Exhibit 99.1

Exhibit 99.1

SCINTILLA

Corporate Presentation

September 2016

Disclaimer

Scintilla Pharmaceuticals, Inc. (“Scintilla”) is a subsidiary of Sorrento Therapeutics Inc. (the “Company”), a publicly traded company on the

Nasdaq Stock Market (“SRNE”). Certain statements contained in this presentation or in other documents of the Company, along with certain statements that may be made by management of the Company orally in presenting this material, may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historic or current facts. They use words such as “estimate,” “expect,” “intend,” “believe,” “plan,” “anticipate,” “projected” and other words and terms of similar meaning in connection with any discussion of future operating or financial perfor- mance or condition. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to signifi- cant risks and uncertainties. Statements regarding future action, future performance and/or future results including, without limitation, those relating to the timing for completion, and results of, scheduled or addition- al clinical trials and the FDA’s or other regulatory review and/or approval and commercial launch and sales results (if any) of the Company’s formula- tions and products and regulatory filings related to the same, partnering and collaboration opportunities, and Scintilla’s proposed acquisition of Semnur

Pharmaceuticals, Inc. may differ from those set forth in the forward-looking statements. Peak sales, market size and incidence estimates have been determined on the basis of market research and comparable product analysis, but no assurances can be given that such sales levels will be achieved, if at all, or that such market size estimates will prove accurate.

The Company assumes no obligation to update forward-looking state- ments as circumstances change. Investors are advised to consult further disclosures that the Company makes or has made on related subjects in the Company’s Form 10-K, 10-Q and 8-K reports.

NASDAQ:SRNE

Because actual results are affected by these and other potential risks, con- tingencies and uncertainties, the Company cautions investors that actual results may differ materially from those expressed or implied in any forward-looking statement. It is not possible to predict or identify all such risks, contingencies and uncertainties. The Company identifies some of these factors in its Securities and Exchange Commission (“SEC”) filings on Forms 10-K, 10-Q and 8-K, and investors are advised to consult the Compa- ny’s filings for a more complete listing of risk factors, contingencies and uncertainties effecting the Company and its business and financial perfor- mance.

Scintilla™, Sorrento™, G-MAB™, CAR.TNK™, TNK Therapeutics™, and the Sorrento logo are trademarks owned by Sorrento Therapeutics, Inc.

All other trademarks and trade names are the property of their respective owners.

Logo—http://photos.prnewswire.com/prnh/20150105/167173LOGO

SCINTILLA

2

Company Overview

3

Vision and Mission

SCINTILLA

Our Vision

To significantly advance treatments and outcomes for pain patients with innovative, non-opioid pain management solutions

Our Mission

To develop and commercialize a new generation of pain medications targeting moderate to severe pain with improved efficacy and reduced risk of opioid side-effects and abuse potential, meeting significant unmet patient and healthcare system needs

4

Scintilla Overview

Scintilla Pharmaceuticals is a majority-owned subsidiary of Sorrento Therapeutics Announced proposed acquisition of Semnur Pharmaceuticals in August 2016

Portfolio of Two Investigational Product Candidates Spanning Interventional

Pain Spectrum

SP-102: first non-opioid, epidural steroid injectable potentially for the SP-102 treatment of Lumbosacral radicular pain

– Phase 1 / 2 trial in chronic back pain completed dosing

– IND filing target in Q1 2017

– Projected to begin Pivotal Phase 3 clinical trials in 2017

RTX: a novel non-opioid molecule targeted for the treatment of intractable cancer pain

– Phase 1 / 2 clinical trials confirmed activity consistent with animal models

– Cancer Pain IND target early 2017 RTX

– Scheduled to begin Phase 2 clinical trials in 2017

– Orphan Drug Designation

Semnur

Pharmaceuticals

SCINTILLA

Sorrento

Sorrento

5

Investment Highlights

Innovative, Non-opioid Pain Management Portfolio Large, Established, yet Underserved Target Markets

Worldwide Commercial Rights to All Product Candidates

Strong Proprietary Platform with High Barriers to Entry Established Reimbursement Access

Two Products with Blockbuster Potential Poised to Replace

Current Standard of Care

Sorrento

6

The Right Team to Deliver Long-Term Value

25+ years of research & development corporate expertise

Henry Ji, PhD Chairman Management experience as founder and executive officer of numerous biotechnology companies

CEO, Sorrento Therapeutics

Jaisim Shah Chief Executive Officer 25+ years of pharma and biotech corporate, commercial and product development expertise

CEO, Semnur Pharma; CBO, Elevation; CBO, PDL BioPharma; VP, Bristol-Myers

20+ years of clinical development at pharmas and biotechs focused in pain and

Dmitri Lissin, MD CNS therapeutic areas

Chief Medical Officer

VP Clinical, Xenoport; VP Clinical, Durect

Glen Sato, JD 20+ years of financial and legal expertise at public biotechs and legal firms

Legal / Interim Chief Financial Officer Support Partner, Cooley; CFO and GC, Exelixis & PDL BioPharma

Suketu Desai, PhD 20+ years of manufacturing / CMC development at pharma / biotech

Chief Technology Officer VP Manufacturing / CMC, Allergan; VP Cephalon / Teva 20 years of research and operations experience at pharma / biotech

Bryan Jones, PhD VP, Operations VP Operations, Sorrento; Senior Director, Amylin

7

The Pain Market is Expanding and Underserved

Chronic pain affects 116 million, or almost one- in-three, Americans (1)

Costs the United States approximately $560 to $635 billion annually (2)

Nearly 30 million patients suffer from lower back pain in the U.S. (3)

Greater than 80% of cancer patients have uncontrolled pain during course or disease (4)

Pain likely a major reason for hospitalizations

Growing government, physician and patient backlash against opioid-based products

High rate of addiction

Myriad of serious side effects (respiratory depression, GI)

Not suitable for long term use

Scintilla Focuses on a Broad Segment of the Pain Market

Pain

Acute Chronic

Chronic

Chronic Non-Malignant malignant Pain Pain

Scintilla Focus

(1) ASIPP, NIH, Snarr, Jared. Risks, Benefits, and Complications from Epidural Steroid Injections: A Case Report. AANA Journal Volume 75, No. 3. June, 2007. http://www.aana.com/newsandjournal/documents/snarr183-188.pdf; (2) Institute of Medicine.

(3) Decisions Resources Group. Chronic Pain: Disease Landscape and Forecast. 2016. (4) Datamonitor December 2009.

Strong Pipeline with Breakthrough Potential

Positioning

Market Opportunity

Development Milestones

SP-102

Potentially the first approved preservative and surfactant free, steroid indicated for epidural administration to treat lumbar radiculopathy

– Novel gel formulation designed to have a prolonged residency time at the site of injection

– Non-particulate, preservative and surfactant free

Progressive disease – often leading to expensive back surgery Current therapies provide limited pain relief and have potential for serious side effects

No currently approved injectable product for epidural administration Estimated ~10 million epidural steroid administrations per year in US alone (2) Potentially significant reduction in opioid use

Phase 1 / 2 trial in chronic back pain completed dosing IND filing target in Q1 2017 Projected to begin Pivotal Phase 3 clinical trials in 2017

RTX

Novel non-opioid potential for treatment of intractable cancer pain

Potentially single injection efficacy with longer term benefit Pain Reduction Potentially significant reduction in opioid use Increase Quality of Life, particularly mobility

More than 80% of cancer patients experience uncontrolled cancer- related pain during course of disease Chemotherapy induced neuropathic pain seen in up to 1/2 of patients with a cost of management of $2.3 billion(1) Potential to replace current costly invasive treatments (nerve stimulation, intrathecal opioids, radiotherapy) Can be used in addition to opiates

Phase 1 / 2 clinical trials confirmed activity consistent with animal models Cancer Pain IND target early 2017 Scheduled to begin Phase 2 clinical trials in 2017 Filing for Breakthrough designation, if granted, would allow for rapid approval Orphan drug status granted

Lema et al 2011

NEJM July 3, 2014 Editorial: Epidural Glucocorticoid Injections in Patients with Lumbar Spinal Stenosis; Gunnar B.J. Andersson, M.D., Ph.D.

9

Significant Near Term Clinical Milestone Targets for Scintilla Programs

Multiple clinical milestones for all programs expected in the next 12 months

– Mid to late stage trials commencing for SP-102 & RTX programs

In addition, potential corporate development milestones may also be achieved with potential collaborations or licensing in ex-US territory in 2017

Program 2016 2017 2018

Period 2H 1H 2H 1H 2H

Phase 1 / 2 Phase 3

SP-102 Phase 3 Start Phase 3

Complete Results

IND and

Phase 1 / 2

RTX Phase 1 / 2 Phase 2

Results

Start

10

SP-102: Innovative Non-opioid Injectable for Chronic Pain

11

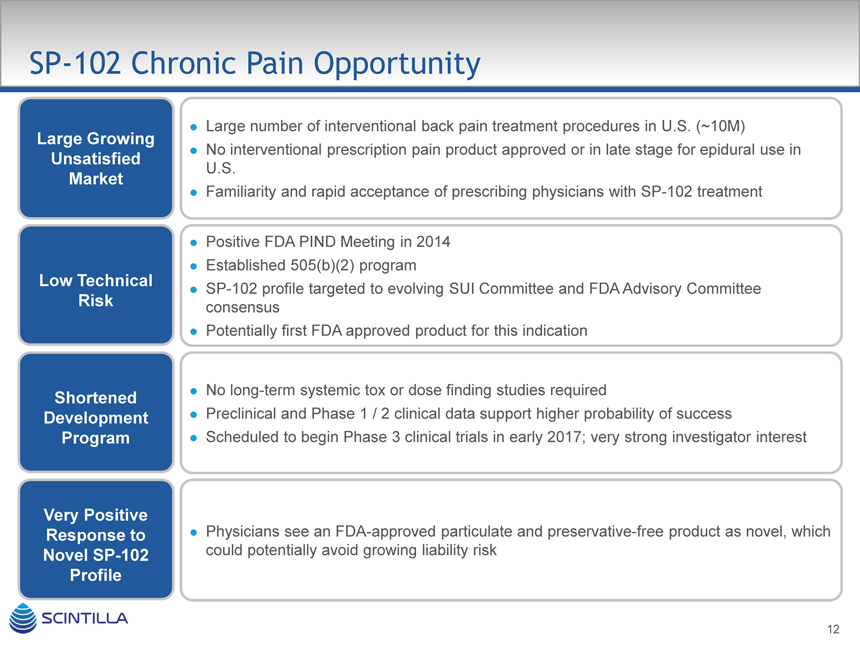

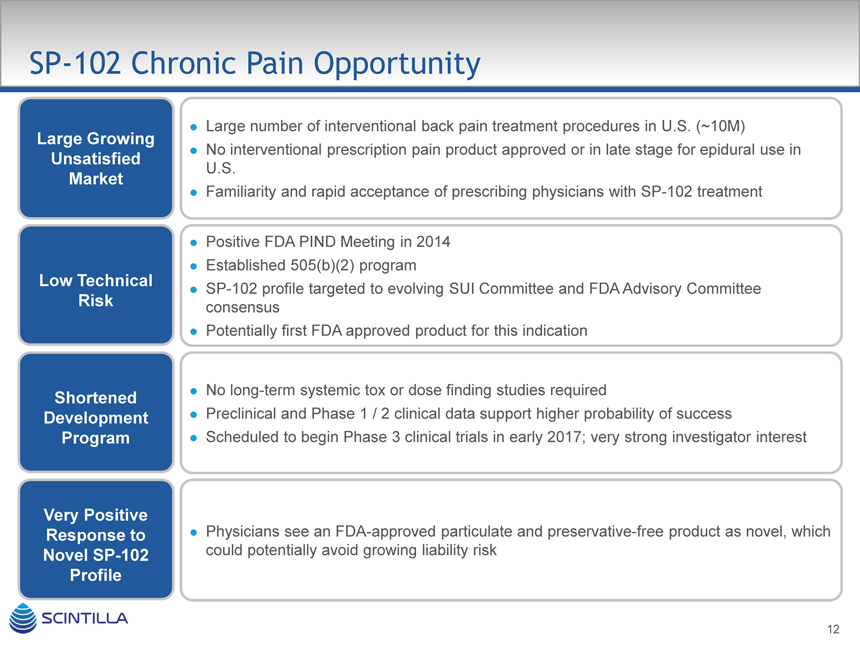

SP-102 Chronic Pain Opportunity

Large Growing

Unsatisfied

Market

Low Technical

Risk

Shortened

Development

Program

Very Positive

Response to

Novel SP-102

Profile

Large number of interventional back pain treatment procedures in U.S. (~10M)

No interventional prescription pain product approved or in late stage for epidural use in U.S.

Familiarity and rapid acceptance of prescribing physicians with SP-102 treatment

Positive FDA PIND Meeting in 2014 Established 505(b)(2) program

SP-102 profile targeted to evolving SUI Committee and FDA Advisory Committee consensus Potentially first FDA approved product for this indication

No long-term systemic tox or dose finding studies required

Preclinical and Phase 1 / 2 clinical data support higher probability of success

Scheduled to begin Phase 3 clinical trials in early 2017; very strong investigator interest

Physicians see an FDA-approved particulate and preservative-free product as novel, which could potentially avoid growing liability risk

12

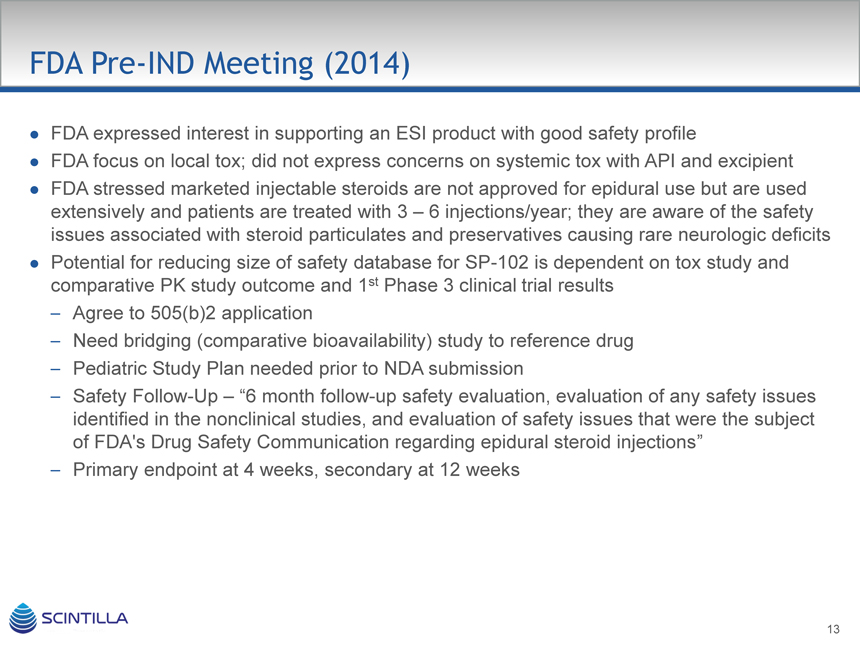

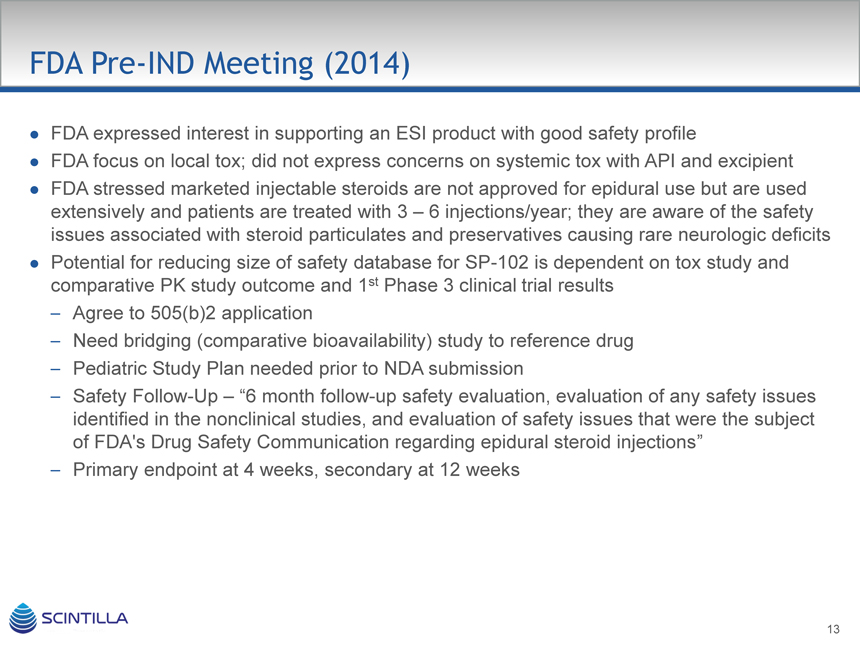

FDA Pre-IND Meeting (2014)

FDA expressed interest in supporting an ESI product with good safety profile

FDA focus on local tox; did not express concerns on systemic tox with API and excipient FDA stressed marketed injectable steroids are not approved for epidural use but are used extensively and patients are treated with 3 – 6 injections/year; they are aware of the safety issues associated with steroid particulates and preservatives causing rare neurologic deficits Potential for reducing size of safety database for SP-102 is dependent on tox study and comparative PK study outcome and 1st Phase 3 clinical trial results

– Agree to 505(b)2 application

– Need bridging (comparative bioavailability) study to reference drug

– Pediatric Study Plan needed prior to NDA submission

– Safety Follow-Up – “6 month follow-up safety evaluation, evaluation of any safety issues identified in the nonclinical studies, and evaluation of safety issues that were the subject of FDA’s Drug Safety Communication regarding epidural steroid injections”

– Primary endpoint at 4 weeks, secondary at 12 weeks

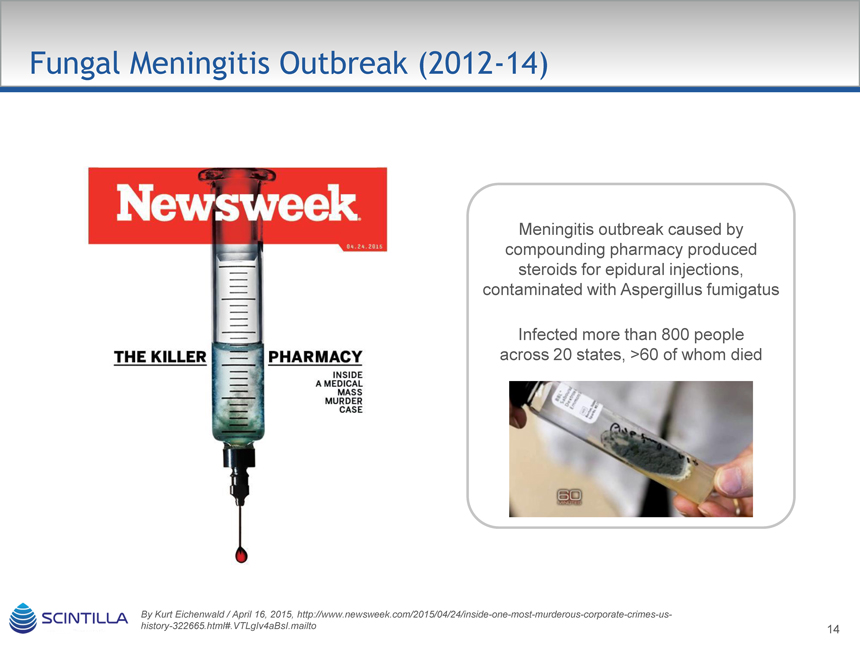

Fungal Meningitis Outbreak (2012-14)

Newsweek

04.24.2016.

THE KILLER PHARMACY

INSIDE

A MEDICAL

MASS

MURDER

CASE

Meningitis outbreak caused by compounding pharmacy produced steroids for spidural injections, contaminated with Aspergillus fumigatus

Infected more than 800 people across 20 states, >60 of whom died

By Kurt Eichenwald / April 16, 2015, http://www.newsweek.com/2015/04/24/inside-one-most-murderous-corporate-crimes-us-history-322665.html#.VTLgIv4aBsI.mailto

14

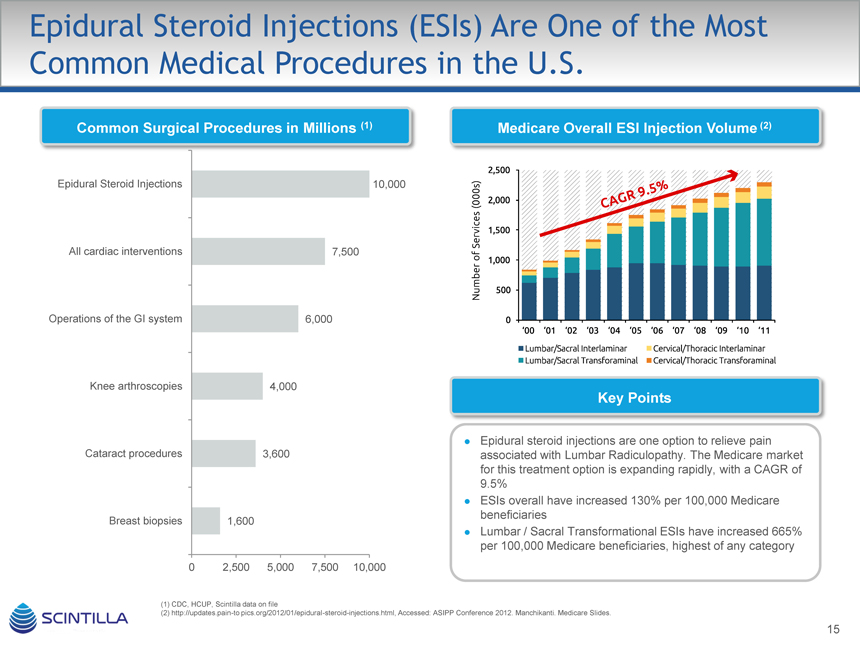

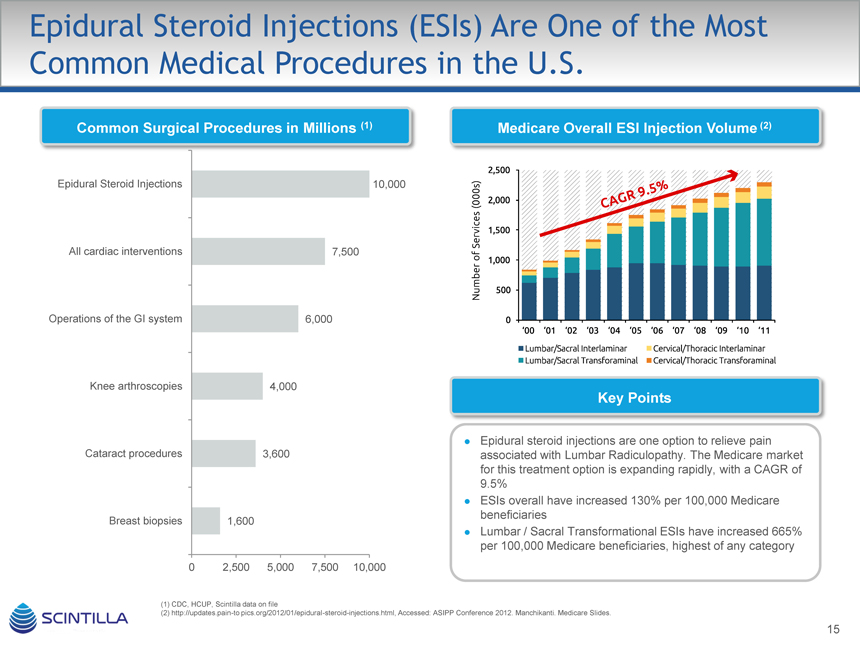

Epidural Steroid Injections (ESIs) Are One of the Most Common Medical Procedures in the U.S.

Common Surgical Procedures in Millions (1)

Epidural Steroid Injections 10,000 All cardiac interventions 7,500 Operations of the GI system 6,000 Knee arthroscopies 4,000 Cataract procedures 3,600 Breast biopsies 1,600

0 2,500 5,000 7,500 10,000

CDC, HCUP, Scintilla data on file

http://updates.pain-to pics.org/2012/01/epidural-steroid-injections.html, Accessed: ASIPP Conference 2012. Manchikanti. Medicare Slides.

Medicare Overall ESI Injection Volume (2)

Key Points

Epidural steroid injections are one option to relieve pain associated with Lumbar Radiculopathy. The Medicare market for this treatment option is expanding rapidly, with a CAGR of 9.5% ESIs overall have increased 130% per 100,000 Medicare beneficiaries Lumbar / Sacral Transformational ESIs have increased 665% per 100,000 Medicare beneficiaries, highest of any category

15

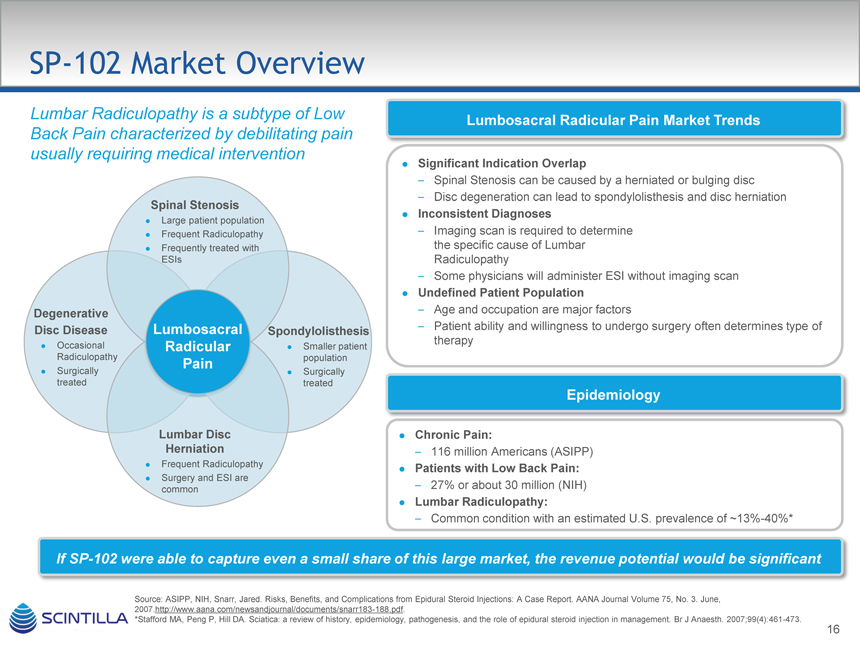

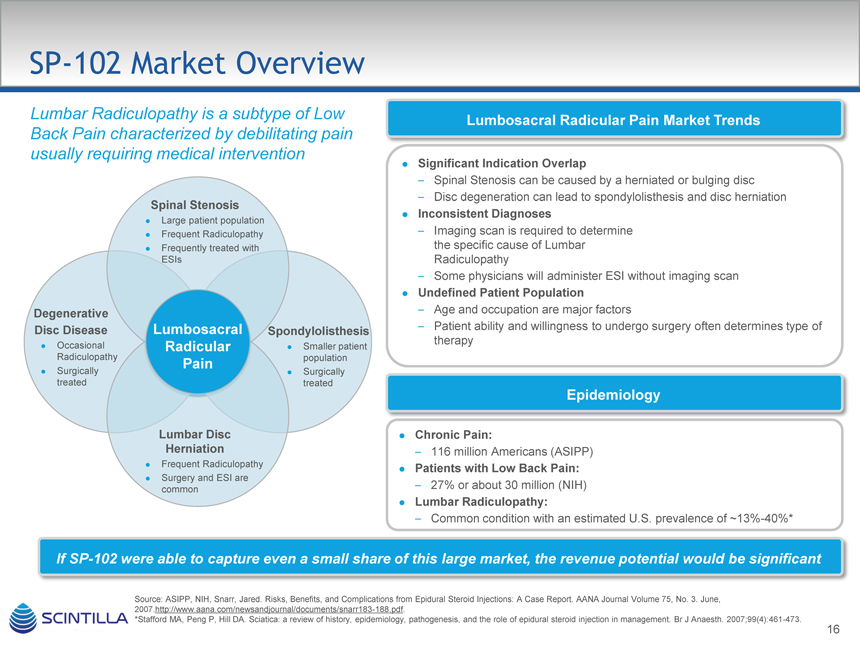

SP-102 Market Overview

Lumbar Radiculopathy is a subtype of Low Back Pain characterized by debilitating pain usually requiring medical intervention

Spinal Stenosis

Large patient population Frequent Radiculopathy Frequently treated with ESIs

Degenerative

Disc Disease Lumbosacral Spondylolisthesis

Occasional Radicular Smaller patient Radiculopathy population

Pain

Surgically Surgically treated treated

Lumbar Disc Herniation

Frequent Radiculopathy Surgery and ESI are common

Lumbosacral Radicular Pain Market Trends

Significant Indication Overlap

– Spinal Stenosis can be caused by a herniated or bulging disc

– Disc degeneration can lead to spondylolisthesis and disc herniation

Inconsistent Diagnoses

– Imaging scan is required to determine the specific cause of Lumbar Radiculopathy

– Some physicians will administer ESI without imaging scan

Undefined Patient Population

– Age and occupation are major factors

– Patient ability and willingness to undergo surgery often determines type of therapy

Epidemiology

Chronic Pain:

– 116 million Americans (ASIPP)

Patients with Low Back Pain:

– 27% or about 30 million (NIH)

Lumbar Radiculopathy:

– Common condition with an estimated U.S. prevalence of ~13%-40%*

If SP-102 were able to capture even a small share of this large market, the revenue potential would be significant

Source: ASIPP, NIH, Snarr, Jared. Risks, Benefits, and Complications from Epidural Steroid Injections: A Case Report. AANA Journal Volume 75, No. 3. June, 2007.http://www.aana.com/newsandjournal/documents/snarr183-188.pdf.

*Stafford MA, Peng P, Hill DA. Sciatica: a review of history, epidemiology, pathogenesis, and the role of epidural steroid injection in management. Br J Anaesth. 2007;99(4):461-473.

16

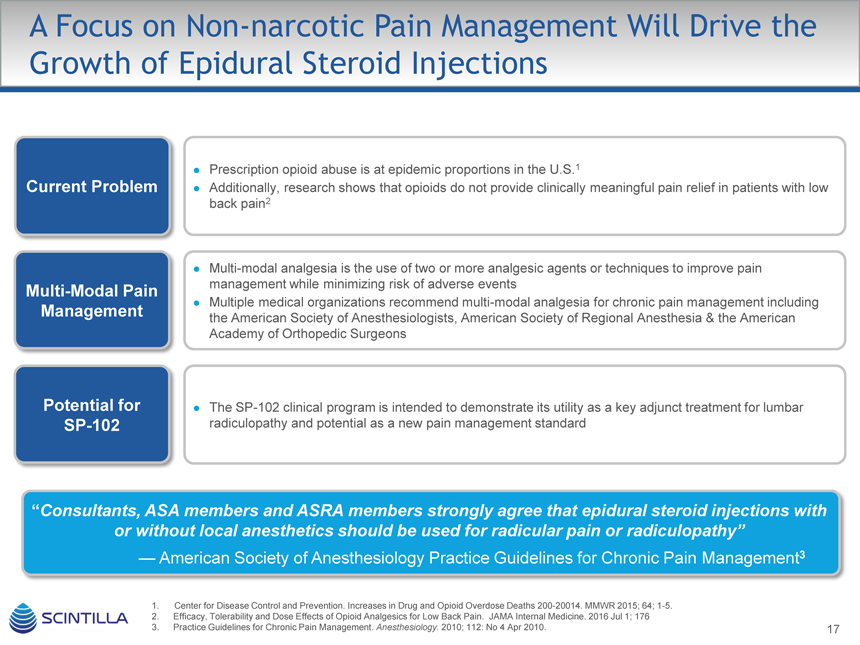

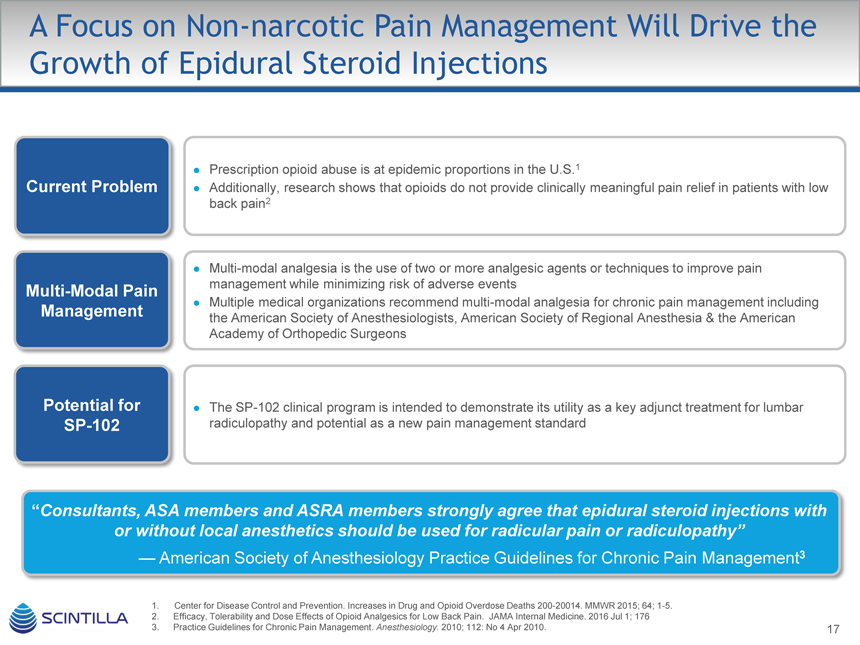

A Focus on Non-narcotic Pain Management Will Drive the Growth of Epidural Steroid Injections

Prescription opioid abuse is at epidemic proportions in the U.S.1

Current Problem Additionally, research shows that opioids do not provide clinically meaningful pain relief in patients with low

back pain2

Multi-modal analgesia is the use of two or more analgesic agents or techniques to improve pain

Multi-Modal Pain management while minimizing risk of adverse events

Multiple medical organizations recommend multi-modal analgesia for chronic pain management including

Management the American Society of Anesthesiologists, American Society of Regional Anesthesia & the American

Academy of Orthopedic Surgeons

Potential for The SP-102 clinical program is intended to demonstrate its utility as a key adjunct treatment for lumbar

SP-102 radiculopathy and potential as a new pain management standard

“Consultants, ASA members and ASRA members strongly agree that epidural steroid injections with or without local anesthetics should be used for radicular pain or radiculopathy”

— American Society of Anesthesiology Practice Guidelines for Chronic Pain Management3

1. Center for Disease Control and Prevention. Increases in Drug and Opioid Overdose Deaths 200-20014. MMWR 2015; 64; 1-5.

2. Efficacy, Tolerability and Dose Effects of Opioid Analgesics for Low Back Pain. JAMA Internal Medicine. 2016 Jul 1; 176

3. Practice Guidelines for Chronic Pain Management. Anesthesiology. 2010; 112: No 4 Apr 2010. 17

17

Chronic Back Pain:

Steroid Injections Bolded Warnings

Less

Used Currently Used

Drug Formulation Potential Issues

The safety and effectiveness of epidural administration

Methylprednisolone acetateof corticosteroids have not been established and

Depomedrol • Contains polyethylene glycol + benzylcorticosteroids are not approved for this use

alcohol• Benzyl alcohol neurotoxicity

The safety and effectiveness of epidural administration

Kenalog • Triamcinolone acetonideof corticosteroids have not been established and

Contains benzyl alcoholcorticosteroids are not approved for this use

• Neurotoxicity of benzyl alcohol

Betamethasone acetate 50% &The safety and effectiveness of epidural administration

Soluspan Betamethasone sodium phosphate 50%of corticosteroids have not been established and

Contains benzalkonium chloride &corticosteroids are not approved for this use

EDTA• Neurotoxicity of benzalkonium chloride & EDTA

The safety and effectiveness of epidural administration

Dexamethasone sodium phosphateof corticosteroids have not been established and

Decadron • Benzyl alcoholcorticosteroids are not approved for this use

• Benzyl alcohol neurotoxicity

All marketed products have bolded label warnings: “serious neurologic events, some resulting in death, have been reported with epidural injection” and that the “safety and effectiveness of epidural administration of corticosteroids have not been established”

All current ESI products have preservatives and surfactants

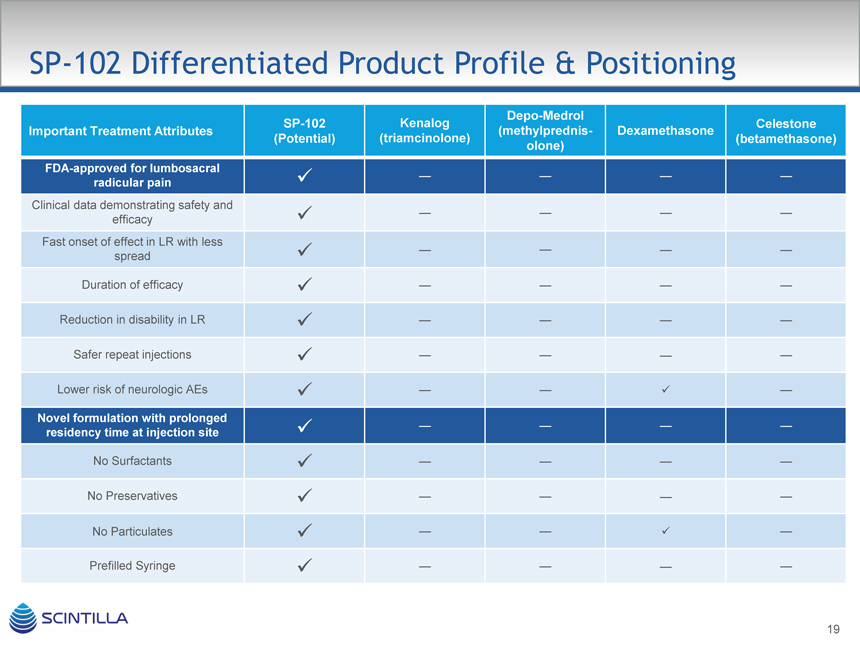

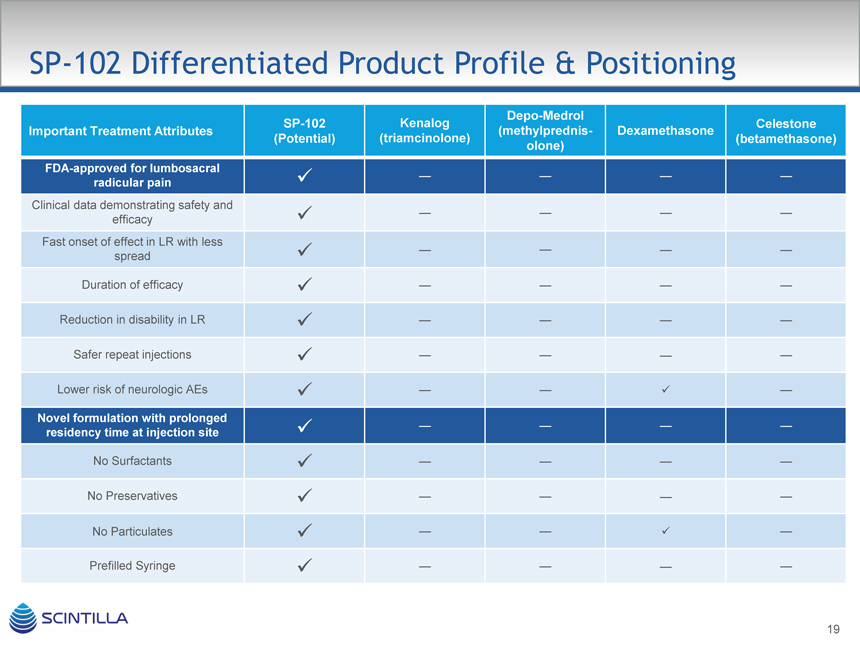

SP-102 Differentiated Product Profile & Positioning

Depo-Medrol

SP-102 KenalogCelestone

Important Treatment Attributes (methylprednis-Dexamethasone

(Potential) (triamcinolone)(betamethasone)

olone)

FDA-approved for lumbosacral

radicular pain ————

Clinical data demonstrating safety and

efficacy ————

Fast onset of effect in LR with less

spread ————

Duration of efficacy ————

Reduction in disability in LR ————

Safer repeat injections ————

Lower risk of neurologic AEs —— —

Novel formulation with prolonged

residency time at injection site ————

No Surfactants ————

No Preservatives ————

No Particulates —— —

Prefilled Syringe ————

SP-102 Clinical Utility of Product Concept is Consistent With Pain Specialists Needs

Physicians reacted favorably to the SP-102 product profile, giving the steroid an average score of 6.2 on a favorability scale of 1 – 7

Overall Reaction

Steroid A’s stated duration of effect, non-particulate form, and immediate onset of action were the most often cited benefits by physicians On a favorability scale of 1 – 7, seven physicians scored it with a 7, four with a 6, and four with 5 Cost was cited often as the only negative aspect of the profile An 8 week duration of effect would increase favorability in some physicians, but decrease favorability in others due to less revenue caused by lower volume of injections

“It’s novel and disruptive. The non-particulate and non-preservative aspects are exciting”

— Anesthesiologist

Steroid A’s Favorability N-15

7 6 543210

6.3 6.1 6.36.2

Anesthesiologists PMR Specialists Other Specialists All Specialists

Specialty Group

“Cost may be high, but if eliminated need for 2nd injection may be well worth it”

— Anesthesiologist

20

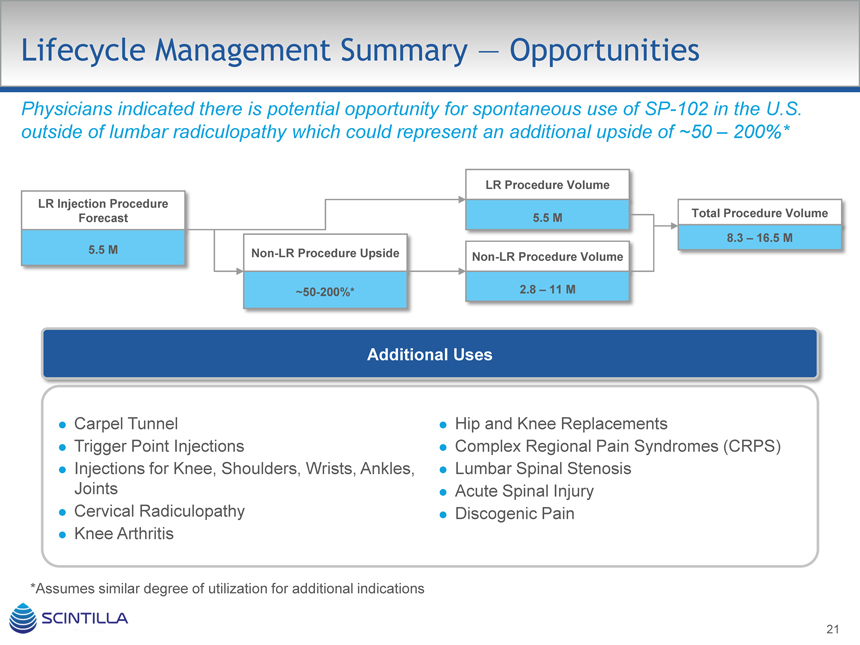

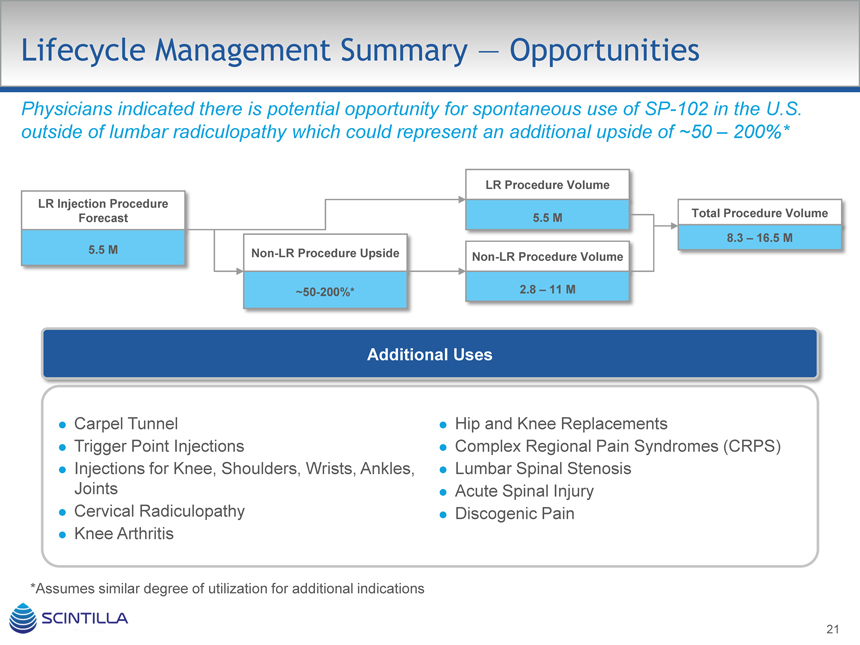

Lifecycle Management Summary — Opportunities

Physicians indicated there is potential opportunity for spontaneous use of SP-102 in the U.S. outside of lumbar radiculopathy which could represent an additional upside of ~50 – 200%*

LR Procedure Volume LR Injection Procedure

Forecast 5.5 M Total Procedure Volume

8.3 – 16.5 M

5.5 M Non-LR Procedure Upside

Non-LR Procedure Volume

~50-200%* 2.8 – 11 M

Additional Uses

Carpel Tunnel

Trigger Point Injections

Injections for Knee, Shoulders, Wrists, Ankles, Joints

Cervical Radiculopathy

Knee Arthritis

Hip and Knee Replacements

Complex Regional Pain Syndromes (CRPS)

Lumbar Spinal Stenosis

Acute Spinal Injury

Discogenic Pain

*Assumes similar degree of utilization for additional indications

21

SP-102 Toxicology Program Design Plan

Identical programs in >100 Beagle dogs and Mini-Pigs (each program costs approximately $2m)

Multiple arm GLP study using 2 routes:

SD Epidural Control (saline) 1 mL

SD Epidural Placebo 0.4 mL

SD Epidural Placebo 1 mL

SD Epidural Low dose:

mg in 0.4 mL

SD Epidural Med dose:

mg in 0.4 mL

SD Epidural High dose:

mg in 1 mL

SD Intrathecal control (saline)

SD Intrathecal low dose

SD Intrathecal Med Dose

SD Intrathecal high dose

Multi-dose epidural control (once a week for 4 weeks)

Multi-dose epidural med dose (once a week for 4 weeks)

22

SP-102 Preclinical Study Results

Hydrodynamic Study Results

Addition of viscosity agent results in a dose dependent prolongation of the residency time of the product within the epidural space Commercial injectable steroid products (i.e., Kenalog, Depo-Medrol and Decadron) have an epidural residency half-life of ~15 minutes and have large spread away from effected site Has an epidural residency half-life of >110 minutes Is more localized to the injection site than commercial products, spread limited to one vertebrae in 1st hour for greater local effect vs 6-7 with commercial products

Toxicology Studies Completed in Concurrence with FDA Pre-IND Meeting Minutes

No drug-related toxicity, local (spinal area) or systemic (including brain), macroscopic or histopathology after both single & repeat (once-a-week for 4W regimen) Histopathology clean in both routine and special stains, NOAEL is highest dose tested 10 mg / animal single dose & 2 mg repeat dose

– Placebo arm clean – non toxic, both routes in both species

Additional Vascular tox study mentioned by FDA also completed successfully

– Direct injection into vertebral artery of pigs

– No toxicity: vessel occlusion or macroscopic brain injury as reported with Depo-Medrol, clean histopathology: no brain or vascular injury

23

SP-102 Clinical Development Plan Overview

Corporate Clinical Strategy is based on a two stage approach…

Stage 1: IND to pivotal Phase 3 decision

– Phase 1 / 2 trial in chronic back pain completed dosing

– Adequate and well-controlled Phase 3 efficacy trial #1 (USA)

– Open-label, long-term safety study

– Phase 3 open label safety study

Stage 2: Commercial scale-up decision through NDA

– Adequate and well-controlled efficacy trial #2

– Pediatric study (plan to request deferral to conduct post-marketing)

24

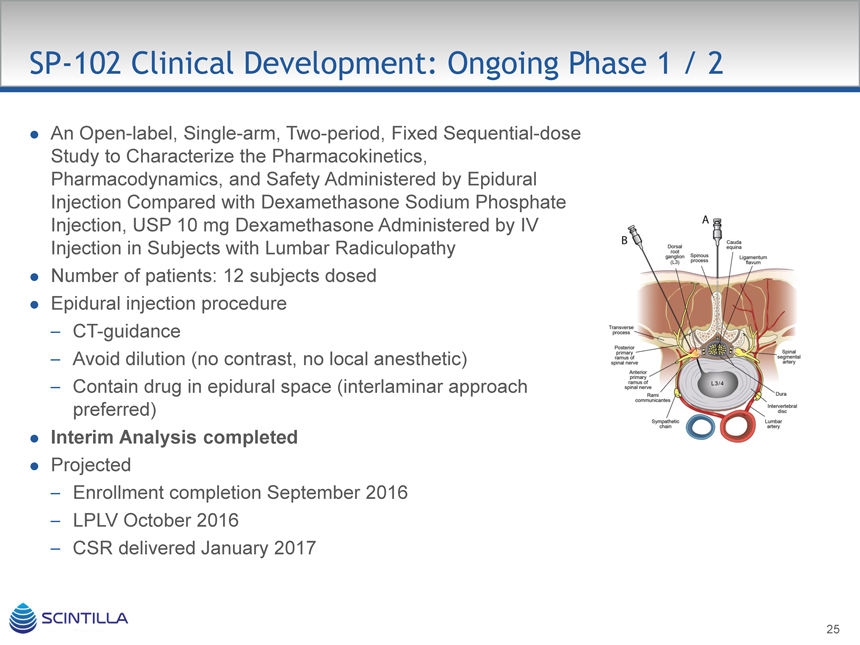

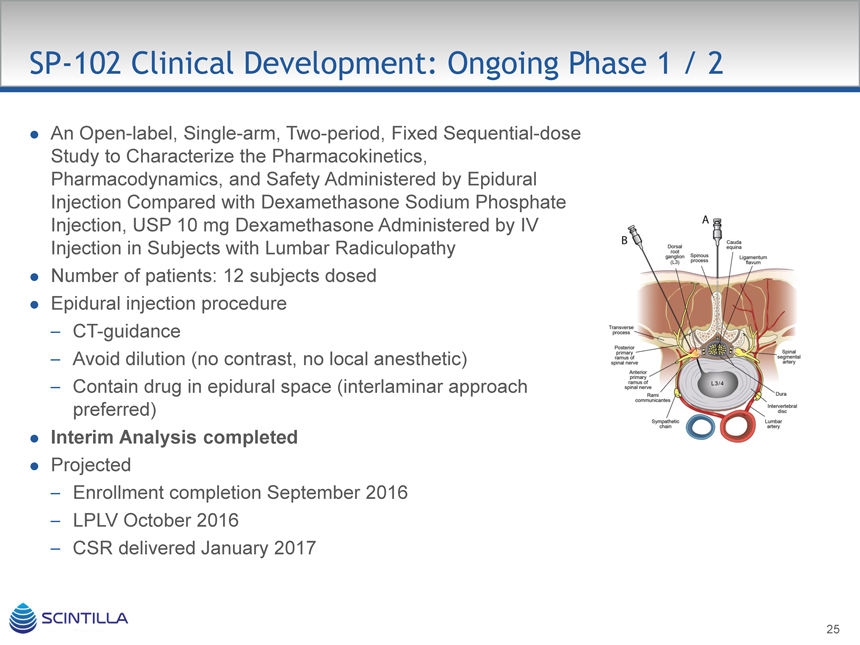

SP-102 Clinical Development: Ongoing Phase 1 / 2

An Open-label, Single-arm, Two-period, Fixed Sequential-dose Study to Characterize the Pharmacokinetics, Pharmacodynamics, and Safety Administered by Epidural Injection Compared with Dexamethasone Sodium Phosphate Injection, USP 10 mg Dexamethasone Administered by IV

Injection in Subjects with Lumbar Radiculopathy Number of patients: 12 subjects dosed Epidural injection procedure

– CT-guidance

– Avoid dilution (no contrast, no local anesthetic)

– Contain drug in epidural space (interlaminar approach preferred)

Interim Analysis completed

Projected

– Enrollment completion September 2016

– LPLV October 2016

– CSR delivered January 2017

25

SP-102 Clinical Development: C.L.E.A.R. Phase 3 Objectives

Corticosteroid Lumbar Epidural Analgesia for Radiculopathy (C.L.E.A.R.)

Evaluate the analgesic effect on leg pain following a single transforaminal epidural injection compared to a single sham injection of placebo saline (0.9% sodium chloride, 2 mL) in subjects with unilateral lumbosacral radiculopathy Evaluate opioid consumption as compared to placebo Evaluate pain at 4 weeks and degree of disability as measured by the Oswestry Disability Index (ODI) Characterize duration of analgesic effect Evaluate the safety and tolerability of multiple epidural injections Indication

– Lumbosacral Radicular Pain Selection Criteria

– Clinical symptoms consistent with the MRI diagnosis of nerve root compression secondary to a pathologic disc condition (e.g., herniated disc, annular tear or foreaminal stenosis)

– Leg pain ( 5, 9) present for at least 2 months and not more than 9 months, intensity being equal or worse than any concurrent lower back pain

26

High Barriers to Entry Protect SP-102

Intellectual Property

Filed IP filing claiming novel formulations (viscosity, dissolution profile, stability, residency time) and method of treating

U.S. Application No. 14/162,625 (“Pharmaceutical Formulation”) filed January 23, 2014 (with priority to U.S.

Provisional Application No. 61/755723 (January 23, 2013) and No. 61/776617 (March 11, 2013). Published December 4, 2014

U.S. Provisional Application No. 62/106,045 (“Pharmaceutical Formulation”) filed January 21, 2015

Barriers to Competition

Generics

– Use of specific excipient in formulation (not in label) will require determination and repeat local tox studies, required for increase in residency time for target indications

– Long term Supply and Exclusivity agreement with key excipient pharma provider completed

– Patents claiming proprietary formulation, method-of-use possible in Orange Book

– FDA requirement for expensive local tox, PK, efficacy/safety studies for new route Manufacturing

– Trade secrets, substantial know-how learned over past few years with formulation steroids and viscous solution gels

27

RTX: First-in-class Therapeutic for

Intractable Pain

28

Product Overview: RTX

Ultra potent TRPV1 agonist selectively targeting afferent neurons in chronic pain states Highly specific: affects only TRPV1 expressing nerves (A and C fibers) RTX vs. capsaicin Mechanism of – 18 Billion Scoville units

Action 2-5000

– Jalapeno

– Dorsal horn = > 12,000 times capsaicin

Pharmacological sequence of effects in vivo TRPV1 receptor activation depolarization apoptosis

Potentially permanent clinically meaningful analgesia regardless of type of pain (nociceptive, visceral and neuropathic) Efficacy Concomitant reduction in opiate use Improvement in QoL and function

Safety Alteration of heat sensation in the targeted area

No effect on normal acute pain perception / sensation or muscle function

Targeted single injection for treatment of intractable pain Dosing One injection

Patient need not discontinue current analgesic medications prior to injection

29

RTX Cancer Pain Epidemiology Overview

Intractable cancer pain is a subset of cancer pain usually requiring significant medical intervention RTX is positioned to replace costly interventional pain management procedures

M Cancer Prevalence

M Cancer Pain

M Moderate – Severe Pain

80% of cancer patients experience moderate to severe pain during the course of their disease progression.

WHO estimates 10 – 20% of cancer pain patients cannot be adequately managed EVEN with optimal opioid therapy (4)

1. NIH / NCI and Scintilla internal research

Van den Beuken-van Everdingen et al. 2007.

Ross et al. 20006 and Scintilla KOL market research

Datamonitor December 2009

Estimated Patients 2019

Cancer Pain

– 18 million Americans (1) Patients with Pain

– 53% or about 10 million (2) Moderate-Severe Cancer Pain

– 33% or about 3.1 million (3)

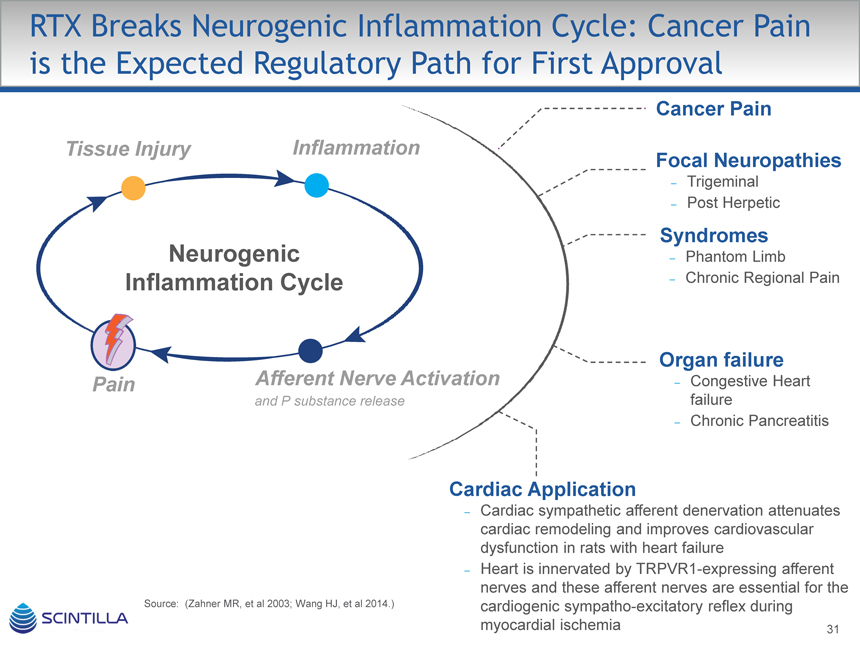

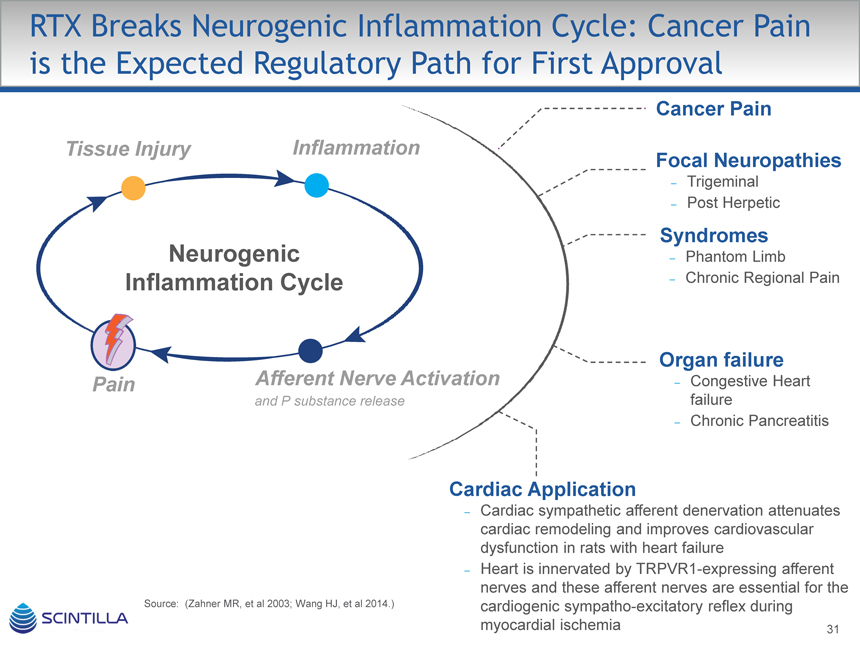

RTX Breaks Neurogenic Inflammation Cycle: Cancer Pain is the Expected Regulatory Path for First Approval

Cancer Pain

Tissue Injury Inflammation

Focal Neuropathies

– Trigeminal

– Post Herpetic

Syndromes

Neurogenic – Phantom Limb

Inflammation Cycle – Chronic Regional Pain

Organ failure

Pain Afferent Nerve Activation – Congestive Heart

and P substance release failure

– Chronic Pancreatitis

Cardiac Application

– Cardiac sympathetic afferent denervation attenuates cardiac remodeling and improves cardiovascular dysfunction in rats with heart failure

– Heart is innervated by TRPVR1-expressing afferent nerves and these afferent nerves are essential for the Source: (Zahner MR, et al 2003; Wang HJ, et al 2014.) cardiogenic sympatho-excitatory reflex during myocardial ischemia 31

RTX POC: Canine Bone Cancer Pain

Preclinical Findings

Permanent Reduction In Pain Measured at Week 14

No Side Effects As Seen With Opiates

Or High Dose NSAIDS Such As Sedation, Constipation Or Nausea mm) 100 to

Could Sense Normal Pain Signals

(0 VAS

No Loss Of Muscle Function

Fully Alert Post-treatment

Return Of “Normal” Personalities

Reported By Owners

Source: Brown et al, Anesthesiology 2005; 103:1052-9

60 n=18

Score 50

40 p=0.0001

Pain for all time points

30

Observational 20

10 n=18 n=8 n=5 n=4

0 2 6 10 14

Weeks

32

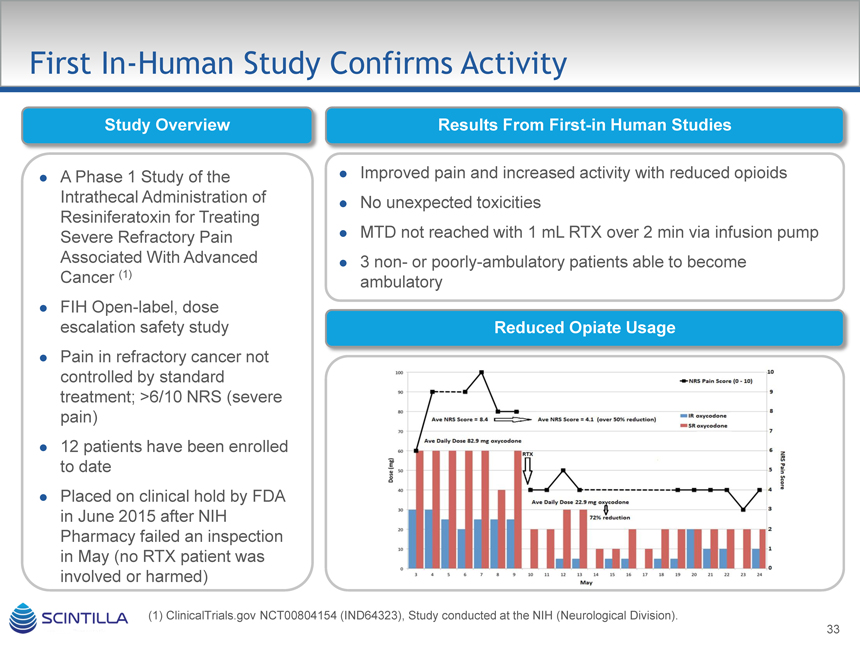

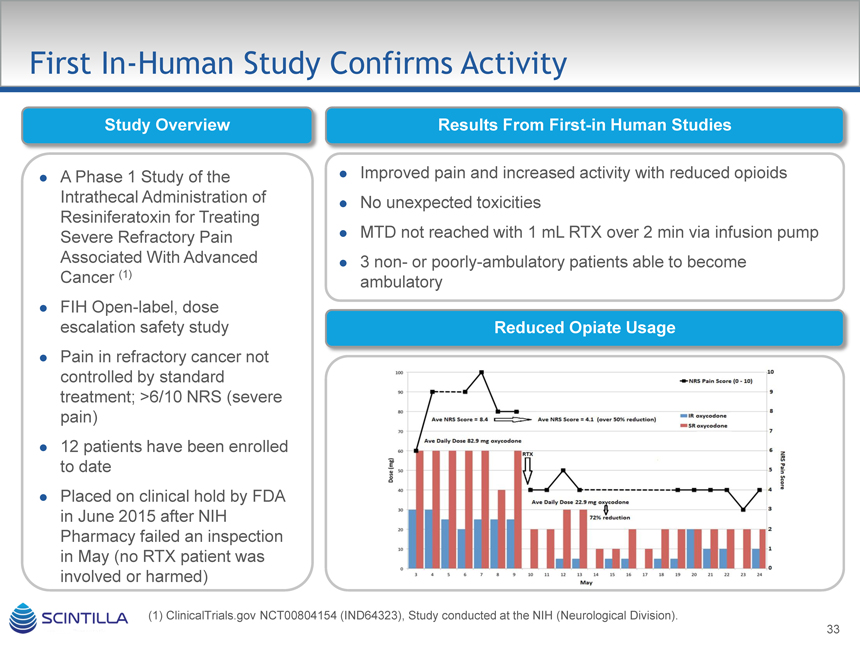

First In-Human Study Confirms Activity

Study Overview Results From First-in Human Studies

A Phase 1 Study of the Intrathecal Administration of Resiniferatoxin for Treating Severe Refractory Pain Associated With Advanced Cancer (1)

FIH Open-label, dose escalation safety study

Pain in refractory cancer not controlled by standard treatment; >6/10 NRS (severe pain)

12 patients have been enrolled to date

Placed on clinical hold by FDA in June 2015 after NIH

Pharmacy failed an inspection in May (no RTX patient was involved or harmed)

Improved pain and increased activity with reduced opioids

No unexpected toxicities

MTD not reached with 1 mL RTX over 2 min via infusion pump

3 non- or poorly-ambulatory patients able to become ambulatory

Reduced Opiate Usage

(1) ClinicalTrials.gov NCT00804154 (IND64323), Study conducted at the NIH (Neurological Division).

Switch to Epidural

Epidural injection into or near the dorsal root ganglion (DRG) for unilateral or diffuse pain

Intrathecal injection into the cerebrospinal fluid space (CSF) targeting both DRGs and dorsal horn neurons

Note: Green = Substance P as marker of Afferent nerves.

Untreated Intrathecal Epidural

34

Human Program Status

GMP API completed (3 registration batches) CMC Commercial supply chain established Investigational drug product available

Mutagenicity studies completed

Tox

Lumbar GLP completed, Pathology and reports ongoing

Cancer Pain

– IND planned early 2017

– Epidural MED study 2017

Clinical,

Cardiovascular

Preclinical &

– Mini Pig study at UCLA ongoing

Regulatory

– 2nd Hypertension Model at Nebraska ongoing

– Pre-IND meeting with Cardio Division, Q1 2017

Current Treatment Cost

Estimated Cost of Patient Controlled Morphine Treatment*

Year 2000Today**

Pump Rental, medications, refill charges, and supplies (Per Day) $154 $228

Per Month $4,625$6,845

6 Month treatment $27,750$41,070

Top 5 Reasons for Unscheduled Readmission to a Cancer Center

(N=1,351)

Fever 15%

Sepsis ** Assuming 3% increase per year 11%

Uncontrolled Pain 8%

Dehydration 6%

Pneumonia 5%

Admission Cost of Uncontrolled Pain $8,025$11,877

Total Cost of Uncontrolled Pain (6 month window with one admission) $35,775 $52,947

Source: MSA Internal Research of the following:

* The Cost of Comfort: Economics of Pain Management in Oncology, Betty Ferrell, City of Hope, ONE

Publication.2000, Vol 1. No. 9:56-61

** Assuming 3% increase per year

36

Market Research(1)

Initial Price Point

Our evaluation suggests that the market will support a potential price range of $15,000 – $30,000 for RTX therapy for pain management in the terminal, intractable pain, cancer patient

Based on Key Study Findings

Current coverage of comparator therapies (IT drug infusions) at a cost ($60 – 100K in first year) that is predictably higher than this range for the targeted population Payers are not expected to limit coverage or access for effective pain management in the terminal population Payers have supported palliative care and quality of life improvements in this population Payers have given a favorable impression of the early clinical profile and results with RTX in this population A majority of payers consulted have suggested that a range of $10 – $30K is within a coverage

“comfort zone” considering the cost of IT drug therapy, surgical and neurolytic procedural options in this population

(1) Study approved by Scintilla and prepared by Alliance Life Sciences.

37

RTX Marketing Opportunities

Opportunities

Inadequate treatment for cancer patients with intractable pain

Innovative, non-opioid, non-addictive analgesic that works by selectively killing the neurons that are responsible for cancer pain while leaving other neurons intact Superior efficacy and safety (TBD) profile with potential competitive cost advantage over opioids

– With long-term use, opioids gradually lose their effectiveness and patients need progressively higher doses to get pain relief but at the cost of a host of debilitating side effects, including impaired consciousness, nausea, vomiting and constipation. In addition, for patients who do not get relief from morphine, there are not a lot of options

Significant Near Term Clinical Milestones for Scintilla Programs

Multiple clinical milestones for all programs expected in the next 12 months

– Mid to late stage trials commencing for SP-102 & RTX programs

In addition, potential corporate development milestones may also be achieved with potential collaborations or licensing in ex-US territory related to SP-102 and RTX in 2017

Program 2016 20172018

Period 2H 1H2H1H2H

Phase 1 / 2 Phase 3

SP-102 Phase 3 Start Phase 3

Complete Results

IND and Phase 1 / 2

RTX Phase 1 / 2 Phase 2

StartResults

39

Financing and Use of Proceeds

~$100 M Private Placement of Common Stock

– Fund clinical trials and NDA submissions

– Pipeline additions

– Key hires across departments

– Commercial launch prep

– Payment to shareholders related to Semnur acquisition

– General corporate purposes

Investment Highlights

Innovative, Non-opioid Pain Management Portfolio Large, Established, yet Underserved Target Markets

Worldwide Commercial Rights to All Product Candidates

Strong Proprietary Platform with High Barriers to Entry Established Reimbursement Access

Two Products with Blockbuster Potential Poised to Replace

Current Standard of Care

41