UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-5824

DOMINI SOCIAL TRUST

(Exact Name of Registrant as Specified in Charter)

536 Broadway, 7th Floor, New York, New York 10012

(Address of Principal Executive Offices)

Amy L. Domini

Domini Social Investments LLC

536 Broadway, 7th Floor

New York, New York 10012

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Date of Fiscal Year End: July 31

Date of Reporting Period: January 31, 2007

Item 1.

Reports to Stockholders.

A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 follows.

SEMI-ANNUAL REPORT 2007 | JANUARY 31, 2007 (UNAUDITED) |

|

|

DOMINI SOCIAL EQUITY TRUST |

DOMINI EUROPEAN SOCIAL EQUITY TRUST |

DOMINI PACASIA SOCIAL EQUITY TRUST |

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST |

EACH A SERIES OF: |

DOMINI SOCIAL TRUST |

TABLE OF CONTENTS

|

| Fund Holdings | |

| 2 | Domini Social Equity Trust | |

| 6 | Domini European Social Equity Trust | |

| 10 | Domini PacAsia Social Equity Trust | |

| 15 | Domini EuroPacific Social Equity Trust | |

| 21 | Expense Example | |

| 23 | Financial Statements | |

| Domini Social Equity Trust | ||

| Domini European Social Equity Trust | ||

| Domini PacAsia Social Equity Trust | ||

| Domini EuroPacific Social Equity Trust | ||

| 36 | Board of Trustees’ Consideration of Management and Submanagement Agreements | |

| 41 | Proxy Voting Information | |

| 41 | Quarterly Portfolio Schedule Information |

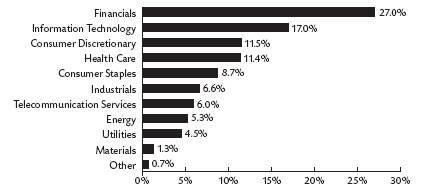

The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini Social Equity Trust and its portfolio holdings by industry sector:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

|

Citigroup Inc |

| 4.35% |

|

AT&T Inc |

| 4.18% |

|

Bank of America Corporation |

| 3.73% |

|

Johnson & Johnson |

| 3.62% |

|

Intl Business Machines Corp |

| 3.47% |

|

JP Morgan Chase & Co |

| 3.35% |

|

Hewlett-Packard Company |

| 2.94% |

|

Goldman Sachs Group Inc |

| 2.77% |

|

Merck & Co. Inc |

| 2.67% |

|

Microsoft Corp |

| 2.38% |

|

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

2

DOMINI SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Consumer Discretionary – 11.5% |

|

|

|

|

|

|

American Eagle |

|

|

|

|

|

|

Outfitters Inc |

| 375,750 |

| $ | 12,166,785 |

|

AutoZone, Inc. (a) |

| 54,047 |

|

| 6,789,925 |

|

Best Buy Co., Inc. |

| 858 |

|

| 43,243 |

|

Bright Horizons Family Solutions, Inc. (a) |

| 443 |

|

| 17,352 |

|

CBS Corporation, Class B |

| 989,200 |

|

| 30,833,364 |

|

Comcast Corporation, Class A (a) |

| 112,700 |

|

| 4,994,864 |

|

Disney (Walt) Company (The) |

| 5,337 |

|

| 187,702 |

|

Family Dollar Stores Inc. |

| 123,071 |

|

| 3,987,500 |

|

Gap Inc. |

| 2,187 |

|

| 41,925 |

|

Home Depot, Inc. (The) |

| 3,344 |

|

| 136,235 |

|

Horton (D.R.), Inc. |

| 1,975 |

|

| 57,394 |

|

Interface, Inc., Class A (a) |

| 1,268 |

|

| 19,299 |

|

Johnson Controls, Inc. |

| 818 |

|

| 75,632 |

|

Kohl's Corporation (a) |

| 385,100 |

|

| 27,307,441 |

|

Limited Brands |

| 868 |

|

| 24,252 |

|

Lowe's Companies, Inc. |

| 2,686 |

|

| 90,545 |

|

McDonald's Corporation |

| 168,474 |

|

| 7,471,822 |

|

McGraw-Hill Companies |

| 1,512 |

|

| 101,425 |

|

Meredith Corporation |

| 623 |

|

| 36,732 |

|

NIKE, Inc., Class B |

| 1,194 |

|

| 117,979 |

|

Nordstrom, Inc. |

| 403,603 |

|

| 22,484,723 |

|

Penney (J.C.) Company, Inc. |

| 111,417 |

|

| 9,051,517 |

|

Pulte Homes, Inc. |

| 1,594 |

|

| 54,738 |

|

Radio One, Inc. (a) |

| 2,279 |

|

| 16,682 |

|

Scholastic Corporation (a) |

| 310,022 |

|

| 10,959,278 |

|

Staples, Inc. (a) |

| 1,858 |

|

| 47,788 |

|

Starbucks Corporation (a) |

| 2,378 |

|

| 83,087 |

|

Target Corporation |

| 1,736 |

|

| 106,521 |

|

Time Warner, Inc. |

| 9,376 |

|

| 205,053 |

|

Washington Post Company, Class B |

| 95 |

|

| 72,457 |

|

Wendy's International, Inc. |

| 1,823 |

|

| 61,909 |

|

Whirlpool Corporation |

| 222,063 |

|

| 20,303,220 |

|

|

|

|

|

| 157,948,389 |

|

Consumer Staples – 8.7% |

|

|

|

|

|

|

Avon Products, Inc. |

| 1,706 |

|

| 58,669 |

|

Campbell Soup Company |

| 703,695 |

|

| 27,078,184 |

|

Church & Dwight Co., Inc. |

| 585 |

| $ | 26,506 |

|

Coca-Cola Company |

| 327,684 |

|

| 15,689,510 |

|

Colgate-Palmolive Company |

| 1,796 |

|

| 122,667 |

|

CVS Corporation |

| 1,905 |

|

| 64,103 |

|

Estee Lauder Companies, Inc. (The), Class A |

| 619,149 |

|

| 29,409,578 |

|

Green Mountain Coffee, Inc. (a) |

| 322 |

|

| 19,034 |

|

Hershey Foods Corporation |

| 1,736 |

|

| 88,605 |

|

Kimberly-Clark Corporation |

| 1,456 |

|

| 101,046 |

|

Kroger Company |

| 1,228,977 |

|

| 31,461,811 |

|

PepsiCo, Inc. |

| 4,153 |

|

| 270,942 |

|

Procter & Gamble Company |

| 233,101 |

|

| 15,121,262 |

|

Smucker (J.M.) Company |

| 1,241 |

|

| 58,935 |

|

SunOpta Inc. (a) |

| 2,500 |

|

| 27,150 |

|

United Natural Foods, Inc. (a) |

| 732 |

|

| 24,185 |

|

Walgreen Company |

| 1,964 |

|

| 88,969 |

|

Wild Oats Markets, Inc. (a) |

| 1,259 |

|

| 18,294 |

|

|

|

|

|

| 119,729,450 |

|

Energy – 5.3% |

|

|

|

|

|

|

Anadarko Petroleum |

|

|

|

|

|

|

Corporation |

| 4,618 |

|

| 202,038 |

|

Apache Corporation |

| 5,462 |

|

| 398,562 |

|

Devon Energy Corporation |

| 3,970 |

|

| 278,257 |

|

EOG Resources, Inc. |

| 3,008 |

|

| 207,943 |

|

Metretek Technologies, Inc. (a) |

| 1,700 |

|

| 22,100 |

|

Noble Energy, Inc. |

| 101,183 |

|

| 5,404,184 |

|

Overseas Shipholding Group, Inc. |

| 335,900 |

|

| 20,869,467 |

|

Unit Corporation (a) |

| 494,200 |

|

| 23,958,816 |

|

XTO Energy Inc. |

| 427,716 |

|

| 21,586,827 |

|

|

|

|

|

| 72,928,194 |

|

Financials – 27.0% |

|

|

|

|

|

|

Allstate Life Insurance Company |

| 58,200 |

|

| 3,501,312 |

|

American Express Company |

| 3,876 |

|

| 225,661 |

|

Assurant, Inc. |

| 218,600 |

|

| 12,149,788 |

|

3

DOMINI SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Financials (Continued) |

|

|

|

|

|

|

Bank of America Corporation |

| 979,600 |

| $ | 51,507,368 |

|

Chubb Corporation |

| 191,666 |

|

| 9,974,299 |

|

Citigroup Inc. |

| 1,087,400 |

|

| 59,948,361 |

|

Fannie Mae |

| 336,116 |

|

| 19,000,637 |

|

FirstFed Financial Corp. (a) |

| 94,000 |

|

| 6,481,300 |

|

Freddie Mac |

| 2,222 |

|

| 144,274 |

|

Goldman Sachs Group, Inc. (The) |

| 180,300 |

|

| 38,252,448 |

|

Hartford Financial Services Group (The) |

| 104,738 |

|

| 9,940,684 |

|

Heartland Financial USA, Inc. |

| 498 |

|

| 14,238 |

|

KeyCorp |

| 89,592 |

|

| 3,419,727 |

|

Lehman Brothers Holdings Inc. |

| 2,000 |

|

| 164,480 |

|

Medallion Financial Corp. |

| 1,275 |

|

| 14,395 |

|

Morgan (J.P.) Chase & Co. |

| 906,630 |

|

| 46,174,666 |

|

Nationwide Financial Services, Inc., Class A |

| 441,000 |

|

| 24,100,650 |

|

PMI Group, Inc. (The) |

| 342,500 |

|

| 16,378,350 |

|

Popular Inc. |

| 4,111 |

|

| 75,067 |

|

Principal Financial Group, Inc. |

| 321,360 |

|

| 19,798,990 |

|

Prudential Financial, Inc. |

| 3,200 |

|

| 285,216 |

|

St. Paul Travelers Companies, Inc. (The) |

| 447,852 |

|

| 22,773,273 |

|

SunTrust Banks, Inc. |

| 323,626 |

|

| 26,893,320 |

|

U.S. Bancorp |

| 5,163 |

|

| 183,803 |

|

Wachovia Corporation |

| 4,083 |

|

| 230,690 |

|

Washington Mutual, Inc. |

| 4,331 |

|

| 193,119 |

|

Wells Fargo & Company |

| 6,826 |

|

| 245,190 |

|

|

|

|

|

| 372,071,306 |

|

Health Care – 11.4% |

|

|

|

|

|

|

Amgen, Inc. (a) |

| 150,766 |

|

| 10,609,403 |

|

Applera Corp.-Applied Biosystems Group |

| 136,000 |

|

| 4,727,360 |

|

Baxter International, Inc. |

| 425,322 |

|

| 21,121,491 |

|

Becton Dickinson and Company |

| 2,202 |

|

| 169,422 |

|

Conceptus, Inc. (a) |

| 1,100 |

|

| 25,509 |

|

Forest Laboratories, Inc. (a) |

| 69,586 |

|

| 3,904,470 |

|

Genentech, Inc. (a) |

| 1,600 |

|

| 139,792 |

|

Gilead Sciences (a) |

| 77,605 |

|

| 4,991,554 |

|

Invacare Corporation |

| 1,260 |

|

| 27,203 |

|

Johnson & Johnson |

| 747,024 |

| $ | 49,901,203 |

|

Medtronic, Inc. |

| 3,455 |

|

| 184,670 |

|

Merck & Co., Inc. |

| 823,602 |

|

| 36,856,190 |

|

Thermo Fisher Scientific (a) |

| 246,581 |

|

| 11,798,901 |

|

Zimmer Holdings, Inc. (a) |

| 146,743 |

|

| 12,358,695 |

|

|

|

|

|

| 156,815,863 |

|

Industrials – 6.6% |

|

|

|

|

|

|

3M Company |

| 2,664 |

|

| 197,935 |

|

Baldor Electric Company |

| 1,190 |

|

| 42,031 |

|

Brady Corporation, Class A |

| 654 |

|

| 24,492 |

|

Cooper Industries, Inc., Class A |

| 1,193 |

|

| 109,028 |

|

Cummins, Inc. |

| 199,916 |

|

| 26,900,697 |

|

Donnelley (R.R.) & Sons Company |

| 2,118 |

|

| 78,578 |

|

Emerson Electric Company |

| 4,408 |

|

| 198,228 |

|

Evergreen Solar, Inc (a) |

| 1,700 |

|

| 14,264 |

|

FedEx Corporation |

| 628 |

|

| 69,331 |

|

Fuel Tech, Inc. (a) |

| 700 |

|

| 20,153 |

|

FuelCell Energy, Inc. (a) |

| 2,600 |

|

| 17,186 |

|

Granite Construction Incorporated |

| 737 |

|

| 39,474 |

|

Herman Miller, Inc. |

| 896 |

|

| 33,690 |

|

Illinois Tool Works, Inc. |

| 2,800 |

|

| 142,772 |

|

JetBlue Airways Corporation (a) |

| 2,293 |

|

| 31,368 |

|

Kadant Inc. (a) |

| 627 |

|

| 17,148 |

|

Monster Worldwide (a) |

| 835 |

|

| 41,257 |

|

Navistar International Corporation (a) |

| 263,000 |

|

| 11,635,120 |

|

PACCAR Inc. |

| 146,700 |

|

| 9,809,829 |

|

Pitney Bowes, Inc. |

| 1,457 |

|

| 69,747 |

|

Ryder System, Inc. |

| 479,584 |

|

| 26,156,511 |

|

Southwest Airlines Co. |

| 3,478 |

|

| 52,518 |

|

Tennant Company |

| 1,296 |

|

| 40,072 |

|

Trex Company, Inc. (a) |

| 888 |

|

| 23,763 |

|

United Parcel Service, Inc., Class B |

| 1,873 |

|

| 135,380 |

|

YRC Worldwide Inc. (a) |

| 344,779 |

|

| 15,290,949 |

|

|

|

|

|

| 91,191,521 |

|

Information Technology – 17.0% |

|

|

|

|

|

|

Alliance Data Systems Corporation (a) |

| 89,100 |

|

| 6,052,563 |

|

Apple Computer, Inc. (a) |

| 1,312 |

|

| 112,478 |

|

Applied Materials, Inc. |

| 740,100 |

|

| 13,121,973 |

|

4

DOMINI SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

SECURITY |

| SHARES |

| VALUE |

| |

Information Technology (Continued) |

|

|

|

|

|

|

Cisco Systems, Inc. (a) |

| 8,816 |

| $ | 234,417 |

|

Dell Inc. (a) |

| 4,184 |

|

| 101,462 |

|

eBay Inc. (a) |

| 2,176 |

|

| 70,481 |

|

Google Inc., Class A (a) |

| 300 |

|

| 150,390 |

|

Hewlett-Packard Company |

| 935,847 |

|

| 40,503,458 |

|

Intel Corporation |

| 10,039 |

|

| 210,417 |

|

International Business Machines Corporation |

| 482,800 |

|

| 47,869,619 |

|

Itron, Inc. (a) |

| 445 |

|

| 25,650 |

|

Jabil Circuit, Inc. |

| 1,500 |

|

| 35,985 |

|

Juniper Networks, Inc. (a) |

| 1,900 |

|

| 34,428 |

|

LAM Research Corporation (a) |

| 338,900 |

|

| 15,525,009 |

|

Lexmark International Group, Inc. (a) |

| 353,850 |

|

| 22,303,166 |

|

MEMC Electronic Materials, Inc. (a) |

| 93,000 |

|

| 4,873,200 |

|

Micron Technology, Inc. (a) |

| 1,283,052 |

|

| 16,615,523 |

|

Microsoft Corporation |

| 1,065,852 |

|

| 32,892,193 |

|

Motorola, Inc. |

| 5,000 |

|

| 99,250 |

|

Power Integrations, Inc. (a) |

| 600 |

|

| 13,608 |

|

Qualcomm, Inc. |

| 3,434 |

|

| 129,324 |

|

SunPower Corporation (a) |

| 400 |

|

| 17,720 |

|

Symantec Corporation (a) |

| 1,276,846 |

|

| 22,612,943 |

|

Texas Instruments, Inc. |

| 3,628 |

|

| 113,157 |

|

Western Digital Corporation (a) |

| 526,800 |

|

| 10,325,280 |

|

Xerox Corporation (a) |

| 3,698 |

|

| 63,606 |

|

|

|

|

|

| 234,107,300 |

|

Materials – 1.3% |

|

|

|

|

|

|

Airgas, Inc. |

| 1,159 |

|

| 48,238 |

|

Ecolab, Inc. |

| 1,757 |

|

| 77,132 |

|

International Paper Company |

| 3,000 |

|

| 101,100 |

|

MeadWestvaco Corp. |

| 2,666 |

| $ | 80,353 |

|

Nucor Corporation |

| 156,016 |

|

| 10,069,272 |

|

Rock-Tenn Company, Class A |

| 592 |

|

| 19,370 |

|

Rohm & Haas Company |

| 1,510 |

|

| 78,611 |

|

Schnitzer Steel Industries Inc., Class A |

| 1,269 |

|

| 48,857 |

|

Sonoco Products Company |

| 1,260 |

|

| 48,510 |

|

Valspar Corporation |

| 320,998 |

|

| 9,045,724 |

|

|

|

|

|

| 19,617,167 |

|

Telecommunication Services – 6.0% |

|

|

|

|

|

|

Alltel Corporation |

| 74,900 |

|

| 4,590,621 |

|

AT&T Inc. |

| 1,531,204 |

|

| 57,619,206 |

|

CenturyTel, Inc. |

| 451,900 |

|

| 20,263,196 |

|

Sprint Corp. – FON Group |

| 5,159 |

|

| 91,985 |

|

Verizon Communications |

| 5,138 |

|

| 197,916 |

|

|

|

|

|

| 82,762,924 |

|

Utilities – 4.5% |

|

|

|

|

|

|

Energen Corporation |

| 363,147 |

|

| 16,806,443 |

|

OGE Energy Corporation |

| 430,182 |

|

| 16,656,647 |

|

ONEOK, Inc. |

| 294,500 |

|

| 12,636,995 |

|

UGI Corporation |

| 563,800 |

|

| 15,453,758 |

|

WGL Holdings |

| 8,577 |

|

| 271,291 |

|

|

|

|

|

| 61,825,134 |

|

Total Investments — 99.3% |

|

|

|

|

|

|

(Cost $1,215,349,476) |

|

|

|

| 1,368,997,248 |

|

Other Assets, less liabilities — 0.7% |

|

|

|

| 10,193,118 |

|

Net Assets — 100.0% |

|

|

| $ | 1,379,190,366 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income tax purposes is $1,330,674,418. The aggregate gross unrealized appreciation is $53,931,600 and the aggregate gross unrealized depreciation is $15,608,770, resulting in net unrealized appreciation of $38,322,830. |

SEE NOTES TO FINANCIAL STATEMENTS

5

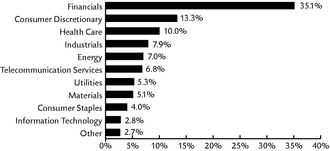

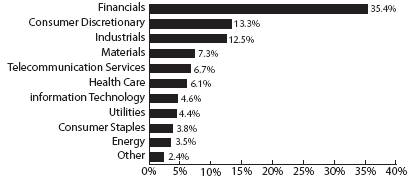

The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini European Social Equity Trust and its portfolio holdings by industry sector and by country:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

|

Vivendi SA |

| 3.14% |

|

Statoil ASA |

| 2.85% |

|

ING Groep NV-CVA |

| 2.69% |

|

National Grid PLC |

| 2.60% |

|

Muenchener Rueckver AG -Reg |

| 2.43% |

|

BNP Paribas |

| 2.36% |

|

Royal Bank of Scotland Group |

| 2.34% |

|

Barclays PLC |

| 2.32% |

|

GlaxoSmithKline PLC |

| 2.30% |

|

Societe Generale |

| 2.20% |

|

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini European Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

6

DOMINI EUROPEAN SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Austria – 2.5% |

|

|

|

|

|

|

|

|

Immoeast AG (a) |

| Real Estate |

| 21,431 |

| $ | 320,258 |

|

Immofinanz AG (a) |

| Real Estate |

| 51,163 |

|

| 774,536 |

|

OMV AG (a) |

| Energy |

| 2,399 |

|

| 128,031 |

|

Voestalpine AG (a) |

| Materials |

| 26,200 |

|

| 1,511,624 |

|

|

|

|

|

|

|

| 2,734,449 |

|

Belgium – 5.3% |

|

|

|

|

|

|

|

|

Bekaert NV |

| Capital Goods |

| 1,417 |

|

| 173,176 |

|

Belgacom SA |

| Telecommunication Services |

| 41,267 |

|

| 1,862,912 |

|

Fortis |

| Diversified Financials |

| 56,680 |

|

| 2,373,094 |

|

Omega Pharma SA (a) |

| Health Care Equipment & Services |

| 19,098 |

|

| 1,529,962 |

|

|

|

|

|

|

|

| 5,939,144 |

|

Denmark – 1.1% |

|

|

|

|

|

|

|

|

Dampskibsselskabet Torm AS (a) |

| Energy |

| 14,326 |

|

| 917,517 |

|

Danske Bank A/S (a) |

| Banks |

| 7,856 |

|

| 360,756 |

|

|

|

|

|

|

|

| 1,278,273 |

|

Finland – 4.2% |

|

|

|

|

|

|

|

|

Kesko OYJ – B shares (a) |

| Food & Staples Retailing |

| 37,695 |

|

| 2,003,395 |

|

Nokia OYJ (a) |

| Technology Hardware & Equipment | 63,202 |

|

| 1,378,926 |

| |

Rautaruukki OYJ (a) |

| Materials |

| 26,846 |

|

| 1,055,272 |

|

Sampo Insurance Co – A shares |

| Insurance |

| 10,454 |

|

| 284,323 |

|

|

|

|

|

|

|

| 4,721,916 |

|

France – 16.0% |

|

|

|

|

|

|

|

|

AGF – Assur Gen De France (a) |

| Insurance |

| 12,227 |

|

| 1,990,813 |

|

Air France – KLM (a) |

| Transportation |

| 17,310 |

|

| 776,475 |

|

BNP Paribas (a) |

| Banks |

| 23,573 |

|

| 2,620,562 |

|

CNP Assurances |

| Insurance |

| 7,311 |

|

| 834,600 |

|

Lafarge SA (a) |

| Materials |

| 10,873 |

|

| 1,660,148 |

|

Michelin(CGDE) – B (a) |

| Automobiles & Components |

| 5,884 |

|

| 536,747 |

|

Sanofi – Aventis (a) |

| Pharma, Biotech & Life Sciences |

| 11,540 |

|

| 1,010,707 |

|

Schneider Electric SA |

| Capital Goods |

| 630 |

|

| 75,848 |

|

Societe Generale (a) |

| Banks |

| 13,880 |

|

| 2,443,928 |

|

Ste Des Ciments Francais – A (a) |

| Materials |

| 3,576 |

|

| 784,385 |

|

Vinci S.A. |

| Capital Goods |

| 11,533 |

|

| 1,579,583 |

|

Vivendi SA (a) |

| Media |

| 85,013 |

|

| 3,488,647 |

|

|

|

|

|

|

|

| 17,802,443 |

|

Germany – 10.7% |

|

|

|

|

|

|

|

|

Allianz SE – Reg (a) |

| Insurance |

| 891 |

|

| 177,146 |

|

Celesio AG (a) |

| Health Care Equipment & Services |

| 28,907 |

|

| 1,644,141 |

|

Continental AG |

| Automobiles & Components |

| 4,491 |

|

| 541,915 |

|

Deutsche Lufthansa – Reg (a) |

| Transportation |

| 47,766 |

|

| 1,332,012 |

|

Deutsche Telekom AG – Reg |

| Telecommunication Services |

| 72,037 |

|

| 1,263,714 |

|

Epcos AG |

| Technology Hardware & Equipment |

| 63,738 |

|

| 1,167,823 |

|

Fresenius AG |

| Health Care Equipment & Services |

| 9,479 |

|

| 1,904,653 |

|

Linde AG |

| Materials |

| 3,975 |

|

| 424,486 |

|

7

DOMINI EUROPEAN SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Germany (continued) |

|

|

|

|

|

|

|

|

Muenchener Rueckver AG – Reg (a) |

| Insurance |

| 17,158 |

| $ | 2,697,812 |

|

ProSieben Sat.1 Media AG |

| Media |

| 21,065 |

|

| 707,042 |

|

|

|

|

|

|

|

| 11,860,744 |

|

Hungary – 0.1% |

|

|

|

|

|

|

|

|

MOL Magyar Olaj – es Gazipari |

| Energy |

| 1,003 |

|

| 102,980 |

|

|

|

|

|

|

|

| 102,980 |

|

Ireland – 2.0% |

|

|

|

|

|

|

|

|

Bank Of Ireland |

| Banks |

| 55,046 |

|

| 1,226,016 |

|

Fyffes PLC |

| Food & Staples Retailing |

| 683,198 |

|

| 976,560 |

|

|

|

|

|

|

|

| 2,202,576 |

|

Italy – 5.4% |

|

|

|

|

|

|

|

|

Banca Popolare Emilia |

|

|

|

|

|

|

|

|

Romagna (a) |

| Banks |

| 20,412 |

|

| 546,402 |

|

Banche Popolari Unite Scrl (a) |

| Banks |

| 40,539 |

|

| 1,144,175 |

|

Banco Popolare Di Verona E N (a) |

| Banks |

| 24,241 |

|

| 759,779 |

|

Benetton Group SPA (a) |

| Consumer Durables & Apparel |

| 56,546 |

|

| 975,062 |

|

Fiat SPA (a) |

| Automobiles & Components |

| 76,275 |

|

| 1,648,292 |

|

Pirelli & Co. |

| Capital Goods |

| 843,562 |

|

| 870,356 |

|

|

|

|

|

|

|

| 5,944,066 |

|

Netherlands – 5.3% |

|

|

|

|

|

|

|

|

Aegon NV |

| Insurance |

| 43,095 |

|

| 842,797 |

|

Fugro NV – CVA |

| Energy |

| 16,079 |

|

| 761,372 |

|

ING Groep NV – CVA |

| Diversified Financials |

| 68,544 |

|

| 2,988,282 |

|

Koninkijke KPN NV |

| Telecommunication Services |

| 87,899 |

|

| 1,262,135 |

|

|

|

|

|

|

|

| 5,854,586 |

|

Norway – 5.8% |

|

|

|

|

|

|

|

|

Bergesen Worldwide |

|

|

|

|

|

|

|

|

Gas ASA |

| Energy |

| 36,200 |

|

| 434,929 |

|

DNB Nor ASA (a) |

| Banks |

| 13,665 |

|

| 204,434 |

|

Norsk Hydro ASA (a) |

| Energy |

| 50,628 |

|

| 1,630,828 |

|

Petroleum Geo – Services (a) |

| Energy |

| 5,067 |

|

| 117,914 |

|

Statoil ASA (a) |

| Energy |

| 118,967 |

|

| 3,162,601 |

|

Tandberg ASA (a) |

| Technology Hardware & Equipment |

| 25,104 |

|

| 416,850 |

|

Telenor ASA (a) |

| Telecommunication Services |

| 23,978 |

|

| 484,292 |

|

|

|

|

|

|

|

| 6,451,848 |

|

Poland – 0.3% |

|

|

|

|

|

|

|

|

Polska Grupa |

|

|

|

|

|

|

|

|

Farmaceutyczna |

| Health Care Equipment & Services |

| 8,317 |

|

| 208,950 |

|

PROKOM Software SA |

| Software & Services |

| 2,768 |

|

| 151,125 |

|

|

|

|

|

|

|

| 360,075 |

|

Spain – 2.0% |

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argenta |

| Banks |

| 68,825 |

|

| 1,703,730 |

|

Corporacion Financiera Alba |

| Diversified Financials |

| 4,480 |

|

| 309,997 |

|

Telefonica SA |

| Telecommunication Services |

| 10,472 |

|

| 227,931 |

|

|

|

|

|

|

|

| 2,241,658 |

|

Sweden – 3.2% |

|

|

|

|

|

|

|

|

Axfood AB (a) |

| Food & Staples Retailing |

| 31,620 |

|

| 1,184,465 |

|

Electrolux AB – Ser B (a) |

| Consumer Durables & Apparel |

| 11,500 |

|

| 217,042 |

|

8

DOMINI EUROPEAN SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

|

| VALUE |

|

Sweden (continued) |

|

|

|

|

|

|

|

|

Industrivarden AB – C shares |

| Diversified Financials |

| 17,400 |

| $ | 668,025 |

|

Investor AB – B shares |

| Diversified Financials |

| 13,400 |

|

| 323,098 |

|

Nordea AB (a) |

| Banks |

| 61,223 |

|

| 954,255 |

|

SSAB Svenskt Stal AB – Ser A (a) |

| Materials |

| 7,050 |

|

| 170,494 |

|

|

|

|

|

|

|

| 3,517,379 |

|

Switzerland – 5.1% |

|

|

|

|

|

|

|

|

Baloise Holding – AG (a) |

| Insurance |

| 8,673 |

|

| 875,085 |

|

Novartis AG – Reg Shs (a) |

| Pharma, Biotech & Life Sciences |

| 26,924 |

|

| 1,543,847 |

|

Rieter Holding AG (a) |

| Automobiles & Components |

| 2,895 |

|

| 1,654,219 |

|

Roche Holding AG (a) |

| Pharma, Biotech & Life Sciences |

| 3,515 |

|

| 658,323 |

|

Swisscom AG – Reg (a) |

| Telecommunication Services |

| 2,376 |

|

| 884,478 |

|

|

|

|

|

|

|

| 5,615,952 |

|

United Kingdom – 28.3% |

|

|

|

|

|

|

|

|

3i Group PLC |

| Diversified Financials |

| 43,411 |

|

| 896,462 |

|

Aggreko PLC |

| Commercial Services & Supplies |

| 170,621 |

|

| 1,482,008 |

|

Alliance Boots PLC |

| Food & Staples Retailing |

| 15,165 |

|

| 239,550 |

|

Arriva PLC |

| Transportation |

| 47,675 |

|

| 670,964 |

|

Aviva PLC |

| Insurance |

| 63,993 |

|

| 1,028,384 |

|

Barclays PLC |

| Banks |

| 177,780 |

|

| 2,575,100 |

|

Barratt Developments PLC |

| Consumer Durables & Apparel |

| 56,469 |

|

| 1,306,493 |

|

Bellway PLC |

| Consumer Durables & Apparel |

| 11,578 |

|

| 319,545 |

|

BG Group PLC |

| Energy |

| 38,952 |

|

| 509,695 |

|

Bradford and Bingley |

| Banks |

| 57,614 |

|

| 515,657 |

|

BT Group PLC |

| Telecommunication Services |

| 263,647 |

|

| 1,579,152 |

|

Firstgroup PLC |

| Transportation |

| 169,611 |

|

| 1,807,721 |

|

GlaxoSmithKline PLC |

| Pharma, Biotech & Life Sciences |

| 95,715 |

|

| 2,557,362 |

|

HSBC Holdings PLC |

| Banks |

| 47,643 |

|

| 862,622 |

|

Inchcape PLC |

| Retailing |

| 21,282 |

|

| 220,368 |

|

Man Group PLC |

| Diversified Financials |

| 147,075 |

|

| 1,539,463 |

|

Marks & Spencer Group PLC |

| Retailing |

| 58,277 |

|

| 771,123 |

|

National Grid PLC |

| Utilities |

| 191,882 |

|

| 2,884,530 |

|

Next PLC |

| Retailing |

| 26,289 |

|

| 1,004,976 |

|

Northern Rock PLC |

| Banks |

| 8,586 |

|

| 197,305 |

|

Resolution PLC |

| Insurance |

| 38,860 |

|

| 495,941 |

|

Royal Bank Of Scotland Group |

| Banks |

| 64,856 |

|

| 2,596,109 |

|

Scottish Power PLC |

| Utilities |

| 112,199 |

|

| 1,640,549 |

|

Severn Trent PLC |

| Utilities |

| 49,950 |

|

| 1,383,476 |

|

Standard Life PLC (a) |

| Insurance |

| 151,181 |

|

| 870,010 |

|

Taylor Woodrow PLC |

| Consumer Durables & Apparel |

| 15,247 |

|

| 121,467 |

|

Whitbread PLC (a) |

| Consumer Services |

| 7,826 |

|

| 248,315 |

|

George Wimpey PLC |

| Consumer Durables & Apparel |

| 100,048 |

|

| 1,053,587 |

|

|

|

|

|

|

|

| 31,377,934 |

|

Total Investments — 97.3% (cost $91,005,011) (b) |

|

|

|

|

|

| 108,006,023 |

|

Other Assets, less liabilities — 2.7% |

|

|

|

|

|

| 3,001,325 |

|

Net Assets — 100.0% |

|

|

|

|

| $ | 111,007,348 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income tax purposes is $91,030,355. The aggregate gross unrealized appreciation is $17,405,297 and the aggregate gross unrealized depreciation is $429,629, resulting in net unrealized appreciation of $16,975,668. |

SEE NOTES TO FINANCIAL STATEMENTS

9

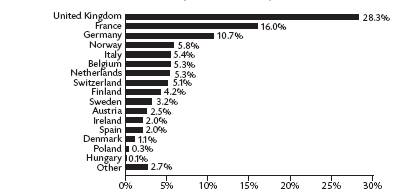

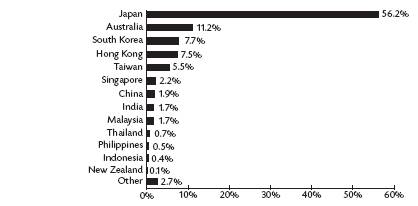

The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini PacAsia Social Equity Trust and its portfolio holdings by industry sector and by country:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

|

Honda Motor Co Ltd |

| 3.79 |

|

Fuji Film Holdings Corp |

| 3.10 |

|

Nippon Telegraph & Telephone |

| 2.98 |

|

Dai Nippon Printing Co Ltd |

| 2.54 |

|

QBE Insurance Group Ltd |

| 2.53 |

|

Resona Holdings Inc |

| 2.34 |

|

Toppan Printing Company Ltd |

| 2.31 |

|

Mediceo Paltac Holding Co |

| 2.22 |

|

Denso Corporation |

| 2.19 |

|

Zinifex Ltd |

| 2.18 |

|

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini PacAsia Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

10

DOMINI PACASIA SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Australia – 11.2% |

|

|

|

|

|

|

|

|

Amcor Ltd |

| Materials |

| 2,081 |

| $ | 11,768 |

|

Australia and New Zealand Banking Group Lt |

| Banks |

| 9,097 |

|

| 205,125 |

|

Commonwealth Bank Of Australia |

| Banks |

| 2,310 |

|

| 89,538 |

|

Insurance Australia Group Lt |

| Insurance |

| 42,922 |

|

| 215,111 |

|

QBE Insurance Group Ltd |

| Insurance |

| 12,029 |

|

| 286,984 |

|

Sonic Healthcare Ltd |

| Health Care Equipment & Services |

| 9,155 |

|

| 102,826 |

|

Telstra Corp Ltd |

| Telecommunication Services |

| 19,793 |

|

| 65,006 |

|

Westpac Banking Corporation |

| Banks |

| 2,668 |

|

| 51,810 |

|

Zinifex Ltd |

| Materials |

| 19,509 |

|

| 247,831 |

|

|

|

|

|

|

|

| 1,275,999 |

|

China – 1.9% |

|

|

|

|

|

|

|

|

Agile Property Holdings Ltd |

| Real Estate |

| 60,416 |

|

| 49,360 |

|

Chaoda Modern Agriculture |

| Food & Beverage |

| 106,903 |

|

| 75,566 |

|

Guangzhou R&F Properties |

| Real Estate |

| 17,502 |

|

| 33,798 |

|

Nine Dragons Paper Holdings |

| Materials |

| 6,886 |

|

| 11,693 |

|

TPV Technology Ltd |

| Technology Hardware & Equipment |

| 66,223 |

|

| 40,960 |

|

|

|

|

|

|

|

| 211,377 |

|

Hong Kong – 7.5% |

|

|

|

|

|

|

|

|

Cathay Pacific Airways Ltd |

| Transportation |

| 18,002 |

|

| 46,336 |

|

Chinese Estates Holdings Ltd |

| Real Estate |

| 48,239 |

|

| 64,244 |

|

First Pacific Co |

| Diversified Financials |

| 58,389 |

|

| 36,264 |

|

Great Eagle Holdings Ltd |

| Real Estate |

| 20,620 |

|

| 67,465 |

|

Hang Lung Group Ltd |

| Real Estate |

| 21,665 |

|

| 74,074 |

|

Hang Lung Properties Ltd |

| Real Estate |

| 8,665 |

|

| 23,635 |

|

Henderson Land Development |

| Real Estate |

| 16,142 |

|

| 93,226 |

|

Jardine Matheson Hldgs Ltd |

| Diversified Financials |

| 1,593 |

|

| 37,436 |

|

Jardine Strategic Hldgs Ltd |

| Diversified Financials |

| 2,359 |

|

| 33,262 |

|

Kingboard Chemicals Holdings |

| Technology Hardware & Equipment |

| 9,553 |

|

| 39,330 |

|

Orient Overseas Intl Ltd |

| Transportation |

| 5,875 |

|

| 39,197 |

|

Sun Hung Kai Properties |

| Real Estate |

| 1,833 |

|

| 22,182 |

|

Swire Pacific Ltd ‘A’ |

| Real Estate |

| 7,164 |

|

| 82,245 |

|

Techtronic Industries Co |

| Consumer Durables & Apparel |

| 18,014 |

|

| 27,682 |

|

Wharf Holdings Ltd |

| Real Estate |

| 17,455 |

|

| 64,375 |

|

Wheelock & Co Ltd |

| Real Estate |

| 45,418 |

|

| 97,476 |

|

|

|

|

|

|

|

| 848,429 |

|

India – 1.7% |

|

|

|

|

|

|

|

|

Gujarat Ambuja Cement |

| Materials |

| 16,012 |

|

| 49,781 |

|

Hindalco Industries – 144A GDR |

| Materials |

| 23,955 |

|

| 95,549 |

|

Infosys Technologies-sp ADR |

| Software & Services |

| 874 |

|

| 50,692 |

|

|

|

|

|

|

|

| 196,022 |

|

11

DOMINI PACASIA SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Indonesia – 0.4% |

|

|

|

|

|

|

|

|

Astra International Inc |

| Automobiles & Components |

| 16,408 |

| $ | 26,776 |

|

Telekomunikasi TBK Pt |

| Telecommunication Services |

| 21,966 |

|

| 22,811 |

|

|

|

|

|

|

|

| 49,587 |

|

Japan – 56.2% |

|

|

|

|

|

|

|

|

Alps Electric Co Ltd |

| Technology Hardware & Equipment |

| 4,751 |

|

| 49,882 |

|

Amada Co Ltd |

| Capital Goods |

| 22,220 |

|

| 238,071 |

|

Asahi Kasei Corporation |

| Materials |

| 1,640 |

|

| 10,874 |

|

Astellas Pharma Inc |

| Pharma, Biotech & Life Sciences |

| 1,684 |

|

| 71,420 |

|

Brother Industries Ltd |

| Technology Hardware & Equipment |

| 1,000 |

|

| 13,881 |

|

Central Japan Railway Co |

| Transportation |

| 13 |

|

| 138,641 |

|

Dai Nippon Printing Co Ltd |

| Commercial Services & Supplies |

| 18,399 |

|

| 287,789 |

|

Daito Trust Construct Co Ltd |

| Consumer Durables & Apparel |

| 984 |

|

| 47,020 |

|

Denso Corporation |

| Automobiles & Components |

| 6,202 |

|

| 248,162 |

|

DENTSU Inc |

| Media |

| 42 |

|

| 125,000 |

|

East Japan Railway Co |

| Transportation |

| 18 |

|

| 124,554 |

|

Eisai Co Ltd |

| Pharma, Biotech & Life Sciences |

| 451 |

|

| 23,079 |

|

Fuji Film Holdings Corp |

| Consumer Durables & Apparel |

| 8,557 |

|

| 352,297 |

|

Fujikura Ltd |

| Capital Goods |

| 12,578 |

|

| 109,600 |

|

Honda Motor Co Ltd |

| Automobiles & Components |

| 10,958 |

|

| 430,311 |

|

Joyo Bank Ltd |

| Banks |

| 23,491 |

|

| 139,633 |

|

Kamigumi Co Ltd |

| Transportation |

| 2,677 |

|

| 22,441 |

|

Kawasaki Kisen Kaisha Ltd |

| Transportation |

| 25,206 |

|

| 217,552 |

|

Konica Minolta Holdings Inc (a) |

| Technology Hardware & Equipment |

| 15,236 |

|

| 207,329 |

|

Kyocera Corporation |

| Technology Hardware & Equipment |

| 1,627 |

|

| 149,169 |

|

Mediceo Paltac Holding Co |

| Health Care Equipment & Services |

| 13,440 |

|

| 251,667 |

|

Mitsui Chemicals Inc |

| Materials |

| 13,880 |

|

| 111,880 |

|

Mitsui Trust Holding Inc |

| Banks |

| 15,163 |

|

| 165,595 |

|

Nintendo Company Ltd |

| Software & Services |

| 40 |

|

| 11,772 |

|

Nippon Paper Group Inc |

| Materials |

| 22 |

|

| 83,482 |

|

Nippon Telegraph & Telephone |

| Telecommunication Services |

| 68 |

|

| 338,426 |

|

Nippon Yusen Kabushiki Kaish |

| Transportation |

| 17,644 |

|

| 134,635 |

|

Nisshin Seifun Group Inc |

| Food & Beverage |

| 13,542 |

|

| 139,271 |

|

Nisshinbo Industries Inc |

| Consumer Durables & Apparel |

| 11,365 |

|

| 126,090 |

|

Nomura Holdings Inc |

| Diversified Financials |

| 1,800 |

|

| 36,533 |

|

NTT Docomo Inc |

| Telecommunication Services |

| 70 |

|

| 106,481 |

|

Orix Corporation |

| Diversified Financials |

| 49 |

|

| 14,016 |

|

Pioneer Corporation |

| Consumer Durables & Apparel |

| 1,620 |

|

| 22,701 |

|

Resona Holdings Inc |

| Banks |

| 96 |

|

| 265,873 |

|

Ricoh Company Limited |

| Technology Hardware & Equipment |

| 10,503 |

|

| 228,364 |

|

SBI Holdings Inc |

| Diversified Financials |

| 353 |

|

| 136,431 |

|

Seiko Epson Corp |

| Technology Hardware & Equipment |

| 6,510 |

|

| 175,451 |

|

Sharp Corp |

| Consumer Durables & Apparel |

| 2,800 |

|

| 47,569 |

|

Shizuoka Bank Ltd |

| Banks |

| 390 |

|

| 4,040 |

|

Sony Corporation |

| Consumer Durables & Apparel |

| 1,378 |

|

| 63,227 |

|

Sumitomo Trust & Bkg |

| Banks |

| 21,874 |

|

| 233,460 |

|

Suzuken Company Limited |

| Health Care Equipment & Services |

| 358 |

|

| 12,401 |

|

Tokyo Steel Mfg Co Ltd |

| Materials |

| 11,676 |

|

| 173,267 |

|

12

DOMINI PACASIA SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Japan (continued) |

|

|

|

|

|

|

|

|

Toppan Printing |

|

|

|

|

|

|

|

|

Company Ltd |

| Commercial Services & Supplies |

| 24,406 |

| $ | 261,896 |

|

Toyo Seikan Kaisha Limited |

| Materials |

| 12,487 |

|

| 225,563 |

|

|

|

|

|

|

|

| 6,376,796 |

|

Malaysia – 1.7% |

|

|

|

|

|

|

|

|

Golden Hope Plantations Bhd |

| Food & Beverage |

| 10,900 |

|

| 20,240 |

|

Kuala Lumpur Kepong BHD |

| Food & Beverage |

| 3,435 |

|

| 14,621 |

|

RHB Capital Berhad |

| Banks |

| 15,918 |

|

| 16,461 |

|

Tenaga Nasional BHD |

| Utilities |

| 19,456 |

|

| 68,364 |

|

YTL Corporation Berhad |

| Utilities |

| 32,940 |

|

| 69,635 |

|

|

|

|

|

|

|

| 189,321 |

|

New Zealand – 0.1% |

|

|

|

|

|

|

|

|

Vector Ltd |

| Utilities |

| 7,535 |

|

| 13,931 |

|

|

|

|

|

|

|

| 13,931 |

|

Philippines – 0.5% |

|

|

|

|

|

|

|

|

Globe Telecom Inc |

| Telecommunication Services |

| 1,827 |

|

| 53,801 |

|

|

|

|

|

|

|

| 53,801 |

|

Singapore – 2.2% |

|

|

|

|

|

|

|

|

Capitamall Trust |

| Real Estate |

| 2,274 |

|

| 4,796 |

|

DBS Group Holdings Ltd. |

| Banks |

| 6,106 |

|

| 87,424 |

|

Jardine Cycle & Carriage Ltd |

| Retailing |

| 6,884 |

|

| 63,170 |

|

United Overseas Bank |

| Banks |

| 7,899 |

|

| 97,160 |

|

|

|

|

|

|

|

| 252,550 |

|

South Korea – 7.7% |

|

|

|

|

|

|

|

|

GS Engineering & Construction |

| Capital Goods |

| 660 |

|

| 54,679 |

|

GS Holdings Corp |

| Energy |

| 3,269 |

|

| 107,983 |

|

Hynix Semiconductor Inc (a) |

| Semiconductors & Semiconductor Equipment |

| 2,180 |

|

| 72,358 |

|

Industrial Bank Of Korea |

| Banks |

| 2,495 |

|

| 45,978 |

|

KCC Corp |

| Capital Goods |

| 50 |

|

| 12,878 |

|

Kookmin Bank |

| Banks |

| 166 |

|

| 13,206 |

|

Korea Investment Holdings Co |

| Diversified Financials |

| 306 |

|

| 13,293 |

|

Korea Zinc Co Ltd |

| Materials |

| 819 |

|

| 72,636 |

|

Korea Telecom Corp |

| Telecommunication Services |

| 2,383 |

|

| 108,582 |

|

KT Freetel |

| Telecommunication Services |

| 1,965 |

|

| 51,343 |

|

LG Corp |

| Capital Goods |

| 2,402 |

|

| 73,093 |

|

LG Electronics Inc |

| Consumer Durables & Apparel |

| 1,375 |

|

| 76,235 |

|

Pacific Corp |

| Household & Personal Products |

| 424 |

|

| 67,552 |

|

Shinhan Financial Group Ltd |

| Banks |

| 1,933 |

|

| 101,013 |

|

|

|

|

|

|

|

| 870,829 |

|

Taiwan – 5.5% |

|

|

|

|

|

|

|

|

China Steel Corp |

| Materials |

| 112,363 |

|

| 116,025 |

|

Chunghwa Telecom Co Ltd |

| Telecommunication Services |

| 42,476 |

|

| 81,528 |

|

Compal Electronics |

| Technology Hardware & Equipment |

| 32,000 |

|

| 28,912 |

|

Far Eastern Textile |

| Capital Goods |

| 33,000 |

|

| 27,862 |

|

Powerchip Semiconductor Corp |

| Semiconductors & Semiconductor Equipment |

| 203,536 |

|

| 130,118 |

|

13

DOMINI PACASIA SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Taiwan (continued) |

|

|

|

|

|

|

|

|

Pro Mos Technologies Inc |

| Semiconductors & |

| 287,394 |

| $ | 110,848 |

|

Quanta Computer Inc |

| Technology Hardware & Equipment |

| 25,616 |

|

| 43,255 |

|

Siliconware Precision Inds |

| Semiconductors |

|

|

|

| ||

Taiwan Cooperative Bank |

|

|

| 18,656 |

|

| 30,936 |

|

Taiwan Mobile Co., Ltd. |

| Telecommunication Services |

| 61,569 |

|

| 45,064 |

|

|

|

|

| 17,000 |

|

| 16,470 |

|

|

|

|

|

|

|

| 631,018 |

|

Thailand – 0.7% |

|

|

|

|

|

|

|

|

Bangkok Bank Pub Co — For Reg |

| Banks |

| 24,318 |

|

| 78,400 |

|

|

|

|

|

|

|

| 78,400 |

|

Total Investments — 97.3% (Cost $10,970,083) (b) |

|

|

|

|

|

| 11,048,060 |

|

Other Assets, less liabilities — 2.7% |

|

|

|

|

|

| 302,544 |

|

Net Assets — 100.0% |

|

|

|

|

| $ | 11,350,604 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income taxes is $10,970,083. The aggregate gross unrealized appreciation is $260,022 and the aggregate gross unrealized depreciation is $182,045, resulting in net unrealized appreciation of $77,977. |

144A — | Security that may be sold to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended. |

ADR — | American Depository Receipt |

GDR — | Global Depository Receipt |

SEE NOTES TO FINANCIAL STATEMENTS

14

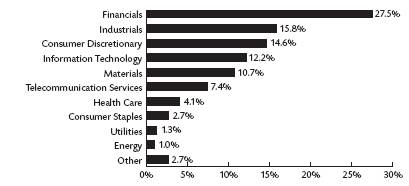

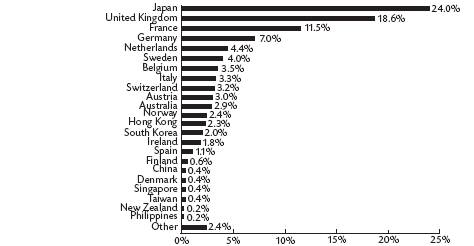

The table and bar chart below provide information as of January 31, 2007, about the ten largest holdings of the Domini EuroPacific Social Equity Trust and its portfolio holdings by industry sector and by country:

TEN LARGEST HOLDINGS

COMPANY |

| % NET |

|

Allianz SE-Reg |

| 3.00 |

|

Societe Generale |

| 2.53 |

|

BNP Paribas |

| 2.45 |

|

Vivendi SA |

| 2.30 |

|

Royal Bank of Scotland Group |

| 2.26 |

|

Muenchener Rueckver AG-Reg |

| 2.21 |

|

Nippon Telegraph & Telephone |

| 2.20 |

|

Severn Trent PLC |

| 2.19 |

|

Dai Nippon Printing Co Ltd |

| 2.11 |

|

Belgacom SA |

| 1.99 |

|

PORTFOLIO HOLDINGS BY INDUSTRY SECTOR (% OF NET ASSETS)

PORTFOLIO HOLDINGS BY COUNTRY (% OF NET ASSETS)

______________

The holdings mentioned above are described in the Domini EuroPacific Social Equity Trust’s Portfolio of Investments at January 31, 2007, included herein. The composition of the Trust’s portfolio is subject to change.

15

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST

PORTFOLIO OF INVESTMENTS

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Australia – 2.9% |

|

|

|

|

|

|

|

|

Insurance Australia Group Lt |

| Insurance |

| 4,823 |

| $ | 24,171 |

|

QBE Insurance Group Ltd |

| Insurance |

| 1,665 |

|

| 39,723 |

|

Sonic Healthcare Ltd |

| Health Care Equipment & Services |

| 543 |

|

| 6,099 |

|

Zinifex Ltd |

| Materials |

| 3,774 |

|

| 47,943 |

|

|

|

|

|

|

|

| 117,936 |

|

Austria – 3.0% |

|

|

|

|

|

|

|

|

Immoeast AG (a) |

| Real Estate |

| 2,560 |

|

| 38,256 |

|

Immofinanz AG (a) |

| Real Estate |

| 4,614 |

|

| 69,849 |

|

Oesterreichische Post AG |

| Transportation |

| 265 |

|

| 12,717 |

|

|

|

|

|

|

|

| 120,822 |

|

Belgium – 3.5% |

|

|

|

|

|

|

|

|

Belgacom SA |

| Telecommunication Services |

| 1,798 |

|

| 81,167 |

|

Fortis Group |

| Diversified Financials |

| 462 |

|

| 19,343 |

|

Omega Pharma SA |

| Health Care Equipment & Services |

| 529 |

|

| 42,379 |

|

|

|

|

|

|

|

| 142,889 |

|

China – 0.4% |

|

|

|

|

|

|

|

|

Chaoda Modern Agriculture |

| Food & Beverage |

| 19,826 |

|

| 14,014 |

|

TPV Technology Ltd |

| Technology Hardware & Equipment |

| 2,000 |

|

| 1,237 |

|

|

|

|

|

|

|

| 15,251 |

|

Denmark – 0.4% |

|

|

|

|

|

|

|

|

Sydbank A/S |

| Banks |

| 324 |

|

| 16,516 |

|

|

|

|

|

|

|

| 16,516 |

|

Finland – 0.6% |

|

|

|

|

|

|

|

|

Outokumpu OYJ |

| Materials |

| 637 |

|

| 25,379 |

|

|

|

|

|

|

|

| 25,379 |

|

France – 11.5% |

|

|

|

|

|

|

|

|

Air France-KLM |

| Transportation |

| 237 |

|

| 10,631 |

|

BNP Paribas |

| Banks |

| 895 |

|

| 99,495 |

|

France Telecom SA |

| Telecommunication Services |

| 373 |

|

| 10,276 |

|

Lafarge SA |

| Materials |

| 235 |

|

| 35,881 |

|

Michelin(CGDE)-Cl B |

| Automobiles & Components |

| 308 |

|

| 28,096 |

|

Sanofi-Aventis |

| Pharma, Biotech & Life Sciences |

| 722 |

|

| 63,282 |

|

Societe Generale |

| Banks |

| 585 |

|

| 103,004 |

|

Vallourec |

| Capital Goods |

| 93 |

|

| 23,964 |

|

Vivendi SA |

| Media |

| 2,282 |

|

| 93,646 |

|

|

|

|

|

|

|

| 468,275 |

|

Germany – 7.0% |

|

|

|

|

|

|

|

|

Allianz SE – Reg |

| Insurance |

| 615 |

|

| 122,271 |

|

Deutsche Lufthansa – Reg |

| Transportation |

| 1,423 |

|

| 39,682 |

|

Deutsche Telekom AG – Reg |

| Telecommunication Services |

| 934 |

|

| 16,385 |

|

Epcos AG (a) |

| Technology Hardware & Equipment |

| 815 |

|

| 14,933 |

|

Muenchener Rueckver AG – Reg |

| Insurance |

| 571 |

|

| 89,780 |

|

ProSieben Sat.1 Media AG |

| Media |

| 76 |

|

| 2,551 |

|

|

|

|

|

|

|

| 285,602 |

|

Hong Kong – 2.3% |

|

|

|

|

|

|

|

|

Cathay Pacific Airways Ltd |

| Transportation |

| 3,944 |

|

| 10,152 |

|

Chinese Estates Hl |

| Real Estate |

| 5,848 |

|

| 7,788 |

|

16

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Hong Kong (continued) |

|

|

|

|

|

|

|

|

Great Eagle Holdings Ltd |

| Real Estate |

| 1,809 |

| $ | 5,919 |

|

Hang Lung Group Ltd |

| Real Estate |

| 3,627 |

|

| 12,401 |

|

Henderson Land Development |

| Real Estate |

| 906 |

|

| 5,232 |

|

Kingboard Chemicals Holdings |

| Technology Hardware & Equipment |

| 1,470 |

|

| 6,052 |

|

Orient Overseas Intl Ltd |

| Transportation |

| 532 |

|

| 3,549 |

|

Swire Pacific Ltd ’A’ |

| Real Estate |

| 834 |

|

| 9,575 |

|

Techtronic Industries Co |

| Consumer Durables & Apparel |

| 774 |

|

| 1,189 |

|

Wharf Holdings Ltd |

| Real Estate |

| 1,971 |

|

| 7,269 |

|

Wheelock & Co Ltd |

| Real Estate |

| 10,604 |

|

| 22,759 |

|

|

|

|

|

|

|

| 91,885 |

|

Ireland – 1.8% |

|

|

|

|

|

|

|

|

Bank Of Ireland |

| Banks |

| 1,138 |

|

| 25,346 |

|

Fyffes PLC |

| Food & Staples Retailing |

| 32,075 |

|

| 45,848 |

|

Total Produce PLC (a) |

| Food & Staples Retailing |

| 2,997 |

|

| 2,804 |

|

|

|

|

|

|

|

| 73,998 |

|

Italy – 3.3% |

|

|

|

|

|

|

|

|

Fiat SPA (a) |

| Automobiles & Components |

| 1,976 |

|

| 42,701 |

|

Ifil SPA |

| Diversified Financials |

| 4,786 |

|

| 41,357 |

|

Pirelli & Co. |

| Capital Goods |

| 49,037 |

|

| 50,595 |

|

|

|

|

|

|

|

| 134,653 |

|

Japan – 24.0% |

|

|

|

|

|

|

|

|

Alps Electric Co Ltd |

| Technology Hardware & Equipment |

| 458 |

|

| 4,809 |

|

Amada Co Ltd |

| Capital Goods |

| 1,584 |

|

| 16,971 |

|

Central Japan Railway Co |

| Transportation |

| 1 |

|

| 10,665 |

|

Dai Nippon Printing Co Ltd |

| Commercial Services & Supplies |

| 5,477 |

|

| 85,669 |

|

Denso Corporation |

| Automobiles & Components |

| 709 |

|

| 28,369 |

|

DENTSU Inc |

| Media |

| 1 |

|

| 2,976 |

|

Fuji Film Holdings Corp |

| Consumer Durables & Apparel |

| 1,525 |

|

| 62,785 |

|

Fujikura Ltd |

| Capital Goods |

| 1,629 |

|

| 14,195 |

|

Honda Motor Co Ltd |

| Automobiles & Components |

| 1,976 |

|

| 77,596 |

|

Joyo Bank Ltd/the |

| Banks |

| 2,781 |

|

| 16,531 |

|

Kawasaki Kisen Kaisha Ltd |

| Transportation |

| 5,454 |

|

| 47,073 |

|

Konica Minolta Holdings Inc (a) |

| Technology Hardware & Equipment |

| 3,087 |

|

| 42,007 |

|

Kyocera Corporation |

| Technology Hardware & Equipment |

| 58 |

|

| 5,318 |

|

Mediceo Paltac Holding Co |

| Health Care Equipment & Services |

| 2,585 |

|

| 48,405 |

|

Mitsui Chemicals Inc |

| Materials |

| 919 |

|

| 7,408 |

|

Mitsui Trust Holding Inc |

| Banks |

| 1,513 |

|

| 16,523 |

|

Nippon Paper Group Inc |

| Materials |

| 2 |

|

| 7,589 |

|

Nippon Telegraph & Telephone |

| Telecommunication Services |

| 18 |

|

| 89,582 |

|

Nisshin Seifun Group Inc |

| Food & Beverage |

| 5,642 |

|

| 58,025 |

|

Nisshinbo Industries Inc |

| Consumer Durables & Apparel |

| 2,638 |

|

| 29,267 |

|

NTT Docomo Inc |

| Telecommunication Services |

| 1 |

|

| 1,521 |

|

Pioneer Corporation |

| Consumer Durables & Apparel |

| 185 |

|

| 2,592 |

|

Resona Holdings Inc |

| Banks |

| 22 |

|

| 60,929 |

|

Ricoh Company Limited |

| Technology Hardware & Equipment |

| 2,388 |

|

| 51,922 |

|

SBI Holdings Inc |

| Diversified Financials |

| 34 |

|

| 13,141 |

|

Seiko Epson Corp |

| Technology Hardware & Equipment |

| 1,643 |

|

| 44,281 |

|

17

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

| VALUE |

| |

Japan (continued) |

|

|

|

|

|

|

|

|

Tokyo Steel Mfg Co Ltd |

| Materials |

| 2,483 |

| $ | 36,847 |

|

Toppan Printing Company Ltd |

| Commercial Services & Supplies |

| 5,622 |

|

| 60,329 |

|

Toyo Seikan Kaisha Limited |

| Materials |

| 1,776 |

|

| 32,081 |

|

|

|

|

|

|

|

| 975,406 |

|

Netherlands – 4.4% |

|

|

|

|

|

|

|

|

Arcelor Mittal |

| Materials |

| 666 |

|

| 30,879 |

|

Fugro NV-CVA |

| Energy |

| 397 |

|

| 18,799 |

|

ING Groep NV-CVA |

| Diversified Financials |

| 1,187 |

|

| 51,748 |

|

Koninkijke KPN NV |

| Telecommunication Services |

| 1,114 |

|

| 15,996 |

|

Koninklijke DSM NV |

| Materials |

| 449 |

|

| 22,195 |

|

SNS Reaal |

| Insurance |

| 732 |

|

| 16,123 |

|

Unilever NV-CVA |

| Food & Beverage |

| 890 |

|

| 23,616 |

|

|

|

|

|

|

|

| 179,356 |

|

New Zealand – 0.2% |

|

|

|

|

|

|

|

|

Contact Energy Ltd |

| Utilities |

| 697 |

|

| 4,130 |

|

Vector Ltd |

| Utilities |

| 2,571 |

|

| 4,753 |

|

|

|

|

|

|

|

| 8,883 |

|

Norway – 2.4% |

|

|

|

|

|

|

|

|

Bergesen Worldwide Gas ASA |

| Energy |

| 750 |

|

| 9,011 |

|

Fred Olsen Energy ASA (a) |

| Energy |

| 259 |

|

| 11,455 |

|

Statoil ASA |

| Energy |

| 2,915 |

|

| 77,492 |

|

|

|

|

|

|

|

| 97,958 |

|

Philippines – 0.2% |

|

|

|

|

|

|

|

|

Globe Telecom Inc |

| Telecommunication Services |

| 248 |

|

| 7,303 |

|

|

|

|

|

|

|

| 7,303 |

|

Singapore – 0.4% |

|

|

|

|

|

|

|

|

DBS Group Holdings Ltd. |

| Banks |

| 519 |

|

| 7,431 |

|

Jardine Cycle & Carriage Ltd |

| Retailing |

| 670 |

|

| 6,148 |

|

United Overseas Bank |

| Banks |

| 380 |

|

| 4,674 |

|

|

|

|

|

|

|

| 18,253 |

|

South Korea – 2.0% |

|

|

|

|

|

|

|

|

GS Holdings Corp |

| Energy |

| 596 |

|

| 19,687 |

|

Hynix Semiconductor Inc (a) |

| Semiconductors & Semiconductor Equipment |

| 180 |

|

| 5,975 |

|

Industrial Bank Of Korea |

| Banks |

| 407 |

|

| 7,500 |

|

Korea Zinc Co Ltd |

| Materials |

| 95 |

|

| 8,425 |

|

Korea Telecom Corp |

| Telecommunication Services |

| 273 |

|

| 12,439 |

|

KT Freetel |

| Telecommunication Services |

| 152 |

|

| 3,972 |

|

LG Corp |

| Capital Goods |

| 494 |

|

| 15,033 |

|

Pacific Corp |

| Household & Personal Products |

| 56 |

|

| 8,922 |

|

|

|

|

|

|

|

| 81,953 |

|

18

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

|

| VALUE |

|

Spain – 1.1% |

|

|

|

|

|

|

|

|

Ac.Acerinox |

| Materials |

| 1,014 |

| $ | 27,591 |

|

Corporacion Financiera Alba |

| Diversified Financials |

| 135 |

|

| 9,341 |

|

Sacyr Vallehermoso SA |

| Capital Goods |

| 124 |

|

| 7,493 |

|

|

|

|

|

|

|

| 44,425 |

|

Sweden – 4.0% |

|

|

|

|

|

|

|

|

Boliden AB |

| Materials |

| 307 |

|

| 7,116 |

|

Electrolux AB-Ser B (a) |

| Consumer Durables & Apparel |

| 1,483 |

|

| 27,989 |

|

Industrivarden AB-C shares |

| Diversified Financials |

| 1,094 |

|

| 42,001 |

|

Investor AB-B shares |

| Diversified Financials |

| 974 |

|

| 23,485 |

|

Scania AB-B shares |

| Capital Goods |

| 845 |

|

| 60,396 |

|

|

|

|

|

|

|

| 160,987 |

|

Switzerland – 3.2% |

|

|

|

|

|

|

|

|

Baloise Holding -R |

| Insurance |

| 208 |

|

| 20,987 |

|

Geberit AG-Reg |

| Capital Goods |

| 11 |

|

| 18,521 |

|

Roche Holding AG |

| Pharma, Biotech & Life Sciences |

| 239 |

|

| 44,762 |

|

Swiss Re-reg |

| Insurance |

| 269 |

|

| 22,291 |

|

Swisscom AG-Reg |

| Telecommunication Services |

| 62 |

|

| 23,080 |

|

|

|

|

|

|

|

| 129,641 |

|

Taiwan – 0.4% |

|

|

|

|

|

|

|

|

China Steel Corp |

| Materials |

| 8,068 |

|

| 8,331 |

|

Powerchip Semiconductor Corp |

| Semiconductors & Semiconductor Equipment |

| 2,752 |

|

| 1,759 |

|

Pro Mos Technologies Inc (a) |

| Semiconductors & Semiconductor Equipment |

| 17,903 |

|

| 6,905 |

|

|

|

|

|

|

|

| 16,995 |

|

United Kingdom – 18.6% |

|

|

|

|

|

|

|

|

3i Group PLC |

| Diversified Financials |

| 3,143 |

|

| 64,905 |

|

Arriva PLC |

| Transportation |

| 472 |

|

| 6,643 |

|

Aviva PLC |

| Insurance |

| 4,200 |

|

| 67,495 |

|

Bellway PLC |

| Consumer Durables & Apparel |

| 432 |

|

| 11,923 |

|

BG Group PLC |

| Energy |

| 502 |

|

| 6,569 |

|

BT Group PLC |

| Telecommunication Services |

| 1,791 |

|

| 10,727 |

|

Firstgroup PLC |

| Transportation |

| 1,446 |

|

| 15,412 |

|

GlaxoSmithKline PLC |

| Pharma, Biotech & Life Sciences |

| 1,573 |

|

| 42,028 |

|

HBOS PLC |

| Banks |

| 2,967 |

|

| 64,523 |

|

Kelda Group PLC |

| Utilities |

| 1,280 |

|

| 23,376 |

|

Legal & General Group PLCE |

| Insurance |

| 608 |

|

| 1,842 |

|

National Grid PLC |

| Utilities |

| 1,883 |

|

| 28,307 |

|

Next PLC |

| Retailing |

| 719 |

|

| 27,486 |

|

Resolution PLC |

| Insurance |

| 915 |

|

| 11,677 |

|

Royal Bank Of Scotland Group |

| Banks |

| 2,302 |

|

| 92,146 |

|

Scottish Power PLC |

| Utilities |

| 2,021 |

|

| 29,551 |

|

Severn Trent PLC |

| Utilities |

| 3,219 |

|

| 89,157 |

|

Standard Life PLC (a) |

| Insurance |

| 11,127 |

|

| 64,033 |

|

Taylor Woodrow PLC |

| Consumer Durables & Apparel |

| 2,040 |

|

| 16,252 |

|

The Berkeley Grp Holdings |

| Consumer Durables & Apparel |

| 568 |

|

| 16,666 |

|

Trinity Mirror PLC |

| Media |

| 1,929 |

|

| 18,048 |

|

19

DOMINI EUROPACIFIC SOCIAL EQUITY TRUST / PORTFOLIO OF INVESTMENTS (CONTINUED)

JANUARY 31, 2007 (UNAUDITED)

COUNTRY/ SECURITY |

| INDUSTRY |

| SHARES |

|

| VALUE |

|

United Kingdom (continued) |

|

|

|

|

|

|

|

|

Vodafone Group PLC |

| Telecommunication Services |

| 713 |

| $ | 2,066 |

|

Whitbread PLC (a) |

| Consumer Services |

| 321 |

|

| 10,185 |

|

Wimpey (George) PLC |

| Consumer Durables & Apparel |

| 3,404 |

|

| 35,847 |

|

|

|

|

|

|

|

| 756,864 |

|

Total Investments — 97.6% (cost $3,949,906) (b) |

|

|

|

|

|

| 3,971,230 |

|

Other Assets, less liabilities — 2.4% |

|

|

|

|

|

| 97,842 |

|

Net Assets — 100.0% |

|

|

|

|

| $ | 4,069,072 |

|

______________

(a) | Non-income producing security. |

(b) | The aggregate cost for federal income tax purposes is $3,950,076. The aggregate gross unrealized appreciation is $87,015 and the aggregate gross unrealized depreciation is $65,861, resulting in net unrealized appreciation of $21,154. |

SEE NOTES TO FINANCIAL STATEMENTS

20

DOMINI SOCIAL TRUST

EXPENSE EXAMPLE

As a shareholder of Domini Social Trust, you incur two types of costs:

• | Transaction costs |

• | Ongoing costs, including management fees and other Trust expenses |

This example is intended to help you understand your ongoing costs (in dollars) of investing in the Trust and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested on August 1, 2006, and held through January 31, 2007.

Actual Expenses

The line of the table captioned “Actual Expenses” below provides information about actual account value and actual expenses. You may use the information in this line, together with the amount invested, to estimate the expenses that you paid over the period as follows:

• | Divide your account value by $1,000. |

• | Multiply your result in step 1 by the number in the first line under the heading “Expenses Paid During Period” in the table. |

• | The result equals the estimated expenses you paid on your account during the period. |

Hypothetical Expenses