| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-04 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$774,228,768

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2019-C49

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Ladder Capital Finance LLC

Rialto Mortgage Finance, LLC

Barclays Capital Real Estate Inc.

C-III Commercial Mortgage LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2019-C49

February 6, 2019

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | | BARCLAYS Co-Lead Manager and Joint Bookrunner |

| | | |

Academy Securities Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2019-C49 | Transaction Highlights |

A. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number of

Mortgage Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off Date Balance | | % of Initial Pool

Balance |

| Wells Fargo Bank, National Association | | 20 | | 23 | | $291,272,404 | | 37.6% |

| Ladder Capital Finance LLC | | 14 | | 15 | | 169,669,884 | | 21.9 |

| Rialto Mortgage Finance, LLC | | 13 | | 13 | | 150,175,367 | | 19.4 |

| Barclays Capital Real Estate Inc. | | 9 | | 9 | | 119,703,524 | | 15.5 |

| C-III Commercial Mortgage LLC | | 8 | | 11 | | 43,407,589 | | 5.6 |

Total | | 64 | | 71 | | $774,228,768 | | 100.0% |

Loan Pool:

| Initial Pool Balance: | $774,228,768 |

| Number of Mortgage Loans: | 64 |

| Average Cut-off Date Balance per Mortgage Loan: | $12,097,324 |

| Number of Mortgaged Properties: | 71 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $10,904,631 |

| Weighted Average Mortgage Interest Rate: | 5.158% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 46.0% |

| Weighted Average Original Term to Maturity or ARD (months): | 116 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 115 |

| Weighted Average Original Amortization Term (months)(2): | 354 |

| Weighted Average Remaining Amortization Term (months)(2): | 353 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.76x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.9% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 62.8% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 58.3% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 0.0% |

| % of Mortgage Loans with Single Tenants(3): | 8.9% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2019-C49 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| Loan Name | Mortgage Loan Seller in WFCM 2019-C49 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| Dominion Tower | LCF | A-1 | $30,350,000 | LCF | Yes | Wells Fargo Bank, National Association(2) | Midland Loan Services, a Division of PNC Bank, National Association(2) |

| A-2A | $15,650,000 | LCF | No |

| A-3A | $15,350,000 | WFCM 2019-C49 | No |

| One River Place | Barclays | A-1 | $15,000,000 | BBCMS 2018-C2 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| A-2 | $10,000,000 | WFCM 2019-C49 | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The related whole loan is expected to initially be serviced under the WFCM 2019-C49 pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2019-C49 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2019-C49 | Characteristics of the Mortgage Pool |

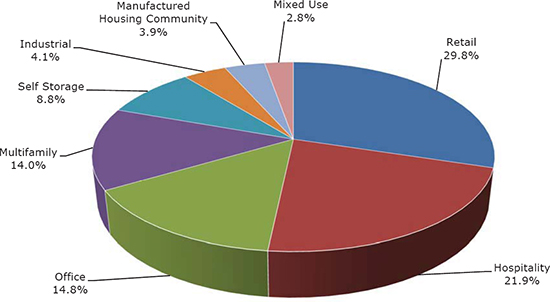

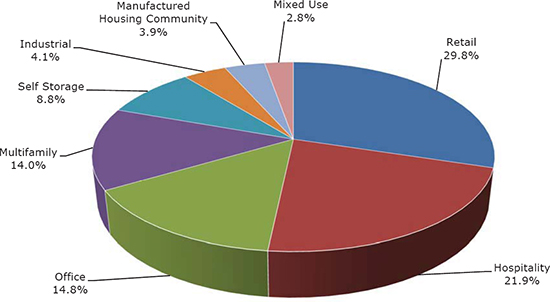

C. Property Type Distribution(1)

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date

Balance ($) | % of Initial

Pool

Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV

Ratio (%) | Weighted Average

U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Retail | 17 | $230,671,236 | 29.8% | 64.1% | 60.5% | 1.69x | 10.0% | 9.5% | 5.055% |

| Anchored | 7 | 158,929,896 | 20.5 | 64.6 | 62.3 | 1.68 | 9.6 | 9.1 | 5.035 |

| Shadow Anchored | 2 | 34,487,500 | 4.5 | 65.4 | 58.4 | 1.73 | 11.5 | 11.0 | 4.919 |

| Single Tenant | 6 | 26,629,277 | 3.4 | 57.8 | 52.8 | 1.78 | 10.6 | 10.5 | 5.245 |

| Unanchored | 2 | 10,624,564 | 1.4 | 69.0 | 59.5 | 1.44 | 9.4 | 9.1 | 5.330 |

| Hospitality | 9 | 169,452,609 | 21.9 | 62.6 | 54.4 | 1.97 | 13.9 | 12.5 | 5.361 |

| Full Service | 4 | 88,091,940 | 11.4 | 63.0 | 52.5 | 1.90 | 14.4 | 12.7 | 5.334 |

| Extended Stay | 3 | 65,784,928 | 8.5 | 62.0 | 57.7 | 2.15 | 13.6 | 12.4 | 5.316 |

| Limited Service | 2 | 15,575,741 | 2.0 | 62.7 | 51.0 | 1.57 | 12.8 | 11.3 | 5.697 |

| Office | 10 | 114,667,011 | 14.8 | 65.3 | 61.9 | 1.97 | 11.8 | 10.6 | 4.959 |

| Suburban | 7 | 87,767,011 | 11.3 | 66.4 | 63.3 | 1.96 | 11.7 | 10.4 | 4.927 |

| CBD | 2 | 25,350,000 | 3.3 | 62.6 | 57.9 | 1.91 | 11.8 | 10.9 | 5.071 |

| R&D | 1 | 1,550,000 | 0.2 | 43.1 | 43.1 | 3.26 | 16.9 | 16.5 | 4.985 |

| Multifamily | 10 | 108,372,091 | 14.0 | 62.7 | 59.8 | 1.38 | 8.4 | 8.1 | 5.290 |

| Garden | 7 | 65,672,091 | 8.5 | 64.4 | 61.0 | 1.42 | 8.7 | 8.4 | 5.258 |

| Mid-Rise | 1 | 17,700,000 | 2.3 | 56.4 | 56.4 | 1.39 | 7.6 | 7.5 | 5.320 |

| Student Housing | 1 | 14,100,000 | 1.8 | 61.6 | 54.9 | 1.29 | 8.9 | 8.6 | 5.350 |

| Mid Rise | 1 | 10,900,000 | 1.4 | 64.5 | 64.5 | 1.29 | 7.1 | 7.0 | 5.355 |

| Self Storage | 9 | 67,846,128 | 8.8 | 61.7 | 57.8 | 1.83 | 10.5 | 10.3 | 4.953 |

| Self Storage | 9 | 67,846,128 | 8.8 | 61.7 | 57.8 | 1.83 | 10.5 | 10.3 | 4.953 |

| Industrial | 3 | 31,900,000 | 4.1 | 56.4 | 56.4 | 1.83 | 9.8 | 9.6 | 5.180 |

| Warehouse | 2 | 17,500,000 | 2.3 | 51.2 | 51.2 | 1.95 | 10.3 | 10.1 | 5.131 |

| Manufacturing/ Warehouse | 1 | 14,400,000 | 1.9 | 62.6 | 62.6 | 1.69 | 9.2 | 9.0 | 5.239 |

| Manufactured Housing Community | 10 | 29,969,692 | 3.9 | 65.7 | 56.8 | 1.40 | 9.6 | 9.4 | 5.408 |

| Manufactured Housing Community | 10 | 29,969,692 | 3.9 | 65.7 | 56.8 | 1.40 | 9.6 | 9.4 | 5.408 |

| Mixed Use | 3 | 21,350,000 | 2.8 | 46.0 | 44.6 | 1.70 | 10.4 | 9.8 | 5.336 |

| Retail/Office | 2 | 15,800,000 | 2.0 | 45.1 | 45.1 | 1.64 | 9.5 | 9.0 | 5.401 |

| Industrial/Office | 1 | 5,550,000 | 0.7 | 48.3 | 42.9 | 1.85 | 13.1 | 12.1 | 5.150 |

| Total/Weighted Average: | 71 | $774,228,768 | 100.0% | 62.8% | 58.3% | 1.76x | 10.9% | 10.2% | 5.158% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2019-C49 | Certain Terms and Conditions |

D. Large Loan Summaries

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| No. 1 – Innisfree Portfolio |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Ladder Capital Finance LLC | | Single Asset/Portfolio: | Portfolio |

Credit Assessment (DBRS/Fitch/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Hospitality – Full Service |

| Original Principal Balance: | $58,500,000 | | Location: | Fort Walton Beach, FL |

| Cut-off Date Balance: | $58,415,464 | | Size: | 330 Rooms |

| % of Initial Pool Balance: | 7.5% | | Cut-off Date Balance Per Room | $177,017 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per Room: | $146,725 |

| | | | Year Built/Renovated: | Various/NAP |

| Borrower Sponsor: | Julian MacQueen | | Title Vesting(2): | Leasehold |

| Guarantor: | Julian MacQueen | | Property Manager: | Self-managed |

| Mortgage Rate: | 5.2100% | | Current Occupancy (As of): | 85.2% (11/30/2018) |

| Note Date: | January 29, 2019 | | YE 2017 Occupancy(3): | 80.9% |

| Seasoning: | 1 month | | YE 2016 Occupancy(3): | NAV |

| Maturity Date: | February 6, 2029 | | YE 2015 Occupancy(3): | NAV |

| IO Period: | 0 months | | YE 2014 Occupancy(3): | NAV |

| Loan Term (Original): | 120 months | | Appraised Value: | $94,800,000 |

| Amortization Term (Original): | 360 months | | Appraised Value Per Room: | $287,273 |

| Loan Amortization Type: | Amortizing Balloon | | Appraisal Valuation Date: | August 21, 2018 |

| Call Protection: | L(25),D(91),O(4) | | |

| Lockbox Type: | Hard/Springing Cash Management | | | |

| Additional Debt: | None | | Underwriting and Financial Information |

| Additional Debt Type (Balance): | NAP | | TTM NOI (11/30/2018)(3): | $8,652,214 |

| | | | YE 2017 NOI(3): | $6,094,140 |

| | | | YE 2016 NOI(3): | $3,248,699 |

| | | | YE 2015 NOI(3): | NAV |

| | | | | | U/W Revenues: | $21,874,518 |

| Escrows and Reserves(1) | | U/W Expenses: | $13,502,902 |

| | Initial | Monthly | Cap | | U/W NOI: | $8,371,616 |

| Taxes | $131,683 | $43,894 | NAP | | U/W NCF: | $7,496,635 |

| Insurance | $213,199 | $23,689 | NAP | | U/W DSCR based on NOI/NCF: | 2.17x / 1.94x |

| FF&E Reserve | $0 | (1) | NAP | | U/W Debt Yield based on NOI/NCF: | 14.3% / 12.8% |

| PIP Reserve | $0 | (1) | NAP | | U/W Debt Yield at Maturity based on NOI/NCF: | 17.3% / 15.5% |

| Seasonality Reserve | $0 | (1) | NAP | | Cut-off Date LTV Ratio: | 61.6% |

| Ground Lease Reserve | $0 | (1) | NAP | | LTV Ratio at Maturity: | 51.1% |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original loan amount | $58,500,000 | | 100.0% | | Loan payoff | $48,731,340 | | 83.3 | % |

| | | | | | Upfront reserves | 344,882 | | 0.6 | |

| | | | | | Closing costs | 1,180,859 | | 2.0 | |

| | | | | | Return of equity | 8,242,919 | | 14.1 | |

| Total Sources | $58,500,000 | | 100.0% | | Total Uses | $58,500,000 | | 100.0 | % |

| (1) | See “Escrows” section below. |

| (2) | See “Ground Lease” section below. |

| (3) | Occupancy information and historical operating statements for periods prior to 2017 are not available with respect to the entire portfolio because the Hilton Garden Inn Fort Walton Beach property was built and began operations in May 2017. The increase in NOI from YE 2017 to TTM (11/30/2018) can be attributed to the YE 2017 NOI only including income from the Hilton Garden Inn Fort Walton Beach property for the portion of 2017 since it began operations. See “Cash Flow Analysis” section below. |

The Mortgage Loan. The mortgage loan (the “Innisfree Portfolio Mortgage Loan”) is evidenced by three promissory notes secured by a first mortgage encumbering the leasehold interest in two full service hotels, the Hilton Garden Inn Fort Walton Beach and the Holiday Inn Fort Walton Beach, located in Fort Walton Beach, Florida (each an “Innisfree Portfolio Property” and together, the “Innisfree Portfolio Properties”).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $58,415,464 |

| 1299 & 1297 Miracle Strip Parkway Southeast | Innisfree Portfolio | Cut-off Date LTV: | | 61.6% |

| Fort Walton Beach, FL 32548 | | U/W NCF DSCR: | | 1.94x |

| | | U/W NOI Debt Yield: | | 14.3% |

The Borrower and Borrower Sponsor.The borrowers under the Innisfree Portfolio Mortgage Loan are Emerald Breeze Resort Group, LLC (the “Emerald I Borrower”) and Emerald Breeze Resort Group II LLC (the “Emerald II Borrower”), each a Florida limited liability company with an independent director. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Innisfree Portfolio Mortgage Loan. The nonrecourse carve-out guarantor of the Innisfree Portfolio Mortgage Loan is Julian MacQueen.

Mr. MacQueen is the chairman and founder of Innisfree Hotels and has over 30 years of real estate experience. Innisfree Hotels owns or manages over 3,300 hotel rooms and has over 1,500 employees. Since 2011, the company has developed 870 new beachfront rooms along the Gulf Coast.

The Properties.The Innisfree Portfolio Properties include two adjacent beachfront hotels, comprised of a total of 330-rooms located in Fort Walton Beach, Florida on an approximately 17.1 acre site. The Innisfree Portfolio Properties are located in southern Okaloosa County, along the south side of Choctawhatchee Bay and along the Gulf of Mexico, off U.S. Highway 98, which provides access across the Florida Panhandle. The Innisfree Portfolio Properties are 7.3 miles from Destin-Fort Walton Beach Airport, which had a passenger count of 915,650 in 2016, the highest passenger count in its 60-year history and an 18 percent increase over 2015. In 2017, the airport set a new record with 1,134,209 passengers, accounting for an approximately 24% increase over 2016.

The Hilton Garden Inn Fort Walton Beach is a 178-room, full service, five-story oceanfront hotel with a unit mix consisting of 139 double queen rooms, 36 king rooms and 3 king suites. Amenities at the property include an indoor and outdoor pool, a whirlpool, a rock climbing wall, a fitness room, outdoor fire pits, a business center and self-guest laundry facilities. The Holiday Inn Fort Walton Beach is a 152-room, full service, five-story oceanfront hotel with a unit mix consisting of 106 double queen rooms , 30 king rooms and 16 king suites. Amenities at the property include an indoor and outdoor pool, a whirlpool, a fitness room, a gaming room, a business center, and self-guest laundry facilities. Both hotels share the Riptides Grill, a Lobby Bar and the Gilligan’s Tiki Bar. The Innisfree Portfolio Properties are subject to a 50-year ground lease with approximately forty-four years remaining before expiration on October 30, 2062. The monthly ground lease base rent for each hotel is the greater of $12,500 (subject to future upward adjustment based on the Consumer Price Index for all Urban Consumers) and 3.25% of the respective hotel’s monthly revenue.

The surrounding area, referred to as the South Walton Beaches, has several major demand drivers including the area beaches, Wild Willy’s Adventure Zone (0.4 miles), the Air Force Armament Museum (7.0 miles), Big Kahuna’s Water and Adventure Park (7.6 miles), and the Indian Bayou Golf and Country Club (8.3 miles). In addition, the Innisfree Portfolio Properties are located approximately 5.2 miles from Destin Harbor Boardwalk. The Destin Harbor neighborhood features one of the largest commercial sport-fishing fleets on the Gulf Coast.

| Property | Year Built/Renovated | Rooms | Allocated Cut-off Date Principal Balance | % of Portfolio

Cut-off Date Principal Balance | Cut-off Date Principal Balance Per Room | Appraised

Value | % of Appraised Value |

| Hilton Garden Inn Fort Walton Beach | 2017/NAP | 178 | $34,500,000 | 59.0% | $193,820 | $54,700,000 | 57.7% |

| Holiday Inn Fort Walton Beach | 2014/NAP | 152 | $24,000,000 | 41.0% | $157,895 | $40,100,000 | 42.3% |

| Total/Average | | 330 | $58,500,000 | 100.0% | $177,273 | $94,800,000 | 100.0% |

The following table presents certain information relating to the 2017 demand analysis with respect to the Innisfree Portfolio Properties based on market segmentation, as provided in the appraisal:

2017 Market Segmentation

(Hilton Garden Inn Fort Walton Beach)

Corporate | Meeting/Group | Leisure |

| 15.0% | 20.0% | 65.0% |

| | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $58,415,464 |

| 1299 & 1297 Miracle Strip Parkway Southeast | Innisfree Portfolio | Cut-off Date LTV: | | 61.6% |

| Fort Walton Beach, FL 32548 | | U/W NCF DSCR: | | 1.94x |

| | | U/W NOI Debt Yield: | | 14.3% |

2017 Market Segmentation

(Holiday Inn Fort Walton Beach)

Corporate | Meeting/Group | Leisure |

| 10.0% | 10.0% | 80.0% |

| | | |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the Innisfree Portfolio Properties:

Cash Flow Analysis

| | 2017(1) | TTM 11/30/2018 | U/W | % of U/W

Total

Revenue(2) | U/W $ per

Room |

| Occupancy | 80.9% | 85.2% | 85.2% | | |

| ADR | $172.96 | $180.59 | $180.59 | | |

| RevPAR | $140.01 | $153.84 | $153.84 | | |

| | | | | | |

| Room Revenue | $13,599,337 | $18,529,991 | $18,529,991 | 84.7% | $56,151 |

| F&B Revenue | 1,661,142 | 2,658,427 | 2,658,427 | 12.2 | 8,056 |

| Other Revenue(3) | 540,156 | 686,100 | 686,100 | 3.1 | 2,079 |

| Total Revenue(1) | $15,800,635 | $21,874,518 | $21,874,518 | 100.0% | $66,286 |

| | | | | | |

| Room Expense | 2,724,182 | 3,587,261 | 3,587,261 | 16.4 | 10,870 |

| F&B Expense | 1,603,394 | 2,210,506 | 2,210,506 | 10.1 | 6,699 |

| Other Department Expense | 124,237 | 122,771 | 122,771 | 0.6 | 372 |

| Total Department Expenses | 4,451,813 | 5,920,538 | 5,920,538 | 27.1 | 17,941 |

| Gross Operating Income | $11,348,823 | $15,953,980 | $15,953,980 | 72.9% | $48,345 |

| | | | | | |

| Total Undistributed Expenses | 4,307,515 | 6,026,377 | 6,144,114 | 28.1 | 18,619 |

| Gross Operating Profit | $7,041,308 | $9,927,603 | $9,809,866 | 44.8% | $29,727 |

| | | | | | |

| Total Fixed Charges | 947,168 | 1,275,388 | 1,438,250 | 6.6 | 4,358 |

| Total Operating Expenses | $9,706,495 | $13,222,304 | $13,502,902 | 61.7% | $40,918 |

| | | | | | |

| Net Operating Income(1) | $6,094,140 | $8,652,214 | $8,371,616 | 38.3% | $25,369 |

| FF&E | 0 | 0 | 874,981 | 4.0 | 2,651 |

| Net Cash Flow | $6,094,140 | $8,652,214 | $7,496,635 | 34.3% | $22,717 |

| | | | | | |

| NOI DSCR | 1.58x | 2.24x | 2.17x | | |

| NCF DSCR | 1.58x | 2.24x | 1.94x | | |

| NOI DY | 10.4% | 14.8% | 14.3% | | |

| NCF DY | 10.4% | 14.8% | 12.8% | | |

| | | | | | |

| (1) | Historical operating statements for periods prior to 2017 are not available with respect to the entire portfolio because the Hilton Garden Inn Fort Walton Beach property was built and began operations in May 2017. The increase in Total Revenue and NOI from 2017 to TTM 11/30/2018 can be attributed to the 2017 Total Revenue and 2017 NOI only including income from the Hilton Garden Inn Fort Walton Beach property for the portion of 2017 since it began operations. |

| (2) | % of U/W Total Revenue for Room Expense, F&B Expense and Other Department Expenses are based on their corresponding revenue line items. |

| (3) | Other Revenue includes income generated from miscellaneous fees, telephone, and ground lease pass through. The ground lease pass through is collected from guests to offset ground rent charged under the Ground Lease (defined below) to the government. The majority but not all of the lease fee is passed through. |

Appraisal.The appraiser for the Holiday Inn Fort Walton Beach property concluded to an “as-is” appraised value of $40,100,000 with an appraisal valuation date of August 21, 2018. The appraiser for the Hilton Garden Inn Fort Walton Beach property concluded to an “as-is” appraised value of $54,700,000 with an appraisal valuation date of August 21, 2018.

Environmental Matters. According to the Phase I environmental assessments dated August 30, 2018, there was no evidence of any recognized environmental conditions at the Holiday Inn Fort Walton Beach property or the Hilton Garden Inn Fort Walton Beach property.

Market Overview and Competition.The Innisfree Portfolio Properties are located in Fort Walton Beach, Florida along the Gulf of Mexico. In 2016, the Destin-Fort Walton Beach Airport had the highest passenger count in its 60 year history (915,650 people), accounting for an approximately 18% increase over 2015. In 2017, the airport set a new record with 1,134,209 passengers, accounting for an approximately 24% increase over 2016. South Walton, which encompasses a strand of 16 distinct beach neighborhoods, is known for its turquoise waters and sugar sand beaches. The Innisfree Portfolio Properties are located 5.2 miles from Destin Harbor,

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $58,415,464 |

| 1299 & 1297 Miracle Strip Parkway Southeast | Innisfree Portfolio | Cut-off Date LTV: | | 61.6% |

| Fort Walton Beach, FL 32548 | | U/W NCF DSCR: | | 1.94x |

| | | U/W NOI Debt Yield: | | 14.3% |

which, according to the appraisal, is known as “The World’s Luckiest Fishing Village” and features one of the largest commercial sport-fishing fleets on the Gulf Coast.

Estimated population in 2018 within a one-, three-, and five- mile radius of the Innisfree Portfolio Properties was 2,435, 19,187, and 64,233, respectively. Estimated average household income in 2018 within the same one-, three-, and five- mile radius was $75,275, $70,887, and $71,301, respectively.

The following table presents historical occupancy, ADR, RevPAR and penetration rates relating to the Hilton Garden Inn Fort Walton Beach’s competitive set:

Subject and Market Historical Occupancy, ADR and RevPAR(1)

(Hilton Garden Inn Fort Walton Beach)

| | Competitive Set | Hilton Garden Inn Fort Walton Beach | Penetration Factor |

Year | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR |

| TTM 11/30/2018 | 74.1% | $164.68 | $122.08 | 84.2% | $195.44 | $164.47 | 113.5% | 118.7% | 134.7% |

| 12/31/2017 | 73.7% | $161.28 | $118.82 | 72.5% | $187.95 | $136.32 | 98.4% | 116.5% | 114.7% |

| 12/31/2016 | NAP | NAP | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| 12/31/2015 | NAP | NAP | NAP | NAP | NAP | NAP | NAP | NAP | NAP |

| (1) | Information obtained from third party hospitality research reports dated December 19, 2018 and January 18, 2018. The competitive set includes the following hotels: Four Points by Sheraton Destin Fort Walton Beach, Hampton Inn Fort Walton Beach, Holiday Inn Resort Fort Walton Beach and Courtyard Fort Walton Beach West Destin. |

The following table presents historical occupancy, ADR, RevPAR and penetration rates relating to the Holiday Inn Fort Walton Beach’s competitive set:

Subject and Market Historical Occupancy, ADR and RevPAR(1)

(Holiday Inn Fort Walton Beach)

| | Competitive Set | Holiday Inn Fort Walton Beach | Penetration Factor |

Year | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR | Occupancy | ADR | RevPAR |

| TTM 11/30/2018 | 60.8% | $169.55 | $103.02 | 85.9% | $171.12 | $146.91 | 141.3% | 100.9% | 142.6% |

| 12/31/2017 | 60.5% | $165.97 | $100.35 | 86.9% | $164.96 | $143.39 | 143.8% | 99.4% | 142.9% |

| 12/31/2016 | 66.0% | $156.68 | $103.36 | 82.7% | $172.33 | $142.56 | 125.4% | 110.0% | 137.9% |

| 12/31/2015 | 61.7% | $155.77 | $96.07 | 82.2% | $169.46 | $139.25 | 133.2% | 108.8% | 145.0% |

| (1) | Information obtained from third party hospitality research reports dated December 18, 2018 and January 18, 2018. The competitive set includes the following hotels: Four Points by Sheraton Destin Fort Walton Beach, Ramada Plaza Fort Walton Beach Resort Destin (12/31/2017, 12/31/2016, 12/31/2015 only), The Island by Hotel RL (TTM 11/30/2018 only), Wyndham Garden Hotel Fort Walton Beach, Best Western Fort Walton Beachfront and Hampton Inn Fort Walton Beach. |

The appraiser for the Hilton Garden Inn Fort Walton Beach property identified four comparable hotel properties ranging from 85 rooms to 216 rooms that were constructed between 1961 and 2016. The competitive set reported a weighted average occupancy of approximately 72.1%, with average daily rates ranging from $145.00 to $175.00. The competitive set’s weighted average revenue per room was $116.79. The appraiser for the Holiday Inn Fort Walton Beach property identified five comparable hotel properties ranging from 100 rooms to 222 rooms that were constructed between 1961 and 2000. The competitive set reported a weighted average occupancy of approximately 57%, with average daily rates ranging from $145.00 to $180.00. The competitive set’s weighted average revenue per room was $97.

The following tables present TTM 7/31/2018 occupancy, estimated ADR and estimated RevPAR relating to each Innisfree Portfolio Property’s primary competitive set according to the appraisal:

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $58,415,464 |

| 1299 & 1297 Miracle Strip Parkway Southeast | Innisfree Portfolio | Cut-off Date LTV: | | 61.6% |

| Fort Walton Beach, FL 32548 | | U/W NCF DSCR: | | 1.94x |

| | | U/W NOI Debt Yield: | | 14.3% |

Primary Competitive Set(1)

Property Name | Location | Rooms | Year Built/Renov. | TTM 7/31/2018 Occupancy | Estimated TTM 7/31/2018 ADR | Estimated TTM 7/31/2018 RevPAR |

| Hilton Garden Inn Fort Walton Beach – Subject(1) | Fort Walton Beach, FL | 178 | 2017/NAP | 84.3% | $193.85 | $163.43 |

| Four Points by Sheraton Destin Fort Walton Beach | Destin, FL | 216 | 1961/NAV | 60.0% - 65.0% | $165.00 - $175.00 | $105.00 – $110.00 |

| Hampton Inn Fort Walton Beach | Fort Walton Beach, FL | 100 | 2000/NAV | 75.0% - 80.0% | $145.00 - $155.00 | $115.00 – $120.00 |

| Holiday Inn Fort Walton Beach | Fort Walton Beach, FL | 152 | 2014/NAV | 80.0% - 85.0% | $160.00 - $170.00 | $135.00 - $140.00 |

| Courtyard Fort Walton Beach – West Destin | Fort Walton Beach, FL | 85 | 2016/NAV | 65.0% - 70.0% | $145.00 - $155.00 | $100.00 - $105.00 |

| (1) | Information obtained from the appraisal, other than for the Hilton Garden Inn Fort Walton Beach – Subject, for which information was obtained from the TTM 11/30/2018 underwriting. |

Primary Competitive Set(1)

Property Name | Location | Rooms | Year Built/Renov. | TTM 7/31/2018 Occupancy | Estimated TTM

7/31/2018 ADR | Estimated TTM

7/31/2018

RevPAR |

| Holiday Inn Fort Walton Beach – Subject(1) | Fort Walton Beach, FL | 152 | 2014/NAP | 86.2% | $165.40 | $142.61 |

| Four Points by Sheraton Destin Fort Walton Beach | Destin, FL | 216 | 1961/NAV | 60.0% - 65.0% | $165.00 - $175.00 | $105.00 – $110.00 |

| The Island by Hotel RL | Fort Walton Beach, FL | 222 | 1971/NAV | 35.0% - 40.0% | $165.00 - $175.00 | $60.00 – $65.00 |

| Wyndham Garden Fort Walton Beach Destin | Pensacola Beach, FL | 195 | 1974/NAV | 70.0% - 75.0% | $170.00 - $180.00 | $120.00 - $125.00 |

Best Western Fort Walton Beachfront | Fort Walton Beach, FL | 100 | 1998/NAV | 65.0% - 70.0% | $170.00 - $180.00 | $115.00 - $120.00 |

| Hampton Inn Fort Walton Beach | Fort Walton Beach, FL | 100 | 2000/NAV | 75.0% - 80.0% | $145.00 - $155.00 | $115.00 - $120.00 |

| (1) | Information obtained from the appraisal, other than for Holiday Inn Fort Walton Beach – Subject, for which information was obtained from the TTM 11/30/2018 underwriting. |

Escrows.

Real Estate Taxes – The Innisfree Portfolio Mortgage Loan documents require an upfront real estate tax reserve of $131,683 and ongoing monthly real estate tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next twelve months (initially $43,894).

Insurance – The Innisfree Portfolio Mortgage Loan documents require an upfront insurance premiums reserve of $213,199 and ongoing monthly insurance premiums in an amount equal to one-twelfth of the insurance premiums that the lender estimates will be payable during the next twelve months (initially $23,689).

FF&E Reserve – The Innisfree Portfolio Mortgage Loan documents require ongoing monthly FF&E Reserves of 4.0% of the total revenue from the Innisfree Portfolio Properties (the initial estimated FF&E monthly deposit is $72,915).

Seasonality Reserve – The Innisfree Portfolio Mortgage Loan documents require springing monthly deposits for seasonality. As to both Innisfree Portfolio Properties, on monthly payment dates from May to August, the borrowers will be required to deposit an aggregate of $1,121,917 (representing the sum of the four months of deposits) and then will disburse an aggregate of $1,121,917 in the months November through February to cover any shortfalls. Amounts are subject to change and adjusted on an annual basis based on lender discretion

Ground Lease Rent Reserve –The Innisfree Portfolio Mortgage Loan documents require that on each monthly payment date the borrowers will be required to deposit the amount payable under the Ground Lease for the month immediately following the month in which such monthly payment date occurs. This amount is expected to be, for each Innisfree Portfolio Property, the greater of $12,500 per month and 3.25% of such property’s gross revenues for the applicable month. The minimum deposit is $300,000 each year for both Innisfree Portfolio Properties in the aggregate under the Ground Lease and Sublease (as definted below), collectively.

PIP Reserve– The Innisfree Portfolio Mortgage Loan documents require that if at any time, any additional PIP work is required under the franchise agreements, the borrower shall deposit an amount equal to 125% of the estimated costs to complete such additional PIP work.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Hospitality – Full Service | Loan #1 | Cut-off Date Balance: | | $58,415,464 |

| 1299 & 1297 Miracle Strip Parkway Southeast | Innisfree Portfolio | Cut-off Date LTV: | | 61.6% |

| Fort Walton Beach, FL 32548 | | U/W NCF DSCR: | | 1.94x |

| | | U/W NOI Debt Yield: | | 14.3% |

Lockbox and Cash Management.A hard lockbox is in place with respect to the Innisfree Portfolio Mortgage Loan. The Innisfree Portfolio Mortgage Loan has springing cash management that will commence upon the occurrence of a Sweep Period (defined below). The borrowers are required to cause all rents including, without limitation, all credit card company payments, to be transmitted directly into the applicable lockbox account, provided, however, that any cash and other sums received at the hotels may be deposited by the borrowers or manager within one (1) business day of receipt. During the continuance of a Sweep Period (as defined below), all funds in the lockbox account are required to be swept daily to a cash management account under the control of the lender and disbursed during each interest period of the loan term in accordance with the Innisfree Portfolio Mortgage Loan documents.

A “Sweep Period” will commence upon the earliest of the following:

| (i) | the occurrence and continuance of an event of default under the Innisfree Portfolio Mortgage Loan; or |

| (ii) | the debt service coverage ratio being less than 1.20x; or |

| (iii) | the date on which the property manager becomes insolvent or a debtor in a bankruptcy action; or |

| (iv) | the delivery of notice by the franchisor/manager of any breach or default by a borrower under the franchise/management agreement that, with the passage of time or delivery of notice, could result in the termination of such agreement. |

A Sweep Period will end upon the occurrence of the following, in each case provided no other cash management period is continuing (and no event of default has occurred and is continuing):

| ● | with regard to clause (i), the lender’s acceptance of a cure or waiver of such event of default; or |

| ● | with regard to clause (ii), the debt service coverage ratio being greater than 1.35x for two consecutive calendar quarters; or |

| ● | with regard to clause (iii), the borrowers having entered into a replacement management agreement with a qualified manager; or |

| ● | with regard to clause (iv), the lenders acceptance of a cure of such event of default under the franchise agreement or management agreement, the borrowers having delivered evidence reasonably satisfactory to the lender, which may include a “good standing” or similar letter from the franchisor, indicating that the franchise agreement is in full force and effect. |

Property Management.The Innisfree Portfolio Properties are managed by an affiliate of the borrower.

Partial Release.Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not permitted.

Ground Lease.The Innisfree Portfolio Properties are subject to a ground lease (the “Ground Lease”) with the United States government through the Secretary of the Air Force, as lessor. The Emerald I Borrower owns a leasehold interest in the Innisfree Portfolio Properties by way of a 50-year ground lease, which expires in October 2062. In 2016, a sublease (the “Sublease”) was entered into for the Hilton Garden Inn Fort Walton Beach Property between the Emerald I Borrower, as sublandlord, and the Emerald II Borrower, as subtenant. The Innisfree Portfolio Properties are located adjacent to each other on the same parcel. The Sublease expires in September 2062 (one month prior to expiration of the Ground Lease). Monthly base rent under the Ground Lease is, as to each Innisfree Portfolio Property, the greater of $12,500 (subject to future upward adjustment based on the Consumer Price Index for all Urban Consumers) and 3.25% of such property’s monthly gross revenue. Base rent under the Sublease is equal to the base rent under the Ground Lease.

The Innisfree Portfolio Properties have a ground lease rent pass through, which consists of collected fees from the guests to offset ground rent charged under the Ground Lease by the United States government. The majority but not all the lease fee is passed through to the guests as a fee at checkout.

Terrorism Insurance.The Innisfree Portfolio Mortgage Loan documents require that the “all risk” insurance policy required to be maintained by the borrower provide coverage for terrorism in an amount equal to the full replacement cost of Innisfree Portfolio Properties, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a twelve-month extended period of indemnity (provided that if TRIPRA or a similar statute is not in effect, the borrower will not be obligated to pay terrorism insurance premiums in excess of two times the premium for the casualty and business interruption coverage on a stand-alone basis).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| No. 2 – Bristow Center |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (DBRS/Fitch/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Retail – Anchored |

| Original Principal Balance: | $53,000,000 | | Location: | Bristow, VA |

| Cut-off Date Balance: | $53,000,000 | | Size: | 158,082 SF |

| % of Initial Pool Balance: | 6.8% | | Cut-off Date Balance Per SF: | $335.27 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per SF: | $335.27 |

| Borrower Sponsor: | Gary D. Rappaport | | Year Built/Renovated: | 2007/NAP |

| Guarantors: | Gary D. Rappaport; Gary D. Rappaport Revocable Trust | | Title Vesting: | Fee |

| Mortgage Rate: | 5.1000% | | Property Manager: | Self-managed |

| Note Date: | January 3, 2019 | | Current Occupancy (As of): | 96.1% (11/1/2018) |

| Seasoning: | 1 month | | YE 2017 Occupancy: | 98.6% |

| Maturity Date: | February 1, 2029 | | YE 2016 Occupancy: | 100.0% |

| IO Period: | 120 months | | YE 2015 Occupancy: | 99.7% |

| Loan Term (Original): | 120 months | | YE 2014 Occupancy: | 95.8% |

| Amortization Term (Original): | NAP | | Appraised Value: | $78,600,000 |

| Loan Amortization Type: | Interest-only, Balloon | | Appraised Value Per SF: | $497.21 |

| Call Protection: | L(25),D(91),O(4) | | Appraisal Valuation Date: | November 26, 2018 |

| Lockbox Type: | Hard/Upfront Cash Management | | | |

| Additional Debt: | None | | Underwriting and Financial Information |

| Additional Debt Type (Balance): | NAP | | TTM NOI (10/31/2018): | $4,319,793 |

| | | | YE 2017 NOI: | $4,370,425 |

| | | | YE 2016 NOI: | $4,299,886 |

| | | | YE 2015 NOI: | NAV |

| | | | U/W Revenues: | $5,812,402 |

| | | | U/W Expenses: | $1,521,164 |

| Escrows and Reserves(1) | | U/W NOI: | $4,291,238 |

| | Initial | Monthly | Cap | | U/W NCF: | $4,142,011 |

| Taxes | $112,298 | $56,150 | NAP | | U/W DSCR based on NOI/NCF: | 1.56x / 1.51x |

| Insurance | $0 | Springing | NAP | | U/W Debt Yield based on NOI/NCF: | 8.1% / 7.8% |

| Replacement Reserve | $0 | $1,581 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF: | 8.1% / 7.8% |

| TI/LC Reserve | $250,000(2) | $13,174(2) | $500,000(2) | | Cut-off Date LTV Ratio: | 67.4% |

| Economic Holdback | (2) | $0 | NAP | | LTV Ratio at Maturity: | 67.4% |

| | | | | | | |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original loan amount | $53,000,000 | | 98.2% | | Loan payoff | $32,108,185 | | 59.5% |

| Cash equity contribution | 985,353 | | 1.8 | | Partner buyout(3) | 19,190,086 | | 35.5 |

| | | | | | Upfront reserves | 1,862,298 | | 3.4 |

| | | | | | Closing costs | 824,784 | | 1.5 |

| Total Sources | $53,985,353 | | 100.0% | | Total Uses | $53,985,353 | | 100.0% |

| (1) | See “Escrows” section below. |

| (2) | At origination, the Bristow Center Mortgage Loan (as defined below) was structured with an economic holdback totaling $1,750,000, which was to be released to the Bristow Center Borrower (as defined below) upon the Bristow Center Property (as defined below) achieving a net operating income debt yield equal to or greater than 8.1%. As of the securitization cut-off date, $1,500,000 of the economic holdback funds were disbursed to the Bristow Center Borrower due to the Bristow Center Property achieving an 8.1% net operating income debt yield. Simultaneously with such disbursement, the remaining $250,000 of the economic holdback funds were deposited into the TI/LC Reserve account. |

| (3) | The borrower sponsor used a portion of the Bristow Center Mortgage Loan to buyout its institutional joint venture partner, Principal Real Estate Investors. |

The Mortgage Loan. The mortgage loan (the “Bristow Center Mortgage Loan”) is evidenced by a single promissory note secured by a first mortgage encumbering the fee interest in an anchored retail shopping center located in Bristow, Virginia (the “Bristow Center Property”).

The Borrower and Borrower Sponsor.The borrower is BLJV, LLC (the “Bristow Center Borrower”), a Virginia limited liability company and single purpose entity with one independent director. Legal counsel to the Bristow Center Borrower delivered a non-consolidation opinion in connection with the origination of the Bristow Center Mortgage Loan. The borrower sponsor is Gary D. Rappaport, and the

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

nonrecourse carve-out guarantors of the Bristow Center Mortgage Loan are Gary D. Rappaport and the Gary D. Rappaport Revocable Trust.

Mr. Rappaport is the Chief Executive Officer of Rappaport, a real estate company he founded in 1984. Rappaport provides leasing, tenant representation, management, and development services for more than 14.5 million square feet of commercial real estate. Rappaport’s portfolio includes more than 60 shopping centers and ground floor retail in approximately 100 mixed-use properties located primarily throughout the mid-Atlantic region.

The Property.The Bristow Center Property is a grocery anchored retail center totaling 158,082 square feet and located in Bristow, Virginia, approximately 30.0 miles southwest of the Washington, D.C. central business district. The Bristow Center Property is anchored by a Harris Teeter grocery store, which is subject to a ground lease and owns its improvements. In addition to Harris Teeter, there are four ground lease tenants at the Bristow Center Property with unowned improvements, including PNC Bank, BB&T, Fauquier Bank and Minnieland Private Day School (“Minnieland”). The Bristow Center Property was constructed by the borrower sponsor in 2007 at a total cost of approximately $60.0 million. The Bristow Center Property is situated on a 25.4-acre site with 915 surface parking spaces resulting in a parking ratio of approximately 5.8 spaces per 1,000 square feet of rentable area. As of November 1, 2018, the Bristow Center Property was 96.1% leased to 33 tenants. The four largest tenants at the Bristow Center Property, totaling approximately 48.8% of the net rentable area and 44.2% of underwritten base rent, are investment grade rated.

Minnieland, which is subject to a ground lease and accounts for 2.7% of underwritten base rent, temporarily closed its facility at the Bristow Center Property in June 2018 following allegations of criminal activity involving an assistant teacher at the school. Minnieland remained current on rent payments and was back in physical occupancy of its space as of January 2019. See “Description of the Mortgage Pool—Litigation and Other Considerations” in the Preliminary Prospectus.

Major Tenants.

Largest Tenant: Harris Teeter (Baa1/BBB by Moody’s/S&P; 56,298 square feet; 35.6% of net rentable area; 19.5% of underwritten base rent; 5/31/2027 lease expiration) – According to a third party market report, Harris Teeter is a part of The Kroger Co. (NYSE: KR) family of stores, which collectively employs approximately 450,000 people in 2,782 supermarkets and multi-department stores in 35 states and the District of Columbia under local banner names including Kroger, City Market, Dillons, Food 4 Less, Fred Meyer, Fry’s, Harris Teeter, Jay C, King Soopers, QFC, Ralphs and Smith’s. Harris Teeter is an original tenant at the Bristow Center Property on a 20-year ground lease and has four, 5-year renewal options following its May 2027 lease expiration.

2ndLargest Tenant: CVS (Baa2/BBB by Moody’s/S&P; 12,900 square feet; 8.2% of net rentable area; 11.0% of underwritten base rent; 1/31/2030 lease expiration) – CVS is a global pharmacy employing more than 290,000 people with more than 9,800 locations throughout the United States, Puerto Rico, and Brazil. CVS has been a tenant at the Bristow Center Property since 2009. CVS’s lease expires on January 31, 2030 with no renewal options.

3rdLargest Tenant: PNC Bank (A+/A3/A- by Fitch/Moody’s/S&P; 3,999 square feet; 2.5% of net rentable area; 7.2% of underwritten base rent; 6/30/2027 lease expiration) – PNC Bank is a diversified financial services institution with assets of approximately $380 billion as of September 30, 2018. PNC Bank has more than 52,000 employees throughout 40 states across the country and international offices in Canada, China, Germany and the United Kingdom. PNC Bank is an original tenant at the Bristow Center Property on a 20-year ground lease and has three, 5-year renewal options following its June 2027 lease expiration.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

The following table presents certain information relating to the tenancy at the Bristow Center Property:

Major Tenants

| Tenant Name | Credit Rating

(Fitch/Moody’s/

S&P)(1) | Tenant

NRSF | % of

NRSF |

Annual U/W Base Rent PSF(2) | Annual

U/W Base

Rent(2) | % of Total

Annual

U/W Base Rent | Lease

Expiration

Date | Extension Options | Termination

Option (Y/N) |

| Major Tenants | | | | | | | | |

| Harris Teeter(3) | NR/Baa1/BBB | 56,298 | 35.6% | $15.67 | $882,000 | 19.5% | 5/31/2027 | 4, 5-year(4) | N |

| CVS | NR/Baa2/BBB | 12,900 | 8.2% | $38.50 | $496,650 | 11.0% | 1/31/2030 | None | N |

| PNC Bank(3) | A+/A3/A- | 3,999 | 2.5% | $81.39(5) | $325,459(5) | 7.2% | 6/30/2027 | 3, 5-year | N |

| BB&T(3) | A+/A2/A- | 3,999 | 2.5% | $72.34(6) | $289,290(6) | 6.4% | 4/30/2027 | 2, 5-year | N |

| Fauquier Bank(3) | NR/NR/NR | 3,000 | 1.9% | $67.19 | $201,570 | 4.5% | 7/31/2024 | 1, 5-year | N |

| Total Major Tenants | 80,196 | 50.7% | $27.37 | $2,194,969 | 48.6% | | | |

| | | | | | | | | | |

| Non-Major Tenant | 71,786 | 45.4% | $32.30 | $2,318,478 | 51.4% | | | |

| | | | | | | | | |

| Occupied Collateral Total | 151,982 | 96.1% | $29.70 | $4,513,447 | 100.0% | | | |

| | | | | | | | | |

| Vacant Space | 6,100 | 3.9% | | | | | | |

| | | | | | | | | |

| Collateral Total | 158,082 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through January 2020 totaling $38,909 and straight line rent averaging through June 2027 totaling $52,686 for investment grade rated tenants. |

| (3) | Harris Teeter, PNC Bank, BB&T and Fauquier Bank are subject to ground leases and own their improvements. |

| (4) | Harris Teeter’s first 5-year extension option is at a rental rate of $18.02 per square foot. |

| (5) | Represents the straight line average over the remaining lease term due to investment grade rating. PNC Bank’s current rental rate is $74.41 per square foot. |

| (6) | Represents the straight line average over the remaining lease term due to investment grade rating. BB&T’s current rental rate is $66.14 per square foot. |

The following table presents certain information relating to major tenant sales at the Bristow Center Property:

Tenant Sales (PSF)

| Major Tenant Name | % of Total

Annual U/W

Base Rent | 2015 | 2016 | 2017 | TTM(1) | Major Tenant Occupancy Cost(1)(2) |

| Harris Teeter | 19.5% | $398 | $402 | $390 | $388 | 6.0% |

| (1) | TTM Sales PSF and Occupancy Cost are for the trailing 12-month period ending February 28, 2018 |

| (2) | Occupancy Cost is based on TTM sales, underwritten base rent and underwritten reimbursements. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

The following table presents certain information relating to the lease rollover schedule at the Bristow Center Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of

Leases Expiring | Expiring

NRSF | % of

Total

NRSF | Cumulative

Expiring

NRSF | Cumulative

% of Total

NRSF | Annual

U/W

Base Rent(3) | % of Total

Annual

U/W Base

Rent | Annual

U/W

Base Rent

PSF |

| MTM | 1 | 4,963 | 3.1% | 4,963 | 3.1% | $162,000 | 3.6% | $32.64 |

| 2019 | 0 | 0 | 0.0% | 4,963 | 3.1% | $0 | 0.0% | $0.00 |

| 2020 | 4 | 6,192 | 3.9% | 11,155 | 7.1% | $205,617 | 4.6% | $33.21 |

| 2021 | 4 | 10,800 | 6.8% | 21,955 | 13.9% | $356,759 | 7.9% | $33.03 |

| 2022 | 10 | 22,525 | 14.2% | 44,480 | 28.1% | $909,333 | 20.1% | $40.37 |

| 2023 | 3 | 5,200 | 3.3% | 49,680 | 31.4% | $174,875 | 3.9% | $33.63 |

| 2024 | 4 | 8,024 | 5.1% | 57,704 | 36.5% | $377,752 | 8.4% | $47.08 |

| 2025 | 0 | 0 | 0.0% | 57,704 | 36.5% | $0 | 0.0% | $0.00 |

| 2026 | 0 | 0 | 0.0% | 57,704 | 36.5% | $0 | 0.0% | $0.00 |

| 2027 | 4 | 67,016 | 42.4% | 124,720 | 78.9% | $1,613,845 | 35.8% | $24.08 |

| 2028 | 1 | 2,862 | 1.8% | 127,582 | 80.7% | $93,416 | 2.1% | $32.64 |

| 2029 | 0 | 0 | 0.0% | 127,582 | 80.7% | $0 | 0.0% | $0.00 |

| Thereafter | 2 | 24,400 | 15.4% | 151,982 | 96.1% | $619,850 | 13.7% | $25.40 |

| Vacant | 0 | 6,100 | 3.9% | 158,082 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 33 | 158,082 | 100.0% | | | $4,513,447 | 100.0% | $29.70(3) |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Total/Weighted Average Annual U/W Base Rent and Annual U/W Base Rent PSF exclude vacant space. |

The following table presents historical occupancy percentages at the Bristow Center Property:

Historical Occupancy

12/31/2014(1) | 12/31/2015(1) | 12/31/2016(1) | 12/31/2017(1) | 11/1/2018(2) |

| 95.8% | 99.7% | 100.0% | 98.6% | 96.1% |

| (1) | Information obtained from a third-party market research provider. |

| (2) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the Bristow Center Property:

Cash Flow Analysis

| | 2016 | 2017 | TTM

10/31/2018 | U/W | %(1) | U/W $ per

SF |

| Rents in Place | $4,508,380 | $4,579,515 | $4,536,386 | $4,421,851 | 73.1% | $27.97 |

| Contractual Rent Steps(2) | 0 | 0 | 0 | 91,596 | 1.5 | 0.58 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 218,042 | 3.6 | 1.38 |

| Gross Potential Rent | $4,508,380 | $4,579,515 | $4,536,386 | $4,731,489 | 78.2% | $29.93 |

| Other Income | 108,076 | 110,519 | 113,654 | 113,654 | 1.9 | 0.72 |

| Total Recoveries | 1,088,997 | 1,210,931 | 1,224,738 | 1,203,834 | 19.9 | 7.62 |

| Net Rental Income | $5,705,453 | $5,900,965 | $5,874,778 | $6,048,976 | 100.0% | $38.26 |

| (Vacancy & Credit Loss) | 0 | 0 | 0 | (236,574)(3) | (5.0) | (1.50) |

| Effective Gross Income | $5,705,453 | $5,900,965 | $5,874,778 | $5,812,402 | 96.1% | $36.77 |

| | | | | | | |

| Real Estate Taxes | 594,372 | 683,319 | 655,141 | 673,798 | 11.6 | 4.26 |

| Insurance | 21,340 | 19,663 | 18,728 | 18,304 | 0.3 | 0.12 |

| Management Fee | 228,831 | 233,576 | 226,427 | 174,372 | 3.0 | 1.10 |

| Other Operating Expenses | 561,025 | 593,982 | 654,690 | 654,690 | 11.3 | 4.14 |

| Total Operating Expenses | $1,405,568 | $1,530,540 | $1,554,985 | $1,521,164 | 26.2% | $9.62 |

| | | | | | | |

| Net Operating Income | $4,299,886 | $4,370,425 | $4,319,793 | $4,291,238 | 73.8% | $27.15 |

| Replacement Reserves | 0 | 0 | 0 | 18,970 | 0.3 | 0.12 |

| TI/LC | 0 | 0 | 0 | 130,257 | 2.2 | 0.82 |

| Net Cash Flow | $4,299,886 | $4,370,425 | $4,319,793 | $4,142,011 | 71.3% | $26.20 |

| | | | | | | |

| NOI DSCR(5) | 1.56x | 1.59x | 1.57x | 1.56x | | |

| NCF DSCR(5) | 1.56x | 1.59x | 1.57x | 1.51x | | |

| NOI Debt Yield(5) | 8.1% | 8.2% | 8.2% | 8.1% | | |

| NCF Debt Yield(5) | 8.1% | 8.2% | 8.2% | 7.8% | | |

| (1) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (2) | Represents contractual rent steps through January 2020 and straight line rent averaging for investment grade tenants (see “Major Tenants” table above). |

| (3) | The underwritten economic vacancy is 5.0%. The Bristow Center Property was 96.1% leased as of November 1, 2018. |

Appraisal.The appraiser concluded to an “as-is” appraised value of $78,600,000 as of November 26, 2018.

Environmental Matters. According to a Phase I environmental site assessment dated November 20, 2018, there was no evidence of any recognized environmental conditions at the Bristow Center Property.

Market Overview and Competition.The Bristow Center Property is located in Bristow, Virginia, approximately 33.8 miles southwest of the Washington, D.C. central business district, 16.0 miles southwest of the Washington Dulles International Airport, and 28.7 miles southwest of the Ronald Reagan Washington National Airport. The Bristow Center Property is situated at 10250 – 10492 Bristow Center Drive, with two points of ingress and egress along Linton Hall Road and Fitzgerald Way, and with frontage along Nokesville Road. I-66 is approximately 5.2 miles north of the Bristow Center Property and access from I-66 is provided by Prince William Highway via Nokesville Road or Lee Highway/Linton Hall Road.

Major employers in the area include Lockheed Martin, Prince William Health System, Micron Technology, Bae Systems, Cogan Air, Aurora Flight Sciences, Didlake, and Comcast. These employers are located within 15 miles of the Bristow Center Property and represent concentrations in the defense, technology, medical, telecommunications, and aerospace industries. Regional employment nodes include Washington, D.C., Fairfax City, Vienna, Chantilly, and the Dulles Corridor.

According to the appraiser, the estimated 2018 population within a one-, three- and five-mile radius of the Bristow Center Property was 7,084, 36,117, and 126,146, respectively; and the estimated 2018 median household income within the same radii was $132,826, $127,211, and $98,880, respectively.

Submarket Information – According to the appraisal, the Bristow Center Property is situated within the Prince William County submarket of the Northern Virginia retail market. As of the second quarter of 2018, the submarket reported a total inventory of 9.8 million square feet with a 7.0% vacancy rate.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

Appraiser’s Comp Set – The appraiser identified six primary competitive properties for the Bristow Center Property totaling approximately 2.0 million square feet, which reported an average occupancy rate of approximately 97.3%. The appraiser concluded to triple net market rents for the Bristow Center Property as described in the Market Rent Summary table below.

The following table presents certain information relating to the appraiser’s market rent conclusion for the Bristow Center Property:

Market Rent Summary(1)

| | In-Line | Large In-Line | Anchor(2) | Outparcel(2) | Drug Store(2) | Day Care(2) | Premium In-Line |

| Market Rent (PSF) | $35.00 | $32.00 | $15.00 | $63.65 | $38.00 | $13.04 | $40.00 |

| Lease Term (Years) | 7 | 7 | 10 | 15 | 15 | 15 | 7 |

| Lease Type (Reimbursements) | NNN | NNN | NNN | NNN | NNN | NNN | NNN |

| Rent Increase Projection | 3.0% per annum | 3.0% per annum | 10.0% every

5 years | 10.0% every

5 years | 10.0% every

5 years | 10.0% every

5 years | 3.0% per annum |

| (1) | Information obtained from the appraisal. |

| (2) | Represents ground lease market rents. |

The table below presents certain information relating to six comparable retail properties to the Bristow Center Property identified by the appraiser:

Competitive Set(1)

| | Bristow Center (Subject) | Center at

Innovation | Braemar

Village Center | Promenade at

Virginia Gateway | Virginia Gateway | The Shops at

Stonewall | Heritage

Marketplace |

| Location | Bristow, VA | Manassas, VA | Bristow, VA | Gainesville, VA | Gainesville, VA | Gainesville, VA | Gainesville, VA |

| Distance from Subject | -- | 1.3 miles | 2.3 miles | 5.2 miles | 5.8 miles | 8.1 miles | 6.9 miles |

| Property Type | Anchored Retail | Anchored Retail | Anchored Retail | Anchored Retail | Power Center | Anchored Retail | Anchored Retail |

Year Built/ Renovated | 2007/NAP | 2008/NAP | 2003/NAP | 2011/NAP | 1999/2008 | 2005/NAP | 2015/NAP |

| Anchors | Harris Teeter | Super Target, TJ Maxx, PetSmart | Safeway | BJ’s Wholesale Club, Regal Cinemas | Best Buy, Giant Food, HomeGoods, Lowe’s, PetSmart, Target, Walgreens | Wegman’s, Dick’s Sporting Goods, Michaels, Staples, Bed, Bath and Beyond, Ross Dress for Less | Harris Teeter |

| Total GLA | 158,082 SF(2) | 277,450 SF | 111,535 SF | 290,800 SF | 904,472 SF | 338,334 SF | 74,695 SF |

| Total Occupancy | 96.1%(2) | 97.0% | 100.0% | 98.0% | 100.0% | 100.0% | 89.0% |

| (1) | Information obtained from the appraisal. |

| (2) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |

The table below presents certain information relating to comparable sales for the Bristow Center Property identified by the appraiser:

Comparable Sales(1)

| Property Name | Location | Rentable

Area (SF) | Sale Date | Sale Price | Sale Price

(PSF) |

| Bristow Center (Subject) | Bristow, VA | 158,082 | Nov-18(2) | $78,600,000(2) | $497(2) |

| Maple Avenue Shopping Center | Vienna, VA | 111,810 | May-18 | $63,600,000 | $569 |

| Shops at Town Center | Germantown, MD | 124,970 | Feb-17 | $53,550,000 | $429 |

| South Lakes Village Shopping Center | Reston, VA | 109,527 | Sept-16 | $62,000,000 | $566 |

| Virginia Gateway | Gainesville, VA | 665,786 | Jan-16 | $255,000,000 | $383 |

| Hastings Marketplace | Manassas, VA | 93,047 | Jan-16 | $32,250,000 | $347 |

| (1) | Information obtained from the appraisal. |

| (2) | Represents the appraised value of the Bristow Center Property. |

Escrows.

Real Estate Taxes – The loan documents require an upfront real estate tax reserve of $112,298 and ongoing monthly real estate tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next twelve months (initially $56,150).

Insurance – The loan documents do not require ongoing monthly escrows for insurance premiums as long as (i) no event of default has occurred and is continuing, (ii) the borrower or borrower affiliate provides the lender with evidence that the Bristow Center Property’s insurance coverage is included in a blanket policy and such policy is in full force and effect and (iii) the borrower pays all applicable insurance premiums and provides the lender with evidence of timely payment of insurance premiums/renewals.

Replacement Reserves – The loan documents require ongoing monthly replacement reserves of $1,581.

Economic Holdback –At origination, the Bristow Center Mortgage Loan was structured with an economic holdback totaling $1,750,000, which was to be released to the Bristow Center Borrower upon the Bristow Center Property achieving a net operating income debt yield equal to or greater than 8.1%. As of the securitization cut-off date, $1,500,000 of the economic holdback funds were disbursed to the Bristow Center Borrower due to Bristow Center Property achieving an 8.1% net operating income debt yield. The remaining $250,000 of the economic holdback funds were deposited into the TI/LC Reserve account.

TI/LC Reserve – As outlined above, $250,000 of the economic holdback funds were deposited into the TI/LC Reserve account. In addition, the borrower is required to deposit ongoing monthly TI/LC reserves of $13,174 (subject to a cap of $500,000).

Lockbox and Cash Management.The Bristow Center Mortgage Loan requires a hard lockbox with in-place cash management, which is already in place, and that the Bristow Center Borrower direct all tenants to pay rent directly into such lockbox account. The loan documents also require that all rents received by the borrower or the property manager be deposited into the lockbox account within one business day of receipt. All funds in the lockbox account are required to be swept each business day into the cash management account controlled by the lender and disbursed on each payment date in accordance with the loan documents. Prior to the occurrence of a Cash Trap Event Period (as defined below), all excess funds are required to be distributed to the borrower. During a Cash Trap Event Period, all excess funds are required to be swept to an excess cash flow subaccount controlled by the lender.

A “Cash Trap Event Period” will commence upon the earliest to occur of the following:

| (i) | an event of default under the Bristow Center Mortgage Loan; |

| (ii) | the net cash flow debt service coverage ratio falling below 1.05x at the end of any calendar quarter; or |

| (iii) | a Harris Teeter Cash Trap Event Period (as defined below). |

A Cash Trap Event Period will end upon the occurrence of:

| ● | with regard to clause (i) above, the cure of such event of default; |

| ● | with regard to clause (ii) above, the net cash flow debt service coverage ratio being equal to or greater than 1.10x for two consecutive calendar quarters; or |

| ● | with regard to clause (iii) above, a Harris Teeter Cash Trap Event Period Cure (as defined below). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

19

| Retail - Anchored | Loan #2 | Cut-off Date Balance: | | $53,000,000 |

| 10250-10492 Bristow Center Drive | Bristow Center | Cut-off Date LTV: | | 67.4% |

| Bristow, VA 20136 | | U/W NCF DSCR: | | 1.51x |

| | | U/W NOI Debt Yield: | | 8.1% |