The following table sets forth certain information regarding grants of options to purchase our common stock made during the fiscal year ended December 26, 2004, to the persons named in the summary compensation table:

The following table sets forth certain information concerning exercises of options to purchase our common stock in the fiscal year ended December 26, 2004, and unexercised options held as of December 26, 2004, by the persons named in the summary compensation table:

Employment Contracts and Termination of Employment and Change-in-Control Arrangements

Employment Contracts

On October 20, 2004, we entered into an employment agreement with J. Jeffrey Meder to continue to serve as our president and chief executive officer. The agreement is effective as of September 1, 2004, and continues through September 1, 2007, unless extended by mutual agreement or terminated sooner under the terms of the agreement. The agreement provides for the payment to Mr. Meder of an initial annual salary of $310,000, subject to annual review and adjustment by our board of directors. Mr. Meder will also be eligible for an annual bonus of $100,000, adjusted upward or downward as appropriate, based on the achievement of specified financial targets. In addition, beginning on September 1, 2005, Mr. Meder will receive a bonus of $50,000 for each new store we open. Either party may terminate the agreement at any time and for any reason upon 30 days written notice to the other party. If we terminate Mr. Meder’s employment prior to the end of the term of the agreement other than for cause (as defined in the agreement), or if his employment is terminated within twelve months following a change of control, he is entitled to receive a lump sum payment equal to twelve months’ base salary and continuation of benefits.

Our other executive officers who are named in the summary compensation table serve as “at will” employees. Each of these officers is eligible to participate in our incentive bonus program and our executive severance plan.

Incentive Bonus Plan. On December 15, 2004, the compensation committee approved our 2005 incentive bonus program with respect to several classes of key employees, including our executive officers. The design of the bonus program is substantially similar to our 2004 bonus program and other prior year programs, and all such programs reward achievement at specified levels of financial and departmental performance.

Under the bonus program, and consistent with the 2004 predecessor program, each of our executive officers (excluding our chief executive officer) is eligible to receive a bonus based on a combination of our earnings from operations improvement over the prior fiscal year, as defined by the compensation committee, and a percentage of his or her salary based on departmental performance and our net income compared to our operating plan.

Each store manager is eligible to receive a bonus based primarily on a combination of store profitability, store gross margin return on inventory investment, and our operating income, all compared to our operating plan. Each corporate and depot-based key employee is eligible to receive a bonus based on departmental performance and our net income compared to our operating plan.

Change-in-Control Arrangements

Amended and Restated 1998 Stock Incentive Compensation Plan. Pursuant to the amended and restated 1998 stock incentive compensation plan, in the event of a change-in-control, if the acquiring company does not assume, or substitute new options for, all outstanding options, all shares subject to outstanding options will become fully vested and exercisable prior to the change-in-control.

Executive Severance Plan. On April 17, 2003, we adopted an executive severance plan, which provides certain severance and other benefits in connection with a change-in-control to certain key employees designated by the board of directors. The severance plan covers our chief executive officer, chief operating officer, chief financial officer, and our senior management-level employees who are classified as a vice president on the date of the change-in-control. The severance plan may not be amended except to bring the plan into compliance with all applicable laws and regulations, to increase the amount or type of severance benefits payable under the plan, or to extend the termination date of the plan. The severance plan automatically terminates on April 17, 2008, unless extended by us or a change-in-control shall have occurred, in which case the plan terminates upon the earlier of twelve months following the change-in-control or the date on which all severance benefits payable have been paid.

Under the severance plan, if the employment of our chief executive officer, our chief operating officer or our chief financial officer is terminated involuntarily (other than for death, disability or cause) or terminates for good reason in connection with or within twelve months of a change-in-control, he or she will receive a lump sum cash severance payment in an amount equal to twelve months’ salary. If the employment of a senior management-level

13

employee who is classified as a vice president is terminated involuntarily (other than for death, disability or cause) or terminates for good reason in connection with or within twelve months of a change-in-control, he or she will receive a lump sum cash severance payment in an amount equal to one month of base salary for each year of service, with a maximum of twelve months’ salary and a minimum of six months’ salary. In addition, each participant covered by the severance plan will have their options, restricted stock or bonus stock accelerate and become exercisable in full upon such termination. Following a participant’s termination upon change-in-control, the severance plan also provides that we will provide the participant with continued health and other group insurance benefits for the participant’s benefit period after the participant’s termination. In addition, if any payment or benefit received or to be received by any participant under the severance plan or otherwise would constitute an “excess parachute payment” within the meaning of Section 280G of the Internal Revenue Code, then the compensation and benefits payable upon a change-in-control will be determined in a manner that maximizes the aggregate present value of the payments without causing any payment to be nondeductible by us under Section 280G.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

Mr. Textor, Mr. Enger and Mr. Nettles served on the compensation committee of the board of directors for the past fiscal year. Mr. Textor has been the chairman of the compensation committee since 2000. None of the members of our compensation committee has at any time been one of our officers or employees. None of our executive officers serves, or in the past has served, as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving on our board of directors or our compensation committee.

EQUITY COMPENSATION PLAN INFORMATION

We currently maintain an amended and restated 1998 stock option plan, which has been approved by shareholders, and provides for the issuance of our common stock to officers and other employees, directors and consultants. The following table sets forth information regarding outstanding options and shares reserved for future issuance under the foregoing plan as of December 26, 2004:

Plan Category

| | | | Number of shares to

be issued upon exercise

of outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of shares remaining

available for future issuance

under equity compensation

plans (excluding shares

reflected in column (a))(1)

(c)

|

|---|

| Equity compensation plans approved by shareholders | | | | | 838,139 | | | $ | 2.88 | | | | 16,882 | |

| Equity compensation plans not approved by shareholders | | | | | None | | | | None | | | | None | |

| Total | | | | | 838,139 | | | $ | 2.88 | | | | 16,882 | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors and persons who beneficially own more than 10% of our common stock to file initial reports of beneficial ownership and reports of changes in beneficial ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

Based solely on our review of the copies of such forms we received and written representations from certain reporting persons, we believe that all filing requirements under Section 16(a) applicable to our executive officers, directors and greater-than-10% shareholders were complied with, except that Messrs. Cain, Lofgren, Meder, Moore, Nettles, Scalzo and Sorensen each failed to timely file one report with respect to one transaction.

14

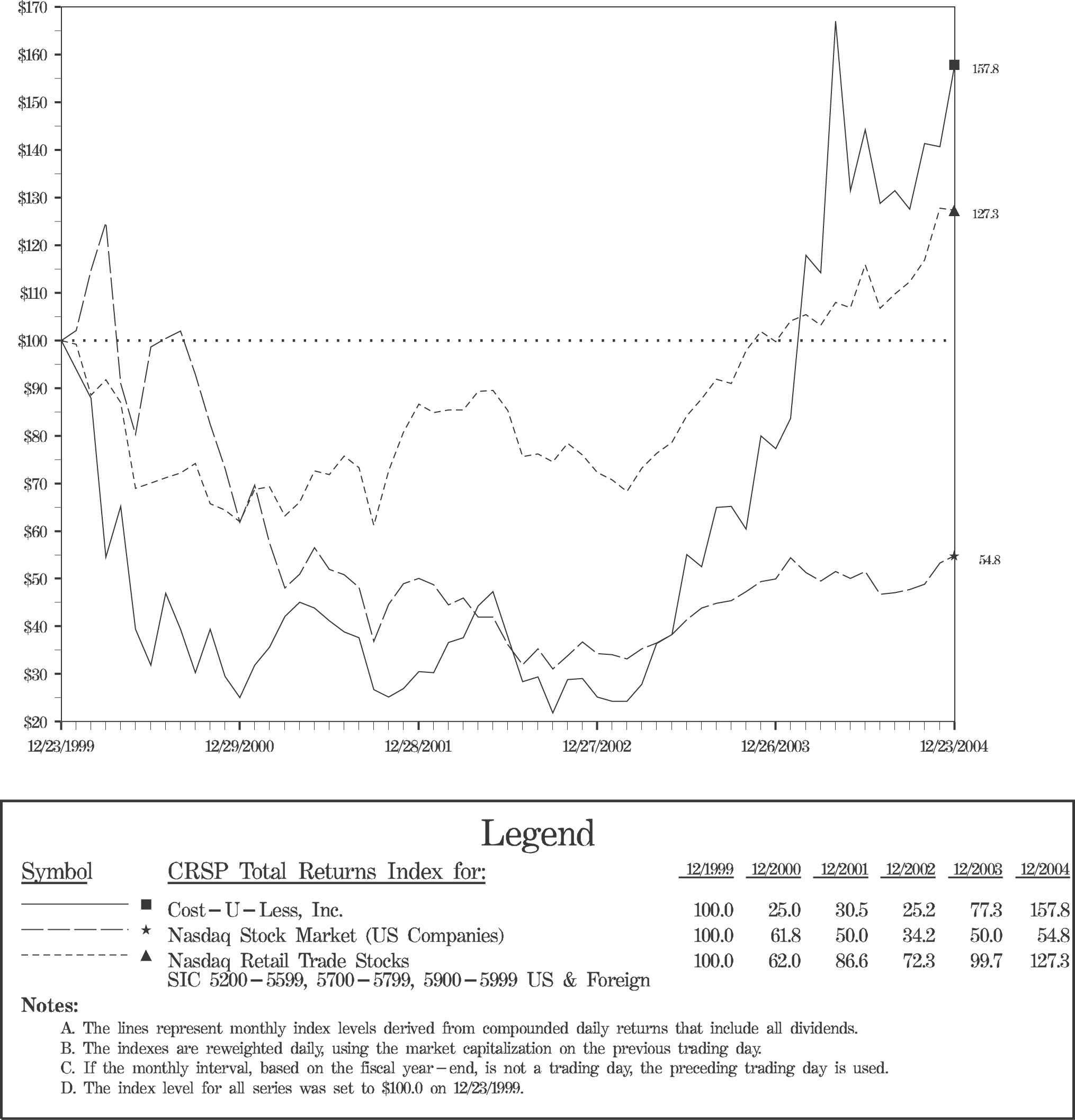

COMPARISON OF SHAREHOLDER RETURN

The graph below compares the cumulative total shareholder return on our common stock for the period commencing on December 23, 1999, and ending on December 23, 2004, with the cumulative total return of the Nasdaq Stock Market Index (US) and the Nasdaq Retail Trade Stocks Index over the same period (assuming an investment of $100 in the common stock, stocks comprising the Nasdaq Stock Market Index (US), and the stocks comprising the Nasdaq Retail Trade Stocks Index December 23, 1999, and the reinvestment of all dividends).

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

Cost U Less, Inc.

15

REPORT BY THE COMPENSATION COMMITTEE

ON EXECUTIVE COMPENSATION

The compensation committee of the board of directors is comprised of non-employee directors. The members of the compensation committee during fiscal 2004 were George C. Textor (Chairman), David A. Enger and Gary W. Nettles. Our board of directors appointed Robert C. Donegan to serve on the compensation committee and as its chairman on December 15, 2004.

The primary purpose of the compensation committee is to discharge the board’s responsibilities relating to compensation and benefits of our executive officers. In carrying out these responsibilities, the compensation committee reviews all components of executive officer compensation for consistency with the committee’s compensation philosophy as in effect from time to time.

The committee has the authority to obtain advice or assistance from consultants, legal counsel, accounting or other advisors as appropriate, to perform its duties and to determine the terms, costs and fees for such engagements. The committee has the sole authority to retain or terminate any consulting firm used to evaluate director, chief executive officer or executive compensation, and to determine and approve the terms of engagement the fees and costs for such engagements. We pay the fees and costs of any consultant or advisor engaged by the committee to assist in it in performing any of its duties.

The committee meets as often as it deems appropriate, but not less frequently than once each year, to review the compensation of our executive officers, and to otherwise perform its duties under its charter.

To fulfill its responsibilities and duties, the committee:

| • | | Determines all compensation for our chief executive officer, including incentive-based and equity-based compensation. Our chief executive officer may not be present during such voting or deliberations. |

| • | | Reviews and approves annual performance objectives and goals relevant to compensation for our chief executive officer and evaluates the performance of our chief executive officer in light of these goals and objectives. |

| • | | Considers, in determining the long-term incentive component of compensation for our chief executive officer, the performance of Cost-U-Less and relative shareholder return, the value of similar incentive awards to chief executive officers at comparable companies, and the awards given to our chief executive officer in past years. |

| • | | Makes recommendations to the board regarding incentive-based or equity-based compensation plans in which our executive officers participate, reviews and approves salaries, incentive and equity awards for other executive officers and oversees the evaluation of management. |

| • | | Approves all employment, severance, or change-in-control agreements, special or supplemental benefits applicable to our executive officers. |

| • | | Periodically reviews and advises the board concerning both regional and industry-wide compensation practices and trends in order to assess the adequacy and competitiveness of our compensation programs for our chief executive officer and our other executive officers relative to comparable companies in our industry. |

The goals of Cost-U-Less’s executive officer compensation policies are to attract, retain and reward executive officers who contribute to our success, to align executive officer compensation with our performance and to motivate executive officers to achieve our business objectives. We use salary, bonus compensation and option grants to attain these goals. Base salaries of executive officers are reviewed annually by the compensation committee and adjustments are made based on (i) individual performance of executive officers for the previous fiscal year, and (ii) our financial results for the previous year.

We strongly believe that equity ownership by executive officers provides incentives to build shareholder value and aligns the interests of executive officers with those of the shareholders, and therefore we make periodic grants of stock options under our stock incentive compensation plan. The size of an option grant to an executive officer

16

has generally been determined with reference to the responsibilities and expected future contributions of the executive officer, previous grants to that officer, as well as recruitment and retention considerations. In fiscal 2004, the compensation committee approved stock option grants to certain of the executive officers consistent with these criteria. See “Option Grants in Last Fiscal Year.”

Mr. Meder’s compensation as president and chief executive officer includes (i) base salary, (ii) annual incentive bonuses and (iii) stock option grants. Mr. Meder’s base salary is based upon market analysis, assessments of individual performance and achievement of operating goals that are established annually by the board of directors. Assessments of individual performance include objective standards and subjective evaluations of the value of Mr. Meder’s contributions. Mr. Meder’s base salary was set at $250,000 for the period of September 1, 2003 through August 31, 2004. Mr. Meder received an incentive bonus in the amount of $199,800 for fiscal 2004 pursuant to the terms of our incentive bonus program. Pursuant to the terms of his employment contract, in fiscal 2004 the compensation committee approved a grant to Mr. Meder of stock options for 66,667 shares under our 1998 stock incentive compensation plan.

On October 20, 2004, we entered into a new employment agreement with Mr. Meder to continue to serve as our president and chief executive officer. The agreement was effective as of September 1, 2004, and continues through September 1, 2007, unless extended by mutual agreement or terminated sooner under the terms of the agreement. The agreement provides for the payment to Mr. Meder of an initial annual salary of $310,000, subject to annual review and adjustment by the board of directors. Mr. Meder will also be eligible for an annual bonus of $100,000, adjusted upward or downward as appropriate, based on the achievement of specified financial targets. In addition, beginning on September 1, 2005, Mr. Meder will receive a bonus of $50,000 for each new store we open.

Either party may terminate the agreement at any time and for any reason upon 30 days written notice to the other party. If we terminate Mr. Meder’s employment prior to the end of the term of the agreement other than for cause (as defined in the agreement), or if his employment is terminated within twelve months following a change of control, he is entitled to receive a lump sum payment equal to twelve months’ base salary and continuation of benefits.

Cost-U-Less has considered the provisions of Section 162(m) of the Internal Revenue Code and related treasury department regulations which restrict deductibility of executive compensation paid to our chief executive officer and each of the four other most highly compensated executive officers holding office at the end of any year to the extent such compensation exceeds $1,000,000 for any of such officers in any year and does not qualify for an exception under the statute or regulations. Income from options granted under the 1998 Stock Incentive Compensation Plan would generally qualify for an exemption from these restrictions so long as the options are granted by a committee whose members are non-employee directors. We expect that the compensation committee will generally be comprised of non-employee directors, and that to the extent that the committee is not so constituted for any period of time, the options granted during such period will not be likely to result in compensation exceeding $1,000,000 in any year. To the extent that total non-exempt compensation exceeds $1,000,000 in fiscal 2004 or any subsequent year, it will not be deductible. The committee does not believe that in general other components of our compensation will be likely to exceed $1,000,000 for any executive officer in the foreseeable future and therefore concluded that no further action with respect to qualifying such compensation for deductibility was necessary at this time. In the future, the committee will continue to evaluate the advisability of qualifying its executive compensation for deductibility of such compensation. The committee’s policy is to qualify its executive compensation for deductibility under applicable tax laws as practicable.

COMPENSATION COMMITTEE

George C. Textor

David A. Enger

Gary W. Nettles

17

REPORT OF THE AUDIT COMMITTEE

The audit committee oversees our financial reporting process on behalf of the board of directors. The board of directors, in its business judgment, has determined that all members of the committee are “independent,” as required by the applicable listing standards of the Nasdaq SmallCap Market, and that Gary W. Nettles is an “audit committee financial expert,” as defined in the rules of the Securities and Exchange Commission.. The audit committee acts pursuant to a written charter that has been adopted by the board of directors. As set forth in the committee’s charter, management has the primary responsibility for the financial statements and reporting process, including the systems of internal controls and the selection, application and disclosure of critical accounting policies. The audit committee is responsible for retaining our independent auditors, reviewing their independence, reviewing and approving the planned scope of our annual audit, reviewing and approving any fee arrangements with our auditors, overseeing their audit work, reviewing and pre-approving any non-audit services that may be performed by them, reviewing the adequacy of accounting and financial controls, reviewing our critical accounting policies and reviewing and approving any related party transactions. In fulfilling its oversight responsibilities, the committee reviewed and discussed our audited financial statements in the annual report with management, including a discussion of the quality of the accounting principles and policies, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The audit committee has reviewed with our auditors, who are responsible for auditing our financial statements and expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgments as to the quality of our accounting principles and such other matters as are required to be discussed with the committee under generally accepted auditing standards. The committee has discussed matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards) which include, among other items, matters related to the conduct of the audit of our financial statements.

The audit committee has received from the auditors a formal written statement describing all relationships between the auditors and Cost-U-Less that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The committee has met with Grant Thornton LLP, with and without management present, to discuss the overall scope of Grant Thornton LLP’s audit, the results of its examinations, its evaluations of Cost-U-Less’s internal controls and the overall quality of its financial reporting.

Based on the review and discussions referred to above, the committee recommended to the board of directors that Cost-U-Less’s audited financial statements be included in our annual report on Form 10-K for the fiscal year ended December 26, 2004.

The audit committee has selected Grant Thornton LLP as independent auditors to audit the consolidated financial statements of Cost-U-Less for fiscal year 2005 ending January 1, 2006.

AUDIT COMMITTEE

Gary W. Nettles

David A. Enger

George C. Textor

18

SHAREHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

Under the SEC’s proxy rules, shareholder proposals that meet certain conditions may be included in the proxy statement and proxy card for a particular annual meeting. Shareholders that intend to present a proposal at the our annual meeting to be held in 2006 must give notice of the proposal at our principal executive offices, addressed to the corporate secretary, no later than 120 calendar days in advance of the one year anniversary of the date our proxy statement was released to shareholders in connection with the previous year’s annual meeting of shareholders to be considered for inclusion in the proxy statement and proxy card relating to that meeting. Shareholders that intend to present a proposal that will not be included in the proxy statement and proxy card must give written notice of the proposal to our corporate secretary no fewer than 60 nor more than 90 days prior to the date of the annual meeting pursuant to our bylaws, except under certain circumstances described in our bylaws. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

OTHER MATTERS

As of the date of this proxy statement, the board of directors knows of no other business that will be conducted at the 2005 annual meeting other than has been described in this proxy statement. If any other matter or matters are properly brought before the meeting, or any adjournment or postponement of the meeting, it is the intention of the persons named in the accompanying form of proxy to vote the proxy on such matters in accordance with their best judgment.

Copies of the Cost-U-Less 2004 Annual Report to Shareholders are being mailed to shareholders, together with this proxy statement, form of proxy and notice of annual meeting of shareholders. Additional copies of the annual report may be obtained from our corporate secretary at 3633 136th Place SE, Suite 110, Bellevue, Washington 98006.

The annual report of Cost-U-Less on Form 10-K for the fiscal year ended December 26, 2004, was filed with the Securities and Exchange Commission on March 23, 2005. Copies of our annual report on Form 10-K may be obtained free of charge from the SEC’s website atwww.sec.gov or from our corporate secretary at 3633 136th Place SE, Suite 110, Bellevue, Washington 98006. Additional information about Cost-U-Less, Inc. is available at www.costuless.com.

BY ORDER OF THE BOARD OF DIRECTORS,

Martin P. Moore

Secretary

Bellevue, Washington

April 7, 2005

19

| | | | | | | | | | | | | | |

| | | | Please

Mark Here

for Address

Change or

Comments | | o |

| | | | | | | | | | | SEE REVERSE SIDE |

| | | | | | | |

| (1) | ELECTION OF THREE DIRECTORS | | | | | |

| | | | | | | |

| | Nominees:

Class I Director – 01 Robert C. Donegan

Class II Director – 02 David A. Enger

Class II Director – 03 Gary W. Nettles | | | FOR

the Nominee

¨ | | WITHHOLD AUTHORITY

to vote for the Nominee

¨ |

| | | | | | | |

| WITHHOLD for the following only: (write the name of the nominee in the space below) |

| | | | | | | |

| |

| Unless otherwise directed, all votes will be apportioned equally among those persons for who authority is given to vote. |

| | | | | | |

| | | | FOR | AGAINST | ABSTAIN |

| (2) | RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE INDEPENDENT AUDITORS OF COST-U-LESS | | ¨ | ¨ | ¨ |

| | | | | |

| I PLAN TO ATTEND THE MEETING | ¨ |

| | | | | |

| SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED BY THE SHAREHOLDER IN THE SPACE PROVIDED. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED “FOR” ITEM 1 AND “FOR” ITEM 2. The Board of Directors recommends a vote “FOR” Item 1 and “FOR” Item 2. |

| | | | | | |

| | | | Dated: | | , 2005 |

| | | | | | |

| | | | Signature |

| | | | | | |

| | | | Signature if held jointly |

| | | | | | |

| | | | Please sign exactly as name appears hereon. Attorneys, trustees, executors and other fiduciaries acting in a representative capacity should sign their names and give their titles. An authorized person should sign on behalf of corporations, partnerships, associates, etc. and give his or her title. If your shares are held by two or more persons, each person must sign. Receipt of the notice of meeting and proxy statement is hereby acknowledged. |

| | | | | |

5FOLD AND DETACH HERE5

| | |

| | COST-U-LESS, INC. |

| | |

| | THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS FOR THE |

| | ANNUAL MEETING OF SHAREHOLDERS-MAY 11, 2005 |

| | |

| | The undersigned hereby appoint(s) J. Jeffrey Meder and Martin P. Moore, and each of them, as proxies, with full power of substitution, to represent and vote as designated all shares of common stock of Cost-U-Less, Inc. held of record by the undersigned on March 25, 2005 at the Annual Meeting of Shareholders of Cost-U-Less to be held at the Doubletree Hotel (Lakehills Room), 300 112th Ave. S.E., Bellevue, Washington, at 10:00 a.m. local time on Wednesday, May 11, 2005, with authority to vote upon the matters listed below and with discretionary authority as to any other matters that may properly come before the meeting or any adjournment or postponement thereof. |

| |

| | IMPORTANT-PLEASE DATE AND SIGN ON THE OTHER SIDE |

| | |

| | |

| | Address Change/Comments (Mark the corresponding box on the reverse side) |

| |

|

/\FOLD AND DETACH HERE/\

You can now access your Cost-U-Less, Inc. account online.

Access your Cost-U-Less, Inc. shareholder account online via Investor ServiceDirect®(ISD).

Mellon Investor Services LLC, Transfer Agent for Cost-U-Less, Inc., now makes it easy and convenient to get current information on your shareholder account.

| | | | |

| Ÿ | View account status | Ÿ | View payment history for dividends |

| Ÿ | View certificate history | Ÿ | Make address changes |

| Ÿ | View book-entry information | Ÿ | Obtain a duplicate 1099 tax form |

| | Ÿ | Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

For Technical Assistance Call 1-877-978-7778 between 9am-7pm

Monday-Friday Eastern Time