UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05812

Legg Mason Partners Premium Money Market Trust

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-877-721-1926

Date of fiscal year end: August 31

Date of reporting period: August 31, 2013

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

Annual Report  August 31, 2013

August 31, 2013

WESTERN ASSET

PREMIUM LIQUID

RESERVES

|

INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to provide shareholders with liquidity and as high a level of current income as is consistent with preservation of capital.

Letter from the president

Dear Shareholder,

We are pleased to provide the annual report of Western Asset Premium Liquid Reserves for the twelve-month reporting period ended August 31, 2013. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

I am pleased to introduce myself as the new President and Chief Executive Officer of the Fund, succeeding R. Jay Gerken, as he embarks upon his retirement. Jay has most recently served as Chairman of the Board, President and Chief Executive Officer of the Fund and other funds in the Legg Mason complex. On behalf of all our shareholders and the Fund’s Board of Trustees, I would like to thank Jay for his vision and guidance, and wish him all the best.

I am honored to have been appointed to my new role with the Fund. During my 23 year career in the financial industry, I have seen it evolve and expand. Despite these changes, keeping an unwavering focus on our shareholders and their needs remains paramount. This was a consistent focus of Jay’s, and I look forward to following his lead in the years to come.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com/individualinvestors. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance, |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

| | |

| II | | Western Asset Premium Liquid Reserves |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

President and Chief Executive Officer

September 27, 2013

| | |

| Western Asset Premium Liquid Reserves | | III |

Investment commentary

Economic review

The U.S. economy continued to grow over the twelve months ended August 31, 2013 (the “reporting period”), but the pace was far from robust. Looking back, U.S. gross domestic product (“GDP”)i growth, as reported by the U.S. Department of Commerce, was 2.8% during the third quarter of 2012. GDP growth then sharply decelerated to 0.1% during the fourth quarter. This weakness was partially driven by moderating private inventory investment and federal government spending. Economic growth then improved, as first quarter 2013 GDP growth was 1.1%. This was partially due to strengthening consumer spending, which rose 2.3% during the first quarter, versus a 1.7% increase during the previous quarter. The U.S. Department of Commerce’s final reading for second quarter 2013 GDP growth, released after the reporting period ended, was 2.5%. This increase was partially driven by increases in exports and non-residential fixed investments, along with a smaller decline in federal government spending versus the previous quarter.

While there was some improvement in the U.S. job market, unemployment remained elevated throughout the reporting period. When the period began, unemployment, as reported by the U.S. Department of Labor, was 7.8%. The unemployment rate fluctuated between 7.8% and 7.9% over the next four months. Unemployment then fell to 7.7% in February 2013 and edged lower over much of the next six months to reach 7.3% in August 2013, its lowest reading since December 2008. In another encouraging sign, the number of longer-term unemployed has generally declined in recent months. In February 2013, 40.2% of the people without a job had been out of work for more than six months. This fell to 37.9% in August 2013.

Meanwhile, the housing market continued to show signs of strength, as sales generally improved and home prices moved higher. According to the National Association of Realtors (“NAR”), existing-home sales rose 1.7% on a seasonally adjusted basis in August 2013 versus the previous month and were 13.2% higher than in August 2012. In addition, the NAR reported that the median existing-home price for all housing types was $212,100 in August 2013, up 14.7% from August 2012. This marked the eighteenth consecutive month that home prices rose compared to the same period a year earlier. The inventory of homes available for sale in August 2013 was 0.4% higher than the previous month at a 4.9 month supply at the current sales pace and was 6.3% lower than in August 2012.

The manufacturing sector expanded during the majority of the reporting period, although it experienced several soft patches. Based on the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, after expanding the prior two months, the PMI fell to 49.5 in November 2012. This represented the PMI’s lowest reading since July 2009 (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). Manufacturing then expanded over the next five months, before contracting again in May 2013, with a PMI of 49.0. However, this was a temporary setback, as the PMI rose to 50.9 in June, 55.4 in July and 55.7 in August, the latter being the best reading since April 2011.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As has been

| | |

| IV | | Western Asset Premium Liquid Reserves |

the case since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. At its meeting in December 2012, the Fed announced that it would continue purchasing $40 billion per month of agency mortgage-backed securities (“MBS”), as well as initially purchasing $45 billion a month of longer-term Treasuries. The Fed also said that it would keep the federal funds rate on hold “…as long as the unemployment rate remains above 6.5%, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2.0% longer-run goal, and longer-term inflation expectations continue to be well anchored.” At its meeting that ended on June 19, 2013, the Fed did not make any material changes to its official policy statement. However, in a press conference following the meeting, Fed Chairman Bernanke said “…the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year; and if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.” This initially triggered a sharp sell-off in both the stock and bond markets. While the stock market subsequently rallied and reached a new record high on July 12, the bond market continued to be weak. As a result, Treasury yields remained sharply higher than they were prior to Chairman Bernanke’s press conference. At its meeting that ended on September 18, 2013, after the reporting period ended, the Fed did not taper its asset purchase program and said that it “…decided to await more evidence that progress will be sustained before adjusting the pace of its purchases.”

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

President and Chief Executive Officer

September 27, 2013

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| | |

| Western Asset Premium Liquid Reserves | | V |

Fund overview

Q. What is the Fund’s investment strategy?

A. The Fund seeks to provide shareholders with liquidity and as high a level of current income as is consistent with preservation of capital. The Fund invests in securities through an underlying mutual fund, Liquid Reserves Portfolio (the “Portfolio”), which has the same investment objective and strategies as the Fund. The Portfolio invests in high-quality, U.S. dollar-denominated short-term debt securities that, at the time of purchase, are rated by one or more rating agencies in the highest short-term rating category or, if not rated, are determined by the subadviser to be of equivalent quality.

The Portfolio may invest in all types of money market instruments, including bank obligations, commercial paper and asset backed securities, structured investments, repurchase agreements and other short-term debt securities. These instruments may be issued or guaranteed by all types of issuers, including U.S. and foreign banks and other private issuers, the U.S. government or any of its agencies or instrumentalities, U.S. states and municipalities, or foreign governments.

The Portfolio may invest without limit in bank obligations, such as certificates of deposit, fixed time deposits and bankers’ acceptances. The Portfolio generally limits its investments in foreign securities to U.S. dollar denominated obligations of issuers, including banks and foreign governments, located in the major industrialized countries, although with respect to bank obligations, the branches of the banks issuing the obligations may be located in The Bahamas or the Cayman Islands.

As a money market fund, the Fund tries to maintain a share price of $1.00 and must follow strict rules as to the credit quality, liquidity, diversification and maturity of its investments.

At Western Asset Management Company (“Western Asset”), the Fund’s and the Portfolio’s subadviser, we utilize a fixed-income team approach, with decisions derived from interaction among various investment management sector specialists. The sector teams are comprised of Western Asset’s senior portfolio management personnel, research analysts and an in-house economist. Under this team approach, management of client fixed-income portfolios will reflect a consensus of interdisciplinary views within the Western Asset organization.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The spread sectors (non-Treasuries) experienced several periods of heightened risk aversion and generated mixed results versus equal-durationi Treasuries over the twelve months ended August 31, 2013. Risk aversion was prevalent at times given shifting economic data, contagion fears from the European sovereign debt crisis and signs of shifting monetary policy by the Federal Reserve Board (“Fed”).ii

Both short- and long-term Treasury coupon-yields moved higher during the twelve months ended August 31, 2013. Two-year Treasury yields rose from 0.22% at the beginning of the period to 0.39% at the end of the period. Their peak of 0.43% occurred on June 25, 2013 and they were as low as 0.20% on April 29, 2013 and in early May 2013. Ten-year Treasury yields were 1.57%

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 1 |

Fund overview (cont’d)

at the beginning of the reporting period, their low for the fiscal year. Ten-year Treasuries peaked at 2.90% on August 22, 2013 and were 2.78% at the end of the period.

With the Fed keeping the federal funds rateiii at a historically low range between zero and 0.25%, the yields available from money market securities continued to be very low during the twelve months ended August 31, 2013. For example, the three-month Treasury bill was 0.03% as of the end of the period. The same dynamic held true for the six-month and one-year Treasury bills, as they ended the reporting period at 0.05% and 0.13%, respectively. In addition, the Fed vowed to keep the federal funds rate on hold “…as long as the unemployment rate remains above 6.5%, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2.0% longer-run goal, and longer-term inflation expectations continue to be well anchored.”

Q. How did we respond to these changing market conditions?

A. During the reporting period, we maintained a modestly long weighted average maturity (“WAM”). We looked to take advantage of the steepness of the U.S. dollar LIBOR curve to lock in higher yields and to limit rollover risk. Throughout the fiscal year, we utilized a combination of both fixed and longer dated floating rate securities.

Performance review

As of August 31, 2013, the seven-day current yield for Western Asset Premium Liquid Reserves was 0.01% and the seven-day effective yield, which reflects compounding, was 0.01%.1

| | | | |

Western Asset Premium Liquid Reserves

Yields as of August 31, 2013 (unaudited) | |

| Seven-Day Current Yield1 | | | 0.01 | % |

| Seven-Day Effective Yield1 | | | 0.01 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Yields will fluctuate. To obtain performance data current to the most recent month-end, please visit our website at www.leggmason.com/individualinvestors.

Absent fee waivers and/or expense reimbursements, the seven-day current yield and the seven-day effective yield would have been -0.26%.

The manager has voluntarily undertaken to limit Fund expenses in order to maintain a minimum yield. Such expense limitations may fluctuate daily and are voluntary and temporary and may be terminated by the manager at any time without notice.

An investment in the Fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

| 1 | The seven-day current yield reflects the amount of income generated by the investment during that seven-day period and assumes that the income is generated each week over a 365-day period. The yield is shown as a percentage of the investment. The seven-day effective yield is calculated similarly to the seven-day current yield but, when annualized, the income earned by an investment in the Fund is assumed to be reinvested. The effective yield typically will be slightly higher than the current yield because of the compounding effect of the assumed reinvestment. |

| | |

| 2 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

Q. What were the most significant factors affecting Fund performance?

A. The U.S. economic recovery strengthened over the reporting period but growth overall remained modest. Global market conditions continued to improve and pressure on short-term funding levels eased with the help of Fed and European Central Bank policy actions. Indicators of stress in money markets improved as global bank liquidity recovered and short-term benchmark interest rates moved lower.

Thank you for your investment in Western Asset Premium Liquid Reserves. As always, we appreciate that you have chosen us to manage your assets and we remain focused

on seeking to achieve the Fund’s investment goals.

Sincerely,

Western Asset Management Company

September 13, 2013

RISKS: An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although the Fund seeks to preserve the value of your investment at one dollar per share, it is still possible to lose money by investing in the Fund. Please see the Fund’s prospectus for a more complete discussion of these and other risks, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | Duration is the measure of the price sensitivity of a fixed-income security to an interest rate change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows. |

| ii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 3 |

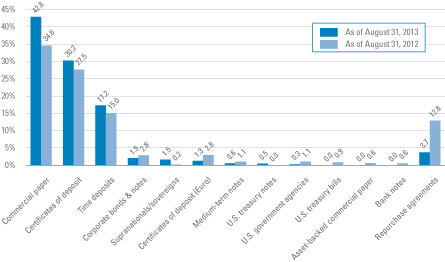

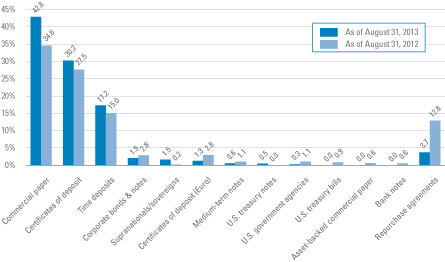

Portfolio at a glance† (unaudited)

Liquid Reserves Portfolio

The Fund invests all of its investable assets in Liquid Reserves Portfolio, the investment breakdown of which is shown below.

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Portfolio’s investments as of August 31, 2013 and August 31, 2012. The Portfolio is actively managed. As a result, the composition of the Portfolio’s investments is subject to change at any time. |

| | |

| 4 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

Fund expenses (unaudited)

Example

As a shareholder of the Fund, you may incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, service and/or distribution (12b-1) fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested on March 1, 2013 and held for the six months ended August 31, 2013.

Actual expenses

The table below titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,600 ending account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During the Period”.

Hypothetical example for comparison purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in the Fund and other funds. To do so, compare the 5.00% hypothetical example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table below are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transaction costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Based on actual total return1 | | | | Based on hypothetical total return1 |

Actual

Total

Return2 | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio3,4 | | Expenses

Paid During

the Period5 | | | | Hypothetical

Annualized

Total Return | | Beginning

Account

Value | | Ending

Account

Value | | Annualized

Expense

Ratio3,4 | | Expenses

Paid During

the Period5 |

| | | 0.01% | | | | $ | 1,000.00 | | | | $ | 1,000.10 | | | | | 0.23 | % | | | $ | 1.16 | | | | | | | 5.00 | % | | | | $1,000.00 | | | | $ | 1,024.05 | | | | | 0.23 | % | | | $ | 1.17 | |

| 1 | For the six months ended August 31, 2013. |

| 2 | Assumes the reinvestment of all distributions, including returns of capital, if any, at net asset value. Total return is not annualized, as it may not be representative of the total return for the year. Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 3 | Includes the Fund’s share of Liquid Reserves Portfolio’s allocated expenses. |

| 4 | In order to maintain a minimum yield, additional waivers were implemented. |

| 5 | Expenses (net of fee waivers and/or expense reimbursements) are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 5 |

Statement of assets and liabilities

August 31, 2013

| | | | |

| |

| Assets: | | | | |

Investment in Liquid Reserves Portfolio, at value | | $ | 418,878,470 | |

Receivable for Fund shares sold | | | 81,783 | |

Receivable from investment manager | | | 6,020 | |

Prepaid expenses | | | 21,400 | |

Total Assets | | | 418,987,673 | |

| |

| Liabilities: | | | | |

Payable for Fund shares repurchased | | | 188,399 | |

Service and/or distribution fees payable | | | 34,948 | |

Distributions payable | | | 2,431 | |

Accrued expenses | | | 46,273 | |

Total Liabilities | | | 272,051 | |

| Total Net Assets | | $ | 418,715,622 | |

| |

| Net Assets: | | | | |

Par value (Note 3) | | $ | 4,187 | |

Paid-in capital in excess of par value | | | 418,884,545 | |

Undistributed net investment income | | | 1,748 | |

Accumulated net realized loss on investments | | | (174,858) | |

| Total Net Assets | | $ | 418,715,622 | |

Shares Outstanding | | | 418,701,875 | |

Net Asset Value | | | $1.00 | |

See Notes to Financial Statements.

| | |

| 6 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

Statement of operations

For the Year Ended August 31, 2013

| | | | |

| |

| Investment Income: | | | | |

Income from Liquid Reserves Portfolio | | $ | 1,049,637 | |

Allocated expenses from Liquid Reserves Portfolio | | | (416,843) | |

Allocated waiver from Liquid Reserves Portfolio | | | 34,859 | |

Total Investment Income | | | 667,653 | |

| |

| Expenses: | | | | |

Investment management fee (Note 2) | | | 1,336,877 | |

Service and/or distribution fees (Note 2) | | | 381,924 | |

Legal fees | | | 41,815 | |

Transfer agent fees | | | 31,857 | |

Shareholder reports | | | 24,789 | |

Registration fees | | | 23,380 | |

Audit and tax | | | 22,775 | |

Insurance | | | 8,853 | |

Fund accounting fees | | | 6,248 | |

Trustees’ fees | | | 6,066 | |

Miscellaneous expenses | | | 5,067 | |

Total Expenses | | | 1,889,651 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (1,260,188) | |

Net Expenses | | | 629,463 | |

| Net Investment Income | | | 38,190 | |

| Net Realized Loss on Investments from Liquid Reserves Portfolio | | | (14,360) | |

| Increase in Net Assets from Operations | | $ | 23,830 | |

See Notes to Financial Statements.

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 7 |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended August 31, | | 2013 | | | 2012 | |

| | |

| Operations: | | | | | | | | |

Net investment income | | $ | 38,190 | | | $ | 49,308 | |

Net realized gain (loss) | | | (14,360) | | | | 25,552 | |

Increase in Net Assets From Operations | | | 23,830 | | | | 74,860 | |

| | |

| Distributions to Shareholders From (Note 1): | | | | | | | | |

Net investment income | | | (38,283) | | | | (49,308) | |

Decrease in Net Assets From Distributions to Shareholders | | | (38,283) | | | | (49,308) | |

| | |

| Fund Share Transactions (Note 3): | | | | | | | | |

Net proceeds from sale of shares | | | 3,208,739,068 | | | | 4,111,006,666 | |

Reinvestment of distributions | | | 11,212 | | | | 22,593 | |

Cost of shares repurchased | | | (3,235,217,203) | | | | (4,100,669,470) | |

Increase (Decrease) in Net Assets From Fund Share Transactions | | | (26,466,923) | | | | 10,359,789 | |

Increase (Decrease) in Net Assets | | | (26,481,376) | | | | 10,385,341 | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 445,196,998 | | | | 434,811,657 | |

End of year* | | $ | 418,715,622 | | | $ | 445,196,998 | |

* Includes undistributed net investment income of: | | | $1,748 | | | | $1,428 | |

See Notes to Financial Statements.

| | |

| 8 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For a share of beneficial interest outstanding throughout each year ended August 31: | |

| | | 20131 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | |

| Net asset value, beginning of year | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

| | | | | |

| Income (loss) from operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.012 | |

Net realized gain (loss)2 | | | (0.000) | | | | 0.000 | | | | 0.000 | | | | 0.000 | | | | 0.000 | |

Total income from operations | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.000 | 2 | | | 0.012 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.012) | |

Total distributions | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.000) | 2 | | | (0.012) | |

| | | | | |

| Net asset value, end of year | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | | | | $1.000 | |

Total return3 | | | 0.01 | % | | | 0.01 | % | | | 0.01 | % | | | 0.02 | % | | | 1.24 | %4 |

| | | | | |

| Net assets, end of year (millions) | | | $419 | | | | $445 | | | | $435 | | | | $447 | | | | $375 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses5 | | | 0.60 | % | | | 0.50 | % | | | 0.48 | % | | | 0.52 | %6 | | | 0.54 | %6 |

Net expenses5,7,8 | | | 0.26 | 9 | | | 0.32 | 9 | | | 0.36 | 9 | | | 0.35 | 6,9 | | | 0.43 | 6 |

Net investment income | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.02 | | | | 1.25 | |

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | Amount represents less than $0.0005 per share. |

| 3 | Performance figures may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. |

| 4 | If the Portfolio had not entered into the Letter and Capital Support Agreements related to certain investments in structured securities, the total return would have been lower. |

| 5 | Includes the Fund’s share of Liquid Reserves Portfolio’s allocated expenses. The ratios presented for the fiscal years prior to 2013 include a 0.10% management fee waiver. |

| 6 | Included in the expense ratios is the Treasury Guarantee Program fees incurred by the Fund during the period. Without these fees, the gross and net expense ratios would have been 0.52% and 0.35%, respectively, and for the year ended August 31, 2010 and 0.51% and 0.40%, respectively, for the year ended August 31, 2009. |

| 7 | As a result of an expense limitation arrangement, the ratio of expenses, other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of the Fund did not exceed 0.45%. This expense limitation arrangement cannot be terminated prior to December 31, 2014 without the Board of Trustees’ consent. Prior to December 1, 2010, the expense limitation was 0.40%. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | In order to maintain a minimum yield, additional waivers were implemented. |

See Notes to Financial Statements.

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 9 |

Notes to financial statements

1. Organization and significant accounting policies

Western Asset Premium Liquid Reserves (the “Fund”) is a separate diversified investment series of Legg Mason Partners Premium Money Market Trust (the “Trust”). The Trust, a Maryland statutory trust, is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Fund invests all of its investable assets in Liquid Reserves Portfolio (the “Portfolio”), a separate investment series of Master Portfolio Trust, that has the same investment objective as the Fund.

The financial statements of the Portfolio, including the schedule of investments, are contained elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. The Fund records its investment in the Portfolio at value. The value of such investment in the Portfolio reflects the Fund’s proportionate interest (0.6% at August 31, 2013) in the net assets of the Portfolio.

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. The disclosure and valuation of securities held by the Portfolio are discussed in Note 1(a) of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

(b) Investment income. The Fund earns income, net of Portfolio expenses, daily based on its investment in the Portfolio.

(c) Expenses. The Fund bears all costs of its operations other than expenses specifically assumed by the manager. Expenses incurred by the Trust with respect to any two or more funds in the series are allocated in proportion to the net assets of each fund, except when allocations of direct expenses to each fund can otherwise be made fairly. Expenses directly attributable to a fund are charged to that fund. The Fund’s share of the Portfolio’s expenses is charged against and reduces the amount of the Fund’s investment in the Portfolio.

(d) Distributions to shareholders. Distributions from net investment income on the shares of the Fund are declared each business day and are paid monthly. Distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from GAAP.

| | |

| 10 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

(e) Credit and market risk. Investments in securities that are collateralized by residential real estate mortgages are subject to certain credit and liquidity risks. When market conditions result in an increase in default rates of the underlying mortgages and the foreclosure values of underlying real estate properties are materially below the outstanding amount of these underlying mortgages, collection of the full amount of accrued interest and principal on these investments may be doubtful. Such market conditions may significantly impair the value and liquidity of these investments and may result in a lack of correlation between their credit ratings and values.

(f) Federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

However, due to the timing of when distributions are made by the Fund, the Fund may be subject to an excise tax of 4% of the amount by which 98.2% of the Fund’s annual taxable income and net realized gains exceed the distributions from such taxable income and realized gains for the calendar year.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of August 31, 2013, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(g) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | | | | | | |

| | | Undistributed Net

Investment Income | | | Paid-in

Capital | |

| (a) | | $ | 413 | | | $ | (413) | |

| (a) | Reclassifications are primarily due to a non-deductible excise tax paid by the Fund. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s and the Portfolio’s investment manager. Western Asset Management Company (“Western Asset”) is the Fund’s and the Portfolio’s subadviser. LMPFA and Western Asset are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

Under the investment management agreements, the Fund and the Portfolio each pay an investment management fee, calculated daily and paid monthly, at an annual rate of 0.35%

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 11 |

Notes to financial statements (cont’d)

and 0.10% of the Fund’s and the Portfolio’s average daily net assets, respectively. Since the Fund invests all or substantially all of its investable assets in Liquid Reserves Portfolio, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by the Liquid Reserves Portfolio.

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. For its services, LMPFA pays Western Asset 70% of the net management fee it receives from the Fund.

As a result of an expense limitation arrangement between the Fund and LMPFA, the ratio of expenses other than brokerage, interest, taxes, extraordinary expenses and acquired fund fees and expenses, to average net assets of the Fund did not exceed 0.45%. This expense limitation arrangement cannot be terminated prior to December 31, 2014 without the Board of Trustees’ consent.

The investment manager has voluntarily undertaken to limit Fund expenses in order to maintain a minimum yield. Such expense limitations may fluctuate daily and are voluntary and temporary and may be terminated by the investment manager at any time without notice.

During the year ended August 31, 2013, fees waived and/or expenses reimbursed amounted to $1,260,188.

The investment manager is permitted to recapture amounts waived or reimbursed to the Fund during the same fiscal year if the Fund’s total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the investment manager recapture any amount that would result, on any particular business day of the Fund, in the Fund’s total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Legg Mason Investor Services, LLC, a wholly-owned broker-dealer subsidiary of Legg Mason, serves as the Fund’s sole and exclusive distributor.

The Fund has adopted a Rule 12b-1 distribution plan and under that plan, the Fund pays a service and/or distribution fee calculated at an annual rate not to exceed 0.10% of the Fund’s average daily net assets. Service and/or distribution fees are calculated daily and paid monthly. For the year ended August 31, 2013, the service and distribution fees paid amounted to $381,924.

All officers and one Trustee of the Trust are employees of Legg Mason or its affiliates and do not receive compensation from the Trust.

3. Shares of beneficial interest

At August 31, 2013, the Trust had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share.

Because the Fund has maintained a $1.00 net asset value per share from inception, the number of shares sold, shares issued on reinvestment of dividends declared, and shares

| | |

| 12 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

repurchased, is equal to the dollar amount shown in the Statements of Changes in Net Assets for the corresponding fund share transactions.

4. Income tax information and distributions to shareholders

Subsequent to the fiscal year end, the Fund has made the following distributions per share:

| | | | |

Record Date

Payable Date | | | |

Daily

9/30/2013 | | $ | 0.000008 | |

The tax character of distributions paid during the fiscal years ended August 31, was as follows:

| | | | | | | | |

| | | 2013 | | | 2012 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 38,283 | | | $ | 49,308 | |

As of August 31, 2013, there were no significant differences between the book and the tax components of net assets.

As of August 31, 2013, the Fund had losses of $6,039 that are deemed to arise on the first day of the next taxable year. Additionally, the Fund had the following net capital loss carryforward remaining:

| | | | |

| Year of Expiration | | Amount | |

| 8/31/2015 | | $ | (6,227 | ) |

| 8/31/2017 | | | (154,271 | ) |

| | | $ | (160,498 | ) |

These amounts will be available to offset any future taxable capital gains.

5. Legal matters

On or about May 30, 2006, John Halebian, a purported shareholder of Western Asset New York Tax Free Money Market Fund (formerly known as CitiSM New York Tax Free Reserves), a series of Legg Mason Partners Money Market Trust, formerly a series of CitiFunds Trust III (the “Subject Trust”), filed a complaint in the United States District Court for the Southern District of New York against the persons who were then the independent trustees of the Subject Trust. The Subject Trust was also named in the complaint as a nominal defendant.

The complaint raised derivative claims on behalf of the Subject Trust and putative class claims against the then independent trustees in connection with the 2005 sale of Citigroup’s asset management business to Legg Mason and the related approval of new investment advisory agreements by the trustees and shareholders. In the derivative claim, the plaintiff alleged that the independent trustees had breached their fiduciary duty to the Subject Trust and its shareholders by failing to negotiate lower fees or to seek competing bids from other qualified investment advisers in connection with Citigroup’s sale to Legg Mason. In the claims brought on behalf of a putative class of shareholders, the

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 13 |

Notes to financial statements (cont’d)

plaintiff alleged that the echo voting provisions applicable to the proxy solicitation process violated the 1940 Act and constituted a breach of fiduciary duty. The relief sought included rescission of the advisory agreement and an award of costs and attorney fees.

In advance of filing the complaint, Plaintiff’s lawyers had made written demand for relief on the Board of the Subject Trust, and the Board’s independent trustees formed a demand review committee to investigate those matters raised in the demand, and the expanded set of matters subsequently raised in the complaint. The demand review committee recommended that the action demanded by Plaintiff would not be in the best interests of the Subject Trust. The independent trustees of the Subject Trust considered the committee’s report, adopted the recommendation of the committee, and directed counsel to move to dismiss the complaint.

The Federal district court dismissed the complaint in its entirety in July 2007. In May 2011, the U.S. Court of Appeals for the Second Circuit affirmed the district court’s dismissal as to the class claims, and remanded the remaining claim relating to the demand review committee that had examined the derivative claim to the district court with instructions to convert the motion to dismiss into a motion for summary judgment. In July 2012, the district court granted summary judgment in favor of the defendants. In August 2012, Plaintiff filed an appeal in the U.S. Court of Appeals for the Second Circuit. The matter was fully briefed, oral argument was heard in September 2013, and the parties await a decision.

| | |

| 14 | | Western Asset Premium Liquid Reserves 2013 Annual Report |

Report of independent registered public accounting firm

The Board of Trustees and Shareholders

Legg Mason Partners Premium Money Market Trust:

We have audited the accompanying statement of assets and liabilities of Western Asset Premium Liquid Reserves (the “Fund”), a series of Legg Mason Partners Premium Money Market Trust, as of August 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included verification of investments owned as of August 31, 2013 by examination of the underlying Liquid Reserves Portfolio. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Western Asset Premium Liquid Reserves as of August 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 16, 2013

| | |

| Western Asset Premium Liquid Reserves 2013 Annual Report | | 15 |

Additional information (unaudited)

Information about Trustees and Officers

The business and affairs of Western Asset Premium Liquid Reserves (the “Fund”) are conducted by management under the supervision and subject to the direction of its Board of Trustees. The business address of each Trustee is c/o Kenneth D. Fuller, 100 International Drive, 5th Floor, Baltimore, Maryland 21202. Information pertaining to the Trustees and officers of the Fund is set forth below.

The Statement of Additional Information includes additional information about Trustees and is available, without charge, upon request by calling the Fund at 1-877-721-1926 or 1-203-703-6002.

| | |

| Independent Trustees†: | | |

| Elliott J. Berv | | |

| Year of birth | | 1943 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1989 |

| Principal occupation(s) during past five years | | President and Chief Executive Officer, Catalyst (consulting) (since 1984); formerly, Chief Executive Officer, Rocket City Enterprises (media) (2000 to 2005) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | World Affairs Council (since 2009); Board Member, American Identity Corp. (doing business as Morpheus Technologies) (biometric information management) (since 2001); formerly, Director, Lapoint Industries (industrial filter company) (2002 to 2007); formerly, Director, Alzheimer’s Association (New England Chapter) (1998 to 2008) |

| |

| A. Benton Cocanougher | | |

| Year of birth | | 1938 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1991 |

| Principal occupation(s) during past five years | | Retired; Dean Emeritus and Professor Emeritus, Texas A&M University (since 2008); Interim Dean, George Bush School of Government and Public Service, Texas A&M University (2009 to 2010); A.P. Wiley Professor, Texas A&M University (2001 to 2008); Interim Chancellor, Texas A&M University System (2003 to 2004); Dean of the Mays Business School, Texas A&M University (1987 to 2001) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | Formerly, Director, First American Bank, Texas (1994 to 1999); formerly, Director, Randle Foods, Inc. (1991 to 1999); formerly, Director, Petrolon, Inc. (engine lubrication products) (1991 to 1994) |

| | |

| 16 | | Western Asset Premium Liquid Reserves |

| | |

| Independent Trustees cont’d | | |

| Jane F. Dasher | | |

| Year of birth | | 1949 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1999 |

| Principal occupation(s) during past five years | | Chief Financial Officer, Long Light Capital, LLC, formerly known as Korsant Partners, LLC (a family investment company) (since 1997) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| |

| Mark T. Finn | | |

| Year of birth | | 1943 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1989 |

| Principal occupation(s) during past five years | | Adjunct Professor, College of William & Mary (since 2002); Chairman, Chief Executive Officer and Owner, Vantage Consulting Group, Inc. (investment management) (since 1988); Principal/Member, Balvan Partners (investment management) (2002 to 2009) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| |

| Stephen R. Gross | | |

| Year of birth | | 1947 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1986 |

| Principal occupation(s) during past five years | | Chairman Emeritus (since 2011) and formerly Chairman, HLB Gross Collins, P.C. (accounting and consulting firm) (1974 to 2011); Executive Director of Business Builders Team, LLC (since 2005); Principal, Gross Consulting Group, LLC (since 2011); CEO, Gross Capital Advisors, LLC (since 2011); CEO, Trusted CFO Solutions, LLC (since 2011) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| |

| Richard E. Hanson, Jr. | | |

| Year of birth | | 1941 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1985 |

| Principal occupation(s) during past five years | | Retired; formerly Headmaster, The New Atlanta Jewish Community High School, Atlanta, Georgia (1996 to 2000) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| | |

| Western Asset Premium Liquid Reserves | | 17 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| | |

| Independent Trustees cont’d |

| Diana R. Harrington | | |

| Year of birth | | 1940 |

| Position(s) with Trust | | Trustee and Chair |

| Term of office1 and length of time served2 | | Since 1992 and since 2013 |

| Principal occupation(s) during past five years | | Babson Distinguished Professor of Finance, Babson College (since 1992) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| |

| Susan M. Heilbron | | |

| Year of birth | | 1945 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1994 |

| Principal occupation(s) during past five years | | Retired; formerly, President, Lacey & Heilbron (communications consulting) (1990 to 2002); formerly, General Counsel and Executive Vice President, The Trump Organization (1986 to 1990); formerly, Senior Vice President, New York State Urban Development Corporation (1984 to 1986); formerly, Associate, Cravath, Swaine & Moore (1980 to 1984) and (1977 to 1979) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | Formerly, Director, Lincoln Savings Bank, FSB (1991 to 1994); formerly, Director, Trump Shuttle, Inc. (air transportation) (1989 to 1990); formerly, Director, Alexander’s Inc. (department store) (1987 to 1990) |

| |

| Susan B. Kerley | | |

| Year of birth | | 1951 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1992 |

| Principal occupation(s) during past five years | | Investment Consulting Partner, Strategic Management Advisors, LLC (investment consulting) (since 1990) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | Director and Trustee (since 1990) and formerly, Chairman (2005 to 2012) of various series of MainStay Family of Funds (66 funds); Investment Company Institute (ICI) Board of Governors (since 2006); ICI Executive Committee (since 2011); Chairman of the Independent Directors Council (since 2012) |

| | |

| 18 | | Western Asset Premium Liquid Reserves |

| | |

| Independent Trustees cont’d |

| Alan G. Merten | | |

| Year of birth | | 1941 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1990 |

| Principal occupation(s) during past five years | | President Emeritus (since 2012) and formerly, President, George Mason University (1996 to 2012) |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | Director Emeritus, Cardinal Financial Corporation (since 2006); Trustee, First Potomac Realty Trust (since 2005); Director, DeVry Inc. (educational services) (since 2012); formerly, Director, Xybernaut Corporation (information technology) (2004 to 2006); formerly, Director, Digital Net Holdings, Inc. (2003 to 2004); formerly, Director, Comshare, Inc. (information technology) (1985 to 2003) |

| |

| R. Richardson Pettit | | |

| Year of birth | | 1942 |

| Position(s) with Trust | | Trustee |

| Term of office1 and length of time served2 | | Since 1990 |

| Principal occupation(s) during past five years | | Retired; formerly, Duncan Professor of Finance, University of Houston (1977 to 2006); previous academic or management positions include: University of Washington, University of Pennsylvania and Purdue University |

| Number of funds in fund complex overseen by Trustee | | 52 |

| Other board memberships held by Trustee | | None |

| | |

| Interested Trustee and Officer: |

| Kenneth D. Fuller3 | | |

| Year of birth | | 1958 |

| Position(s) with Trust | | Trustee, President, and Chief Executive Officer |

| Term of office1 and length of time served2 | | Since 2013 |

| Principal occupation(s) during past five years | | Managing Director of Legg Mason & Co., LLC (“Legg Mason & Co.”) (since 2013); Officer and/or Trustee/Director of 166 funds associated with Legg Mason Fund Advisor, LLC (“LMPFA”) or its affiliates (since 2013); President and Chief Executive Officer of LMPFA (since 2013); President and Chief Executive Officer of LM Asset Services, LLC (“LMAS”) and Legg Mason Fund Asset Management, Inc. (“LMFAM”) (formerly registered investment advisers) (since 2013); formerly, Senior Vice President of LMPFA (2012 to 2013); formerly, Director of Legg Mason & Co. (2012 to 2013); formerly, Vice President of Legg Mason & Co. (2009 to 2012); formerly, Vice President – Equity Division of T. Rowe Price Associates (1993 to 2009), as well as Investment Analyst and Portfolio Manager for certain asset allocation accounts (2004 to 2009). |

| Number of funds in fund complex overseen by Trustee | | 154 |

| Other board memberships held by Trustee | | None |

| | |

| Western Asset Premium Liquid Reserves | | 19 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| | |

| Additional Officers: |

Ted P. Becker Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | | |

| Year of birth | | 1951 |

| Position(s) with Trust | | Chief Compliance Officer |

| Term of office1 and length of time served2 | | Since 2007 |

| Principal occupation(s) during past five years | | Director of Global Compliance at Legg Mason (since 2006); Chief Compliance Officer of LMPFA (since 2006); Managing Director of Compliance of Legg Mason & Co. (since 2005); Chief Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) |

| |

Susan Kerr Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | | |

| Year of birth | | 1949 |

| Position(s) with Trust | | Chief Anti-Money Laundering Compliance Officer |

| Term of office1 and length of time served2 | | Since 2013 |

| Principal occupation(s) during past five years | | Assistant Vice President of Legg Mason & Co. and Legg Mason Investor Services, LLC (“LMIS”) (since 2010); Chief Anti-Money Laundering Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2013) and Anti-Money Laundering Compliance Officer of LMIS (since 2012); Senior Compliance Officer of LMIS (since 2011); formerly, AML Consultant, DTCC (2010); formerly, AML Consultant, Rabobank Netherlands, (2009); formerly, First Vice President, Director of Marketing & Advertising Compliance and Manager of Communications Review Group at Citigroup Inc. (1996 to 2008) |

| |

Vanessa A. Williams Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 | | |

| Year of birth | | 1979 |

| Position(s) with Trust | | Identity Theft Prevention Officer |

| Term of office1 and length of time served2 | | Since 2011 |

| Principal occupation(s) during past five years | | Vice President of Legg Mason & Co. (since 2012); Identity Theft Prevention Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2011); formerly, Chief Anti-Money Laundering Compliance Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (2011 to 2013); formerly, Senior Compliance Officer of Legg Mason & Co. (2008 to 2011); formerly, Compliance Analyst of Legg Mason & Co. (2006 to 2008) and Legg Mason & Co. predecessors (prior to 2006) |

| | |

| 20 | | Western Asset Premium Liquid Reserves |

| | |

| Additional Officers cont’d |

Robert I. Frenkel Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 | | |

| Year of birth | | 1954 |

| Position(s) with Trust | | Secretary and Chief Legal Officer |

| Term of office1 and length of time served2 | | Since 2007 |

| Principal occupation(s) during past five years | | Vice President and Deputy General Counsel of Legg Mason (since 2006); Managing Director and General Counsel of Global Mutual Funds for Legg Mason & Co. (since 2006) and Legg Mason & Co. predecessors (since 1994); Secretary and Chief Legal Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) and Legg Mason & Co. predecessors (prior to 2006) |

| |

Thomas C. Mandia Legg Mason 100 First Stamford Place, 6th Floor, Stamford, CT 06902 | | |

| Year of birth | | 1962 |

| Position(s) with Trust | | Assistant Secretary |

| Term of office1 and length of time served2 | | Since 2007 |

| Principal occupation(s) during past five years | | Managing Director and Deputy General Counsel of Legg Mason & Co. (since 2005) and Legg Mason & Co. predecessors (prior to 2005); Secretary of LMPFA (since 2006); Assistant Secretary of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2006) and Legg Mason & Co. predecessors (prior to 2006); Secretary of LMAS (since 2002) and LMFAM (since 2013) |

| |

Richard F. Sennett Legg Mason 100 International Drive, 5th Floor, Baltimore, MD 21202 | | |

| Year of birth | | 1970 |

| Position(s) with Trust | | Principal Financial Officer |

| Term of office1 and length of time served2 | | Since 2011 |

| Principal occupation(s) during past five years | | Principal Financial Officer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2011); Managing Director of Legg Mason & Co. and Senior Manager of the Treasury Policy group for Legg Mason & Co.’s Global Fiduciary Platform (since 2011); formerly, Chief Accountant within the SEC’s Division of Investment Management (2007 to 2011); formerly, Assistant Chief Accountant within the SEC’s Division of Investment Management (2002 to 2007) |

| | |

| Western Asset Premium Liquid Reserves | | 21 |

Additional information (unaudited) (cont’d)

Information about Trustees and Officers

| | |

| Additional Officers cont’d |

James Crowley

Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | | |

| Year of birth | | 1966 |

| Position(s) with Trust | | Treasurer |

| Term of office1 and length of time served2 | | Since 2011 |

| Principal occupation(s) during past five years | | Vice President of Legg Mason & Co. (since 2010); Treasurer of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2011); formerly, Controller of certain mutual funds associated with Legg Mason & Co. or its affiliates (prior to 2011); formerly, Controller of Security Fair Valuation and Project Management for Legg Mason & Co. or its affiliates (prior to 2010) |

| |

Jeanne M. Kelly Legg Mason 620 Eighth Avenue, 49th Floor, New York, NY 10018 | | |

| Year of birth | | 1951 |

| Position(s) with Trust | | Senior Vice President |

| Term of office1 and length of time served2 | | Since 2007 |

| Principal occupation(s) during past five years | | Senior Vice President of certain mutual funds associated with Legg Mason & Co. or its affiliates (since 2007); Senior Vice President of LMPFA (since 2006) and LMFAM (since 2013); Managing Director of Legg Mason & Co. (since 2005) and Legg Mason & Co. predecessors (prior to 2005) |

| † | Trustees who are not “interested persons” of the Fund within the meaning of section 2(a)(19) of the 1940 Act. |

| 1 | Each Trustee and officer serves until his or her respective successor has been duly elected and qualified or until his or her earlier death, resignation, retirement or removal. |

| 2 | Indicates the earliest year in which the Trustee became a board member for a fund in the Legg Mason fund complex or the officer took such office. |

| 3 | Effective June 1, 2013, Mr. Fuller was appointed to the position of President and Chief Executive Officer. Prior to this date, R. Jay Gerken served as Chairman, President and Chief Executive Officer. Mr. Gerken retired effective May 31, 2013. Mr. Fuller is an “interested person” of the Fund, as defined in the 1940 Act, because of his position with LMPFA and/or certain of its affiliates. |

| | |

| 22 | | Western Asset Premium Liquid Reserves |

Important tax information (unaudited)

The following information is provided with respect to the distributions paid during the taxable year ended August 31, 2013:

| | | | |

| Record date: | | Daily | | Daily |

| Payable date: | | September 2012 through

December 2012 | | January 2013 through

August 2013 |

| Interest from Federal Obligations | | 1.40% | | 1.87% |

The law varies in each state as to whether and what percentage of dividend income attributable to Federal obligations is exempt from state income tax. We recommend that you consult with your tax adviser to determine if any portion of the dividends you received is exempt from state income taxes.

The following information is applicable to non-U.S. resident shareholders:

50% of the ordinary income distributions paid monthly by the Fund represent Qualified Net Interest Income and Qualified Short-Term Capital Gains eligible for exemption from U.S. withholding tax for nonresident aliens and foreign corporations.

Please retain this information for your records.

| | |

| Western Asset Premium Liquid Reserves | | 23 |

Schedule of investments

August 31, 2013

Liquid Reserves Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

| Short-Term Investments — 100.3% | |

Certificates of Deposit — 30.3% | |

Bank of Montreal Chicago | | | 0.240 | % | | | 10/10/13 | | | $ | 496,000,000 | | | $ | 496,000,000 | |

Bank of Montreal Chicago | | | 0.180 | % | | | 10/11/13 | | | | 200,000,000 | | | | 200,000,000 | |

Bank of Montreal Chicago | | | 0.190 | % | | | 10/11/13 | | | | 18,250,000 | | | | 18,250,000 | |

Bank of Montreal Chicago | | | 0.355 | % | | | 10/11/13 | | | | 145,000,000 | | | | 145,007,331 | (a) |

Bank of Montreal Chicago | | | 0.200 | % | | | 10/17/13 | | | | 300,000,000 | | | | 300,000,000 | |

Bank of Montreal Chicago | | | 0.240 | % | | | 10/24/13 | | | | 362,000,000 | | | | 362,000,000 | |

Bank of Montreal Chicago | | | 0.180 | % | | | 11/12/13 | | | | 65,000,000 | | | | 65,001,298 | |

Bank of Montreal Chicago | | | 0.180 | % | | | 11/14/13 | | | | 100,000,000 | | | | 99,999,999 | |

Bank of Montreal Chicago | | | 0.273 | % | | | 6/12/14 | | | | 100,000,000 | | | | 100,000,000 | (a) |

Bank of Nova Scotia | | | 0.240 | % | | | 10/10/13 | | | | 240,000,000 | | | | 240,000,000 | |

Bank of Nova Scotia | | | 0.466 | % | | | 10/18/13 | | | | 70,000,000 | | | | 70,015,462 | (a) |

Bank of Nova Scotia | | | 0.230 | % | | | 1/23/14 | | | | 364,500,000 | | | | 364,500,000 | |

Bank of Nova Scotia | | | 0.230 | % | | | 3/3/14 | | | | 250,000,000 | | | | 250,000,000 | |

Bank of Tokyo-Mitsubishi UFJ NY | | | 0.240 | % | | | 11/7/13 | | | | 315,000,000 | | | | 315,000,000 | |

Bank of Tokyo-Mitsubishi UFJ NY | | | 0.220 | % | | | 11/18/13 | | | | 245,000,000 | | | | 245,000,000 | |

Bank of Tokyo-Mitsubishi UFJ NY | | | 0.260 | % | | | 1/10/14 | | | | 500,000,000 | | | | 500,000,000 | |

Bank of Tokyo-Mitsubishi UFJ NY | | | 0.250 | % | | | 2/7/14 | | | | 395,000,000 | | | | 395,000,000 | |

Bank of Tokyo-Mitsubishi UFJ NY | | | 0.250 | % | | | 2/21/14 | | | | 100,000,000 | | | | 100,000,000 | |

BNP Paribas NY Branch | | | 0.420 | % | | | 9/6/13 | | | | 200,000,000 | | | | 200,000,000 | |

BNP Paribas NY Branch | | | 0.300 | % | | | 9/13/13 | | | | 700,000,000 | | | | 700,000,000 | |

Canadian Imperial Bank | | | 0.040 | % | | | 9/5/13 | | | | 175,000,000 | | | | 175,000,000 | |

Canadian Imperial Bank | | | 0.285 | % | | | 10/23/13 | | | | 100,000,000 | | | | 100,000,000 | (a) |

Canadian Imperial Bank | | | 0.272 | % | | | 6/13/14 | | | | 100,000,000 | | | | 100,000,000 | (a) |

Canadian Imperial Bank | | | 0.288 | % | | | 7/15/14 | | | | 445,000,000 | | | | 445,000,000 | (a) |

Credit Agricole Corp. | | | 0.310 | % | | | 11/12/13 | | | | 974,550,000 | | | | 974,550,000 | |

Credit Suisse NY | | | 0.270 | % | | | 9/9/13 | | | | 290,000,000 | | | | 290,000,000 | |

Credit Suisse NY | | | 0.270 | % | | | 12/11/13 | | | | 295,000,000 | | | | 295,000,000 | |

Deutsche Bank AG NY | | | 0.365 | % | | | 10/15/13 | | | | 225,000,000 | | | | 225,000,000 | |

Deutsche Bank AG NY | | | 0.320 | % | | | 2/26/14 | | | | 47,000,000 | | | | 47,000,000 | |

DnB NOR Bank ASA | | | 0.235 | % | | | 11/8/13 | | | | 399,250,000 | | | | 399,250,000 | |

DnB NOR Bank ASA | | | 0.235 | % | | | 11/14/13 | | | | 100,000,000 | | | | 99,998,974 | |

JPMorgan Chase Bank N.A. | | | 0.280 | % | | | 11/26/13 | | | | 600,000,000 | | | | 600,000,000 | |

JPMorgan Chase Bank N.A. | | | 0.314 | % | | | 7/29/14 | | | | 560,000,000 | | | | 560,000,000 | (a) |

Mitsubishi UFJ Trust & Banking NY | | | 0.270 | % | | | 10/18/13 | | | | 195,000,000 | | | | 195,000,000 | |

Mizuho Bank Ltd. | | | 0.230 | % | | | 9/6/13 | | | | 50,000,000 | | | | 50,000,000 | |

Mizuho Bank Ltd. | | | 0.230 | % | | | 9/6/13 | | | | 50,000,000 | | | | 50,000,000 | |

Mizuho Bank Ltd. | | | 0.280 | % | | | 10/1/13 | | | | 254,000,000 | | | | 254,000,000 | |

See Notes to Financial Statements.

| | |

| 24 | | Liquid Reserves Portfolio 2013 Annual Report |

Liquid Reserves Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Certificates of Deposit — continued | |

Mizuho Bank Ltd. | | | 0.250 | % | | | 10/23/13 | | | $ | 181,000,000 | | | $ | 181,000,577 | |

Mizuho Bank Ltd. | | | 0.270 | % | | | 11/6/13 | | | | 200,000,000 | | | | 200,000,000 | |

Mizuho Bank Ltd. | | | 0.260 | % | | | 11/22/13 | | | | 100,000,000 | | | | 100,000,000 | |

Mizuho Bank Ltd. | | | 0.250 | % | | | 1/2/14 | | | | 237,000,000 | | | | 236,999,937 | �� |

National Bank of Canada | | | 0.325 | % | | | 9/11/13 | | | | 400,000,000 | | | | 400,000,000 | (a) |

National Bank of Canada | | | 0.321 | % | | | 10/7/13 | | | | 170,000,000 | | | | 170,000,000 | (a) |

Nordea Bank Finland PLC | | | 0.260 | % | | | 9/13/13 | | | | 165,000,000 | | | | 165,000,000 | |

Nordea Bank Finland PLC | | | 0.220 | % | | | 11/29/13 | | | | 100,000,000 | | | | 99,997,531 | |

Nordea Bank Finland PLC | | | 0.240 | % | | | 1/2/14 | | | | 50,000,000 | | | | 50,005,109 | |

Nordea Bank Finland PLC | | | 0.245 | % | | | 1/3/14 | | | | 200,000,000 | | | | 200,000,000 | |

Nordea Bank Finland PLC | | | 0.250 | % | | | 2/5/14 | | | | 100,000,000 | | | | 99,999,995 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.240 | % | | | 9/6/13 | | | | 100,000,000 | | | | 100,000,000 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.200 | % | | | 9/24/13 | | | | 200,000,000 | | | | 200,000,000 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.200 | % | | | 9/26/13 | | | | 100,000,000 | | | | 100,000,000 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.210 | % | | | 11/12/13 | | | | 50,000,000 | | | | 49,999,000 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.240 | % | | | 12/5/13 | | | | 100,000,000 | | | | 99,997,364 | |

Oversea-Chinese Banking Corp. Ltd. | | | 0.260 | % | | | 1/3/14 | | | | 99,000,000 | | | | 99,000,000 | |

Rabobank Nederland NY | | | 0.405 | % | | | 1/8/14 | | | | 250,000,000 | | | | 250,174,065 | |

Rabobank Nederland NY | | | 0.351 | % | | | 7/11/14 | | | | 495,000,000 | | | | 495,000,000 | (a) |

Rabobank Nederland NY | | | 0.301 | % | | | 9/3/14 | | | | 500,000,000 | | | | 500,000,000 | (a) |

Royal Bank of Canada | | | 0.310 | % | | | 1/27/14 | | | | 125,000,000 | | | | 125,000,000 | (a) |

Royal Bank of Canada | | | 0.310 | % | | | 1/30/14 | | | | 199,000,000 | | | | 199,000,000 | (a) |

Royal Bank of Canada | | | 0.310 | % | | | 2/3/14 | | | | 278,000,000 | | | | 278,000,000 | (a) |

Royal Bank of Canada | | | 0.300 | % | | | 2/19/14 | | | | 100,000,000 | | | | 100,000,000 | (a) |

Royal Bank of Canada | | | 0.280 | % | | | 6/10/14 | | | | 75,000,000 | | | | 75,000,000 | (a) |

Royal Bank of Canada | | | 0.297 | % | | | 7/2/14 | | | | 200,000,000 | | | | 200,000,000 | (a) |

Standard Chartered Bank NY | | | 0.320 | % | | | 9/16/13 | | | | 75,000,000 | | | | 75,000,309 | |

Standard Chartered Bank NY | | | 0.280 | % | | | 1/27/14 | | | | 345,000,000 | | | | 345,000,000 | |

Standard Chartered Bank NY | | | 0.295 | % | | | 2/26/14 | | | | 322,000,000 | | | | 322,007,948 | |

Sumitomo Mitsui Banking Corp. | | | 0.270 | % | | | 9/9/13 | | | | 100,000,000 | | | | 100,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 10/15/13 | | | | 150,000,000 | | | | 150,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 10/17/13 | | | | 150,000,000 | | | | 150,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 10/22/13 | | | | 297,000,000 | | | | 297,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 12/23/13 | | | | 99,140,000 | | | | 99,140,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 1/8/14 | | | | 255,000,000 | | | | 255,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 1/17/14 | | | | 100,000,000 | | | | 100,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.250 | % | | | 2/7/14 | | | | 147,000,000 | | | | 147,000,000 | |

Sumitomo Mitsui Banking Corp. | | | 0.250 | % | | | 2/12/14 | | | | 100,000,000 | | | | 100,000,000 | |

See Notes to Financial Statements.

| | |

| Liquid Reserves Portfolio 2013 Annual Report | | 25 |

Schedule of investments (cont’d)

August 31, 2013

Liquid Reserves Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Certificates of Deposit — continued | |

Sumitomo Mitsui Banking Corp. | | | 0.260 | % | | | 2/24/14 | | | $ | 297,000,000 | | | $ | 297,000,000 | |

Svenska Handelsbanken AB | | | 0.185 | % | | | 9/4/13 | | | | 100,000,000 | | | | 100,000,040 | |

Svenska Handelsbanken AB | | | 0.185 | % | | | 9/6/13 | | | | 150,000,000 | | | | 150,000,104 | |

Svenska Handelsbanken AB | | | 0.185 | % | | | 9/16/13 | | | | 200,000,000 | | | | 200,000,319 | |

Svenska Handelsbanken AB | | | 0.200 | % | | | 10/25/13 | | | | 75,000,000 | | | | 75,000,000 | |

Svenska Handelsbanken AB | | | 0.250 | % | | | 1/17/14 | | | | 80,000,000 | | | | 80,000,000 | |

Svenska Handelsbanken AB | | | 0.230 | % | | | 1/30/14 | | | | 160,000,000 | | | | 160,000,000 | |

Swedbank AB | | | 0.300 | % | | | 12/18/13 | | | | 100,000,000 | | | | 100,000,000 | |

Swedbank AB | | | 0.290 | % | | | 12/27/13 | | | | 100,000,000 | | | | 100,000,000 | |

Swedbank AB | | | 0.250 | % | | | 2/18/14 | | | | 170,000,000 | | | | 170,000,000 | |

Toronto Dominion Bank NY | | | 0.230 | % | | | 9/13/13 | | | | 300,000,000 | | | | 300,000,000 | |

Toronto Dominion Bank NY | | | 0.272 | % | | | 9/13/13 | | | | 210,000,000 | | | | 210,000,000 | (a) |

Toronto Dominion Bank NY | | | 0.266 | % | | | 10/21/13 | | | | 250,000,000 | | | | 250,000,000 | (a) |

Toronto Dominion Bank NY | | | 0.260 | % | | | 1/23/14 | | | | 350,000,000 | | | | 350,000,000 | |

Toronto Dominion Bank NY | | | 0.220 | % | | | 2/14/14 | | | | 297,000,000 | | | | 297,000,000 | |

Toronto Dominion Bank NY | | | 0.230 | % | | | 2/20/14 | | | | 342,000,000 | | | | 342,000,000 | |

UBS AG Stamford Branch | | | 0.300 | % | | | 10/17/13 | | | | 400,000,000 | | | | 399,997,448 | |

UBS AG Stamford Branch | | | 0.255 | % | | | 12/10/13 | | | | 500,000,000 | | | | 499,993,066 | |

Wells Fargo Bank N.A. | | | 0.210 | % | | | 9/9/13 | | | | 915,000,000 | | | | 915,000,000 | |

Wells Fargo Bank N.A. | | | 0.200 | % | | | 10/7/13 | | | | 60,000,000 | | | | 60,000,000 | |

Wells Fargo Bank N.A. | | | 0.220 | % | | | 4/21/14 | | | | 300,000,000 | | | | 300,000,000 | |

Total Certificates of Deposit | | | | | | | | | | | | | | | 22,295,885,876 | |

Certificates of Deposit (Euro) — 1.3% | | | | | | | | | | | | | | | | |

Standard Chartered Bank | | | 0.370 | % | | | 9/23/13 | | | | 145,000,000 | | | | 145,000,884 | |

Standard Chartered Bank | | | 0.380 | % | | | 9/25/13 | | | | 321,000,000 | | | | 321,002,136 | |

Standard Chartered Bank | | | 0.365 | % | | | 1/17/14 | | | | 150,000,000 | | | | 150,002,870 | |

Standard Chartered Bank | | | 0.310 | % | | | 1/24/14 | | | | 375,000,000 | | | | 375,000,000 | |

Total Certificates of Deposit (Euro) | | | | | | | | | | | | | | | 991,005,890 | |

Commercial Paper — 43.0% | | | | | | | | | | | | | | | | |

ANZ National International Ltd. | | | 0.230 | % | | | 10/17/13 | | | | 100,000,000 | | | | 99,970,611 | (b)(c) |

ANZ National International Ltd. | | | 0.354 | % | | | 12/6/13 | | | | 125,000,000 | | | | 125,000,000 | (a)(c) |

ASB Finance Ltd. | | | 0.355 | % | | | 11/12/13 | | | | 160,000,000 | | | | 159,996,835 | (a)(c) |

ASB Finance Ltd. | | | 0.235 | % | | | 11/29/13 | | | | 100,000,000 | | | | 99,941,903 | (b)(c) |

ASB Finance Ltd. | | | 0.245 | % | | | 1/15/14 | | | | 100,000,000 | | | | 99,907,444 | (b)(c) |

ASB Finance Ltd. | | | 0.230 | % | | | 1/17/14 | | | | 95,000,000 | | | | 94,916,242 | (b)(c) |

ASB Finance Ltd. | | | 0.230 | % | | | 2/7/14 | | | | 78,930,000 | | | | 78,849,821 | (b)(c) |

Australia & New Zealand Banking Group | | | 0.314 | % | | | 11/20/13 | | | | 191,000,000 | | | | 191,000,000 | (a)(c) |

Bank Nederlandse Gemeenten NV | | | 0.180 | % | | | 11/4/13 | | | | 150,000,000 | | | | 149,952,000 | (b)(c) |

See Notes to Financial Statements.

| | |

| 26 | | Liquid Reserves Portfolio 2013 Annual Report |

Liquid Reserves Portfolio

| | | | | | | | | | | | | | | | |

| Security | | Rate | | | Maturity

Date | | | Face

Amount | | | Value | |

Commercial Paper — continued | | | | | | | | | | | | | | | | |

Bank Nederlandse Gemeenten NV | | | 0.190 | % | | | 1/2/14 | | | $ | 100,000,000 | | | $ | 99,935,083 | (b)(c) |