| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-19 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$705,379,517

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2017-C40

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Barclays Bank PLC

Wells Fargo Bank, National Association

Rialto Mortgage Finance, LLC

C-III Commercial Mortgage LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2017-C40

September 27, 2017

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | | BARCLAYS Co-Lead Manager and Joint Bookrunner |

| | | |

| | Academy Securities Co-Manager | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number of

Mortgage Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off Date Balance | | % of Initial Pool

Balance |

| Barclays Bank PLC | | 17 | | 93 | | $263,526,846 | | 37.4 | % |

| Wells Fargo Bank, National Association | | 17 | | 22 | | 261,105,441 | | 37.0 | |

| Rialto Mortgage Finance, LLC | | 12 | | 16 | | 109,139,205 | | 15.5 | |

| C-III Commercial Mortgage LLC | | 19 | | 19 | | 71,608,026 | | 10.2 | |

Total | | 65 | | 150 | | $705,379,517 | | 100.0 | % |

Loan Pool:

| Initial Pool Balance: | $705,379,517 |

| Number of Mortgage Loans: | 65 |

| Average Cut-off Date Balance per Mortgage Loan: | $10,851,993 |

| Number of Mortgaged Properties: | 150 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $4,702,530 |

| Weighted Average Mortgage Interest Rate: | 4.357% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 49.2% |

| Weighted Average Original Term to Maturity or ARD (months): | 118 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 353 |

| Weighted Average Remaining Amortization Term (months)(2): | 352 |

| Weighted Average Seasoning (months): | 3 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.10x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 11.4% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 56.6% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 50.7% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 12.8% |

| % of Mortgage Loans with Single Tenants(3): | 4.7% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Transaction Highlights |

Loan Structural Features:

Amortization:Based on the Initial Pool Balance, 57.6% of the mortgage pool (52 mortgage loans) has scheduled amortization, as follows:

32.6% (35 mortgage loans) requires amortization during the entire loan term; and

25.0% (17 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only:Based on the Initial Pool Balance, 42.4% of the mortgage pool (13 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 48.7% and 2.74x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 47.2% of the mortgage pool (15 mortgage loans) have hard lockboxes in place.

Reserves:The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 58.0% of the pool |

| Insurance: | 24.2% of the pool |

| Capital Replacements: | 59.0% of the pool |

| TI/LC: | 48.3% of the pool(1) |

| (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

88.6% of the mortgage pool (53 mortgage loans) features a lockout period, then defeasance only until an open period;

7.8% of the mortgage pool (eight mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

3.4% of the mortgage pool (three mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period; and

0.2% of the mortgage pool (one mortgage loan) features a lockout period, then defeasance period then requires the greater of a prepayment premium or yield maintenance until an open period.

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Based on the seasoning of a mortgage loan, it may no longer be prohibited from prepayment. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| II. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

Mortgage

Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of Mortgage Loans / Mortgaged Properties | | Mortgage Loan Cut-off Date Balance ($) | | % of Initial Pool Balance (%) | | Property

Type | | Number of Rooms / SF | | Cut-off Date Balance

Per

Room / SF | | Cut-off

Date LTV

Ratio (%) | | Balloon or ARD LTV

Ratio (%) | | U/W NCF

DSCR (x) | | U/W NOI

Debt

Yield (%) |

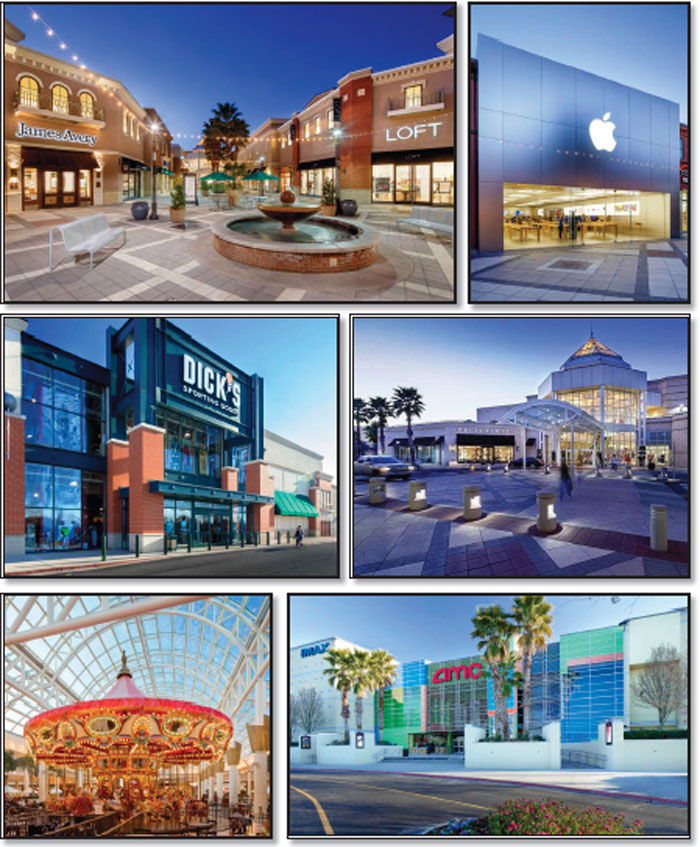

| Barclays | | 225 & 233 Park Avenue South | | New York | | NY | | 1 / 1 | | $60,000,000 | | | 8.5 | % | | Office | | 675,756 | | | $348 | | 31.3 | % | | 31.3 | % | | 3.27 | x | | 12.6 | % |

| Barclays | | Mall of Louisiana | | Baton Rouge | | LA | | 1 / 1 | | 50,000,000 | | | 7.1 | | | Retail | | 776,789 | | | 418 | | 57.0 | | | 49.3 | | | 1.85 | | | 11.1 | |

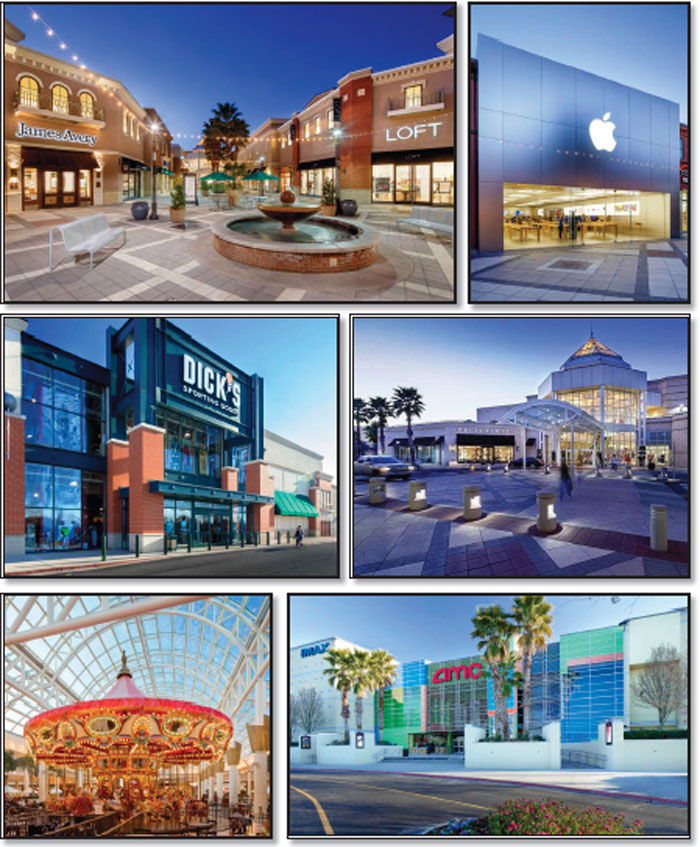

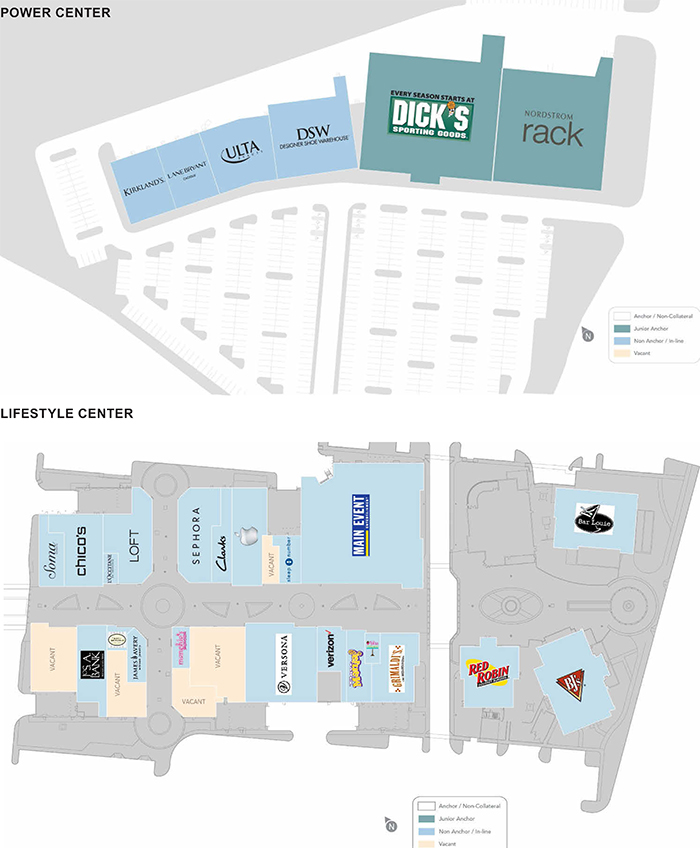

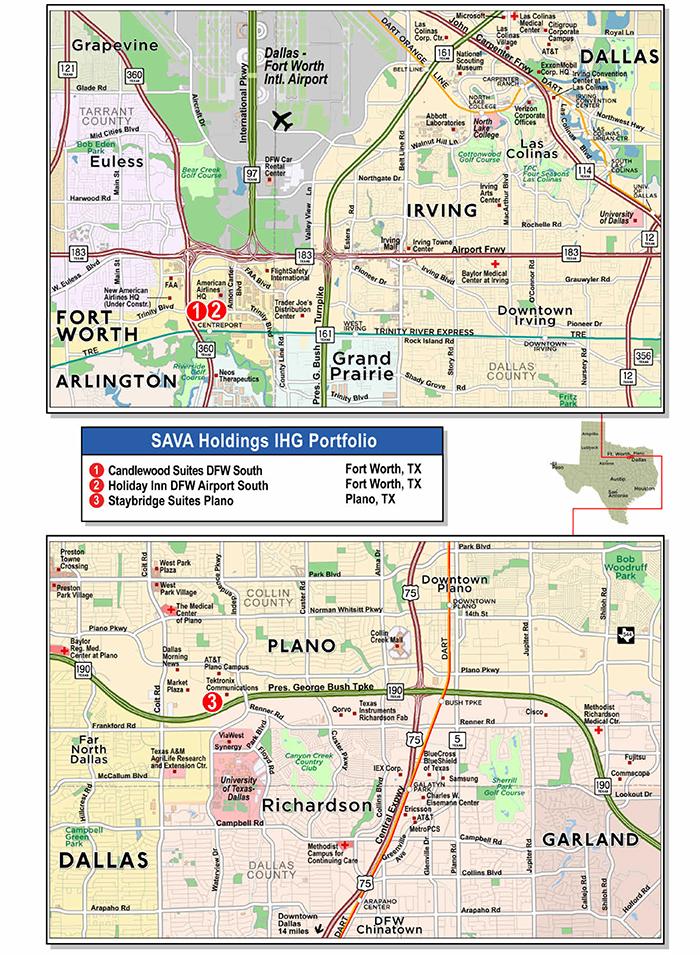

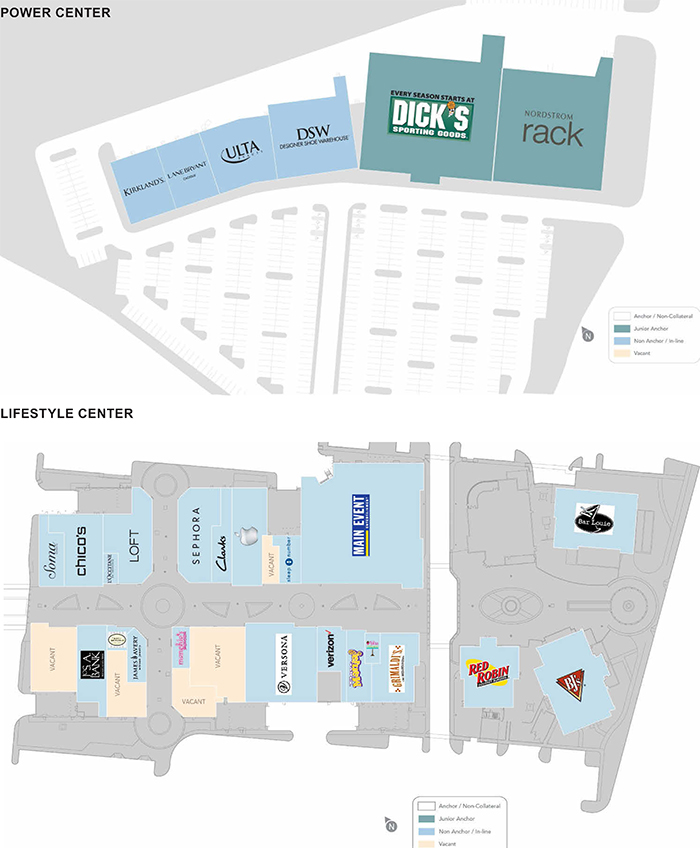

| WFB | | Marketplace at Millcreek | | Buford | | GA | | 1 / 1 | | 39,600,000 | | | 5.6 | | | Retail | | 401,947 | | | 99 | | 52.2 | | | 52.2 | | | 2.77 | | | 11.9 | |

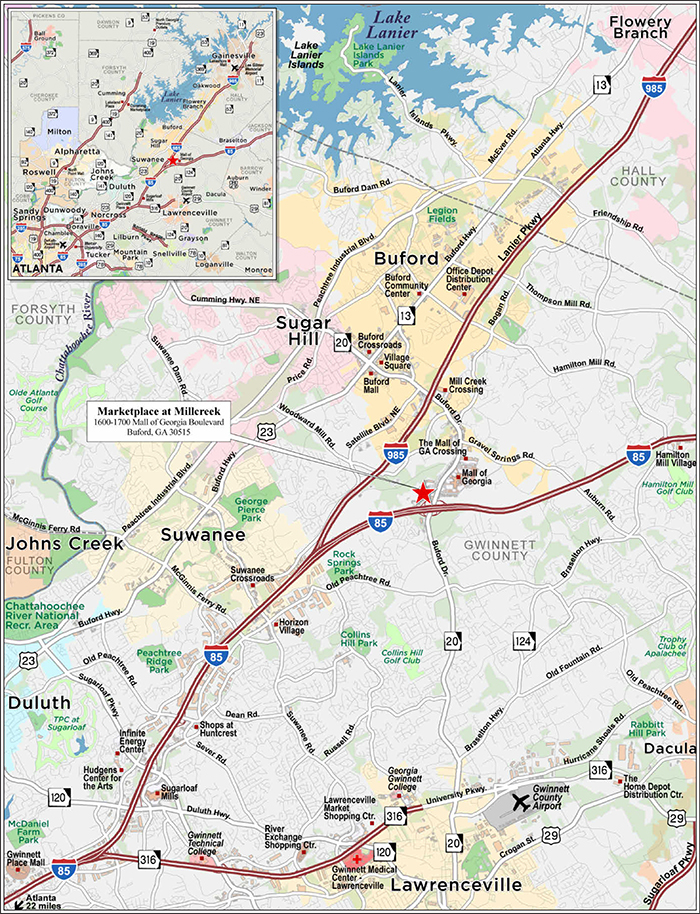

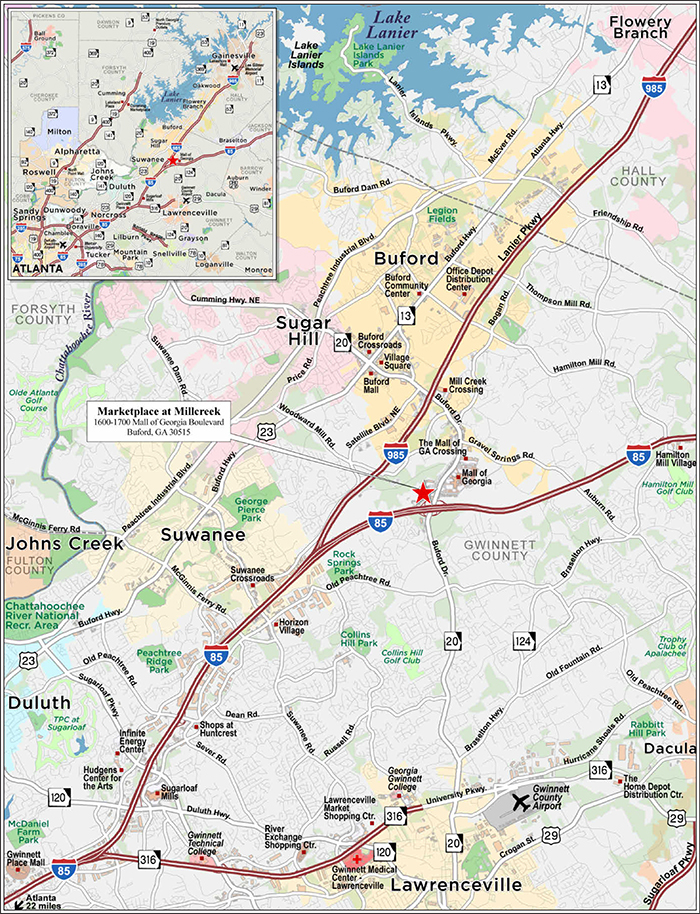

| RMF | | SAVA Holdings IHG Portfolio | | Various | | TX | | 1 / 3 | | 37,000,000 | | | 5.2 | | | Hospitality | | 429 | | | 86,247 | | 57.0 | | | 49.3 | | | 1.94 | | | 14.0 | |

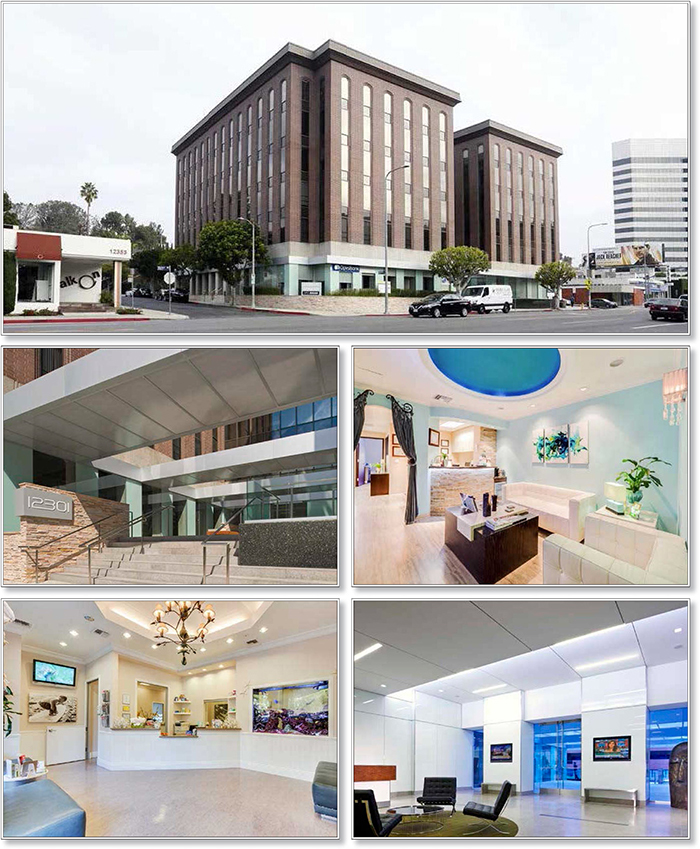

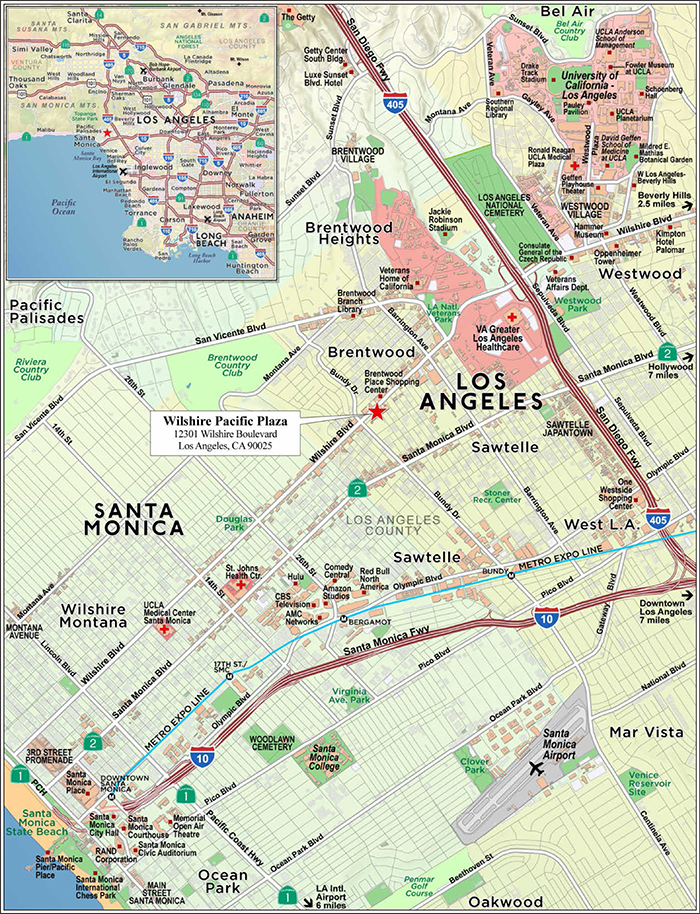

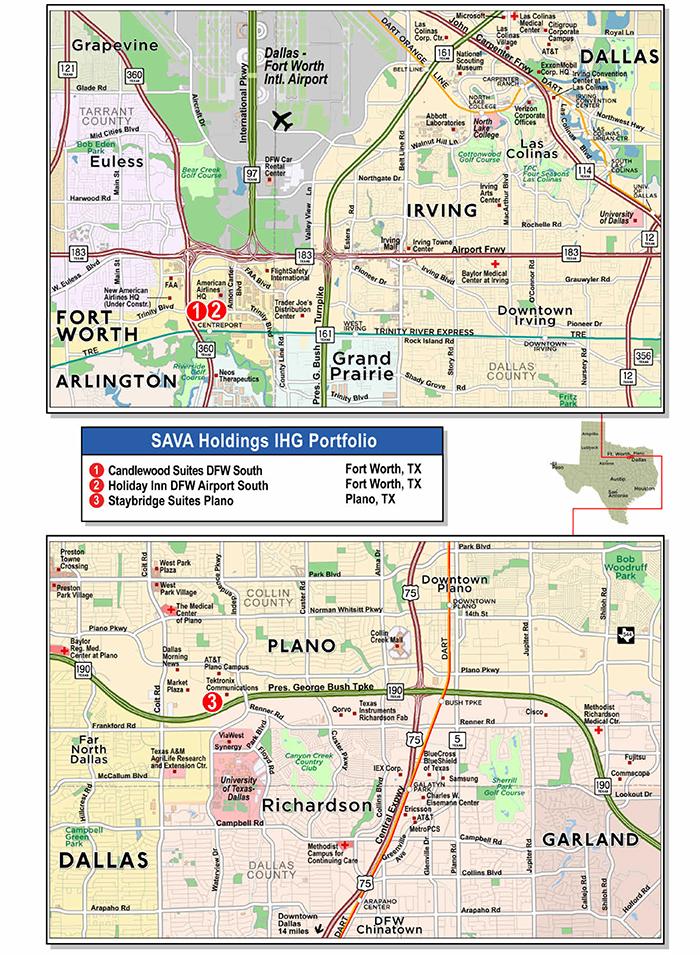

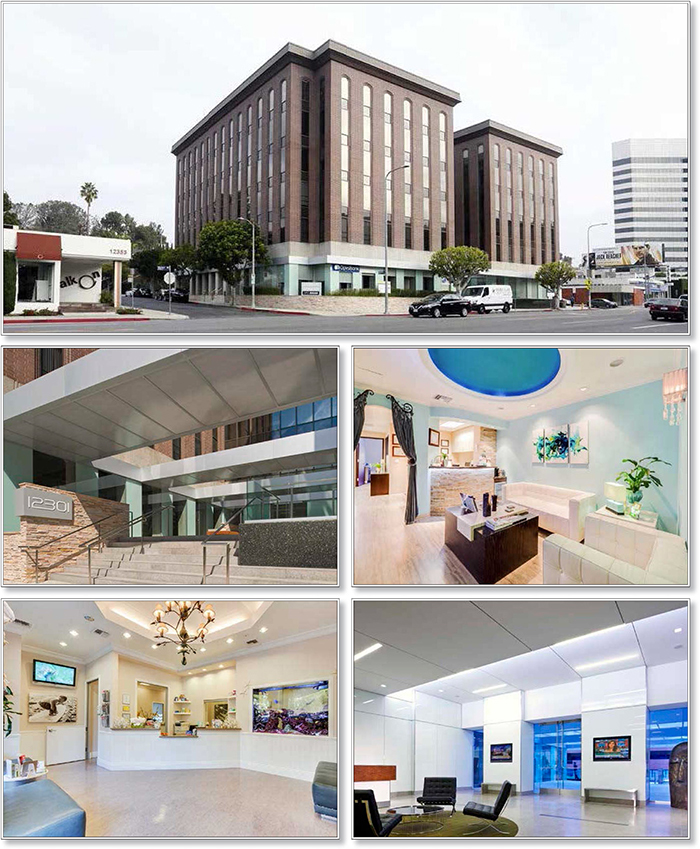

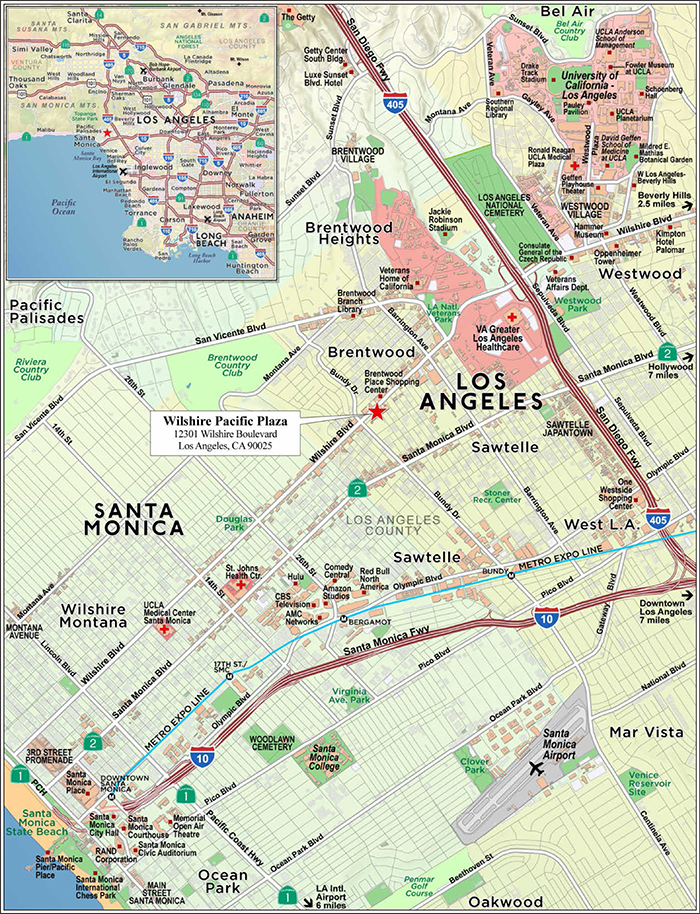

| WFB | | Wilshire Pacific Plaza | | Los Angeles | | CA | | 1 / 1 | | 32,850,000 | | | 4.7 | | | Office | | 107,737 | | | 305 | | 55.7 | | | 55.7 | | | 2.42 | | | 10.4 | |

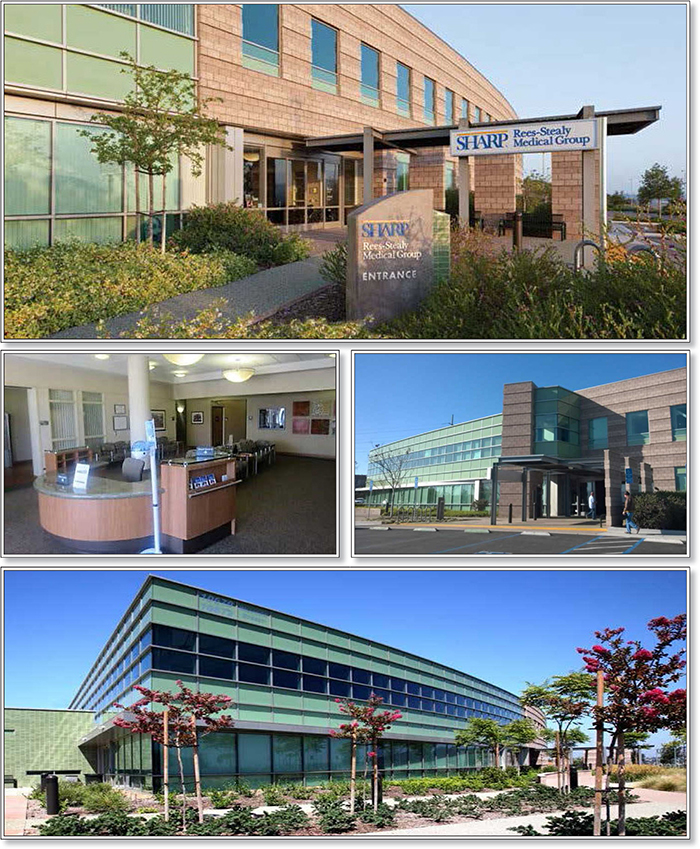

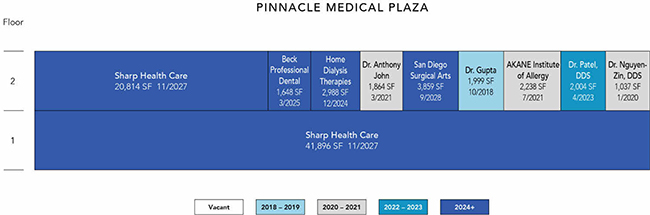

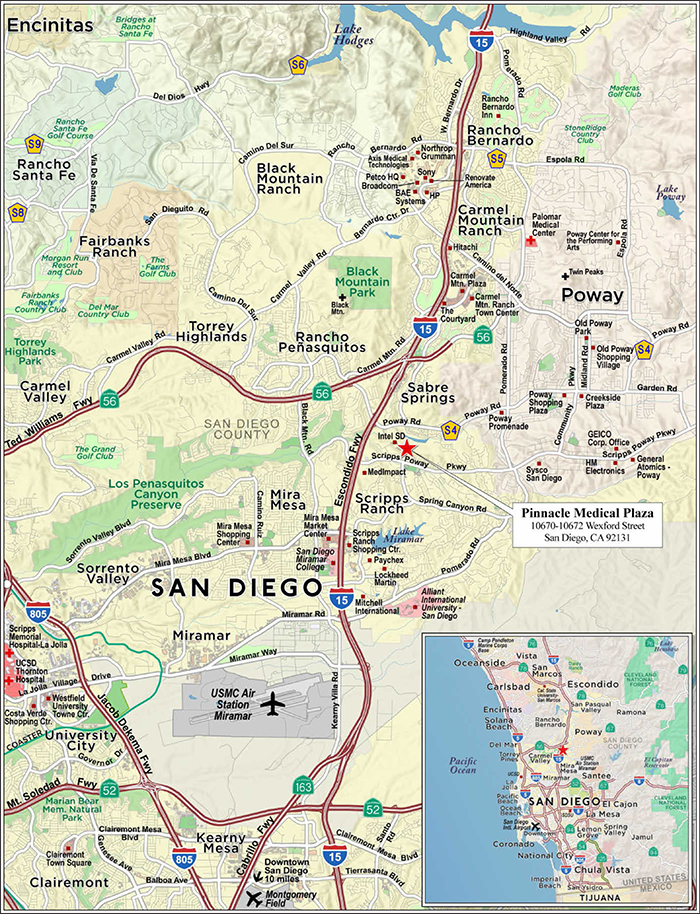

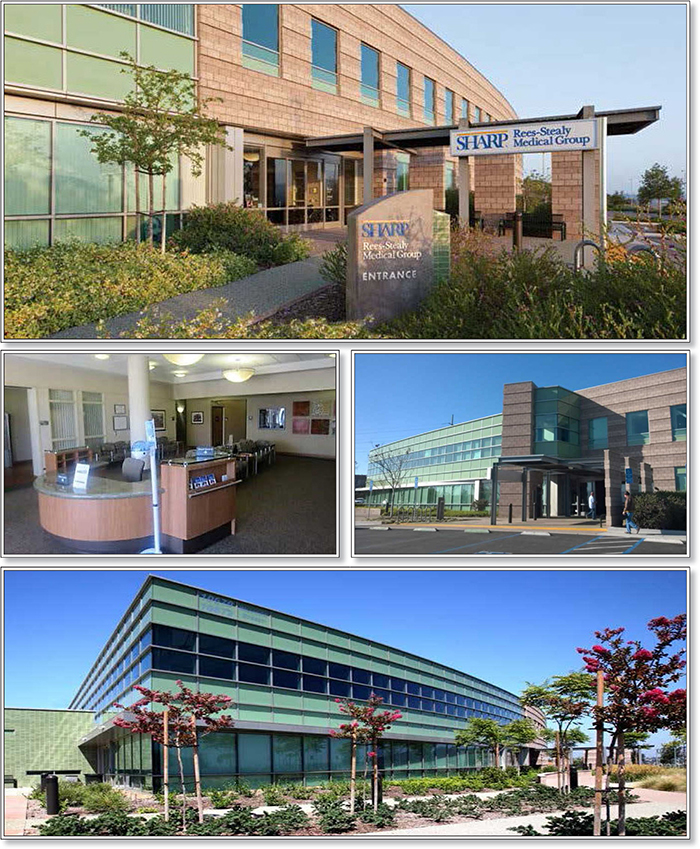

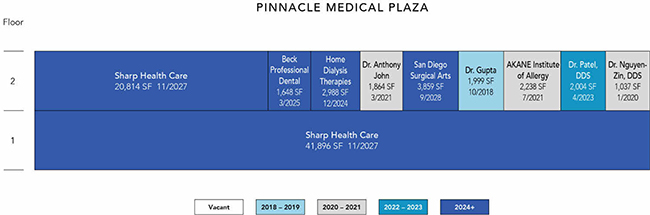

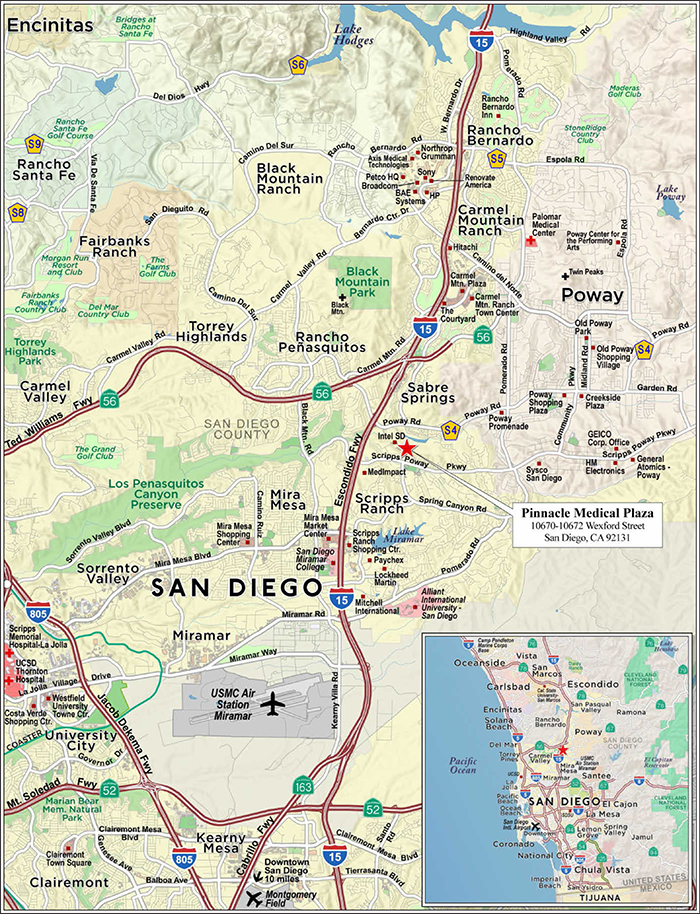

| WFB | | Pinnacle Medical Plaza | | San Diego | | CA | | 1 / 1 | | 29,000,000 | | | 4.1 | | | Office | | 80,402 | | | 361 | | 58.1 | | | 58.1 | | | 2.08 | | | 9.7 | |

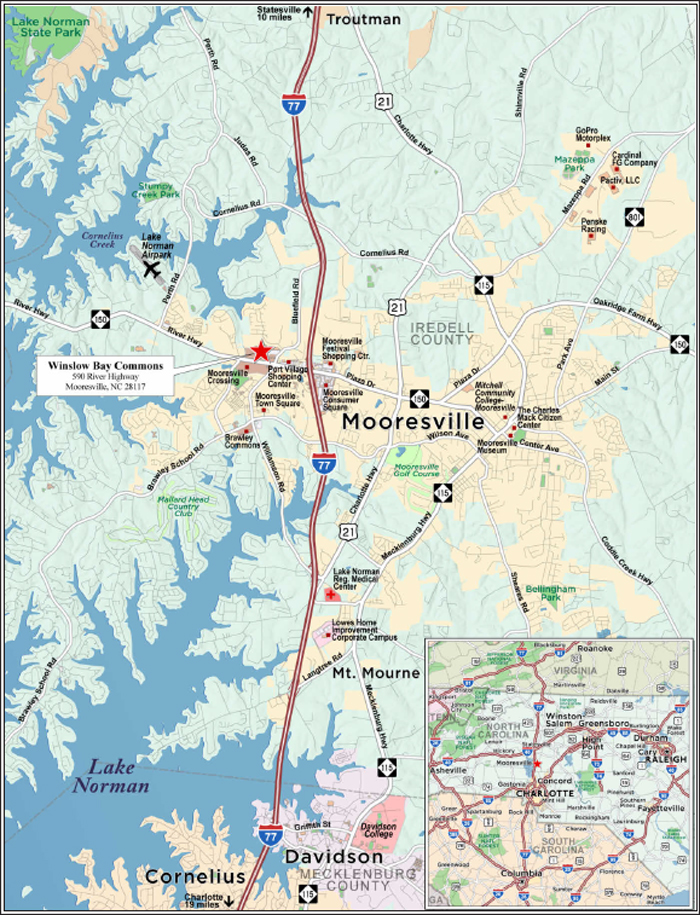

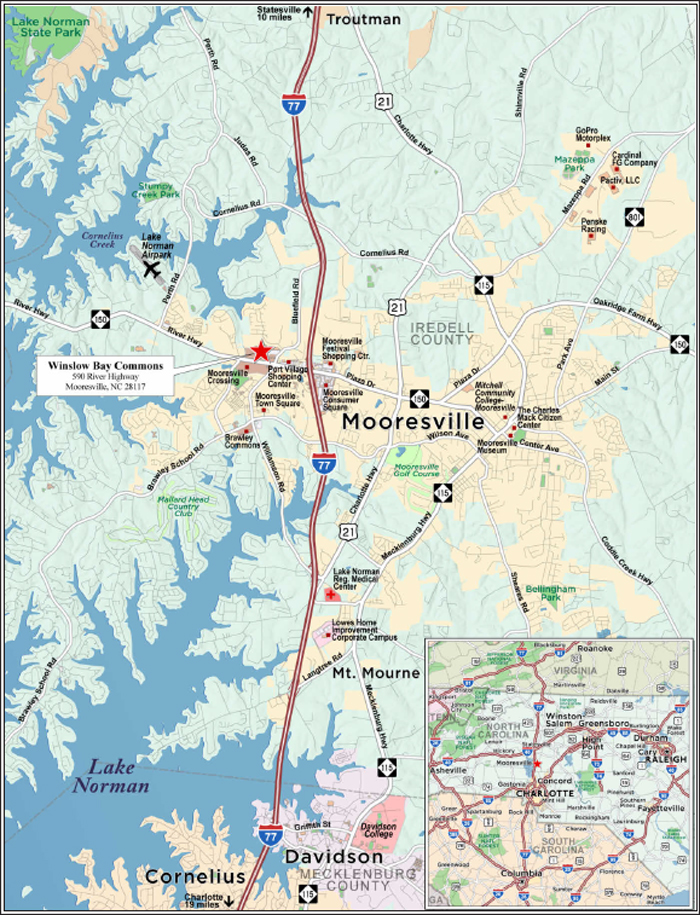

| WFB | | Winslow Bay Commons | | Mooresville | | NC | | 1 / 1 | | 25,800,000 | | | 3.7 | | | Retail | | 255,598 | | | 101 | | 45.8 | | | 45.8 | | | 3.26 | | | 13.8 | |

| Barclays | | Del Amo Fashion Center | | Torrance | | CA | | 1 / 1 | | 25,000,000 | | | 3.5 | | | Retail | | 1,769,525 | | | 260 | | 39.8 | | | 39.8 | | | 3.34 | | | 12.9 | |

| WFB | | Pleasant Prairie Premium Outlets | | Pleasant Prairie | | WI | | 1 / 1 | | 25,000,000 | | | 3.5 | | | Retail | | 402,615 | | | 360 | | 50.0 | | | 50.0 | | | 2.66 | | | 11.2 | |

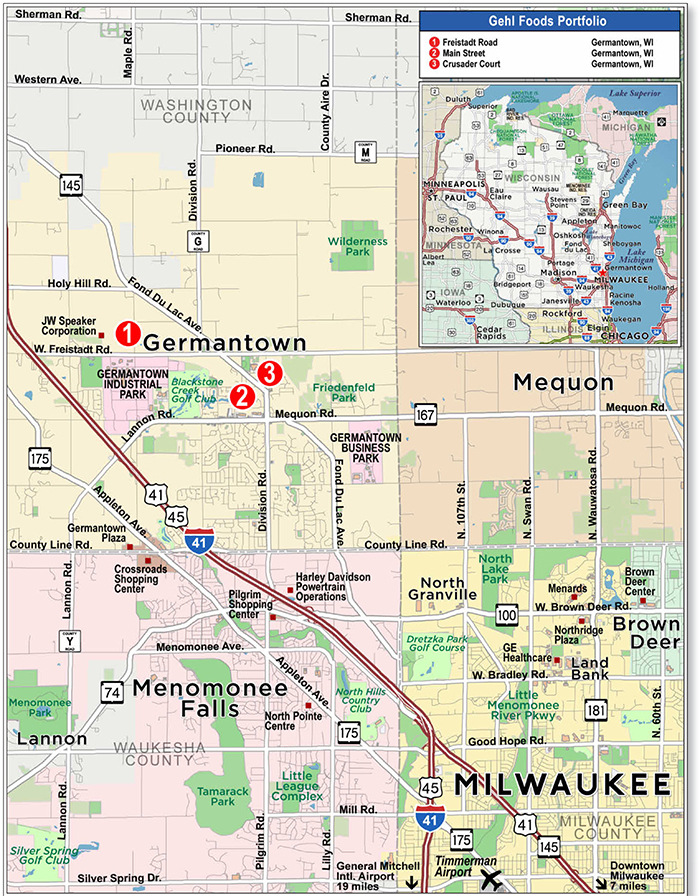

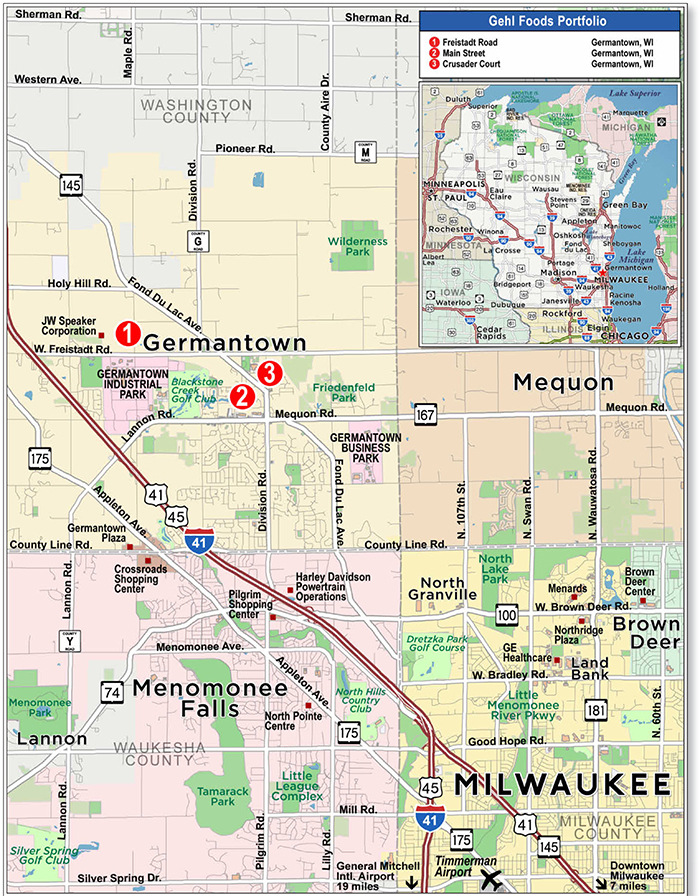

| WFB | | Gehl Foods Portfolio | | Germantown | | WI | | 1 / 3 | | 22,500,000 | | | 3.2 | | | Industrial | | 628,657 | | | 36 | | 65.2 | | | 59.4 | | | 1.59 | | | 10.2 | |

| Top Three Total/Weighted Average | | | | 3 / 3 | | $149,600,000 | | | 21.2 | % | | | | | | | | | 45.4 | % | | 42.8 | % | | 2.66 | x | | 11.9 | % |

| Top Five Total/Weighted Average | | | | 5 / 7 | | $219,450,000 | | | 31.1 | % | | | | | | | | | 48.9 | % | | 45.9 | % | | 2.50 | x | | 12.0 | % |

| Top Ten Total/Weighted Average | | | | 10 / 14 | | $346,750,000 | | | 49.2 | % | | | | | | | | | 49.9 | % | | 47.6 | % | | 2.54 | x | | 11.9 | % |

| Non-Top Ten Total/Weighted Average | | | | 55 / 136 | | $358,629,517 | | | 50.8 | % | | | | | | | | | 63.1 | % | | 53.8 | % | | 1.68 | x | | 10.9 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per Room/SF, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Property Name | Mortgage Loan Seller in WFCM 2017-C40 | Note(s) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| 225 & 233 Park Avenue South | Barclays | A-1 | $70,000,000 | WFCM 2017-C39 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $60,000,000 | CGCMT 2017-P8(2) | No |

| A-3 | $60,000,000 | WFCM 2017-C40 | No |

| A-4 | $45,000,000 | WFCM 2017-C38 | No |

| Mall of Louisiana | Barclays | A-1 | $65,000,000 | BANK 2017-BNK7(3) | Yes | Wells Fargo Bank, National Association | Rialto Capital

Advisors, LLC |

| A-2 | $44,000,000 | Bank of America, N.A. | No |

| A-3-1, A-5-2 | $47,000,000 | CGCMT 2017-P8(2) | No |

| A-3-2 | $28,000,000 | Citi Real Estate Funding Inc. | No |

| A-4 | $50,000,000 | COMM 2017-COR2(4) | No |

| A-5-1 | $41,000,000 | Barclays | No |

| A-6, A-7 | $50,000,000 | WFCM 2017-C40 | No |

| Del Amo Fashion Center | Barclays | A-1-1, A-2-1, A-3-1,

A-4-1, B-1-1, B-2-1,

B-3-1, B-4-1 | $59,300,000(5) | DAFC 2017-AMO | Yes | KeyBank National

Association | Cohen Financial, a Division of SunTrust Bank |

A-1-2, A-4-2,

B-1-2, B-4-2 | $90,000,000 | BANK 2017-BNK5 | No |

A-1-3, A-4-4, B-1-3,

B-1-4, B-4-4 | $59,543,000 | BANK 2017-BNK6 | No |

| A-1-4 | $20,457,000 | CGCMT 2017-B1 | No |

| A-2-2-A, B-2-2-A | $30,000,000 | WFCM 2017-C39 | No |

| A-2-2-B, B-2-2-B | $15,000,000 | Barclays | No |

| A-2-4, B-2-4 | $25,000,000 | WFCM 2017-C40 | No |

A-2-3, A-4-3,

B-2-3, B-4-3 | $60,000,000 | WFCM 2017-C38 | No |

| A-3-2, B-3-2 | $50,000,000 | UBS 2017-C3 | No |

| A-3-3, B-3-3 | $45,000,000 | UBS 2017-C2 | No |

| A-3-4, B-3-4 | $5,000,000 | UBS 2017-C4(6) | No |

| Pleasant Prairie Premium Outlets | WFB | A-1 | $34,000,000 | CGCMT 2017-P8(2) | Yes | Wells Fargo Bank, National Association(2) | KeyBank National Association(2) |

| A-2 | $41,000,000 | Citi Real Estate Funding Inc. | No |

| A-3 | $45,000,000 | WFB | No |

| A-4 | $25,000,000 | WFCM 2017-C40 | No |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| iStar Leased Fee Portfolio | Barclays | A-1-1 | $55,000,000 | MSC 2017-H1 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | LNR Partners, LLC |

| A-1-2 | $40,600,000 | WFCM 2017-C38 | No |

| A-1-3-1 | $20,600,000 | WFCM 2017-C39 | No |

| A-1-3-2 | $20,000,000 | WFCM 2017-C40 | No |

| A-2 | $45,400,000 | DBJPM 2017-C6 | No |

| A-3 | $45,400,000 | BANK 2017-BNK5 | No |

| Hilton Garden Inn Chicago/North Loop | WFB | A-1 | $20,000,000 | WFCM 2017-C40 | Yes | Wells Fargo Bank, National Association | C-III Asset

Management LLC |

| A-2 | $14,000,000 | WFCM 2017-C39 | No |

| Magnolia Hotel Denver | RMF | A-1, A-2 | $40,000,000 | MSC 2017-H1 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | LNR Partners, LLC |

| A-3 | $14,000,000 | WFCM 2017-C40 | No |

| Starwood Capital Group Hotel Portfolio | Barclays | A-1, A-7 | $80,000,000 | DBJPM 2017-C6 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-2-1, A-16-1 | $60,000,000 | JPMCC 2017-JP7 | No |

| A-2-2, A-9, A-14 | $46,817,500 | JPMorgan Chase Bank, N.A. | No |

| A-3 | $72,500,000 | BANK 2017-BNK5 | No |

| A-4 | $59,317,500 | BANK 2017-BNK6 | No |

| A-5 | $50,000,000 | WFCM 2017-C38 | No |

| A-6-1 | $40,000,000 | WFCM 2017-C39 | No |

| A-6-2 | $10,000,000 | WFCM 2017-C40 | No |

| A-8, A-10 | $40,000,000 | CD 2017-CD5 | No |

| A-11, A-12, A-13-2 | $37,500,000 | UBS 2017-C2 | No |

| A-13-1 | $14,317,500 | Deutsche Bank AG,

New York Branch | No |

| A-15 | $25,000,000 | Starwood Mortgage Funding II LLC | No |

| A-16-2, A-17 | $41,817,500 | CGCMT 2017-P8(2) | No |

| Atrisco Plaza Shopping Center | RMF | A-1 | $14,750,000 | RMF | Yes(7) | Wells Fargo Bank,

National Association(7) | C-III Asset

Management LLC(7) |

| A-2 | $5,000,000 | WFCM 2017-C40 | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The CGCMT 2017-P8 transaction is expected to close on September 29, 2017. |

| (3) | The BANK 2017-BNK7 transaction is expected to close on September 28, 2017. |

| (4) | The COMM 2017-COR2 transaction is expected to close on September 28, 2017. |

| (5) | The related whole loan also includes certain related junior notes, which have been contributed to the related standalone securitization listed under the “Holder of Note” column. Such related junior notes are not reflected in the “Note(s)” column. |

| (6) | The UBS 2017-C4 transaction is expected to close on October 18, 2017. |

| (7) | The related whole loan is expected to initially be serviced under the WFCM 2017-C40 pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2017-C40 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | | Mortgage Loan Seller | | Mortgage Loan Name | | Mortgage

Loan

Cut-off Date Balance ($) | | % of Initial Pool Balance (%) | | Sub Debt Cut-off Date Balance ($) | | Mezzanine Debt Cut-off Date Balance ($) | | Total Debt Interest Rate (%)(1) | | Mortgage Loan U/W NCF DSCR (x)(2) | | Total Debt U/W NCF DSCR (x) | | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | | Total Debt Cut-off Date U/W NOI Debt Yield (%) | | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | | Barclays | | 225 & 233 Park Avenue South | | $60,000,000 | | 8.5 | % | | NAP | | | $195,000,000 | | 4.1133 | % | | 3.27 | x | | 1.59 | x | | 12.6 | % | | 6.9 | % | | 31.3 | % | | 57.3 | % |

| 8 | | Barclays | | Del Amo Fashion Center | | 25,000,000 | | 3.5 | | | 125,700,000 | | | NAP | | 3.6575 | | | 3.34 | | | 2.63 | | | 12.9 | | | 10.1 | | | 39.8 | | | 50.6 | |

| 40 | | Barclays | | Sterling Oaks | | 4,993,253 | | 0.7 | | | 802,163 | | | NAP | | 5.0065 | | | 1.75 | | | 1.26 | | | 11.4 | | | 9.8 | | | 66.6 | | | 77.3 | |

| Total/Weighted Average | | $89,993,253 | | 12.8 | % | | $126,502,163 | | | $195,000,000 | | 4.0362 | % | | 3.21 | x | | 1.86 | x | | 12.6 | % | | 7.9 | % | | 35.6 | % | | 56.5 | % |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | | Mortgage Loan Seller | | Mortgage

Loan or Mortgaged

Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | | % of

Initial Pool Balance

(%) | | Previous Securitization |

| 2 | | Barclays | | Mall of Louisiana | | Baton Rouge | | LA | | Retail | | $50,000,000 | | | 7.1 | % | | MLMT 2006-C1 |

| 3 | | WFB | | Marketplace at Millcreek | | Buford | | GA | | Retail | | 39,600,000 | | | 5.6 | | | BACM 2007-3 |

| 4 | | RMF | | SAVA Holdings IHG Portfolio | | Various | | TX | | Hospitality | | 37,000,000 | | | 5.2 | | | JPMBB 2013-C12 |

| 7 | | WFB | | Winslow Bay Commons | | Mooresville | | NC | | Retail | | 25,800,000 | | | 3.7 | | | BACM 2007-3 |

| 9 | | WFB | | Pleasant Prairie Premium Outlets | | Pleasant Prairie | | WI | | Retail | | 25,000,000 | | | 3.5 | | | WBCMT 2006-C23; WBCMT 2006-C25; JPMCC 2007-CB18 |

| 12 | | Barclays | | 45 Eisenhower Drive | | Paramus | | NJ | | Office | | 19,949,869 | | | 2.8 | | | PFP 2014-1 |

| 14 | | Barclays | | Sentinel Business Center | | San Antonio | | TX | | Industrial | | 17,455,975 | | | 2.5 | | | BSCMS 2007-PW18 |

| 15 | | Barclays | | Southridge Plaza Austin | | Austin | | TX | | Retail | | 14,200,000 | | | 2.0 | | | MLCFC 2007-8 |

| 16 | | RMF | | Magnolia Hotel Denver | | Denver | | CO | | Hospitality | | 13,925,501 | | | 2.0 | | | GSMS 2007-GG10 |

| 17 | | WFB | | North Point Village | | Alpharetta | | GA | | Retail | | 13,000,000 | | | 1.8 | | | CSMC 2007-C3 |

| 19 | | Barclays | | Blossom Business Center | | San Antonio | | TX | | Industrial | | 10,972,327 | | | 1.6 | | | BSCMS 2007-PW18 |

| 20 | | WFB | | Hampton Inn - Frederick | | Frederick | | MD | | Hospitality | | 10,232,399 | | | 1.5 | | | MLMT 2008-C1 |

| 21.01 | | Barclays | | Larkspur Landing Sunnyvale | | Sunnyvale | | CA | | Hospitality | | 590,158 | | | 0.1 | | | COMM 2013-CR7 |

| 21.02 | | Barclays | | Larkspur Landing Milpitas | | Milpitas | | CA | | Hospitality | | 497,273 | | | 0.1 | | | COMM 2013-CR7 |

| 21.03 | | Barclays | | Larkspur Landing Campbell | | Campbell | | CA | | Hospitality | | 437,238 | | | 0.1 | | | COMM 2013-CR7 |

| 21.04 | | Barclays | | Larkspur Landing San Francisco | | South San Francisco | | CA | | Hospitality | | 360,212 | | | 0.1 | | | COMM 2013-CR7 |

| 21.05 | | Barclays | | Larkspur Landing Pleasanton | | Pleasanton | | CA | | Hospitality | | 352,283 | | | 0.0 | | | COMM 2013-CR7 |

| 21.06 | | Barclays | | Larkspur Landing Bellevue | | Bellevue | | WA | | Hospitality | | 313,769 | | | 0.0 | | | COMM 2013-CR7 |

| 21.07 | | Barclays | | Larkspur Landing Sacramento | | Sacramento | | CA | | Hospitality | | 234,477 | | | 0.0 | | | COMM 2013-CR7 |

| 21.09 | | Barclays | | Larkspur Landing Hillsboro | | Hillsboro | | OR | | Hospitality | | 228,814 | | | 0.0 | | | COMM 2013-CR7 |

| 21.10 | | Barclays | | Larkspur Landing Renton | | Renton | | WA | | Hospitality | | 226,548 | | | 0.0 | | | COMM 2013-CR7 |

| 21.11 | | Barclays | | Holiday Inn Arlington Northeast Rangers Ballpark | | Arlington | | TX | | Hospitality | | 217,486 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.13 | | Barclays | | Residence Inn Williamsburg | | Williamsburg | | VA | | Hospitality | | 206,159 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.14 | | Barclays | | Hampton Inn Suites Waco South | | Waco | | TX | | Hospitality | | 190,301 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.15 | | Barclays | | Holiday Inn Louisville Airport Fair Expo | | Louisville | | KY | | Hospitality | | 186,902 | | | 0.0 | | | WFRBS 2012-C10 |

| 21.16 | | Barclays | | Courtyard Tyler | | Tyler | | TX | | Hospitality | | 183,504 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.17 | | Barclays | | Hilton Garden Inn Edison Raritan Center | | Edison | | NJ | | Hospitality | | 183,504 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.20 | | Barclays | | Peoria, AZ Residence Inn | | Peoria | | AZ | | Hospitality | | 177,840 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.25 | | Barclays | | Courtyard Wichita Falls | | Wichita Falls | | TX | | Hospitality | | 159,717 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.26 | | Barclays | | Hampton Inn Morehead | | Morehead City | | NC | | Hospitality | | 155,186 | | | 0.0 | | | CSMC 2008-C1 |

| 21.28 | | Barclays | | Courtyard Lufkin | | Lufkin | | TX | | Hospitality | | 143,858 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.29 | | Barclays | | Hampton Inn Carlisle | | Carlisle | | PA | | Hospitality | | 142,725 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.30 | | Barclays | | Springhill Suites Williamsburg | | Williamsburg | | VA | | Hospitality | | 142,725 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.32 | | Barclays | | Waco Residence Inn | | Waco | | TX | | Hospitality | | 138,194 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.33 | | Barclays | | Holiday Inn Express Fishers | | Fishers | | IN | | Hospitality | | 129,133 | | | 0.0 | | | WFRBS 2012-C10 |

| 21.34 | | Barclays | | Larkspur Landing Folsom | | Folsom | | CA | | Hospitality | | 125,734 | | | 0.0 | | | COMM 2013-CR7 |

| 21.36 | | Barclays | | Holiday Inn Express & Suites Paris | | Paris | | TX | | Hospitality | | 117,805 | | | 0.0 | | | WFCM 2012-LC5 |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

Loan

No. | | Mortgage Loan Seller | | Mortgage

Loan or Mortgaged

Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | | % of

Initial Pool Balance

(%) | | Previous Securitization |

| 21.37 | | Barclays | | Toledo Homewood Suites | | Maumee | | OH | | Hospitality | | 117,805 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.38 | | Barclays | | Grand Rapids Homewood Suites | | Grand Rapids | | MI | | Hospitality | | 114,407 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.39 | | Barclays | | Fairfield Inn Laurel | | Laurel | | MD | | Hospitality | | 106,478 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.40 | | Barclays | | Cheyenne Fairfield Inn and Suites | | Cheyenne | | WY | | Hospitality | | 106,478 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.41 | | Barclays | | Courtyard Akron Stow | | Stow | | OH | | Hospitality | | 104,212 | | | 0.0 | | | WFRBS 2012-C10 |

| 21.43 | | Barclays | | Larkspur Landing Roseville | | Roseville | | CA | | Hospitality | | 98,549 | | | 0.0 | | | COMM 2013-CR7 |

| 21.44 | | Barclays | | Hampton Inn Danville | | Danville | | PA | | Hospitality | | 97,416 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.45 | | Barclays | | Holiday Inn Norwich | | Norwich | | CT | | Hospitality | | 96,283 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.46 | | Barclays | | Hampton Inn Suites Longview North | | Longview | | TX | | Hospitality | | 95,150 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.48 | | Barclays | | Hampton Inn Suites Buda | | Buda | | TX | | Hospitality | | 94,018 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.49 | | Barclays | | Shawnee Hampton Inn | | Shawnee | | OK | | Hospitality | | 94,018 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.50 | | Barclays | | Racine Fairfield Inn | | Racine | | WI | | Hospitality | | 91,752 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.51 | | Barclays | | Hampton Inn Selinsgrove Shamokin Dam | | Shamokin Dam | | PA | | Hospitality | | 89,487 | | | 0.0 | | | WFRBS 2013-C11 |

| 21.52 | | Barclays | | Holiday Inn Express & Suites Terrell | | Terrell | | TX | | Hospitality | | 84,956 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.53 | | Barclays | | Westchase Homewood Suites | | Houston | | TX | | Hospitality | | 82,228 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.54 | | Barclays | | Holiday Inn Express & Suites Tyler South | | Tyler | | TX | | Hospitality | | 81,557 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.55 | | Barclays | | Holiday Inn Express & Suites Huntsville | | Huntsville | | TX | | Hospitality | | 78,159 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.56 | | Barclays | | Hampton Inn Sweetwater | | Sweetwater | | TX | | Hospitality | | 71,363 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.57 | | Barclays | | Comfort Suites Buda Austin South | | Buda | | TX | | Hospitality | | 60,035 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.58 | | Barclays | | Fairfield Inn & Suites Weatherford | | Weatherford | | TX | | Hospitality | | 56,637 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.59 | | Barclays | | Holiday Inn Express & Suites Altus | | Altus | | OK | | Hospitality | | 45,895 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.60 | | Barclays | | Comfort Inn & Suites Paris | | Paris | | TX | | Hospitality | | 40,779 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.61 | | Barclays | | Hampton Inn Suites Decatur | | Decatur | | TX | | Hospitality | | 39,022 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.62 | | Barclays | | Holiday Inn Express & Suites Texarkana East | | Texarkana | | AR | | Hospitality | | 36,136 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.63 | | Barclays | | Mankato Fairfield Inn | | Mankato | | MN | | Hospitality | | 32,383 | | | 0.0 | | | GSMS 2012-GCJ9 |

| 21.64 | | Barclays | | Candlewood Suites Texarkana | | Texarkana | | TX | | Hospitality | | 25,037 | | | 0.0 | | | WFCM 2012-LC5 |

| 21.65 | | Barclays | | Country Inn & Suites Houston Intercontinental Airport East | | Humble | | TX | | Hospitality | | 23,777 | | | 0.0 | | | WFCM 2012-LC5 |

| 23 | | WFB | | St. Louis Ground Lease | | St. Louis | | MO | | Other | | 9,526,304 | | | 1.4 | | | CSMC 2007-C5 |

| 24 | | WFB | | Shady Willow Plaza | | Brentwood | | CA | | Retail | | 9,150,000 | | | 1.3 | | | BSCMS 2007-PW18 |

| 26 | | WFB | | 215 South Brea Boulevard | | Brea | | CA | | Mixed Use | | 8,270,439 | | | 1.2 | | | JPMCC 2007-LD11 |

| 31 | | RMF | | Salida & Manteca Secured Storage Portfolio | | Various | | CA | | Self Storage | | 6,300,000 | | | 0.9 | | | MLCFC 2007-9 |

| 32 | | RMF | | Hampton Inn - Farmville | | Farmville | | VA | | Hospitality | | 6,153,606 | | | 0.9 | | | CMLT 2008-LS1 |

| 33 | | Barclays | | Heacock Business Center | | Moreno Valley | | CA | | Office | | 5,991,508 | | | 0.8 | | | BSCMS 2007-PW18 |

| 35 | | CIIICM | | Douglasville Center | | Douglasville | | GA | | Retail | | 5,950,000 | | | 0.8 | | | MLCFC 2007-8 |

| 36 | | CIIICM | | Wanamaker Crossing | | Topeka | | KS | | Retail | | 5,771,950 | | | 0.8 | | | CSMC 2007-C3 |

| 38 | | RMF | | Battlefield Square Shoppes | | Springfield | | MO | | Retail | | 5,028,685 | | | 0.7 | | | MSC 2007-HQ13 |

| 52 | | CIIICM | | Kaysville Business Park | | Kaysville | | UT | | Industrial | | 3,288,321 | | | 0.5 | | | BACM 2008-1 |

| 58 | | CIIICM | | Cypress Self Storage | | Cypress | | TX | | Self Storage | | 2,591,069 | | | 0.4 | | | BSCMS 2007-PW18 |

| 61 | | WFB | | Creekview Apartments | | Chico | | CA | | Multifamily | | 2,000,000 | | | 0.3 | | | BSCMS 2007-T28 |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

Loan

No. | | Mortgage Loan Seller | | Mortgage

Loan or Mortgaged

Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | | % of

Initial Pool Balance

(%) | | Previous Securitization |

| 62 | | WFB | | Pomona Townhomes | | Chico | | CA | | Multifamily | | 1,900,000 | | | 0.3 | | | BSCMS 2007-T28 |

| 65 | | CIIICM | | Lloyds MHC | | Bradenton | | FL | | Manufactured Housing Community | | 1,293,835 | | | 0.2 | | | JPMCC 2007-LDP12 |

| | | Total | | | | | | | | | | $358,257,350 | | | 50.8 | % | | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

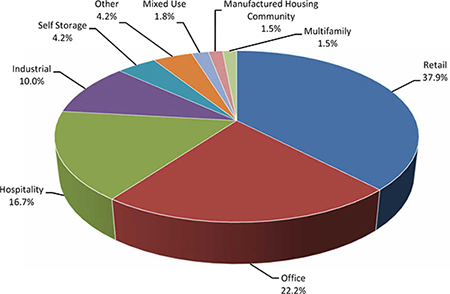

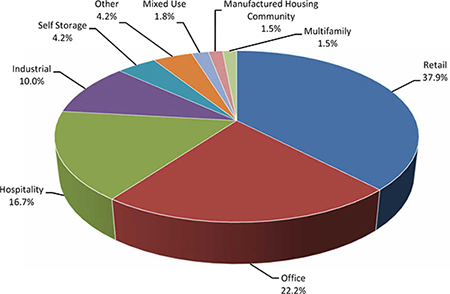

| E. | Property Type Distribution(1) |

| Property Type | | Number of Mortgaged Properties | | Aggregate

Cut-off Date Balance ($) | | % of Initial Pool

Balance (%) | | Weighted Average Cut-off Date LTV Ratio (%) | | Weighted Average Balloon or ARD LTV

Ratio (%) | | Weighted Average

U/W NCF DSCR (x) | | Weighted Average U/W NOI Debt Yield (%) | | Weighted Average U/W NCF Debt Yield (%) | | Weighted Average Mortgage Rate (%) |

| Retail | | 24 | | | $267,225,432 | | | 37.9 | % | | 56.2 | % | | 51.4 | % | | 2.22 | x | | 11.1 | % | | 10.4 | % | | 4.166 | % |

| Anchored | | 4 | | | 84,600,000 | | | 12.0 | | | 52.3 | | | 51.7 | | | 2.73 | | | 12.0 | | | 10.9 | | | 3.953 | |

| Super Regional Mall | | 2 | | | 75,000,000 | | | 10.6 | | | 51.3 | | | 46.1 | | | 2.35 | | | 11.7 | | | 11.2 | | | 3.875 | |

| Unanchored | | 10 | | | 53,823,505 | | | 7.6 | | | 68.2 | | | 56.8 | | | 1.41 | | | 9.5 | | | 8.9 | | | 4.681 | |

| Outlet Center | | 1 | | | 25,000,000 | | | 3.5 | | | 50.0 | | | 50.0 | | | 2.66 | | | 11.2 | | | 10.8 | | | 3.995 | |

| Shadow Anchored | | 5 | | | 18,463,214 | | | 2.6 | | | 67.7 | | | 56.9 | | | 1.53 | | | 10.5 | | | 9.6 | | | 4.782 | |

| Single Tenant | | 2 | | | 10,338,713 | | | 1.5 | | | 56.4 | | | 51.7 | | | 1.54 | | | 8.3 | | | 8.2 | | | 4.660 | |

| Office | | 6 | | | 156,491,377 | | | 22.2 | | | 49.1 | | | 46.5 | | | 2.49 | | | 11.2 | | | 10.5 | | | 4.072 | |

| CBD | | 1 | | | 60,000,000 | | | 8.5 | | | 31.3 | | | 31.3 | | | 3.27 | | | 12.6 | | | 12.1 | | | 3.651 | |

| Suburban | | 3 | | | 58,791,377 | | | 8.3 | | | 59.4 | | | 54.2 | | | 2.07 | | | 10.9 | | | 10.0 | | | 4.321 | |

| Medical | | 2 | | | 37,700,000 | | | 5.3 | | | 61.3 | | | 58.9 | | | 1.91 | | | 9.6 | | | 8.9 | | | 4.355 | |

| Hospitality | | 76 | | | 117,972,942 | | | 16.7 | | | 59.2 | | | 50.7 | | | 1.88 | | | 13.3 | | | 11.9 | | | 5.002 | |

| Limited Service | | 45 | | | 42,694,630 | | | 6.1 | | | 61.9 | | | 51.6 | | | 1.99 | | | 14.1 | | | 12.5 | | | 4.972 | |

| Select Service | | 2 | | | 31,905,023 | | | 4.5 | | | 57.1 | | | 47.7 | | | 1.70 | | | 12.1 | | | 10.8 | | | 4.879 | |

| Extended Stay | | 25 | | | 28,947,116 | | | 4.1 | | | 59.1 | | | 51.8 | | | 2.07 | | | 14.1 | | | 12.7 | | | 5.062 | |

| Full Service | | 4 | | | 14,426,173 | | | 2.0 | | | 56.3 | | | 52.6 | | | 1.62 | | | 12.0 | | | 10.7 | | | 5.243 | |

| Industrial | | 11 | | | 70,707,684 | | | 10.0 | | | 65.8 | | | 55.4 | | | 1.63 | | | 11.0 | | | 9.8 | | | 4.426 | |

| Warehouse | | 4 | | | 39,955,975 | | | 5.7 | | | 68.5 | | | 59.2 | | | 1.54 | | | 10.2 | | | 9.2 | | | 4.340 | |

| Flex | | 7 | | | 30,751,709 | | | 4.4 | | | 62.3 | | | 50.5 | | | 1.75 | | | 12.1 | | | 10.6 | | | 4.537 | |

| Self Storage | | 10 | | | 29,671,066 | | | 4.2 | | | 61.7 | | | 54.9 | | | 1.82 | | | 10.1 | | | 9.9 | | | 4.751 | |

| Self Storage | | 10 | | | 29,671,066 | | | 4.2 | | | 61.7 | | | 54.9 | | | 1.82 | | | 10.1 | | | 9.9 | | | 4.751 | |

| Other | | 13 | | | 29,526,304 | | | 4.2 | | | 60.1 | | | 54.1 | | | 1.91 | | | 9.2 | | | 9.2 | | | 3.964 | |

| Leased Fee | | 13 | | | 29,526,304 | | | 4.2 | | | 60.1 | | | 54.1 | | | 1.91 | | | 9.2 | | | 9.2 | | | 3.964 | |

| Mixed Use | | 2 | | | 12,515,141 | | | 1.8 | | | 62.0 | | | 54.6 | | | 1.33 | | | 8.6 | | | 8.3 | | | 4.734 | |

| Multifamily/Retail | | 2 | | | 12,515,141 | | | 1.8 | | | 62.0 | | | 54.6 | | | 1.33 | | | 8.6 | | | 8.3 | | | 4.734 | |

| Manufactured Housing Community | | 4 | | | 10,670,154 | | | 1.5 | | | 61.1 | | | 48.8 | | | 1.53 | | | 10.2 | | | 10.0 | | | 4.909 | |

| Manufactured Housing Community | | 4 | | | 10,670,154 | | | 1.5 | | | 61.1 | | | 48.8 | | | 1.53 | | | 10.2 | | | 10.0 | | | 4.909 | |

| Multifamily | | 4 | | | 10,599,416 | | | 1.5 | | | 54.1 | | | 41.9 | | | 1.67 | | | 14.1 | | | 13.1 | | | 4.687 | |

| Garden | | 4 | | | 10,599,416 | | | 1.5 | | | 54.1 | | | 41.9 | | | 1.67 | | | 14.1 | | | 13.1 | | | 4.687 | |

| Total/Weighted Average: | | 150 | | | $705,379,517 | | | 100.0 | % | | 56.6 | % | | 50.7 | % | | 2.10 | x | | 11.4 | % | | 10.5 | % | | 4.357 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

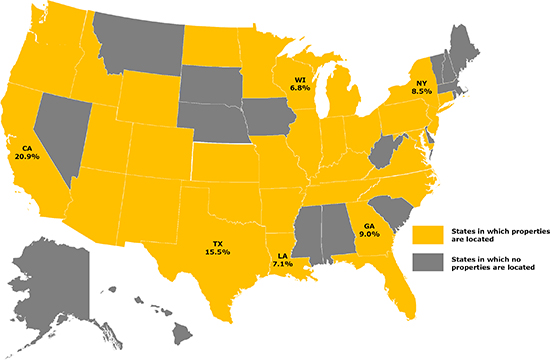

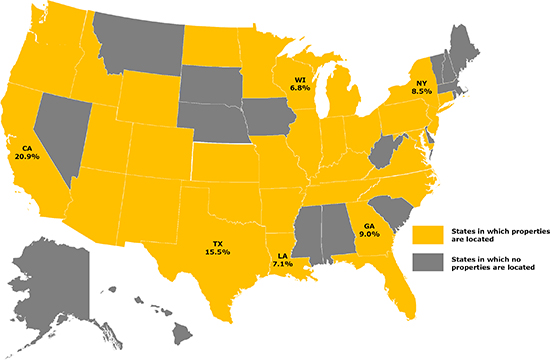

| F. | Geographic Distribution(1)(2) |

| Location | | Number of Mortgaged Properties | | Aggregate

Cut-off Date Balance ($) | | % of Initial

Pool

Balance (%) | | Weighted Average Cut-off Date LTV Ratio (%) | | Weighted Average Balloon or ARD LTV Ratio (%) | | Weighted Average U/W NCF DSCR (x) | | Weighted Average U/W NOI Debt Yield (%) | | Weighted Average U/W NCF Debt Yield (%) | | Weighted Average Mortgage Rate (%) |

| California | | 26 | | | $147,441,696 | | | 20.9 | % | | 54.0 | % | | 52.2 | % | | 2.28 | x | | 10.6 | % | | 10.1 | % | | 4.209 | % |

| Southern | | 8 | | | 114,108,867 | | | 16.2 | | | 52.4 | | | 51.4 | | | 2.37 | | | 10.7 | | | 10.1 | | | 4.146 | |

| Northern | | 18 | | | 33,332,829 | | | 4.7 | | | 59.3 | | | 54.6 | | | 1.97 | | | 10.5 | | | 10.1 | | | 4.422 | |

| Texas | | 35 | | | 109,055,949 | | | 15.5 | | | 62.9 | | | 54.0 | | | 1.80 | | | 11.9 | | | 10.8 | | | 4.773 | |

| Georgia | | 5 | | | 63,342,577 | | | 9.0 | | | 59.7 | | | 55.6 | | | 2.25 | | | 10.8 | | | 9.8 | | | 4.115 | |

| New York | | 1 | | | 60,000,000 | | | 8.5 | | | 31.3 | | | 31.3 | | | 3.27 | | | 12.6 | | | 12.1 | | | 3.651 | |

| Louisiana | | 1 | | | 50,000,000 | | | 7.1 | | | 57.0 | | | 49.3 | | | 1.85 | | | 11.1 | | | 10.6 | | | 3.984 | |

| Wisconsin | | 6 | | | 47,911,840 | | | 6.8 | | | 57.3 | | | 54.5 | | | 2.15 | | | 10.7 | | | 10.1 | | | 4.100 | |

| Other(3) | | 76 | | | 227,627,454 | | | 32.3 | | | 61.0 | | | 51.5 | | | 1.83 | | | 11.6 | | | 10.5 | | | 4.642 | |

| Total/Weighted Average | | 150 | | | $705,379,517 | | | 100.0 | % | | 56.6 | % | | 50.7 | % | | 2.10 | x | | 11.4 | % | | 10.5 | % | | 4.357 | % |

| (1) | The mortgaged properties are located in 33 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan.See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 27 other states.

|

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 1,293,835 - 2,000,000 | | 6 | | $10,707,694 | | 1.5 | % |

| 2,000,001 - 3,000,000 | | 6 | | 15,304,192 | | 2.2 | |

| 3,000,001 - 4,000,000 | | 10 | | 34,756,548 | | 4.9 | |

| 4,000,001 - 5,000,000 | | 7 | | 31,734,667 | | 4.5 | |

| 5,000,001 - 6,000,000 | | 6 | | 33,867,240 | | 4.8 | |

| 6,000,001 - 7,000,000 | | 3 | | 18,944,667 | | 2.7 | |

| 7,000,001 - 8,000,000 | | 1 | | 7,050,000 | | 1.0 | |

| 8,000,001 - 9,000,000 | | 2 | | 16,970,439 | | 2.4 | |

| 9,000,001 - 10,000,000 | | 4 | | 38,676,304 | | 5.5 | |

| 10,000,001 - 15,000,000 | | 6 | | 73,306,898 | | 10.4 | |

| 15,000,001 - 20,000,000 | | 4 | | 77,310,867 | | 11.0 | |

| 20,000,001 - 30,000,000 | | 5 | | 127,300,000 | | 18.0 | |

| 30,000,001 - 50,000,000 | | 4 | | 159,450,000 | | 22.6 | |

| 50,000,001 - 60,000,000 | | 1 | | 60,000,000 | | 8.5 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Average | | $10,851,993 | | | | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 1.28 | | 1 | | $1,706,163 | | 0.2 | % |

| 1.29 - 1.40 | | 6 | | 22,885,155 | | 3.2 | |

| 1.41 - 1.50 | | 14 | | 79,028,606 | | 11.2 | |

| 1.51 - 1.60 | | 4 | | 13,985,272 | | 2.0 | |

| 1.61 - 1.70 | | 7 | | 49,601,200 | | 7.0 | |

| 1.71 - 1.80 | | 7 | | 86,992,926 | | 12.3 | |

| 1.81 - 1.90 | | 2 | | 12,823,901 | | 1.8 | |

| 1.91 - 2.00 | | 4 | | 64,772,995 | | 9.2 | |

| 2.01 - 2.50 | | 11 | | 142,542,240 | | 20.2 | |

| 2.51 - 3.00 | | 4 | | 70,641,061 | | 10.0 | |

| 3.01 - 3.50 | | 4 | | 134,600,000 | | 19.1 | |

| 3.51 - 3.57 | | 1 | | 25,800,000 | | 3.7 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 2.26x | | | | | |

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 1.16 | | 1 | | $1,706,163 | | 0.2 | % |

| 1.17 - 1.30 | | 2 | | 3,884,904 | | 0.6 | |

| 1.31 - 1.40 | | 16 | | 86,939,916 | | 12.3 | |

| 1.41 - 1.50 | | 9 | | 67,074,269 | | 9.5 | |

| 1.51 - 1.60 | | 10 | | 93,885,557 | | 13.3 | |

| 1.61 - 1.70 | | 1 | | 7,050,000 | | 1.0 | |

| 1.71 - 1.80 | | 4 | | 22,676,308 | | 3.2 | |

| 1.81 - 1.90 | | 3 | | 58,579,099 | | 8.3 | |

| 1.91 - 2.00 | | 2 | | 40,195,455 | | 5.7 | |

| 2.01 - 2.50 | | 10 | | 131,687,846 | | 18.7 | |

| 2.51 - 3.00 | | 4 | | 80,900,000 | | 11.5 | |

| 3.01 - 3.34 | | 3 | | 110,800,000 | | 15.7 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 2.10x | | | | | |

| LOAN PURPOSE |

| Loan Purpose | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Refinance | | 50 | | $523,753,394 | | 74.3 | % |

| Recapitalization | | 3 | | 95,000,000 | | 13.5 | |

| Acquisition | | 12 | | 86,626,123 | | 12.3 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| MORTGAGE RATE |

| Range of Mortgage Rates (%) | | Number of Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 3.651 - 3.750 | | 2 | | $85,000,000 | | 12.1 | % |

| 3.751 - 4.000 | | 5 | | 160,400,000 | | 22.7 | |

| 4.001 - 4.250 | | 5 | | 78,736,963 | | 11.2 | |

| 4.251 - 4.500 | | 11 | | 109,913,920 | | 15.6 | |

| 4.501 - 4.750 | | 16 | | 105,237,348 | | 14.9 | |

| 4.751 - 5.000 | | 15 | | 74,690,525 | | 10.6 | |

| 5.001 - 5.250 | | 5 | | 51,816,287 | | 7.3 | |

| 5.251 - 5.500 | | 5 | | 37,878,311 | | 5.4 | |

| 5.501 - 6.000 | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 4.357% | | | | | |

| UNDERWRITTEN NOI DEBT YIELD |

| Range of U/W NOI Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 7.9 | | 1 | | $7,050,000 | | 1.0 | % |

| 8.0 - 9.0 | | 7 | | 63,206,209 | | 9.0 | |

| 9.1 - 10.0 | | 19 | | 102,198,061 | | 14.5 | |

| 10.1 - 11.0 | | 13 | | 152,871,171 | | 21.7 | |

| 11.1 - 12.0 | | 7 | | 146,935,969 | | 20.8 | |

| 12.1 - 13.0 | | 7 | | 117,319,355 | | 16.6 | |

| 13.1 - 14.0 | | 6 | | 84,479,742 | | 12.0 | |

| 14.1 - 15.0 | | 1 | | 5,991,508 | | 0.8 | |

| 15.1 - 16.0 | | 3 | | 23,621,337 | | 3.3 | |

| 16.1 - 28.1 | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 11.4% | | | | | |

| UNDERWRITTEN NCF DEBT YIELD |

| Range of U/W NCF Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 7.7 | | 1 | | $7,050,000 | | 1.0 | % |

| 7.8 - 9.0 | | 17 | | 119,667,697 | | 17.0 | |

| 9.1 - 10.0 | | 21 | | 197,313,910 | | 28.0 | |

| 10.1 - 11.0 | | 9 | | 158,935,899 | | 22.5 | |

| 11.1 - 12.0 | | 2 | | 12,721,759 | | 1.8 | |

| 12.1 - 13.0 | | 11 | | 184,362,752 | | 26.1 | |

| 13.1 - 14.0 | | 2 | | 17,467,731 | | 2.5 | |

| 14.1 - 15.0 | | 1 | | 6,153,606 | | 0.9 | |

| 15.1 - 25.5 | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 10.5% | | | | | |

| ORIGINAL TERM TO MATURITY OR ARD |

Range of Original Terms to

Maturity or ARD (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 60 - 84 | | 2 | | $22,195,940 | | 3.1 | % |

| 85 - 120 | | 62 | | 681,477,413 | | 96.6 | |

| 121 - 240 | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 118 months | | | | | |

| (1) | The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity or ARD) and may be currently prepayable. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Wells Fargo Commercial Mortgage Trust 2017-C40 | Characteristics of the Mortgage Pool |

| REMAINING TERM TO MATURITY OR ARD | | | | | | | |

Range of Remaining Terms to

Maturity or ARD (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 55 - 60 | | 2 | | $22,195,940 | | 3.1 | % |

| 61 - 84 | | 1 | | 1,706,163 | | 0.2 | |

| 85 - 120 | | 62 | | 681,477,413 | | 96.6 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 116 months | | | | | |

| ORIGINAL AMORTIZATION TERM(2) | | | | | | | |

Range of Original

Amortization Terms

(months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Non- Amortizing | | 13 | | $298,925,000 | | 42.4 | % |

| 240 | | 3 | | 12,526,302 | | 1.8 | |

| 241 - 300 | | 3 | | 19,293,062 | | 2.7 | |

| 301 - 360 | | 46 | | 374,635,153 | | 53.1 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average(3): | | 353 months | | | | | |

| (2) | The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (3) | Excludes the non-amortizing mortgage loans. |

| REMAINING AMORTIZATION TERM(4) | | | | | | | |

Range of Remaining Amortization Terms

(months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Non-Amortizing | | 13 | | $298,925,000 | | 42.4 | % |

| 61 - 120 | | 1 | | 1,706,163 | | 0.2 | |

| 121 - 240 | | 2 | | 10,820,139 | | 1.5 | |

| 241 - 300 | | 3 | | 19,293,062 | | 2.7 | |

| 301 - 360 | | 46 | | 374,635,153 | | 53.1 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average(5): | | 352 months | | | | | |

| (4) | The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (5) | Excludes the non-amortizing mortgage loans. |

| LOCKBOXES |

| Type of Lockbox | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Springing | | 44 | | $340,992,508 | | 48.3 | % |

| Hard/Springing Cash Management | | 13 | | 273,639,785 | | 38.8 | |

| Hard/Upfront Cash Management | | 2 | | 59,500,000 | | 8.4 | |

| None | | 5 | | 21,247,224 | | 3.0 | |

| Soft/Springing Cash Management | | 1 | | 10,000,000 | | 1.4 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| PREPAYMENT PROVISION SUMMARY(6) | | | | | | | |

| Prepayment Provision | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Lockout / Defeasance / Open | | 53 | | $624,920,938 | | 88.6 | % |

| Lockout / GRTR 1% or YM / Open | | 8 | | 54,852,416 | | 7.8 | |

| Lockout / GRTR 1% or YM or Defeasance / Open | | 3 | | 23,900,000 | | 3.4 | |

| Lockout / Defeasance / GRTR 1% or YM / Open | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| (6) | As a result of property releases or the application of funds in a performance reserve, partial principal prepayments could occur during a period that voluntary principal prepayments are otherwise prohibited. |

CUT-OFF DATE LOAN-TO-VALUE RATIO | | | | | | | |

Range of Cut-off Date LTV

Ratios (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 21.9 - 30.0 | | 1 | | $1,706,163 | | 0.2 | % |

| 30.1 - 35.0 | | 1 | | 60,000,000 | | 8.5 | |

| 35.1 - 40.0 | | 1 | | 25,000,000 | | 3.5 | |

| 40.1 - 45.0 | | 3 | | 18,782,569 | | 2.7 | |

| 45.1 - 50.0 | | 5 | | 64,817,806 | | 9.2 | |

| 50.1 - 55.0 | | 3 | | 46,686,365 | | 6.6 | |

| 55.1 - 60.0 | | 15 | | 244,489,043 | | 34.7 | |

| 60.1 - 65.0 | | 8 | | 42,172,504 | | 6.0 | |

| 65.1 - 70.0 | | 17 | | 101,823,531 | | 14.4 | |

| 70.1 - 74.4 | | 11 | | 99,901,536 | | 14.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 56.6% | | | | | |

BALLOON OR ARD LOAN-TO-VALUE RATIO | | | | | | | |

| Range of Balloon or ARD LTV Ratios (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 1.3 - 25.0 | | 1 | | $1,706,163 | | 0.2 | % |

| 25.1 - 30.0 | | 1 | | 9,526,304 | | 1.4 | |

| 30.1 - 35.0 | | 2 | | 66,491,061 | | 9.4 | |

| 35.1 - 40.0 | | 5 | | 36,776,845 | | 5.2 | |

| 40.1 - 45.0 | | 4 | | 16,675,078 | | 2.4 | |

| 45.1 - 50.0 | | 8 | | 180,579,390 | | 25.6 | |

| 50.1 - 55.0 | | 12 | | 105,418,833 | | 14.9 | |

| 55.1 - 60.0 | | 23 | | 209,051,803 | | 29.6 | |

| 60.1 - 65.0 | | 8 | | 59,154,040 | | 8.4 | |

| 65.1 - 65.6 | | 1 | | 20,000,000 | | 2.8 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 50.7% | | | | | |

AMORTIZATION TYPE | | | | | | | |

| Amortization Type | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| Interest-only, Balloon | | 12 | | $278,925,000 | | 39.5 | % |

| Amortizing Balloon | | 34 | | 228,448,354 | | 32.4 | |

| Interest-only, Amortizing Balloon | | 17 | | 176,300,000 | | 25.0 | |

| Interest-only, ARD | | 1 | | 20,000,000 | | 2.8 | |

| Fully Amortizing | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 12 | | 1 | | $4,125,000 | | 0.6 | % |

| 18 | | 1 | | 5,000,000 | | 0.7 | |

| 24 | | 12 | | 85,525,000 | | 12.1 | |

| 36 | | 2 | | 59,150,000 | | 8.4 | |

| 60 | | 1 | | 22,500,000 | | 3.2 | |

| Total: | | 17 | | $176,300,000 | | 25.0 | % |

| Weighted Average: | | 32 months | | | | | |

SEASONING | | | | | | |

| Seasoning (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | Percent by

Aggregate Cut-

off Date Pool

Balance (%) |

| 0 | | 3 | | $38,450,000 | | 5.5 | % |

| 1 | | 24 | | 296,262,567 | | 42.0 | |

| 2 | | 20 | | 158,599,358 | | 22.5 | |

| 3 | | 10 | | 48,530,904 | | 6.9 | |

| 4 | | 4 | | 114,905,023 | | 16.3 | |

| 5 | | 2 | | 26,925,501 | | 3.8 | |

| 6 | | 1 | | 20,000,000 | | 2.8 | |

| 179 | | 1 | | 1,706,163 | | 0.2 | |

| Total: | | 65 | | $705,379,517 | | 100.0 | % |

| Weighted Average: | | 3 months | | | | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

(THIS PAGE INTENTIONALLY LEFT BLANK)

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

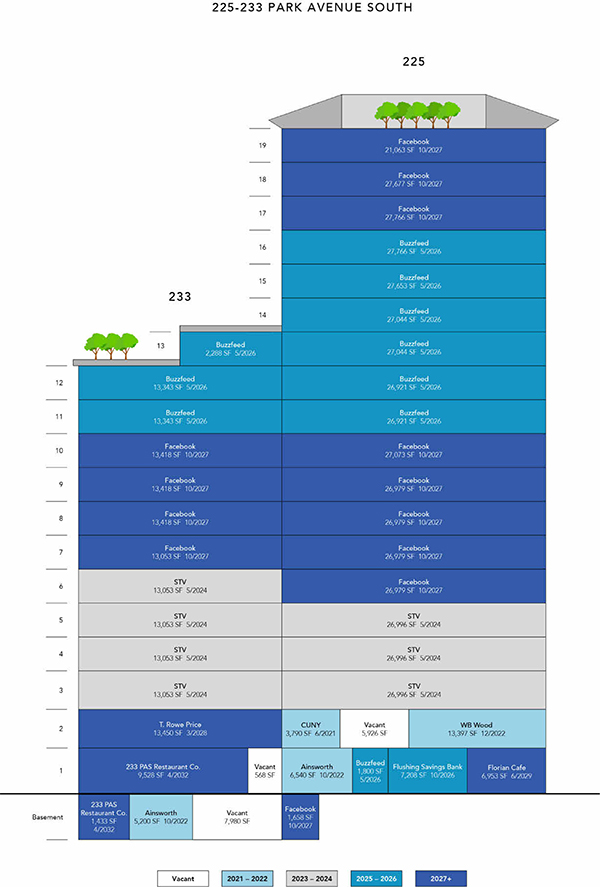

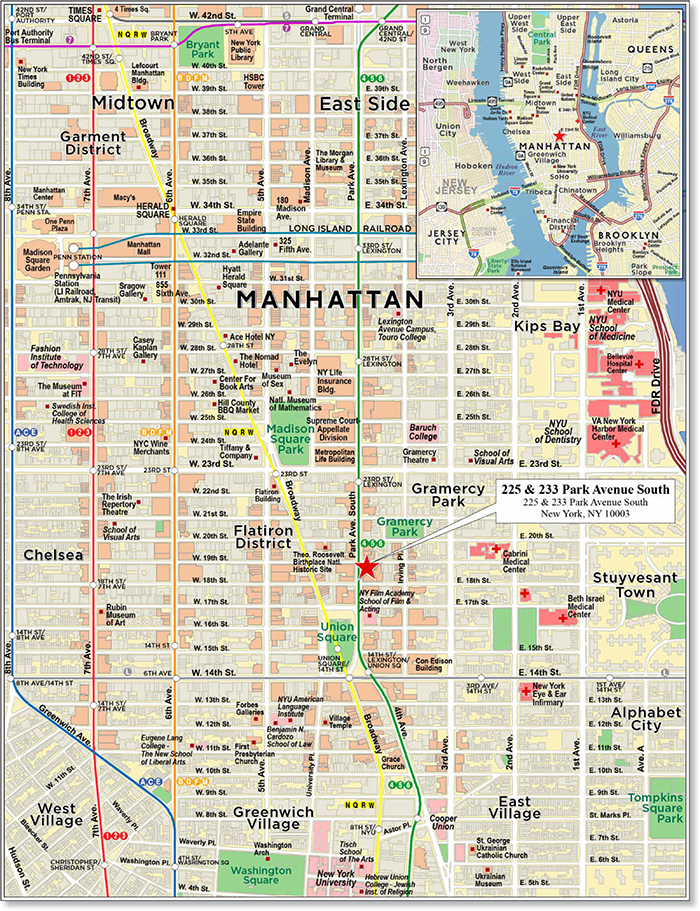

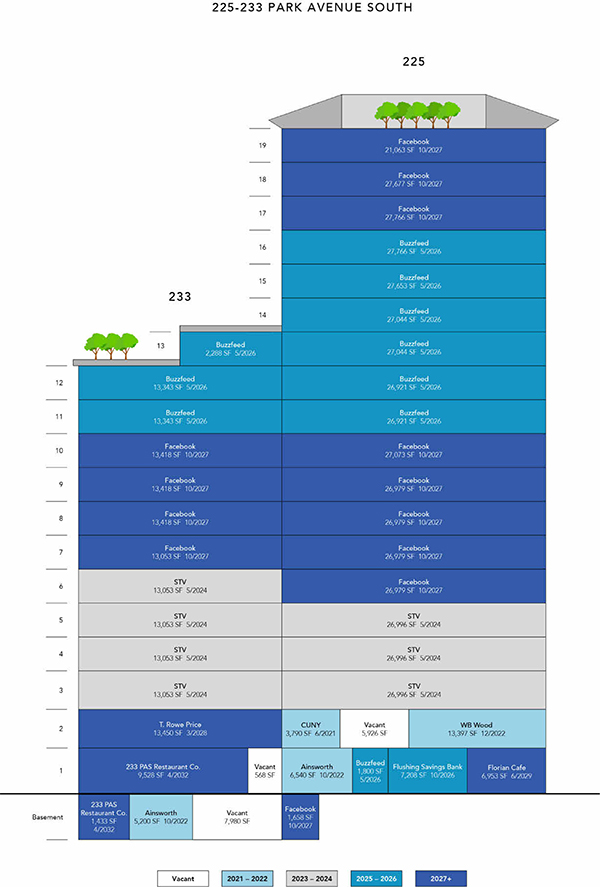

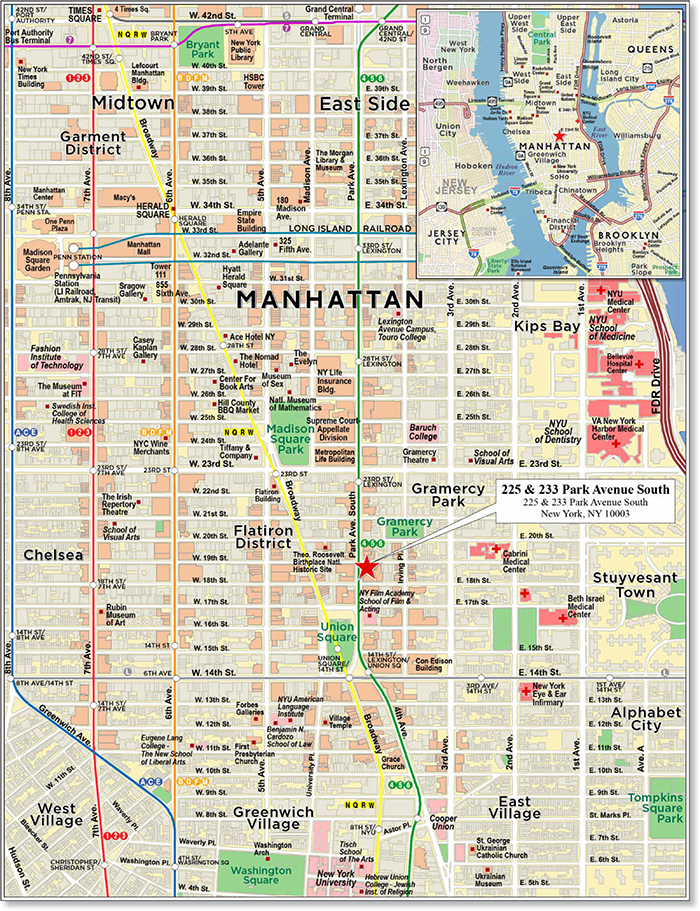

225 & 233 PARK AVENUE SOUTH

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

225 & 233 PARK AVENUE SOUTH

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

225 & 233 PARK AVENUE SOUTH

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

19

| No. 1 – 225 & 233 Park Avenue South |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Barclays Bank PLC | | Single Asset/Portfolio: | Single Asset |

Credit Assessment

(Fitch/KBRA/Moody’s): | BBB+/A/NR | | Property Type: | Office |

| Original Principal Balance(1): | $60,000,000 | | Specific Property Type: | CBD |

| Cut-off Date Balance(1): | $60,000,000 | | Location: | New York, NY |

| % of Initial Pool Balance: | 8.5% | | Size: | 675,756 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $347.76 |

| Borrower Name: | 225 Fourth LLC | | Year Built/Renovated: | 1909/2017 |

| Borrower Sponsor: | Orda Management Corporation | | Title Vesting: | Fee |

| Mortgage Rate: | 3.6514% | | Property Manager: | Self-Managed |

| Note Date: | May 31, 2017 | | 4thMost Recent Occupancy (As of)(5): | 100.0% (12/31/2013) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of)(5): | 95.8% (12/31/2014) |

| Maturity Date: | June 6, 2027 | | 2ndMost Recent Occupancy (As of)(5): | 49.2% (12/31/2015) |

| IO Period: | 120 months | | Most Recent Occupancy (As of)(5): | 96.6% (12/31/2016) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of)(5)(6)(7): | 97.9% (5/24/2017) |

| Seasoning: | 4 months | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | 4thMost Recent NOI (As of)(8): | $21,053,461 (12/31/2014) |

| Interest Accrual Method: | Actual/360 | | 3rdMost Recent NOI (As of)(8): | $22,749,971 (12/31/2015) |

| Call Protection(2): | L(28),D(87),O(5) | | 2ndMost Recent NOI (As of)(8): | $16,244,360 (12/31/2016) |

| Lockbox Type: | Hard/Springing Cash Management | | Most Recent NOI (As of)(8): | $15,248,156 (TTM 3/31/2017) |

| Additional Debt(1): | Yes | | | |

| Additional Debt Type(1)(3): | Pari Passu; Mezzanine; Future Mezzanine | | |

| | | | U/W Revenues: | $48,106,942 |

| | | | U/W Expenses: | $18,601,103 |

| | | | U/W NOI(8): | $29,505,839 |

| Escrows and Reserves(4): | | | U/W NCF: | $28,439,583 |

| | | | U/W NOI DSCR(1)(7): | 3.39x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF DSCR(1)(7): | 3.27x |

| Taxes | $0 | Springing | NAP | | U/W NOI Debt Yield(1)(7): | 12.6% |

| Insurance | $0 | Springing | NAP | | U/W NCF Debt Yield(1)(7): | 12.1% |

| Replacement Reserves | $0 | Springing | NAP | | As-Is Appraised Value(9): | $750,000,000 |

| TI/LC Reserve | $8,106,455 | Springing | NAP | | As-Is Appraisal Valuation Date: | April 1, 2017 |

| Remaining Capital Expenditures | $11,529,288 | $0 | NAP | | Cut-off Date LTV Ratio(1)(9): | 31.3% |

| Free Rent Reserve | $14,864,252 | $0 | NAP | | LTV Ratio at Maturity or ARD(1)(9): | 31.3% |

| Buzzfeed Rollover Reserve | $0 | Springing | $13,000,000 | | | |

| | | | | | | |

| | | | | | | | | |

| (1) | See “The Mortgage Loan” section. All statistical information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on the 225 & 233 Park Avenue South Whole Loan (as defined below). The Cut-off Date LTV Ratio, U/W NCF DSCR and U/W NOI Debt Yield based on the 225 & 233 Park Avenue South Total Debt (as defined below), including the 225 & 233 Park Avenue South Mezzanine Loan (as defined below), are 57.3%, 1.59x and 6.9%, respectively. |

| (2) | The lockout period will be at least 28 payments, beginning with and including the first payment date of July 6, 2017. Defeasance of the 225 & 233 Park Avenue South Mortgage Loan is permitted at any time after the earlier to occur of (i) May 31, 2020 or (ii) two years after the closing date of the securitization that includes the last note to be securitized. |

| (3) | See “Subordinate and Mezzanine Indebtedness” section. |

| (4) | See “Escrows” section. |

| (5) | See “Historical Occupancy” section. |

| (6) | Current Occupancy includes the Facebook Expansion Space (as defined below) and Facebook’s 8th floor space (40,397 square feet), which have lease commencement dates of July 1, 2018 and June 1, 2017, respectively. The tenant is currently building out both spaces. The tenant expects to take occupancy of the 8th floor space in November 2017. All free rent amounts attributable to both spaces were deposited into escrow by the borrower on the origination date. |

| (7) | In September 2017, the borrower indicated that two tenants, Florian Café and Ainsworth, comprising in the aggregate, 2.8% of the net rentable area and 2.6% of the underwritten rent, have vacated their respective spaces. Excluding these two tenants, the U/W NOI DSCR, U/W NCF DSCR, U/W NOI Debt Yield and U/W NCF Debt Yield is 3.29x, 3.17x, 12.2% and 11.7%, respectively. Per the borrower, it is in negotiations with two restaurant tenants for the available space, with one of the spaces expected to be signed at a similar rental rate and the other expected to be signed at a higher rental rate. |

| (8) | See “Cash Flow Analysis” section. |

| (9) | See “Appraisal” section. The As-Is Appraised Value reflects the “As-is assuming holdbacks” value for the 225 & 233 Park Avenue South Property (as defined below) which assumes that all outstanding amounts for TI/LCs, free rent and capital expenditures are deposited into escrow on the origination date. The borrower deposited all such amounts into escrow on the origination date. The “As-is” appraised value is $720,000,000, which represents a Cut-off Date LTV Ratio and an LTV at Maturity or ARD for the 225 & 233 Park Avenue South Whole Loan and 225 & 233 Park Avenue South Total Debt of 32.6% and 59.7%, respectively. |

The Mortgage Loan.The mortgage loan (the “225 & 233 Park Avenue South Mortgage Loan”) is part of a whole loan (the “225 & 233 Park Avenue South Whole Loan”) evidenced by fourpari passu notes secured by a first mortgage encumbering the fee interest in two, contiguous office buildings located on Park Avenue South between East 18th and East 19th streets in Manhattan, New York (the “225 & 233 Park Avenue South Property”). The 225 & 233 Park Avenue South Whole Loan was originated on May 31, 2017 by Barclays Bank PLC. The 225 & 233 Park Avenue South Whole Loan had an original principal balance of $235,000,000, has an

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

20

225 & 233 PARK AVENUE SOUTH

outstanding principal balance as of the Cut-off Date of $235,000,000 and accrues interest at an interest rate of 3.6514%per annum. The 225 & 233 Park Avenue South Whole Loan had an initial term of 120 months, has a remaining term of 116 months as of the Cut-off Date and requires payments of interest-only through the term of the 225 & 233 Park Avenue South Whole Loan. The 225 & 233 Park Avenue South Whole Loan matures on June 6, 2027.