| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-257991-12 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$713,960,139

(Approximate Initial Pool Balance)

$652,381,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2024-C63

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Argentic Real Estate Finance 2 LLC

JPMorgan Chase Bank, National Association

National Cooperative Bank, N.A.

Goldman Sachs Mortgage Company

Societe Generale Financial Corporation

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2024-C63

August 12, 2024

WELLS FARGO

SECURITIES | GOLDMAN SACHS &

CO. LLC | J.P MORGAN | SOCIÉTÉ

GÉNÉRALE |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and

Joint Bookrunner | Co-Lead Manager and

Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

Academy Securities Co-Manager | Drexel Hamilton Co-Manager | Siebert Williams Shank Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-257991) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. Eastern Time) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, SG Americas Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

Société Générale is the marketing name for SG Americas Securities, LLC.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Certificate Structure |

| Class | Expected Ratings

(Fitch/Moody’s /

KBRA)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approximate Initial Available Certificate Balance or Notional Amount(2) | Approximate Initial Retained Certificate Balance or Notional Amount(2)(3) | Approx. Initial Credit Support(4) | Pass-Through Rate Description | Weighted Average Life (Years)(5) | Expected

Principal

Window(5) | Certificate Principal to Value Ratio(6) | Certificate Principal U/W NOI Debt Yield(7) |

| Offered Certificates | | | | |

| A-1 | AAAsf/Aaa(sf)/AAA(sf) | $9,518,000 | $9,171,000 | $347,000 | 30.000% | (8) | 2.68 | 09/24 - 08/29 | 32.0% | 24.9% |

| A-3 | AAAsf/Aaa(sf)/AAA(sf) | $65,000,000 | $62,627,000 | $2,373,000 | 30.000% | (8) | 6.88 | 07/31 - 07/31 | 32.0% | 24.9% |

| A-SB | AAAsf/Aaa(sf)/AAA(sf) | $15,597,000 | $15,028,000 | $569,000 | 30.000% | (8) | 7.51 | 08/29 - 06/34 | 32.0% | 24.9% |

| A-4 | AAAsf/Aaa(sf)/AAA(sf) | (9) | (9) | (9) | 30.000% | (8) | (9) | (9) | 32.0% | 24.9% |

| A-5 | AAAsf/Aaa(sf)/AAA(sf) | (9) | (9) | (9) | 30.000% | (8) | (9) | (9) | 32.0% | 24.9% |

| X-A | AAAsf/Aaa(sf)/AAA(sf) | $499,772,000(10) | $481,530,000(10) | $18,242,000(10) | N/A | Variable(11) | N/A | N/A | N/A | N/A |

| X-B | A-sf/NR/AAA(sf) | $152,609,000(12) | $147,039,000(12) | $5,570,000(12) | N/A | Variable(13) | N/A | N/A | N/A | N/A |

| A-S | AAAsf/Aa1(sf)/AAA(sf) | $101,739,000 | $98,026,000 | $3,713,000 | 15.750% | (8) | 9.96 | 08/34 - 08/34 | 38.5% | 20.7% |

| B | AA-sf/NR/AA-(sf) | $32,128,000 | $30,955,000 | $1,173,000 | 11.250% | (8) | 9.96 | 08/34 - 08/34 | 40.6% | 19.6% |

| C | A-sf/NR/A-(sf) | $18,742,000 | $18,058,000 | $684,000 | 8.625% | (8) | 9.96 | 08/34 - 08/34 | 41.8% | 19.1% |

| Non-Offered Certificates | | | | | | | | |

| X-D | BBB-sf/NR/BBB-(sf) | $18,741,000(14) | $18,057,000(14) | $684,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A |

| X-F | BB-sf/NR/BB-(sf) | $13,387,000(16) | $12,898,000(16) | $489,000(16) | N/A | Variable(17) | N/A | N/A | N/A | N/A |

| D | BBBsf/NR/BBB(sf) | $11,601,000 | $11,178,000 | $423,000 | 7.000% | (8) | 9.96 | 08/34 - 08/34 | 42.5% | 18.8% |

| E | BBB-sf/NR/BBB-(sf) | $7,140,000 | $6,879,000 | $261,000 | 6.000% | (8) | 9.96 | 08/34 - 08/34 | 43.0% | 18.6% |

| F | BB-sf/NR/BB-(sf) | $13,387,000 | $12,898,000 | $489,000 | 4.125% | (8) | 9.96 | 08/34 - 08/34 | 43.8% | 18.2% |

| G-RR | B-sf/NR/B-(sf) | $8,924,000 | $8,598,000 | $326,000 | 2.875% | (8) | 9.96 | 08/34 - 08/34 | 44.4% | 18.0% |

| J-RR | NR/NR/NR | $20,527,138 | $19,778,138 | $749,000 | 0.000% | (8) | 9.96 | 08/34 - 08/34 | 45.7% | 17.4% |

Notes:

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and Kroll Bond Rating Agency, LLC (“KBRA”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated August 12, 2024 (the “Preliminary Prospectus”). Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Initial Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller in connection with any variation in the Certificate Balance of the VRR Interest and/or the Horizontal Risk Retention Certificates following the calculation of the actual fair value of all of the ABS interests (as such term is defined in the Credit Risk Retention Rules) issued by the issuing entity, as described under “Credit Risk Retention” in the Preliminary Prospectus. The actual initial Certificate Balances and Notional Amounts also depend on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, X-B, X-D and X-F Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) and, if, as a result of such pricing, the pass-through rate of any of the Class X-A, X-B, X-D and X-F Certificates, as applicable, would be equal to zero at all times, such Class of Certificates may not be issued on the closing date of this securitization. |

| (3) | On the closing date, the Certificates with the initial Certificate Balances or Notional Amounts, as applicable, set forth in the table above under “Approximate Initial Retained Certificate Balance or Notional Amount” (such Certificates, collectively the “VRR Interest”) are expected to be purchased for cash from the underwriters by a majority-owned affiliate of Argentic Real Estate Finance 2 LLC (a sponsor and affiliate of the special servicer), as the “retaining sponsor” (as such term is defined in the Credit Risk Retention Rules), as further described in “Credit Risk Retention” in the Preliminary Prospectus. |

| (4) | The approximate initial credit support with respect to the Class A-1, A-3, A-SB, A-4 and A-5 Certificates represents the approximate credit enhancement for the Class A-1, A-3, A-SB, A-4 and A-5 Certificates in the aggregate. |

| (5) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (6) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-3, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-3, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (7) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-3, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-3, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Certificate Structure |

| | total initial Certificate Balance of such Classes of Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (8) | The pass-through rates for the Class A-1, A-3, A-SB, A-4, A-5, A-S, B, C, D, E, F, G-RR and J-RR Certificates (collectively, the “Principal Balance Certificates”) for any distribution date, in each case, will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (9) | The exact initial Certificate Balances of the Class A-4 and A-5 Certificates are unknown and will be determined based on the final pricing of the Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-4 and A-5 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-4 and A-5 Certificates is expected to be approximately $409,657,000, subject to a variance of plus or minus 5%. In the event that the Class A-5 Certificates are issued with the maximum certificate balance (i.e., with an initial certificate balance of $409,657,000), the Class A-4 Certificates will not be issued. |

| | Class of Certificates | | Expected Range of Approximate Initial Certificate Balance | | Expected Range of Weighted Average Life (Years) | | Expected Range of Principal Window |

| | Class A-4 | | $0 – $200,000,000 | | N/A – 9.83 | | N/A / 06/34 - 07/34 |

| | Class A-5 | | $209,657,000 – $409,657,000 | | 9.85 – 9.88 | | 06/34 - 08/34 / 07/34 - 08/34 |

| (10) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-3, A-SB, A-4 and A-5 Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (11) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-3, A-SB, A-4 and A-5 Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (12) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (13) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (14) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and E Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class D and E Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (16) | The Class X-F Certificates are notional amount certificates. The Notional Amount of the Class X-F Certificates will be equal to the Certificate Balance of the Class F Certificates outstanding from time to time. The Class X-F Certificates will not be entitled to distributions of principal. |

| (17) | The pass-through rate for the Class X-F Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate Cut-off Date Balance | % of Initial Pool

Balance |

| Wells Fargo Bank, National Association / JPMorgan Chase Bank, National Association | 3 | 3 | $174,952,149 | 24.5 | % |

| Wells Fargo Bank, National Association | 4 | 4 | 144,150,000 | 20.2 | |

| Argentic Real Estate Finance 2 LLC | 7 | 7 | 137,550,000 | 19.3 | |

| National Cooperative Bank, N.A. | 9 | 9 | 85,252,990 | 11.9 | |

| JPMorgan Chase Bank, National Association | 2 | 2 | 70,000,000 | 9.8 | |

| Goldman Sachs Mortgage Company | 2 | 2 | 42,000,000 | 5.9 | |

| Wells Fargo Bank, National Association / Goldman Sachs Mortgage Company | 1 | 1 | 38,000,000 | 5.3 | |

| Societe Generale Financial Corporation | 2 | 2 | 22,055,000 | 3.1 | |

Total | 30 | 30 | $713,960,139 | 100.0% | |

Loan Pool:

| Initial Pool Balance: | $713,960,139 |

| Number of Mortgage Loans: | 30 |

| Average Cut-off Date Balance per Mortgage Loan: | $23,798,671 |

| Number of Mortgaged Properties: | 30 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $23,798,671 |

| Weighted Average Mortgage Interest Rate: | 6.3267% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 68.8% |

| Weighted Average Original Term to Maturity (months): | 117 |

| Weighted Average Remaining Term to Maturity (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 360 |

| Weighted Average Remaining Amortization Term (months)(2): | 360 |

| Weighted Average Seasoning (months): | 1 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 2.52x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 17.4% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 45.7% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 43.9% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 21.2% |

| % of Mortgage Loans with Single Tenants(3): | 0.0% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property are calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | Seven (7) of the mortgage loans, each of which is secured by a residential cooperative property and is being sold to the depositor by National Cooperative Bank, N.A., currently have in place either (i) subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”) or (ii) subordinate wraparound mortgages to the related mortgage borrowers that are currently held by the cooperative sponsors (such loans, collectively, the “Subordinate Wrap Mortgages”). The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 31.6% of the mortgage pool (12 mortgage loans) has scheduled amortization, as follows:

9.2% (2 mortgage loans) provide for an interest-only period followed by an amortization period; and

22.4% (10 mortgage loans) require amortization during the entire loan term.

Interest-Only: Based on the Initial Pool Balance, 68.4% of the mortgage pool (18 mortgage loans) provide for interest-only payments during the entire loan term through maturity or anticipated repayment date. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 43.0% and 2.63x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 78.6% of the mortgage pool (15 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 57.7% of the pool |

| Insurance: | 14.8% of the pool |

| Capital Replacements: | 53.3% of the pool |

| TI/LC: | 49.6% of the pool(1) |

| | (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include office, retail, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

75.2% of the mortgage pool (17 mortgage loans) feature a lockout period, then defeasance only until an open period;

11.9% of the mortgage pool (9 mortgage loans) feature the greater of a prepayment premium (1%) or yield maintenance, a prepayment premium (1%) until an open period;

7.7% of the mortgage pool (1 mortgage loan) feature a lockout period, then the greater of a prepayment premium (1%) or yield maintenance, then the greater of a prepayment premium (1%) or yield maintenance or defeasance until an open period;

5.2% of the mortgage pool (3 mortgage loans) feature a lockout period, then the greater of a prepayment premium (1%) or yield maintenance until an open period;

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Issue Characteristics |

| III. | Issue Characteristics |

| Securities Offered: | $652,381,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of ten classes (Classes A-1, A-3, A-SB, A-4, A-5, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Argentic Real Estate Finance 2 LLC (“AREF2”), JPMorgan Chase Bank, National Association (“JPMCB”), National Cooperative Bank, N.A. (“NCB”), Goldman Sachs Mortgage Company (“Goldman”) and Societe Generale Financial Corporation (“SGFC”) |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC and SG Americas Securities, LLC |

| Co-Managers: | Academy Securities, Inc., Drexel Hamilton, LLC and Siebert Williams Shank & Co., LLC |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and Moody’s Investors Service, Inc. |

| Master Servicers: | Wells Fargo Bank, National Association and National Cooperative Bank, N.A. |

| Special Servicers: | Argentic Services Company LP and National Cooperative Bank, N.A. |

| Certificate Administrator: | Computershare Trust Company, N.A. |

| Trustee: | Computershare Trust Company, N.A. |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| NCB Back-up Advancing Agent: | Deutsche Bank National Trust Company |

| Initial Majority Controlling Class Certificateholder: | Argentic Securities Holdings 2 Cayman Limited, an affiliate of Argentic Real Estate Finance 2 LLC and Argentic Services Company LP |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Argentic Real Estate Finance 2 LLC, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. Argentic Real Estate Finance 2 LLC, the retaining sponsor, intends to cause Argentic Securities Holdings 2 Cayman Limited, a majority-owned affiliate, to retain (i) an “eligible horizontal residual interest”, in the form of certificates representing approximately 1.40% of the fair value of all of the ABS interests issued, which will be comprised of the Class G-RR and J-RR certificates (other than the portion that comprises the VRR Interest) and (ii) an “eligible vertical interest”, in the form of certificates representing approximately 3.65% of the certificate balance, notional amount or percentage interest of each class of certificates (other than the Class R certificates) in a manner that satisfies the U.S. credit risk retention requirements. Under the U.S. credit risk retention rules, Argentic Real Estate Finance 2 LLC or the applicable majority-owned affiliate will be permitted to transfer the horizontal risk retention certificates to a subsequent third-party purchaser. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU/UK Credit Risk Retention | None of the sponsors, the depositor, the underwriters, or their respective affiliates, or any other party to the transaction intends to retain a material net economic interest in the securitization constituted by the issue of the Certificates, or take any other action in respect of such securitization, in a manner prescribed or contemplated by (i) Regulation (EU) 2017/2402, or (ii) such Regulation as it forms part of UK domestic law. In particular, no such person undertakes to take any action which may be required by any investor for the purposes of its compliance with any applicable requirement under either such Regulation. Furthermore, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring compliance by any person with any requirements of either such Regulation. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Regulation and UK Securitization Regulation Due Diligence Requirements” in the Preliminary Prospectus. |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the payment due date for the monthly debt service payment that is due in August 2024 (or, in the case of any mortgage loan that has its first payment due date in September 2024, the date that would have been its payment due date in August 2024 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Issue Characteristics |

| Expected Closing Date: | On or about August 29, 2024. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2024. |

| Distribution Dates: | The 4th business day following the Determination Date in each month, commencing in September 2024. |

| Rated Final Distribution Date: | The Distribution Date in August 2057. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| Clean-up Call: | 1.0% |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., CRED iQ, Trepp, LLC, Intex Solutions, Inc., Interactive Data Corp., Markit Group Limited, BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., Morningstar Credit Information & Analytics, LLC, KBRA Analytics, LLC, MBS Data, LLC, Thomson Reuters Corporation, DealView Technologies Ltd. and RealINSIGHT. |

| Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of one or more REMICs arranged in a tiered structure. The Offered Certificates will represent REMIC regular interests. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

Mortgage

Loan

Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance(%) | Property

Type | Number

of

SF/Units/

Rooms | Cut-off Date Balance

Per SF/Unit/Room ($) | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | U/W

NCF

DSCR

(x) | U/W NOI Debt

Yield (%) |

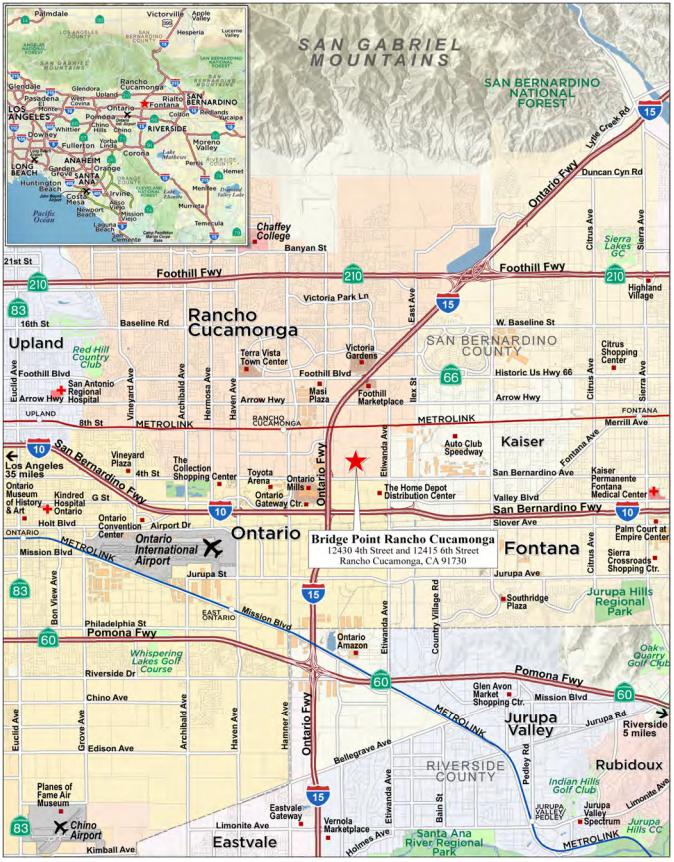

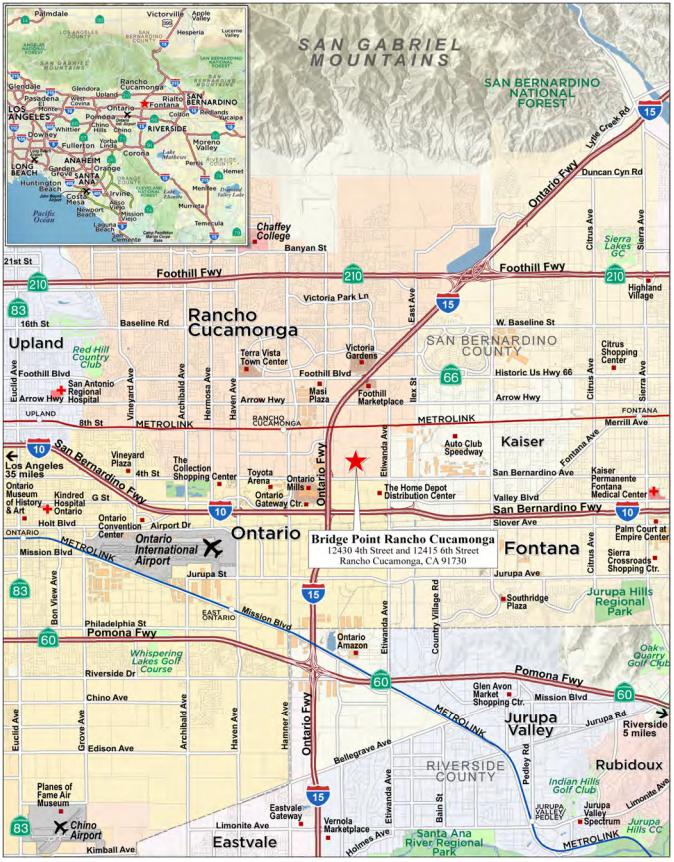

| WFB | Bridge Point Rancho Cucamonga | Rancho Cucamonga | CA | 1 / 1 | $65,000,000 | 9.1 | % | Industrial | 2,168,119 | $123 | 34.5 | % | 34.5 | % | 2.73 | x | 16.2 | % |

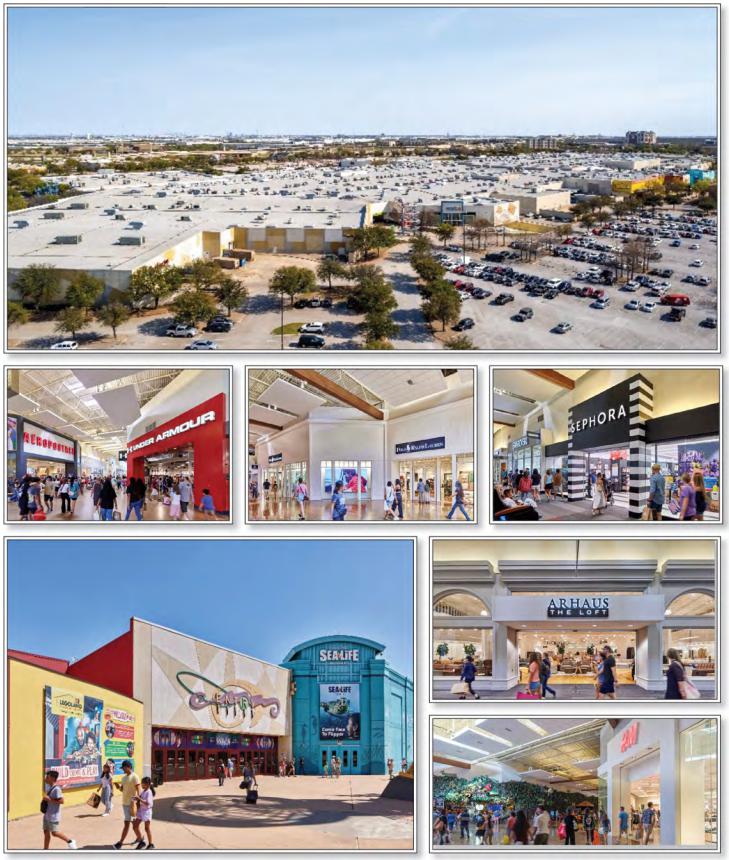

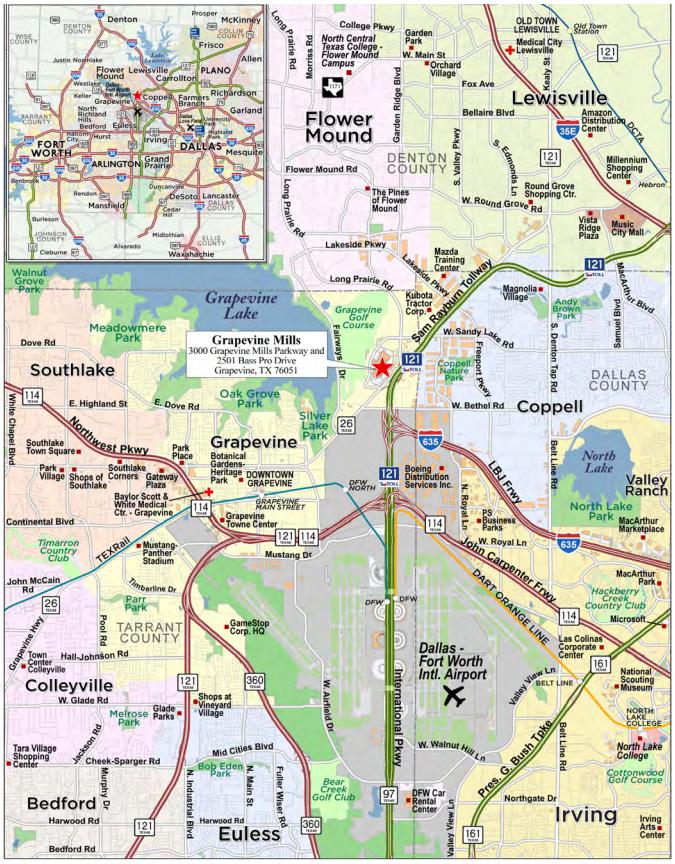

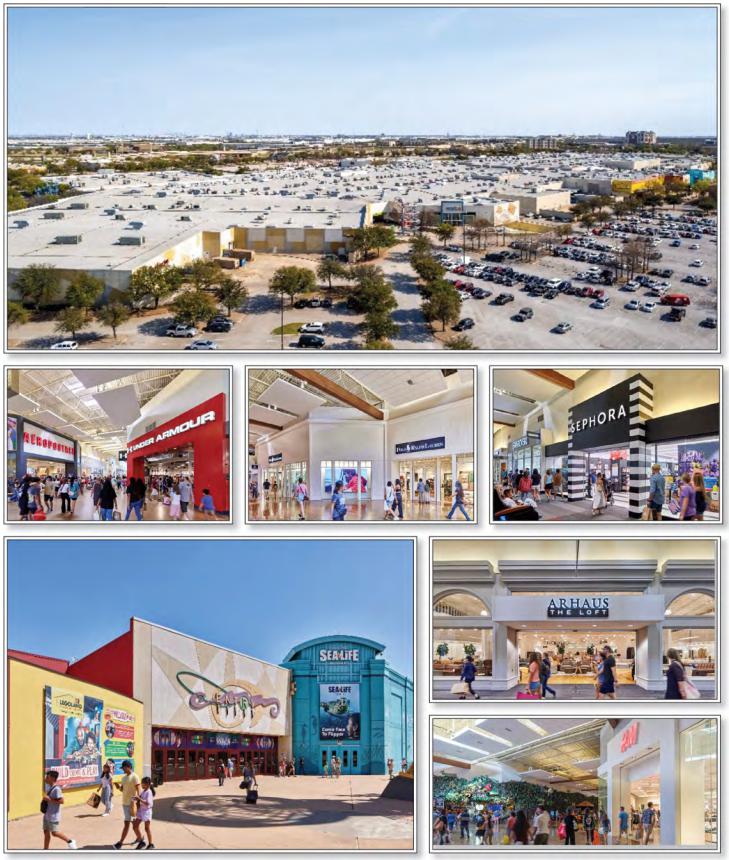

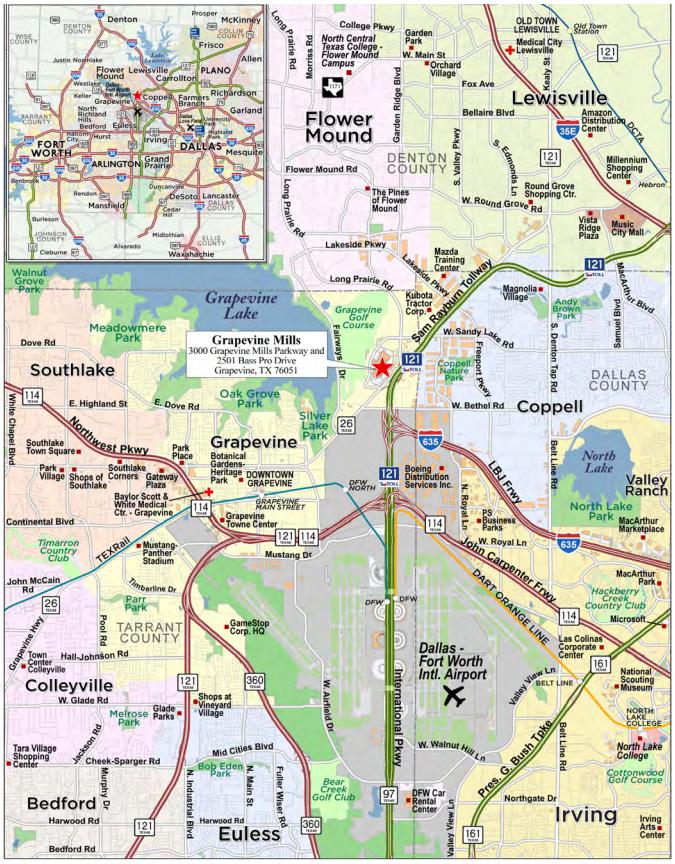

| WFB, JPMCB | Grapevine Mills | Grapevine | TX | 1 / 1 | 60,000,000 | 8.4 | | Retail | 1,628,140 | 154 | 45.6 | | 45.6 | | 2.68 | | 18.0 | |

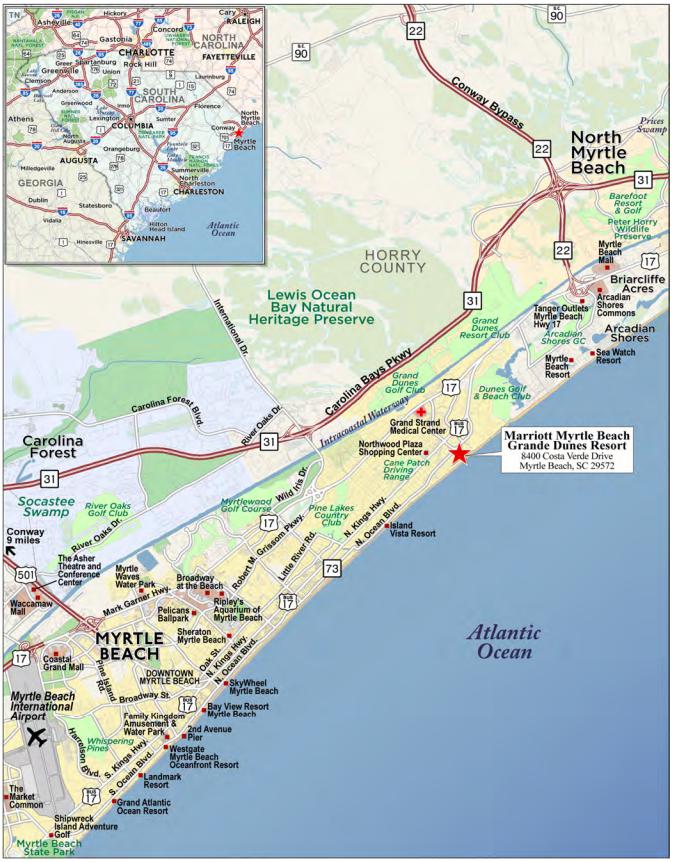

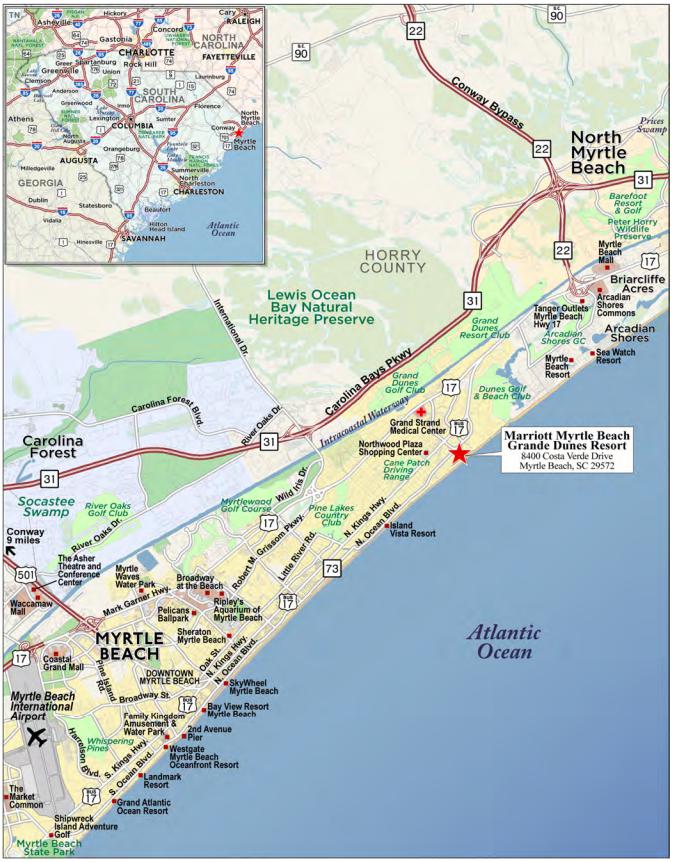

| WFB, JPMCB | Marriott Myrtle Beach Grande Dunes Resort | Myrtle Beach | SC | 1 / 1 | 59,952,149 | 8.4 | | Hospitality | 405 | 246,717 | 44.8 | | 38.3 | | 2.69 | | 21.4 | |

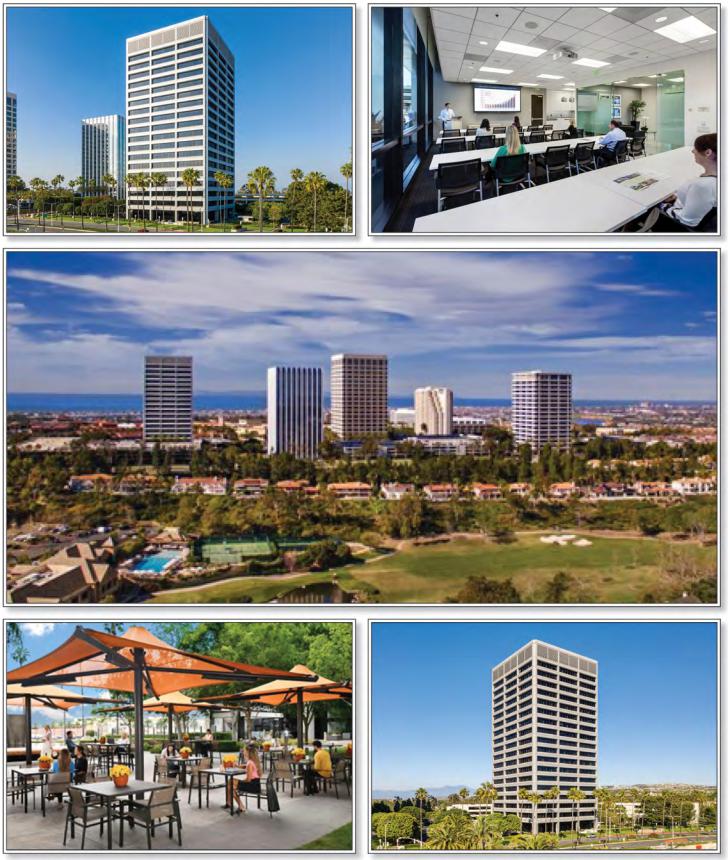

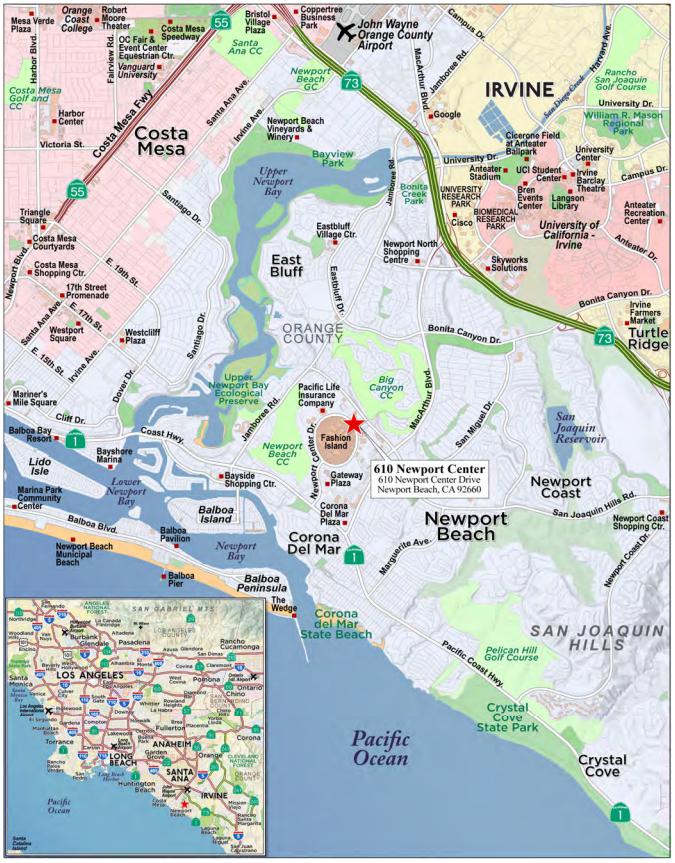

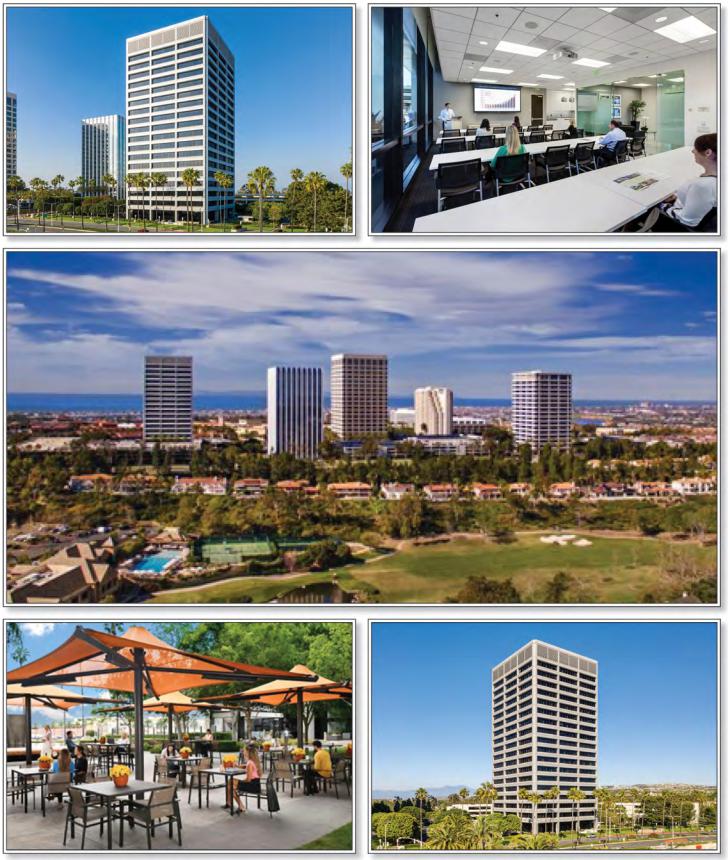

| WFB, JPMCB | 610 Newport Center | Newport Beach | CA | 1 / 1 | 55,000,000 | 7.7 | | Office | 285,638 | 298 | 44.5 | | 44.5 | | 2.92 | | 17.2 | |

| WFB | Holiday Inn & Suites Ocean City | Ocean City | MD | 1 / 1 | 53,000,000 | 7.4 | | Hospitality | 210 | 252,381 | 59.8 | | 56.6 | | 1.55 | | 13.6 | |

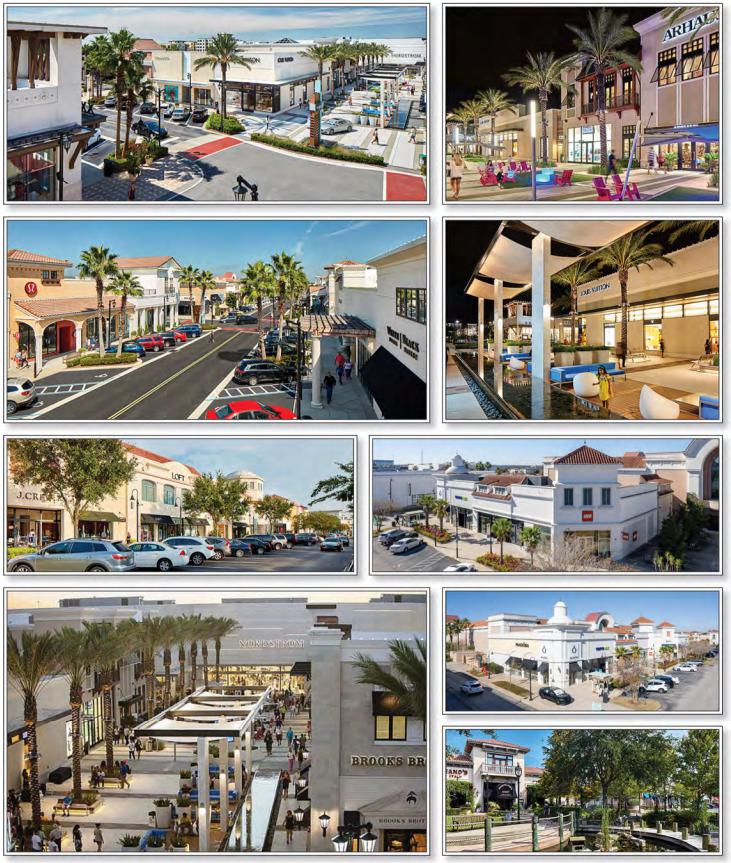

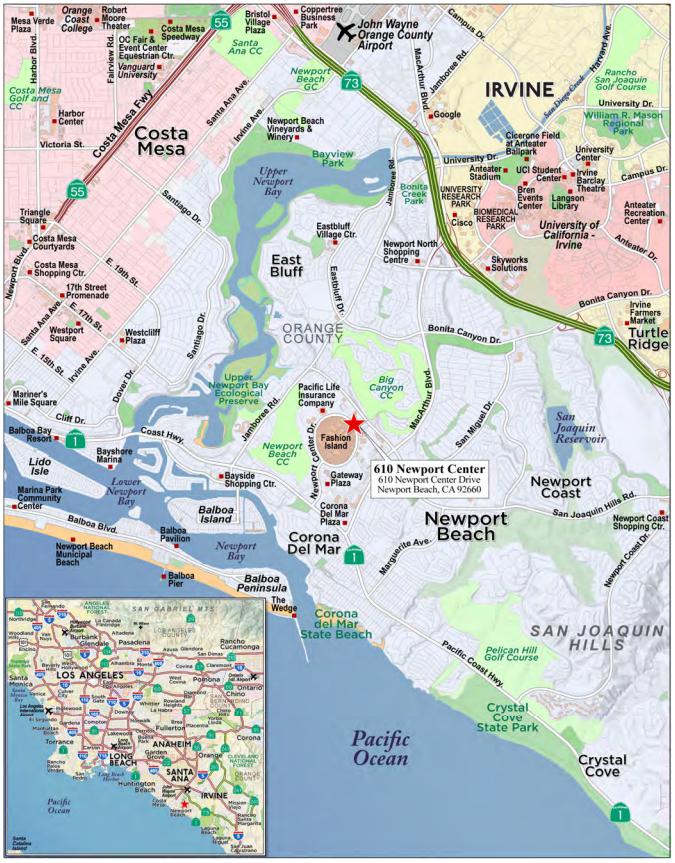

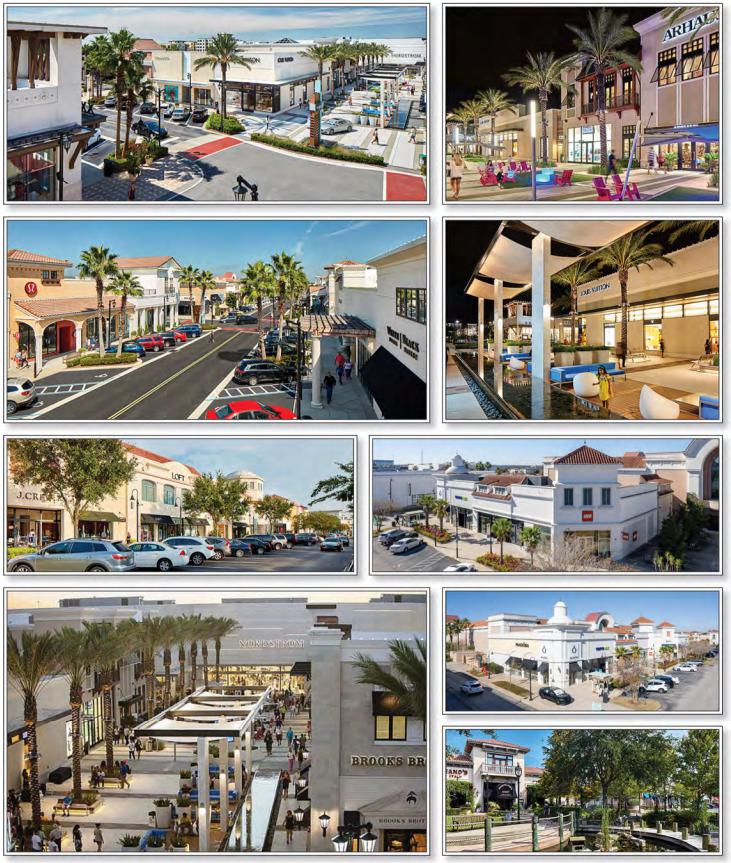

| JPMCB | St. Johns Town Center | Jacksonville | FL | 1 / 1 | 46,000,000 | 6.4 | | Retail | 1,022,042 | 352 | 47.8 | | 47.8 | | 2.09 | | 13.3 | |

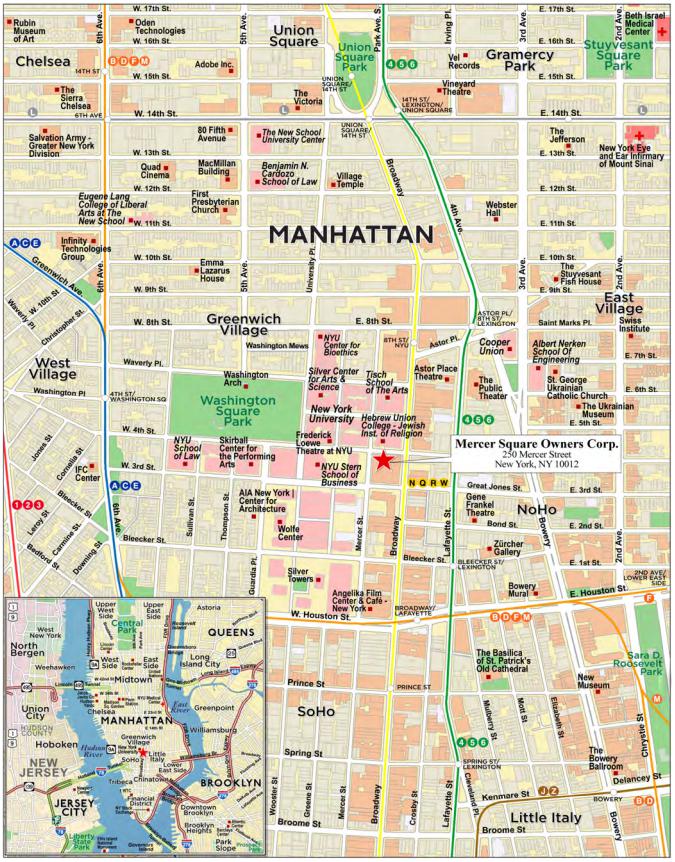

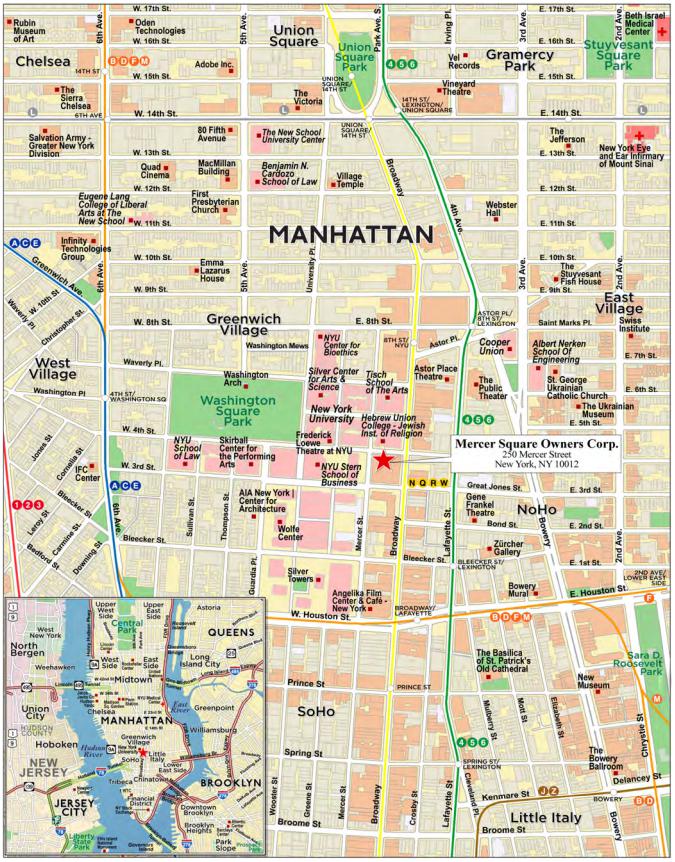

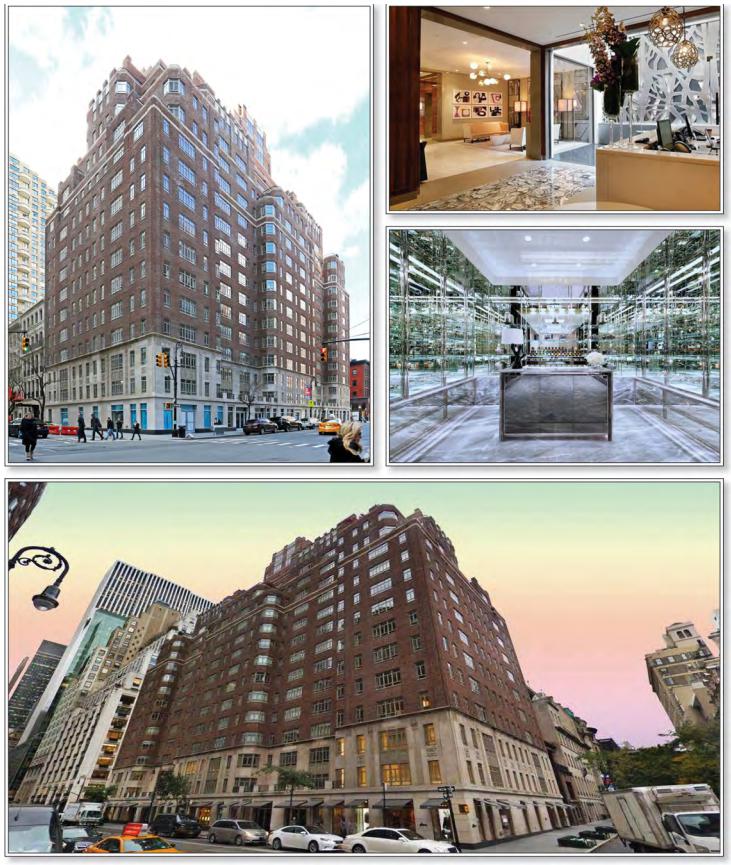

| NCB | Mercer Square Owners Corp. | New York | NY | 1 / 1 | 43,000,000 | 6.0 | | Multifamily | 258 | 166,667 | 12.6 | | 12.6 | | 4.00 | | 24.6 | |

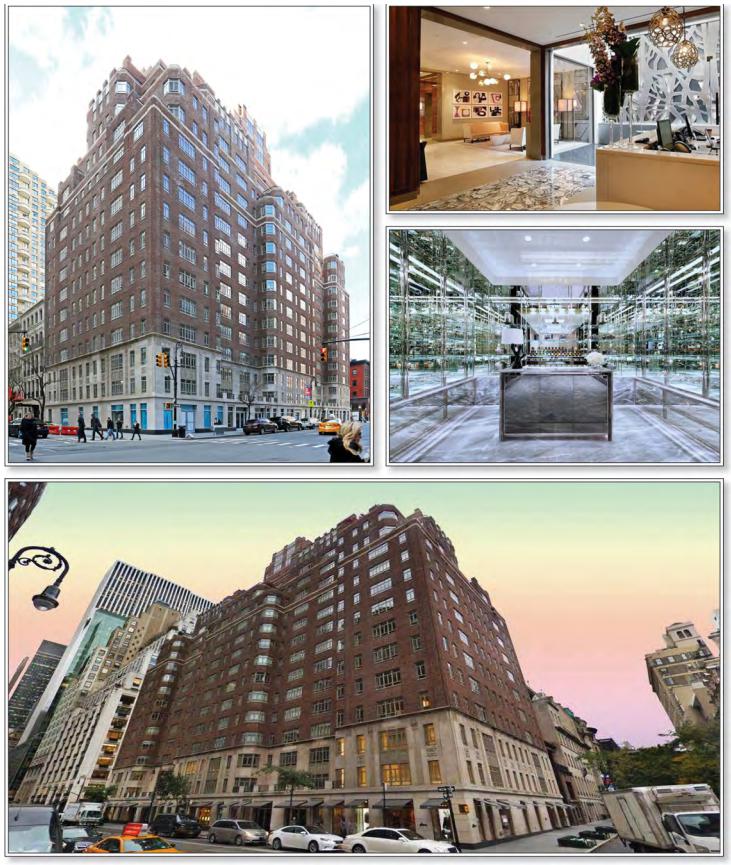

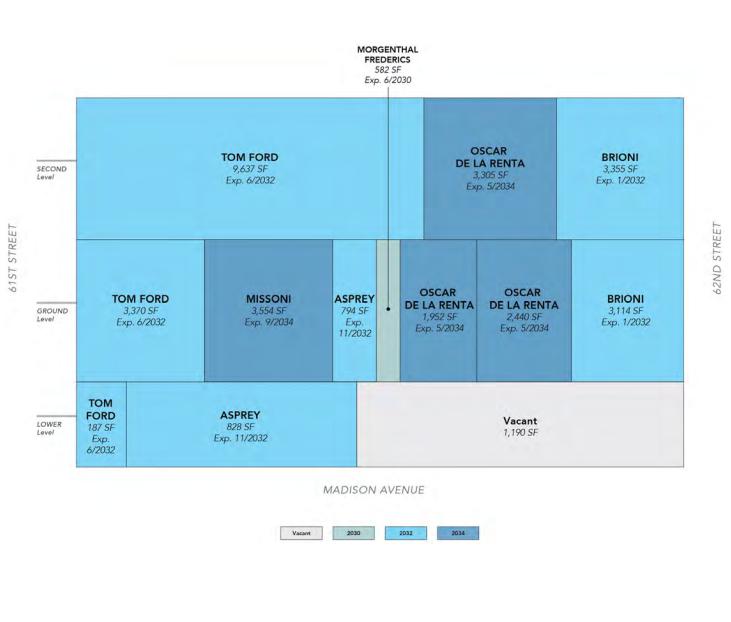

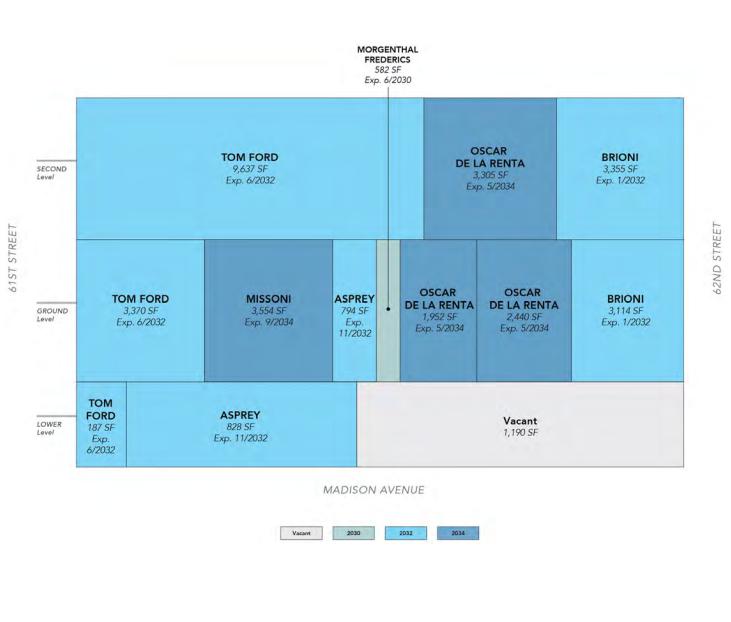

| AREF2 | 680 Madison Avenue | New York | NY | 1 / 1 | 40,000,000 | 5.6 | | Retail | 34,298 | 3,499 | 64.9 | | 64.9 | | 1.84 | | 12.6 | |

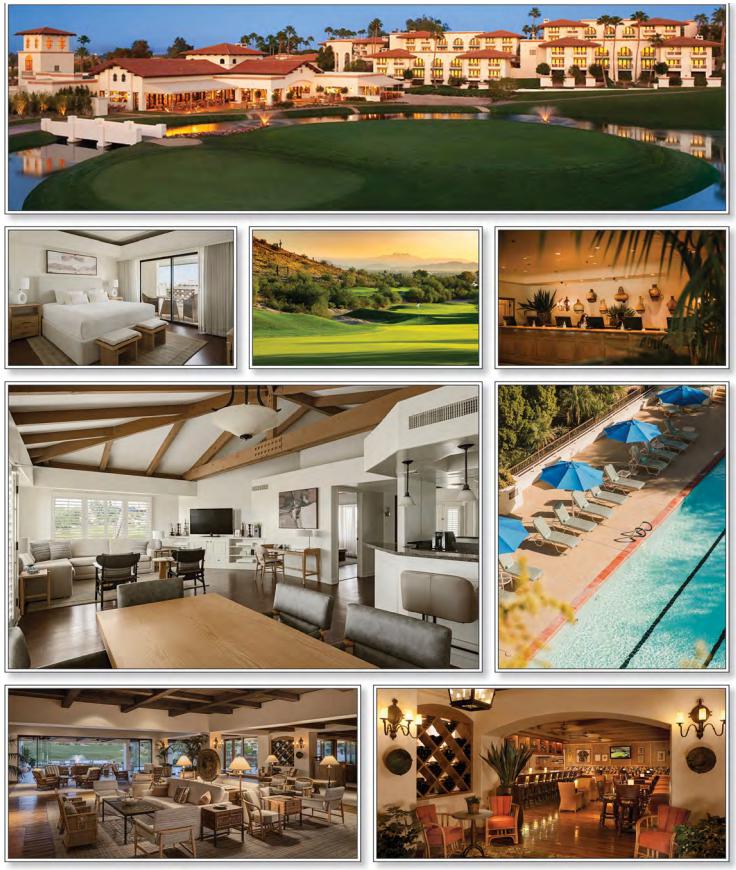

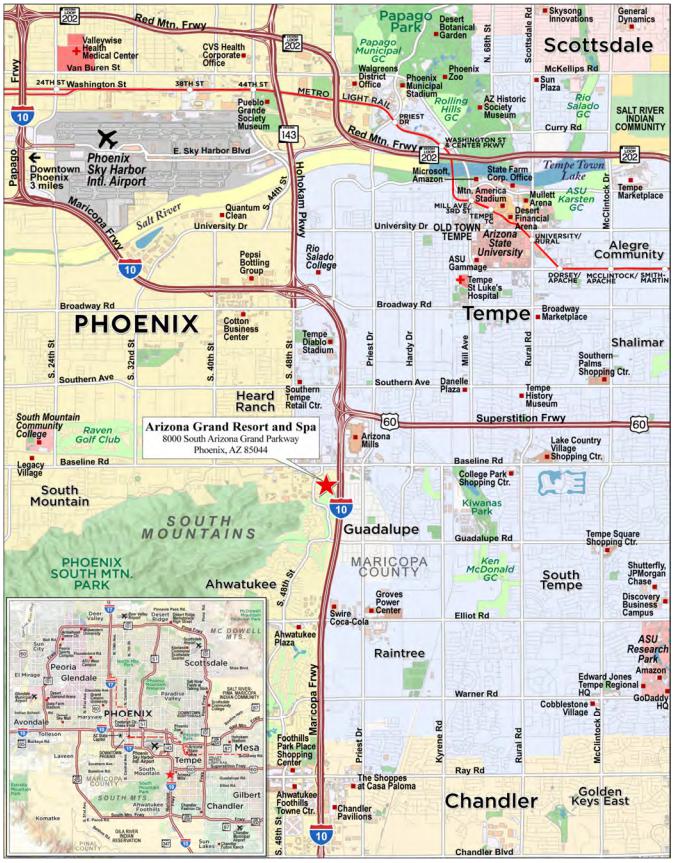

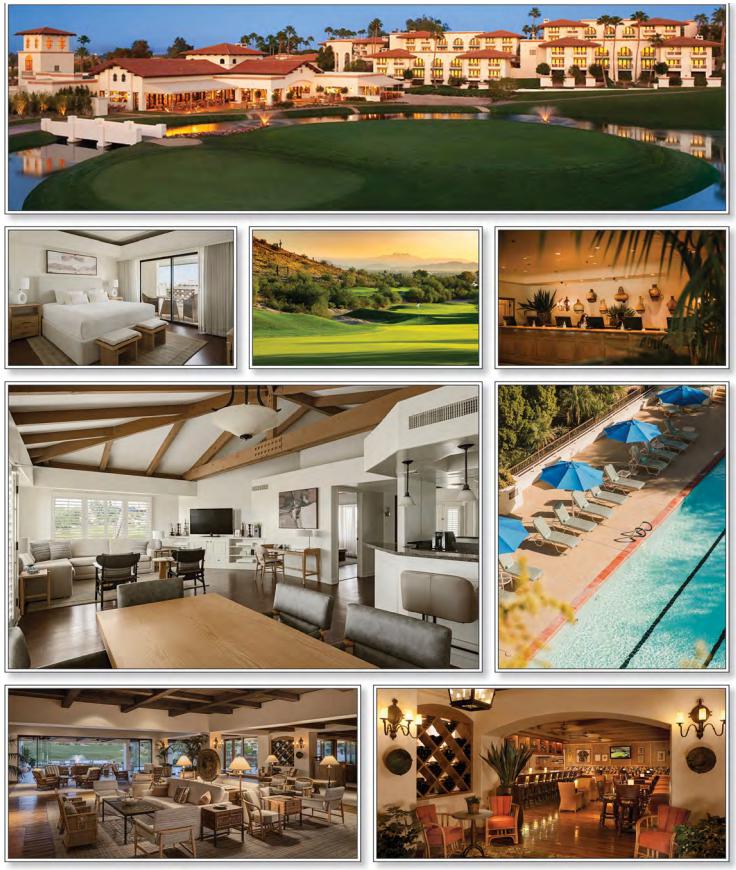

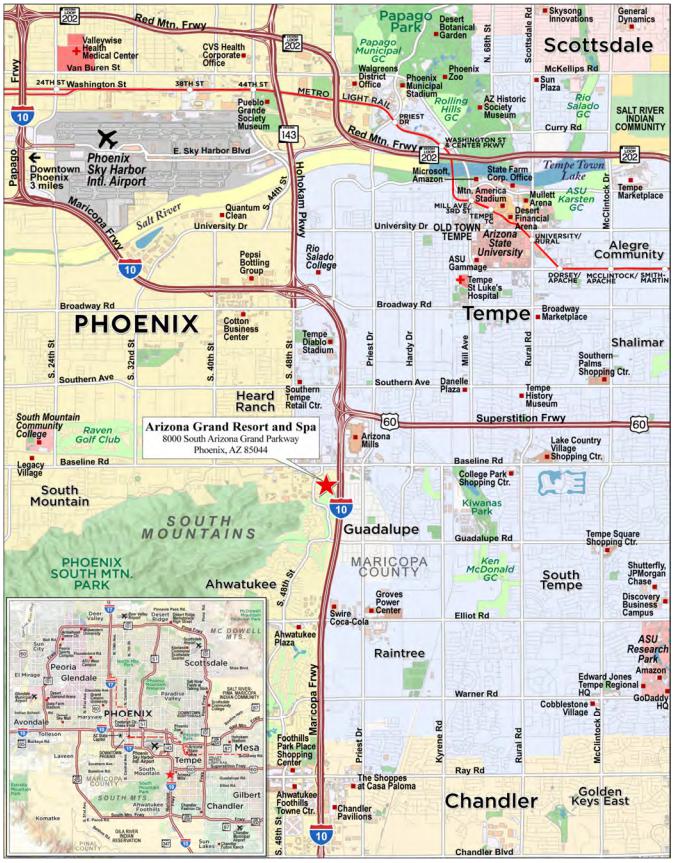

| WFB, GSMC | Arizona Grand Resort and Spa | Phoenix | AZ | 1 / 1 | 38,000,000 | 5.3 | | Hospitality | 744 | 168,011 | 39.2 | | 39.2 | | 3.76 | | 24.2 | |

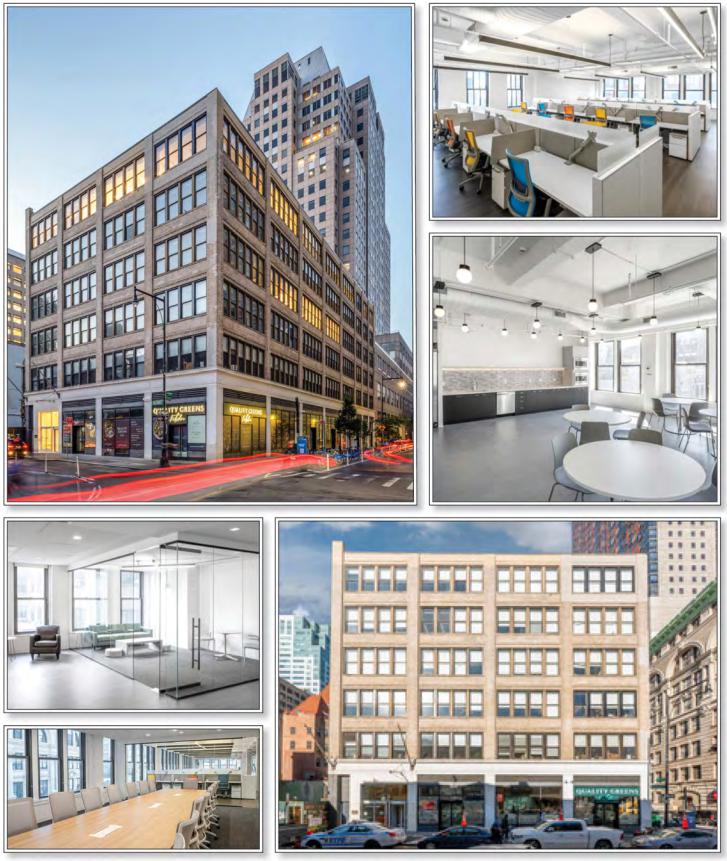

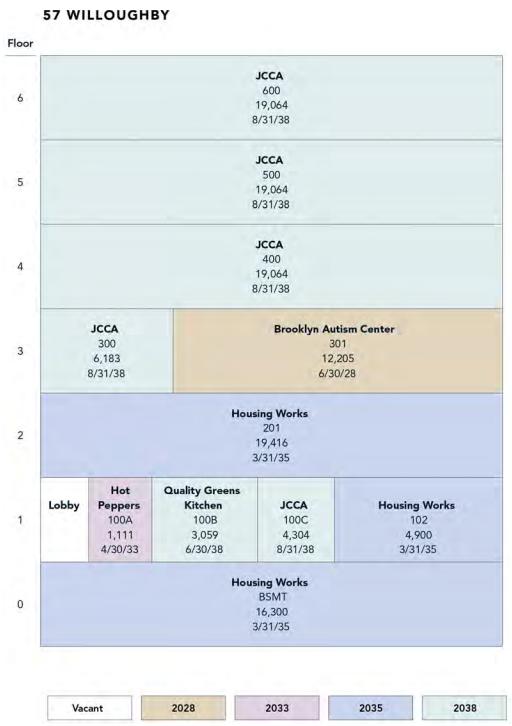

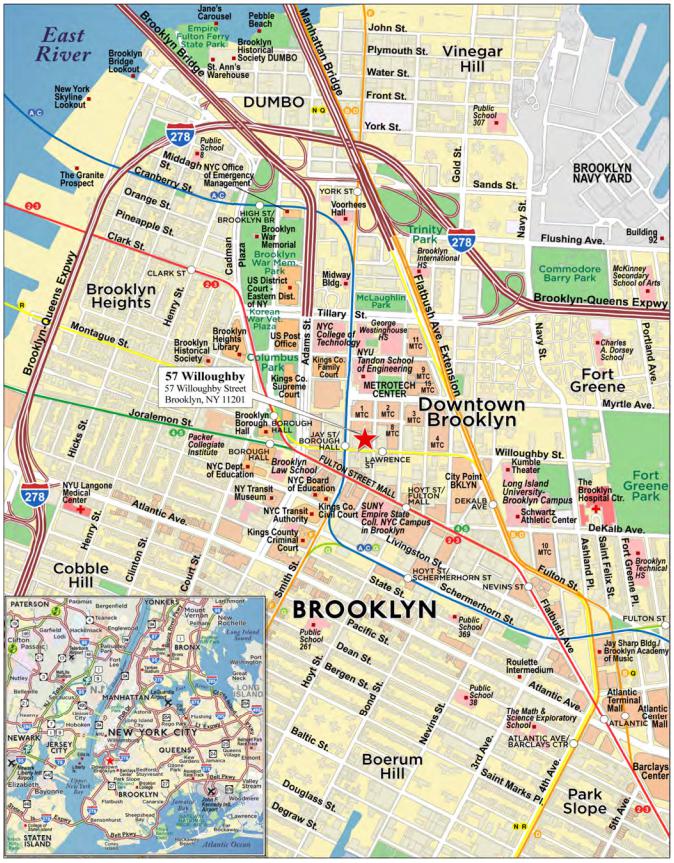

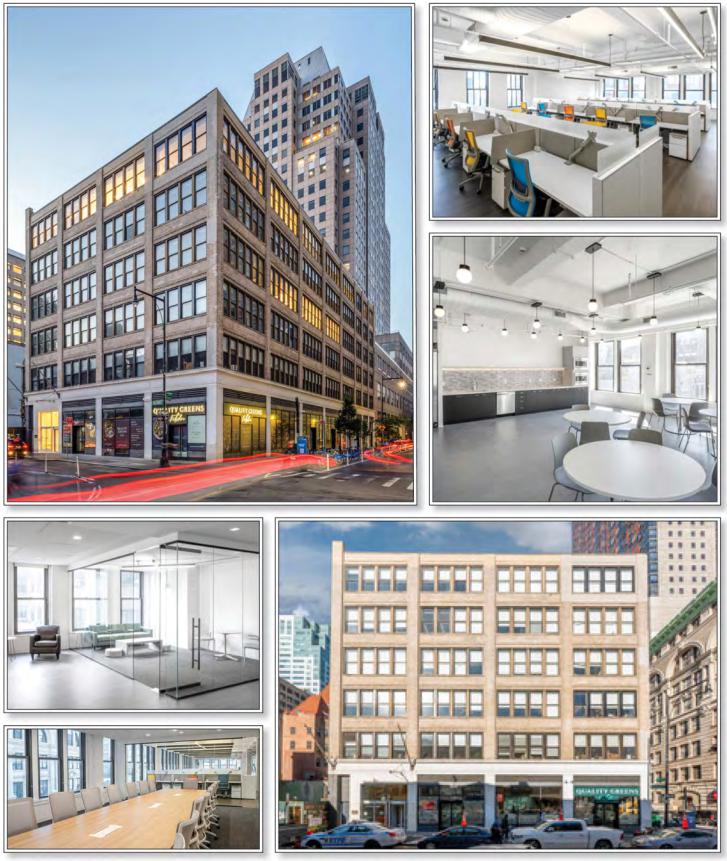

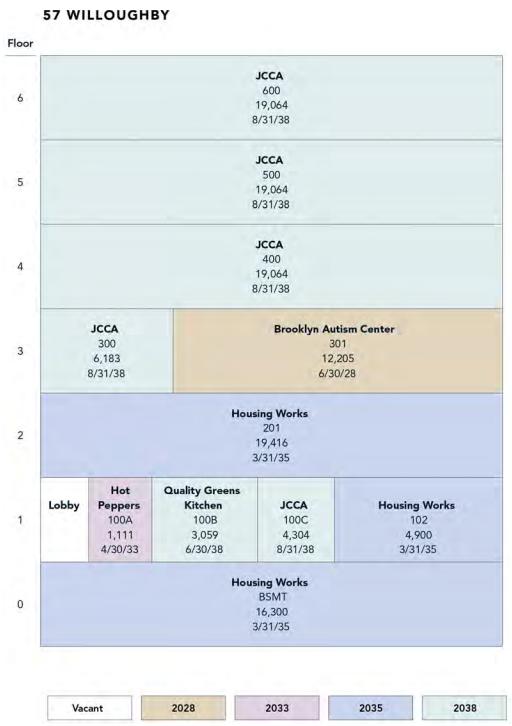

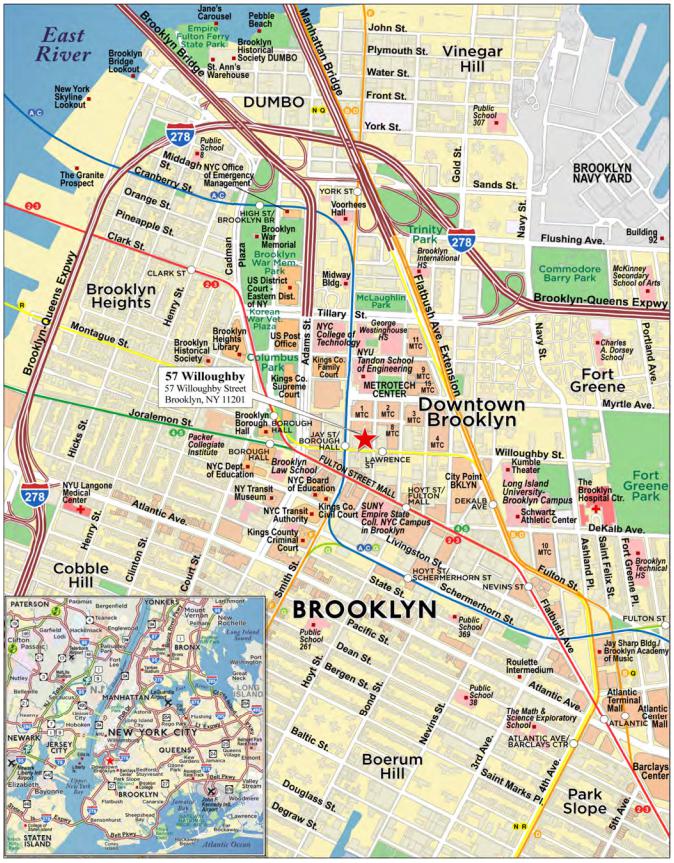

| AREF2 | 57 Willoughby | Brooklyn | NY | 1 / 1 | 31,200,000 | 4.4 | | Office | 124,670 | 250 | 56.6 | | 49.6 | | 1.43 | | 12.2 | |

| Top Three Total/Weighted Average | | 3 / 3 | $184,952,149 | 25.9 | % | | | | 41.4 | % | 39.3 | % | 2.70 | x | 18.5 | % |

| Top Five Total/Weighted Average | | 5 / 5 | $292,952,149 | 41.0 | % | | | | 45.3 | % | 43.4 | % | 2.53 | x | 17.4 | % |

| Top Ten Total/Weighted Average | | 10 / 10 | $491,152,149 | 68.8 | % | | | | 44.5 | % | 43.0 | % | 2.59 | x | 17.4 | % |

| Non-Top Ten Total/Weighted Average | | 20 / 20 | $222,807,990 | 31.2 | % | | | | 48.3 | % | 46.1 | % | 2.36 | x | 17.5 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property, which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| No. | Property Name | Mortgage Loan Seller in WFCM 2024-C63 | Mortgage Loan Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Combined Cut-off Date Balance | Controlling Pooling / Trust and Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Combined UW NCF DSCR(2) | Combined UW NOI Debt Yield(2) | Combined Cut-off Date LTV(2) |

| 1 | Bridge Point Rancho Cucamonga | WFB | $65,000,000 | $202,610,000 | $267,610,000 | WFCM 2024-BPRC(3) | Wells Fargo Bank, National Association | Argentic Services Company LP | WFCM 2024-BPRC, BBCMS 2024-C28 | 2.73x | 16.2% | 34.5% |

| 2 | Grapevine Mills | WFB, JPMCB | $60,000,000 | $190,000,000 | $250,000,000 | WFCM 2024-C63 | Wells Fargo Bank, National Association | Argentic Services Company LP | BMO 2024-C9 | 2.68x | 18.0% | 45.6% |

| 3 | Marriott Myrtle Beach Grande Dunes Resort | WFB, JPMCB | $59,952,149 | $39,968,099 | $99,920,248 | WFCM 2024-C63 | Wells Fargo Bank, National Association | Argentic Services Company LP | Future Securitization | 2.69x | 21.4% | 44.8% |

| 4 | 610 Newport Center | WFB, JPMCB | $55,000,000 | $30,000,000 | $85,000,000 | WFCM 2024-C63 | Wells Fargo Bank, National Association | Argentic Services Company LP | Future Securitization | 2.92x | 17.2% | 44.5% |

| 6 | St. Johns Town Center | JPMCB | $46,000,000 | $314,000,000 | $360,000,000 | BBCMS 2024-C28(4) | Wells Fargo Bank, National Association | LNR Partners, LLC | BANK 2024-BNK47, BMO 2024-C9, BBCMS 2024-C28 | 2.09x | 13.3% | 47.8% |

| 8 | 680 Madison Avenue | AREF2 | $40,000,000 | $80,000,000 | $120,000,000 | BMO 2024-C9 | Midland Loan Services | Argentic Services Company LP | BMO 2024-C9 | 1.84x | 12.6% | 64.9% |

| 9 | Arizona Grand Resort and Spa | WFB, GSMC | $38,000,000 | $87,000,000 | $125,000,000 | BBCMS 2024-C28(4) | Wells Fargo Bank, National Association | LNR Partners, LLC | BBCMS 2024-C28 | 3.76x | 24.2% | 39.2% |

| 13 | Dallas Market Center | GSMC | $22,000,000 | $215,000,000 | $237,000,000 | BANK 2024-BNK47 | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC | BMO 2024-C9, BBCMS 2024-C28 | 2.46x | 17.0% | 37.2% |

| 15 | 900 North Michigan | GSMC | $20,000,000 | $160,000,000 | $180,000,000 | BBCMS 2024-C28(4) | Wells Fargo Bank, National Association | LNR Partners, LLC | BBCMS 2024-C28 | 1.77x | 12.6% | 57.1% |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes any related Subordinate Companion Loans. |

| (2) | DSCR, Debt Yield and LTV calculations include any related pari passu companion loans and exclude any subordinate companion loans and/or mezzanine loans, as applicable. |

| (3) | Control rights are currently exercised by the holder of the related Subordinate Companion Loan until the occurrence and during the continuance of a control appraisal period for the related Whole Loan, as described under “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced AB Whole Loan—The Bridge Point Ranch Cucamonga Pari Passu AB Whole Loan” in the Preliminary Prospectus. |

| (4) | The BBCMS 2024-C28 securitization transaction is expected to close on or about August 29, 2024. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(2) | Mortgage Loan U/W NCF DSCR (x)(3) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(3) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(3) | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | WFB | Bridge Point Rancho Cucamonga | $65,000,000 | 9.1 | % | $162,390,000 | NAP | 6.1530 | % | 2.73 | x | 1.61 | x | 16.2 | % | 10.1 | % | 34.5 | % | 55.4 | % |

| 19 | AREF2 | Drum Hill | 12,750,000 | 1.8 | | 665,049 | NAP | 6.8341 | | 1.61 | | 1.57 | | 13.2 | | 12.6 | | 55.2 | | 58.1 | |

| Total/Weighted Average | $77,750,000 | 10.9 | % | $163,055,049 | | 6.2647 | % | 2.55 | x | 1.60 | x | 15.7 | % | 10.5 | % | 37.9 | % | 55.8 | % |

| (1) | In addition, seven (7) of the mortgage loans, each of which is secured by a residential cooperative property and is being sold to the depositor by National Cooperative Bank, N.A, currently have in place Subordinate Coop LOCs. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” and “Description of the Mortgage Pool—Additional Indebtedness—Other Secured Indebtedness—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives Sold to the Depositor by National Cooperative Bank, N.A.” in the Preliminary Prospectus. |

| (2) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (3) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History |

| Loan No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Previous

Securitization |

| 2.00 | WFB, JPMCB | Grapevine Mills | Grapevine | TX | Retail | $60,000,000 | 8.4 | % | JPMBB 2014-C23,

JPMBB 2014-C24,

JPMBB 2014-C25 |

| 3.00 | WFB, JPMCB | Marriott Myrtle Beach Grande Dunes Resort | Myrtle Beach | SC | Hospitality | 59,952,149 | 8.4 | | COMM 2014-LC17,

COMM 2014-UBS6,

COMM 2014-CR20 |

| 5.00 | WFB | Holiday Inn & Suites Ocean City | Ocean City | MD | Hospitality | 53,000,000 | 7.4 | | COMM 2014-UBS4 |

| 6.00 | JPMCB | St. Johns Town Center | Jacksonville | FL | Retail | 46,000,000 | 6.4 | | WFRBS 2014-C24,

WFRBS 2014-C25 |

| 8.00 | AREF2 | 680 Madison Avenue | New York | NY | Retail | 40,000,000 | 5.6 | | MSC 2015-XLF1 |

| 9.00 | WFB, GSMC | Arizona Grand Resort and Spa | Phoenix | AZ | Hospitality | 38,000,000 | 5.3 | | CSAIL 2015-C3,

CSAIL 2015-C4 |

| 10.00 | AREF2 | 57 Willoughby | Brooklyn | NY | Office | 31,200,000 | 4.4 | | FORT 2022-FL3 |

| 13.00 | GSMC | Dallas Market Center | Dallas | TX | Mixed Use | 22,000,000 | 3.1 | | GSMS 2015-GC30,

CGCMT 2015-GC31,

GSMS 2015-GC32 |

| 15.00 | GSMC | 900 North Michigan | Chicago | IL | Mixed Use | 20,000,000 | 2.8 | | LBUBS 2005-C3 |

| 18.00 | AREF2 | Gila Valley Shopping Center | Thatcher | AZ | Retail | 13,600,000 | 1.9 | | CSAIL 2015-C4 |

| 21.00 | NCB | Warminster Heights Home Ownership Association, Inc. | Warminster | PA | Multifamily | 9,992,248 | 1.4 | | WFRBS 2014-C21 |

| 22.00 | AREF2 | Crossroads Plaza | Adrian | MI | Retail | 8,400,000 | 1.2 | | CSAIL 2015-C3 |

| 24.00 | AREF2 | 13140 Coit Road | Dallas | TX | Office | 6,400,000 | 0.9 | | WFCM 2014-LC16 |

| 26.00 | NCB | Sted Tenant Owners Corp. | Brooklyn | NY | Multifamily | 1,998,553 | 0.3 | | WFRBS 2014-C22 |

| 28.00 | NCB | 3215 Owners, Ltd. | Bronx | NY | Multifamily | 1,430,000 | 0.2 | | WFRBS 2014-C22 |

| 29.00 | NCB | 406 West 46th Street Corp. | New York | NY | Multifamily | 1,099,257 | 0.2 | | WFRBS 2014-C22 |

| | Total | | | | | $413,072,207 | 57.9 | % | |

The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes(1) |

| Class A-3 |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool

Balance (%) | Mortgage

Loan Balance at Maturity or ARD($) | % of Class A-3 Certificate Principal

Balance (%)(2) | SF/Rooms | Loan per

SF/Room ($)(3) | U/W NCF DSCR

(x)(3) | U/W NOI Debt Yield (%)(3) | Cut-off Date LTV Ratio (%)(3) | Balloon or ARD

LTV Ratio (%)(3) | Rem. IO Period (mos.) | Rem. Term to Maturity or ARD (mos.) |

| 1 | WFB | Bridge Point Rancho Cucamonga | CA | Industrial | $65,000,000 | 9.1% | $65,000,000 | 100.0% | 2,168,119 | 123 | 2.73x | 16.2% | 34.5% | 34.5% | 83 | 83 |

| Total/Weighted Average | | | $65,000,000 | 9.1% | 65,000,000 | 100.0% | | | 2.73x | 16.2% | 34.5% | 34.5% | 83 | 83 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Mortgage Loan Balance at Maturity or ARD divided by the initial Class A-3 Certificate Balance. |

| (3) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan(s). |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date

Balance ($) | % of Initial

Pool

Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV

Ratio (%) | Weighted Average

U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Retail | 6 | $192,000,000 | 26.9 | % | 52.5 | % | 52.5 | % | 2.07 | x | 13.9 | % | 13.3 | % | 6.3598 | % |

| Super Regional Mall | 2 | 106,000,000 | 14.8 | | 46.6 | | 46.6 | | 2.42 | | 16.0 | | 15.1 | | 6.1269 | |

| Anchored | 4 | 86,000,000 | 12.0 | | 59.9 | | 59.9 | | 1.63 | | 11.3 | | 11.0 | | 6.6470 | |

| Hospitality | 4 | 165,952,149 | 23.2 | | 49.7 | | 46.4 | | 2.51 | | 19.0 | | 17.1 | | 6.2824 | |

| Full Service | 3 | 150,952,149 | 21.1 | | 48.7 | | 45.0 | | 2.56 | | 19.4 | | 17.4 | | 6.2410 | |

| Limited Service | 1 | 15,000,000 | 2.1 | | 60.5 | | 60.5 | | 2.04 | | 15.4 | | 13.8 | | 6.6990 | |

| Multifamily | 12 | 120,057,990 | 16.8 | | 27.5 | | 25.5 | | 3.78 | | 26.4 | | 25.8 | | 6.4460 | |

| Cooperative | 9 | 85,252,990 | 11.9 | | 15.8 | | 15.6 | | 4.75 | | 32.5 | | 31.8 | | 6.2325 | |

| Garden | 2 | 22,055,000 | 3.1 | | 56.7 | | 49.4 | | 1.27 | | 10.2 | | 10.0 | | 6.8935 | |

| Independent Living | 1 | 12,750,000 | 1.8 | | 55.2 | | 51.0 | | 1.61 | | 13.2 | | 13.0 | | 7.1000 | |

| Office | 4 | 117,800,000 | 16.5 | | 52.0 | | 48.0 | | 2.11 | | 14.4 | | 13.8 | | 6.3408 | |

| Suburban | 2 | 61,400,000 | 8.6 | | 46.3 | | 45.5 | | 2.78 | | 16.8 | | 16.3 | | 5.8030 | |

| CBD | 2 | 56,400,000 | 7.9 | | 58.2 | | 50.7 | | 1.39 | | 11.8 | | 11.0 | | 6.9262 | |

| Industrial | 1 | 65,000,000 | 9.1 | | 34.5 | | 34.5 | | 2.73 | | 16.2 | | 16.2 | | 5.8331 | |

| Warehouse/Distribution | 1 | 65,000,000 | 9.1 | | 34.5 | | 34.5 | | 2.73 | | 16.2 | | 16.2 | | 5.8331 | |

| Mixed Use | 2 | 42,000,000 | 5.9 | | 46.7 | | 46.7 | | 2.13 | | 14.9 | | 14.3 | | 6.6691 | |

| Merchandise Mart/Retail | 1 | 22,000,000 | 3.1 | | 37.2 | | 37.2 | | 2.46 | | 17.0 | | 16.2 | | 6.5020 | |

| Retail/Office | 1 | 20,000,000 | 2.8 | | 57.1 | | 57.1 | | 1.77 | | 12.6 | | 12.3 | | 6.8530 | |

| Self Storage | 1 | 11,150,000 | 1.6 | | 59.0 | | 59.0 | | 1.29 | | 8.7 | | 8.6 | | 6.5700 | |

| Self Storage | 1 | 11,150,000 | 1.6 | | 59.0 | | 59.0 | | 1.29 | | 8.7 | | 8.6 | | 6.5700 | |

| Total/Weighted Average | 30 | $713,960,139 | 100.0 | % | 45.7 | % | 43.9 | % | 2.52 | x | 17.4 | % | 16.6 | % | 6.3267 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

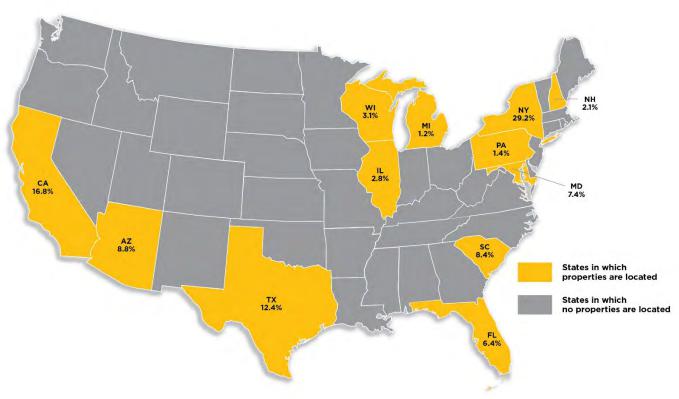

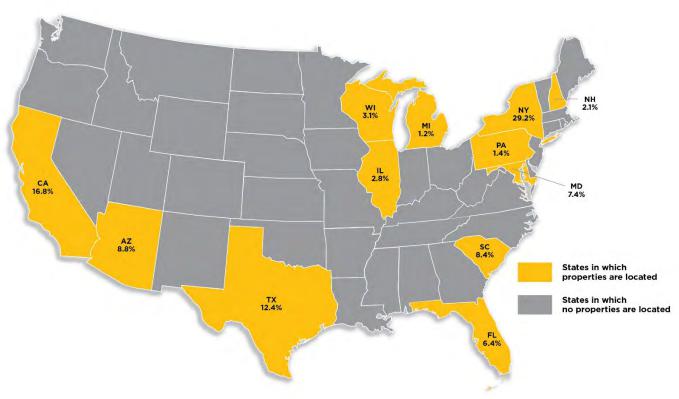

| G. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Initial Pool

Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| New York | 13 | $208,410,742 | 29.2 | % | 43.2 | % | 40.9 | % | 2.56 | x | 17.9 | % | 17.5 | % | 6.5991 | % |

| California | 2 | 120,000,000 | 16.8 | | 39.1 | | 39.1 | | 2.82 | | 16.7 | | 16.5 | | 5.7565 | |

| Southern California | 2 | 120,000,000 | 16.8 | | 39.1 | | 39.1 | | 2.82 | | 16.7 | | 16.5 | | 5.7565 | |

| Texas | 3 | 88,400,000 | 12.4 | | 44.7 | | 44.1 | | 2.54 | | 17.4 | | 16.5 | | 6.3751 | |

| Arizona | 3 | 62,750,000 | 8.8 | | 48.3 | | 48.3 | | 2.82 | | 18.4 | | 16.4 | | 5.9371 | |

| South Carolina | 1 | 59,952,149 | 8.4 | | 44.8 | | 38.3 | | 2.69 | | 21.4 | | 19.7 | | 6.1450 | |

| Maryland | 1 | 53,000,000 | 7.4 | | 59.8 | | 56.6 | | 1.55 | | 13.6 | | 12.2 | | 6.8450 | |

| Florida | 1 | 46,000,000 | 6.4 | | 47.8 | | 47.8 | | 2.09 | | 13.3 | | 12.6 | | 5.9480 | |

| Other(3) | 6 | 75,447,248 | 10.6 | | 51.7 | | 49.4 | | 2.44 | | 18.7 | | 17.7 | | 6.7596 | |

| Total/Weighted Average | 30 | $713,960,139 | 100.0 | % | 45.7 | % | 43.9 | % | 2.52 | x | 17.4 | % | 16.6 | % | 6.3267 | % |

| (1) | The mortgaged properties are located in 12 states |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 5 other states. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1,000,000 - 5,000,000 | 6 | $11,860,742 | 1.7 | % |

| 5,000,001 - 15,000,000 | 9 | 99,347,248 | 13.9 | |

| 15,000,001 - 30,000,000 | 5 | 111,600,000 | 15.6 | |

| 30,000,001 - 50,000,000 | 5 | 198,200,000 | 27.8 | |

| 50,000,001 - 65,000,000 | 5 | 292,952,149 | 41.0 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Average: | $23,798,671 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.30 - 1.50 | 5 | 82,405,000 | 11.5 | % |

| 1.51 - 2.00 | 8 | 185,350,000 | 26.0 | |

| 2.01 - 2.50 | 2 | 61,000,000 | 8.5 | |

| 2.51 - 3.00 | 5 | 261,952,149 | 36.7 | |

| 3.01 - 3.50 | 3 | 25,999,257 | 3.6 | |

| 3.51 - 8.00 | 4 | 83,998,553 | 11.8 | |

| 8.01 - 12.00 | 2 | 11,422,248 | 1.6 | |

| 12.01 - 21.78 | 1 | 1,832,932 | 0.3 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 2.64x | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 8.7 - 12.0 | 7 | $104,405,000 | 14.6 | % |

| 12.1 - 16.0 | 8 | 224,350,000 | 31.4 | |

| 16.1 - 20.0 | 4 | 202,000,000 | 28.3 | |

| 20.1 - 168.1 | 11 | 183,205,139 | 25.7 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 17.4% | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Refinance | 25 | $570,927,207 | 80.0 | % |

| Recapitalization | 3 | 71,832,932 | 10.1 | |

| Acquisition | 2 | 71,200,000 | 10.0 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| MORTGAGE RATE |

Range of Mortgage

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 5.5500 - 5.7500 | 2 | $93,000,000 | 13.0 | % |

| 5.7501 - 6.0000 | 2 | 111,000,000 | 15.5 | |

| 6.0001 - 6.2500 | 3 | 112,944,397 | 15.8 | |

| 6.2501 - 6.5000 | 4 | 95,998,553 | 13.4 | |

| 6.5001 - 6.7500 | 10 | 145,782,189 | 20.4 | |

| 6.7501 - 7.0000 | 7 | 111,285,000 | 15.6 | |

| 7.0001 - 7.1000 | 2 | 43,950,000 | 6.2 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 6.3267% | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.27 - 1.50 | 7 | $127,205,000 | 17.8 | % |

| 1.51 - 2.00 | 6 | 140,550,000 | 19.7 | |

| 2.01 - 2.50 | 3 | 83,000,000 | 11.6 | |

| 2.51 - 3.00 | 4 | 239,952,149 | 33.6 | |

| 3.01 - 3.50 | 3 | 25,999,257 | 3.6 | |

| 3.51 - 4.00 | 2 | 81,000,000 | 11.3 | |

| 4.01 - 14.00 | 4 | 14,420,801 | 2.0 | |

| 14.01 - 21.45 | 1 | 1,832,932 | 0.3 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 2.52x | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 8.6 - 12.0 | 8 | $135,605,000 | 19.0 | % |

| 12.1 - 16.0 | 7 | 193,150,000 | 27.1 | |

| 16.1 - 20.0 | 5 | 261,952,149 | 36.7 | |

| 20.1 - 165.5 | 10 | 123,252,990 | 17.3 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 16.6% | | |

| (1) | For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio and debt yield for each such mortgaged property is calculated using U/W Net Operating Income or U/W Net Cash Flow, as applicable, for the related residential cooperative property which is the projected net operating income or net cash flow, as applicable, reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date and the loan-to-value ratio, is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative, inclusive of the amount of the underlying debt encumbering such residential cooperative property. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity) and may be currently prepayable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Wells Fargo Commercial Mortgage Trust 2024-C63 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Original Terms to

Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 84 | 1 | $65,000,000 | 9.1 | % |

| 120 | 29 | 648,960,139 | 90.9 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 117 months | | |

| REMAINING TERM TO MATURITY |

Range of Remaining

Terms to Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 83 | 1 | $65,000,000 | 9.1 | % |

| 118 - 120 | 29 | 648,960,139 | 90.9 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 116 months | | |

| ORIGINAL AMORTIZATION TERM(1) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 18 | $488,480,000 | 68.4 | % |

| 360 | 12 | 225,480,139 | 31.6 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average(3): | 360 months | | |

| REMAINING AMORTIZATION TERM(2) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 18 | $488,480,000 | 68.4 | % |

| 359 - 360 | 12 | 225,480,139 | 31.6 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average(3): | 360 months | | |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Hard / Springing Cash Management | 14 | $539,352,149 | 75.5 | % |

| None | 9 | 85,252,990 | 11.9 | |

| Springing | 6 | 67,355,000 | 9.4 | |

| Hard / In Place Cash Management | 1 | 22,000,000 | 3.1 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Lockout / Defeasance / Open | 17 | $536,652,149 | 75.2 | % |

| GRTR 1% or YM / 1% / Open | 9 | 85,252,990 | 11.9 | |

| Lockout / GRTR 1% or YM / GRTR 1% or YM or Defeasance / Open | 1 | 55,000,000 | 7.7 | |

| Lockout / GRTR 1% or YM / Open | 3 | 37,055,000 | 5.2 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off

Date LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 4.6 - 20.0 | 8 | $64,852,990 | 9.1 | % |

| 20.1 - 30.0 | 1 | 20,400,000 | 2.9 | |

| 30.1 - 40.0 | 3 | 125,000,000 | 17.5 | |

| 40.1 - 50.0 | 5 | 244,952,149 | 34.3 | |

| 50.1 - 60.0 | 8 | 158,555,000 | 22.2 | |

| 60.1 - 64.9 | 5 | 100,200,000 | 14.0 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 45.7% | | |

| BALLOON LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 4.0 - 20.0 | 8 | $64,852,990 | 9.1 | % |

| 20.1 - 30.0 | 1 | 20,400,000 | 2.9 | |

| 30.1 - 40.0 | 4 | 184,952,149 | 25.9 | |

| 40.1 - 50.0 | 7 | 238,255,000 | 33.4 | |

| 50.1 - 60.0 | 7 | 136,900,000 | 19.2 | |

| 60.1 - 64.9 | 3 | 68,600,000 | 9.6 | |

| Total: | 30 | $713,960,139 | 100.0 | % |

| Weighted Average: | 43.9% | | |

| AMORTIZATION TYPE |

| Amortization Type | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Interest Only | 18 | $488,480,000 | 68.4 | % |

| Amortizing Balloon | 10 | 159,730,139 | 22.4 | |