so . These forward - looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this document . Accordingly, undue reliance should not be placed upon the forward - looking statements .

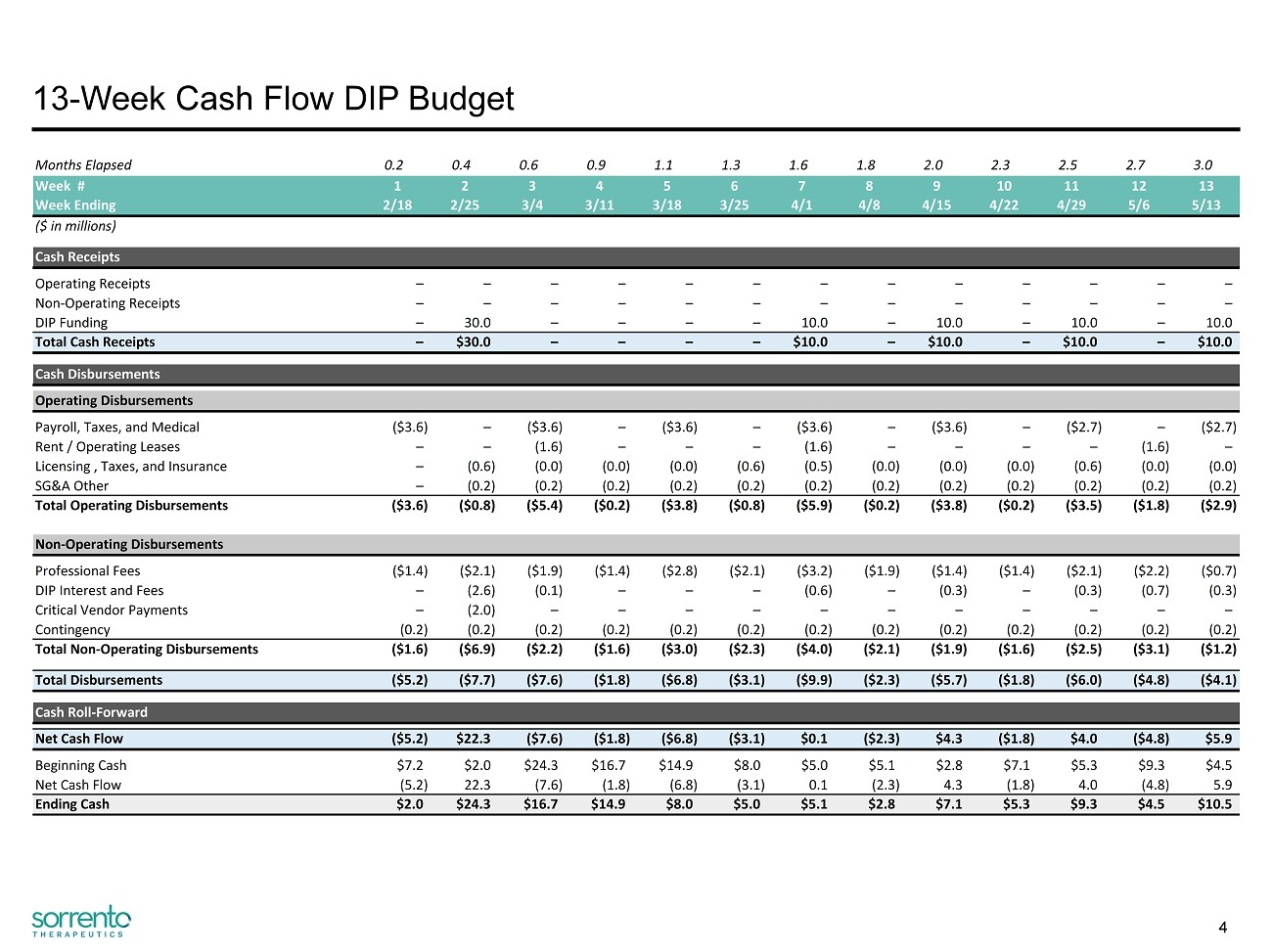

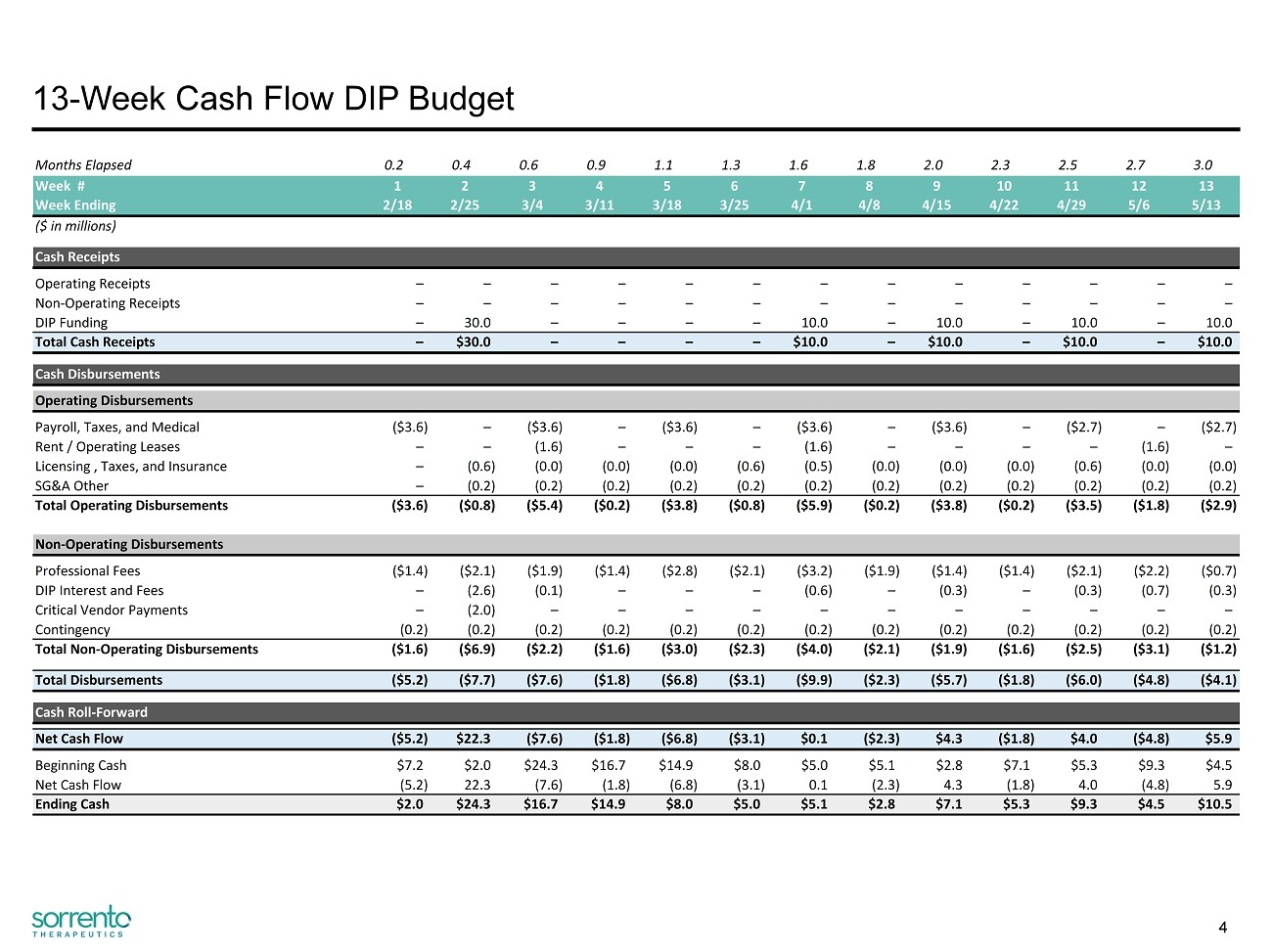

4 13 - Week Cash Flow DIP Budget Months Elapsed 0.2 0.4 0.6 0.9 1.1 1.3 1.6 1.8 2.0 2.3 2.5 2.7 3.0 Week # 1 2 3 4 5 6 7 8 9 10 11 12 13 Week Ending 2/18 2/25 3/4 3/11 3/18 3/25 4/1 4/8 4/15 4/22 4/29 5/6 5/13 ($ in millions) Cash Receipts Operating Receipts – – – – – – – – – – – – – Non-Operating Receipts – – – – – – – – – – – – – DIP Funding – 30.0 – – – – 10.0 – 10.0 – 10.0 – 10.0 Total Cash Receipts – $30.0 – – – – $10.0 – $10.0 – $10.0 – $10.0 Cash Disbursements Operating Disbursements Payroll, Taxes, and Medical ($3.6) – ($3.6) – ($3.6) – ($3.6) – ($3.6) – ($2.7) – ($2.7) Rent / Operating Leases – – (1.6) – – – (1.6) – – – – (1.6) – Licensing , Taxes, and Insurance – (0.6) (0.0) (0.0) (0.0) (0.6) (0.5) (0.0) (0.0) (0.0) (0.6) (0.0) (0.0) SG&A Other – (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) Total Operating Disbursements ($3.6) ($0.8) ($5.4) ($0.2) ($3.8) ($0.8) ($5.9) ($0.2) ($3.8) ($0.2) ($3.5) ($1.8) ($2.9) Non-Operating Disbursements Professional Fees ($1.4) ($2.1) ($1.9) ($1.4) ($2.8) ($2.1) ($3.2) ($1.9) ($1.4) ($1.4) ($2.1) ($2.2) ($0.7) DIP Interest and Fees – (2.6) (0.1) – – – (0.6) – (0.3) – (0.3) (0.7) (0.3) Critical Vendor Payments – (2.0) – – – – – – – – – – – Contingency (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) (0.2) Total Non-Operating Disbursements ($1.6) ($6.9) ($2.2) ($1.6) ($3.0) ($2.3) ($4.0) ($2.1) ($1.9) ($1.6) ($2.5) ($3.1) ($1.2) Total Disbursements ($5.2) ($7.7) ($7.6) ($1.8) ($6.8) ($3.1) ($9.9) ($2.3) ($5.7) ($1.8) ($6.0) ($4.8) ($4.1) Cash Roll-Forward Net Cash Flow ($5.2) $22.3 ($7.6) ($1.8) ($6.8) ($3.1) $0.1 ($2.3) $4.3 ($1.8) $4.0 ($4.8) $5.9 Beginning Cash $7.2 $2.0 $24.3 $16.7 $14.9 $8.0 $5.0 $5.1 $2.8 $7.1 $5.3 $9.3 $4.5 Net Cash Flow (5.2) 22.3 (7.6) (1.8) (6.8) (3.1) 0.1 (2.3) 4.3 (1.8) 4.0 (4.8) 5.9 Ending Cash $2.0 $24.3 $16.7 $14.9 $8.0 $5.0 $5.1 $2.8 $7.1 $5.3 $9.3 $4.5 $10.5