| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-12 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,634,271,868

(Approximate Initial Pool Balance)

$1,401,183,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

BANK 2020-BNK25

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Morgan Stanley Mortgage Capital Holdings LLC

Bank of America, National Association

Wells Fargo Bank, National Association

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2020-BNK25

January 21, 2020

WELLS FARGO SECURITIES | BofA SECURITIES | MORGAN STANLEY |

| | |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

| | |

Academy Securities, Inc. Co-Manager | | Drexel Hamilton Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, BofA Securities, Inc., Morgan Stanley & Co. LLC, Academy Securities, Inc., Drexel Hamilton, LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

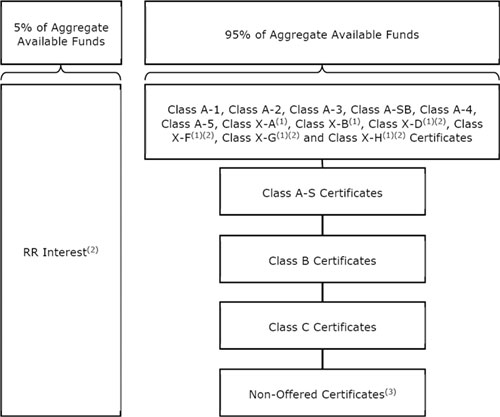

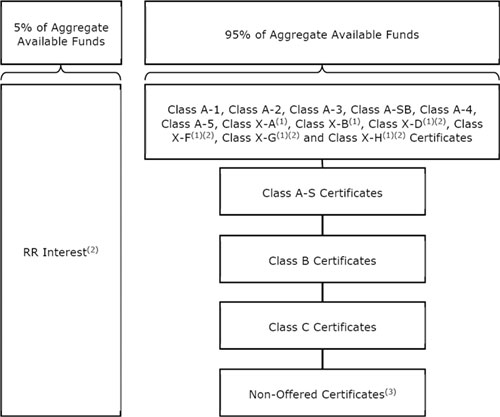

BANK 2020-BNK25 | Certificate Structure |

I. Certificate Structure

Class | Expected Ratings

(Fitch/KBRA/S&P)(1) | Approximate Initial

Certificate Balance or

Notional Amount(2) | Approx.

Initial Credit

Support(3) | Pass-Through

Rate Description | Weighted

Average

Life

(Years)(4) | Expected

Principal

Window(4) | Certificate

Principal to

Value

Ratio(5) | Certificate

Principal

U/W NOI

Debt Yield(6) |

| Offered Certificates | | | | |

A-1 | AAAsf/AAA(sf)/AAA(sf) | $15,250,000 | 30.000% | (7) | 2.63 | 03/20 - 01/25 | 36.0% | 19.7% |

A-2 | AAAsf/AAA(sf)/AAA(sf) | $8,461,000 | 30.000% | (7) | 4.92 | 01/25 - 01/25 | 36.0% | 19.7% |

A-3 | AAAsf/AAA(sf)/AAA(sf) | $61,183,000 | 30.000% | (7) | 6.85 | 12/26 - 01/27 | 36.0% | 19.7% |

A-SB | AAAsf/AAA(sf)/AAA(sf) | $22,612,000 | 30.000% | (7) | 7.25 | 01/25 - 08/29 | 36.0% | 19.7% |

A-4 | AAAsf/AAA(sf)/AAA(sf) | (8) | 30.000% | (7) | (8) | (8) | 36.0% | 19.7% |

A-5 | AAAsf/AAA(sf)/AAA(sf) | (8) | 30.000% | (7) | (8) | (8) | 36.0% | 19.7% |

X-A | AAAsf/AAA(sf)/AAA(sf) | $1,086,790,000(9) | N/A | Variable(10) | N/A | N/A | N/A | N/A |

X-B | A-sf/AAA(sf)/A(sf) | $314,393,000(11) | N/A | Variable(12) | N/A | N/A | N/A | N/A |

A-S | AAAsf/AAA(sf)/AAA(sf) | $194,070,000 | 17.500% | (7) | 9.92 | 01/30 - 01/30 | 42.5% | 16.7% |

B | AA-sf/AA-(sf)/AA(sf) | $62,102,000 | 13.500% | (7) | 9.92 | 01/30 - 01/30 | 44.5% | 16.0% |

C | A-sf/A-(sf)/A(sf) | $58,221,000 | 9.750% | (7) | 9.92 | 01/30 - 01/30 | 46.5% | 15.3% |

| Non-Offered Certificates | | | | | | | |

X-D | BBB-sf/BBB-(sf)/NR | $58,221,000(13) | N/A | Variable(14) | N/A | N/A | N/A | N/A |

X-F | BB-sf/BB-(sf)/NR | $29,111,000(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A |

X-G | B-sf/B-(sf)/NR | $15,525,000(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A |

X-H | NR/NR/NR | $48,518,274(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A |

D | BBBsf/BBB(sf)/NR | $36,874,000 | 7.375% | (7) | 9.92 | 01/30 - 01/30 | 47.7% | 14.9% |

E | BBB-sf/BBB-(sf)/NR | $21,347,000 | 6.000% | (7) | 9.92 | 01/30 - 01/30 | 48.4% | 14.7% |

F | BB-sf/BB-(sf)/NR | $29,111,000 | 4.125% | (7) | 9.96 | 01/30 - 02/30 | 49.4% | 14.4% |

G | B-sf/B-(sf)/NR | $15,525,000 | 3.125% | (7) | 10.01 | 02/30 - 02/30 | 49.9% | 14.2% |

H | NR/NR/NR | $48,518,274 | 0.000% | (7) | 10.01 | 02/30 - 02/30 | 51.5% | 13.8% |

| Non-Offered Eligible Vertical Interest | | | | | |

RR Interest | NR/NR/NR | $81,713,593.41 | N/A | WAC(17) | 9.60 | 03/20 - 02/30 | N/A | N/A |

Notes:

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, Inc. (“KBRA”) and S&P Global Ratings (“S&P”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated January 21, 2020 (the “Preliminary Prospectus”). Fitch, KBRA and S&P have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-H Certificates (collectively referred to herein as “Class X Certificates”) may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined in the Preliminary Prospectus) whose Certificate Balances comprise such Notional Amounts and, if as a result of such pricing the pass-through rate of any Class of the Class X Certificates would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates in the aggregate. The RR Interest only provides credit support to the limited extent that losses incurred on the underlying mortgage loans are allocated to it, on the one hand, and to the Offered Certificates and the Non-Offered Certificates, on the other hand, pro rata, in accordance with their respective Percentage Allocation Entitlements. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RR Interest). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (other than the RR Interest). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

BANK 2020-BNK25 | Certificate Structure |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RR Interest) and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (other than the RR Interest) and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-SB, A-4, A-5, A-S, B, C, D, E, F, G and H Certificates will, in each case, be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The exact initial Certificate Balances of the Class A-4 and A-5 Certificates are unknown and will be determined based on the final pricing of those Classes of Certificates. However, the respective approximate initial Certificate Balances, weighted average lives and principal windows of the Class A-4 and A-5 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-4 and A-5 Certificates is expected to be approximately $979,284,000, subject to a variance of plus or minus 5%. |

Class of Certificates | | Expected Range of Approximate Initial

Certificate Balance | | Expected Range of Weighted Average Life (Years) | | Expected Range of

Principal Window |

| Class A-4 | | $100,000,000 - $480,000,000 | | 9.59 – 9.76 | | 08/29 – 10/29 / 08/29 – 12/29 |

| Class A-5 | | $499,284,000 - $879,284,000 | | 9.84 – 9.86 | | 10/29 – 01/30 / 12/29 – 01/30 |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-SB, A-4 and A-5 Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (12) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (13) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and E Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (14) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and E Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (15) | The Class X-F, Class X-G and Class X-H Certificates are notional amount certificates. The Notional Amounts of the Class X-F, Class X-G and Class X-H Certificates will be equal to the Certificate Balance of the Class F, Class G and Class H Certificates, respectively, outstanding from time to time. None of the Class X-F, Class X-G and Class X-H Certificates will be entitled to distributions of principal. |

| (16) | The pass-through rates for the Class X-F, Class X-G and Class X-H Certificates for any distribution date will, in each case, be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F, Class G and Class H Certificates, respectively, for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (17) | The effective interest rate for the RR Interest will be a variable rate per annum (described in the table as “WAC”) equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date. For purposes of calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

BANK 2020-BNK25 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

Mortgage Loan Seller | | Number

of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | Approx. % of

Initial Pool

Balance |

Morgan Stanley Mortgage Capital Holdings LLC | | 17 | | 26 | | $528,035,571 | | 32.3% |

Bank of America, National Association | | 23 | | 34 | | 520,230,000 | | 31.8 |

Wells Fargo Bank, National Association | | 12 | | 12 | | 376,185,669 | | 23.0 |

National Cooperative Bank, N.A. | | 24 | | 24 | | 109,820,629 | | 6.7 |

Wells Fargo Bank, National Association / Morgan Stanley Mortgage Capital Holdings LLC | | 1 | | 1 | | 100,000,000 | | 6.1 |

Total | | 77 | | 97 | | $1,634,271,868 | | 100.0% |

Loan Pool:

Initial Pool Balance: | $1,634,271,868 |

Number of Mortgage Loans: | 77 |

Average Cut-off Date Balance per Mortgage Loan: | $21,224,310 |

Number of Mortgaged Properties: | 97 |

Average Cut-off Date Balance per Mortgaged Property(1): | $16,848,164 |

Weighted Average Mortgage Interest Rate: | 3.433% |

Ten Largest Mortgage Loans as % of Initial Pool Balance: | 48.3% |

Weighted Average Original Term to Maturity or ARD (months): | 118 |

Weighted Average Remaining Term to Maturity or ARD (months): | 116 |

Weighted Average Original Amortization Term (months)(2): | 375 |

Weighted Average Remaining Amortization Term (months)(2): | 374 |

Weighted Average Seasoning (months): | 2 |

(1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

(2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

Weighted Average U/W Net Cash Flow DSCR(1): | 3.56x |

Weighted Average U/W Net Operating Income Debt Yield(1): | 13.8% |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 51.5% |

Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 50.5% |

% of Mortgage Loans with Additional Subordinate Debt(2): | 34.2% |

% of Mortgage Loans with Single Tenants(3): | 15.1% |

(1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property are calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

(2) | Twenty (20) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A., currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description |

of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus.

(3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

BANK 2020-BNK25 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 15.5% of the mortgage pool (35 mortgage loans) has scheduled amortization, as follows:

9.5% (26 mortgage loans) requires amortization during the entire loan term; and

6.1% (9 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Initial Pool Balance, 84.5% of the mortgage pool (42 mortgage loans) provides for interest-only payments during the entire loan term through maturity or ARD. The weighted average Cut-off Date Loan-to-Value Ratio and weighted average U/W Net Cash Flow DSCR for those mortgage loans are 53.0% and 3.45x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 51.2% of the mortgage pool (16 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

Real Estate Taxes: | 48.8% of the pool |

Insurance: | 25.5% of the pool |

Capital Replacements: | 42.6% of the pool |

TI/LC: | 37.5% of the pool(1) |

(1) The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, mixed use, retail and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

52.0% of the mortgage pool (37 mortgage loans) features a lockout period, then defeasance only until an open period;

17.5% of the mortgage pool (8 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period; and

11.6% of the mortgage pool (5 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period;

9.1% of the mortgage pool (2 mortgage loans) features no lockout period, but the greater of a prepayment premium or yield maintenance, then the greater of a prepayment premium or yield maintenance or defeasance until an open period;

6.7% of the mortgage pool (24 mortgage loans) features no lockout period, but requires the greater of a prepayment premium or yield maintenance, then a prepayment premium until an open period;

3.1% of the mortgage pool (1 mortgage loan) features a lockout period, then yield maintenance until an open period;

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

BANK 2020-BNK25 | Issue Characteristics |

III. Issue Characteristics

Securities Offered: | $1,401,183,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eleven classes (Classes A-1, A-2, A-3, A-SB, A-4, A-5, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

Mortgage Loan Sellers: | Morgan Stanley Mortgage Capital Holdings LLC (“MSMCH”), Bank of America, National Association (“BANA”), Wells Fargo Bank, National Association (“WFB”) and National Cooperative Bank, N.A. (“NCB”). |

Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, BofA Securities, Inc. and Morgan Stanley & Co. LLC |

Co-Manager: | Academy Securities, Inc. and Drexel Hamilton, LLC |

Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, Inc. and S&P Global Ratings |

Master Servicers: | Wells Fargo Bank, National Association and National Cooperative Bank, N.A. |

Special Servicers: | KeyBank National Association and National Cooperative Bank, N.A. |

Certificate Administrator: | Wells Fargo Bank, National Association |

Trustee: | Wilmington Trust, National Association |

Operating Advisor: | Pentalpha Surveillance LLC |

Asset Representations Reviewer: | Pentalpha Surveillance LLC |

U.S. Credit Risk Retention: | For a discussion of the manner in which the U.S. credit risk retention requirements are being addressed by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. |

EU Risk Retention: | None of the sponsors, the depositor, the underwriters or their respective affiliates, or any other person is required or intends to retain a material net economic interest in the securitization constituted by the issue of the Certificates, or to take any other action in respect of such securitization, in a manner prescribed or contemplated by the European Union’s Securitization Regulation (Regulation (EU) 2017/2402). In particular, no such person undertakes to take any action which may be required by any investor for the purposes of its compliance with such regulations or any similar requirements. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any investor with such Regulation. |

Initial Risk Retention Consultation Party: | Wells Fargo Bank, National Association |

Initial Majority Controlling Class Certificateholder: | Ellington Management Group, LLC or its affiliate |

Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in February 2020 (or, in the case of any mortgage loan that has its first due date in March 2020, the date that would have been its due date in February 2020 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

Expected Closing Date: | On or about February 13, 2020. |

Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in March 2020. |

Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in March 2020. |

Rated Final Distribution Date: | The Distribution Date in January 2063. |

Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

BANK 2020-BNK25 | Issue Characteristics |

Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| | |

Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

Clean-up Call: | 1.0% |

Delivery: | DTC, Euroclear and Clearstream Banking |

ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics and Thomson Reuters Corporation. |

Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of one or more REMICs and the Offered Certificates will represent REMIC regular interests. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

Mortgage

Loan

Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property Type | Number of

SF, Rooms

or Units | Cut-off Date Balance Per SF, Room or Unit ($) | Cut-off

Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt

Yield (%) |

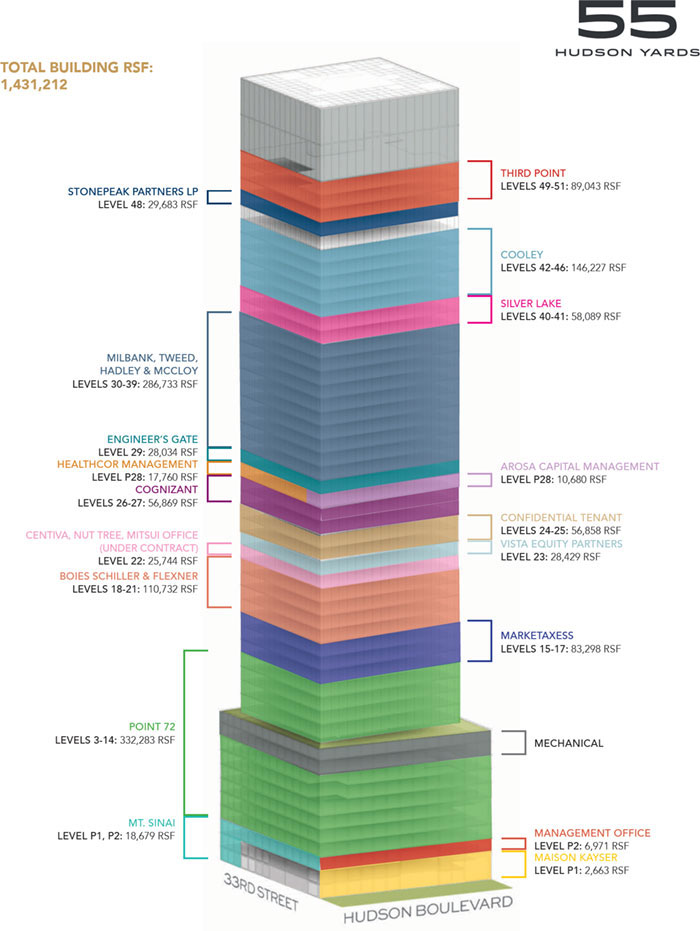

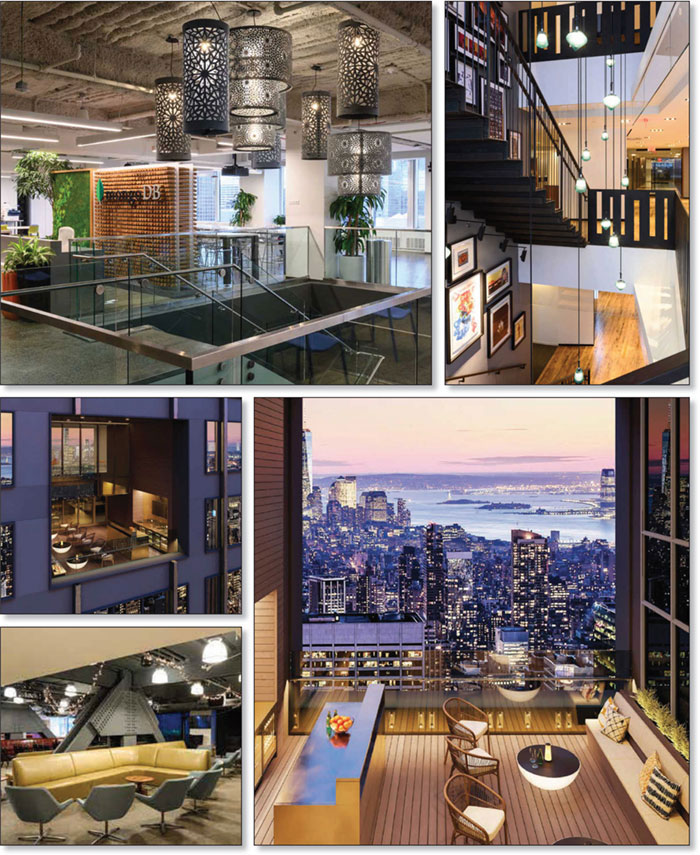

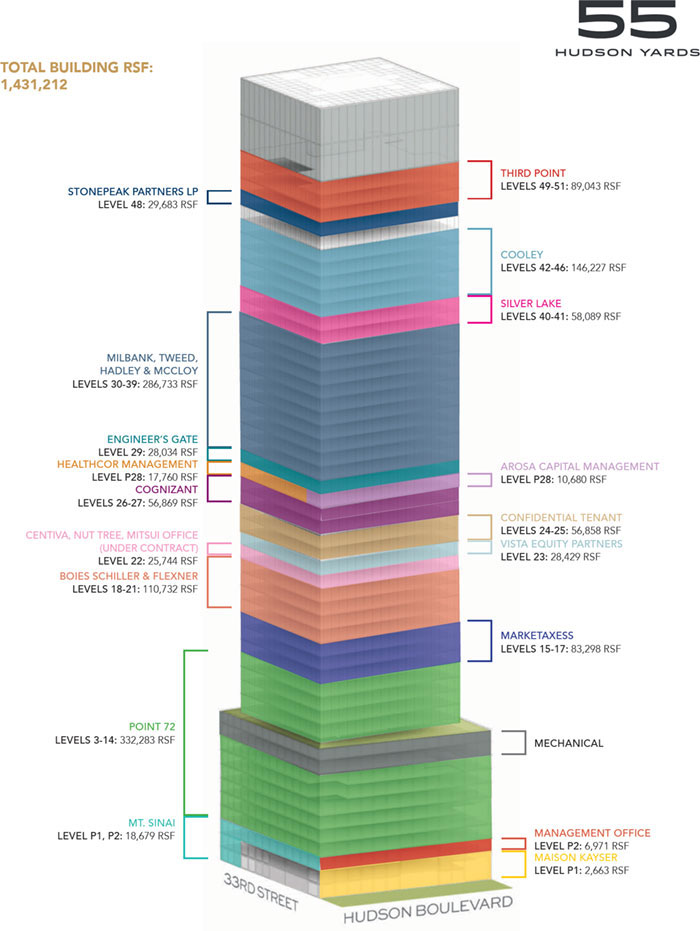

WFB; MSMCH | 55 Hudson Yards | New York | NY | 1 / 1 | $100,000,000 | 6.1% | Office | 1,431,212 | $660 | 39.4% | 39.4% | 3.53x | 11.0% |

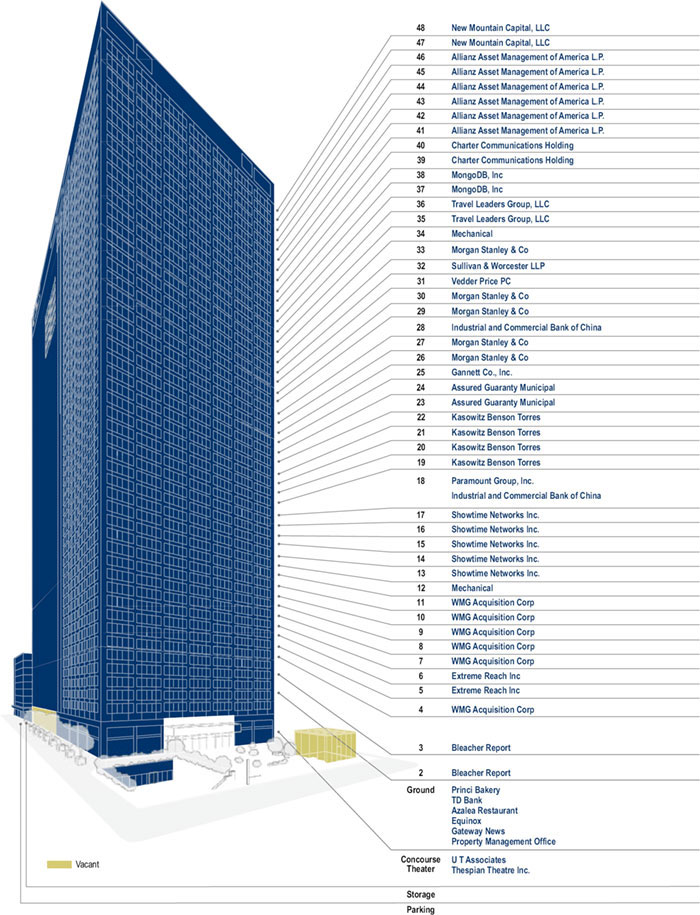

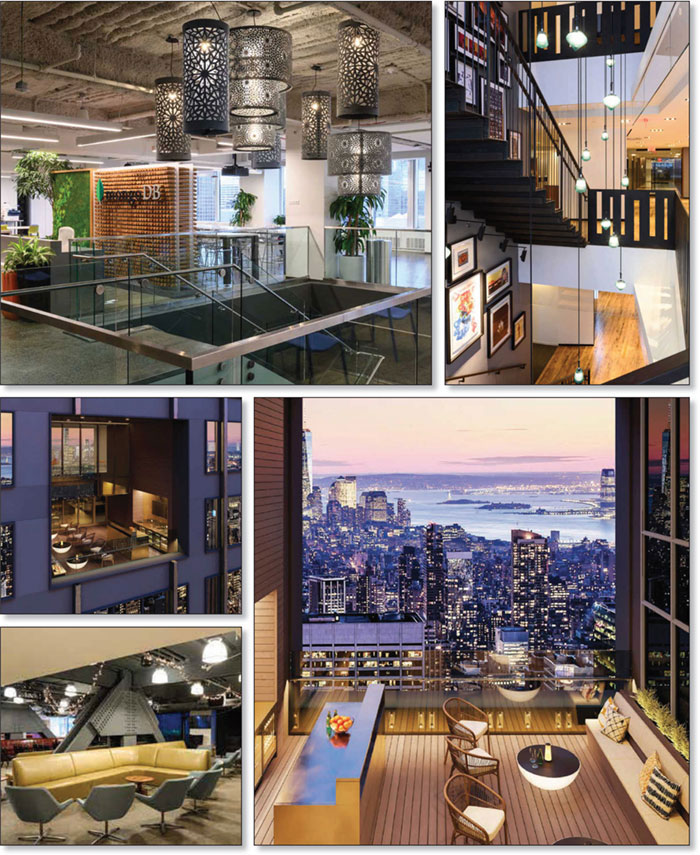

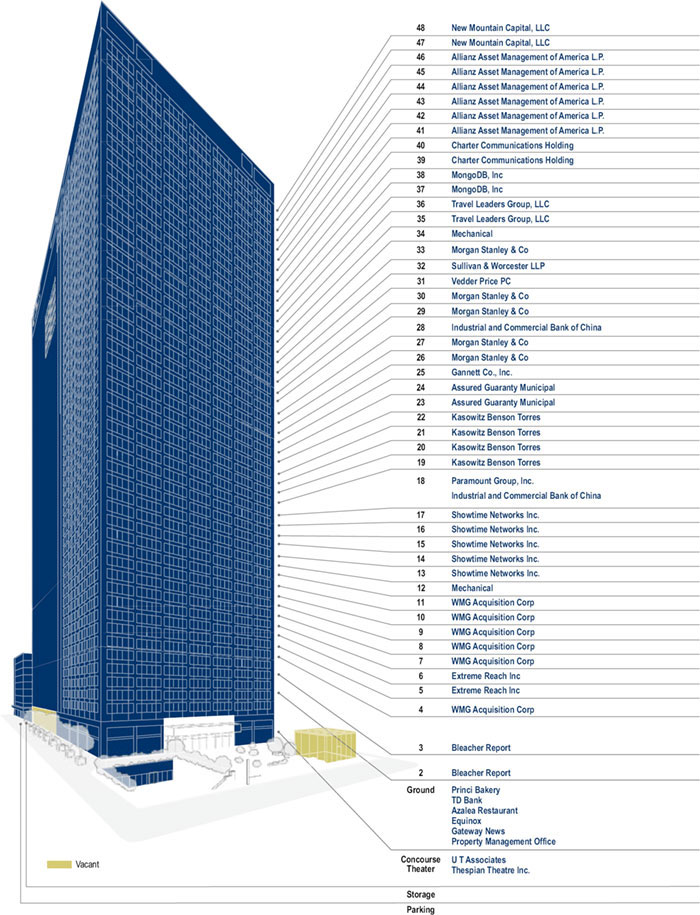

WFB | 1633 Broadway | New York | NY | 1 / 1 | 100,000,000 | 6.1 | Office | 2,561,512 | 391 | 41.7 | 41.7 | 3.83 | 11.9 |

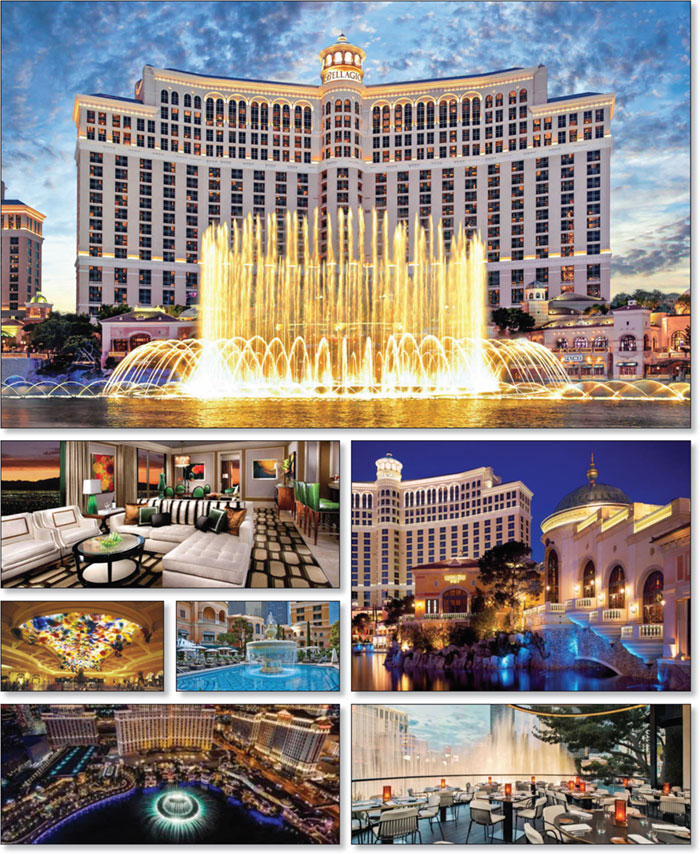

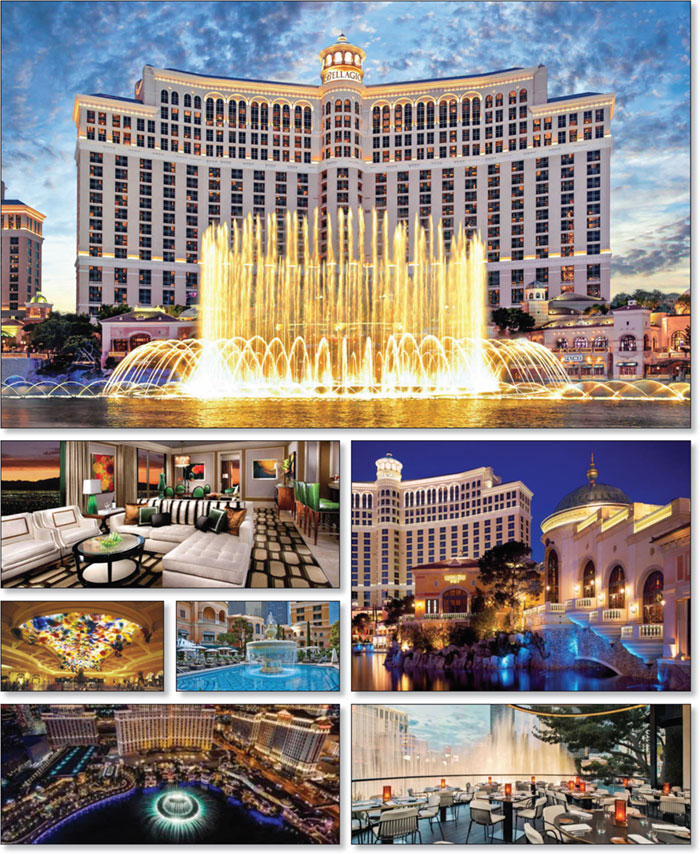

MSMCH | Bellagio Hotel and Casino | Las Vegas | NV | 1 / 1 | 100,000,000 | 6.1 | Hospitality | 3,933 | 426,189 | 39.3 | 39.3 | 8.42 | 28.3 |

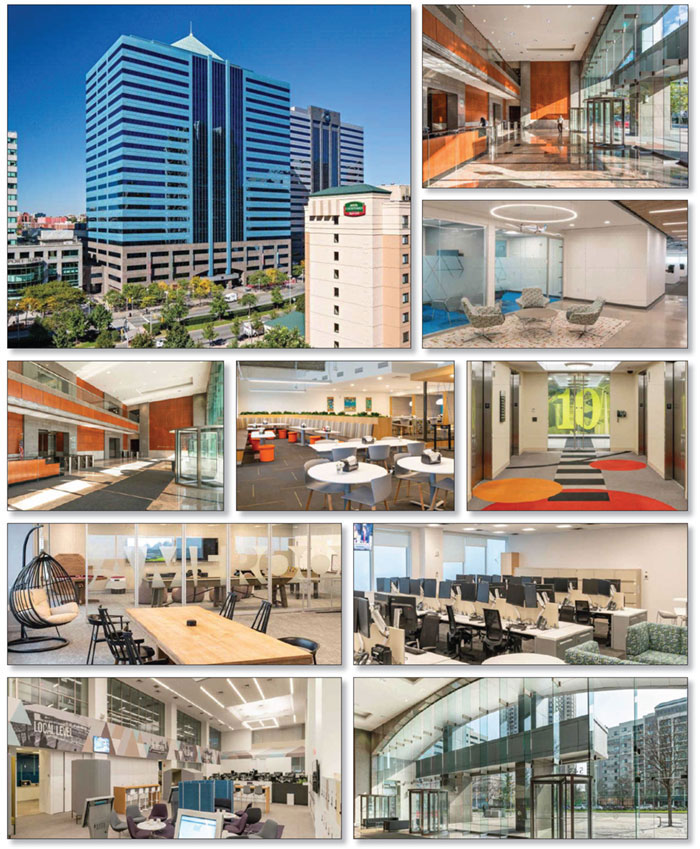

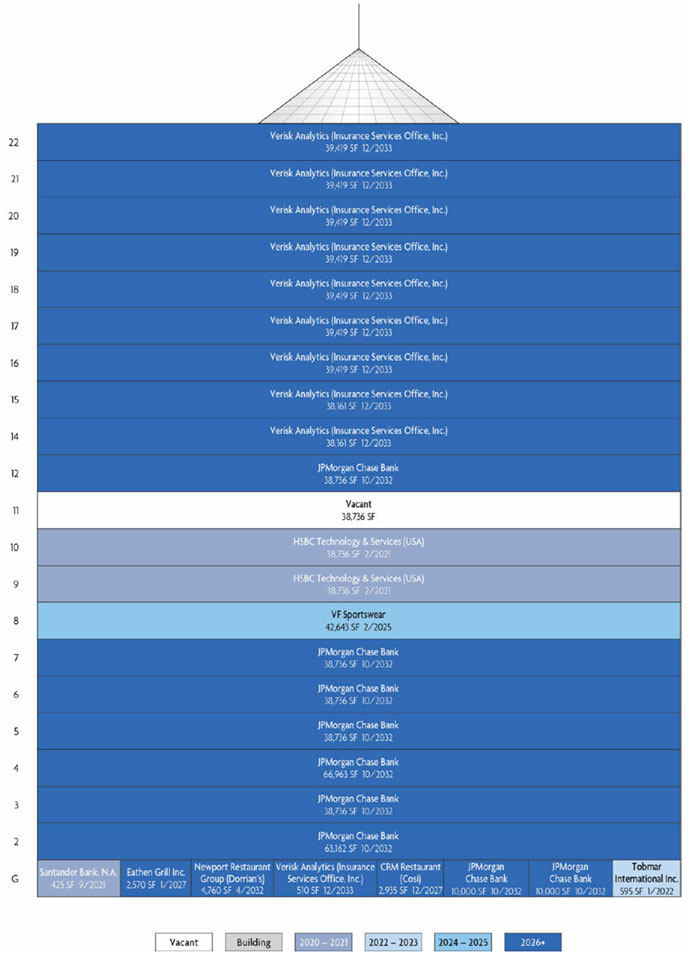

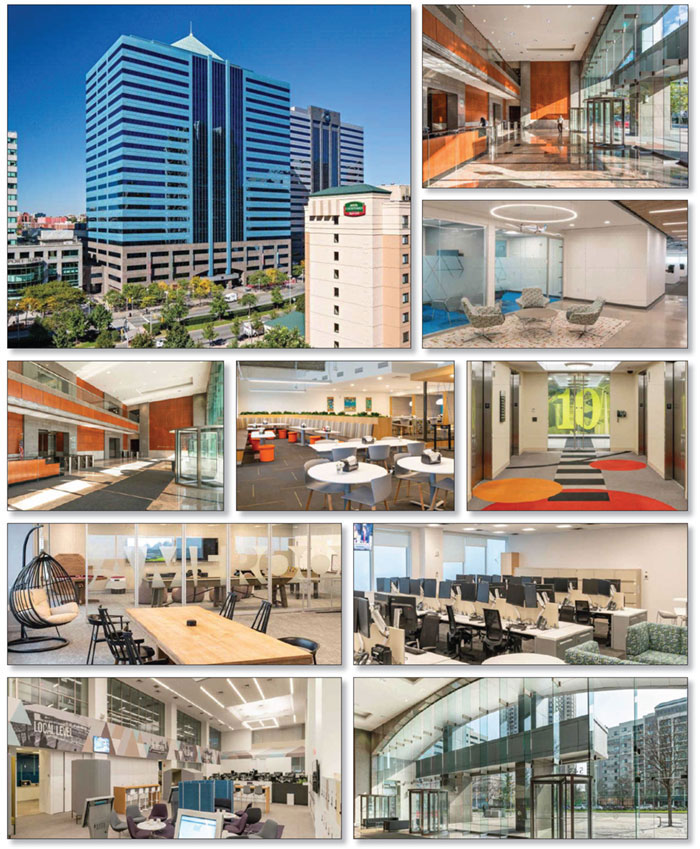

MSMCH | 545 Washington Boulevard | Jersey City | NJ | 1 / 1 | 81,285,000 | 5.0 | Office | 866,706 | 290 | 61.4 | 61.4 | 2.50 | 8.8 |

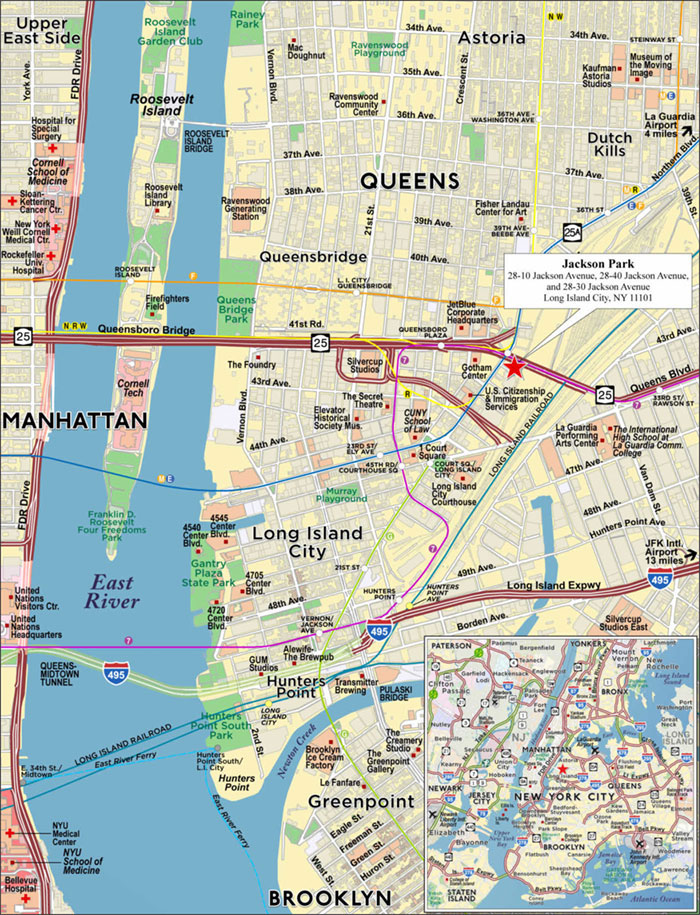

BANA | Jackson Park | Long Island City | NY | 1 / 1 | 75,000,000 | 4.6 | Multifamily | 1,871 | 293,960 | 34.4 | 34.4 | 3.92 | 13.0 |

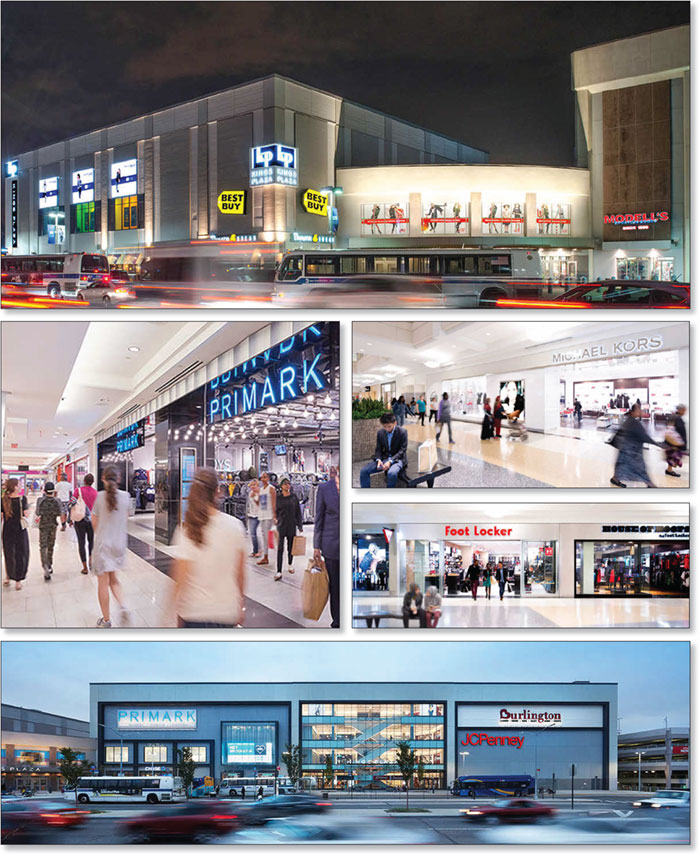

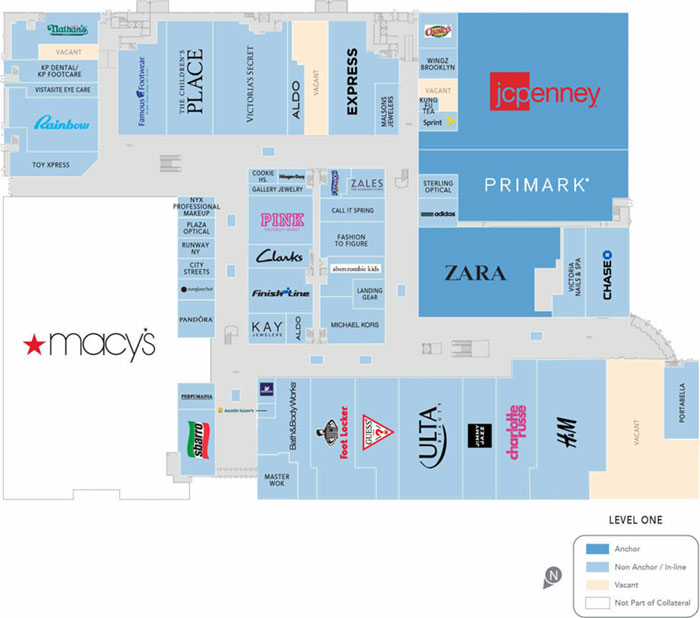

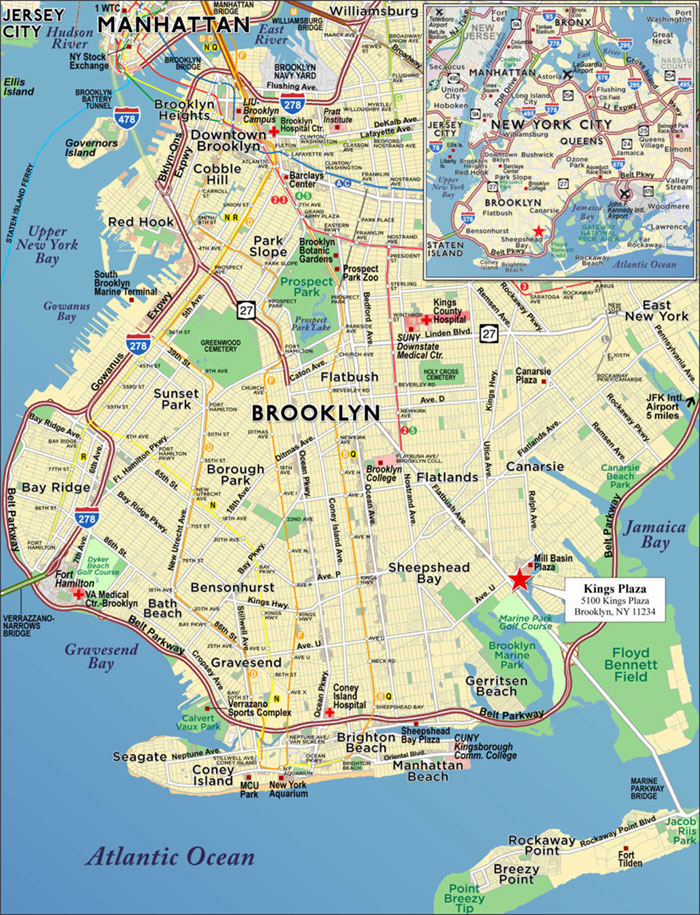

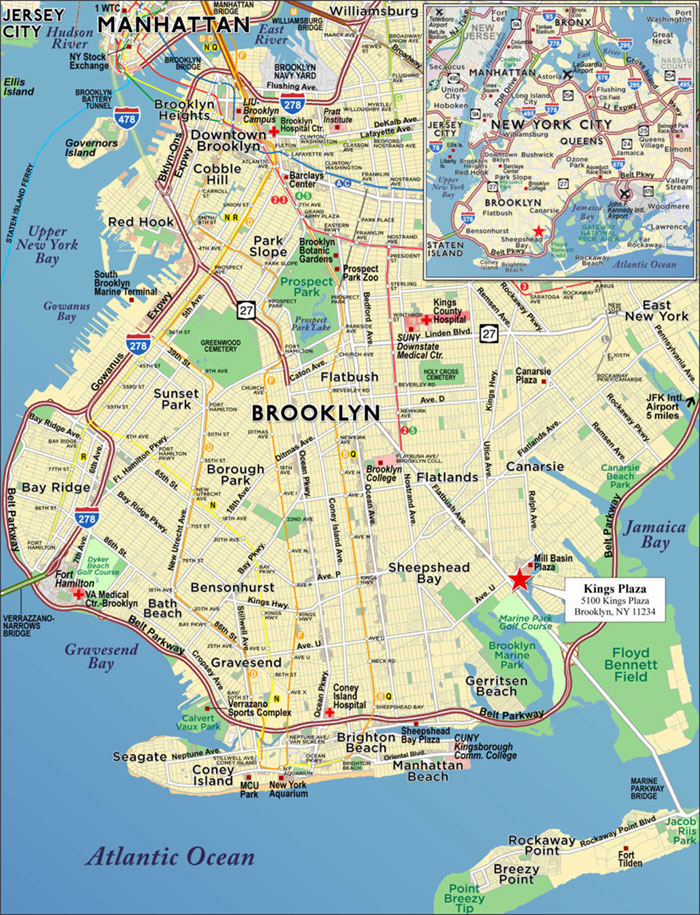

WFB | Kings Plaza | Brooklyn | NY | 1 / 1 | 75,000,000 | 4.6 | Retail | 811,797 | 600 | 54.1 | 54.1 | 3.06 | 10.7 |

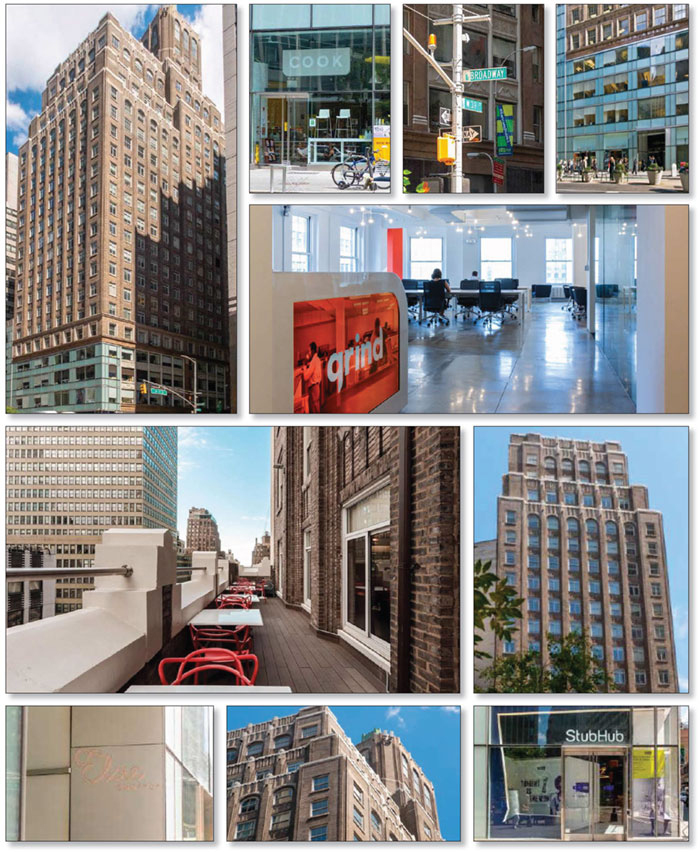

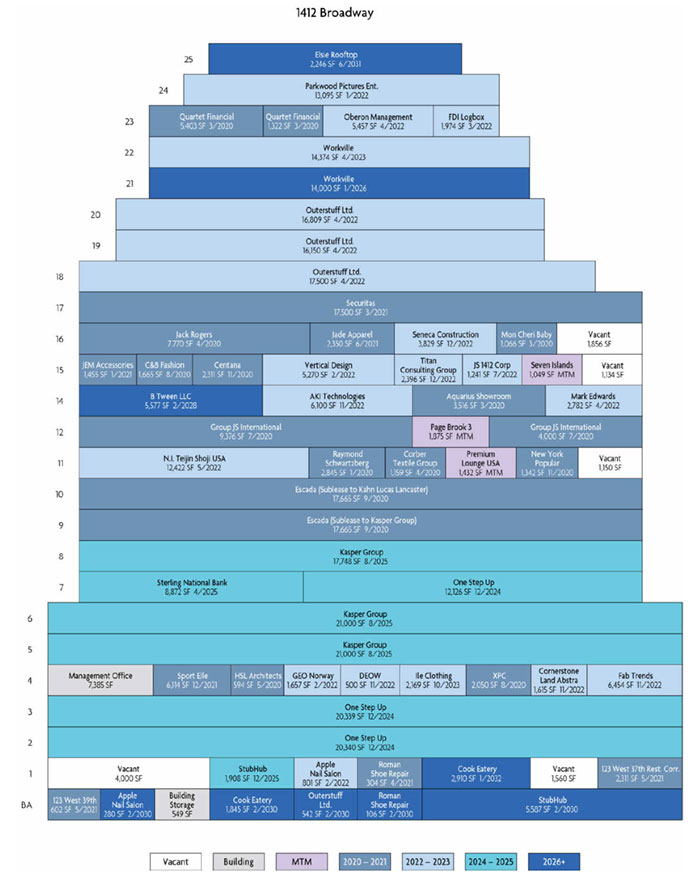

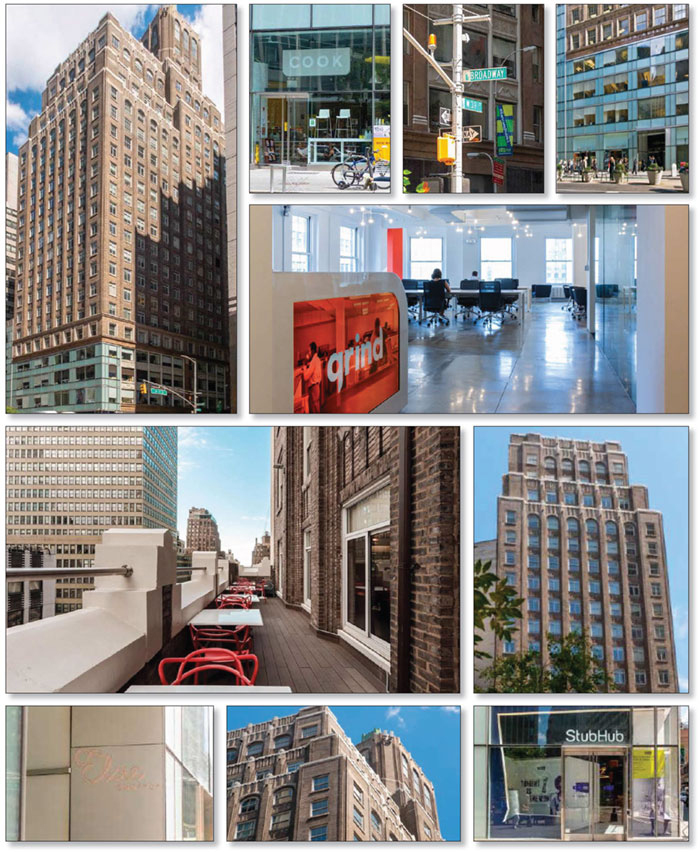

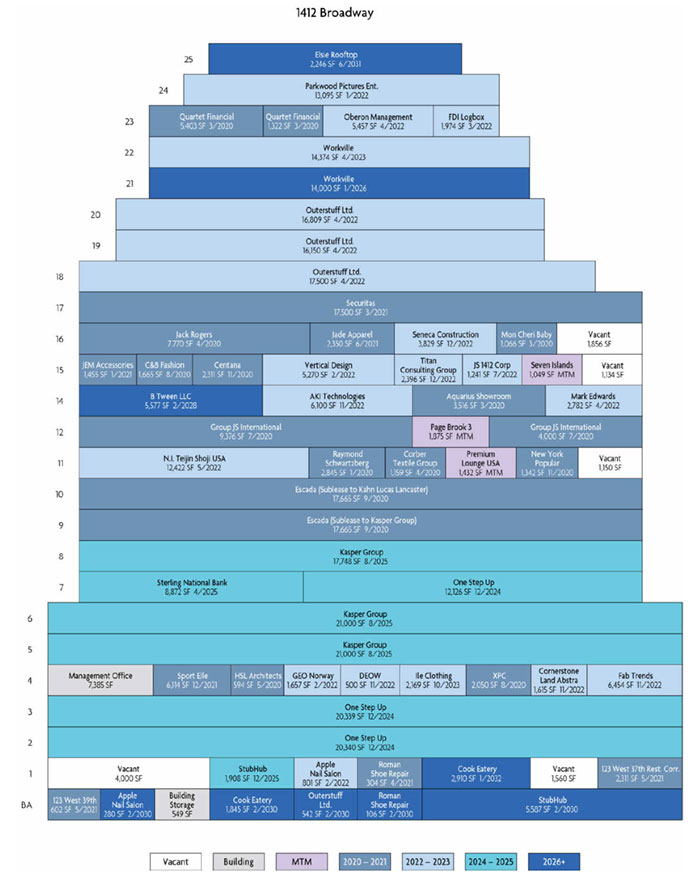

MSMCH | 1412 Broadway | New York | NY | 1 / 1 | 70,000,000 | 4.3 | Office | 421,396 | 498 | 58.3 | 58.3 | 1.92 | 7.5 |

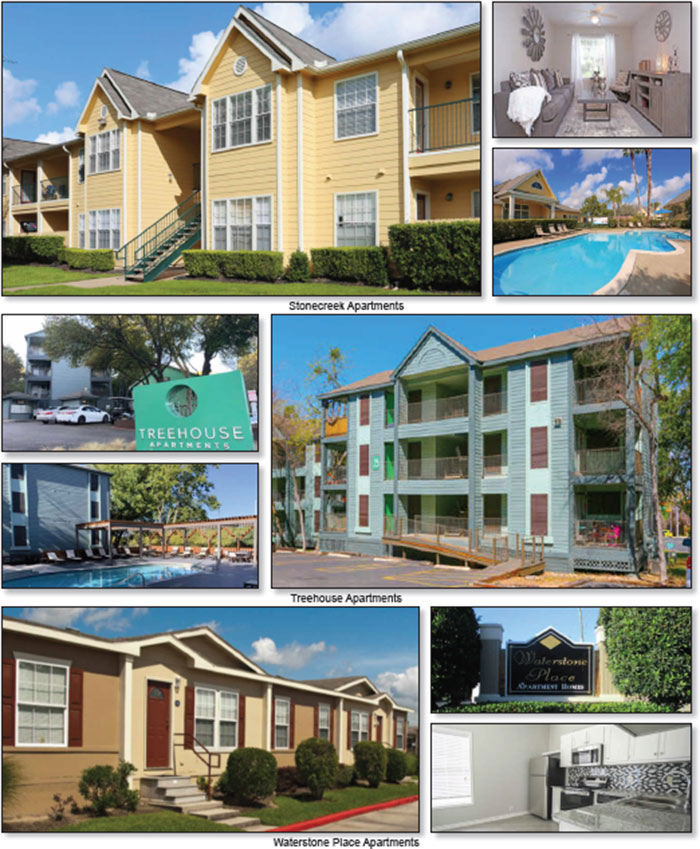

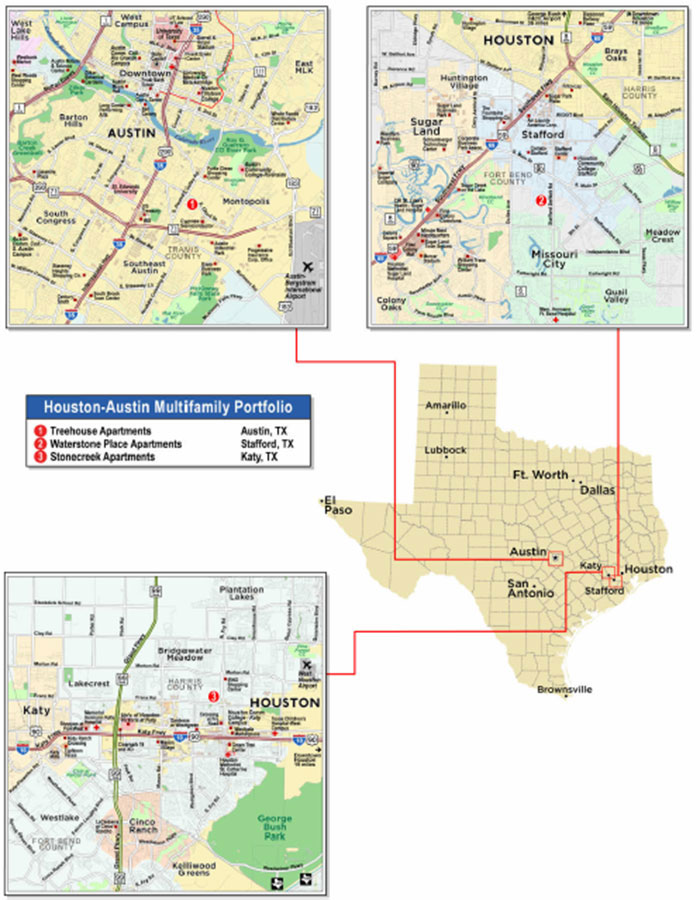

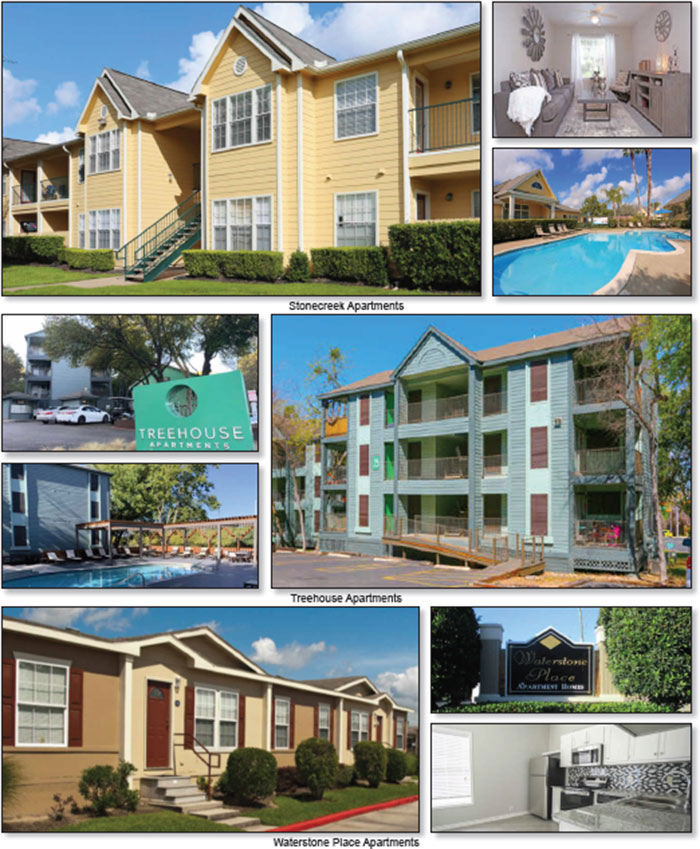

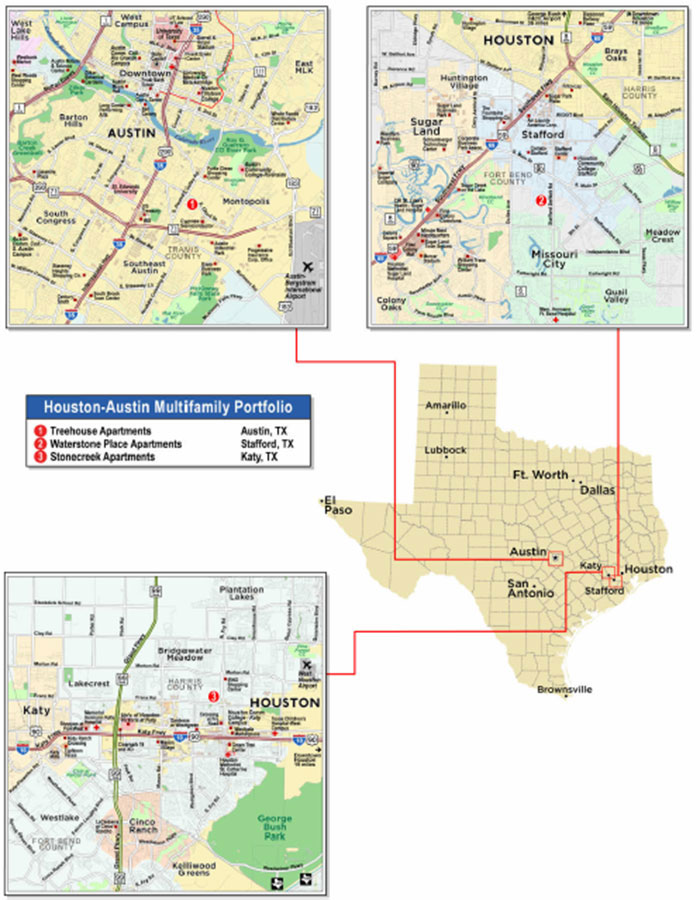

MSMCH | Houston-Austin Multifamily Portfolio | Various | TX | 1 / 3 | 68,000,000 | 4.2 | Multifamily | 671 | 101,341 | 67.9 | 67.9 | 1.91 | 7.6 |

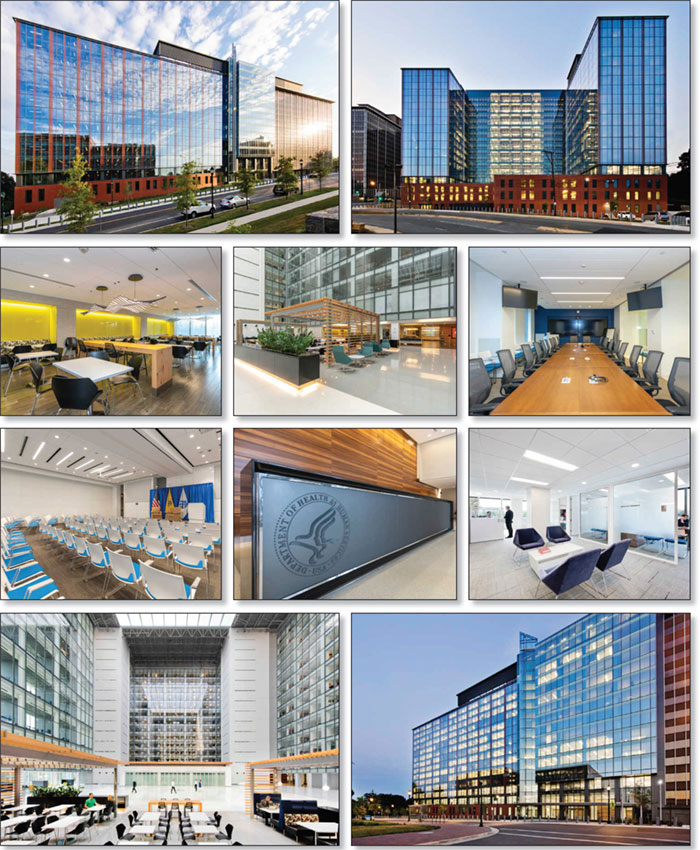

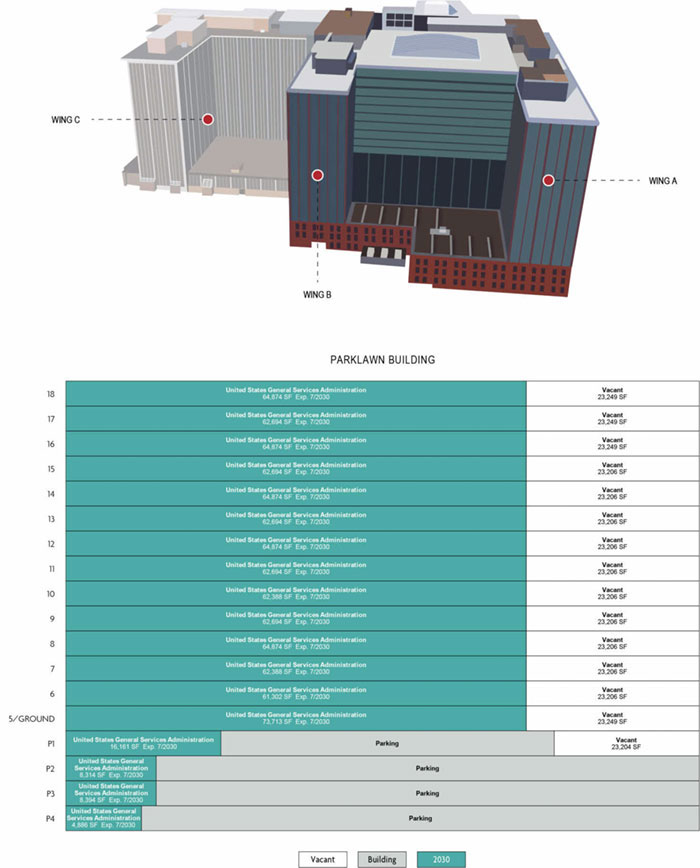

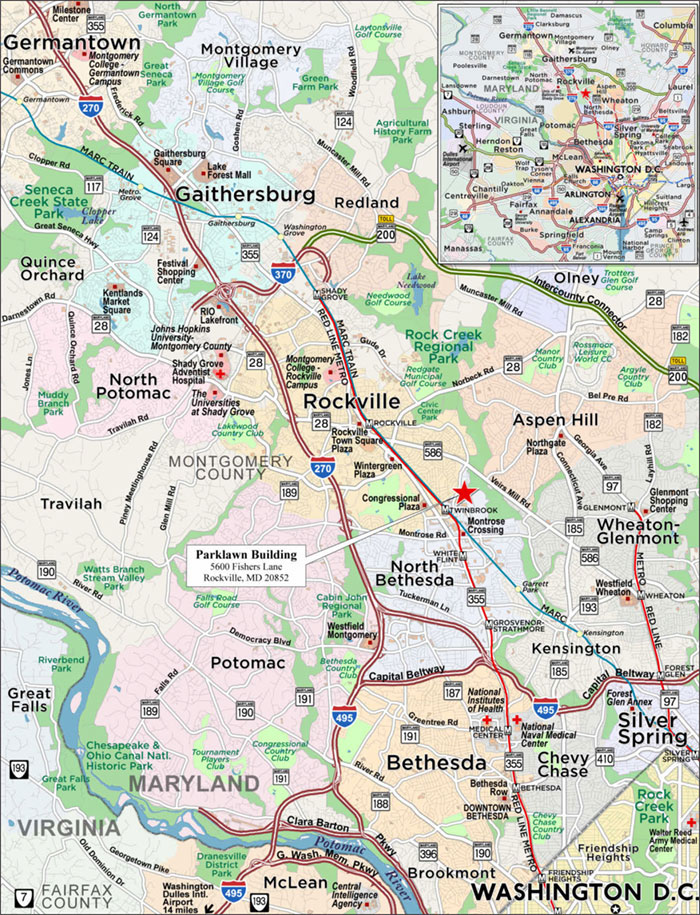

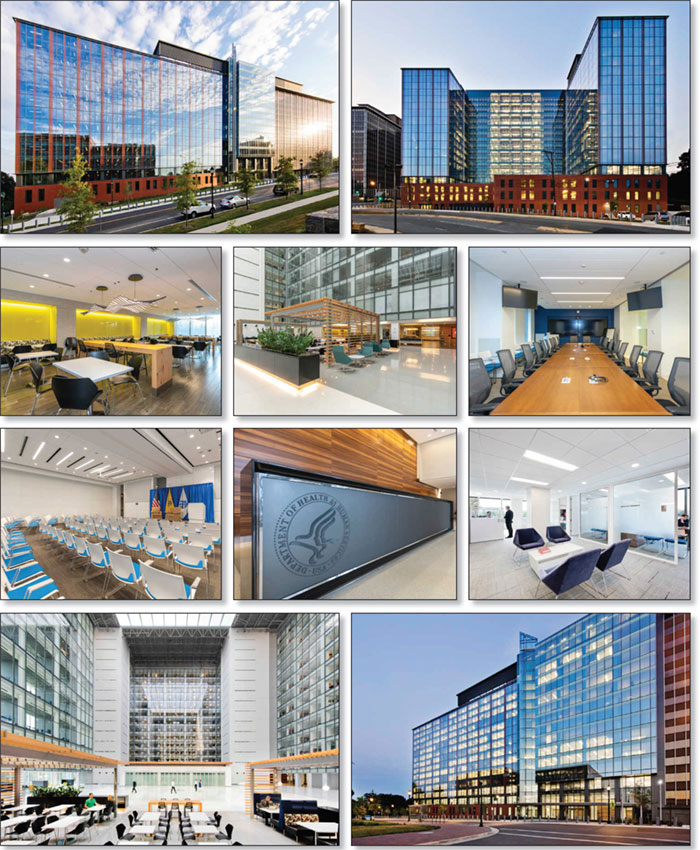

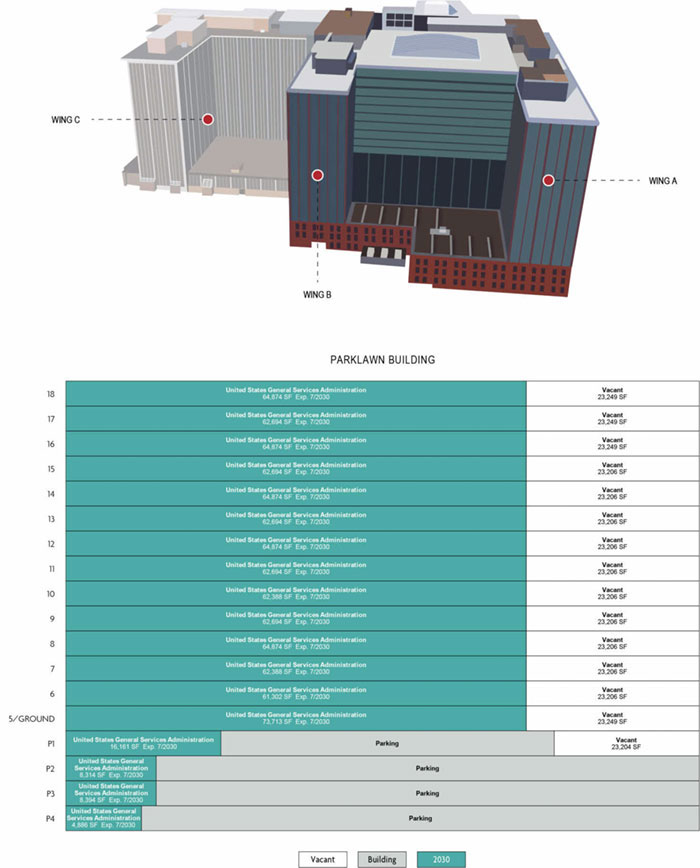

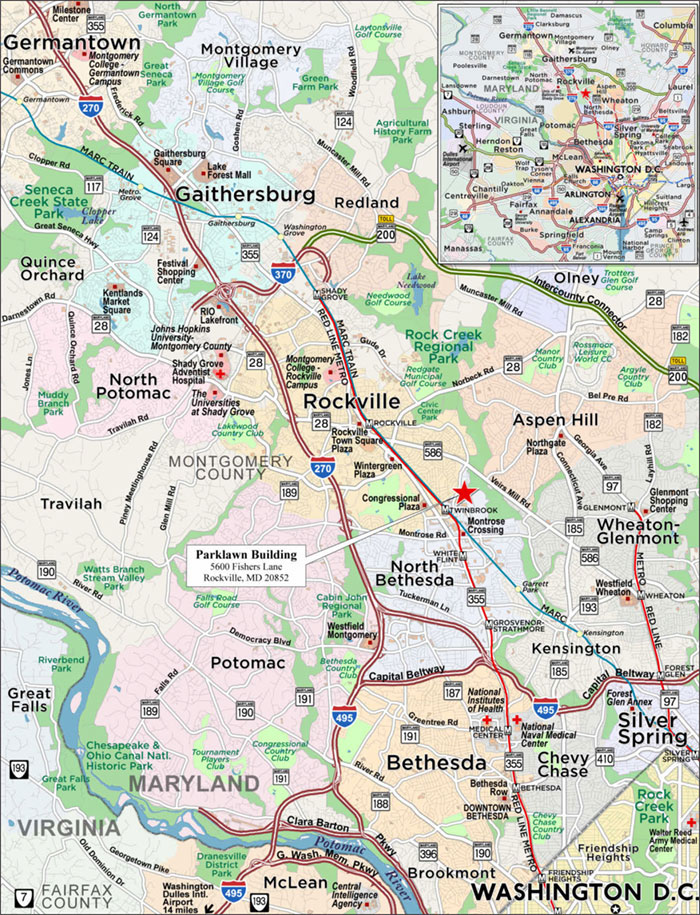

BANA | Parklawn Building | Rockville | MD | 1 / 1 | 65,400,000 | 4.0 | Office | 1,283,646 | 204 | 60.0 | 60.0 | 2.68 | 9.4 |

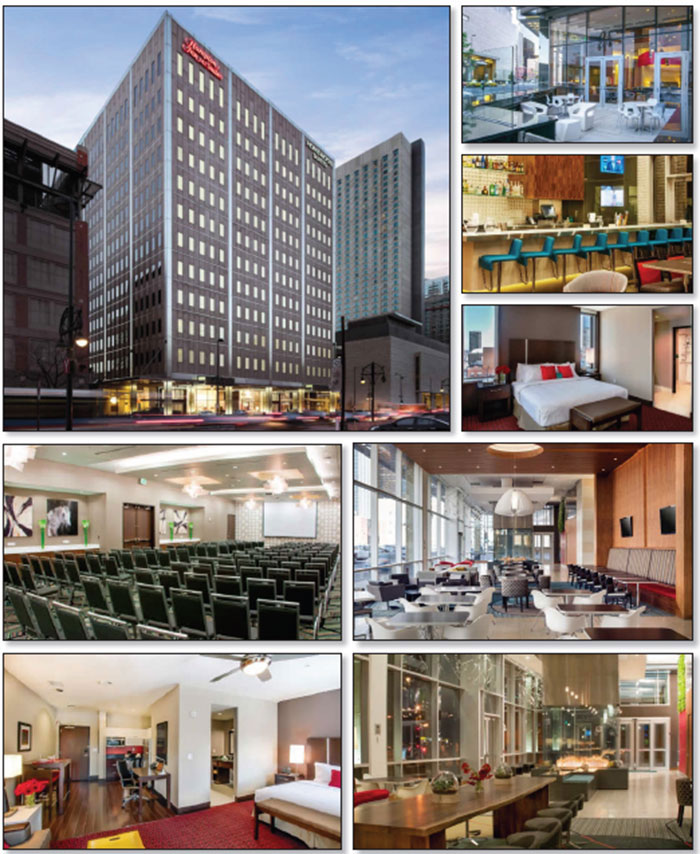

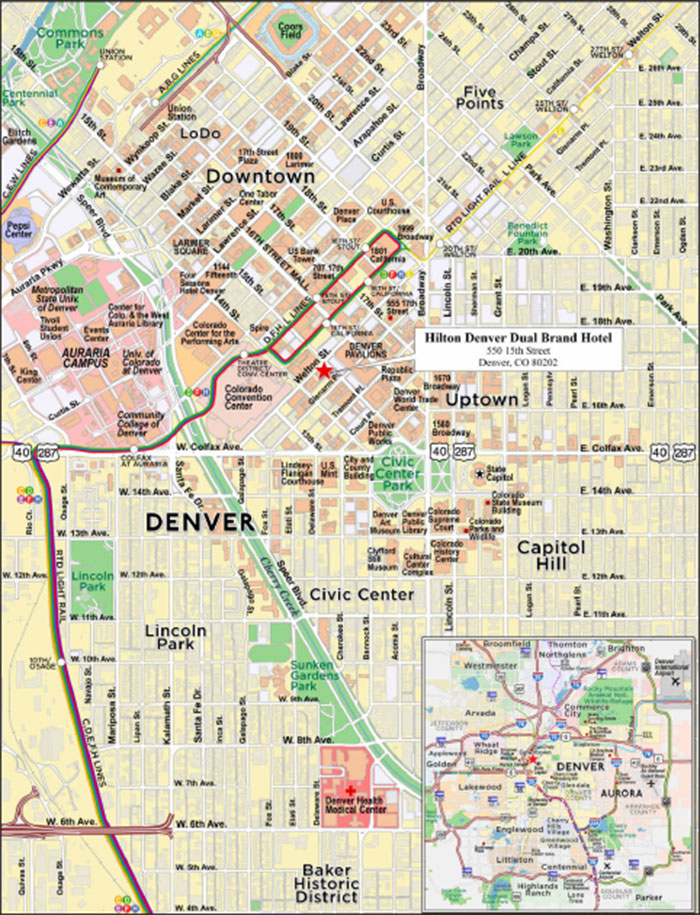

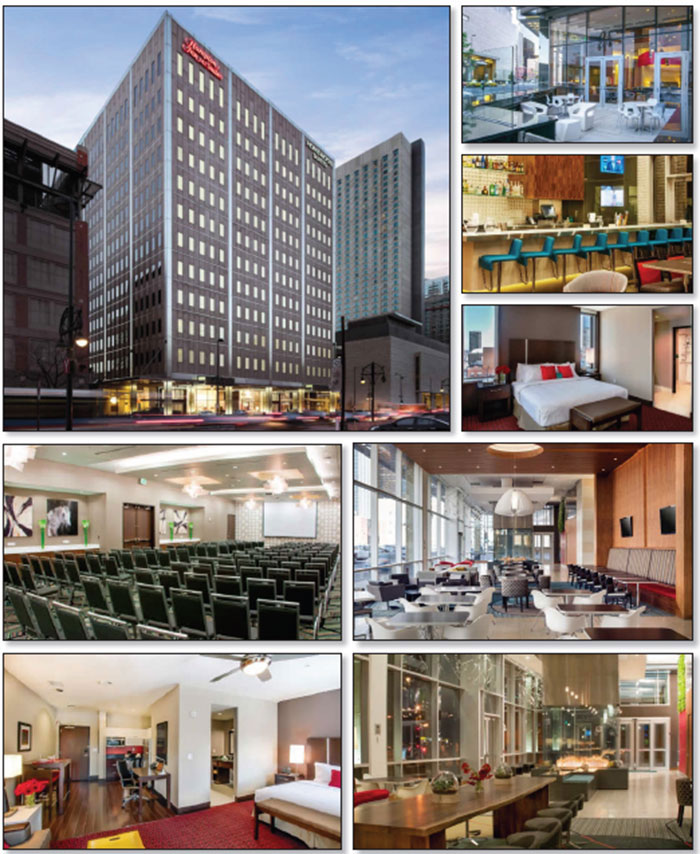

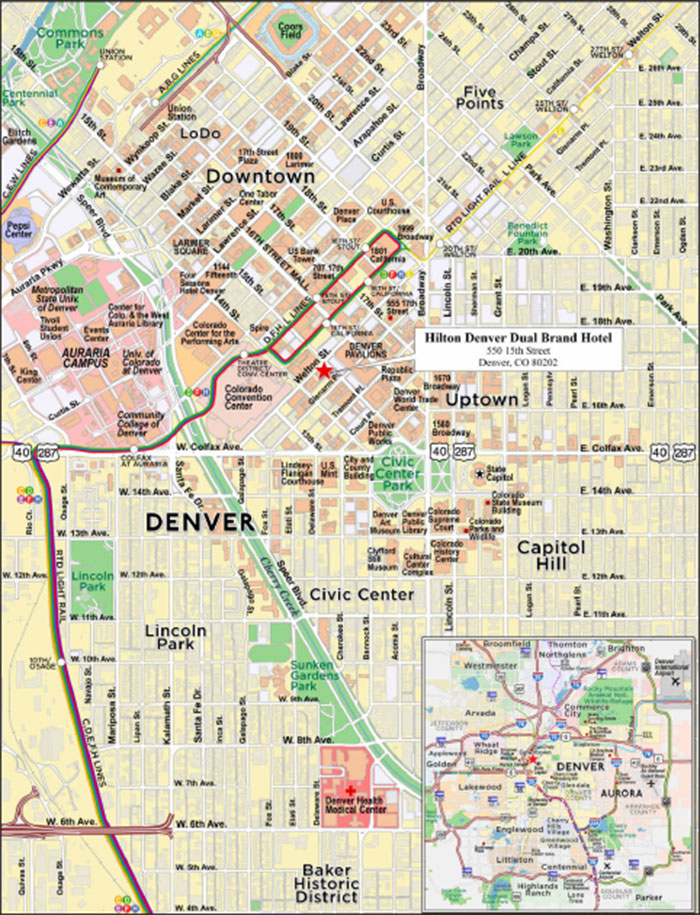

WFB | Hilton Denver Dual Brand Hotel | Denver | CO | 1 / 1 | 54,650,000 | 3.3 | Hospitality | 302 | 180,960 | 63.2 | 63.2 | 2.81 | 12.4 |

Top Three Total/Weighted Average | | | 3 / 3 | $300,000,000 | 18.4% | | | | 40.1% | 40.1% | 5.26x | 17.1% |

Top Five Total/Weighted Average | | | 5 / 5 | $456,285,000 | 27.9% | | | | 43.0% | 43.0% | 4.55x | 14.9% |

Top Ten Total/Weighted Average | | | 10 / 12 | $789,335,000 | 48.3% | | | | 50.4% | 50.4% | 3.67x | 12.6% |

Non-Top Ten Total/Weighted Average | | | 67 / 85 | $844,936,868 | 51.7% | | | | 52.5% | 50.6% | 3.46x | 14.9% |

(1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Room/Unit($) loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

Property Name | Mortgage Loan Seller in BANK 2020-BNK25 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

55 Hudson Yards | WFB/MSMCH | A-1-S1, A-2-S2, A-2-S3, A-3-S1, A-1-S2, A-1-S3, A-2-S1, A-3-S2, A-3-S3, A-1-C1, A-1-C2, A-1-C8, A-2-C1, A-2-C2, A-2-C8, A-3-C1, A-3-C2, A-3-C8 | $510,500,000 | Hudson Yards 2019-55HY | Yes | Wells Fargo Bank, National Association | CWCapital Asset Management LLC |

A-1-C5, A-3-C5 | $100,000,000 | BANK 2019-BNK24 | No |

A-1-C6, A-3-C6 | $100,000,000 | BANK 2020-BNK25 | No |

A-1-C3, A-1-C4, A-1-C7 | $110,700,000 | Wells Fargo Bank, National Association | No |

A-2-C3, A-2-C4, A-2-C5, A-2-C6, A-2-C7 | $86,900,000 | DBR Investments Co. Limited | No |

A-3-C3, A-3-C4, A-3-C7 | $36,900,000 | Morgan Stanley Bank, N.A | No |

B-1, B-2, B-3 | $300,000,000 | Hudson Yards 2019-55HY | Yes |

1633 Broadway | WFB | A-1-S-1, A-2-S-1, A-3-S-1, A-4-S-1 | $1,000,000 | BWAY 2019-1633 | No | KeyBank National Association | Situs Holdings, LLC |

A-1-C-1, A-1-C-3, A-1-C-4, A-1-C-5, A-1-C-6, A-1-C-7 | $205,000,000 | Goldman Sachs Bank USA | No |

A-2-C-1-B, A-3-C-1-B | $45,000,000 | Benchmark 2020-B16(2) | No |

A-2-C-1-A, A-2-C-2, A-2-C-3, A-2-C-4, A-2-C-6, A-2-C-7 | $212,500,000 | DBR Investments Co. Limited | No |

A-3-C-1-A, A-3-C-2, A-3-C-3, A-3-C-4, A-3-C-5, A-3-C-6, A-3-C-7 | $227,500,000 | JPMorgan Chase Bank, National Association | No |

A-1-C-2, A-2-C-5 | $60,000,000 | GSMS 2020-GC45(3) | No |

A-4-C-1, A-4-C-2 | $100,000,000 | BANK 2020-BNK25 | No |

A-4-C-3, A-4-C-4, A-4-C-5, A-4-C-6, A-4-C-7 | $150,000,000 | Wells Fargo Bank, N.A | No |

B-1, B-2, B-3, B-4 | $249,000,000 | BWAY 2019-1633 | Yes(4) |

Bellagio Hotel and Casino | MSMCH | A-1-S1, A-1-S2, A-2-S1, A-2-S2, A-3-S1, A-3-S2 | $716,000,000 | BX 2019-OC11 | Yes | KeyBank National Association | Situs Holdings, LLC |

A-1-C1 | $100,000,000 | BANK 2020-BNK25 | No |

A-1-RL, A-2-RL, A-3-RL | $360,200,000 | Third Party | No |

A-1-C2, A-1-C3, A-1-C4, A-1-C5 | $200,000,000 | Morgan Stanley Bank, N.A | No |

A-2-C1 | $50,000,000 | GSMS 2020-GC45(3) | No |

A-2-C3, A-2-C4, A-2-C5 | $70,000,000 | Citi Real Estate Funding Inc. | No |

A-2-C2, A-3-C2 | $60,000,000 | Benchmark 2020-B16(2) | No |

A-3-C1, A-3-C3, A-3-C4, A-3-C5 | $120,000,000 | JPMorgan Chase Bank, National Association | No |

B-1-S, B-2-S, B-3-S | $510,700,000 | BX 2019-OC11 | Yes |

B-1-RL, B-2-RL, B-3-RL | $139,800,000 | Third Party | No |

C-1-S, C-2-S, C-3-S | $683,300,000 | BX 2019-OC11 | Yes |

545 Washington Boulevard | MSMCH | A-1 | $81,285,000 | BANK 2020-BNK25 | Yes | | KeyBank National Association |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

Property Name | Mortgage Loan Seller in BANK 2020-BNK25 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| | A-2, A-3 | $120,000,000 | Morgan Stanley Bank, N.A. | No | Wells Fargo Bank, National Association | |

A-4 | $50,321,250 | Barclays Capital Real Estate Inc. | No |

Jackson Park | BANA | A-1, A-2, A-4, A-9, A-10 | $275,000,000 | JAX 2019-LIC | Yes | Wells Fargo Bank, National Association | AEGON USA Realty Advisors, LLC. |

A-3 | $75,000,000 | BANK 2020-BNK25 | No |

A-5, A-6 | $100,000,000 | BANK 2019-BNK23 | No |

A-7, A-8 | $100,000,000 | BANK 2019-BNK24 | No |

B-1, B-2 | $450,000,000 | JAX 2019-LIC | No |

Kings Plaza | WFB | A-1-1 | $70,000,000 | JPMorgan Chase Bank, National Association | Yes | Midland Loan Services, a Division of PNC Bank, National Association(5) | KeyBank National Association(5) |

A-1-2 | $50,000,000 | Benchmark 2020-B16(2) | No |

A-1-3, A-1-4 | $51,108,108 | JPMorgan Chase Bank, National Association | No |

A-2-1, A-2-2, A-2-3, A-2-4 | $157,945,946 | Société Générale Financial Corporation | No |

A-3-1, A-3-4 | $75,000,000 | BANK 2020-BNK25 | No |

A-3-2, A-3-3 | $82,945,946 | Wells Fargo Bank, N.A | No |

1412 Broadway | MSMCH | A-1 | $100,000,000 | BANK 2019-BNK24 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

A-2 | $70,000,000 | BANK 2020-BNK25 | No |

A-3 | $40,000,000 | Morgan Stanley Bank, N.A. | No |

Parklawn Building | BANA | A-1 | $70,000,000 | MSC 2019-L3 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

A-2, A-3 | $60,800,000 | CF 2019-CF3 | No |

A-4 | $65,400,000 | BANK 2019-BNK24 | No |

A-5 | $65,400,000 | BANK 2020-BNK25 | No |

Park Tower at Transbay | BANA | A-1, A-8 | $120,000,000 | BANK 2019-BNK20 | No | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

A-2 | $100,000,000 | BANK 2019-BNK23 | No |

A-3, A-9 | $115,000,000 | BANK 2019-BNK21 | Yes |

A-4, A-7, A-10 | $115,000,000 | BANK 2019-BNK22 | No |

A-5 | $50,000,000 | BANK 2019-BNK24 | No |

A-6 | $50,000,000 | BANK 2020-BNK25 | No |

560 Mission Street | BANA | A-1-1 | $60,000,000 | GSMS 2020-GC45(3) | No | Midland Loan Services, a Division of PNC Bank, National Association | KeyBank National Association |

A-1-2 | $50,000,000 | Benchmark 2020-B16(2) | Yes |

A-1-3, A-1-4 | $40,000,000 | DBR Investments Co. Limited | No |

A-2-A | $100,000,000 | Bank of America, National Association | No |

A-2-B | $50,000,000 | BANK 2020-BNK25 | No |

Chroma Apartments | WFB | A-1 | $35,000,000 | UBS 2019-C18 | Yes | | Rialto Capital Advisors, LLC |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

Property Name | Mortgage Loan Seller in BANK 2020-BNK25 | Note(s)(1) | Original Balance | Holder of Note | Lead Servicer for Whole Loan | Master Servicer Under Lead Securitization Servicing Agreement | Special Servicer Under Lead Securitization Servicing Agreement |

| | A-2 | $15,000,000 | BANK 2020-BNK25 | No | Wells Fargo Bank, National Association | |

Sacramento Office Portfolio | BANA | A-1 | $35,000,000 | BANK 2019-BNK23 | Yes | Wells Fargo Bank, National Association | KeyBank National Association |

A-2 | $14,400,000 | BANK 2020-BNK25 | No |

| (1) | No assurance can be provided that any unsecuritized note will not be split further. |

| (2) | The Benchmark 2020-B16 transaction is expected to close on or about February 12, 2020. |

| (3) | The GSMS 2020-GC45 transaction is expected to close on or about January 30, 2020. |

| (4) | No single promissory note comprising a part of the whole loan is the related control note; however, the BWAY 2019-1633 securitization trust is the related controlling note holder, and a party designated under the related trust and servicing agreement is entitled to exercise the rights thereof. |

| (5) | The related whole loan is expected to initially be serviced under the Benchmark 2020-B16 securitization pooling and servicing agreement until the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), after which the related whole loan will be serviced under the pooling and servicing agreement governing such securitization of the related “lead” pari passu note. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the BANK 2020-BNK25 certificates after the closing of such securitization. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing(1) |

Loan

No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date

Balance ($) | % of Cut-

off Date

Balance

(%) | Sub Debt Cut-off

Date Balance ($) | Mezzanine Debt

Cut-off Date

Balance ($) | Total Debt

Interest

Rate (%)(2) | Mortgage

Loan U/W

NCF DSCR

(x)(3) | Total Debt

U/W NCF

DSCR (x) | Mortgage

Loan Cut-

off Date

U/W NOI

Debt Yield

(%)(3) | Total Debt

Cut-off Date

U/W NOI

Debt Yield

(%) | Mortgage

Loan Cut-

off Date

LTV Ratio

(%)(3) | Total Debt Cut-

off Date

LTV Ratio

(%) |

1 | WFB; MSMCH | 55 Hudson Yards | $100,000,000 | 6.1 | % | $300,000,000 | $0 | 2.9500 | % | 3.53 | x | 2.68 | x | 11.0 | % | 8.3 | % | 39.4 | % | 51.9 | % |

2 | WFB | 1633 Broadway | 100,000,000 | 6.1 | | 249,000,000 | 0 | 2.9900 | | 3.83 | | 3.07 | | 11.9 | | 9.5 | | 41.7 | | 52.1 | |

3 | MSMCH | Bellagio Hotel and Casino | 100,000,000 | 6.1 | | 1,333,800,000 | 0 | 3.6650 | | 8.42 | | 4.06 | | 28.3 | | 15.7 | | 39.3 | | 70.7 | |

5 | BANA | Jackson Park | 75,000,000 | 4.6 | | 450,000,000 | 0 | 3.2500 | | 3.92 | | 2.15 | | 13.0 | | 7.1 | | 34.4 | | 62.5 | |

6 | WFB | Kings Plaza | 75,000,000 | 4.6 | | 0 | 53,000,000 | 3.6180 | | 3.06 | | 1.73 | | 10.7 | | 9.6 | | 54.1 | | 60.0 | |

29 | WFB | Chroma Apartments | 15,000,000 | 0.9 | | 0 | 10,100,000 | 4.9767 | | 1.81 | | 1.20 | | 7.4 | | 6.2 | | 68.5 | | 82.3 | |

Total/Weighted Average | $465,000,000 | 28.5 | % | $2,332,800,000 | $63,100,000 | 3.3339 | % | 4.58 | x | 2.77 | x | 15.1 | % | 10.1 | % | 42.4 | % | 60.0 | % |

(1) | In addition, twenty (20) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A, currently have in place Subordinate Coop LOCs. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness“ and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

(2) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

(3) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | Mortgage

Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property

Type | Mortgage Loan

or Mortgaged

Property Cut-off

Date Balance ($) | % of Initial

Pool Balance

(%) | Previous

Securitization |

6 | WFB | Kings Plaza | Brooklyn | NY | Retail | $75,000,000 | 4.6 | % | GSMS 2013-KING |

8.03 | MSMCH | Stonecreek Apartments | Katy | TX | Multifamily | 18,200,000 | 1.1 | | XAN 2018-RSO6 |

14 | MSMCH | Stop & Shop Portfolio | Various | Various | Retail | 45,000,000 | 2.8 | | JPMCC 2011-C4 |

20 | BANA | Marriott - Bakersfield | Bakersfield | CA | Hospitality | 24,700,000 | 1.5 | | WFRBS 2014-C23 |

38 | NCB | 440 East 79th Street Owners Corp. | New York | NY | Multifamily | 10,483,982 | 0.6 | | WFCM 2016-C32 |

40 | WFB | Best Storage - Henderson, NV | Henderson | NV | Self Storage | 10,000,000 | 0.6 | | JPMBB 2013-C15 |

41 | NCB | 310/312 East 23rd Apartment Corp. | New York | NY | Multifamily | 9,135,614 | 0.6 | | MSC 2007-IQ13 |

42 | NCB | Crest Manor Housing Corporation | Yonkers | NY | Multifamily | 8,986,243 | 0.5 | | CSMC 2006-C1 |

44 | BANA | Proguard Self Storage - Houston | Houston | TX | Self Storage | 8,520,000 | 0.5 | | WFRBS 2011-C4 |

46 | NCB | Rocky Point Owners, Inc. | Rocky Point | NY | Multifamily | 8,392,798 | 0.5 | | WFRBS 2013-C16 |

53 | NCB | Chateau Villa Corp. | Staten Island | NY | Multifamily | 6,843,818 | 0.4 | | WFRBS 2014-C23 |

60 | NCB | Hillcrest Point Apartments Owners, Corp. | Spring Valley | NY | Multifamily | 5,491,745 | 0.3 | | BSCMS 2006-T22 |

76 | NCB | 6035 Broadway Owners Corp. | Bronx | NY | Multifamily | 1,291,037 | 0.1 | | CSFB 2004-C1 |

| Total | | | | | $232,045,237 | 14.2 | % | |

(1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

Class A-2(1) |

Loan

No. | Mortgage

Loan

Seller | Mortgage Loan Name | State | Property

Type | Mortgage Loan

Cut-off Date

Balance ($) | % of

Initial

Pool

Balance

(%) | Mortgage Loan

Balance at

Maturity ($) | % of Class

A-2

Certificate

Principal

Balance

(%)(2) | SF/

Rooms/

Pads/

Units | Loan

per SF/

Room/

Pad/

Unit ($) | U/W NCF

DSCR (x) | U/W NOI

Debt

Yield

(%) | Cut-off

Date LTV

Ratio (%) | Balloon

or ARD

LTV Ratio

(%) | Rem. IO

Period

(mos.) | Rem.

Term to

Maturity

(mos.) |

44 | BANA | Proguard Self Storage - Houston | TX | Self Storage | $8,520,000 | 0.5% | $8,520,000 | 100.7% | 76,587 | $111 | 2.30x | 9.5% | 60.0% | 60.0% | 59 | 59 |

Total/Weighted Average | | | $8,520,000 | 0.5% | $8,520,000 | 100.7% | | | 2.30x | 9.5% | 60.0% | 60.0% | 59 | 59 |

(1) | The table above presents the mortgage loan whose balloon payment would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |

Class A-3(1) |

Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Mortgage Loan Balance at Maturity ($) | % of Class A-3 Certificate Principal Balance (%)(2) | SF/

Rooms/ Pads/ Units | Loan per SF/

Room/

Pad/

Unit ($) | U/W NCF DSCR (x) | U/W

NOI

Debt Yield

(%) | Cut-off Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to Maturity (mos.) |

10 | WFB | Hilton Denver Dual Brand Hotel | CO | Hospitality | $54,650,000 | 3.3% | $54,650,000 | 89.3% | 302 | $180,960 | 2.81x | 12.4% | 63.2% | 63.2% | 82 | 82 |

37 | BANA | Southern CVS Portfolio | Various | Retail | 11,000,000 | 0.7 | 9,752,856 | 15.9 | 38,070 | 289 | 1.81 | 10.5 | 64.9 | 57.5 | 11 | 83 |

Total/Weighted Average | | | $65,650,000 | 4.0% | $64,402,856 | 105.3% | | | 2.64x | 12.1% | 63.5% | 62.2% | 70 | 82 |

1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-3 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

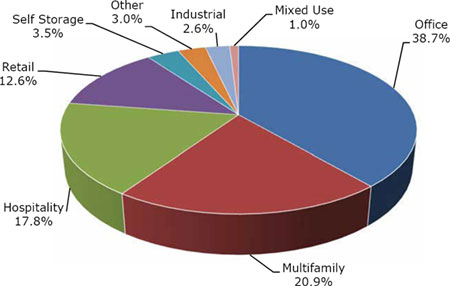

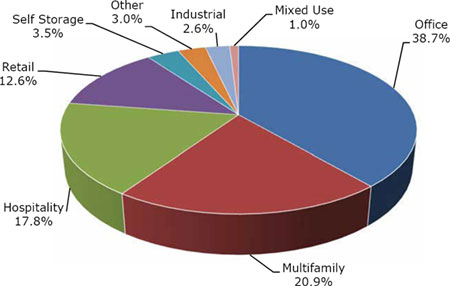

| F. | Property Type Distribution(1) |

Property Type | Number of

Mortgaged

Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off Date Balance (%) | Weighted Average Cut- off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

Office | 14 | $632,387,040 | 38.7 | % | 52.1 | % | 51.9 | % | 3.08 | x | 10.4 | % | 10.0 | % | 3.257 | % |

CBD | 6 | 451,285,000 | 27.6 | | 47.5 | | 47.5 | | 3.28 | | 10.5 | | 10.2 | | 3.159 | |

Suburban | 8 | 181,102,040 | 11.1 | | 63.5 | | 63.0 | | 2.56 | | 9.9 | | 9.3 | | 3.504 | |

Multifamily | 41 | 341,154,479 | 20.9 | | 42.2 | | 40.6 | | 4.28 | | 19.5 | | 19.2 | | 3.539 | |

Garden | 8 | 115,550,000 | 7.1 | | 65.6 | | 65.4 | | 2.00 | | 8.2 | | 8.0 | | 3.842 | |

Cooperative | 24 | 109,820,629 | 6.7 | | 17.9 | | 14.7 | | 7.68 | | 39.4 | | 38.7 | | 3.326 | |

High Rise | 1 | 75,000,000 | 4.6 | | 34.4 | | 34.4 | | 3.92 | | 13.0 | | 12.9 | | 3.250 | |

Townhouse | 2 | 20,110,000 | 1.2 | | 58.1 | | 52.9 | | 2.79 | | 11.2 | | 11.0 | | 3.509 | |

Student Housing | 1 | 11,250,000 | 0.7 | | 59.2 | | 54.0 | | 1.54 | | 9.3 | | 9.1 | | 4.270 | |

Mid Rise | 5 | 9,423,850 | 0.6 | | 46.3 | | 46.3 | | 2.19 | | 9.0 | | 8.5 | | 3.800 | |

Hospitality | 10 | 290,235,669 | 17.8 | | 51.4 | | 49.2 | | 4.91 | | 19.0 | | 17.6 | | 3.529 | |

Full Service | 2 | 124,700,000 | 7.6 | | 44.1 | | 42.9 | | 7.14 | | 25.3 | | 23.9 | | 3.301 | |

Select Service | 3 | 101,150,000 | 6.2 | | 56.9 | | 56.9 | | 3.34 | | 13.9 | | 12.6 | | 3.729 | |

Limited Service | 5 | 64,385,669 | 3.9 | | 57.1 | | 49.5 | | 3.06 | | 14.7 | | 13.4 | | 3.655 | |

Retail | 13 | 206,705,837 | 12.6 | | 57.6 | | 56.6 | | 2.78 | | 10.8 | | 10.4 | | 3.554 | |

Super Regional Mall | 1 | 75,000,000 | 4.6 | | 54.1 | | 54.1 | | 3.06 | | 10.7 | | 10.5 | | 3.359 | |

Anchored | 3 | 67,979,687 | 4.2 | | 59.6 | | 57.7 | | 2.56 | | 11.2 | | 10.5 | | 3.748 | |

Single Tenant | 7 | 56,000,000 | 3.4 | | 61.8 | | 60.4 | | 2.66 | | 10.3 | | 10.1 | | 3.554 | |

Unanchored | 2 | 7,726,150 | 0.5 | | 43.0 | | 43.0 | | 2.81 | | 12.3 | | 10.7 | | 3.738 | |

Self Storage | 7 | 56,490,917 | 3.5 | | 60.5 | | 58.9 | | 2.36 | | 9.7 | | 9.5 | | 3.679 | |

Self Storage | 7 | 56,490,917 | 3.5 | | 60.5 | | 58.9 | | 2.36 | | 9.7 | | 9.5 | | 3.679 | |

Other | 2 | 48,900,000 | 3.0 | | 60.4 | | 60.4 | | 2.73 | | 9.4 | | 9.0 | | 3.268 | |

Data Center | 2 | 48,900,000 | 3.0 | | 60.4 | | 60.4 | | 2.73 | | 9.4 | | 9.0 | | 3.268 | |

Industrial | 7 | 42,652,960 | 2.6 | | 62.7 | | 62.7 | | 2.42 | | 9.9 | | 9.1 | | 3.736 | |

Warehouse | 5 | 26,940,000 | 1.6 | | 61.2 | | 61.2 | | 2.46 | | 10.2 | | 9.3 | | 3.750 | |

Flex | 2 | 15,712,960 | 1.0 | | 65.3 | | 65.3 | | 2.34 | | 9.4 | | 8.8 | | 3.711 | |

Mixed Use | 3 | 15,744,967 | 1.0 | | 60.5 | | 57.2 | | 2.56 | | 10.3 | | 9.8 | | 3.659 | |

Office/Retail | 1 | 6,500,000 | 0.4 | | 58.0 | | 58.0 | | 2.52 | | 9.7 | | 9.2 | | 3.610 | |

Office/Industrial | 1 | 5,554,083 | 0.3 | | 55.0 | | 55.0 | | 3.27 | | 11.4 | | 10.8 | | 3.250 | |

Multifamily/Retail | 1 | 3,690,884 | 0.2 | | 73.1 | | 59.0 | | 1.57 | | 9.8 | | 9.4 | | 4.360 | |

Total/Weighted Average: | 97 | $1,634,271,868 | 100.0 | % | 51.5 | % | 50.5 | % | 3.56 | x | 13.8 | % | 13.2 | % | 3.433 | % |

(1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

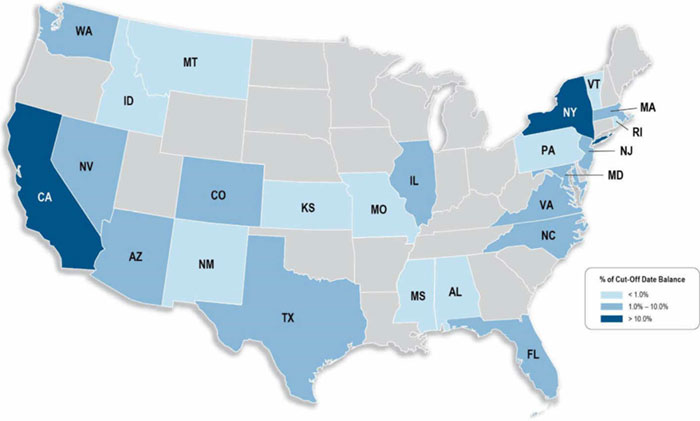

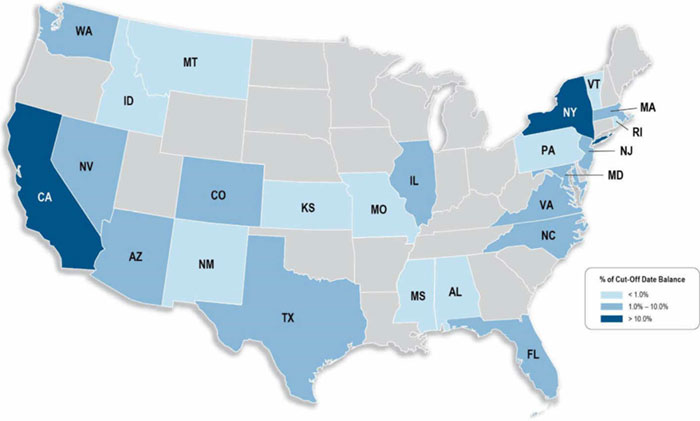

| G. | Geographic Distribution(1)(2) |

Location | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of

Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

New York | 36 | | $547,470,629 | | 33.5 | % | 39.6 | % | 39.0 | % | 4.16 | x | 16.6 | % | 16.2 | % | 3.239 | % |

California | 16 | | 290,979,687 | | 17.8 | | 54.4 | | 52.9 | | 2.94 | | 11.3 | | 10.7 | | 3.505 | |

Northern California | 9 | | 160,950,000 | | 9.8 | | 50.8 | | 50.4 | | 3.48 | | 11.5 | | 11.1 | | 3.274 | |

Southern California | 7 | | 130,029,687 | | 8.0 | | 58.8 | | 55.9 | | 2.28 | | 11.1 | | 10.2 | | 3.790 | |

Nevada | 3 | | 115,450,000 | | 7.1 | | 41.9 | | 41.1 | | 7.51 | | 25.8 | | 24.7 | | 3.255 | |

Texas | 6 | | 106,088,000 | | 6.5 | | 66.2 | | 66.2 | | 2.29 | | 9.0 | | 8.6 | | 3.744 | |

Other(3) | 36 | | 574,283,553 | | 35.1 | | 60.6 | | 59.2 | | 2.74 | | 10.9 | | 10.2 | | 3.560 | |

Total/Weighted Average | 97 | | $1,634,271,868 | | 100.0 | % | 51.5 | % | 50.5 | % | 3.56 | x | 13.8 | % | 13.2 | % | 3.433 | % |

(1) | The mortgaged properties are located in 24 states. |

(2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property, which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

(3) | Includes 20 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

BANK 2020-BNK25 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

998,487 - 1,000,000 | 1 | $998,487 | 0.1% |

1,000,001 - 2,000,000 | 6 | 8,929,316 | 0.5 |

2,000,001 - 3,000,000 | 4 | 11,257,409 | 0.7 |

3,000,001 - 4,000,000 | 3 | 10,684,444 | 0.7 |

4,000,001 - 5,000,000 | 1 | 4,046,323 | 0.2 |

5,000,001 - 6,000,000 | 7 | 39,573,300 | 2.4 |

6,000,001 - 7,000,000 | 3 | 19,843,818 | 1.2 |

7,000,001 - 8,000,000 | 6 | 46,317,930 | 2.8 |

8,000,001 - 9,000,000 | 5 | 42,995,889 | 2.6 |

9,000,001 - 10,000,000 | 2 | 19,135,614 | 1.2 |

10,000,001 - 15,000,000 | 11 | 137,328,669 | 8.4 |

15,000,001 - 20,000,000 | 7 | 116,335,669 | 7.1 |

20,000,001 - 30,000,000 | 6 | 156,140,000 | 9.6 |

30,000,001 - 50,000,000 | 5 | 231,350,000 | 14.2 |

50,000,001 - 70,000,000 | 4 | 258,050,000 | 15.8 |

70,000,001 - 80,000,000 | 2 | 150,000,000 | 9.2 |

80,000,001 - 90,000,000 | 1 | 81,285,000 | 5.0 |

90,000,001 - 100,000,000 | 3 | 300,000,000 | 18.4 |

Total: | 77 | $1,634,271,868 | 100.0% |

Average | $21,224,310 | | |

|

UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

1.57 - 1.60 | 1 | $11,250,000 | 0.7% |

1.61 - 1.70 | 4 | 32,720,884 | 2.0 |

1.71 - 1.80 | 1 | 10,000,000 | 0.6 |

1.81 - 1.90 | 2 | 26,000,000 | 1.6 |

1.91 - 2.00 | 1 | 68,000,000 | 4.2 |

2.01 - 2.50 | 14 | 237,829,673 | 14.6 |

2.51 - 3.00 | 12 | 374,976,709 | 22.9 |

3.01 - 3.50 | 9 | 259,911,323 | 15.9 |

3.51 - 4.00 | 5 | 292,500,000 | 17.9 |

4.01 - 23.88 | 28 | 321,083,279 | 19.6 |

Total: | 77 | $1,634,271,868 | 100.0% |

Weighted Average: | 3.72x | | |

|

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

1.54 - 1.60 | 3 | $29,910,884 | 1.8% |

1.61 - 1.80 | 3 | 24,060,000 | 1.5 |

1.81 - 1.90 | 2 | 26,000,000 | 1.6 |

1.91 - 2.00 | 6 | 212,979,673 | 13.0 |

2.01 - 2.50 | 14 | 238,435,682 | 14.6 |

2.51 - 3.00 | 13 | 373,356,026 | 22.8 |

3.01 - 3.50 | 4 | 121,946,323 | 7.5 |

3.51 - 4.00 | 6 | 333,000,000 | 20.4 |

4.01 - 23.52 | 26 | 274,583,279 | 16.8 |

Total: | 77 | $1,634,271,868 | 100.0% |

Weighted Average: | 3.56x | | |

LOAN PURPOSE |

Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

Refinance | 56 | $948,676,868 | 58.0% |

Acquisition | 15 | 505,345,000 | 30.9 |

Recapitalization | 6 | 180,250,000 | 11.0 |

Total: | 77 | $1,634,271,868 | 100.0% |

|

MORTGAGE RATE |

Range of Mortgage

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

2.589 - 3.500 | 42 | $1,045,612,831 | 64.0% |

3.501 - 3.750 | 14 | 244,687,485 | 15.0 |

3.751 - 4.000 | 15 | 282,410,669 | 17.3 |

4.001 - 4.250 | 4 | 46,620,000 | 2.9 |

4.251 - 4.360 | 2 | 14,940,884 | 0.9 |

Total: | 77 | $1,634,271,868 | 100.0% |

Weighted Average: | 3.433% | | |

|

UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

7.4 - 8.0 | 3 | $153,000,000 | 9.4% |

8.1 - 9.0 | 6 | 152,685,000 | 9.3 |

9.1 - 10.0 | 15 | 232,395,884 | 14.2 |

10.1 - 11.0 | 8 | 366,390,000 | 22.4 |

11.1 - 12.0 | 4 | 140,015,000 | 8.6 |

12.1 - 13.0 | 6 | 192,929,673 | 11.8 |

13.1 - 14.0 | 3 | 44,679,687 | 2.7 |

14.1 - 15.0 | 5 | 81,093,345 | 5.0 |

15.1 - 16.0 | 1 | 29,500,000 | 1.8 |

16.1 - 20.0 | 2 | 34,000,000 | 2.1 |

20.1 - 125.3 | 24 | 207,583,279 | 12.7 |

Total: | 77 | $1,634,271,868 | 100.0% |

Weighted Average: | 13.8% | | |

|

UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

7.0 - 8.0 | 4 | $173,000,000 | 10.6% |

8.1 - 9.0 | 9 | 224,885,000 | 13.8 |

9.1 - 10.0 | 15 | 270,585,884 | 16.6 |

10.1 - 11.0 | 8 | 292,244,673 | 17.9 |

11.1 - 12.0 | 6 | 220,900,000 | 13.5 |

12.1 - 13.0 | 4 | 116,235,682 | 7.1 |

13.1 - 14.0 | 3 | 85,000,000 | 5.2 |

14.1 - 15.0 | 4 | 43,837,350 | 2.7 |

15.1 - 20.0 | 1 | 7,600,000 | 0.5 |

20.1 - 123.2 | 23 | 199,983,279 | 12.2 |

Total: | 77 | $1,634,271,868 | 100.0% |

Weighted Average: | 13.2% | | |

| (1) | For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property, which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity). |