Filed pursuant to Rule 424(b)(3)

Registration No. 333-130869

PW EAGLE, INC.

1,323,334 Shares of Common Stock

This prospectus relates to the resale of 1,018,667 shares of common stock of PW Eagle, Inc. previously issued as described below and up to 304,667 shares of our common stock that may be issued upon the exercise of warrants held by the selling shareholders. The selling shareholders listed on page52 may sell the shares from time to time. As used in this prospectus, we, us, our and similar expressions refer to PW Eagle, Inc.

The selling shareholders may offer their shares from time to time through or to one or more underwriters, brokers or dealers, on the National Market at market prices prevailing at the time of sale, in one or more negotiated transactions at prices acceptable to the selling shareholders or in private transactions. We will not receive any proceeds from the sale of shares by the selling shareholders. In connection with any sales, the selling shareholders and any underwriters, agents, brokers or dealers participating in such sales may be deemed to be “underwriters” within the meaning of the Securities Act.

We will pay the expenses related to the registration of the shares covered by this prospectus. The selling shareholders will pay commissions and selling expenses, if any, incurred by them.

Our common stock is listed on the Nasdaq National Market under the symbol “PWEI.” On January 3, 2006, the closing price of our common stock was $21.37.

On December 6, 2005, we sold 1,000,000 shares of our common stock at $18.75 per share for gross proceeds of $18.75 million, and net proceeds of $17.5 million. In connection with this transaction, we also issued warrants for the purchase of 250,000 shares of common stock to the investors in the transaction and 50,000 warrants to our placement agent. Subsequently, we sold for gross proceeds of $350,000, an additional 18,667 shares together with warrants to purchase 4,667 shares of our common stock. Proceeds received by us from these transactions were used primarily to pay down existing debt. All warrants are exercisable for a period of five years from the date of issuance and have an exercise price of $27.00 per share. Under the terms of the warrants, the number of shares issuable upon exercise may be increased if we issue common stock in the future at a price less than the exercise price of the warrants subject to certain exceptions. These warrants have a Black-Scholes value of approximately $4.682 million.

Investing in our common stock is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus isFebruary 23, 2006.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the common stock. This document may be used only where it is legal to sell these securities.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission using the SEC’s shelf registration rules. Under the shelf registration rules, using this prospectus and, if required, one or more prospectus supplements, the selling shareholders may sell from time to time, in one or more offerings, the shares of common stock covered by this prospectus. The shares covered by this prospectus include 1,018,667 outstanding shares of common stock and 304,667 shares of common stock issuable on the exercise of warrants.

This prospectus also covers any shares of common stock that may become issuable pursuant to anti-dilution adjustment provisions that would increase the number of shares issuable upon exercise of the warrants as a result of issuances of our common stock in the future at a price less than the exercise price of the warrants subject to certain exceptions or as a result of stock splits, stock dividends or similar transactions.

A prospectus supplement may add, update or change information contained in this prospectus. We recommend that you read carefully this entire prospectus, especially the section entitled “Risk Factors” beginning on page 6, together with any supplements before making a decision to invest in our common stock.

i

PROSPECTUS SUMMARY

This summary does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the “Risk Factors” section and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in shares of our common stock.

Our Business

PW Eagle, Inc., a Minnesota corporation, which we refer to herein as we, us or PW Eagle, manufactures and distributes polyvinyl chloride (PVC) pipe and fittings used for potable water and sewage transmission, turf and agricultural irrigation, water wells, fiber optic lines, electronic and telephone lines, and commercial and industrial plumbing. We distribute our products throughout the entire United States, with a minimal amount of shipments to selected foreign countries. Our wholly-owned subsidiary, USPoly Company, LLC (USPoly) manufactures and distributes polyethylene (PE) pipe products and accessories.

Our executive offices and operating headquarters are located in Eugene, Oregon and USPoly headquarters are located in Shawnee, Oklahoma. We have production facilities in Cameron Park, Visalia and Perris, California; Columbia, Missouri; Hastings, Nebraska; Shawnee and Tulsa, Oklahoma; Eugene, Oregon; Conroe, Texas; Buckhannon, West Virginia; Tacoma and Sunnyside, Washington; and West Jordan, Utah.

Recent Events

Acquisition of Minority Interest in USPoly

On October 17, 2005, PW Eagle completed a transaction whereby it acquired all of the shares of USPoly that it did not previously own. The Company’s former majority-owned subsidiary, USPoly Company, was merged into a wholly-owned subsidiary of PW Eagle and the new company is known as USPoly Company, LLC. PW Eagle paid a total of $3.2 million cash and issued 351,904 shares of common stock to the holders of the minority shares in USPoly in consideration for their shares.

In connection with the merger, USPoly agreed with its subordinated lender that also held warrants to purchase shares in USPoly Company, to exchange the lender’s rights under those warrants for a $1.9 million note payable to the lender. The note bears interest at 12% per annum and matures September 2009. This note was paid in full in the fourth quarter of 2005. The warrants had a put feature and were reflected as a liability on USPoly’s financial statements. As of September 30, 2005, USPoly Company revised its estimate of the fair value of the warrant to $1.9 million, with a non-cash charge of $0.6 million, representing the amount of the increase, reflected in interest expense for third quarter of 2005. In addition, former USPoly Company holders of 599,392 common stock options were issued 113,096 PW Eagle common stock options. This was based on a ratio of 0.1889 shares of PW Eagle for each option to purchase one share of USPoly common stock.

Sale of Interest in W.L. Plastics

On November 1, 2005, USPoly sold its approximately 23% interest in W.L. Plastics. USPoly received $23.5 million cash and an additional $1.2 million will be held in escrow for a period of 18 months and is subject to customary post-closing contingencies. The purchase price is subject to a working capital adjustment which is expected to be resolved by the first quarter of 2006. A substantial portion of the cash was used to pay down debt obligations of USPoly and PW Eagle. An after-tax gain, estimated to be approximately $13 million, will be recorded in the fourth quarter of 2005 related to this transaction.

Proposed USPoly Merger

On November 30, 2005, we announced that we intend to combine our polyvinyl chloride (PVC) and polyethylene (PE) pipe businesses into one entity by merging our wholly-owned subsidiary, USPoly into PW

1

Eagle. In that process, all of USPoly’s outstanding debt will be prepaid. We expect this merger to occur during the first fiscal quarter of 2006.

Dividend Policy

On December 14, 2005, we announced a dividend policy under which PW Eagle will begin paying a quarterly cash dividend of $0.075 per share. The record date for the first dividend, payable January 13, 2006, was December 30, 2005. The payment of future dividends, if any, is subject to the discretion of the Board of Directors, and will depend on our earnings, financial condition, capital requirements and other relevant factors.

Company Information

We are a Minnesota corporation with our principal executive offices located at 1550 Valley River Drive, Eugene, Oregon 97401 and our telephone number is (541) 343-0200. Our web address is www.pweagleinc.com. USPoly’s web address is www.uspolycompany.com. We file reports with the Securities and Exchange Commission, or as referred to herein the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports from time to time. PW Eagle is an electronic filer and the SEC maintains an Internet site at www.sec.gov that contains the reports, proxy, information statements and other information filed electronically. The information contained on our website is not a part of this prospectus. We have included our website address in this document as an inactive textual reference only.

2

THE OFFERING

| | |

Common stock offered by selling shareholders | | 1,323,334 shares, of which 1,018,667 are issued and outstanding and up to 304,667 shares may be issued upon exercise of warrants held by selling shareholders. |

| |

Common stock outstanding1 | | 11,191,751 shares |

| |

Use of proceeds | | We will not receive any proceeds from the resale of the common stock pursuant to this prospectus. However, we will receive approximately $8,226,009 upon the exercise of all of the warrants held by the selling shareholders, which proceeds will be used for general working capital. |

| |

Risk factors | | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| |

Plan of Distribution | | The shares of common stock offered for resale may be sold by the selling shareholders pursuant to this prospectus in the manner described under “Plan of Distribution.” |

| |

Nasdaq National Market symbol | | PWEI |

| 1 | The number of shares of our common stock outstanding is based on11,191,751 shares outstanding as of January 2, 2006, and excludes: |

| | • | | 1,132,596 shares of common stock issuable as of the date of this prospectus upon the exercise of outstanding stock options under our 1991 and 1997 Stock Option Plans at an average exercise price of $7.84 per share; |

| | • | | 666,667 shares of common stock issuable as of the date of this prospectus upon the exercise of outstanding warrants, including the 304,667 shares issuable in connection with the warrants issued to investors in the private offering of the securities registered hereby and the Company’s placement agent in that offering. |

3

SUMMARY FINANCIAL INFORMATION

The following tables summarize our financial information. You should read this information together with our financial statements and the related notes appearing at the end of this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus.

Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | |

| | | Nine months ended

| | Years ended December 31 (in thousands, except for per share amounts)

|

| | | September 30, 2005

| | 20041

| | | 20032

| | | 2002

| | 2001

| | | 2000

|

Net sales | | $ | 480,422 | | $ | 474,954 | | | $ | 331,787 | | | $ | 251,275 | | $ | 246,130 | | | $ | 343,974 |

Gross profit | | | 75,905 | | | 70,136 | | | | 36,749 | | | | 45,479 | | | 26,471 | | | | 87,358 |

Operating expenses | | | 49,464 | | | 58,858 | | | | 45,837 | | | | 33,534 | | | 34,881 | | | | 43,859 |

Operating income (loss) | | | 26,441 | | | 11,278 | | | | (9,088 | ) | | | 11,945 | | | (8,410 | ) | | | 43,499 |

Interest expense | | | 13,063 | | | 20,668 | | | | 11,828 | | | | 11,001 | | | 11,775 | | | | 13,655 |

Income (loss) from continuing operations before income taxes, minority interest and equity in undistributed earnings of unconsolidated affiliate | | | 13,378 | | | (9,390 | ) | | | (20,916 | ) | | | 944 | | | (20,185 | ) | | | 29,844 |

Income (loss) from continuing operations (net of tax) | | | 7,892 | | | (5,540 | ) | | | (12,912 | ) | | | 571 | | | (12,856 | ) | | | 18,218 |

Income from discontinued operations (net of tax) | | | — | | | — | | | | 194 | | | | — | | | — | | | | — |

Net income (loss) | | | 7,892 | | | (5,540 | ) | | | (12,718 | ) | | | 571 | | | (12,856 | ) | | | 18,218 |

Income (loss) from continuing operations per share: | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.93 | | $ | (0.78 | ) | | $ | (1.89 | ) | | $ | 0.09 | | $ | (1.80 | ) | | $ | 2.34 |

Diluted | | $ | 0.81 | | $ | (0.78 | ) | | $ | (1.89 | ) | | $ | 0.06 | | $ | (1.80 | ) | | $ | 1.72 |

Income from discontinued operations per share: | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | — | | $ | — | | | $ | 0.03 | | | $ | — | | $ | — | | | $ | — |

Diluted | | $ | — | | $ | — | | | $ | 0.03 | | | $ | — | | $ | — | | | $ | — |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.93 | | $ | (0.78 | ) | | $ | (1.86 | ) | | $ | 0.09 | | $ | (1.80 | ) | | $ | 2.34 |

Diluted | | $ | 0.81 | | $ | (0.78 | ) | | $ | (1.86 | ) | | $ | 0.06 | | $ | (1.80 | ) | | $ | 1.72 |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 8,516 | | | 7,096 | | | | 6,852 | | | | 6,717 | | | 7,139 | | | | 7,778 |

Diluted | | | 9,794 | | | 7,096 | | | | 6,852 | | | | 9,376 | | | 7,139 | | | | 10,592 |

| 1 | Includes operations of UAC from September 27, 2004, the date of acquisition. (See Note 2: Acquisitions & Divestitures in the Notes to the Consolidated Financial Statements as of December 31, 2004). |

| 2 | Includes operations of ETI from March 14, 2003, the date of acquisition. (See Note 2: Acquisitions & Divestitures in the Notes to the Consolidated Financial Statements as of December 31, 2004). |

4

Consolidated Balance Sheet

| | | | | | | | | | | | | | | | | | | | | |

| | | Sept. 30 2005

| | December 31 (in thousands)

|

| | | | 2004

| | | 2003

| | | 2002

| | 2001

| | | 2000

|

Working capital | | $ | 3,453 | | $ | (17,480 | ) | | $ | (3,610 | ) | | $ | 13,620 | | $ | (1,431 | ) | | $ | 19,459 |

Total assets | | | 215,418 | | | 210,776 | | | | 165,178 | | | | 133,402 | | | 137,410 | | | | 158,379 |

Long-term and subordinated debt and financing lease obligation, net of current portion | | | 53,370 | | | 54,713 | | | | 59,827 | | | | 58,725 | | | 53,724 | | | | 55,568 |

Stock warrants (included under liabilities) | | | 4,721 | | | 2,627 | | | | — | | | | — | | | — | | | | 5,887 |

Stockholders’ equity | | | 20,946 | | | 12,613 | | | | 15,235 | | | | 25,919 | | | 24,259 | | | | 41,979 |

5

RISK FACTORS

This offering is highly speculative and involves a high degree of risk. You should consider carefully the risks and uncertainties described below and the other information in this prospectus, including the financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in shares of our common stock. If any of the following risks or uncertainties actually occurs, our business, prospects, financial condition and operating results would likely suffer, possibly materially. In that event, the market price of our common stock could decline and you could lose all or part of your investment.

The pipe industry and our business are heavily dependent on the price and trend of resin, our main raw material.

Our gross margin percentage is sensitive to raw material resin prices and the demand for PVC and PE pipe. Historically, when resin prices are rising or stable, our margins and sales volume have been higher. Conversely, when resin prices are falling, our sales volumes and margins have been lower. PVC resin prices increased $0.03 per pound during the first quarter of 2005, then decreased $0.01 per pound in both June and July. In response to hurricane-related supply disruptions and increasing energy and raw material costs, PVC resin producers implemented increases of $0.02 per pound in September 2005 and $0.12 per pound in October 2005.

Our gross margins decrease when the supply of resin and pipe is greater than demand. Conversely, our gross margins improve when resin and pipe are in short supply. In April 2001, a major producer of PVC resin filed for bankruptcy and, during the first quarter of 2002 ceased operations at two manufacturing facilities. This resulted in a reduction of approximately 1.0 billion pounds of production capacity, or 5% of the North American industry capacity. Although two PVC producers have subsequently purchased these two facilities, only one of them has re-started a portion of its capacity in 2005. In December 2004, a major PVC producer announced plans to build a PVC plant with annual capacity of 1.3 billion pounds together with integrated production of chlorine and vinyl chloride monomer (VCM), with completion expected by 2007 for the first phase and by 2008 for the second phase. If these capacity increases result in industry capacity exceeding demand when they begin production, it could result in decreasing prices for PVC resin. In addition, we believe the production of PVC resin may be limited by the availability of chlorine, a major raw material component.

The demand for our products is directly affected by the growth and contraction of the Gross Domestic Product and economic conditions.

Due to the commodity nature of resin, pipe and the dynamic supply and demand factors worldwide, the markets for both resin and pipe have historically been very cyclical with significant fluctuations in prices and gross margins. Generally, after a period of rising or stable prices, capacity has increased to exceed demand with a resulting decrease in prices and gross margins. Over the last ten years, there have been consolidations in both markets, particularly with respect to PVC resin manufacturers. During the same period, the capacity of PVC resin producers has increased from just over 9 billion pounds to over 18 billion pounds today. In the last 10 years published PVC resin prices have fluctuated between approximately $0.25 and $.61 per pound. Currently, resin prices are at historic highs.

While we expect the demand for PVC and PE pipe to continue to increase over the long term, we also expect that the industry will continue to be subject to cyclical fluctuations and times when supply will exceed demand, driving prices and margins down. These conditions could result from a general economic slowdown either domestically or elsewhere in the world or capacity increases in either the resin or pipe markets. General economic conditions both in the United States and abroad will continue to have a significant impact on our prices and gross margins.

We are dependent on suppliers of our raw materials. Our production or reputation could be seriously harmed if these suppliers were unable to timely meet our requirements on a cost effective basis.

Our PVC and PE products contain raw materials that are procured from a variety of suppliers. The cost, quality and availability of these raw materials, chief among them PVC and PE resin, are essential to the successful production and sale of our products. There are a limited number of suppliers for some of these raw materials. Alternative sources are not always available or may not be available on terms acceptable to us. For example, there are currently

6

only five suppliers of PVC resin and four suppliers of PE resin in North America who are capable of providing us the material in an amount that would meet our requirements on terms acceptable to us. We believe our relationships with our raw materials suppliers are good and currently have long-term agreements in place with several of our key suppliers. However, if our suppliers were unable or unwilling to meet our demand for raw materials on terms acceptable to us and if we are unable to obtain an alternative source or if the price for an alternative source is prohibitive, our ability to maintain timely and cost-effective production of our products will be seriously harmed.

In September and October of 2005, all five PVC resin suppliers and all four PE resin suppliers declaredforce majeure due to the effects of Hurricanes Katrina and Rita and due to an accident at one resin manufacturing facility. While we have been able to secure sufficient amounts of raw material to maintain our operations at reasonable levels, any further supply disruptions could further challenge our ability to utilize our manufacturing capacity.

We have a significant amount of outstanding debt and must continue to operate our business to meet our outstanding obligations.

At September 30, 2005, PW Eagle had approximately $46.6 million in outstanding debt on a consolidated basis under the PW Eagle and USPoly revolving credit facilities. Of this amount, approximately $41.5 million was outstanding under the PW Eagle revolving credit facility, which bears interest at rates between 5.75% and 6.75%, and approximately $5.1 million was outstanding under the USPoly Senior Credit Facility, which bears interest at a rate of 7.75%.

At September 30, 2005, PW Eagle also had approximately $56.7 million in other long-term debt obligations on a consolidated basis. PW Eagle’s total current annual consolidated debt service obligation is approximately $11.3 million. On December 23, 2005, PW Eagle paid the entire outstanding balance of its subordinated notes. The total payment of $28.4 million included a prepayment penalty of $4.4 million which will be charged to interest expense.

At December 31, 2004, PW Eagle was in full compliance with all debt covenants. PW Eagle completed a refinancing in the fourth quarter of 2004 and has new senior and subordinated debt facilities in place. At December 31, 2004, USPoly was not in compliance with certain financial covenants of its Senior Credit Facility and Subordinated Debt Agreement. On March 10, 2005, the lenders waived all covenant violations and amended their Agreements such that we believe USPoly will be in compliance with the covenants in the future. In addition, the maximum borrowing under the Senior Credit Facility was increased to $15 million. At September 30, 2005, both PW Eagle and USPoly were in compliance with all debt covenants.

We expect these new credit facilities to provide sufficient liquidity to operate our business and meet our obligations for the next several years. These conditions could change, however, if general economic conditions or other unforeseen events should cause a significant deterioration in our business results.

In the event of a default under our debt agreements, we would be required to either obtain a waiver from our lenders or amend our lending agreements. There is no assurance that our lenders would waive any future default or agree to any future amendments of our credit facilities and leases. If we failed to obtain a waiver or an amendment, we would be required to obtain new financing from alternative financial sources. There is no assurance that we could obtain new financing, and if we did, there is no assurance that we could obtain terms as favorable as our current credit facilities.

Interest rates affect our ability to finance our indebtedness and may adversely affect the demand for our products when higher rates slow the growth of our economy.

We are exposed to certain market risks on $40.3 million of outstanding variable interest-rate debt obligations at September 30, 2005. Market risk is the potential loss arising from adverse changes in market rates and prices, such as interest rates. Market risk is estimated as the potential increase in fair value resulting from a hypothetical one percent increase in interest rates, which would result in an annual interest expense increase to PW Eagle of approximately $0.4 million. Accordingly, interest rate increases would further challenge our ability to pay the interest expense on our debt and fixed charges. In addition, an increase in interest rates could slow the growth of the economy and affect the demand for our products.

7

A significant portion of our business and the demand for our products is seasonal in nature and any adverse weather conditions that result in a slowdown in the construction industry may adversely affect demand for our products.

Our products are used in new residential and commercial construction. Because of this, the demand for these products tends to be seasonal to correspond with increased construction activity in the late spring, summer, and early fall. Any significant or prolonged adverse weather conditions that negatively affect the construction industry or slow the growth of new construction activity may negatively affect our operating results.

Our operating results are dependent on the price of resin and any competitive pressure in the resin industry that increases supply or decreases the price of resin may negatively affect our profitability.

The primary raw material used in most of our products is PVC resin. Generally, in periods of strong demand and limited supply of PVC resin, prices of resin tend to increase. Conversely, PVC resin prices tend to decrease when demand is weak and there is excess supply. Historically, in response to increasing resin prices, we have been able to increase the price of our products at a greater rate, resulting in better margins. During periods of decreasing resin prices, our selling prices have tended to decrease faster than our raw material costs, resulting in lower margins. In the event of a significant increase in PVC resin capacity or a significant decrease in the demand for PVC resin, resulting in a period where there is an excess supply of PVC resin, our margins and profitability could be negatively impacted.

A loss or limitation of prior utilization of net operating loss carryforwards could have a material adverse impact on our financial position and results of operations.

Our cumulative deferred tax asset recorded in prior years totaling approximately $13.5 million associated with net operating loss carryforwards has been fully utilized. We have evaluated tax-reporting compliance relating to the past utilization of the net operating loss carryforwards, and believe we have complied in all respects. A failure to meet the requirements could result in a loss or limitation of the utilization of carryforwards, which could have a material adverse effect on our financial position and results of operations in future periods.

Our inability to utilize current net operating loss carryforwards could have a material adverse impact on our financial position and results of operations.

We have not provided any valuation allowance associated with deferred tax assets of approximately $9.5 million at September 30, 2005. Although PW Eagle’s industry and operating profits are highly cyclical, management believes that we will be profitable over our operating cycle, based on historical results and other analysis. This belief is largely based on a combination of 1) our participation as one of the PVC pipe industry leaders, 2) distribution centered on populated growth markets, 3) professional management dedicated to the PVC pipe industry and 4) debt paydown and corresponding reduction in future financing costs. PW Eagle’s cyclical nature and corresponding operating results are significantly influenced by the overall US future economic cycles, which, in addition to driving demand for our products, also influence the cost of the primary raw material, PVC resin. Generally, as PVC resin costs are rising during our operating cycles, our profitability associated with product shipments increases. These factors have been considered as part of PW Eagle’s evaluation of the need for a valuation allowance associated with deferred tax assets. We will continue to monitor the need for a valuation allowance at each balance sheet date in 2005, to ensure the conclusions reached in 2004 are sustainable. Any change in this conclusion would result in a direct reduction of our reported results from operations, and could result in a significant reduction of our shareholders’ equity as of the date of the potential determination of the need for such a valuation allowance for financial reporting purposes.

The deferred tax assets are primarily the result of net operating loss carryforwards for federal and state tax purposes. These net operating losses, which expire at various dates through 2024, amounted to approximately $33.8 million and $25.8 million for federal and state tax purposes, respectively, at December 31, 2004. To fully utilize the deferred tax assets, PW Eagle is required to earn these amounts of taxable income over the next 20 years. For the nine months ending September 30, 2005, our income before income taxes and minority interest amounted to $13.4 million.

8

We may be forced to pay liquidated damages to investors.

The purchase agreement by which the shares of common stock and warrants were sold to the selling shareholders contains liquidated damages provisions. PW Eagle may be forced to pay substantial penalties to the selling shareholders if this Registration Statement is not filed and declared effective within the time periods called for by the purchase agreement. Additionally, PW Eagle may be forced to pay liquidated damages to the selling shareholders if we are forced to suspend use of this Registration Statement in a manner that does not comply with the terms and conditions of the purchase agreement.

9

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this prospectus regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management are forward-looking statements. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this prospectus, particularly in the “Risk Factors” section, that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Other risks, uncertainties and factors, including those discussed under “Risk Factors,” could cause our actual results to differ materially from those projected in any forward-looking statements we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make. We do not assume any obligation to update or revise any forward-looking statements, or to so update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Some of our current beliefs and expectations are discussed below.

We believe the Gross Domestic Product (GDP) is closely correlated to the demand for PVC and PE pipe, and we recognize that our business is tied to economic cycles. GDP is estimated to have grown at an annual rate of 4.1% in the third quarter of 2005, as compared to 3.8% in the first quarter of 2005 and 3.3% in the second quarter of 2005. We believe GDP growth will remain at similar levels for the fourth quarter of 2005.

PVC and PE resin manufacturers were significantly impacted by Hurricanes Katrina and Rita during the third quarter of 2005. Manufacturing plants in both Louisiana and Texas experienced outages during the storms as well as continued curtailments due to lack of utilities and/or raw material supply. The subsequent difficulties the rail systems experienced made the situation worse. Also, one manufacturer experienced production disruptions as a result of an accident and fire at one of its facilities. All major suppliers declaredforce majeure and for a period of time supplied customers on some form of allocation. As a result, there have been significant price increases in both PE and PVC resin.

In light of the potential supply disruptions, PVC and PE pipe buyers accelerated their purchasing patterns, resulting in a very strong demand surge in September and early October. Faced with this strong demand, limited raw material supply and rising costs, pipe manufacturers implemented multiple price increases.

As the supply and demand changes discussed previously took place, our margins increased near the end of the third quarter of 2005. We expect that as long as demand for PVC and PE pipe remains greater than supply, we will continue to experience increased margins. However, when supply and demand return to a more balanced situation, we expect our margins will decrease from their current levels.

After increasing early in the year, PVC resin prices decreased $0.01 per pound in both June and July in response to weaker demand and lower raw material costs. Prior to the impact of Hurricanes Katrina and Rita, PVC resin producers announced an increase of $0.02 per pound for September. In the aftermath of these storms, the September increase was fully implemented and followed by an increase of $0.12 per pound for October. PVC resin is currently at record high prices. In response to strong demand and PVC resin cost increases, prices for PVC pipe increased rapidly in September and October and, like PVC resin, are at record high prices. As long as demand for resin remains greater than supply, we expect to continue to experience strong margins.

Similar to PVC, the price of PE resin increased and then decreased during the period from January through May 2005. PE prices increased $0.06 per pound in each of June and August, followed by an increase of $0.07 per pound in October. Additional increases totaling $0.13 per pound have been announced for mid-October and November. PE pipe manufacturers have implemented multiple price increases in response to these cost increases. PE resin and pipe are also currently at record high prices.

Over time, we expect the demand for plastic pipe to grow as acceptance of plastic pipe over metal pipe continues and the overall economy continues to grow. Industry growth projections call for annual sales growth rates for PVC pipe of 3% or greater in 2005. The actual growth rate may be less than or greater than 3% based on short-term economic conditions. Our strategy has been, and continues to be, to concentrate growth initiatives in higher profit products and geographic regions.

10

We believe that the operational restructuring we began in the fourth quarter of 2003 and completed in the second quarter of 2004 has positioned PW Eagle for improved future results by improving our manufacturing efficiency and reducing our selling, general and administrative costs. The refinancing we completed in 2004 will reduce our future interest charges.

USE OF PROCEEDS

The selling shareholders will receive the proceeds from the resale of shares of our common stock pursuant to this prospectus. We will not receive any proceeds from the resale of the shares held by selling shareholders. However, we will receive approximately $8,226,009 if all of the warrants held by the selling shareholders are exercised to purchase shares of common stock the resale of which shares may be made pursuant to this prospectus. We intend to use any such proceeds for general working capital. We reserve the right to use the proceeds for other purposes in the event of changes in our business plan.

We originally received gross proceeds of $18.75 million and net proceeds of $17.5 million on December 6, 2005 when we sold 1,000,000 shares of our common stock at $18.75 per share, together with warrants for the purchase of an additional 300,000 shares of our common stock at $27.00 per share, to certain of the selling shareholders. Subsequently, we received gross proceeds of $350,000 from an additional selling shareholder when we sold 18,667 shares of our common stock at $18.75 per share, together with warrants for the purchase of an additional 4,667 shares of our common stock at $27.00 per share. We used the proceeds from both of these offerings to pay down our revolving credit facility.

DIVIDEND POLICY

On December 14, 2005, we announced a dividend policy under which it will begin paying a quarterly cash dividend of $0.075 per share. The record date for the first dividend, payable January 13, 2006, was December 30, 2005. The payment of future dividends, if any, is subject to the discretion of the Board of Directors, and will depend on PW Eagle’s earnings, financial condition, capital requirements and other relevant factors.

11

PRO FORMA INFORMATION

The following table sets forth our capitalization as of September 30, 2005 on an actual basis, and on a pro-forma basis giving effect to our sale of 1,018,667 shares of common stock and 304,667 warrants to purchase PW Eagle common stock. After deducting offering expenses the net proceeds were $17.9 million. As further described below, the pro-forma capitalization reflects application of all of the net proceeds to pay down debt.

The following comments explain the changes between September 30, 2005 reported amounts and the pro-forma amounts:

The gross proceeds of $19.1 million from the private offering of the securities registered hereby, less investment banking fees of $1.1 million and other costs of $0.1, result in net cash proceeds of $17.9 million. The private offering of the securities registered hereby includes the sales of 1,018,667 shares of PW Eagle common stock and warrants to purchase 304,667 shares of PW Eagle common stock. The common stock purchase agreement also requires a payment of 1% of the gross proceeds per month ($191,000) should this Form S-1 not be declared effective prior to April 4, 2006 (90 days after the filing date).

The net proceeds of the private offering of the securities registered hereby have been applied to debt on a pro-forma basis as of September 30, 2005 as follows:

| | |

| In Thousands | | |

Repayment of revolving debt | | $17,891 |

You should read this information together with the sections of this prospectus entitled “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes appearing elsewhere in this prospectus.

| | | | | | | | |

| | | Actual September 30, 2005 (unaudited: in

thousands, except

share amounts)

| | | Pro-Forma September 30, 2005 (unaudited: in

thousands, except

share amounts)

| |

Capitalization: | | | | | | | | |

Revolving credit facility(1) | | $ | 46,552 | | | $ | 28,661 | |

Current maturities of long-term debt and capital leases | | | 3,925 | | | | 3,925 | |

Long term liabilities | | | 56,745 | | | | 56,745 | |

| | |

|

|

| |

|

|

|

Long term obligations, including current maturities | | | 107,222 | | | | 89,331 | |

| | |

|

|

| |

|

|

|

Stock warrants(4) | | | 1,069 | | | | 5,751 | |

Common stock, par value of $.01 per share; authorized 30,000,000 shares; 8,847,937 shares outstanding at September 30, 2005 and 9,866,604 pro-forma shares outstanding at September 30, 2005(2) | | | 88 | | | | 99 | |

Class B Common stock, par value $.01 per share; authorized 3,500,000 shares; 595,508 shares issued and outstanding | | | 6 | | | | 6 | |

Additional paid in capital(3,4) | | | 39,358 | | | | 52,556 | |

Unearned compensation | | | (380 | ) | | | (380 | ) |

Other Comprehensive (loss) income | | | 425 | | | | 425 | |

Accumulated Deficit | | | (19,620 | ) | | | (19,620 | ) |

| | |

|

|

| |

|

|

|

Total stockholder’s equity | | | 20,946 | | | | 38,837 | |

| | |

|

|

| |

|

|

|

Total Capitalization | | $ | 128,168 | | | $ | 128,168 | |

| | |

|

|

| |

|

|

|

12

2005

| (1) | Represents net pay down of revolving credit facility, on a pro-forma basis of $17,891. |

| (2) | Represents the increase in par value associated with the common shares sold in the private offering of the securities registered hereby of $11. |

| (3) | Represents the net proceeds of $17,891 less par value of the common shares sold. |

| (4) | Represents the fair value of the stock warrants issued in the private offering of the securities registered hereby of $4,682. |

As a result of these transactions, on a pro-forma basis, our interest expense and earnings (loss) per share for the first nine months of 2005 and for the year ended December 31, 2004 would have been reduced and our income or (loss) per share would have been increased (reduced) as follows:

| | | | | | | | | | |

| | | Nine Months

Ended

September 30,

2005 Actual

| | Nine Months

Ended

September 30,

2005

Pro-Forma

| | Year Ended

December 31,

2004 Actual

| | | Year Ended

December 31,

2004

Pro-Forma

| |

Interest expense^ | | 13,063 | | 12,355 | | 20,668 | | | 19,951 | |

Income tax expense (benefit) | | 5,365 | | 5,648 | | (3,059 | ) | | (2,785 | ) |

Net income (loss) | | 7,892 | | 8,317 | | (5,540 | ) | | (5,097 | ) |

Net income (loss) per share | | | | | | | | | | |

Basic | | 0.93 | | 0.87 | | (0.78 | ) | | (0.63 | ) |

Diluted | | 0.81 | | 0.77 | | (0.78 | ) | | (0.63 | ) |

Weighted Average Shares Outstanding: | | | | | | | | | | |

Basic | | 8,516 | | 9,535 | | 7,096 | | | 8,115 | |

Diluted | | 9,794 | | 10,813 | | 7,096 | | | 8,115 | |

The newly granted warrants do not impact the diluted weighted average shares outstanding due to the fact that the exercise price is greater than the share price as of September 30, 2005 and December 31, 2004, respectively.

| ^ | The pro-forma reduction of interest expense on revolving debt for the nine months ended September 30, 2005 would amount to $708, and for the year ended December 31, 2004 would amount to $717. These reductions were calculated using the average interest rates of 5.3% and 4.0% for each period respectively. |

13

The pro-forma weighted average shares outstanding includes the following adjustments:

| | | | | | | | |

| | | Nine Months Ended

September 30, 2005

| | Year Ended

December 31, 2004

|

| | | Basic

| | Diluted

| | Basic

| | Diluted

|

Common Shares issued | | 1,019 | | 1,019 | | 1,019 | | 1,019 |

14

SELECTED FINANCIAL DATA

You should read the following selected financial information together with our financial statements and the related notes appearing at the end of this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. We have derived the following historical information from our audited consolidated financial statements as of December 31, 2004, 2003, 2002, 2001 and 2000 and for each of the years then ended and our unaudited consolidated financial statements as of September 30, 2005 and for each of the nine-month periods ended September 30, 2005 and 2004. The selected financial data for the nine months ended September 30, 2005 and 2004 has been derived from our unaudited consolidated financial statements which, in our opinion, contain all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the financial condition, results of operations and cash flows for these periods. Historical results of operations may not be indicative of results to be expected for any future period.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Nine Months Ended September 30

| | | Years Ended December 31

|

| | | | | | | | (in thousands, except for per share amounts) |

| | | 2005

| | 2004

| | | 20041

| | | 20032

| | | 2002

| | 2001

| | | 2000

|

Net sales | | $ | 480,422 | | $ | 342,710 | | | $ | 474,954 | | | $ | 331,787 | | | $ | 251,275 | | $ | 246,130 | | | $ | 343,974 |

Gross profit | | | 75,905 | | | 51,577 | | | | 70,136 | | | | 36,749 | | | | 45,479 | | | 26,471 | | | | 87,358 |

Operating expenses | | | 49,464 | | | 42,554 | | | | 58,858 | | | | 45,837 | | | | 33,534 | | | 34,881 | | | | 43,859 |

Operating income (loss) | | | 26,441 | | | 9,023 | | | | 11,278 | | | | (9,088 | ) | | | 11,945 | | | (8,410 | ) | | | 43,499 |

Interest expense | | | 13,063 | | | 11,697 | | | | 20,668 | | | | 11,828 | | | | 11,001 | | | 11,775 | | | | 13,655 |

Income (loss) from continuing operations before income taxes, minority interest and equity in undistributed earnings of unconsolidated affiliate | | | 13,378 | | | (2,674 | ) | | | (9,390 | ) | | | (20,916 | ) | | | 944 | | | (20,185 | ) | | | 29,844 |

Income (loss) from continuing operations (net of tax) | | | 7,892 | | | (1,170 | ) | | | (5,540 | ) | | | (12,912 | ) | | | 571 | | | (12,856 | ) | | | 18,218 |

Income from discontinued operations (net of tax) | | | — | | | — | | | | — | | | | 194 | | | | — | | | — | | | | — |

Net income (loss) | | | 7,892 | | | (1,170 | ) | | | (5,540 | ) | | | (12,718 | ) | | | 571 | | | (12,856 | ) | | | 18,218 |

Income (loss) from continuing operations per share: | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.93 | | $ | (0.17 | ) | | $ | (0.78 | ) | | $ | (1.89 | ) | | $ | 0.09 | | $ | (1.80 | ) | | $ | 2.34 |

Diluted | | $ | 0.81 | | $ | (0.17 | ) | | $ | (0.78 | ) | | $ | (1.89 | ) | | $ | 0.06 | | $ | (1.80 | ) | | $ | 1.72 |

Income from discontinued operations per share: | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | — | | $ | — | | | $ | — | | | $ | 0.03 | | | $ | — | | $ | — | | | $ | — |

Diluted | | $ | — | | $ | — | | | $ | — | | | $ | 0.03 | | | $ | — | | $ | — | | | $ | — |

Net income (loss) per share: | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 0.93 | | $ | (0.17 | ) | | $ | (0.78 | ) | | $ | (1.86 | ) | | $ | 0.09 | | $ | (1.80 | ) | | $ | 2.34 |

Diluted | | $ | 0.81 | | $ | (0.17 | ) | | $ | (0.78 | ) | | $ | (1.86 | ) | | $ | 0.06 | | $ | (1.80 | ) | | $ | 1.72 |

Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 8,516 | | | 7,027 | | | | 7,096 | | | | 6,852 | | | | 6,717 | | | 7,139 | | | | 7,778 |

Diluted | | | 9,794 | | | 7,027 | | | | 7,096 | | | | 6,852 | | | | 9,376 | | | 7,139 | | | | 10,592 |

15

CONSOLIDATED BALANCE SHEET

| | | | | | | | | | | | | | | | | | | | | |

| | | Sept. 30 2005

| | December 31 (in thousands)

|

| | | | 2004

| | | 2003

| | | 2002

| | 2001

| | | 2000

|

Working capital | | $ | 3,453 | | $ | (17,480 | ) | | $ | (3,610 | ) | | $ | 13,620 | | $ | (1,431 | ) | | $ | 19,459 |

Total assets | | | 215,418 | | | 210,776 | | | | 165,178 | | | | 133,402 | | | 137,410 | | | | 158,379 |

Long-term and subordinated debt and financing lease obligation, net of current portion | | | 53,370 | | | 54,713 | | | | 59,827 | | | | 58,725 | | | 53,724 | | | | 55,568 |

Stock warrants (included under liabilities) | | | 4,721 | | | 2,627 | | | | — | | | | — | | | — | | | | 5,887 |

Stockholders’ equity | | | 20,946 | | | 12,613 | | | | 15,235 | | | | 25,919 | | | 24,259 | | | | 41,979 |

| 1 | Includes operations of UAC from September 27, 2004, the date of acquisition. (See Note 2: Acquisitions & Divestitures in the Notes to the Consolidated Financial Statements as of December 31, 2004). |

| 2 | Includes operations of ETI from March 14, 2003, the date of acquisition. (See Note 2: Acquisitions & Divestitures in the Notes to the Consolidated Financial Statements as of December 31, 2004). |

16

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes appearing at the end of this prospectus. Some of the information contained in this discussion and analysis or set forth elsewhere in this prospectus, including information with respect to our plans and strategy for our business and related financing, includes forward-looking statements that involve risks and uncertainties. You should review the “Risk Factors” section of this prospectus for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Executive Summary

Throughout 2004 and the first nine months of 2005, the performance of our business has continued to improve. Both our volumes and margins increased in both periods compared to the previous year’s comparable periods. This has allowed us to significantly deleverage our balance sheet and, as of September 30, 2005, we were in full compliance with all of our lending agreements.

In September 2004, USPoly acquired the UAC business, making our PE business a much bigger and more competitive business. During the third quarter of 2005, we announced our plan to sell USPoly’s interest in W.L. Plastics. This transaction closed during the fourth quarter of 2005 and allowed us to further reduce our debt.

We monitor several non-financial indicators in evaluating our business operations and future prospects, including:

| | • | | Price of PVC and PE resin |

| | • | | U.S. gross domestic product (GDP) |

| | • | | Demand for PVC and PE pipe products, and |

| | • | | Dollars per pound of pipe sold. |

We provide a more detailed discussion of PVC and PE resin prices, GDP, interest rates and demand for PVC and PE pipe products under the “Future Outlook and Risks to Our Business” section of this discussion.

We believe the main drivers of industry performance are GDP growth and supply and demand of PVC resin. Historically, our profitability has improved during periods of strong GDP growth and decreased during periods of slower growth or recession. GDP growth improved in the first nine months of 2005 compared to 2004 and 2003, demand for PVC resin for use in pipe was strong, and our margins increased.

In our PVC business, selling prices in terms of dollars per pound of pipe sold increased 14% in 2004 and 18% in the first nine months of 2005. Primarily as a result of increasing PVC resin costs, cost of goods sold in terms of dollars per pound increased 9% in 2004 and 16% in the nine months ended September 30, 2005. With the relatively strong demand for PVC pipe, we were able to increase selling prices faster than material costs increased, resulting in the improved margins seen in both periods compared to the previous year’s comparable periods. Operating expenses in terms of dollars per pound were relatively constant.

In our PE business, selling prices and cost of goods sold, in terms of dollars per pound, increased by similar amounts in both 2004 and the nine months ended September 30, 2005. As a result, our gross profit per pound was relatively constant in both periods. The acquisition of the UAC business significantly increased the volume of our PE business in 2005, which yielded a significant decrease in operating expenses per pound of pipe sold.

17

Consolidated Results of Operations for the Years Ended December 31, 2004, 2003 and 2002

The following table sets forth items from our statements of operations as percentages of net sales:

| | | | | | | | | |

| | | 2004

| | | 2003

| | | 2002

| |

Net sales | | 100.0 | % | | 100.0 | % | | 100.0 | % |

Cost of goods sold | | 85.2 | | | 88.9 | | | 81.9 | |

Gross profit | | 14.8 | | | 11.1 | | | 18.1 | |

Operating expenses | | 12.4 | | | 13.8 | | | 13.3 | |

Operating income (loss) | | 2.4 | | | (2.7 | ) | | 4.8 | |

Interest expense | | 4.3 | | | 3.6 | | | 4.4 | |

Income (loss) from continuing operations before income taxes, minority interest and equity in undistributed earnings of unconsolidated affiliate | | (1.9 | ) | | (6.3 | ) | | 0.4 | |

Income tax expense (benefit) | | (0.6 | ) | | (2.4 | ) | | 0.2 | |

Minority interest and equity in undistributed earnings of unconsolidated affiliate, net of tax | | 0.1 | | | 0.0 | | | 0.0 | |

Income (loss) from continuing operations | | (1.2 | ) | | (3.9 | ) | | 0.2 | |

Income from discontinued operations, net of income tax | | 0.0 | | | 0.1 | | | 0.0 | |

Net income (loss) | | (1.2 | )% | | (3.8 | )% | | 0.2 | % |

Net Sales.We posted net sales of $475 million in 2004, which was an increase of 43% from 2003, and net sales of $332 million in 2003, an increase of 32% from 2002. The PVC segment increased net sales by $127 million (40%) in 2004 from 2003 due to volume increases of 23% as well as average price increases, and increased net sales by $79 million (33%) in 2003 from 2002 due to volume increases of 21%, primarily from the ETI acquisition in March of 2003, and price increases. The PE segment increased net sales by $16 million (129%) in 2004 from 2003, due to both volume (89%) and price increases, and PE increased net sales by $1 million (11%) in 2003 from 2002 due to volume and price increases. Most of the PE volume increase in 2004 is a result of the UAC Acquisition (See Note 2: Acquisitions and Divestitures, found in the Notes to the Consolidated Financial as of December 31, 2004.) late in the third quarter of 2004.

Gross Profit.Gross profit, as a percent of net sales, increased to 15% in 2004 as compared to 11% in 2003, while 2003 had decreased by 7 percentage points from 2002. Gross profit for the PVC segment was 14.5% in 2004, 10.6% in 2003 and 18.3% in 2002. The 2004 PVC improvement was due to both the higher volume, and increased PVC pricing spread over raw material costs, a reversal from 2003 when prices were declining and demand was weaker than normal, especially in the second and third quarters. Gross profit for the PE segment was 18.4% in 2004, 23% in 2003, and 14% in 2002. The 2004 gross profit reflects a continuation of margin levels from our traditional PE business, and the lower margin products included as a result of the UAC Acquisition. The 2003 increase from 2002 was due to increasing prices rebounding from 2002 levels where both excess capacity and the telecommunications market depressed prices.

Operating Expenses.Operating expenses, as a percent of net sales, decreased to 12.3% in 2004 as compared to 14.0% in 2003, a reduction of 1.7 percentage points. Most of this decrease is from a reduction in general and administrative costs, both in total dollars (about $1.1 million) and a 1.4 percentage point decrease as a percent of net sales. This reduction is a result of the restructuring activities begun in 2003 and ongoing cost control measures. Selling expenses were also down as a percentage of net sales, but this was partially offset by increases in freight expense during 2004. PVC operating expenses were 11.9% in 2004 compared to 13.7% in 2003, and PE operating expenses were 18.1% in 2004 compared to 20.1% in 2003. Operating expenses as a percent of net sales increased

18

0.6 percentage points in 2003 as compared to 2002. PVC operating expenses were 13.7% in 2003 compared to 13.3% in 2002. The PVC increase in 2003 was the result of restructuring charges of $1.3 million, as well as higher freight costs associated with ETI’sUltra product line. PE Operating expenses were 20.1% in 2003 compared to 16% in 2002. The PE increase in 2003 was due to increased staffing as a result of the separation from PW Eagle.

Non-operating Expenses.Non-operating expenses increased to $21.1 million in 2004 from $11.4 million in 2003. Interest expense increased by $8.8 million during 2004 from 2003 due to higher interest rates and higher debt levels. At the time of our refinancing in October 2004, we incurred $5.3 million in interest charges from prepayment penalties, debt discount amortization and write-off of related deferred finance costs (see Note 5 to Consolidated Financial Statements under Item 8 for further detail). Interest expense also includes a $0.2 million non-cash charge for the PVC segment and a $0.8 million non-cash charge for the PE segment in 2004 to adjust to fair value the warrants issued with subordinated debt as also discussed in Note 5: Financing Arrangements in the Notes to the Consolidated Financial Statements as of December 31, 2004. The PVC segment recorded a loss of $0.4 million on the sale of two manufacturing facilities in the second quarter of 2004. The PE segment recorded equity in earnings of affiliate of $0.6 million net of tax during 2004, which represents its 23% ownership interest in W. L. Plastics. Non-operating expenses increased to $11.4 million in 2003 from $10.7 million in 2002. This increase resulted from increased interest expense related to higher debt incurred as a result of the ETI acquisition, partially offset by the gain on the sale of our idled manufacturing facility in Phoenix, Arizona.

Income Taxes.The income tax provision (benefit) for the years ended December 31, 2004, 2003 and 2002 was calculated based on management’s estimates of the annual effective tax rate for each year. The annual effective tax rate for 2004 reflects our statutory federal and applicable state tax rates of approximately 33%, down from 38% in 2003 and 39.5% in 2002. The decrease in 2004 is primarily due to permanent differences related to stock warrants.

19

Consolidated Results of Operations for the Nine Months Ended September 30, 2005 and 2004

| | | | | | | | | | | | | | |

| | | Nine months ended

September 30,

| | | Increase

(Decrease)

|

| | | 2005

| | | 2004

| | | $

| | | %

|

| | | (in millions) |

Net sales | | $ | 480.4 | | | $ | 342.7 | | | $ | 137.7 | | | 40.2 |

Cost of goods sold | | | 404.5 | | | | 291.1 | | | | 113.4 | | | 39.0 |

Gross profit | | | 75.9 | | | | 51.6 | | | | 24.3 | | | 47.1 |

Operating expenses | | | 49.4 | | | | 42.6 | | | | 6.8 | | | 16.0 |

Operating income | | | 26.5 | | | | 9.0 | | | | 17.5 | | | 194.4 |

Interest expense | | | 13.1 | | | | 11.7 | | | | 1.4 | | | 12.0 |

Income (loss) before income taxes, minority interest and equity in undistributed earnings of unconsolidated affiliate | | | 13.4 | | | | (2.7 | ) | | | 16.1 | | | 596.3 |

Income tax expense (benefit) | | | 5.4 | | | | (1.0 | ) | | | 6.4 | | | 640.0 |

Minority interest in loss of USPoly Company | | | (.1 | ) | | | — | | | | (.1 | ) | | — |

Equity in undistributed earnings of unconsolidated affiliate, net of tax | | | — | | | | .5 | | | | (.5 | ) | | -100.0 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

Net income (loss) | | $ | 7.9 | | | $ | (1.2 | ) | | $ | 9.1 | | | 758.3 |

| | |

|

|

| |

|

|

| |

|

|

| |

|

Net Sales.Net sales for the first nine months of 2005 were $480.4 million, up $137.7 million, or 40.2% from $342.7 million in the same period last year. Approximately 33% of the increase in sales is due to the inclusion in 2005 of results from the UAC acquisition by USPoly on September 27, 2004. While overall volume of pounds sold is higher by 13% in 2005 from 2004, average selling prices have risen 24% in 2005 from 2004 due primarily to the increasing cost of resin.

Gross Profit.Gross profit as a percent of net sales increased to 15.8% for the first nine months of 2005 as compared to 15.0% in 2004, as selling prices increased slightly faster than raw material costs.

Operating Expenses.Operating expenses were $49.4 million for the first nine months of 2005, an increase of $6.8 million, or 16.0% from $42.6 million in 2004. The increase in operating expenses is the result of increased costs of $4.6 million at USPoly, due primarily to the UAC acquisition, increased commission costs due to higher sales dollars, and higher freight costs due to higher volume and higher transportation rates. In addition, profit-based expense accruals in 2005 increased $0.9 million over the same period in 2004. These increased costs were offset in part by USPoly recording a gain on the sale of its metals parts business of $1.2 million in the second quarter of 2005, a gain on the sale of land of $0.5 million in 2005, a loss of $0.4 million on the sale of two manufacturing facilities in 2004, and the fact that there are no restructuring costs in 2005 compared to $1.6 million in 2004.

Interest Expense.Interest expense was $13.1 million for the first nine months of 2005, compared to $11.7 million in 2004, or an increase of $1.4 million. This increase results from higher debt levels at USPoly in 2005 compared to 2004 (which were incurred to finance the UAC acquisition) which increased interest by $1.1 million, offset in part by the general reduction of interest rates in PW Eagle following the refinance that was completed in October of 2004, and lower debt levels at PW Eagle as we have been paying down debt in 2005. In addition, 2005 interest expense includes $2.1 million non-cash charges for fair value adjustments to our liabilities for outstanding stock warrants, compared to $0.9 million in 2004.

Income Taxes.The income tax provision (benefit) for the nine months ending September 30, 2005 and 2004 were calculated based on management’s then-current estimates of the annual effective rate for the year, with an estimated effective tax rate of 40.1% for 2005, and 38.3% for 2004.

During the first nine months of 2004, USPoly recorded $0.5 million, net of tax, as equity in undistributed earnings of W.L. Plastics, as this investment was being accounted for on the equity method. Effective December 1, 2004, this was discontinued and USPoly changed to the cost method of accounting for this investment, as further explained in Note 2: Acquisitions & Divestitures in the Notes to the Consolidated Financial Statements as of December 31, 2004.). Using the cost method in 2005, USPoly does not record any income or expense related to this investment.

20

Results of Operations by Segment.

| | | | | | | | | | | | | |

| | | Nine months ended

September 30,

| | | Increase

(Decrease)

|

| | | 2005

| | | 2004

| | | $

| | %

|

| | | (in millions) |

Net sales: | | | | | | | | | | | | | |

PVC products | | $ | 418.5 | | | $ | 329.4 | | | $ | 89.1 | | 27.0 |

PE products | | | 61.9 | | | | 13.3 | | | | 48.6 | | 365.4 |

| | |

|

|

| |

|

|

| |

|

| |

|

Consolidated net sales | | $ | 480.4 | | | $ | 342.7 | | | $ | 137.7 | | 40.2 |

| | |

|

|

| |

|

|

| |

|

| |

|

Operating income: | | | | | | | | | | | | | |

PVC products | | $ | 23.3 | | | $ | 8.6 | | | $ | 14.7 | | 170.9 |

% of sales | | | 5.6 | % | | | 2.6 | % | | | | | |

PE products | | | 3.2 | | | | .4 | | | | 2.8 | | 700.0 |

% of sales | | | 5.2 | % | | | 3.0 | % | | | | | |

| | |

|

|

| |

|

|

| |

|

| |

|

Consolidated operating income | | | 26.5 | | | | 9.0 | | | | 17.5 | | 194.4 |

% of sales | | | 5.6 | % | | | 2.6 | % | | | | | |

Interest expense | | | 13.1 | | | | 11.7 | | | | 1.4 | | 12.0 |

| | |

|

|

| |

|

|

| |

|

| |

|

Income (loss) before income taxes, minority interest and equity in undistributed earnings of unconsolidated affiliate | | $ | 13.4 | | | $ | (2.7 | ) | | $ | 16.1 | | 596.3 |

| | |

|

|

| |

|

|

| |

|

| |

|

PVC Products.PVC sales increased 27.0% from $329.4 million in the first nine months of 2004 to $418.5 million in 2005. While volume shipped increased by 5%, average selling prices rose by over 20% from 2004. In addition, the spread of selling prices over raw material costs continued to increase in the first nine months of 2005, resulting in better gross margins. Operating expenses increased by $2.3 million in 2005 compared to 2004. Increasing freight, sales commissions and other expenses were offset by not incurring any restructuring charges in 2005, by a gain on sale of land of $0.5 million in 2005, and 2004 included a loss on sale of facilities of $0.4 million. In addition, profit based expense accruals in 2005 increased $0.9 million over the same period in 2004. The result was an increase in operating income of $14.7 million, from $8.6 million in 2004 to $23.3 million in 2005, or 5.6% of sales.

PE Products.PE sales increased $48.6 million, or 365.4%, from $13.3 million in the first nine months of 2004 to $61.9 million in 2005. Of this increase, the UAC business acquired in September 2004 accounted for $45.4 million, with the additional increase coming from the previous PE business. The much higher sales volume resulted in an increase in gross margins of $7.5 million in 2005. Operating expenses increased by $4.6 million due to the UAC acquisition and higher freight and commission costs, and USPoly recorded a gain on the sale of its metals parts business of $1.2 million in the second quarter of 2005. The result was an increase in operating income of $2.8 million, from $0.4 million in 2004 to $3.2 million in 2005, or 5.2% of sales.

Liquidity and Capital Resources

Total assets of $215.4 million at September 30, 2005 represented a $4.6 million increase from the $210.8 million at December 31, 2004. This increase was from current assets, with the net increase in accounts receivable and inventories amounting to $16.5 million, offset by decreases in property and equipment of $(6.5) million and decreases in deferred income taxes of $(4.8) million. Total capitalization at September 30, 2005 was $128.2 million, consisting of $107.2 million of debt and $21.0 million of equity, with debt decreasing by $37.9 million and equity increasing by $8.3 million from December 31, 2004. The increase in current assets is due to increased sales volume in 2005 compared to the fourth quarter of 2004, as well as higher selling prices and a higher cost of resin. The decrease in property and equipment is primarily due to depreciation in excess of capital expenditures, along with a small land sale, and the USPoly sale of its metals line of business as discussed in Note 3: Acquisition of Uponor Aldyl Company in the Notes to Condensed Consolidated Financial Statements as of September 30, 2005. The decrease in deferred tax assets is primarily a result of the income tax provisions for the current year.

We had working capital of $3.4 million at September 30, 2005, which is an improvement of $20.9 million from the negative working capital of $(17.5) million at December 31, 2004. This improvement is the result of our return to profitability in the 2005, and the resulting positive cash flow from operations of $39.2 million for the nine months

21

ending September 30, 2005. The portion of our revolving credit facility collateralized by fixed assets was $18.6 million at September 30, 2005. Had this portion of current debt been converted to long-term loans consistent with the long-term collateral, our working capital would be positive by $22.0 million at September 30, 2005.

In addition to the improvement in working capital, we had additional availability on our revolving credit facilities of over $60 million at September 30, 2005. Management believes that, for the foreseeable future, PW Eagle can fund requirements for working capital, capital expenditures and other obligations with cash generated from operations and borrowing from existing credit facilities and proceeds of approximately $17.9 million from the sale of common stock as described in the Pro Forma Information section on page 12.

Cash provided by operating activities was $39.3 million in the first nine months of 2005, compared to $(9.5) million of cash used in operating activities for the first nine months of 2004. This net change of $48.8 million is primarily a result of a net change in net income of $9.1 million, and a net change in operating assets and liabilities of $37.3 million.

Cash used in operating activities was $(9.8) million in 2004, compared to cash provided of $1.6 million and $0.1 million in 2003 and 2002, respectively. The key component in changes in cash flow levels is the fluctuation in accounts receivable and inventories.

Cash provided from investing activities provided $0.6 million in the first nine months of both 2005, compared to $(12.9) million net cash used by investing activities in 2004. In the first quarter of 2005, we sold an excess parcel of land adjacent to our Perris facility for $0.9 million and in the second quarter we sold the metals division of USPoly for $2.5 million. Investing activities in the first nine months of 2004 included the receipt of $4.2 million in proceeds relating to the sale of facilities, and an additional $1.6 million investment in WL Plastics. Purchases of property and equipment were $2.8 million in the first nine months of 2005 and $1.3 million in the first nine months of 2004.

Investing activities used $(15.1) million in 2004, compared to $(16.8) million in 2003 and provided $0.6 million in 2002. The UAC Acquisition in 2004 used $(13.9) million in cash. Capital expenditures for 2004 were $2.0 million. In 2003, the ETI acquisition used $19.1 million in cash and the sale of Mid States Plastics provided $4.4 million. In 2004, we sold our Hastings and Baker City facilities for $1.9 million, acquired an additional interest in W.L. Plastics for $1.6 million, and received proceeds from the sale of miscellaneous equipment of $0.3 million. In 2002, we sold our Hillsboro manufacturing facility and certain equipment for $1.4 million, which was partially offset by capital expenditures of $0.8 million. The annual capital expenditures, reflect a spending program consistent with our recurring replacement needs.

Financing activities used $(39.5) million in the first nine months of 2005, primarily for a net reduction of our revolving credit facilities and repayment of long-term debt. In the first nine months of 2004, financing activities provided $26.6 million, primarily from our revolving credit facilities and a sale-leaseback transaction, plus net additional long-term debt obtained to finance the UAC acquisition.

Financing activities provided $25.5 million during 2004. The primary sources of cash were net borrowings under the Senior Credit Facilities of PW Eagle and USPoly. Debt issuance and financing costs of $3.8 million were incurred primarily in connection with the PW Eagle refinancing and UAC Acquisition financing. In 2003, financing activities provided $15.2 million primarily from net borrowings under the Senior and Revolving Credit Facilities for PWPipe, PWPoly and ETI. Financing activities used $1.0 million in 2002. In 2002, we entered into a sale-leaseback transaction, which generated $13.4 million in proceeds. The proceeds were used to reduce the term debt by $8.8 million. The remaining proceeds of approximately $4 million were used to pay down the Revolving Credit Facility.

As reported in Note 12, Subsequent Events, in the Notes to Condensed Consolidated Financial Statements as of September 30, 2005, on November 1, 2005, USPoly sold its approximately 23% interest in W.L. Plastics. USPoly received $23.5 million cash proceeds from this transaction and expects to record an after-tax gain of approximately $13 million. The net proceeds were used to repay USPoly’s outstanding debt obligations, and thus reducing the ongoing interest expense amounts related to the debt.

22

Credit Facilities

A summary of amounts outstanding under each of our credit facilities at September 30, 2005 and December 31, 2004 follows (in thousands):

| | | | | | |

| | | September 30,

2005

| | December 31,

2004

|

Borrowings under revolving credit facilities | | | | | | |

PW Eagle | | $ | 41,484 | | $ | 76,323 |

USPoly | | | 5,068 | | | 5,694 |

| | |

|

| |

|

|

Total amounts outstanding under revolving credit facilities | | | 46,552 | | | 82,017 |

| | |

|

| |

|

|

Long-term debt, net of discounts | | | | | | |

PW Eagle Subordinated Notes | | | 24,625 | | | 23,116 |

PW Eagle Capital Lease Obligation | | | 16,389 | | | 16,492 |

USPoly Seller Note | | | 2,125 | | | 2,125 |

USPoly Senior Term Notes | | | 3,837 | | | 6,622 |

USPoly Senior Subordinated Note | | | 4,731 | | | 4,672 |

USPoly Capital Lease Obligations | | | 3,355 | | | 3,378 |

| | |

|

| |

|

|

Total amounts outstanding under long-term credit facilities | | | 55,062 | | | 56,405 |

| | |

|

| |

|

|

Total amounts outstanding | | $ | 101,614 | | $ | 138,422 |

| | |

|

| |

|

|

PW Eagle and USPoly each have separate financing arrangements with each entity responsible for its own obligations without any guarantees or cross-defaults. The following is a summary of the financing arrangements for PW Eagle and USPoly.

PW Eagle.On October 25, 2004, PW Eagle completed a refinancing of its debt. In connection with the refinancing, PW Eagle entered into a new $100 million Revolving Credit Facility with Bank of America (formerly Fleet Capital Corporation), the CIT Group/Business Credit, Inc. and Wells Fargo Business Credit, Inc. (the “Agreement”). PW Eagle’s borrowing capacity under the Agreement is limited to the sum of a Current Asset Collateral Component (CACC) based on percentages of accounts receivable and inventories and a Fixed Asset Collateral Component (FACC) of $22 million. The FACC is reduced by $0.8 million quarterly beginning March 31, 2005. Borrowings under the FACC bear interest at LIBOR plus 2.75% and borrowings under the CACC bear interest at LIBOR plus 2.5%. PW Eagle is required to pay a fee equal to 0.5% of the unused portion of the Revolving Credit Facility. At September 30, 2005, the LIBOR rate was 3.75%.

Under the Agreement, PW Eagle is required to comply with certain restrictive financial covenants including minimum interest coverage, minimum EBITDA (earnings before interest, taxes, depreciation and amortization), maximum capital expenditures, as well as other customary covenants, representations, warranties and funding conditions. Borrowings under the Agreement are collateralized by substantially all of PW Eagle’s assets. The Agreement expires on October 25, 2009.

In connection with the refinancing, PW Eagle issued $16 million of Senior Subordinated Notes and $8 million of Junior Subordinated Notes together with detachable warrants to purchase 366,651 shares of PW Eagle common stock (the “Subordinated Notes”). The Subordinated Notes are due on October 25, 2010, and are collateralized by substantially all assets of PW Eagle, subordinated to the security interest granted under the Revolving Credit

23

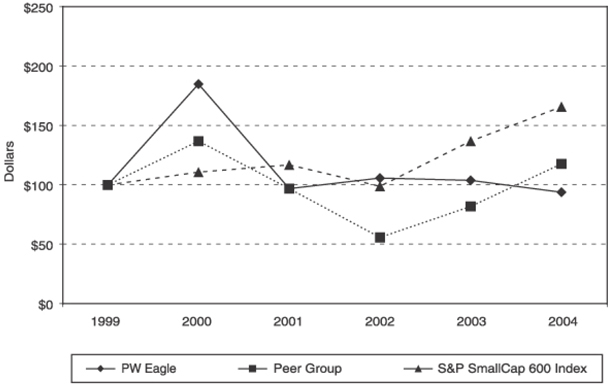

Facility. The Senior Subordinated Notes bear interest at 19%, of which 13% is payable in cash monthly and 6% is deferred until October 31, 2009. The Junior Subordinated Notes bear interest at 22.5%, of which 13% is payable in cash monthly and 9.5% is deferred until October 31, 2009.