| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-257991-03 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,173,324,212

(Approximate Initial Pool Balance)

$999,012,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

BANK 2022-BNK40

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Morgan Stanley Mortgage Capital Holdings LLC

Bank of America, National Association

National Cooperative Bank, N.A.

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2022-BNK40

February 21, 2022

| WELLS FARGO SECURITIES | BofA SECURITIES | MORGAN STANLEY |

| | | |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

| | | |

Academy Securities, Inc. Co-Manager | Drexel Hamilton Co-Manager | Siebert Williams Shank Co-Manager |

| | | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-257991) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Morgan Stanley & Co. LLC, BofA Securities, Inc., Academy Securities, Inc., Drexel Hamilton, LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

“BofA Securities” is the marketing name for the global banking and global markets businesses of Bank of America Corporation. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., member FDIC. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation, including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and member of FINRA and SIPC, and, in other jurisdictions, locally registered entities.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

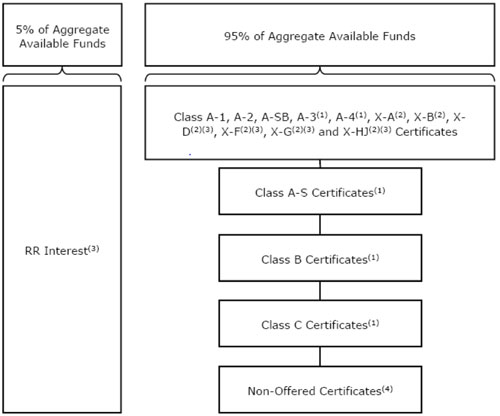

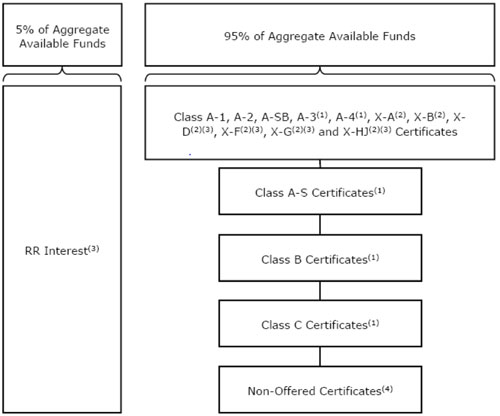

| BANK 2022-BNK40 | Certificate Structure |

I. Certificate Structure

| | | Class | Expected Ratings

(Fitch/KBRA/S&P)(1) | Approximate Initial

Certificate Balance or

Notional Amount(2) | Approx.

Initial Credit Support(3) | Pass-Through

Rate Description | Weighted Average Life (Years)(4) | Expected

Principal

Window(4) | Certificate Principal to Value

Ratio(5) | Certificate Principal

U/W NOI

Debt Yield(6) |

| | | Offered Certificates | | | | |

| | | A-1 | AAAsf/AAA(sf)/AAA(sf) | $11,750,000 | 30.000% | (7) | 2.90 | 04/22 - 03/27 | 34.5% | 20.1% |

| | | A-2 | AAAsf/AAA(sf)/AAA(sf) | $6,857,000 | 30.000% | (7) | 5.01 | 03/27 - 03/27 | 34.5% | 20.1% |

| | | A-SB | AAAsf/AAA(sf)/AAA(sf) | $20,730,000 | 30.000% | (7) | 7.46 | 03/27 - 12/31 | 34.5% | 20.1% |

| | | A-3(8) | AAAsf/AAA(sf)/AAA(sf) | (8)(9) | 30.000% | (7) | (9) | (9) | 34.5% | 20.1% |

| | | A-4(8) | AAAsf/AAA(sf)/AAA(sf) | (8)(9) | 30.000% | (7) | (9) | (9) | 34.5% | 20.1% |

| | | X-A | AAAsf/AAA(sf)/AAA(sf) | $780,260,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| | | X-B | A-sf/AAA(sf)/NR | $218,752,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A |

| | | A-S(8) | AAAsf/AAA(sf)/AA+(sf) | $133,759,000(8) | 18.000% | (7) | 10.00 | 02/32 - 03/32 | 40.4% | 17.2% |

| | | B(8) | AA-sf/AA(sf)/AA-(sf) | $43,193,000(8) | 14.125% | (7) | 10.01 | 03/32 - 03/32 | 42.3% | 16.4% |

| | | C(8) | A-sf/A-(sf)/NR | $41,800,000(8) | 10.375% | (7) | 10.01 | 03/32 - 03/32 | 44.1% | 15.7% |

| | | Non-Offered Certificates | | | | | | |

| | | X-D | BBB-sf/BBB-(sf)/NR | $45,979,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A |

| | | X-F | BB-sf/BB-(sf)/NR | $23,687,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A |

| | | X-G | B-sf/B-(sf)/NR | $11,146,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A |

| | | X-HJ | NR/NR/NR | $34,834,001(18) | N/A | Variable(19) | N/A | N/A | N/A | N/A |

| | | D | BBBsf/BBB+(sf)/NR | $26,473,000 | 8.000% | (7) | 10.01 | 03/32 - 03/32 | 45.3% | 15.3% |

| | | E | BBB-sf/BBB-(sf)/NR | $19,506,000 | 6.250% | (7) | 10.01 | 03/32 - 03/32 | 46.1% | 15.0% |

| | | F | BB-sf/BB-(sf)/NR | $23,687,000 | 4.125% | (7) | 10.01 | 03/32 - 03/32 | 47.2% | 14.7% |

| | | G | B-sf/B-(sf)/NR | $11,146,000 | 3.125% | (7) | 10.01 | 03/32 - 03/32 | 47.7% | 14.6% |

| | | H | NR/NR/NR | $11,147,000 | 2.125% | (7) | 10.01 | 03/32 - 03/32 | 48.2% | 14.4% |

| | | J | NR/NR/NR | $23,687,001 | 0.000% | (7) | 10.01 | 03/32 - 03/32 | 49.2% | 14.1% |

| | | | Non-Offered Eligible Vertical Interest | | | | |

| | | RR

Interest | NR/NR/NR | $58,666,210.61 | N/A | WAC(20) | 9.76 | 04/22 - 03/32 | N/A | N/A |

| |

| Notes: |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and S&P Global Ratings (“S&P”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated February 21, 2022 (the “Preliminary Prospectus”). Fitch, KBRA and S&P have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, Class X-B, Class X-D, Class X-F, Class X-G and Class X-HJ Certificates (collectively referred to herein as “Class X Certificates”) may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) or trust components whose Certificate Balances comprise such Notional Amounts and, if as a result of such pricing the pass-through rate of any Class of the Class X Certificates would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (3) | The Approximate Initial Credit Support with respect to the Class A-1, A-2, A-SB, A-3 and A-4 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-SB, A-3 and A-4 Certificates in the aggregate, taking into account the Certificate Balances of the Class A-3 and Class A-4 trust components. The Approximate Initial Credit Support set forth for the Class A-S certificates represents the approximate credit support for the underlying Class A-S trust component. The Approximate Initial Credit Support set forth for the Class B certificates represents the approximate credit support for the underlying Class B trust component. The Approximate Initial Credit Support set forth for the Class C certificates represents the approximate credit support for the underlying Class C trust component. The RR Interest only provides credit support to the limited extent that losses incurred on the underlying mortgage loans are allocated to it, on the one hand, and to the Offered Certificates and the Non-Offered Certificates, on the other hand, pro rata, in accordance with their respective Percentage Allocation Entitlements. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation)(other than the RR Interest). The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates (or, with respect to the Class A-3 or A-4 Certificates, the trust component with the same alphanumeric designation) and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| BANK 2022-BNK40 | Certificate Structure |

| | B or C Certificates, the trust component with the same alphanumeric designation)(other than the RR Interest). In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) (other than the RR Interest) and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation) senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates (or, with respect to the Class A-3, A-4, A-S, B or C Certificates, the trust component with the same alphanumeric designation)(other than the RR Interest) and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-SB, A-3 and A-4 Certificates (or, with respect to the Class A-3 or A-4 Certificates, the trust component with the same alphanumeric designation). In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-SB, A-3, A-4, A-S, B, C, D, E, F, G, H and J Certificates for any distribution date will, in each case, be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (8) | The Class A-3-1, A-3-2, A-3-X1, A-3-X2, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S-1, A-S-2, A-S-X1, A-S-X2, B-1, B-2, B-X1, B-X2, C-1, C-2, C-X1 and C-X2 Certificates are also offered certificates. Such Classes of Certificates, together with the Class A-3, A-4, A-S, B and C Certificates, constitute the “Exchangeable Certificates”. The Class A-1, A-2, A-SB, D, E, F, G, H and J Certificates, together with the Exchangeable Certificates with a Certificate Balance, are referred to as the “Principal Balance Certificates.” Each Class of Exchangeable Certificates will have the Certificate Balance or Notional Amount and pass-through rate described below under “Exchangeable Certificates.” |

| (9) | The exact initial Certificate Balances or Notional Amounts of the Class A-3, A-3-X1, A-3-X2, A-4, A-4-X1 and A-4-X2 trust components (and consequently, the exact aggregate Initial Certificate Balances or Notional Amounts of the Exchangeable Certificates with an “A-3” or “A-4” designation) are unknown and will be determined based on the final pricing of those Classes of Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-3 and A-4 trust components are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-3 and A-4 trust components is expected to be approximately $740,923,000, subject to a variance of plus or minus 5%. The Class A-3-X1 and A-3-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-3 trust component. The Class A-4-X1 and A-4-X2 trust components will have initial Notional Amounts equal to the initial Certificate Balance of the Class A-4 trust component. In the event that the Class A-4 trust component is issued with an initial certificate balance of $740,923,000, the Class A-3 trust component will not be issued. |

| | Trust

Components | | Expected Range of

Approximate Initial

Certificate Balance | | Expected Range of

Weighted Average

Life (Years) | | Expected Range of Principal Window | |

| | Class A-3 | | $0 - $350,000,000 | | N/A – 9.82 | | N/A / 12/31 - 01/32 | |

| | Class A-4 | | $390,923,000 - $740,923,000 | | 9.87 – 9.91 | | 12/31-02/32 / 01/32-02/32 | |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2 and A-SB Certificates and the Class A-3 and A-4 trust components outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2 and A-SB Certificates and the Class A-3, A-3-X1, A-3-X2, A-4, A-4-X1 and A-4-X2 trust components for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C trust components outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, A-S-X1, A-S-X2, B, B-X1, B-X2, C, C-X1 and C-X2 trust components for the related distribution date, weighted on the basis of their respective Certificate Balances or Notional Amounts outstanding immediately prior to that distribution date (but excluding trust components with a Notional Amount in the denominator of such weighted average calculation). For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and E Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and E Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (16) | The Class X-F and X-G Certificates are notional amount certificates. The Notional Amount of the Class X-F and X-G Certificates will be equal to the Certificate Balance of the Class F and G Certificates, respectively, outstanding from time to time. None of the Class X-F and X-G Certificates will be entitled to distributions of principal. |

| (17) | The pass-through rate for the Class X-F and X-G Certificates for any distribution date will, in each case, be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rates on the Class F and G Certificates, respectively, for the related distribution date. |

| (18) | The Class X-HJ Certificates are notional amount certificates. The Notional Amount of the Class X-HJ Certificates will be equal to the aggregate Certificate Balance of the Class H and J Certificates outstanding from time to time. The Class X-HJ Certificates will not be entitled to distributions of principal. |

| (19) | The pass-through rate for the Class X-HJ Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class H and J Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (20) | The effective interest rate for the RR Interest will be a variable rate per annum (described in the table as “WAC”) equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date. For purposes of calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| BANK 2022-BNK40 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

| Mortgage Loan Seller | | Number

of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | Approx. % of

Initial Pool

Balance |

| Wells Fargo Bank, National Association | | 16 | | 21 | | $324,798,437 | | 27.7% |

| Morgan Stanley Mortgage Capital Holdings LLC | | 21 | | 33 | | 315,949,120 | | 26.9 |

| Bank of America, National Association | | 8 | | 15 | | 242,125,000 | | 20.6 |

| Wells Fargo Bank, National Association / Morgan Stanley Mortgage Capital Holdings LLC | | 1 | | 1 | | 110,000,000 | | 9.4 |

| Wells Fargo Bank, National Association / Bank of America, National Association | | 1 | | 9 | | 110,000,000 | | 9.4 |

| National Cooperative Bank, N.A. | | 23 | | 23 | | 70,451,655 | | 6.0 |

| Total | | 70 | | 102 | | $1,173,324,212 | | 100.0% |

Loan Pool:

| Initial Pool Balance: | $1,173,324,212 |

| Number of Mortgage Loans: | 70 |

| Average Cut-off Date Balance per Mortgage Loan: | $16,761,774 |

| Number of Mortgaged Properties: | 102 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $11,503,179 |

| Weighted Average Interest Rate: | 3.4155% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 60.8% |

| Weighted Average Original Term to Maturity (months): | 120 |

| Weighted Average Remaining Term to Maturity (months): | 118 |

| Weighted Average Original Amortization Term (months)(2): | 370 |

| Weighted Average Remaining Amortization Term (months)(2): | 370 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 4.00x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 14.1% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 49.2% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 47.8% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 18.8% |

| % of Mortgage Loans with Single Tenants(3): | 3.0% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property are calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | Seventeen (17) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A., currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| BANK 2022-BNK40 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 18.5% of the mortgage pool (27 mortgage loans) has scheduled amortization, as follows:

11.1% (6 mortgage loans) provides for an interest-only period followed by an amortization period; and

7.4% (21 mortgage loans) requires amortization during the entire loan term

Interest-Only: Based on the Initial Pool Balance, 81.5% of the mortgage pool (43 mortgage loans) provides for interest-only payments during the entire loan term through maturity. The weighted average Cut-off Date Loan-to-Value Ratio and weighted average U/W Net Cash Flow DSCR for those mortgage loans are 48.3% and 4.24x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 38.1% of the mortgage pool (7 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 51.0% of the pool |

| Insurance: | 22.6% of the pool |

| Capital Replacements: | 50.6% of the pool |

| TI/LC: | 29.0% of the pool (1) |

| (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, mixed use, retail and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

69.3% of the mortgage pool (33 mortgage loans) features a lockout period, then defeasance only until an open period;

13.5% of the mortgage pool (4 mortgage loans) features a lockout period, then defeasance or greater of a prepayment premium (1.0%) or yield maintenance until an open period;

11.2% of the mortgage pool (10 mortgage loans) features a lockout period, then the greater of a prepayment premium (1.0%) or yield maintenance until an open period;

6.0% of the mortgage pool (23 mortgage loans) features no lockout period, but requires the greater of a prepayment premium (1.0%) or yield maintenance, then a prepayment premium (1.0%) until an open period;

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| BANK 2022-BNK40 | Issue Characteristics |

III. Issue Characteristics

| Securities Offered: | $999,012,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of thirty classes (Classes A-1, A-2, A-SB, A-3, A-3-1, A-3-2, A-3-X1, A-3-X2, A-4, A-4-1, A-4-2, A-4-X1, A-4-X2, A-S, A-S-1, A-S-2, A-S-X1, A-S-X2, B, B-1, B-2, B-X1, B-X2, C, C-1, C-2, C-X1, C-X2, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such Classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Morgan Stanley Mortgage Capital Holdings LLC (“MSMCH”), Bank of America, National Association (“BANA”) and National Cooperative Bank, N.A. (“NCB”). |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, Morgan Stanley & Co. LLC and BofA Securities, Inc. |

| Co-Manager: | Academy Securities, Inc., Drexel Hamilton, LLC and Siebert Williams Shank & Co., LLC |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and S&P Global Ratings, acting through Standard and Poor’s Financial Services LLC |

| Master Servicers: | Wells Fargo Bank, National Association and National Cooperative Bank, N.A. |

| Special Servicers: | CWCapital Asset Management LLC and National Cooperative Bank, N.A. |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Pentalpha Surveillance LLC |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| U.S. Credit Risk Retention: | For a discussion of the manner in which the U.S. credit risk retention requirements are being addressed by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Securitization Regulation and UK Securitization Regulation: | None of the sponsors, the depositor, the underwriters, or their respective affiliates, or any other party to the transaction intends to retain a material net economic interest in the securitization constituted by the issue of the Certificates, or take any other action in respect of such securitization, in a manner prescribed or contemplated by (i) Regulation (EU) 2017/2402, or (ii) such Regulation as it forms part of UK domestic law. In particular, no such person undertakes to take any action which may be required by any investor for the purposes of its compliance with any applicable requirement under either such Regulation. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirements of either such Regulation. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Regulation and UK Securitization Regulation Due Diligence Requirements” in the Preliminary Prospectus. |

| Initial Risk Retention Consultation Party: | Wells Fargo Bank, National Association |

| Initial Majority Controlling Class Certificateholder: | Ellington Management Group, LLC |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in March 2022 (or, in the case of any mortgage loan that has its first due date after March 2022, the date that would have been its due date in March 2022 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Closing Date: | On or about March 10, 2022. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in April 2022. |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in April 2022. |

| | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| BANK 2022-BNK40 | Issue Characteristics |

| Rated Final Distribution Date: | The Distribution Date in March 2064. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| Clean-up Call: | 1.0% |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “SUMMARY OF RISK FACTORS” AND “RISK FACTORS” SECTIONS OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., Morningstar Credit Information & Analytics, LLC, KBRA Analytics, LLC, MBS Data, LLC, RealInsight and Thomson Reuters Corporation. |

| Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of one or more REMICs arranged in a tiered structure and a trust (the “grantor trust”). The upper-most REMIC will issue REMIC regular interests some of which will be held by the grantor trust (such grantor trust-held REMIC regular interests, the “trust components”). The Offered Certificates (other than the Exchangeable Certificates) will represent REMIC regular interests (other than the trust components). The Exchangeable Certificates will represent beneficial ownership of one or more of the trust components held by the grantor trust. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans or Groups

Mortgage Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of Mortgage Loans / Mortgaged Properties | | Mortgage Loan Cut-off Date Balance ($) | | % of Initial Pool Balance (%) | | Property

Type | | Number

of

SF / Units | | Cut-off Date Balance

Per SF / Unit ($) | | Cut-off Date LTV Ratio (%) | | Balloon LTV Ratio (%) | | U/W

NCF

DSCR

(x) | | U/W NOI Debt

Yield (%) |

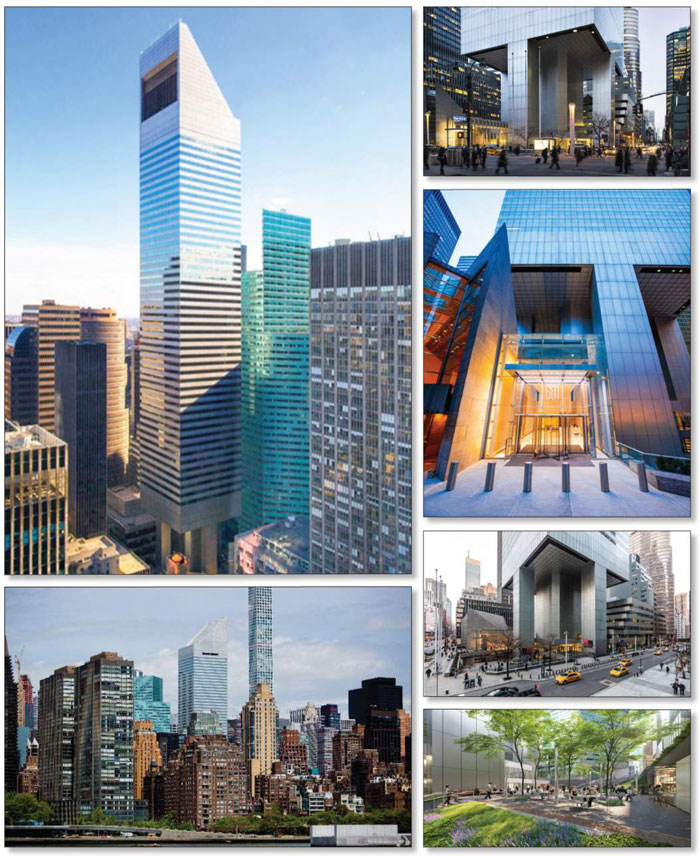

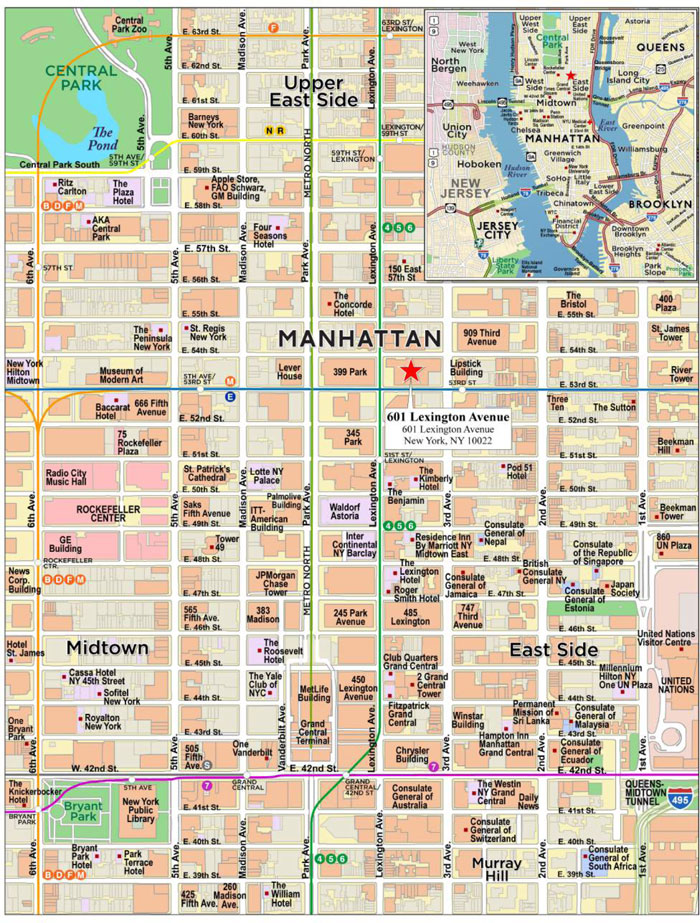

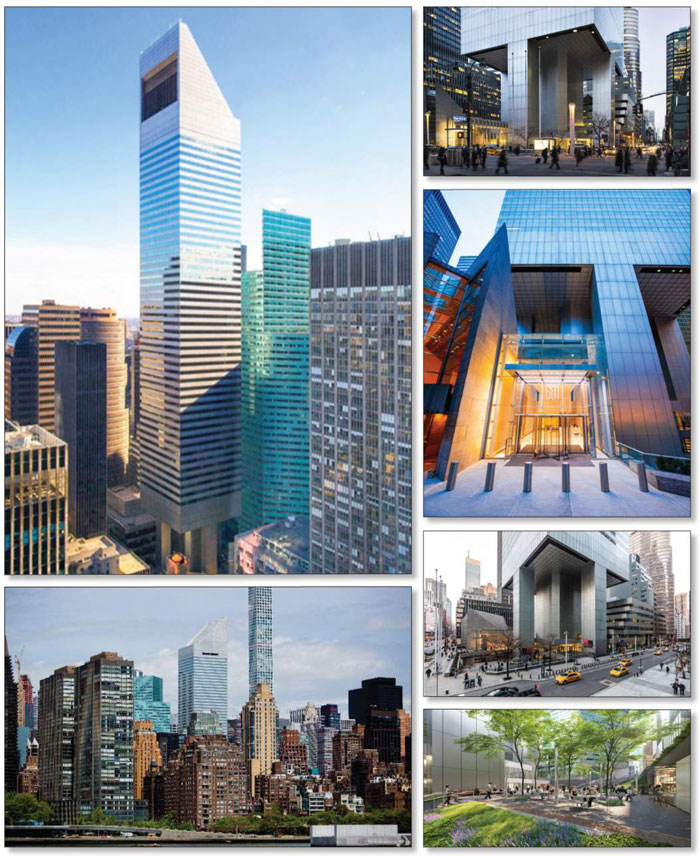

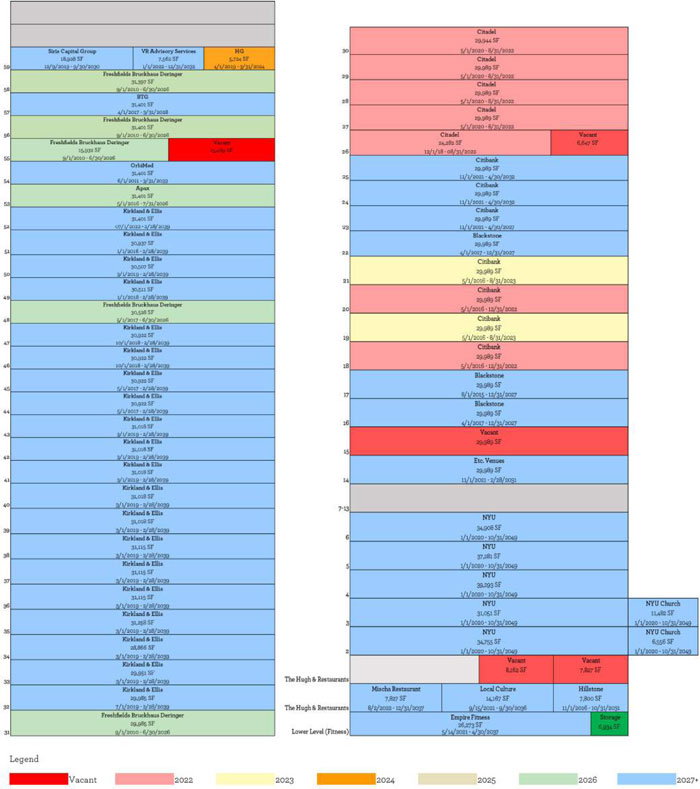

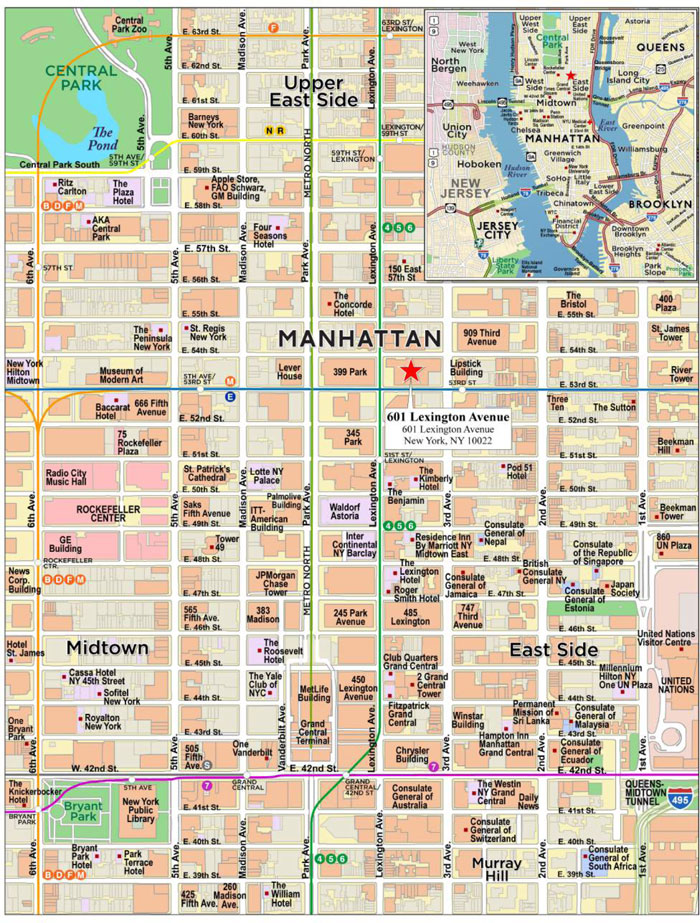

| WFB/MSMCH | | 601 Lexington Avenue | | New York | | NY | | 1 / 1 | | $110,000,000 | | 9.4 | % | | Office | | 1,675,659 | | | $432 | | 42.5 | % | | 42.5 | % | | 4.50 | x | | 13.2 | % |

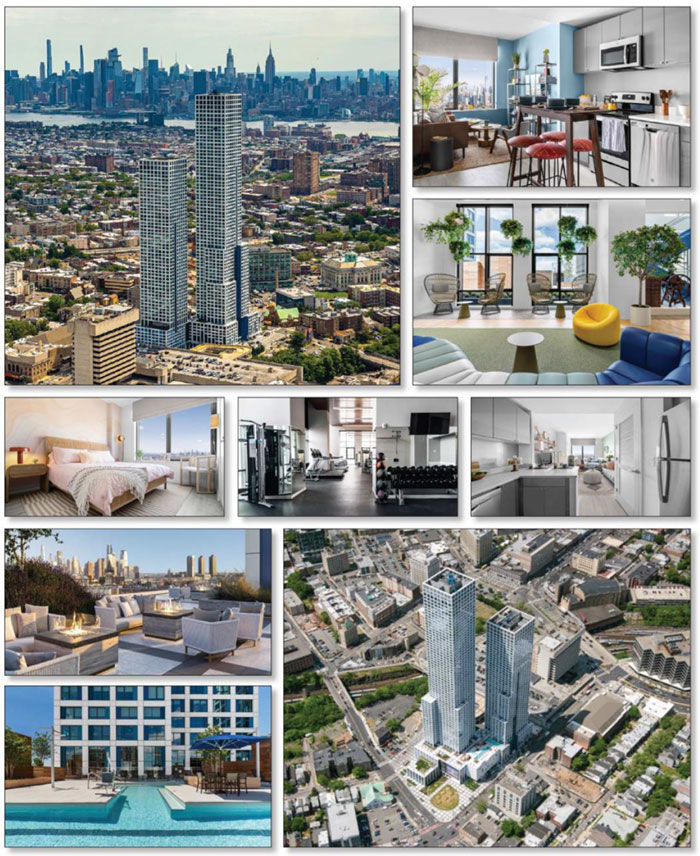

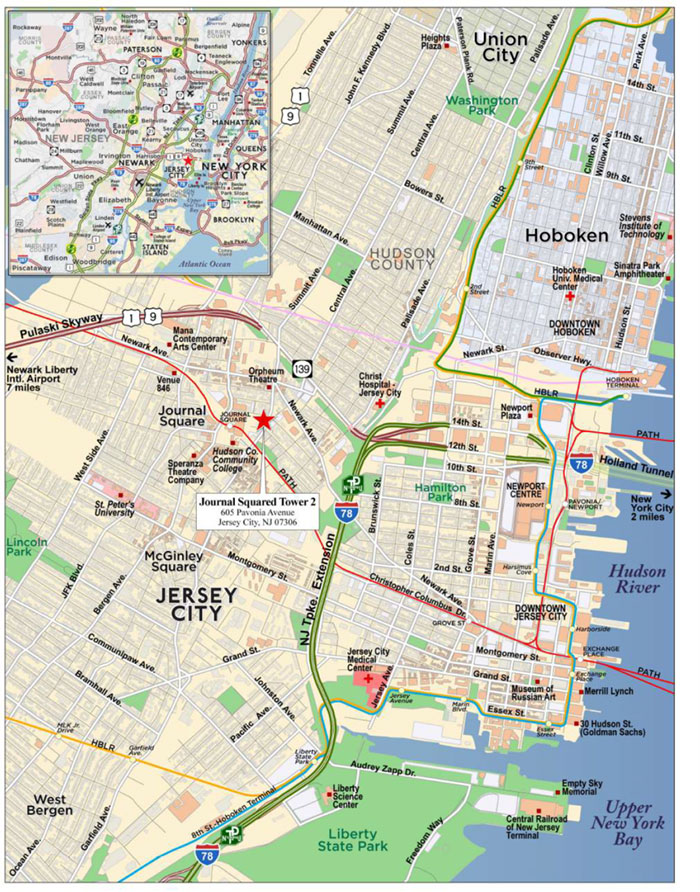

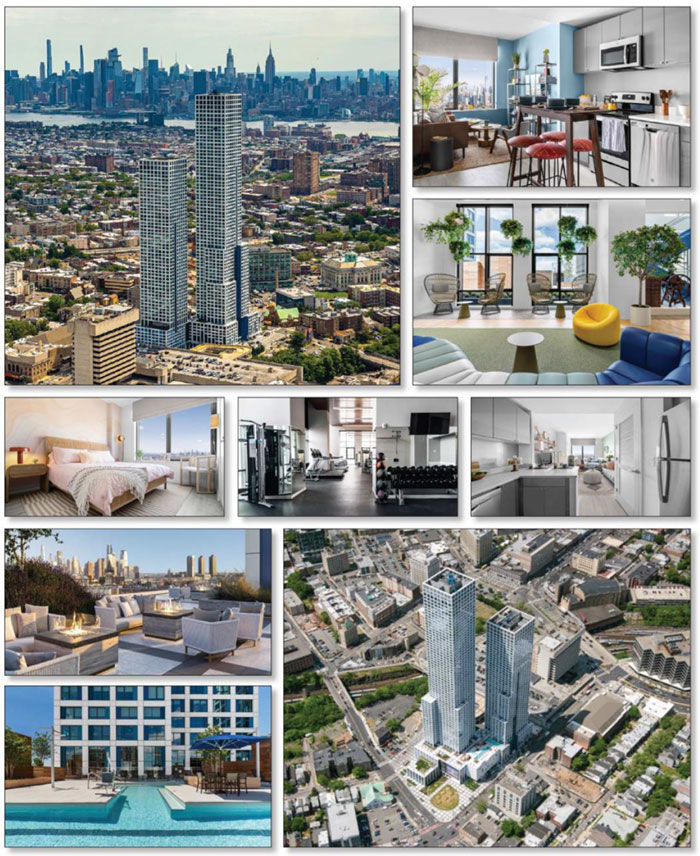

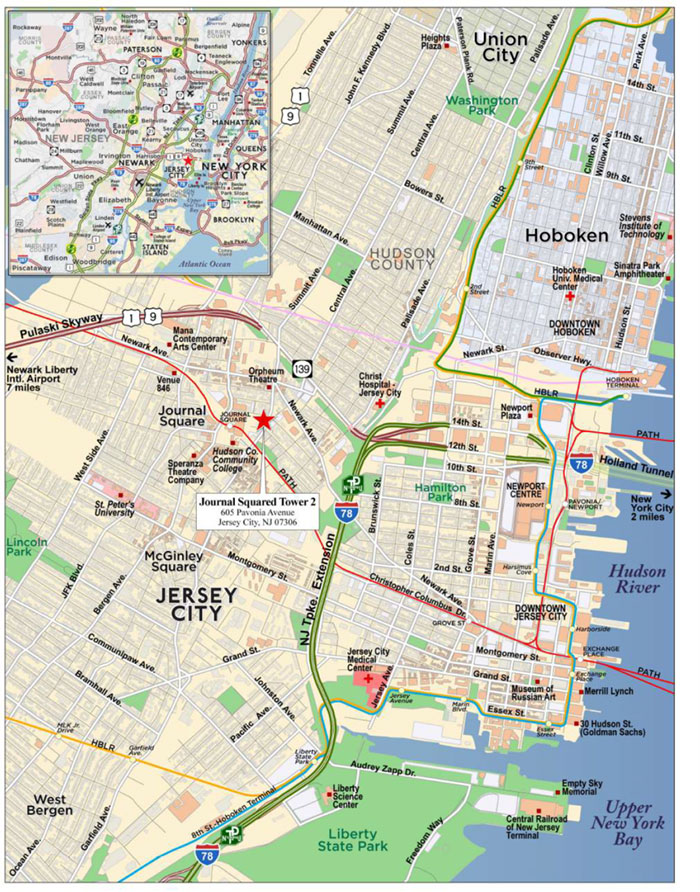

| WFB | | Journal Squared Tower 2 | | Jersey City | | NJ | | 1 / 1 | | 110,000,000 | | 9.4 | | | Multifamily | | 704 | | | 260,653 | | 38.0 | | | 38.0 | | | 3.37 | | | 12.0 | |

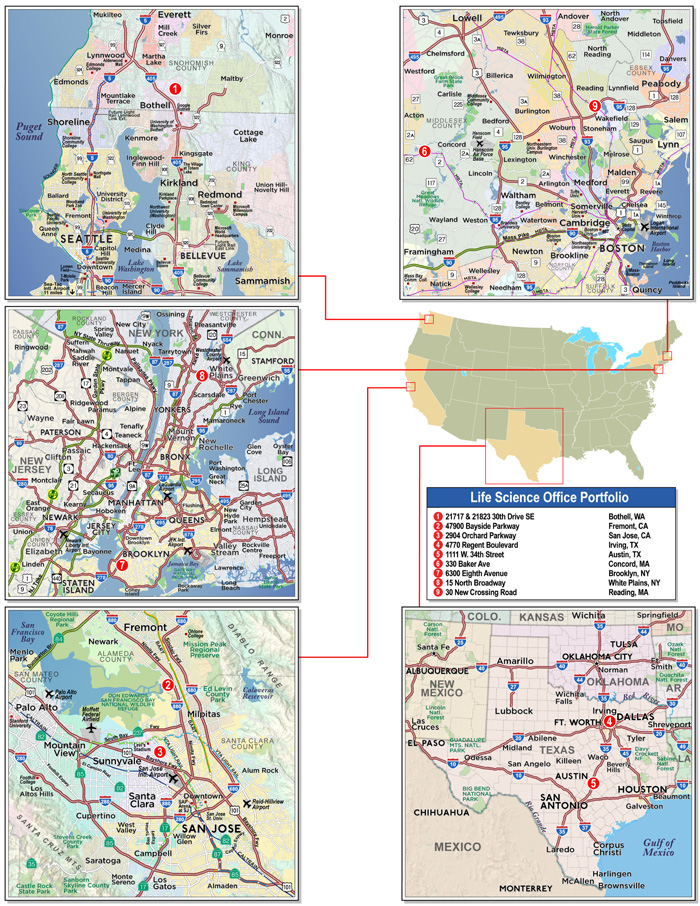

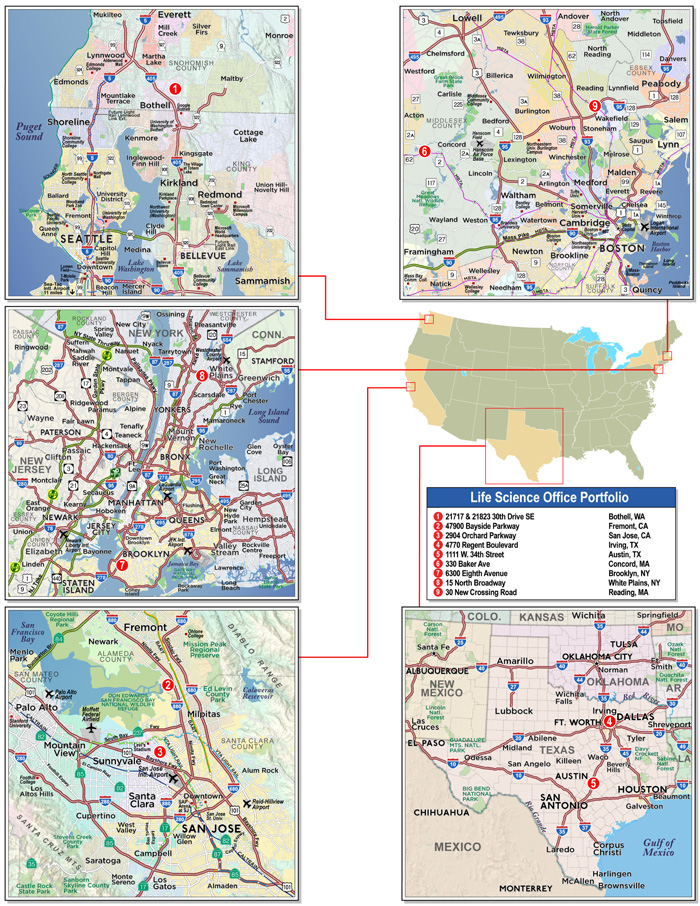

| WFB/BANA | | Life Science Office Portfolio | | Various | | Various | | 1 / 9 | | 110,000,000 | | 9.4 | | | Office | | 737,871 | | | 257 | | 62.3 | | | 62.3 | | | 2.50 | | | 9.2 | |

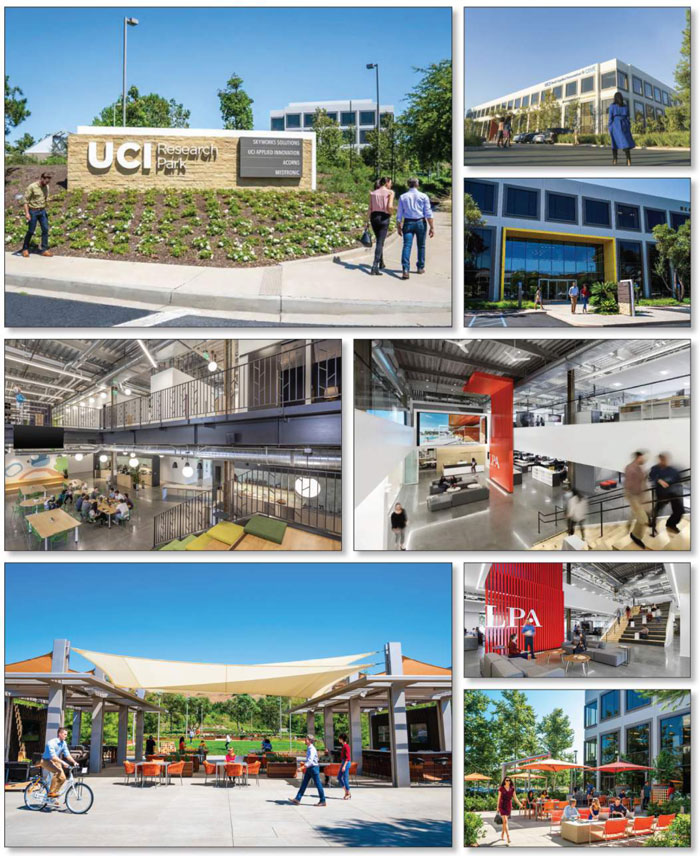

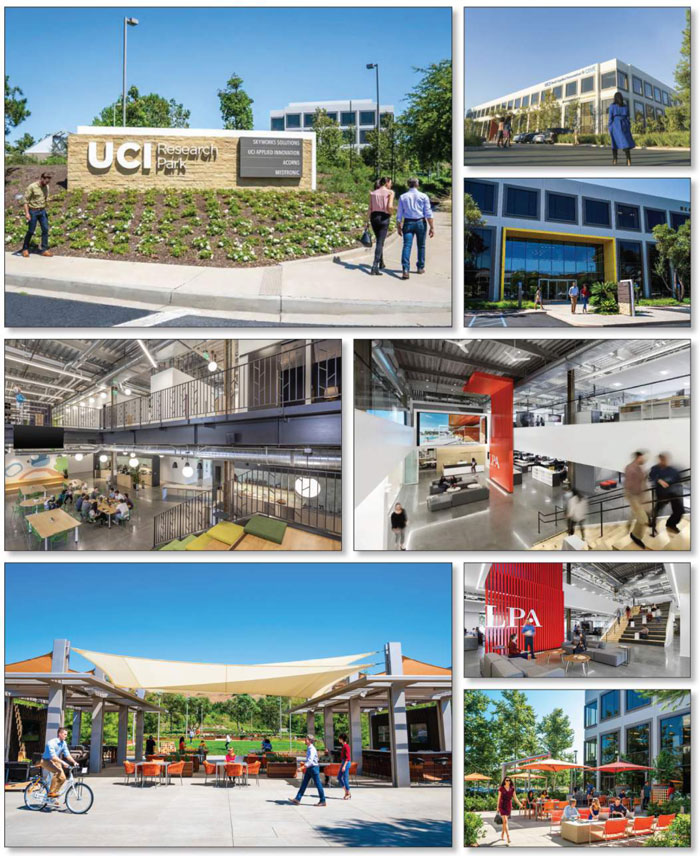

| BANA | | UCI Research Park Phases 12 & 13 | | Irvine | | CA | | 1 / 1 | | 100,000,000 | | 8.5 | | | Office | | 686,276 | | | 219 | | 50.0 | | | 50.0 | | | 3.66 | | | 12.1 | |

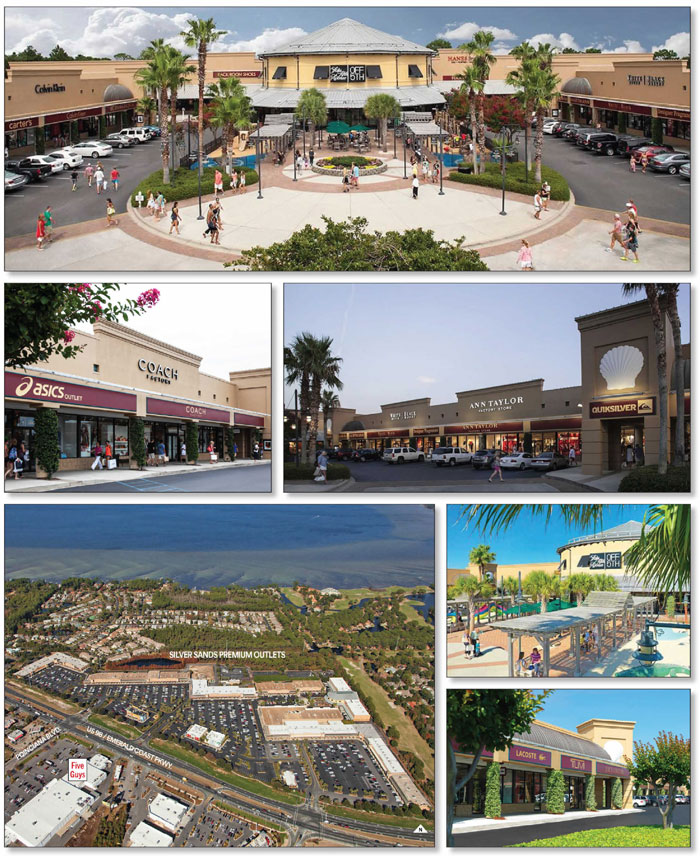

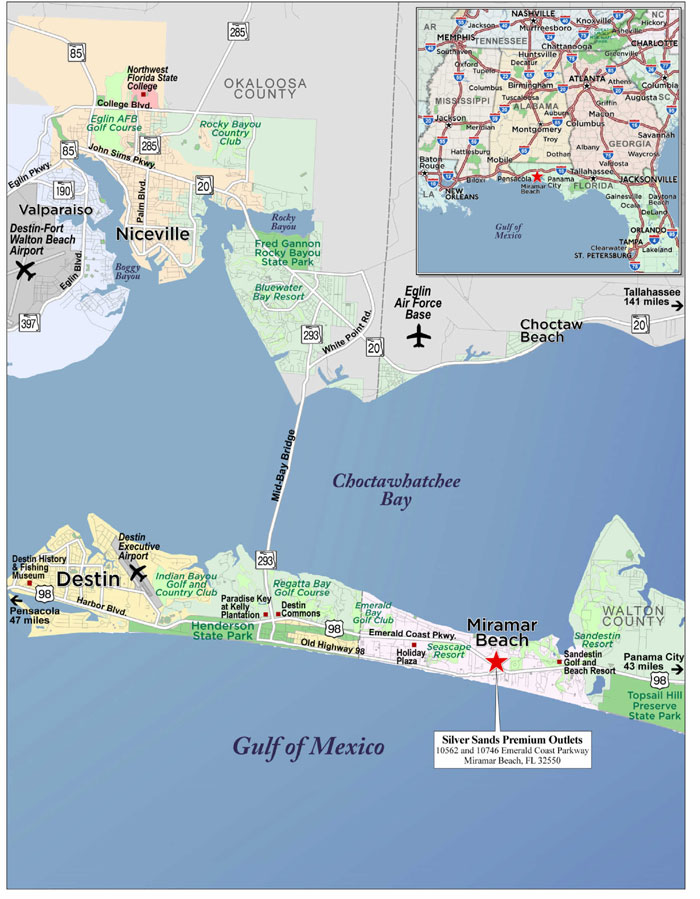

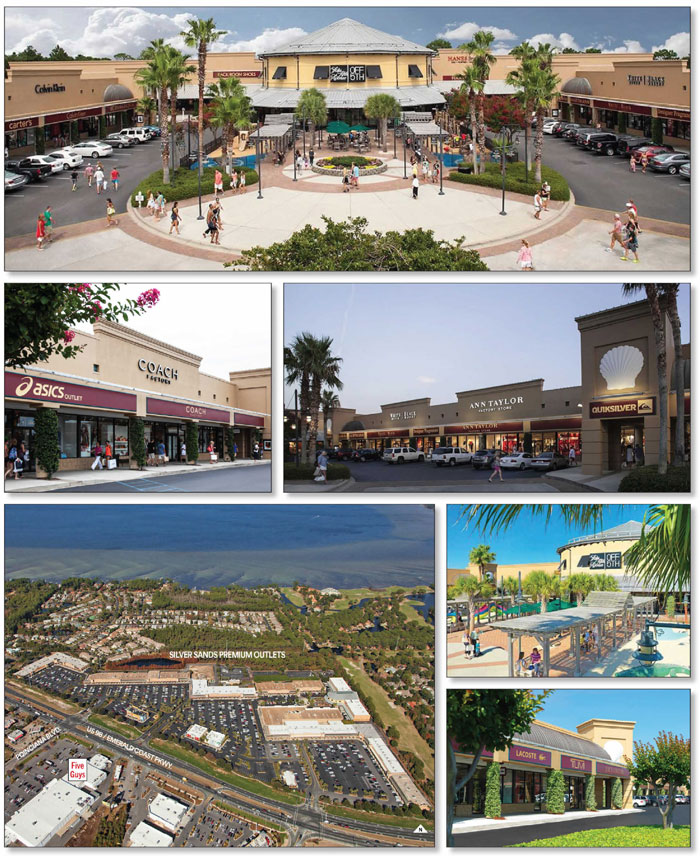

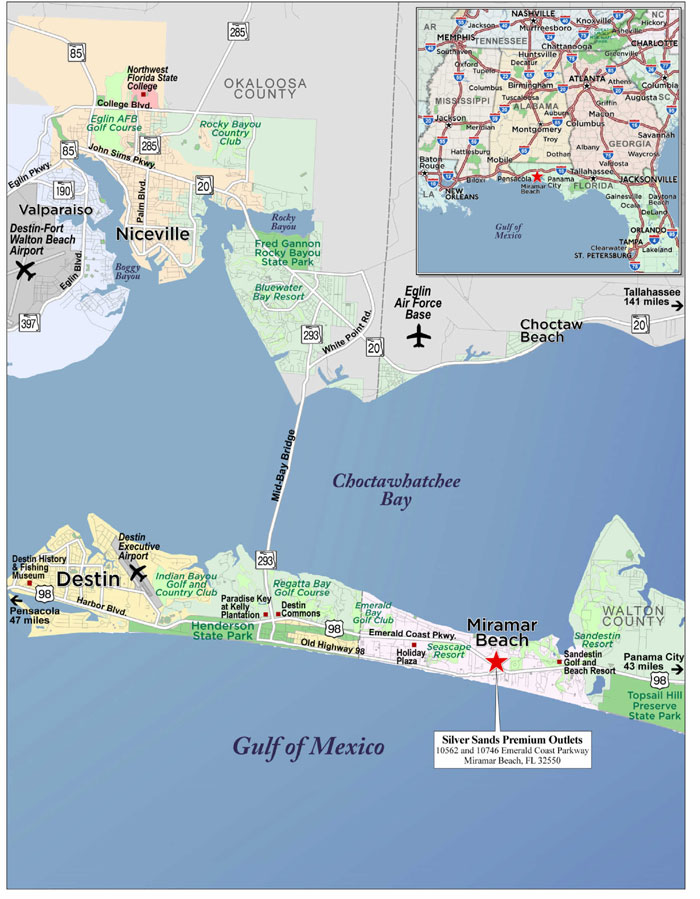

| BANA | | Silver Sands Premium Outlets | | Miramar Beach | | FL | | 1 / 1 | | 65,000,000 | | 5.5 | | | Retail | | 435,156 | | | 322 | | 50.7 | | | 50.7 | | | 3.27 | | | 13.8 | |

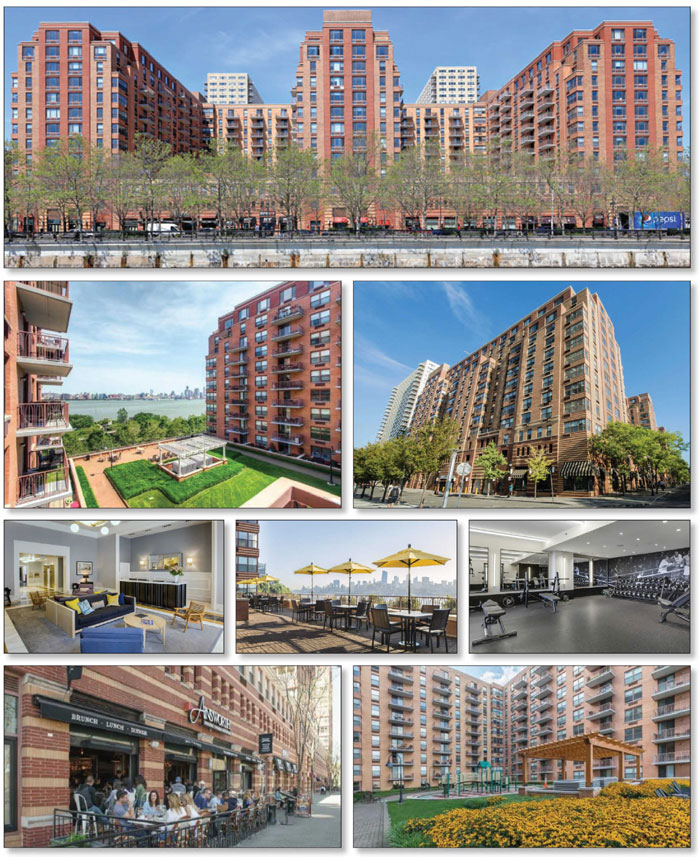

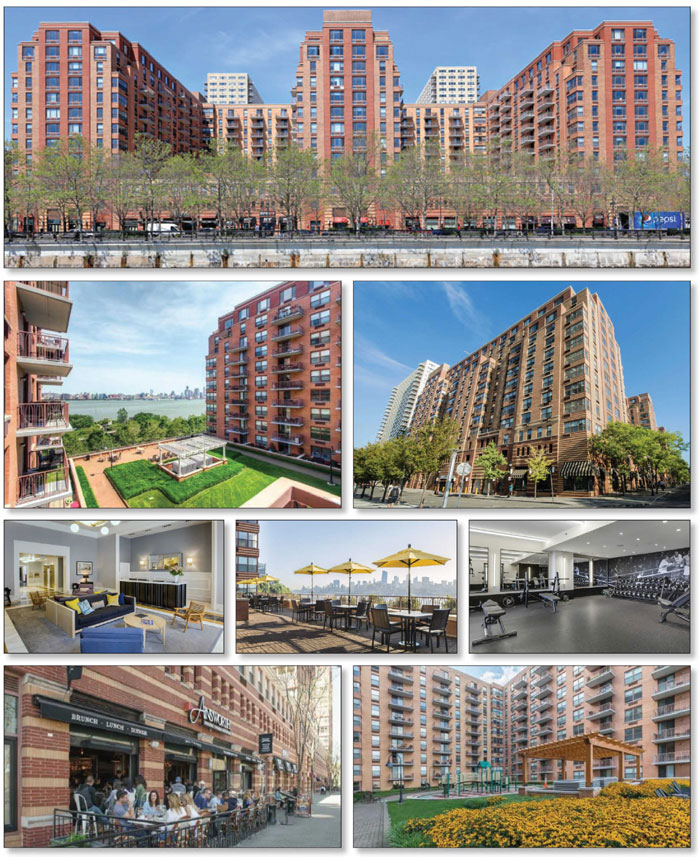

| MSMCH | | 333 River Street | | Hoboken | | NJ | | 1 / 1 | | 50,000,000 | | 4.3 | | | Multifamily | | 526 | | | 237,643 | | 34.5 | | | 34.5 | | | 5.22 | | | 12.4 | |

| MSMCH | | Midtown Square | | Troy | | MI | | 1 / 1 | | 50,000,000 | | 4.3 | | | Retail | | 580,251 | | | 139 | | 62.9 | | | 53.1 | | | 1.55 | | | 9.3 | |

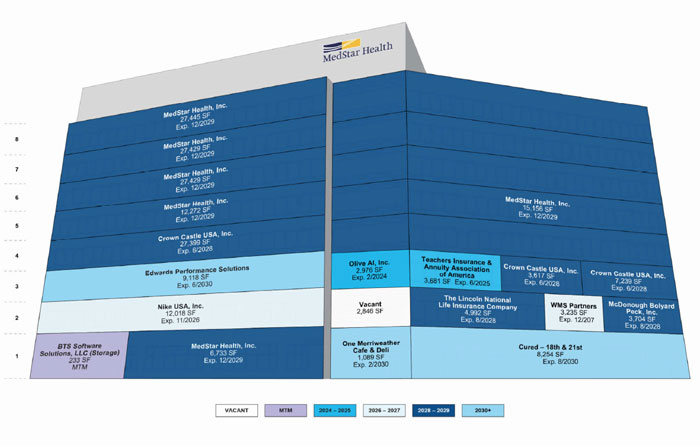

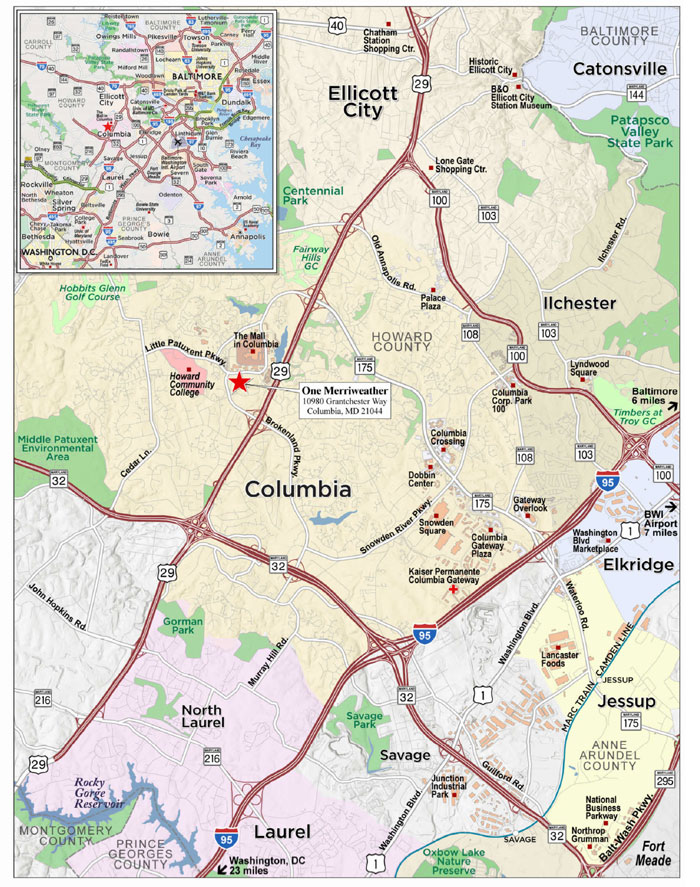

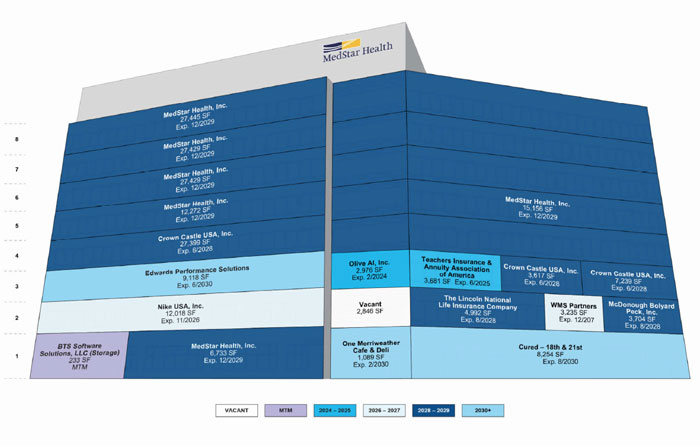

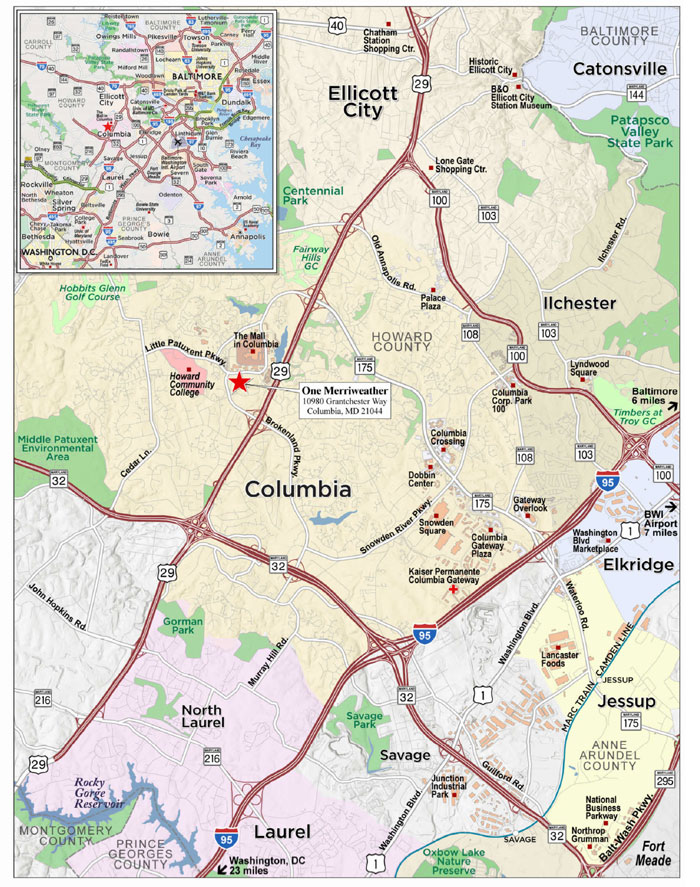

| WFB | | One Merriweather | | Columbia | | MD | | 1 / 1 | | 49,800,000 | | 4.2 | | | Office | | 206,865 | | | 241 | | 58.5 | | | 58.5 | | | 2.62 | | | 10.1 | |

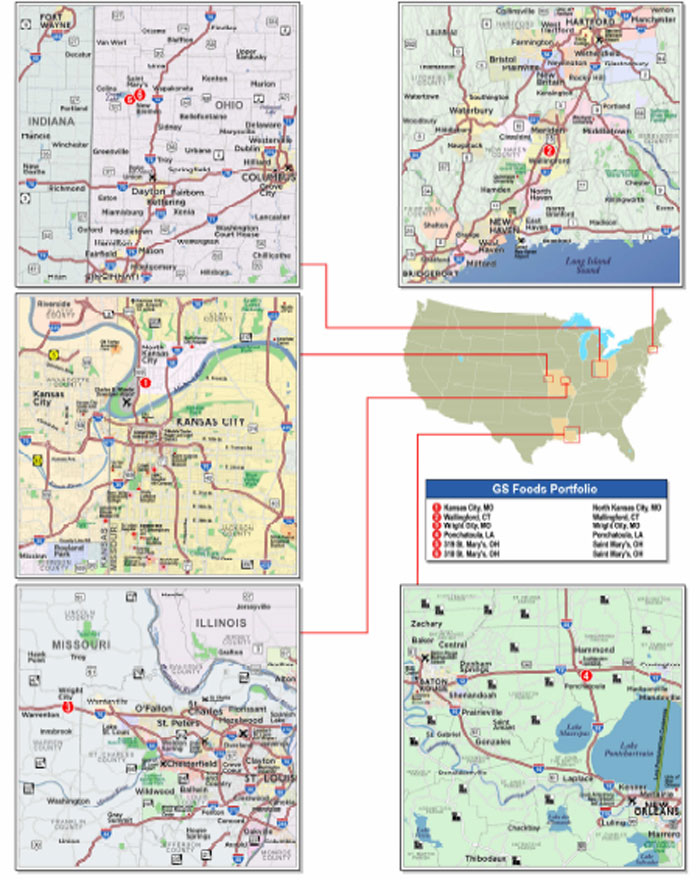

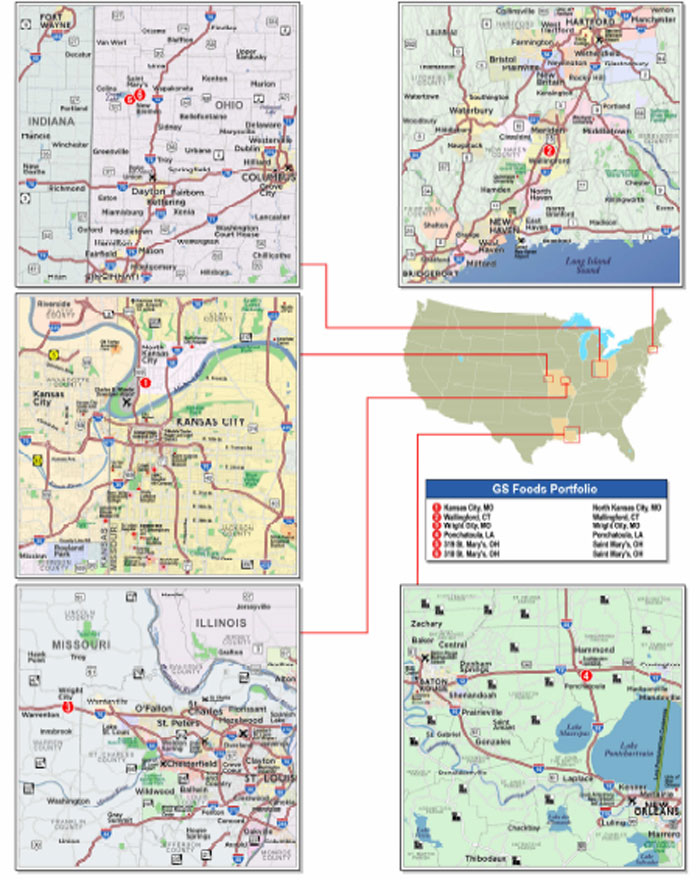

| WFB | | GS Foods Portfolio | | Various | | Various | | 1 / 6 | | 40,000,000 | | 3.4 | | | Industrial | | 516,288 | | | 111 | | 67.2 | | | 60.9 | | | 1.45 | | | 8.6 | |

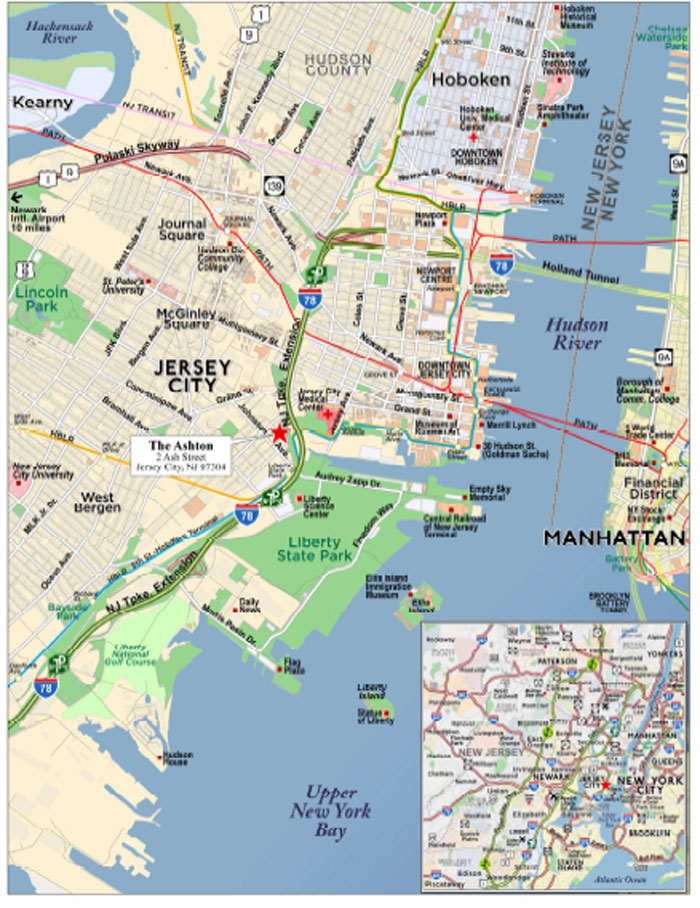

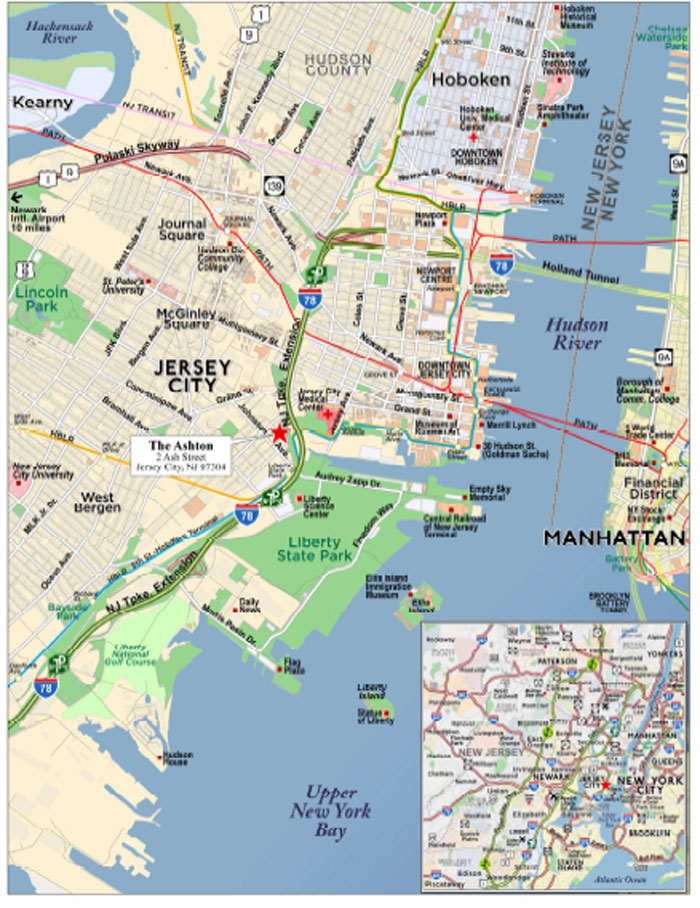

| MSMCH | | The Ashton | | Jersey City | | NJ | | 1 / 1 | | 28,500,000 | | 2.4 | | | Multifamily | | 93 | | | 306,452 | | 59.0 | | | 59.0 | | | 1.54 | | | 6.2 | |

| Top Three Total/Weighted Average | | 3 / 11 | | $330,000,000 | | 28.1 | % | | | | | | | | | 47.6 | % | | 47.6 | % | | 3.46 | x | | 11.5 | % |

| Top Five Total/Weighted Average | | 5 / 13 | | $495,000,000 | | 42.2 | % | | | | | | | | | 48.5 | % | | 48.5 | % | | 3.47 | x | | 11.9 | % |

| Top Ten Total/Weighted Average | | 10 / 23 | | $713,300,000 | | 60.8 | % | | | | | | | | | 50.7 | % | | 49.6 | % | | 3.21 | x | | 11.2 | % |

| Non-Top Ten Total/Weighted Average | | 60 / 79 | | $460,024,212 | | 39.2 | % | | | | | | | | | 46.9 | % | | 44.9 | % | | 5.23 | x | | 18.6 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit($) loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

B. Summary of the Whole Loans

| No. | Property Name | Mortgage Loan Seller in BANK 2021-BNK37 | Trust Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Controlling Pooling / Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Related Pari Passu Companion Loan(s) Original Balance |

| 1 | 601 Lexington Avenue | WFB/MSMCH | $110,000,000 | $723,300,000 | BXP 2021-601L | Wells Fargo Bank, National Association | Situs Holdings, LLC | BANK 2022-BNK39 | $613,300,000 |

| 2 | Journal Squared Tower 2 | WFB | $110,000,000 | $183,500,000 | WFCM 2022-JS2 | Wells Fargo Bank, National Association | Wells Fargo Bank, National Association | Future securitizations | $73,500,000 |

| 3 | Life Science Office Portfolio | WFB/BANA | $110,000,000 | $189,800,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | Future securitizations | $79,800,000 |

| 4 | UCI Research Park Phases 12 & 13 | BANA | $100,000,000 | $150,000,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | Future securitizations | $50,000,000 |

| 5 | Silver Sands Premium Outlets | BANA | $65,000,000 | $140,000,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | Future securitizations | $75,000,000 |

| 6 | 333 River Street | MSMCH | $50,000,000 | $125,000,000 | BANK 2022-BNK39 | Wells Fargo Bank, National Association | LNR Partners, LLC | BANK 2022-BNK39 | $75,000,000 |

| 7 | Midtown Square | MSMCH | $50,000,000 | $80,430,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | Future securitizations | $30,430,000 |

| 9 | GS Foods Portfolio | WFB | $40,000,000 | $57,520,000 | BANK 2022-BNK40 | Wells Fargo Bank, National Association | CWCapital Asset Management LLC | Future securitizations | $17,520,000 |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

C. Mortgage Loans with Additional Secured and Mezzanine Financing(1)

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) | % of Cut-off Date Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(2) | Mortgage Loan U/W NCF DSCR (x)(3) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(3) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(3) | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | WFB/MSMCH | 601 Lexington Avenue | $110,000,000 | 9.4% | $276,700,000 | $0 | 2.7920% | 4.50x | 3.25x | 13.2% | 9.5% | 42.5% | 58.8% |

| 2 | WFB | Journal Squared Tower 2 | 110,000,000 | 9.4 | 166,500,000 | 0 | 3.4900 | 3.37 | 1.77 | 12.0 | 6.3 | 38.0 | 72.4 |

| Total/Weighted Average | $220,000,000 | 18.8% | $443,200,000 | $0 | 3.1410% | 3.94x | 2.51x | 12.6% | 7.9% | 40.3% | 65.6% |

| (1) | In addition, seventeen (17) of the mortgage loans, each of which is secured by a residential cooperative property sold to the depositor by National Cooperative Bank, N.A, currently have in place Subordinate Coop LOCs. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (2) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (3) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

D. Previous Securitization History(1)

Loan

No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property

Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of Initial Pool

Balance (%) | Previous Securitization |

| 5 | BANA | Silver Sands Premium Outlets | Miramar Beach | FL | Retail | $65,000,000 | 5.5% | MSBAM 2012-C5 |

| 6 | MSMCH | 333 River Street | Hoboken | NJ | Multifamily | 50,000,000 | 4.3 | FN 470772 |

| 11.01 | BANA | BS&L Industrial Drive | Bethlehem | PA | Self Storage | 9,041,063 | 0.8 | WFRBS 2014-C19 |

| 11.02 | BANA | BS&L Schantz Road | Allentown | PA | Self Storage | 8,294,327 | 0.7 | WFRBS 2014-C19 |

| 16 | WFB | Market at Liberty Crossing - OH | Powell | OH | Retail | 19,930,922 | 1.7 | WFRBS 2013-C16 |

| 21.01 | BANA | MySpace Self Storage - Lansing | Lansing | MI | Self Storage | 4,599,909 | 0.4 | CGCMT 2016-C1 |

| 21.02 | BANA | MySpace Self Storage - Pierson | Flint | MI | Self Storage | 3,859,348 | 0.3 | CGCMT 2016-C1 |

| 21.03 | BANA | MySpace Self Storage - Brighton | Brighton | MI | Self Storage | 2,378,225 | 0.2 | CGCMT 2016-C1 |

| 21.04 | BANA | MySpace Self Storage - Hill Road | Flint | MI | Self Storage | 1,788,185 | 0.2 | CGCMT 2016-C1 |

| 27 | NCB | 159 Madison Owners Corp. | New York | NY | Multifamily | 10,487,100 | 0.9 | WFRBS 2014-C19 |

| 33 | WFB | Stadium Industrial Park | Las Vegas | NV | Industrial | 7,500,000 | 0.6 | RAITF 2016-FL6 |

| 39 | WFB | Out O’ Space Storage - Cantonment | Cantonment | FL | Self Storage | 5,125,000 | 0.4 | WFCM 2015-C27 |

| 44 | WFB | Out O’ Space Storage - Dade City | Dade City | FL | Self Storage | 4,000,000 | 0.3 | WFCM 2016-C32 |

| 45 | WFB | Out O’ Space Storage - Pensacola | Pensacola | FL | Self Storage | 3,750,000 | 0.3 | WFCM 2015-C28 |

| 46 | BANA | Coachella MHC | Coachella | CA | Manufactured Housing | 3,600,000 | 0.3 | WFRBS 2013-C13 |

| 47 | WFB | Out O’ Space Storage - Tavares | Tavares | FL | Self Storage | 3,575,000 | 0.3 | WFCM 2016-C35 |

| 48 | NCB | 67-35 Yellowstone Blvd. Owners Corp. | Forest Hills | NY | Multifamily | 3,295,978 | 0.3 | WFRBS 2014-C21 |

| 52 | NCB | 17th Street Artists Corp. | New York | NY | Multifamily | 2,794,840 | 0.2 | WFRBS 2013-C15 |

| | Total | | | | | $209,019,898 | 17.8% | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

| Class A-2(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool

Balance (%) | Mortgage

Loan Balance at Maturity ($) | % of Class A-2 Certificate Principal

Balance (%)(2) | SF | Loan per

SF ($) | U/W NCF DSCR

(x) | U/W NOI Debt Yield (%) | Cut-off Date LTV Ratio (%) | Balloon

LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to Maturity (mos.) |

| 35 | MSMCH | Galveston Self Storage | TX | Self Storage | $6,825,000 | 0.6% | $6,825,000 | 99.5% | 57,057 | $120 | 1.69x | 9.1% | 63.8% | 63.8% | 60 | 60 |

| Total/Weighted Average | | | $6,825,000 | 0.6% | $6,825,000 | 99.5% | | | 1.69x | 9.1% | 63.8% | 63.8% | 60 | 60 |

| | | | | | | | | | | | | | | | | |

| (1) | The table above presents the mortgage loan whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

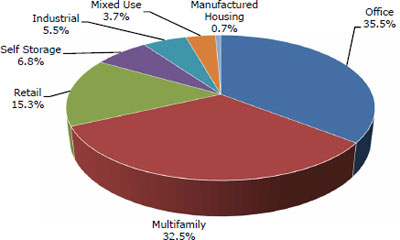

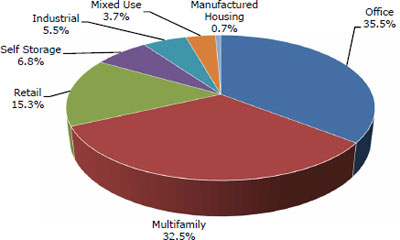

F. Property Type Distribution(1)

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off

Date Balance ($) | % of Cut-off

Date Balance (%) | Weighted

Average Cut-

off Date LTV

Ratio (%) | Weighted

Average

Balloon LTV

Ratio (%) | Weighted

Average

U/W NCF

DSCR (x) | Weighted

Average

U/W NOI

Debt Yield

(%) | Weighted

Average

U/W NCF

Debt Yield

(%) | Weighted

Average

Interest

Rate (%) |

| Office | 14 | $417,070,000 | 35.5% | 53.3% | 53.3% | 3.32x | 11.1% | 10.6% | 3.2413% |

| Suburban | 3 | 175,400,000 | 14.9 | 52.8 | 52.8 | 3.25 | 11.5 | 10.9 | 3.3413 |

| CBD | 2 | 131,670,000 | 11.2 | 46.4 | 46.4 | 4.09 | 12.2 | 11.8 | 2.9279 |

| Medical | 9 | 110,000,000 | 9.4 | 62.3 | 62.3 | 2.50 | 9.2 | 8.8 | 3.4570 |

| Multifamily | 49 | 381,426,655 | 32.5 | 34.4 | 34.0 | 6.57 | 21.1 | 20.8 | 3.0753 |

| High Rise | 2 | 160,000,000 | 13.6 | 36.9 | 36.9 | 3.95 | 12.1 | 12.0 | 3.1228 |

| Cooperative | 24 | 86,451,655 | 7.4 | 10.9 | 9.5 | 15.70 | 52.6 | 51.9 | 2.9440 |

| Garden | 7 | 85,700,000 | 7.3 | 41.6 | 41.6 | 4.92 | 13.6 | 13.2 | 2.6626 |

| Mid Rise | 2 | 38,500,000 | 3.3 | 53.0 | 53.0 | 2.05 | 7.7 | 7.5 | 3.7534 |

| Low Rise | 14 | 10,775,000 | 0.9 | 63.0 | 58.4 | 1.63 | 9.3 | 9.0 | 4.2823 |

| Retail | 8 | 179,630,042 | 15.3 | 59.2 | 53.7 | 2.28 | 11.1 | 10.5 | 4.0438 |

| Anchored | 4 | 91,900,922 | 7.8 | 64.9 | 55.7 | 1.69 | 9.4 | 8.9 | 4.0004 |

| Outlet Center | 1 | 65,000,000 | 5.5 | 50.7 | 50.7 | 3.27 | 13.8 | 13.1 | 3.9590 |

| Unanchored | 3 | 22,729,120 | 1.9 | 60.8 | 54.5 | 1.85 | 10.5 | 9.7 | 4.4618 |

| Self Storage | 17 | 79,595,056 | 6.8 | 59.8 | 59.1 | 2.14 | 9.0 | 8.9 | 4.0132 |

| Self Storage | 17 | 79,595,056 | 6.8 | 59.8 | 59.1 | 2.14 | 9.0 | 8.9 | 4.0132 |

| Industrial | 9 | 64,327,459 | 5.5 | 61.9 | 57.2 | 1.79 | 9.8 | 9.2 | 3.7248 |

| Cold Storage | 2 | 23,661,445 | 2.0 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 |

| Warehouse | 2 | 16,827,459 | 1.4 | 52.0 | 49.0 | 2.30 | 13.0 | 11.9 | 3.6284 |

| Warehouse/Cold Storage | 2 | 11,779,284 | 1.0 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 |

| Manufacturing | 1 | 7,500,000 | 0.6 | 56.0 | 56.0 | 2.44 | 9.4 | 8.9 | 3.5930 |

| Cold Storage/Warehouse/Distribution | 1 | 3,413,608 | 0.3 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 |

| Manufacturing/Cold Storage/Warehouse | 1 | 1,145,663 | 0.1 | 67.2 | 60.9 | 1.45 | 8.6 | 8.1 | 3.7900 |

| Mixed Use | 3 | 43,475,000 | 3.7 | 61.1 | 57.1 | 2.06 | 9.5 | 8.8 | 3.7757 |

| Multifamily/Retail | 1 | 19,250,000 | 1.6 | 68.0 | 58.9 | 1.29 | 7.5 | 7.4 | 3.9700 |

| Office/Industrial/Retail | 1 | 13,000,000 | 1.1 | 60.5 | 60.5 | 2.58 | 10.5 | 9.3 | 3.5430 |

| Medical Office/Retail | 1 | 11,225,000 | 1.0 | 49.9 | 49.9 | 2.79 | 11.7 | 10.5 | 3.7120 |

| Manufactured Housing | 2 | 7,800,000 | 0.7 | 46.2 | 46.2 | 2.94 | 12.6 | 12.2 | 4.2442 |

| RV Park | 1 | 4,200,000 | 0.4 | 58.3 | 58.3 | 2.22 | 11.2 | 10.6 | 4.7200 |

| Manufactured Housing | 1 | 3,600,000 | 0.3 | 32.0 | 32.0 | 3.77 | 14.2 | 14.1 | 3.6890 |

| Total | 102 | $1,173,324,212 | 100.0% | 49.2% | 47.8% | 4.00x | 14.1% | 13.7% | 3.4155% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

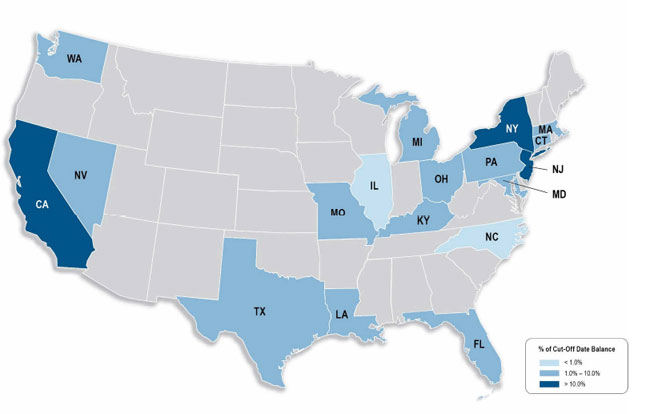

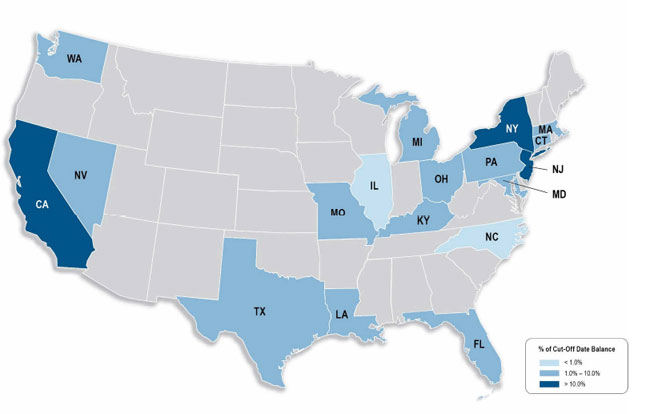

G. Geographic Distribution(1)(2)

| Location | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of

Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Interest Rate (%) |

| New York | 28 | $233,146,334 | 19.9% | 34.4% | 33.1% | 8.24x | 27.0% | 26.5% | 2.9954% |

| New Jersey | 3 | 188,500,000 | 16.1 | 40.2 | 40.2 | 3.58 | 11.2 | 11.1 | 3.2449 |

| California | 6 | 152,417,703 | 13.0 | 52.6 | 52.6 | 3.30 | 11.4 | 10.9 | 3.2790 |

| Southern California | 3 | 114,825,000 | 9.8 | 49.4 | 49.4 | 3.58 | 12.1 | 11.6 | 3.2009 |

| Northern California | 3 | 37,592,703 | 3.2 | 62.4 | 62.4 | 2.45 | 9.1 | 8.8 | 3.5174 |

| Kentucky | 7 | 85,700,000 | 7.3 | 41.6 | 41.6 | 4.92 | 13.6 | 13.2 | 2.6626 |

| Florida | 5 | 81,450,000 | 6.9 | 53.5 | 53.2 | 3.05 | 12.9 | 12.3 | 3.9456 |

| Michigan | 7 | 76,600,000 | 6.5 | 62.6 | 56.2 | 1.84 | 9.5 | 9.1 | 3.9905 |

| Maryland | 2 | 75,400,000 | 6.4 | 56.5 | 56.5 | 2.70 | 10.7 | 9.9 | 3.6269 |

| Other(3) | 44 | 280,110,176 | 23.9 | 61.3 | 58.1 | 2.09 | 9.4 | 9.0 | 3.8165 |

| Total/Weighted Average | 102 | $1,173,324,212 | 100.0% | 49.2% | 47.8% | 4.00x | 14.1% | 13.7% | 3.4155% |

| | | | | | | | | | |

| (1) | The mortgaged properties are located in 18 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property, which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 11 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| BANK 2022-BNK40 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date

Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 997,000 - 1,000,000 | 3 | $2,993,403 | 0.3% |

| 1,000,001 - 2,000,000 | 9 | 16,230,896 | 1.4 |

| 2,000,001 - 3,000,000 | 8 | 20,764,385 | 1.8 |

| 3,000,001 - 4,000,000 | 7 | 24,594,353 | 2.1 |

| 4,000,001 - 5,000,000 | 3 | 12,889,874 | 1.1 |

| 5,000,001 - 6,000,000 | 4 | 21,689,159 | 1.8 |

| 6,000,001 - 7,000,000 | 2 | 13,325,000 | 1.1 |

| 7,000,001 - 8,000,000 | 3 | 22,229,120 | 1.9 |

| 8,000,001 - 9,000,000 | 3 | 25,695,000 | 2.2 |

| 9,000,001 - 10,000,000 | 1 | 10,000,000 | 0.9 |

| 10,000,001 - 15,000,000 | 8 | 96,262,100 | 8.2 |

| 15,000,001 - 20,000,000 | 4 | 70,280,922 | 6.0 |

| 20,000,001 - 30,000,000 | 6 | 151,570,000 | 12.9 |

| 30,000,001 - 50,000,000 | 4 | 189,800,000 | 16.2 |

| 50,000,001 - 70,000,000 | 1 | 65,000,000 | 5.5 |

| 70,000,001 - 100,000,000 | 1 | 100,000,000 | 8.5 |

| 100,000,001 - 110,000,000 | 3 | 330,000,000 | 28.1 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Average: | $16,761,774 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date

Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.31 - 1.40 | 1 | $19,250,000 | 1.6% |

| 1.41 - 1.50 | 2 | 27,060,042 | 2.3 |

| 1.51 - 1.60 | 4 | 85,945,000 | 7.3 |

| 1.61 - 1.70 | 2 | 53,750,000 | 4.6 |

| 1.71 - 1.80 | 2 | 9,820,056 | 0.8 |

| 1.81 - 2.00 | 1 | 13,300,000 | 1.1 |

| 2.01 - 2.25 | 4 | 43,070,000 | 3.7 |

| 2.26 - 2.50 | 8 | 61,075,000 | 5.2 |

| 2.51 - 2.75 | 4 | 128,877,459 | 11.0 |

| 2.76 - 3.00 | 3 | 76,100,000 | 6.5 |

| 3.01 - 3.50 | 4 | 211,825,000 | 18.1 |

| 3.51 - 4.00 | 3 | 113,600,000 | 9.7 |

| 4.01 - 6.00 | 12 | 258,519,894 | 22.0 |

| 6.01 - 8.00 | 5 | 26,275,167 | 2.2 |

| 8.01 - 10.00 | 2 | 5,792,769 | 0.5 |

| 10.01 - 20.00 | 9 | 17,773,812 | 1.5 |

| 20.01 - 30.00 | 3 | 5,290,013 | 0.5 |

| 30.01 - 46.13 | 1 | 16,000,000 | 1.4 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Weighted Average: | 4.13x | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 6.2 - 7.0 | 1 | $28,500,000 | 2.4% |

| 7.1 - 8.0 | 2 | 40,920,000 | 3.5 |

| 8.1 - 9.0 | 8 | 128,335,042 | 10.9 |

| 9.1 - 10.0 | 12 | 219,465,056 | 18.7 |

| 10.1 - 11.0 | 5 | 88,600,000 | 7.6 |

| 11.1 - 12.0 | 5 | 161,025,000 | 13.7 |

| 12.1 - 13.0 | 5 | 204,900,000 | 17.5 |

| 13.1 - 14.0 | 2 | 175,000,000 | 14.9 |

| 14.1 - 15.0 | 2 | 11,200,000 | 1.0 |

| 15.1 - 20.0 | 4 | 36,550,000 | 3.1 |

| 20.1 - 118.8 | 24 | 78,829,114 | 6.7 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Weighted Average: | 14.1% | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Refinance | 57 | $827,951,873 | 70.6% |

| Recapitalization | 7 | 250,498,219 | 21.3 |

| Acquisition | 6 | 94,874,120 | 8.1 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| INTEREST RATE |

Range of Interest

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 2.3150 - 2.5000 | 1 | $50,000,000 | 4.3% |

| 2.5001 - 2.7500 | 7 | 99,200,000 | 8.5 |

| 2.7501 - 3.0000 | 9 | 143,654,021 | 12.2 |

| 3.0001 - 3.2500 | 11 | 138,954,231 | 11.8 |

| 3.2501 - 3.5000 | 8 | 227,843,403 | 19.4 |

| 3.5001 - 3.7500 | 12 | 173,672,459 | 14.8 |

| 3.7501 - 4.0000 | 11 | 250,550,000 | 21.4 |

| 4.0001 - 4.2500 | 3 | 28,050,978 | 2.4 |

| 4.2501 - 5.2500 | 8 | 61,399,120 | 5.2 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Weighted Average: | 3.4155% | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.29 - 1.30 | 1 | $19,250,000 | 1.6% |

| 1.31 - 1.40 | 2 | 27,060,042 | 2.3 |

| 1.41 - 1.50 | 3 | 57,445,000 | 4.9 |

| 1.51 - 1.60 | 2 | 78,500,000 | 6.7 |

| 1.61 - 1.70 | 2 | 10,575,000 | 0.9 |

| 1.71 - 1.80 | 1 | 2,995,056 | 0.3 |

| 1.81 - 2.00 | 2 | 34,970,000 | 3.0 |

| 2.01 - 2.25 | 7 | 35,827,459 | 3.1 |

| 2.26 - 2.50 | 8 | 175,525,000 | 15.0 |

| 2.51 - 2.75 | 2 | 62,800,000 | 5.4 |

| 2.76 - 3.00 | 3 | 50,125,000 | 4.3 |

| 3.01 - 3.50 | 3 | 185,000,000 | 15.8 |

| 3.51 - 4.00 | 2 | 103,600,000 | 8.8 |

| 4.01 - 6.00 | 14 | 278,109,768 | 23.7 |

| 6.01 - 8.00 | 3 | 6,685,293 | 0.6 |

| 8.01 - 10.00 | 3 | 7,536,698 | 0.6 |

| 10.01 - 20.00 | 8 | 16,029,883 | 1.4 |

| 20.01 - 30.00 | 3 | 5,290,013 | 0.5 |

| 30.01 - 45.53 | 1 | 16,000,000 | 1.4 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Weighted Average: | 4.00x | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 6.1 - 7.0 | 1 | $28,500,000 | 2.4% |

| 7.1 - 8.0 | 2 | 40,920,000 | 3.5 |

| 8.1 - 9.0 | 14 | 320,105,042 | 27.3 |

| 9.1 - 10.0 | 10 | 102,995,056 | 8.8 |

| 10.1 - 11.0 | 3 | 28,725,000 | 2.4 |

| 11.1 - 12.0 | 5 | 271,200,000 | 23.1 |

| 12.1 - 13.0 | 4 | 189,300,000 | 16.1 |

| 13.1 - 14.0 | 1 | 65,000,000 | 5.5 |

| 14.1 - 15.0 | 3 | 15,400,000 | 1.3 |

| 15.1 - 20.0 | 3 | 32,350,000 | 2.8 |

| 20.1 - 118.2 | 24 | 78,829,114 | 6.7 |

| Total: | 70 | $1,173,324,212 | 100.0% |

| Weighted Average: | 13.7% | | |