| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-14 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$637,555,685

(Approximate Initial Pool Balance)

$531,482,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2017-RB1

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Barclays Bank PLC

Wells Fargo Bank, National Association

UBS AG

Société Générale

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2017-RB1

March 14, 2017

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | BARCLAYS Co-Lead Manager and Joint Bookrunner |

SOCIETE GENERALE Co-Lead Manager and Joint Bookrunner | UBS SECURITIES LLC Co-Lead Manager and Joint Bookrunner |

| | Academy Securities Co-Manager | |

| | | | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., SG Americas Securities, LLC, UBS Securities LLC, Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Certificate Structure |

| Class | Expected Ratings

(DBRS/Fitch/Moody’s)(1) | Approximate Initial

Certificate Balance or

Notional Amount(2) | Approx.

Initial Credit

Support(3) | Pass-Through

Rate Description | Weighted

Average

Life

(Years)(4) | Expected

Principal

Window(4) | Certificate

Principal to

Value Ratio(5) | Certificate

Principal

U/W NOI

Debt Yield(6) |

| Offered Certificates | | | | |

| A-1 | AAA(sf)/AAAsf/Aaa(sf) | $10,516,000 | 30.000% | (7) | 2.81 | 04/17 – 02/22 | 39.5% | 15.3% |

| A-2 | AAA(sf)/AAAsf/Aaa(sf) | $19,868,000 | 30.000% | (7) | 4.88 | 02/22 – 02/22 | 39.5% | 15.3% |

| A-3 | AAA(sf)/AAAsf/Aaa(sf) | $5,556,000 | 30.000% | (7) | 6.87 | 02/24 – 02/24 | 39.5% | 15.3% |

| A-4 | AAA(sf)/AAAsf/Aaa(sf) | $160,000,000 | 30.000% | (7) | 9.80 | 12/26 – 02/27 | 39.5% | 15.3% |

| A-5 | AAA(sf)/AAAsf/Aaa(sf) | $203,194,000 | 30.000% | (7) | 9.89 | 02/27 – 03/27 | 39.5% | 15.3% |

| A-SB | AAA(sf)/AAAsf/Aaa(sf) | $24,840,000 | 30.000% | (7) | 7.38 | 02/22 – 12/26 | 39.5% | 15.3% |

| A-S | AAA(sf)/AAAsf/Aa3(sf) | $37,855,000 | 23.750% | (7) | 9.96 | 03/27 – 03/27 | 43.1% | 14.0% |

| X-A | AAA(sf)/AAAsf/Aaa(sf) | $423,974,000(8) | N/A | Variable(9) | N/A | N/A | N/A | N/A |

| X-B | A(sf)/A-sf/NR | $107,508,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| B | AA(low)(sf)/AA-sf/NR | $42,397,000 | 16.750% | (7) | 9.96 | 03/27 ��� 03/27 | 47.0% | 12.9% |

| C | A(low)(sf)/A-sf/NR | $27,256,000 | 12.250% | (7) | 9.96 | 03/27 – 03/27 | 49.6% | 12.2% |

| | | | | | | | | |

| Non-Offered Certificates | | | | | | |

| X-D | BBB(sf)/BBB-sf/NR | $31,798,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A |

| D | BBB(low)(sf)/BBB-sf/NR | $31,798,000 | 7.000% | (7) | 9.96 | 03/27 – 03/27 | 52.5% | 11.5% |

| E-1(14) | BB(sf)/BB+sf/NR | $7,192,500 | 5.813% | (7) | 9.97 | 03/27 – 04/27 | 53.2% | 11.4% |

| E-2(14) | BB(low)(sf)/BB-sf/NR | $7,192,500 | 4.625% | (7) | 10.04 | 04/27 – 04/27 | 53.9% | 11.2% |

| F-1(14) | B(high)(sf)/NR/NR | $3,407,000 | 4.063% | (7) | 10.04 | 04/27 – 04/27 | 54.2% | 11.2% |

| F-2(14) | B(sf)/NR/NR | $3,407,000 | 3.500% | (7) | 10.04 | 04/27 – 04/27 | 54.5% | 11.1% |

| G-1(14) | B(low)(sf)/NR/NR | $2,649,500 | 3.063% | (7) | 10.04 | 04/27 – 04/27 | 54.7% | 11.0% |

| G-2(14) | B(low)(sf)/NR/NR | $2,649,500 | 2.625% | (7) | 10.04 | 04/27 – 04/27 | 55.0% | 11.0% |

| H-1(14) | NR/NR/NR | $7,949,950 | 1.313% | (7) | 10.04 | 04/27 – 04/27 | 55.7% | 10.9% |

| H-2(14) | NR/NR/NR | $7,949,950 | 0.000% | (7) | 10.04 | 04/27 – 04/27 | 56.5% | 10.7% |

| | | | | | | | | |

| Non-Offered Eligible Vertical Interest | | | | | | |

| RR Interest | NR/NR/NR | $31,877,784.26 | N/A | WAC(15) | 9.47 | 04/17 – 04/27 | N/A | N/A |

Notes:

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Fitch Ratings, Inc. (“Fitch”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated March 15, 2017 (the “Preliminary Prospectus”). DBRS, Fitch and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The certificate balances and notional amounts set forth in the table are approximate. The actual initial certificate balances and notional amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates in the aggregate. The RR Interest only provides credit support to the limited extent that losses incurred on the underlying mortgage loans are allocated to it, on the one hand, and to the Offered Certificates and the Non-Offered Certificates, on the other hand,pro rata, in accordance with their respective Percentage Allocation Entitlements. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RR Interest). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RR Interest). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Certificate Structure |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RR Interest) and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RR Interest) and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, D, E-1, E-2, F-1, F-2, G-1, G-2, H-1 and H-2 Certificates in each case will be one of the following: (i) a fixed rateper annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (9) | The pass-through rate for the Class X-A Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (10) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-B Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-D Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | On and after the Closing Date, a holder of a uniform percentage interest of such class of certificates may exchange such percentage interest for a corresponding class of exchangeable certificates pursuant to the terms of the pooling and servicing agreement. |

| (15) | The effective interest rate for the RR Interest will be the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | % of Initial

Pool

Balance |

| Barclays Bank PLC(1) | | 8 | | 21 | | $202,110,000 | | 31.7 | % |

| Wells Fargo Bank, National Association | | 13 | | 16 | | 173,727,264 | | 27.2 | |

| UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York(2) | | 8 | | 12 | | 170,554,269 | | 26.8 | |

| Société Générale | | 8 | | 23 | | 91,164,152 | | 14.3 | |

Total | | 37 | | 72 | | $637,555,685 | | 100.0 | % |

| (1) | One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as The Summit Birmingham, representing approximately 3.6% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by Bank of America, N.A. (“BANA”) and Barclays. One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as Merrill Lynch Drive, representing approximately 3.2% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by Morgan Stanley Bank, N.A. (“MSBNA”) and Barclays. |

| (2) | One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as KOMO Plaza, representing approximately 5.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was co-originated by UBSAG and MSBNA. The $69,500,000 Note A-5 of the KOMO Plaza whole loan, which was originated by MSBNA, was subsequently sold by Morgan Stanley Mortgage Capital Holdings LLC (“MSMCH”) into the BACM 2017-BNK3 securitization. One mortgage loan secured by the mortgaged property identified on Annex A-1 to the Preliminary Prospectus as 340 Bryant, representing approximately 2.3% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, is part of a whole loan that was originated by Cantor Commercial Real Estate Lending, L.P. (“CCRE”) and the related Note A-2 of the 340 Bryant whole loan was later purchased by UBSAG. |

| Loan Pool: | |

| | |

| Initial Pool Balance: | $637,555,685 |

| Number of Mortgage Loans: | 37 |

| Average Cut-off Date Balance per Mortgage Loan: | $17,231,235 |

| Number of Mortgaged Properties: | 72 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $8,854,940 |

| Weighted Average Mortgage Interest Rate: | 4.748% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 57.0% |

| Weighted Average Original Term to Maturity or ARD (months): | 118 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 117 |

| Weighted Average Original Amortization Term (months)(2): | 354 |

| Weighted Average Remaining Amortization Term (months)(2): | 354 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

| Credit Statistics: | |

| | |

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.82x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.7% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 56.5% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 52.6% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 4.5% |

| % of Mortgage Loans with Single Tenants(3): | 8.1% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Transaction Highlights |

Loan Structural Features:

Amortization:Based on the Initial Pool Balance, 47.7% of the mortgage pool (24 mortgage loans) has scheduled amortization, as follows:

33.1% (12 mortgage loans) provides for an interest-only period followed by an amortization period; and

14.6% (12 mortgage loans) requires amortization during the entire loan term.

Interest-Only:Based on the Initial Pool Balance, 52.3% of the mortgage pool (13 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 50.2% and 2.00x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 55.0% of the mortgage pool (17 mortgage loans) have hard lockboxes in place.

Reserves:The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | Real Estate Taxes: | 53.1% of the pool | |

| | Insurance: | 38.7% of the pool | |

| | Capital Replacements: | 39.2% of the pool | |

| | TI/LC: | 30.7% of the pool(1) | |

| | (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, mixed use and industrial properties. | |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

67.3% of the mortgage pool (27 mortgage loans) features a lockout period, then defeasance only until an open period;

17.9% of the mortgage pool (six mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

9.8% of the mortgage pool (one mortgage loan) features no lockout period but requires the greater of a prepayment premium or yield maintenance, then the greater of a prepayment premium or yield maintenance or defeasance until an open period;

3.2% of the mortgage pool (one mortgage loan) features no lockout period but requires the greater of a prepayment premium or yield maintenance until an open period; and

1.8% of the mortgage pool (two mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Issue Characteristics |

| III. | Issue Characteristics |

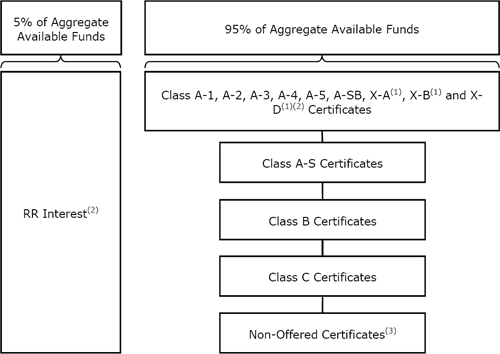

| | Securities Offered: | $531,482,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eleven classes (Classes A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| | | |

| | Mortgage Loan Sellers: | Barclays Bank PLC (“Barclays”), Wells Fargo Bank, National Association (“WFB”), UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBSAG”) and Société Générale (“SG”). |

| | | |

| | Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, Barclays Capital Inc., SG Americas Securities, LLC and UBS Securities LLC |

| | | |

| | Co-Managers: | Academy Securities, Inc. |

| | | |

| | Rating Agencies: | DBRS, Inc., Fitch Ratings, Inc. and Moody’s Investors Service, Inc. |

| | | |

| | Master Servicer: | Wells Fargo Bank, National Association |

| | | |

| | Special Servicer: | C-III Asset Management LLC |

| | | |

| | Certificate Administrator: | Wells Fargo Bank, National Association |

| | | |

| | Trustee: | Wilmington Trust, National Association |

| | | |

| | Operating Advisor: | Trimont Real Estate Advisors, LLC |

| | | |

| | Asset Representations Reviewer: | Trimont Real Estate Advisors, LLC |

| | | |

| | Initial Majority Controlling Class Certificateholder: | C-III Investment Management LLC or an affiliate |

| | | |

| | U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. |

| | | |

| | EU Credit Risk Retention | None of the sponsors, the depositor or the issuing entity intends to retain a material net economic interest in the securitization constituted by the issue of the Offered Certificates in accordance with the EU risk retention and due diligence requirements or to take any other action which may be required by EEA-regulated investors for the purposes of their compliance with the EU risk retention and due diligence requirements or similar requirements. |

| | | |

| | Risk Retention Consultation Party: | Wells Fargo Bank, National Association |

| | | |

| | Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in March 2017 (or, in the case of any mortgage loan that has its first due date in April or May 2017, the date that would have been its due date in March 2017 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | |

| | Expected Closing Date: | On or about March 30, 2017. |

| | | |

| | Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in April 2017. |

| | | |

| | Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in April 2017. |

| | | |

| | Rated Final Distribution Date: | The Distribution Date in March 2050. |

| | | |

| | Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| | | |

| | Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | |

| | Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | |

| | Clean-up Call: | 1.0% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Issue Characteristics |

| | Delivery: | DTC, Euroclear and Clearstream Banking |

| | | |

| | ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | |

| | Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| | | |

| | Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics and Thomson Reuters Corporation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

Mortgage Loan

Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property

Type | Number of Rooms / SF | Cut-off Date Balance

Per

Room / SF | Cut-off

Date LTV

Ratio (%) | Balloon or ARD LTV

Ratio (%) | U/W NCF

DSCR (x) | U/W NOI

Debt

Yield (%) |

| Barclays | 123 William Street | New York | NY | 1 / 1 | $62,500,000 | 9.8% | Office | 545,216 | $257 | 48.3% | 48.3% | 1.56x | ��8.4% |

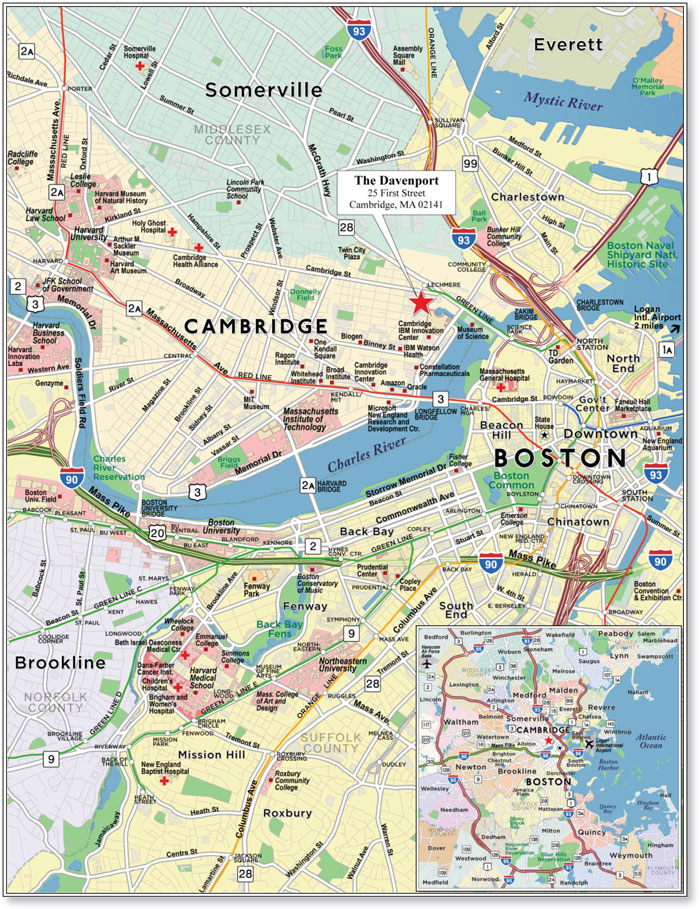

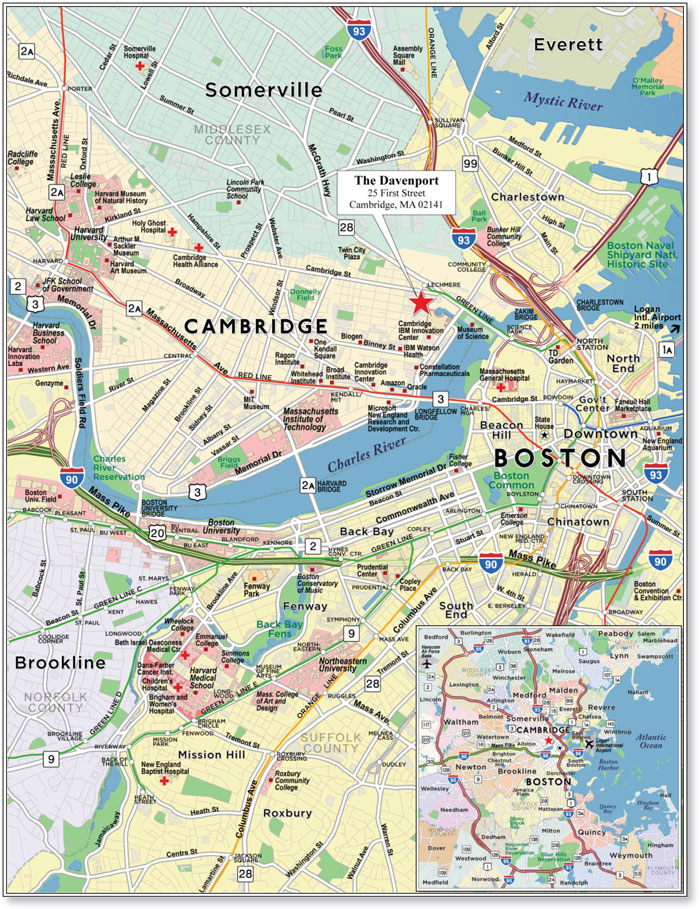

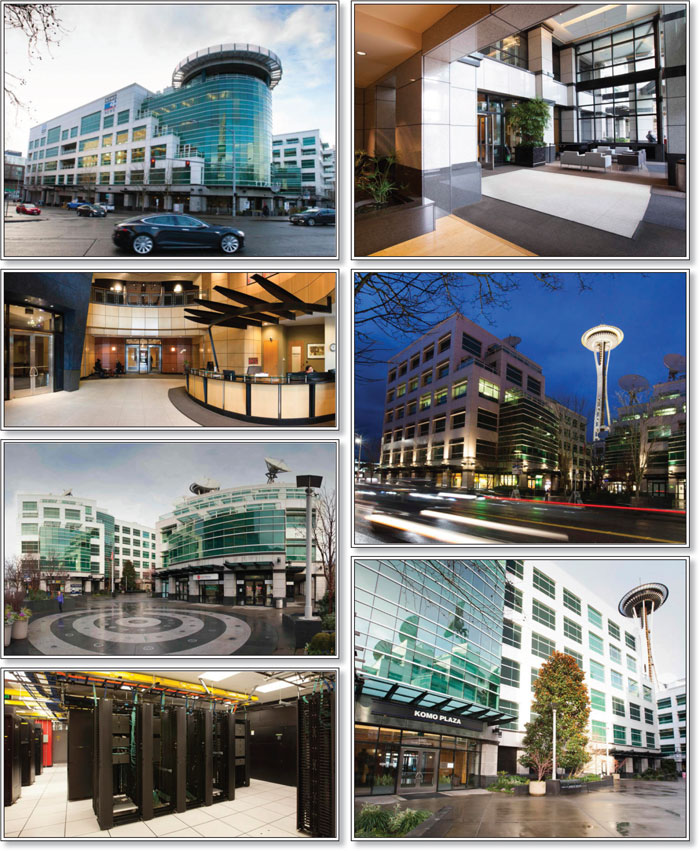

| WFB | The Davenport | Cambridge | MA | 1 / 1 | 55,000,000 | 8.6 | Office | 230,864 | 455 | 49.1 | 49.1 | 1.86 | 8.6 |

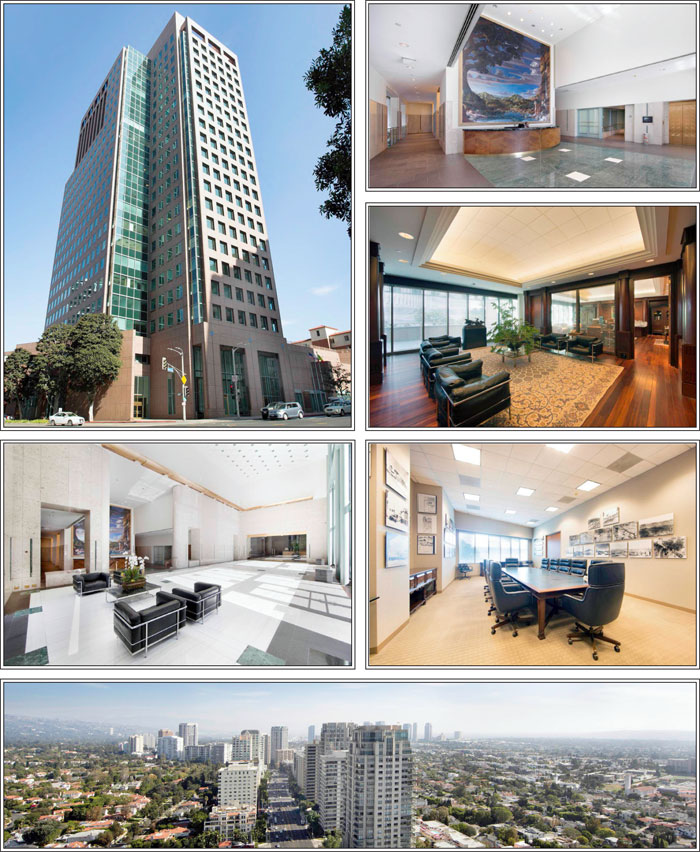

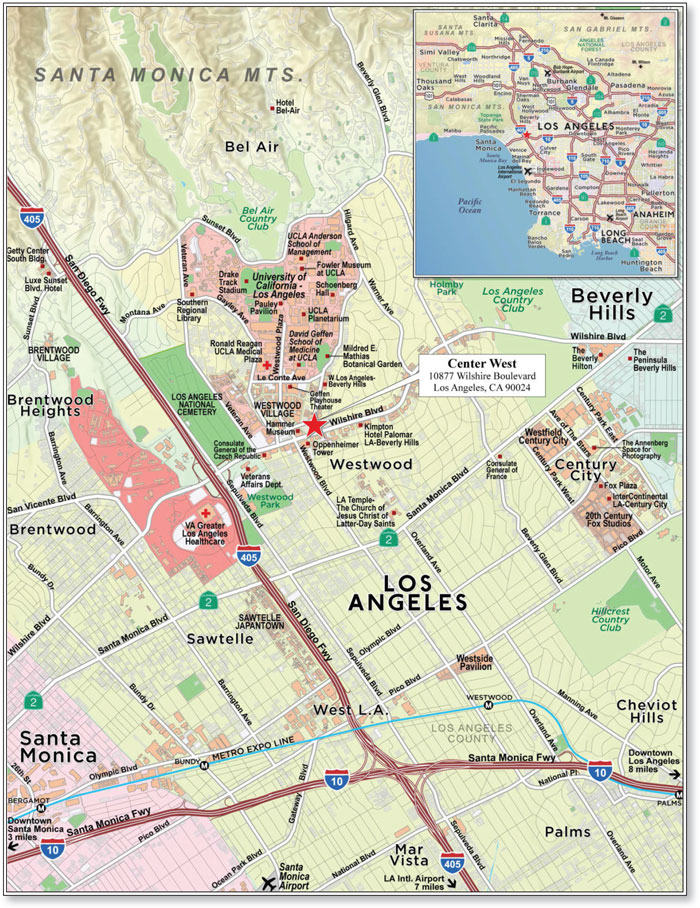

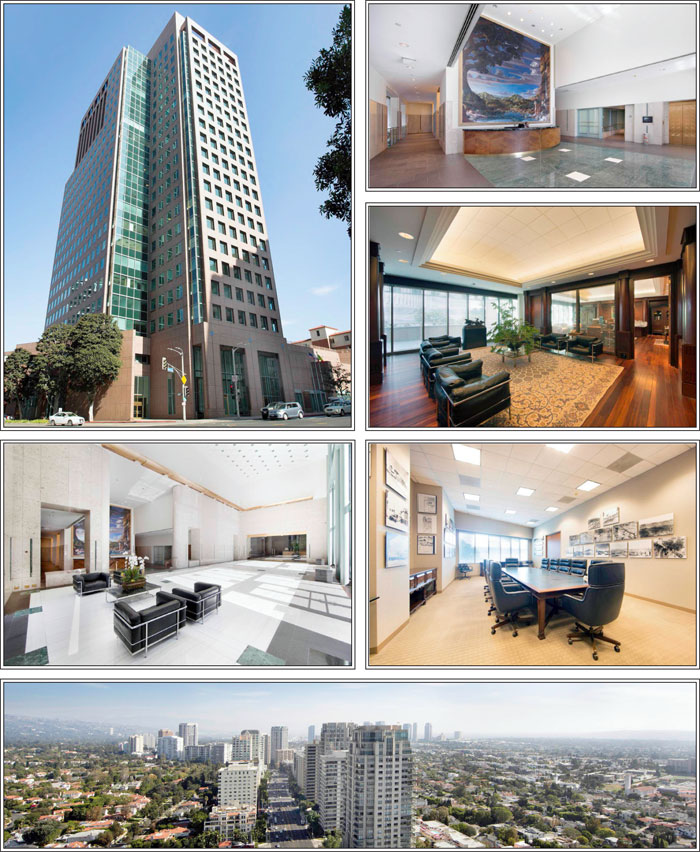

| UBSAG | Center West | Los Angeles | CA | 1 / 1 | 40,000,000 | 6.3 | Office | 349,298 | 229 | 38.3 | 38.3 | 1.94 | 9.7 |

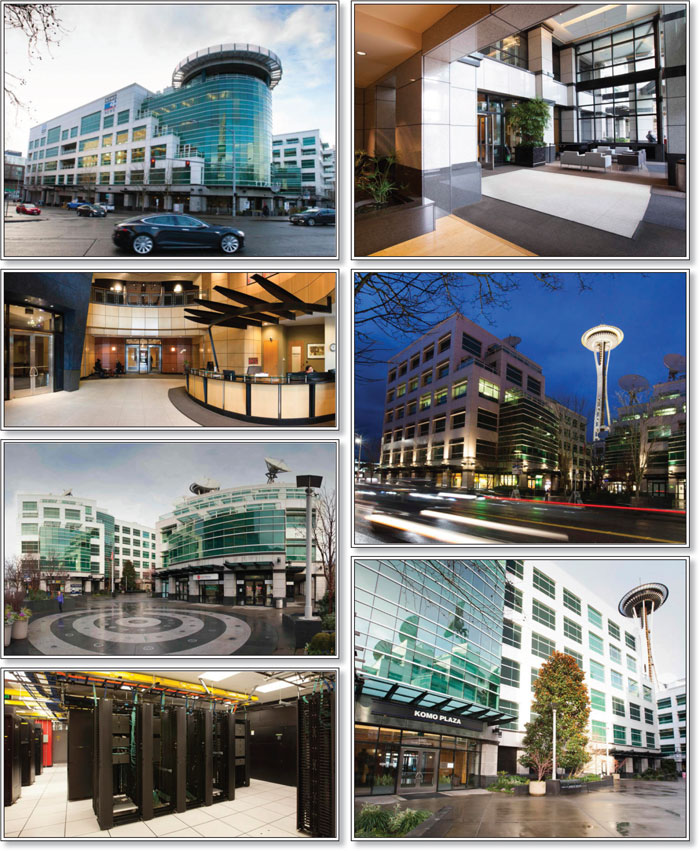

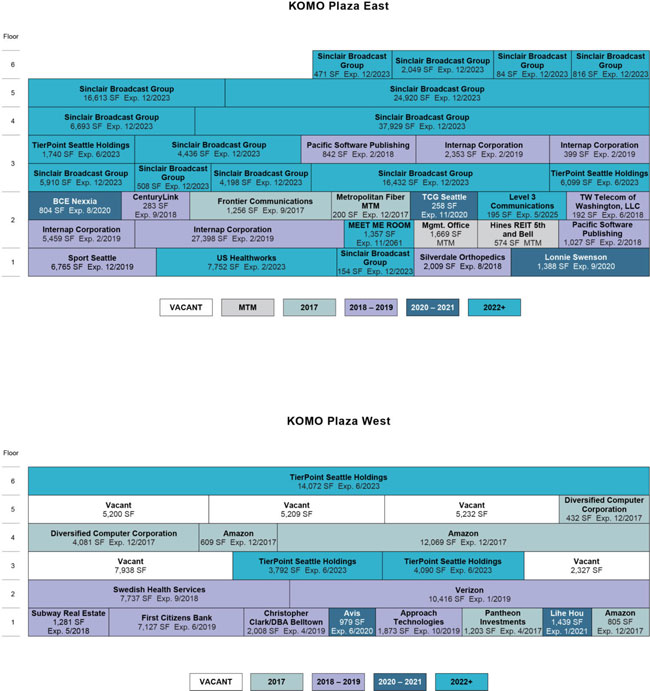

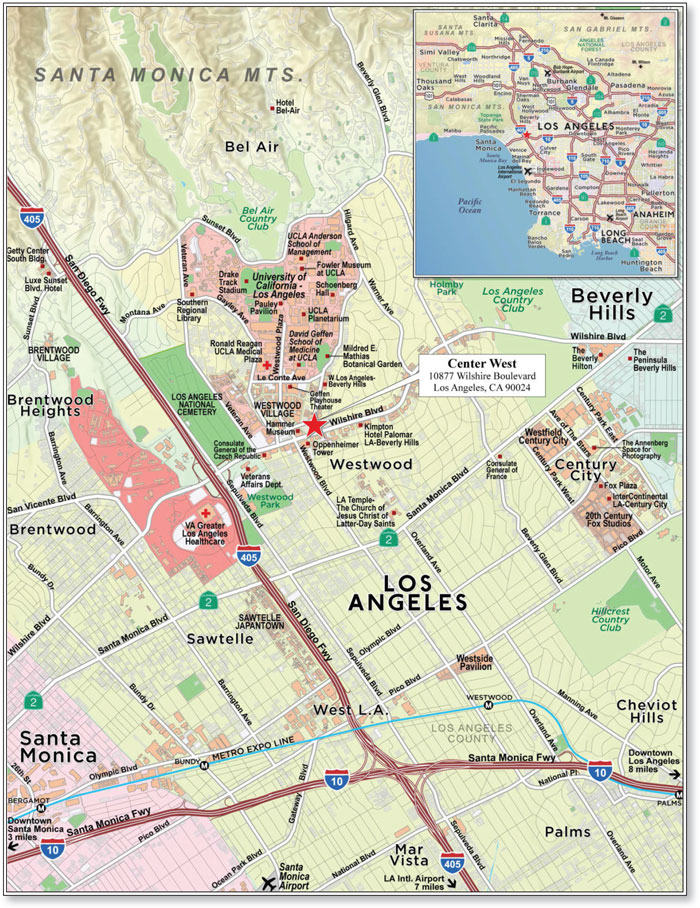

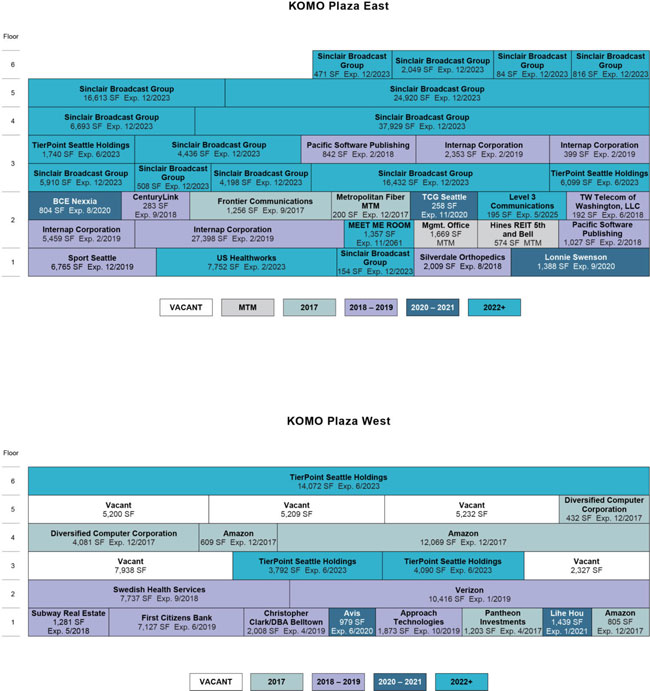

| UBSAG | KOMO Plaza | Seattle | WA | 1 / 1 | 32,500,000 | 5.1 | Mixed Use | 291,151 | 477 | 50.0 | 50.0 | 2.47 | 11.3 |

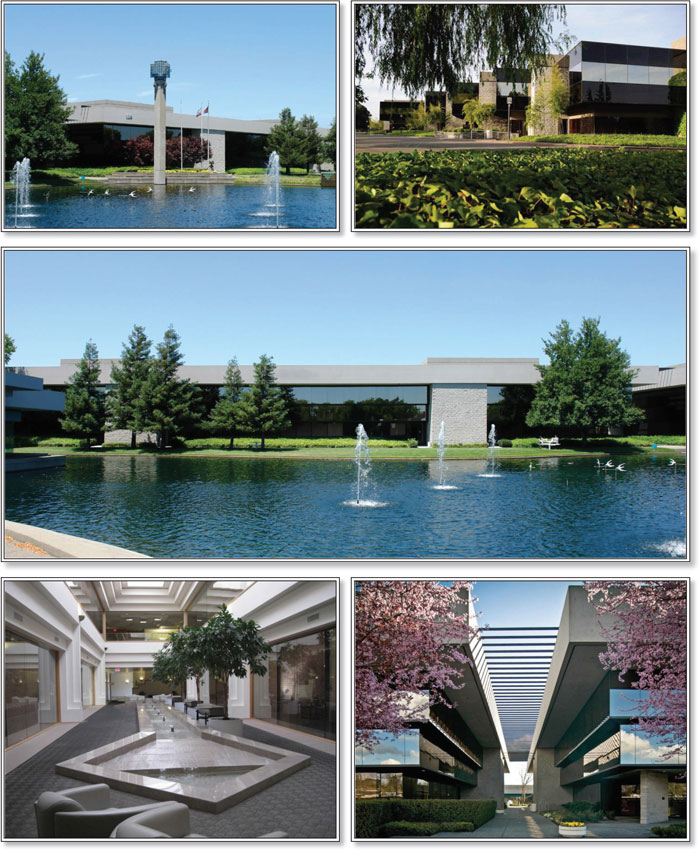

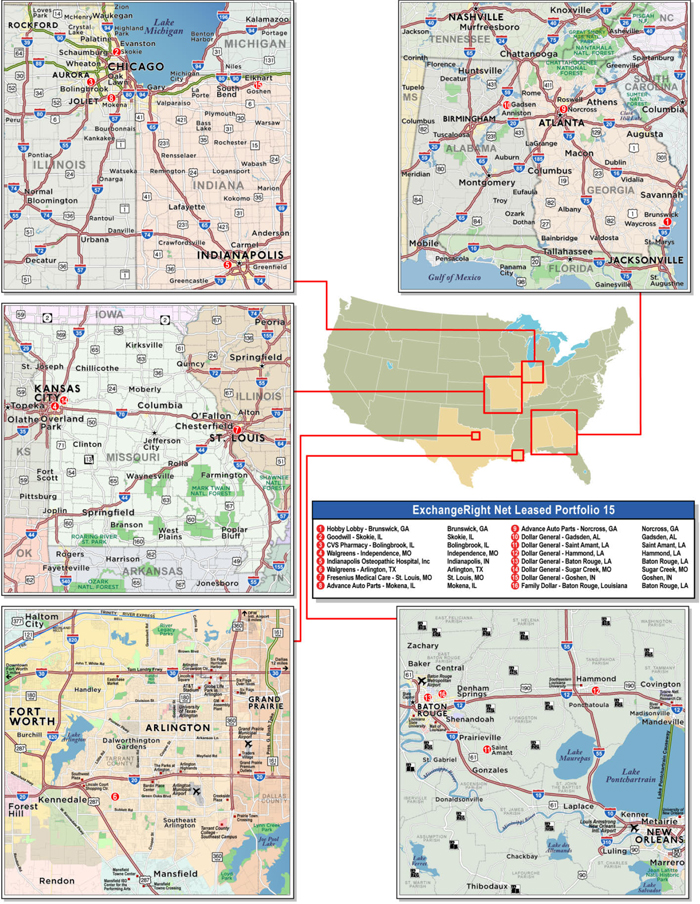

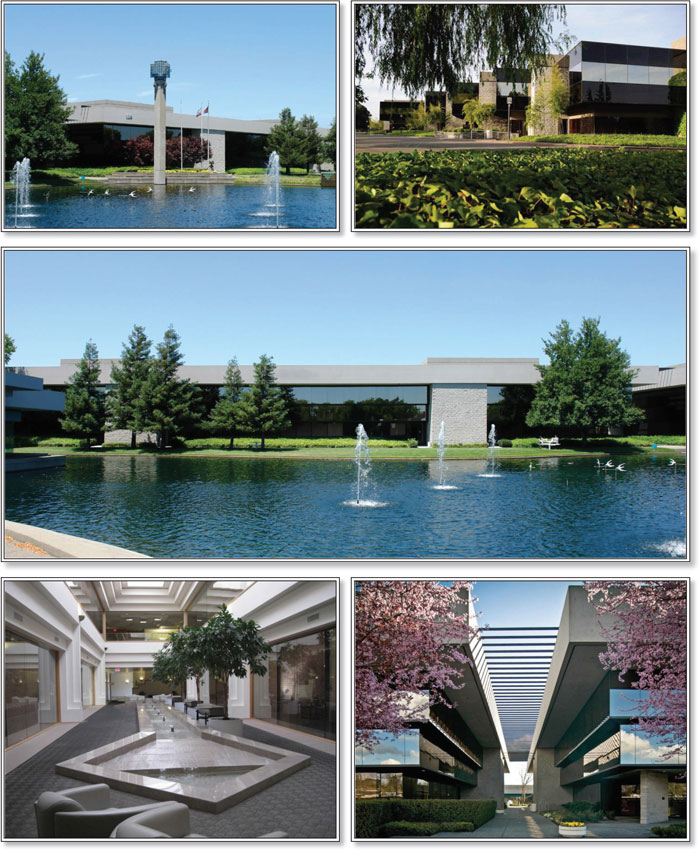

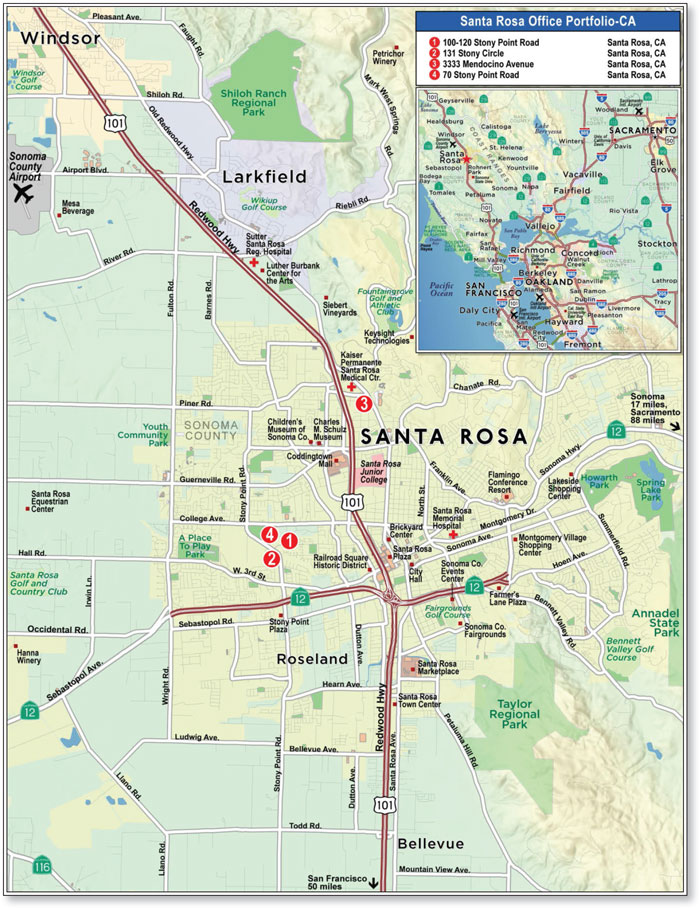

| WFB | Santa Rosa Office Portfolio | Santa Rosa | CA | 1 / 4 | 31,900,000 | 5.0 | Office | 337,082 | 95 | 69.0 | 60.6 | 1.44 | 10.4 |

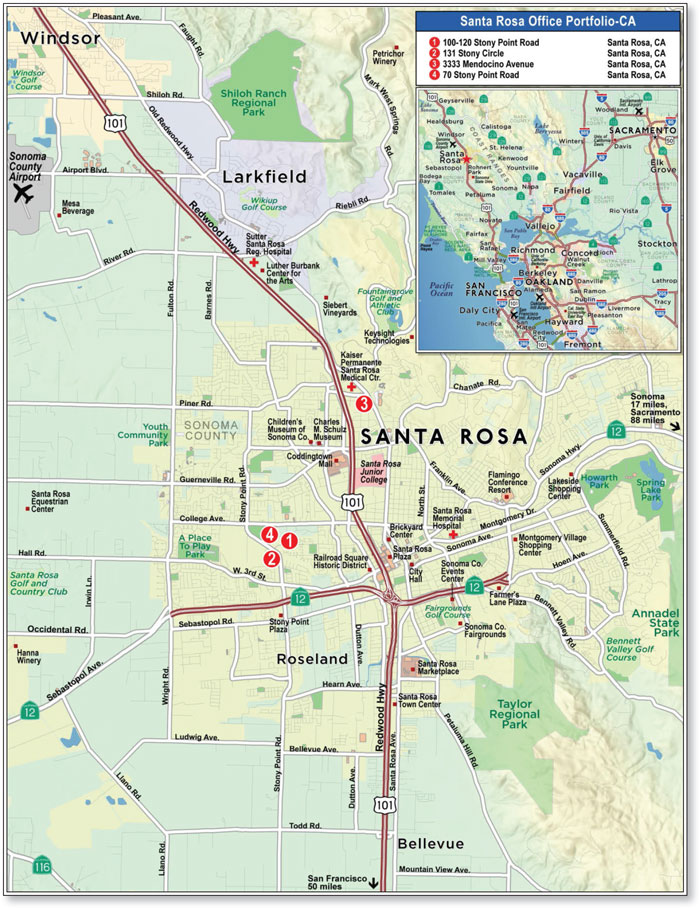

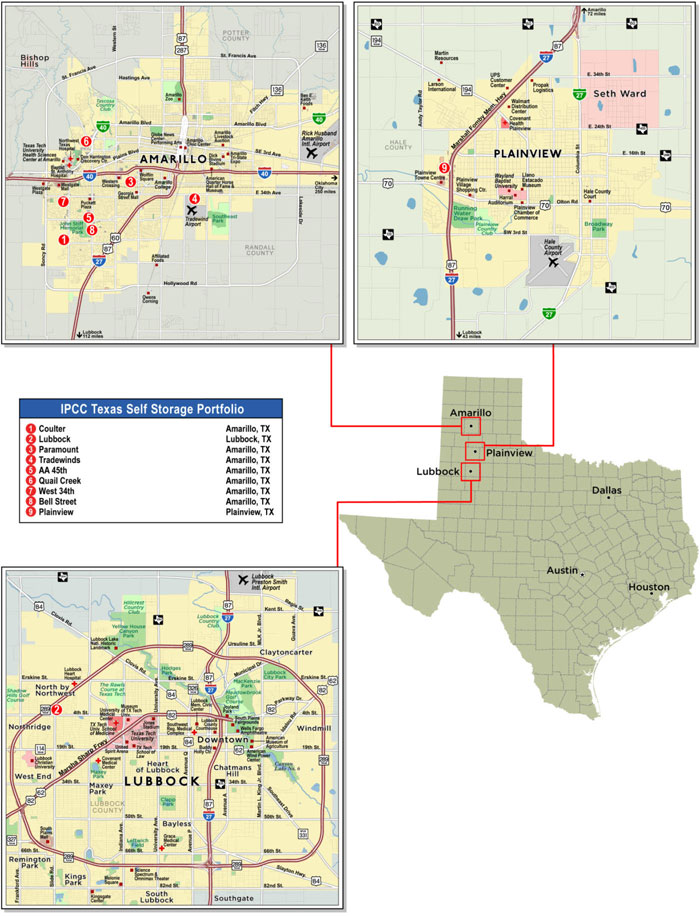

| Barclays | IPCC Texas Self Storage Portfolio | Various | TX | 1 / 9 | 31,500,000 | 4.9 | Self Storage | 685,835 | 46 | 57.8 | 53.3 | 1.62 | 10.6 |

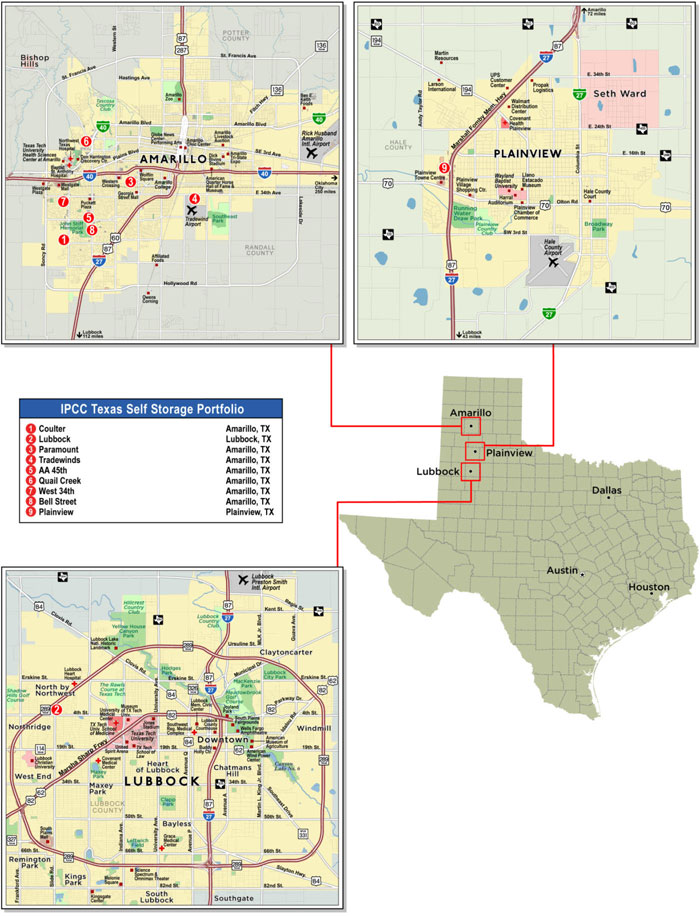

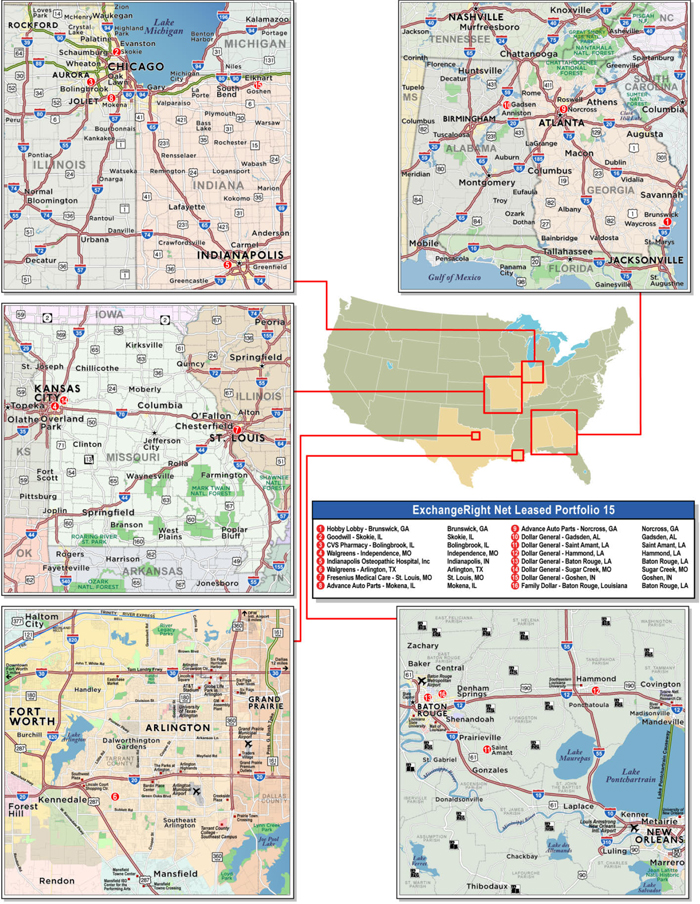

| SG | ExchangeRight Net Leased Portfolio 15 | Various | Various | 1 / 16 | 31,200,000 | 4.9 | Various | 218,276 | 143 | 60.0 | 60.0 | 2.09 | 9.6 |

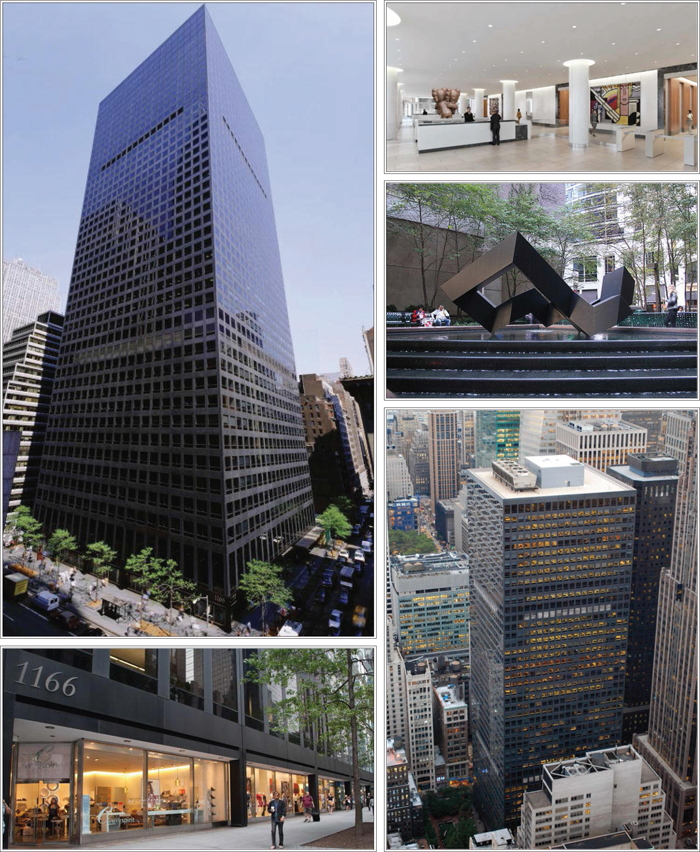

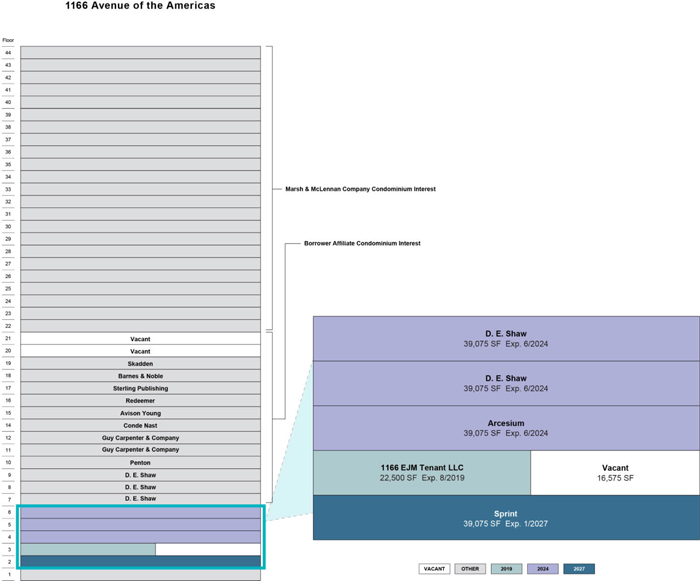

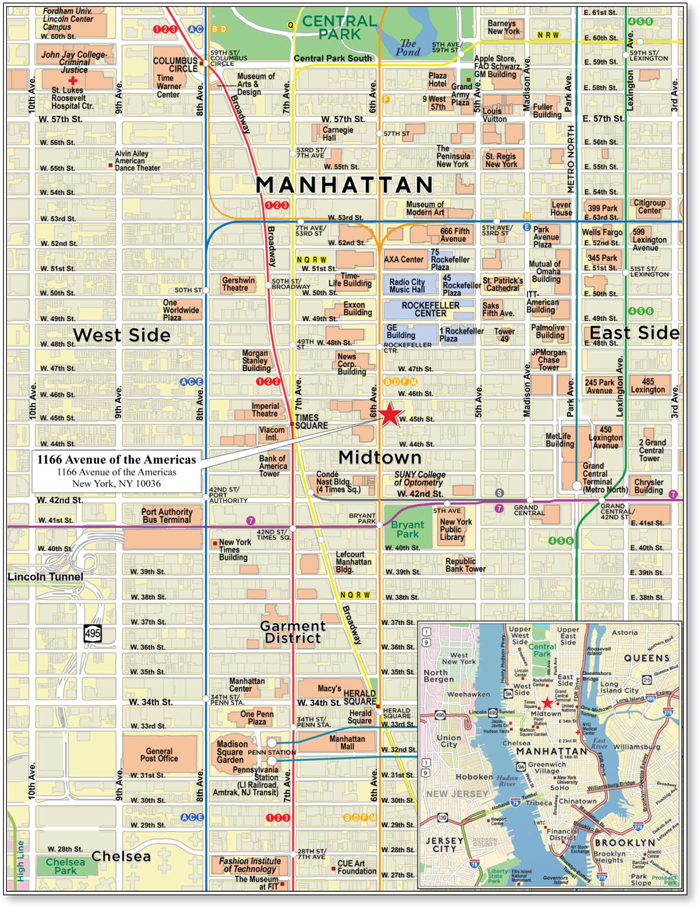

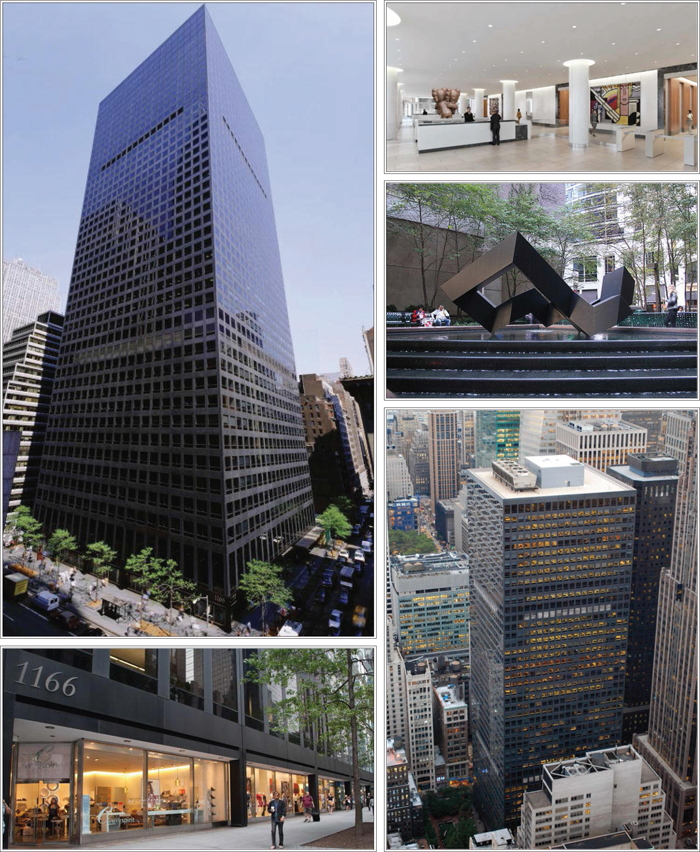

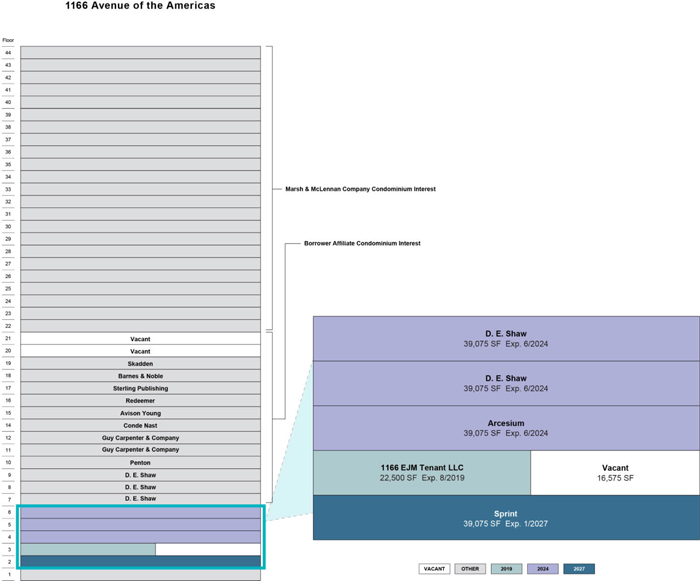

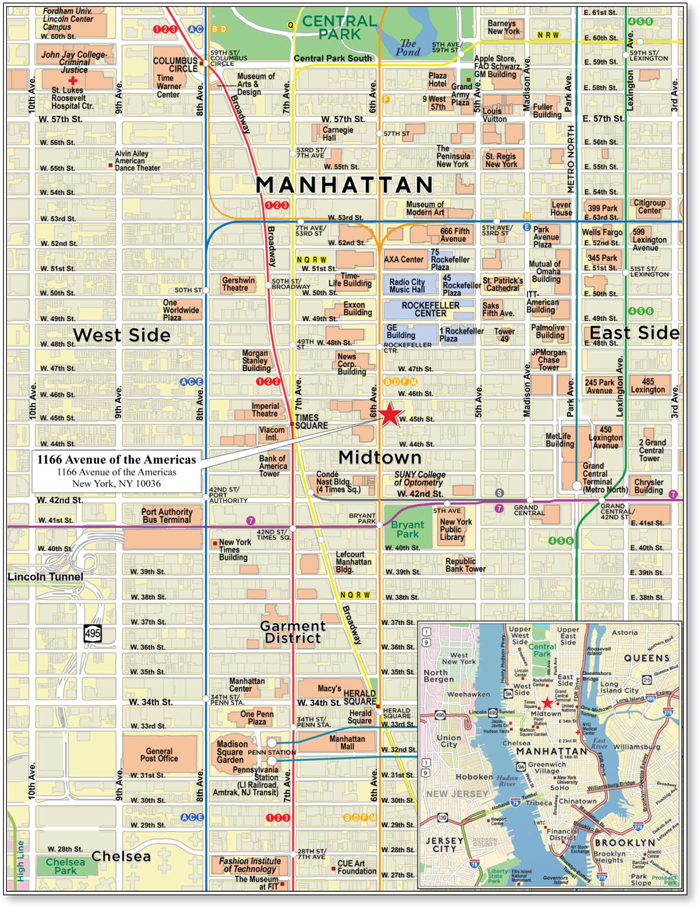

| Barclays | 1166 Avenue of the Americas | New York | NY | 1 / 1 | 28,750,000 | 4.5 | Office | 195,375 | 435 | 37.8 | 37.8 | 1.79 | 10.2 |

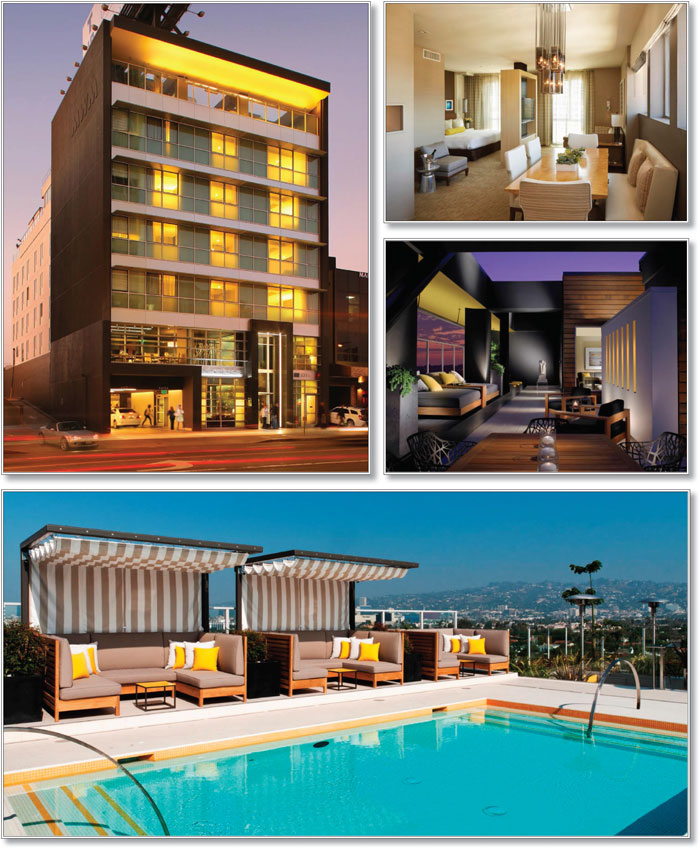

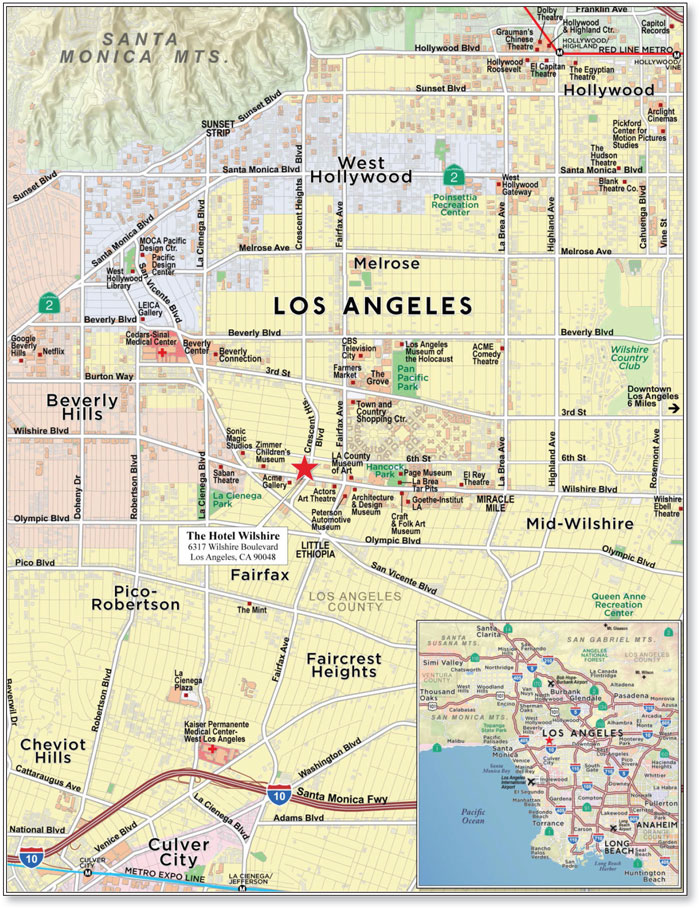

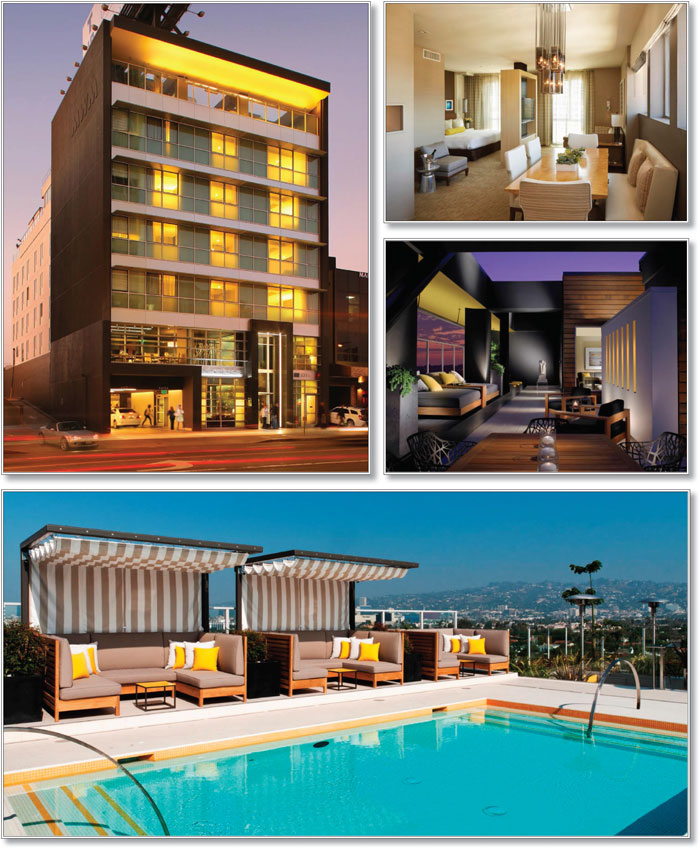

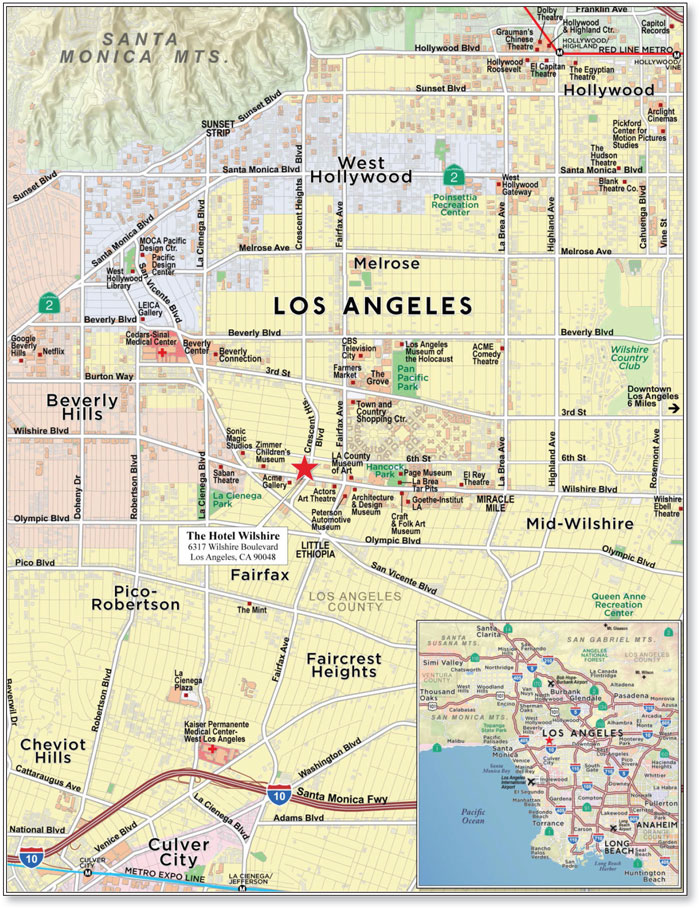

| WFB | Hotel Wilshire | Los Angeles | CA | 1 / 1 | 25,800,000 | 4.0 | Hospitality | 74 | 348,649 | 64.5 | 59.4 | 1.71 | 11.9 |

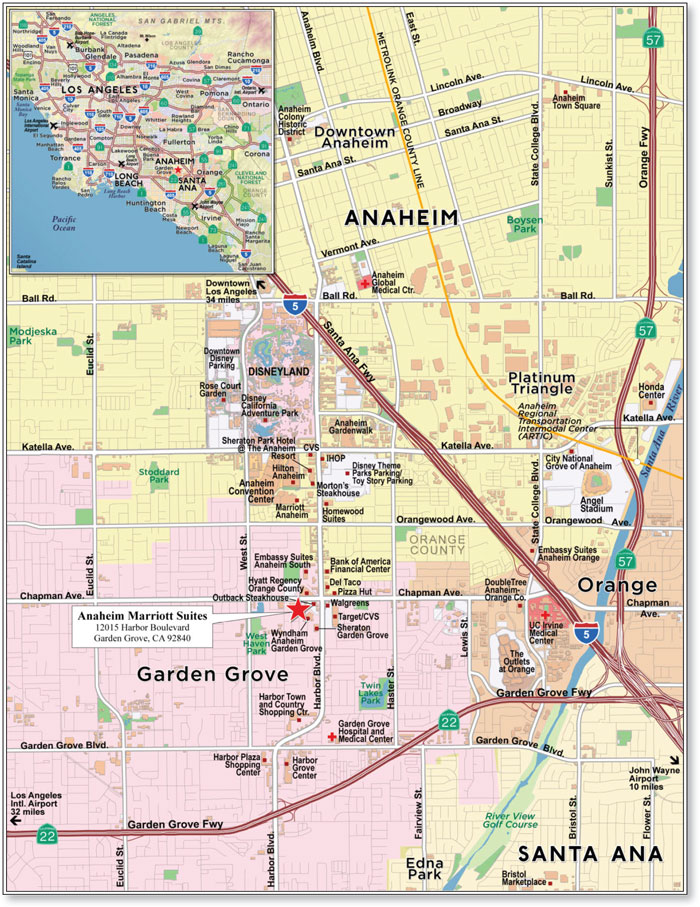

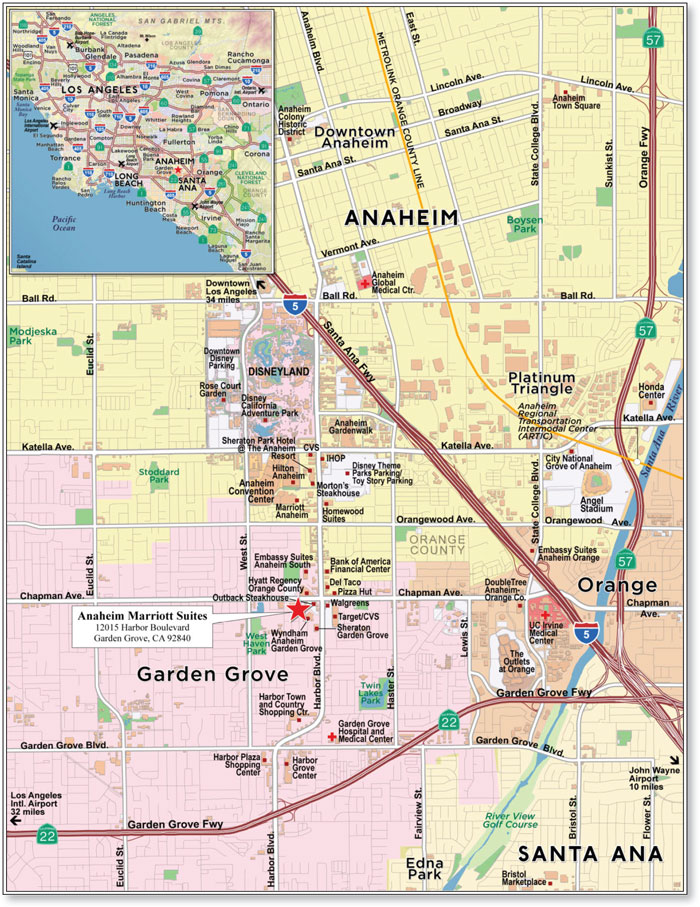

| UBSAG | Anaheim Marriott Suites | Garden Grove | CA | 1 / 1 | 24,000,000 | 3.8 | Hospitality | 371 | 145,553 | 65.1 | 60.3 | 1.62 | 12.8 |

| Top Three Total/Weighted Average | | 3 / 3 | $157,500,000 | 24.7% | | | | 46.0% | 46.0% | 1.76x | 8.8% |

| Top Five Total/Weighted Average | | 5 / 8 | $221,900,000 | 34.8% | | | | 49.9% | 48.7% | 1.82x | 9.4% |

| Top Ten Total/Weighted Average | | 10 / 36 | $363,150,000 | 57.0% | | | | 52.5% | 50.7% | 1.80x | 10.0% |

| Non-Top Ten Total/Weighted Average | | 27 / 36 | $274,405,685 | 43.0% | | | | 61.7% | 55.1% | 1.85x | 11.7% |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per Room/SF, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Property Name | Mortgage Loan Seller | Note(s) | Related Notes in Loan Group

(Original Balance) | Holder of Note | Lead Servicer for

the Entire Whole loan | Current Master Servicer Under Related

Securitization Servicing Agreement | Current Special Servicer Under Related Securitization Servicing Agreement |

| 123 William Street | Barclays | A-1 | $62,500,000 | WFCM 2017-RB1 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Barclays | A-2 & A-3 | $77,500,000 | (1) | No | TBD | TBD |

| The Davenport | WFB | A-1 | $55,000,000 | WFCM 2017-RB1 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| WFB | A-2 | $50,000,000 | (2) | No | TBD | TBD |

| Center West | UBSAG | A-1 | $30,000,000 | BBCMS 2017-C1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| UBSAG | A-2 & A-3 | $40,000,000 | WFCM 2017-RB1 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| UBSAG | A-4 | $10,000,000 | (3) | No | TBD | TBD |

| KOMO Plaza | UBSAG | A-1 & A-4 | $32,500,000 | WFCM 2017-RB1 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| UBSAG | A-2 & A-3 | $37,000,000 | BBCMS 2017-C1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| MSMCH | A-5 | $69,500,000 | BACM 2017-BNK3 | No | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| 1166 Avenue of the Americas(4) | Barclays | A-1 | $56,250,000 | BBCMS 2017-C1 | Yes(5) | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| Barclays | A-2 | $28,750,000 | WFCM 2017-RB1 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Anaheim Marriott Suites | UBSAG | A-1 & A-3 | $30,000,000 | BBCMS 2017-C1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| UBSAG | A-2 & A-4 | $24,000,000 | WFCM 2017-RB1 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| The Summit Birmingham | BANA | A-1 | $61,875,000 | (6) | No | TBD | TBD |

| BANA | A-2 | $73,325,000 | BACM 2017-BNK3 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| Barclays | A-3 | $50,000,000 | BBCMS 2017-C1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| Barclays | A-4 | $22,800,000 | WFCM 2017-RB1 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Connecticut Financial Center | UBSAG | A-1 | $22,750,000 | BBCMS 2017-C1 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| UBSAG | A-2 & A-3 | $22,750,000 | WFCM 2017-RB1 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Merrill Lynch Drive | Barclays | A-1 | $41,500,000 | BBCMS 2017-C1 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| Barclays | A-2 | $20,660,000 | WFCM 2017-RB1 | No | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| MSBNA | A-3 | $41,440,000 | (7) | No | TBD | TBD |

| Art Van Portfolio | UBSAG | A-1, A-2 & A-3 | $50,000,000 | (8) | Yes(9) | TBD | TBD |

| UBSAG | A-4 & A-5 | $18,750,000 | WFCM 2017-RB1 | No(9) | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| 340 Bryant | CCRE | A-1 | $16,000,000 | (10) | Yes(11) | TBD | TBD |

| UBSAG | A-2 | $14,700,000 | WFCM 2017-RB1 | No(11) | Wells Fargo Bank, National Association | C-III Asset Management LLC |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| (1) | The relatedpari passu Note A-2 and Note A-3 are currently held by Barclays and are expected to be contributed to one or more future securitization(s). No assurance can be provided that Note A-2 or Note A-3 will not be split further. |

| (2) | The relatedpari passu Note A-2 is currently held by WFB and is expected to be contributed to a future securitization. No assurance can be provided that Note A-2 will not be split further. |

| (3) | The relatedpari passu Note A-4 is currently held by UBSAG and is expected to be contributed to a future securitization. No assurance can be provided that Note A-4 will not be split further. |

| (4) | The 1166 Avenue of the Americas whole loan includes a subordinate companion loan with an original principal balance of $25,000,000. Such subordinate companion loan is not reflected in, and is subordinate to all of the notes listed in the “Related Notes in Loan Group (Original Balance)” column. |

| (5) | The 1166 Avenue of the Americas whole loan will be serviced pursuant to the BBCMS 2017-C1 pooling and servicing agreement. However, so long as no control appraisal period has occurred and is continuing, the holder of the 1166 Avenue of the Americas subordinate companion loan will be the controlling noteholder and will have the right to approve certain modifications and consent to certain actions to be taken with respect to the 1166 Avenue of the Americas whole loan. If a control appraisal period has occurred and is continuing, the holder of Note A-1 will be the controlling note holder. |

| (6) | The relatedpari passu Note A-1 is currently held by BANA and is expected to be contributed to a future securitization. No assurance can be provided that Note A-1 will not be split further. |

| (7) | The relatedpari passu Note A-3 is currently held by MSBNA and is expected to be contributed to a future securitization. No assurance can be provided that Note A-3 will not be split further. |

| (8) | The relatedpari passu Note A-1, Note A-2 and Note A-3 are currently held by UBSAG and are expected to be contributed to one or more future securitization(s). No assurance can be provided that Note A-1, Note A-2 or Note A-3 will not be split further. |

| (9) | The Art Van Portfolio whole loan is expected to initially be serviced under the WFCM 2017-RB1 pooling and servicing agreement until the securitization of the related controllingpari passu Note A-1 (the “Art Van Portfolio Servicing Shift Securitization Date”), after which the Art Van Portfolio whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1 (the “Art Van Portfolio Servicing Shift PSA”). The master servicer and special servicer under the Art Van Portfolio Servicing Shift PSA will be identified in a notice, report or statement to holders of the WFCM 2017-RB1 certificates after the securitization of the related controllingpari passu Note A-1. |

| (10) | The relatedpari passu Note A-1 is currently held by CCRE and is expected to be contributed to a future securitization. No assurance can be provided that Note A-1 will not be split further. |

| (11) | The 340 Bryant whole loan is expected to initially be serviced under the WFCM 2017-RB1 pooling and servicing agreement until the securitization of the related controllingpari passuNote A-1 (the “340 Bryant Servicing Shift Securitization Date”), after which the 340 Bryant whole loan will be serviced under the pooling and servicing agreement related to the securitization of the related controllingpari passu Note A-1 (the “340 Bryant Servicing Shift PSA”). The master servicer and special servicer under the 340 Bryant Servicing Shift PSA will be identified in a notice, report or statement to holders of the WFCM 2017-RB1 certificates after the securitization of the related controllingpari passu Note A-1. |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W

NOI Debt

Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 8 | Barclays | 1166 Avenue of the Americas | $28,750,000 | 4.5% | $25,000,000 | $20,000,000 | 5.3761% | 1.79x | 1.15x | 10.2% | 6.6% | 37.8% | 57.8% |

| Total/Weighted Average | $28,750,000 | 4.5% | $25,000,000 | $20,000,000 | 5.3761% | 1.79x | 1.15x | 10.2% | 6.6% | 37.8% | 57.8% |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to the 1166 Avenue of the Americas mortgage loan, which is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of

Initial Pool Balance (%) | Previous

Securitization |

| 1 | Barclays | 123 William Street | New York | NY | Office | 62,500,000 | 9.8% | GECMC 2005-C3 |

| 3 | UBSAG | Center West | Los Angeles | CA | Office | 40,000,000 | 6.3 | JPMCC 2007-LDPX |

| 5.01 | WFB | 100-120 Stony Point Road | Santa Rosa | CA | Office | 19,000,000 | 3.0 | BSCMS 2007-T26 |

| 5.02 | WFB | 131 Stony Circle | Santa Rosa | CA | Office | 5,995,000 | 0.9 | BSCMS 2007-T26 |

| 6.08 | Barclays | Bell Street | Amarillo | TX | Self Storage | 2,650,000 | 0.4 | BSCMS 2007-PW16 |

| 8 | Barclays | 1166 Avenue of the Americas | New York | NY | Office | 28,750,000 | 4.5 | LBUBS 2007-C1 |

| 9 | WFB | Hotel Wilshire | Los Angeles | CA | Hospitality | 25,800,000 | 4.0 | JPMCC 2013-C10 |

| 10 | UBSAG | Anaheim Marriott Suites | Garden Grove | CA | Hospitality | 24,000,000 | 3.8 | LBUBS 2007-C2 |

| 12 | UBSAG | Connecticut Financial Center | New Haven | CT | Office | 22,715,562 | 3.6 | BACM 2007-2 |

| 15.01 | Barclays | Towne Centre Village Retail Center | McDonough | GA | Retail | 4,650,000 | 0.7 | BSCMS 2006-T24 |

| 15.02 | Barclays | Hillcrest Shopping Center | Millbrook | AL | Retail | 3,125,000 | 0.5 | LBUBS 2007-C7 |

| 15.03 | Barclays | Shippensburg Shopping Center | Shippensburg | PA | Retail | 2,600,000 | 0.4 | MLCFC 2006-3 |

| 18 | UBSAG | Quail Lakes Shopping Center | Stockton | CA | Retail | 13,100,000 | 2.1 | CSMC 2007-C2 |

| 22 | Barclays | Center Ithaca | Ithaca | NY | Mixed Use | 10,000,000 | 1.6 | LBUBS 2007-C7 |

| 25 | Barclays | Hampton Inn Munster | Munster | IN | Hospitality | 9,300,000 | 1.5 | JPMCC 2007-LDPX |

| 28 | WFB | Fairfield Inn & Suites - Bend, OR | Bend | OR | Hospitality | 6,590,302 | 1.0 | MSC 2007-IQ14 |

| 30 | WFB | The Promenade Shopping Centre | Smyrna | GA | Retail | 5,900,000 | 0.9 | COMM 2007-C9 |

| 31 | UBSAG | StoreSmart Conway | Conway | AR | Self Storage | 4,788,707 | 0.8 | BACM 2007-1 |

| 33 | WFB | CT Storage Outlet Pomona | Pomona | CA | Self Storage | 4,477,003 | 0.7 | LBUBS 2007-C7 |

| 34 | SG | Shops at The Artisan | Decatur | GA | Mixed Use | 3,000,000 | 0.5 | CWCI 2007-C2 |

| 35 | SG | The Milliken Building | Saint George | UT | Industrial | 2,800,000 | 0.4 | MLCFC 2007-6 |

| 37 | WFB | Snellville Place | Snellville | GA | Retail | 2,075,000 | 0.3 | RCMT 2014-1A |

| | Total | | | | | $303,816,574 | 47.7% | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| Class A-2(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Mortgage Loan Balance at ARD ($) | % of Class A-2 Certificate Principal Balance (%)(2) | SF | Loan per

SF ($) | U/W NCF DSCR

(x) | U/W NOI Debt Yield (%) | Cut-off

Date LTV Ratio (%) | Balloon Or ARD LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to ARD (mos.) |

| 13 | Barclays | Merrill Lynch Drive | NJ | Office | $20,660,000 | 3.2% | $20,660,000 | 104.0% | 553,841 | $187 | 2.95x | 11.8% | 67.7% | 67.7% | 59 | 59 |

| Total/Weighted Average | | | $20,660,000 | 3.2% | $20,660,000 | 104.0% | | | 2.95x | 11.8% | 67.7% | 67.7% | 59 | 59 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |

| Class A-3(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Mortgage Loan Balance at Maturity ($) | % of Class A-3 Certificate Principal Balance (%)(2) | Rooms | Loan per

Room ($) | U/W NCF DSCR

(x) | U/W NOI Debt Yield (%) | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to Maturity (mos.) |

| 28 | WFB | Fairfield Inn & Suites - Bend, OR | OR | Hospitality | $6,590,302 | 1.0% | $5,848,756 | 105.3% | 80 | $82,379 | 2.64x | 19.2% | 48.5% | 43.0% | 0 | 83 |

| Total/Weighted Average | | | $6,590,302 | 1.0% | $5,848,756 | 105.3% | | | 2.64x | 19.2% | 48.5% | 43.0% | 0 | 83 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-3 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

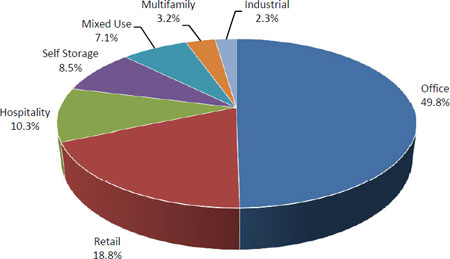

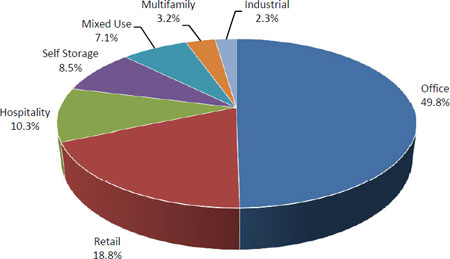

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of Initial

Pool

Balance (%) | Weighted Average Cut-off Date LTV

Ratio (%) | Weighted Average Balloon or ARD LTV

Ratio (%) | Weighted Average

U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Office | 16 | $317,306,355 | 49.8% | 53.6% | 50.9% | 1.77x | 10.0% | 9.0% | 4.644% |

| CBD | 6 | 223,665,562 | 35.1 | 47.7 | 46.3 | 1.76 | 9.7 | 8.7 | 4.673 |

| Suburban | 8 | 88,672,000 | 13.9 | 68.1 | 62.0 | 1.78 | 10.6 | 9.5 | 4.584 |

| Medical | 2 | 4,968,793 | 0.8 | 60.0 | 60.0 | 2.09 | 9.6 | 9.3 | 4.379 |

| Retail | 30 | 120,165,347 | 18.8 | 61.3 | 56.1 | 1.79 | 10.8 | 10.0 | 4.798 |

| Single Tenant | 18 | 42,670,347 | 6.7 | 60.1 | 55.6 | 1.99 | 11.0 | 10.6 | 4.634 |

| Shadow Anchored | 7 | 27,850,000 | 4.4 | 66.3 | 60.2 | 1.72 | 11.6 | 10.4 | 5.026 |

| Lifestyle Center | 1 | 22,800,000 | 3.6 | 54.3 | 54.3 | 1.68 | 8.7 | 8.1 | 4.762 |

| Anchored | 2 | 20,120,000 | 3.2 | 63.2 | 52.5 | 1.59 | 11.2 | 10.2 | 4.862 |

| Unanchored | 2 | 6,725,000 | 1.1 | 67.3 | 59.8 | 1.72 | 11.9 | 10.8 | 4.828 |

| Hospitality | 4 | 65,690,302 | 10.3 | 63.2 | 57.4 | 1.75 | 13.0 | 11.5 | 5.161 |

| Full Service | 2 | 49,800,000 | 7.8 | 64.8 | 59.8 | 1.67 | 12.3 | 10.8 | 5.113 |

| Limited Service | 2 | 15,890,302 | 2.5 | 58.2 | 49.6 | 2.03 | 15.2 | 13.5 | 5.314 |

| Self Storage | 14 | 54,080,669 | 8.5 | 54.5 | 48.6 | 1.86 | 11.6 | 11.3 | 4.910 |

| Self Storage | 14 | 54,080,669 | 8.5 | 54.5 | 48.6 | 1.86 | 11.6 | 11.3 | 4.910 |

| Mixed Use | 3 | 45,500,000 | 7.1 | 53.5 | 51.1 | 2.20 | 10.9 | 10.4 | 4.562 |

| Office/Data Center/Retail | 1 | 32,500,000 | 5.1 | 50.0 | 50.0 | 2.47 | 11.3 | 10.8 | 4.299 |

| Multifamily/Office/Retail/Self Storage | 1 | 10,000,000 | 1.6 | 63.1 | 52.4 | 1.36 | 9.6 | 9.1 | 5.302 |

| Office/Retail | 1 | 3,000,000 | 0.5 | 58.8 | 58.8 | 2.02 | 10.7 | 10.1 | 4.940 |

| Multifamily | 2 | 20,235,000 | 3.2 | 58.1 | 58.1 | 2.24 | 10.9 | 10.4 | 4.582 |

| Garden | 2 | 20,235,000 | 3.2 | 58.1 | 58.1 | 2.24 | 10.9 | 10.4 | 4.582 |

| Industrial | 3 | 14,578,012 | 2.3 | 62.7 | 52.4 | 1.58 | 11.5 | 10.7 | 4.973 |

| Distribution | 2 | 11,778,012 | 1.8 | 68.2 | 58.9 | 1.47 | 10.1 | 9.4 | 4.962 |

| Manufacturing | 1 | 2,800,000 | 0.4 | 39.4 | 24.9 | 2.06 | 17.6 | 16.4 | 5.020 |

| Total/Weighted Average: | 72 | $637,555,685 | 100.0% | 56.5% | 52.6% | 1.82x | 10.7% | 9.8% | 4.748% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

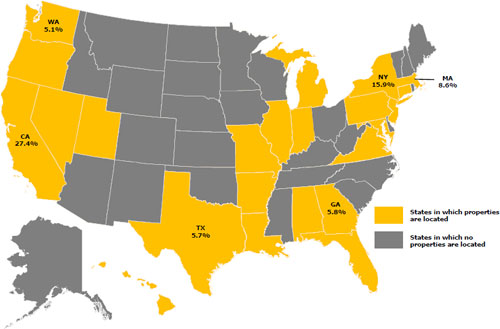

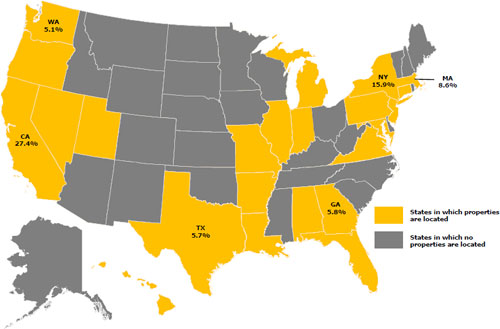

| G. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate Cut-off

Date Balance ($) | % of Initial Pool

Balance (%) | Weighted Average Cut-

off Date LTV

Ratio (%) | Weighted Average Balloon or ARD LTV

Ratio (%) | Weighted Average

U/W NCF DSCR (x) | Weighted Average U/W NOI Debt

Yield (%) | Weighted Average U/W NCF Debt

Yield (%) | Weighted Average Mortgage Rate (%) |

| California | 12 | $174,427,003 | 27.4% | 58.4% | 52.8% | 1.63x | 10.8% | 9.7% | 4.855% |

| Southern | 6 | 114,727,003 | 18.0 | 55.2 | 50.7 | 1.71 | 11.0 | 9.8 | 4.842 |

| Northern | 6 | 59,700,000 | 9.4 | 64.7 | 56.7 | 1.47 | 10.5 | 9.4 | 4.879 |

| New York | 3 | 101,250,000 | 15.9 | 46.8 | 45.7 | 1.61 | 9.0 | 8.2 | 4.903 |

| Massachusetts | 1 | 55,000,000 | 8.6 | 49.1 | 49.1 | 1.86 | 8.6 | 8.0 | 4.220 |

| Georgia | 7 | 36,733,426 | 5.8 | 66.8 | 60.3 | 1.64 | 10.9 | 9.8 | 4.868 |

| Texas | 11 | 36,191,497 | 5.7 | 58.1 | 53.6 | 1.66 | 10.6 | 10.3 | 4.915 |

| Washington | 1 | 32,500,000 | 5.1 | 50.0 | 50.0 | 2.47 | 11.3 | 10.8 | 4.299 |

| Other(3) | 37 | 201,453,759 | 31.6 | 60.6 | 55.8 | 2.04 | 11.9 | 11.0 | 4.744 |

| Total/Weighted Average | 72 | $637,555,685 | 100.0% | 56.5% | 52.6% | 1.82x | 10.7% | 9.8% | 4.748% |

| (1) | The mortgaged properties are located in 23 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 17 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 2,075,000 - 3,000,000 | 4 | $9,969,959 | 1.6% |

| 3,000,001 - 5,000,000 | 3 | 13,985,710 | 2.2 |

| 5,000,001 - 6,000,000 | 1 | 5,900,000 | 0.9 |

| 6,000,001 - 7,000,000 | 2 | 13,090,302 | 2.1 |

| 7,000,001 - 8,000,000 | 2 | 14,720,000 | 2.3 |

| 8,000,001 - 10,000,000 | 4 | 38,767,152 | 6.1 |

| 10,000,001 - 15,000,000 | 5 | 60,785,000 | 9.5 |

| 15,000,001 - 20,000,000 | 3 | 51,012,000 | 8.0 |

| 20,000,001 - 30,000,000 | 6 | 144,725,562 | 22.7 |

| 30,000,001 - 50,000,000 | 5 | 167,100,000 | 26.2 |

| 50,000,001 - 62,500,000 | 2 | 117,500,000 | 18.4 |

| Total: | 37 | $637,555,685 | 100.0% |

| Average | $17,231,235 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 1.36 - 1.40 | 1 | $4,788,707 | 0.8% |

| 1.41 - 1.50 | 3 | 35,000,000 | 5.5 |

| 1.51 - 1.60 | 3 | 30,975,000 | 4.9 |

| 1.61 - 1.70 | 5 | 89,682,000 | 14.1 |

| 1.71 - 1.80 | 5 | 107,514,959 | 16.9 |

| 1.81 - 1.90 | 6 | 102,327,003 | 16.0 |

| 1.91 - 2.50 | 10 | 201,017,714 | 31.5 |

| 2.51 - 3.00 | 3 | 59,750,302 | 9.4 |

| 3.01 - 3.76 | 1 | 6,500,000 | 1.0 |

| Total: | 37 | $637,555,685 | 100.0% |

| Weighted Average: | 1.98x | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF DSCRs (x) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 1.31 - 1.40 | 3 | $25,088,707 | 3.9% |

| 1.41 - 1.50 | 7 | 99,137,000 | 15.5 |

| 1.51 - 1.60 | 4 | 91,920,000 | 14.4 |

| 1.61 - 1.70 | 6 | 95,114,959 | 14.9 |

| 1.71 - 1.80 | 3 | 59,027,003 | 9.3 |

| 1.81 - 1.90 | 2 | 71,600,000 | 11.2 |

| 1.91 - 2.00 | 2 | 62,715,562 | 9.8 |

| 2.01 - 2.50 | 7 | 99,202,152 | 15.6 |

| 2.51 - 3.00 | 2 | 27,250,302 | 4.3 |

| 3.01 - 3.70 | 1 | 6,500,000 | 1.0 |

| Total: | 37 | $637,555,685 | 100.0% |

| Weighted Average: | 1.82x | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Acquisition | 19 | $354,072,000 | 55.5% |

| Refinance | 17 | 273,483,685 | 42.9 |

| Recapitalization | 1 | 10,000,000 | 1.6 |

| Total: | 37 | $637,555,685 | 100.0% |

| MORTGAGE RATE |

| Range of Mortgage Rates (%) | Number of

Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 3.930 - 4.000 | 1 | $20,660,000 | 3.2% |

| 4.001 - 4.250 | 1 | 55,000,000 | 8.6 |

| 4.251 - 4.500 | 5 | 122,735,000 | 19.3 |

| 4.501 - 4.750 | 5 | 128,820,000 | 20.2 |

| 4.751 - 5.000 | 10 | 165,154,565 | 25.9 |

| 5.001 - 5.250 | 6 | 39,477,454 | 6.2 |

| 5.251 - 5.500 | 8 | 91,008,666 | 14.3 |

| 5.501 - 5.675 | 1 | 14,700,000 | 2.3 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 4.748% | | |

| UNDERWRITTEN NOI DEBT YIELD |

| Range of U/W NOI Debt Yields (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 8.4 - 9.0 | 3 | $140,300,000 | 22.0% |

| 9.1 - 10.0 | 7 | 116,438,707 | 18.3 |

| 10.1 - 11.0 | 11 | 176,692,000 | 27.7 |

| 11.1 - 12.0 | 7 | 101,674,959 | 15.9 |

| 12.1 - 13.0 | 3 | 49,900,000 | 7.8 |

| 13.1 - 15.0 | 1 | 4,477,003 | 0.7 |

| 15.1 - 16.0 | 2 | 32,182,714 | 5.0 |

| 16.1 - 18.0 | 2 | 9,300,000 | 1.5 |

| 18.1 - 19.2 | 1 | 6,590,302 | 1.0 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 10.7% | | |

| UNDERWRITTEN NCF DEBT YIELD |

| Range of U/W NCF Debt Yields (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 7.4 – 8.0 | 2 | $117,500,000 | 18.4% |

| 8.1 - 9.0 | 4 | 105,000,000 | 16.5 |

| 9.1 - 10.0 | 12 | 171,710,707 | 26.9 |

| 10.1 - 11.0 | 9 | 143,740,000 | 22.5 |

| 11.1 - 12.0 | 4 | 47,054,959 | 7.4 |

| 12.1 - 13.0 | 1 | 22,715,562 | 3.6 |

| 13.1 - 14.0 | 1 | 4,477,003 | 0.7 |

| 14.1 - 16.0 | 1 | 9,467,152 | 1.5 |

| 16.1 - 17.0 | 2 | 9,300,000 | 1.5 |

| 17.1 - 17.2 | 1 | 6,590,302 | 1.0 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 9.8% | | |

| ORIGINAL TERM TO MATURITY OR ARD |

Original Terms to

Maturity or ARD (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 60 | 1 | $20,660,000 | 3.2% |

| 84 | 1 | 6,590,302 | 1.0 |

| 120 | 33 | 572,605,383 | 89.8 |

| 121 | 2 | 37,700,000 | 5.9 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 118 months | | |

| (1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity or ARD). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Characteristics of the Mortgage Pool |

| REMAINING TERM TO MATURITY OR ARD |

Range of Remaining Terms to

Maturity or ARD (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 59 | 1 | $20,660,000 | 3.2% |

| 83 | 1 | 6,590,302 | 1.0 |

| 84 - 120 | 33 | 572,605,383 | 89.8 |

| 121 | 2 | 37,700,000 | 5.9 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 117 months | | |

| ORIGINAL AMORTIZATION TERM(2) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Non-Amortizing | 13 | $333,145,000 | 52.3% |

| 240 | 2 | 7,277,003 | 1.1 |

| 300 | 2 | 15,367,152 | 2.4 |

| 348 | 1 | 7,020,000 | 1.1 |

| 360 | 19 | 274,746,530 | 43.1 |

| Total: | 37 | $637,555,685 | 100.0% |

| Weighted Average(3): | 354 months | | |

(2) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (3) Excludes the non-amortizing mortgage loans. |

| REMAINING AMORTIZATION TERM(4) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Non-Amortizing | 13 | $333,145,000 | 52.3% |

| 238 - 240 | 2 | 7,277,003 | 1.1 |

| 241 - 300 | 2 | 15,367,152 | 2.4 |

| 301 - 360 | 20 | 281,766,530 | 44.2 |

| Total: | 37 | $637,555,685 | 100.0% |

| Weighted Average(5): | 354 months | | |

(4) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (5) Excludes the non-amortizing mortgage loans. |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Springing | 15 | $263,884,305 | 41.4% |

| Hard/Springing Cash Management | 13 | 238,521,421 | 37.4 |

| Hard/Upfront Cash Management | 4 | 112,060,000 | 17.6 |

| None | 5 | 23,089,959 | 3.6 |

| Total: | 37 | $637,555,685 | 100.0% |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Lockout/Def/Open | 27 | $428,973,383 | 67.3% |

| Lockout/GRTR 1% or YM/Open | 5 | 74,112,000 | 11.6 |

| GRTR 1.0% or YM/GRTR 1% or YM or Def/Open | 1 | 62,500,000 | 9.8 |

| Lockout/GRTR 2% or YM/Open | 1 | 40,000,000 | 6.3 |

| GRTR 0.5% or YM/Open | 1 | 20,660,000 | 3.2 |

| Lockout/GRTR 1% or YM or Def/Open | 2 | 11,310,302 | 1.8 |

| Total: | 37 | $637,555,685 | 100.0% |

CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off Date LTV

Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 37.8 - 45.0 | 4 | $78,050,000 | 12.2% |

| 45.1 - 50.0 | 4 | 156,590,302 | 24.6 |

| 50.1 - 55.0 | 5 | 49,164,155 | 7.7 |

| 55.1 - 60.0 | 6 | 87,283,666 | 13.7 |

| 60.1 - 65.0 | 7 | 103,450,562 | 16.2 |

| 65.1 - 69.6 | 11 | 163,017,000 | 25.6 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 56.5% | | |

BALLOON OR ARD LOAN-TO-VALUE RATIO |

| Range of Balloon or ARD LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 24.9 - 30.0 | 1 | $2,800,000 | 0.4% |

| 30.1 - 35.0 | 1 | 4,477,003 | 0.7 |

| 35.1 - 40.0 | 3 | 75,250,000 | 11.8 |

| 40.1 - 45.0 | 2 | 16,057,454 | 2.5 |

| 45.1 - 50.0 | 7 | 174,703,666 | 27.4 |

| 50.1 - 55.0 | 8 | 124,615,562 | 19.5 |

| 55.1 - 60.0 | 8 | 108,295,000 | 17.0 |

| 60.1 - 65.0 | 6 | 110,697,000 | 17.4 |

| 65.1 - 67.7 | 1 | 20,660,000 | 3.2 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 52.6% | | |

AMORTIZATION TYPE |

| Amortization Type | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| Interest-only, Balloon | 12 | $312,485,000 | 49.0% |

| Interest-only, Amortizing Balloon | 12 | 211,102,000 | 33.1 |

| Amortizing Balloon | 11 | 83,841,533 | 13.2 |

| Interest-only, ARD | 1 | 20,660,000 | 3.2 |

| Amortizing ARD | 1 | 9,467,152 | 1.5 |

| Total: | 37 | $637,555,685 | 100.0% |

ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 24 | 4 | $46,220,000 | 7.2% |

| 36 | 2 | 36,620,000 | 5.7 |

| 60 | 6 | 128,262,000 | 20.1 |

| Total: | 12 | $211,102,000 | 33.1% |

| WeightedAverage: | 48 months | | |

SEASONING |

| Seasoning (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by Aggregate Cut-off Date Pool Balance (%) |

| 0 | 15 | $241,845,000 | 37.9% |

| 1 | 15 | 279,582,864 | 43.9 |

| 2 | 6 | 76,127,821 | 11.9 |

| 3 | 1 | 40,000,000 | 6.3 |

| Total: | 37 | $637,555,685 | 100.0% |

| WeightedAverage: | 1 month | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2017-RB1 | Certain Terms and Conditions |

| V. | Certain Terms and Conditions |