UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | |

| Filed by the Registrant | x | Filed by a Party other than the Registrant | ¨ |

Check the appropriate box:

| | | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | |

| ENCORE WIRE CORPORATION |

| (Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | |

| x | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | | | | | | | |

| ¨ | Fee paid previously with preliminary materials. |

| |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

ENCORE WIRE CORPORATION

1329 Millwood Road

McKinney, Texas 75069

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 4, 2021

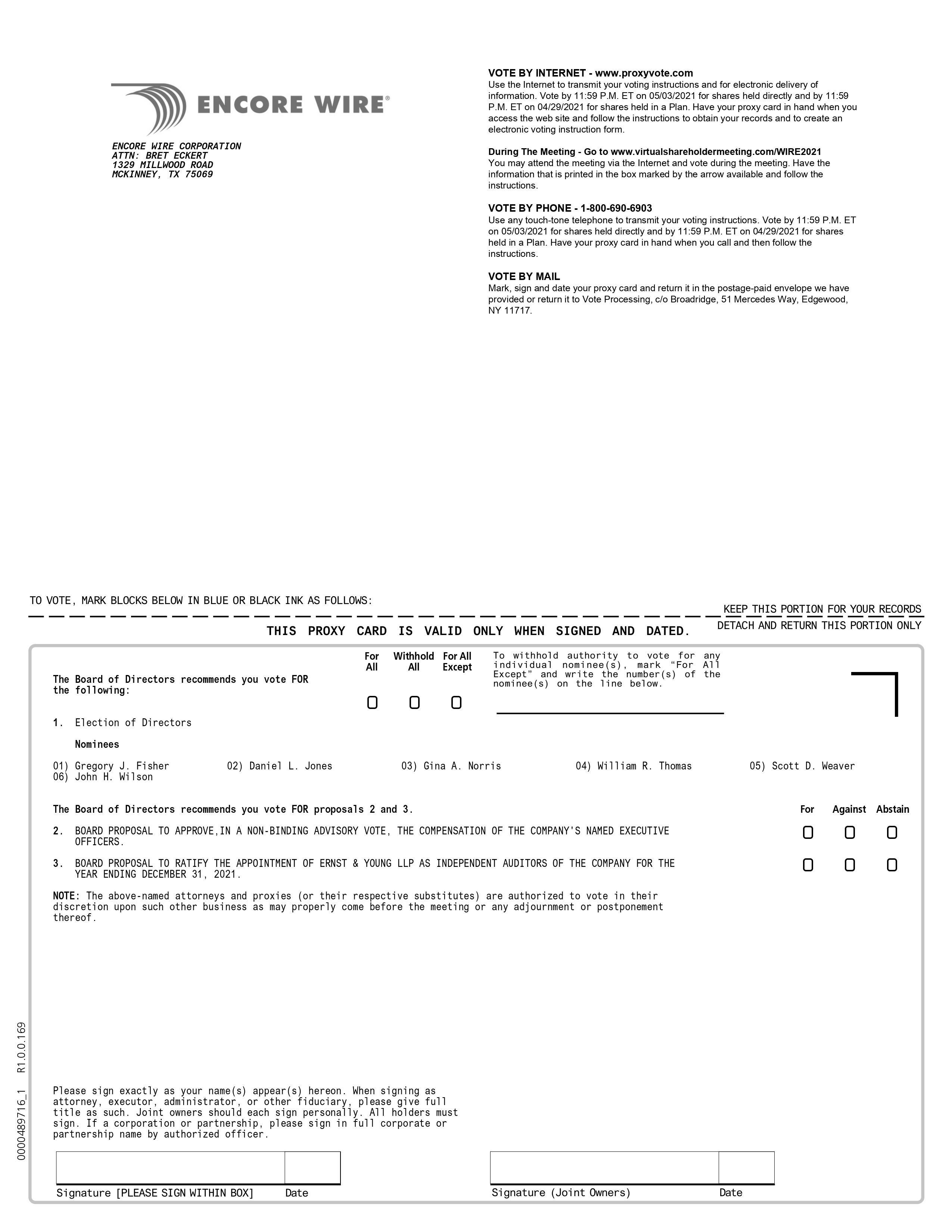

NOTICE is hereby given that the annual meeting of stockholders of Encore Wire Corporation (the “Company”) will be held in a live virtual meeting format only, via webcast, at www.virtualshareholdermeeting.com/WIRE2021, on Tuesday, May 4, 2021, at 9:00 a.m., Central time, for the following purposes:

1. To elect a Board of Directors for the ensuing year;

2. To approve, in a non-binding advisory vote, the compensation of the Company’s named executive officers;

3. To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for the year ending December 31, 2021; and

4. To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on March 18, 2021 are entitled to notice of and to vote at the meeting or any adjournment or postponement thereof.

You can attend the meeting online, submit questions and vote shares electronically during the annual meeting by visiting www.virtualshareholdermeeting.com/WIRE2021 at the time of the meeting. Online check-in will begin at 8:45 a.m., Central time, and you should allow approximately 15 minutes for the online check-in procedure. Please have the control number on your proxy card available for check-in. Prior to the date of the annual meeting, you will be able to vote at www.proxyvote.com, and the proxy materials will be available at that site. You may also vote prior to the date of the meeting by telephone by calling 1-800-690-6903. Please consult your proxy card for additional information regarding these alternative methods. Questions submitted during the meeting will be subject to standard screening criteria such as relevancy, tone and elimination of redundancy. The Company will plan to post appropriate questions received during the meeting and the Company’s answers to those questions on its website.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. The Company’s 2020 Annual Report, containing a record of the Company’s activities and financial statements for the year ended December 31, 2020, is also enclosed.

Dated: March 22, 2021

By Order of the Board of Directors

BRET J. ECKERT

Secretary

YOUR VOTE IS IMPORTANT.

THE ENCLOSED PROXY ALLOWS YOU TO VOTE BY INTERNET BEFORE THE MEETING, VOTE BY INTERNET AT THE MEETING, VOTE BY PHONE OR VOTE BY MAIL. IF YOU CHOOSE TO VOTE BY MAIL, PLEASE MARK, SIGN AND DATE THE ENCLOSED PROXY AND RETURN IT PROMPTLY IN THE ACCOMPANYING ENVELOPE. THE PROMPT RETURN OF PROXIES WILL INSURE A QUORUM AND SAVE THE COMPANY THE EXPENSE OF FURTHER SOLICITATION.

ENCORE WIRE CORPORATION

1329 Millwood Road

McKinney, Texas 75069

PROXY STATEMENT

For Annual Meeting of Stockholders

To be Held on May 4, 2021

GENERAL

The accompanying proxy is solicited by the Board of Directors (the “Board” or the “Board of Directors”) of Encore Wire Corporation (the “Company” or “Encore Wire” or “Encore”) for use at the annual meeting of stockholders of the Company to be held at the time and for the purposes set forth in the foregoing notice. Due to concerns relating to COVID-19, the meeting will be held completely virtually. The approximate date on which this proxy statement and the accompanying proxy are first being sent to stockholders is March 29, 2021.

The cost of soliciting proxies will be borne by the Company. The Company may use certain of its officers and employees (who will receive no special compensation therefor) to solicit proxies in person or by telephone, facsimile, telegraph or similar means.

Proxies

Shares entitled to vote and provided either via the Internet or by telephone or represented by a proxy in the accompanying form duly signed, dated and returned to the Company and not revoked, will be voted at the meeting in accordance with the directions given. If no direction is given, such shares will be voted for the election of the nominees for directors named in the accompanying form of proxy and in accordance with the recommendations of the Board of Directors on the other proposals listed on the proxy card and at the proxies’ discretion on any other matter that may properly come before the meeting. Any stockholder returning a proxy may revoke it at any time before it has been exercised by giving written notice of such revocation to the Secretary of the Company, by filing with the Company a proxy bearing a subsequent date or by voting online at the meeting. Authorizing your proxy will not limit your right to participate in the virtual annual meeting and vote your shares online. Participating in the virtual annual meeting does not revoke your proxy unless you also vote online at the annual meeting.

Attending the Annual Meeting

Due to the COVID-19 pandemic and for the health and safety of our shareholders, employees, and families, we will be hosting the annual meeting live via the Internet. You will not be able to attend the annual meeting in person. The annual meeting will only be held virtually at www.virtualshareholdermeeting.com/WIRE2021. Shareholders of record as of the close of business on March 18, 2021, the record date, or their legal proxy holders, are entitled to attend the annual meeting. To be admitted to the annual meeting, you must log-in using the 16-digit control number found on your proxy card or Voter Instruction Form. The annual meeting will begin promptly at 9:00 a.m., Central time, on Tuesday, May 4, 2021. We encourage you to access the annual meeting prior to the start time. Online access will begin at 8:45 a.m., central time. Instructions on how to connect and participate in the annual meeting are posted at www.virtualshareholdermeeting.com/WIRE2021.

Shareholders will have substantially the same opportunities to participate as they would have at an in-person meeting. Shareholders may submit questions while connected to the annual meeting on the Internet. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/WIRE2021, typing the question into the “Ask a Question” field and clicking “Submit”. Additional information regarding the ability of shareholders to ask questions during the annual meeting will be set forth in the annual meeting’s Rules of Conduct, which will be made available within the virtual annual meeting platform.

If shareholders encounter any difficulties accessing the annual meeting webcast during the check-in or meeting time, there will be a technical support number posted on the virtual meeting login page for assistance. Technical support will be available beginning at 8:45 a.m., Central time, on May 4, 2021 through the conclusion of the annual meeting. The virtual annual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari), and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Shareholders should ensure that they have a strong Internet connection if they intend to attend and/or participate in the annual meeting. Shareholders should allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the annual meeting.

Voting Procedures and Tabulation

The Company will appoint one or more inspectors of election to conduct the voting at the meeting. Prior to the meeting, the inspectors will sign an oath to perform their duties in an impartial manner and to the best of their abilities. The inspectors will ascertain the number of shares outstanding and the voting power of each share, determine the shares represented at the meeting and the validity of proxies and ballots, count all votes and ballots and perform certain other duties as required by law. The inspectors will tabulate the

number of votes cast for or withheld as to the vote on each nominee for director and the number of votes cast for, against or withheld, as well as the number of abstentions and broker non-votes, as applicable, with respect to the other proposals listed on the proxy card and any other matter that may properly come before the meeting.

Quorum and Voting Requirements

A majority of shares of the outstanding common stock, par value $0.01 per share (“Common Stock”), present in person or by proxy, is necessary to constitute a quorum. Abstentions are counted as present at the meeting for purposes of determining whether a quorum exists. Broker non-votes only count towards quorum if at least one proposal on the proxy is considered a routine matter under New York Stock Exchange (“NYSE”) Rule 452. A broker non-vote occurs when a broker or other nominee returns a proxy but does not vote on a particular proposal because the broker or nominee does not have authority to vote on that particular item and has not received voting instructions from the beneficial owner. Under NYSE Rule 452, brokers have the authority to vote such shares on routine matters, but not on non-routine matters. Routine matters include the proposal to ratify the appointment of the auditors, but do not include the election of directors or the approval, in a non-binding advisory vote, of the compensation of the Company’s named executive officers.

The only voting security of the Company outstanding is its Common Stock. Only the holders of record of shares of Common Stock at the close of business on March 18, 2021, the record date for the meeting, are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. On the record date, there were 20,634,145 shares of Common Stock outstanding and entitled to be voted at the meeting. Each share of Common Stock is entitled to one vote.

Election of Directors. Directors are elected by a plurality of the votes of the shares of Common Stock present virtually or represented by proxy at the meeting and entitled to vote on the election of directors, subject to the Company’s Majority Voting Policy described in further detail below. This means that the six nominees receiving the highest number of votes cast for the number of positions to be filled will be elected, subject to the Company’s Majority Voting Policy. Cumulative voting is not permitted. New York Stock Exchange Rule 452 prohibits brokers from casting discretionary votes in any election of directors. Under Delaware law and the Company’s Certificate of Incorporation and Bylaws, abstentions and broker non-votes will have no effect on voting on the election of directors, provided a quorum is present.

Majority Voting Policy. In February 2013, the Board adopted the Company’s Majority Voting Policy, pursuant to which a director nominee that is not elected by a majority of the votes cast in an uncontested election must tender such director’s resignation promptly following the failure to receive the required vote. This means that the number of votes cast “for” a director nominee must exceed the number of votes “withheld” from that nominee. Abstentions and broker non-votes are not counted as votes “for” or “withheld” from a director nominee. Following a director’s resignation under the policy, the Nominating and Corporate Governance Committee would then be required to make a recommendation to the Board as to whether the Board should accept the resignation, and the Board would be required to decide whether to accept the resignation and to disclose its decision-making process. In contested elections, the required vote is a plurality of votes cast.

Non-Binding Approval of Say on Pay. The advisory vote on the proposal to approve the compensation of the Company’s named executive officers, commonly known as “say on pay” is non-binding. The affirmative vote of a majority of the holders of shares of Common Stock having voting power present virtually or represented by proxy is required for the non-binding approval of the say on pay proposal. Abstentions will have the effect of votes against the say on pay proposal, but broker non-votes and other limited proxies will have no effect on the say on pay proposal.

Ratification of Appointment of Independent Auditors. The proposal to ratify the appointment of auditors must be approved by a vote of a majority of the holders of shares of Common Stock having voting power present virtually or represented by proxy. An abstention with respect to such proposal will therefore effectively count as a vote against the proposal. Ratification of the appointment of the Company’s independent auditors is a routine matter to which a broker has authority to cast discretionary votes if the broker has not received voting instructions from the beneficial owner of such shares at least ten days before the annual meeting. Broker discretionary votes as to the proposal to ratify the appointment of independent auditors will be counted towards a meeting quorum and will be considered a part of the voting power with respect to such proposal.

PROPOSAL ONE

ELECTION OF DIRECTORS

The business and affairs of the Company are managed by the Board of Directors, which exercises all corporate powers of the Company and establishes broad corporate policies. The Bylaws of the Company provide for a minimum of five directors, with such number of directors to be fixed by the Board of Directors from time to time. The Board of Directors has fixed at six the number of directors that will constitute the full Board of Directors. Therefore, six directors will be elected at the annual meeting.

All duly submitted and unrevoked proxies will be voted for the nominees for director selected by the Board of Directors, except where authorization to vote is withheld. If any nominee should become unavailable for election for any presently unforeseen reason, the

persons designated as proxies will have full discretion to vote for another person designated by the Board. Directors are elected to serve until the next annual meeting of stockholders and until their successors have been elected and qualified.

The nominees of the Board for directors of the Company are named below. Each of the nominees has consented to serve as a director if elected. The table below sets forth certain information with respect to the nominees, including the ages of the nominees as of the date of the annual meeting of stockholders and their business experience. All of the nominees are presently directors of the Company. With the exception of John H. Wilson, all of the nominees have served continuously as directors since the date of their first election or appointment to the Board. Mr. Wilson served as a director of the Company from April 1989 until May 1993 and was re-elected to the Board in May 1994.

| | | | | |

| Gregory J. Fisher, age 70, Director since February 2012. | Mr. Fisher was the Chief Financial Officer of Taylor Companies, LLC, a private oil field transportation company, from 2008 to 2010. Mr. Fisher was the Senior Vice President, Chief Financial Officer and Controller of ElkCorp, a formerly publicly-traded company in the building materials industry, from 2004 until it was acquired by another company in 2007. Mr. Fisher had also previously served as the Vice President Finance and Administration of Elk, a subsidiary of ElkCorp, from 1985 to 2004. Mr. Fisher serves on the Advisory Board of The Catholic Foundation of Dallas. Mr. Fisher also serves on the Parish Leadership Team of his church in Allen, Texas and is a seed investor in a private internet startup company, LocoValue, Inc. He is also a Certified Management Accountant. Mr. Fisher was selected as a nominee to serve as a director of the Company due to his extensive experience in the building materials industry and his understanding of public company finance, financial reporting and internal control gained while serving a public company. |

| |

| Daniel L. Jones, age 57, Director since May 1992 and Chairman since November 2014. | Mr. Jones has held the office of President and Chief Executive Officer of the Company since February 2006. He performed the duties of the Chief Executive Officer in an interim capacity from May 2005 to February 2006. From May 1998 until February 2006, Mr. Jones was President and Chief Operating Officer of the Company. He previously held the positions of Chief Operating Officer from October 1997 until May 1998, Executive Vice President from May 1997 to October 1997, Vice President-Sales and Marketing from 1992 to May 1997, after serving as Director of Sales since joining the Company in November 1989. Mr. Jones currently serves as a director of Baylor Scott & White Medical Center - McKinney. Mr. Jones was selected as a nominee to serve as a director of the Company due to his depth of knowledge of the Company, including its strategies, operations, supply sources and markets, his extensive knowledge of the building wire industry and his past and present positions with the Company. |

| |

| Gina A Norris, age 62, Director since May 2020 | Ms. Norris has been Senior Vice President, Partner Relations at Matthews Southwest, a private real estate development company, since 2013. Ms. Norris also serves as an independent director of Texas Security Bankshares, Inc., a privately-held bank holding company, and as a director of the State Fair of Texas, a private nonprofit, where she was elected Board Chair in 2019. From 2010 to 2012, Ms. Norris was president of Stratford Lending, an affiliate of Stratford Land, a private real estate investment fund based in Dallas, Texas. From 2000 to 2010, Ms. Norris served as Managing Director at Crow Holdings, a private investment company, where she was responsible for a portfolio of investments in real estate, industrial manufacturing and real estate-based operating businesses in the U.S. and Europe. Ms. Norris started her career in 1982, spending eighteen years in corporate banking at First Chicago and Bank One. Ms. Norris was selected as nominee to serve as a director of the Company due to her board experience in the fields of banking, industrial manufacturing and real estate, serving on the boards of four privately-held companies and numerous nonprofit and civic entities in various positions including board chair, audit committee chair and compensation committee chair. Ms. Norris is a CFA charterholder and brings to the Board her qualifications as an audit committee financial expert as well as expertise in assisting portfolio companies in value enhancement, stakeholder alignment and strategic planning. |

| |

| | | | | |

| William R. Thomas, age 49, Director since May 2007. | Mr. Thomas is a private investor who invests in, and provides leadership for, organizations that create financial return, social impact or both. He also serves as a director of Capital Southwest Corporation, a credit-focused business development company that is an active capital provider to middle market companies. Mr. Thomas served at Capital Southwest as Vice President from July 2010 to September 2012, Assistant Vice President from July 2008 to July 2010, and Investment associate from July 2006 until July 2008. During this time, Mr. Thomas made, enhanced and monetized investments in stand-alone private companies and add-on opportunities, served on the boards of eleven private companies, and oversaw valuation and regulatory compliance. From 2004 to 2006, Mr. Thomas earned his M.B.A. from Harvard Business School. During a portion of his time at Harvard, he served as a consultant to private equity clients at Investor Group Services. From 1993 through 2004, Mr. Thomas served in the U.S. Air Force as a pilot in multiple aircraft and a leader in areas of training, safety, acquisitions and logistics operations, achieving the rank of Major. He has served as President of the Thomas Heritage Foundation, a nonprofit grant-making corporation, since 2008. Mr. Thomas is recognized as a National Association of Corporate Directors (NACD) Board Leadership Fellow and graduated from the United States Air Force Academy. Mr. Thomas was selected as nominee to serve as a director of the Company due to his experience serving on the boards of eleven privately-held companies, one publicly-traded company and three nonprofit entities in various positions including treasurer, chairman, compliance officer, compensation committee chair and nominating and governance committee chair. Mr. Thomas brings to the Board his expertise in assisting portfolio companies in acquisition analysis, new product development planning and strategic planning. |

| |

| Scott D. Weaver, age 62, Director since May 2002. | Mr. Weaver served as a director of Western Refining, Inc., a public refining and marketing company located in El Paso, Texas from 2005 until it was sold in June 2017. Mr. Weaver served as Vice President of Western Refining from December 2007 until December 2016. From August 2009 to January 2010, Mr. Weaver served as interim Treasurer of Western Refining. From August 2005 to December 2007, Mr. Weaver served as Chief Administrative Officer of Western Refining and from June 2000 to August 2005, Mr. Weaver served as Chief Financial Officer of Western Refining. From 1993 until June 2000, Mr. Weaver was the Vice President-Finance, Treasurer and Secretary of Encore Wire. Mr. Weaver also served on the board of managers of Western Refining Logistics GP, LLC, the general partner of Western Refining Logistics, L.P., a publicly-traded master limited partnership with logistics operations in the oil and gas industry until June 2017, and he served on the board of managers of Northern Tier Energy GP LLC from 2013 until 2016. Mr. Weaver was selected as a nominee to serve as a director of the Company due to his valuable knowledge of the building wire industry and familiarity with the Company gained while serving as an officer of the Company and his extensive knowledge of finance and public accounting. |

| |

| John H. Wilson, age 78, Director from 1989 until May 1993 and since May 1994 and Lead Independent Director since November 2014. | Mr. Wilson has been President of U.S. Equity Corporation, a venture capital firm, since 1983. Mr. Wilson was formerly a director of Capital Southwest Corporation. Mr. Wilson was selected as a nominee to serve as a director of the Company due to his extensive experience over 45 years serving as either an executive or an investor in numerous companies in industries ranging from banking, insurance, manufacturing, communications, health and transportation. |

There are no family relationships between any of the nominees or between any of the nominees and any director or executive officer of the Company. Mr. Wilson was originally elected to the Board of Directors of the Company pursuant to the terms of an investment purchase agreement entered into in connection with the formation of the Company in 1989. The director election provisions of the agreement were terminated in connection with the Company’s initial public offering in 1992.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING “FOR” THE NOMINEES SET FORTH ABOVE.

CORPORATE GOVERNANCE AND OTHER BOARD MATTERS

Board Independence

The Board has determined that each of the following directors and director nominees is “independent” as defined by Rule 5605(a)(2) of the listing standards of the NASDAQ Stock Market (“NASDAQ”):

Gregory J. Fisher

Gina A. Norris

William R. Thomas

Scott D. Weaver

John H. Wilson

The Board has determined that each of the current members of the Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee of the Board of Directors is “independent” within the rules set forth in the listing standards of NASDAQ. In assessing the director independence standards, the Board considered that Scott Weaver was employed by the Company from 1993 until June 2000. The Board concluded, based on all the facts and circumstances, that this past relationship with the Company does not affect Mr. Weaver’s independence as a director under NASDAQ’s independence definition.

Board Structure and Committee Composition

As of the date of this proxy statement, the Board has six directors and the following three committees: Audit Committee, Nominating and Corporate Governance Committee, and Compensation Committee. The membership and function of each committee is described below. The Audit Committee, Nominating and Corporate Governance Committee and Compensation Committee each operate under a written charter adopted by the Board of Directors. A current copy of each charter is available under the “Investors” section of the Company’s website at www.encorewire.com.

During the Company’s calendar year ended December 31, 2020, the Board of Directors held a total of four meetings. Each director attended all of such meetings held during the period in which such director served. Each director attended all of the meetings held by all committees on which such director served. Directors are encouraged to attend annual meetings of the stockholders of the Company. All of the Company’s directors virtually attended the 2020 annual meeting of the stockholders of the Company.

Board Leadership Structure

The Board of Directors does not have a formal policy with respect to whether the Chief Executive Officer should also serve as Chairman of the Board. The Board makes this decision based on its evaluation of the circumstances in existence and the specific needs of the Company and the Board at any time it is considering either or both roles. In November 2014, the Board of Directors unanimously elected Daniel L. Jones, the current Chief Executive Officer of the Company, as Chairman of the Board. In connection with this appointment, the Board of Directors created the position of Lead Independent Director of the Board and appointed John H. Wilson to such position, effective as of the same date. The appointment of a Lead Independent Director ensures that the Company benefits from effective oversight of the independent directors of the Board.

The Board believes that its current Board leadership structure is appropriate for the Company, because it gives the Company’s stockholders the benefit of Board leadership by Mr. Jones, an executive with extensive day-to-day knowledge of the Company’s operations, strategic plan execution and future needs, promotes strategy development and execution and facilitates information flow between management and the Board of Directors, which are essential to effective governance. The Board continually evaluates the Company’s leadership structure and could in the future decide to separate the Chairman and Chief Executive Officer positions, if it understands that doing so would serve the best interests of the Company and the Company’s stockholders.

Lead Independent Director

John H. Wilson was elected by the independent members of the Board to serve as the Lead Independent Director in November 2014. The Board adopted a Lead Independent Director Charter that sets forth the powers and responsibilities of the Lead Independent Director. The Lead Independent Director position responsibilities currently include presiding at all meetings of the Board at which the Chairman is not present; serving as the principal liaison between the Chairman and the independent members of the Board; approving all information sent to the Board; approving meeting agendas for the Board; approving the frequency of Board meetings and Board meeting schedules; calling meetings of the independent members of the Board when necessary; being available for consultation and direct communication with major stockholders upon request; overseeing the development, recommendation and implementation of a process for the assessment of the effectiveness of the Board, each committee and the Board members; and such other responsibilities as the Board delegates. In performing these responsibilities, the Lead Independent Director is expected to consult with the chairpersons of other Board committees as appropriate and solicit their participation in order to avoid the appearance of diluting the authority or responsibility of the Board committees and their chairpersons.

Risk Oversight

The Board of Directors oversees the Company’s risk management, satisfying itself that the Company’s risk management practices are consistent with its corporate strategy and are functioning appropriately. The Board does not have a separate risk committee, but instead believes that the entire Board is responsible for overseeing the Company’s risk management.

The Board conducts certain risk oversight activities through its committees. The Audit Committee oversees the Company’s compliance risk, including reviewing reports of the Company’s compliance with the Sarbanes-Oxley Act. The Nominating and Corporate Governance Committee’s role in risk oversight includes recommending director candidates who have appropriate experience that will enable them to provide competent oversight of the Company’s material risks. The Compensation Committee monitors the risks to which the Company’s compensation policies and practices could subject the Company.

The Board helps ensure that management is properly focused on risk by, among other things, reviewing and discussing the performance of senior management and conducting succession planning for key leadership positions at the Company. The Board also takes an active role in monitoring cyber security risks and is committed to the prevention, timely detection, and mitigation of the effects of any such incidents on the Company. In addition to regular reports from each of the Board’s committees, the Board receives regular reports from the Company’s management on the Company’s material risks and the degree of its exposure to those risks.

Audit Committee

The current members of the Audit Committee are Scott D. Weaver (Chairman), Gregory J. Fisher, John H. Wilson and Gina A. Norris, each of whom meets the independence requirements of the applicable NASDAQ and Securities and Exchange Commission (“SEC”) rules. The same individuals served as members of the Audit Committee during 2020, except that Gina A. Norris was appointed to serve as a member of the Audit Committee effective as of May 5, 2020. The Audit Committee met four times in 2020. The role of the Audit Committee is to review, with the Company’s auditors, the scope of the audit procedures to be applied in the conduct of the annual audit as well as the results of the annual audit. The Audit Committee works closely with management as well as the Company’s independent auditors. A current copy of the Audit Committee Charter is available under the “Investors” section of the Company’s website at www.encorewire.com.

The Board has determined that Scott D. Weaver, Gregory J. Fisher, John H. Wilson and Gina A. Norris are the “audit committee financial experts” of the Company, as defined in the rules established by the NASDAQ and the SEC.

Nominating and Corporate Governance Committee

The current members of the Nominating and Corporate Governance Committee are Gregory J. Fisher (Chairman), John H. Wilson, William R. Thomas, Scott D. Weaver and Gina A. Norris. The same individuals served as members of the Nominating and Corporate Governance Committee during 2020, except that Gina A. Norris was appointed to serve as a member of the Nominating and Corporate Governance Committee effective as of May 5, 2020. The Nominating and Corporate Governance Committee met once in 2020. The Nominating and Corporate Governance Committee assists the Board by identifying individuals qualified to become Board members, advises the Board concerning Board membership, leads the Board in an annual review of Board performance, and recommends director nominees to the Board. The Nominating and Corporate Governance Committee also periodically assesses each director’s compliance with the Company’s stock ownership guidelines. A current copy of the Nominating and Corporate Governance Committee Charter is available under the “Investors” section of the Company’s website at www.encorewire.com.

Compensation Committee

The current members of the Compensation Committee are John H. Wilson (Chairman), Scott D. Weaver, Gregory J. Fisher, William R. Thomas and Gina A. Norris. The same individuals served as members of the Compensation Committee during 2020, except that Gina A. Norris was appointed to serve as a member of the Compensation Committee effective as of May 5, 2020. The Compensation Committee met twice in 2020. The role of the Compensation Committee is to review the performance of officers, including those officers who are also members of the Board, and to set their compensation. The Compensation Committee also periodically assesses each executive officer’s compliance with the Company’s stock ownership guidelines and supervises and administers all compensation and benefit policies, practices and plans of the Company. The Compensation Committee also administers the 2020 Long Term Incentive Plan except to the extent the Board elects to administer it. On February 18, 2019, the Board dissolved the Stock Option Committee and the Compensation Committee resumed all duties previously delegated to the Stock Option Committee, including administering the 2010 Stock Option Plan, which expired in February 2020. The Board dissolved the Stock Option Committee because, following the effectiveness of the Tax Cuts and Jobs Act on December 22, 2017, Section 162(m) of the internal revenue code repealed the exception to the $1 million deduction limitation for grants of certain performance-based compensation. As a result, the Stock Option Committee was no longer necessary to administer the 2010 Stock Option Plan. A current copy of the Compensation Committee Charter is available under the “Investors” section of the Company’s website at www.encorewire.com.

Consideration of Director Nominees

Stockholder nominees

The policy of the Nominating and Corporate Governance Committee is to consider properly submitted nominations for candidates for membership on the Board, as described below under “Identifying and Evaluating Nominees for Directors.” In evaluating such nominations, the Nominating and Corporate Governance Committee shall address the membership criteria as described below in “Director Qualifications.” Any stockholder director nomination proposed for consideration by the Nominating and Corporate Governance Committee should include the nominee’s name and qualifications for Board membership and should be addressed to:

Nominating and Corporate Governance Committee

c/o Corporate Secretary

Encore Wire Corporation

1329 Millwood Road

McKinney, Texas 75069

Director Qualifications

The Board has adopted criteria that apply to nominees recommended by the Nominating and Corporate Governance Committee for a position on the Board. Among the qualifications provided by the criteria, nominees must be of the highest ethical character and share the values of the Company. Nominees must have reputations consistent with that of the Company and should be highly accomplished in their respective fields, possessing superior credentials and recognition. Nominees should also be active or former senior executive officers of public or significant private companies or leaders in their industry. Experience in the electrical wire and cable industry is not mandatory but is considered by the Board among the criteria for selection as a nominee. Nominees should also have the demonstrated ability to exercise sound business judgment.

Identifying and Evaluating Nominees for Directors

The Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating nominees for director. Upon the need to add a new director or fill a vacancy on the Board, the Nominating and Corporate Governance Committee will consider prospective candidates. Candidates for director may come to the attention of the Nominating and Corporate Governance Committee through current Board members, professional search firms, stockholders, or other persons as provided by the Charter of the Nominating and Corporate Governance Committee. As described above, the Nominating and Corporate Governance Committee considers properly submitted stockholder nominations for candidates to the Board. Following verification of stockholder status of persons proposing candidates, recommendations are aggregated and considered by the Nominating and Corporate Governance Committee along with the other recommendations. In evaluating such nominations, the Nominating and Corporate Governance Committee shall address the membership criteria as described above in “Director Qualifications,” which seeks to achieve a balance of knowledge, experience, and expertise on the Board.

Diversity

The Board values the varied personal and professional backgrounds, perspective and experience as an important factor when identifying nominees for director. The Board focuses on selecting the best candidates and endeavors to see that its membership, as a whole, possesses a diverse range of talents, expertise and backgrounds and represents diverse experiences at the policy-making levels of significant financial, industrial or commercial enterprises. In evaluating the suitability of individual Board members, our Board considers many factors, including general understanding of management, operations, manufacturing, finance, and other disciplines relevant to the success of the Company in today’s business environment; understanding of the wire industry; educational and professional background; personal accomplishment; and gender, age, and ethnic diversity. Although the Board has not adopted a policy with respect to the consideration of diversity in identifying director nominees, the Board continues to actively seek highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. The Board recently added Gina A. Norris who is a highly qualified and distinguished woman and was elected as a director at the 2020 annual meeting of stockholders of the Company. The Board’s continued objective is to recommend a group that can best perpetuate the success of our business and represent stockholder interests through the exercise of sound judgment using its diversity of experience and perspectives.

Stockholder Communications with the Board

The Board provides a process for stockholders of the Company to send written communications to the entire Board. Stockholders of the Company may send written communications to the Board of Directors c/o Corporate Secretary, Encore Wire Corporation, 1329 Millwood Road, McKinney, Texas 75069. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board on a periodic basis.

Report of the Audit Committee

To the Stockholders of Encore Wire Corporation:

The Audit Committee of the Board of Directors oversees the Company’s financial reporting process on behalf of the Board of Directors.

Management has the primary responsibility for the financial reporting process, including the Company’s system of internal controls and the preparation of the Company’s financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors are responsible for auditing those financial statements. The Audit Committee’s responsibility is to monitor and review these processes.

It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures. Members of the Audit Committee are not employees of the Company and may not represent themselves to be or to serve as accountants or auditors of the Company. As a result, the Audit Committee has relied, without independent verification, on management’s representation that the financial statements have been prepared with integrity and objectivity and in conformity with accounting principles generally accepted in the United States and on the representations of the independent auditors included in their report on the Company’s financial statements.

In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements in the Company’s annual report referred to below, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. The Audit Committee also reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the Securities and Exchange Commission. The Audit Committee has received the written disclosures and the letter from the independent auditors required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent auditor’s communications with the Audit Committee concerning independence, and has discussed with the independent auditors the independent auditor’s independence.

The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the considerations and discussions with management and the independent auditors do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent accountants are in fact “independent.”

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audits. The Audit Committee has met with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. In addition, the Audit Committee met with management during the year to review the Company’s Sarbanes-Oxley Section 404 compliance efforts related to internal controls over financial reporting. The Audit Committee held four meetings during 2020.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board has approved) that the audited financial statements be included in the annual report on Form 10-K for the year ended December 31, 2020 for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended the selection of Ernst & Young LLP as the Company’s independent auditors.

AUDIT COMMITTEE

Scott D. Weaver, Chairman

John H. Wilson

Gregory J. Fisher

Gina A. Norris

The above report of the Audit Committee and the information disclosed above related to Audit Committee independence under the heading “Board Independence” shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to the SEC’s proxy rules or to the liabilities of Section 18 of the Exchange Act, and such information shall not be deemed to be incorporated by reference into any filing made by the Company under the Exchange Act or under the Securities Act of 1933, as amended (the “Securities Act”).

Code of Business Conduct and Ethics

In connection with the Company’s long-standing commitment to conduct its business in compliance with applicable laws and regulations and in accordance with its ethical principles, the Board of Directors has adopted a Code of Business Conduct and Ethics applicable to all employees, officers, directors, and advisors of the Company. The Code of Business Conduct and Ethics of the Company is available under the “Investors” section of the Company’s website at www.encorewire.com and is incorporated herein by reference.

Environmental, Social and Governance

The Company is committed to operating all aspects of its business with integrity, contributing to our local community in a variety of ways, promoting a culture of diversity and inclusion, and using our natural resources thoughtfully and responsibly. During 2021, we will provide updates on our initiatives and activities in the environmental, social responsibility and governance aspects of our business under the “Investors” section of the Company’s website at www.encorewire.com, which provides information on our policies, social impact and environmental programs, as well as our sustainability efforts.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, DIRECTORS

AND NAMED EXECUTIVE OFFICERS

The following table sets forth, as of March 18, 2021, the beneficial ownership of Common Stock of the Company (the only equity securities of the Company presently outstanding) by (i) each director and nominee for director of the Company, (ii) the named executive officers listed in the Summary Compensation Table elsewhere in this proxy statement, (iii) all directors and named executive officers of the Company as a group and (iv) each person who was known to the Company to be the beneficial owner of more than five percent of the outstanding shares of Common Stock.

| | | | | | | | | | | | | | |

| Common Stock |

| Beneficially Owned (1) |

| Name | Number of Shares | | Percent of Class |

| Directors and Nominees for Director | | | | |

| Gregory J. Fisher | 8,600 | | | | * |

| Daniel L. Jones | 593,120 | | (2) | | 2.87% |

| Gina A. Norris | 1,100 | | | | * |

| William R. Thomas | 8,600 | | | | * |

| Scott D. Weaver | 24,100 | | | | * |

| John H. Wilson | 9,100 | | | | * |

| Named Executive Officers (excluding directors and nominees named above) | | | | |

| Bret J. Eckert | 50,000 | | | | * |

| All Directors and Named Executive Officers as a group (7 persons) | 694,620 | | | | 3.37% |

| | | | |

| | | | |

| Beneficial Owners of More than 5% (excluding persons named above) | | | | |

| | | | |

BlackRock Inc. 40 East 52nd Street New York, NY 10022 | 3,183,590 | | (3) | | 15.43% |

| | | | |

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355 | 2,036,839 | | (4) | | 9.87% |

| | | | |

Dimensional Fund Advisors LP

Palisades West, Building One, 6300 Bee Cave Road

Austin, TX 78746 | 1,609,669 | | (5) | | 7.80% |

| | | | |

Victory Capital Management Inc.

4900 Tiedeman Rd. 4th Floor

Brooklyn, OH 44144 | 1,466,411 | | (6) | | 7.11% |

| | | | |

| | | | |

* Less than one percent.

(1) Except as otherwise indicated, each stockholder named in the table has sole voting and investment power with respect to all shares of Common Stock indicated as being beneficially owned by such stockholder.

(2) Includes 141,000 shares of Common Stock underlying stock options that are exercisable within 60 days, 5,542 shares held in Mr. Jones's account under the Company's 401(k) Plan, 10,125 shares of Common Stock owned by Mr. Jones’s spouse and 337 shares owned by Mr. Jones’s son. Mr. Jones disclaims beneficial ownership of the shares owned by his spouse and his son.

(3) As reported in to Schedule 13G filed by BlackRock, Inc. (“BlackRock”) on January 25, 2021 with the SEC. BlackRock has sole power to vote or to direct the vote of 3,183,590 shares of common stock and sole power to dispose or to direct the disposition of all of such shares of Common Stock.

(4) As reported in Amendment No. 7 to Schedule 13G filed by The Vanguard Group, Inc. (“Vanguard Group”) on February 10, 2021 with the SEC. Vanguard Group holds sole voting power with respect to none of such shares and shares dispositive power with respect to 37,940 of such shares..

(5) As reported in Amendment No. 9 to Schedule 13G filed by Dimensional Fund Advisors LP (“Dimensional”) on February 12, 2021 with the SEC. Dimensional has sole power to vote or to direct the vote of 1,560,295 shares of common stock and sole power to dispose or to direct the disposition of 1,609,669 shares of Common Stock. Dimensional, an investment adviser

registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional may act as an adviser or sub-adviser to certain Funds. In its role as investment advisor, sub-advisor and/or manager, neither Dimensional nor its subsidiaries possess voting and/or investment power over the securities owned by the Funds and may be deemed to be the beneficial owner of such shares. However, all shares reported by Dimensional are owned by the Funds. Dimensional disclaims beneficial ownership of such securities.

(6) As reported in Amendment No. 2 to Schedule 13G filed by Victory Capital Management Inc. (“Victory”) on February 3, 2021 Victory holds sole voting power with respect to only 1,466,411 of such shares but holds sole dispositive power with respect to all of such shares.

EXECUTIVE COMPENSATION

Compensation Discussion & Analysis

This Compensation Discussion and Analysis section addresses the following topics: (i) the members and role of the Company’s Compensation Committee; (ii) our compensation-setting process; (iii) our compensation philosophy; (iv) the components of our executive officer compensation program; and (v) our decisions for compensation earned by the Company’s named executive officers in 2020.

The Board of Directors has determined that Daniel L. Jones, Chairman, President and Chief Executive Officer of the Company, and Bret J. Eckert, Vice President—Finance, Treasurer, Secretary and Chief Financial Officer of the Company, were the Company’s only named executive officers for the year ended December 31, 2020. As previously disclosed, Frank J. Bilban ceased serving as a named executed officer of the Company on December 31, 2019, and Mr. Eckert became a named executive officer on January 1, 2020. Throughout this proxy statement, Mr. Jones and Mr. Eckert are referred to as the “named executive officers.” In this “Compensation Discussion and Analysis” section, the terms, “we,” “our,” “us,” and the “Committee” refer to the Compensation Committee.

The Compensation Committee

Committee Members and Independence

John H. Wilson (Chairman), Scott D. Weaver, Gregory J. Fisher, William R. Thomas and Gina A. Norris are the current members of the Compensation Committee. Each member of the Compensation Committee qualifies as an independent director under NASDAQ listing standards.

Role of the Compensation Committee

The Compensation Committee administers the compensation program for the officers and certain key employees of the Company and makes all related decisions. The Compensation Committee also administers the Company’s compensation and benefit policies, practices and plans of the Company, including supervising and administering the 2020 Long Term Incentive Plan. The Compensation Committee ensures that the total compensation paid to the officers is fair, reasonable and competitive. The Compensation Committee did not retain compensation advisors with respect to compensation earned during 2020, nor has it done so in the past. The Compensation Committee operates under a written charter adopted by the Board. The charter is available under the “Investors” section of the Company’s website at www.encorewire.com. The fundamental responsibilities of the Compensation Committee are:

• to review at least annually the goals and objectives and the structure of the Company’s plans for officer compensation, incentive compensation, equity-based compensation, and its general compensation plans and employee benefit plans (including retirement and health insurance plans);

• to evaluate annually the performance of the Chief Executive Officer in light of the goals and objectives of the Company’s compensation plans, and to determine his compensation level based on this evaluation;

• to review annually and determine the compensation level of all officers and certain key employees of the Company, in light of the goals and objectives of the Company’s compensation plans;

• in consultation with the Chief Executive Officer, to oversee the annual evaluation of management of the Company, including other officers and key employees of the Company; and

• to review, recommend to the Board, and administer all equity-based compensation plans.

Committee Meetings

The Compensation Committee meets as often as necessary to perform its duties and responsibilities. The Compensation Committee held three meetings during 2020. We typically meet with the Chief Executive Officer and the Chief Financial Officer. We also meet in executive session without management.

The Compensation-Setting Process

We meet in executive session each year to evaluate the performance of the officers and certain key employees of the Company, to determine their incentive bonuses for the prior year, to set their base salaries for the next calendar year, and to consider and approve any grants to them of equity incentive compensation.

Although many compensation decisions are made in the fourth quarter, our compensation planning process continues throughout the year. Compensation decisions are designed to promote our fundamental business objectives and strategy. Business and succession planning, evaluation of management performance and consideration of the business environment are year-round processes.

Management plays a significant role in the compensation-setting process. The most significant aspects of management’s role are:

• evaluating employee performance; and

• recommending salary levels, bonus awards and equity incentive awards.

The Chief Executive Officer and Chief Financial Officer also participate in Compensation Committee meetings at the Committee’s request to provide:

• background information regarding the Company’s strategic objectives;

• detailed background information regarding the accomplishments of the Company and management;

• their evaluation of the performance of the other officers and key employees; and

• compensation recommendations as to the other officers.

Compensation Philosophy

The Company believes in rewarding officers based on individual performance as well as aligning the officers’ interests with those of the stockholders with the ultimate objective of improving stockholder value. To that end, the Compensation Committee believes officer compensation packages provided by the Company to its officers should include both cash and stock-based compensation that reward performance.

The Compensation Committee seeks to achieve the following goals with the Company’s officer compensation programs: to attract, retain and motivate officers and to reward them for value creation. The individual judgments made by the Compensation Committee are somewhat subjective and are based largely on the Compensation Committee’s perception of each officer’s contribution to both past performance and the long-term growth potential of the Company. These judgments start with an evaluation of the Company's overall performance and are then paired with five basic criteria of that individual's performance that are used to compare their performance to that of their peers. The Compensation Committee chose this approach to reward individuals who have both contributed to the Company’s overall success and performed well compared to their peers, while not rewarding poor performance. The Compensation Committee does not establish specific performance targets for officers to avoid any incentive for officers to behave in a self-interested manner or a manner otherwise detrimental to the Company to achieve such targets. The Compensation Committee believes that this approach promotes teamwork and aligns with the long-term interests of the stockholders.

At the core of our compensation philosophy is our guiding belief that pay should be linked to performance, and several factors underscore that philosophy. Performance is measured both from the macro level of Company earnings and performance, and the micro level of the specific officers’ performance. A substantial portion of officer compensation is determined by each officer’s contribution to the Company’s profitability and performance based largely on a review of each officer’s performance of his or her specific duties and responsibilities that the Chief Executive Officer conducts with the Compensation Committee. We do not have any employment, severance or change-in-control agreements with any of our officers.

The Compensation Committee believes that total compensation and accountability should increase with position and responsibility. Consistent with this philosophy, total compensation is higher for individuals with greater responsibility and greater ability to influence the Company’s targeted results and strategic initiatives. As position and responsibility increases, a greater portion of the officer’s total compensation is performance-based pay.

In addition, our compensation methods focus management on achieving strong annual performance in a manner that supports and encourages the Company’s long-term success and profitability. Our bonus payouts are highly variable based on Company and individual performance. We believe that equity incentive compensation awards issued under the 2020 Long Term Incentive Plan or

previously issued under the 2010 Stock Option Plan create long-term incentives that align the interests of management with the interests of long-term stockholders. Further, the Company’s stock ownership guidelines encourage our executive officers to focus on the long-term interests of the Company’s stockholders. Finally, while the Company’s overall compensation levels must be sufficiently competitive to attract and retain talented leaders, we believe that compensation should be set at responsible levels.

The 2020 Long Term Incentive Plan enables the Company to provide stock-based incentives that align the interests of employees and directors with those of the stockholders of the Company, motivate employees and directors to achieve long-term results, reward employees and directors for their achievements, and attract and retain the types of employees and directors who will contribute to the Company’s long-term success. A summary of the 2020 Long Term Incentive Plan is as follows:

2020 Long Term Incentive Plan

The 2020 Long Term Incentive Plan, which was approved by stockholders on May 5, 2020, is administered by the Compensation Committee except to the extent the Board elects to administer it. The Compensation Committee has the authority to, among other things, interpret the 2020 Long Term Incentive Plan, determine who will be granted awards, determine the type and number of awards, determine the terms and conditions of each award, modify or waive the terms and conditions of each award, and take action as it determines to be necessary or advisable for the administration of the 2020 Long Term Incentive Plan. The Compensation Committee has the right to delegate to a subcommittee of the Board or any officers of the Company any right granted to the Compensation Committee under the 2020 Long Term Incentive Plan, except where such delegation would violate state corporate law or result in the loss of an exemption under Rule 16b-3(d)(1). The Compensation Committee may grant awards to any employee, officer or director of the Company and its affiliates. The 2020 Long Term Incentive Plan authorizes the issuance of up to 1,000,000 shares of common stock with respect to awards under the Plan.

Subject to the limits in the 2020 Long Term Incentive Plan, the Compensation Committee has the authority to set the size and type of award and any vesting or performance conditions. The types of awards that may be granted under the 2020 Long Term Incentive Plan are: stock options (including both ISOs and nonstatutory options), stock appreciation rights (“SARs”), restricted stock, restricted stock units (“RSUs”), stock awards, dividend equivalents and other stock-based awards and cash awards. The 2020 Long Term Incentive Plan allows for awards subject to either time-based vesting or performance-based vesting, or both. Awards that are designated to be settled solely in shares of common stock have a minimum vesting period of one year, subject to a five percent exception and the permitted acceleration of vesting in the event of a participant’s death, disability, retirement, termination of employment, as a result of a change in control or such other events that the Compensation Committee determines. A detailed summary of the types of awards approved under the 2020 Long Term Incentive Plan follows:

a.Stock Options – A stock option is the right to purchase shares of common stock at a future date at a specified price per share called the exercise price. An option may be either an ISO or a nonstatutory stock option. ISOs and nonstatutory stock options are taxed differently, as described under “Federal Income Tax Treatment of Awards Under the Plan.” The exercise price of a stock option may not be less than the greater of (i) the par value per share of common stock or (ii) the fair market value (or in the case of an ISO granted to a ten percent stockholder, 110% of the fair market value) of a share of common stock on the grant date. Full payment of the exercise price must be made at the time of such exercise either in cash or in another manner approved by the Compensation Committee.

b.Stock Appreciation Rights – A SAR is the right to receive the excess of (i) the fair market value of one share of common stock on the date of exercise over (ii) the grant price of the SAR in cash or common stock as determined by the Compensation Committee. The exercise price of a SAR may not be less than the greater of (i) the par value per share of common stock or (ii) the fair market value of a share of common stock on the grant date. SARs may be granted alone or in tandem with options.

c.Restricted Stock – A restricted stock award is an award of actual shares of common stock which are subject to certain restrictions for a period of time determined by the Compensation Committee. Restricted stock shall be subject to such restrictions on transferability, risk of forfeiture and other restrictions, if any, as the Compensation Committee may impose. Participants who receive restricted stock awards generally have the rights and privileges of stockholders regarding the shares of restricted stock during the restricted period, including the right to vote and the right to receive dividends upon vesting.

d.Restricted Stock Units – An RSU is an award of hypothetical common stock units having a value equal to the fair market value of an identical number of shares of common stock, which are subject to certain restrictions for a period of time determined by the Compensation Committee. No shares of common stock are issued at the time an RSU is granted, and the Company is not required to set aside any funds for the payment of any RSU award. Because no shares are outstanding, the participant does not have any rights as a stockholder. An RSU is settled in shares of common stock as determined by the Compensation Committee.

e.Stock Awards – A stock award is an unrestricted share of common stock which may be granted at the discretion of the Compensation Committee as a bonus, as additional compensation, or in lieu of cash compensation any such participant is otherwise entitled to receive.

f.Dividend Equivalents – A dividend equivalent is a right to receive cash, common stock or other property equal in value to dividends paid with respect to a specified number of shares of common stock. No dividend equivalent will vest or be payable sooner than the date on which the underlying award has vested.

g.Cash Awards – A cash award may be granted on a free-standing basis or as an element of, a supplement to, or in lieu of any other award under the 2020 Long Term Incentive Plan in such amounts and subject to such other terms as the Compensation Committee in its discretion determines to be appropriate.

h.Performance Awards – A performance award is an award to receive cash, shares of common stock or a combination of both upon the achievement of certain performance goals over a performance period. Performance awards may be combined with other awards to impose performance criteria as part of the terms of the other awards. The Compensation Committee may establish the applicable performance goals based on the following business criteria: (1) revenues, sales or other income; (2) cash flow, discretionary cash flow, cash flows from operations, cash flows from investing activities, and/or cash flows from financing activities; (3) return on net assets, return on assets, return on investment, return on capital, return on capital employed or return on equity; (4) income, operating income or net income; (5) earnings or earnings margin determined before or after any one or more of depletion, depreciation and amortization expense; impairment of inventory and other property and equipment; accretion of discount on asset retirement obligations; interest expense; net gain or loss on the disposition of assets; income or loss from discontinued operations, net of tax; noncash derivative related activity; amortization of stock-based compensation; income taxes; or other items; (6) equity; net worth; tangible net worth; book capitalization; debt; debt, net of cash and cash equivalents; capital budget or other balance sheet goals; (7) debt or equity financings or improvement of financial ratings; (8) general and administrative expenses; (9) net asset value; (10) fair market value of the common stock, share price, share price appreciation, total stockholder return or payments of dividends; (11) achievement of savings from business improvement projects and achievement of capital projects deliverables; (12) working capital or working capital changes; (13) operating profit or net operating profit; (14) internal research or development programs; (15) geographic business expansion; (16) corporate development (including licenses, innovation, research or establishment of third party collaborations); (17) performance against environmental, ethics or sustainability targets; (18) safety performance and/or incident rate; (19) human resources management targets, including medical cost reductions, employee satisfaction or retention, workforce diversity and time to hire; (20) satisfactory internal or external audits; (21) consummation, implementation or completion of a change in control or other strategic partnerships, transactions, projects, processes or initiatives or other goals relating to acquisitions or divestitures (in whole or in part), joint ventures or strategic alliances; (22) regulatory approvals or other regulatory milestones; (23) legal compliance or risk reduction; (24) market share; (25) economic value added; or (26) cost reduction targets.

2020 Compensation

This section describes the compensation decisions that the Compensation Committee made with respect to the named executive officers for 2020.

Executive Summary

In 2020 and in the first quarter of 2021, we continued to apply the compensation principles described above in determining the compensation of our named executive officers. In summary, the compensation decisions made for 2020 for the named executive officers were as follows:

•We kept the base salary for Mr. Jones at $925,000 for fiscal year 2020, and the base salary for Mr. Eckert was $400,000 for fiscal year 2020;

•We awarded cash incentive bonus payments to the named executive officers in the amount of $1,400,000 to Mr. Jones and $600,000 to Mr. Eckert in the fourth quarter of 2020 as compensation for performance in fiscal year 2020; and

•We granted 50,000 restricted stock units subject to time-based vesting to Mr. Jones and 25,000 restricted stock units to Mr. Eckert in the first quarter of 2021 as compensation for performance in fiscal year 2020.

In setting compensation policies and making compensation decisions for the named executive officers, we do not use specific formula-driven plans. We do, however, consider a number of factors, including the Company’s overall performance in terms of revenue, profitability, market share and cost containment among others. We take into account the overall economic and industry specific environments that management faces in any given period. We also heavily weigh the individual’s personal performance and how such individual contributed to the success of the rest of the management team. We discuss the performance of the Company and members

of the executive staff with the Chief Executive Officer at quarterly Board meetings and at other appropriate points throughout the year. Many of the officers make presentations at quarterly Board meetings, enabling the Board to discuss that officer’s area of functional responsibility and performance personally. Our two named executive officers participate in all Board meetings. While the final amount of any compensation paid to the named executive officers is somewhat discretionary, based on our business judgment, and is not generated or calculated by reference to any particular formula or performance target, it is based on our assessment of their performance in managing the Company and performing their specific duties. We believe this methodology is superior to other more formula-based calculations that can lead to executives focusing on short-term and personal performance to the detriment of the Company’s team-oriented performance.

Compensation Components.

As described in more detail below, the three main components that we use to compensate and incentivize the named executive officers are base salary, cash incentive bonuses and equity incentive awards. The named executive officers have no employment, severance or change-in-control agreements with the Company.

Base Salary. In determining base salaries, we consider each named executive officer’s qualifications and experience, scope of responsibilities, the goals and objectives established for the executive, the executive’s past performance, internal pay equity and the extent to which the Company’s earnings were affected by the executive’s actions. We must also consider the Company’s past performance and the general economic climate and more specifically the industry climate in which the Company operates and competes in determining whether salary increases are appropriate in that context.

The Company competes in an industry consisting primarily of private companies or public companies with divisions or subsidiaries that compete with the Company. Because of the lack of directly comparable salary information with producers of electric building wire, we also periodically refer to surveys of salary data with respect to executives in comparable positions at comparable companies. To set salary levels for 2020 for our named executive officers, we referred to the Institutional Shareholder Services “ISS” national salary survey gathered from all public companies’ proxy data in the United States. That information is then broken down to manufacturing and industrial companies with annual revenue between $750 million and $2.25 billion and over 500 employees (the “Comparison Group”). The survey reported 267 salaries in the Comparison Group for CEOs and 266 salaries in the Comparison Group for CFOs.

We have historically kept our base salaries at reasonable levels while trying to incentivize our executives with strong bonus and stock award programs that allow the executives to have significant upside when the Company performs well. To that end, the relative amounts of the base salary and bonus of our executives are set at levels so that a significant portion of the total compensation that such executive can earn is performance-based pay. Base salary is largely determined based on the methodology described above in concert with data from salary surveys.

Cash Incentive. Cash incentive bonus payments are determined as described above, based primarily on each named executive officer’s contribution to the Company’s performance of key objectives and profitability over the previous calendar year. The Committee believes that profitability is one of the most useful measures of management’s effectiveness in creating value for the stockholders of the Company. We employ the methodology described above in concert with data from salary surveys in determining the amount of cash incentive bonus awards.

Equity Incentive. The Company’s named executive officers were eligible to receive equity awards granted under the 2010 Stock Option Plan, as more fully described in Note 6 to the Financial Statements of the Company’s Annual Report on Form 10-K for the year ended December 31, 2020 and incorporated herein by reference which expired in accordance with its terms on February 15, 2020. Following expiration of the 2010 Stock Option Plan, the Company had adopted the 2020 Long Term Incentive Plan which was approved at the 2020 annual meeting of stockholders on May 5, 2020. The Company granted all equity awards in 2020 under the 2010 Stock Option Plan, prior to its expiration, with an exercise price that is at the fair market value of the Company’s Common Stock as of the date of grant. The equity awards granted in 2020 were made in connection with each named executive officer’s efforts in fiscal year 2019. The exercise price for equity award grants is determined by reference to the closing price per share on NASDAQ at the close of business on the date of grant. Other than the 2020 Long Term Incentive Plan, as of December 31, 2020, the Company had not adopted any other equity incentive plans in which the named executive officers or directors may participate. The Compensation Committee makes equity awards at regular or special meetings of the Compensation Committee and sets the effective date at such meetings. The Company also made grants of equity incentive awards, including grants of unrestricted stock, restricted stock subject to vesting and restricted stock units subject to vesting, at the discretion of the Compensation Committee.

In determining the number of equity incentives to be granted to officers and the frequency of such grants, the Compensation Committee has taken into account the individual’s position, scope of responsibility, ability to affect profitability, the individual’s performance and the value of stock awards in relation to other elements of total compensation. In addition, since the Company believes that profitability is the most useful measure of management’s effectiveness in creating value for the stockholders, the Company’s profitability over the prior calendar year is also taken into account when determining the number and type equity awards to be granted to officers.

Analysis

The Compensation Committee kept the base salary for Mr. Jones for fiscal year 2020 at $925,000 which is the same base salary as fiscal year 2019. In making this decision with respect to Mr. Jones’s 2020 salary level, the Committee considered the following:

•Mr. Jones is a veteran executive in the wire industry and performed extremely well in leading the Company over the past several years, including in 2019 in which the Company believes it gained market share, produced strong earnings and added strength to a solid balance sheet. In addition, Mr. Jones has successfully led the Company to continue to significantly expand its product offerings and / or its current products by managing the upgrades and capacity improvements throughout the plants.