UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-05833

| T. Rowe Price Institutional International Funds, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

Item 1. Report to Shareholders

Institutional Emerging Markets

Equity Fund | October 31, 2016 |

| ● | Emerging markets stocks rallied during the 12-month period ended October 31, 2016, as investors grew more confident that the U.S. Federal Reserve would take a gradual approach to raising interest rates.

|

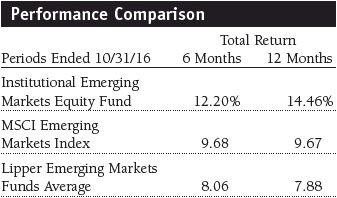

| ● | The Institutional Emerging Markets Equity Fund gained 14.46% and outperformed its benchmark and Lipper peer group.

|

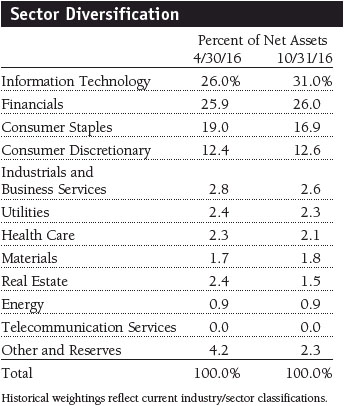

| ● | Stock selection in Brazil and China boosted relative results, while our overweight to the consumer staples sector and underweight to energy detracted.

|

| ● | Valuations for emerging markets stocks are attractive, with many trading at discounts to their historical averages and relative to their growth prospects. |

The views and opinions in this report were current as of October 31, 2016. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

Manager’s Letter

T. Rowe Price Institutional Emerging Markets Equity Fund

Dear Investor

Emerging markets stocks rallied during the past year as global central banks stayed accommodative, commodities prices recovered, and investors grew more confident in the reform outlook for some key emerging markets. Brazil’s market soared as investors anticipated an economic turnaround under President Michel Temer and important reforms after the impeachment of former President Dilma Rousseff. During the period, your fund outperformed its benchmark, thanks in large part to stock selection in the financials and consumer discretionary sectors.

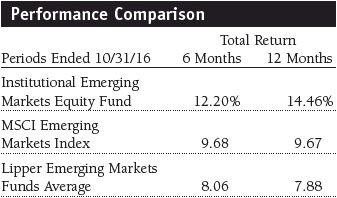

Performance Review

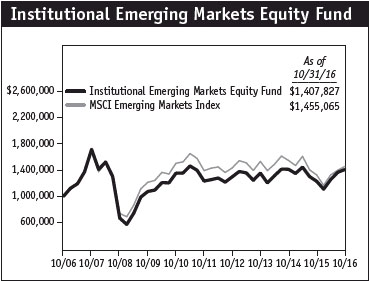

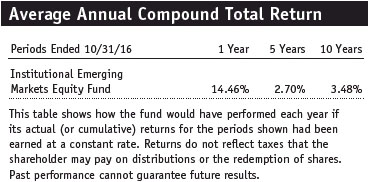

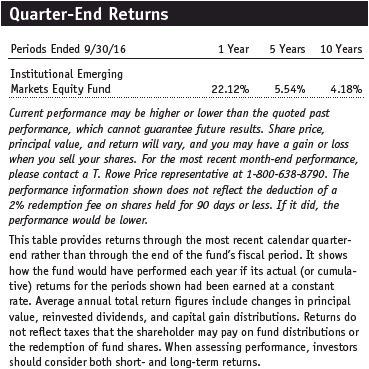

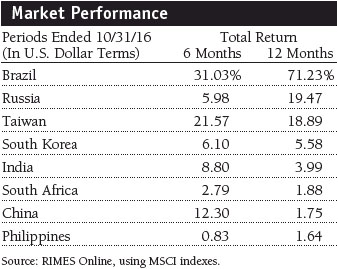

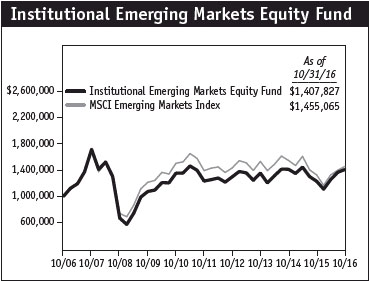

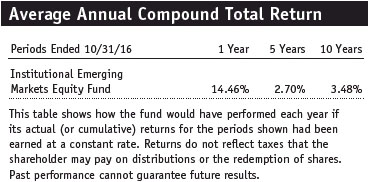

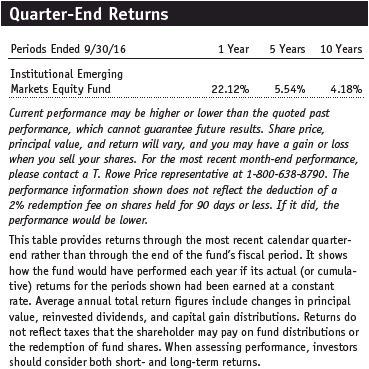

The Institutional Emerging Markets Equity Fund returned 14.46% for the 12 months ended October 31, 2016, beating the 9.67% return of its benchmark, the MSCI Emerging Markets Index, and exceeding its Lipper peer group average return of 7.88%.

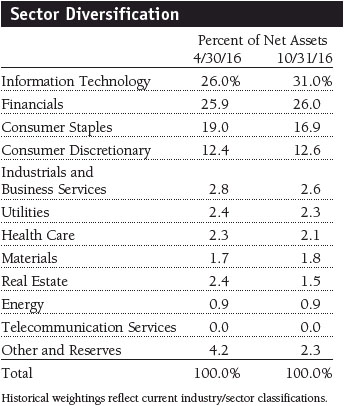

On a relative basis, the fund benefited from stock selection in China and Brazil. In China, our investments in some of the leading Internet companies helped performance, as these companies continued to increase their user base and broaden their services. Internet sales in China now exceed those in the U.S. Our underweight to Chinese banks also contributed. Within Brazil, our focus on high-quality companies with seasoned management teams, strong growth prospects, and solid competitive positions benefited the fund, as those stocks performed well during Brazil’s rally toward the end of the period. India’s market, which has been a strong performer over the past few years, declined as earnings and economic growth disappointed somewhat. The Royal Bank of India has been very proactive in ensuring that banks adequately recognize and reserve for nonperforming loans (NPL). While oversight will ensure that the Indian banking system is in better shape, it cast a near-term cloud over those companies’ shares. Several of our positions in the financials sector added to returns. On the other hand, stock selection in Russia and India detracted from relative results. The fund’s underweight exposure to the energy and materials sectors detracted as commodity prices rallied after a prolonged period of price declines.

Market Environment

Emerging markets stocks rallied over the past 12 months as deep pessimism at the start of the period gave way to rising optimism about the outlook for most developing countries. Worries about China’s growth slowdown and collapsing commodity prices prevailed when our reporting period began last November. But starting early this year, investor sentiment began to turn as China stepped up efforts to stabilize its economy and currency and oil prices rebounded from 13-year lows. Emerging markets stocks also benefited from accommodative monetary policies, which played a key role in supporting risk appetite. Low or negative government bond yields in many developed countries further encouraged investors to buy riskier assets, such as emerging markets stocks.

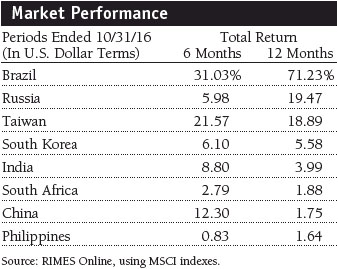

Most emerging markets advanced in U.S. dollar terms over the past 12 months. Brazil’s stocks led the advancers as investors anticipated an economic turnaround under the new president after the impeachment of his predecessor. Stocks in Indonesia and Russia posted slimmer double-digit gains as stronger commodity prices lifted the outlook for their resource-driven economies. China underperformed as the country’s slowing growth, rising debt, and weakening currency unnerved investors in the early part of our reporting period. Some individual emerging markets suffered from increased political risk. Most notably, investors shied from investments in Mexico amid concerns that the new Trump administration could seek to change established trade agreements.

Portfolio Review

Our investments in quality companies with long runways for growth weathered the challenging economic conditions in many of emerging markets countries and had promising results. In particular, the fund benefited overall from its investments in China and Brazil. From a sector perspective, our financial and consumer discretionary stocks added value. In China, our positions in leading technology companies helped performance, while in Brazil our focus on banking stocks contributed. On the other hand, our stock selection in, and overweight to, the United Arab Emirates, the Philippines, and Turkey hurt results.

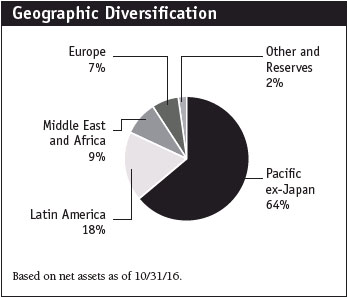

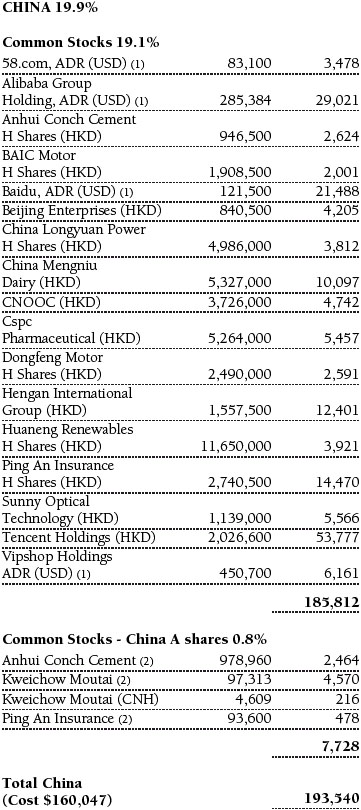

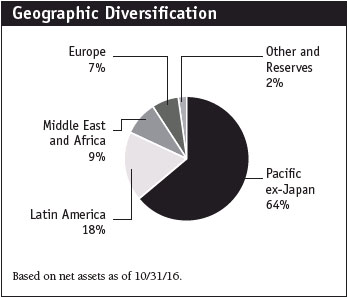

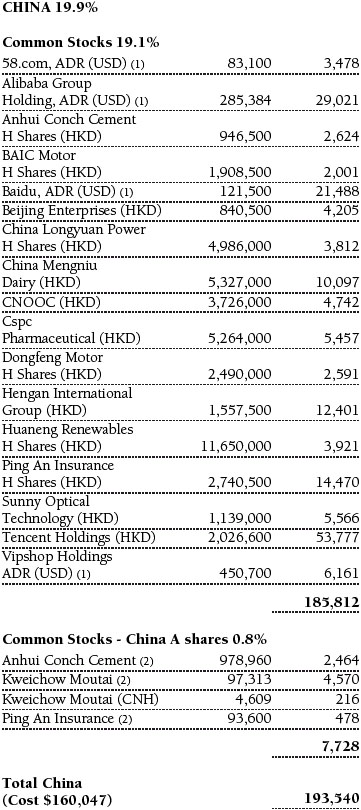

Asia

Our Asian holdings represented about two-thirds of the portfolio. Although China is the largest country allocation, it is also our largest underweight as we have little exposure to its manufacturing and banking sectors. We focus on companies in industries exposed to long-term growth in domestic demand and disposable incomes, such as Internet, consumer products, clean energy, and insurance, or what we call the “new China.” Tencent Holdings, the country’s dominant online social media and gaming company, was a strong performer, adding value as it increased its user base and advertising revenues. We also hold a large position in Baidu, the leading Chinese online search engine operator. (Please refer to the portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

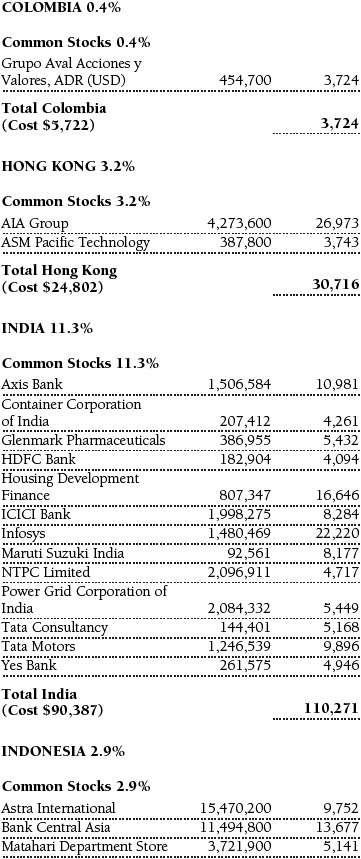

We have a large allocation to India, where the economic fortunes of many companies have greatly improved, thanks in part to low oil prices, a better monsoon season, and new reforms being introduced by the Modi administration. While the pace of those reforms has been somewhat frustrating to many investors, we think the country is heading in the right direction, and we hold significant positions in the financials and information technology sectors. Our position in Infosys, India’s leading IT company, weighed on performance, but the company is an important long-term holding that stands to benefit from solid long-term demand and management initiatives.

We have long maintained underweight allocations to South Korea and Taiwan, two of Asia’s most developed markets. While they lack the demographic tailwinds and rapid economic growth rates of less mature emerging markets, they are home to some attractively valued technology suppliers that have done a good job of capturing and increasing global market share. Our global emerging markets analyst team visited South Korea and Taiwan earlier this fall to research several companies, an informative trip that helped shape our views of the changing investment opportunities in each market. In South Korea, we increased our position in Samsung Electronics on weakness after the company scrapped its Galaxy Note 7 smartphone following numerous reports of the devices catching fire. While the Note 7’s issues weighed on Samsung’s stock, we see it as a temporary problem. More important are the prospects for its components business, which we think are turning, in part, because margins should improve. Furthermore, we are optimistic that a new generation of leaders within the company will usher in more shareholder-friendly capital allocation policies, which could lead to a higher payout ratio for dividends.

Taiwan’s technology sector features many highly innovative, cost-effective producers that consistently deliver high-quality products. Besides generating steady earnings growth, many of these companies have shareholder-friendly policies and a willingness to pay high dividends. Taiwan Semiconductor Manufacturing was one of the top contributors to relative performance. Catcher Technology, which makes metal casings for Apple’s iPhone and other mobile devices, detracted from results, in part, due to disappointing iPhone sales trends. We believe the company will continue to generate attractive growth as it gains share in the high-end metal casings market.

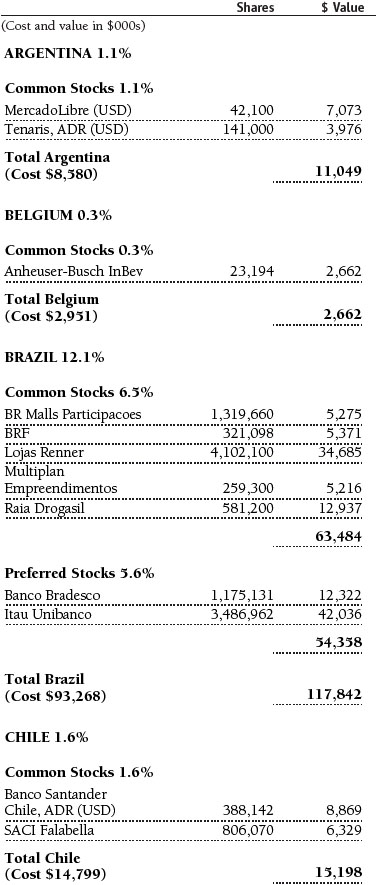

Latin America

Our allocation to Brazil rose over the period as its market surged roughly 71% in dollar terms. The political turmoil over the past year created significant volatility, which allowed us to add to some of our holdings at very attractive valuations. Longer term, we have a favorable view of Brazil’s prospects, particularly as some of the much needed reforms are implemented and the economy begins to heal.

Many of our Brazilian holdings have successfully weathered challenging economic conditions. Although many positions have rallied strongly, we believe that their earnings prospects are attractive, particularly as the economy is expected to resume expanding next year.

Our sector positioning is concentrated in domestic-focused names in the financials and consumers sectors. We like private banks, which we expect to improve as macroeconomic headwinds continue to dissipate, NPL provisions fall, and loan growth picks up. Brazil has a consolidated and well-capitalized banking system, with the retail franchises of leading banks generating a sustainable competitive advantage. Itau Unibanco Holding, one of Brazil’s largest financial institutions with exposure to retail and corporate lending, contributed the most to absolute and relative returns for the 12-month period.

Brazilian financial services conglomerate Banco Bradesco was also a top contributor. Shares of both banks rallied as it appeared that interest rates and their provisions for NPLs were peaking. As always, we will keep a keen eye on valuations and will trim positions if the stocks become too rich.

Our preference for quality consumer stocks helped results. These include department store chain Lojas Renner and drugstore retailer Raia Drogasil. Both stocks have done very well, even as Brazil has struggled. As the economy recovers, so too will employment, wages, and consumption, which should allow both companies to continue to deliver strong earnings growth.

Mexican stocks were the region’s worst performers for the year, declining more than 4%. The antitrade rhetoric from the U.S. presidential election hurt investment in the country, especially as the peso became a proxy for a Trump victory. However, the Mexican consumer remains strong, buoyed by remittances, real wage increases, and employment growth.

Our positions are concentrated in consumer and financial companies, with very limited exposure to the more commodity-related firms. One exception is Fresnillo, the world’s largest primary silver producer and Mexico’s second-largest gold producer, which performed strongly amid the rebound in commodity prices. Discount retailer Wal-Mart de Mexico (Walmex) came under pressure this year, though we added to our position on weakness as we are confident that it will increase its market share. Within financials, Grupo Financiero Santander Mexico suffered during the period, but we believe its earnings should improve on increased loan growth and net interest margin.

Europe, Middle East, and Africa (EMEA)

The fund benefited from our position in Russia’s dominant bank, Sberbank of Russia. Sberbank is another example of a quality company, with leading technology and a solid management team, that was able to successfully navigate tough economic conditions better than its competitors. Investors were particularly impressed with its ability to increase its return on equity and take market share during tumultuous times.

On the other hand, food retailer Magnit weighed on results. We think the stock is attractively valued and that the company’s management can turn the business around. Magnit should also benefit from Russia’s improving macroeconomic conditions.

We maintained slight overweights to Turkey and South Africa. In Turkey, some of our holdings were negatively affected by the politics-driven sell-off in the country’s stock market. As a result, our overweight to food retailer BIM Birlesik Magazalar hurt results. We eliminated Turkiye Halk Bankasi due in part to its weak growth prospects. We are concerned about developments in the country, including the failed military coup and President Erdogan’s push for increased power and control, but are comfortable with the quality and growth prospects of our holdings.

In South Africa, we favor companies that have a strong competitive position and that will benefit from a better macro environment as the country begins to move out of its period of sluggish growth. Department store operator Woolworths Holdings and Shoprite, the continent’s biggest food retailer, rank among our top holdings.

Outlook

As of this writing, global investors are digesting the U.S. presidential election’s unexpected outcome. Many of the president-elect’s campaign proposals, if enacted, could change longstanding global trade and security agreements and negatively affect investors’ risk appetite. We will carefully monitor U.S. trade and economic policy and its impact on your fund by increasing positions in our preferred companies during times of volatility or reducing names whose risk/reward profile has grown less favorable. We have a high level of conviction in our holdings, which are all high-quality companies that should do well in the longer term despite a high level of uncertainty in the near term.

Outside the U.S., our outlook for emerging markets has brightened as several headwinds weighing on our asset class in recent years have begun to subside. Oil and other commodities prices have rebounded after plunging in 2015. Many emerging markets currencies have recovered after hitting record lows early this year. China’s economy appears to have stabilized thanks to stepped-up stimulus, while Brazil and Russia—which have been in recession since 2014—are expected to return to economic growth next year. Finally, while fears of higher U.S. interest rates have periodically led to emerging markets sell-offs in recent years, we do not anticipate a significant or lasting decline in most emerging markets once the Fed starts to gradually tighten policy in the coming months, as we expect it will.

Our outlook varies by country and is tempered by several risks. Continued global oversupply in commodities will force raw materials producers to adjust to lower revenues. Many emerging markets are prone to domestic strife and geopolitical tensions, which flared up in several countries this year and contributed to stock market and currency volatility. Finally, China’s ongoing reliance on government spending to drive growth has raised alarm about the country’s rapid debt buildup. We believe that China’s policymakers are attuned to the risks of too much debt and will steer the economy to avoid a full-blown crisis. Over the long term, deleveraging China’s banking system and overhauling the economy will be a long and slow process. We should gain more insight into the scope of reforms in late 2017, when China holds its twice-a-decade party congress and five of the seven members of the country’s top leadership committee are due to retire.

Even after the past year’s advances, valuations among emerging markets stocks are attractive and trade at a discount relative to their history and developed markets peers. As we have noted in previous letters, returns in the emerging universe have shown greater dispersion in recent years. Thanks to the insights of T. Rowe Price’s global emerging markets equity analyst team, we continue to find companies around the world with underappreciated potential and scope for improved performance. We look forward to buying and holding these companies for your fund in our ongoing effort to deliver solid returns.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Gonzalo Pángaro

Portfolio manager and chairman of the fund’s Investment Advisory Committee

November 28, 2016

The committee chairman has day-to-day responsibility for managing the portfolio and executing the fund’s investment program.

| Risks of International Investing |

Funds that invest overseas generally carry more risk than funds that invest strictly in U.S. assets. Funds investing in a single country or in a limited geographic region tend to be riskier than more diversified funds. Risks can result from varying stages of economic and political development; differing regulatory environments, trading days, and accounting standards; and higher transaction costs of non-U.S. markets. Non-U.S. investments are also subject to currency risk, or a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in categories defined by Lipper Inc.

MSCI Emerging Markets Index: A capitalization-weighted index of stocks from 26 emerging markets countries that only includes securities that may be traded by foreign investors.

Price-to-earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its reported earnings per share. The ratio is a measure of how much investors are willing to pay for the company’s earnings.

Note: MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI.

Portfolio Highlights

Performance and Expenses

T. Rowe Price Institutional Emerging Markets Equity Fund

This chart shows the value of a hypothetical $1 million investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

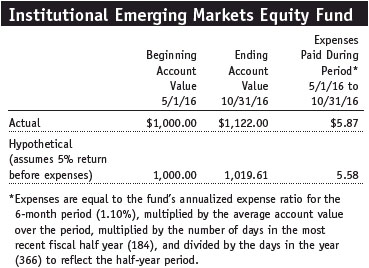

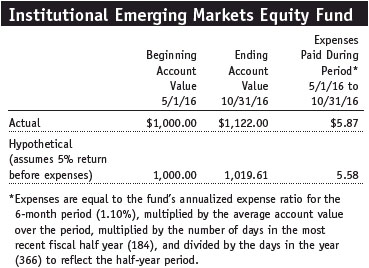

Fund Expense Example

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and actual expenses. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

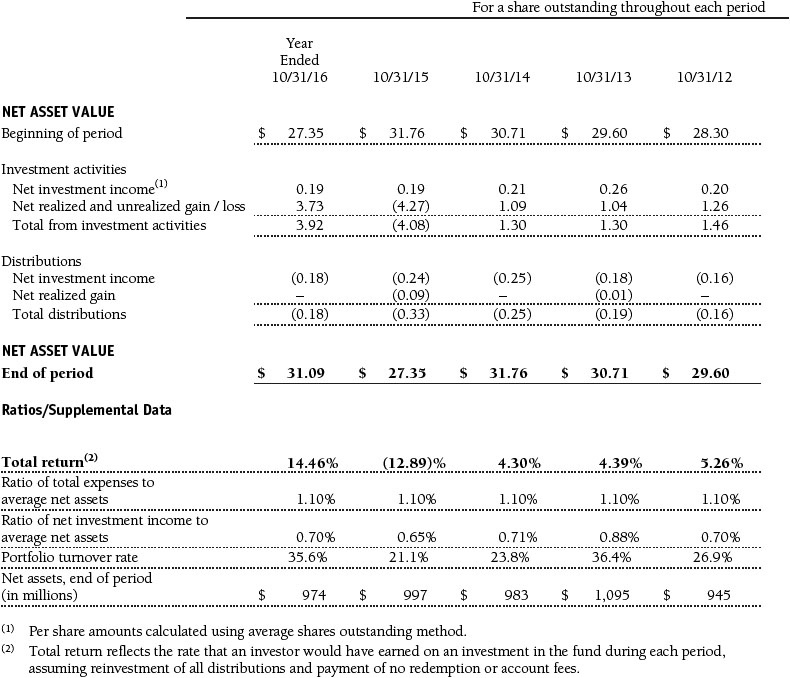

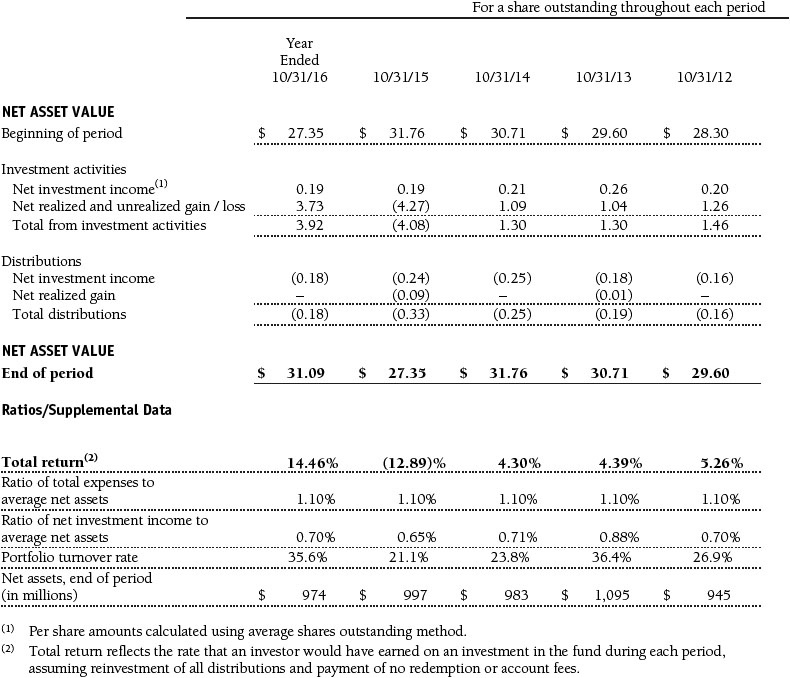

Financial Highlights

T. Rowe Price Institutional Emerging Markets Equity Fund

The accompanying notes are an integral part of these financial statements.

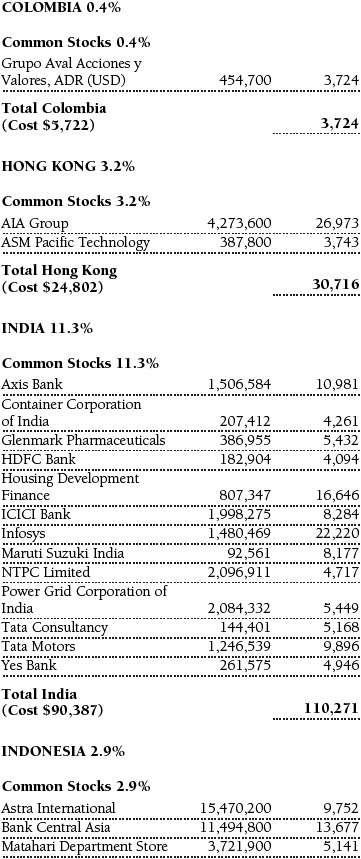

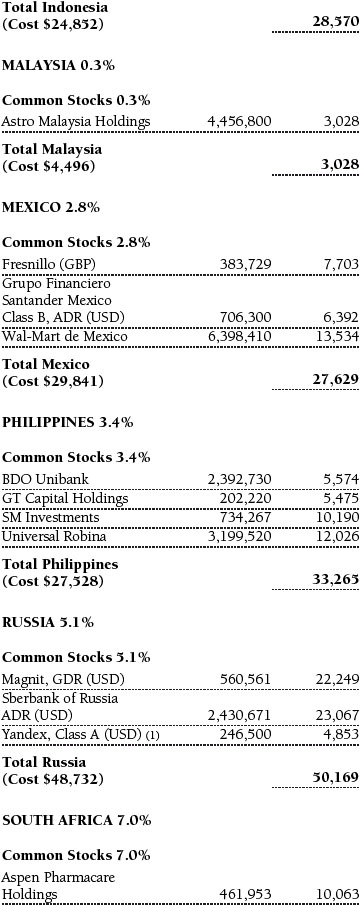

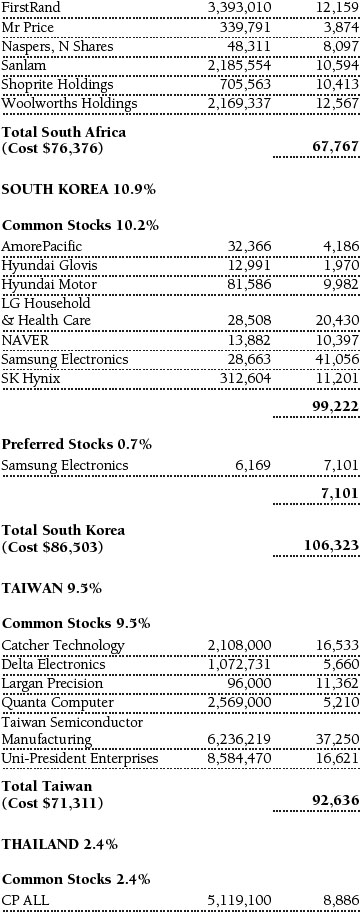

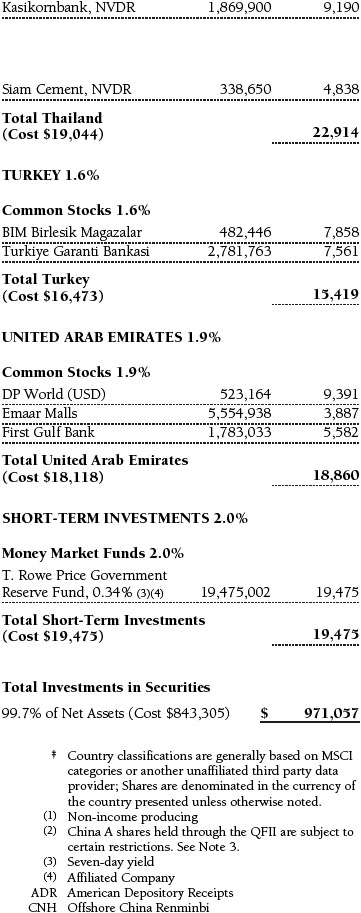

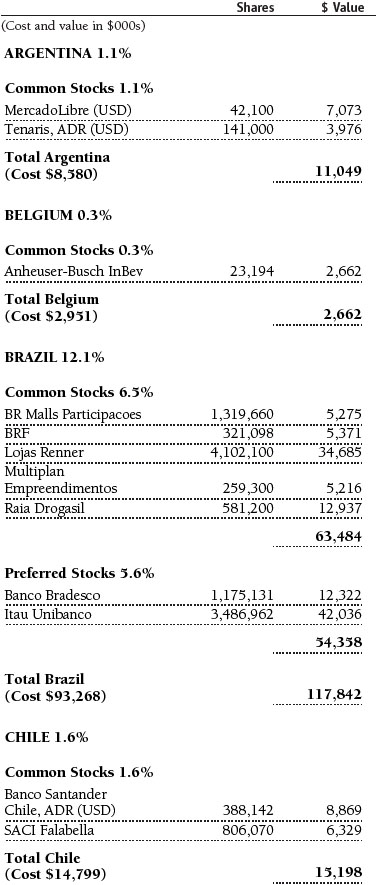

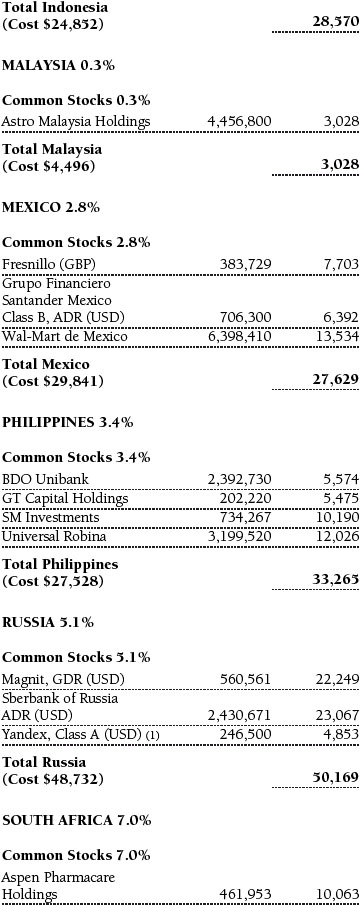

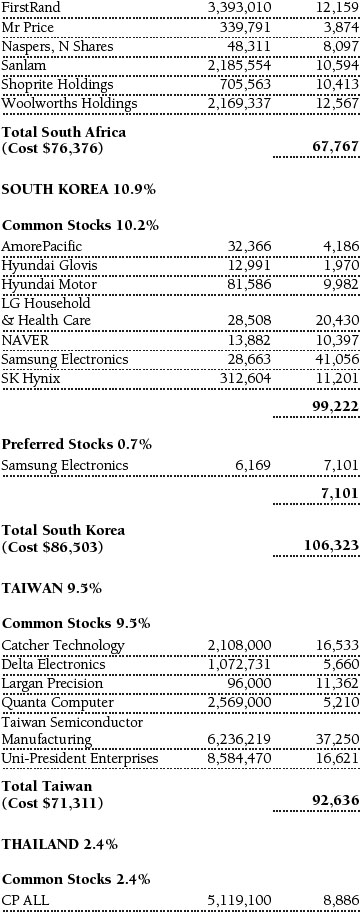

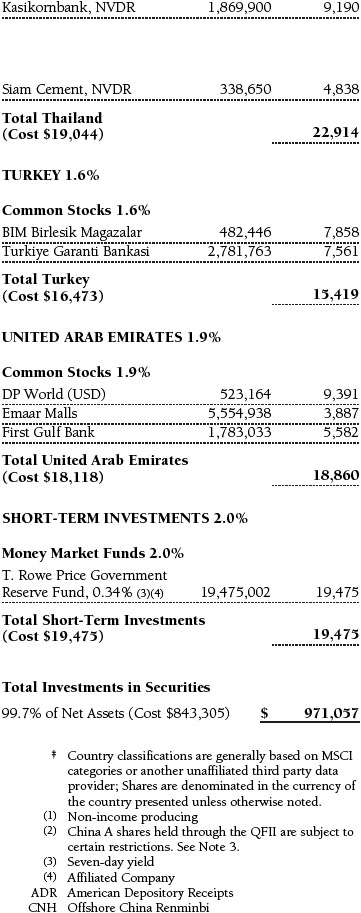

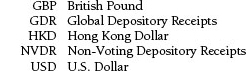

Portfolio of Investments‡

T. Rowe Price Institutional Emerging Markets Equity Fund

October 31, 2016

The accompanying notes are an integral part of these financial statements.

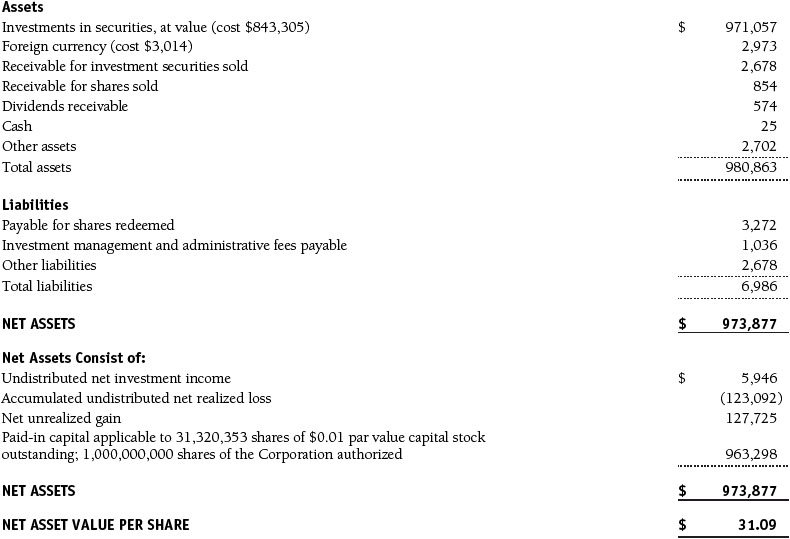

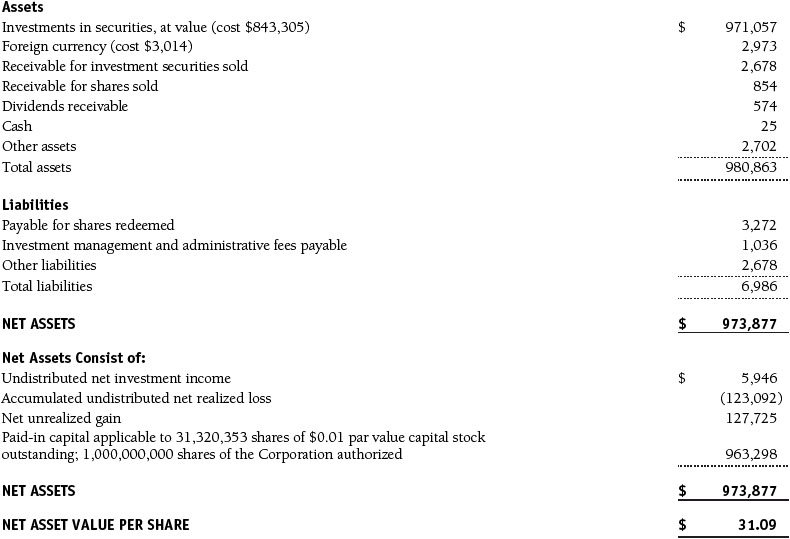

Statement of Assets and Liabilities

T. Rowe Price Institutional Emerging Markets Equity Fund

October 31, 2016

($000s, except shares and per share amounts)

The accompanying notes are an integral part of these financial statements.

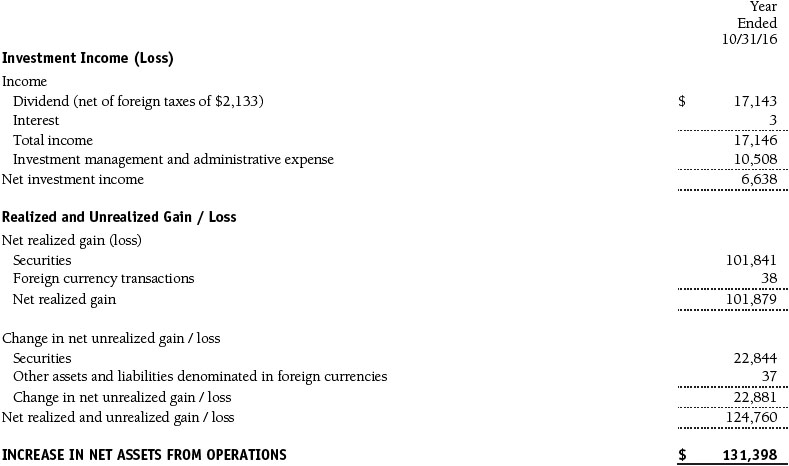

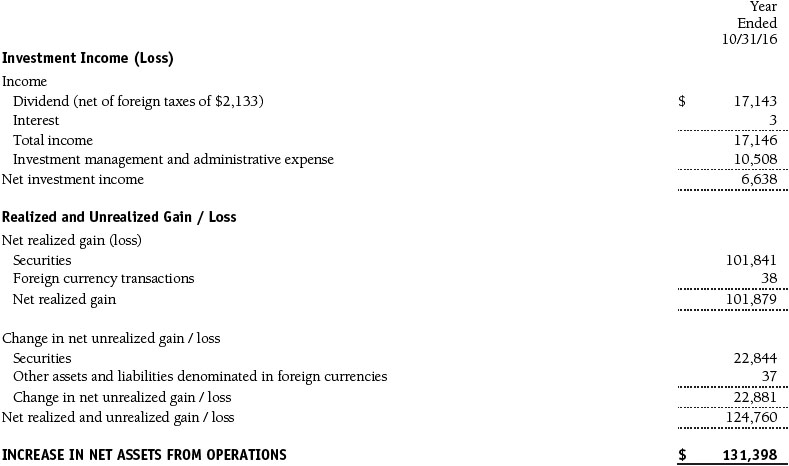

Statement of Operations

T. Rowe Price Institutional Emerging Markets Equity Fund

($000s)

The accompanying notes are an integral part of these financial statements.

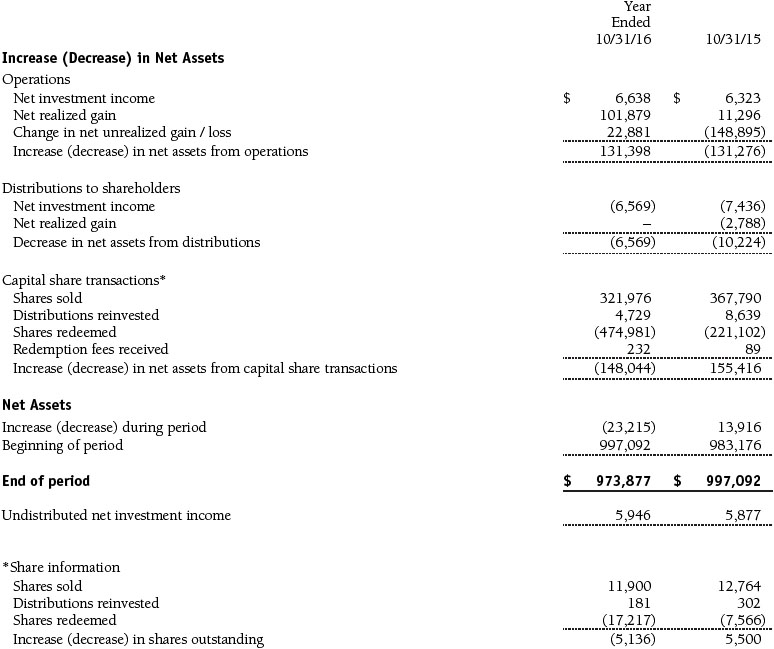

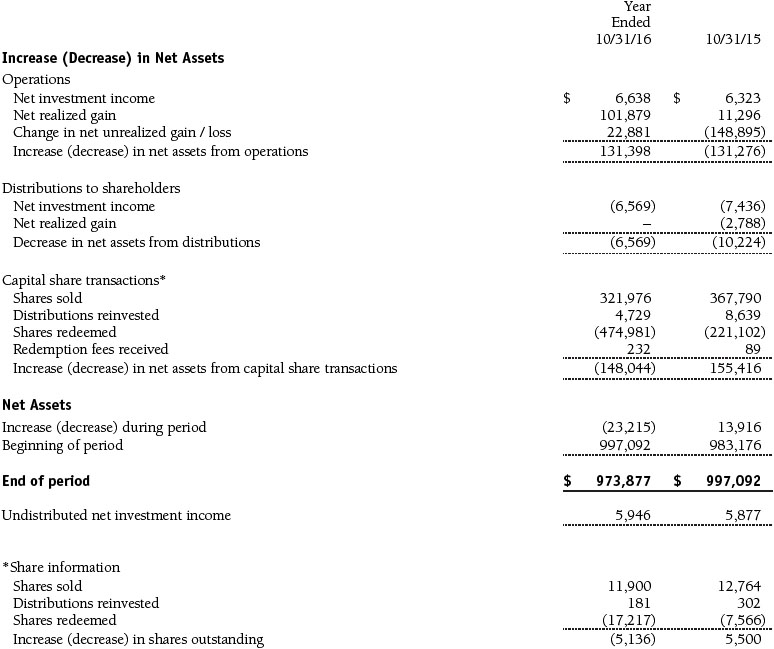

Statement of Changes in Net Assets

T. Rowe Price Institutional Emerging Markets Equity Fund

($000s)

The accompanying notes are an integral part of these financial statements.

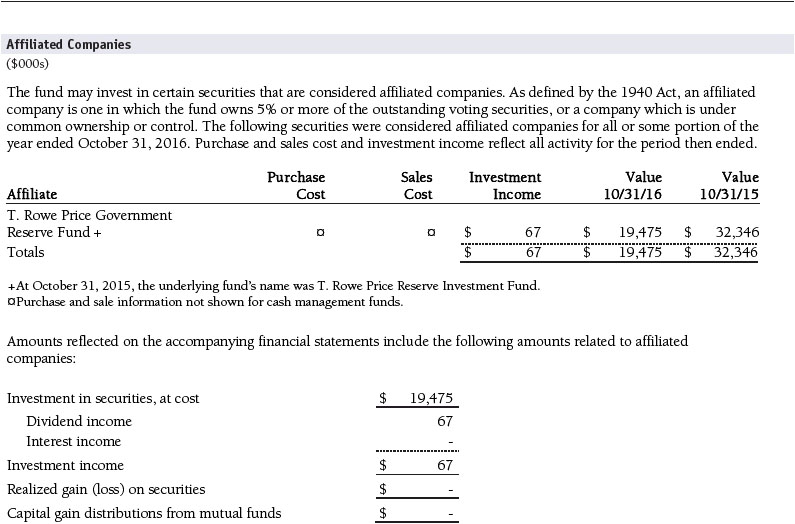

Notes to Financial Statements

T. Rowe Price Institutional Emerging Markets Equity Fund

October 31, 2016

T. Rowe Price Institutional International Funds, Inc. (the corporation), is registered under the Investment Company Act of 1940 (the 1940 Act). The Institutional Emerging Markets Equity Fund (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks long-term growth of capital through investments primarily in the common stocks of companies located (or with primary operations) in emerging markets.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Income distributions are declared and paid annually. Distributions to shareholders are recorded on the ex-dividend date. Capital gain distributions are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Redemption Fees A 2% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, and when considered to be in the best interest of all shareholders, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended October 31, 2016, the fund realized $15,705,000 of net gain on $44,666,000 of in-kind redemptions.

New Accounting Guidance In October 2016, the Securities and Exchange Commission (SEC) issued a new rule, Investment Company Reporting Modernization, which, among other provisions, amends Regulation S-X to require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Compliance with the guidance is required for financial statements filed with the SEC on or after August 1, 2017; adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and its net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices for domestic securities and the last quoted sale or closing price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

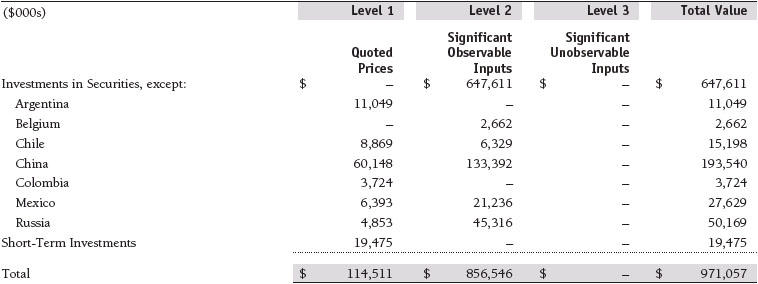

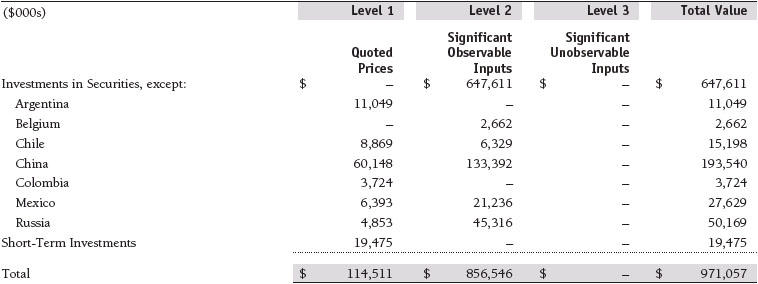

Valuation Inputs The following table summarizes the fund’s financial instruments, based on the inputs used to determine their fair values on October 31, 2016:

There were no material transfers between Levels 1 and 2 during the year ended October 31, 2016.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Emerging and Frontier Markets The fund may invest, either directly or through investments in T. Rowe Price institutional funds, in securities of companies located in, issued by governments of, or denominated in or linked to the currencies of emerging and frontier market countries; at period-end, approximately 93% of the fund’s net assets were invested in emerging markets and 1% in frontier markets. Emerging markets, and to a greater extent frontier markets, generally have economic structures that are less diverse and mature, and political systems that are less stable, than developed countries. These markets may be subject to greater political, economic, and social uncertainty and differing regulatory environments that may potentially impact the fund’s ability to buy or sell certain securities or repatriate proceeds to U.S. dollars. Such securities are often subject to greater price volatility, less liquidity, and higher rates of inflation than U.S. securities. Investing in frontier markets is significantly riskier than investing in other countries, including emerging markets.

China A shares The fund invests in certain Chinese equity securities (A shares) that have limited availability to investors outside of China. The fund gains access to the A share market either through the Shanghai-Hong Kong Stock Connect program (Stock Connect) or through a wholly owned subsidiary of Price Associates, which serves as the registered Qualified Foreign Institutional Investor (QFII) for all participating T. Rowe Price-sponsored products (each a participating account). Related to A shares held through the QFII, investment decisions are specific to each participating account, and each account bears the economic consequences of its holdings and transactions in A shares. Further, the fund’s ability to repatriate cash associated with its A shares held through the QFII is subject to certain restrictions and administrative processes involving the Chinese government; consequently, the fund may experience substantial delays in gaining access to its assets or incur a loss of value in the event of noncompliance with governmental requirements. A shares acquired through the QFII are valued using the onshore renminbi exchange rate (CNY), and those acquired through Stock Connect are valued using the offshore renminbi exchange rate (CNH). CNY and CNH exchange rates may differ; accordingly, A shares of the same issue purchased through different channels may not have the same U.S. dollar value. Generally, the fund is not subject to capital gain tax related to its A share investments.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $329,707,000 and $468,462,000, respectively, for the year ended October 31, 2016.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

Reclassifications to paid-in capital relate primarily to redemptions in kind. For the year ended October 31, 2016, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

Distributions during the years ended October 31, 2016 and October 31, 2015, totaled $6,569,000 and $10,224,000, respectively, and were characterized as ordinary income for tax purposes. At October 31, 2016, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales and/or the realization of gains/losses on passive foreign investment companies for tax purposes.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. Because the fund is required to use capital loss carryforwards that do not expire before those with expiration dates, all or a portion of its capital loss carryforwards subject to expiration could ultimately go unused. During the year ended October 31, 2016, the fund utilized $76,298,000 of capital loss carryforwards. The fund’s available capital loss carryforwards as of October 31, 2016, expire as follows: $103,822,000 in fiscal 2017, $2,829,000 in fiscal 2018, and $1,881,000 in fiscal 2019.

NOTE 5 - FOREIGN TAXES

The fund is subject to foreign income taxes imposed by certain countries in which it invests. Additionally, certain foreign currency transactions are subject to tax, and capital gains realized upon disposition of securities issued in or by certain foreign countries are subject to capital gains tax imposed by those countries. All taxes are computed in accordance with the applicable foreign tax law, and, to the extent permitted, capital losses are used to offset capital gains. Taxes attributable to income are accrued by the fund as a reduction of income. Taxes incurred on the purchase of foreign currencies are recorded as realized loss on foreign currency transactions. Current and deferred tax expense attributable to capital gains is reflected as a component of realized or change in unrealized gain/loss on securities in the accompanying financial statements. At October 31, 2016, the fund had no deferred tax liability attributable to foreign securities and $4,456,000 of foreign capital loss carryforwards, including $1,865,000 that expire in 2017, $786,000 that expire in 2020, $607,000 that expire in 2022, and $1,198,000 that expire in 2024.

NOTE 6 - RELATED PARTY TRANSACTIONS

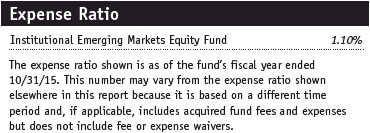

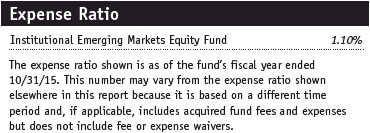

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). Price Associates has entered into a sub-advisory agreement(s) with one or more of its wholly owned subsidiaries, to provide investment advisory services to the fund. The investment management and administrative agreement between the fund and Price Associates provides for an all-inclusive annual fee equal to 1.10% of the fund’s average daily net assets. The fee is computed daily and paid monthly. The all-inclusive fee covers investment management, shareholder servicing, transfer agency, accounting, and custody services provided to the fund, as well as fund directors’ fees and expenses. Interest, taxes, brokerage commissions, and other non-recurring expenses permitted by the investment management agreement are paid directly by the fund.

Mutual funds, trusts, and other accounts managed by Price Associates or its affiliates (collectively, Price funds and accounts) may invest in the fund. No Price fund or account may invest for the purpose of exercising management or control over the fund. At October 31, 2016, approximately 22% of the fund’s outstanding shares were held by Price funds and accounts.

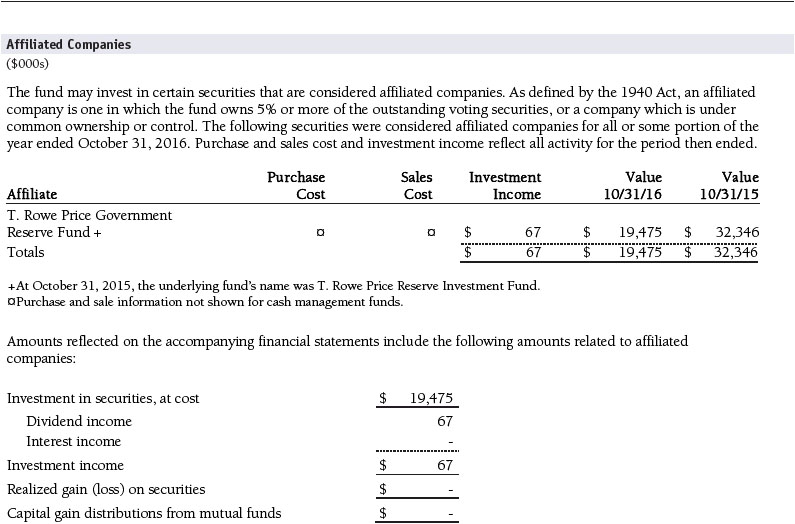

The fund may invest in the T. Rowe Price Government Reserve Fund, the T. Rowe Price Treasury Reserve Fund, or the T. Rowe Price Short-Term Fund (collectively, the Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The Price Reserve Investment Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Investment Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended October 31, 2016, the fund had no purchases or sales cross trades with other funds or accounts advised by Price Associates.

NOTE 7 - BORROWING

To provide temporary liquidity, the fund may borrow from other T. Rowe Price-sponsored mutual funds under an interfund borrowing program developed and managed by Price Associates. The program permits the borrowing and lending of cash at rates beneficial to both the borrowing and lending funds. Pursuant to program guidelines, loans totaling 10% or more of a borrowing fund’s total assets require collateralization at 102% of the value of the loan; loans of less than 10% are unsecured. During the year ended October 31, 2016, the fund incurred $1,000 in interest expense related to outstanding borrowings on two days in the average amount of $8,150,000 and at an average annual rate of 1.45%. At October 31, 2016, there were no borrowings outstanding.

Report of Independent Registered Public Accounting Firm

To the Board of Directors of T. Rowe Price Institutional International Funds, Inc. and

Shareholders of T. Rowe Price Institutional Emerging Markets Equity Fund

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the T. Rowe Price Institutional Emerging Markets Equity Fund (one of the portfolios comprising T. Rowe Price Institutional International Funds, Inc., hereafter referred to as the “Fund”) at October 31, 2016, the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2016 by correspondence with the custodian, and confirmation of the underlying fund by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

December 15, 2016

| Tax Information (Unaudited) for the Tax Year Ended 10/31/16 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

For taxable non-corporate shareholders, $8,317,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $30,000 of the fund’s income qualifies for the dividends-received deduction.

The fund will pass through foreign source income of $9,800,000 and foreign taxes paid of $2,048,000.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

Independent Directors

Name (Year of Birth)

Year Elected* [Number of

T. Rowe Price Portfolios

Overseen] | | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years |

| | | |

William R. Brody, M.D., Ph.D. (1944)

2009 [186] | | President and Trustee, Salk Institute for Biological Studies (2009 to present); Director, BioMed Realty Trust (2013 to 2016); Chairman of the Board, Mesa Biotech, a molecular diagnostic company (March 2016 to present); Director, Radiology Partners, an integrated radiology practice management company (June 2016 to present); Director, Novartis, Inc. (2009 to 2014); Director, IBM (2007 to present) |

| | | |

Anthony W. Deering (1945)

1991 [186] | | Chairman, Exeter Capital, LLC, a private investment firm (2004 to present); Director, Brixmor Real Estate Investment Trust (2012 to present); Director and Advisory Board Member, Deutsche Bank North America (2004 to present); Director, Under Armour (2008 to present); Director, Vornado Real Estate Investment Trust (2004 to 2012) |

| | | |

Bruce W. Duncan (1951)

2013 [186] | | Chief Executive Officer and Director (2009 to present), Chairman of the Board (January 2016 to present), and President (2009 to September 2016), First Industrial Realty Trust, an owner and operator of industrial properties; Chairman of the Board (2005 to May 2016) and Director (1999 to May 2016), Starwood Hotels & Resorts, a hotel and leisure company; Director, Boston Properties (May 2016 to present) |

| | | |

Robert J. Gerrard, Jr. (1952)

2012 [186] | | Advisory Board Member, Pipeline Crisis/Winning Strategies, a collaborative working to improve opportunities for young African Americans (1997 to present) |

| | | |

Paul F. McBride (1956)

2013 [186] | | Advisory Board Member, Vizzia Technologies (2015 to present) |

| | | |

Cecilia E. Rouse, Ph.D. (1963)

2012 [186] | | Dean, Woodrow Wilson School (2012 to present); Professor and Researcher, Princeton University (1992 to present); Director, MDRC, a nonprofit education and social policy research organization (2011 to present); Member of National Academy of Education (2010 to present); Research Associate of Labor Program (2011 to present) and Board Member (2015 to present), National Bureau of Economic Research (2011 to present); Chair of Committee on the Status of Minority Groups in the Economic Profession (2012 to present) and Vice President (2015 to present), American Economic Association |

| | | |

John G. Schreiber (1946)

2001 [186] | | Owner/President, Centaur Capital Partners, Inc., a real estate investment company (1991 to present); Cofounder, Partner, and Cochairman of the Investment Committee, Blackstone Real Estate Advisors, L.P. (1992 to 2015); Director, General Growth Properties, Inc. (2010 to 2013); Director, Blackstone Mortgage Trust, a real estate financial company (2012 to 2016); Director and Chairman of the Board, Brixmor Property Group, Inc. (2013 to present); Director, Hilton Worldwide (2013 to present); Director, Hudson Pacific Properties (2014 to 2016) |

| | | |

Mark R. Tercek (1957)

2009 [186] | | President and Chief Executive Officer, The Nature Conservancy (2008 to present) |

| | | |

*Each independent director serves until retirement, resignation, or election of a successor. |

| | | |

| Inside Directors |

| |

Name (Year of Birth)

Year Elected* [Number of

T. Rowe Price Portfolios

Overseen] | | Principal Occupation(s) and Directorships of Public Companies and Other Investment Companies During the Past Five Years |

| | | |

Edward C. Bernard (1956)

2006 [186] | | Director and Vice President, T. Rowe Price; Vice Chairman of the Board, Director, and Vice President, T. Rowe Price Group, Inc.; Chairman of the Board, Director, and President, T. Rowe Price Investment Services, Inc.; Chairman of the Board and Director, T. Rowe Price Retirement Plan Services, Inc., and T. Rowe Price Services, Inc.; Chairman of the Board, Chief Executive Officer, Director, and President, T. Rowe Price International and T. Rowe Price Trust Company; Chairman of the Board, all funds |

| | | |

Brian C. Rogers, CFA, CIC (1955)

2006 [131] | | Chief Investment Officer, Director, and Vice President, T. Rowe Price; Chairman of the Board, Chief Investment Officer, Director, and Vice President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price Trust Company |

| | | |

*Each inside director serves until retirement, resignation, or election of a successor. |

| Officers | | |

| |

| Name (Year of Birth) | | |

| Position Held With Institutional International Funds | | Principal Occupation(s) |

| | | |

Ulle Adamson, CFA (1979)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Roy H. Adkins (1970)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Christopher D. Alderson (1962)

President | | Company’s Representative and Vice President, Price Hong Kong; Vice President, Price Singapore; Director and Vice President, T. Rowe Price International; Vice President, T. Rowe Price Group, Inc. |

| | | |

Paulina Amieva (1981)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Malik S. Asif (1981)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, student, The University of Chicago Booth School of Business (to 2012) |

| | | |

Harishankar Balkrishna (1983)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Sheena L. Barbosa (1983)

Vice President | | Vice President, Price Hong Kong and T. Rowe Price Group, Inc. |

| | | |

Peter J. Bates, CFA (1974)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Oliver D.M. Bell, IMC (1969)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

R. Scott Berg, CFA (1972)

Executive Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Steven E. Boothe, CFA (1977)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Peter I. Botoucharov (1965)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Director, EMEA Macroeconomic Research and Strategy (to 2012) |

| | | |

Tala Boulos (1984)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Vice President, CEEMEA Corporate Credit Research, Deutsche Bank (to 2013) |

| | | |

Darrell N. Braman (1963)

Vice President and Secretary | | Vice President, Price Hong Kong, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, T. Rowe Price Investment Services, Inc., and T. Rowe Price Services, Inc. |

| | | |

Carolyn Hoi Che Chu (1974)

Vice President | | Vice President, Price Hong Kong and T. Rowe Price Group, Inc. |

| | | |

Archibald Ciganer Albeniz, CFA (1976)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Richard N. Clattenburg, CFA (1979)

Executive Vice President | | Vice President, Price Singapore, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Michael J. Conelius, CFA (1964)

Executive Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, and T. Rowe Price Trust Company |

| | | |

Richard de los Reyes (1975)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Michael Della Vedova (1969)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Shawn T. Driscoll (1975)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Bridget A. Ebner (1970)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

David J. Eiswert, CFA (1972)

Executive Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Mark S. Finn, CFA, CPA (1963)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Quentin S. Fitzsimmons (1968)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Portfolio Manager, Royal Bank of Scotland Group (to 2015); Executive Director, Threadneedle Investment, Ltd. (to 2012) |

| | | |

John R. Gilner (1961)

Chief Compliance Officer | | Chief Compliance Officer and Vice President, T. Rowe Price; Vice President, T. Rowe Price Group, Inc., and T. Rowe Price Investment Services, Inc. |

| | | |

Paul D. Greene II (1978)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Benjamin Griffiths, CFA (1977)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Amanda B. Hall, CFA (1985)

Vice President | | Vice President, T. Rowe Price International; formerly, student, Stanford Graduate School of Business (to 2014); Investment Analyst, Bill Gates Investments (to 2012) |

| | | |

Richard L. Hall (1979)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc.; formerly, Financial Attaché, U.S. Department of Treasury, International Affairs Division (to 2012) |

| | | |

Nabil Hanano, CFA (1984)

Vice President | | Employee, T. Rowe Price; formerly, Senior Equity Research Associate, Raymond James (to 2012) |

| | | |

Steven C. Huber, CFA, FSA (1958)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Stefan Hubrich, Ph.D., CFA (1974)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Arif Husain, CFA (1972)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, Director/Head of UK and Euro Fixed Income, AllianceBernstein (to 2013) |

| | | |

Randal S. Jenneke (1971)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Nina P. Jones, CPA (1980)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Yoichiro Kai (1973)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Jai Kapadia (1982)

Vice President | | Vice President, Price Hong Kong and T. Rowe Price Group, Inc. |

| | |

Andrew J. Keirle (1974)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Paul J. Krug, CPA (1964)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Christopher J. Kushlis, CFA (1976)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Mark J. Lawrence (1970)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Anh Lu (1968)

Vice President | | Vice President, Price Hong Kong and T. Rowe Price Group, Inc. |

| | | |

Sebastien Mallet (1974)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Catherine D. Mathews (1963)

Treasurer and Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Jonathan H.W. Matthews, CFA (1975)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Raymond A. Mills, Ph.D., CFA (1960)

Executive Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price International, and T. Rowe Price Trust Company |

| | | |

Eric C. Moffett (1974)

Vice President | | Vice President, Price Hong Kong and T. Rowe Price Group, Inc. |

| | | |

Tobias F. Mueller (1980)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Sudhir Nanda, Ph.D., CFA (1959)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Joshua Nelson (1977)

Executive Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Sridhar Nishtala (1975)

Vice President | | Vice President, Price Singapore and T. Rowe Price Group, Inc. |

| | | |

Jason Nogueira, CFA (1974)

Executive Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

David Oestreicher (1967)

Vice President | | Director, Vice President, and Secretary, T. Rowe Price Investment Services, Inc., T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Services, Inc., and T. Rowe Price Trust Company; Chief Legal Officer, Vice President, and Secretary, T. Rowe Price Group, Inc.; Vice President and Secretary, T. Rowe Price and T. Rowe Price International; Vice President, Price Hong Kong and Price Singapore |

| | | |

Michael D. Oh, CFA (1974)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Kenneth A. Orchard (1975)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Oluwaseun A. Oyegunle, CFA (1984)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International; formerly, student, The Wharton School, University of Pennsylvania (to 2013); Summer Investment Analyst, T. Rowe Price International (2012); Analyst, Asset & Resource Management Limited (to 2012) |

| | | |

Gonzalo Pángaro, CFA (1968)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

John W. Ratzesberger (1975)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company; formerly, North American Head of Listed Derivatives Operation, Morgan Stanley (to 2013) |

| | | |

Shannon H. Rauser (1987)

Assistant Secretary | | Employee, T. Rowe Price |

| | | |

Federico Santilli, CFA (1974)

Executive Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Sebastian Schrott (1977)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Deborah D. Seidel (1962)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., T. Rowe Price Investment Services, Inc., and T. Rowe Price Services, Inc. |

| | | |

Robert W. Sharps, CFA, CPA (1971)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

John C.A. Sherman (1969)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Robert W. Smith (1961)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Gabriel Solomon (1977)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Joshua K. Spencer, CFA (1973)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

David A. Stanley (1963)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Taymour R. Tamaddon, CFA (1976)

Vice President | | Vice President, T. Rowe Price and T. Rowe Price Group, Inc. |

| | | |

Ju Yen Tan (1972)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Dean Tenerelli (1964)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Eric L. Veiel, CFA (1972)

Vice President | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe Price Trust Company |

| | | |

Verena Wachnitz, CFA (1978)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Dai Wang (1989)

Vice President | | Employee, T. Rowe Price; formerly, student Harvard Business School (to 2014); Analyst, Goldman Sachs (to 2012) |

| | | |

Christopher S. Whitehouse (1972)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

J. Howard Woodward, CFA (1974)

Vice President | | Vice President, T. Rowe Price Group, Inc., and T. Rowe Price International |

| | | |

Ernest C. Yeung, CFA (1979)

Vice President | | Director, Responsible Officer, and Vice President, Price Hong Kong; Vice President, T. Rowe Price Group, Inc. |

| | | |

Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Bruce W. Duncan qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Duncan is considered independent for purposes of Item 3 of Form N-CSR.

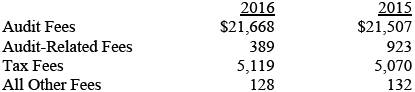

Item 4. Principal Accountant Fees and Services.

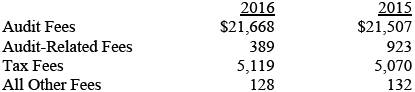

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,890,000 and $2,366,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Institutional International Funds, Inc.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date December 15, 2016 | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date December 15, 2016 | | |

| |

| |

| By | /s/ Catherine D. Mathews |

| | Catherine D. Mathews |

| | Principal Financial Officer |

| |

| Date December 15, 2016 | | |