|

Exhibit 99.1

|

Allergan

Review of Valeant’s Statements Regarding a Contingent Value Right (“CVR”)

Exhibit 99.1

Our Pursuit. Life’s Potential.®

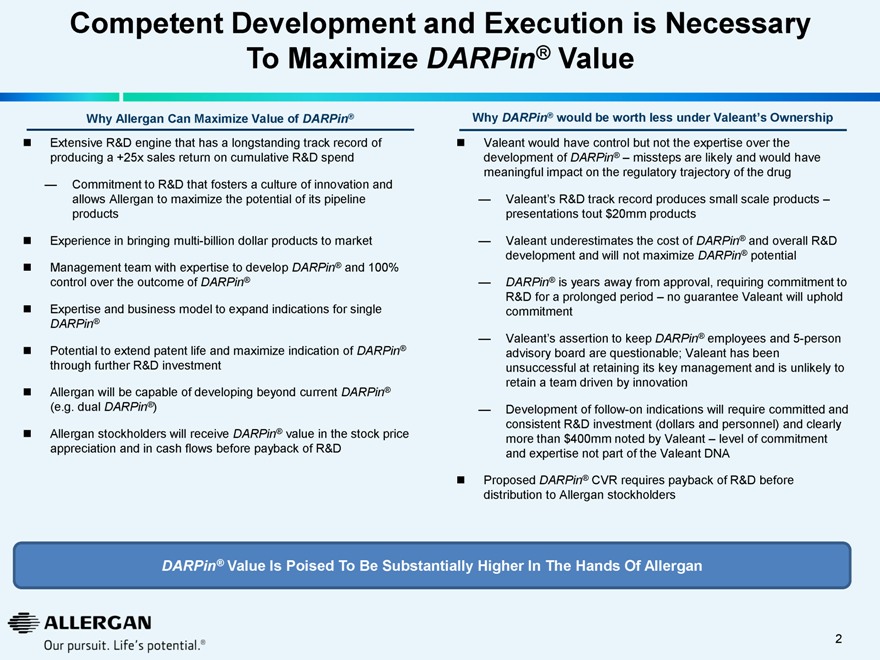

Competent Development and Execution is Necessary To Maximize DARPin® Value

Why Allergan Can Maximize Value of DARPin®

Extensive R&D engine that has a longstanding track record of producing a +25x sales return on cumulative R&D spend

— Commitment to R&D that fosters a culture of innovation and allows Allergan to maximize the potential of its pipeline products

Experience in bringing multi-billion dollar products to market

Management team with expertise to develop DARPin® and 100% control over the outcome of DARPin®

Expertise and business model to expand indications for single

DARPin®

Potential to extend patent life and maximize indication of DARPin® through further R&D investment

Allergan will be capable of developing beyond current DARPin®

(e.g. dual DARPin®)

Allergan stockholders will receive DARPin® value in the stock price appreciation and in cash flows before payback of R&D

Why DARPin® would be worth less under Valeant’s Ownership

Valeant would have control but not the expertise over the development of DARPin® – missteps are likely and would have meaningful impact on the regulatory trajectory of the drug

Valeant’s R&D track record produces small scale products – presentations tout $20mm products

Valeant underestimates the cost of DARPin® and overall R&D development and will not maximize DARPin® potential

DARPin® is years away from approval, requiring commitment to R&D for a prolonged period – no guarantee Valeant will uphold commitment

Valeant’s assertion to keep DARPin® employees and 5-person advisory board are questionable; Valeant has been unsuccessful at retaining its key management and is unlikely to retain a team driven by innovation

Development of follow-on indications will require committed and consistent R&D investment (dollars and personnel) and clearly more than $400mm noted by Valeant – level of commitment and expertise not part of the Valeant DNA

Proposed DARPin® CVR requires payback of R&D before distribution to Allergan stockholders

2

Our Pursuit. Life’s Potential.®

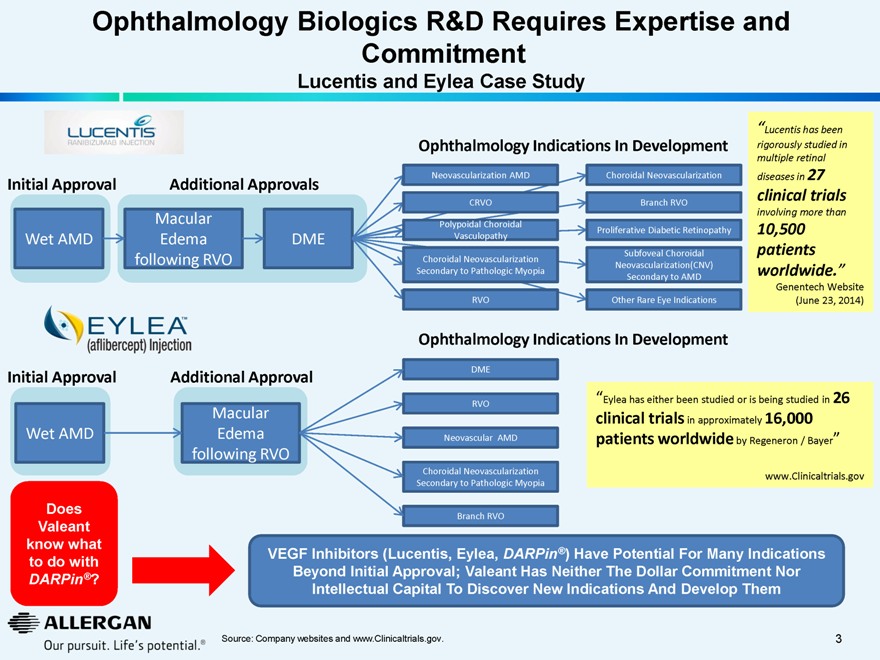

Ophthalmology Biologics R&D Requires Expertise and Commitment

Lucentis and Eylea Case Study

Initial Approval

Additional Approvals

Wet AMD

Macular Edema following RVO

DME

Initial Approval

Additional Approval

Wet AMD

Macular Edema following RVO

Ophthalmology Indications In Development

Neovascularization AMD

CRVO

Polypoidal Choroidal Vasculopathy

Choroidal Neovascularization Secondary to Pathologic Myopia

RVO

Choroidal Neovascularization

Branch RVO

Proliferative Diabetic Retinopathy

Subfoveal Choroidal Neovascularization(CNV) Secondary to AMD

Other Rare Eye Indications

“Lucentis has been

rigorously studied in multiple retinal diseases in 27

clinical trials

involving more than

10,500 patients worldwide.”

Genentech Website (June 23, 2014)

Ophthalmology Indications In Development

DME

RVO

Neovascular AMD

Choroidal Neovascularization Secondary to Pathologic Myopia

Branch RVO

“Eylea has either been studied or is being studied in 26

clinical trials in approximately 16,000

patients worldwide by Regeneron / Bayer”

www.Clinicaltrials.gov

Does Valeant know what to do with

DARPin®?

VEGF Inhibitors (Lucentis, Eylea, DARPin®) Have Potential For Many Indications Beyond Initial Approval; Valeant Has Neither The Dollar Commitment Nor Intellectual Capital To Discover New Indications And Develop Them

Source: Company websites and www.Clinicaltrials.gov.

3

Our Pursuit. Life’s Potential.®

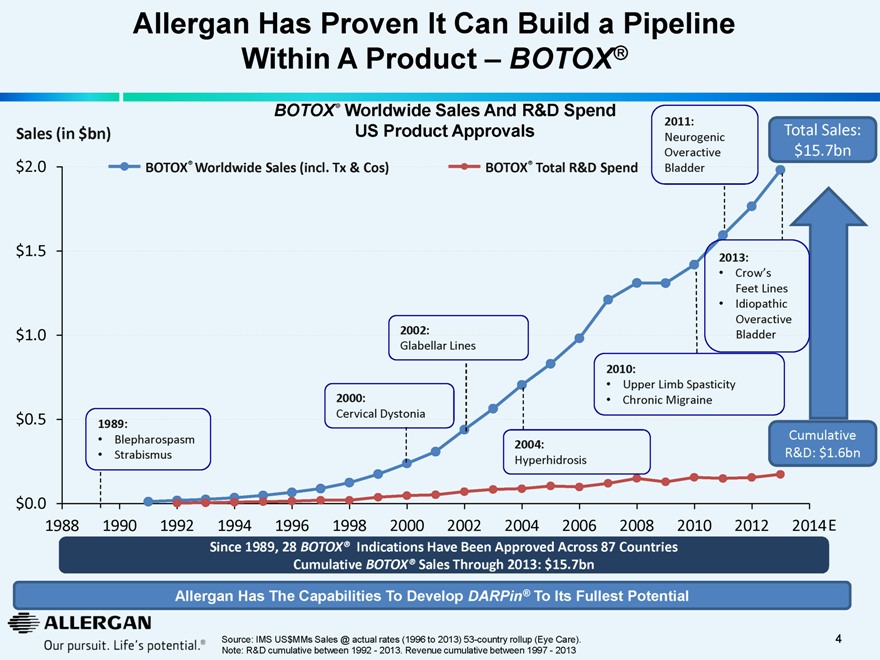

Allergan Has Proven It Can Build a Pipeline Within A Product — BOTOX®

BOTOX® Worldwide Sales And R&D Spend US Product Approvals

Sales (in $bn)

BOTOX® Worldwide Sales (incl. Tx & Cos) BOTOX® Total R&D Spend

2011:

Neurogenic Overactive Bladder

Total Sales: $15.7bn

1989:

Blepharospasm

Strabismus

2000:

Cervical Dystonia

2002:

Glabellar Lines

2004:

Hyperhidrosis

2010:

Upper Limb Spasticity

Chronic Migraine

2013:

Crow’s

Feet Lines

Idiopathic Overactive Bladder

Cumulative R&D: $1.6bn

$2.0 $1.5 $1.0 $0.5 $0.0

1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014E

Since 1989, 28 BOTOX® Indications Have Been Approved Across 87 Countries Cumulative BOTOX® Sales Through 2013: $15.7bn

Allergan Has The Capabilities To Develop DARPin® To Its Fullest Potential

Source: IMS US$MMs Sales @ actual rates (1996 to 2013) 53-country rollup (Eye Care). Note: R&D cumulative between 1992—2013. Revenue cumulative between 1997–2013

4

Our Pursuit. Life’s Potential.®

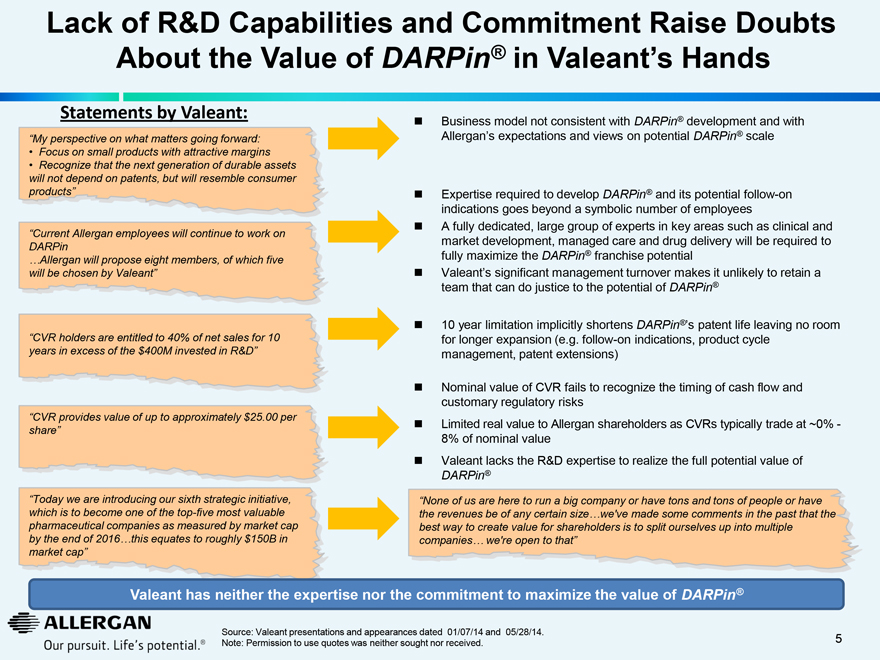

Lack of R&D Capabilities and Commitment Raise Doubts About the Value of DARPin® in Valeant’s Hands

Statements by Valeant:

“My perspective on what matters going forward:

Focus on small products with attractive margins Recognize that the next generation of durable assets will not depend on patents, but will resemble consumer products”

“Current Allergan employees will continue to work on

DARPin

…Allergan will propose eight members, of which five will be chosen by Valeant”

“CVR holders are entitled to 40% of net sales for 10 years in excess of the $400M invested in R&D”

“CVR provides value of up to approximately $25.00 per share”

“Today we are introducing our sixth strategic initiative, which is to become one of the top-five most valuable pharmaceutical companies as measured by market cap by the end of 2016…this equates to roughly $150B in market cap”

Business model not consistent with DARPin® development and with

Allergan’s expectations and views on potential DARPin® scale

Expertise required to develop DARPin® and its potential follow-on indications goes beyond a symbolic number of employees

A fully dedicated, large group of experts in key areas such as clinical and market development, managed care and drug delivery will be required to fully maximize the DARPin® franchise potential

Valeant’s significant management turnover makes it unlikely to retain a team that can do justice to the potential of DARPin®

10 year limitation implicitly shortens DARPin®’s patent life leaving no room for longer expansion (e.g. follow-on indications, product cycle management, patent extensions)

Nominal value of CVR fails to recognize the timing of cash flow and customary regulatory risks

Limited real value to Allergan shareholders as CVRs typically trade at ~0% - 8% of nominal value

Valeant lacks the R&D expertise to realize the full potential value of

DARPin®

“None of us are here to run a big company or have tons and tons of people or have the revenues be of any certain size…we’ve made some comments in the past that the best way to create value for shareholders is to split ourselves up into multiple companies… we’re open to that”

Valeant has neither the expertise nor the commitment to maximize the value of DARPin®

Source: Valeant presentations and appearances dated 01/07/14 and 05/28/14.

Note: Permission to use quotes was neither sought nor received.

5

Our Pursuit. Life’s Potential.®

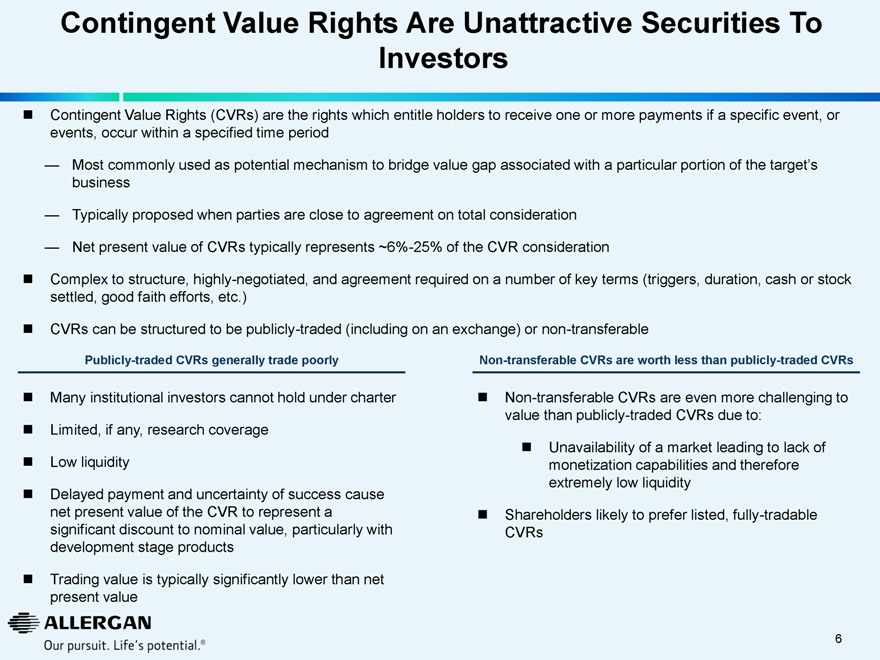

Contingent Value Rights Are Unattractive Securities To Investors

Contingent Value Rights (CVRs) are the rights which entitle holders to receive one or more payments if a specific event, or events, occur within a specified time period

Most commonly used as potential mechanism to bridge value gap associated with a particular portion of the target’s business

Typically proposed when parties are close to agreement on total consideration

Net present value of CVRs typically represents ~6%-25% of the CVR consideration

Complex to structure, highly-negotiated, and agreement required on a number of key terms (triggers, duration, cash or stock settled, good faith efforts, etc.)

CVRs can be structured to be publicly-traded (including on an exchange) or non-transferable

Publicly-traded CVRs generally trade poorly

Many institutional investors cannot hold under charter Limited, if any, research coverage Low liquidity

Delayed payment and uncertainty of success cause net present value of the CVR to represent a significant discount to nominal value, particularly with development stage products

Trading value is typically significantly lower than net present value

Non-transferable CVRs are worth less than publicly-traded CVRs

Non-transferable CVRs are even more challenging to value than publicly-traded CVRs due to:

Unavailability of a market leading to lack of monetization capabilities and therefore extremely low liquidity

Shareholders likely to prefer listed, fully-tradable CVRs

6

Our Pursuit. Life’s Potential.®

CVRs Trade at Virtually No Value Even in Hands of Companies That Can Develop Assets

Valuation of Select Precedent Publicly-Traded CVRs

Target / Acquiror Announcement

CVR Trigger

(Status of product at announcement)

CVR Nominal (As announced)

Weighted

NPV(1)

First Trading Day Close

Latest Close(2) (as % of Nominal)

July 30, 2013 February 16, 2011 June 30, 2010 July 7, 2008

Cumulative net sales over

1.5 year period for Dificid (Marketed)

FDA approval and sales of Lemtrada, sales of Cerezyme and Fabrazyme through 12/31/2020 (In Development)

FDA approval and annual net sales over 20 years of Abraxane (PhIII data for non-small cell lung cancer, PhII for advanced pancreatic cancer)

Cumulative Adj. EBITDA over 3 year period on multiple products

Valeant’s proposed CVR in previous offer

$5.00

$3.87

$2.18

$0.15 (3%)

$14.00

$5.58

$2.35

$0.49 (4%)

$34.69

$12.80

$5.55

(2)

$2.70 (8%)

$6.00

$1.79

$0.92

(3)

$0.00 (0%)

$25.00

$25 CVR from Valeant will have significantly lower value for Allergan shareholders

CVRs typically trade at a significant discount (~0%-8%) of nominal value

Moreover, Valeant’s current offer excludes CVR. Given Valeant’s business model and limited understanding of R&D, investors should not assign much, if any, value to a CVR as it is purely a tactic to engage Allergan stockholders and not to provide true value to Allergan stockholders

Source: FactSet and public filings.

(1) Probability-weighted value of CVR disclosed by financial advisors.

(2) Latest close date is 06/23/14 for all CVRs except for APP/Fresenius, which has expired without value on 03/04/11. Value for Abraxis/Celgene excludes $6.93/share dividend paid out for FDA approval on 10/07/13.

(3) Expired without value.

7

Our Pursuit. Life’s Potential.®

Allergan

Review of Valeant’s Statements Regarding a Contingent Value Right (“CVR”)

Our Pursuit. Life’s Potential.®