| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential , for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

COGNEX CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held on May 1, 2024

To our Shareholders:

The 2024 Annual Meeting of Shareholders of COGNEX CORPORATION will be held at 9:00 a.m. local time on Wednesday, May 1, 2024, at Cognex’s headquarters located at One Vision Drive, Natick, Massachusetts 01760, for the following purposes:

| 1. | To elect two Directors to serve for a term of three years; |

| 2. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2024; and |

| 3. | To cast a non-binding advisory vote to approve executive compensation (“say-on-pay”). |

In addition, we will consider any other business that may properly come before the meeting or any adjournments or postponements of the meeting.

The Board of Directors has fixed the close of business on March 1, 2024 as the record date for the meeting. All shareholders of record on that date are entitled to receive notice of and to vote at the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE VOTE YOUR SHARES BY TELEPHONE, VIA THE INTERNET, OR BY COMPLETING AND RETURNING A PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY CONTINUE TO HAVE YOUR SHARES VOTED AS INSTRUCTED IN THE PROXY, OR YOU MAY WITHDRAW YOUR PROXY AT THE MEETING AND VOTE YOUR SHARES IN PERSON.

By Order of the Board of Directors, |

Mark T. Fennell, Secretary |

Natick, Massachusetts

March 15, 2024

Important

Please note that due to security procedures, you may be required to show a form of picture identification to gain access to our headquarters. Please contact the Cognex Department of Investor Relations at (508) 650-3000 if you plan to attend the meeting.

TABLE OF CONTENTS

| 1 | ||||

• General | 1 | |||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

| 8 | ||||

• Compensation/Stock Option Committee Interlocks and Insider Participation | 12 | |||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

• Policy Relating to the Recovery of Erroneously Awarded Compensation | 32 | |||

| 33 | ||||

COGNEX CORPORATION

PROXY STATEMENT

INFORMATION ABOUT THE MEETING AND VOTING PROCEDURES

General

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of Directors of Cognex Corporation (“Cognex” or the “company”) for use at the 2024 Annual Meeting of Shareholders (the “meeting” or “this meeting”) to be held at 9:00 a.m. local time on Wednesday, May 1, 2024, at our headquarters located at One Vision Drive, Natick, Massachusetts 01760, and at any adjournments or postponements of that meeting. Our telephone number is (508) 650-3000. At this meeting, shareholders will consider and vote on the following proposals:

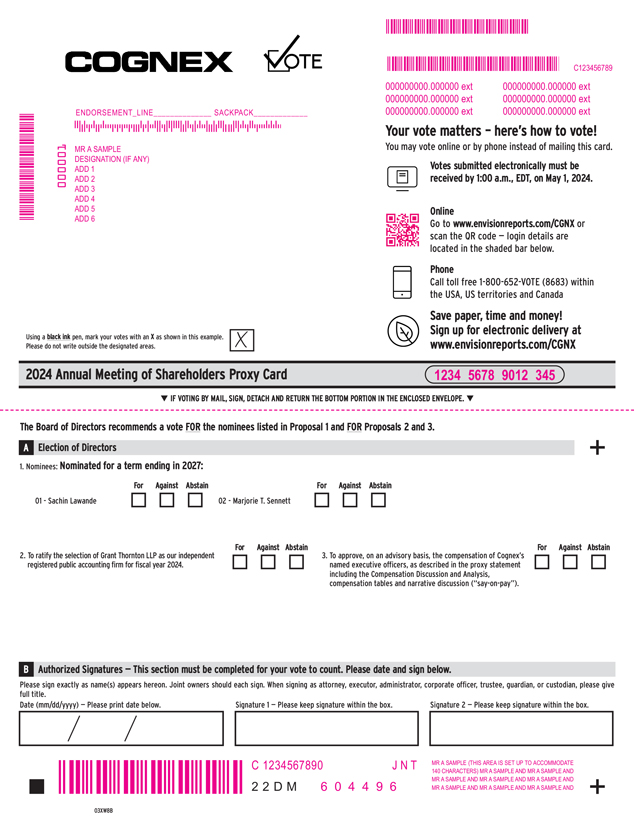

| 1. | To elect two Directors to serve for a term of three years; |

| 2. | To ratify the selection of Grant Thornton LLP as our independent registered public accounting firm for fiscal year 2024; and |

| 3. | To cast a non-binding advisory vote to approve executive compensation (“say-on-pay”). |

The Board of Directors (the “Board”) recommends that you vote your shares “FOR” each proposal. The Board knows of no other matters to be presented at this meeting.

This proxy statement is first being made available to our shareholders on or about March 15, 2024.

Voting Rights and Quorum

Shareholders of record at the close of business on March 1, 2024 (the “Record Date”) are entitled to receive notice of and to vote at the meeting. As of the close of business on the Record Date, there were 171,821,187 shares of our common stock outstanding and entitled to vote. Each outstanding share of our common stock entitles the record holder to one vote. Shareholders have no right to cumulative voting as to any matter. Our common stock is listed and trades on the NASDAQ Global Select Market.

The holders of a majority of our common stock outstanding on the Record Date are required to be present in person or be represented by proxy at the meeting to constitute a quorum for the transaction of business. Therefore, a quorum will be present if 85,910,594 shares of our common stock are present in person or represented by executed proxies timely received by us at the meeting. Following the determination of a quorum, the vote required for approval of the matters to be considered at the meeting is as follows:

| • | Nominees for Director will be elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election. An incumbent Director who does not receive more votes “for” than “against” his or her election will promptly offer to tender his or her resignation. The resignation would be considered by the Nominating, Governance and Sustainability Committee and acted upon by our Board (without participation by the incumbent Director who tendered his or her resignation) within 90 days of the election. Thereafter, the Board of Directors will promptly disclose its decision whether to accept the Director’s resignation in a Current Report on Form 8-K furnished to the U.S. Securities and Exchange Commission (the “SEC”). |

1

| • | Other matters presented at the meeting require the affirmative vote of a majority of votes cast on the matter. |

Treatment of Abstentions and Broker Non-Votes

We will count both abstentions and broker “non-votes” as present for the purpose of determining the existence of a quorum for the transaction of business. For the purpose of determining the number of shares voting on a particular proposal, we will not count abstentions and broker “non-votes” as votes cast or shares voting. As a result, abstentions and broker non-votes, if any, will have no effect on the voting results for any of the proposals to be presented at the meeting.

If you are a beneficial owner of shares held in a brokerage account and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the New York Stock Exchange, which are also applicable to NASDAQ-listed companies, brokers, banks and other securities intermediaries that are subject to New York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on matters considered to be “routine” under New York Stock Exchange rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank or other agent cannot vote the shares because the matter is considered “non-routine” under New York Stock Exchange rules. Proposals 1 and 3 are considered to be “non-routine” under New York Stock Exchange rules such that your broker, bank or other agent may not vote your shares on those proposals in the absence of your voting instructions. Conversely, proposal 2 is considered to be “routine” under New York Stock Exchange rules and, thus, if you do not return voting instructions to your broker, your shares may be voted by your broker in its discretion on proposal 2.

Voting Your Shares

If you received a paper copy of the proxy materials, you may vote your shares by submitting the proxy card accompanying the material for use at the meeting. Please complete, date, sign and submit the proxy card as instructed on the card. You may also vote your shares by telephone or via the Internet by following the instructions included on the proxy card or on the Notice of Internet Availability of Proxy Materials. The Internet and telephone voting facilities for shareholders of record will close at 1:00 a.m. Eastern time on May 1, 2024. If you are a shareholder who holds shares through a broker, bank or other similar organization (that is, in “street name”), please refer to the instructions from the broker, bank or other organization holding your shares.

The Board recommends an affirmative vote on all proposals described in the notice for the meeting. Proxies will be voted as specified. If your proxy is properly submitted, it will be voted in the manner that you direct. If you do not specify instructions with respect to any particular matter to be acted upon at the meeting, proxies will be voted in favor of the Board of Directors’ recommendations as set forth in this proxy statement.

You may revoke your proxy at any time before your proxy is voted at the meeting by:

| • | Giving written notice of revocation of your proxy to the Secretary of Cognex at the company’s headquarters; |

2

| • | Completing and submitting a new proxy card relating to the same shares and bearing a later date; |

| • | Properly casting a new vote through the Internet or by telephone at any time before the closure of the Internet or telephone voting facilities; or |

| • | Voting in person at the meeting, although meeting attendance will not, by itself, revoke a proxy. |

If a broker, bank or other similar organization holds your shares, you must contact them in order to find out how to revoke or change your vote.

Expense of Solicitation

The cost of this solicitation will be borne by Cognex. It is expected that the solicitation will be made primarily by delivery of these materials, but regular employees or representatives of Cognex (none of whom will receive any extra compensation for their activities) may also solicit proxies by telephone, email, fax and in person and arrange for brokerage houses and other custodians, nominees and fiduciaries to send proxy materials to their principals at our expense.

How to Obtain an Annual Report on Form 10-K

Our Annual Report on Form 10-K, including the financial statements and schedules to such report, required to be filed with the SEC for our most recent fiscal year is available on our website at www.cognex.com under “Company—Investor Information—Financial Reports—SEC Filings.” Shareholders can send a written request to Investor Relations at Cognex Corporation, One Vision Drive, Natick, Massachusetts 01760 or by email at IR@cognex.com and we will provide a printed copy to such person without charge.

The information contained in our website, including any documents referenced herein that appear on our website, is not included as part of, or incorporated by reference into, this proxy statement, and any references to our website are intended to be inactive textual references only.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may send only one copy of our proxy statement and annual report to multiple shareholders in the same household unless contrary instructions were received. To obtain a copy of either document, please contact Cognex Investor Relations at the mailing address or email address noted above. To receive a copy of either document in the future, or if you are receiving multiple copies and want to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above mailing or email address.

Investor Contact

If you have any questions about the meeting or your ownership of our common stock, please contact Cognex Investor Relations at the above mailing or email address.

3

STOCK OWNERSHIP

Security Ownership of Certain Beneficial Owners

The following table shows as of the Record Date, any person who is known by us to be the beneficial owner of more than five percent of our common stock. For purposes of this proxy statement, beneficial ownership is defined in accordance with Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, agreement, understanding, relationship or otherwise has or shares the power to vote such security or to dispose of such security.

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership of Common Stock | Percent of Class (1) | ||||||||

The Vanguard Group, Inc. (and affiliates) | 17,334,047 | (2) | 10.1 | % | ||||||

BlackRock, Inc. (and affiliates) | 14,840,415 | (3) | 8.6 | % | ||||||

The Bank of New York Mellon Corporation (and affiliates) | 10,520,621 | (4) | 6.1 | % | ||||||

| (1) | Percentages are calculated on the basis of 171,821,187 shares of our common stock outstanding as of March 1, 2024. |

| (2) | Information regarding The Vanguard Group, Inc. is based solely upon a Schedule 13G/A filed by The Vanguard Group with the SEC on February 13, 2024, which indicates that The Vanguard Group held shared voting power over 59,079 shares, sole dispositive power over 17,092,299 shares and shared dispositive power over 241,748 shares. |

| (3) | Information regarding BlackRock, Inc. is based solely upon a Schedule 13G/A filed by BlackRock with the SEC on January 25, 2024, which indicates that BlackRock held sole voting power over 14,444,392 shares and sole dispositive power over 14,840,415 shares. |

| (4) | Information regarding The Bank of New York Mellon Corporation is based solely upon a Schedule 13G/A filed by The Bank of New York Mellon Corporation with the SEC on January 24, 2024, which indicates that: The Bank of New York Mellon Corporation held sole voting power over 7,733,394 shares, shared voting power over 1,455 shares, sole dispositive power over 8,437,942 shares and shared dispositive power over 1,747,842 shares; each of BNY Mellon IHC, LLC and MBC Investments Corporation held sole voting power over 7,066,989 shares, sole dispositive power over 7,729,481 shares and shared dispositive power over 1,734,241 shares; and each of BNY Mellon Investment Management (Jersey) Limited, BNY Mellon Investment Management Europe Holdings limited, BNY Melon International Asset Management Group Limited, BNY Mellon International Asset Management (Holdings) Limited, and Walter Scott and Partners Limited held sole voting power over 6,413,875 shares, sole dispositive power over 7,038,967 shares and shared dispositive power over 1,671,990 shares. |

4

Security Ownership of Directors and Executive Officers

The following information is furnished as of the Record Date, with respect to our common stock beneficially owned within the meaning of Rule 13d-3 of the Exchange Act by each of our Directors, each Director nominee, each of the “named executive officers” (as defined in Item 402(a)(3) of Regulation S-K) and by all of our Directors and executive officers as a group. Unless otherwise indicated, the individuals named held sole voting and investment power over the shares listed below. The address for each individual is c/o Cognex Corporation, One Vision Drive, Natick, Massachusetts 01760.

Name | Amount and Nature of Beneficial Ownership of Common Stock (1) | Percent of Class (2) | ||||||||

Robert J. Willett | 804,716 | (3) | * | |||||||

Anthony Sun | 475,002 | (4) | * | |||||||

Sheila M. DiPalma | 285,726 | * | ||||||||

Carl W. Gerst III | 255,530 | * | ||||||||

Joerg Kuechen | 210,821 | * | ||||||||

Paul D. Todgham | 133,556 | * | ||||||||

Dianne M. Parrotte | 48,740 | * | ||||||||

Sachin Lawande | 6,340 | * | ||||||||

Marjorie T. Sennett | 3,573 | * | ||||||||

John T.C. Lee | 1,906 | * | ||||||||

Angelos Papadimitriou | 1,016 | * | ||||||||

All Directors and Executive Officers as a group (11 persons) | 2,226,926 | (5) | 1.3 | % | ||||||

| * | Less than 1% |

| (1) | Includes the following shares, which the specified individual has the right to acquire upon the exercise of outstanding options, exercisable currently or within 60 days of March 1, 2024: Mr. Willett, 788,912 shares; Mr. Sun (by Sun Management Associates, LLC, a California limited liability company), 135,400 shares; Ms. DiPalma, 281,724 shares; Mr. Gerst, 248,748 shares; Mr. Kuechen, 202,556 shares; Mr. Todgham, 103,416 shares; and Dr. Parrotte, 39,400 shares. |

| (2) | Percentages are calculated on the basis of 173,621,343 shares of our common stock outstanding as of March 1, 2024. The total number of shares outstanding used in this calculation assumes that the currently exercisable options or options which become exercisable within 60 days of March 1, 2024, as well as shares issuable upon settlement of restricted stock units (“RSUs”) that are expected to vest within 60 days of March 1, 2024, held by the specified person are exercised or vest, as applicable. Such number of shares outstanding does not include the number of shares of our common stock underlying options or RSUs held by any other person. |

| (3) | Includes 15,804 shares of common stock held by Willett Parkhill Investment Trust dated August 2, 2010, of which Mr. Willett is a trustee and beneficiary. Mr. Willett has disclaimed beneficial ownership of these securities except to the extent of his pecuniary interest therein. |

| (4) | Includes 26,608 shares of common stock and 135,400 options held by Sun Management Associates, LLC, a California limited liability company, of which Mr. Sun is a member. Mr. Sun has disclaimed beneficial ownership of these securities except to the extent of his pecuniary interest therein. |

| (5) | Includes 1,800,156 shares which certain Directors and executive officers have the right to acquire upon the exercise of outstanding options, exercisable currently or within 60 days of March 1, 2024. |

5

DELINQUENT SECTION 16(a) BENEFICIAL OWNERSHIP REPORTS

Section 16(a) of the Exchange Act requires our executive officers and Directors and persons owning more than 10% of our outstanding common stock to file reports of ownership and changes in ownership with the SEC. Our executive officers, Directors and greater than 10% holders of our common stock are required by SEC regulations to furnish us with copies of all forms they file with the SEC under Section 16(a).

Prior to February 27, 2023, Mr. Willett transferred 7,903 shares of Cognex common stock to the Willett Parkhill Investment Trust dated August 2, 2010, of which Mr. Willett is a trustee and beneficiary. A late Form 5 was filed on March 11, 2024 disclosing the related gifts and Mr. Willett’s indirect ownership of the shares. With the exception of this disclosure, based solely on copies of such forms furnished to us as provided above, we believe that during fiscal year 2023, our executive officers, Directors and owners of greater than 10% of our common stock complied with applicable Section 16(a) filing requirements.

6

CORPORATE GOVERNANCE

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics that applies to our Board of Directors and our employees, including our named executive officers. Predating this code are our company’s ten corporate values, which include “integrity” and are the basis for ensuring that we maintain the highest ethical standards in all that we do. Copies of our company’s Code of Business Conduct and Ethics are available on our website at www.cognex.com under “Company—Investor Information—ESG—Governance Documents” and our ten core values are available under “Company—Investor Information—ESG—ESG Overview.” We intend to disclose on our website any amendment to, or waiver of, any provision of this code applicable to our Directors and named executive officers that would otherwise be required to be disclosed under the rules of the SEC or The NASDAQ Stock Market LLC (“Nasdaq”).

Director Independence

Our Board of Directors has determined that the Director nominees and other incumbent Directors are “independent” as such term is defined in the applicable listing standards of Nasdaq, except for Robert J. Willett, who is an executive officer of Cognex. In making this determination, the Board considered that Dr. Lee is the President and Chief Executive Officer of MKS Instruments, Inc. and Mr. Lawande is President and Chief Executive Officer of Visteon Corporation, each of which is a company with which Cognex has done a small amount of business, all through arm’s length, ordinary course transactions, in which Dr. Lee and Mr. Lawande, as applicable, have no material interest.

Board Leadership Structure

The positions of Chief Executive Officer and Chairman of the Board of Directors were separated in March 2011. At that time, Mr. Willett was promoted to become our Chief Executive Officer. Anthony Sun was appointed Chairman of the Board of Directors in May 2021. Mr. Sun provides an independent voice on the Board in addition to his deep knowledge of Cognex acquired through his tenure on our Board. Mr. Sun continues to lead executive sessions of the independent Directors, which occur regularly. Our Board believes that this leadership structure (specifically, maintaining the separation of the CEO and Chairman roles), promotes the proper balance of leadership and direction for the Board and management that assists the Board in the administration of its risk oversight responsibilities.

The Board’s Role in Risk Oversight

The role of our Board of Directors in our company’s risk oversight process includes receiving regular reports from management on areas of material risk to our company, including operational, financial, legal, regulatory, strategic and reputational risks, and reviewing the outputs of our company’s “Enterprise Risk Management” program. The Board (or the appropriate committee in the case of risks that are under the purview of a particular committee) receives these reports from the appropriate “risk owner” within our company so that it can understand our risk identification, risk management and risk mitigation strategies. When a committee receives the report, the Chairman of the relevant committee reports on the discussion to the full Board. This enables the Board and its committees to coordinate the risk oversight role. Our Board of Directors also

7

administers its risk oversight function through the required approval by the Board (or a committee of the Board) of significant transactions and other material decisions, and regular periodic reports from our company’s independent registered public accounting firm and other outside consultants regarding various areas of potential risk, including, among others, those relating to our cybersecurity, internal controls and financial reporting. As part of its charter, the Audit Committee discusses with management and our independent registered public accounting firm significant risks and exposures and the steps management has taken to minimize those risks. The Audit Committee receives reports regarding cybersecurity risks from the company’s Information Security Team on an annual basis. The Audit Committee periodically reports on cybersecurity risk management to the full Board of Directors.

Policy on Pledging, Hedging and Trading of Cognex Stock

Our insider trading policy governs the timing and type of transactions in Cognex stock by our Board of Directors and certain Cognex employees who have regular access to material non-public information, including our executive officers (collectively, “Insiders”). For example, Insiders are prohibited from trading in Cognex securities during “quiet periods” designated by the company’s Chief Financial Officer. Among other provisions, the policy:

| • | prohibits our Directors and any Cognex employee, including our executive officers, from engaging in short sales of Cognex stock (with violators subject to immediate termination); |

| • | prohibits our Directors and executive officers from trading in exchange-traded options for Cognex stock or any other derivative security designed to hedge or offset risk of a decline in the market value of Cognex stock; and |

| • | prohibits our Directors and executive officers from pledging Cognex stock as collateral for a loan without the approval of the Compensation/Stock Option Committee of the Board of Directors. |

Communications to Directors

Shareholders who wish to communicate with our Board of Directors or with a particular Director may send a letter to the Secretary of Cognex Corporation at One Vision Drive, Natick, Massachusetts 01760. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Shareholder-Board Communication” or “Shareholder-Director Communication.” The letter should clearly state whether the intended recipients are all members of our Board or certain specified individual Directors. The Secretary will make copies of all letters and circulate them to the appropriate Director(s).

Board Meetings, Committees and Attendance

Our Board of Directors held eight meetings during 2023. During 2023, each Director attended at least 75% of the total number of meetings of the Board of Directors held during the period the Director served on the Board and meetings of the committees on which such Director served during the period the Director served on the Board. Our Directors are strongly encouraged to attend the annual meeting of shareholders or any special meeting in lieu of the annual meeting; however, we do not have a formal policy with respect to attendance at that meeting. All of our Directors attended the 2023 Annual Meeting of Shareholders held on May 3, 2023.

The Board has three standing committees: the Compensation/Stock Option Committee, the Audit Committee and the Nominating, Governance and Sustainability Committee. Each committee acts according to a

8

written charter approved by the Board. The charters are available on our website at www.cognex.com under “Company—Investor Information—ESG—Governance Documents.” Each Director who served on a Board committee during 2023 was “independent” as such term is defined in the applicable listing standards of Nasdaq and SEC rules. The agenda for committee meetings is determined by its Chairman in consultation with the other members of the committee and management. The Chairman reports the actions and determinations of the committee to the full Board on a regular basis.

The following table provides current committee membership information for each of the Board committees:

Name | Compensation/ Stock Option | Audit | Nominating, Governance and Sustainability | |||||||||

Sachin Lawande | X | X | ||||||||||

John T.C. Lee | * | X | ||||||||||

Angelos Papadimitriou | X | |||||||||||

Dianne M. Parrotte | X | X | ||||||||||

Marjorie T. Sennett | * | |||||||||||

Anthony Sun | X | * | ||||||||||

| * | Committee Chairman |

| X | Committee Member |

Theodor Krantz, a former Director whose term on the Board ended on May 3, 2023, served as Chairman of the Compensation/Stock Option Committee and the Audit Committee through the end of his term.

Compensation/Stock Option Committee

In accordance with its written charter, the Compensation/Stock Option Committee:

| • | Discharges the Board’s responsibilities relating to the compensation of Cognex’s executives, including the determination of the compensation of our Chief Executive Officer and other executive officers; |

| • | Oversees our overall compensation structure, policies and programs; |

| • | Administers our stock option and equity incentive plans; |

| • | Periodically reviews the level of equity ownership of our named executive officers and Directors to determine compliance with our Stock Ownership Guidelines; and |

| • | Reviews and makes recommendations to the Board regarding the compensation of our Directors. |

Since 2020, the Compensation/Stock Option Committee has engaged the independent compensation consulting services of Pay Governance LLC (“Pay Governance”). Pay Governance reports directly to the Compensation/Stock Option Committee and assists it in evaluating and designing our executive and Director compensation programs and policies. During 2023, Pay Governance reviewed and provided market information and analysis regarding the competitiveness of our executive and Director compensation program design and our award values in relationship to our performance and peer group. Additionally, Pay Governance provided market

9

data and regulatory updates as well as governance best practices. Pay Governance attends committee meetings, as requested, and communicates with the chairman of the Compensation/Stock Option Committee and our Executive Vice President of Employee Services between meetings; however, the Compensation/Stock Option Committee makes all of our executive compensation decisions. Pay Governance is retained only by the Compensation/Stock Option Committee and does not provide any other consulting services to the company. Additional information about the Compensation/Stock Option Committee’s role in setting executive compensation and the services Pay Governance performed for the Compensation/Stock Option Committee in 2023 is described in our “Compensation Discussion and Analysis” section below.

The Compensation/Stock Option Committee regularly reviews the services provided by Pay Governance and believes that Pay Governance is independent in providing compensation consulting services. The Compensation/Stock Option Committee conducted a specific review of its relationship with Pay Governance in 2023, and determined that Pay Governance’s work for the committee did not raise any conflicts of interest, consistent with the regulations adopted by the SEC and Nasdaq. In addition, Pay Governance delivered a letter to the Compensation/Stock Option Committee certifying to its independence in accordance with the independence standards of the SEC and Nasdaq.

Our Chief Executive Officer, other Cognex executives, and the Cognex Employee Services Department also support the Compensation/Stock Option Committee in its duties and may be delegated authority to fulfill certain administrative duties regarding Cognex’s compensation programs. In addition, our Chief Executive Officer makes recommendations to the Compensation/Stock Option Committee on an annual basis regarding salary increases, potential bonuses, and equity-based awards for each of our other executive officers. Our Chief Executive Officer is not present during voting or deliberations concerning his compensation. Our Chief Executive Officer has also been delegated the authority to approve stock options, restricted stock unit awards and other equity-based awards to non-executive employees of Cognex not to exceed 80,000 shares to any one individual in the aggregate per calendar year.

The Compensation/Stock Option Committee has sole authority under its charter to retain, approve fees for, determine the scope of the assignment of, and terminate advisors and consultants as it deems necessary to assist in the fulfillment of its responsibilities. The Compensation/Stock Option Committee utilizes independent third-party benchmarking surveys acquired by Cognex and, as described above, may retain compensation consultants from time to time.

Committee meetings are regularly attended by our Executive Vice President of Employee Services, Sheila DiPalma, except when her compensation is being discussed, and may also include other executives at the invitation of the Compensation/Stock Option Committee. The Compensation/Stock Option Committee also meets in executive session as appropriate. The Compensation/Stock Option Committee met three times in 2023.

The full Board determines the compensation of our Directors, after considering any recommendations of the Compensation/Stock Option Committee.

Further information regarding the processes and procedures of the Compensation/Stock Option Committee for establishing and overseeing our executive compensation programs is provided under the heading “Compensation Discussion and Analysis.”

10

Audit Committee

In accordance with its written charter, the Audit Committee’s general responsibilities include, among other things, the following:

| • | Appointing, compensating, retaining, terminating, and overseeing of the work of Cognex’s independent registered public accounting firm; |

| • | Reviewing the qualifications, performance and independence of Cognex’s independent registered public accounting firm; |

| • | Reviewing our audited and unaudited financial statements; |

| • | Reviewing the adequacy and effectiveness of our internal control over financial reporting with management and our independent registered public accounting firm; |

| • | Reviewing and authorizing both audit and non-audit services and related fees to be provided to Cognex by its independent registered public accounting firm; |

| • | Reviewing and approving related party transactions; and |

| • | To the extent deemed necessary by the Audit Committee to carry out its responsibilities, engaging independent counsel and other advisors and determining the compensation payable to them. |

For 2023, among other functions, the Audit Committee reviewed with our independent registered public accounting firm the scope of the audit for the year, the results of the audit when completed and the independent registered public accounting firm’s fees for services performed. The Audit Committee also appointed the independent registered public accounting firm and reviewed with management various matters related to our internal controls. The Board delegated responsibility for oversight of risks from cybersecurity threats to the Audit Committee. The Audit Committee receives reports from the company’s Information Security Team on an annual basis. The Audit Committee held five meetings during 2023.

The Board of Directors has determined that all members of the Audit Committee are financially literate, and that Ms. Sennett qualifies as an “audit committee financial expert” under the rules of the SEC.

Nominating, Governance and Sustainability Committee

The Nominating, Governance and Sustainability Committee is responsible for identifying individuals qualified to serve as members of the Board and recommending to the Board nominees for election as Directors at each annual meeting of shareholders and when vacancies in the Board occur for any reason. The Nominating, Governance and Sustainability Committee is also responsible for developing and recommending to the Board a set of corporate governance guidelines to assist and guide the Board in the exercise of its responsibilities, periodically reviewing these guidelines and recommending changes deemed appropriate, and coordinating any evaluations of the Board and its committees. Further, the Committee is responsible for the general oversight of Cognex’s environmental, social and governance (“ESG”) strategy, practices and policies, including the consideration of emerging ESG trends that may affect the business, operations, performance or reputation of Cognex. The Nominating, Governance and Sustainability Committee met three times during 2023.

In February 2024, the Board met and, upon the recommendation of the Nominating, Governance and Sustainability Committee, recommended the Director nominees for election at the meeting. Sachin Lawande and Marjorie T. Sennett have been nominated for election to the Board.

11

Compensation/Stock Option Committee Interlocks and Insider Participation

During 2023, Dr. Lee, Dr. Parrotte, Mr. Sun and Mr. Krantz (through May 3, 2023, the end of Mr. Krantz’s term on the Board) served on the Compensation/Stock Option Committee. No member of the Compensation/Stock Option Committee served as an officer or employee of Cognex or any of its subsidiaries, nor, other than Dr. Lee as described above, had any business relationship or affiliation with Cognex or any of its subsidiaries during 2023 other than his or her service as a Director.

Certain Relationships and Related Transactions

In accordance with its written charter, the Audit Committee conducts an appropriate review of all related party transactions for potential conflict of interest situations on an ongoing basis, and the approval of the Audit Committee is required for all related party transactions. Since the beginning of 2023, there were no related party transactions, and there are not currently any proposed related party transactions, that would require disclosure under SEC rules. Under our Code of Business Conduct and Ethics, any transaction or relationship engaged in by our employees that reasonably could be expected to give rise to a conflict of interest should be reported promptly to our Compliance Officer, who may notify our Board of Directors or a committee thereof as he or she deems appropriate. Actual or potential conflicts of interest involving a Director or executive officer are required to be disclosed directly to the Chairman of our Board of Directors.

Board Diversity Matrix

The following shows the diversity make-up of the Board as of March 1, 2024.

Board Diversity Matrix (as of March 1, 2024) | ||||||||||||||||||||

Total Number of Directors | 7 | |||||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||||||

Gender Identity | ||||||||||||||||||||

Directors | 2 | 5 | 0 | 0 | ||||||||||||||||

Demographic Background | ||||||||||||||||||||

African American or Black | 0 | 0 | ||||||||||||||||||

Alaskan Native or Native American | 0 | 0 | ||||||||||||||||||

Asian | 0 | 3 | ||||||||||||||||||

Hispanic or Latinx | 0 | 0 | ||||||||||||||||||

Native Hawaiian or Pacific Islander | 0 | 0 | ||||||||||||||||||

White | 1 | 2 | ||||||||||||||||||

Two or More Races or Ethnicities | 0 | 0 | ||||||||||||||||||

LGBTQ+ | 0 | 0 | ||||||||||||||||||

Did Not Disclose Demographic Background | 1 | 0 | ||||||||||||||||||

Director Nominees

When considering a potential candidate for membership on our Board of Directors, the Nominating, Governance and Sustainability Committee will consider any criteria it deems appropriate, including, among other things, the experience and qualifications of any particular candidate as well as such candidate’s past or

12

anticipated contributions to our Board and its committees. At a minimum, each nominee is expected to have high personal and professional integrity and demonstrated ability and judgment to be effective, with the other Directors and management, in collectively serving the long-term interests of our shareholders. Each nominee is expected to be personable and support our “Work Hard, Play Hard, Move Fast” culture. Further, each nominee is expected to have direct and significant experience in one or more industries or markets in which our company does, or plans to do, business, and/or significant senior-level management experience in functions or roles which are helpful to our company. This includes finance, accounting, legal, human resources, engineering, manufacturing, and sales and marketing.

In addition to the minimum qualifications set forth above, when considering potential candidates for our Board of Directors, the Nominating, Governance and Sustainability Committee seeks to ensure that the Board of Directors is comprised of a majority of independent Directors, that the committees of the Board are comprised entirely of independent Directors, and that at least one member of the Audit Committee qualifies as an “audit committee financial expert” under SEC rules. The Nominating, Governance and Sustainability Committee may also consider any other standards that it deems appropriate.

The Nominating, Governance and Sustainability Committee considers the composition of our Board overall, with the goal of having a combination of backgrounds, skills and knowledge to help promote Cognex’s long-term strategy. In particular, the committee, when recommending director candidates to the full Board for nomination, may consider whether a director candidate, if elected, assists in achieving a mix of Board members that represents a diversity of background and experience.

Board diversity, including with respect to ethnicity, age and gender, continues to be a priority of the Board. In 2017, our Board amended our corporate governance guidelines to require our Nominating, Governance and Sustainability Committee to include women and individuals from minority groups who meet the required qualifications on the initial list of director candidates from which new board nominees are chosen. In addition, any search firm retained by the Nominating, Governance and Sustainability Committee is required to abide by these guidelines. Since these requirements were added to our corporate governance guidelines, Dr. Parrotte (in 2018), Mr. Lawande (in 2021), Ms. Sennett (in 2021), Dr. Lee (in 2022), and Mr. Papadimitriou (in 2023) have been elected to the Board. The Nominating, Governance and Sustainability Committee believes that there will be opportunities over the next one-to-three years to continue to add strong, independent and diverse directors to the Board.

In practice, the Nominating, Governance and Sustainability Committee generally will evaluate and consider all candidates recommended by our Directors, officers and shareholders. The Nominating, Governance and Sustainability Committee intends to consider shareholder recommendations for directors using the same criteria as potential nominees recommended by the members of the Nominating, Governance and Sustainability Committee or others. The Nominating, Governance and Sustainability Committee did not receive any shareholder nominations for director with respect to this Annual Meeting of Shareholders.

Shareholders who wish to submit Director candidates for consideration as nominees for election at our 2025 Annual Meeting of Shareholders should send such recommendations to the Secretary of Cognex Corporation at our executive offices on or before November 15, 2024. These recommendations must include:

| • | the name and address of record of the shareholder; |

13

| • | a representation that the shareholder is a record holder of our common stock, or if the shareholder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Exchange Act; |

| • | the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding ten full fiscal years of the proposed Director candidate; |

| • | a description of the qualifications and background of the proposed Director candidate which addresses the minimum qualifications described above and any other criteria for Board membership approved by the Board from time to time; |

| • | a description of all arrangements or understandings between the shareholder and the proposed Director candidate; and |

| • | the consent of the proposed Director candidate to be named in the proxy statement, to serve as a Director if elected at such meeting, and to give our company the authority to carry out a detailed and thorough investigation of his/her educational, professional, financial and personal history. |

Shareholders must also submit any other information regarding the proposed Director candidate that is required to be included in a proxy statement filed pursuant to SEC rules. See also the information under the heading “Shareholder Proposals.”

14

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of seven Directors and is divided into three classes, with one class being elected each year for a term of three years. We are proposing that Sachin Lawande and Marjorie T. Sennett be elected to serve terms expiring at the 2027 Annual Meeting of Shareholders and in each case until a successor is duly elected and qualified or until his or her earlier death, resignation or removal. Biographical information including the key attributes and skills the director nominees bring to our Board is set forth below.

Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF SACHIN LAWANDE AND MARJORIE T. SENNETT.

The persons named in the accompanying proxy will vote, unless a shareholder specifies otherwise, “FOR” the election of the nominees named above. Our Board of Directors anticipates that each nominee, if elected, will serve as a Director. If a nominee is unable to accept election, the persons named in the accompanying proxy will vote for such substitute as our Board of Directors may recommend. There are no family relationships between any incumbent Director or any Director nominee and any executive officer of Cognex or its subsidiaries.

Information Regarding Directors and the Director Nominees

Set forth below is information furnished to us by the Director nominees and the incumbent Directors whose terms will continue after the meeting. The biographical description for each Director and Director nominee includes his or her age, all positions he or she holds with Cognex, his or her principal occupation and business experience over the past five years, and the names of other publicly held companies for which he or she currently serves as a director or has served during the past five years. It also includes the specific experience, qualifications, attributes and skills that led to our Board’s conclusion that the nominee should serve as a director of Cognex or, with respect to each Director who is not standing for election, that the Board would expect to consider if it were making a conclusion currently as to whether he or she should serve as a director.

We believe that all of our Directors have a reputation for integrity, honesty and adherence to high ethical standards. Each has demonstrated business acumen and an ability to exercise sound judgment as well as a commitment of service to Cognex and, to the extent applicable, our Board. Our Board does not currently evaluate whether incumbent Directors who are not standing for election should serve as directors, as the terms for which they were previously elected continue beyond the meeting.

Nominated for a term ending in 2027:

Sachin Lawande, 56, has served as a Director since January 1, 2021. Mr. Lawande is the President and Chief Executive Officer of Visteon Corporation (VC), a leading global technology supplier of vehicle cockpit electronic products. Mr. Lawande has held this position since 2015. Previously, he worked for Harman International Industries, Inc. (HAR), which was an independent public company at the time, for 10 years, where he held a range of leadership positions including president of the company’s largest division with nearly $3 billion in annual sales. Since 2015, Mr. Lawande has served as a Director of Visteon Corporation, a publicly held company listed on Nasdaq. He was also on the board of DXC Technology Company (DXC) from 2015 until

15

August 2020. Mr. Lawande holds a B.S. from Bombay University, and a Master’s Degree from Southern Illinois University at Edwardsville, in Electrical and Electronics Engineering. We believe Mr. Lawande’s qualifications for sitting on the Board of Directors include his executive leadership experience, including his service as chief executive officer of a large public company, perspective from his service on other public company boards, expertise in the automotive, technology and software industries, and international experience, including experience with manufacturing and engineering operations in India.

Marjorie T. Sennett, 63, has served as a Director and member of the Audit Committee since November 3, 2021. Ms. Sennett currently serves as a member of the Board of Directors and Chair of the Audit Committee of The diaTribe Foundation, a private entity focused on improving the outcomes of people with diabetes. From 2014 to 2018, she was a Director and member of the Audit Committee at QuinStreet, Inc. (QNST), a performance marketing technology company. Named one of “20 Women in Finance You Should Add to Your Company’s Board” by Business Insider, Ms. Sennett previously served as a Managing Director of Farallon Capital Management, LLC where she invested in publicly traded securities for eight years. Before that, she was Chief Financial Officer at eGroups, Inc., where she co-led the sale of the company to then publicly held Yahoo! Inc., and at Amylin Pharmaceuticals, Inc., where she led the company’s initial public offering and multiple follow-on public offerings. Ms. Sennett holds a B.A. from Vanderbilt University and an M.B.A. from Stanford University. We believe Ms. Sennett’s qualifications for sitting on our Board of Directors include her public board experience, extensive knowledge of corporate finance and financial reporting, financial leadership for fast-growing companies in the biotechnology and technology sectors, and experience as an institutional investor.

Serving a term ending in 2026:

Angelos Papadimitriou, 57, has served as a Director since February 17, 2023. Mr. Papadimitriou currently serves as Chairman of the Board of Directors of Athena Ventures, an investment firm focusing on early-stage ventures. Mr. Papadimitriou is also the Executive Chairman of the Board of Director of Celli Group, a global leader in drink dispensing systems, headquartered in Italy. Mr. Papadimitriou has held this position since July 2023. From August 2020 to February 2021, Mr. Papadimitriou was the Co-Chief Executive Officer of Pirelli & C. S.p.A., a public company listed on the Milan Stock Exchange. Mr. Papadimitriou previously led Coesia S.p.A., a group of global industrial and packaging solutions companies as their Chief Executive Officer for ten years. Prior to that, Mr. Papadimitriou spent over fifteen years in the pharmaceutical industry, including as Senior Vice President for Italy and Southeast Europe at GlaxoSmithKline. Mr. Papadimitriou also serves as a board member of several private companies. Mr. Papadimitriou holds an M.B.A. from Harvard Business School and a B.A. in Computer Science and Business Economics from Brown University. We believe Mr. Papadimitriou’s qualifications for sitting on our Board of Directors include his executive leadership experience, including his service as chief executive officer of a large public company, perspective from his service on other company boards and expertise in the packaging machinery and industrial automation industries and European and international markets.

Dianne M. Parrotte, M.D., M.P.H., 74, has served as a Director since 2018. Since 1995, Dr. Parrotte has been an independent consultant to corporations, law firms and insurance companies on human resource matters involving employee health and wellness. She was a trustee of the Shillman Foundation from March 2000 until her resignation in February 2018. From 1989 until 1995, Dr. Parrotte was chief in charge of occupational health at Bath Iron Works (later acquired by General Dynamics). From 1982 to 1988, she was the on-site Medical Director at Polaroid Corporation. Dr. Parrotte served as a Cognex Director from 1981, at the time of the

16

company’s incorporation, to 1982. In addition to numerous certifications and licenses, Dr. Parrotte holds an M.P.H. from the Medical College of Wisconsin, an M.D. from the Boston University School of Medicine and a B.A. from Boston University. She is Board Certified in Occupational and Environmental Medicine as well as in Internal Medicine. She is a former Fellow of the American College of Occupational and Environmental Medicine. She also completed the Penn State Executive Program. During the past five years, Dr. Parrotte has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. We believe Dr. Parrotte’s qualifications for sitting on our Board of Directors include her experience with a wide range of human resource and organizational matters related to large public companies, as well as her significant knowledge of the history and culture of Cognex.

Serving a term ending in 2025:

John T.C. Lee, 61, has served as a Director since May 4, 2022. Dr. Lee is currently the President and Chief Executive Officer of MKS Instruments, Inc. (Nasdaq: MKSI), a global provider of instruments, systems, subsystems and process control solutions for advanced manufacturing processes. Dr. Lee has held this position since January 2020. He has also served on the MKS Board of Directors since January 2020. From October 2007 to January 2020, Dr. Lee held a series of progressive leadership roles at MKS, including Chief Operating Officer from 2016 to 2019. Prior to joining MKS, Dr. Lee served in various capacities in various technology industries, including semiconductor and solar as well as plasma processing research, at leading technology companies, including Applied Materials, Lucent Technologies and AT&T Bell Labs. He has served as a member of the Executive Committee of the Board of Directors of the Massachusetts High Technology Council since 2021, as their Vice Chair from 2021 to 2023 and as their Chair since 2023. Dr. Lee holds a B.S. from Princeton University and both an M.S.C.E.P. and a Ph.D. from the Massachusetts Institute of Technology, all in Chemical Engineering. We believe Dr. Lee’s qualifications for sitting on the Board of Directors include his executive leadership experience, including his service as chief executive officer of a large public company, perspective from his service on other public company boards, expertise in the semiconductor and technology industries, and international experience.

Anthony Sun, 71, has served as a Director since 1982. Mr. Sun served as a managing general partner and Chief Executive Officer of Venrock Associates, a venture capital partnership, from 1997 until his retirement in 2010. He began his tenure at Venrock in 1979 and was a general partner from 1980 to 1997. Mr. Sun has also served as a member of the Boards of Directors of several private companies. During the past five years, Mr. Sun has not served as a member of the Board of Directors of another publicly held company or of a registered investment company. Mr. Sun holds a B.S. and M.S. in Engineering from the Massachusetts Institute of Technology and an M.B.A. from Harvard University. We believe Mr. Sun’s qualifications for sitting on our Board of Directors include his executive experience, his expertise in the high-technology industry, particularly having served as a member of the Board of Directors of more than a dozen public high-tech companies in the past, and the deep understanding of our company that he has acquired through service on our Board.

Robert J. Willett, 56, has served as a Director and Chief Executive Officer of Cognex since 2011. Mr. Willett joined our company in 2008 as President of the Modular Vision Systems Division and was promoted to President and Chief Operating Officer in 2010. He came to Cognex from Danaher Corporation, where he served as Vice President of Business Development and Innovation for the Product Identification Business Group and as President of Videojet Technologies, a leader in coding and marking products. Prior to that, Mr. Willett served as Chief Executive Officer of Willett International Ltd., a coding and marking company that was sold to

17

Danaher and merged with Videojet. Mr. Willett currently serves as a Director of Clean Harbors, Inc. (CLH), a publicly held company listed on the New York Stock Exchange. Mr. Willett holds a B.A. from Brown University, and an M.B.A. from Yale University. We believe Mr. Willett’s qualifications for sitting on our Board of Directors include his experience in the machine vision industry, his executive leadership experience and the knowledge of our company that he has acquired through his management roles.

18

DIRECTOR COMPENSATION

The following table sets forth the compensation earned by or awarded to each Director who served on our Board of Directors in 2023, other than Mr. Willett. Details of Mr. Willett’s compensation is set forth under the heading “Executive Compensation—Summary Compensation Table.”

Director Compensation Table—2023

Name | Fees Earned or Paid in Cash (1) ($) | Stock Awards (2)(3) ($) | Option Awards (4) ($) | All Other Compensation ($) | Total Compensation ($) | |||||||||||||||

Patrick A. Alias (5) | $ | — | $ | — | $ | — | $ | 98,722 | (6) | $ | 98,722 | |||||||||

Theodor Krantz (7) | $ | 30,000 | $ | — | $ | — | $ | — | $ | 30,000 | ||||||||||

Sachin S. Lawande | $ | 64,333 | $ | 271,533 | $ | — | $ | — | $ | 335,866 | ||||||||||

John T.C. Lee | $ | 73,333 | $ | 271,533 | $ | — | $ | — | $ | 344,866 | ||||||||||

Dianne M. Parrotte | $ | 72,000 | $ | 271,533 | $ | — | $ | — | $ | 343,533 | ||||||||||

Angelos Papadimitriou | $ | 70,886 | $ | 236,531 | $ | — | $ | — | $ | 307,417 | ||||||||||

Marjorie T. Sennett | $ | 68,333 | $ | 271,533 | $ | — | $ | — | $ | 339,866 | ||||||||||

Anthony Sun | $ | 128,000 | (8) | $ | 271,533 | $ | — | $ | — | $ | 399,533 | |||||||||

| (1) | Fees are presented in the year earned. The payment of such amounts may occur in other years (i.e., 2024). |

| (2) | In 2023, each Director, other than Mr. Willett, Mr. Papadimitriou, Mr. Alias and Mr. Krantz, was granted 5,826 RSUs. Mr. Papadimitriou was granted 5,075 RSUs upon his appointment to the Board in February 2023. All Director RSU awards began vesting in annual installments of 20%, 30% and 50% on February 21, 2024. All equity award agreements covering the unvested equity awards held by our non-employee Directors provide for such equity awards to vest immediately upon a “change of control” of Cognex, which is defined as a corporate transaction in which the holders of Cognex common stock before the transaction control less than 51% of the stock of Cognex or any successor corporation after the transaction. Amounts listed in this column represent the grant date fair value of RSUs. The methodology and assumptions used to calculate the grant date fair value are described in “Note 16, Stock-Based Compensation” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. Cognex recognizes the grant date fair value as an expense for financial reporting purposes over the service-based vesting period. See also the information under the heading “Director Compensation—Elements of Director Compensation.” |

| (3) | Each Director, other than Mr. Willett, had the following unvested RSUs outstanding on December 31, 2023: Mr. Alias, 4,934 shares; Mr. Krantz, 0 shares; Mr. Lawande, 10,760 shares; Dr. Lee 8,783 shares; Dr. Parrotte, 10,760 shares; Mr. Papadimitriou, 5,075 shares; Ms. Sennett, 9,513 shares; and Mr. Sun, 10,760 shares. Mr. Krantz forfeited 4,934 RSUs in connection with the completion of his term on the Board on May 3, 2023. No other Directors forfeited any RSUs in 2023. |

| (4) | Each Director, other than Mr. Willett, had the following options outstanding on December 31, 2023: Mr. Alias, 129,231 shares; Mr. Krantz, 0 shares; Mr. Lawande, 0 shares; Dr. Lee 0 shares; Dr. Parrotte, 44,000 shares; Mr. Papadimitriou, 0 shares; Ms. Sennett, 0 shares; and Mr. Sun, 166,000 shares. 12,400 stock options held by Mr. Krantz were terminated in connection with the completion of his term on the Board on May 3, 2023. No other Directors forfeited any stock options in 2023. |

19

| (5) | Mr. Alias completed his term on the Board on May 3, 2023 following the 2023 Annual Meeting of Shareholders. Mr. Alias remains an employee of the company in an advisory role. As such, the RSUs and options held by Mr. Alias remain eligible to continue vesting in accordance with their terms. |

| (6) | Includes Mr. Alias’ salary of $94,087 and a $3,547 bonus under our annual bonus program, both of which were earned by Mr. Alias during 2023 in his capacity as a non-executive employee of Cognex, as well as life insurance premiums of $1,088. |

| (7) | Mr. Krantz completed his term on the Board on May 3, 2023 following the 2023 Annual Meeting of Shareholders. |

| (8) | Paid to Sun Management Associates, LLC, a California limited liability company, of which Mr. Sun is a member. |

Elements of Director Compensation

The Compensation/Stock Option Committee reviews our non-employee Director compensation on a regular basis. The Compensation/Stock Option Committee considers various factors in making a recommendation to the Board, including a competitive assessment of Director compensation with that of our peer group (as described under the heading “Compensation Discussion and Analysis”), market trends, the responsibilities of our non-employee Directors, the anticipated time commitment and amount of work, the responsibilities of the various committees of the Board, and our ability to attract and retain high caliber non-employee Directors to serve on the Board. The Compensation/Stock Option Committee also retained an independent compensation consultant, Pay Governance, to help benchmark and set non-employee Director compensation for 2023.

We provide a significant portion of the total compensation of our non-employee Directors in the form of equity compensation to align their long-term interests with those of our shareholders. Each non-employee Director is paid an annual cash retainer for their service on their Board and is eligible for a grant of RSUs. We believe that this compensation model has enabled us to create an attractive and market competitive compensation package for Board candidates while reducing dilution and administrative costs to the company as compared to our prior program of granting only options to Directors.

The following table sets forth the elements of cash compensation in 2023 for our non-employee Directors for their service on our Board of Directors and its committees. Mr. Willett, who is an executive officer of Cognex, receives no additional compensation for his service on the Board, and Mr. Alias, who is a non-executive employee of Cognex, received no additional cash compensation for his service on the Board.

Type of Fee | Board of Directors | Compensation/Stock Option Committee (1) | Audit Committee (1) | Nominating, Governance and Sustainability Committee (1) | ||||||||||||

Annual Cash Retainer | $ | 50,000 | $ | 8,000 | $ | 10,000 | $ | 5,000 | ||||||||

Annual Chairman Retainer | $ | 60,000 | $ | 20,000 | $ | 20,000 | $ | 10,000 | ||||||||

| (1) | Annual Committee Chairman retainers are inclusive of the respective Committee cash retainers. For example, the Chairman of the Audit Committee receives $20,000 in total for serving on the Audit Committee, not $30,000. |

20

In 2023, each Director (other than Mr. Krantz, Mr. Alias and Mr. Willett) also received a grant of RSUs in consideration for serving on our Board. RSU grant amounts and vesting schedules are detailed in the “Director Compensation Table—2023” under the heading “Stock Awards.”

Director Stock Ownership Guidelines

In February 2022, the Compensation/Stock Option Committee approved stock ownership guidelines for our Directors based on our belief that stock ownership further aligns the interests of our Directors with those of our shareholders. These guidelines provide that each non-employee Director is expected to accumulate and hold an amount of qualifying shares equal to three times his or her annual cash retainer for service on the Board. Further, each employee Director is expected to accumulate and hold an amount of qualifying shares equal to three times his or her annual base salary. For clarity, the “annual cash retainer” excludes any retainer for serving as a member or as a chairman of any Board committee, or for serving as the Chairman of the Board. The ownership requirement may be satisfied through (i) shares of Cognex common stock (whether granted by the company as an equity award or purchased by the Director independently), and/or (ii) RSUs granted by the company to the Director that vest over a specified time period, in each case the value of which is calculated based on the closing price of our common stock on the date of determining compliance with the minimum stock ownership guidelines. Directors have five years from the later of the adoption of these guidelines or their election to the Board to achieve the requisite level of ownership under these guidelines. Compliance is measured as of the last day of each fiscal year. As of the Record Date, the Board believes that all of our Directors are making satisfactory progress toward compliance with our stock ownership guidelines.

21

COMPENSATION POLICIES AND PROCEDURES

Cognex’s approach to compensation and performance management is to provide a competitive total compensation package with periodic reviews to encourage ongoing high-quality performance. We strive to hire, retain and promote talented individuals based on their achievements, to reward employees based on their overall contribution to the success of our company, and to motivate employees to increase shareholder value.

In addition to salary, total compensation may include overtime pay, commissions, equity-based awards and potential bonuses depending on the employee’s job and level within Cognex. It also includes benefits consistent with our “Work Hard, Play Hard, Move Fast” culture that recognize employee achievement and encourage new levels of success, such as President’s Awards, which reward our top performers, and Perseverance Awards, which reward employee longevity, commitment and loyalty. Other benefits available to employees include company-paid basic group term life insurance, basic accidental death and dismemberment insurance, an employer match of eligible compensation that employees invest in their 401(k) accounts, and tuition reimbursement.

The Compensation/Stock Option Committee oversees the compensation program for Cognex employees. The committee has discussed risk as it relates to our compensation program and does not believe that our compensation program is structured to encourage excessive or inappropriate risk taking for the following reasons:

| • | Compensation for most salaried employees consists of both fixed and variable components. The fixed portion (i.e., base salary) provides a steady income to our employees regardless of company performance or stock price. The variable portion (i.e., annual company bonus, sales commissions and equity-based awards) is based upon individual, company and stock price performance. This mix of compensation is designed to motivate our employees, including our named executive officers, to produce superior short- and long-term corporate performance without taking unnecessary or excessive risks to the detriment of important business metrics. |

| • | The company bonus is an annual program and is focused on profitability, while the equity award program generally has a three to five year service-based vesting period and is focused on stock price performance. We believe that these programs provide a check on excessive risk taking because to inappropriately benefit one would be a detriment to the other. For example, focusing solely on profitability would be detrimental to our company over the long term, ultimately harming our stock price and the value of equity-based awards, such as stock options and RSUs. |

| • | We prohibit all hedging transactions involving Cognex stock by our Board of Directors and certain employees who have regular access to material non-public information, including our named executive officers, so that they cannot insulate themselves from the effects of poor stock performance. Further, any Cognex employee engaged in short sales of Cognex stock is subject to immediate termination. |

| • | In order for any employee to be eligible for an annual company bonus, Cognex must first achieve certain financial goals that are established annually by the Board of Directors related to our consolidated operating income as a percentage of revenue (we refer to this metric as “operating margin”). We believe that focusing on profitability rather than other measures encourages a balanced approach to performance and emphasizes consistent behavior across the organization. |

| • | Our annual bonus program is capped for each employee at director level and above, which includes our named executive officers, which we believe mitigates excessive risk taking by limiting bonus payouts even if our company dramatically exceeds its operating margin target. |

22

| • | Our annual bonus program has been structured around attaining a certain level of profitability for many years and we have seen no evidence that it encourages unnecessary or excessive risk taking. |

| • | The calculation of our operating margin target for purposes of our annual bonus is defined annually by our Board of Directors and is designed to keep it from being susceptible to manipulation by any employee, including our named executive officers. We have a Code of Business Conduct and Ethics that covers, among other things, accuracy of books and records. And, predating this code, is our company’s ten corporate values, which include “integrity” and are the basis for ensuring we maintain the highest ethical standards in all that we do. |

| • | Our executive stock ownership guidelines require our Directors and named executive officers to hold a substantial amount of qualifying shares, which aligns an appropriate portion of their personal wealth to the long-term performance of Cognex. |

| • | Our Clawback Policy enables us to recover erroneously awarded incentive-based compensation paid to a named executive officer due to a restatement of previously issued financial statements, thus reducing any incentive to engage in misconduct to meet financial targets. |

23

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

We maintain a pay-for-performance compensation philosophy that favors variable compensation based on individual, company and stock performance over fixed compensation such as base salary. We target paying our named executive officers, including our CEO, a base salary positioned at only the 25th percentile of our peer group; we establish a potential annual bonus that is market competitive and linked to individual and company performance objectives; and we grant equity awards in a manner that aligns the interests of our named executive officers with those of our shareholders. Compensation is weighted towards equity awards so that our named executive officers adopt an ownership mentality and take a long-term view of the business.

Total compensation for our named executive officers also includes other benefits that are available to Cognex employees generally. This includes Perseverance Awards (which reward employee longevity, commitment and loyalty), company-paid basic group term life insurance and basic accidental death and dismemberment insurance, an employer match of eligible compensation that employees invest in their 401(k) accounts, and tuition reimbursement.

The Compensation/Stock Option Committee, which consists entirely of independent Directors, reviews and approves compensation for our named executive officers, using its judgment and experience in determining the mix of compensation. The committee views salary and bonuses as short-term compensation to reward our named executive officers for meeting annual individual and company performance objectives, and equity-based awards as a reward for increasing shareholder value and improving corporate performance over the long term. The Compensation/Stock Option Committee also believes that our equity award program is instrumental to our ability to recruit, retain and motivate our high caliber employees.

The Compensation/Stock Option Committee is continually working to enhance our compensation programs to help ensure that our performance-based compensation philosophy and long-term perspective perseveres as our company grows. Specifically, in 2022, the Compensation/Stock Option Committee approved a performance-based equity award for our CEO based on relative total shareholder return, as well as stock ownership guidelines for all of our Directors and named executive officers. Further, in 2023, the committee introduced a compensation recovery policy to enable the recoupment of erroneously awarded incentive-based compensation paid to a named executive officer due to a restatement of previously issued financial statements.

Determinations with respect to compensation for a fiscal year are generally made in the first quarter following our Board of Directors’ approval of Cognex’s annual budget for that year, which typically occurs at the end of the previous year.

Say-on-Pay Feedback from Shareholders

At our 2023 Annual Meeting of Shareholders, approximately 85% of the votes cast on the say-on-pay proposal were in favor of the approval of the compensation of our named executive officers, with approximately 15% of the votes cast against such proposal. The Compensation/Stock Option Committee believes that this shareholder vote endorses the compensation philosophy of our company, and the Compensation/Stock Option Committee did not make any significant changes to our executive compensation program for 2023 as a result of

24

the say-on-pay vote by our shareholders. Based on the voting results at our 2023 Annual Meeting, and consistent with the recommendation of the Board of Directors, we will continue to conduct an advisory vote on the compensation of our named executive officers on an annual basis until the next advisory vote on the frequency of the say-on-pay vote, which we expect will occur at our 2029 Annual Meeting of Shareholders.

2023 Business Results

2023 was a year of perseverance at Cognex. We advanced many high-potential strategic initiatives while navigating a global manufacturing recession. We continued to take important steps toward achieving our strategic priorities and long-term goals.

After growing almost 30% in 2021 fueled by a pandemic-related acceleration in logistics and electronics investments, revenue was slightly down in 2022 and then declined 17% in 2023 from the prior year. Customers have remained cautious with investments resulting in lower spending trends across our factory automation business, most notably in the consumer electronics and semiconductor industries, and we experienced a continued pause in investments by a few large e-commerce logistics customers. Over half of our overall 2023 revenue decline was driven by two large, long-standing customers, who reduced their overall capital expenditures after heavy investment in prior years.

Gross margin as a percentage of revenue remained consistent with the prior year at 72%, as the deleveraging impact of lower sales volume, less favorable revenue mix, and charges related to the acquisition of Moritex Corporation in the fourth quarter of 2023 were offset by lower inventory costs due to a reduction in premiums paid to brokers for the purchase of components.

Operating expenses were relatively flat with the prior year, as the favorable year-over-year impact of losses from the fire at our primary contract manufacturer’s warehouse in 2022 compared to recoveries from the fire in 2023, lower incentive compensation, and cost management were offset by investment in our “Emerging Customer” sales initiative and expenses related to the acquisition of Moritex Corporation in the fourth quarter of 2023.

Operating income decreased to 16% of revenue in 2023 compared to 24% of revenue in 2022 driven by the operating deleveraging resulting from the lower revenue levels.

On October 18, 2023, the company acquired all the outstanding shares of Moritex Corporation, a provider of optical components based in Japan, for an enterprise value of ¥40 billion Japanese Yen, or approximately $270 million U.S. Dollars based on the closing date foreign exchange rate. Additionally, in 2023, Cognex spent approximately $79.8 million to repurchase our common stock and paid approximately $49.1 million in dividends to shareholders.

We remain focused on strict cost management, while continuing to invest in our long-term growth prospects. We launched a record number of new products in 2023 and commenced a multi-year investment in our Emerging Customer initiative to expand our customer base. We believe these actions position us well to capitalize on exciting industry trends as growth returns.

25

Compensation Program Highlights

Our executive compensation program is designed to be largely performance-based with base salary providing a steady income and the annual company bonus, RSU awards and stock option awards based upon individual, company and stock price performance. In its deliberations of compensation for our named executive officers, the Compensation/Stock Option Committee considers the following:

| • | Objective competitive market data of peer companies provided by Pay Governance (“Competitive Analysis”); |

| • | The levels of responsibility associated with each executive’s position; |

| • | The past performance of the individual executive; |

| • | The extent to which individual, departmental and company-wide goals have been met; |

| • | The overall competitive environment and the level of compensation necessary to attract and retain talented and motivated individuals in key positions; |

| • | The recommendations of our Chief Executive Officer with respect to the salary increases, potential bonuses and equity award grants for those executive officers that report to him; |

| • | The link between our named executive officers’ compensation and Cognex’s performance (pay-for-performance); |

| • | Each named executive officer’s compliance, or progress toward compliance during the phase-in period, as applicable, with our Stock Ownership Guidelines; and |

| • | The outcome of advisory shareholder votes on executive compensation (commonly known as “say-on-pay” proposals). |