| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-05 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$937,965,076

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2019-C50

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

UBS AG

Rialto Mortgage Finance, LLC

Barclays Capital Real Estate Inc.

Rialto Real Estate Fund III – Debt, LP

Argentic Real Estate Finance LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2019-C50

April 17, 2019

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | BARCLAYS Co-Lead Manager and Joint Bookrunner | UBS Securities LLC Co-Lead Manager and Joint Bookrunner |

| | | |

Academy Securities Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., UBS Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Transaction Highlights |

A. Transaction Highlights

Mortgage Loan Sellers:

| Mortgage Loan Seller | | Number of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off Date Balance | | % of Initial Pool

Balance |

| Wells Fargo Bank, National Association | | 16 | | 19 | | $242,029,521 | | | 25.8 | % |

| UBS AG | | 14 | | 263 | | 215,571,505 | | | 23.0 | |

| Rialto Mortgage Finance, LLC | | 11 | | 14 | | 136,256,998 | | | 14.5 | |

| Barclays Capital Real Estate Inc. | | 8 | | 32 | | 123,216,458 | | | 13.1 | |

| Rialto Real Estate Fund III – Debt, LP(1) | | 9 | | 12 | | 120,005,526 | | | 12.8 | |

| Argentic Real Estate Finance LLC | | 6 | | 6 | | 100,885,068 | | | 10.8 | |

| Total | | 64 | | 346 | | $937,965,076 | | | 100.0 | % |

| (1) | Rialto Real Estate Fund III – Debt, LP (“RREF”) acquired the RREF Mortgage Loans from BSPRT CMBS Finance, LLC, an affiliate of Benefit Street Partners L.L.C., and re-underwrote all of the RREF Mortgage Loans in accordance with the underwriting guidelines and processes. With respect to the Z Tower mortgage loan, BSPRT CMBS Finance, LLC acquired such mortgage loan from Basis Real Estate Capital II, LLC. |

Loan Pool:

| Initial Pool Balance: | $937,965,076 |

| Number of Mortgage Loans: | 64 |

| Average Cut-off Date Balance per Mortgage Loan: | $14,655,704 |

| Number of Mortgaged Properties: | 346 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $2,710,882 |

| Weighted Average Mortgage Interest Rate: | 5.043% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 34.7% |

| Weighted Average Original Term to Maturity or ARD (months): | 116 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 114 |

| Weighted Average Original Amortization Term (months)(2): | 350 |

| Weighted Average Remaining Amortization Term (months)(2): | 350 |

| Weighted Average Seasoning (months): | 2 |

|

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | | 1.83 | x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | | 11.7 | % |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | | 62.7 | % |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | | 55.7 | % |

| % of Mortgage Loans with Additional Subordinate Debt(2): | | 15.3 | % |

| % of Mortgage Loans with Single Tenants(3): | | 8.3 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| Property Name | Mortgage Loan Seller in WFCM 2019-C50 | Note(s)(1) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| Great Wolf Lodge Southern California | WFB | A-1 | $35,000,000 | WFCM 2019-C50 | Yes | Wells Fargo Bank National Association | Rialto Capital Advisors, LLC |

| A-2 | $25,000,000 | BANK 2019-BNK17 | No |

| A-3 | $25,000,000 | WFB | No |

| A-4 | $50,000,000 | Column Financial, Inc. | No |

| A-5 | $15,000,000 | WFB | No |

| | | B-1 | $20,000,000 | KSL Capital Partners Co Trust II | No | | |

| Hilton at University Place | Barclays | A-1 | $35,000,000 | WFCM 2019-C50 | Yes | Wells Fargo Bank National Association | Rialto Capital Advisors, LLC |

| A-2 | $11,000,000 | Barclays | No |

| Goodyear Portfolio | RMF | A-1 | $30,000,000 | WFCM 2019-C50 | Yes | Wells Fargo Bank National Association | Rialto Capital Advisors, LLC |

| A-2 | $16,000,000 | RMF | No |

| A-3 | $2,000,000 | WFCM 2019-C50 | No |

| A-4 | $1,500,000 | WFCM 2019-C50 | No |

| A-5 | $1,000,000 | WFCM 2019-C50 | No |

| B | $9,920,000 | Townsend Real Estate Fund, L.P. | No |

| Inland Devon Self Storage Portfolio | Barclays | A-1 | $41,000,000 | Barclays | Yes | Wells Fargo Bank National Association(2) | Rialto Capital Advisors, LLC(2) |

| A-2 | $30,000,000 | WFCM 2019-C50 | No |

| The Colonnade Office Complex | UBS AG | A-1 | $5,000,000 | UBS 2019-C16 | Yes | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-2-1 | $15,000,000 | WFCM 2019-C50 | No |

| A-2-2 | $3,000,000 | WFCM 2019-C50 | No |

| A-2-3 | $2,000,000 | UBS 2019-C16 | No |

| A-3 | $15,000,000 | UBS AG | No |

| A-4 | $10,000,000 | UBS 2019-C16 | No |

| A-5 | $10,000,000 | WFCM 2019-C50 | No |

| A-6 | $10,000,000 | UBS AG | No |

| A-7 | $30,000,000 | UBS 2019-C16 | No |

| A-8 | $5,000,000 | UBS AG | No |

| B-1 | $30,000,000 | The Lincoln National Life Insurance Company | No |

| B-2 | $5,000,000 | Athene Annuity & Life Assurance Company | No |

| B-3 | $5,000,000 | Athene Annuity and Life Company | No |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Characteristics of the Mortgage Pool |

| Property Name | Mortgage Loan Seller in WFCM 2019-C50 | Note(s)(1) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| | | B-4 | $5,000,000 | American Equity Investment Life Insurance Company | No | | |

| B-5 | $5,000,000 | Athene Annuity & Life Assurance Company | No |

| B-6 | $5,000,000 | Athene Annuity & Life Assurance Company | No |

| C | $63,000,000 | Nonghyup Bank as Trustee for Up Global Private Real Estate Fund V | No |

| Great Value Storage Portfolio | UBS AG | A-1 | $35,000,000 | UBS 2018-C15 | No | Midland Loan Services, a Division of PNC Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-2-1 | $30,000,000 | UBS 2019-C16 | Yes |

| A-2-2 | $5,000,000 | WFCM 2019-C50 | No |

| A-3 | $20,000,000 | UBS 2018-C15 | No |

| A-4 | $10,000,000 | WFCM 2019-C50 | No |

| A-5 | $5,000,000 | WFCM 2019-C50 | No |

| A-6 | $5,000,000 | WFCM 2019-C50 | No |

| The Block Northway | UBS AG | A-1-1 | $25,000,000 | WFCM 2019-C50 | No | Wells Fargo Bank National Association(3) | Rialto Capital Advisors, LLC(3) |

| A-1-2 | $5,000,000 | UBS AG | No |

| A-2 | $20,000,000 | UBS 2019-C16 | No |

| A-3 | $10,000,000 | UBS AG | No |

| A-4 | $8,000,000 | Morgan Stanley Mortgage Capital Holdings LLC | No |

| A-5 | $5,000,000 | Morgan Stanley Mortgage Capital Holdings LLC | No |

| A-6 | $1,000,000 | UBS AG | Yes |

| A-7-1 | $1,000,000 | UBS AG | No |

| A-7-2 | $3,000,000 | UBS 2019-C16 | No |

| A-8 | $6,000,000 | Morgan Stanley Mortgage Capital Holdings LLC | No |

| Wolverine Portfolio | UBS AG | A-1 | $10,000,000 | WFCM 2019-C50 | No | Wells Fargo Bank National Association(2) | Rialto Capital Advisors, LLC(2) |

| A-2 | $10,000,000 | WFCM 2019-C50 | No |

| A-3 | $10,000,000 | UBS AG | No |

| | | A-4 | $5,000,000 | UBS AG | No |

| | | A-5 | $5,000,000 | WFCM 2019-C50 | No |

| | | A-6 | $5,000,000 | UBS AG | No |

| | | A-7 | $5,000,000 | UBS AG | No |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Characteristics of the Mortgage Pool |

| Property Name | Mortgage Loan Seller in WFCM 2019-C50 | Note(s)(1) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| | | A-8 | $5,000,000 | UBS AG | No | | |

| | | A-9 | $2,000,000 | UBS AG | No |

| | | A-10 | $2,000,000 | UBS AG | Yes |

| Town Square | RREF | A-1 | $24,000,000 | WFCM 2019-C50 | Yes | Wells Fargo Bank National Association | Rialto Capital Advisors, LLC |

| A-2 | $10,000,000 | BSPRT CMBS Finance, LLC | No |

| Heartland Dental Medical Office Portfolio | UBS AG | A-1 | $40,000,000 | UBS 2018-C14 | No | Wells Fargo Bank National Association | Rialto Capital Advisors, LLC |

| A-2-1 | $22,000,000 | WFCM 2019-C50 | Yes |

| A-2-2 | $8,000,000 | UBS AG | No |

| A-3 | $20,000,000 | Deutsche Bank | No |

| A-4 | $20,000,000 | UBS 2018-C15 | No |

| A-5 | $20,000,000 | UBS 2018-C15 | No |

| A-6 | $15,000,000 | UBS 2018-C15 | No |

| A-7 | $15,000,000 | UBS 2019-C16 | No |

| A-8 | $10,000,000 | UBS 2019-C16 | No |

| A-9 | $6,500,000 | UBS AG | No |

| A-10 | $4,000,000 | UBS 2018-C14 | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The related whole loan is expected to initially be serviced under the WFCM 2019-C50 pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2019-C50 certificates after the closing of such securitization. |

| (3) | The related whole loan is expected to initially be serviced under the UBS 2019-C16 pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the UBS 2019-C16 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Characteristics of the Mortgage Pool |

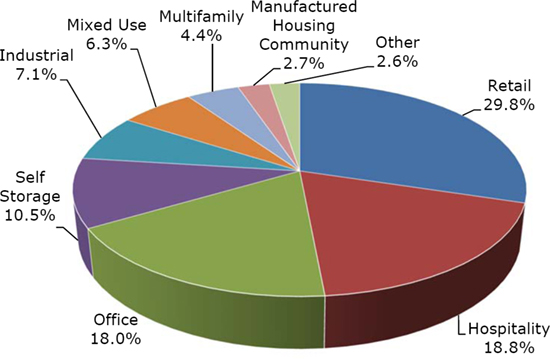

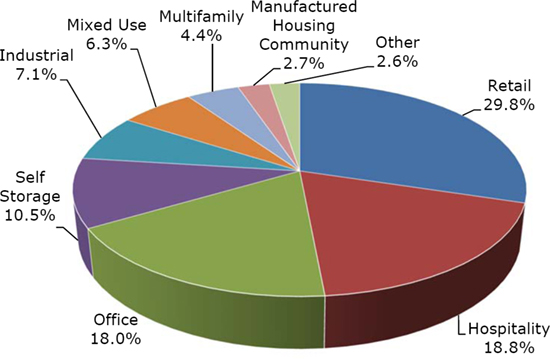

C. Property Type Distribution(1)

| Property Type | | Number of

Mortgaged

Properties | | Aggregate

Cut-off Date

Balance ($) | | % of Initial

Pool

Balance (%) | | Weighted

Average Cut-

off Date LTV

Ratio (%) | | Weighted

Average

Balloon LTV

Ratio (%) | | Weighted Average

U/W NCF

DSCR (x) | | Weighted Average U/W

NOI Debt

Yield (%) | | Weighted Average U/W

NCF Debt Yield

(%) | | Weighted

Average

Mortgage Rate

(%) |

| Retail | | 24 | | $279,119,671 | | | 29.8 | % | | 66.1 | % | | 59.1 | % | | 1.62 | x | | 10.6 | % | | 9.9 | % | | 5.051 | % |

| Anchored | | 12 | | 171,344,974 | | | 18.3 | | | 65.8 | | | 57.5 | | | 1.54 | | | 10.7 | | | 10.0 | | | 5.141 | |

| Unanchored | | 6 | | 49,455,304 | | | 5.3 | | | 69.6 | | | 62.5 | | | 1.54 | | | 10.3 | | | 9.6 | | | 4.978 | |

| Single Tenant | | 4 | | 43,075,000 | | | 4.6 | | | 62.8 | | | 62.8 | | | 1.99 | | | 10.0 | | | 9.7 | | | 4.792 | |

| Shadow Anchored | | 2 | | 15,244,392 | | | 1.6 | | | 67.4 | | | 55.5 | | | 1.67 | | | 11.7 | | | 10.8 | | | 5.012 | |

| Hospitality | | 17 | | 175,931,378 | | | 18.8 | | | 61.5 | | | 50.7 | | | 1.95 | | | 14.7 | | | 13.0 | | | 5.348 | |

| Full Service | | 4 | | 91,132,357 | | | 9.7 | | | 56.9 | | | 49.9 | | | 1.99 | | | 14.2 | | | 12.2 | | | 5.244 | |

| Limited Service | | 12 | | 75,819,083 | | | 8.1 | | | 67.4 | | | 53.3 | | | 1.86 | | | 14.7 | | | 13.2 | | | 5.424 | |

| Extended Stay | | 1 | | 8,979,937 | | | 1.0 | | | 58.3 | | | 38.0 | | | 2.26 | | | 20.9 | | | 19.1 | | | 5.750 | |

| Office | | 161 | | 168,831,304 | | | 18.0 | | | 61.0 | | | 53.8 | | | 1.98 | | | 12.5 | | | 11.5 | | | 5.040 | |

| Suburban | | 8 | | 106,090,724 | | | 11.3 | | | 61.5 | | | 54.3 | | | 2.14 | | | 12.9 | | | 12.0 | | | 4.900 | |

| Medical | | 150 | | 37,160,432 | | | 4.0 | | | 58.5 | | | 49.6 | | | 1.66 | | | 12.0 | | | 11.0 | | | 5.222 | |

| CBD | | 2 | | 19,838,483 | | | 2.1 | | | 61.9 | | | 58.6 | | | 1.89 | | | 12.3 | | | 10.9 | | | 5.389 | |

| Urban | | 1 | | 5,741,665 | | | 0.6 | | | 64.9 | | | 54.3 | | | 1.25 | | | 8.9 | | | 8.4 | | | 5.250 | |

| Self Storage | | 90 | | 98,200,000 | | | 10.5 | | | 56.3 | | | 51.0 | | | 2.32 | | | 12.1 | | | 11.9 | | | 4.448 | |

| Self Storage | | 90 | | 98,200,000 | | | 10.5 | | | 56.3 | | | 51.0 | | | 2.32 | | | 12.1 | | | 11.9 | | | 4.448 | |

| Industrial | | 8 | | 66,240,414 | | | 7.1 | | | 62.7 | | | 58.3 | | | 1.97 | | | 11.6 | | | 11.0 | | | 4.938 | |

| Flex | | 8 | | 66,240,414 | | | 7.1 | | | 62.7 | | | 58.3 | | | 1.97 | | | 11.6 | | | 11.0 | | | 4.938 | |

| Mixed Use | | 26 | | 59,197,927 | | | 6.3 | | | 61.1 | | | 60.0 | | | 1.72 | | | 9.3 | | | 9.0 | | | 5.019 | |

| Office/Industrial | | 1 | | 27,000,000 | | | 2.9 | | | 64.3 | | | 64.3 | | | 1.77 | | | 8.8 | | | 8.5 | | | 4.750 | |

| Retail/Office | | 1 | | 23,500,000 | | | 2.5 | | | 60.0 | | | 60.0 | | | 1.73 | | | 9.4 | | | 9.1 | | | 5.180 | |

| Self Storage/Industrial | | 1 | | 4,800,000 | | | 0.5 | | | 53.2 | | | 47.3 | | | 1.44 | | | 10.0 | | | 9.5 | | | 5.190 | |

| Medical/Retail | | 23 | | 3,897,927 | | | 0.4 | | | 55.2 | | | 46.6 | | | 1.59 | | | 11.8 | | | 11.2 | | | 5.700 | |

| Multifamily | | 9 | | 41,444,383 | | | 4.4 | | | 60.1 | | | 48.3 | | | 1.43 | | | 10.6 | | | 9.7 | | | 5.409 | |

| Garden | | 6 | | 32,788,581 | | | 3.5 | | | 58.5 | | | 46.5 | | | 1.39 | | | 10.4 | | | 9.6 | | | 5.472 | |

| Student Housing | | 2 | | 4,758,897 | | | 0.5 | | | 69.0 | | | 58.1 | | | 1.31 | | | 9.4 | | | 9.1 | | | 5.640 | |

| High Rise | | 1 | | 3,896,904 | | | 0.4 | | | 62.8 | | | 51.0 | | | 1.93 | | | 13.3 | | | 11.9 | | | 4.600 | |

| Manufactured Housing Community | | 10 | | 25,000,000 | | | 2.7 | | | 69.8 | | | 63.0 | | | 1.29 | | | 8.4 | | | 8.2 | | | 4.900 | |

| Manufactured Housing Community | | 10 | | 25,000,000 | | | 2.7 | | | 69.8 | | | 63.0 | | | 1.29 | | | 8.4 | | | 8.2 | | | 4.900 | |

| Other | | 1 | | 24,000,000 | | | 2.6 | | | 70.4 | | | 70.4 | | | 1.51 | | | 7.7 | | | 7.7 | | | 5.020 | |

| Leased Fee | | 1 | | 24,000,000 | | | 2.6 | | | 70.4 | | | 70.4 | | | 1.51 | | | 7.7 | | | 7.7 | | | 5.020 | |

| Total/Weighted Average: | | 346 | | $937,965,076 | | | 100.0 | % | | 62.7 | % | | 55.7 | % | | 1.83 | x | | 11.7 | % | | 10.9 | % | | 5.043 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2019-C50 | Certain Terms and Conditions |

D.Large Loan Summaries

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| No. 1 – Crown Center Office Park |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Wells Fargo Bank, National Association | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Office – Suburban |

| Original Principal Balance: | $43,500,000 | | Location: | Fort Lauderdale, FL |

| Cut-off Date Balance: | $43,500,000 | | Size: | 341,965 SF |

| % of Initial Pool Balance: | 4.6% | | Cut-off Date Balance Per SF: | $127.21 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per SF: | $110.52 |

| Borrower Sponsors: | James Goldstein; Anders Schroeder | | Year Built/Renovated: | 1987/2018 |

| Guarantors: | James Goldstein; Anders Schroeder | | Title Vesting: | Fee |

| Mortgage Rate: | 5.1600% | | Property Manager: | Self-managed |

| Note Date: | March 6, 2019 | | Current Occupancy (As of): | 85.5% (3/1/2019) |

| Seasoning: | 2 months | | YE 2017 Occupancy: | 79.4% |

| Maturity Date: | March 11, 2029 | | YE 2016 Occupancy(2): | 78.4% |

| IO Period: | 24 months | | YE 2015 Occupancy(2): | 67.8% |

| Loan Term (Original): | 120 months | | YE 2014 Occupancy(2): | 47.3% |

| Amortization Term (Original): | 360 months | | As-Is Appraised Value: | $58,800,000 |

| Loan Amortization Type: | Interest-only, Amortizing Balloon | | As-Is Appraised Value Per SF: | $171.95 |

| Call Protection: | L(26),D(90),O(4) | | As-Is Appraisal Valuation Date: | November 20, 2018 |

| | | | | |

| Lockbox Type: | Soft/Springing Cash Management | | Underwriting and Financial Information |

| Additional Debt: | None | | TTM NOI (2/28/2019)(3): | $3,639,012 |

| Additional Debt Type (Balance): | NAP | | TTM 9/30/2017 NOI(3): | $3,269,241 |

| | | | TTM 9/30/2016 NOI(3): | $2,195,356 |

| | | | YE 2015 NOI: | NAV |

| | | | U/W Revenues: | $7,228,469 |

| | | | U/W Expenses: | $3,098,611 |

| Escrows and Reserves(1) | | U/W NOI: | $4,129,858 |

| | Initial | Monthly | Cap | | U/W NCF: | $3,884,348 |

| Taxes | $298,636 | $59,727 | NAP | | U/W DSCR based on NOI/NCF: | 1.45x / 1.36x |

| Insurance | $166,516 | $41,630 | NAP | | U/W Debt Yield based on NOI/NCF: | 9.5% / 8.9% |

| Replacement Reserve | $0 | $5,984 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF: | 10.9% / 10.3% |

| Leasing Reserve | $3,000,000 | $28,497 | $3,000,000 | | Cut-off Date LTV Ratio: | 74.0% |

| Rent Concession Reserve | $242,500 | $0 | NAP | | LTV Ratio at Maturity: | 64.3% |

| Existing TI/LC Reserve | $293,631 | $0 | NAP | | | |

| | | | | | | |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original loan amount | $43,500,000 | | 100.0% | | Loan payoff | $33,396,671 | | 76.8% |

| | | | | | Upfront reserves | 4,001,283 | | 9.2 |

| | | | | | Closing costs | 925,379 | | 2.1 |

| | | | | | Return of equity | 5,176,667 | | 11.9 |

| Total Sources | $43,500,000 | | 100.0% | | Total Uses | $43,500,000 | | 100.0% |

| (1) | See “Escrows” section. |

| (2) | See “Historical Occupancy” section for a discussion of historical occupancy increases. |

| (3) | See “Cash Flow Analysis” section for a discussion of historical NOI increases and the increase in U/W NOI compared to the most recent NOI. |

The Mortgage Loan. The mortgage loan (the “Crown Center Office Park Mortgage Loan”) is evidenced by a single promissory note secured by a first mortgage encumbering the fee interest in a class B office property in Fort Lauderdale, Florida (the “Crown Center Office Park Property”).

The Borrower and Borrower Sponsors.The borrower is Fort Lauderdale Crown Center, LLC, a Delaware limited liability company and single purpose entity with one independent director. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the Crown Center Office Park Mortgage Loan. The borrower sponsors and non-recourse carve-out guarantors of the Crown Center Office Park Mortgage Loan are James Goldstein and Anders Schroeder.

Mr. Goldstein and Mr. Schroeder co-founded the Midgard Group (“Midgard”), a South Florida real estate development, investment, and management company, of which Mr. Goldstein is the CEO and Mr. Schroeder is the Chairman. Midgard acquires, develops and manages office, industrial, hotel and other commercial real estate properties for its clients. Midgard owns and/or manages seven office properties totaling approximately 634,883 square feet in South Florida (Hollywood, Pompano Beach, Miami, Pembroke Pines and Fort Lauderdale, Florida). Mr. Goldstein has over 30 years of real estate experience, including land acquisition and commercial development of office,

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

warehouse, flex, self-storage and retail properties. Mr. Schroeder has over 35 years of real estate experience and is the former CEO of Jacob Holm, a Copenhagen Stock Exchange company involved in real estate development and industrial businesses, where he served for 11 years. Mr. Schroeder is the Chairman/CEO of Asgard, Ltd, a company with real estate investments and developments in the U.S. and Europe. An affiliate of Mr. Goldstein was involved in a mortgage default related to a storage facility project in which Mr. Goldstein was a limited partner. The general partner of the borrowing entity subsequently passed away with an unresolved estate and Mr. Goldstein took over as the active general partner of the borrowing entity. Mr. Goldstein filed Chapter 11 bankruptcy in order to be able to refinance the storage facility property. See“Description of the Mortgage Pool— Loan Purpose; Default History, Bankruptcy Issues and Other Proceedings”in the Preliminary Prospectus.

The Property.The Crown Center Office Park Property comprises five, 2- and 3-story class B office buildings totaling 341,965 square feet and located in Fort Lauderdale, Florida. Constructed in 1987 and renovated from 2015-2018, the Crown Center Office Park Property was 85.5% leased as of March 1, 2019 to 22 tenants across various industries, including financial, media, insurance, government and education, with no single tenant representing more than 18.1% of net rentable area or 18.9% of underwritten base rent. Approximately 23.8% of the net rentable area and 36.4% of underwritten base rent at the Crown Center Office Park Property is attributed to investment grade tenants (Broward County Sheriff’s Office, CBS Corporation, GSA – DOD, United Insurance Company of America and Branch Bank and Trust Company).

Renovations totaling approximately $1.7 million were completed at all five buildings of the Crown Center Office Park Property since 2015. Such renovations included a gut renovation to include a second floor and building expansion from 45,000 to 75,000 square feet at the 1401 Crown Center building; new restrooms and a newly renovated lobby with new flooring and lighting at the 1415 Crown Center building; new elevators, restrooms and lobby renovations at the 1475 Crown Center building; and new elevators, restrooms, corridors, executive suites and lobby renovations at the 1451 Crown Center building. The 1451 Crown Center building has received LEED Silver Certifications, a BOMA Award, and a Community Appearance Award from the City of Fort Lauderdale; while the 1475 Crown Center building has received LEED Certifications.

The Crown Center Office Park Property is situated on an approximately 11.8-acre site. The Crown Center Office Park Property has access to 1,713 total surface parking spaces (resulting in a parking ratio of approximately 5.0 spaces per 1,000 SF of net rentable area), of which 973 spaces are located on an adjacent surface parking lot ground leased by an affiliate of the borrower from the City of Fort Lauderdale, pursuant to a cross-easement agreement (the ground lease and cross-easement agreement each have a fully extended term expiring in 2080). See “Description of the Mortgage Pool—Mortgage Pool Characteristics—Property Types—Office Properties” in the Preliminary Prospectus.

Major Tenants.

Largest Tenant by UW Base Rent: Bayview Loan Servicing, LLC (61,884 square feet; 18.1% of net rentable area; 18.9% of underwritten base rent; 8/31/2022 lease expiration) – Founded in 1999, Bayview Loan Servicing, LLC (“Bayview”) is a servicer of both residential and commercial mortgage loans. Bayview services loans in all 50 states, Puerto Rico and Guam and is an approved seller/servicer by Fannie Mae and Freddie Mac. Bayview’s headquarters is located in Coral Gables, Florida, approximately 37.8 miles southwest of the Crown Center Office Park Property. Bayview has been a tenant at the Crown Center Office Park Property since January 2015 and has two, 5-year renewal options remaining following its August 2022 lease expiration. Bayview has a termination option for either its entire leased premises or its smaller 16,626 square foot space at the 1425 Crown Center building, each effective as of January 31, 2020 with a nine-month notice period. The termination option is subject to a fee in an amount equal to unamortized costs of landlord’s work, any future landlord concessions, base rent abatement and all leasing commissions, plus an interest rate of 6.0% per annum on a straight-line basis for all of the foregoing amounts.

2nd Largest Tenant by UW Base Rent: Broward County Sherriff’s Office (AAA/Aaa/AAA by Fitch/Moody’s/S&P; 32,600 square feet; 9.5% of net rentable area; 15.1% of underwritten base rent; 9/30/2026 lease expiration) – The Broward County Sherriff’s Office (“BSO”) is a full-service, nationally accredited public safety agency with approximately 5,400 employees, including more than 2,800 certified deputies and more than 600 fire rescue professionals. BSO’s space at the Crown Center Office Park Property serves as offices for the Child Protective Investigations Section (“CPIS”). The unit, which investigates allegations of abuse and neglect of children, has approximately 145 employees that work in the building, and complete between 1,000 and 1,200 investigations every month. BSO has been a tenant at the Crown Center Office Park Property since October 2016 and has two, 5-year renewal options remaining following its September 2026 lease expiration. The tenant has an appropriations related termination option with 60 days’ notice, which can be exercised only in the event that the approved annual funding is insufficient to pay the tenant’s rent under the lease or if the tenant ceases to provide CPIS (or its substantial equivalent) for the State of Florida in Broward County.

3rd Largest Tenant by UW Base Rent: CBS Corporation (BBB/Baa2/BBB by Fitch/Moody’s/S&P; 34,622 square feet; 10.1% of net rentable area; 14.1% of underwritten base rent; 3/31/2020 lease expiration) – CBS Corporation (“CBS”) is a mass media company that creates and distributes content across a variety of platforms to audiences around the world. CBS’s operations span multiple fields of media and entertainment, including cable, publishing, local TV, film and interactive. The Crown Center Office Park Property houses CBS Sports Digital, a division of CBS Interactive, which covers the full spectrum of sports leagues, and provides premium content across all digital platforms. With a focus on serving fans live coverage every day, CBS Sports Digital offers exclusive access to sports events, live and on-demand video, in-depth analysis, breaking news, scores and statistics, and a wide range of fantasy games and advice. CBS has been a tenant at the Crown Center Office Park Property since January 2010 and has two, 5-year renewal options remaining following its March 2020 lease expiration. CBS is currently in negotiations to expand its space by approximately 9,000 square feet and extend its lease through July 2027 at an estimated annual base rent of $17.00 per square foot with 3.0% annual increases; however, the lender provides no assurances that the lease extension and expansion will be executed or effectuated.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

The following table presents certain information relating to the tenancy at the Crown Center Office Park Property:

Major Tenants

| Tenant Name | Credit Rating (Fitch/

Moody’s/

S&P)(1) | Tenant

NRSF | % of

NRSF | Annual U/W Base Rent PSF(2) | Annual

U/W Base Rent(2) | % of Total Annual U/W Base Rent | Lease

Expiration

Date | Extension Options | Termination Option (Y/N) |

| Major Tenants | | | | | | | | |

| Bayview Loan Servicing, LLC | NR/NR/NR | 61,884 | 18.1% | $15.36 | $950,538 | 18.9% | 8/31/2022(3) | 2, 5-year | Y(3) |

| Broward County Sheriff’s Office(4)(5) | AAA/Aaa/AAA | 32,600 | 9.5% | $23.31(4)(5) | $759,958(4) | 15.1% | 9/30/2026(6) | 2, 5-year | Y(6) |

| CBS Corporation(7) | BBB/Baa2/BBB | 34,622 | 10.1% | $20.56(7) | $711,720(7) | 14.1% | 3/31/2020(7) | 2, 5-year | N |

| Crown Center Executive Suites, Inc.(8) | NR/NR/NR | 32,246 | 9.4% | $16.60 | $535,284 | 10.6% | 10/31/2032 | 2, 5-year | N |

| Parkson Corporation | NR/NR/NR | 22,171 | 6.5% | $15.75 | $349,096 | 6.9% | 8/31/2027 | 3, 3-year | N |

| Total Major Tenants | 183,523 | 53.7% | $18.02 | $3,306,596 | 65.6% | | | |

| | | | | | | | | |

| Non-Major Tenant | 109,025 | 31.9% | $15.89 | $1,732,434 | 34.4% | | | |

| | | | | | | | | |

| Occupied Collateral Total | 292,548 | 85.5% | $17.22 | $5,039,030 | 100.0% | | | |

| | | | | | | | | |

| Vacant Space | 49,417 | 14.5% | | | | | | |

| | | | | | | | | |

| Collateral Total | 341,965 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (2) | Annual U/W Base Rent PSF and Annual U/W Base Rent include contractual rent steps through April 2020 totaling $90,037 and straight-line rent averaging for the investment grade tenants Broward County Sheriff’s Office and Branch Banking and Trust Company over their remaining lease terms totaling $88,762. |

| (3) | Bayview has a termination option for either its entire leased premises or its 16,626 square foot space at the 1425 Crown Center building, each effective as of January 31, 2020 with a nine-month notice period. The termination fee will consist of reimbursement of unamortized costs of landlord’s work, any future landlord concessions, base rent abatement and all leasing commissions, plus an interest rate of 6.0% per annum on a straight-line basis for all of the foregoing amounts. |

| (4) | Annual U/W Base Rent PSF and Annual U/W Base Rent for Broward County Sheriff’s Office represents straight-line rent averaging over the remaining lease term totaling $80,010. Broward County Sheriff’s Office’s current base rent is $20.86 per square foot. |

| (5) | The Broward County Sheriff’s Office lease is a gross lease, while the majority of leases at the Crown Center Office Park Property (including all leases shown on the table above) are triple net. |

| (6) | Broward County Sheriff’s Office has an appropriations related termination option with 60 days’ notice which can be exercised only in the event that the approved annual funding is insufficient to pay the tenant’s rent under the lease or if the tenant ceases to provide Child Protective Investigation Section services (or its substantial equivalent) for the State of Florida in Broward County. |

| (7) | CBS Corporation is currently in negotiations to expand its space by approximately 9,000 square feet and extend its lease through July 2027 at an estimated annual base rent of $17.00 per square foot with 3.0% annual increases; however, the lender provides no assurances that the lease extension and expansion will be executed or effectuated. |

| (8) | Crown Center Executive Suites, Inc. is affiliated with the Midgard Group, a borrower sponsor affiliate (see “The Borrower and Borrower Sponsors” section above for a full discussion of the Midgard Group). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

The following table presents certain information relating to the lease rollover schedule at the Crown Center Office Park Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of Leases Expiring | Expiring NRSF | % of Total NRSF | Cumulative Expiring NRSF | Cumulative % of Total NRSF | Annual

U/W

Base Rent(3) | % of Total Annual U/W Base Rent | Annual

U/W

Base Rent

PSF(3) |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2019 | 3 | 19,129 | 5.6% | 19,129 | 5.6% | $210,952 | 4.2% | $11.03 |

| 2020 | 4 | 49,462 | 14.5% | 68,591 | 20.1% | $939,727 | 18.6% | $19.00 |

| 2021 | 4 | 18,734 | 5.5% | 87,325 | 25.5% | $358,159 | 7.1% | $19.12 |

| 2022 | 5 | 89,308 | 26.1% | 176,633 | 51.7% | $1,462,333 | 29.0% | $16.37 |

| 2023 | 1 | 7,322 | 2.1% | 183,955 | 53.8% | $108,751 | 2.2% | $14.85 |

| 2024 | 0 | 0 | 0.0% | 183,955 | 53.8% | $0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 183,955 | 53.8% | $0 | 0.0% | $0.00 |

| 2026 | 2 | 38,624 | 11.3% | 222,579 | 65.1% | $850,469 | 16.9% | $22.02 |

| 2027 | 1 | 22,171 | 6.5% | 244,750 | 71.6% | $349,096 | 6.9% | $15.75 |

| 2028 | 0 | 0 | 0.0% | 244,750 | 71.6% | $0 | 0.0% | $0.00 |

| 2029 | 1 | 15,552 | 4.5% | 260,302 | 76.1% | $224,260 | 4.5% | $14.42 |

| Thereafter | 1 | 32,246 | 9.4% | 292,548 | 85.5% | $535,284 | 10.6% | $16.60 |

| Vacant | 0 | 49,417 | 14.5% | 341,965 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 22 | 341,965 | 100.0% | | | $5,039,030 | 100.0% | $17.22 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Total/Weighted Average Annual U/W Base Rent and Annual U/W Base Rent PSF exclude vacant space. |

The following table presents historical occupancy percentages at the Crown Center Office Park Property:

Historical Occupancy

12/31/2014(1)(2)(3) | 12/31/2015(1)(3)(4) | 12/31/2016(1)(4) | 12/31/2017(1) | 3/1/2019(5) |

| 47.3% | 67.8% | 78.4% | 79.4% | 85.5% |

| (1) | Information obtained from the borrower. |

| (2) | Year-end 2014 occupancy was impacted by Bank of America vacating its space at lease expiration on March 31, 2013 (106,218 square feet, 30.8% of net rentable area) and GSA-DEA vacating its space upon lease expiration on July 31, 2014 (34,463 square feet, 10.0% of net rentable area). |

| (3) | The increase in occupancy from 2014 to 2015 is attributed to six new leases signed at the Crown Center Office Park Property between January 2015 and October 2015 totaling approximately 25.6% of net rentable area. |

| (4) | The increase in occupancy from 2015 to 2016 is attributed to four new leases signed at the Crown Center Office Park Property between July 2016 and October 2016 totaling approximately 11.5% of net rentable area |

| (5) | Information obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at the Crown Center Office Park Property:

Cash Flow Analysis

| | TTM

9/30/2016(1) | TTM

9/30/17(1)(2) | TTM

2/28/2019(2)(3) | U/W(3) | %(4) | U/W $ per

SF |

| Base Rent | $3,258,326 | $4,414,972 | $4,456,063 | $4,860,231 | 60.9% | $14.21 |

| Contractual Rent Steps(5) | 0 | 0 | 0 | 178,799 | 2.2 | 0.52 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 746,908 | 9.4 | 2.18 |

| Gross Potential Rent | $3,258,326 | $4,414,972 | $4,456,063 | $5,785,938 | 72.5% | $16.92 |

| Other Income(6) | 14,100 | 16,223 | 14,265 | 14,808 | 0.2 | 0.04 |

| Total Recoveries | 1,651,961 | 1,803,272 | 2,121,754 | 2,174,631 | 27.3 | 6.36 |

| Net Rental Income | $4,924,387 | $6,234,467 | $6,592,081 | $7,975,377 | 100.0% | $23.32 |

| (Vacancy & Credit Loss) | 0 | 0 | 0 | (746,908)(7) | (12.9) | (2.18) |

| Effective Gross Income | $4,924,387 | $6,234,467 | $6,592,081 | $7,228,469 | 90.6% | $21.14 |

| | | | | | | |

| Real Estate Taxes | 647,503 | 685,242 | 715,035 | 936,744 | 13.0 | 2.74 |

| Insurance | 380,224 | 390,969 | 438,808 | 475,768 | 6.6 | 1.39 |

| Management Fee | 345,542 | 355,084 | 333,996 | 216,854 | 3.0 | 0.63 |

| Other Operating Expenses | 1,355,762 | 1,533,931 | 1,465,231 | 1,469,245 | 20.3 | 4.30 |

| Total Operating Expenses | $2,729,031 | $2,965,226 | $2,953,070 | $3,098,611 | 42.9% | $9.06 |

| | | | | | | |

| Net Operating Income | $2,195,356 | $3,269,241 | $3,639,012 | $4,129,858 | 57.1% | $12.08 |

| Replacement Reserves | 0 | 0 | 0 | 70,813 | 1.0 | 0.21 |

| TI/LC | 0 | 0 | 0 | 174,697 | 2.4 | 0.51 |

| Net Cash Flow | $2,195,356 | $3,269,241 | $3,639,012 | $3,884,348 | 53.7% | $11.36 |

| | | | | | | |

| NOI DSCR | 0.77x | 1.15x | 1.28x | 1.45x | | |

| NCF DSCR | 0.77x | 1.15x | 1.28x | 1.36x | | |

| NOI Debt Yield | 5.0% | 7.5% | 8.4% | 9.5% | | |

| NCF Debt Yield | 5.0% | 7.5% | 8.4% | 8.9% | | |

| (1) | The increase in Net Operating Income from TTM 9/30/2016 to TTM 9/30/2017 was driven by eight new leasestotaling 22.3% of underwritten base rent commencing between October 2015 and April 2017 andone renewal leasetotaling 1.8% of underwritten base rent commencing July 2016. |

| (2) | The increase in Net Operating Income from TTM 9/30/2017 to TTM 2/28/2019 was driven by three new leasestotaling 6.3% of underwritten base rent commencing between December 2017 and October 2018 andone renewal leasetotaling 6.9% of underwritten base rent commencing May 2018. |

| (3) | The increase in Net Operating Income from TTM 2/28/2019 to U/W was driven by (i) one new lease totaling 4.5% of underwritten base rent commencing April 2019 and (ii) the inclusion of contractual rent steps through April 2020 totaling $90,037 and straight-line rent averaging for the investment grade tenants Broward County Sheriff’s Office and Branch Banking and Trust Company over their remaining lease terms totaling $88,762. |

| (4) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (5) | Represents contractual rent steps through April 2020 and straight-line rent averaging for the investment grade tenants over their remaining lease terms (see “Major Tenants” table above). |

| (6) | Other Income is primarily composed of parking revenue. |

| (7) | The underwritten economic vacancy is 12.9%. The Crown Center Office Park Property was 85.5% physically occupied as of March 1, 2019. |

Appraisal. The appraiser concluded to an “as-is” Appraised Value for the Crown Center Office Park Property of $58,800,000 as of November 20, 2018.

Environmental Matters. According to the Phase I environmental site assessment dated October 8, 2018, the presence of an on-site diesel underground storage tank is considered a recognized environmental condition. Based on the lack of release cases, the results of the Florida Department of Environmental Protection inspections, and availability of financial resources including insurance should a release occur, no further investigation was recommended by the environmental consultant. There was no evidence of any other recognized environmental conditions at the Crown Center Office Park Property.

Market Overview and Competition.The Crown Center Office Park Property is located in Fort Lauderdale, Broward County, Florida, approximately 1.2 miles west of Interstate 95 (provides access southbound to Hollywood and Miami), 3.3 miles west of Highway 1, 7.0 miles northwest of the Fort Lauderdale central business district and 12.8 miles northwest of the Fort Lauderdale-Hollywood International Airport. Cypress Creek Station is located approximately 0.9 miles southeast of the Crown Center Office Park Property and provides rail access northbound to West Palm Beach and southbound to the Miami International Airport via the Tri-Rail system. The Fort Lauderdale Station and Fort Lauderdale/Hollywood International Airport Station are each respectively located one and two

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

stops south of the Cypress Creek Station stop. Cypress Creek Station shopping center is located approximately 1.2 miles northeast of the Crown Center Office Park Property and features an LA Fitness, Office Depot, Longhorn Steakhouse, Five Guys and a 16-screen Regal Cinemas Theater.

According to a third party market research provider, the estimated 2019 population within a three- and five-mile radius of the Crown Center Office Park Property was approximately 128,730 and 437,255, respectively; and the estimated 2019 average household income within the same radii was approximately $63,609 and $64,560, respectively.

Submarket Information – According to a third-party market research report, the Crown Center Office Park Property is situated within the Cypress Creek submarket of the Fort Lauderdale Office Market. As of April 4, 2019, the Cypress Creek submarket reported a total inventory of approximately 8.2 million square feet with a 12.1% vacancy rate and average asking rent of $26.70 per square foot, gross. The submarket vacancy rate has decreased from 18.3% in 2013 and has averaged 14.9% from 2013 through 2018. Within a one-mile radius of the Crown Center Office Park Property, as of April 11, 2019, there were 85 office properties totaling approximately 4.1 million square feet with a 12.5% vacancy rate, per a third-party market research provider.

The following table presents certain information relating to the appraiser’s market rent conclusions for the Crown Center Office Park Property:

Market Rent Summary(1)

| | < 5,000 SF | 5,000 – 10,000 SF | 10,000 – 20,000 SF | > 20,000 SF | Bank Space |

| Market Rent (PSF) | $16.00 | $15.50 | $15.00 | $14.50 | $30.00 |

| Lease Term (Years) | 3-5 | 3-5 | 3-5 | 10 | 10 |

| Concessions | 3 mos. | 3 mos. | 6 mos. | 6 mos. | 6 mos. |

| Lease Type (Reimbursements) | Triple Net | Triple Net | Triple Net | Triple Net | Triple Net |

| Rent Increase Projection | 3.0% per annum | 3.0% per annum | 3.0% per annum | 3.0% per annum | 3.0% per annum |

| Tenant Improvements (New Tenants) (PSF) | $10.00 | $10.00 | $10.00 | $10.00 | $10.00 |

| Tenant Improvements (Renewals) (PSF) | $2.50 | $2.50 | $2.50 | $2.50 | $2.50 |

| (1) | Information obtained from the appraisal. |

The table below presents certain information relating to comparable sales pertaining to the Crown Center Office Park Property identified by the appraiser:

Comparable Sales(1)

| Property Name | Location | Rentable Area (SF) | Sale Date | Sale Price | Sale Price (PSF) |

| Waterford at Blue | Miami, FL | 357,466 | May-16 | $74,000,000 | $207.01 |

| Doral Corporate Center I | Doral, FL | 279,098 | Aug-16 | $48,750,000 | $174.67 |

| Arvida Executive Center | Boca Raton, FL | 122,608 | Apr-17 | $24,000,000 | $195.75 |

| Colonial Center at Town | Lake Mary, FL | 662,320 | May-17 | $136,070,000 | $205.44 |

| 301 Yamato | Boca Raton, FL | 206,946 | Jul-17 | $39,200,000 | $189.42 |

| Sabal Business Center | Tampa, FL | 100,001 | Jun-18 | $15,225,000 | $152.25 |

| Hillsboro Center | Deerfield Beach, FL | 216,114 | Nov-18 | $29,000,000 | $134.19 |

| (1) | Information obtained from the appraisal. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

The following table presents certain information relating to comparable properties to Crown Center Office Park Property:

Comparable Properties(1)

| Property Name/Location | Year Built/ Renovated | Total GLA (SF) | Distance from Subject | Occupancy | Available Space Size | Asking Base Rent PSF | Lease Type |

Cypress Court 6360 NW. 5th Way Fort Lauderdale, FL | 1986/NAP | 42,021 | 1.0 mile | 69.4% | 14,366 SF | $14.00 | NNN |

Cypress Creek Tower 800 W. Cypress Creek Fort Lauderdale, FL | 1974/2014 | 61,917 | 0.6 miles | 87.9% | 2,976 SF | $14.95 | NNN |

1901 W. Cypress Creek Fort Lauderdale, FL | 1987/NAP | 140,635 | 0.4 miles | 61.9% | 15,793 SF | $15.50 | NNN |

Roschman Business 6300 NE. 1st Ave. Fort Lauderdale, FL | 1987/NAP | 31,144 | 1.2 miles | 67.6% | 10,081 SF | $16.50 | NNN |

Hotwire Technology 2100 W. Cypress Creek Fort Lauderdale, FL | 1969/2006 | 185,000 | 0.6 miles | 90.9% | 16,779 SF | $17.50 | NNN |

1201 W Cypress Creek Fort Lauderdale, FL | 1980/1995 | 110,500 | 0.2 miles | 71.3% | 31,692 SF | $17.50 | NNN |

| (1) | Information obtained from the appraisal. |

Escrows.

Real Estate Taxes – The Crown Center Office Park Mortgage Loan documents require an upfront real estate tax reserve of $298,636 and ongoing monthly real estate tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next twelve months (initially $59,727).

Insurance – The Crown Center Office Park Mortgage Loan documents require an upfront insurance reserve of $166,516 and ongoing monthly insurance reserves in an amount equal to one-twelfth of the insurance premiums that the lender estimates will be payable for the renewal of the coverage during the next twelve months (initially $41,630).

Replacement Reserve – The Crown Center Office Park Mortgage Loan documents require ongoing monthly replacement reserves of $5,984, which the lender may require the borrower to increase (not more than once per year) if the lender reasonably determines such increase is necessary to maintain the proper operation of the Crown Center Office Park Property.

Leasing Reserve –The Crown Center Office Park Mortgage Loan documents require an upfront general tenant improvements and leasing commissions (“TI/LC”) reserve of $3,000,000 and ongoing monthly TI/LC reserves of $28,497, subject to a cap of $3,000,000 (which cap will only apply so long as no event of default is continuing, the net cash flow debt yield (“NCF Debt Yield”) is equal to or greater than 8.25% and the Crown Center Office Park Property’s occupancy is no less than 80.0%). Of the $3,000,000 upfront general TI/LC reserve, $500,000 will be restricted to qualified leasing expenses for Bayview (“Restricted Funds”).

In the event that (i) Bayview waives its termination right or the termination option lapses (see “The Property” section above) or (ii) Bayview exercises its termination option and, following such termination, the NCF Debt Yield is greater than or equal to 8.25% and the Crown Center Office Park Property’s occupancy is at least 80.0%, the TI/LC reserve cap will be reduced to $1,500,000 and any funds in excess of the reduced cap will be (x) if no Cash Trap Event Period (as defined in the “Lockbox and Cash Management Section” below) is continuing, disbursed to the borrower and (y) if a Cash Trap Event Period is continuing, deposited into the lender-controlled cash management account to be applied in accordance with the Crown Center Office Park Mortgage Loan documents.

Provided that the NCF Debt Yield is greater than or equal to 8.25% and the Crown Center Office Park Property’s occupancy is at least 80.0% and upon either (i) a Major Tenant Re-Tenanting Event (as defined in the “Lockbox and Cash Management Section” below) having occurred with respect to space at the Crown Center Office Park Property in an amount equal to at least 75.0% of the Bayview space or (ii) Bayview having extended the term of its lease for at least 75.0% of the Bayview space at the Crown Center Office Park Property with one or more tenants satisfactory to the lender in accordance with the Crown Center Office Park Mortgage Loan documents together with receipt of an estoppel confirming that all obligations of the borrower to such tenant with respect to tenant improvements and leasing commissions have been satisfied in full and that such tenant is then paying full, unabated rent pursuant to the terms thereof (or amounts equal to the free or abated rent having been reserved) (collectively, a “Major Tenant Re-Leasing Event”), any Restricted Funds remaining after paying all related leasing expenses will be: (x) if no Cash Trap Event Period is continuing, disbursed to borrower and (y) if a Cash Trap Event Period is continuing, deposited into the lender-controlled cash management account to be applied in accordance with the Crown Center Office Park Mortgage Loan documents.

Starting with the August 2021 monthly payment date, all TI/LC reserve funds will only be available for lease renewals or new leases to be entered into for existing leases set to expire in 2022 until all such space has been leased to one or more satisfactory tenants which are in occupancy, paying full, unabated rent (or amounts equal to such free or abated rent having been reserved) and TI/LCs having been paid.

Rent Concession Reserve – The Crown Center Office Park Mortgage Loan documents require an upfront reserve of $242,500 for rent concessions related to the Early Learning Center tenant.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

Office – Suburban 1401, 1415, 1425, 1451 & 1475 West Cypress Creek Road Fort Lauderdale, Florida 33309 | Loan #1 Crown Center Office Park | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $43,500,000 74.0% 1.36x 9.5% |

Existing TI/LC Reserve – The Crown Center Office Park Mortgage Loan documents require an upfront reserve of $293,631 for TI/LCs related to the Early Learning Center tenant.

Lockbox and Cash Management. The Crown Center Office Park Mortgage Loan is structured with a soft lockbox, which is already in place, and springing cash management. Prior to the occurrence of a Cash Trap Event Period (as defined below), the Crown Center Office Park Mortgage Loan documents require that the borrower or the property manager deposit all rents into the lockbox account within one business day of receipt and all funds in the lockbox account are required to be distributed to the borrower. During a Cash Trap Event Period, the borrower is required to direct all tenants to pay rent directly into such lockbox account and funds in the lockbox account are required to be swept on each business day to a lender-controlled cash management account and all excess funds are required to be swept to an excess cash flow subaccount controlled by the lender.

A “Cash Trap Event Period” will commence upon the earlier of the following:

| (i) | the occurrence and continuance of an event of default; |

| (ii) | the amortizing net cash flow debt service coverage ratio (“NCF DSCR”) falling below 1.15x at the end of any calendar quarter; or |

| (iii) | the occurrence and continuation of a Major Tenant Event Period (as defined below). |

A Cash Trap Event Period will end upon the occurrence of the following:

| ● | with regard to clause (i), the cure of such event of default; |

| ● | with regard to clause (ii), the amortizing NCF DSCR being greater than or equal to 1.20x for two consecutive calendar quarters; or |

| ● | with regard to clause (iii), a Major Tenant Event Period Cure (as defined below). |

A “Major Tenant Event Period” will commence upon the earliest to occur of the following:

| (i) | Bayview failing to renew or extend its lease on the terms set forth in its lease on or prior to the deadline to renew such lease (Bayview’s lease stipulates a nine-month notice period); |

| (ii) | a default, beyond any notice and grace period, under Bayview’s lease; |

| (iii) | Bayview filing, as a debtor, a bankruptcy or similar insolvency proceeding, or otherwise becoming involved, as a debtor, in a bankruptcy or any similar insolvency proceeding; or |

| (iv) | Bayview terminating or canceling its lease (or such lease otherwise fails to be in full force and effect), or giving notice of, or commencing a legal proceeding asserting any of the foregoing. |

A “Major Tenant Event Period Cure” will occur upon:

| ● | with regard to clause (i) above, upon the occurrence of (x) a Major Tenant Re-Tenanting Event (as defined below) or (y) a Major Tenant Re-Leasing Event; |

| ● | with regard to clause (ii) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) the applicable default having been cured and no other default under the related lease having occurred (beyond any notice and cure period) for a period of two consecutive calendar quarters; |

| ● | with regard to clause (iii) above, (x) a Major Tenant Re-Tenanting Event having occurred or (y) the bankruptcy or insolvency proceeding having been terminated in a manner satisfactory to the lender, the related lease having been affirmed, and the terms of such lease, as affirmed, being satisfactory to the lender; or |

| ● | with regard to clause (iv) above, (x) a Major Tenant Re-Tenanting Event having occurred. |

A “Major Tenant Re-Tenanting Event” will occur upon the lender receiving satisfactory evidence, including, without limitation, a satisfactory estoppel certificate from each such replacement tenant affirming, that: (i) space at the Crown Center Office Park Property in an amount equal to at least 75.0% of the Bayview space has been leased to one or more satisfactory replacement tenants pursuant to a satisfactory replacement lease, (ii) each such tenant is in occupancy of its premises, is open for business and is paying full, unabated rent pursuant to the terms of its lease (or such abatement having been reserved), and (iii) all tenant improvement costs and leasing commissions provided in each such replacement lease have been paid.

Property Management. The Crown Center Office Park Property is managed by an affiliate of the borrower.

Partial Release. Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not permitted.

Ground Lease. None.

Terrorism Insurance.The Crown Center Office Park Mortgage Loan documents require that the “all risk” insurance policy required to be maintained by the borrower provides coverage for terrorism in an amount equal to the full replacement cost of the Crown Center Office Park Property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 6-month extended period of indemnity.

Windstorm Insurance. The Crown Center Office Park Mortgage Loan documents require windstorm insurance (including named storms) covering 100% of the full replacement cost of the Crown Center Office Park Property during the loan term.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| No. 2 – Ohio Hotel Portfolio |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | RREF | | Single Asset/Portfolio: | Portfolio |

Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Hospitality – Various |

| Original Principal Balance: | $35,500,000 | | Location: | Various, OH |

| Cut-off Date Balance: | $35,429,107 | | Size: | 359 Rooms |

| % of Initial Pool Balance: | 3.8% | | Cut-off Date Balance Per Room | $98,688 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per Room: | $82,885 |

| | | | Year Built/Renovated: | Various/NAP |

| Borrower Sponsors: | Har S. Bhatnagar; Rani B. Bhatnagar | | Title Vesting: | Fee |

| Guarantors: | Har S. Bhatnagar; Rani B. Bhatnagar | | Property Manager: | Self-managed |

| Mortgage Rate: | 5.6000% | | Current Occupancy (As of): | 75.3% (02/28/2019) |

| Note Date: | February 21, 2019 | | YE 2018 Occupancy: | 74.8% |

| Seasoning: | 2 months | | YE 2017 Occupancy: | 72.3% |

| Maturity Date: | March 6, 2029 | | YE 2016 Occupancy(2): | 69.7% |

| IO Period: | NAP | | YE 2015 Occupancy(2): | 70.4% |

| Loan Term (Original): | 120 months | | Appraised Value: | $53,000,000 |

| Amortization Term (Original): | 360 months | | Appraised Value Per Room: | $147,632 |

| Loan Amortization Type: | Amortizing Balloon | | Appraisal Valuation Date: | December 5, 2018 |

| Call Protection: | L(26),D(90),O(4) | | |

| Lockbox Type: | Hard/Upfront Cash Management | | | |

| Additional Debt: | None | | Underwriting and Financial Information |

| Additional Debt Type (Balance): | NAP | | TTM 2/28/2019 NOI: | $4,389,142 |

| | | | YE 2018 NOI: | $4,266,285 |

| | | | YE 2017 NOI: | $4,056,508 |

| | | | YE 2016 NOI(2): | $2,917,736 |

| | | | | | U/W Revenues: | $14,267,968 |

| Escrows and Reserves(1) | | U/W Expenses: | $9,726,731 |

| | Initial | Monthly | Cap | | U/W NOI: | $4,541,237 |

| Taxes | $145,847 | $59,032 | NAP | | U/W NCF: | $3,970,518 |

| Insurance | $941 | Springing | NAP | | U/W DSCR based on NOI/NCF: | 1.86x / 1.62x |

| FF&E Reserve | $0 | (1) | NAP | | U/W Debt Yield based on NOI/NCF: | 12.8% / 11.2% |

| PIP Reserve | $898,701 | $0 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF: | 15.3% / 13.3% |

| Seasonality Reserve | $0 | (1) | $480,000 | | Cut-off Date LTV Ratio: | 66.8% |

| Promissory Note Reserve | $1,393,751 | $0 | NAP | | LTV Ratio at Maturity: | 56.1% |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original loan amount | $35,500,000 | | 98.9% | | Loan payoff | $32,423,163 | | 90.3% |

| Sponsor equity | 408,147 | | 1.1 | | Upfront reserves | 2,439,240 | | 6.8 |

| | | | | | Closing costs | 1,045,744 | | 2.9 |

| | | | | | | | | |

| Total Sources | $35,908,147 | | 100.0% | | Total Uses | $35,908,147 | | 100.0% |

| (1) | See “Escrows” section below. |

| (2) | The Holiday Inn West Chester and SpringHill Suites Beavercreek opened in 2015 and 2016, respectively. Historical occupancy information for 2015 includes only the Holiday Inn Express & Suites Dayton. 2016 occupancy and NOI information includes only a partial year of the Holiday Inn West Chester and excludes the SpringHill Suites Beavercreek. 2017 occupancy and NOI information includes only a partial year of the SpringHill Suites Beavercreek. |

The Mortgage Loan. The mortgage loan (the “Ohio Hotel Portfolio Mortgage Loan”) is evidenced by a first mortgage encumbering the fee simple interest in two limited service hotels and one full service hotel, the SpringHill Suites Beavercreek located in Beavercreek, OH, the Holiday Inn West Chester located in West Chester, OH and the Holiday Inn Express & Suites Dayton located in Dayton, OH (collectively, the “Ohio Hotel Portfolio Properties”).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

Hospitality – Various Property Addresses - Various, OH | Loan #2 Ohio Hotel Portfolio | Cut-off Date Balance: Cut-off Date LTV: U/W NCF DSCR: U/W NOI Debt Yield: | | $35,429,107 66.8% 1.62x 12.8% |

The Borrowers and Borrower Sponsors.The borrowers under the Ohio Hotel Portfolio Mortgage Loan are Mall Innkeepers, LLC, Primary Dayton Innkeepers, LLC and Union Centre Innkeepers, LLC (collectively, the “Ohio Hotel Portfolio Borrowers”). The nonrecourse carve-out guarantors of the Ohio Hotel Portfolio Mortgage Loan are Har S. Bhatnagar and Rani B. Bhatnagar (collectively, the “Ohio Hotel Portfolio Sponsors”).

Har Bhatnagar founded Middletown Hotel Management (“Middletown”) in 1989 and has developed and operated 11 hotels. Middletown’s current portfolio consists of 968 keys across 8 properties.

The Properties.The Ohio Hotel Portfolio Properties include three properties located across Ohio comprised of a total of 359 rooms.

The SpringHill Suites Beavercreek, developed by the Ohio Hotel Portfolio Sponsors and opened in late 2016, is a 118-room, all-suite limited-service hotel located in Beavercreek, OH. The property offers a 24-hour reception desk, free high speed WiFi, 24-hour sundry marketplace, complimentary breakfast, a fitness center, a heated indoor pool, an onsite business center, a lounge serving beer/wine after 5pm, and an outdoor patio with fire pit. All standard guestrooms and suites feature en suite bathrooms with showers and tubs, black-out shades, a hair dryer, flat-screen TVs, a work desk with lamp, microwaves and mini refrigerators, and coffee or tea makers.

The Holiday Inn West Chester, developed by the Ohio Hotel Portfolio Sponsors and opened in late 2015, is a 130-room full-service hotel located in West Chester, OH. The property offers a 24-hour reception desk, free high speed WiFi, Johnny’s Italian Steakhouse, Blue Bar, room service, a fitness center, a heated indoor pool, and an onsite business center. The hotel features 25,605 SF of dedicated meeting space, spread across six interior and two exterior event spaces, the biggest of which is a 8,909 SF ballroom. All standard guestrooms and suites feature en suite bathrooms with showers and/or tubs, black-out shades, a hair dryer, flat-screen TVs, work desk with lamp, microwaves and mini refrigerators, and coffee or tea makers.