As filed with the Securities and Exchange Commission on April 22, 2014

Registration No. 333-193976

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM S-1/A

(Amendment No. 1)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENERJEX RESOURCES, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 1311 | 88-0422242 | ||

(State or other jurisdiction of incorporation) | (Primary Standard Industrial Classification Code Number) | (IRS Employer Identification No.) |

4040 Broadway, Suite 508

San Antonio, TX 78209

Telephone: (210) 451-5545

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive

offices)

National Corporate Research, Ltd.

202 South Minnesota Street

Carson City, NV 89703

Telephone: (888) 600-9540

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael E. Pfau, Esq. Fernando Velez, Jr., Esq. Reicker, Pfau, Pyle & McRoy LLP 1421 State Street, Ste. B Santa Barbara, CA 93101 Telephone: (805) 966-2440 | Jonathan R. Zimmerman Alyn Bedford 2200 Wells Fargo Center 90 S. 7th Street Minneapolis, MN 55402-3901 Telephone: (612) 766-7000 |

Approximate Date of Commencement of Proposed Sale to the Public: From time to time after the date this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per unit | Proposed maximum aggregate offering price | Amount of registration fee | ||||||||||||

| Series A Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share | 400,000 | $ | 25.00 | $ | 10,000,000.00 | (1) | $ | 1,288.00 | (2) | |||||||

| Underwriters' warrants(3) | — | — | — | (4) | ||||||||||||

| Common stock, par value $0.001 per share, underlying the underwriters' warrants | (5) | — | — | — | ||||||||||||

| (1) | Calculated in accordance with Rule 457(o) of the Securities Act based on a per share liquidation preference of $25.00, which may be different then the offering price. |

| (2) | $966 of this amount was previously paid on February 14, 2014, upon the initial filing of this Registration Statement, the balance shall be paid upon the filing of this amendment. | |

| (3) | We have agreed to issue warrants exercisable for a period of 5 years starting on the effective date of this registration statement representing a number of shares of our common stock equal to 5% of the gross proceeds from the offering hereby of the Series A Cumulative Redeemable Perpetual Preferred Stock to the underwriters of such offering for nominal consideration. Resales of such warrants on a delayed or continuous basis pursuant to Rule 415 of the Securities Act are hereby registered. Resales of common stock issuable upon exercise of the warrants are also being registered hereby on a delayed or continuous basis. See "Underwriting." | |

| (4) | No fee required pursuant to Rule 457(g) of the Securities Act. | |

| (5) | Pursuant to Rule 416 of the Securities Act, there are also being registered such additional securities as may be issued to prevent dilution resulting from share splits, share dividends, or similar transactions. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

SUBJECT TO COMPLETION, DATED April 22, 2014

ENERJEX RESOURCES, INC.

[ ] Shares of 10% Series A Cumulative Redeemable Perpetual Preferred Stock

$[ ] - $ [ ] Per Share

Liquidation Preference $25.00 Per Share

We are offering [ ] shares of our 10% Series A Cumulative Redeemable Perpetual Preferred Stock, which we refer to as the Series A preferred stock.

Dividends on the Series A preferred stock are cumulative from the date of original issue and will be payable on the last day of each calender month commencing [ ], 2014 when, as and if declared by our board of directors. Dividends will be payable out of amounts legally available therefore at an initial rate equal to 10% per annum per $25.00 of stated liquidation preference per share, or $2.50 per share of Series A preferred stock per year.

Commencing on [ ], 201[ ], we may redeem, at our option, the Series A preferred stock, in whole or in part, at a cash redemption price of $25,00 per share, plus any accrued and unpaid dividends to, but not including, the redemption date. The Series A preferred stock have no stated maturity, will not be subject to any sinking fund or other mandatory redemption, and will not be convertible into or exchangeable for any of our other securities.

Holders of the Series A preferred stock generally will have no voting rights except for limited voting rights if dividends payable on the outstanding Series A preferred stock are in arrears for six or more consecutive or non-consecutive monthly dividend periods, or if we fail to maintain the listing of the Series A preferred stock on a national securities exchange for a period of at least 180 days ..

There is no established trading market for the Series A preferred stock. Subject to issuance of the offered shares, we anticipate that the outstanding shares of Series A preferred stock will be listed on the NYSE MKT, under the symbol "[ ]."

Northland Capital Markets and Euro Pacific Capital Inc. are acting as our underwriters in the public offering on a best efforts basis. The underwriters are not required to sell any specific number or dollar amount of Series A preferred stock, but will use their best efforts to sell the Series A preferred stock offered. We have agreed to pay the underwriters cash commissions equal to [ ]% of the gross proceeds received by us, if any, in this offering. The offering is not contingent upon the occurrence of any event or sale of a minimum or maximum number of shares.

If we sell all [ ] shares of Series A preferred stock we are offering pursuant to this prospectus and assuming an offering price of $[ ] per share, the midpoint of the range shown above, we will receive a maximum of $[ ] in gross proceeds and approximately $[ ] in net proceeds, after deducting the underwriting commissions and estimated offering expenses payable by us.

However, because this is a best efforts, no minimum offering, the underwriters do not have an obligation to purchase any shares and, as a result, there is a possibility that we may not receive any proceeds from the offering. See “Use of Proceeds” in this prospectus. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

We expect the Series A preferred stock will be ready for delivery in book-entry form through The Depositary Trust Company on or about [ ] , 2014.

Investing in our Series A preferred stock involves significant risks. You should carefully consider the risk factors beginning on page [ ]of this prospectus before purchasing any of the Series A preferred stock offered by this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions(1) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | In addition to the cash commissions, we have also agreed to issue to the underwriters warrants exercisable within 5 years from the effective date of the registration statement, to grant the underwriters a 12-month right of first refusal in connection with certain underwritten securities issuances we might undertake within 1 year from the date of the effectiveness of this registration statement, and agreed to pay up to $[ ] of the expenses of the underwriters in connection with this offering. Please see “Underwriting” in this prospectus for more information regarding our arrangements with the underwriters. |

|  |

The date of this prospectus is , 2014.

TABLE OF CONTENTS

| Page | ||||

| Prospectus Summary | 1 | |||

| The Offering | 2 | |||

| Risk Factors | 7 | |||

| Special Note Regarding Forward-Looking Statements | 23 | |||

Use of Proceeds | 23 | |||

| Capitalization | 23 | |||

| Selected Historical Financial Data | 25 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operation | 26 | |||

| Business and Properties | 32 | |||

| Management | 46 | |||

| Corporate Governance of the Company | 48 | |||

| Security Ownership of Management and Principal Stockholders | 59 | |||

| Certain Relationships and Related Party Transactions | 60 | |||

| Description of Capital Stock | 61 | |||

| Description of Our Series A Preferred Stock | 64 | |||

| Material U.S. Federal Income Tax Consequences | 70 | |||

| Underwriting | 77 | |||

| Legal Matters | 79 | |||

| Experts | 79 | |||

| Where You Can Find More Information | 79 | |||

| Index to Financial Statements | F-1 | |||

ABOUT THIS PROSPECTUS

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities, in any jurisdiction in which, or from any person to whom, it is unlawful to make any such offer or solicitation in such jurisdiction. The securities are not being offered in any jurisdiction where the offer of such securities is not permitted.

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date. You should read this prospectus and the registration statement of which this prospectus is a part in their entirety before making an investment decision.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to this prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We are not making any representation to you regarding the legality of an investment in our securities by you under applicable law. You should consult with your own legal advisors as to the legal, tax, business, financial and related aspects of a purchase of our securities.

The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or the time of issuance or sale of any securities.

The EnerJex Resources logo is the property of EnerJex Resources, Inc. or a subsidiary thereof. References herein to “$” and “dollars” are to the currency of the United States of America.

In this prospectus, we refer to information regarding potential markets for our products and other industry data. We believe that all such information has been obtained from reliable sources that are customarily relied upon by companies in our industry. However, we have not independently verified any such information.

Information contained on or accessible through our website, www.enerjex.com does not constitute part of this prospectus.

| i |

The registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices mentioned under the heading “Where You Can Find More Information.”

Northland Capital Markets is the trade name for certain capital markets and investment banking services of Northland Securities, Inc., member FINRA/SIPC.

We expect that delivery of the shares of our Series A preferred stock will be made to investors on or about the fifth business day following the date of the final prospectus (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market are required to settle in three business days unless the parties to any such trade expressly agree otherwise. Accordingly, if you wish to trade shares of our Series A preferred stock before their delivery, you will be required to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement caused by the initial T+5 settlement. If you wish to trade shares of our Series A preferred stock before their delivery, you should consult your advisors.

| ii |

PROSPECTUS SUMMARY

The following summary provides an overview of certain information contained elsewhere in this prospectus. Because this is a summary, it does not contain all of the information you should consider before investing in our Series A preferred stock. You should read this entire prospectus carefully before making a decision about whether to invest in our Series A preferred stock. Unless the context requires otherwise or unless otherwise noted, all references in this prospectus to “the Company,” “EnerJex” “we,” “us” or “our” are to EnerJex Resources, Inc. and its consolidated subsidiaries and Black Raven Energy, Inc., a wholly-owned subsidiary.

Overview

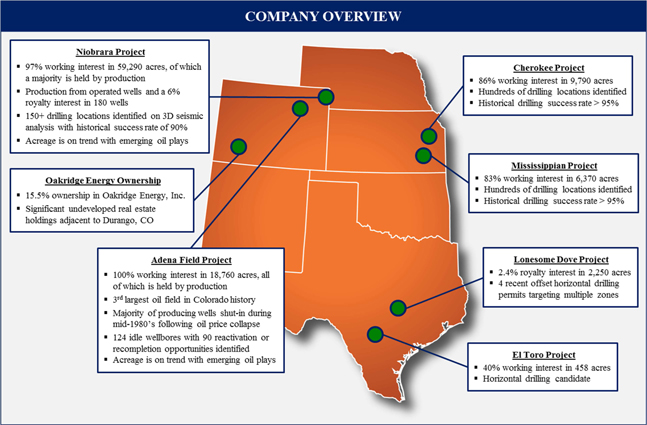

We operate as an independent exploration and production company focused on the acquisition and development of oil and natural gas properties located in the mid-continent region of the United States.

Our primary business objective is to increase our oil and natural gas production, reserves, and cash flow in a manner that is accretive for our shareholders by acquiring and developing properties that have low production decline rates and offer abundant drilling opportunities with low risk profiles.

We drilled 48 oil wells in 2013 with a 100% success rate, and our ratio of proved reserves to production is 32.8 years based on our annualized production volumes for the three months ended December 31, 2013.

As of December 31, 2013, we owned oil and natural gas leases covering more than 90,000 net acres in Kansas, Colorado, Nebraska, and Texas, of which approximately 64% is held by production. We have identified more than 500 drilling locations on this acreage from which we expect to recover commercial quantities of oil and natural gas.

Our total net proved oil and natural gas reserves as of December 31, 2013 were 5.8 million barrels of oil equivalent (Boe), of which 77% was oil. Of the 5.8 million Boe of total proved reserves, approximately 49% were classified as proved developed producing, approximately 17% were classified as proved developed non-producing, and approximately 34% were classified as proved undeveloped. The total PV10 (present value) of our proved reserves as of December 31, 2013 was $102.4 million.

The principal elements of our business strategy are to:

| · | Develop Our Existing Properties . We plan to increase our oil and natural gas production, reserves, and cash flow by developing our extensive inventory of drilling locations that we have identified on our existing properties. |

| · | Maximize Operational Control . We seek to operate and maintain a substantial working interest in the majority of our properties. We believe the ability to control our drilling inventory will provide us with the opportunity to more efficiently allocate capital, manage resources, control operating and development costs, and utilize our experience and knowledge of oil and gas field technologies. |

| 1 |

| · | Pursue Selective Acquisitions and Joint Ventures . We believe our local presence in Kansas, Colorado, Nebraska, and Texas makes us well-positioned to pursue selected acquisitions and joint venture arrangements. |

| · | Reduce Unit Costs Through Economies of Scale and Efficient Operations. As we increase our oil and natural gas production and develop our existing properties, we expect that our unit cost structure will benefit from economies of scale. In particular, we anticipate reducing unit costs through greater utilization of our existing infrastructure over a larger number of wells. |

| · | Reduce Oil Price Risk . We seek to minimize the risk to our business of a decline in future oil prices by entering into derivative or physical hedging arrangements with respect to a portion of our anticipated future oil production. |

We were formerly known as Millennium Plastics Corporation and were incorporated in the State of Nevada on March 31, 1999. We abandoned a prior business plan focusing on the development of biodegradable plastic materials. In August 2006, we acquired Midwest Energy, Inc., a Nevada corporation, pursuant to a reverse merger. After the merger, Midwest Energy became a wholly owned subsidiary, and as a result of the merger the former Midwest Energy stockholders controlled approximately 98% of our outstanding shares of common stock. We changed our name to EnerJex Resources, Inc. in connection with the merger, and in November 2007 we changed the name of Midwest Energy (now our wholly owned subsidiary) to EnerJex Kansas, Inc. All of our current operations are conducted through EnerJex Kansas, Inc., Black Raven Energy, Inc., and Black Sable Energy, LLC, and our leasehold interests are held in our wholly owned subsidiaries Black Raven Energy, Inc., Adena, LLC, DD Energy, Inc., Black Sable Energy, LLC, Working Interest, LLC, PRB Gathering, Inc., and EnerJex Kansas, Inc.

EnerJex's corporate offices are located at 4040 Broadway, Suite 508, San Antonio, Texas 78209 and its telephone number is (210) 451-5545. EnerJex's website is located at www.enerjex.com. The information contained on or connected to EnerJex's website is expressly not incorporated by reference into this prospectus. Additional information about EnerJex is included elsewhere in this prospectus. See the sections entitled " Business," " Management's Discussion and Analysis of Financial Condition and Results of Operations" and EnerJex's financial statements beginning on pages 32, 26 and F-1, respectively.

Recent Developments

On March 14, 2014, Black Raven Energy, Inc. ("Black Raven"), a wholly-owned subsidiary of EnerJex entered into a Settlement and Release Agreement with Atlas Resources, LLC, pursuant to which the parties settled certain disputes regarding the rights and obligations of the parties under that certain Farmout Agreement dated effective as of July 23, 2010.

Pursuant to the Settlement Agreement, among other matters, the parties released each other from certain claims and obligations, the Farmout Agreement was terminated, and the parties entered into a new Gathering Agreement and Contract Operating Agreement under which Atlas shall pay to Black Raven an overhead charge of $12,000 per month from December 1, 2013 through November 30, 2015. Unless the Contract Operating Agreement is terminated at the option of either party, after November 30, 2015, from and after December 1, 2015, the overhead charge per month shall be the lesser of (a) $12,000, and (b) an amount equal to $0.25 per thousand cubic feet of natural gas produced in each such month from wells that Black Raven operates for Atlas pursuant to the Contract Operating Agreement.

Pursuant to the Settlement Agreement, Atlas also agreed to pay Black Raven the sum of $687,938.50 and assign to Black Raven its rights to depth in any zone below the Niobrara formation on approximately 8,360 acres that are held by production in Phillips and Sedgwick counties in the State of Colorado. In additional, Black Raven agreed to purchase seven non-producing wells from Atlas for $150,000.

| 2 |

On April 9, 2014, pursuant to a lease purchase agreement effective as of March 31, 2014, we closed a sale to Venado Operating Company, LLC of our interests in approximately 2,250 gross acres comprising our Lonesome Dove Project in Lee County, Texas, for (i) $450,000 in cash, and (ii) the right to receive an average overriding royalty interest of approximately 2.4% in the acreage.

Effective immediately prior to the issuance and sale of shares of Series A preferred stock pursuant to this registration statement, we intend to adopt the Amended and Restated Certificate of Designation in the form attached hereto, and thereby modified the terms of the Series A preferred stock as set forth therein and as described in this prospectus. Concurrently with the adoption and filing of such Amended and Restated Certificate of Designation, the holders of our existing Series A preferred stock, which is currently convertible into shares of our common stock on a one-for-one basis upon repayment of the original principal value, will exchange each outstanding share of such existing Series A preferred stock for (i) 1 share of common stock and (ii) a number of shares of Series A preferred stock equal to the quotient determined by dividing (x) that portion of the holder's original Series A preferred stock purchase price that has not yet been paid in dividends, by (y) the original issue price per share at which we sell our shares of Series A preferred stock under this registration statement.

That share exchange will be effected under an exchange agreement in the form attached hereto. As a result of that share exchange, [ ] shares of Series A preferred stock are issued and outstanding; those shares are not being registered under this registration statement, but will be eligible for resale in the public capital markets under Rule 144. Each holder of such shares is executing with EnerJex a lock-up agreement, under which such holder has agreed not to sell such shares in the public capital markets for a period of 90 days after the date of the final prospectus.

Executive Offices

Our principal executive offices are located at 4040 Broadway, Suite 508, San Antonio, Texas 78209, and our telephone number is (210) 451-5545. Our website is www.enerjexr.com. Additional information that may be obtained through our website does not constitute part of this prospectus.

THE OFFERING

The following is a brief description of certain terms of this offering and does not purport to be complete. For a more complete description of the terms of the Series A preferred stock, see “Description of Series A Preferred Stock” beginning on page 64 of this prospectus.

| Securities we are offering: | [ ] shares of 10% Series A Cumulative Redeemable Perpetual Preferred Stock | ||

| Series A preferred stock outstanding before offering: | [ ] shares | ||

| Series A preferred stock outstanding after offering: | [ ] shares, assuming all offered shares are purchased | ||

Use of proceeds:

| We intend to use the net proceeds of this offering for general corporate purposes, including capital expenditures to accelerate the development of our oil and natural gas properties. See “Use of Proceeds” on page 23 for further information. | ||

Capital Market:

| Our Series A preferred stock is not yet listed on an exchange, and there is not an established trading market for the shares. | ||

| Best Efforts: | The underwriters are selling shares of the Series A preferred stock on a “best efforts” basis and are not required to sell any specific number or dollar amount of Series A preferred stock, but will use their best efforts to sell the Series A preferred stock offered in this prospectus.

| ||

| 3 |

| Dividends: | Holders of the Series A preferred stock will be entitled to receive, when and as declared by the board of directors, out of funds legally available for the payment of dividends, cumulative cash dividends on the Series A preferred stock at a rate of 10% per annum of the $25.00 liquidation preference per share (equivalent to $2.50 per annum per share). However, if cash dividends on any outstanding Series A preferred stock have not been paid in full for any six consecutive or non-consecutive monthly dividend periods, or if we fail to maintain the listing of the Series A preferred stock on the NYSE, NYSE MKT, NASDAQ or a successor exchange or quotation system for a period of at least 180 consecutive days, the dividend rate on the Series A preferred stock will increase to 12% per annum, which we refer to as the “Penalty Rate.” increasing by 1.0% per annum for each subsequent failure to pay a monthly dividend, up to a maximum dividend rate of 15.00% per annum. Dividends will generally be payable on the last day of each calendar month, to holders of record as of the 15th day of such calendar month. Dividends on the Series A preferred stock will accrue regardless of whether: | ||

| • | the terms of our senior shares (as defined below) or our agreements, including our credit facilities, at any time prohibit the current payment of dividends; | ||

| • | we have earnings; | ||

| • | there are funds legally available for the payment of such dividends; or | ||

| • | the dividends are declared by our board of directors. | ||

| All payments of dividends made to the holders of Series A preferred stock will be credited against the previously accrued dividends on such shares of Series A preferred stock. We will credit any dividends paid on the Series A preferred stock first to the earliest accrued and unpaid dividend due. As described more fully under “Ranking” below, the payment of dividends with respect to the Series A preferred stock is senior to any dividends to which holders of our common stock are entitled, if any. | |||

Penalties as a Result of | If, at any time, there is a dividend default because cash dividends on the outstanding Series A preferred stock are accrued but not paid in full for any monthly dividend period for a total of six consecutive or non-consecutive monthly dividend periods, or if we fail to maintain the listing of the Series A preferred stock on the NYSE, NYSE MKT, NASDAQ or a successor exchange or quotation system for a period of at least 180 consecutive days, then, until we have paid all accumulated and unpaid dividends on the shares of our Series A preferred stock in full and reinstated such listing | ||

| • | Dividends will accrue at the dividend rate of 12.00% per annum, increasing by 1.0% per annum in the case of a dividend default for each subsequent failure to pay a monthly dividend, up to a maximum dividend rate of 15.00% per annum; | ||

| • | for any period in which we fail to pay the accrued cash dividends in full on the outstanding Series A preferred stock for any six consecutive or non-consecutive monthly periods, if the dividends are not paid in cash, then dividends on the Series A preferred stock, including all accrued but unpaid dividends, will be paid by issuing to the holders thereof (i) if our common stock is then listed on a national securities exchange and to the extent permitted under the rules of the national exchange on which such shares are listed, shares of our common stock (based on the weighted average daily trading price for the 10 business day period ending on the business day immediately preceding the payment) and cash in lieu of any fractional share, or (ii) if our common stock is not listed on a national securities exchange, additional shares of Series A preferred stock with a liquidation value equal to the amount of the dividend and cash in lieu of any fractional share. | ||

| • | if the dividends are not paid in cash, then dividends on the Series A Preferred Stock, including all accrued but unpaid dividends, will be paid by issuing to the holders thereof (i) if the Corporation's common stock is then listed on a National Exchange and to the extent permitted under the rules of the National Exchange on which such shares are listed, shares of the Corporation's commonstock (based on the weighted average daily trading price for the 10 business day period ending on the business day immediately preceding the payment) and cash in lieu of any fractional share or (ii) if the Corporation's common stock is not listed on a National Exchange, additional shares of Series A Preferred Stock with a liquidation value equal to the amount of the dividend; and | ||

| 4 |

| • | the holders of Series A preferred stock, voting separately as a class with holders of all other series of parity preferred shares upon which like voting rights have been conferred and are exercisable, will have the right to elect two directors to serve on our board of directors, in addition to those directors then serving on our board of directors, until we have paid all dividends on the shares of our Series A preferred stock for all dividend periods up to and including the dividend payment date on which the accumulated and unpaid dividends are paid in full. Once we have paid all accumulated and unpaid dividends in full and have paid cash dividends at the penalty rate in full the dividend rate will be restored to the stated rate and the foregoing provisions will not be applicable unless we again fail to pay a dividend during any future monthly dividend period. |

| Optional Redemption: | We may not redeem the Series A preferred stock prior to [ ], except pursuant to the special redemption upon a Change of Control discussed below. On and after [ ], we may redeem the Series A preferred stock for cash at our option, from time to time, in whole or in part, at a redemption price of $25.00 per share, plus accrued and unpaid dividends (whether or not earned or declared) to the redemption date. | |

Special Redemption Upon Change of Ownership or Control:

| Upon the occurrence of a Change of Control, we will have the option upon written notice mailed by us, not less than 30 nor more than 90 days prior to the redemption date and addressed to the holders of record of the Series A preferred stock to be redeemed, to redeem the Series A preferred stock, in whole or in part within 120 days after the first date on which such Change of Ownership or Control occurred, for cash at the following price: |

| Redemption Date | Redemption Price per share(1) | |||

| On or before [ ], 2015 | $ | 25.75 | ||

| After [ ], 2015 and on or before [ ], 2016 | $ | 25.50 | ||

| After [ ], 2016 and on or before [ ], 2017 | $ | 25.25 | ||

| After [ ], 2017 | $ | 25.00 | ||

| (1) | plus accrued and unpaid dividends (whether or not declared), if any, up to, but not including, the redemption date |

Please see the section entitled “Description of the Series A preferred stock—Redemption” in this prospectus.

A “Change of Control” shall be deemed to have occurred on the date (i) that a “person,” “group” or “entity” (within the meaning of Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act) becomes the ultimate “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a person or group shall be deemed to have beneficial ownership of all shares of voting stock that such person or group has the right to acquire regardless of when such right is first exercisable), directly or indirectly, of voting stock representing more than 50% of the total voting power of our total voting stock; (ii) that we sell, transfer, or otherwise dispose of all or substantially all of our assets; or (iii) of the consummation of a merger or share exchange of us with another entity where our stockholders immediately prior to the merger or share exchange would not beneficially own, immediately after the merger or share exchange, securities representing 50% or more of the outstanding voting stock of the entity issuing cash or securities in the merger or share exchange (without consideration of the rights of any class of stock to elect directors by a separate group vote), or where members of our board of directors immediately prior to the merger or share exchange would not, immediately after the merger or share exchange, constitute a majority of the board of directors of the entity issuing cash or securities in the merger or share exchange. | ||

| No Maturity or Mandatory Redemption: | The Series A preferred stock does not have any stated maturity date and will not be subject to any sinking fund or mandatory redemption provisions except for redemption at our option (or the option of the acquiring entity) under some circumstances upon a Change of Ownership or Control as described above or after [ ] . |

| 5 |

| Ranking: | The Series A preferred stock will rank: (i) senior to our common stock and any other equity securities that we may issue in the future, the terms of which specifically provide that such equity securities rank junior to such Series A preferred stock, in each case with respect to payment of dividends and amounts upon liquidation, dissolution or winding up, referred to as “junior shares,” (ii) equal to any other shares of equity securities that we may issue in the future, the terms of which specifically provide that such equity securities rank on par with our Series A preferred stock, in each case with respect to payment of dividends and amounts upon liquidation, dissolution or winding up (any such issuance would require the affirmative vote of the holders of at least a majority of the outstanding shares of Series A preferred stock), referred to as “parity shares,” (iii) junior to all other equity securities issued by us, the terms of which specifically provide that such equity securities rank senior to the Series A preferred stock, in each case with respect to payment of dividends and amounts upon liquidation, dissolution or winding up (any such issuance would require the affirmative vote of the holders of at least a majority of the outstanding shares of Series A preferred stock), referred to as “senior shares,” and (iv) junior to all our existing and future indebtedness. | |

| Liquidation Preference: | If we liquidate, dissolve or wind up our operations, the holders of our Series A preferred stock will have the right to receive $25.00 per share, plus all accrued and unpaid dividends (whether or not earned or declared) to and including the date of payment, before any payments are made to the holders of our common stock and any other of our junior shares. The rights of the holders of the Series A preferred stock to receive the liquidation preference will be subject to the proportionate rights of holders of each other future series or class of parity shares and subordinate to the rights of senior shares. | |

| Voting Rights: | Holders of the Series A preferred stock will generally be entitled to vote only on changes to our articles of incorporation that would be materially adverse to the rights of holders of Series A preferred stock provided that an increase of the authorized number of shares of Series A preferred stock shall be deemed to not materially or adversely affect such rights. However, if cash dividends on any outstanding Series A preferred stock have not been paid in full for any monthly dividend period for any six consecutive or non-consecutive monthly periods, or if we fail to maintain the listing of the Series A preferred stock on the NYSE, NYSE MKT, NASDAQ, or a successor exchange or quotation system for a period of at least 180 consecutive days, then the holders of the Series A preferred stock, voting separately as a class with holders of all other series of parity shares upon which like voting rights have been conferred and are exercisable, will have the right to elect two directors to serve on our board of directors in addition to those directors then serving on our board of directors until such time as the dividend arrearage is eliminated. | |

| Material U.S. Federal Income Tax Consequences: | The material U.S. federal income tax consequences of purchasing, owning and disposing of Series A preferred stock are described in “Material U.S. Federal Income Tax Consequences” beginning on page 70 of this prospectus. You should consult your tax advisor with respect to the U.S. federal income tax consequences of owning our Series A preferred stock in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. | |

| Form: | The Series A preferred stock will be issued and maintained in book-entry form registered in the name of the nominee of The Depository Trust Company & Clearing Corporation, except under limited circumstances. | |

| Listing: | There is no established trading market for the Series A preferred stock. Subject to issuance of the shares offered hereby, we anticipate that the outstanding shares of Series A preferred stock will be listed on the NYSE MKT under the symbol "[ ]." |

| 6 |

Conversion Rights:

| The Series A preferred stock is not convertible into common stock. | |

| Risk Factors: | Investing in the Series A preferred stock involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus for a discussion of factors to consider before deciding to invest in our securities. |

RISK FACTORS

I nvesting in our securities has a significant degree of risk. Before you invest in the Series A preferred stock offered by this prospectus, you should carefully consider the risks described below, in addition to the other information presented in this prospectus. If any of the following risks actually occur, they could seriously harm our business, financial condition, results of operations or cash flows. This could cause the trading price of our Series A preferred stock to decline and you could lose all or part of your investment.

Risks Related to Ownership of Our Series A Preferred Stock

The Series A preferred stock might not have an active trading market, which could reduce its market value and your ability to sell your shares.

An active trading market for the Series A preferred stock might not exist after issuance of the Series A preferred stock offered hereby or, even if it develops, might not last, in which case the trading price of the shares could be reduced and your ability to transfer your shares of Series A preferred stock could be limited. The trading price of the shares will depend on many factors, including the following:

• prevailing interest rates;

• the market for similar securities;

• general economic conditions; and

• our financial condition, performance and prospects.

We could be prevented from paying dividends on the Series A preferred stock.

Although dividends on the Series A preferred stock are cumulative and will accrue until paid, you will receive cash dividends on the Series A preferred stock only if we have funds legally available for the payment of dividends and such payment is not restricted or prohibited by law, the terms of any senior shares, or any documents governing our indebtedness. Our business may not generate sufficient cash flow from operations to enable us to pay dividends on the Series A preferred stock when payable.

Further, pursuant to the terms of our credit facility as set forth in the Amended and Restated Credit Agreement dated effective October 3, 2011, as amended, with Texas Capital Bank, we are prohibited from declaring or paying dividends. Therefore we are currently required to receive the consent of the bank prior to declaring and making dividend payments for the Series A preferred stock, and we expect to receive such consent prior to the effectiveness of this registration statement. In addition, future debt, contractual covenants or arrangements we enter into may restrict or prevent future dividend payments. Accordingly, there is no guarantee that we will be able to pay any cash dividends on our Series A preferred stock.

| 7 |

The Series A preferred stock has not been rated and will be subordinated to all of our existing and future debt.

The Series A preferred stock has not been rated by any nationally recognized statistical rating organization. In addition, with respect to dividend rights and rights upon our liquidation, winding-up or dissolution, the Series A preferred stock will be subordinated to all of our existing and future debt. We may also incur additional indebtedness in the future to finance potential acquisitions or other activities and the terms of the Series A preferred stock do not require us to obtain the approval of the holders of the Series A preferred stock prior to incurring additional indebtedness. As a result, our existing and future indebtedness may be subject to restrictive covenants or other provisions that may prevent or otherwise limit our ability to make dividend or liquidation payments on our Series A preferred stock. Upon our liquidation, our obligations to our creditors would rank senior to our Series A preferred stock and would be required to be paid before any payments could be made to holders of our Series A preferred stock.

Investors should not expect us to redeem the Series A preferred stock on the date the Series A preferred stock becomes redeemable or on any particular date afterwards .

We generally may not redeem the Series A preferred stock prior to [ ]. On and after [ ], we may redeem the Series A preferred stock for cash at our option, from time to time, in whole or in part, at a redemption price of $25.00 per share, plus accrued and unpaid dividends (whether or not earned or declared) to the redemption date. The Series A preferred stock does not have any stated maturity date and will not be subject to any sinking fund or mandatory redemption provisions. Any decision we may make at any time to redeem the Series A preferred stock will depend upon, among other things, our evaluation of our capital position, including the composition of our stockholders’ equity and general market conditions at that time.

Holders of Series A preferred stock have extremely limited voting rights.

Except as expressly stated in the certificate of designations governing the Series A preferred stock, as a holder of Series A preferred stock, you will not have any relative, participating, optional or other special voting rights and powers and your approval will not be required for the taking of any corporate action other than as provided in the certificate of designations. For example, your approval would not be required for any merger or consolidation in which we may become involved or any sale of all or substantially all of our assets except to the extent that such transaction materially adversely changes the express powers, preferences, rights or privileges of the holders of Series A preferred stock. The provisions relating to the Series A preferred stock do not afford the holders of the Series A preferred stock protection in the event of a highly leveraged or other transaction, including a merger or the sale, lease or conveyance of all or substantially all of our assets or business, that might adversely affect the holders of the Series A preferred stock, so long as the terms and rights of the holders of Series A preferred stock are not materially and adversely changed.

The issuance of future offerings of preferred stock may adversely affect the value of our Series A preferred stock.

Our articles of incorporation, as amended, currently authorizes us to issue up to 25,000,000 shares of preferred stock in one or more series on terms that may be determined at the time of issuance by our board of directors. We may issue other classes of preferred shares that would rank on parity with or senior to the Series A preferred stock as to dividend rights or rights upon liquidation, winding up or dissolution. The creation and subsequent issuance of additional classes of preferred shares that, with the consent of a majority of the holders of the Series A preferred stock, would be senior to or on parity with our Series A preferred stock would dilute the interests of the holders of Series A preferred stock and any issuance of preferred stock that is senior to the Series A preferred stock could affect our ability to pay dividends on, redeem or pay the liquidation preference on the Series A preferred stock.

Holders of the Series A preferred stock may be unable to use the dividends-received deduction.

Distributions paid to corporate U.S. holders of the Series A preferred stock may be eligible for the dividends-received deduction if we have current or accumulated earnings and profits, as determined for U.S. federal income tax purposes. We do not currently have accumulated earnings and profits. Additionally, we may not have sufficient current earnings and profits during future fiscal years for the distributions on the Series A preferred stock to qualify as dividends for U.S. federal income tax purposes. If the distributions fail to qualify as dividends, U.S. holders would be unable to use the dividends-received deduction. If any distributions on the Series A preferred stock with respect to any fiscal year are not eligible for the dividends-received deduction because of insufficient current or accumulated earnings and profits, it is possible that the market value of the Series A preferred stock might decline.

| 8 |

Non-U.S. Holders may be subject to U.S. income tax with respect to gain on disposition of their Series A preferred stock.

If we are a U.S. real property holding corporation at any time within the five-year period preceding a disposition of Series A preferred stock by a non-U.S. holder or the holder’s holding period of the shares disposed of, whichever period is shorter, such non-U.S. holder may be subject to U.S. federal income tax with respect to gain on such disposition. If we are a U.S. real property holding corporation, which we expect we are, so long as the Series A preferred stock is regularly traded on an established securities market, a non-U.S. holder will not be subject to U.S. federal income tax on the disposition of the Series A preferred stock unless the holder beneficially owns (directly or by attribution) more than 5% of the total fair market value of the Series A preferred stock at any time during the five-year period ending either on the date of disposition of such interest or other applicable determination date. For additional information concerning these matters, see “Material U.S. Federal Income Tax Consequences.”

Our Series A preferred stock is not convertible and if the price of our common stock increases, then holders of Series A preferred stock may not realize a corresponding increase in the value of their Series A preferred stock.

Our Series A preferred stock is not convertible into our common stock and earns dividends at a fixed rate. Accordingly, the market value of our Series A preferred stock may depend on dividend and interest rates for other preferred stock, commercial paper and other investment alternatives and our actual and perceived ability to pay dividends on, and, in the event of dissolution, to satisfy the liquidation preference with respect to, our Series A preferred stock. Moreover, our right to redeem the Series A preferred stock on or after [ ] could impose a ceiling on its value.

Risks Related to the Oil and Natural Gas Industry and Our Business

in General

Declining economic conditions and worsening geopolitical conditions could negatively impact our business

Our operations are affected by local, national and worldwide economic conditions. Markets in the United States and elsewhere have been experiencing extreme volatility and disruption for more than 5 years, due in part to the financial stresses affecting the liquidity of the banking system and the financial markets generally. The consequences of a potential or prolonged recession may include a lower level of economic activity and uncertainty regarding energy prices and the capital and commodity markets.

In addition, actual and attempted terrorist attacks in the United States, Middle East, Southeast Asia and Europe, and war or armed hostilities in the Middle East, the Persian Gulf, North Africa, Iran, North Korea or elsewhere, or the fear of such events, could further exacerbate the volatility and disruption to the financial markets and economy.

While the ultimate outcome and impact of the current economic conditions cannot be predicted, a lower level of economic activity might result in a decline in energy consumption, which may materially adversely affect the price of oil and gas, our revenues, liquidity and future growth. Instability in the financial markets, as a result of recession or otherwise, also may affect the cost of capital and our ability to raise capital.

The oil and natural gas business involves numerous uncertainties and operating risks that can prevent us from realizing profits and can cause substantial losses.

Our development, exploitation and exploration activities may be unsuccessful for many reasons, including weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of a well does not ensure a profit on investment. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economical. In addition to their cost, unsuccessful wells can hurt our efforts to replace reserves.

| 9 |

The oil and natural gas business involves a variety of operating risks, including:

| · unexpected operational events and/or conditions; |

| · reductions in oil and natural gas prices; |

| · limitations in the market for oil and natural gas; |

| · adverse weather conditions; |

| · facility or equipment malfunctions; |

| · title problems; |

| · oil and gas quality issues; |

| · pipe, casing, cement or pipeline failures; |

| · natural disasters; |

| · fires, explosions, blowouts, surface cratering, pollution and other risks or accidents; |

| · environmental hazards, such as oil spills, pipeline ruptures and discharges of toxic gases; |

| · compliance with environmental and other governmental requirements; and |

| · uncontrollable flows of oil or natural gas or well fluids. |

If we experience any of these problems, it could affect well bores, gathering systems and processing facilities, which could adversely affect our ability to conduct operations. We could also incur substantial losses as a result of:

| · injury or loss of life; |

| · severe damage to and destruction of property, natural resources and equipment; |

| · pollution and other environmental damage; |

| · clean-up responsibilities; |

| · regulatory investigation and penalties; |

| · suspension of our operations; and |

| · repairs to resume operations. |

Because we use third-party drilling contractors to drill our wells, we may not realize the full benefit of worker compensation laws in dealing with their employees. Our insurance does not protect us against all operational risks. We do not carry business interruption insurance at levels that would provide enough funds for us to continue operating without access to other funds. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. In addition, pollution and environmental risks generally are not fully insurable. If a significant accident or other event occurs and is not fully covered by insurance, it could impact our operations enough to force us to cease our operations.

Drilling wells is speculative, and any material inaccuracies in our forecasted drilling costs, estimates or underlying assumptions will materially affect our business.

Developing and exploring for oil and natural gas involves a high degree of operational and financial risk, which precludes definitive statements as to the time required and costs involved in reaching certain objectives. The budgeted costs of drilling, completing and operating wells are often exceeded and can increase significantly when drilling costs rise due to a tightening in the supply of various types of oilfield equipment and related services. Drilling may be unsuccessful for many reasons, including geological conditions, weather, cost overruns, equipment shortages and mechanical difficulties. Moreover, the successful drilling of an oil or gas well does not ensure a profit on investment. Exploratory wells bear a much greater risk of loss than development wells. Substantially all of EnerJex's wells drilled through December 31, 2013 have been development wells, while a majority of the wells drilled by Black Raven have been considered by Black Raven to be development wells. A variety of factors, both geological and market-related, can cause a well to become uneconomical or only marginally economic. Our initial drilling and development sites, and any potential additional sites that may be developed, require significant additional exploration and development, regulatory approval and commitments of resources prior to commercial development. If our actual drilling and development costs are significantly more than our estimated costs, we may not be able to continue our business operations as proposed and would be forced to modify our plan of operation.

| 10 |

Development of our reserves, when established, may not occur as scheduled and the actual results may not be as anticipated. Drilling activity and lack of access to economically acceptable capital may result in downward adjustments in reserves or higher than anticipated costs. Our estimates will be based on various assumptions, including assumptions over which we have no control and assumptions required by the SEC relating to oil and gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. We have limited control over our operations that affect, among other things, acquisitions and dispositions of properties, availability of funds, use of applicable technologies, hydrocarbon recovery efficiency, drainage volume and production decline rates that are part of these estimates and assumptions and any variance in our operations that affects these items within our control may have a material effect on reserves. The process of estimating our oil and gas reserves is extremely complex, and requires significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each reservoir. Our estimates may not be reliable enough to allow us to be successful in our intended business operations. Our actual production, revenues, taxes, development expenditures and operating expenses will likely vary from those anticipated. These variances may be material.

Unless we replace our oil and natural gas reserves, our reserves and production will decline, which would adversely affect our cash flows and income.

Unless we conduct successful development, exploitation and exploration activities or acquire properties containing proved reserves, our proved reserves will decline as those reserves are produced. Producing oil and gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our future oil and gas production, and, therefore our cash flow and income, are highly dependent on our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves. We may be unable to make such acquisitions because we are:

| · unable to identify attractive acquisition candidates or negotiate acceptable purchase contracts with them; |

| · unable to obtain financing for these acquisitions on economically acceptable terms; or |

| · outbid by competitors. |

If we are unable to develop, exploit, find or acquire additional reserves to replace our current and future production, our cash flow and income will decline as production declines, until our existing properties would be incapable of sustaining commercial production.

Our decision to acquire a property will depend in part on the evaluation of data obtained from production reports and engineering studies, geophysical and geological analyses and seismic and other information, the results of which are often incomplete or inconclusive.

Our reviews of acquired properties can be inherently incomplete because it is not always feasible to perform an in-depth review of the individual properties involved in each acquisition. Even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it permit a buyer to become sufficiently familiar with the properties to assess fully their deficiencies and potential. Inspections may not always be performed on every well, and environmental problems, such as ground water contamination, plugging or orphaned well liability are not necessarily observable even when an inspection is undertaken.

We must obtain governmental permits and approvals for drilling operations, which can result in delays in our operations, be a costly and time consuming process, and result in restrictions on our operations.

Regulatory authorities exercise considerable discretion in the timing and scope of well drilling permit issuances in the region in which we operate. Compliance with the requirements imposed by these authorities can be costly and time consuming and may result in delays in the commencement or continuation of our exploration or production operations and/or fines. Regulatory or legal actions in the future may materially interfere with our operations or otherwise have a material adverse effect on us. In addition, we are often required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that a proposed project may have on the environment, threatened and endangered species, and cultural and archaeological artifacts. Accordingly, the well drilling permits we need may not be issued, or if issued, may not be issued in a timely fashion, or may involve requirements that restrict our ability to conduct our operations or to do so profitably.

| 11 |

Cost and availability of drilling rigs, equipment, supplies, personnel and other services could adversely affect our ability to execute on a timely basis our development, exploitation and exploration plans.

Shortages or an increase in cost of drilling rigs, equipment, supplies or personnel could delay or interrupt our operations, which could impact our financial condition and results of operations. Drilling activity in the geographic areas in which we conduct drilling activities may increase, which would lead to increases in associated costs, including those related to drilling rigs, equipment, supplies and personnel and the services and products of other vendors to the industry. Increased drilling activity in these areas may also decrease the availability of rigs. We do not have any contracts for drilling rigs and drilling rigs may not be readily available when we need them. Drilling and other costs may increase further and necessary equipment and services may not be available to us at economical prices.

Our exposure to possible leasehold defects and potential title failure could materially adversely impact our ability to conduct drilling operations.

We obtain the right and access to properties for drilling by obtaining oil and natural gas leases either directly from the hydrocarbon owner, or through a third party that owns the lease. The leases may be taken or assigned to us without title insurance. There is a risk of title failure with respect to such leases, and such title failures could materially adversely impact our business by causing us to be unable to access properties to conduct drilling operations.

We operate in a highly competitive environment and our competitors may have greater resources than do we.

The oil and natural gas industry is intensely competitive and we compete with other companies, many of which are larger and have greater financial, technological, human and other resources. Many of these companies not only explore for and produce crude oil and/or natural gas, but also carry on refining operations and market petroleum and other products on a regional, national or worldwide basis. Such companies may be able to pay more for productive oil and properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, such companies may have a greater ability to continue exploration activities during periods of low oil and gas market prices. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. If we are unable to compete, our operating results and financial position may be adversely affected.

Oil and natural gas prices are volatile. Future volatility may cause negative change in our cash flows which may result in our inability to cover our operating or capital expenditures.

Our future revenues, profitability, future growth and the carrying value of our properties is anticipated to depend substantially on the prices we may realize for our oil and natural gas production. Our realized prices may also affect the amount of cash flow available for operating or capital expenditures and our ability to borrow and raise additional capital.

Oil and natural gas prices are subject to wide fluctuations in response to relatively minor changes in or perceptions regarding supply and demand. Historically, the markets for oil and natural gas have been volatile, and they are likely to continue to be volatile in the future. Among the factors that can cause this volatility are:

| · | Commodities speculators; | |

| · | local, national and worldwide economic conditions; | |

| · | worldwide or regional demand for energy, which is affected by economic conditions; | |

| · | the domestic and foreign supply of oil and gas; | |

| · | weather conditions; | |

| · | natural disasters; | |

| · | acts of terrorism; | |

| · | domestic and foreign governmental regulations and taxation; | |

| · | political and economic conditions in oil producing countries, including those in the Middle East and South America; | |

| · | impact of the U.S. dollar exchange rates on oil prices; | |

| · | the availability of refining capacity; |

| 12 |

| · | actions of the Organization of Petroleum Exporting Countries, or OPEC, and other state controlled oil companies relating to oil price and production controls; and | |

| · | the price and availability of other fuels. |

It is impossible to predict oil and gas price movements with certainty. A drop in prices may not only decrease our future revenues on a per unit basis but also may reduce the amount of oil and gas that we can produce economically. A substantial or extended decline in oil and gas prices may materially and adversely affect our future business enough to force us to cease our business operations. In addition, our reserves, financial condition, results of operations, liquidity and ability to finance and execute planned capital expenditures will also suffer in such a price decline.

Lower prices for oil and natural gas reduce demand for our services and could have a material adverse effect on our revenue and profitability.

Benchmark crude prices peaked at over $140 per barrel in July 2008 and then declined to approximately $92 per barrel at year-end 2012. During 2013, the benchmark for crude prices fluctuated between $85 per barrel and $110 per barrel. Demand for our services depends on oil and natural gas industry activity and expenditure levels that are directly affected by trends in oil and natural gas prices. In addition, demand for our services is particularly sensitive to the level of exploration, development and production activity of and the corresponding capital spending by, oil and natural gas companies. Any prolonged reduction in oil and natural gas prices could depress the near-term levels of exploration, development, and production activity. Perceptions of longer-term lower oil and natural gas prices by oil and natural gas companies could similarly reduce or defer major expenditures given the long-term nature of many large-scale development projects. Lower levels of activity result in a corresponding decline in the demand for our services, which could have a material adverse effect on our revenue and profitability. Additionally, these factors may adversely impact our financial position if they are determined to cause an impairment of our long-lived assets.

Our business is affected by local, national and worldwide economic conditions and the condition of the oil and natural gas industry.

Recent economic data indicates the rate of economic growth worldwide has declined significantly from the growth rates experienced in recent years. Current economic conditions have resulted in uncertainty regarding energy and commodity prices. In addition, future economic conditions may cause many oil and natural gas production companies to further reduce or delay expenditures in order to reduce costs, which in turn may cause a further reduction in the demand for drilling services. If conditions worsen, our business and financial condition may be adversely impacted.

Our business involves numerous operating hazards, and our insurance and contractual indemnity rights may not be adequate to cover our losses.

Our operations are subject to the usual hazards inherent in the drilling and operation of oil and natural gas wells, such as blowouts, reservoir damage, loss of production, loss of well control, punch throughs, craterings, fires and pollution. The occurrence of these events could result in the suspension of drilling or production operations, claims by the operator and others affected by such events, severe damage to, or destruction of, the property and equipment involved, injury or death to drilling personnel, environmental damage and increased insurance costs. We may also be subject to personal injury and other claims of drilling personnel as a result of our drilling operations. Operations also may be suspended because of machinery breakdowns, abnormal operating conditions, failure of subcontractors to perform or supply goods or services and personnel shortages.

Damage to the environment could result from our operations, particularly through oil spillage or extensive uncontrolled fires. We may also be subject to property, environmental and other damage claims by host governments, oil and natural gas companies and other businesses operating offshore and in coastal areas, as well as claims by individuals living in or around coastal areas.

| 13 |

As is customary in our industry, the risks of our operations are partially covered by our insurance and partially by contractual indemnities from our customers. However, insurance policies and contractual rights to indemnity may not adequately cover losses, and we may not have insurance coverage or rights to indemnity for all risks. Moreover, pollution and environmental risks generally are not fully insurable. If a significant accident or other event resulting in damage to our drilling units, including severe weather, terrorist acts, war, civil disturbances, pollution or environmental damage, occurs and is not fully covered by insurance or a recoverable indemnity from a customer, it could adversely affect our financial condition and results of operations.

Our business is subject to numerous governmental laws and regulations, including those that may impose significant costs and liability on us for environmental and natural resource damages.

Many aspects of our operations are affected by governmental laws and regulations that may relate directly or indirectly to the contract drilling industry, including those requiring us to control the discharge of oil and other contaminants into the environment or otherwise relating to environmental protection. Countries where we currently operate have environmental laws and regulations covering the discharge of oil and other contaminants and protection of the environment in connection with operations. Additionally, our operations and activities in the United States and its territorial waters are subject to numerous environmental laws and regulations, including the Clean Water Act, the OPA, the Outer Continental Shelf Lands Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Clean Air Act, the Resource Conservation and Recovery Act and MARPOL. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations, the denial or revocation of permits or other authorizations and the issuance of injunctions that may limit or prohibit our operations.

Laws and regulations protecting the environment have become more stringent in recent years and may in certain circumstances impose strict liability, rendering us liable for environmental and natural resource damages without regard to negligence or fault on our part. These laws and regulations may expose us to liability for the conduct of, or conditions caused by, others or for acts that were in compliance with all applicable laws at the time the acts were performed. The application of these requirements, the modification of existing laws or regulations or the adoption of new laws or regulations relating to exploratory or development drilling for oil and natural gas could materially limit future contract drilling opportunities or materially increase our costs. In addition, we may be required to make significant capital expenditures to comply with such laws and regulations.

In addition, some financial institutions are imposing, as a condition to financing, requirements to comply with additional non-governmental environmental and social standards in connection with operations outside the United States, such as the Equator Principles, a credit risk management framework for determining, assessing and managing environmental and social risk in project finance transactions. Such additional standards could impose significant new costs on us, which may materially and adversely affect us.

Changes in U.S. federal laws and regulations, or in those of other jurisdictions where we operate, including those that may impose significant costs and liability on us for environmental and natural resource damages, may adversely affect our operations.

If the U.S. government amends or enacts new federal laws or regulations, our potential exposure to liability for operations and activities in the United States and its territorial waters may increase. Although the Oil Pollution Act of 1990 provides federal caps on liability for pollution or contamination, future laws and regulations may increase our liability for pollution or contamination resulting from any operations and activities that the Company may have in the United States and its territorial waters including punitive damages and administrative, civil and criminal penalties. Additionally, other jurisdictions where we operate have modified, or may in the future modify, their laws and regulations in a manner that would increase our liability for pollution and other environmental damage.

| 14 |

Our financial condition may be adversely affected if we are unable to identify and complete future acquisitions, fail to successfully integrate acquired assets or businesses we acquire, or are unable to obtain financing for acquisitions on acceptable terms.

The acquisition of assets or businesses that we believe to be complementary to our exploration and production operations is an important component of our business strategy. We believe that acquisition opportunities for EnerJex, such as the merger with Black Raven, may arise from time to time, and that any such acquisition could be significant. At any given time, discussions with one or more potential sellers may be at different stages. However, any such discussions may not result in the consummation of an acquisition transaction, and we may not be able to identify or complete any acquisitions. We cannot predict the effect, if any, that any announcement or consummation of an acquisition would have on the trading price of our securities. Our business is capital intensive and any such transactions could involve the payment by us of a substantial amount of cash. We may need to raise additional capital through public or private debt or equity financings to execute our growth strategy and to fund acquisitions. Adequate sources of capital may not be available when needed on favorable terms. If we raise additional capital by issuing additional equity securities, existing stockholders may be diluted. If our capital resources are insufficient at any time in the future, we may be unable to fund acquisitions, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

Any future acquisitions could present a number of risks, including:

| · | the risk of using management time and resources to pursue acquisitions that are not successfully completed; | |

| · | the risk of incorrect assumptions regarding the future results of acquired operations; | |

| · | the risk of failing to integrate the operations or management of any acquired operations or assets successfully and timely; and | |

| · | the risk of diversion of management's attention from existing operations or other priorities. |

If we are unsuccessful in completing acquisitions of other operations or assets, our financial condition could be adversely affected and we may be unable to implement an important component of our business strategy successfully. In addition, if we are unsuccessful in integrating our acquisitions in a timely and cost-effective manner, our financial condition and results of operations could be adversely affected.

The loss of some of our key executive officers and employees could negatively impact our business prospects.

Our future operational performance depends to a significant degree upon the continued service of key members of our management as well as marketing, sales and operations personnel. The loss of one or more of our key personnel could have a material adverse effect on our business. We believe our future success will also depend in large part upon our ability to attract, retain and further motivate highly skilled management, marketing, sales and operations personnel. We may experience intense competition for personnel, and we cannot assure you that we will be able to retain key employees or that we will be successful in attracting, assimilating and retaining personnel in the future.

Failure to employ a sufficient number of skilled workers or an increase in labor costs could hurt our operations.