| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-282099-02 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$822,168,756

(Approximate Initial Pool Balance)

$719,397,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2025-C64

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Goldman Sachs Mortgage Company

Citi Real Estate Funding Inc.

UBS AG

Societe Generale Financial Corporation

JPMorgan Chase Bank, National Association

Bank of Montreal

LMF Commercial, LLC

Natixis Real Estate Capital LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2025-C64

February 3, 2025

WELLS

FARGO

SECURITIES | BMO

CAPITAL

MARKETS | CITIGROUP | GOLDMAN

SACHS & CO.

LLC | J.P.

MORGAN | SOCIÉTÉ

GÉNÉRALE | UBS

SECURITIES

LLC |

Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner | Co-Lead

Manager and

Joint

Bookrunner |

| Academy Securities, Inc. | Drexel Hamilton | Natixis Securities Americas LLC | Siebert Williams Shank |

| Co-Manager | Co-Manager | Co-Manager | Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-282099) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of (i) Regulation (EU) 2017/1129 (as amended), (ii) such Regulation as it forms part of UK domestic law, or (iii) Part VI of the UK Financial Services and Markets Act 2000, as amended; and does not constitute an offering document for any other purpose.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, BMO Capital Markets Corp., Citigroup Global Markets Inc., Goldman Sachs & Co. LLC, UBS Securities LLC, J.P. Morgan Securities LLC, SG Americas Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, Natixis Securities Americas LLC, Siebert Williams Shank & Co., LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

J.P. Morgan is the marketing name for the investment banking businesses of JPMorgan Chase & Co. and its subsidiaries worldwide. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by JPMS and its securities affiliates, and lending, derivatives and other commercial banking activities are performed by JPMorgan Chase Bank, National Association and its banking affiliates. JPMS is a member of SIPC and the NYSE.

BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Europe p.l.c, and Bank of Montreal (China) Co. Ltd, the institutional broker dealer business of BMO Capital Markets Corp. (Member FINRA and SIPC) and the agency broker dealer business of Clearpool Execution Services, LLC (Member FINRA and SIPC) in the U.S., and the institutional broker dealer businesses of BMO Nesbitt Burns Inc. (Member Investment Industry Regulatory Organization of Canada and Member Canadian Investor Protection Fund) in Canada and Asia, Bank of Montreal Europe p.l.c. (authorized and regulated by the Central Bank of Ireland) in Europe and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in the UK and Australia.

Société Générale is the marketing name for SG Americas Securities, LLC.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 2 | |

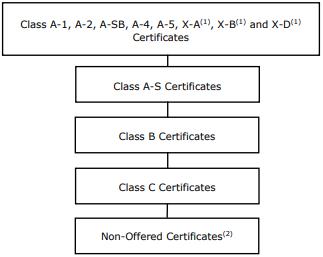

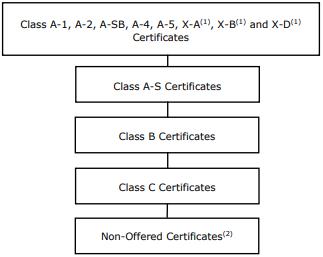

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Certificate Structure |

| Class | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | Approximate Initial Certificate Balance or Notional Amount(2) | Approx. Initial Credit Support(3) | Pass-Through Rate Description | Weighted Average Life (Years)(4) | Expected Principal

Window(4) | Certificate Principal UW NOI Debt Yield(5) | Certificate Principal to Value Ratio(6) |

| | Offered Certificates | | | | | |

| A-1 | AAAsf/AAA(sf)/Aaa(sf) | $11,231,000 | 30.000% | (7) | 2.73 | 03/25-02/30 | 19.0% | 37.9% |

| A-2 | AAAsf/AAA(sf)/Aaa(sf) | $21,000,000 | 30.000% | (7) | 4.97 | 02/30-02/30 | 19.0% | 37.9% |

| A-SB | AAAsf/AAA(sf)/Aaa(sf) | $16,454,000 | 30.000% | (7) | 7.32 | 02/30-08/34 | 19.0% | 37.9% |

| A-4 | AAAsf/AAA(sf)/Aaa(sf) | (8) | 30.000% | (7) | (8) | (8) | 19.0% | 37.9% |

| A-5 | AAAsf/AAA(sf)/Aaa(sf) | (8) | 30.000% | (7) | (8) | (8) | 19.0% | 37.9% |

| X-A | AAAsf/AAA(sf)/Aaa(sf) | $575,518,000(9) | N/A | Variable IO(10) | N/A | N/A | N/A | N/A |

| X-B | A-sf/AAA(sf)/NR | $143,879,000(11) | N/A | Variable IO(12) | N/A | N/A | N/A | N/A |

| A-S | AAAsf/AAA(sf)/Aa1(sf) | $68,856,000 | 21.625% | (7) | 9.88 | 01/35-01/35 | 16.9% | 42.5% |

| B | AA-sf/AA+(sf)/NR | $43,164,000 | 16.375% | (7) | 9.96 | 01/35-02/35 | 15.9% | 45.3% |

| C | A-sf/A+(sf)/NR | $31,859,000 | 12.500% | (7) | 9.97 | 02/35-02/35 | 15.2% | 47.4% |

| Non-Offered Certificates | | | | | | | |

| X-D | BBB-sf/AAA(sf)/NR | (13)(15) | N/A | Variable IO(14) | N/A | N/A | N/A | N/A |

| D | BBBsf/A(sf)/NR | $13,596,000 | 10.846% | (7) | 9.97 | 02/35-02/35 | 14.9% | 48.3% |

| E | BBB-sf/A-(sf)/NR | (15) | (15) | (7) | 9.97 | 02/35-02/35 | 14.7% | 48.8% |

| F-RR | BB+sf/BBB+(sf)/NR | (15) | 8.000% | (7) | 9.97 | 02/35-02/35 | 14.4% | 49.8% |

| G-RR | BB-sf/BBB-(sf)/NR | $11,305,000 | 6.625% | (7) | 9.97 | 02/35-02/35 | 14.2% | 50.6% |

| J-RR | B-sf/BB(sf)/NR | $13,360,000 | 5.000% | (7) | 9.97 | 02/35-02/35 | 14.0% | 51.5% |

| K-RR | NR/NR/NR | $41,108,756 | 0.000% | (7) | 9.97 | 02/35-02/35 | 13.3% | 54.2% |

| (1) | The expected ratings presented are those of Fitch Ratings, Inc. (“Fitch”), Kroll Bond Rating Agency, LLC (“KBRA”) and Moody’s Investors Service Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each Class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A, X-B and X-D Certificates, the ultimate distribution of principal due on those Classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated February 3, 2025 (the “Preliminary Prospectus”). Fitch, KBRA and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The Certificate Balances and Notional Amounts set forth in the table are approximate. The actual initial Certificate Balances and Notional Amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the Notional Amounts of the Class X-A, X-B and X-D Certificates (collectively referred to herein as “Class X Certificates”) may vary depending upon the final pricing of the Classes of Principal Balance Certificates (as defined below) whose Certificate Balances comprise such Notional Amounts and, if as a result of such pricing the pass-through rate of any Class of the Class X Certificates would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (3) | The Approximate Initial Credit Support with respect to the Class A-1, A-2, A-SB, A-4 and A-5 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-SB, A-4 and A-5 Certificates in the aggregate. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-SB, A-4 and A-5 Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-4 and A-5 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-SB, A-4 and A-5 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-SB, A-4, A-5, A-S, B, C, D, E, F-RR, G-RR, J-RR and K-RR Certificates (collectively, the “Principal Balance Certificates”) for any distribution date will, in each case, be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 3 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Certificate Structure |

| (8) | The exact initial Certificate Balances of the Class A-4 and A-5 Certificates are unknown and will be determined based on the final pricing of those Classes of Certificates. However, the initial Certificate Balances, weighted average lives and principal windows of the Class A-4 and A-5 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial Certificate Balance of the Class A-4 and A-5 Certificates is expected to be approximately $526,833,000, subject to a variance of plus or minus 5%. In the event that the Class A-5 Certificates is issued with the maximum certificate balance (i.e., with an initial certificate balance of $526,833,000), the Class A-4 Certificates will not be issued. |

| | Class of Certificates | | Expected Range of Approximate Initial Certificate Balance | | Expected Range of Weighted Average Life (Years) | | Expected Range of

Principal Window |

| | Class A-4 | | $0 - $250,000,000 | | N/A – 9.62 | | N/A / 08/34 - 11/34 |

| | Class A-5 | | $276,833,000 - $526,833,000 | | 9.71 – 9.80 | | 08/34- 01/35 / 11/34 – 01/35 |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-SB, A-4 and A-5 Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-SB, A-4 and A-5 Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (12) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (13) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the aggregate Certificate Balance of the Class D and E Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (14) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average pass-through rates on the Class D and E Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (15) | The initial Certificate Balance of each of the Class E and Class F-RR Certificates is estimated based in part on the estimated ranges of Certificate Balances and estimated fair values described in “Credit Risk Retention” in the Preliminary Prospectus. The initial Certificate Balance of the Class E Certificates is expected to fall within a range of $6,547,000 to $8,222,000, and the initial Certificate Balance of the Class F-RR Certificates is expected to fall within a range of $15,180,000 to $16,855,000, with the ultimate initial Certificate Balance of each determined such that the aggregate fair value of the Class F-RR, G-RR, J-RR and K-RR Certificates will equal at least 5% of the estimated fair value as of the Closing Date of all of the Classes of Certificates (other than the Class R Certificates) issued by the issuing entity. Any variation in the initial Certificate Balance of the Class E Certificates would affect the initial notional amount of the Class X-D certificates. Additionally, the Approximate Initial Credit Support for the Class E Certificates will range between approximately 9.846% and 10.050%. |

| | |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 4 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

Mortgage Loan Seller | Number of

Mortgage Loans | Number of

Mortgaged

Properties | Aggregate Cut-off Date Balance | Approx. % of Initial Pool

Balance |

| Goldman Sachs Mortgage Company | 5 | | 7 | | $193,000,055 | | 23.5 | % |

| Citi Real Estate Funding Inc. | 8 | | 28 | | 172,246,464 | | 21.0 | |

| Wells Fargo Bank, National Association | 5 | | 5 | | 132,187,683 | | 16.1 | |

| UBS AG | 3 | | 10 | | 81,500,000 | | 9.9 | |

| Societe Generale Financial Corporation | 6 | | 6 | | 78,004,605 | | 9.5 | |

| JPMorgan Chase Bank, National Association | 1 | | 2 | | 70,000,000 | | 8.5 | |

| Bank of Montreal | 1 | | 1 | | 45,000,000 | | 5.5 | |

| LMF Commercial, LLC | 2 | | 2 | | 30,229,949 | | 3.7 | |

| Natixis Real Estate Capital LLC | 1 | | 1 | | 20,000,000 | | 2.4 | |

Total | 32 | | 62 | | $822,168,756 | | 100.0 | % |

Loan Pool:

| Initial Pool Balance: | $822,168,756 |

| Number of Mortgage Loans: | 32 |

| Average Cut-off Date Balance per Mortgage Loan: | $25,692,774 |

| Number of Mortgaged Properties: | 62 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $13,260,786 |

| Number of crossed loans | 2 |

| Crossed loans as a percentage | 2.2% |

| Weighted Average Interest Rate: | 6.6418% |

| Ten Largest Mortgage/Cross-collateralized Loans as % of Initial Pool Balance: | 58.8% |

| Weighted Average Original Term to Maturity (months): | 118 |

| Weighted Average Remaining Term to Maturity (months): | 116 |

| Weighted Average Original Amortization Term (months)(2): | 356 |

| Weighted Average Remaining Amortization Term (months)(2): | 355 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.80x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 13.3% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 54.2% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 52.2% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 17.5% |

| % of Mortgage Loans with Single Tenants(3): | 4.5% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with one or more other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 5 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 30.8% of the mortgage pool (16 mortgage loans) has scheduled amortization, as follows:

22.4% (13 mortgage loans) requires amortization during the entire loan term; and

8.4% (3 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Initial Pool Balance, 69.2% of the mortgage pool (16 mortgage loans) provides for interest-only payments during the entire loan term through maturity. The weighted average Cut-off Date Loan-to-Value Ratio and weighted average U/W Net Cash Flow DSCR for those mortgage loans are 53.9% and 1.86x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 60.7% of the mortgage pool (15 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 85.9% of the pool |

| Insurance: | 31.3% of the pool |

| Capital Replacements: | 77.0% of the pool |

| TI/LC: | 38.0% of the pool(1) |

| (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include mixed use, retail and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

52.1% of the mortgage pool (19 mortgage loans) features a lockout period, then defeasance only until an open period;

41.3% of the mortgage pool (11 mortgage loans) features a lockout period, then greater of a prepayment premium (1.0%) or yield maintenance until an open period; and

6.6% of the mortgage pool (2 mortgage loans) features a lockout period, then defeasance or greater of a prepayment premium (1.0%) or yield maintenance until an open period.

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 6 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Issue Characteristics |

| III. | Issue Characteristics |

| Securities Offered: | $719,397,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of ten classes (Classes A-1, A-2, A-SB, A-4, A-5, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such Classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Goldman Sachs Mortgage Company (“GSMC”), Citi Real Estate Funding Inc. (“CREFI”), UBS AG (“UBS AG”), Societe Generale Financial Corporation (“SGFC”), JPMorgan Chase Bank, National Association (“JPMCB”), Bank of Montreal (“BMO”), LMF Commercial, LLC (“LMF”) and Natixis Real Estate Capital LLC (“Natixis”) |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC, BMO Capital Markets Corp., Goldman Sachs & Co. LLC, J.P. Morgan Securities LLC, UBS Securities LLC, Citigroup Global Markets Inc and SG Americas Securities, LLC. |

| Co-Managers: | Academy Securities, Inc., Drexel Hamilton, LLC, Natixis Securities Americas LLC and Siebert Williams Shank & Co., LLC |

| Rating Agencies: | Fitch Ratings, Inc., Kroll Bond Rating Agency, LLC and Moody’s Investors Service, Inc. |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | Rialto Capital Advisors, LLC |

| Certificate Administrator: | Computershare Trust Company, N.A. |

| Trustee: | Computershare Trust Company, N.A. |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| U.S. Credit Risk Retention: | For a discussion of the manner in which the U.S. credit risk retention requirements are being addressed by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus. This transaction is being structured with a “third-party purchaser” that will acquire an “eligible horizontal residual interest”, which will be comprised of the Class F-RR, G-RR, J-RR and K-RR Certificates (the “horizontal risk retention certificates”). RREF V - D AIV RR H, LLC (in satisfaction of the retention obligations of Wells Fargo Bank, National Association, as the retaining sponsor) will be contractually obligated to retain (or to cause its “majority-owned affiliate” to retain) the horizontal risk retention certificates for a minimum of five years after the closing date, subject to certain permitted exceptions provided for under the risk retention rules. During this time, RREF V - D AIV RR H, LLC will agree to comply with hedging, transfer and financing restrictions that are applicable to third party purchasers under the credit risk retention rules. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus. |

EU Securitization Regulation

and UK Securitization

Regulation: | No transaction party, or any other person, intends to retain a material net economic interest in the securitization constituted by the issuance of the Certificates, or to take any other action in respect of such securitization, in a manner prescribed or contemplated (i) in the European Union by Regulation (EU) 2017/2402 and related technical standards (collectively the “EU Securitization Rules”), or (ii) in the United Kingdom by the Securitisation Regulations 2024 and related rules made by each of the Financial Conduct Authority and the Prudential Regulation Authority (collectively the “UK Securitization Rules”). In particular, no such person undertakes to take any action, or refrain from taking any action, for purposes of, or in connection with, compliance by any prospective investor or Certificateholder with any applicable requirement of the EU Securitization Rules or the UK Securitization Rules. In addition, the arrangements described under “Credit Risk Retention” in the Preliminary Prospectus have not been structured with the objective of ensuring or facilitating compliance by any person with any applicable requirement of the EU Securitization Rules or the UK Securitization Rules. See “Risk Factors—Other Risks Relating to the Certificates—EU Securitization Rules and UK Securitization Rules” in the Preliminary Prospectus |

Initial Controlling Class

Certificateholder: | RREF V – D AIV RR H, LLC |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 7 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Issue Characteristics |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in February 2025 (or, in the case of any mortgage loan that has its first due date after February 2025, the date that would have been its due date in February 2025 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Closing Date: | On or about February 27, 2025. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in March 2025. |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in March 2025. |

| Rated Final Distribution Date: | The Distribution Date in February 2058. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| Clean-up Call: | 1.0% |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be Secondary Mortgage Market Enhancement Act of 1984, as amended (“SMMEA”) eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “SUMMARY OF RISK FACTORS” AND “RISK FACTORS” SECTIONS OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., CRED iQ, Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, Inc., Morningstar Credit Information & Analytics, LLC, KBRA Analytics, LLC, MBS Data, LLC, RealInsight, Thomson Reuters Corporation and DealX. |

| Tax Treatment | For U.S. federal income tax purposes, the issuing entity will consist of one or more REMICs arranged in a tiered structure. The Offered Certificates will represent REMIC regular interests. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 8 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans or Cross-Collateralized Mortgage Loans |

| Mortgage Loan Seller | Mortgage Loan Name | City | State | Number of Mortgage Loans/ Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Property Type | Number of SF/ Units/ Rooms | Cut-off Date Balance Per SF/Unit/ Room ($) | Cut-off Date LTV Ratio (%) | Balloon or ARD LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

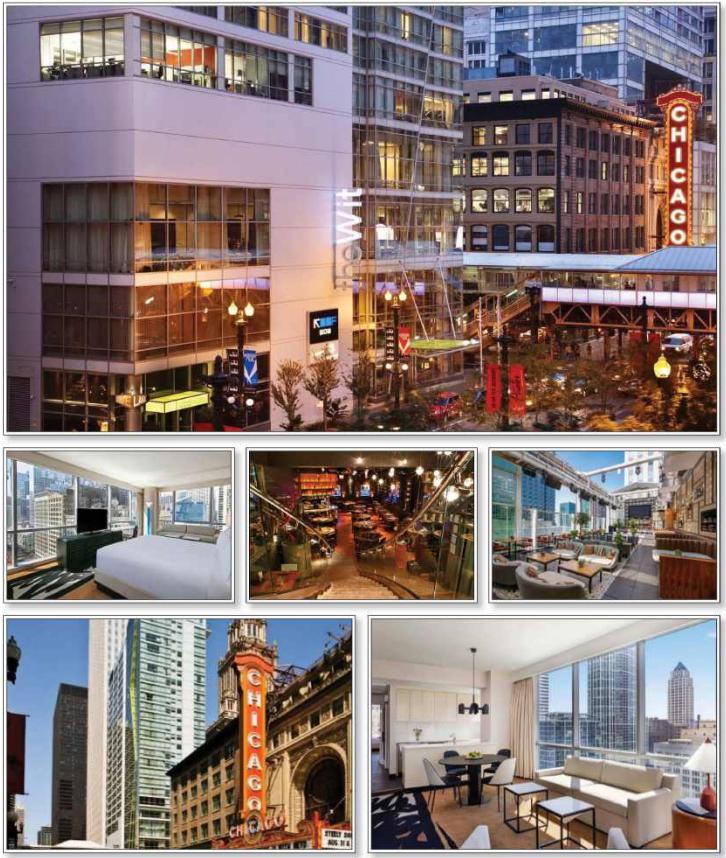

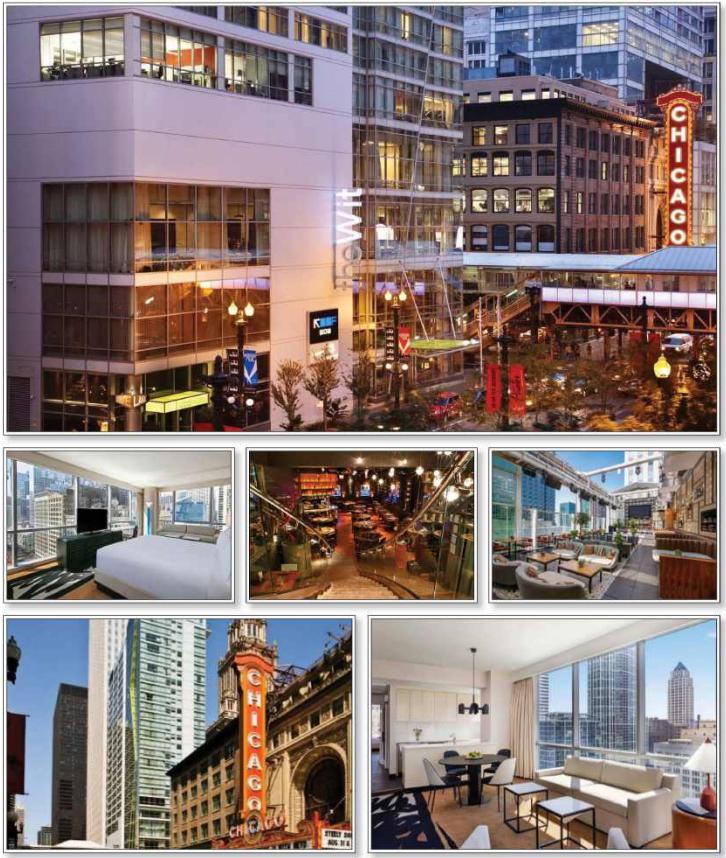

| GSMC | TheWit Chicago | Chicago | IL | 1 / 1 | $81,000,000 | 9.9 | % | Hospitality | 310 | $261,290 | 54.4 | % | 54.4 | % | 1.59 | x | 13.5 | % |

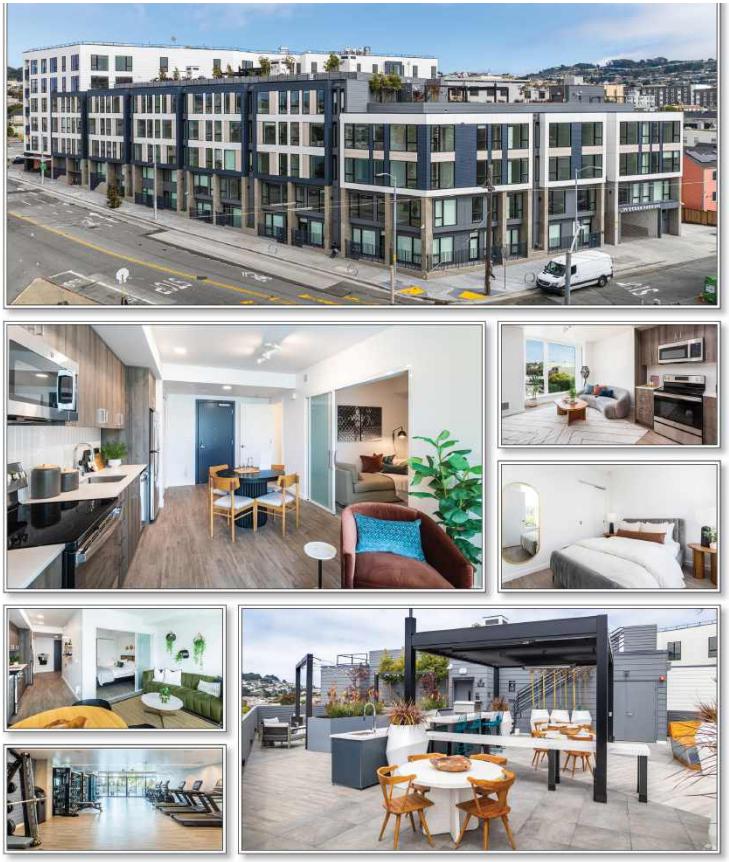

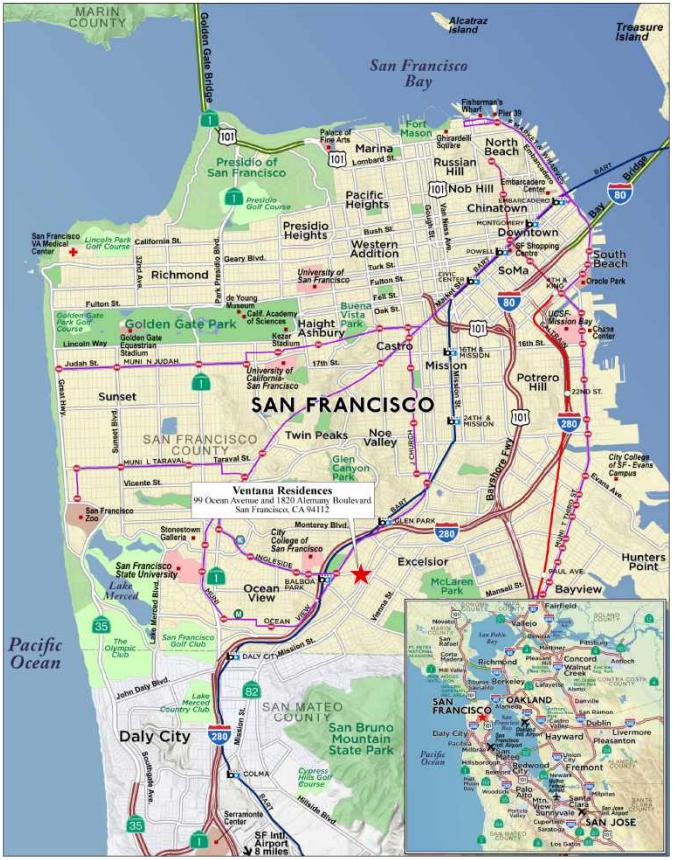

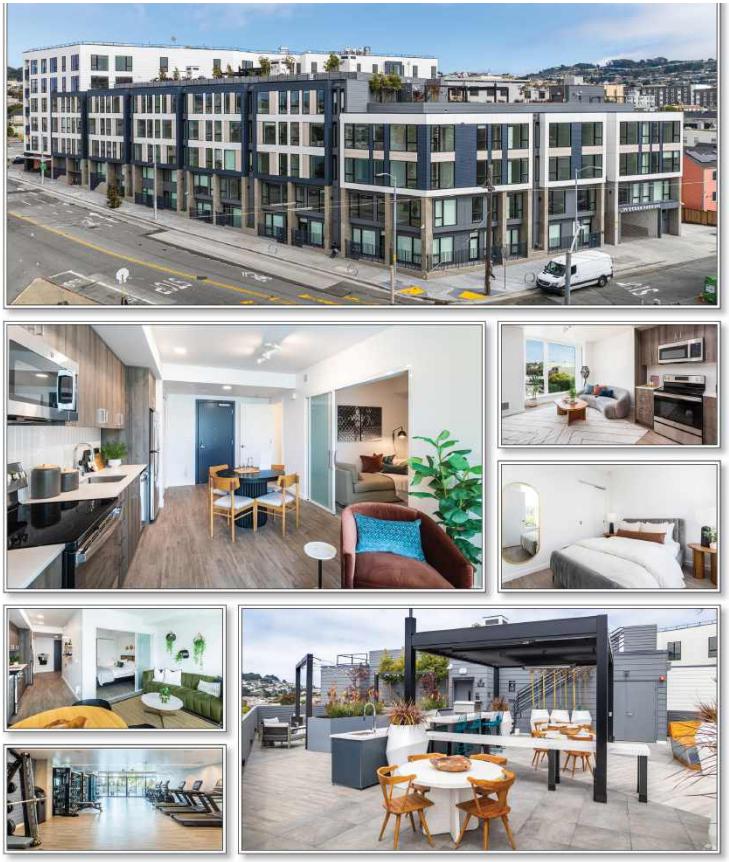

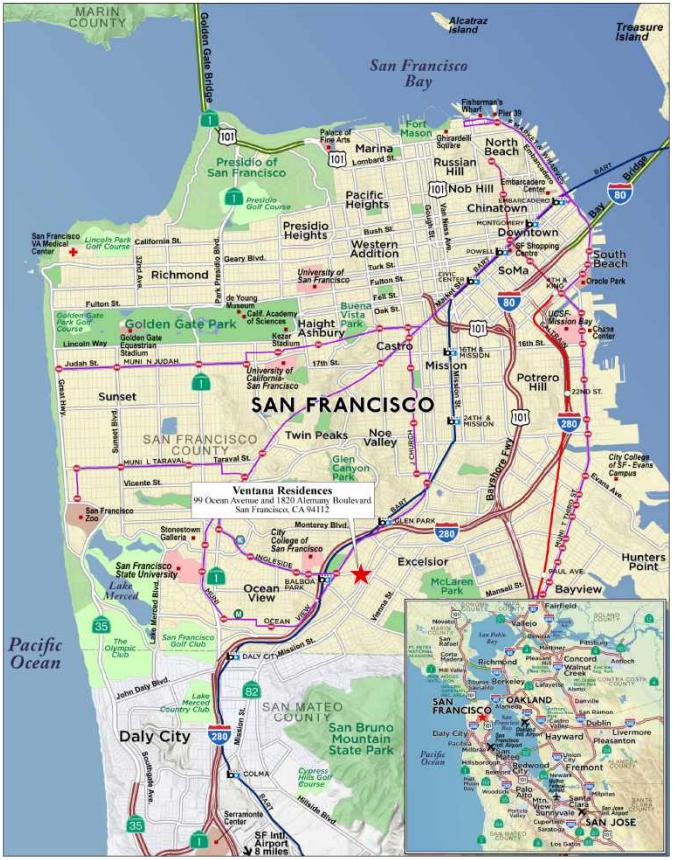

| WFB | Ventana Residences | San Francisco | CA | 1 / 1 | 73,500,000 | 8.9 | | Multifamily | 193 | 380,829 | 65.6 | | 65.6 | | 1.25 | | 7.9 | |

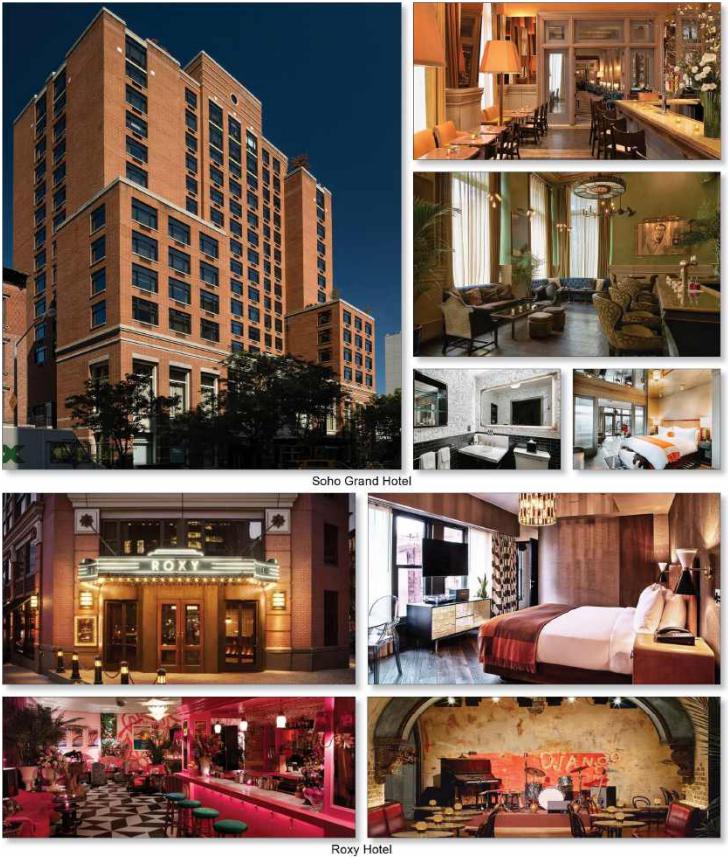

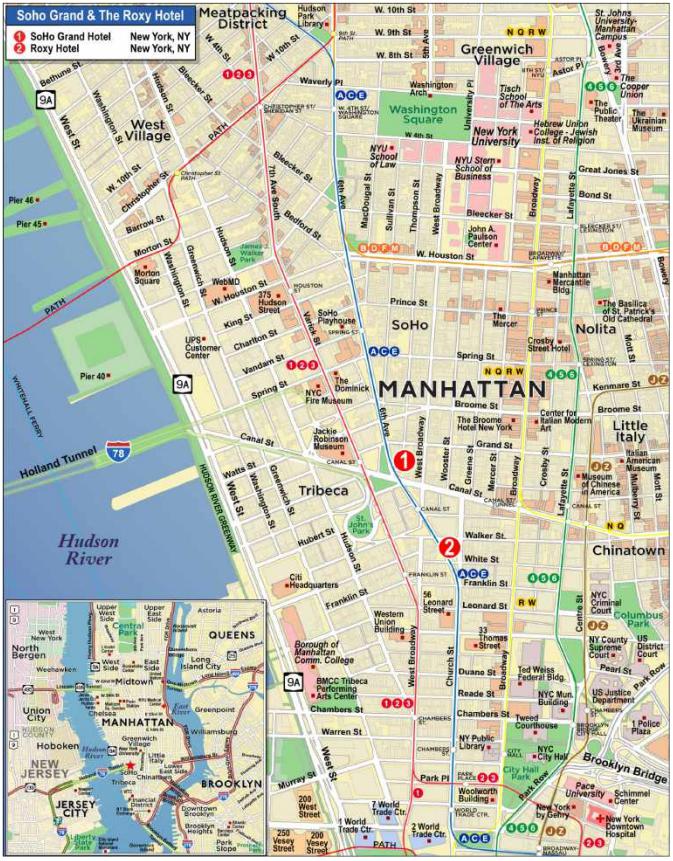

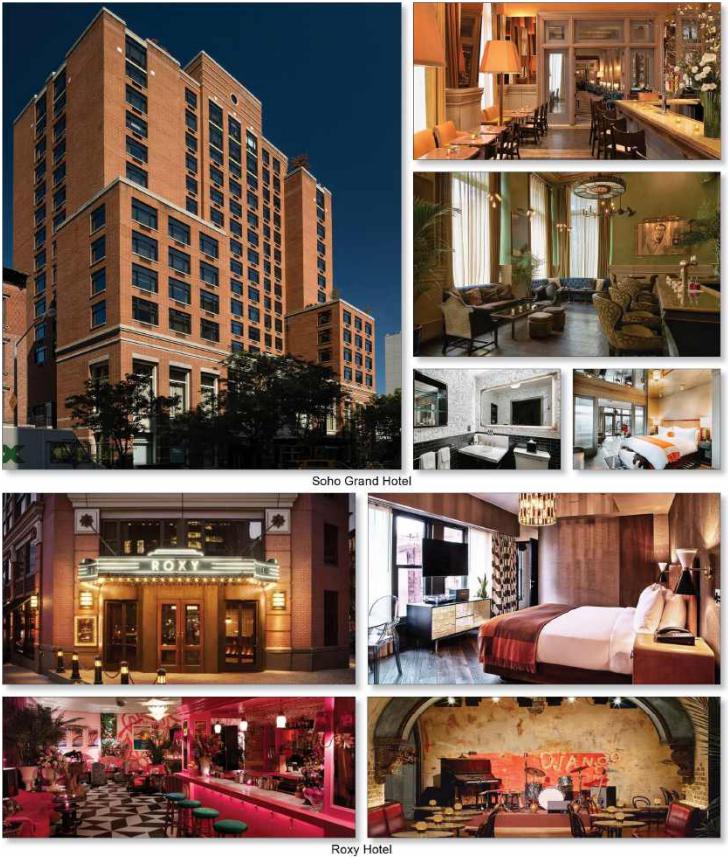

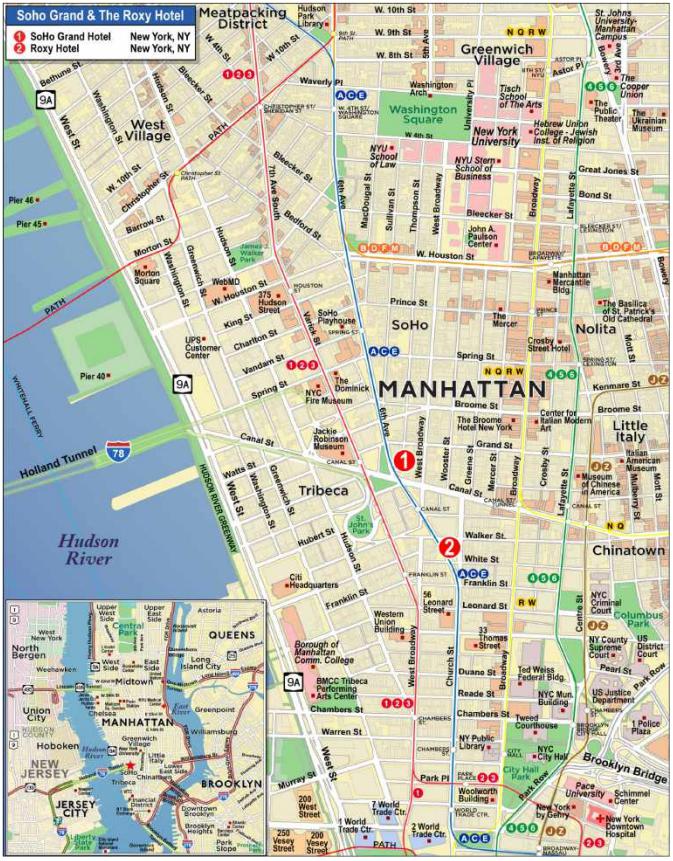

| JPMCB | Soho Grand & The Roxy Hotel | New York | NY | 1 / 2 | 70,000,000 | 8.5 | | Hospitality | 548 | 371,350 | 40.1 | | 40.1 | | 3.49 | | 21.9 | |

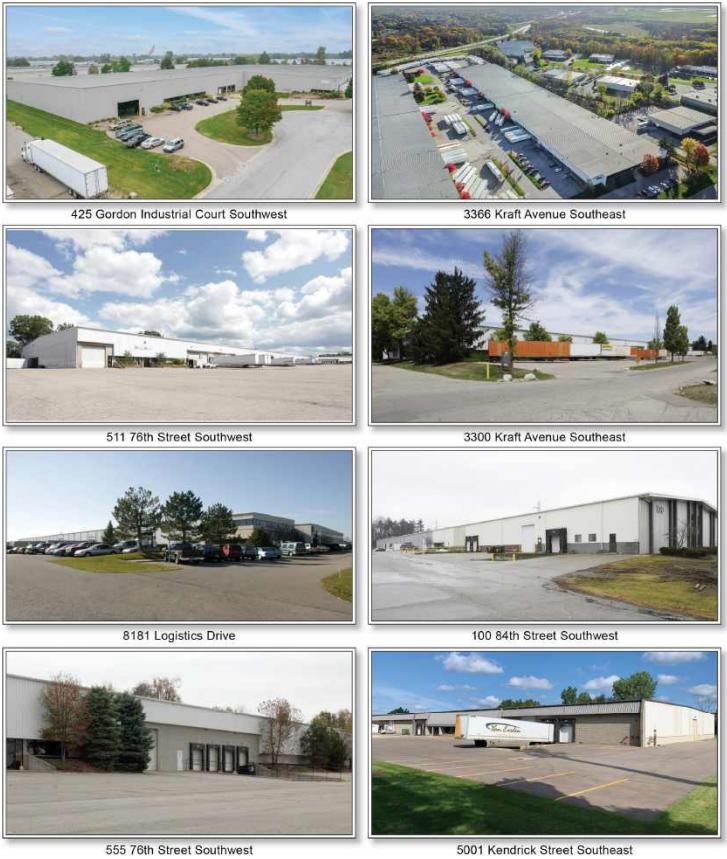

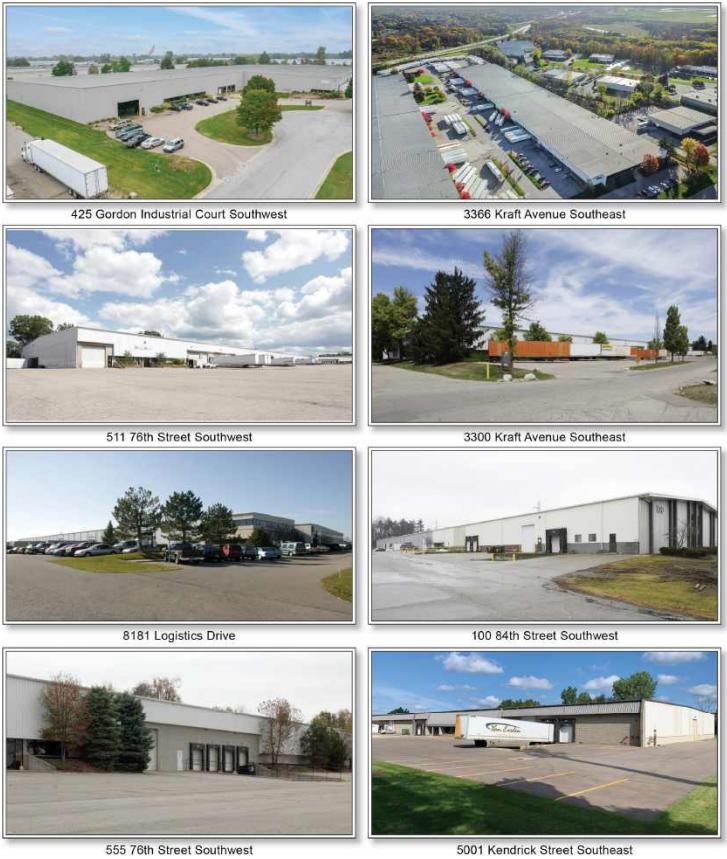

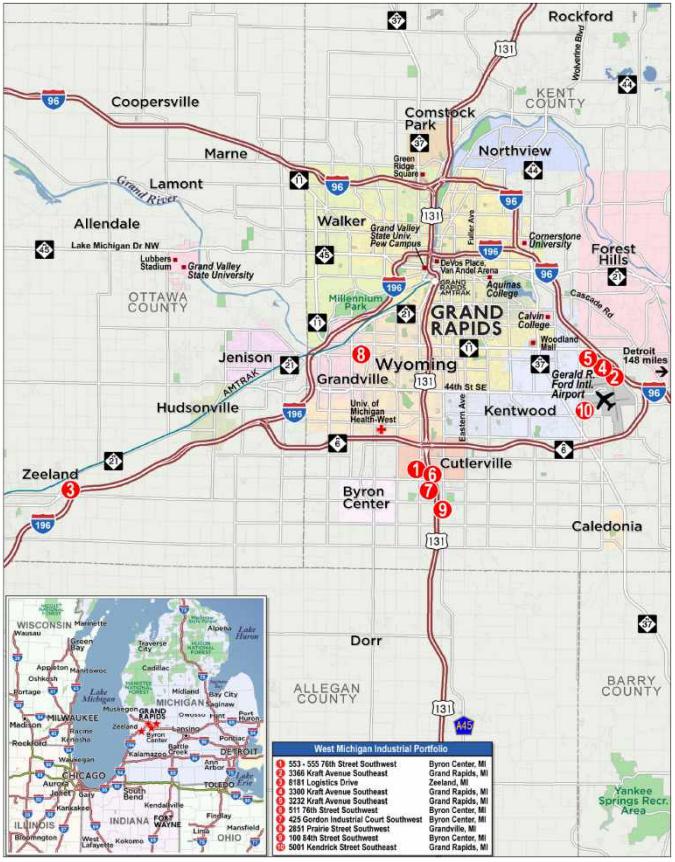

| CREFI | West Michigan Industrial Portfolio | Various | MI | 1 / 10 | 57,000,000 | 6.9 | | Industrial | 1,696,701 | 34 | 57.6 | | 57.6 | | 1.90 | | 12.6 | |

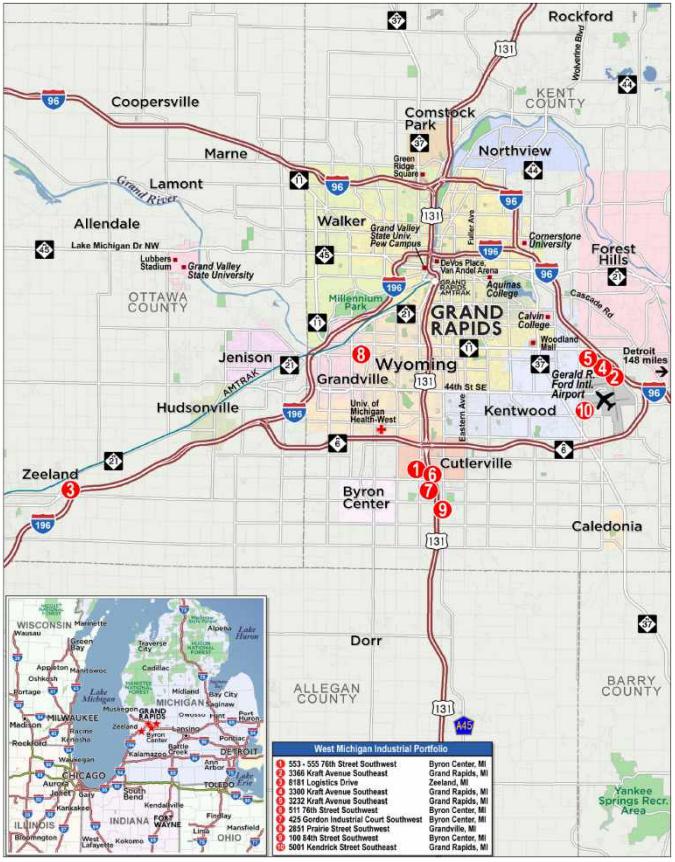

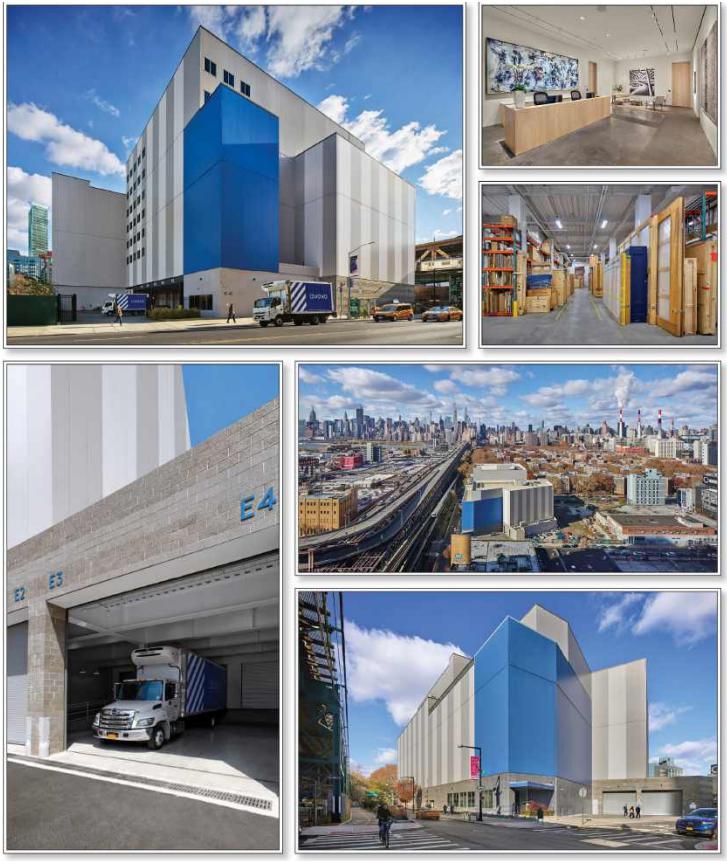

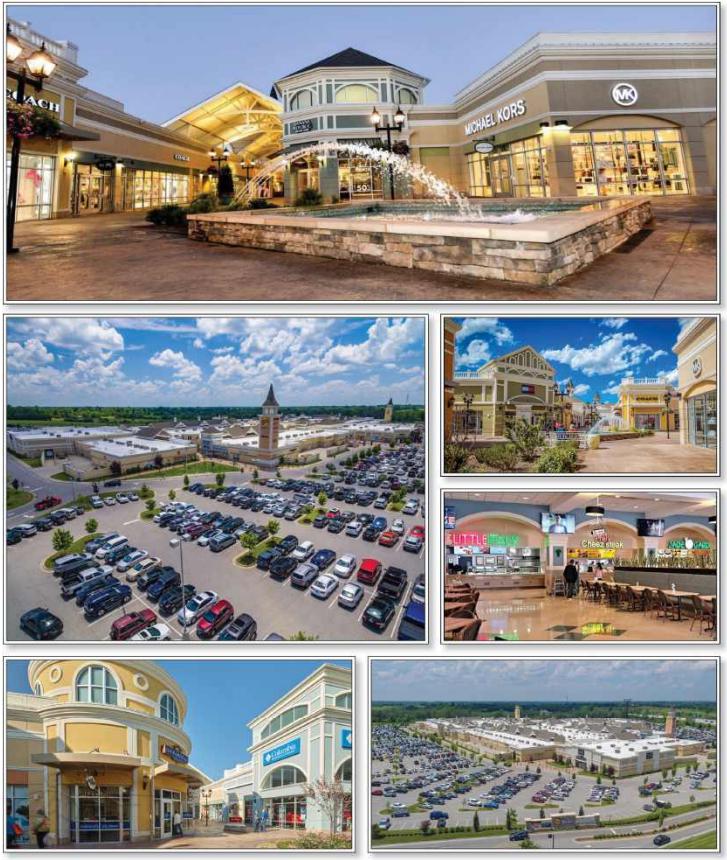

| GSMC | Outlet Shoppes of the Bluegrass | Simpsonville | KY | 1 / 1 | 45,900,055 | 5.6 | | Retail | 428,074 | 154 | 60.4 | | 52.6 | | 1.72 | | 14.2 | |

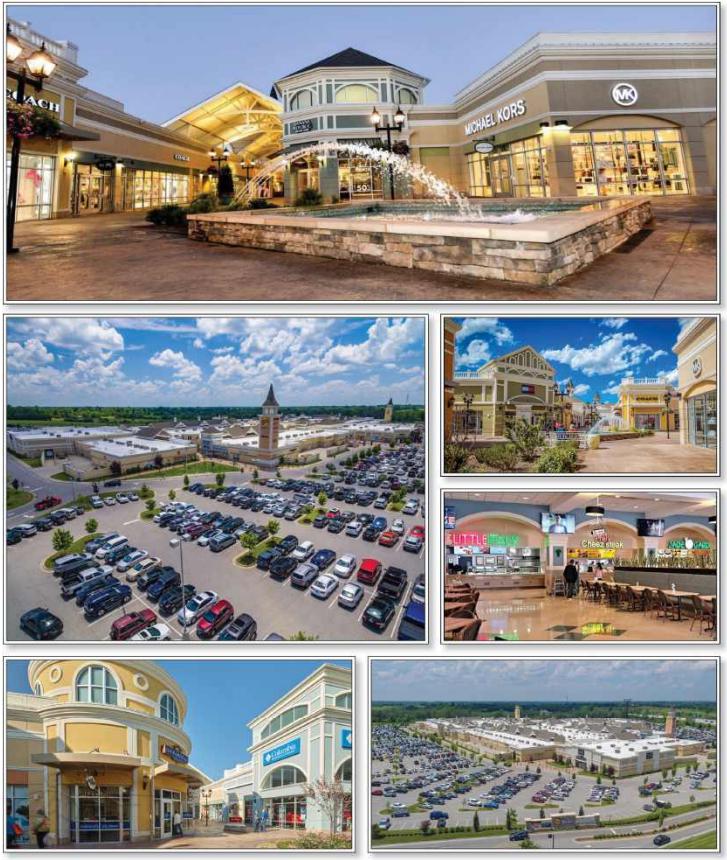

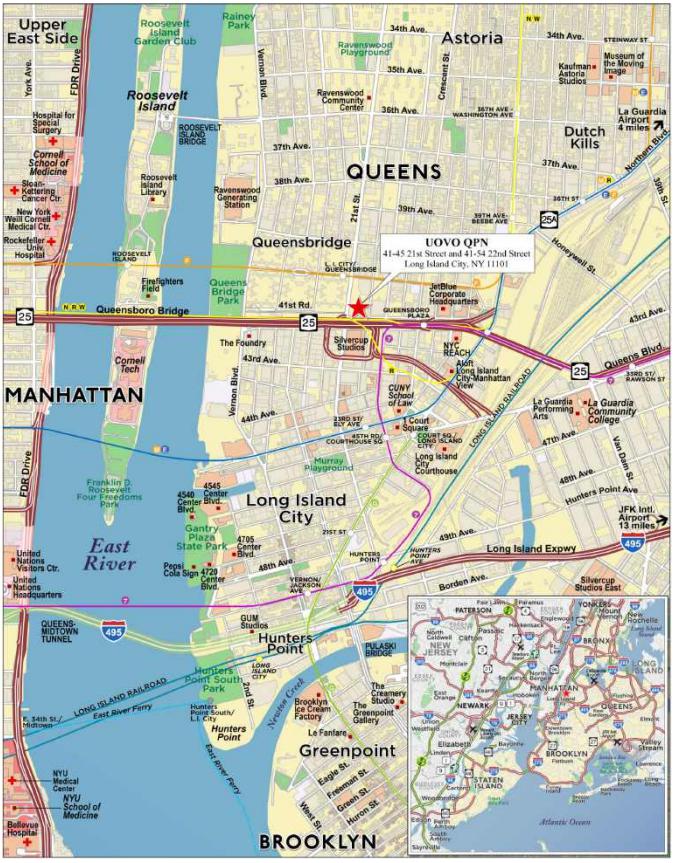

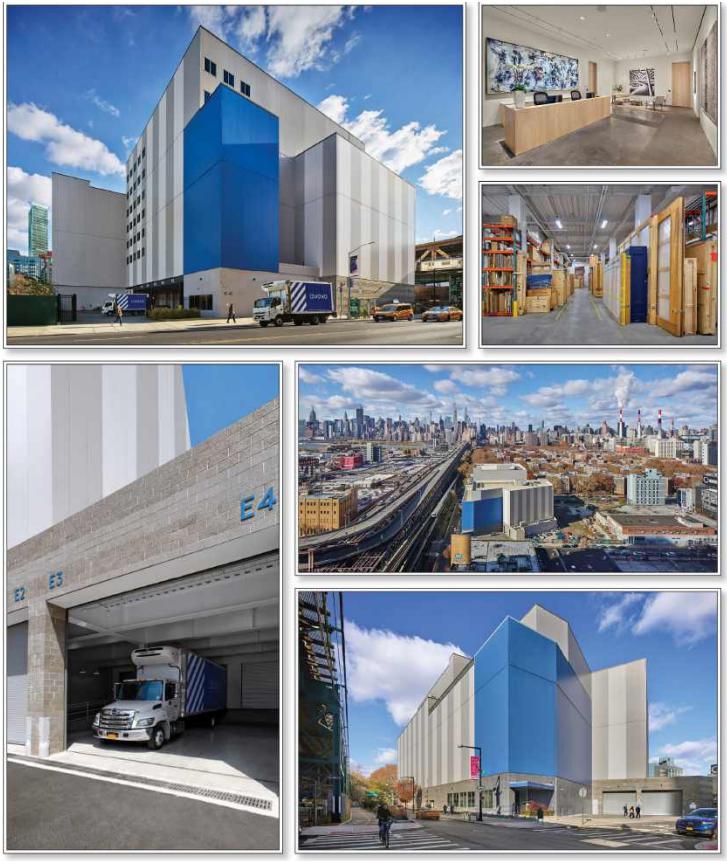

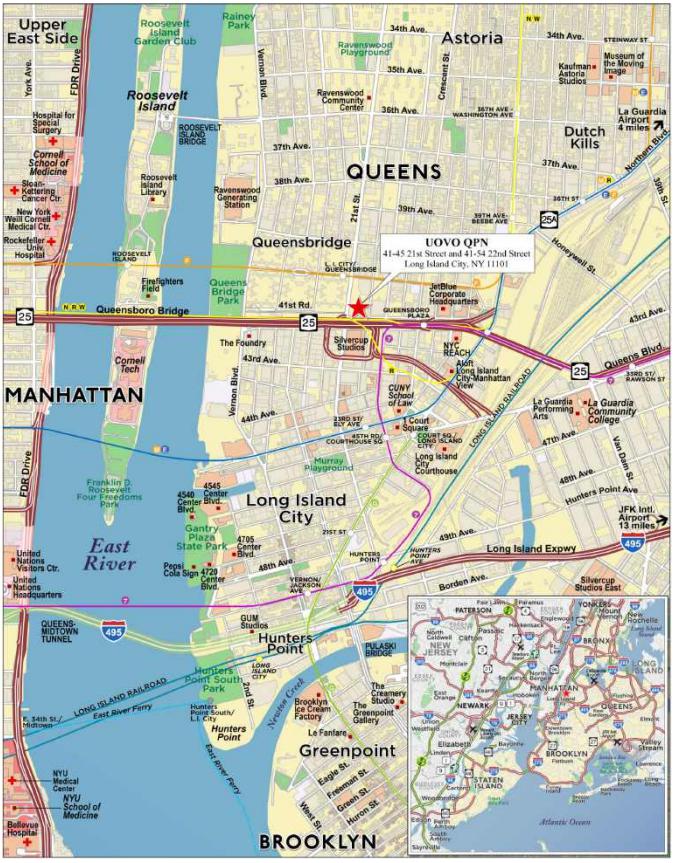

| BMO | UOVO QPN | Long Island City | NY | 1 / 1 | 45,000,000 | 5.5 | | Self Storage | 281,494 | 508 | 60.9 | | 60.9 | | 1.47 | | 9.7 | |

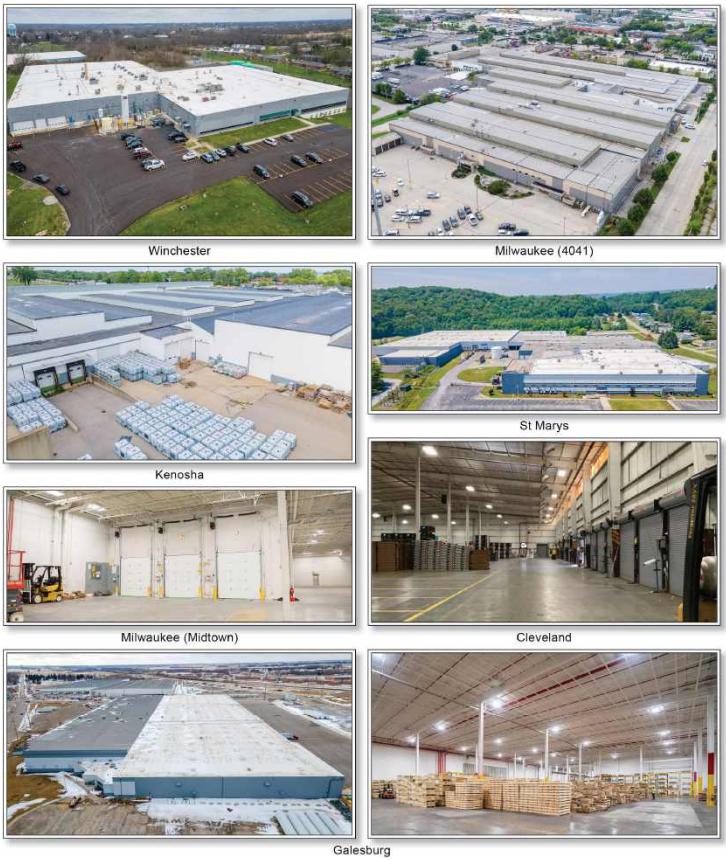

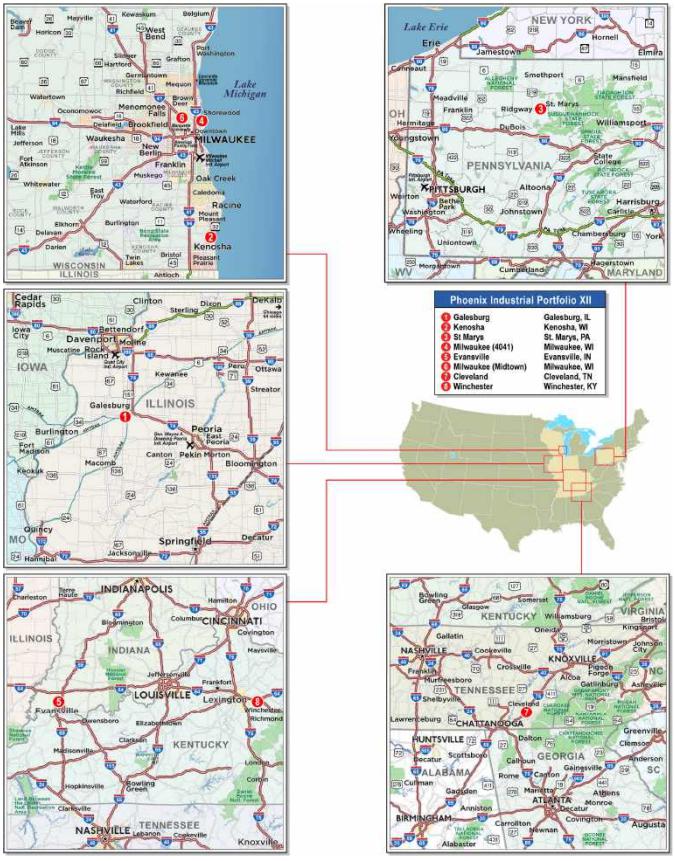

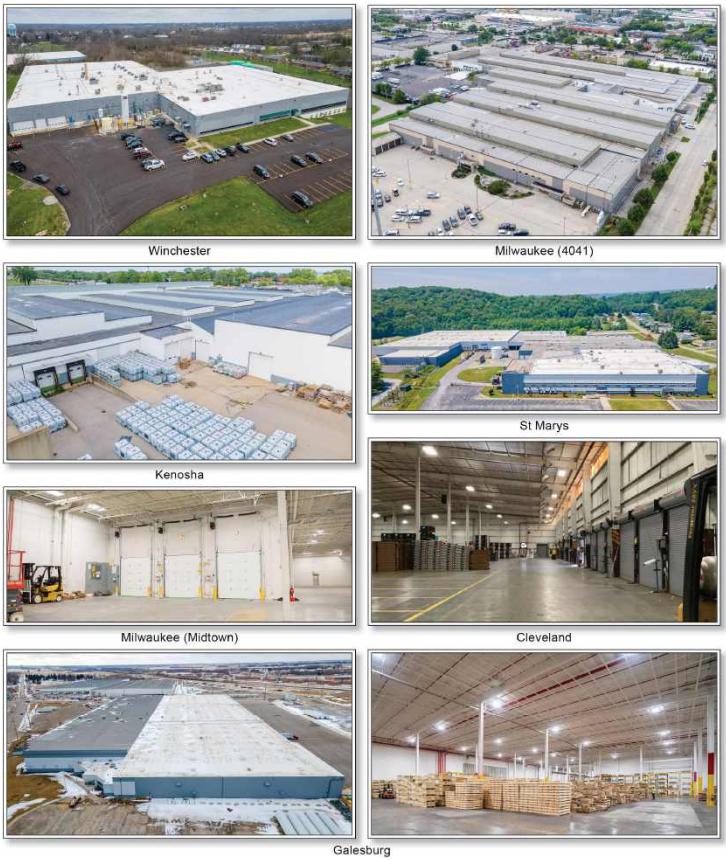

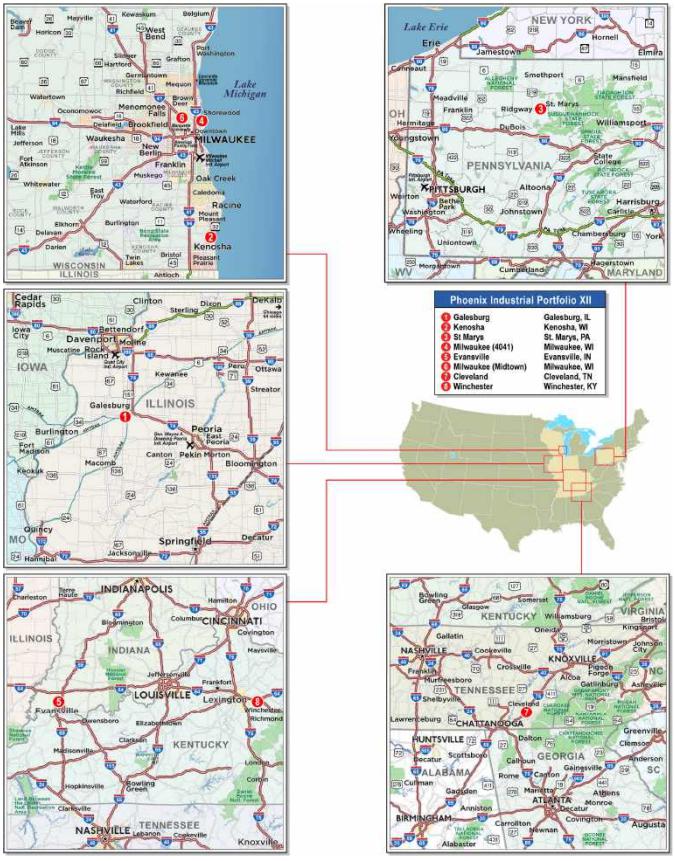

| UBS AG | Phoenix Industrial Portfolio XII | Various | Various | 1 / 8 | 30,000,000 | 3.6 | | Industrial | 2,013,085 | 26 | 48.1 | | 48.1 | | 1.60 | | 11.7 | |

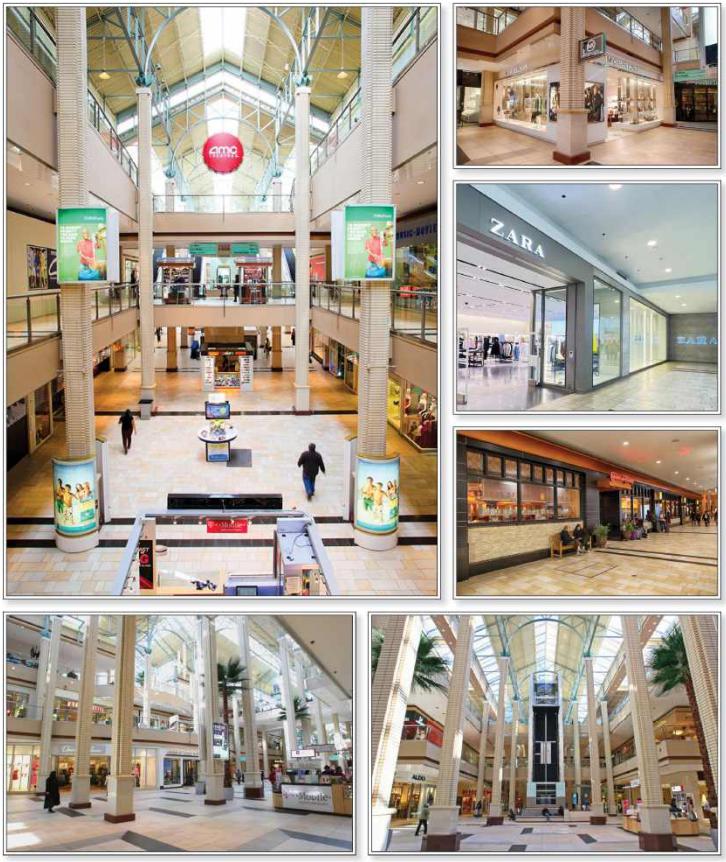

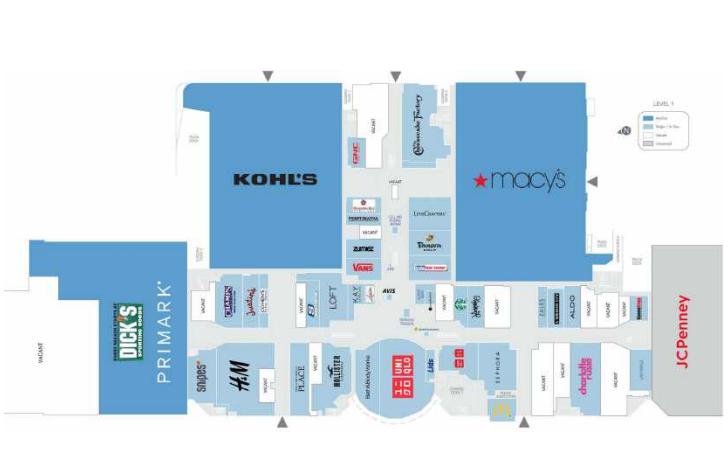

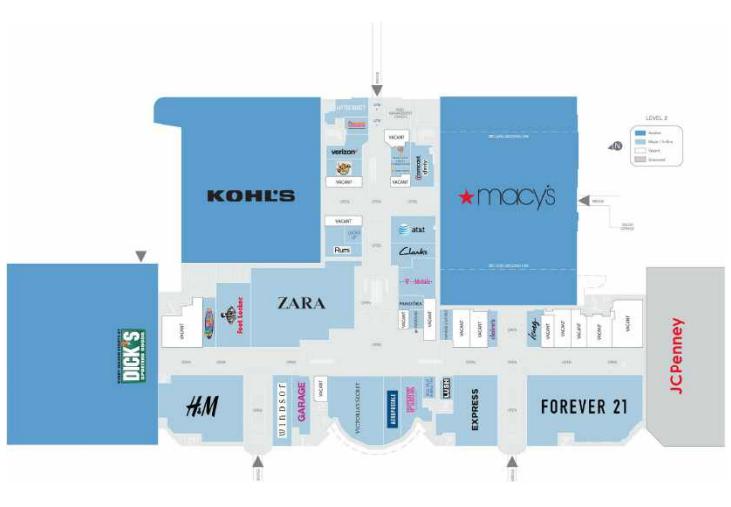

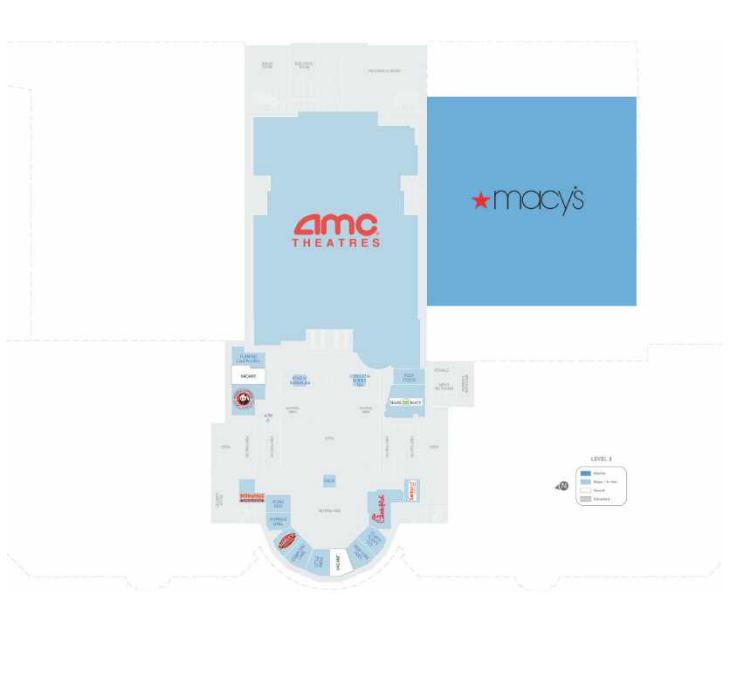

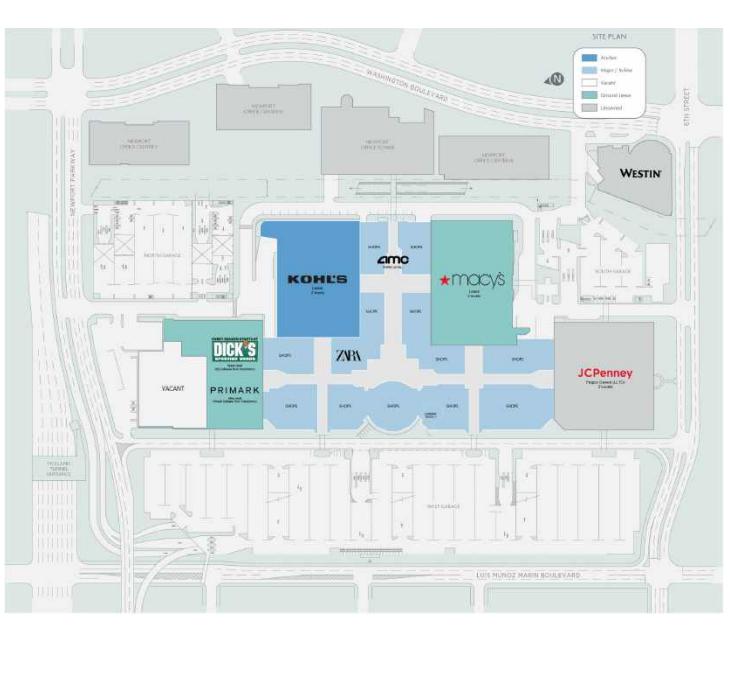

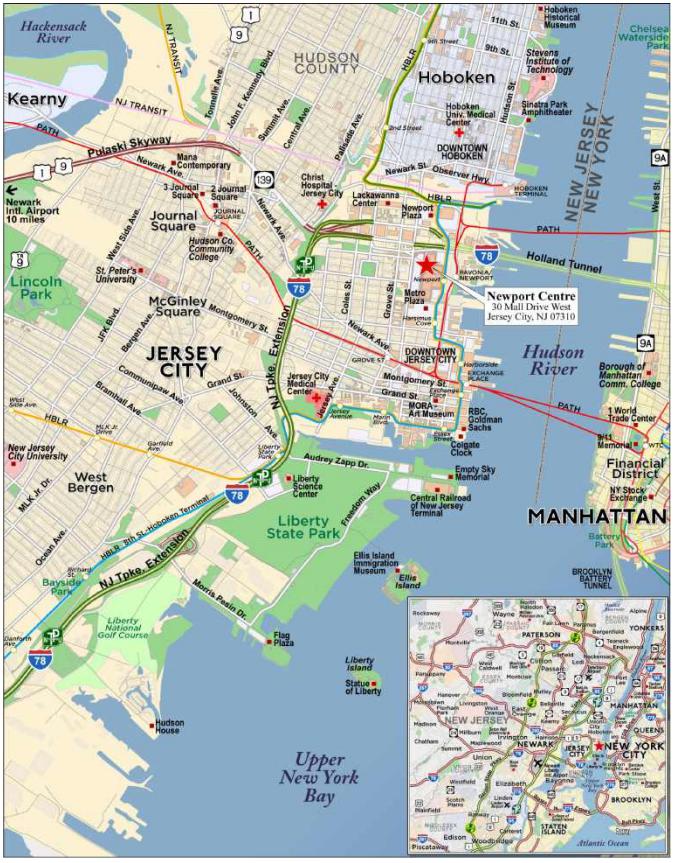

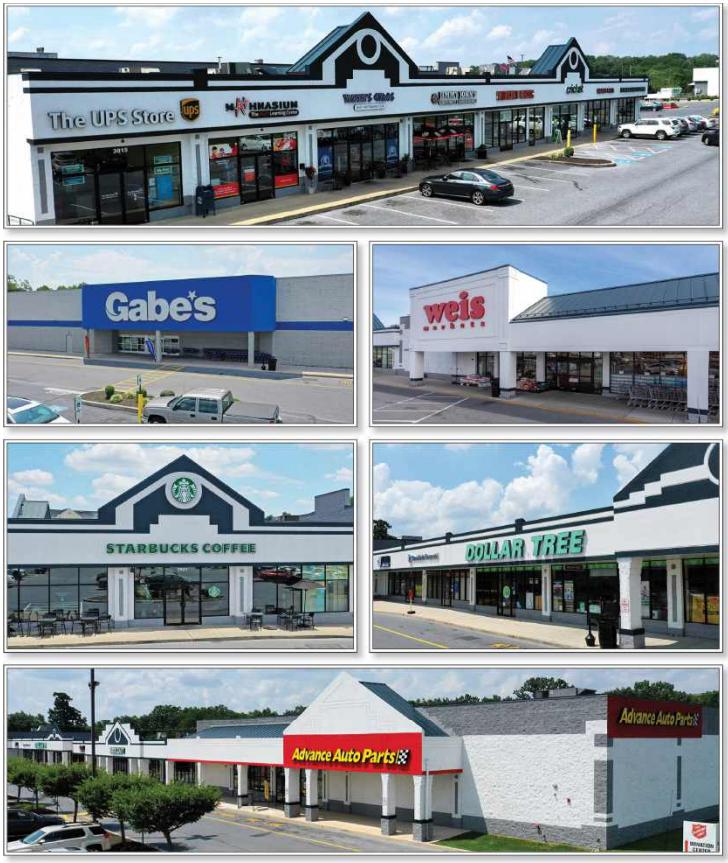

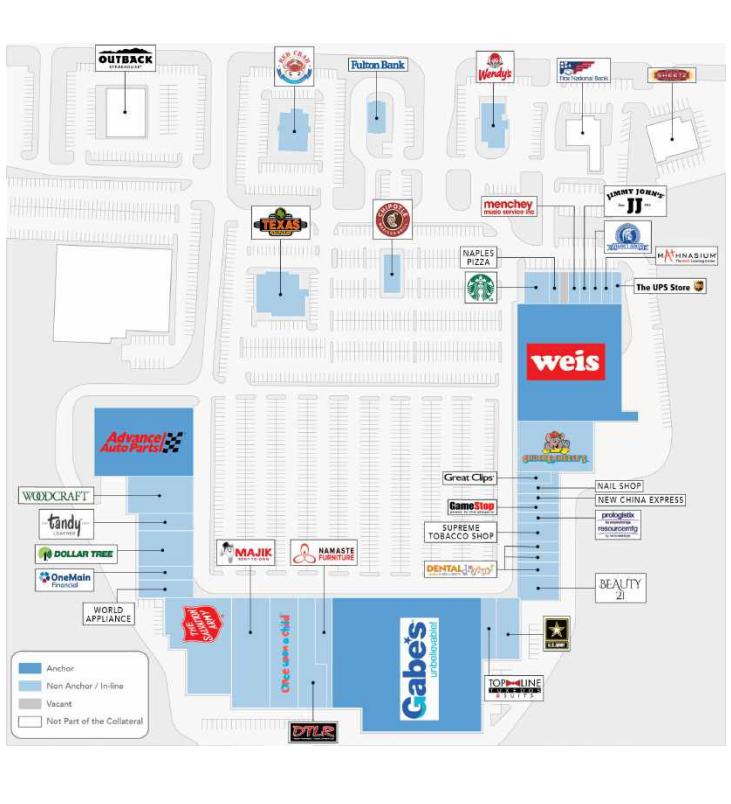

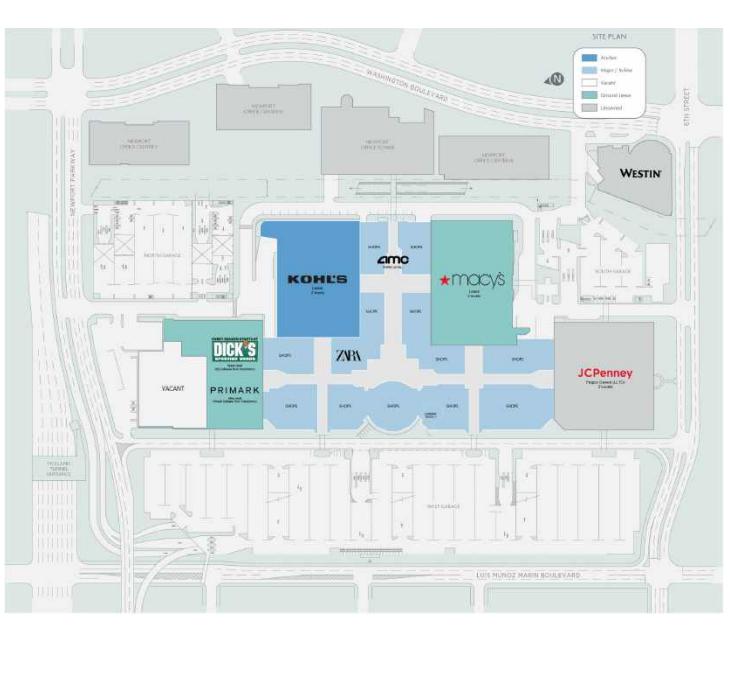

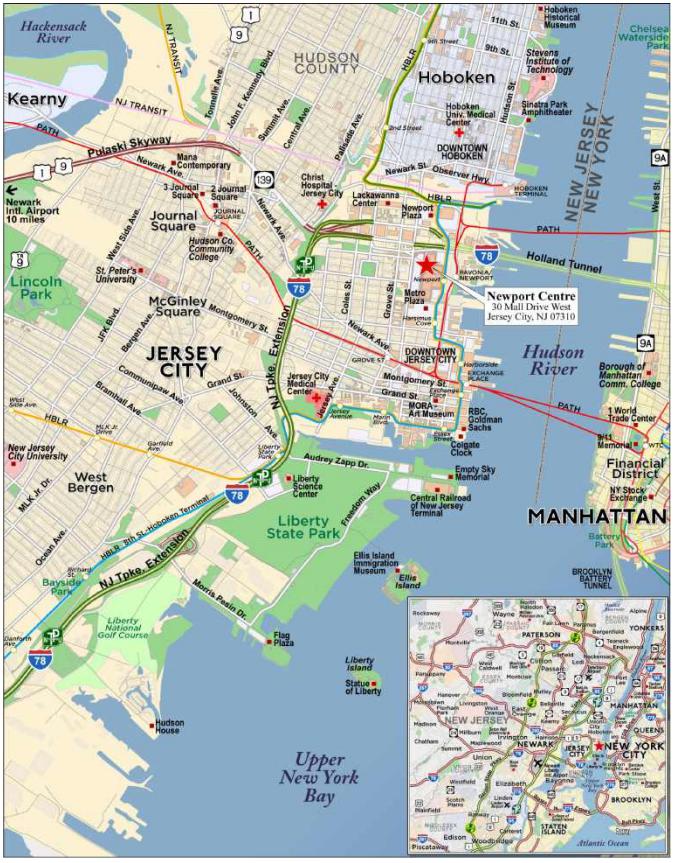

| GSMC | Newport Centre | Jersey City | NJ | 1 / 1 | 28,000,000 | 3.4 | | Retail | 966,186 | 195 | 43.0 | | 43.0 | | 2.66 | | 15.3 | |

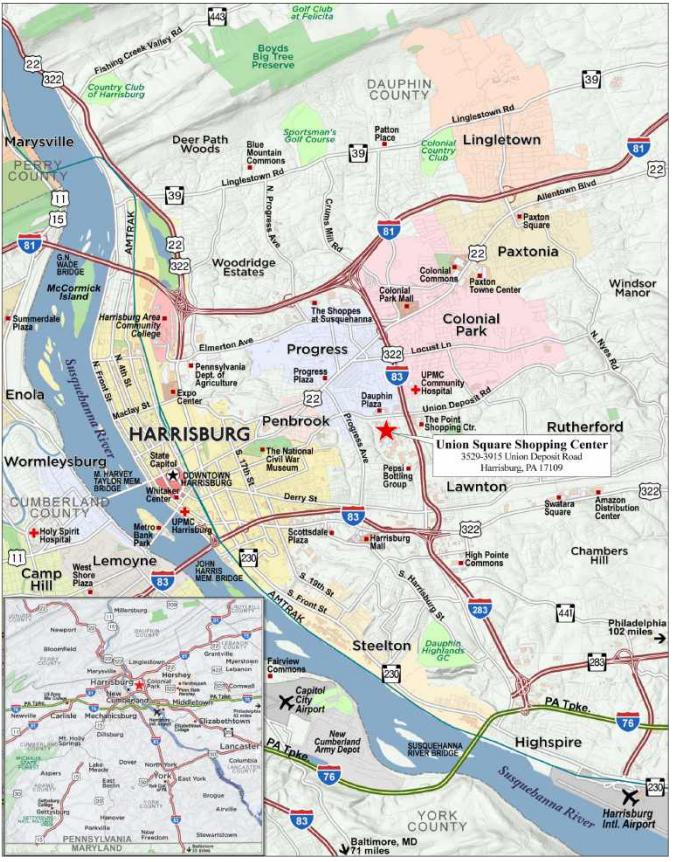

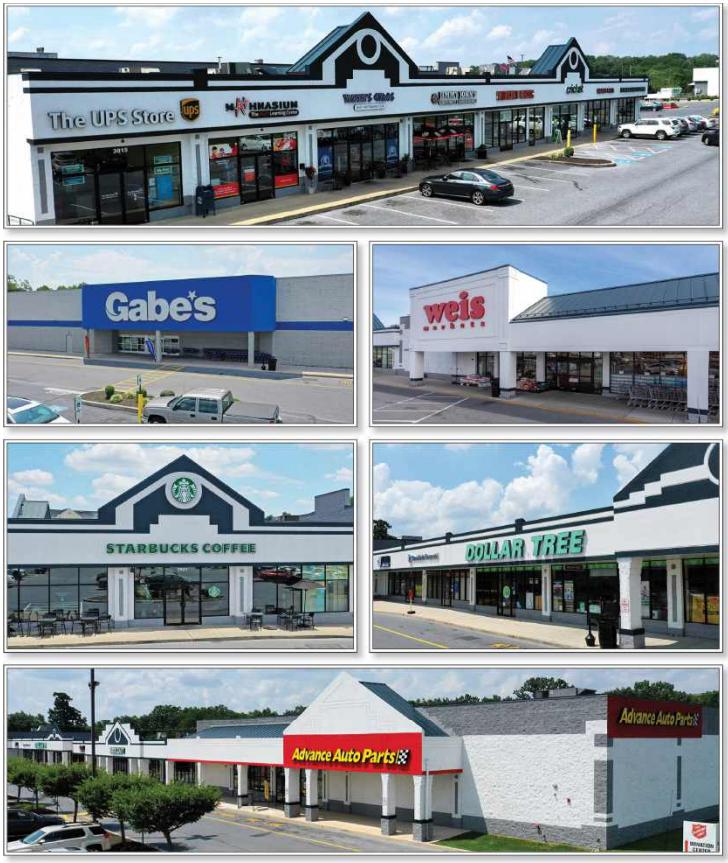

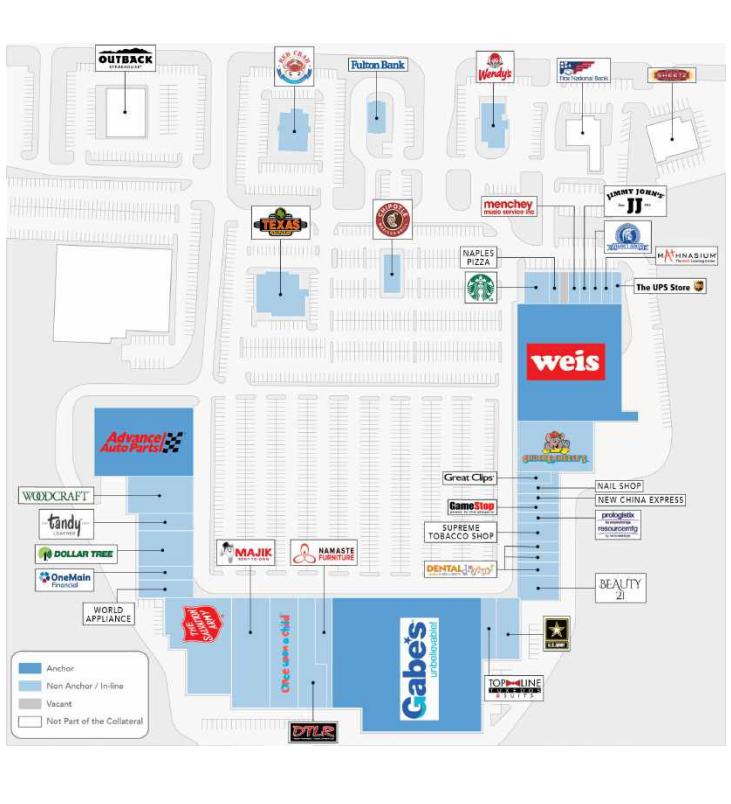

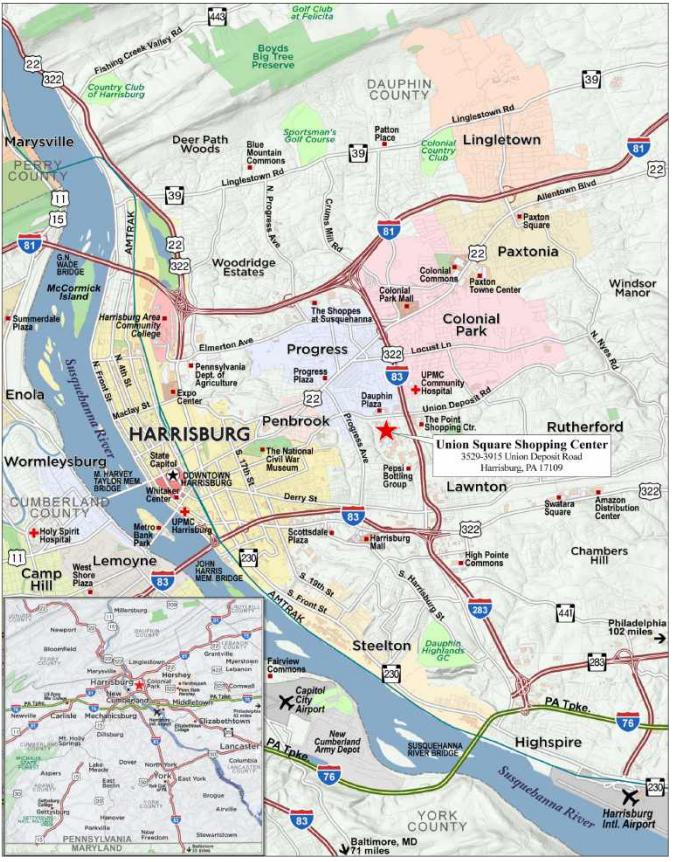

| UBS AG | Union Square Shopping Center | Harrisburg | PA | 1 / 1 | 27,950,000 | 3.4 | | Retail | 307,913 | 91 | 65.0 | | 65.0 | | 1.56 | | 11.2 | |

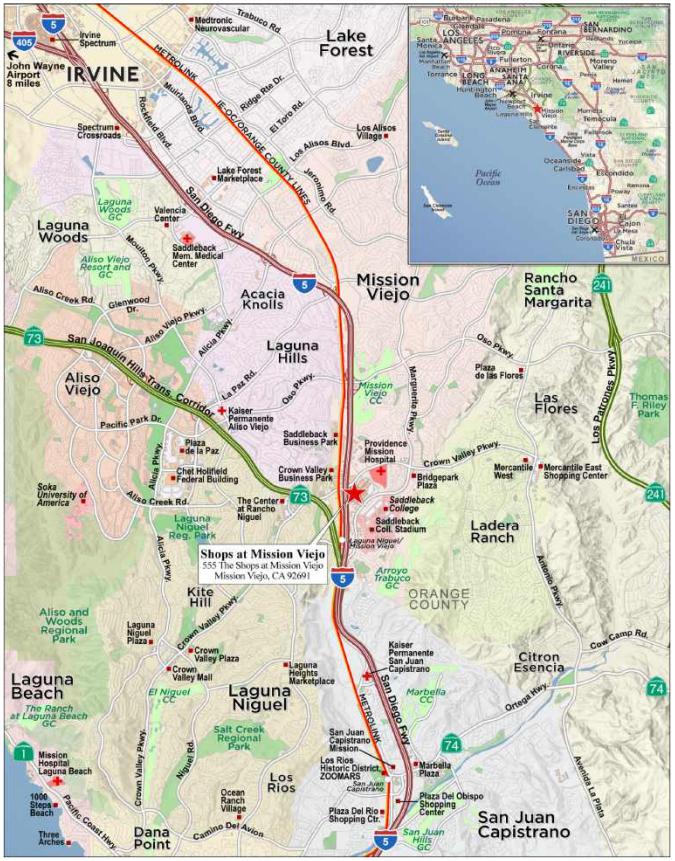

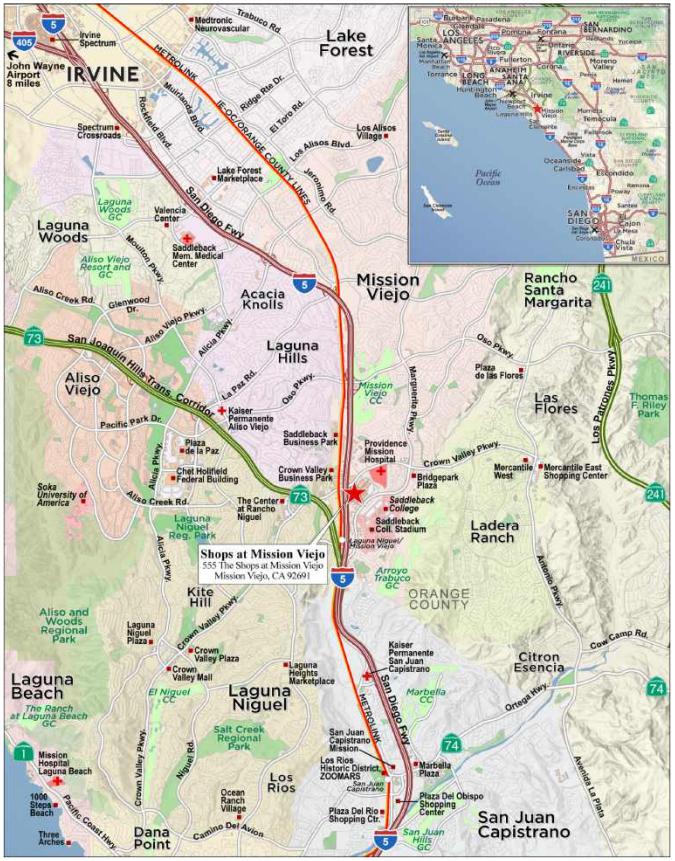

| CREFI | Shops at Mission Viejo | Mission Viejo | CA | 1 / 1 | 25,000,000 | 3.0 | | Retail | 1,012,005 | 178 | 52.4 | | 49.5 | | 1.69 | | 13.4 | |

| Top Three Total/Weighted Average | | 3 / 4 | $224,500,000 | 27.3 | % | | | | 53.6 | % | 53.6 | % | 2.07 | x | 14.3 | % |

| Top Five Total/Weighted Average | | 5 / 15 | $327,400,055 | 39.8 | % | | | | 55.3 | % | 54.2 | % | 1.99 | x | 14.0 | % |

| Top Ten Total/Weighted Average | | 10 / 27 | $483,350,055 | 58.8 | % | | | | 55.0 | % | 54.2 | % | 1.92 | x | 13.3 | % |

| Non-Top Ten Total/Weighted Average | | 22 / 35 | $338,818,701 | 41.2 | % | | | | 53.0 | % | 49.5 | % | 1.64 | x | 13.2 | % |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 9 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Loan No. | Property Name | Mortgage Loan Seller in WFCM 2025-C64 | Mortgage Loan Cut-off Date Balance | Aggregate Pari-Passu Companion Loan Cut-off Date Balance(1) | Combined Cut-off Date Balance | Controlling Pooling / Trust and Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Companion Loan(s) Securitizations | Combined UW NCF DSR(2) | Combined UW NOI Debt Yield(2) | Combined Cut-off Date LTV(2) |

| 3 | Soho Grand & The Roxy Hotel | JPMCB | $70,000,000 | $133,500,000 | $203,500,000 | BANK 2024-BNK48 | Wells Fargo | LNR | BANK 2024-BNK48 | 3.09x | 19.4% | 45.3% |

| 5 | Outlet Shoppes of the Bluegrass | GSMC | $45,900,055 | $19,956,546 | $65,856,600 | WFCM 2025-C64 | Wells Fargo | Rialto Capital Advisors, LLC | Future Securitization | 1.72x | 14.2% | 60.4% |

| 6 | UOVO QPN | BMO | $45,000,000 | $98,000,000 | $143,000,000 | WFCM 2025-C64 | Wells Fargo | Rialto Capital Advisors, LLC | Future Securitization | 1.47x | 9.7% | 60.9% |

| 7 | Phoenix Industrial Portfolio XII | UBS AG | $30,000,000 | $22,500,000 | $52,500,000 | WFCM 2025-C64 | Wells Fargo | Rialto | BBCMS 2025-C32 | 1.60x | 11.7% | 48.1% |

| 8 | Newport Centre | GSMC | $28,000,000 | $160,000,000 | $188,000,000 | BBCMS 2024-C30 | Midland | Rialto Capital Advisors, LLC | BBCMS 2024-C30; BMO 2024-C10; BANK 2024-BNK48 | 2.66x | 15.3% | 43.0% |

| 10 | Shops at Mission Viejo | CREFI | $25,000,000 | $155,000,000 | $180,000,000 | BBCMS 2025-C32 | Midland | Argentic Services Company LP | BBCMS 2025-C32 | 1.69x | 13.4% | 52.4% |

| 11 | 900 North Michigan | GSMC | $25,000,000 | $155,000,000 | $180,000,000 | BBCMS 2024-C28 | Wells Fargo | LNR Partners, LLC | BBCMS 2024-C28; WFCM 2024-C63; BANK 2024-BNK48; BBCMS 2024-C30 | 1.77x | 12.6% | 57.1% |

| 19 | Twin Cities Premium Outlets | Natixis | $20,000,000 | $75,000,000 | $95,000,000 | BBCMS 2024-C30 | Midland | Rialto Capital Advisors, LLC | BBCMS 2024-C30 | 2.01x | 14.3% | 47.0% |

| (1) | The Aggregate Pari Passu Companion Loan Cut-off Date Balance excludes the related Subordinate Companion Loans. |

| (2) | DSCR, Debt Yield and LTV calculations include any related pari passu companion loans and exclude any subordinate companion loans and/or mezzanine loans, as applicable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 10 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Sub Debt Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 2 | WFB | Ventana Residences | $73,500,000 | 8.9% | NAP | $34,750,000 | 6.7547% | 1.25x | 0.78x | 7.9% | 5.4% | 65.6% | 96.7% |

| 3 | JPMCB | Soho Grand & The Roxy Hotel | 70,000,000 | 8.5 | $26,500,000 | NAP | 5.5400 | 3.49 | 3.09 | 21.9 | 19.4 | 40.1 | 45.3 |

| Total/Weighted Average | $143,500,000 | 17.5% | $26,500,000 | $34,750,000 | 6.1622% | 2.34x | 1.91x | 14.7% | 12.2% | 53.2% | 71.6% |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but excludes any related subordinate companion loan or mezzanine debt. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 11 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan No. | Mortgage Loan Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of Cut-off Date Pool Balance (%) | Previous Securitization |

| 3.00 | JPMCB | Soho Grand & The Roxy Hotel | New York | NY | Hospitality | $70,000,000 | 8.5 | % | CSAIL 2015-C1; CSAIL 2015-C2; CSAIL 2015-C3 |

| 4.01 | CREFI | 553 - 555 76th Street Southwest | Byron Center | MI | Industrial | 7,600,000 | 0.9 | | COMM 2015-PC1 |

| 4.02 | CREFI | 3366 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 7,400,000 | 0.9 | | COMM 2015-PC1 |

| 4.03 | CREFI | 8181 Logistics Drive | Zeeland | MI | Industrial | 7,100,000 | 0.9 | | COMM 2015-PC1 |

| 4.04 | CREFI | 3300 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 7,100,000 | 0.9 | | COMM 2015-PC1 |

| 4.05 | CREFI | 3232 Kraft Avenue Southeast | Grand Rapids | MI | Industrial | 6,900,000 | 0.8 | | COMM 2015-PC1 |

| 4.06 | CREFI | 511 76th Street Southwest | Byron Center | MI | Industrial | 6,800,000 | 0.8 | | COMM 2015-PC1 |

| 4.07 | CREFI | 425 Gordon Industrial Court Southwest | Byron Center | MI | Industrial | 5,400,000 | 0.7 | | COMM 2015-PC1 |

| 4.08 | CREFI | 2851 Prairie Street Southwest | Grandville | MI | Industrial | 4,100,000 | 0.5 | | COMM 2015-PC1 |

| 4.09 | CREFI | 100 84th Street Southwest | Byron Center | MI | Industrial | 2,700,000 | 0.3 | | COMM 2015-PC1 |

| 4.10 | CREFI | 5001 Kendrick Street Southeast | Grand Rapids | MI | Industrial | 1,900,000 | 0.2 | | COMM 2015-PC1 |

| 5.00 | GSMC | Outlet Shoppes of the Bluegrass | Simpsonville | KY | Retail | 45,900,055 | 5.6 | | JPMBB 2015-C27 |

| 6.00 | BMO | UOVO QPN | Long Island City | NY | Self Storage | 45,000,000 | 5.5 | | CD 2017-CD4 |

| 8.00 | GSMC | Newport Centre | Jersey City | NJ | Retail | 28,000,000 | 3.4 | | CSMC 2022-NWPT |

| 9.00 | UBS AG | Union Square Shopping Center | Harrisburg | PA | Retail | 27,950,000 | 3.4 | | CGCMT 2015-GC27; JPMCC 2004-C3 |

| 11.00 | GSMC | 900 North Michigan | Chicago | IL | Mixed Use | 25,000,000 | 3.0 | | LBUBS 2005-C3 |

| 15.04 | CREFI | Tuckaway Village MHP | Germantown Hills | IL | Manufactured Housing | 2,150,000 | 0.3 | | WFCM 2015-C31 |

| 15.05 | CREFI | Minot MHP | Minot | ND | Manufactured Housing | 2,020,000 | 0.2 | | CGCMT 2015-GC35 |

| 16.00 | SGFC | Escondido HHSA Building | Escondido | CA | Mixed Use | 21,000,000 | 2.6 | | CSAIL 2016-C5 |

| 19.00 | Natixis | Twin Cities Premium Outlets | Eagan | MN | Retail | 20,000,000 | 2.4 | | GSMS 2014-GC26; CGCMT 2015-GC27 |

| 28.00 | WFB | Security Public Storage | Fairfield | CA | Self Storage | 9,465,474 | 1.2 | | WFRBS 2014-C24 |

| 29.00 | WFB | North Huntingdon Square | Irwin | PA | Retail | 7,974,238 | 1.0 | | JPMBB 2014-C19 |

| 31.00 | CREFI | Skyview Plaza | East Liverpool | OH | Retail | 7,481,998 | 0.9 | | JPMBB 2014-C24 |

| | Total | | | | | $368,941,765 | 44.9 | % | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 12 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| Class A-2(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool

Balance (%) | Mortgage

Loan Balance at Maturity ($) | % of Class A-2 Certificate Principal

Balance (%)(2) | Pads | Loan per

Pad ($) | U/W NCF DSCR

(x) | U/W NOI Debt Yield (%) | Cut-off Date LTV Ratio (%) | Balloon

LTV Ratio (%) | Rem. IO Period (mos.) | Rem. Term to Maturity (mos.) |

| 15 | CREFI | Elevation MHC Portfolio | Various | Manufactured Housing | $21,200,000 | 2.6% | $21,200,000 | 101.0% | 1,139 | $18,613 | 1.44x | 10.4% | 40.5% | 40.5% | 60 | 60 |

| Total/Weighted Average | | | $21,200,000 | 2.6% | $21,200,000 | 101.0% | | 1.44x | 10.4% | 40.5% | 40.5% | 60 | 60 |

| (1) | The table above presents the mortgage loan whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the applicable Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Balance. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 13 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

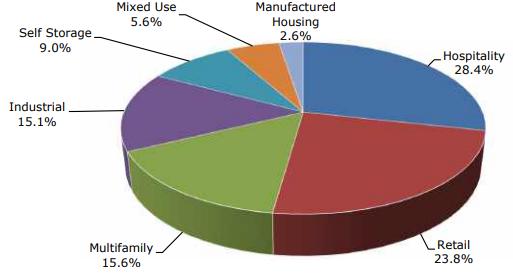

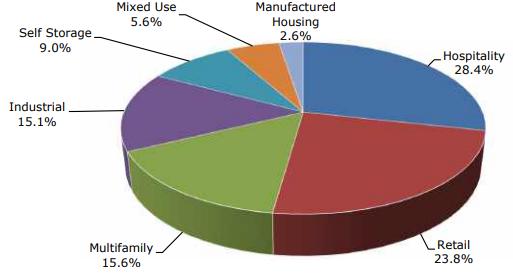

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate Cut-off Date Balance ($) | % of Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon or ARD LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Mortgage Rate (%) |

| Hospitality | 8 | $233,712,386 | 28.4% | 47.6% | 45.7% | 2.28x | 17.5% | 15.5% | 6.8065% |

| Full Service | 4 | 174,550,000 | 21.2 | 47.1 | 47.1 | 2.35 | 17.0 | 15.0 | 6.7208 |

| Extended Stay | 1 | 20,947,971 | 2.5 | 25.7 | 22.1 | 2.99 | 25.6 | 22.3 | 6.3100 |

| Select Service | 1 | 15,800,000 | 1.9 | 72.1 | 59.6 | 1.34 | 13.4 | 12.4 | 7.9900 |

| Limited Service; Extended Stay | 1 | 11,584,466 | 1.4 | 48.5 | 42.1 | 1.98 | 17.3 | 15.5 | 6.7800 |

| Limited Service | 1 | 10,829,949 | 1.3 | 59.8 | 52.9 | 1.64 | 15.3 | 13.8 | 7.4500 |

| Retail | 11 | 195,706,291 | 23.8 | 57.6 | 54.3 | 1.80 | 13.2 | 12.6 | 6.5322 |

| Outlet Center | 2 | 65,900,055 | 8.0 | 56.3 | 50.9 | 1.81 | 14.2 | 13.6 | 6.7949 |

| Anchored | 3 | 55,731,998 | 6.8 | 65.8 | 63.3 | 1.54 | 11.7 | 11.1 | 6.5945 |

| Super Regional Mall | 2 | 53,000,000 | 6.4 | 47.4 | 46.1 | 2.20 | 14.4 | 13.9 | 6.0445 |

| Shadow Anchored | 4 | 21,074,238 | 2.6 | 65.1 | 62.0 | 1.46 | 11.2 | 10.6 | 6.7727 |

| Multifamily | 6 | 127,904,605 | 15.6 | 60.8 | 59.0 | 1.31 | 9.2 | 9.0 | 6.5677 |

| Mid Rise | 1 | 73,500,000 | 8.9 | 65.6 | 65.6 | 1.25 | 7.9 | 7.8 | 6.1660 |

| Garden | 4 | 33,004,605 | 4.0 | 57.0 | 49.9 | 1.28 | 10.6 | 10.4 | 7.1560 |

| Student Housing | 1 | 21,400,000 | 2.6 | 50.4 | 50.4 | 1.55 | 11.5 | 11.1 | 7.0400 |

| Industrial | 21 | 123,780,000 | 15.1 | 51.4 | 50.8 | 1.73 | 12.4 | 11.6 | 6.5346 |

| Warehouse/Distribution | 9 | 41,881,018 | 5.1 | 53.2 | 53.2 | 1.76 | 12.2 | 11.3 | 6.3512 |

| Warehouse | 6 | 37,001,651 | 4.5 | 56.5 | 56.5 | 1.86 | 12.5 | 11.7 | 6.2240 |

| Manufacturing/Warehouse | 1 | 24,000,000 | 2.9 | 38.1 | 35.2 | 1.55 | 12.9 | 12.6 | 7.1950 |

| Manufacturing/Distribution | 2 | 12,780,000 | 1.6 | 56.1 | 56.1 | 1.60 | 12.0 | 11.1 | 6.8400 |

| Manufacturing | 3 | 8,117,331 | 1.0 | 50.3 | 50.3 | 1.67 | 11.9 | 10.9 | 6.4634 |

| Self Storage | 3 | 73,865,474 | 9.0 | 60.2 | 59.2 | 1.46 | 9.8 | 9.8 | 6.4396 |

| Self Storage | 3 | 73,865,474 | 9.0 | 60.2 | 59.2 | 1.46 | 9.8 | 9.8 | 6.4396 |

| Mixed Use | 2 | 46,000,000 | 5.6 | 59.3 | 55.8 | 1.64 | 12.6 | 12.2 | 6.9489 |

| Retail/Office | 1 | 25,000,000 | 3.0 | 57.1 | 57.1 | 1.77 | 12.6 | 12.3 | 6.8530 |

| Office/Retail | 1 | 21,000,000 | 2.6 | 61.9 | 54.2 | 1.49 | 12.7 | 12.0 | 7.0630 |

| Manufactured Housing | 11 | 21,200,000 | 2.6 | 40.5 | 40.5 | 1.44 | 10.4 | 10.1 | 6.9500 |

| Manufactured Housing | 11 | 21,200,000 | 2.6 | 40.5 | 40.5 | 1.44 | 10.4 | 10.1 | 6.9500 |

| Total/Weighted Average | 62 | $822,168,756 | 100.0% | 54.2% | 52.2% | 1.80x | 13.3% | 12.4% | 6.6418% |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 14 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

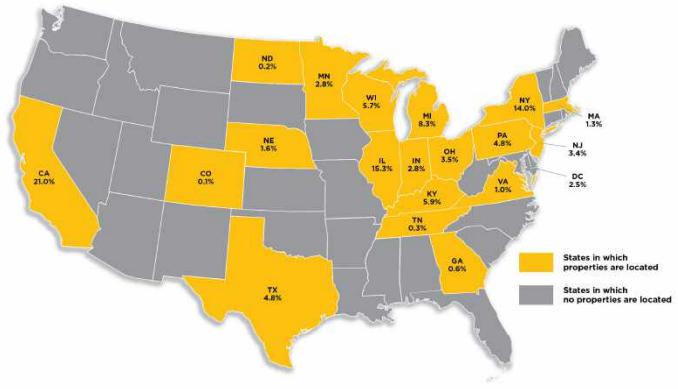

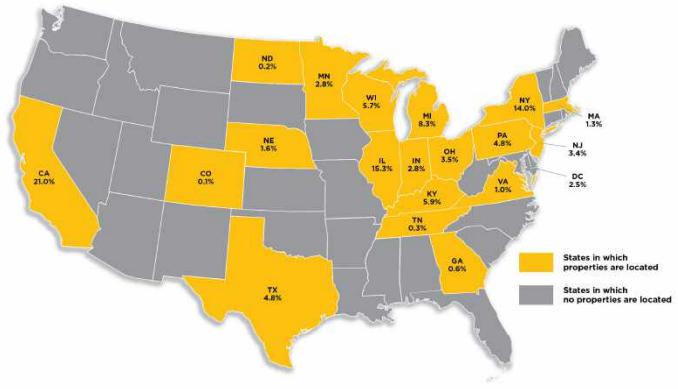

| G. | Geographic Distribution(1)(2) |

| Location | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of

Cut-off Date Balance (%) | Weighted Average Cut-off Date LTV Ratio (%) | Weighted Average Balloon LTV Ratio (%) | Weighted Average U/W NCF DSCR (x) | Weighted Average U/W NOI Debt Yield (%) | Weighted Average U/W NCF Debt Yield (%) | Weighted Average Interest Rate (%) |

| California | 6 | | $172,365,474 | 21.0 | % | 58.3 | % | 56.1 | % | 1.42 | x | 10.3 | % | 10.1 | % | 6.5336 | % |

| Northern California | 3 | | 102,365,474 | 12.5 | | 63.7 | | 63.0 | | 1.31 | | 8.5 | | 8.4 | | 6.2232 | |

| Southern California | 3 | | 70,000,000 | 8.5 | | 50.3 | | 46.0 | | 1.58 | | 13.0 | | 12.6 | | 6.9875 | |

| Illinois | 6 | | 126,188,074 | 15.3 | | 53.2 | | 53.2 | | 1.61 | | 12.9 | | 11.6 | | 7.1096 | |

| New York | 3 | | 115,000,000 | 14.0 | | 48.2 | | 48.2 | | 2.70 | | 17.1 | | 15.7 | | 5.9098 | |

| Michigan | 11 | | 68,584,466 | 8.3 | | 56.1 | | 55.0 | | 1.91 | | 13.4 | | 12.5 | | 6.2813 | |

| Kentucky | 2 | | 48,265,942 | 5.9 | | 59.8 | | 52.4 | | 1.71 | | 14.1 | | 13.5 | | 6.8239 | |

| Wisconsin | 11 | | 46,478,484 | 5.7 | | 53.9 | | 48.9 | | 1.36 | | 10.9 | | 10.4 | | 7.0073 | |

| Other(3) | 23 | | 245,286,316 | 29.8 | | 53.0 | | 50.8 | | 1.82 | | 14.0 | | 13.0 | | 6.8162 | |

| Total/Weighted Average | 62 | | $822,168,756 | 100.0 | % | 54.2 | % | 52.2 | % | 1.80 | x | 13.3 | % | 12.4 | % | 6.6418 | % |

| (1) | The mortgaged properties are located in 19 states and the District of Columbia. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated loan amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate) and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized or cross-defaulted with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio and debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group (without regard to any limitation on the amount of indebtedness secured by any mortgaged property in such cross-collateralized group). On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate secured loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 13 other states and the District of Columbia. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 15 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7,284,605 - 8,000,000 | 4 | $30,410,841 | 3.7 | % |

| 8,000,001 - 9,000,000 | 1 | 8,600,000 | 1.0 | |

| 9,000,001 - 10,000,000 | 2 | 18,915,474 | 2.3 | |

| 10,000,001 - 15,000,000 | 4 | 48,294,415 | 5.9 | |

| 15,000,001 - 20,000,000 | 3 | 55,200,000 | 6.7 | |

| 20,000,001 - 30,000,000 | 12 | 288,347,971 | 35.1 | |

| 30,000,001 - 50,000,000 | 2 | 90,900,055 | 11.1 | |

| 50,000,001 - 70,000,000 | 2 | 127,000,000 | 15.4 | |

| 70,000,001 - 80,000,000 | 1 | 73,500,000 | 8.9 | |

| 80,000,001 - 81,000,000 | 1 | 81,000,000 | 9.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Average: | $25,692,774 | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.27 - 1.30 | 1 | $73,500,000 | 8.9 | % |

| 1.31 - 1.40 | 5 | 52,404,605 | 6.4 | |

| 1.41 - 1.50 | 3 | 82,000,000 | 10.0 | |

| 1.51 - 1.60 | 5 | 86,374,238 | 10.5 | |

| 1.61 - 1.70 | 3 | 58,815,474 | 7.2 | |

| 1.71 - 1.80 | 5 | 98,811,998 | 12.0 | |

| 1.81 - 1.90 | 4 | 162,730,003 | 19.8 | |

| 1.91 - 2.00 | 1 | 57,000,000 | 6.9 | |

| 2.01 - 2.25 | 2 | 31,584,466 | 3.8 | |

| 2.26 - 3.00 | 1 | 28,000,000 | 3.4 | |

| 3.01 - 3.50 | 1 | 20,947,971 | 2.5 | |

| 3.51 - 3.91 | 1 | 70,000,000 | 8.5 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 1.93x | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7.9 - 8.0 | 1 | $73,500,000 | 8.9 | % |

| 8.1 - 12.1 | 15 | 261,574,317 | 31.8 | |

| 12.2 - 16.1 | 13 | 384,562,001 | 46.8 | |

| 16.2 - 20.1 | 1 | 11,584,466 | 1.4 | |

| 20.2 - 25.6 | 2 | 90,947,971 | 11.1 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 13.3% | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Refinance | 29 | $769,688,756 | 93.6 | % |

| Acquisition | 2 | 39,700,000 | 4.8 | |

| Recapitalization | 1 | 12,780,000 | 1.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| MORTGAGE RATE |

Range of Mortgage

Rates (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 5.4370 - 5.5000 | 1 | $28,000,000 | 3.4 | % |

| 5.5001 - 5.7500 | 1 | 70,000,000 | 8.5 | |

| 5.7501 - 6.0000 | 1 | 9,465,474 | 1.2 | |

| 6.0001 - 6.2500 | 2 | 130,500,000 | 15.9 | |

| 6.2501 - 6.5000 | 4 | 81,404,207 | 9.9 | |

| 6.5001 - 6.7500 | 6 | 142,650,000 | 17.4 | |

| 6.7501 - 7.0000 | 6 | 123,749,126 | 15.1 | |

| 7.0001 - 7.2500 | 7 | 105,220,000 | 12.8 | |

| 7.2501 - 7.5000 | 2 | 91,829,949 | 11.2 | |

| 7.5001 - 8.3450 | 2 | 39,350,000 | 4.8 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 6.6418% | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 1.25 - 1.30 | 5 | $106,504,605 | 13.0 | % |

| 1.31 - 1.40 | 2 | 35,200,000 | 4.3 | |

| 1.41 - 1.50 | 6 | 128,574,238 | 15.6 | |

| 1.51 - 1.60 | 9 | 237,627,472 | 28.9 | |

| 1.61 - 1.70 | 2 | 35,829,949 | 4.4 | |

| 1.71 - 1.80 | 2 | 70,900,055 | 8.6 | |

| 1.81 - 1.90 | 1 | 57,000,000 | 6.9 | |

| 1.91 - 2.00 | 1 | 11,584,466 | 1.4 | |

| 2.01 - 2.25 | 1 | 20,000,000 | 2.4 | |

| 2.26 - 2.75 | 1 | 28,000,000 | 3.4 | |

| 2.76 - 3.00 | 1 | 20,947,971 | 2.5 | |

| 3.01 - 3.49 | 1 | 70,000,000 | 8.5 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 1.80x | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate

Cut-off Date Balance ($) | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 7.8 - 8.1 | 1 | $73,500,000 | 8.9 | % |

| 8.2 - 12.1 | 19 | 428,056,315 | 52.1 | |

| 12.2 - 16.1 | 10 | 229,664,470 | 27.9 | |

| 16.2 - 22.3 | 2 | 90,947,971 | 11.1 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 12.4% | | |

(1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity) and may be currently prepayable. |

| THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. |

| | 16 | |

| Wells Fargo Commercial Mortgage Trust 2025-C64 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Original Terms to

Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 60 | 1 | $21,200,000 | 2.6 | % |

| 120 | 31 | 800,968,756 | 97.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 118 months | | |

| REMAINING TERM TO MATURITY |

Range of Remaining

Terms to Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 60 | 1 | $21,200,000 | 2.6 | % |

| 114 - 120 | 31 | 800,968,756 | 97.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 116 months | | |

| ORIGINAL AMORTIZATION TERM(1) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 16 | $568,880,000 | 69.2 | % |

| 300 | 1 | 15,800,000 | 1.9 | |

| 360 | 15 | 237,488,756 | 28.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average(3): | 356 months | | |

| REMAINING AMORTIZATION TERM(2) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Non-Amortizing | 16 | $568,880,000 | 69.2 | % |

| 300 | 1 | 15,800,000 | 1.9 | |

| 356 - 360 | 15 | 237,488,756 | 28.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average(3): | 355 months | | |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Hard / Springing Cash Management | 14 | $486,374,293 | 59.2 | % |

| Springing | 15 | 204,514,463 | 24.9 | |

| Soft / Springing Cash Management | 2 | 118,500,000 | 14.4 | |

| Hard / In Place Cash Management | 1 | 12,780,000 | 1.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Lockout / Defeasance / Open | 19 | $428,148,677 | 52.1 | % |

| Lockout / GRTR 1% or YM / Open | 11 | 339,554,605 | 41.3 | |

| Lockout / GRTR 1% or YM or Defeasance / Open | 2 | 54,465,474 | 6.6 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off

Date LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 25.7 - 30.0 | 1 | $20,947,971 | 2.5 | % |

| 30.1 - 40.0 | 1 | 24,000,000 | 2.9 | |

| 40.1 - 45.0 | 4 | 142,750,000 | 17.4 | |

| 45.1 - 50.0 | 3 | 61,584,466 | 7.5 | |

| 50.1 - 55.0 | 4 | 136,865,474 | 16.6 | |

| 55.1 - 60.0 | 10 | 154,070,790 | 18.7 | |

| 60.1 - 65.0 | 5 | 159,250,055 | 19.4 | |

| 65.1 - 70.0 | 3 | 106,900,000 | 13.0 | |

| 70.1 - 72.1 | 1 | 15,800,000 | 1.9 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 54.2% | | |

| BALLOON LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 22.1 - 25.0 | 1 | $20,947,971 | 2.5 | % |

| 25.1 - 40.0 | 1 | 24,000,000 | 2.9 | |

| 40.1 - 45.0 | 6 | 163,799,940 | 19.9 | |

| 45.1 - 50.0 | 6 | 100,720,000 | 12.3 | |

| 50.1 - 55.0 | 8 | 202,870,844 | 24.7 | |

| 55.1 - 60.0 | 4 | 110,580,000 | 13.4 | |

| 60.1 - 65.0 | 3 | 92,350,000 | 11.2 | |

| 65.1 - 68.8 | 3 | 106,900,000 | 13.0 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 52.2% | | |

| AMORTIZATION TYPE |

| Amortization Type | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| Interest Only | 16 | $568,880,000 | 69.2 | % |

| Amortizing Balloon | 13 | 183,988,756 | 22.4 | |

Interest Only, Amortizing

Balloon | 3 | 69,300,000 | 8.4 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 36 | 1 | $24,000,000 | 2.9 | % |

| 60 | 2 | 45,300,000 | 5.5 | |

| Total: | 3 | $69,300,000 | 8.4 | % |

| Weighted Average: | 52 months | | |

| SEASONING |

| Seasoning (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | Percent by

Aggregate

Cut-off Date

Pool Balance (%) |

| 0 | 8 | $202,220,000 | 24.6 | % |

| 1 | 4 | 153,550,000 | 18.7 | |

| 2 | 6 | 115,784,466 | 14.1 | |

| 3 | 9 | 210,174,578 | 25.6 | |

| 4 | 2 | 17,439,712 | 2.1 | |

| 5 | 2 | 98,000,000 | 11.9 | |

| 6 | 1 | 25,000,000 | 3.0 | |

| Total: | 32 | $822,168,756 | 100.0 | % |

| Weighted Average: | 2 months | | |