- CGNX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Cognex (CGNX) PRE 14APreliminary proxy

Filed: 25 Feb 16, 12:00am

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant x

Check the appropriate box

| x | Preliminary Proxy Statement | |

| ¨ | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

COGNEX CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| 1 | Title of each class of securities to which transaction applies:

| |||

| 2 | Aggregate number of securities to which transaction applies:

| |||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4 | Proposed maximum aggregate value of transaction:

| |||

| 5 | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1 | Amount Previously Paid:

| |||

| 2 | Form, Schedule or Registration Statement No.:

| |||

| 3 | Filing Party:

| |||

| 4 | Date Filed:

| |||

COGNEX CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 28, 2016

To the Shareholders:

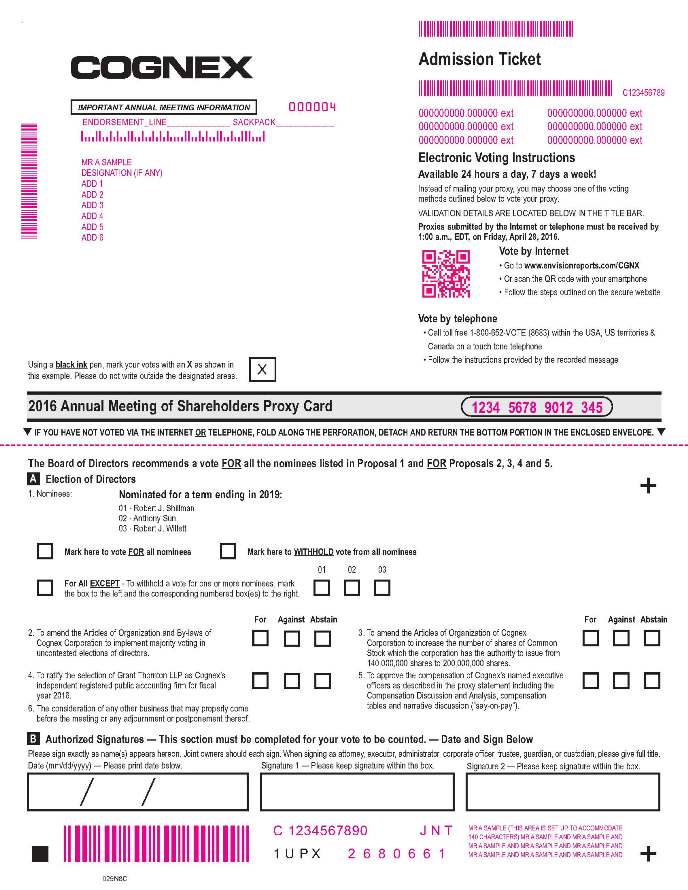

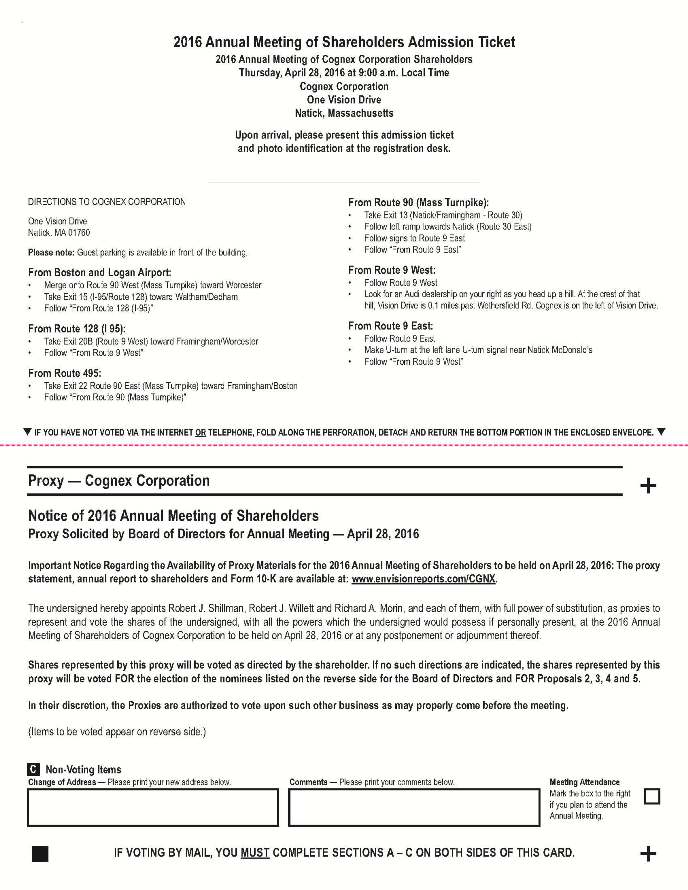

The 2016 Annual Meeting of Shareholders of COGNEX CORPORATION will be held at 9:00 a.m. local time on Thursday, April 28, 2016, at Cognex’s headquarters at One Vision Drive, Natick, Massachusetts, for the following purposes:

| 1. | To elect three Directors to serve for a term of three years, all as more fully described in the proxy statement for the meeting; |

| 2. | To amend our Articles of Organization and By-laws to implement majority voting for uncontested elections of directors; |

| 3. | To amend our Articles of Organization to increase the number of shares of common stock that we have the authority to issue from 140,000,000 to 200,000,000 shares; |

| 4. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2016; |

| 5. | To cast a non-binding advisory vote to approve executive compensation (“say-on-pay”); and |

| 6. | To consider and act upon any other business that may properly come before the meeting or any adjournment or postponement thereof. |

The Board of Directors has fixed the close of business on March 4, 2016 as the record date for the meeting. All shareholders of record on that date are entitled to receive notice of and to vote at the meeting.

The proposal for the election of Directors relates solely to the election of three Directors nominated by the Board of Directors and does not include any other matters relating to the election of Directors, including, without limitation, the election of Directors nominated by any shareholder of Cognex Corporation.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES BY TELEPHONE, VIA THE INTERNET, OR BY COMPLETING AND RETURNING A PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY CONTINUE TO HAVE YOUR SHARES VOTED AS INSTRUCTED IN THE PROXY OR YOU MAY WITHDRAW YOUR PROXY AT THE MEETING AND VOTE YOUR SHARES IN PERSON.

By Order of the Board of Directors

Richard A. Morin,Secretary

Natick, Massachusetts

March ●, 2016

Important

Please note that due to security procedures, you may be required to show a form of picture identification to gain access to our headquarters. Please contact the Cognex Department of Investor Relations at (508) 650-3000 if you plan to attend the meeting.

| 1 | ||||

• General | 1 | |||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

• Compensation/Stock Option Committee Interlocks and Insider Participation | 9 | |||

| 9 | ||||

| 9 | ||||

| 11 | ||||

| 11 | ||||

| 11 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

• Discussion of Summary Compensation and Grants of Plan-Based Awards Tables | 25 | |||

| 26 | ||||

| 26 |

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm | 33 | |||

| 33 | ||||

• Fees Paid to Independent Registered Public Accounting Firm and Other Matters | 33 | |||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| A-1 |

COGNEX CORPORATION

PROXY STATEMENT

INFORMATION ABOUT THE MEETING AND VOTING PROCEDURES

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors of Cognex Corporation (“Cognex”) for use at the 2016 Annual Meeting of Shareholders to be held at 9:00 a.m. local time on Thursday, April 28, 2016, at our headquarters at One Vision Drive, Natick, Massachusetts 01760, and at any adjournments or postponements of that meeting. Our telephone number is (508) 650-3000. At this meeting, shareholders will consider and vote on the following proposals:

| 1. | To elect three Directors to serve for a term of three years, all as more fully described in this proxy statement; |

| 2. | To amend our Articles of Organization and By-laws to implement majority voting for uncontested elections of directors; |

| 3. | To amend our Articles of Organization to increase the number of shares of common stock that we have the authority to issue from 140,000,000 to 200,000,000 shares; |

| 4. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2016; |

| 5. | To cast a non-binding advisory vote to approve executive compensation (“say-on-pay”); and |

| 6. | To consider and act upon any other business which may properly come before the meeting or any adjournment or postponement thereof. |

This proxy statement is first being made available to our shareholders on or about March ●, 2016.

Shareholders of record at the close of business on March 4, 2016 (the “Record Date”) are entitled to receive notice of and to vote at the meeting. As of the close of business on the Record Date, there were ● shares of our common stock outstanding and entitled to vote. Each outstanding share of our common stock entitles the record holder to one vote.

The holders of a majority of our common stock outstanding on the Record Date for the meeting are required to be present in person or be represented by proxy at the meeting in order to constitute a quorum for the transaction of business. Following the determination of a quorum, the vote required for approval of the matters to be considered at the meeting is as follows:

| • | The election of a nominee for Director will be decided by a plurality of the votes cast. Votes may be cast for or withheld from each nominee. The majority vote standard, if approved as described in this proxy statement, would be applicable to the election of Cognex Directors at the 2017 Annual Meeting of Shareholders (if uncontested). |

| • | The affirmative vote of the holders of at least two-thirds of the outstanding shares of common stock on the Record Date is required to approve the amendments to our Articles of Organization and By-laws to implement a majority voting standard in uncontested elections of directors. |

| • | The affirmative vote of the holders of at least a majority of the shares of common stock outstanding on the Record Date is required to approve the increase in the number of shares of common stock which Cognex has the authority to issue. |

1

| • | The affirmative vote of a majority of the votes cast at the meeting is required to approve the ratification of the selection of our independent registered public accounting firm and the non-binding advisory proposal regarding executive compensation. |

Treatment of Abstentions and Broker Non-Votes

We will count both abstentions and broker “non-votes” as present for the purpose of determining the existence of a quorum for the transaction of business. A broker “non-vote” refers to shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter. For the purpose of determining the number of shares voting on a particular proposal, we will not count abstentions and broker “non-votes” as votes cast or shares voting. As a result, abstentions and broker non-votes will have no effect on the voting for the election of Directors, the ratification of the selection of our independent registered public accounting firm or the non-binding advisory proposal regarding executive compensation. Abstentions and broker non-votes will have the same effect as a vote against proposals 2 and 3 regarding the proposed amendments to our Articles of Organization and By-laws.

If you received a paper copy of the proxy materials, you may vote your shares by submitting the proxy card accompanying this material for use at the meeting. Please complete, date, sign and submit the proxy card as instructed. You may also vote your shares by telephone or via the Internet by following the instructions included on the proxy card or on the Notice of Internet Availability of Proxy Materials. The Internet and telephone voting facilities for shareholders of record will close at 1:00 a.m. Eastern time on April 28, 2016.

Our Board of Directors recommends an affirmative vote on all proposals described in the notice for the meeting. Proxies will be voted as specified. If your proxy is properly submitted, it will be voted in the manner that you direct.If you do not specify instructions with respect to any particular matter to be acted upon at the meeting, proxies will be voted in favor of the Board of Directors’ recommendations as set forth in this proxy statement.

You may revoke your proxy at any time before your proxy is voted at the meeting by:

| • | giving written notice of revocation of your proxy to the Secretary of Cognex; |

| • | completing and submitting a new proxy card relating to the same shares and bearing a later date; |

| • | properly casting a new vote through the Internet or by telephone at any time before the closure of the Internet or telephone voting facilities; or |

| • | voting in person at the meeting, although meeting attendance will not, by itself, revoke a proxy. |

The cost of this solicitation will be borne by Cognex. It is expected that the solicitation will be made primarily by mail, but regular employees or representatives of Cognex (none of whom will receive any extra compensation for their activities) may also solicit proxies by telephone, email, fax and in person and arrange for brokerage houses and other custodians, nominees and fiduciaries to send proxy materials to their principals at our expense.

How to Obtain an Annual Report on Form 10-K

Our Annual Report on Form 10-K, including the financial statements and schedules to such report, required to be filed with the Securities and Exchange Commission (SEC) for our most recent fiscal year is available on our website at www.cognex.com under “Company—Investor Information—Financial

2

Information—SEC Filings.” Shareholders can send a written request to Investor Relations at Cognex Corporation, One Vision Drive, Natick, Massachusetts 01760 or by email at IR@cognex.com and we will provide a printed copy to such person without charge.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may send only one copy of our proxy statement and annual report to multiple shareholders in the same household unless contrary instructions were received. To obtain a copy of either document, please contact Cognex Investor Relations at the mailing address or email address noted above. To receive a copy of either document in the future, or if you are receiving multiple copies and want to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above mailing or email address.

If you have any questions about the meeting or your ownership of our common stock, please contact Cognex Investor Relations at the above mailing or email address.

3

Security Ownership of Certain Beneficial Owners

The following table shows as of the Record Date, any person who is known by us to be the beneficial owner of more than five percent of our common stock. For purposes of this proxy statement, beneficial ownership is defined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Accordingly, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, agreement, understanding, relationship or otherwise has or shares the power to vote such security or to dispose of such security.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class(1) | ||||||

Brown Capital Management, LLC | 6,275,552 | (2) | ● | |||||

1201 N. Calvert Street | ||||||||

Baltimore, MD 21202 | ||||||||

BlackRock, Inc. | 5,760,487 | (3) | ● | |||||

55 East 52nd Street | ||||||||

New York, NY 10055 | ||||||||

The Vanguard Group, Inc. | 5,603,077 | (4) | ● | |||||

100 Vanguard Blvd. | ||||||||

Malvern, PA 19355 | ||||||||

T. Rowe Price Associates, Inc. | 4,714,576 | (5) | ● | |||||

100 E. Pratt Street | ||||||||

Baltimore, MD 21202 | ||||||||

| (1) | Percentages are calculated on the basis of ● shares of our common stock outstanding as of March 4, 2016. |

| (2) | Information regarding Brown Capital Management, LLC is based solely upon a Schedule 13G filed by Brown Capital with the SEC on February 16, 2016, which indicates that Brown Capital held sole voting power over 3,550,237 shares and sole dispositive power over 6,275,552 shares. Per the Schedule 13G, the shares beneficially owned by Brown Capital were held by various investment advisory clients with no individual client holding more than five percent of the class. |

| (3) | Information regarding BlackRock, Inc. is based solely upon a Schedule 13G filed by BlackRock with the SEC on January 26, 2016, which indicates that BlackRock held sole voting power over 5,479,079 shares and sole dispositive power over 5,760,487 shares. |

| (4) | Information regarding The Vanguard Group, Inc. is based solely upon a Schedule 13G filed by The Vanguard Group with the SEC on February 11, 2016, which indicates that The Vanguard Group held sole voting power over 63,018 shares, shared voting power over 4,200 shares, sole dispositive power over 5,540,859 shares and shared dispositive power over 62,218 shares. Per the Schedule 13G, Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 58,018 shares as a result of its serving as investment manager of collective trust accounts. Also, Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 9,200 shares as a result of its serving as investment manager of Australian investment offerings. |

| (5) | Information regarding T. Rowe Price Associates, Inc. is based solely upon a Schedule 13G filed by Price Associates with the SEC on February 12, 2016, which indicates that Price Associates held sole voting power over 2,251,116 shares and sole dispositive power over 4,714,576 shares. |

4

Security Ownership of Directors and Executive Officers

The following information is furnished as of the Record Date, with respect to our common stock beneficially owned within the meaning of Rule 13d-3 of the Exchange Act by each of our Directors, each Director nominee, each of the “named executive officers” (as defined in Item 402(a)(3) of Regulation S-K) and by all of our Directors and executive officers as a group. Unless otherwise indicated, the individuals named held sole voting and investment power over the shares listed below. The address for each individual is c/o Cognex Corporation, One Vision Drive, Natick, Massachusetts 01760.

Name | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | ||||||

Robert J. Shillman | ● | (3 | ) | ● | ||||

Robert J. Willett | ● | * | ||||||

Anthony Sun | ● | * | ||||||

Theodor Krantz | ● | * | ||||||

Richard A. Morin | ● | * | ||||||

Jeffrey B. Miller | ● | (4 | ) | * | ||||

Reuben Wasserman | ● | * | ||||||

Patrick A. Alias | ● | * | ||||||

J. Bruce Robinson | ● | * | ||||||

Eugene Banucci | ● | * | ||||||

All Directors and Executive Officers as a group (10 persons) | ● | (5 | ) | ● | ||||

| * | Less than 1% |

| (1) | Includes the following shares which the specified individual has the right to acquire upon the exercise of outstanding options, exercisable currently or within 60 days of March 4, 2016: Dr. Shillman, 0 shares; Mr. Willett, ● shares; Mr. Sun, ● shares; Mr. Krantz, ● shares; Mr. Morin, ● shares; Mr. Miller, ● shares; Mr. Wasserman, ● shares; Mr. Alias, ● shares; Mr. Robinson, ● shares; and Dr. Banucci, ● shares. |

| (2) | Percentages are calculated on the basis of ● shares of our common stock outstanding as of March 4, 2016. The total number of shares outstanding used in this calculation also assumes that the currently exercisable options or options which become exercisable within 60 days of March 4, 2016 held by the specified person are exercised but does not include the number of shares of our common stock underlying options held by any other person. |

| (3) | Includes ● shares held in a trust with respect to which Dr. Shillman serves as trustee. |

| (4) | Mr. Miller has shared voting and investment power with respect to 400 shares owned jointly with his spouse. |

| (5) | Includes ● shares which certain Directors and executive officers have the right to acquire upon the exercise of outstanding options, exercisable currently or within 60 days of March 4, 2016. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and Directors and persons owning more than 10% of our outstanding common stock to file reports of ownership and changes in ownership with the SEC. Our executive officers, Directors and greater than 10% holders of our common stock are required by SEC regulations to furnish us with copies of all forms they file with the SEC under Section 16(a).

Based solely on copies of such forms furnished to us as provided above, we believe that during fiscal year 2015, all Section 16(a) filing requirements applicable to our executive officers, Directors and owners of greater than 10% of our common stock were complied with.

5

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to our Board of Directors and our employees, including our named executive officers. Pre-dating this code are our company’s ten corporate values, which include integrity, that are the basis for ensuring we maintain the highest ethical standards in all that we do. Copies of our company’s Code of Business Conduct and Ethics and ten corporate values are available on our website atwww.cognex.com under “Company—Investor Information—Governance.” We intend to disclose on our website any amendment to, or waiver of, any provision of this code applicable to our directors and named executive officers that would otherwise be required to be disclosed under the rules of the SEC or The NASDAQ Stock Market LLC (Nasdaq).

Our Board of Directors has determined that all of the Director nominees and incumbent Directors are “independent” as such term is defined in the applicable listing standards of Nasdaq, except for Robert J. Shillman and Robert J. Willett, who are executive officers of Cognex, and Patrick A. Alias, who is a non-executive employee of Cognex.

The positions of Chief Executive Officer and Chairman of the Board of Directors were separated in March 2011. At that time, Mr. Willett was promoted to become our Chief Executive Officer. Dr. Shillman retained his position as Chairman of the Board of Directors.

Because Dr. Shillman continues to serve as an executive officer of Cognex, our Board has appointed Anthony Sun to serve in the role of Lead Independent Director. As Lead Independent Director, Mr. Sun presides at all meetings of our Board of Directors at which the Chairman is not present, and he chairs the executive sessions of independent Directors, who regularly meet in executive sessions at which only independent Directors are present. Mr. Sun may also provide input regarding meeting agendas and bear such further responsibilities as our Board may designate from time to time.

Our Board believes this leadership structure promotes unified leadership and direction for the Board and management that, together with having a Lead Independent Director, assists the Board in the administration of its risk oversight responsibilities.

The Board’s Role in Risk Oversight

The role of our Board of Directors in our company’s risk oversight process includes receiving regular reports from management on areas of material risk to our company, including operational, financial, legal and regulatory, and strategic and reputational risks. The full Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within our company so that it can understand our risk identification, risk management and risk mitigation strategies. When a committee receives the report, the Chairman of the relevant committee reports on the discussion to the full Board. This enables the Board and its committees to coordinate the risk oversight role. Our Board of Directors also administers its risk oversight function through the required approval by the Board (or a committee of the Board) of significant transactions and other material decisions, and regular periodic reports from our company’s independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to our internal controls and financial reporting. As part of its charter, the Audit Committee discusses with management and our independent registered public accounting firm significant risks and exposures and the steps management has taken to minimize those risks.

6

Policy on Pledging, Hedging and Trading of Cognex Stock

Our insider trading policy governs the timing and type of transactions in Cognex stock by our Board of Directors and certain Cognex employees who have regular access to material non-public information, including our executive officers. Among other provisions, the policy:

| • | prohibits our Directors and any Cognex employee, including our executive officers, from engaging in short sales of Cognex stock with violators subject to immediate termination; |

| • | prohibits our Directors and executive officers from trading in exchange-traded options for Cognex stock or any other derivative security designed to hedge or offset risk of a decline in the market value of Cognex stock; and |

| • | prohibits our Directors and executive officers from pledging Cognex stock as collateral for a loan without the approval of the Compensation/Stock Option Committee of the Board of Directors. |

Shareholders who wish to communicate with our Board of Directors or with a particular Director may send a letter to the Secretary of Cognex Corporation at One Vision Drive, Natick, Massachusetts 01760. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” The letter should clearly state whether the intended recipients are all members of our Board or certain specified individual Directors. The Secretary will make copies of all letters and circulate them to the appropriate Director(s).

Board Meetings, Committees and Attendance

Our Board of Directors held twelve meetings during 2015. All of our Directors during their tenure on the Board attended at least 75% of the aggregate of the total number of meetings of our Board of Directors held in 2015, and the total number of meetings held by committees of the Board on which they served during 2015, with the exception of Mr. Sun, who attended 72%. Our Directors are strongly encouraged to attend the annual meeting of shareholders or the special meeting in lieu of the annual meeting; however, we do not have a formal policy with respect to attendance at that meeting. All of our Directors, except for Messrs. Sun and Wasserman, attended the 2015 Annual Meeting of Shareholders held on April 17, 2015.

The Board has three standing committees: The Compensation/Stock Option Committee, the Audit Committee and the Nominating and Corporate Governance Committee. Each committee acts according to a written charter approved by the Board. The charters are available on our website atwww.cognex.com under “Company—Investor Information—Governance.” Each Director who served on a Board committee during 2015 was “independent” as such term is defined in the applicable listing standards of Nasdaq and rules of the SEC. The agenda for committee meetings is determined by its Chairman in consultation with the other members of the committee and management. The Chairman reports the actions and determinations of the committee to the full Board on a regular basis.

The following table provides current committee membership information for each of the Board committees:

Name | Compensation/ Stock Option | Audit | Nominating and Corporate Governance | |||

Theodor Krantz | X | * | ||||

Jeffrey B. Miller | X | X | ||||

J. Bruce Robinson | X | |||||

Anthony Sun | X | * | ||||

Reuben Wasserman | * | X |

| * | Committee Chairman |

| X | Committee Member |

7

Dr. Banucci was appointed to the Board on December 10, 2015, and as of the date of this proxy statement, we have not yet determined the Board committees on which Dr. Banucci may sit.

Compensation/Stock Option Committee

In accordance with its written charter, the Compensation/Stock Option Committee:

| • | discharges the Board’s responsibilities relating to the compensation of Cognex’s executives, including the determination of the compensation of our Chief Executive Officer and other executive officers; |

| • | oversees our overall compensation structure, policies and programs; |

| • | administers our stock option and other equity-based plans; |

| • | reviews and makes recommendations to the Board regarding the compensation of our Directors; and |

| • | is responsible for producing the annual report included in this proxy statement. |

Our Chief Executive Officer, other Cognex executives, and the Cognex Human Resources department support the Compensation/Stock Option Committee in its duties and may be delegated authority to fulfill certain administrative duties regarding Cognex’s compensation programs. In addition, our Chief Executive Officer makes recommendations to the Compensation/Stock Option Committee on an annual basis regarding salary increases, potential bonuses, and stock option grants for each of our other executive officers. Our Chief Executive Officer also has been delegated the authority to approve stock options and other equity-based awards to non-executive employees of Cognex not to exceed 40,000 shares to any one individual in the aggregate per calendar year.

The Compensation/Stock Option Committee has sole authority under its charter to retain, approve fees for, determine the scope of the assignment of, and terminate advisors and consultants as it deems necessary to assist in the fulfillment of its responsibilities. The Compensation/Stock Option Committee typically does not retain compensation consultants, but may utilize independent third-party benchmarking surveys acquired by Cognex.

Committee meetings are regularly attended by our Chief Executive Officer, except when his compensation is being discussed, and may also include other executives at the invitation of the Committee. The Compensation/Stock Option Committee also meets in executive session as appropriate. The Compensation/Stock Option Committee met four times in 2015.

The full Board determines the compensation of our Directors, after considering any recommendations of the Compensation/Stock Option Committee.

Further information regarding the processes and procedures of the Compensation/Stock Option Committee for establishing and overseeing our executive compensation programs is provided under the heading “Compensation Discussion and Analysis.”

Audit Committee

For 2015, among other functions, the Audit Committee reviewed with our independent registered public accounting firm the scope of the audit for the year, the results of the audit when completed and the independent registered public accounting firm’s fees for services performed. The Audit Committee also appointed the independent registered public accounting firm and reviewed with management various matters related to our internal controls. The Audit Committee held six meetings during 2015.

The Board of Directors has determined that all members of the Audit Committee are financially literate, and that Mr. Krantz qualifies as an “audit committee financial expert” under the rules of the SEC.

8

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to serve as members of the Board and recommending to the Board nominees for election as Directors at each annual meeting of shareholders and when vacancies in the Board occur for any reason. The Nominating and Corporate Governance Committee is also responsible for developing and recommending to the Board a set of corporate governance guidelines to assist and guide the Board in the exercise of its responsibilities, periodically reviewing these guidelines and recommending changes deemed appropriate, and coordinating any evaluations of the Board and its committees.

The Nominating and Corporate Governance Committee met twice during 2015. On December 10, 2015, upon the recommendation of the Nominating and Corporate Governance Committee, Eugene Banucci was appointed to our Board of Directors. Dr. Banucci was initially recommended to the Nominating and Corporate Governance Comittee for election to the Board by Mr. Robinson. In February 2016, the Nominating and Corporate Governance Committee met and recommended the Director nominees for election at the meeting.

Compensation/Stock Option Committee Interlocks and Insider Participation

During 2015, Messrs. Krantz, Sun and Wasserman served on the Compensation/Stock Option Committee. No member of the Compensation/Stock Option Committee has served as an officer or employee of Cognex or any of its subsidiaries, nor had any business relationship or affiliation with Cognex or any of its subsidiaries during 2015 other than his service as a Director.

Certain Relationships and Related Transactions

In accordance with its written charter, the Audit Committee conducts an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and the approval of the Audit Committee is required for all related party transactions. Under our Code of Business Conduct and Ethics, any transaction or relationship engaged in by our employees that reasonably could be expected to give rise to a conflict of interest should be reported promptly to our Compliance Officer, who may notify our Board of Directors or a committee thereof as he deems appropriate. Actual or potential conflicts of interest involving a Director or executive officer are required to be disclosed directly to the Chairman of our Board of Directors.

When considering a potential candidate for membership on our Board of Directors, the Nominating and Corporate Governance Committee will consider any criteria it deems appropriate, including, among other things, the experience and qualifications of any particular candidate as well as such candidate’s past or anticipated contributions to our Board and its committees. At a minimum, each nominee is expected to have high personal and professional integrity and demonstrated ability and judgment to be effective, with the other Directors and management, in collectively serving the long-term interests of our shareholders. Each nominee is expected to be personable and support our “Work Hard, Play Hard, Move Fast” culture. And, each nominee is expected to have direct and significant experience in one or more industries or markets in which our company does, or plans to do, business, and/or significant senior-level management experience in functions or roles which are helpful to our company, such as, for example, finance, accounting, engineering, manufacturing, and sales and marketing.

In addition to the minimum qualifications set forth above, when considering potential candidates for our Board of Directors, the Nominating and Corporate Governance Committee seeks to ensure that the Board of Directors is comprised of a majority of independent Directors, that the committees of the Board are comprised entirely of independent Directors, and that at least one member of the Audit Committee qualifies as an “audit committee financial expert” under SEC rules. The Nominating and Corporate Governance Committee may also consider any other standards that it deems appropriate. Although there is no specific policy regarding diversity in identifying director nominees, both the Nominating and Corporate Governance Committee and our Board seek

9

the talents and backgrounds that would be most helpful to Cognex in selecting Director nominees. In particular, the Committee, when recommending Director candidates to the full Board for nomination, may consider whether a Director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience.

In practice, the Nominating and Corporate Governance Committee generally will evaluate and consider all candidates recommended by our Directors, officers and shareholders. The Nominating and Corporate Governance Committee intends to consider shareholder recommendations for Directors using the same criteria as potential nominees recommended by the members of the Nominating and Corporate Governance Committee or others. The Nominating and Corporate Governance Committee did not receive any shareholder nominations for Director with respect to this meeting.

On December 10, 2015, upon the recommendation of the Nominating and Corporate Governance Committee, Eugene Banucci was appointed to our Board of Directors. Dr. Banucci was initially recommended to the Nominating and Corporate Governance Comittee for election to the Board by Mr. Robinson.

Shareholders who wish to submit Director candidates for consideration as nominees for election at our 2017 Annual Meeting of Shareholders should send such recommendations to the Secretary of Cognex Corporation at our executive offices on or before November ●, 2016. These recommendations must include:

| • | the name and address of record of the shareholder; |

| • | a representation that the shareholder is a record holder of our common stock, or if the shareholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Exchange Act; |

| • | the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding ten full fiscal years of the proposed Director candidate; |

| • | a description of the qualifications and background of the proposed Director candidate which addresses the minimum qualifications described above and any other criteria for Board membership approved by the Board from time to time; |

| • | a description of all arrangements or understandings between the shareholder and the proposed Director candidate; and |

| • | the consent of the proposed Director candidate to be named in the proxy statement, to serve as a Director if elected at such meeting, and to give our company the authority to carry out a detailed and thorough investigation of his/her educational, professional, financial and personal history. |

Shareholders must also submit any other information regarding the proposed Director candidate that is required to be included in a proxy statement filed pursuant to SEC rules. See also the information under the heading “Shareholder Proposals.”

10

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of nine Directors and is divided into three classes, with one class being elected each year for a term of three years. We are proposing that Robert J. Shillman, Anthony Sun and Robert J. Willett be elected to serve terms of three years and in each case until their successors are duly elected and qualified or until they sooner die, resign or are removed.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ROBERT J. SHILLMAN, ANTHONY SUN AND ROBERT J. WILLETT.

The persons named in the accompanying proxy will vote, unless authority is withheld, “FOR” the election of the nominees named above. Our Board of Directors anticipates that each of the nominees, if elected, will serve as a Director. If any nominee is unable to accept election, the persons named in the accompanying proxy will vote for such substitute as our Board of Directors may recommend. Should our Board not recommend a substitute for any nominee, then the proxy will be voted for the election of the remaining nominees. There are no family relationships between any Director and executive officer of Cognex or its subsidiaries.

Information Regarding Directors

Set forth below is information furnished to us by the Director nominees and the incumbent Directors whose terms will continue after the meeting. The biographical description for each Director includes his age, all positions he holds with Cognex, his principal occupation and business experience over the past five years, and the names of other publicly held companies for which he currently serves as a director or has served during the past five years. It also includes the specific experience, qualifications, attributes and skills that led to our Board’s conclusion that he should serve as a director of Cognex or, with respect to each Director who is not standing for election, that the Board would expect to consider if it were making a conclusion currently as to whether he should serve as a director.

We believe that all of our directors have a reputation for integrity, honesty and adherence to high ethical standards. Each has demonstrated business acumen and an ability to exercise sound judgment as well as a commitment of service to Cognex and, to the extent applicable, our Board. Our Board did not currently evaluate whether the incumbent Directors who are not standing for election should serve as directors, as the terms for which they were previously elected continue beyond the meeting.

Nominated for a term ending in 2019:

Robert J. Shillman, 69, known to many as “Doctor Bob,” is the founder of Cognex. He has served as Chairman of the Board of Directors and as an executive officer of Cognex since the company’s founding in 1981. Dr. Shillman was Chief Executive Officer of Cognex from 1981 through March 2011, at which time, and upon his recommendation, Mr. Willett was promoted to fill that role. During the past five years, Dr. Shillman has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. We believe Dr. Shillman’s qualifications for remaining on our Board of Directors include his 35 years of executive leadership experience building Cognex into the world’s largest and most successful company that specializes in machine vision.

Anthony Sun, 63, has served as a director since 1982. Mr. Sun served as a managing general partner and Chief Executive Officer of Venrock Associates, a venture capital partnership, from 1997 until his retirement in 2010. He began his tenure at Venrock in 1979 and was a general partner from 1980 to 1997. Mr. Sun also serves as a member of the Boards of Directors of several private companies. During the past five years, he served as a director of Keynote Systems, Inc. (KEYN) when it was a publicly held company. We believe Mr. Sun’s

11

qualifications for sitting on our Board of Directors include his executive experience, his expertise in the high-technology industry, particularly having served as a member of the Board of Directors of more than a dozen public high tech companies in the past, and the deep understanding of our company that he has acquired in his 34 years of service on our Board.

Robert J. Willett, 48, has served as a director and Chief Executive Officer of Cognex since 2011. Mr. Willett joined our company in 2008 as President of the Modular Vision Systems Division, and was promoted to President and Chief Operating Officer in 2010. He came to Cognex from Danaher Corporation, a diversified manufacturer of industrial controls and technologies, where he served as Vice President of Business Development and Innovation for the Product Identification Business Group and as President of Videojet Technologies, a leader in coding and marking products. Prior to that, Mr. Willett served as Chief Executive Officer of Willett International Ltd., a coding and marking company that was sold to Danaher and merged with Videojet. During the past five years, Mr. Willett has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. He holds a B.A. from Brown University, and an M.B.A. from Yale University. We believe Mr. Willett’s qualifications for sitting on our Board of Directors include his experience in the machine vision industry, his executive leadership experience and the knowledge of our company that he has acquired through his management roles.

Serving a term ending in 2018:

Eugene Banucci, 72, has served as a director since 2015. Dr. Banucci is the founder and former Chairman and Chief Executive Officer of ATMI, Inc. (ATMI), a publicly held company that was acquired by Entegris, Inc. (ENTG) in 2014. Dr. Banucci served as Chief Executive Officer of ATMI from its founding in 1986 until the beginning of 2005. Prior to starting ATMI, he held management positions at General Electric Company and American Cyanamid Company. Dr. Banucci has served on numerous boards; in particular, from 2003 through 2010, he was a member of the Board of Directors of Zygo Corporation (ZIGO), a publicly held company that was also acquired in 2014. He currently serves on the Boards of Clean Harbors, Inc. (CLH), a publicly held company, and two private companies. Dr. Banucci holds a B.A. in Chemistry from Beloit College and Ph.D. in Organic Chemistry from Wayne State University. We believe Dr. Banucci’s qualifications for sitting on our Board ofDirectors include his experience in developing and managing high-technology companies and his participation in other public company boards.

Jeffrey B. Miller, 59, has served as a director since 2010. Mr. Miller is the former President of Markem Corporation, a leading global provider of product identification solutions. In 2006, he managed the sale of the then-private company to Dover Corporation. Mr. Miller retired from Markem in 2008, after a 27-year career. He has served on numerous non-profit boards and local government agencies and commissions, and continues to devote significant time in an advisory and board capacity to non-profit organizations. Mr. Miller is a member of the Boards of Directors of two private companies. During the past five years, he has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. He holds an A.B. from Dartmouth College, and an M.B.A. from Harvard University. We believe Mr. Miller’s qualifications for sitting on our Board of Directors include his industry and executive leadership experience.

Reuben Wasserman, 86, has served as a director since 1990. Mr. Wasserman has been an independent business consultant serving high-technology corporations and venture capital firms, and has served on numerous boards, since 1985. Prior to 1985, he was Vice President of Strategic Planning for Gould Electronics, Inc. During the past five years, Mr. Wasserman served as a member of the Board of Overseers of Lahey Clinic, the Board of Directors of AMR, Inc., the Advisory Board for the Threshold Program at Lesley University, and the Advisory Council Board of Scripps Florida Research Institution. Mr. Wasserman has a BSEE from the City College of New York, a MSEE in Computer Science from the University of Michigan, and further education at the Massachusetts Institute of Technology. We believe Mr. Wasserman’s qualifications for sitting on our Board of Directors include his significant experience providing strategic advisory services to high-technology companies.

12

Serving a term ending in 2017:

Patrick A. Alias, 70, has served as a director since 2001. Mr. Alias has served as Senior Vice President of Cognex since April 2005, and previously was Executive Vice President from 1991 through April 2005. Prior to joining Cognex, Mr. Alias spent more than 20 years in various high-technology management positions in Europe, Japan and the United States. He holds Master’s Degrees in Electronics, Mathematics and Economics, and is a graduate of Harvard Business School’s Advanced Management Program. During the past five years, Mr. Alias has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. We believe Mr. Alias’s qualifications for sitting on our Board of Directors include his four decades of experience working with high-technology companies, including nearly fifteen years as our company’s Executive Vice President of Worldwide Sales and Marketing, and his extensive management experience.

Theodor Krantz, 73, has served as a director since 2007. Mr. Krantz has been Vice President and Chief Financial Officer of Airmar Technology Corporation since May 2011, and previously served as President from 2000 to 2011. He was President, and later Chief Executive Officer, of Velcro Industries from 1984 to 1999. For more than 10 years, Mr. Krantz has been serving as a member of the Boards of Directors and Audit Committees of Hitchiner Manufacturing Company and Control Air, Inc. Mr. Krantz holds a B.A. from Princeton University, and an M.B.A. from Harvard University. We believe Mr. Krantz’s qualifications for sitting on our Board of Directors include his extensive executive leadership experience and his accounting and financial management expertise.

J. Bruce Robinson, 73, has served as a director since 2013. Mr. Robinson is the former Chief Executive Officer (from 1999 to 2010) and Chairman of the Board of Directors (from 2000 to 2009) of then publicly held company Zygo Corporation (ZIGO), a worldwide supplier of optical metrology instruments, precision optics, and electro-optical design and manufacturing services. He was a consultant to Zygo from 2010 to 2014. Zygo was acquired in 2014. Previously, Mr. Robinson spent 25 years with The Foxboro Company. He holds a B.Sc. in Electrical Engineering from the University of Waterloo in Canada. We believe Mr. Robinson’s qualifications for sitting on our Board of Directors include his executive experience and his expertise in the high-technology industry.

13

The following table sets forth the compensation earned by or awarded to each Director who served on our Board of Directors in 2015, other than Dr. Shillman and Mr. Willett. Details of Dr. Shillman’s and Mr. Willett’s compensation are set forth under the heading “Executive Compensation—Summary Compensation Table.”

Director Compensation Table—2015

Name | Fees Earned or Paid in Cash | Option Awards(1)(2) | All Other Compensation(3) | Total Compensation | ||||||||||||

Patrick A. Alias | $ | — | $ | 252,263 | $ | 125,516 | $ | 377,779 | ||||||||

Eugene Banucci(4) | $ | 9,900 | $ | — | $ | — | $ | 9,900 | ||||||||

Theodor Krantz | $ | 55,325 | $ | 187,395 | $ | — | $ | 242,720 | ||||||||

Jeffrey B. Miller | $ | 49,275 | $ | 187,395 | $ | — | $ | 236,670 | ||||||||

J. Bruce Robinson | $ | 42,625 | $ | 187,395 | $ | — | $ | 230,020 | ||||||||

Anthony Sun | $ | 43,725 | $ | 187,395 | $ | — | $ | 231,120 | ||||||||

Reuben Wasserman | $ | 45,675 | $ | 187,395 | $ | — | $ | 233,070 | ||||||||

| (1) | In 2015, each Director other than Dr. Shillman, Mr. Willett and Dr. Banucci were granted options to purchase 13,000 shares of our common stock at an exercise price of $41.25 per share on February 17, 2015 (except that Mr. Alias was granted options to purchase 17,500 shares). These options have a ten-year life and vest in four equal annual installments commencing on February 17, 2016. Amounts listed in this column represent the aggregate grant date fair value of these options granted but disregarding estimated forfeitures for this purpose. The methodology and assumptions used to calculate the grant date fair value are described in Note 14, “Stock-Based Compensation” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015. Cognex recognizes the grant date fair value as an expense for financial reporting purposes over the service-based vesting period. See also the information under the heading “Director Compensation—Elements of Director Compensation.” |

| (2) | Each Director, other than Dr. Shillman and Mr. Willett, had the following unexercised options outstanding at December 31, 2015: Mr. Alias, options to purchase 90,000 shares; Dr. Banucci, options to purchase 0 shares; Mr. Krantz, options to purchase 143,250 shares; Mr. Miller, options to purchase 91,000 shares; Mr. Robinson, options to purchase 48,000 shares; Mr. Sun, options to purchase 129,500 shares; and Mr. Wasserman, options to purchase 86,000 shares. The Directors listed above did not forfeit any stock option grants in 2015. |

| (3) | Amounts listed in this column include salary of $90,646 and a bonus under our annual bonus program of $33,750, both of which were earned by Mr. Alias during 2015 in his capacity as a non-executive employee of Cognex. Also includes insurance premiums of $1,120. |

| (4) | Dr. Banucci was appointed to our Board of Directors on December 10, 2015. |

14

Elements of Director Compensation

The following table sets forth the elements of compensation in 2015 for our non-employee directors for their service on our Board of Directors and its committees. Dr. Shillman and Mr. Willett, both of whom are executive officers of Cognex, receive no compensation to serve on our Board, and Mr. Alias, who is a non-executive employee of Cognex, receives no additional cash compensation for his service on the Board.

Type of Fee | Board of Directors | Compensation/Stock Option Committee(1) | Audit Committee(1) | Nominating and Corporate Governance Committee(2) | ||||||||||||

Annual cash retainer | $ | 11,000 | $ | 2,100 | $ | 4,725 | $ | 525 | ||||||||

Meeting fee(3) | $ | 5,250 | $ | — | $ | 1,575 | $ | — | ||||||||

Meeting fee(4) | $ | 5,500 | $ | — | $ | 1,650 | $ | — | ||||||||

Telephonic meeting fee(3) | $ | 525 | $ | 525 | $ | 525 | $ | — | ||||||||

Telephonic meeting fee(4) | $ | 550 | $ | 550 | $ | 550 | $ | — | ||||||||

Annual Chairman fee | $ | — | $ | — | $ | 4,200 | $ | — | ||||||||

| (1) | A fee for attending a committee meeting is paid if the meeting is not held in conjunction with a regular Board meeting, or for participation in discussions that are beyond the scope covered by the annual cash retainer. |

| (2) | An additional fee may be paid to members of this committee from time to time in connection with evaluation of director candidates. |

| (3) | Effective for meetings held between January 1, 2015 and April 16, 2015. |

| (4) | Effective for meetings held between April 17, 2015 and December 31, 2015. |

In 2015, each Director (other than Dr. Shillman, Mr. Willett, Mr. Alias and Dr. Banucci) also received his 2015 annual grant of options to purchase 13,000 shares of our common stock at an exercise price of $41.25 per share that began vesting on February 17, 2016. Mr. Alias was granted options to purchase an additional 4,500 shares (17,500 total shares) as compensation for services performed by him as an employee of Cognex. All of the options described in this paragraph have a ten-year term, vest in four equal annual installments and have an exercise price equal to the closing price of our common stock as reported by Nasdaq on the date of grant.

15

COMPENSATION POLICIES AND PROCEDURES

Cognex’s approach to compensation and performance management is to provide a competitive total compensation package with periodic reviews to encourage ongoing high-quality performance. We strive to hire, retain and promote talented individuals based on their achievements, to reward employees based on their overall contribution to the success of our company, and to motivate employees to continue increasing shareholder value.

In addition to salary, total compensation may include overtime pay, commissions, stock options and potential bonuses depending on the employee’s job and level within Cognex. It also includes benefits consistent with our “Work Hard, Play Hard, Move Fast” culture that recognize employee achievement and encourage new levels of success, such as President’s Awards, which are given annually to our top performers, and Perseverance Awards, which reward employee longevity, commitment and loyalty. Other benefits available to all employees include company-paid basic group term life insurance, basic accidental death and dismemberment insurance, an employer match of eligible compensation that employees invest in their 401(k) accounts, and tuition reimbursement.

The Compensation/Stock Option Committee oversees the compensation program for all Cognex employees. The Committee has discussed the concept of risk as it relates to our compensation program and does not believe that our compensation program is structured to encourage excessive or inappropriate risk taking for the following reasons:

| • | Compensation consists of both fixed and variable components. The fixed portion (i.e. base salary) provides a steady income to our employees regardless of the performance of our company or stock price. The variable portion (i.e. annual company bonus and stock option awards) is based upon company and stock price performance. This mix of compensation is designed to motivate our employees, including our named executive officers, to produce superior short- and long-term corporate performance without taking unnecessary or excessive risks to the detriment of important business metrics. |

| • | For the variable portion of compensation, the company bonus is an annual program and is focused on profitability, while the stock option program generally has a four year service-based vesting period and is focused on stock price performance. We believe that these programs provide a check on excessive risk taking because to inappropriately benefit one would be a detriment to the other. For example, focusing solely on profitability would be detrimental to our company over the long term, ultimately harming our stock price and the value of stock options. |

In addition, we prohibit all hedging transactions involving Cognex stock by our Board of Directors and certain employees who have regular access to material non-public information, including our named executive officers, so that they cannot insulate themselves from the effects of poor stock performance. And, any Cognex employee engaged in short sales of Cognex stock is subject to immediate termination.

| • | In order for any employee to be eligible for a company bonus, Cognex must first achieve certain financial goals that are established annually by the Compensation/Stock Option Committee related to profitability (we refer to this metric as “operating margin”). Operating margin for our corporate employees, which includes our named executive officers, is based upon our consolidated financial results while operating margin for division employees has been based upon the financial results of their operating division. We believe that focusing on profitability rather than other measures encourages a balanced approach to performance and emphasizes consistent behaviour across the organization. |

| • | Our annual bonus program is capped, which we believe mitigates excessive risk taking by limiting bonus payouts even if our company dramatically exceeds its operating margin target. |

| • | Our annual bonus program has been structured around attaining a certain level of profitability for many years and we have seen no evidence that it encourages unnecessary or excessive risk taking. |

16

| • | The calculation of our operating margin target is defined annually by our Compensation/Stock Option Committee and is designed to keep it from being susceptible to manipulation by any employee, including our named executive officers. We have a Code of Business Conduct and Ethics that covers, among other things, accuracy of books and records. And, pre-dating this code is our company’s ten corporate values, which include integrity, that are the basis for ensuring we maintain the highest ethical standards in all that we do. |

17

COMPENSATION DISCUSSION AND ANALYSIS

We maintain a performance-based compensation philosophy. The compensation program for our named executive officers utilizes a combination of base salaries, annual bonuses and stock option awards. We target paying our named executive officers a base salary that is in the mid-range of benchmarks from the Radford Executive Compensation Report, which is an independent third-party survey of compensation practices by companies in the high-technology industry; we establish a potential annual bonus that is market competitive and linked to individual and company performance objectives; and we grant stock options in a manner that aligns the interests of our named executive officers with those of our shareholders.

Total compensation for our named executive officers also includes other benefits that are available to all Cognex employees generally. This includes Perseverance Awards (which reward employee longevity, commitment and loyalty), company-paid basic group term life insurance and basic accidental death and dismemberment insurance, an employer match of eligible compensation that employees invest in their 401(k) accounts, and tuition reimbursement.

The Compensation/Stock Option Committee, which consists entirely of independent directors, reviews and approves all compensation for our named executive officers, using its judgment and experience in determining the mix of compensation. The Committee views salary and bonuses as short-term compensation to reward our named executive officers for meeting individual and company performance objectives, and stock option awards as a reward for increasing shareholder value and improving corporate performance over the long term. The Compensation/Stock Option Committee also believes that the stock option program is instrumental in our ability to recruit, retain and motivate our high caliber employees.

Determinations with respect to compensation for a fiscal year are generally made in conjunction with our Board of Directors’ approval of Cognex’s annual budget for that year, which typically occurs at the end of the prior fiscal year.

Say-on-Pay Feedback from Shareholders

At our 2015 Annual Meeting of Shareholders, approximately 73% of the votes cast on the say-on-pay proposal were in favor of the approval of the compensation of our named executive officers, with 27% of the votes cast against such proposal. The Compensation/Stock Option Committee carefully considered these results and the feedback we received during in-person and telephonic meetings with a number of our shareholders. While our shareholders generally support our compensation philosophy and programs, we believe the lower support at our 2015 Annual Meeting was due to certain stock option awards with extended vesting periods granted to our Chief Executive Officer in 2014. Because our Chief Executive Officer was not eligible to participate in our annual stock option grants in 2015, the Compensation/Stock Option Committee did not make any changes to our executive compensation program for 2015 as a result of the say-on-pay vote by our shareholders, but will take such feedback into account when considering future compensation decisions. We have conducted an advisory vote on the compensation of our named executive officers on an annual basis since the last advisory vote on the frequency of such say-on-pay proposals in 2011.

Cognex reported record revenue of $450.6 million for 2015 and was highly profitable, reporting an operating margin of 27% and a net margin of 24%, all from continuing operations. We made significant investments in engineering and in our sales and support organization to drive long-term growth. We brought new products to market and broadened our global footprint in high-potential geographies for machine vision. We also sold our Surface Inspection Systems Division, which in addition to realizing a net gain of $78 million enables us to sharpen our focus on our core business where we see stronger long-term growth and profitability. And, we spent $126.4 million to repurchase our common stock and paid out $18.1 million in dividends to shareholders.

18

Compensation Program Highlights

Our executive compensation program is designed to be largely performance-based with base salary providing a steady income to our employees and the annual company bonus and stock option awards based upon individual, company and stock price performance. In its deliberations of compensation for our named executive officers, the Compensation/Stock Option Committee considers the following:

| • | the levels of responsibility associated with each executive’s position; |

| • | the past performance of the individual executive; |

| • | the extent to which individual, departmental and company-wide goals have been met; |

| • | the overall competitive environment and the level of compensation necessary to attract and retain talented and motivated individuals in key positions; |

| • | the recommendations of our Chief Executive Officer with respect to the salary increases, potential bonuses and stock option grants for those executive officers that report to him; and |

| • | the outcome of advisory shareholder votes on executive compensation (commonly known as “say-on-pay” proposals). |

The Compensation/Stock Option Committee also considers ways to maximize deductibility of executive compensation under U.S. tax laws, while retaining the discretion of the Compensation/Stock Option Committee as is appropriate to compensate executive officers at levels commensurate with their responsibilities and achievements.

Neither Cognex nor the Compensation/Stock Option Committee typically uses compensation consultants other than independent third-party benchmarking surveys of annual compensation paid by companies in the high-technology industry, such as the Radford Executive Compensation Report described above.

Base Salary

In determining the base salaries paid to our named executive officers for fiscal year 2015, the Compensation/Stock Option Committee considered, in particular, their levels of responsibility, salary increases awarded in the past, and the executive’s experience and potential. The base salary approved for each of our named executive officers for fiscal year 2015 was made based on the following criteria:

| • | the Radford Executive Compensation Report’s benchmarking survey of annual compensation paid by companies in the high-technology industry that have between $250 million and $500 million of annual revenue, with our named executive officers’ salaries in 2015 falling below the 50th percentile of their position; |

| • | the levels of responsibility associated with each executive’s position; |

| • | the past performance of the individual employee; and |

| • | the increase in salary levels approved by our Board of Directors in the fourth quarter of 2014 in conjunction with its approval of our annual budget for fiscal year 2015. |

During 2015, Mr. Morin received a salary increase of 1.7%. Mr. Willett declined to accept his salary increase and his salary remained consistent with 2014 at $375,000. Dr. Shillman’s salary also remained consistent with 2014 at $200,000, which he elected to forgo as in prior years and, as requested by him, we donated this amount to a public charity.

Annual Company Bonuses

The Compensation/Stock Option Committee views annual company bonuses as a way to reward employees for meeting individual and company performance objectives. All Cognex employees, including our named

19

executive officers, are eligible to participate in the performance-based annual company bonus program except for those employees on a sales commission plan. The Compensation/Stock Option Committee approves the annual company bonus plan in conjunction with our Board of Directors’ approval of Cognex’s annual budget, which typically takes place at the end of the prior fiscal year.

The annual company bonus plan is designed to be variable. In order for any employee to be eligible for an annual company bonus, Cognex must first achieve financial goals set forth in the annual budget related to budgeted non-GAAP operating income as a percentage of revenue (we refer to this metric as “operating margin”). Once the operating margin criterion is met, the amount each employee at director level and above, which includes our named executive officers, receives depends upon the achievement of individual performance goals, which are established annually.

The Compensation/Stock Option Committee determined that operating margin is an appropriate metric for our bonus plan because the Committee believes employee performance is integral in achieving desired levels of company profitability. Non-GAAP operating income as used in the calculation of operating margin for purposes of our bonus program is calculated by adjusting our operating income as determined in accordance with generally accepted accounting principles (GAAP) for expense related to stock options and other equity-based awards and foreign currency gains or losses.

For our corporate employees, including our named executive officers, operating margin is based upon our consolidated financial results. For division employees, operating margin is based upon the financial results of their operating division. During 2015, Cognex sold its Surface Inspection Systems Division (SISD), which was the smaller and less profitable of our company’s two operating divisions (the larger remaining division is the Modular Vision Systems Division, or MVSD). Due to this transaction, we restated our annual budget to exclude SISD from our financial goals for 2015 and adjusted the operating margin targets for corporate and division employees accordingly.

In order for any cash bonus to be paid to an employee, a minimum level of operating margin for the company or division, as the case may be, must be achieved. Once the minimum level has been achieved, each employee’s eligible bonus is calculated as follows:

| • | if the actual operating margin is above the minimum level but below the operating margin target in the annual budget, each employee is eligible to receive a pro-rata portion of his or her target bonus; |

| • | if the actual operating margin is equal to the operating margin target in the annual budget, each employee is eligible to receive 100% of his or her target bonus; and |

| • | if the actual operating margin is above the operating margin target in the annual budget, all “exempt” employees are eligible to receive an additional amount depending upon his or her grade level up to a maximum level approved by the Compensation/Stock Option Committee. The payout is scaled in such a way that this additional amount is funded by a portion of the incremental operating income above Cognex’s operating margin target. (“Exempt” employees are those employees who receive an annual salary and are exempt from certain wage and hour laws.) |

The Compensation/Stock Option Committee approves the target bonus for each employee at vice president level and above, which includes our named executive officers, and the amount by which each individual can participate in any increase due to company or division performance, as the case may be, in excess of the operating margin target. The target bonus amount is based upon a percentage of base salary with the percentage based upon the individual’s grade level. Individual performance goals are established annually and generally relate to near-term strategic, financial and operational performance that supports the company’s business objectives. A weighting is assigned to each individual performance goal. For fiscal year 2015:

| • | the target bonus for Dr. Robert J. Shillman, our Executive Chairman, was $100,000, with the opportunity to earn 0-250% of this amount based on company performance and the achievement of individual performance goals; |

20

| • | the target bonus for Robert J. Willett, our President and Chief Executive Officer, was $243,750, with the opportunity to earn 0-300% of this amount based on company performance and the achievement of individual performance goals; and |

| • | the target bonus for Richard A. Morin, our Executive Vice President and Chief Financial Officer, was $165,000, with the opportunity to earn 0-200% of this amount based on company performance and the achievement of individual performance goals. |

The Compensation/Stock Option Committee believes that the payment of an annual company bonus based upon the achievement of company and individual performance goals is an appropriate way to reward our named executive officers for meeting performance objectives while also achieving desired levels of company profitability.

For 2015, the consolidated operating margin target was above our long-term financial model of 20% to 30% of revenue. The actual consolidated operating margin achieved was 27%, which was below the target for the year. As a result, each of our named executive officers was eligible to receive up to 75% of the pro-rata portion of his bonus target (i.e. none of our named executive officers had the opportunity to achieve more than 75% of his bonus target). In addition, our named executive officers indicated to the Compensation/Stock Option Committee that they would forgo any salary increase for 2016 if one were to be provided by the Committee because we did not achieve our consolidated operating margin target for 2015. The annual bonuses for 2015 for our named executive officers are listed under the heading “Executive Compensation—Summary Compensation Table” and will be paid in the first quarter of 2016. Consistent with prior years, Dr. Shillman elected to forgo his 2015 bonus, and, as requested by him, we will donate this amount to a public charity.

Stock Option Awards

Cognex’s stock option program is intended to reward the majority of our exempt employees, which includes our named executive officers, for their efforts in building shareholder value and improving corporate performance over the long-term. The Compensation/Stock Option Committee believes that the stock option program is instrumental in our ability to recruit, retain and motivate our high caliber employees.

The Compensation/Stock Option Committee approves the options granted to our named executive officers on an individual basis. Our Chief Executive Officer has been delegated the authority to approve stock options and other equity-based awards to our non-executive employees not to exceed 40,000 shares to any one individual in the aggregate per calendar year.

Each year, the Compensation/Stock Option Committee determines the stock options to be granted to current employees in the form of annual grants by considering, among other factors, the impact of the options on shareholder dilution. We have always been, and will continue to be, sensitive to shareholders’ concerns about the increase in the number of outstanding shares caused by new option grants. In that regard, we have reduced our net yearly option grants over the past ten years from 4.1% of average outstanding shares in fiscal 2005 to 1.8% of average outstanding shares in fiscal 2015. We have also reduced share dilution by repurchasing more than 25 million shares of Cognex stock on the open market during that period. As a result, the number of outstanding shares has decreased by 8% from January 1, 2005 to December 31, 2015. We intend to continue to actively manage our use of shares each year.

During 2015, Mr. Morin participated in our annual stock option grants, which were completed in the first quarter of the year. His annual option grant was consistent with the vesting schedules and expiration dates of the majority of grants made to our other employees, except that his grant does not vest in equal annual installments. Mr. Willett was not eligible to participate in our annual stock option grants due to the additional option grants with extended vesting periods he was awarded in November 2014 in order to provide him with greater incentive to increase shareholder value and improve corporate performance over the long term. Dr. Shillman declined to accept an annual option award when offered by the Compensation/Stock Option Committee as he feels that he

21

has been adequately rewarded in the past and would prefer that any options that would be granted to him be available for granting to other employees.

The Compensation/Stock Option Committee granted Mr. Willett options in November 2014 to purchase 640,000 shares of our common stock in addition to his annual grant. These options consisted of three grants as follows: 1) an option to purchase 240,000 shares which began to vest in four equal annual installments commencing on November 3, 2015; 2) an option to purchase 200,000 shares which vests in one installment on November 3, 2019; and 3) an option to purchase 200,000 shares which vests in one installment on November 3, 2020, subject in each case, to Mr. Willett’s continued employment with Cognex. In determining the number of option shares and vesting schedule, the Compensation/Stock Option Committee considered various criteria including: the Radford Executive Compensation Report’s benchmarking survey referred to above; the fact that the initial stock option grants provided to Mr. Willett upon commencement of his employment with Cognex had vested earlier in the year; and Mr. Willett’s level of responsibility, experience and potential.

Our policy is to grant stock options on certain fixed dates. The annual grants are predetermined to occur each year on the fourth Monday in January of such year. The options for employees hired or promoted during a month are granted on the last Monday of that month. If any such Monday falls within a designated quiet period, then the grants will instead be made on the first Monday following the completion of the quiet period. If Nasdaq is closed on the appropriate Monday as described above, then the grants will instead be made on the next day that Nasdaq is open for trading. The Compensation/Stock Option Committee retains the discretion to grant options at such other times as it may otherwise deem appropriate. The exercise price for all stock options granted equals the closing price of our common stock on Nasdaq on the date of grant.

The Compensation/Stock Option Committee believes that the primary purpose of stock option awards is to align employee interests with the interests of our shareholders, and to provide our employees, including our named executive officers, with incentives to increase shareholder value over time. Change of control transactions typically represent events where our shareholders are realizing the value of their equity interests in our company. We believe it is appropriate for our Directors and named executive officers to share in this realization of shareholder value.