Exhibit 99.2

ALLERGAN

Our pursuit. Life’s potential.®

May 2014

Allergan

A Specialist in the Biopharmaceutical

& Medical Device Industries

Forward-Looking Statements

This presentation contains “forward-looking statements,” including statements regarding product acquisition and development, regulatory approvals, market potential, expected growth, efficiencies, and Allergan’s expected, estimated or anticipated future results, including Allergan’s earnings per share and revenue forecasts, among other statements. All forward-looking statements herein are based on Allergan’s current expectations of future events and represent Allergan’s judgment only as of the date of this presentation. If underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could vary materially from Allergan’s expectations and projections. Therefore, you are cautioned not to rely on any of these forward-looking statements and Allergan expressly disclaims any intent or obligation to update these forward-looking statements except as required to do so by law.

Actual results may differ materially from Allergan’s current expectations based on a number of factors affecting Allergan’s businesses, including changing competitive, market and regulatory conditions; the timing and uncertainty of the results of both the research and development and regulatory processes; domestic and foreign health care and cost containment reforms, including government pricing, tax and reimbursement policies; revisions to regulatory policies related to the approval of competitive generic products; technological advances and patents obtained by competitors; the ability to obtain and maintain adequate protection of intellectual property rights; the performance of new products, including obtaining government approval and consumer and physician acceptance, the continuing acceptance of currently marketed products, and consistency of treatment results among patients; the effectiveness of promotional and advertising campaigns; the potential for negative publicity concerning any of Allergan’s products; the timely and successful implementation of strategic initiatives, including expansion of new or existing products into new markets; the results of any pending or future litigation, investigations or claims; the uncertainty associated with the identification of, and successful consummation, execution and integration of, external corporate development initiatives and strategic partnering transactions; potential difficulties in manufacturing; and Allergan’s ability to obtain and successfully maintain a sufficient supply of products to meet market demand in a timely manner. In addition, matters generally affecting the U.S. and international economies, including consumer confidence and debt levels, changes in interest and currency exchange rates, political uncertainty, international relations, the status of financial markets and institutions, impact of natural disasters or geo-political events and the state of the economy worldwide, may materially affect Allergan’s results.

These and other risks and uncertainties affecting Allergan’s businesses and operations may be found in Allergan’s most recently filed

Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, including under the heading “Risk Factors”. These filings, as well as Allergan’s other public filings with the U.S. Securities and Exchange Commission (SEC), can be obtained without charge at the SEC’s web site at www.sec.gov. These SEC filings are also available at Allergan’s web site at www.allergan.com along with copies of Allergan’s press releases and additional information about Allergan. For further information, you can contact the Allergan Investor Relations Department by calling 714 -246-4636.

© 2014 Allergan, Inc. All rights reserved.

ALLERGAN

Our pursuit. Life’s potential.®

® & ™ Marks owned by Allergan, Inc.

JUVÉDERM® is a registered trademark of Allergan Industrie SAS

All other products are registered trademarks of their respective companies

2

Update on Selected Recent Developments

On April 22, 2014, Valeant and Pershing Square proposed an acquisition of Allergan

The proposal consisted of $48.30 / share in cash and 0.83 Valeant shares / Allergan share in stock

On May 10, 2014, the Allergan Board of Directors reviewed Valeant’s unsolicited proposal in consultation with financial and legal advisors

It is the unanimous view of the Allergan Board of Directors that Valeant’s unsolicited proposal substantially undervalues Allergan, creates significant risks and uncertainties for the stockholders of Allergan, and is not in the best interests of the Company and its stockholders

Allergan has a long history of producing consistent growth and delivering solid results through a combination of innovation, execution and discipline

We are confident in our ability to extend our strong track record of innovation, which has yielded unique expertise and insights that drive innovation and value

We do not believe Valeant’s proposal reflects value due to our leading market positions, future growth prospects, and industry-leading research and development efforts. In addition, we do not believe that the Valeant business model is sustainable

Allergan Board of Directors is confident that our plan will create significantly more value than Valeant’s hostile, unsolicited proposal

Allergan management team is best equipped to deliver this value – our track record speaks for itself

ALLERGAN

Our pursuit. Life’s potential.®

3

Highlights of Business

Allergan Now

We have built a pre-eminent specialty pharmaceutical and medical device company based on a track record of innovation and shareholder value creation

#1 or #2 positions in high growth markets, based on premium high quality products

Taking advantage of market dislocation and weakening competitors

Targeted expansion into high value geographies and new specialty areas

Innovation in products and marketing drives our success

Prolific R&D generates products that customers want and make us a market leader

Sophisticated and proprietary sales, support and marketing infrastructure

Allergan in the Future

Our management team is best positioned to drive growth through innovation and operational excellence

Continue to maximize value through market expansion and new market creation

In mid-2013, management and our Board of Directors began working on a plan to further enhance sales and earnings performance

Capitalize on value of critical mass built over past five years

Strong pipeline and continued delivery of product flow driving top line growth

Operational efficiency and leveraging commercial infrastructure accelerating bottom line growth

ALLERGAN

Our pursuit. Life’s potential.®

4

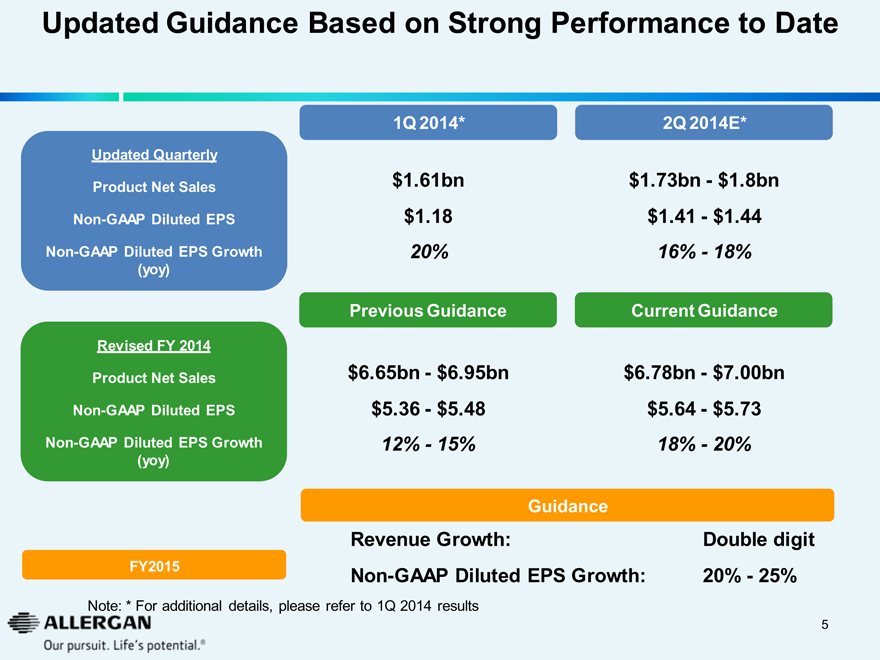

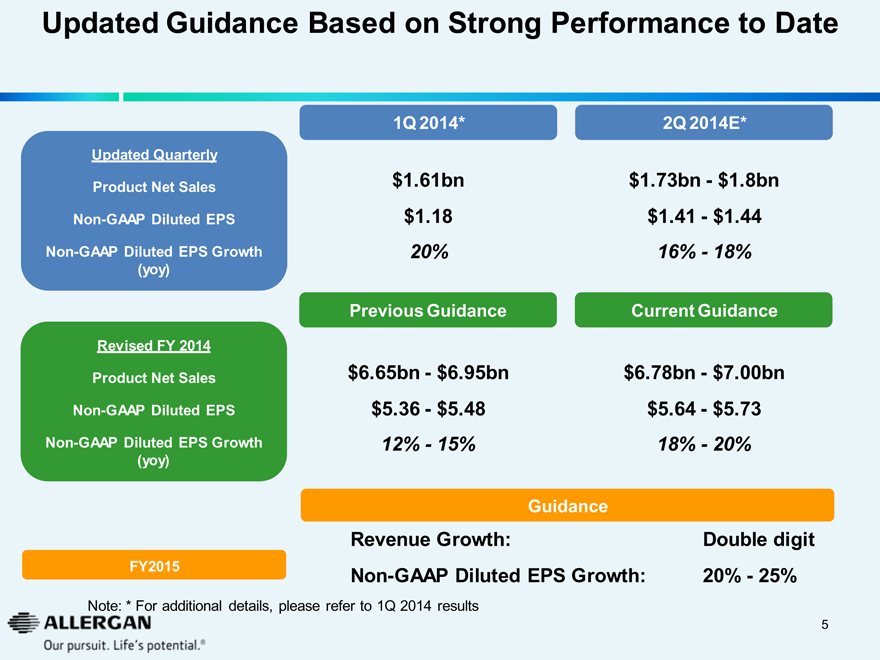

Updated Guidance Based on Strong Performance to Date

1Q 2014* 2Q 2014E*

Updated Quarterly

Product Net Sales $1.61bn $1.73bn - $1.8bn

Non-GAAP Diluted EPS $1.18 $1.41 - $1.44

Non-GAAP Diluted EPS Growth (yoy) 20% 16% - 18%

Previous Guidance Current Guidance

Revised FY 2014

Product Net Sales $6.65bn - $6.95bn $6.78bn - $7.00bn

Non-GAAP Diluted EPS $5.36 - $5.48 $5.64 - $5.73

Non-GAAP Diluted EPS Growth (yoy) 12% - 15% 18% - 20%

Guidance

Revenue Growth: Double digit

FY2015 Non-GAAP Diluted EPS Growth: 20% - 25%

Note: * For additional details, please refer to 1Q 2014 results

ALLERGAN

Our pursuit. Life’s potential. ®

5

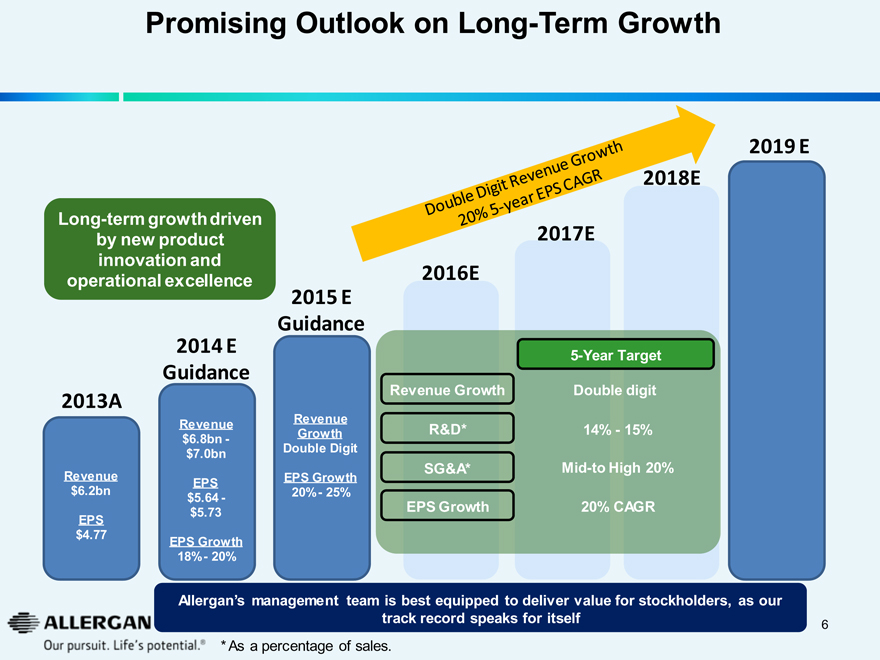

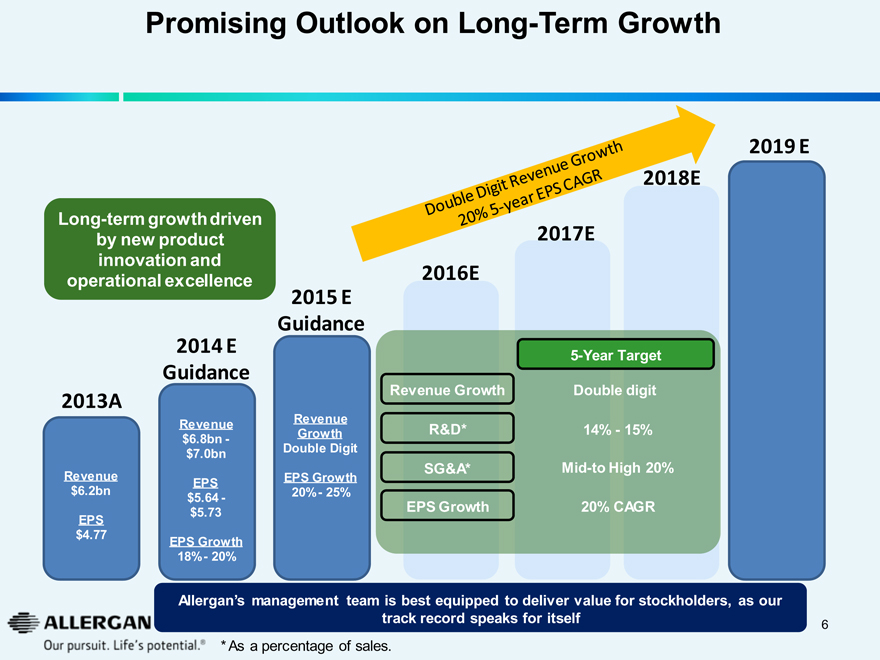

Promising Outlook on Long-Term Growth

Double Digit Revenue Growth 20% 5-year EPS CAGR

Long-term growth driven by new product innovation and operational excellence

2013A 2014 E Guidance 2015 E Guidance 2016E 2017E 2018E 2019 E

Revenue

$6.2bn

EPS

$4.77

Revenue

$6.8bn - $7.0bn

EPS

$5.64 - $5.73

EPS Growth

18% - 20%

Revenue Growth

Double Digit

EPS Growth

20% - 25%

5-Year Target

Revenue Growth Double digit

R&D* 14% - 15%

SG&A* Mid-to High 20%

EPS Growth 20% CAGR

ALLERGAN

Our pursuit. Life’s potential. ®

Allergan’s management team is best equipped to deliver value for stockholders, as our track record speaks for itself

* As a percentage of sales.

6

Introduction to Allergan

ALLERGAN

Our pursuit. Life’s potential. ®

7

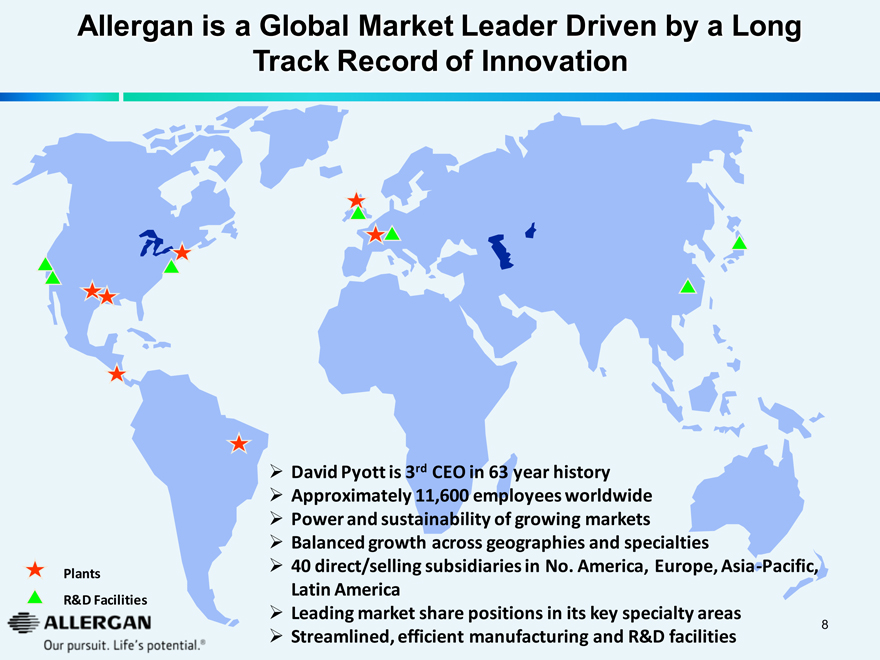

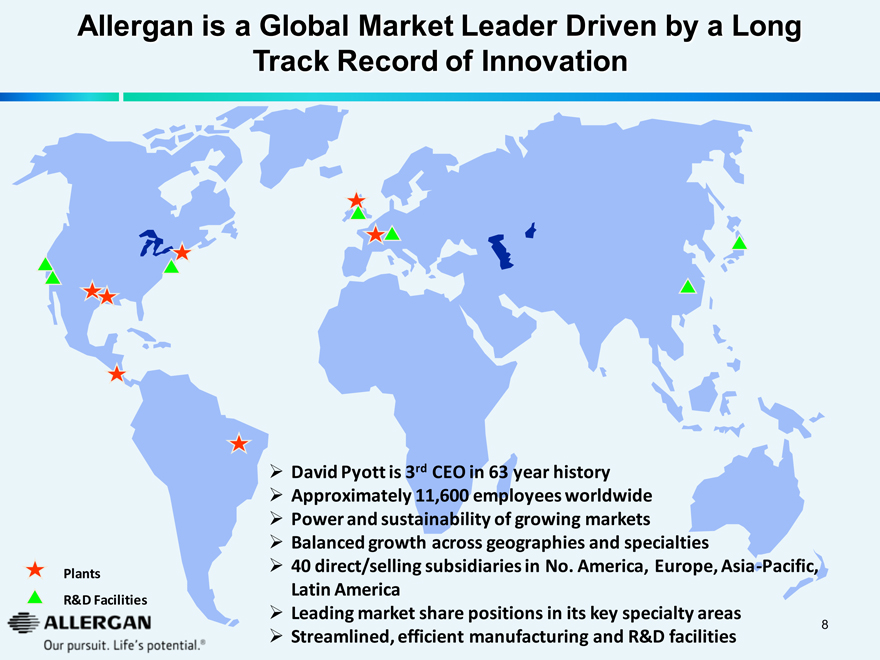

Allergan is a Global Market Leader Driven by a Long Track Record of Innovation

David Pyott is 3rd CEO in 63 year history

Approximately 11,600 employees worldwide

Power and sustainability of growing markets

Balanced growth across geographies and specialties

40 direct/selling subsidiaries in No. America, Europe, Asia-Pacific, Latin America

Leading market share positions in its key specialty areas

Streamlined, efficient manufacturing and R&D facilities

Plants

R&D Facilities

ALLERGAN

Our pursuit. Life’s potential. ®

8

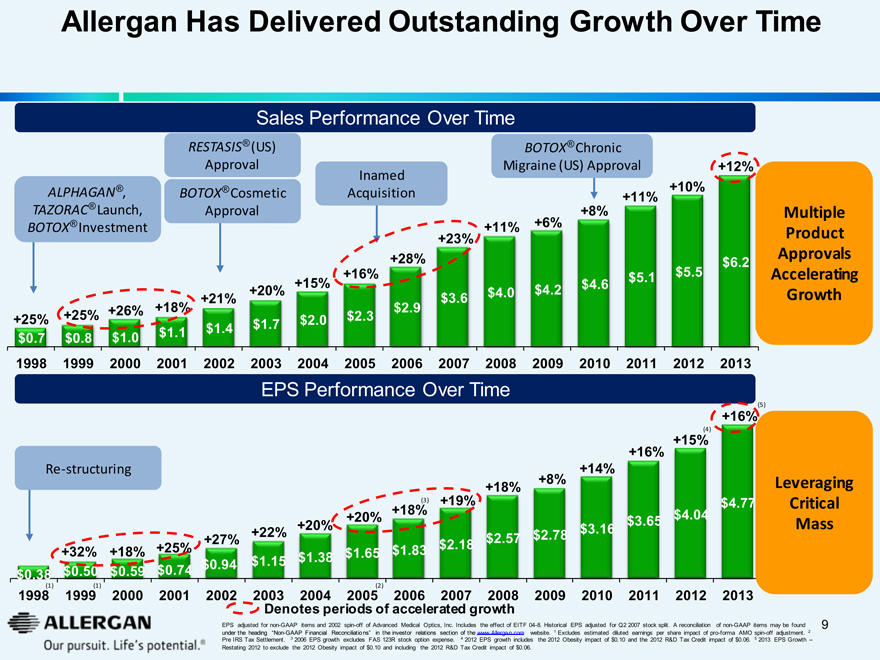

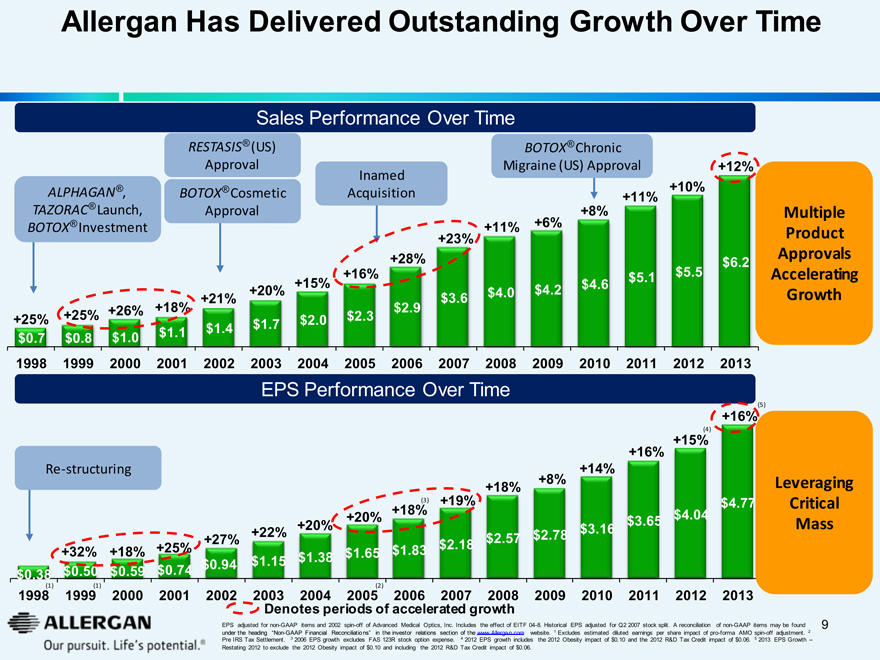

Allergan Has Delivered Outstanding Growth Over Time

Sales Performance Over Time

ALPHAGAN® , TAZORAC® Launch, BOTOX® Investment

RESTASIS® (US) Approval

BOTOX® Cosmetic Approval

Inamed Acquisition

BOTOX® Chronic Migraine (US) Approval

+25% +25% +26% +18% +21% +20% +15% +16% +28% +23% +11% +6% +8% +11% +10% +12%

Multiple Product Approvals Accelerating Growth

$0.7 $0.8 $1.0 $1.1 $1.4 $1.7 $2.0 $2.3 $2.9 $3.6 $4.0 $4.2 $4.6 $5.1 $5.5 $6.2

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

EPS Performance Over Time

Re-structuring

+32% +18% +25% +27% +22% +20% +20% +18%(3) +19% +18% +8% +14% +16% +15%(4) +16%(5)

$0.38 $0.50 $0.59 $0.74 $0.94 $1.15 $1.38 $1.65 $1.83 $2.18 $2.57 $2.78 $3.16 $3.65 $4.04 $4.77

Leveraging Critical Mass

1998(1) 1999(1) 2000 2001 2002 2003 2004 2005(2) 2006 2007 2008 2009 2010 2011 2012 2013

Denotes periods of accelerated growth

ALLERGAN

Our pursuit. Life’s potential. ®

EPS adjusted for non-GAAP items and 2002 spin-off of Advanced Medical Optics, Inc. Includes the effect of EITF 04-8. Historical EPS adjusted for Q2 2007 stock split. A reconciliation of non-GAAP items may be found under the heading “Non-GAAP Financial Reconciliations” in the investor relations section of the www.Allergan.com website. 1 Excludes estimated diluted earnings per share impact of pro-forma AMO spin-off adjustment. 2 Pre IRS Tax Settlement. 3 2006 EPS growth excludes FAS 123R stock option expense. 4 2012 EPS growth includes the 2012 Obesity impact of $0.10 and the 2012 R&D Tax Credit impact of $0.06. 5 2013 EPS Growth – Restating 2012 to exclude the 2012 Obesity impact of $0.10 and including the 2012 R&D Tax Credit impact of $0.06.

9

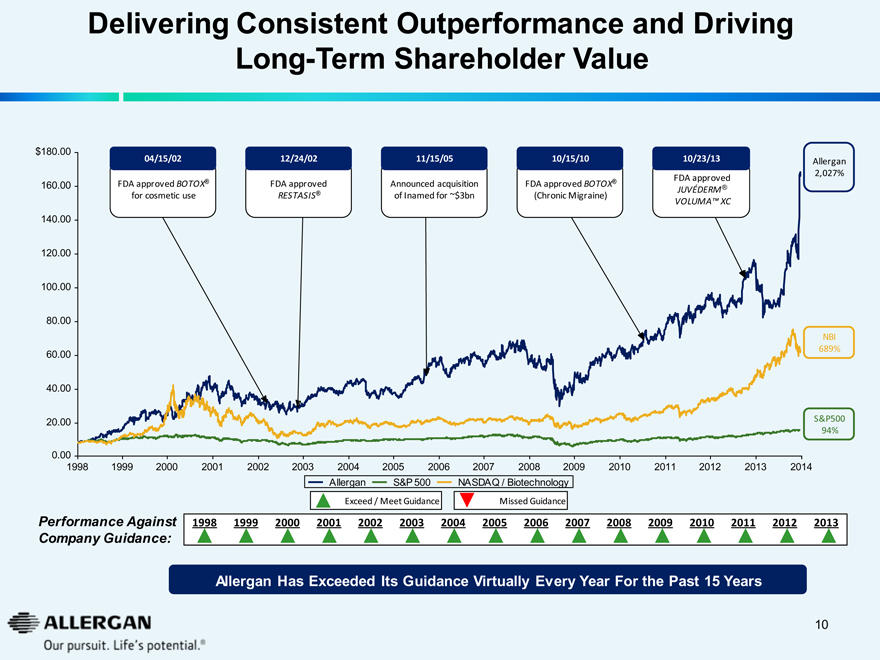

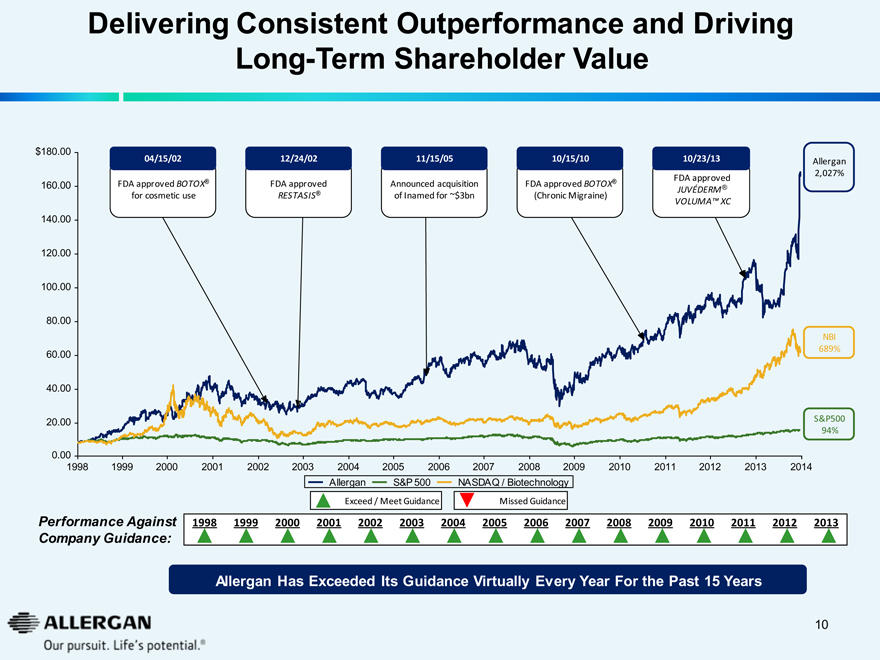

Delivering Consistent Outperformance and Driving

Long-Term Shareholder Value

$180.00

160.00

140.00

120.00

100.00

80.00

60.00

40.00

20.00

0.00

04/15/02

FDA approved BOTOX® for cosmetic use

12/24/02

FDA approved RESTASIS®

11/15/05

Announced acquisition of Inamed for ~$3bn

10/15/10

FDA approved BOTOX® (ChronicMigraine)

10/23/13

FDA approved JUVÉDERM® VOLUMATM XC

Allergan 2,027%

NBI 689%

S&P500 94%

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Allergan S&P 500 NASDAQ / Biotechnology

Exceed / Meet Guidance Missed Guidance

Performance Against Company Guidance:

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Allergan Has Exceeded Its Guidance Virtually Every Year For the Past 15 Years

ALLERGAN

Our pursuit. Life’s potential.®

10

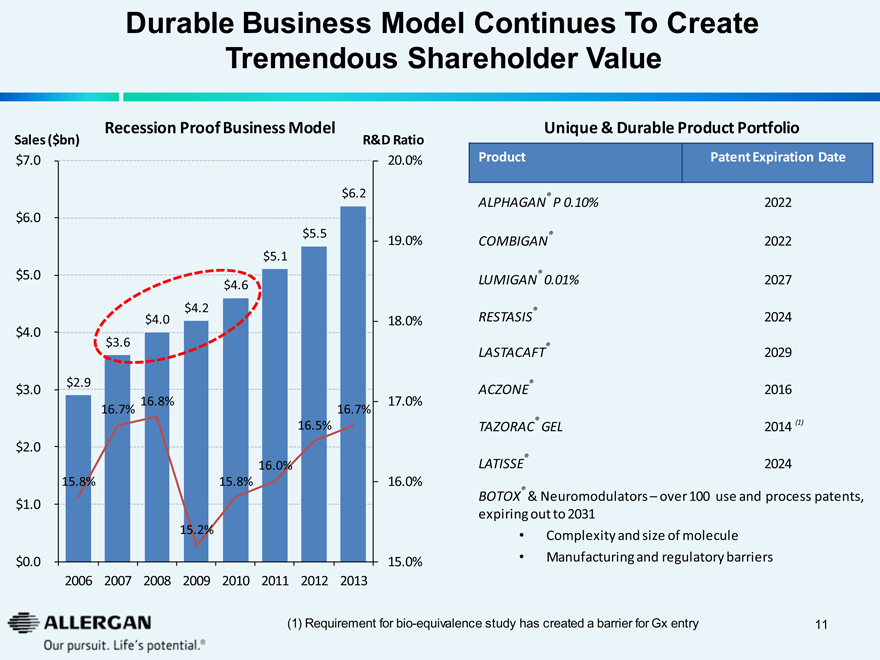

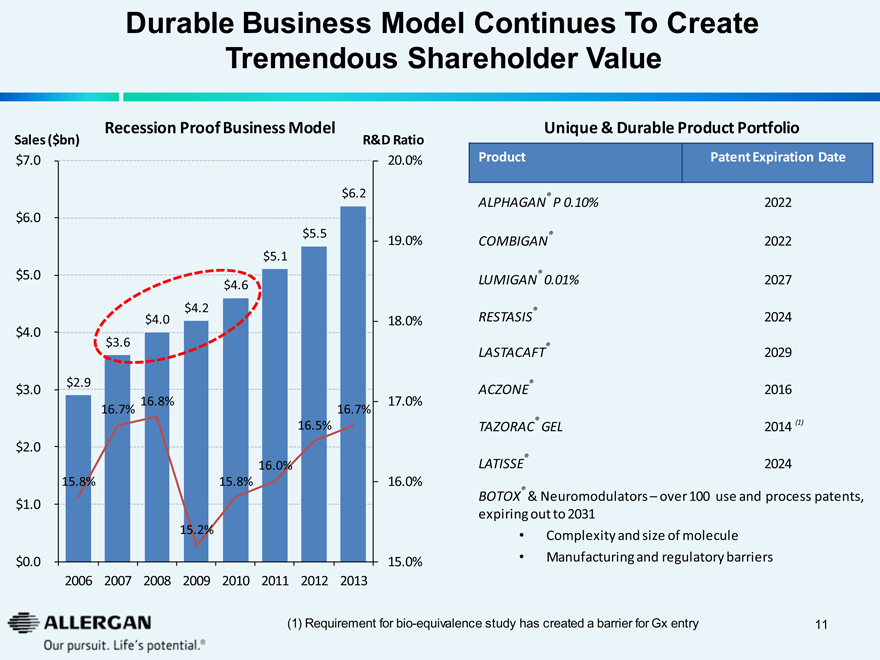

Durable Business Model Continues To Create

Tremendous Shareholder Value

Recession Proof Business Model

Sales ($bn) R&D Ratio

$7.0 20.0%

$6.2

$6.0

$5.5

19.0% $5.1 $5.0 $4.6 $4.2 $4.0

18.0% $4.0 $3.6 $3.0 $2.9

16.8%

17.0%

16.7%

16.7%

16.5%

$2.0

16.0%

15.8%

15.8%

16.0%

$1.0

15.2%

$0.0

15.0%

2006

2007 2008 2009 2010 2011 2012

2013

Unique & Durable Product Portfolio

Product Patent Expiration Date

ALPHAGAN® P 0.10% 2022

COMBIGAN® 2022

LUMIGAN® 0.01% 2027

RESTASIS® 2024

LASTACAFT® 2029

ACZONE® 2016

TAZORAC® GEL 2014(1)

LATISSE® 2024

BOTOX® & Neuromodulators – over 100 use and process patents, expiring out to 2031

Complexity and size of molecule

Manufacturing and regulatory barriers

ALLERGAN

Our pursuit. Life’s potential.®

(1) Requirement for bio-equivalence study has created a barrier for Gx entry

11

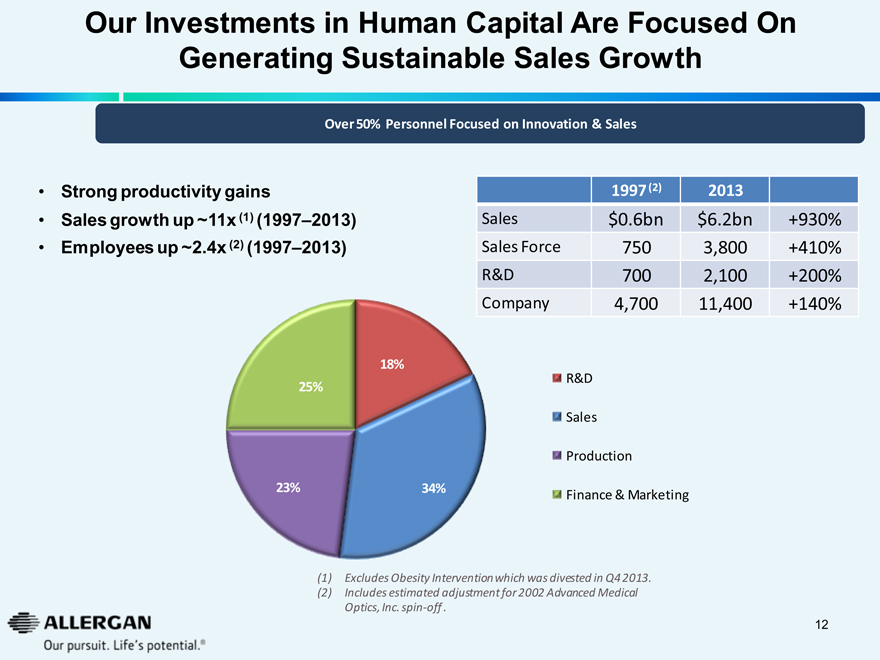

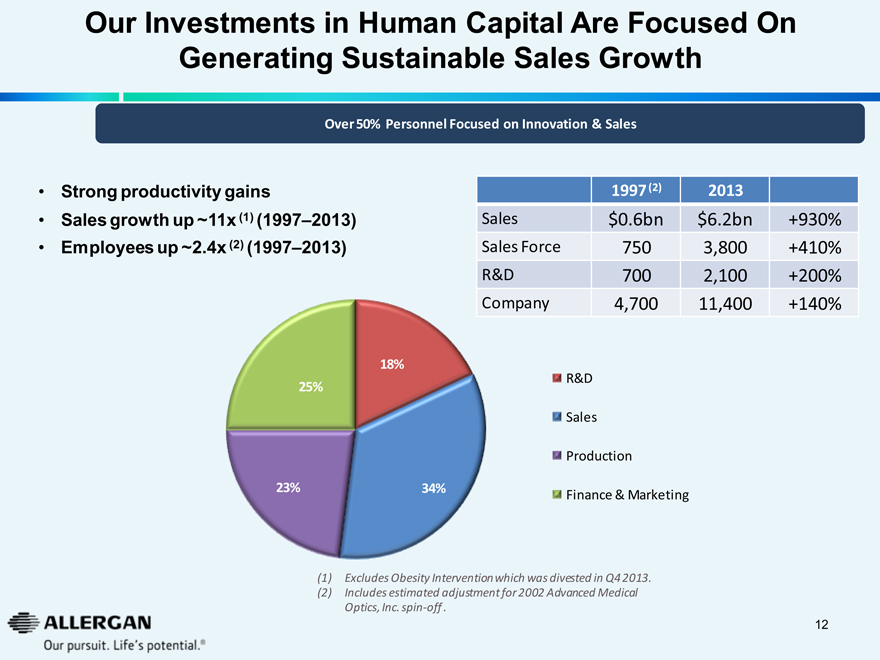

Our Investments in Human Capital Are Focused On

Generating Sustainable Sales Growth

Over 50% Personnel Focused on Innovation & Sales

Strong productivity gains

Sales growth up ~11x (1) (1997–2013)

Employees up ~2.4x (2) (1997–2013)

18%

25%

23%

34%

1997 (2) 2013

Sales $0.6bn $6.2bn +930%

Sales Force 750 3,800 +410%

R&D 700 2,100 +200%

Company 4,700 11,400 +140%

R&D

Sales

Production

Finance & Marketing

(1) Excludes Obesity Intervention which was divested in Q4 2013.

(2) Includes estimated adjustment for 2002 Advanced Medical Optics, Inc. spin-off.

ALLERGAN

Our pursuit. Life’s potential.®

12

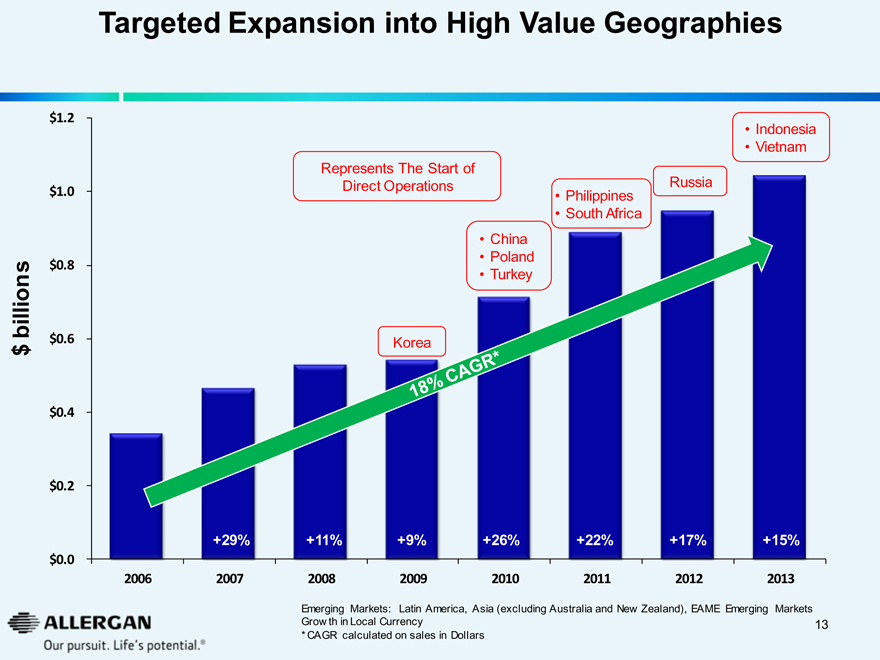

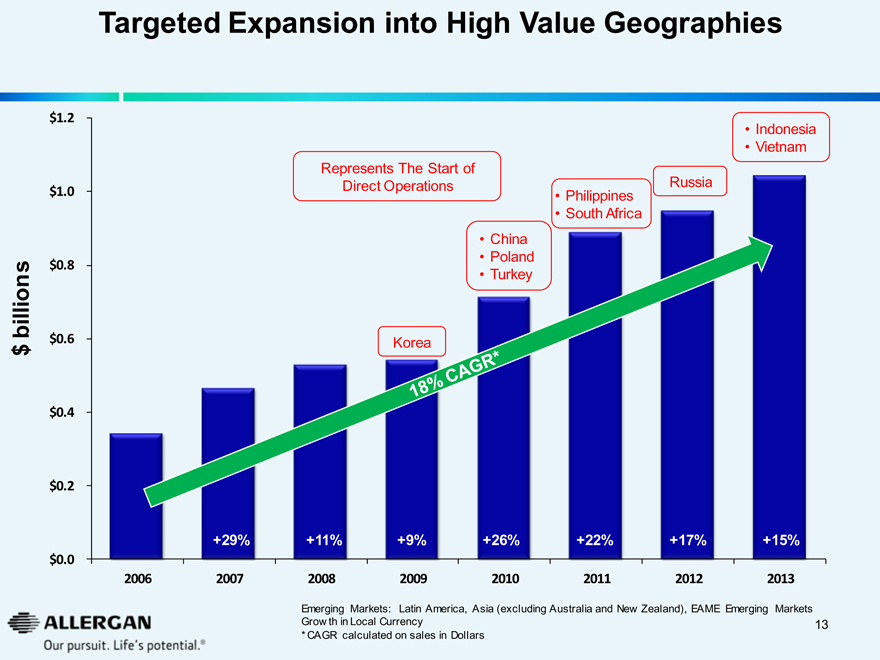

Targeted Expansion into High Value Geographies

$ billion

$1.2 $1.0 $0.8 $0.6 $0.4 $0.2 $0.0

Indonesia

Vietnam

Represents The Start of

Direct Operations Russia

Philippines

South Africa

China

Poland

Turkey

Korea

+29% +11% +9% +26% +22% +17% +15%

2006 2007 2008 2009 2010 2011 2012 2013

18% CAGR*

Emerging Markets: Latin America, Asia (excluding Australia and New Zealand), EAME Emerging Markets Growth in Local Currency

* CAGR calculated on sales in Dollars

ALLERGAN

Our pursuit. Life’s potential. ®

13

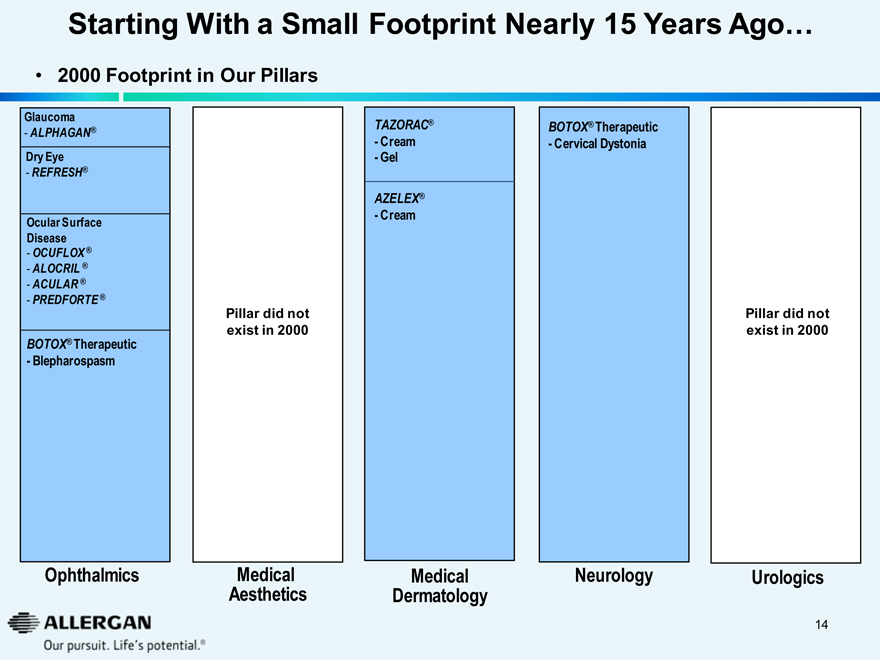

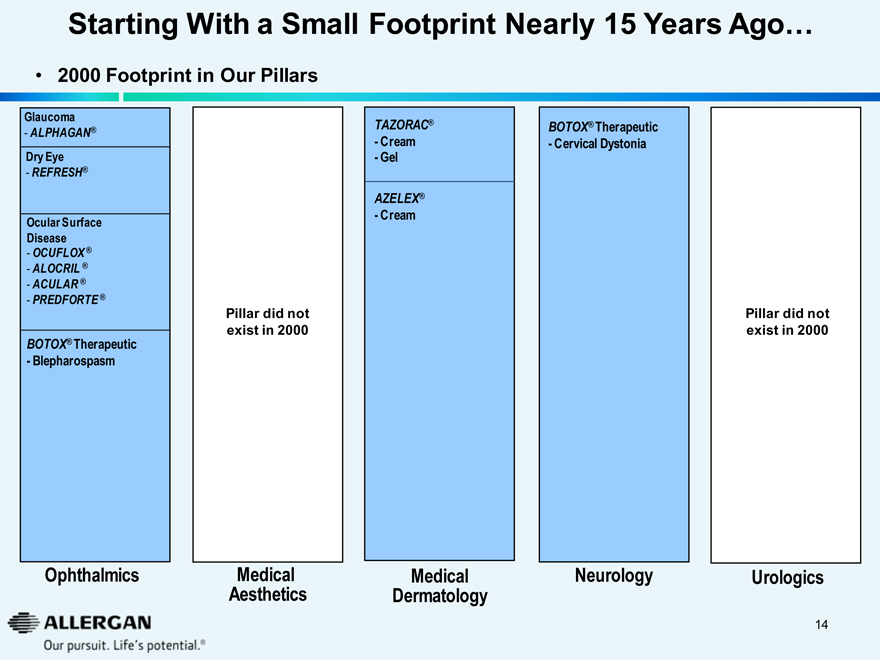

Starting With a Small Footprint Nearly 15 Years Ago…

2000 Footprint in Our Pillars

Glaucoma

- ALPHAGAN®

Dry Eye

- REFRESH®

Ocular Surface

Disease

- OCUFLOX®

- ALOCRIL®

- ACULAR®

- PREDFORTE®

BOTOX® Therapeutic

- Blepharospasm

Ophthalmics

TAZORAC®

- Cream

- Gel

AZELEX®

- Cream

Medical Dermatology

Pillar did not exist in 2000

Medical Aesthetics

BOTOX® Therapeutic

- Cervical Dystonia

Neurology

Pillar did not exist in 2000

Urologics

ALLERGAN

Our pursuit. Life’s potential.®

14

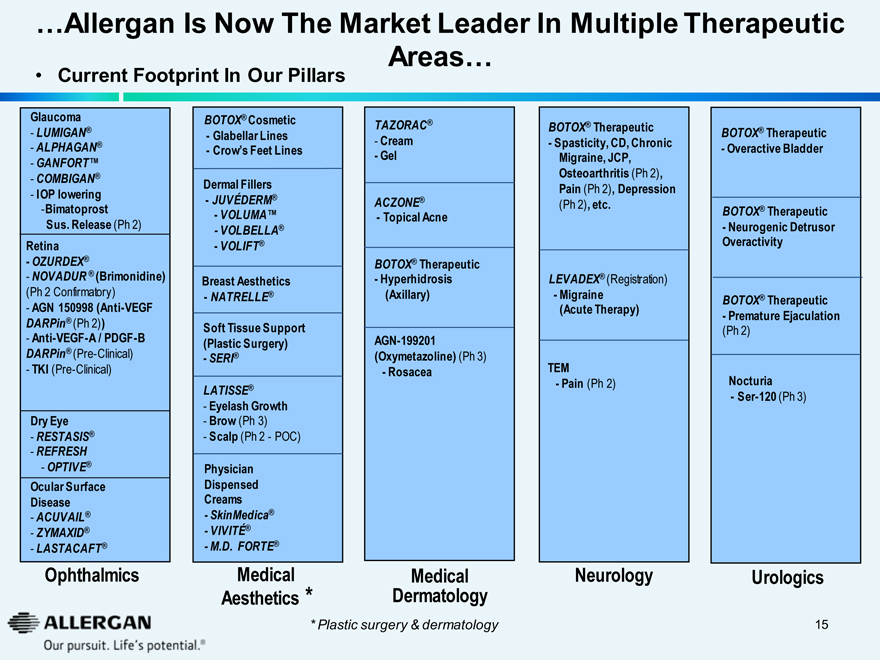

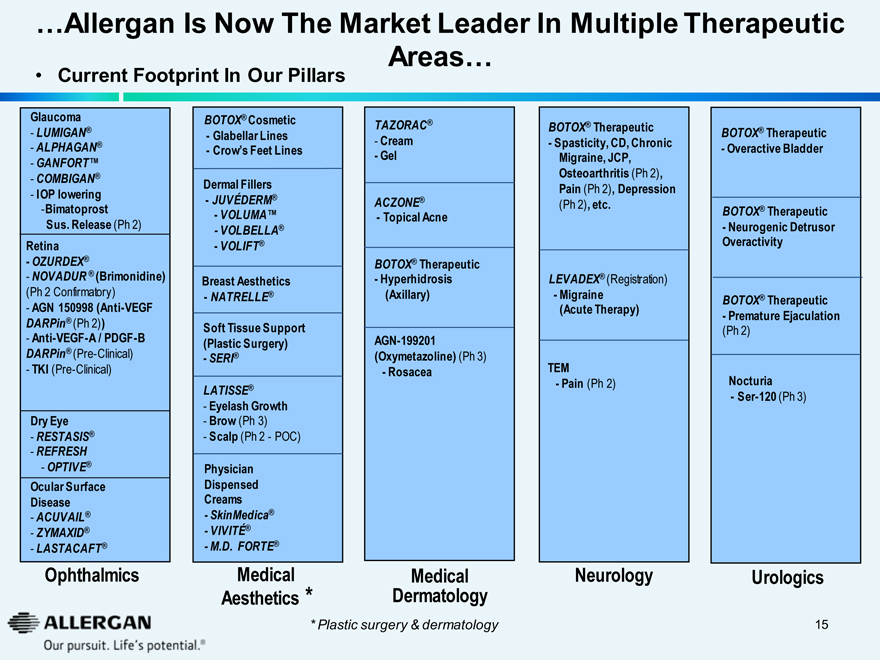

…Allergan Is Now The Market Leader In Multiple Therapeutic Areas…

Current Footprint In Our Pillars

Glaucoma

- LUMIGAN®

- ALPHAGAN®

- GANFORT™

- COMBIGAN®

- IOP lowering

-Bimatoprost Sus. Release (Ph 2)

Retina

- OZURDEX®

- NOVADUR ® (Brimonidine) (Ph 2 Confirmatory)

- AGN 150998 (Anti-VEGF DARPin® (Ph 2))

- Anti-VEGF-A / PDGF-B

DARPin® (Pre-Clinical)

- TKI (Pre-Clinical)

Dry Eye

- RESTASIS®

- REFRESH

- OPTIVE®

Ocular Surface Disease

- ACUVAIL®

- ZYMAXID®

- LASTACAFT®

Ophthalmics

BOTOX® Cosmetic

- Glabellar Lines

- Crow’s Feet Lines

Dermal Fillers

- JUVÉDERM®

- VOLUMA™

- VOLBELLA®

- VOLIFT®

Breast Aesthetics

- NATRELLE®

Soft Tissue Support (Plastic Surgery)

- SERI®

LATISSE®

- Eyelash Growth

- Brow (Ph 3)

- Scalp (Ph 2 - POC)

Physician Dispensed Creams

- SkinMedica®

- VIVITÉ®

- M.D. FORTE®

Medical Aesthetics *

TAZORAC®

- Cream

- Gel

ACZONE®

- Topical Acne

BOTOX® Therapeutic

- Hyperhidrosis (Axillary)

AGN-199201 (Oxymetazoline) (Ph 3)

- Rosacea

Medical Dermatology

BOTOX® Therapeutic

- Spasticity, CD, Chronic Migraine, JCP, Osteoarthritis (Ph 2), Pain (Ph 2), Depression (Ph 2), etc.

LEVADEX® (Registration)

- Migraine (Acute Therapy)

TEM

- Pain (Ph 2)

Neurology

BOTOX® Therapeutic

- Overactive Bladder

BOTOX® Therapeutic

- Neurogenic Detrusor Overactivity

BOTOX® Therapeutic

- Premature Ejaculation (Ph 2)

Nocturia

- Ser-120 (Ph 3)

Urologics

* Plastic surgery & dermatology

ALLERGAN

Our pursuit. Life’s potential.®

15

Allergan Today

16

ALLERGAN

Our pursuit. Life’s potential.®

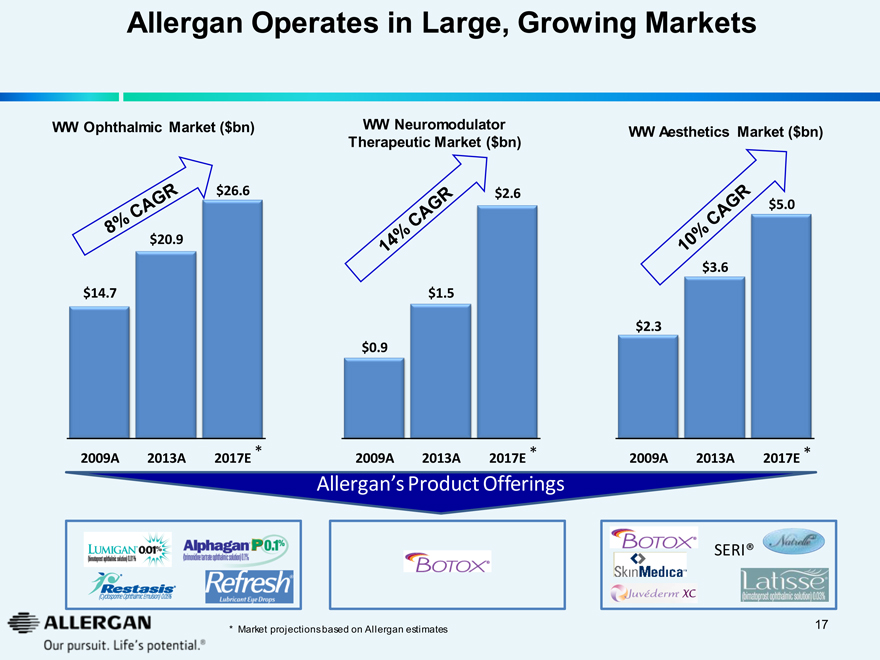

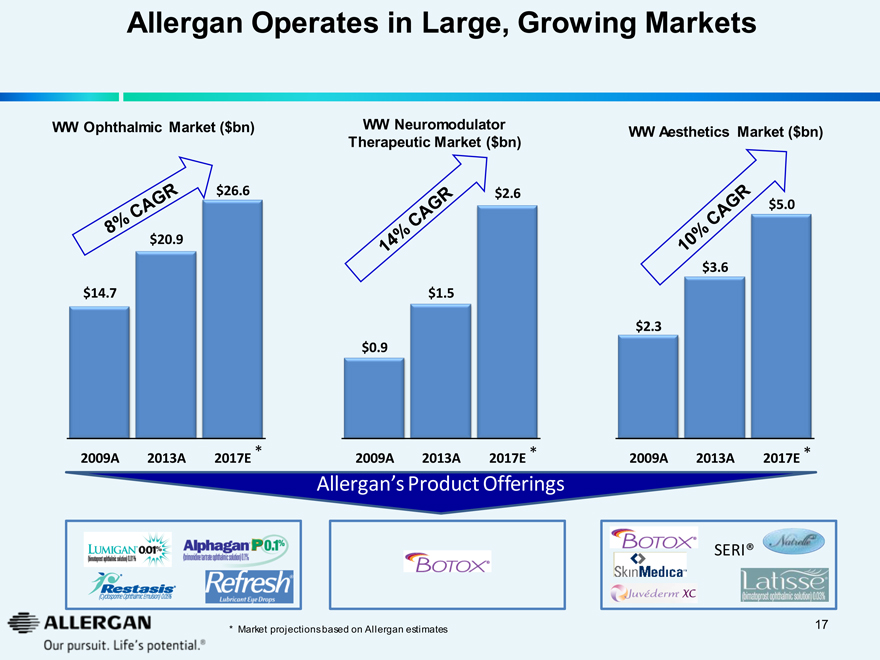

Allergan Operates in Large, Growing Markets

WW Ophthalmic Market ($bn)

8% CAGR

$20.9

$14.7

$26.6

2009A 2013A 2017E *

WW Neuromodulator

Therapeutic Market ($bn)

14% CAGR

$1.5

$0.9

$2.6

2009A 2013A 2017E *

WW Aesthetics Market ($bn)

10% CAGR

$3.6

$2.3

$5.0

2009A 2013A 2017E *

Allergan’s Product Offerings

LUMIGAN 0.01%

(bimataprost ophthalmic solution) 0.01%

RESTASIS®

(Cyclosporine Ophthalmic Emulsion) 0.05%

Alphagan P0.1%

(brimonidine tartrate ophthalmic solution) 0.1%

Refresh Lubricant Eye Drops

Botox

Botox

Skin Medica

Juvederm XC

SERI®

Natrelle

Latisse

(bimataprost ophthalmic solution) 0.03%

* Market projections based on Allergan estimates 17

ALLERGAN

Our pursuit. Life’s potential.®

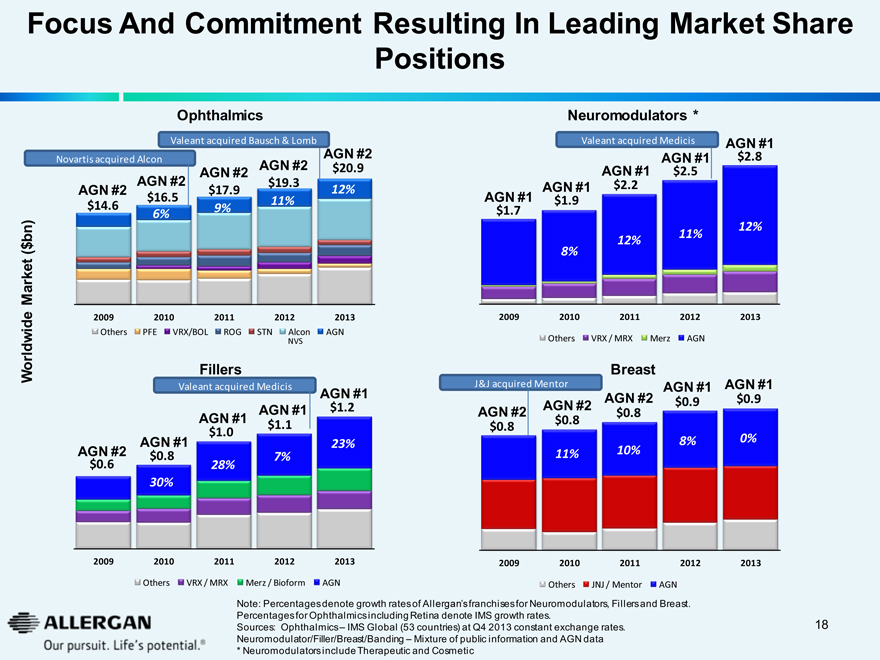

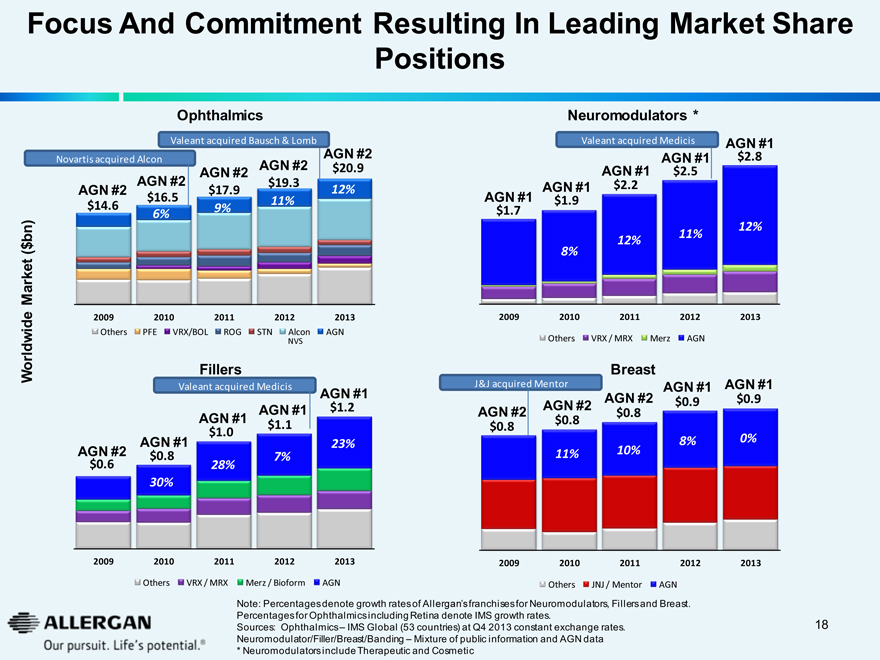

Focus And Commitment Resulting In Leading Market Share Positions

Ophthalmics

Valeant acquired Bausch & Lomb

Novartis acquired Alcon AGN #2 $20.9 12%

AGN #2 $14.6

AGN #2 $19.3 11%

AGN #2 $17.9 9%

AGN #2 $16.5 6%

Worldwide Market ($bn)

2009 2010 2011 2012 2013

Others PFE VRX/BOL ROG STN Alcon NVS AGN

Fillers

Valeant acquired Medicis

AGN #1 $1.2 23%

AGN #1 $1.1 7%

AGN #1 $1.0 28%

AGN #1 $0.8 30%

AGN #2 $0.6

2009 2010 2011 2012 2013

Others VRX/MRX Merz/Bioform AGN

Neuromodulators *

Valeant acquired Medicis

AGN #1 $2.8 12%

AGN #1 $2.5 11%

AGN #1 $2.2 12%

AGN #1 $1.9 8%

AGN #1 $1.7

2009 2010 2011 2012 2013

Others VRX / MRX Merz AGN

Breast

J&J acquired Mentor AGN #1 $0.9 0%

AGN #1 $0.9 8%

AGN #2 $0.8 10%

AGN #2 $0.8 11%

AGN #2 $0.8

2009 2010 2011 2012 2013

Others JNJ / Mentor AGN

Note: Percentages denote growth rates of Allergan’s franchises for Neuromodulators, Fillers and Breast. Percentages for Ophthalmics including Retina denote IMS growth rates.

Sources: Ophthalmics – IMS Global (53 countries) at Q4 2013 constant exchange rates. Neuromodulator/Filler/Breast/Bannding – Mixture of public information and AGN data

* Neuromodulators include Therapeutic and Cosmetic

18

ALLERGAN

Our pursuit. Life’s potential.®

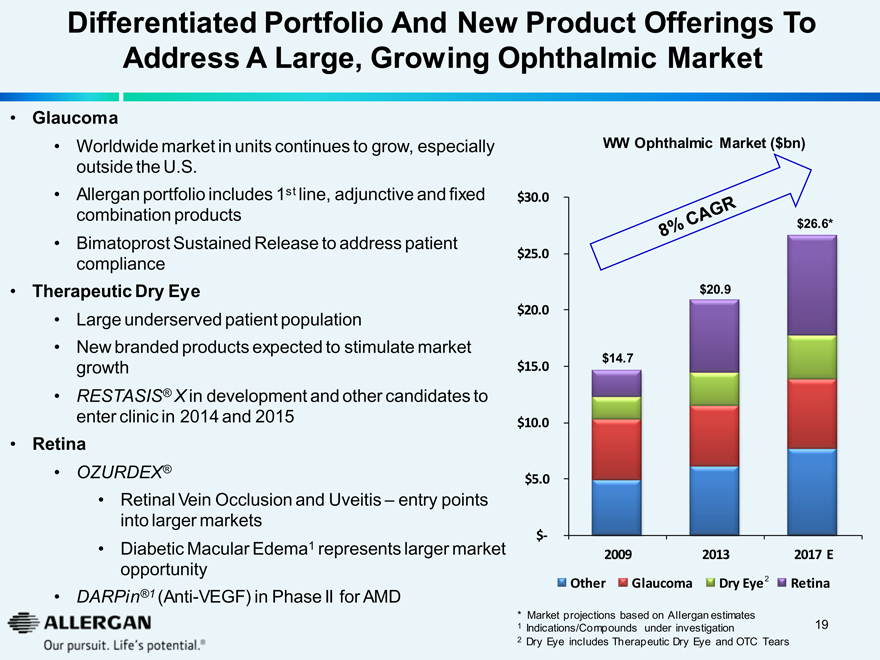

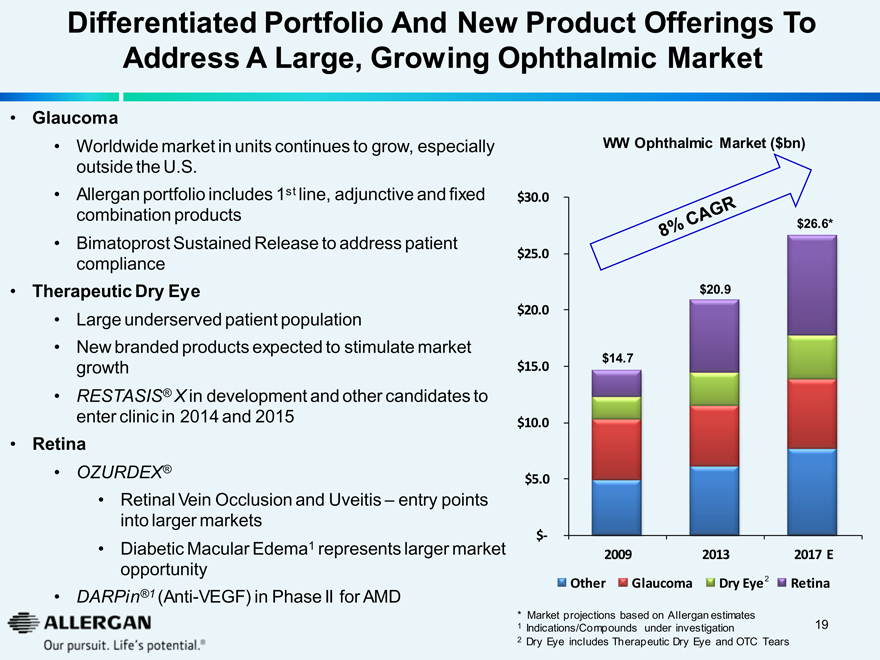

Differentiated Portfolio And New Product Offerings To

Address A Large, Growing Ophthalmic Market

Glaucoma

Worldwide market in units continues to grow, especially outside the U.S.

Allergan portfolio includes 1st line, adjunctive and fixed combination products

Bimatoprost Sustained Release to address patient compliance

Therapeutic Dry Eye

Large underserved patient population

New branded products expected to stimulate market growth

RESTASIS® X in development and other candidates to enter clinic in 2014 and 2015

Retina

OZURDEX®

Retinal Vein Occlusion and Uveitis – entry points into larger markets

Diabetic Macular Edema1 represents larger market opportunity

DARPin®1 (Anti-VEGF) in Phase II for AMD

WW Ophthalmic Market ($bn)

$30.0 8% CAGR

$26.6* $20.9 $14.7

$25.0

$20.0

$15.0

$10.0

$5.0

$-

2009 2013 2017 E

Other Glaucoma Dry Eye 2 Retina

* Market projections based on Allergan estimates

1 Indications/Compounds under investigation

2 Dry Eye includes Therapeutic Dry Eye and OTC Tears

ALLERGAN 19

Our pursuit. Life’s potential.®

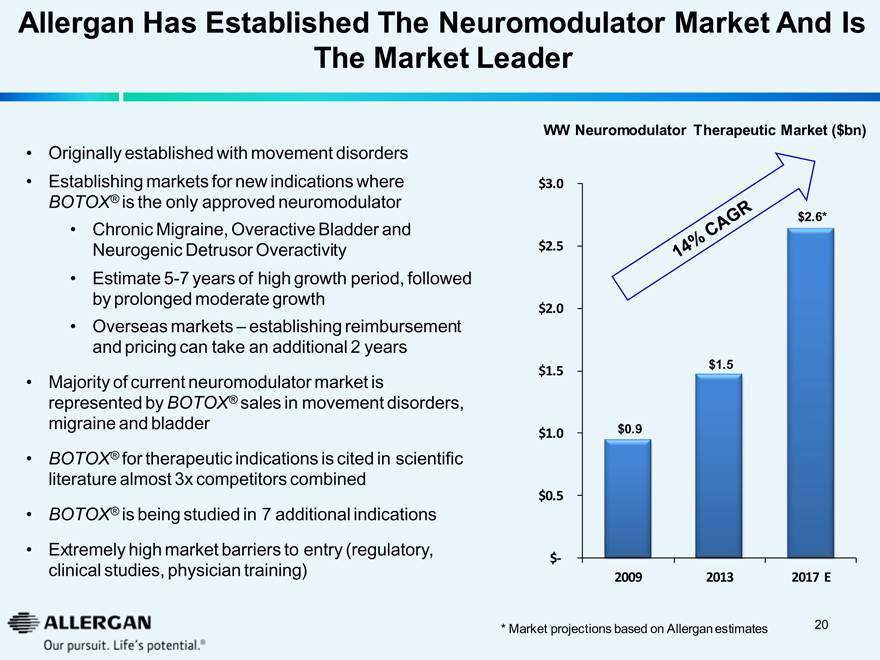

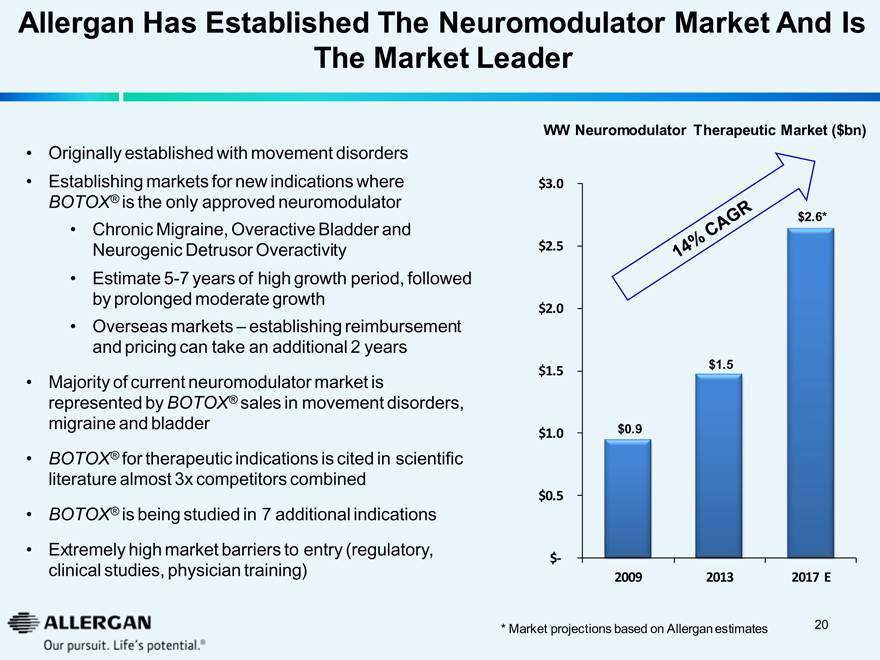

Allergan Has Established The Neuromodulator Market And Is

The Market Leader

Originally established with movement disorders

Establishing markets for new indications where BOTOX® is the only approved neuromodulator

Chronic Migraine, Overactive Bladder and Neurogenic Detrusor Overactivity

Estimate 5-7 years of high growth period, followed by prolonged moderate growth

Overseas markets – establishing reimbursement and pricing can take an additional 2 years

Majority of current neuromodulator market is represented by BOTOX® sales in movement disorders, migraine and bladder

BOTOX® for therapeutic indications is cited in scientific literature almost 3x competitors combined

BOTOX® is being studied in 7 additional indications

Extremely high market barriers to entry (regulatory, clinical studies, physician training)

WW Neuromodulator Therapeutic Market ($bn)

$3.0

14% CAGR $2.6* $1.5 $0.9

$2.5

$2.0

$1.5

$1.0

$0.5

$-

2009 2013 2017 E

* Market projections based on Allergan estimates

ALLERGAN 20

Our pursuit. Life’s potential.®

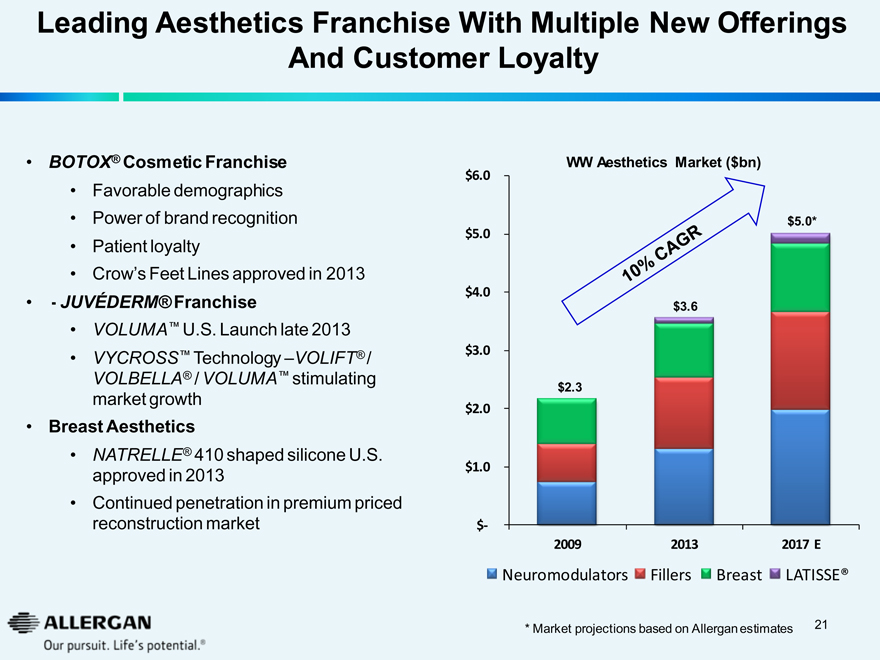

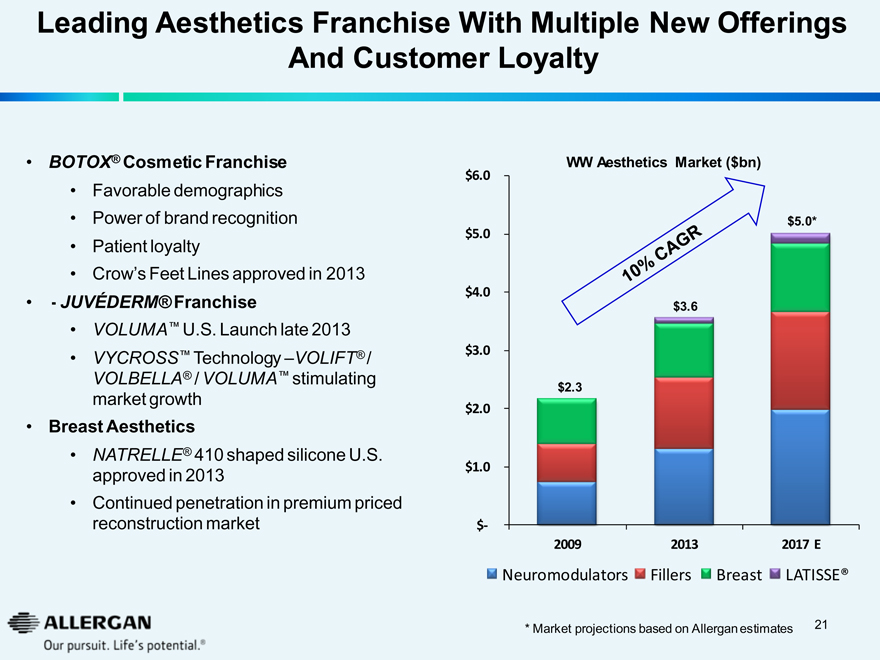

Leading Aesthetics Franchise With Multiple New Offerings

And Customer Loyalty

BOTOX® Cosmetic Franchise

Favorable demographics

Power of brand recognition

Patient loyalty

Crow’s Feet Lines approved in 2013

- JUVÉDERM® Franchise

VOLUMATM U.S. Launch late 2013

VYCROSSTM Technology -VOLIFT® / VOLBELLA® / VOLUMATM stimulating market growth

Breast Aesthetics

NATRELLE® 410 shaped silicone U.S. approved in 2013

Continued penetration in premium priced reconstruction market

WW Aesthetics Market ($bn)

$6.0

10%CAGR

$5.0*

$5.0

$4.0

$3.6

$3.0

$2.3

$2.0

$1.0

$-

2009

2013

2017 E

Neuromodulators

Fillers

Breast

LATISSE®

* Market projections based on Allergan estimates 21

ALLERGAN

Our pursuit. Life’s potential.®

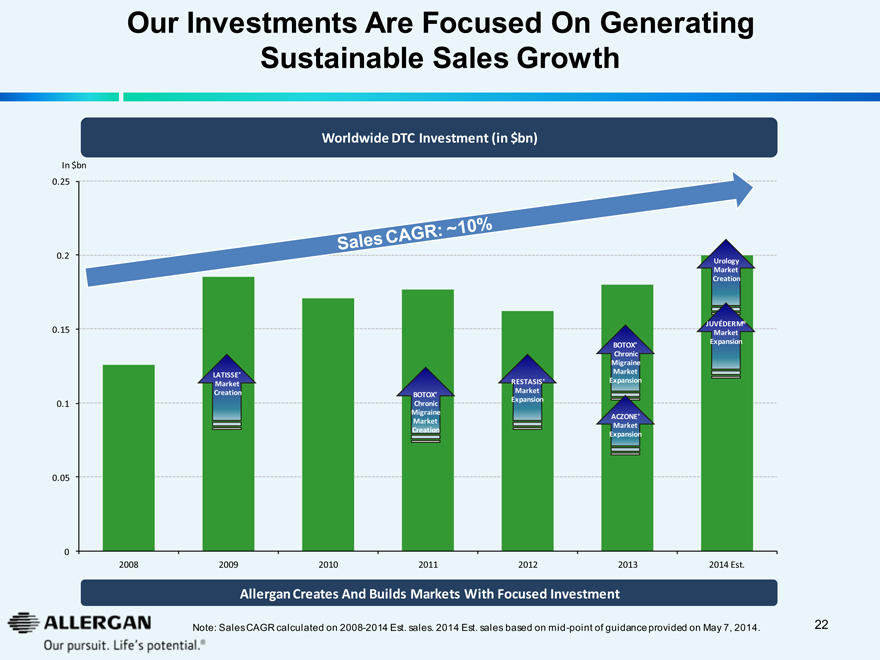

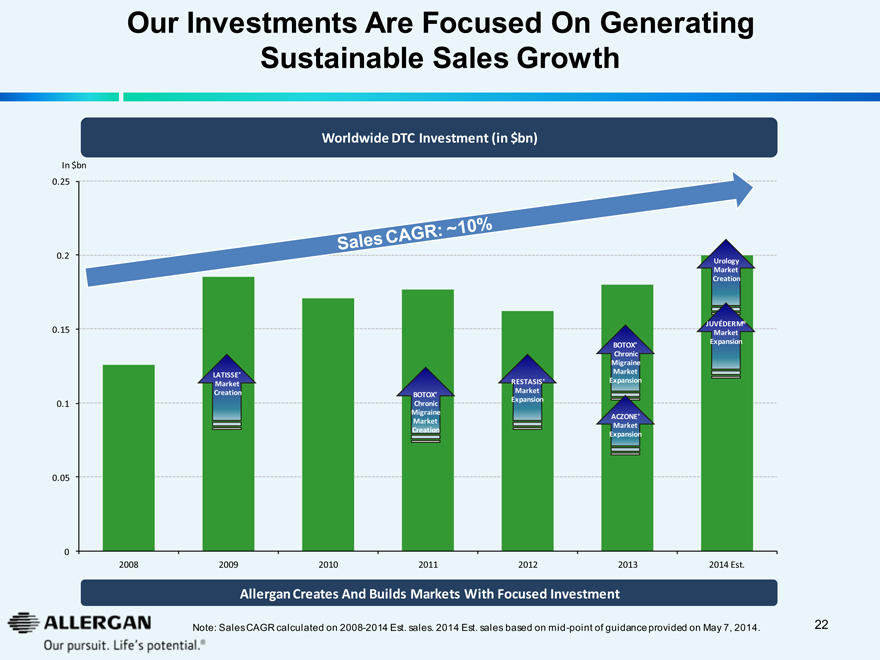

Our Investments Are Focused On Generating

Sustainable Sales Growth

Worldwide DTC Investment (in $bn)

In $bn

0.25

0.2

Urology

Market

Creation

JUVÉDERM®

0.15

Market

BOTOX®

Expansion

Chronic

Migraine

LATISSE®

Market

Market

RESTASIS®

Expansion

Creation

BOTOX®

Market

0.1

Chronic

Expansion

Migraine

ACZONE®

Market

Market

Creation

Expansion

0.05

0

2008

2009

2010

2011

2012

2013

2014 Est.

Allergan Creates And Builds Markets With Focused Investment

Note: Sales CAGR calculated on 2008-2014 Est. sales. 2014 Est. sales based on mid-point of guidance provided on May 7, 2014.

22

ALLERGAN

Our pursuit. Life’s potential.®

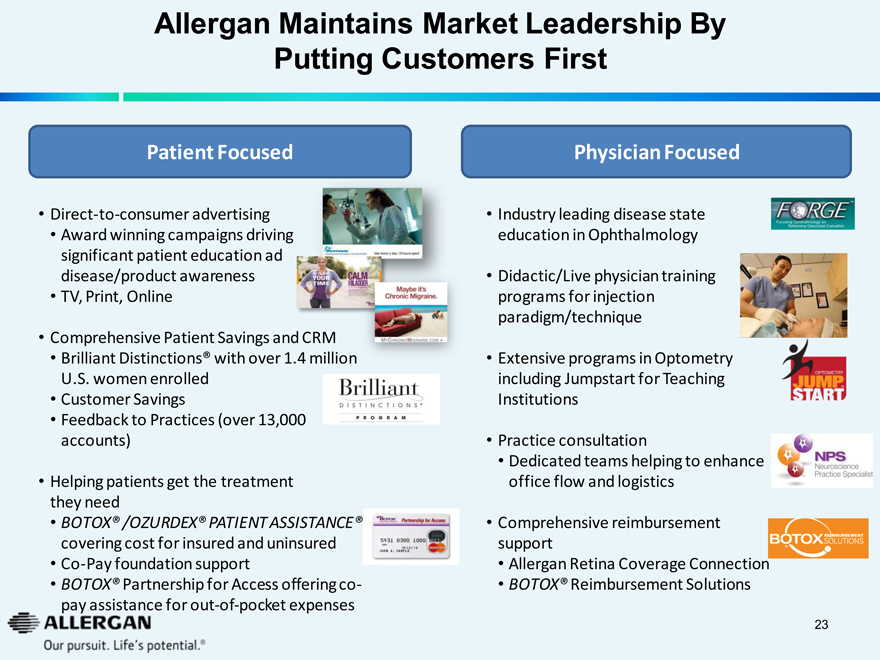

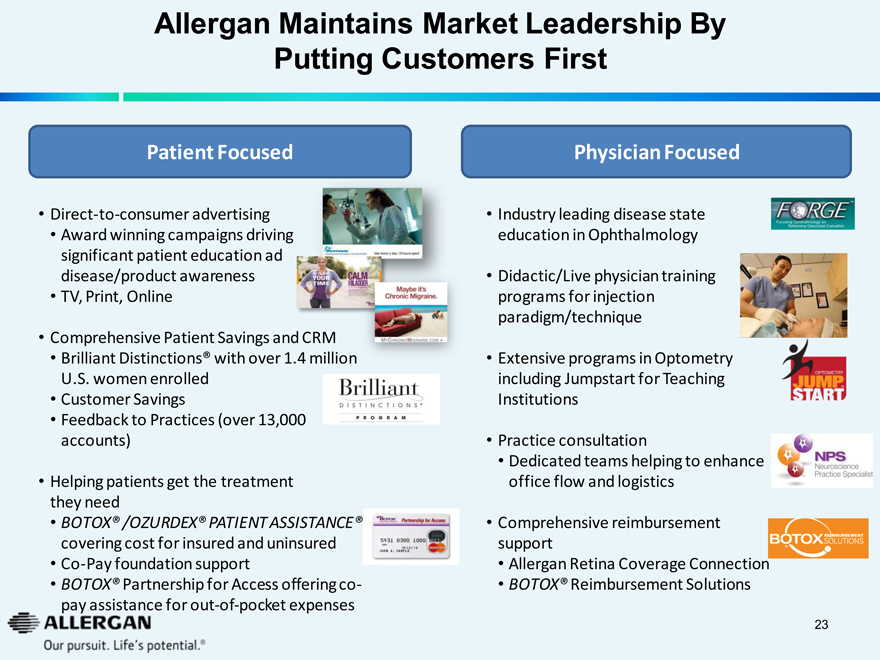

Allergan Maintains Market Leadership By

Putting Customers First

Patient Focused

Direct-to-consumer advertising

Restasis use twice a day 12 hours apart

Award winning campaigns driving significant patient education ad

RECLAIM YOUR TIME

disease/product awareness

CALM YOUR BLADDER

TV, Print, Online

Comprehensive Patient Savings and CRM

Maybe it’s Chronic Migraine.

Brilliant Distinctions® with over 1.4 million

MYCHRONICMIGRAINE.COM

U.S. women enrolled

Customer Savings

Brilliant DISTINCTIONS® PROGRAM

Feedback to Practices (over 13,000 accounts)

Helping patients get the treatment

BOTOX Partnership for Access

they need

5431 0300 1000 0080 MasterCard 12/10

BOTOX® /OZURDEX® PATIENT ASSISTANCE®

JOHN A. SAMPLE

covering cost for insured and uninsured

Co-Pay foundation support

BOTOX® Partnership for Access offering co-pay assistance for out-of-pocket expenses

Physician Focused

Industry leading disease state education in Ophthalmology

FORGETM Focusing Ophthalmology on Reframing Glaucoma Evaluation

Didactic/Live physician training programs for injection paradigm/technique

OPTOMETRY JUMP STARTTM

Extensive programs in Optometry including Jumpstart for Teaching

NPS Neuroscience Practice Specialist

Institutions

Practice consultation

Dedicated teams helping to enhance

BOTOX REIMBURSEMENT SOLUTIONS

office flow and logistics

Comprehensive reimbursement support

Allergan Retina Coverage Connection

BOTOX® Reimbursement Solutions

23

ALLERGAN

Our pursuit. Life’s potential.®

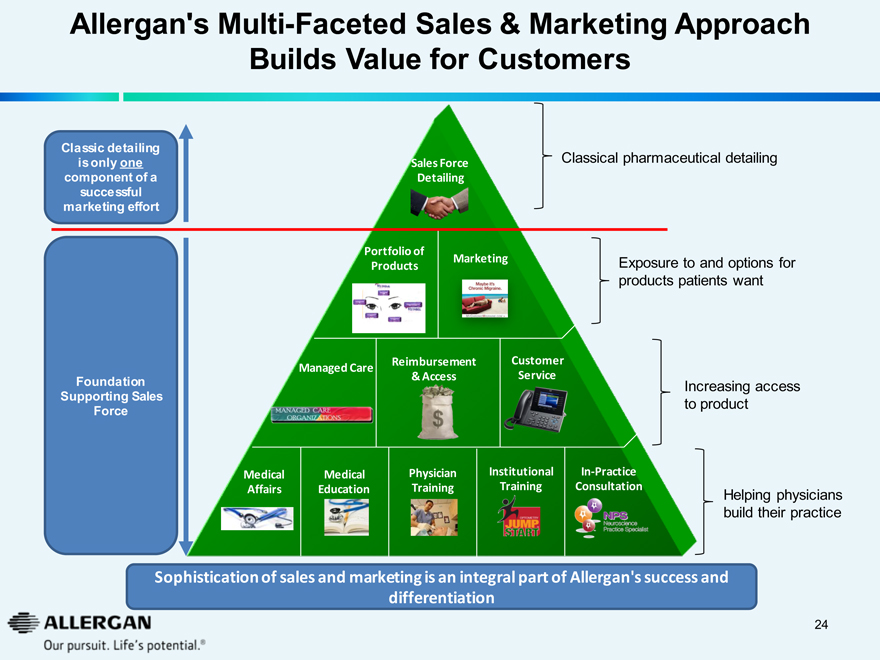

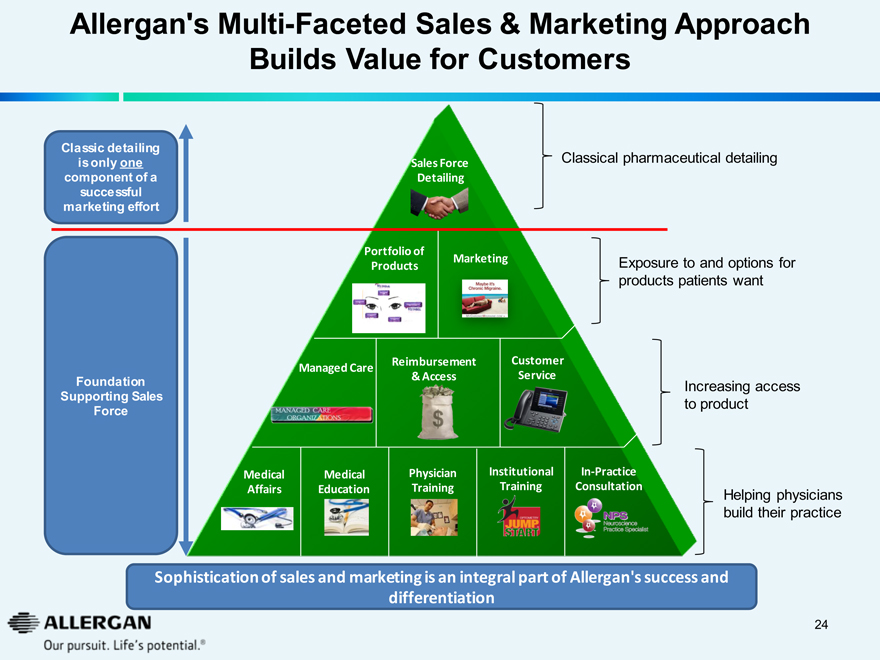

Allergan’s Multi-Faceted Sales & Marketing Approach Builds Value for Customers

Classic detailing

is only one component of a successful marketing effort

Sales Force Detailing

Classical pharmaceutical detailing

Portfolio of Products

Marketing

Exposure to and options for products patients want

Managed Care

MANAGED CARE ORGANIZATIONS

Reimbursement & Access

Customer Service

Foundation Supporting Sales Force

Increasing access to product

Medical Affairs

Medical Education

Physician Training

Institutional Training

OPTOMETRY JUMP START

In-Practice Consultation

NPS Neuroscience Practice Specialist

Helping physicians build their practice

Sophistication of sales and marketing is an integral part of Allergan’s success and differentiation

24

ALLERGAN

Our pursuit. Life’s potential.®

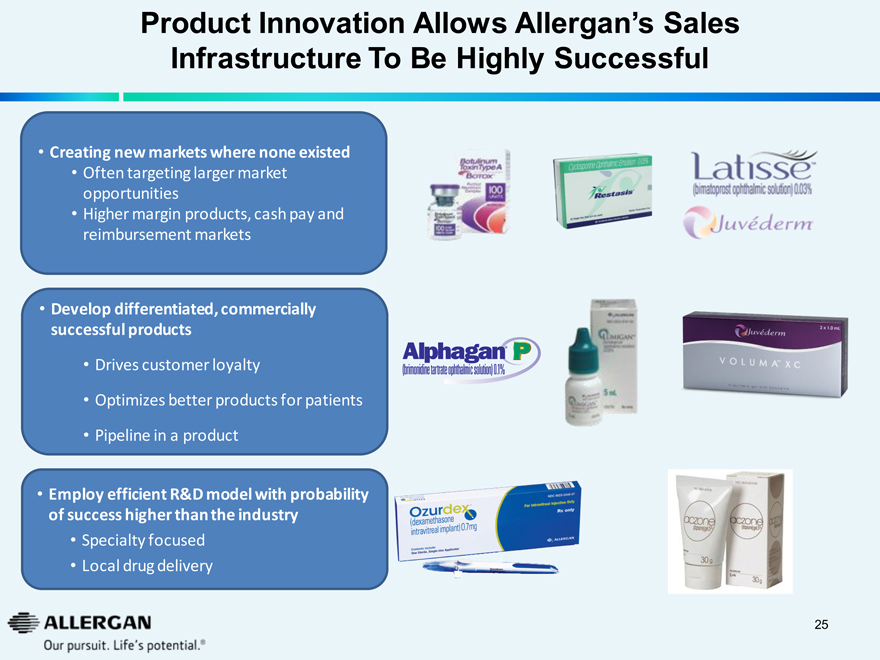

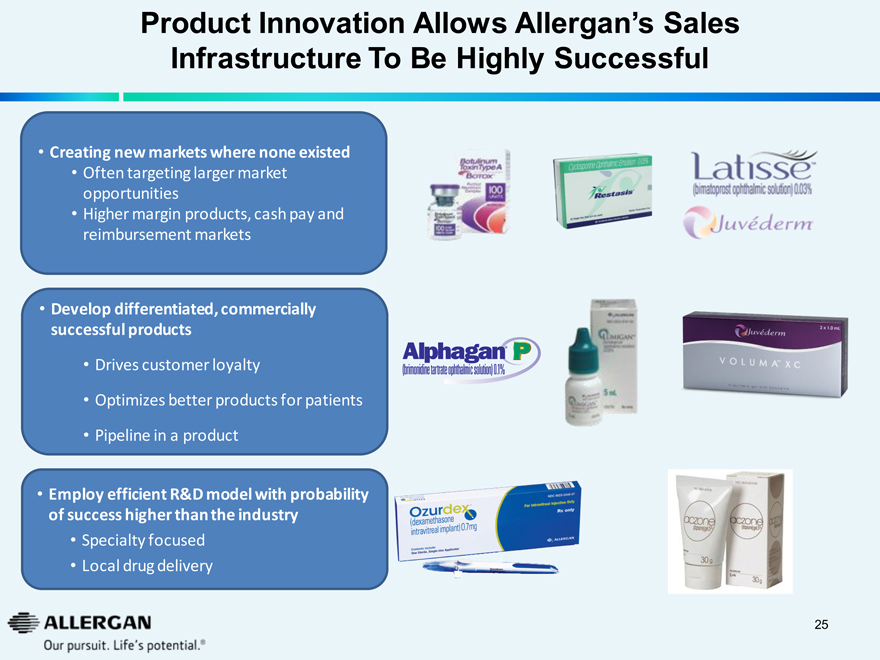

Product Innovation Allows Allergan’s Sales Infrastructure To Be Highly Successful

Creating new markets where none existed

Often targeting larger market opportunities

Higher margin products, cash pay and reimbursement markets

Toxin Type A Botox Cyclosporine Ophthalmic Emulsion 0.05% Restasis Latisse (bimatoprost ophthalmic solution) 0.03% Juvederm

Develop differentiated, commercially successful products

Drives customer loyalty

Optimizes better products for patients

Pipeline in a product

Alphagan P (brimonidine tartrate ophthalmic solution) 0.1% Juvederm VOLUMATM XC

Employ efficient R&D model with probability of success higher than the industry

Specialty focused

Local drug delivery Ozurdex (dexamethason intravitreal implant) 0.7mg aczone 30g

ALLERGAN 25

Our pursuit. Life’s potential.®

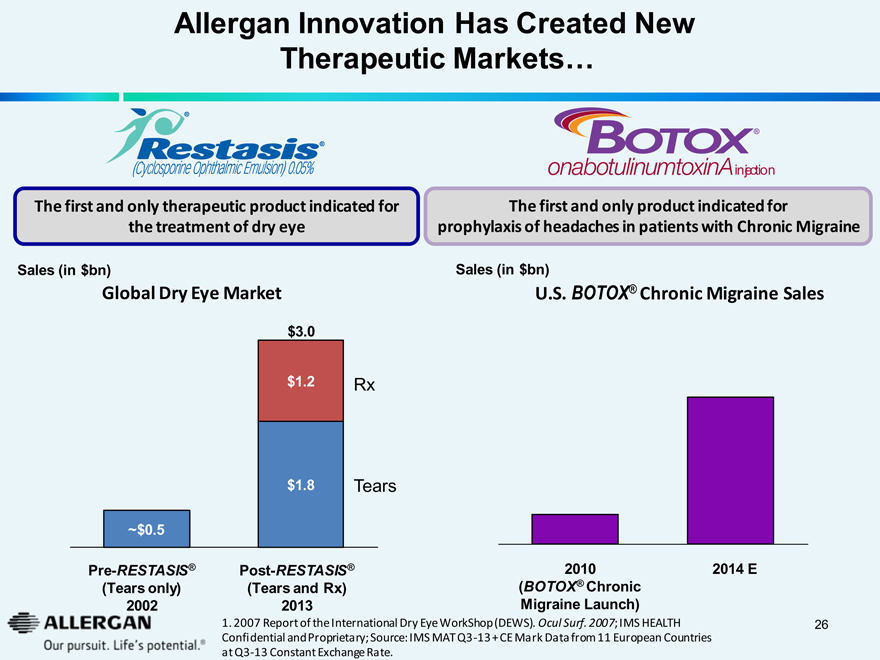

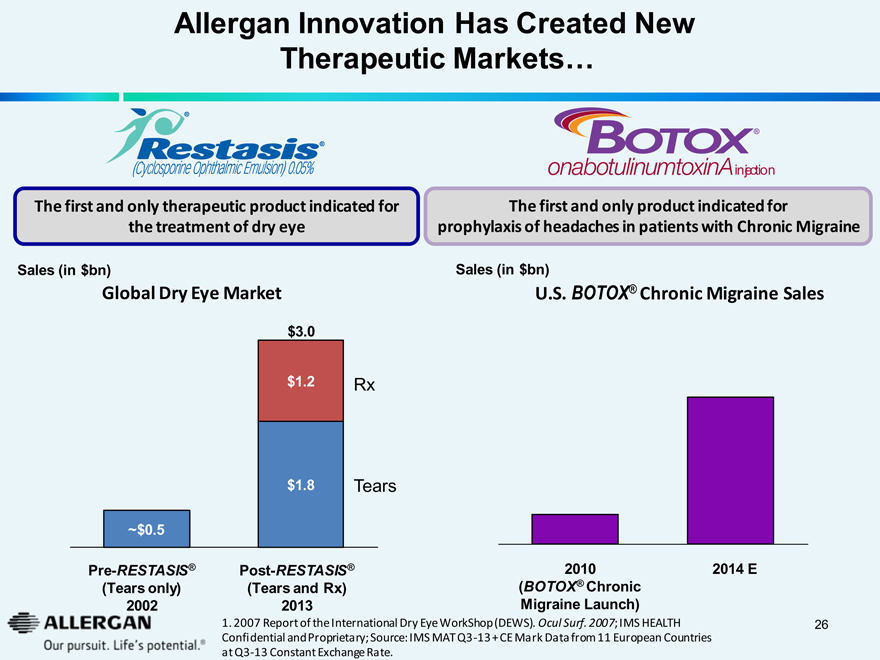

Allergan Innovation Has Created New

Therapeutic Markets…

Restasis®

(Cyclosporine Ophthalmic Emulsion) 0.05%

BOTOX®

onabotulinumtoxinA injection

The first and only therapeutic product indicated for the treatment of dry eye

The first and only product indicated for prophylaxis of headaches in patients with Chronic Migraine

Sales (in $bn)

Sales (in $bn)

Global Dry Eye Market

U.S. BOTOX® Chronic Migraine Sales

$3.0

$1.2

Rx

$1.8

Tears

~$0.5

Pre-RESTASIS®

Post-RESTASIS®

2010

2014 E

(Tears only)

(Tears and Rx)

(BOTOX® Chronic

2002

2013

Migraine Launch)

ALLERGAN

Our pursuit. Life’s potential.®

1. 2007 Report of the International Dry Eye WorkShop (DEWS). Ocul Surf. 2007; IMS HEALTH Confidential and Proprietary; Source: IMS MAT Q3 -13 + CE Mark Data from 11 European Countries at Q3-13 Constant Exchange Rate.

26

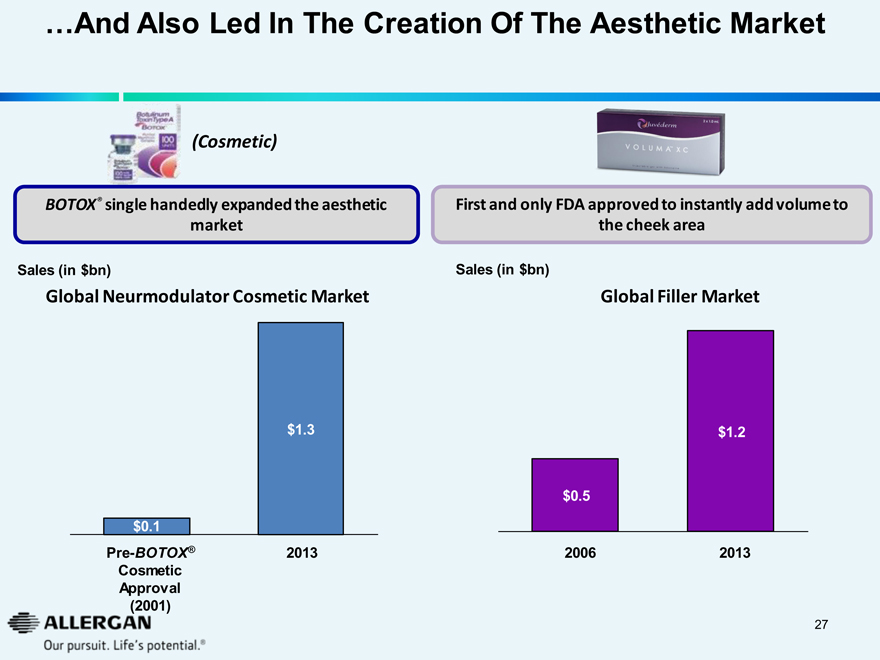

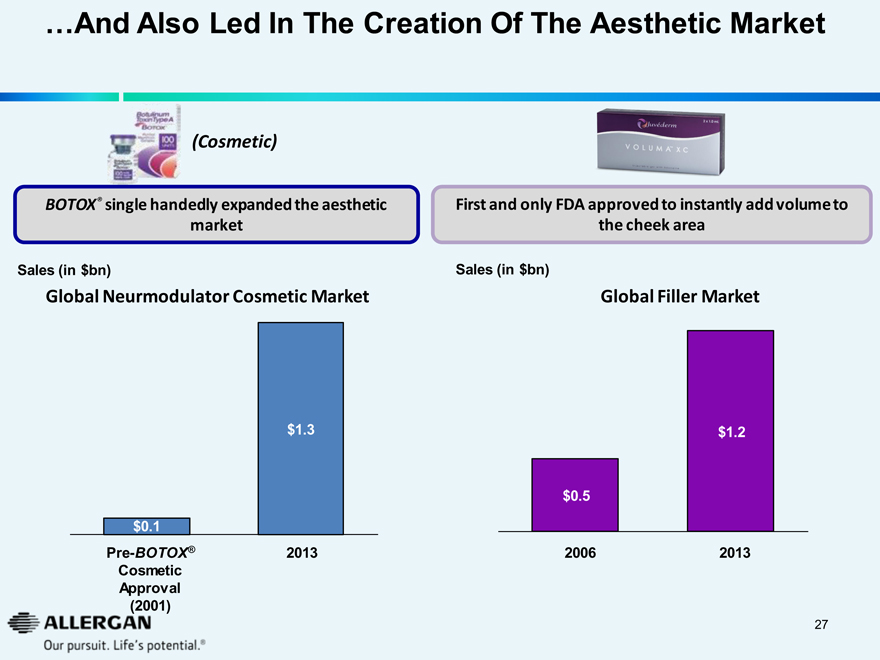

...And Also Led In The Creation Of The Aesthetic Market

Toxin Type A BOTOX (Cosmetic)

BOTOX® single handedly expanded the aesthetic market

Sales (in $bn)

Global Neurmodulator Cosmetic Market

$1.3

$0.1

Pre-BOTOX®

2013

Cosmetic

Approval

(2001)

Juvederm 2x1.0 ml VOLUMATM XC

First and only FDA approved to instantly add volume to the cheek area

Sales (in $bn)

Global Filler Market

$1.2

$0.5

2006

2013

27

ALLERGAN

Our pursuit. Life’s potential.®

Successful “Customer First” Approach

Sustains Market Leadership in Neurotoxins Builds Shares in Fillers

Global Neuromodulator Market Share - Quarterly

100%

80%

60%

40%

20%

0%

Q2-12

Q3-12

Q4-12

Q1-13

Q2-13

Q3-13

Q4-13

BOTOX® / Vistabel®

Dysport® / Azzalure®

(Valeant / Galderma / Ipsen)

others*

Global Fillers Market share - Yearly

40%

30%

20%

10%

0%

Valeant announces Medicis Acquisition 09/03/12, completed 12/11/12

2009

2010

2011

2012

2013

AGN

VRX / MRX / Dermik

GLD

Merz / BioForm

JNJ

others

With Multiple Global And Regional Competitors, Allergan Still Maintains ~80% Market Share

* Others includes Xeomin / Bocouture (Q4-13 share 5.3%), Neuronox / Meditoxin (1.2%), Prosigne / C-BTX-A (1.2%), Botulax (0.8%) and NeuroBloc / Myobloc (0.7%). Products listed are registered trademarks of their respective companies.

ALLERGAN

Our pursuit. Life’s potential. ®

28

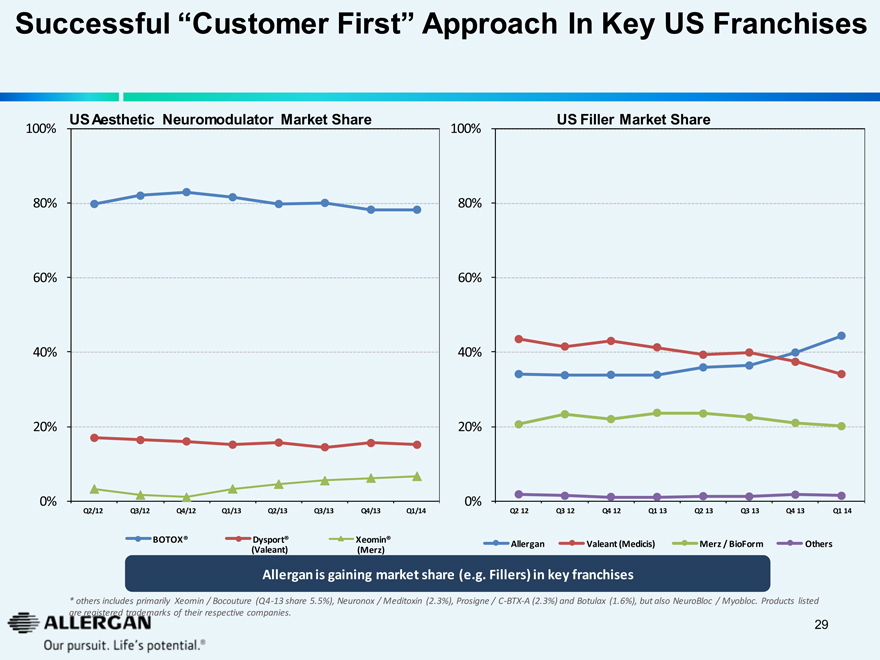

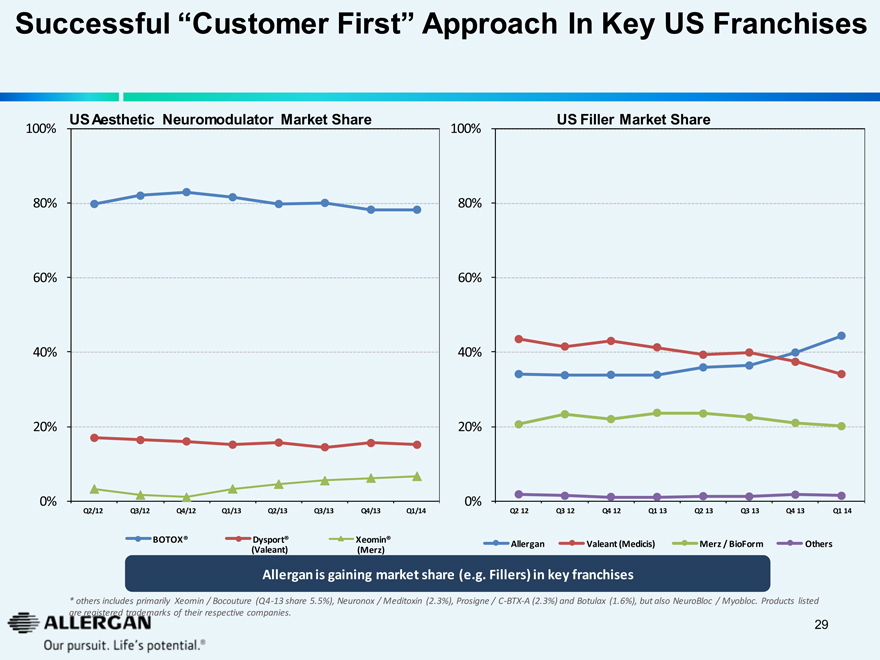

Successful “Customer First” Approach In Key US Franchises

US Aesthetic Neuromodulator Market Share

100%

80%

60%

40%

20%

0%

Q2/12 Q3/12 Q4/12 Q1/13 Q2/13 Q3/13 Q4/13 Q1/14

BOTOX® Dysport® (Valeant) Xeomin® (Merz)

US Filler Market Share

100%

80%

60%

40%

20%

0%

Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14

Allergan Valeant (Medicis) Merz / BioForm Others

Allergan is gaining market share (e.g. Fillers) in key franchises

* others includes primarily Xeomin / Bocouture (Q4-13 share 5.5%), Neuronox / Meditoxin (2.3%), Prosigne / C-BTX-A (2.3%) and Botulax (1.6%), but also NeuroBloc / Myobloc. Products listed are registered trademarks of their respective companies.

ALLERGAN

Our pursuit. Life’s potential.®

29

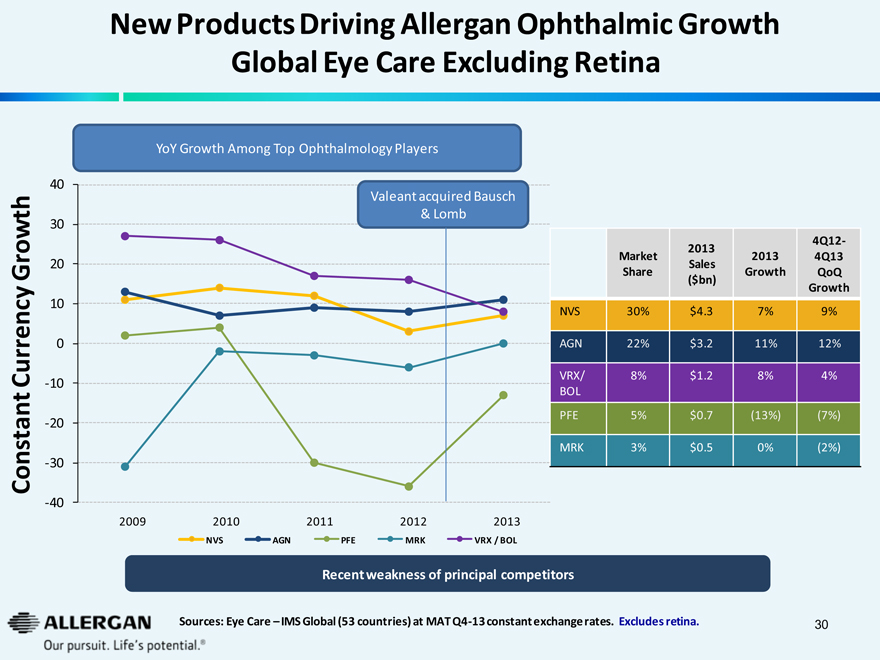

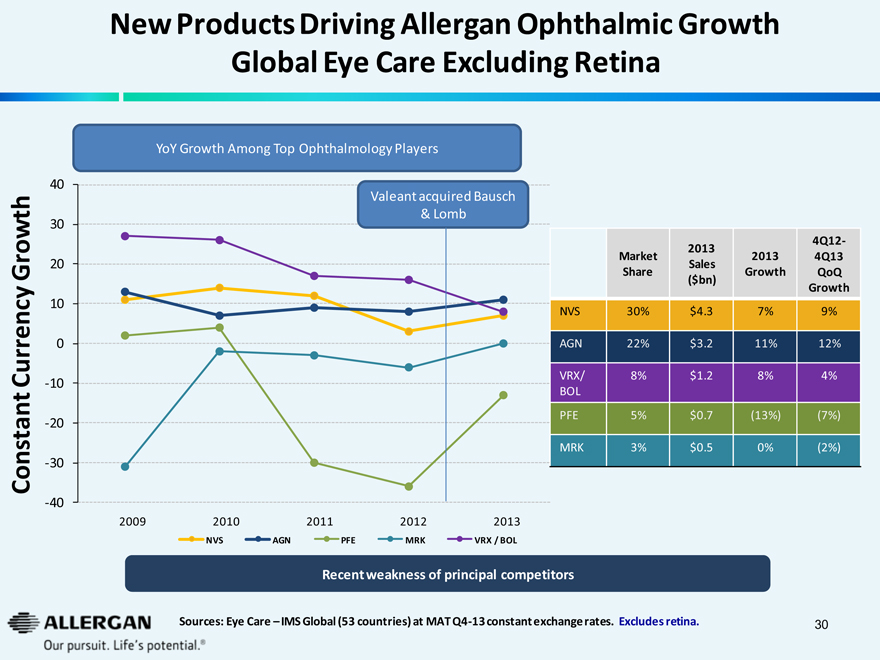

New Products Driving Allergan Ophthalmic Growth Global Eye Care Excluding Retina

YoY Growth Among Top Ophthalmology Players

Valeant acquired Bausch & Lomb

Constant Currency Growth

40

30

20

10

0

-10

-20

-30

-40

2009 2010 2011 2012 2013

NVS AGN PFE MRK VRX / BOL

Market Share 2013 Sales ($bn) 2013 Growth 4Q12-4Q13 QoQ Growth

NVS 30% $4.3 7% 9%

AGN 22% $3.2 11% 12%

VRX/BOL 8% $1.2 8% 4%

PFE 5% $0.7 (13%) (7%)

MRK 3% $0.5 0% (2%)

Recent weakness of principal competitors

Sources: Eye Care - IMS Global (53 countries) at MAT Q4-13 constant exchange rates. Excludes retina.

ALLERGAN

Our pursuit. Life’s potential.®

30

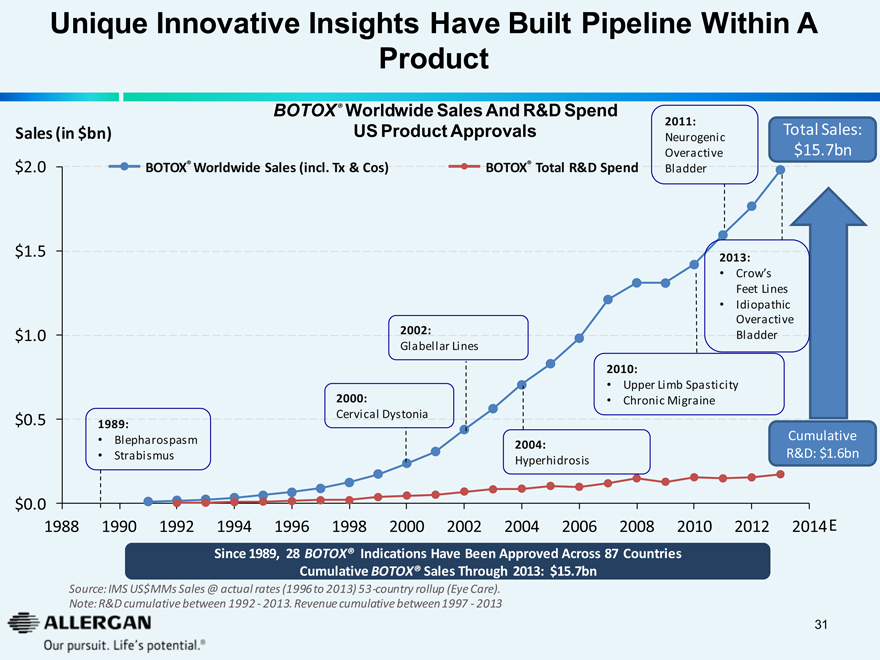

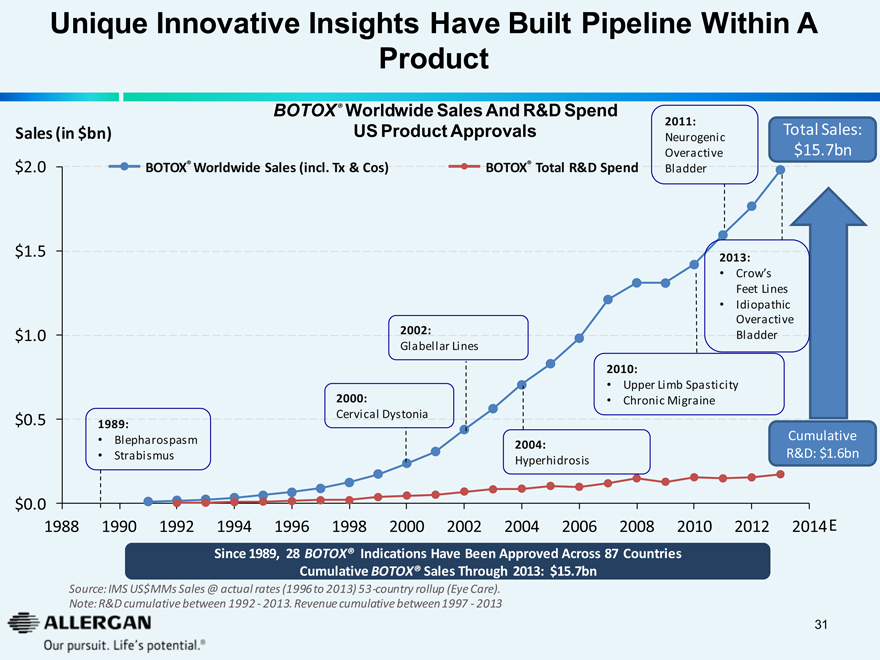

Unique Innovative Insights Have Built Pipeline Within A Product

BOTOX® Worldwide Sales And R&D Spend US Product Approvals

Sales (in $bn)

BOTOX® Worldwide Sales (incl. Tx & Cos)

BOTOX® Total R&D Spend

$2.0

$1.5

$1.0

$0.5

$0.0

1989:

Blepharospasm

Strabismus

2000:

Cervical Dystonia

2002:

Glabellar Lines

2004:

Hyperhidrosis

2010:

Upper Limb Spasticity

Chronic Migraine

2013:

Crow’s Feet Lines

Idiopathic Overactive Bladder

2011:

Neurogenic Overactive Bladder

Total Sales:

$15.7bn

Cumulative R&D: $1.6bn

1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 E

Since 1989, 28 BOTOX® Indications Have Been Approved Across 87 Countries Cumulative BOTOX® Sales Through 2013: $15.7bn

Source: IMS US$MMs Sales @ actual rates (1996 to 2013) 53-country rollup (Eye Care).

Note: R&D cumulative between 1992 - 2013. Revenue cumulative between 1997 - 2013

ALLERGAN

Our pursuit. Life’s potential.®

31

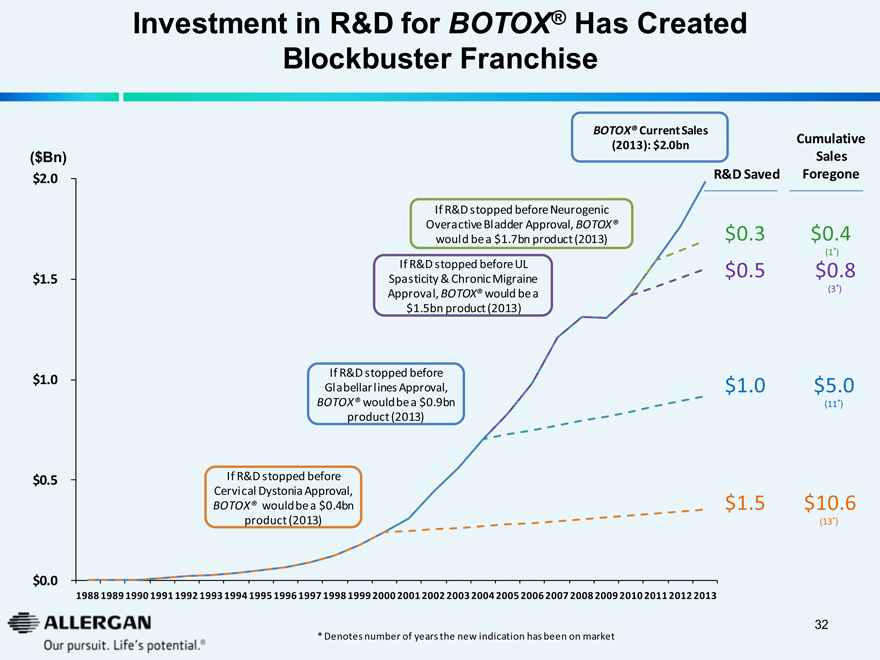

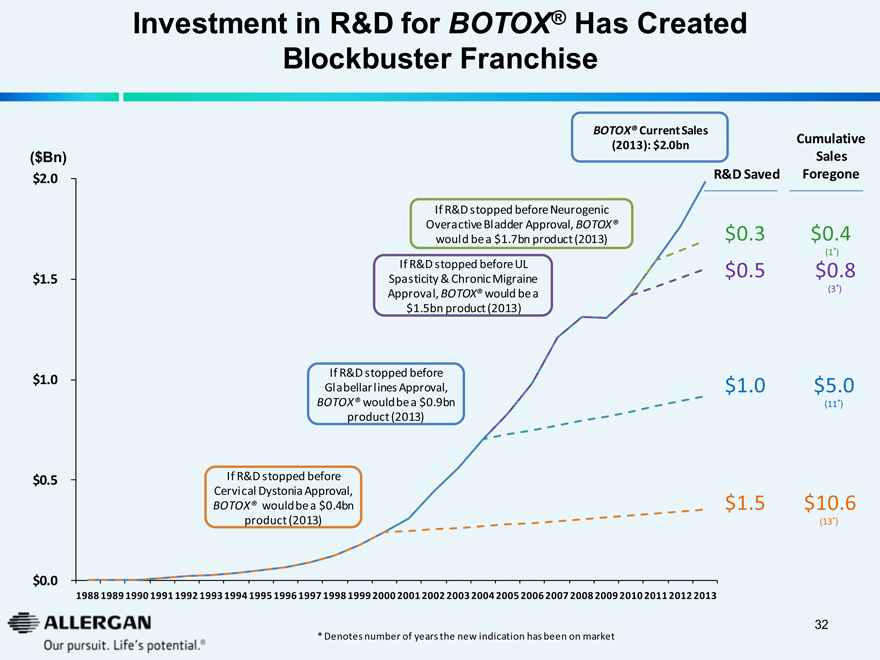

Investment in R&D for BOTOX® Has Created Blockbuster Franchise

($Bn)

$2.0

$1.5

$1.0

$0.5

$0.0

If R&D stopped before Cervical Dystonia Approval, BOTOX® would be a $0.4bn product (2013)

If R&D stopped before Glabellar lines Approval, BOTOX® would be a $0.9bn product (2013)

If R&D stopped before UL Spasticity & Chronic Migraine Approval, BOTOX® would be a $1.5bn product (2013)

If R&D stopped before Neurogenic Overactive Bladder Approval, BOTOX® would be a $1.7bn product (2013)

BOTOX® Current Sales (2013): $2.0bn

R&D Saved

$ 0.3

$ 0.5

$ 1.0

$ 1.5

Cumulative Sales Foregone

$0.4 (1*)

$0.8 (3*)

$5.0 (11*)

$10.6 (13*)

1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

* Denotes number of years the new indication has been on market

ALLERGAN

Our pursuit. Life’s potential.®

32

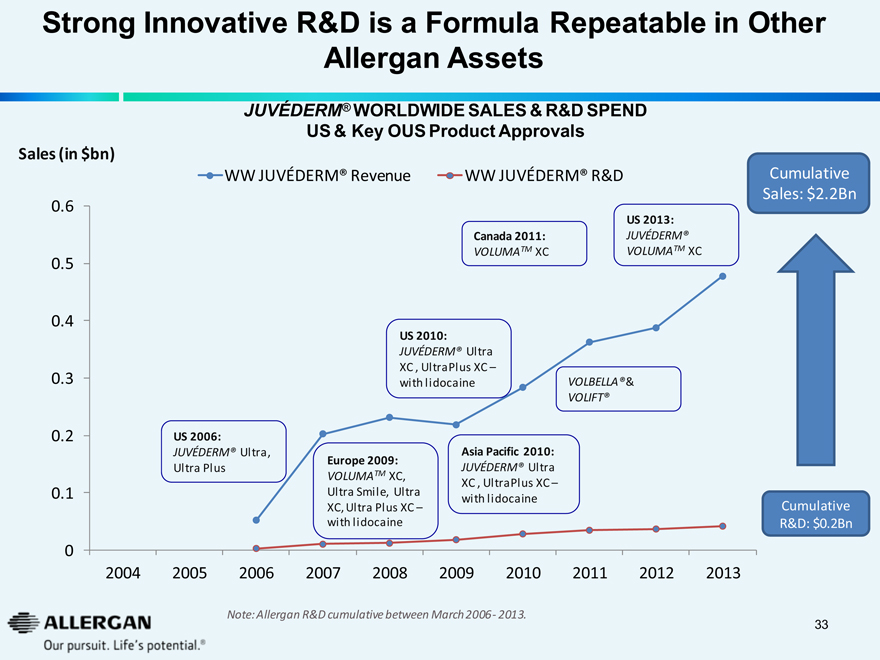

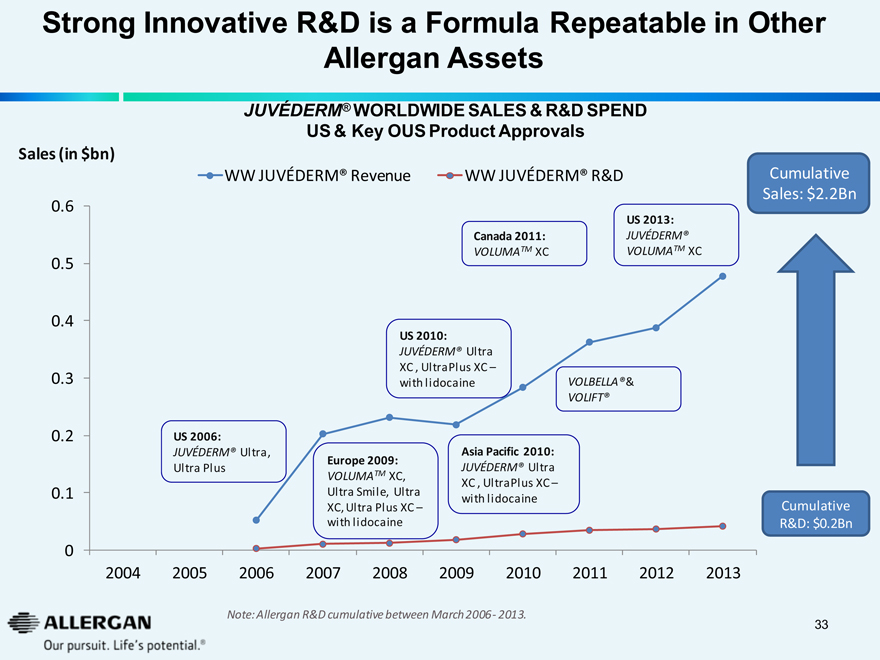

Strong Innovative R&D is a Formula Repeatable in Other Allergan Assets

JUVEDERM® WORLDWIDE SALES & R&D SPEND US & Key OUS Product Approvals

Sales (in $bn)

WW JUVEDERM® Revenue

WW JUVEDERM® R&D

0.6

0.5

0.4

0.3

0.2

0.1

0

US 2006:

JUVEDERM® Ultra, Ultra Plus

Europe 2009:

VOLUMATM XC, Ultra Smile, Ultra XC, Ultra Plus XC - with lidocaine

US 2010:

JUVEDERM® Ultra XC , UltraPlus XC - with lidocaine

Asia Pacific 2010:

JUVEDERM® Ultra XC , UltraPlus XC - with lidocaine

Canada 2011:

VOLUMATM XC

VOLBELLA® & VOLIFT®

US 2013:

JUVEDERM® VOLUMATM XC

Cumulative Sales: $2.2Bn

Cumulative R&D: $0.2Bn

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Note: Allergan R&D cumulative between March 2006- 2013.

ALLERGAN

Our pursuit. Life’s potential.®

33

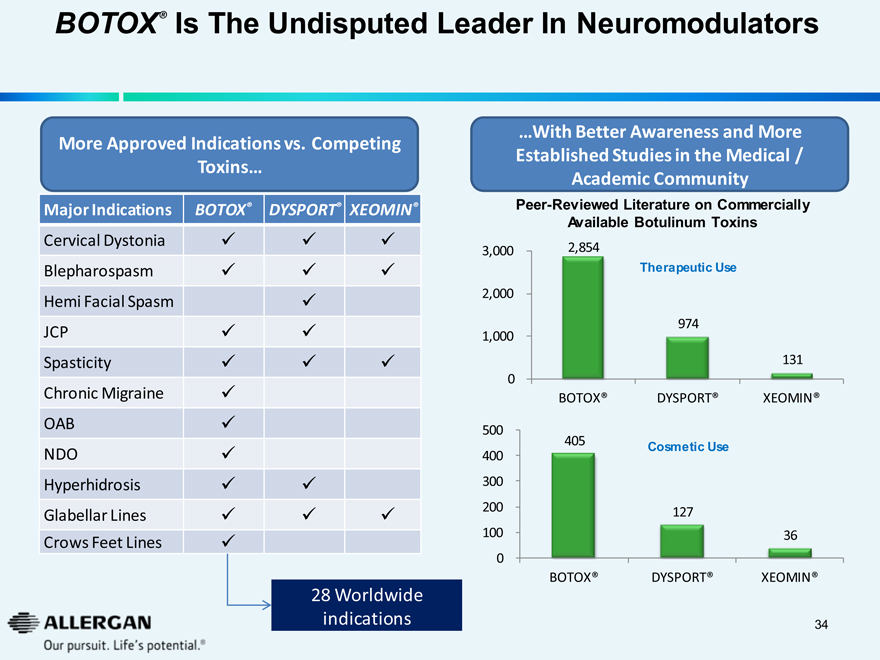

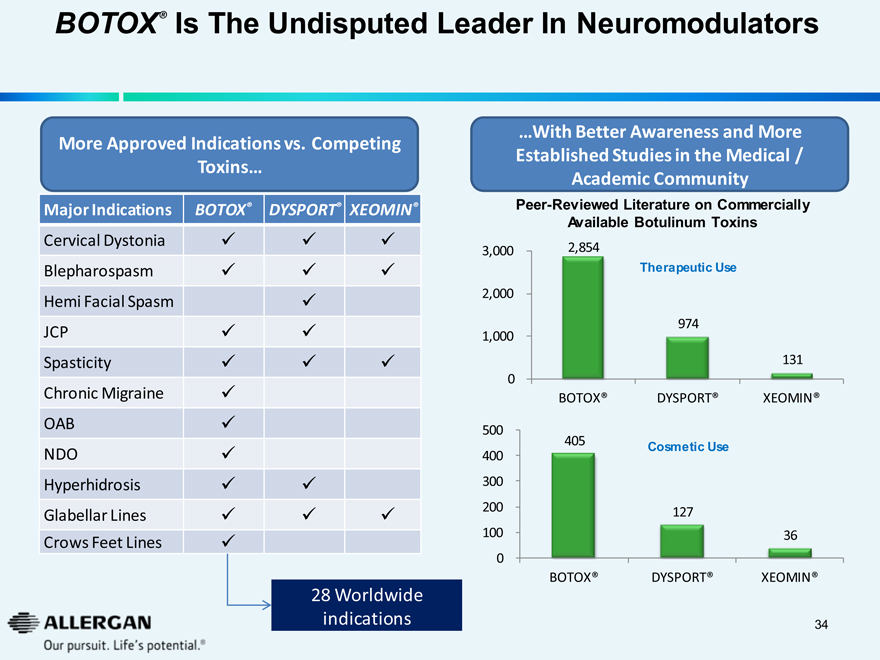

BOTOX® Is The Undisputed Leader In Neuromodulators

More Approved Indications vs. Competing Toxins...

Major Indications BOTOX® DYSPORT® XEOMIN®

Cervical Dystonia

Blepharospasm

Hemi Facial Spasm

JCP

Spasticity

Chronic Migraine

OAB

NDO

Hyperhidrosis

Glabellar Lines

Crows Feet Lines

...With Better Awareness and More Established Studies in the Medical / Academic Community

Peer-Reviewed Literature on Commercially Available Botulinum Toxins

Therapeutic Use

3,000

2,000

1,000

0

2,854

BOTOX®

974

DYSPORT®

131

XEOMIN®

Cosmetic Use

500

400

300

200 100

0

405

BOTOX®

127 DYSPORT®

36

XEOMIN®

28 Worldwide indications

ALLERGAN

Our pursuit. Life’s potential.®

34

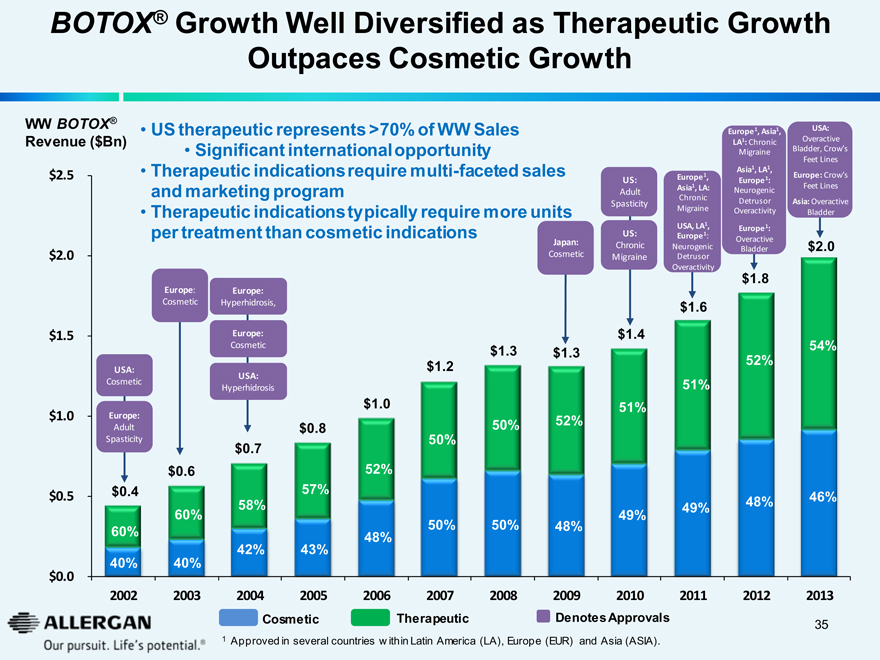

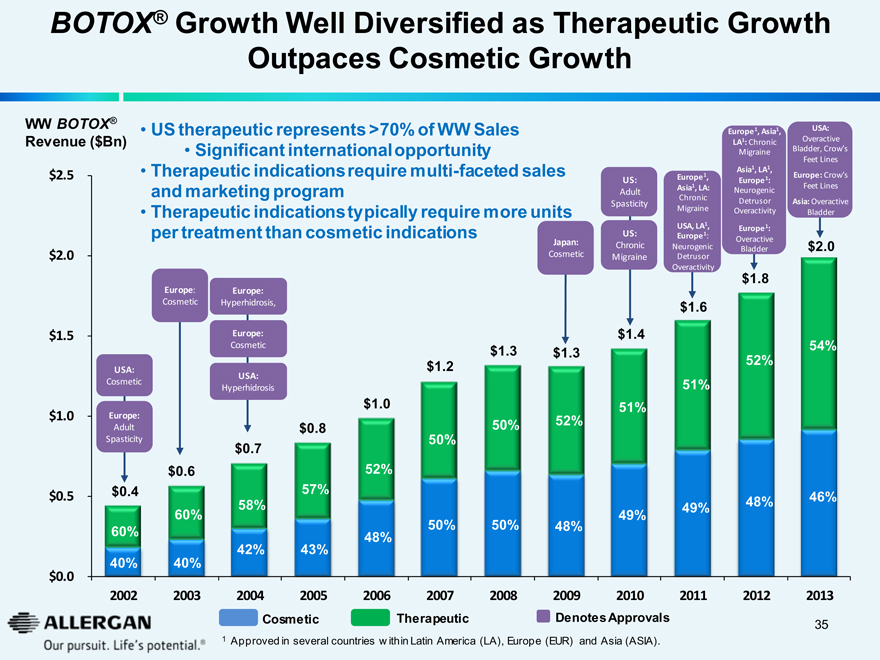

BOTOX® Growth Well Diversified as Therapeutic Growth Outpaces Cosmetic Growth

WW BOTOX®

Revenue ($Bn)

US therapeutic represents >70% of WW Sales

Significant international opportunity

Therapeutic indications require multi-faceted sales and marketing program

Therapeutic indications typically require more units per treatment than cosmetic indications

$2.5 $2.0 $1.5 $1.0 $0.5 $0.0

USA: Cosmetic Europe: Adult Spasticity $0.4 60% 40% 2002

Europe: Cosmetic $0.6 60% 40% 2003

Europe: Hyperhidrosis, Europe: Cosmetic USA: Hyperhidrosis $0.7 58% 42% 2004

$0.8 57% 43% 2005

$1.0 52% 48% 2006

$1.2 50% 50% 2007

$1.3 50% 50% 2008

Japan: Cosmetic $1.3 52% 48% 2009

US: Adult Spasticity US: Chronic Migraine $1.4 51% 49% 2010

Europe1, Asia1, LA: Chronic Migraine USA, LA1, Europe1: Neurogenic Detrusor Overactivity $1.6 51% 49% 2011

Europe1, Asia1, LA1: Chronic Migraine Asia1, LA1, Europe1: Neurogenic Detrusor Overactivity Europe1: Overactive Bladder $1.8 52% 48% 2012

USA: Overactive Bladder, Crow’s Feet Lines Europe: Crow’s Feet Lines Asia: Overactive Bladder $2.0 54% 46% 2013

ALLERGAN

Our pursuit. Life’s potential.®

Cosmetic Therapeutic Denotes Approvals

1 Approved in several countries within Latin America (LA), Europe (EUR) and Asia (ASIA).

35

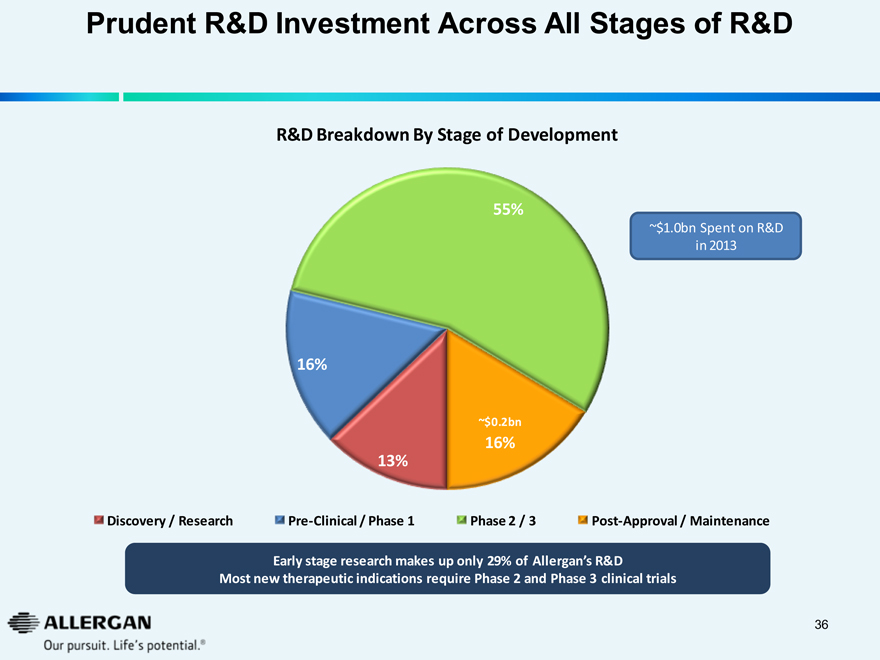

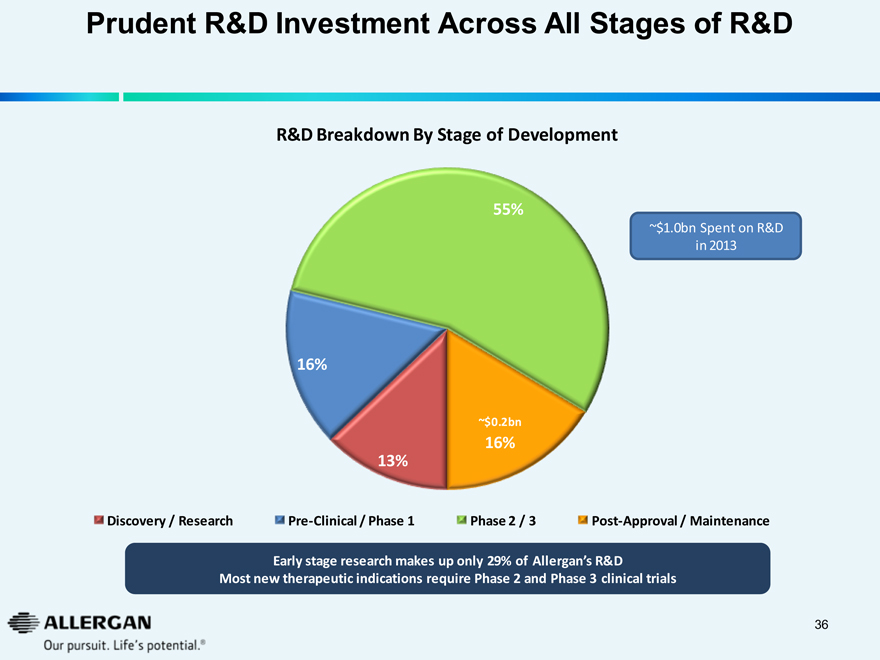

Prudent R&D Investment Across All Stages of R&D

R&D Breakdown By Stage of Development

~$1.0bn Spent on R&D in 2013

55% 16% 13% ~$0.2bn 16%

Discovery / Research Pre-Clinical / Phase 1 Phase 2 / 3 Post-Approval / Maintenance

Early stage research makes up only 29% of Allergan’s R&D

Most new therapeutic indications require Phase 2 and Phase 3 clinical trials

ALLERGAN

Our pursuit. Life’s potential.®

36

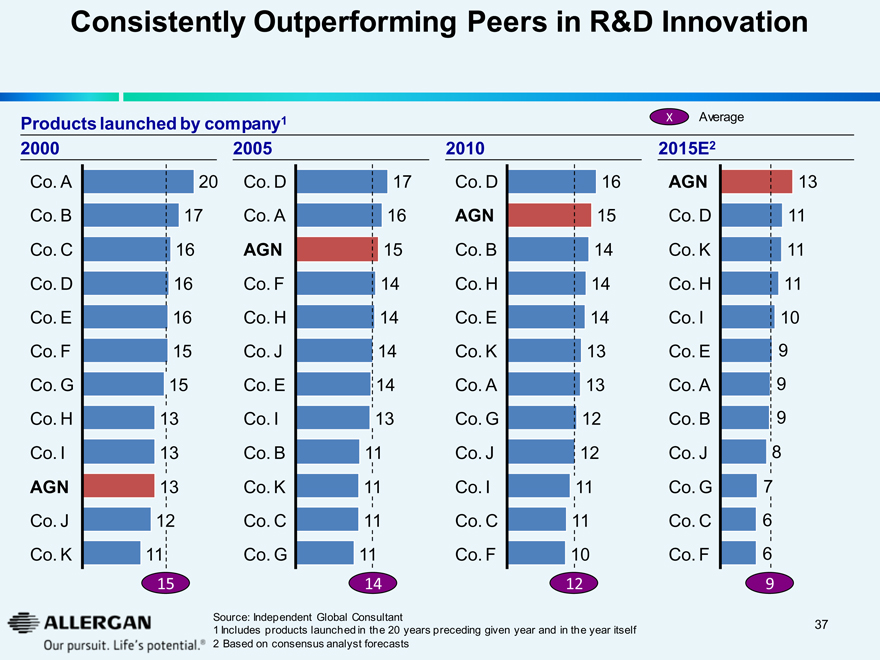

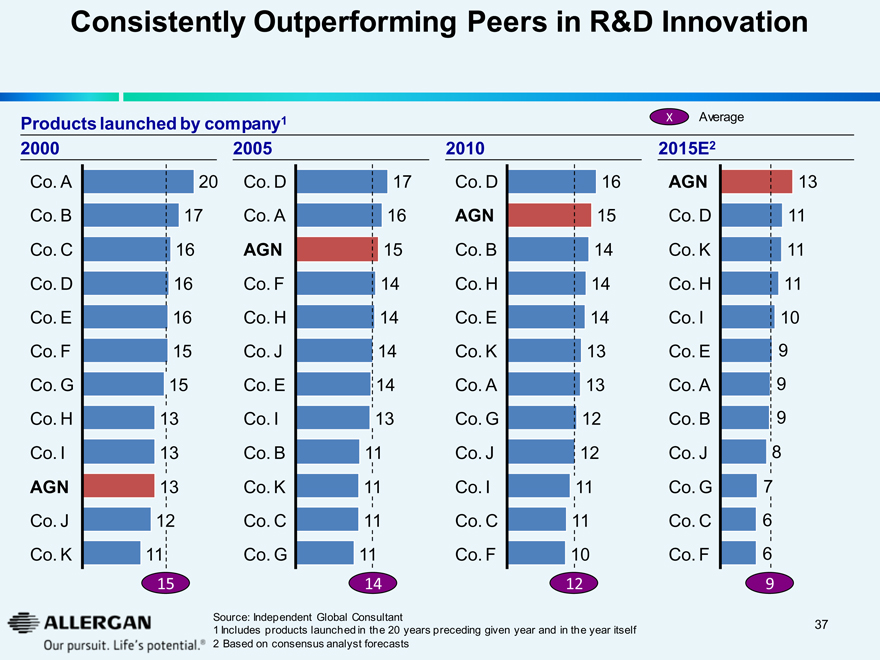

Consistently Outperforming Peers in R&D Innovation

Products launched by company1 X Average

2000 2005 2010 2015E2

Co. A 20 Co. D 17 Co. D 16 AGN 13

Co. B 17 Co. A 16 AGN 15 Co. D 11

Co. C 16 AGN 15 Co. B 14 Co. K 11

Co. D 16 Co. F 14 Co. H 14 Co. H 11

Co. E 16 Co. H 14 Co. E 14 Co. I 10

Co. F 15 Co. J 14 Co. K 13 Co. E 9

Co. G 15 Co. E 14 Co. A 13 Co. A 9

Co. H 13 Co. I 13 Co. G 12 Co. B 9

Co. I 13 Co. B 11 Co. J 12 Co. J 8

AGN 13 Co. K 11 Co. I 11 Co. G 7

Co. J 12 Co. C 11 Co. C 11 Co. C 6

Co. K 11 Co. G 11 Co. F 10 Co. F 6

15 14 12 9

ALLERGAN

Our pursuit. Life’s potential.®

Source: Independent Global Consultant

1 Includes products launched in the 20 years preceding given year and in the year itself

2 Based on consensus analyst forecasts

37

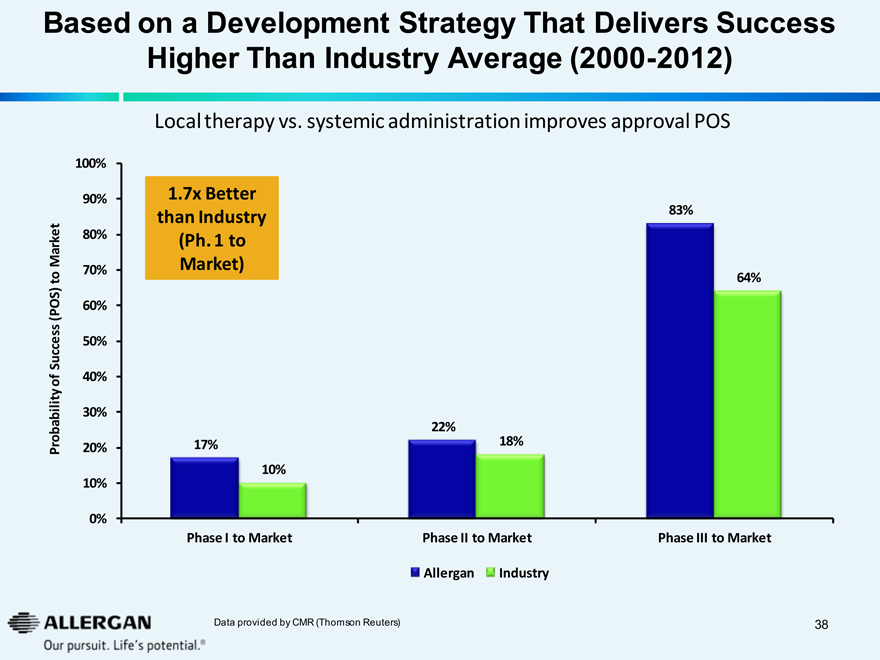

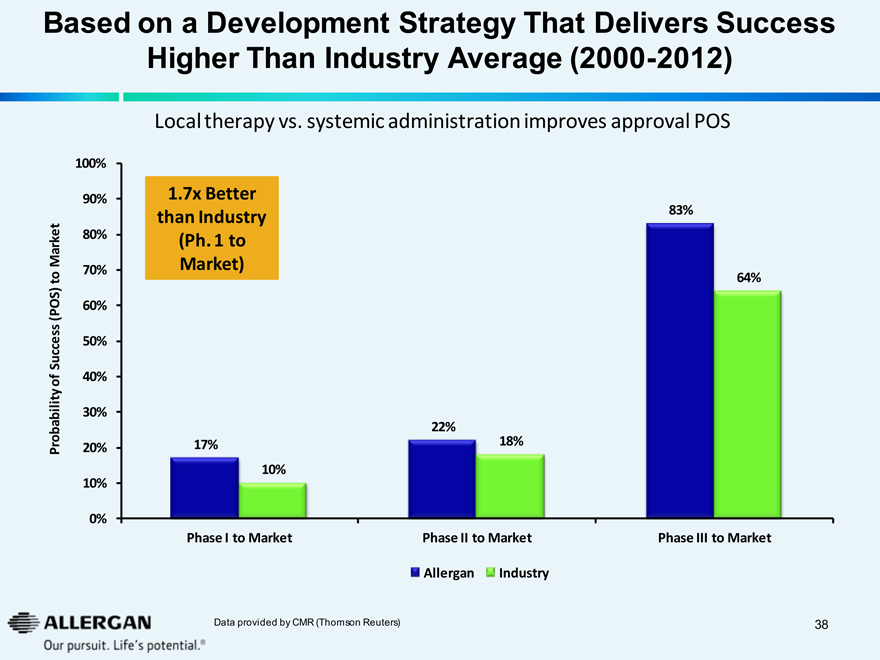

Based on a Development Strategy That Delivers Success Higher Than Industry Average (2000-2012)

Local therapy vs. systemic administration improves approval POS

Probability of Success (POS) to Market

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

1.7x Better than Industry (Ph. 1 to Market)

17%

10%

22%

18%

83%

64%

Phase I to Market Phase II to Market Phase III to Market

Allergan Industry

ALLERGAN

Our pursuit. Life’s potential.®

Data provided by CMR (Thomson Reuters)

38

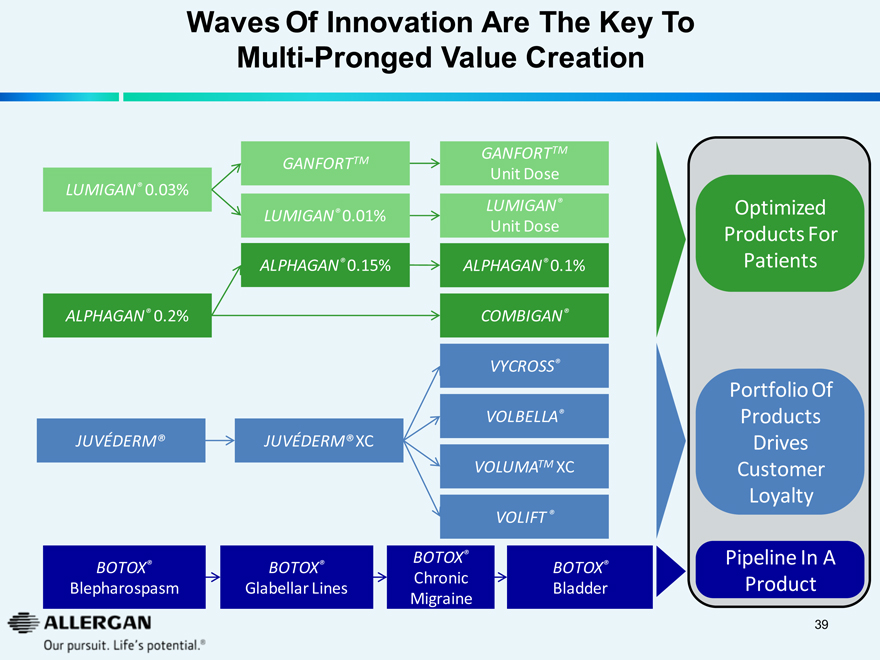

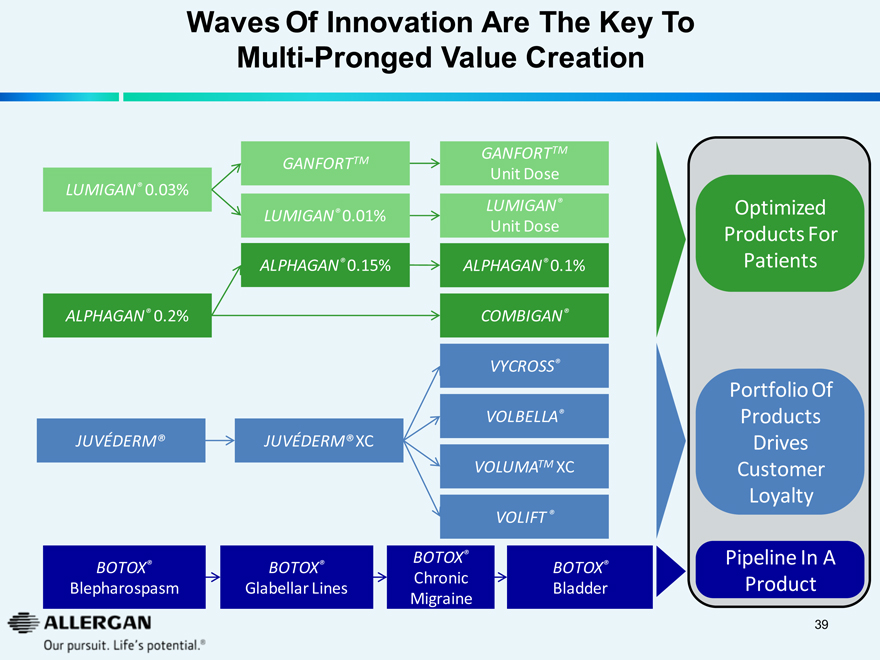

Waves Of Innovation Are The Key To

Multi-Pronged Value Creation

LUMIGAN® 0.03%

ALPHAGAN® 0.2%

JUVÉDERM®

GANFORTTM

LUMIGAN® 0.01%

ALPHAGAN® 0.15%

JUVÉDERM® XC

GANFORTTM

Unit Dose

LUMIGAN®

Unit Dose

ALPHAGAN® 0.1%

COMBIGAN®

VYCROSS®

VOLBELLA®

VOLUMATM XC

VOLIFT®

Optimized Products For Patients

Portfolio Of Products Drives Customer Loyalty

BOTOX® Blepharospasm

BOTOX® Glabellar Lines

BOTOX® Chronic Migraine

BOTOX® Bladder

Pipeline In A Product

ALLERGAN

Our pursuit. Life’s potential.®

39

Substantial Sales Return On Relentless Product

Optimization / Life Cycle Extension Products

($ in bn)

$1.8

$1.6

$1.4

$1.2

$1.0

$0.8

$0.6

$0.4

$0.2

$0.0

ALLERGAN

Alphagan®

0.2% Sterile

5 mL

Return on R&D: 24x $0.1 $1.4

ALLERGAN

NDC 0023-9177-05

Alphagan® P

(brimonidine tartrate ophthalmic solution)

0.15% 5 mL Rx Only sterile

Return on R&D: 18x

$0.1 $0.8

Alphagan® P

(brimonidine tartrate ophthalmic solution) 0.1%

Return on R&D: 32x

$0.1

$1.7

Combigan

brimonidine tartrate

2 mg/mL and

5 mg/mL eye drops

STERILE 5 mL

ALLERGAN

Return on R&D: 21x

$0.1 $1.1

Alphagan® 0.2% Alphagan® P 0.15% Alphagan® P 0.1% Combigan®

Cumulative R&D (1992–2013) Cumulative Total Rev (1997–2013)

Improvements:

Reduced ocular allergies

Improved efficacy Better tolerated Less systemic exposure

Improved efficacy

Much lower ocular allergies

ALLERGAN

Our pursuit. Life’s potential.®

40

Value Created Through Investments in

All Pre-Phase III Projects

All currently approved and ongoing development projects required or require pre-phase 3 work

If Allergan were to stop DARPin® development today ...

Sales Return +25x ~$120bn

~$7bn ~$50bn $0.35bn –$0.40bn ~$20bn

Cumulative R&D Spend 1992–2013

Cumulative Sales 1997–2013

2014 – 2024 Potential Additional Sales Associated with R&D Spent

Potential Phase 3 R&D Savings *

Potential Cumulative 10-year DARPin® Sales*

Abandoning pre-phase III projects will be value destructive

ALLERGAN

Our pursuit. Life’s potential.®

Note: All projections based on Allergan estimates.

* R&D investments and potential sales figures exclude Dual DARPin®.

41

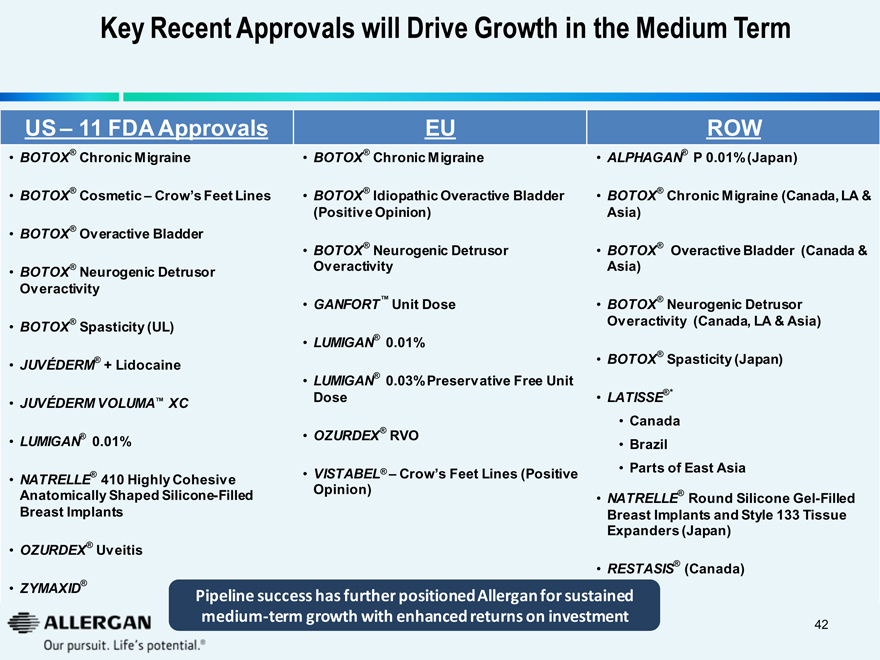

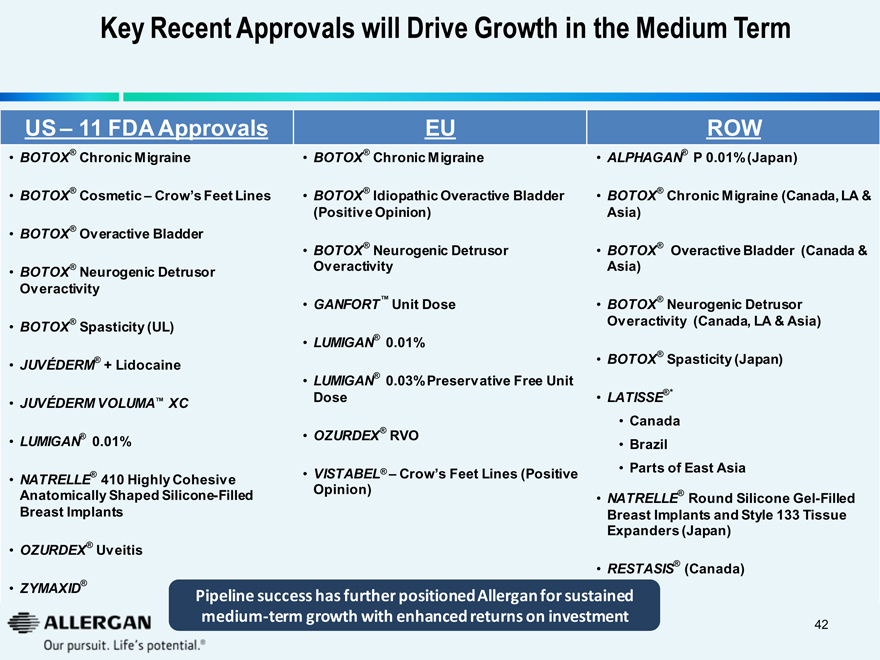

Key Recent Approvals will Drive Growth in the Medium Term

US – 11 FDA Approvals

BOTOX® Chronic Migraine

BOTOX® Cosmetic – Crow’s Feet Lines

BOTOX® Overactive Bladder

BOTOX® Neurogenic Detrusor

Overactivity

BOTOX® Spasticity (UL)

JUVÉDERM® + Lidocaine

JUVÉDERM VOLUMA™ XC

LUMIGAN® 0.01%

NATRELLE® 410 Highly Cohesive

Anatomically Shaped Silicone-Filled

Breast Implants

OZURDEX® Uveitis

ZYMAXID®

EU

BOTOX® Chronic Migraine

BOTOX® Idiopathic Overactive Bladder

(Positive Opinion)

BOTOX® Neurogenic Detrusor

Overactivity

GANFORT™ Unit Dose

LUMIGAN® 0.01%

LUMIGAN® 0.03% Preservative Free Unit Dose

OZURDEX® RVO

VISTABEL® – Crow’s Feet Lines (Positive Opinion)

ROW

ALPHAGAN® P 0.01% (Japan)

BOTOX® Chronic Migraine (Canada, LA & Asia)

BOTOX® Overactive Bladder (Canada & Asia)

BOTOX® Neurogenic Detrusor

Overactivity (Canada, LA & Asia)

BOTOX® Spasticity (Japan)

LATISSE®*

Canada

Brazil

Parts of East Asia

NATRELLE® Round Silicone Gel-Filled Breast Implants and Style 133 Tissue Expanders (Japan)

RESTASIS® (Canada)

Pipeline success has further positioned Allergan for sustained medium-term growth with enhanced returns on investment

ALLERGAN

Our pursuit. Life’s potential.®

42

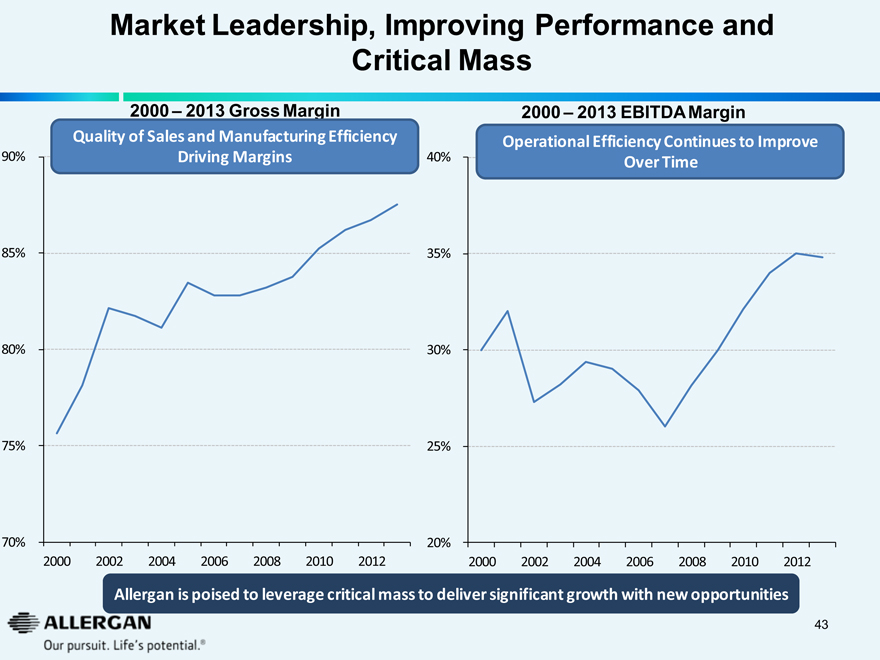

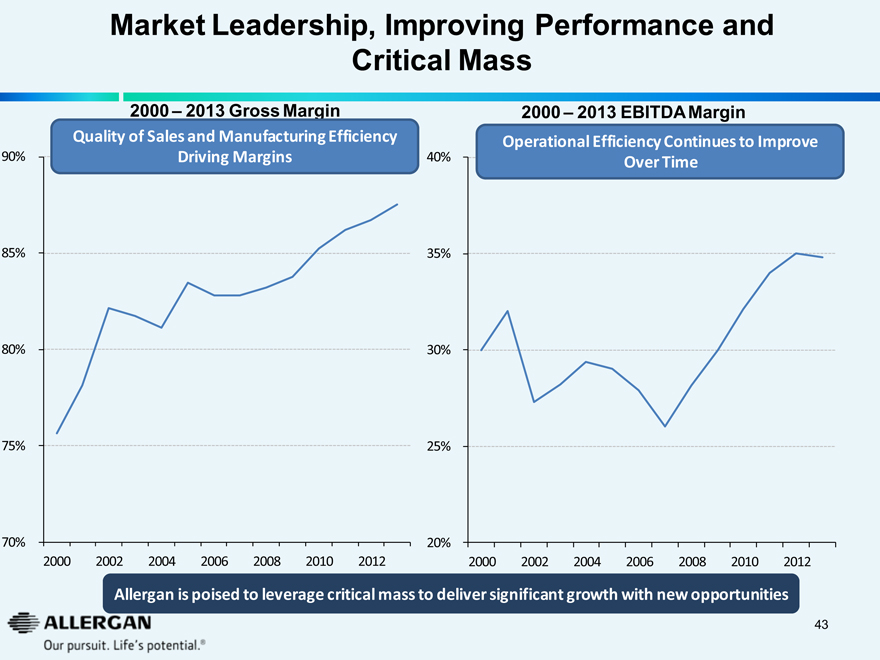

Market Leadership, Improving Performance and Critical Mass

2000 – 2013 Gross Margin

Quality of Sales and Manufacturing Efficiency Driving Margins

90%

85%

80%

75%

70%

2000 2002 2004 2006 2008 2010 2012

2000 – 2013 EBITDA Margin

Operational Efficiency Continues to Improve Over Time

40%

35%

30%

25%

20%

2000 2002 2004 2006 2008 2010 2012

Allergan is poised to leverage critical mass to deliver significant growth with new opportunities

ALLERGAN

Our pursuit. Life’s potential.®

43

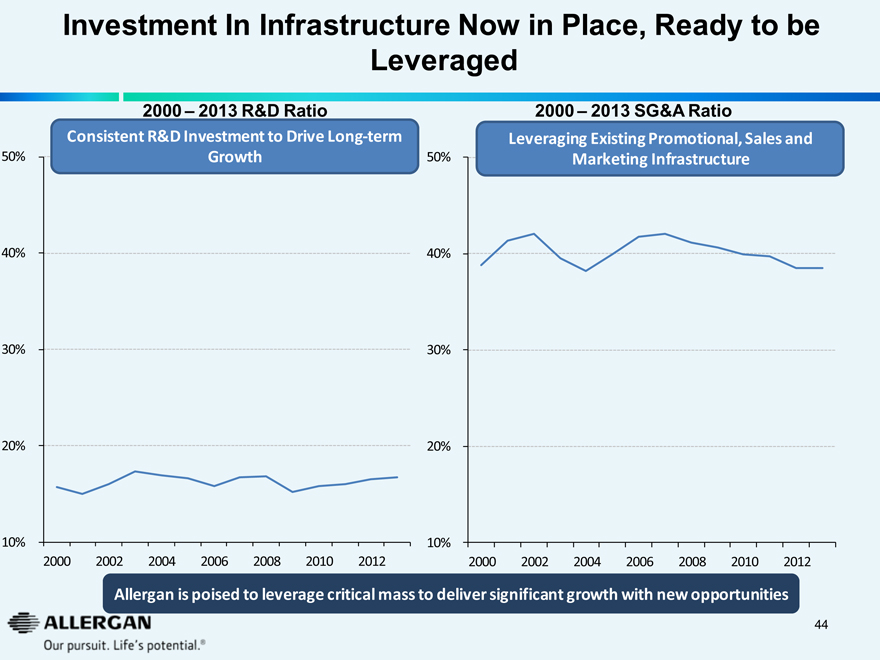

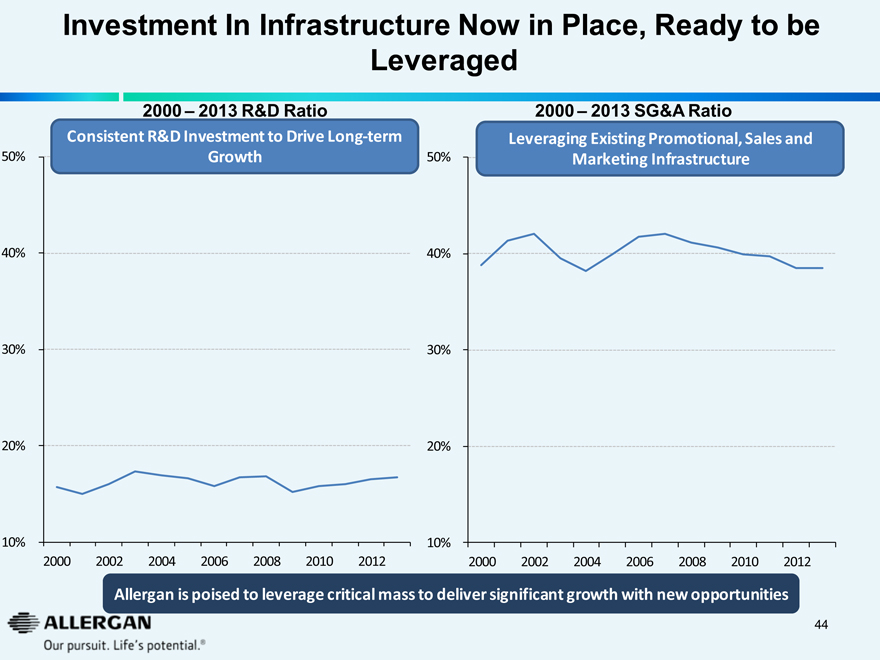

Investment In Infrastructure Now in Place, Ready to be Leveraged

2000 – 2013 R&D Ratio

Consistent R&D Investment to Drive Long-term Growth

50%

40%

30%

20%

10%

2000 2002 2004 2006 2008 2010 2012

2000 – 2013 SG&A Ratio

Leveraging Existing Promotional, Sales and Marketing Infrastructure

50%

40%

30%

20%

10%

2000 2002 2004 2006 2008 2010 2012

Allergan is poised to leverage critical mass to deliver significant growth with new opportunities

ALLERGAN

Our pursuit. Life’s potential.®

44

Allergan Tomorrow

ALLERGAN

Our pursuit. Life’s potential.®

45

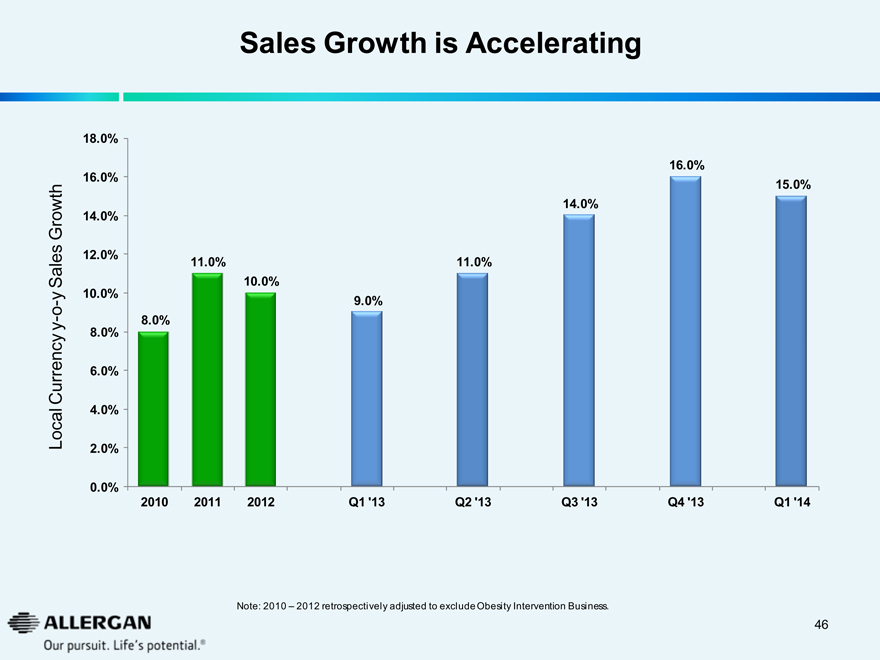

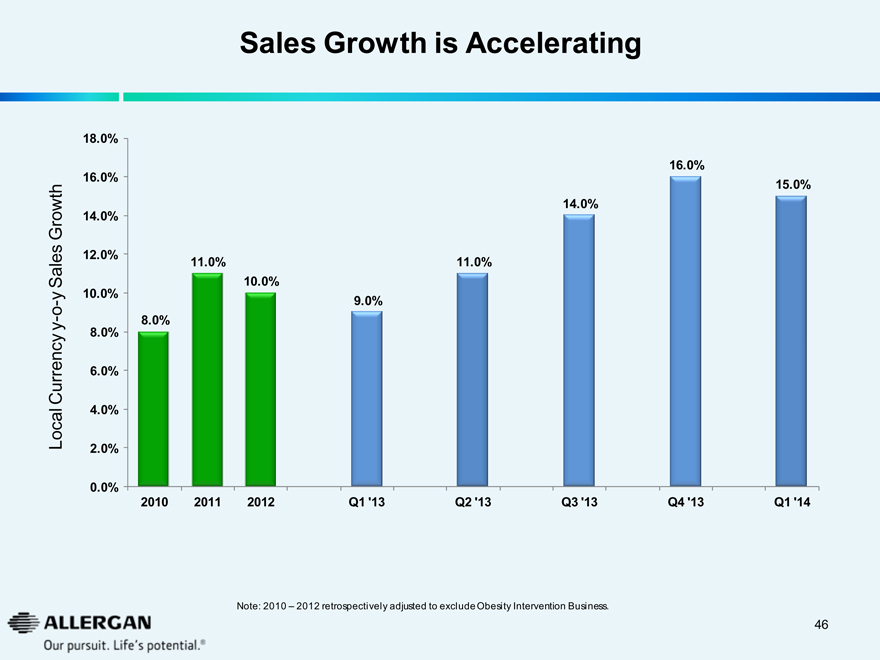

Sales Growth is Accelerating

Local Currency y-o-y Sales Growth

18.0%

16.0%

16.0% 15.0%

14.0% 14.0%

12.0% 11.0% 11.0%

10.0% 10.0% 9.0%

8.0% 8.0%

6.0%

4.0%

2.0%

0.0%

2010 2011 2012 Q1 ‘13 Q2 ‘13 Q3 ‘13 Q4 ‘13 Q1 ‘14

Note: 2010 – 2012 retrospectively adjusted to exclude Obesity Intervention Business.

ALLERGAN

Our pursuit. Life’s potential.®

46

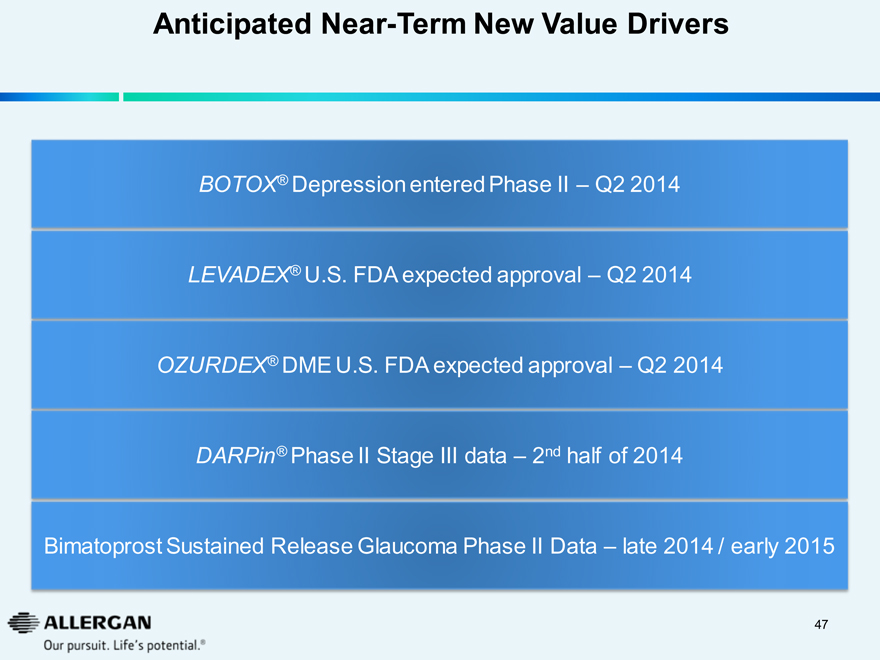

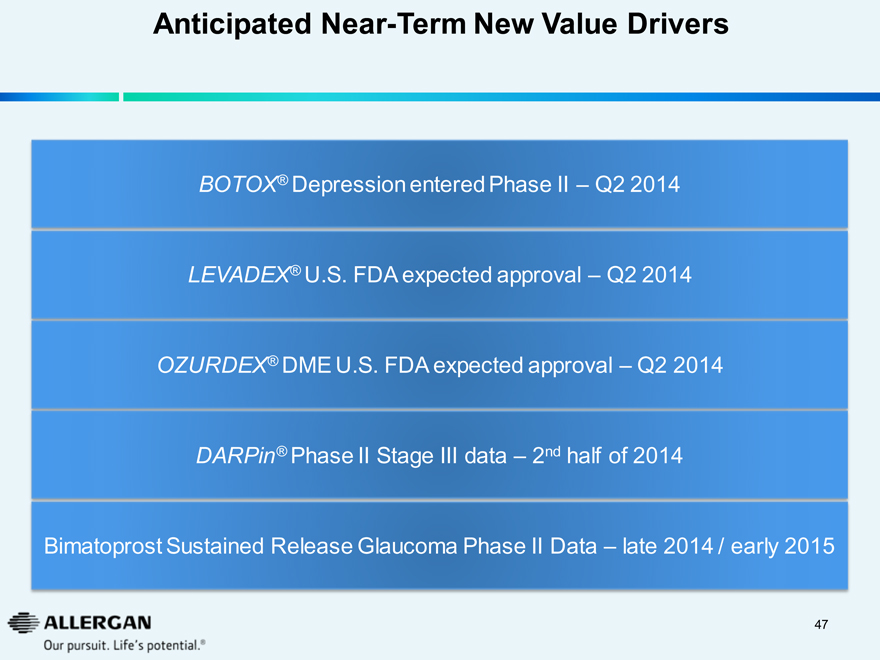

Anticipated Near-Term New Value Drivers

BOTOX® Depression entered Phase II – Q2 2014

LEVADEX® U.S. FDA expected approval – Q2 2014

OZURDEX® DME U.S. FDA expected approval – Q2 2014

DARPin® Phase II Stage III data – 2nd half of 2014

Bimatoprost Sustained Release Glaucoma Phase II Data – late 2014 / early 2015

ALLERGAN

Our pursuit. Life’s potential.®

47

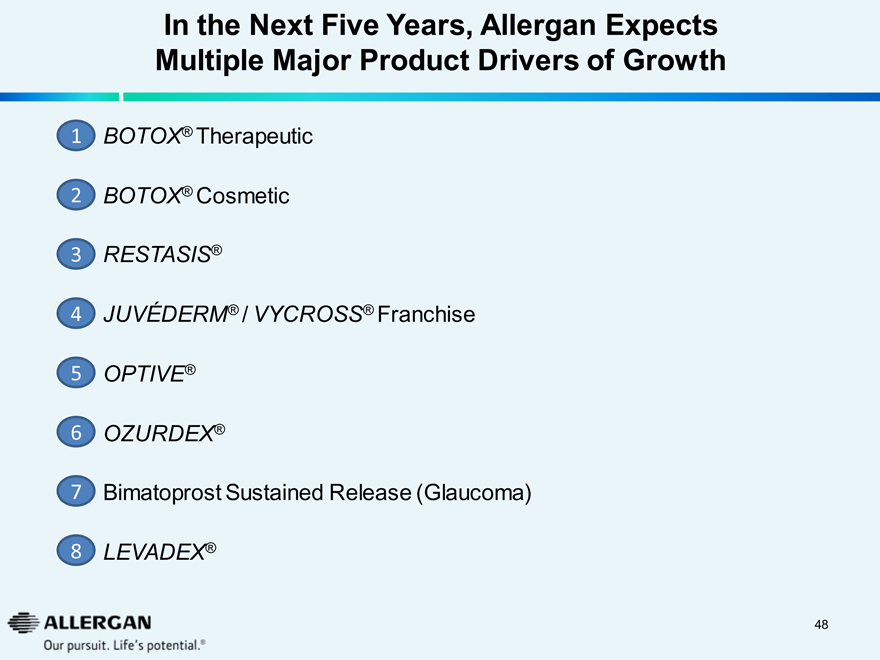

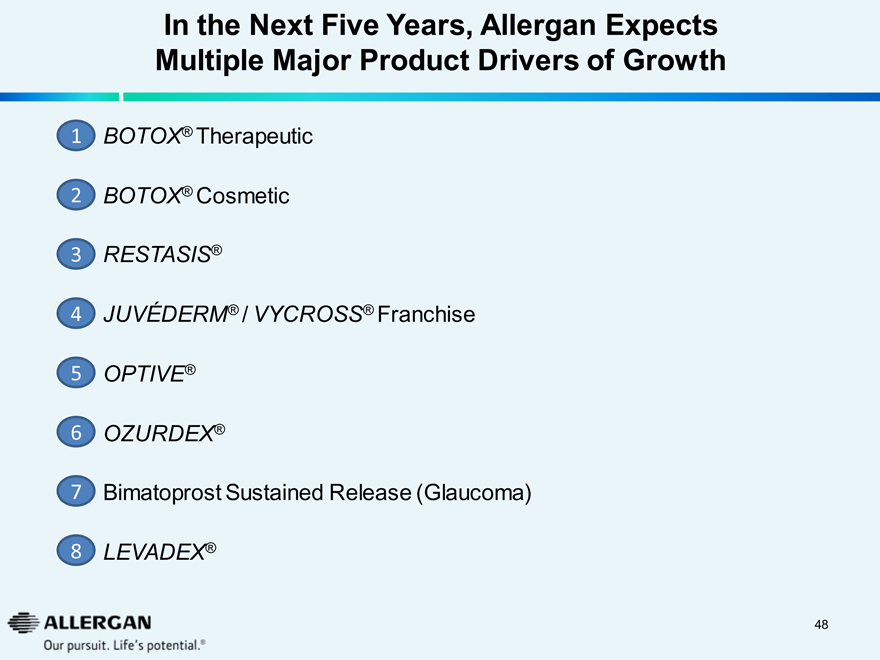

In the Next Five Years, Allergan Expects Multiple Major Product Drivers of Growth

1 BOTOX® Therapeutic

2 BOTOX® Cosmetic

3 RESTASIS®

4 JUVÉDERM® / VYCROSS® Franchise

5 OPTIVE®

6 OZURDEX®

7 Bimatoprost Sustained Release (Glaucoma)

8 LEVADEX®

ALLERGAN

Our pursuit. Life’s potential.®

48

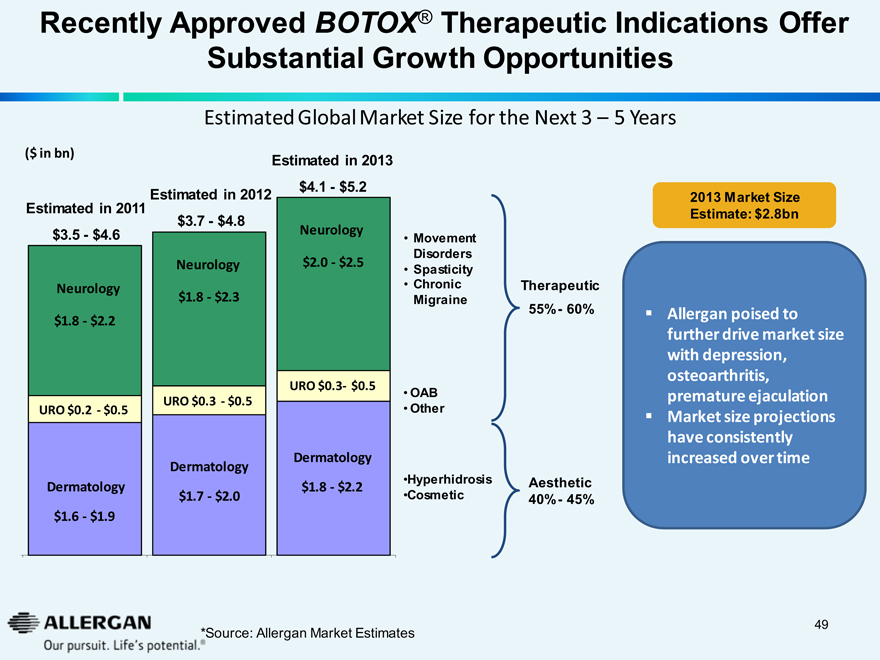

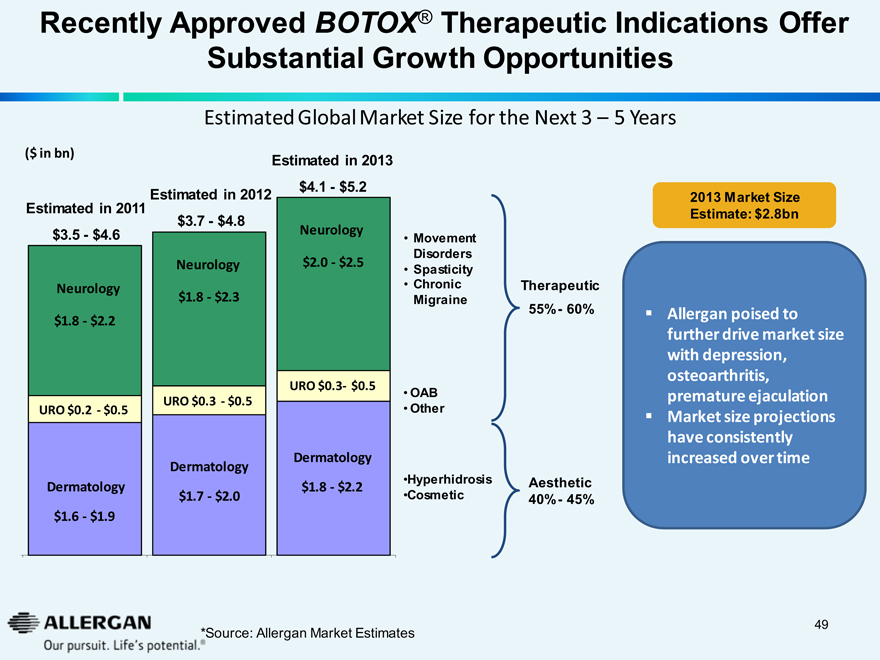

Recently Approved BOTOX® Therapeutic Indications Offer

Substantial Growth Opportunities

Estimated Global Market Size for the Next 3 - 5 Years

($ in bn)

Estimated in 2013

Estimated in 2011

Estimated in 2012

$3.5 - $4.6

$3.7 - $4.8

$4.1 - $5.2

Neurology

Neurology

Neurology

$1.8 - $2.2

$1.8 - $2.3

$2.0 - $2.5

Movement

Disorders

Spasticity

Chronic

Migraine

OAB

Other

Hyperhidrosis

Cosmetic

Therapeutic

55% - 60%

Aesthetic

40% - 45%

URO $0.2 - $0.5

URO $0.3 - $0.5

URO $0.3 - $0.5

Dermatology

Dermatology

Dermatology

$1.6 - $1.9

$1.7 - $2.0

$1.8 - $2.2

2013 Market Size

Estimate: $2.8bn

Allergan poised to further drive market size with depression, osteoarthritis, premature ejaculation

Market size projections have consistently increased over time

*Source: Allergan Market Estimates

ALLERGAN

Our pursuit. Life’s potential.®

49

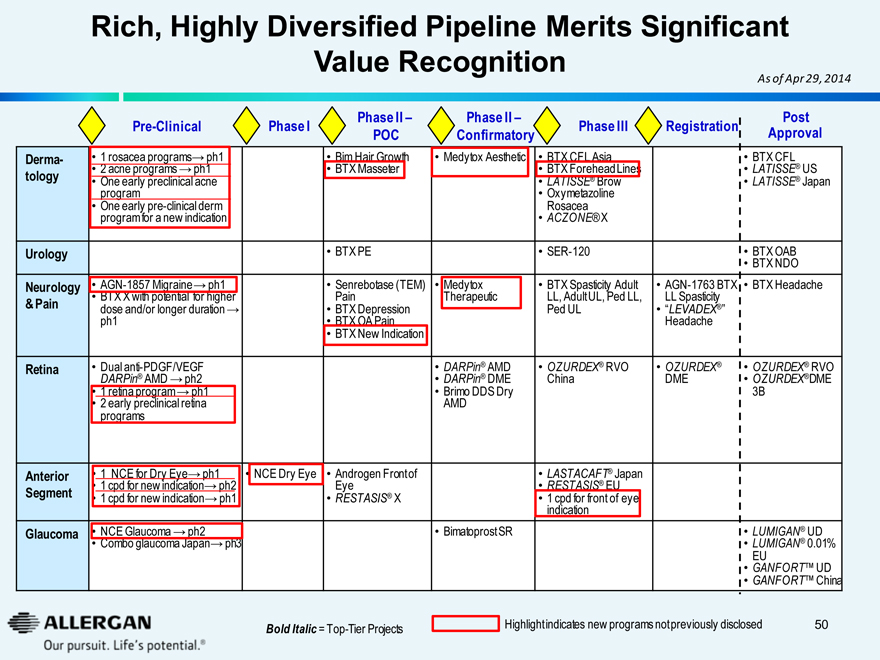

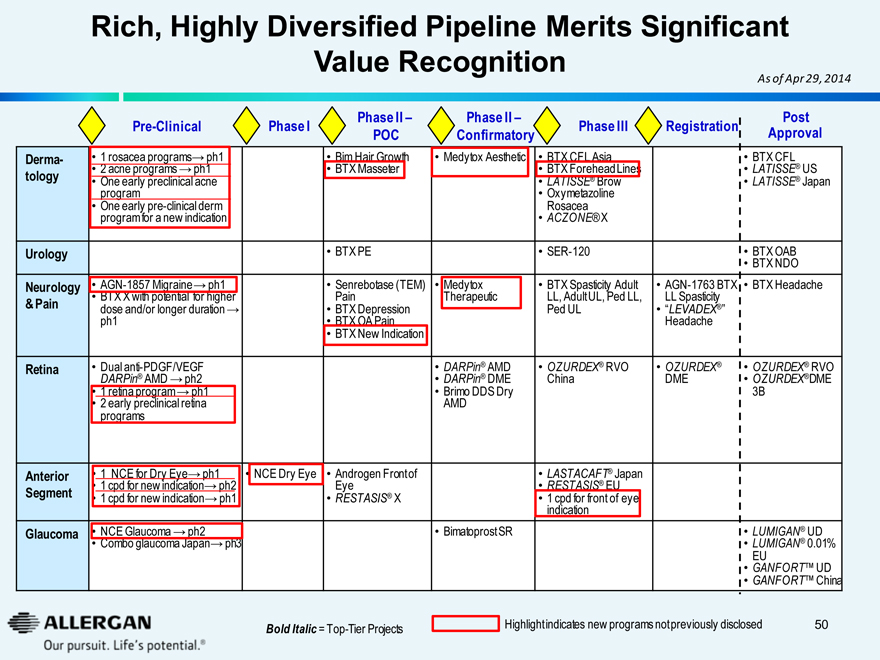

Rich, Highly Diversified Pipeline Merits Significant Value Recognition

As of Apr 29, 2014

Pre-Clinical Phase I Phase II - POC Phase II - Confirmatory Phase III Registration Post Approval

Derma-

tology

1 rosacea programs® ph1

2 acne programs® ph1

One early preclinical acne program

One early pre-clinical derm program for a new indication

Bim Hair Growth

BTX Masseter

Medytox Aesthetic

BTX CFL Asia

BTX Forehead Lines

LATISSE® Brow

Oxymetazoline Rosacea

ACZONE® X

BTX CFL

LATISSE® US

LATISSE® Japan

Urology

BTX PE

SER-120

BTX OAB

BTX NDO

Neurology & Pain

AGN-1857 Migraine® ph1

BTX X with potential for higher

dose and/or longer duration® ph1

Senrebotase (TEM) Pain BTX Depression BTX OA Pain BTX New Indication

Medytox Therapeutic

BTX Spasticity Adult LL, Adult UL, Ped LL, Ped UL

AGN-1763 BTX LL Spasticity “LEVADEX®” Headache

BTX Headache

Retina

Dual anti-PDGF/VEGF DARPin® AMD® ph2 1 retina program® ph1 2 early preclinical retina programs

DARPin® AMD DARPin® DME Brimo DDS Dry AMD

OZURDEX® RVO China

OZURDEX® DME

OZURDEX® RVO OZURDEX®DME 3B

Anterior Segment

1 NCE for Dry Eye® ph1 1 cpd for new indication® ph2 1 cpd for new indication® ph1

NCE Dry Eye

Androgen Front of Eye RESTASIS® X

LASTACAFT® Japan RESTASIS® EU 1 cpd for front of eye indication

Glaucoma NCE Glaucoma® ph2 Combo glaucoma Japan® ph3

Bimatoprost SR

LUMIGAN® UD LUMIGAN® 0.01% EU GANFORT™ UD GANFORT™ China

Bold Italic = Top-Tier Projects

Highlight indicates new programs not previously disclosed

ALLERGAN

Our pursuit. Life’s potential.®

50

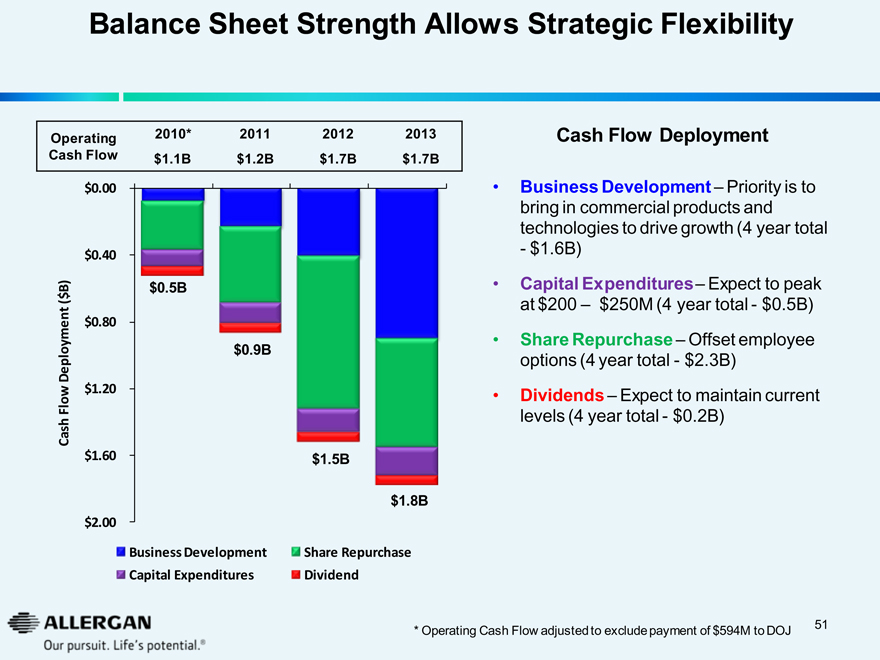

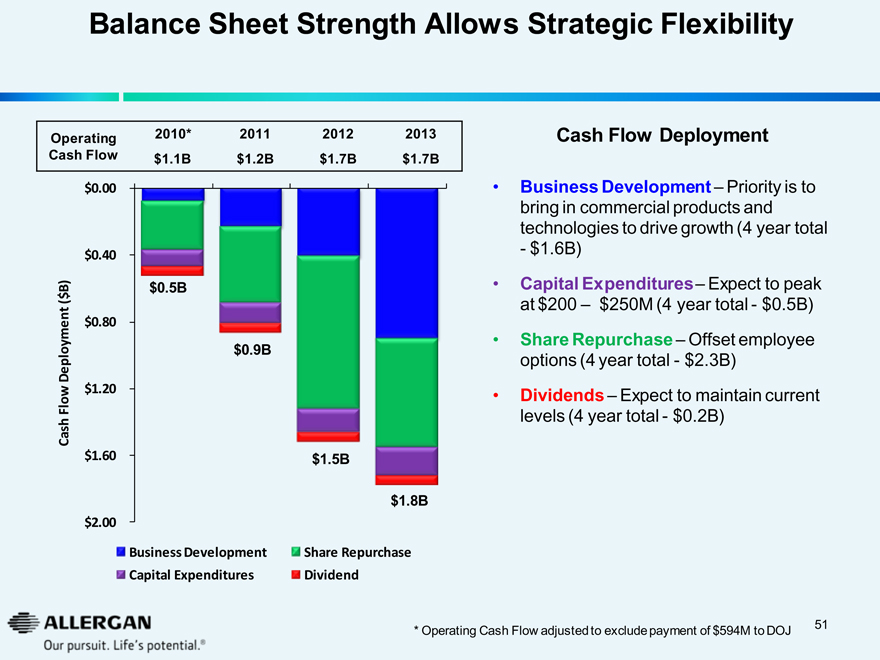

Balance Sheet Strength Allows Strategic Flexibility

Operating 2010* 2011 2012 2013

Cash Flow $1.1B $1.2B $1.7B $1.7B

$0.00

$0.40

$0.80

$1.20

$1.60

$2.00

$0.5B

$0.9B

$1.5B

$1.8B

Cash Flow Deployment ($B)

Business Development

Share Repurchase

Capital Expenditures

Dividend

Cash Flow Deployment

Business Development - Priority is to

bring in commercial products and

technologies to drive growth (4 year total

- $1.6B)

Capital Expenditures - Expect to peak

at $200 - $250M (4 year total - $0.5B)

Share Repurchase - Offset employee

options (4 year total - $2.3B)

Dividends - Expect to maintain current

levels (4 year total - $0.2B)

* Operating Cash Flow adjusted to exclude payment of $594M to DOJ

ALLERGAN

Our pursuit. Life’s potential.®

51

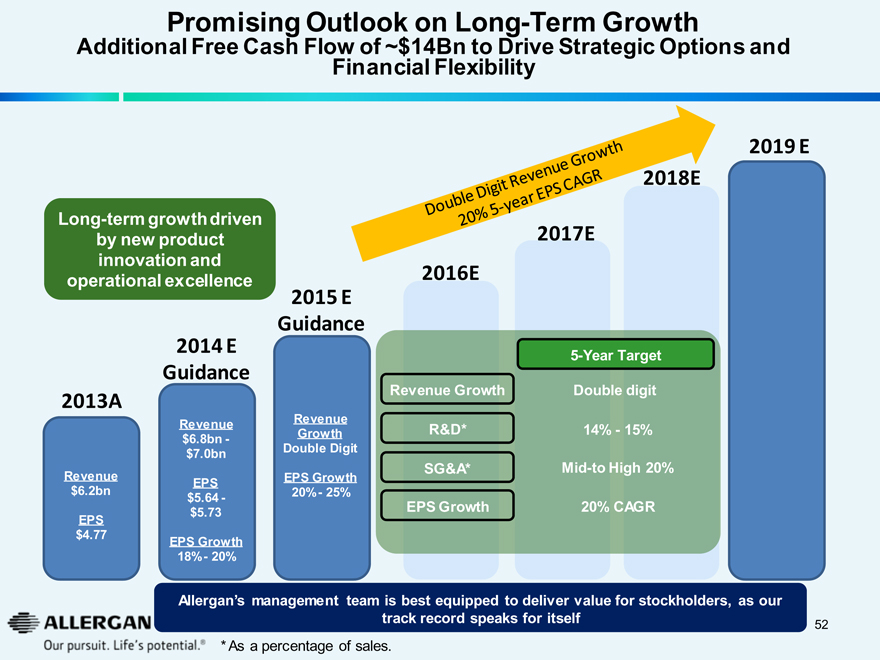

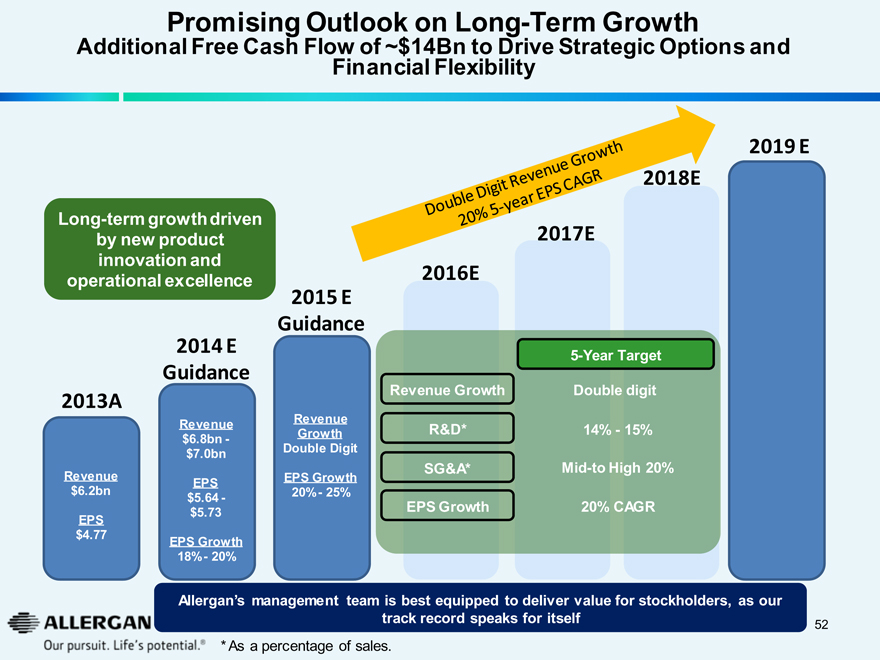

Promising Outlook on Long-Term Growth

Additional Free Cash Flow of ~$14Bn to Drive Strategic Options and Financial Flexibility

Long-term growth driven by new product innovation and operational excellence

2013A

Revenue

$6.2bn

EPS

$4.77

2014 E

Guidance

Revenue

$6.8bn -

$7.0bn

EPS

$5.64 -

$5.73

EPS Growth

18% - 20%

2015 E

Guidance

Revenue

Growth

Double Digit

EPS Growth

20% - 25%

Double Digit Revenue Growth

20% 5-year EPS CAGR

2016E

Revenue Growth

R&D*

SG&A*

EPS Growth

2017E

5-Year Target

Double digit

14% - 15%

Mid-to High 20%

20% CAGR

2018E

2019 E

Allergan’s management team is best equipped to deliver value for stockholders, as our track record speaks for itself

*As a percentage of sales.

ALLERGAN

Our pursuit. Life’s potential.®

52

Allergan in the Future

We have built a pre-eminent specialty pharmaceutical company

Investments over long period yielding consistent flow of regulatory approvals, revenue growth and margin expansion

Consistent delivery of results leading to share price outperformance

Longevity and depth of expertise in our specialties

In mid-2013, management and our Board of Directors began working on a plan to further enhance sales and earnings performance

Poised to leverage critical mass

Operational efficiency and leveraging commercial infrastructure will accelerate bottom line growth

Which has produced an enhanced and attractive outlook

Our management team is best positioned to drive future growth through innovation and operational excellence

Continue to maximize value through market expansion and new market creation

Further increase productivity in clinical development

Optionality of High Peak Revenue R&D Projects

DARPin® / dual DARPin®

Brimonidine Sustained Release - Dry AMD

BOTOX® Depression

Scalp Hair Growth

Bimatoprost Sustained Release (Glaucoma)

ALLERGAN

Our pursuit. Life’s potential.®

53

Reconciliation of Selected Non-GAAP Financial Measures

“GAAP” refers to financial information presented in accordance with generally accepted accounting principles in the

United States.

In this presentation, Allergan included historical non -GAAP financial measures, as defined in Regulation G promulgated by the Securities and Exchange Commission, with respect to estimates for the year ended

December 31, 2013, and the corresponding periods for 1999 through 2012. The information for 2012 and 2011 has been retrospectively adjusted to reflect the obesity intervention unit, which was sold on December 2, 2013, as discontinued operations. Allergan believes that its presentation of historical non -GAAP financial measures provides useful supplementary information to investors. The presentation of historical non -GAAP financial measures is not meant to be considered in isolation from or as a substitute for results prepared in accordance with GAAP.

In this presentation, Allergan reported certain financial measures including “Adjusted Sales”, “Adjusted SG&A”,

“Adjusted R&D”, “Adjusted EPS”, “Proforma Growth” and “Sales Growth at constant exchange rates” as adjusted for

Non-GAAP items. Allergan uses these financial measures to enhance the investor’s overall understanding of the financial performance and prospects for the future of Allergan’s core business activities. Specifically, Allergan believes that a report of these financial measures provides consistency in Allergan’s financial reporting and facilitates the comparison of results of core business operations between its current, past and future periods. Adjusted Sales, Adjusted SG&A, Adjusted R&D, Adjusted EPS, Proforma Growth and Sales Growth are the primary indicators management uses for planning and forecasting in future periods. Allergan also uses Adjusted Sales, Adjusted R&D and Adjusted EPS for evaluating management performance for compensation purposes.

A reconciliation of non -GAAP items may be found under the heading “Non -GAAP Financial Reconciliation” in the investor relations section of the www.Allergan.com website.

ALLERGAN

Our pursuit. Life’s potential.®

54

ALLERGAN

Our pursuit. Life’s potential.®

May 2014

Allergan

A Specialist in the Biopharmaceutical

& Medical Device Industries

55