U.S. SECURITIES AND EXCHANGE COMMISSION

Pre-Effective Amendment No. __

Post-Effective Amendment No. __

CASH TRUST SERIES, INC.

John W. McGonigle, Esquire

HILLIARD-LYONS GOVERNMENT FUND, INC.

a portfolio of Cash Trust Series, Inc.

under the Securities Act of 1933, as amended.

on June 1, 2010 pursuant to Rule 488.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

Dear Shareholder,

We are pleased to announce that after extensive review, Hilliard Lyons has decided to utilize the services of Federated Investors, Inc. to provide money market fund investments for our clients’ accounts. Since 1955, millions of investors in the United States and around the globe have relied on Federated Investors, Inc. (NYSE: FII) (“Federated”) for world-class investment management. Federated has grown to become one of the nation’s largest investment managers with more than $389 billion in assets under management as of December 31, 2009, including over $313 billion in various money market funds.

Federated provides comprehensive investment management to more than 5,400 institutions and intermediaries (corporations, government entities, insurance companies, foundations and endowments, banks and broker/dealers) and is a component of the S&P 500 Index.

The Hilliard-Lyons Government Fund, Inc. will be reorganized into Government Cash Series, a portfolio of Cash Trust Series, Inc., and a money market mutual fund within the Federated family of mutual funds. This reorganization is expected to occur on or about July 23, 2010.

As you can see by reading the enclosed materials, Federated can offer its fund shareholders new services previously unavailable to owners of the Hilliard-Lyons Government Fund.

Please take the time to read and understand the material closely. While you do not need to take any action with respect to the reorganization, you may need to take some action to take advantage of all the services Federated has to offer.

We have been very pleased with the relationship that we have had with Federated over the years, and look forward to expanding it to include money market funds. After you review the material, we believe that you will be pleased with the enhanced features Federated provides.

Sincerely,

James R. Allen

Chief Executive Officer

PROSPECTUS/INFORMATION STATEMENT

June , 2010

RELATING TO THE ACQUISITION OF THE ASSETS OF

HILLIARD-LYONS GOVERNMENT FUND, INC.

500 West Jefferson Street

Louisville, Kentucky 40202-2823

Telephone No: 1-800-444-1854

BY AND IN EXCHANGE FOR SHARES OF

GOVERNMENT CASH SERIES

A portfolio of Cash Trust Series, Inc.

Federated Investors Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

Telephone No: 1-800-341-7400

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

This Prospectus/Information Statement is being furnished to shareholders of Hilliard-Lyons Government Fund, Inc. (the “Hilliard Fund”) in connection with an Agreement and Plan of Reorganization (the “Plan”), dated as of March 19, 2010, by and between Cash Trust Series, Inc., a Maryland corporation (the “Federated Corporation”), with respect to Government Cash Series (the “Federated Fund”), a series of the Federated Corporation, and the Hilliard Fund, a Maryland corporation. For purposes of this Prospectus/Information Statement, the Hilliard Fund and the Federated Fund may be referred to individually, as applicable, as a “Fund” and, collectively, as the “Funds”. Both Funds are money market mutual funds that are subject to Rule 2a-7 under the Investment Company Act of 1940, as amended, the regulation which governs money market mutual funds.

Under the Plan, the Hilliard Fund will transfer all or substantially all of its assets to the Federated Fund in exchange solely for shares of the Federated Fund (the “Reorganization”). The Hilliard Fund will then distribute, pro rata to its shareholders of record, determined as of the date of the Reorganization (the “Closing Date”), all of the Federated Fund shares received by the Hilliard Fund in redemption of all outstanding shares of the Hilliard Fund and in complete liquidation and dissolution of the Hilliard Fund. After the liquidating distribution is made by the Hilliard Fund, the Hilliard Fund will have no shares of stock outstanding. Certificates representing shares of the Hilliard Fund, if any, should be turned in to the Hilliard Fund and will be cancelled by the Hilliard Fund upon the Reorganization being consummated. The Hilliard Fund will be required to discharge all of its liabilities and obligations prior to the consummation of the Reorganization. The Federated Fund will be the accounting survivor in the Reorganization. From and after June 1, 2010, the Hilliard Fund will stop accepting new accounts, and such new accounts will be directed to the Federated Fund. Existing accountholders on June 1, 2010, will be able to continue to make investments in the Hilliard Fund until a few days prior to the Closing Date. The Hilliard Fund may stop accepting new investments, and purchasing portfolio securities, a few days prior to the Closing Date of the Reorganization in order to facilitate the transfer of its portfolio securities to the Federated Fund as part of the Reorganization. As a result of the Reorganization, each owner of the Hilliard Fund will become the owner of Federated Fund shares, having an amount equal in value to the aggregate net asset value (“NAV”) of his or her holdings in the Hilliard Fund as of the Closing Date. As soon as practicable after the distribution and liquidation of the Hilliard Fund described above, the Hilliard Fund will take steps to wind up its affairs and to have its existence dissolved in accordance with Maryland law and other applicable requirements, and shall file with the Securities and Exchange Commission (“SEC”) an application for deregistration as an investment company on Form N-8F and such other filings as may be required. The Reorganization will result in a complete liquidation and dissolution of the Hilliard Fund.

This Prospectus/Information Statement will be mailed to shareholders of record of the Hilliard Fund as of June 1, 2010 (the “Record Date”).

The Plan has been approved by the Board of Directors of the Hilliard Fund and the Board of Directors of the Federated Corporation on behalf of the Federated Fund. The Board of Directors of the Hilliard Fund determined that participation in the Reorganization is in the best interests of the Hilliard Fund. The Board of Directors of the Federated Fund determined that participation in the Reorganization is in the best interests of the Federated Fund. Information on the rationale for the Reorganization is included in this Prospectus/Information Statement in the section entitled “Summary – Rationale for the Proposed Reorganization.” For purposes of this Prospectus/Information Statement, the Board of Directors of the Hilliard Fund and the Board of Directors of the Federated Corporation are each referred to, as applicable, as the “Board”.

The Plan is not required to be approved by the shareholders of the Hilliard Fund. Accordingly, shareholders of the Hilliard Fund are not being asked to vote on or approve the Plan.

The Reorganization is expected to be a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). For information on the tax consequences of the Reorganization, see the sections entitled “Summary – Tax Consequences” and “Information About the Reorganization – Federal Income Tax Consequences” in this Prospectus/Information Statement.

The investment objectives of the Funds are similar. The Hilliard Fund seeks preservation of capital, liquidity and the highest possible level of current income consistent with these objectives. The Federated Fund’s objective is to seek current income consistent with the stability of principal and liquidity. For a comparison of the investment objectives, policies, limitations and risks of the Hilliard Fund and the Federated Fund, see the section entitled “Summary – Comparison of Investment Objectives, Policies, Limitations and Risks” in this Prospectus/Information Statement. Information concerning Hilliard Fund shares, as compared to the shares of the Federated Fund, is included in this Prospectus/Information Statement in the sections entitled “Summary – Procedures for Purchasing, Redeeming and Exchanging Shares,” “Summary – Comparative Fee Tables,” “Summary – Comparisons of Investment Objectives, Policies, Limitations, and Risks” and “Information about the Reorganization – Description of the Federated Fund’s Shares and Capitalization”.

The investment adviser for the Hilliard Fund is J.J.B. Hilliard, W.L. Lyons, LLC (the “Hilliard Adviser”), and the investment adviser for the Federated Fund is Federated Investment Management Company (the “Federated Adviser”).

In addition to this Prospectus/Information Statement, certain shareholders of the Hilliard Fund who are customers of the Hilliard Adviser, in its capacity as a registered broker-dealer, also will receive a negative consent letter in compliance with NASD Rule 2510(d), in order to provide the Hilliard Adviser, in its capacity as a registered broker-dealer, with the authority to invest/sweep such customers’ cash account assets into the Federated Fund after the Reorganization is consummated.

This Prospectus/Information Statement should be retained for future reference. It sets forth concisely the information about the Funds that a prospective investor should know before investing and it should be read and retained by investors for future reference. This Prospectus/Information Statement is accompanied by the Prospectus for the Federated Fund dated July 31, 2009, which is incorporated herein by reference. A Statement of Additional Information (“SAI”) for the Federated Fund dated July 31, 2009 (relating to the Federated Fund’s Prospectus of the same date), as well as an SAI dated June , 2010, relating to this Prospectus/Information Statement), all containing additional information, have been filed with the SEC and are incorporated herein by reference. The Prospectus and SAI dated January 1, 2010, for the Hilliard Fund also are incorporated herein by reference. Further information about the Federated Fund’s performance is contained in its Annual Report dated May 31, 2009, as well as its Semi-Annual Report dated November 30, 2009, which are incorporated herein by reference. Further information about the performance of the Hilliard Fund is contained in its Annual Report dated August 31, 2009, which is incorporated herein by reference. Copies of these materials and other information about the Federated Fund and the Hilliard Fund may be obtained without charge by writing to or calling the Federated Fund or the Hilliard Fund at the addresses and telephone numbers shown on the previous pages.

This Prospectus/Information Statement is expected to be sent to shareholders of the Hilliard Fund on or about June 11, 2010.

SHAREHOLDER APPROVAL IS NOT REQUIRED TO EFFECT THE REORGANIZATION. NO ACTION ON YOUR PART IS REQUIRED TO EFFECT THE REORGANIZATION.

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS/INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

NO PERSON HAS BEEN AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS OTHER THAN THOSE CONTAINED IN THIS PROSPECTUS/INFORMATION STATEMENT AND IN THE MATERIALS EXPRESSLY INCORPORATED HEREIN BY REFERENCE AND, IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATIONS MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED BY THE FUNDS.

SHARES OF THE FUNDS ARE NOT DEPOSITS OR OBLIGATIONS OF, OR GUARANTEED OR ENDORSED BY, ANY BANK. SHARES OF THE FUNDS ARE NOT FEDERALLY INSURED BY, GUARANTEED BY, OBLIGATIONS OF, OR OTHERWISE SUPPORTED BY THE U.S. GOVERNMENT, THE FEDERAL DEPOSIT INSURANCE CORPORATION, THE FEDERAL RESERVE BOARD OR ANY OTHER GOVERNMENTAL AGENCY. AN INVESTMENT IN THE FUNDS INVOLVES INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF PRINCIPAL AMOUNT INVESTED.

TABLE OF CONTENTS

Page

SUMMARY

Reasons For The Proposed Reorganization

Tax Consequences

Comparison Of Investment Objectives, Policies, Limitations and Risks

Comparative Fee Tables

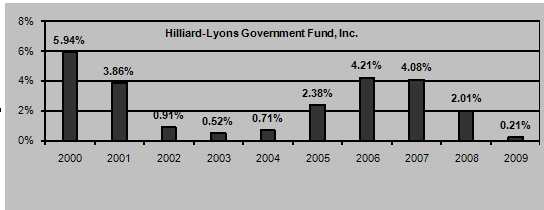

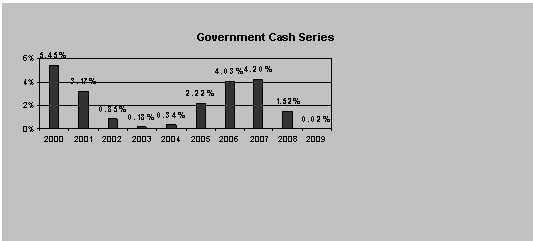

Comparison Of Potential Risks And Rewards; Performance Information

Financial Highlights

Investment Adviser

Investment Advisory Fees and Other Fees/Expenses

Procedures For Purchasing, Redeeming And Exchanging Shares

Dividends and Distributions; Tax Information; Frequent Trading;

Portfolio Holdings Disclosure Policies

INFORMATION ABOUT THE REORGANIZATION

Description of the Agreement and Plan of Reorganization

Costs of the Reorganization

Description of the Hilliard fund's and Federated Fund's Shares and Capitalization

Federal Income Tax Consequences

Agreement Between Federated and The Hilliard Adviser

Comparative Information on Shareholder Rights

INFORMATION ABOUT THE FEDERATED FUND AND HILLIARD FUND

Where to Find Additional Information

Legal Proceedings

ADDITIONAL INFORMATION ABOUT THE FUNDS

Share Ownership of the Funds

Interests of Certain Persons

OTHER MATTERS

ANNEX A -- FORM OF AGREEMENT AND PLAN OF REORGANIZATION

ANNEX B -- FINANCIAL HIGHLIGHTS

SUMMARY

This Summary is qualified in its entirety by reference to the additional information contained elsewhere in this Prospectus/Information Statement, or incorporated by reference into this Prospectus/Information Statement.

A copy of the Form of Agreement and Plan of Reorganization (the “Plan”), by and between Cash Trust Series, Inc., a Maryland corporation (the “Federated Corporation”), with respect to Government Cash Series (the “Federated Fund”), a series of the Federated Corporation, and Hilliard-Lyons Government Fund, Inc. (the “Hilliard Fund”), a Maryland corporation, pursuant to which the reorganization will be conducted is attached to this Prospectus/Information Statement as Annex A. For purposes of this Prospectus/Information Statement, the Hilliard Fund and the Federated Fund may be referred to individually, as applicable, as a “Fund” and, collectively, as the “Funds”. Both Funds are money market mutual funds that are subject to Rule 2a-7 under the Investment Company Act of 1940, as amended, the regulation which governs money market mutual funds.

Under the Plan, the Hilliard Fund would transfer all or substantially all of its assets to the Federated Fund solely in exchange for shares of the Federated Fund (the “Reorganization”). The Hilliard Fund will then distribute, pro rata to its shareholders of record, determined as of the date of the Reorganization (the “Closing Date”), all of the Federated Fund shares received by the Hilliard Fund in redemption of all outstanding shares of the Hilliard Fund and in complete liquidation and dissolution of the Hilliard Fund. After the liquidating distribution is made by the Hilliard Fund, the Hilliard Fund will have no shares of stock outstanding. Certificates representing shares of the Hilliard Fund, if any, should be turned in to the Hilliard Fund and will be cancelled by the Hilliard Fund upon the Reorganization being consummated. The Hilliard Fund will be required to discharge all of its liabilities and obligations prior to the consummation of the Reorganization. The Federated Fund will be the accounting survivor in the Reorganization. From and after June 1, 2010, the Hilliard Fund will stop accepting new accounts, and such new accounts will be directed to the Federated Fund. Existing accountholders on June 1, 2010, will be able to continue to make investments in the Hilliard Fund until a few days prior to the Closing Date. The Hilliard Fund may stop accepting new investments, and purchasing portfolio securities, a few days prior to the Closing Date of the Reorganization in order to facilitate the transfer of its portfolio securities to the Federated Fund as part of the Reorganization. As a result of the Reorganization, each owner of the Hilliard Fund will become the owner of Federated Fund shares, having an amount equal in value to the aggregate NAV of his or her holdings in the Hilliard Fund as of the Closing Date. As soon as practicable after the distribution and liquidation of the Hilliard Fund described above, the Hilliard Fund will take steps to wind up its affairs and to have its existence dissolved in accordance with Maryland law and other applicable requirements, and shall file with the SEC an application for deregistration as an investment company on Form N-8F and such other filings as may be required. The Reorganization will result in a complete liquidation and dissolution of the Hilliard Fund.

The investment adviser for the Hilliard Fund is J.J.B. Hilliard, W.L. Lyons, LLC (the “Hilliard Adviser”), and the investment adviser for the Federated Fund is Federated Investment Management Company (the “Federated Adviser”).

The Financial Highlights for the Hilliard Fund and the Federated Fund are attached to this Prospectus/Information Statement as Annex B.

For more complete information, please read the Prospectus of the Hilliard Fund and the Federated Fund. The Prospectus for the Federated Fund accompanies this Prospectus/Information Statement.

In addition to this Prospectus/Information Statement, certain shareholders of the Hilliard Fund who are customers of the Hilliard Adviser, in its capacity as a registered broker-dealer, also will receive a negative consent letter in compliance with NASD Rule 2510(d), in order to provide the Hilliard Adviser, in its capacity as a registered broker-dealer, with the authority to invest/sweep such customers’ cash account assets into the Federated Fund after the Reorganization is consummated.

Reasons for the Proposed Reorganization

The Board of Directors of the Hilliard Fund, (the “Hilliard Board”), including a majority of the directors who are not “interested persons,” within the meaning of Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), determined that participation in the Reorganization is in the best interests of the Hilliard Fund. The Board of Directors of the Federated Corporation (the “Federated Board”), including a majority of the directors who are not “interested persons,” determined that participation in the Reorganization is in the best interests of the Federated Fund. For purposes of this Prospectus/Information Statement, the Board of Directors of the Hilliard Fund and the Board of Directors of the Federated Corporation are each referred to, as applicable, as the “Board”.

The Hilliard Board was presented with various information regarding the Reorganization during its regular meeting on December 16, 2009, which representatives of the Hilliard Adviser and Federated attended and provided information to the Board regarding the Reorganization. The Hilliard Board also met at its regular meeting on March 18, 2010 to further consider the Reorganization, which representatives of the Hilliard Adviser attended. The Hilliard Board was informed that the Reorganization is being completed for financial and strategic reasons. In particular, the Hilliard Adviser has determined to discontinue its sponsorship of the Hilliard Fund. The Hilliard Board was informed that there are concerns about the ability of the Hilliard Fund to continue to operate at current expense levels, and about the continued overall viability of the Hilliard Fund, given the relatively small average shareholder account size. Accordingly, alternatives have been actively pursued that would allow shareholders of the Hilliard Fund to (i) continue to pursue their original investment objectives through a tax-free combination of the Hilliard Fund with a comparable portfolio of another fund group; (ii) become part of a larger and more diverse family of mutual funds; (iii) invest in a larger combined fund with increased long-term growth prospects; and (iv) invest in a family of mutual funds managed by a large investment adviser with extensive money market fund experience. After discussions between representatives of the Hilliard Adviser and the Federated Adviser, the Hilliard Adviser recommended to the Hilliard Board that it consider and approve the Reorganization as being in the best interests of the Hilliard Fund and its shareholders. In recommending that the Hilliard Board consider and approve the Plan for the Reorganization, the Hilliard Adviser noted, among other things, Federated’s commitment to its mutual fund business, including growing its money market fund business, the compatibility between the Hilliard Fund and the Federated Fund in terms of investment objectives and investment strategies, the long-term performance record of the Federated Fund, the broad distribution capacity of Federated Investors, Inc. (“Federated”), and the additional cash management services that would be available to Hilliard Fund shareholders after the Reorganization is consummated.

The Hilliard Board was informed that the Reorganization would give the Hilliard Fund’s shareholders the opportunity to participate in a significantly larger overall fund family and in the Federated Fund with a similar investment objective and substantially similar strategy. Federated, through its advisory subsidiaries (including the Federated Adviser), is one of the largest investment managers in the United States. As of December 31, 2009, Federated’s advisory subsidiaries had assets under management that totaled approximately $389.3 billion, with approximately 145 funds, including approximately 50 money market funds (nearly all of which were managed by the Federated Adviser), and a variety of separately managed account options.

At the December 16, 2009 meeting of the Hilliard Board, the Hilliard Board was further informed regarding Federated’s commitment to its mutual fund business, including growing its money market fund business. Information was made available to the Hilliard Board regarding the qualifications and stability of the investment personnel and management for the Federated Adviser and Federated Fund, including the security selection process, and the resources and enterprise commitment of the Federated Adviser devoted to compliance and risk management functions. Information was also made available to the Hilliard Board regarding Federated’s distribution capabilities. For additional information regarding Federated, please see the section entitled “Summary – Investment Adviser” in this Prospectus/Information Statement.

The Hilliard Board was also informed that the investment objectives of the Hilliard Fund and Federated Fund are similar. The Hilliard Fund seeks preservation of capital, liquidity and the highest possible level of current income consistent with these objectives. The Federated Fund’s objective is to seek current income consistent with the stability of principal and liquidity. Both Funds have the same Lipper classification of U.S. Government Money Market Fund, and fall within the same iMoneyNet Category of Government and Agency Retail.

At the December 16, 2009 meeting of the Hilliard Board, the portfolio manager of the Federated Fund discussed (a) the Federated Fund’s use of repurchase agreements, including the operational, legal and credit procedures in place for the Federated Fund’s use of repurchase agreement transactions, as well as the potential yield and liquidity benefit of using such investments in the management of the Federated Fund, (b) the Federated Adviser’s credit policies in general, (c) the difference in philosophy between the Hilliard Fund and the Federated Fund regarding floating rate securities, including Federal Deposit Insurance Corporation (“FDIC”) guaranteed securities, and (d) the risk profile of the Hilliard Fund, taking into account the longer stated (or legal) final maturity dates, or dates on which payment may be demanded, for its portfolio securities (the “Spread Weighted Average Maturity” or “Spread WAM”). While the investment strategies of the Hilliard Fund and the Federated Fund are substantially similar, the Hilliard Adviser also noted to the Hilliard Board that differences exist: (i) for fixed-rate Treasury or agency securities, the Federated Fund invests primarily in a portfolio of U.S. Treasury and government agency securities maturing in 397 days or less whereas the Hilliard Fund typically invests in fixed-rate U.S. Treasury and government agency securities maturing in six months or less; (ii) the Federated Fund uses repurchase agreements with counterparties believed to be of high quality as a means of managing liquidity and as a foundation for a barbelled portfolio structure, whereas the Hilliard Fund utilizes a short-term ladder of Treasury or agency securities to meet liquidity needs; (iii) the Hilliard Fund invests in securities issued by certain financial institutions participating in the Temporary Liquidity Guarantee Program adopted by the FDIC, whereas the Federated Fund is able to but has not yet participated in these offerings; (iv) the Federated Fund may invest in callable agency securities, in which the Hilliard Fund does not invest; and (v) the Federated Fund may invest its assets in securities of other investment companies, including the securities of affiliated money market funds, as an efficient means of implementing its investment strategies and/or investing its uninvested cash.

The Hilliard Board was also made aware that there are differences in the investment policies or limitations of the Funds which are attributable primarily to the fact that the Federated Fund is part of the Federated “family” of funds, and, therefore, has policies that are consistent with other funds in the Federated family of mutual funds. For example, the following policies/limitations of the Federated Fund are non-fundamental, and may be changed by the Federated Board without shareholder approval, whereas corresponding Hilliard Fund policies/limitations are fundamental, and may not be changed without shareholder approval: (a) pledging assets, (b) purchases on margin, and (c) illiquid securities and restricted securities. The Hilliard Fund also has several policies/limitations that the Federated Fund does not have. It was noted that the principal risks of the Funds are substantially the same. As mentioned above, since the Federated Fund may invest in callable securities, it is subject to call risks. The Prospectus for the Federated Fund also discloses risks associated with investing share purchase proceeds as a principal risk factor for the Federated Fund. The Prospectus for the Hilliard Fund also discloses that redemption risk as a principal risk factor for the Hilliard Fund. The investment objectives, policies, limitations and risks of the Hilliard Fund and the Federated Fund are discussed in the section entitled “Summary – Comparison of Investment Objectives, Policies, Limitations and Risks” in this Prospectus/Information Statement.

The Hilliard Board also was made aware of the expense ratio and performance of the Federated Fund. The Federated Fund has a higher gross management fee of 0.50% compared to the advisory fee with breakpoints paid by the Hilliard Fund, which amounted to 0.28% for the Hilliard Fund for the fiscal year ended August 31, 2009. In addition, the Federated Fund has a higher stated total gross expense ratio of 1.36% (which includes a stated 0.35% Rule 12b-1 fee not imposed by the Hilliard Fund), compared to 0.73% for the Hilliard Fund. As of March 31, 2010, the Federated Fund was being operated at a net expense ratio of 0.11% and the Hilliard Fund was being operated at a net expense ratio of 0.22% due to additional voluntary waivers. These additional voluntary waivers generally are being implemented, in large part, in order to maintain at least a one basis point yield on the Funds in the current market environment. After the Reorganization is consummated, it is expected that the pro forma gross expenses of the Federated Fund would decrease from 1.36% to 1.31%. See “Summary – Comparative Fee Tables – Fees and Expenses” below in this Prospectus/Information Statement for more information. As of March 31, 2010, the 7-day yield and 30-day yield of the Federated Fund were 0.01% and 0.01%, respectively, and the 7-day yield and 30-day yield of the Hilliard Fund were 0.01% and 0.01%, respectively. While the performance of the Federated Fund generally has trailed that of the Hilliard Fund on a 1-year, 3-year, 5-year and 10-year basis, the Hilliard Board was informed that the Federated Fund performance has been competitive. The Hilliard Board was provided with information regarding the performance of the Federated Fund and discussions were undertaken regarding the relative underperformance of the Federated Fund when compared to the Hilliard Fund. It was noted that the long-term performance of the Federated Fund in a variety of market conditions was evidence of the viability of the Federated Fund from the perspective of long-term management. For additional information regarding fees, expenses and performance of each of the Funds, see the sections entitled “Summary – Comparative Fee Tables,” “Summary – Comparison Of Potential Risks And Rewards; Performance Information” and “Summary – Investment Advisory Fees and Other Fees/Expenses” in this Prospectus/Information Statement.

The Hilliard Board was informed that the Hilliard Fund’s shareholders will be receiving shares of the Federated Fund in a Reorganization that is intended to be a tax-free reorganization under Section 368(a) of the Code. In the opinion of the Hilliard Adviser, the Reorganization would generally provide a more preferable tax result for shareholders as compared to a liquidation of the Hilliard Fund (which generally would result in taxable redemptions). The Hilliard Board also was informed that, as an open-end management investment company incorporated in the State of Maryland but domiciled in the Commonwealth of Pennsylvania, the Federated Fund is subject to the Pennsylvania Franchise Tax. This franchise tax is assessed annually on the value of the Federated Fund, as represented by average net assets for the tax year. For additional information on the tax consequences of the Reorganization, see the sections entitled “Summary – Tax Consequences” and “Information About the Reorganization – Federal Income Tax Consequences” in this Prospectus/Information Statement. The Hilliard Board also was advised that the Reorganization is preferable to other methods of transferring shareholder accounts to other money market funds from a portfolio management perspective because it does not involve a liquidation of Hilliard Fund assets.

The Hilliard Board was advised that the Hilliard Fund and Federated Fund would not bear any expenses associated with their participation in the Reorganization, and that all expenses associated with the Reorganization would be borne by the Hilliard Adviser and Federated Adviser, or their affiliates, as mutually agreed between them, except the Federated Fund may bear expenses associated with the qualification of the Federated Fund’s shares on an as incurred basis and the Funds may incur transaction expenses associated with the purchase and/or sale of portfolio securities to the extent that any transition of portfolio securities is required in connection with the Reorganization. Prior to the Reorganization being consummated, the Hilliard Adviser may sell from the portfolio of the Hilliard Fund certain securities to better align the portfolios of the Hilliard Fund and the Federated Fund. Promptly after the Hilliard Board’s March 18, 2010 regular meeting, the Hilliard Fund filed a supplement to its registration statement informing shareholders of the proposed Reorganization. Based on feedback from certain financial intermediaries since the supplement was filed, it is likely that certain shareholders will redeem, or be redeemed by their financial intermediaries, from the Hilliard Fund prior to the Reorganization. Any redemption requests may require the Hilliard Adviser to sell securities of the Hilliard Fund to meet such redemption requests. Given the types of money market securities in which the Hilliard Fund and Federated Fund invest, it is not anticipated that the transaction expenses relating to such dispositions and acquisitions of portfolio securities would be significant.

The Hilliard Adviser also summarized the terms of a purchase agreement (the “Purchase Agreement”) entered into by Federated and the Hilliard Adviser, which is further described under “Information About the Reorganization – Agreement between Federated and the Hilliard Adviser” in this Prospectus/Information Statement. Under the terms of the Purchase Agreement, the Hilliard Adviser will sell to Federated certain assets relating to the Hilliard Adviser’s business of providing investment management services to the Hilliard Fund. The Purchase Agreement includes provisions relating to the payment/sharing of transaction expenses and related matters. The Purchase Agreement also contains provisions pursuant to which the parties agree to use commercially reasonable efforts not to cause, and to prevent their respective affiliates from causing, a violation of Section 15(f) of the 1940 Act in connection with the transactions contemplated by the Purchase Agreement, including the Reorganization. In connection with the Purchase Agreement, it is also anticipated that the Hilliard Adviser may, under agreements with Federated, be eligible to receive distribution or servicing fees on shareholder accounts for which the Hilliard Adviser, or its affiliates, serves as the broker-dealer of record and performs services. It also is anticipated that the Hilliard Adviser and its affiliates may be eligible to received Federated-paid supplemental payments for services rendered to the Federated funds (including the Federated Fund).

Given the above considerations, the Hilliard Adviser advised the Hilliard Board that it believes that the Reorganization will result in shareholders of the Hilliard Fund receiving shares in a compatible, larger and thus more viable combined money market fund, and that the benefits to Hilliard Fund shareholders of investing in a competitive Federated Fund with greater long-term viability as part of a larger mutual fund complex justify a determination that the Reorganization is in the best interests of Hilliard Fund shareholders.

From and after June 1, 2010, the Hilliard Fund will stop accepting new accounts, and such new accounts will be directed to the Federated Fund. Existing accountholders on June 1, 2010, will be able to continue to make investments in the Hilliard Fund until a few days prior to the Closing Date. The Hilliard Board was informed that the Hilliard Fund may stop accepting new investments, and purchasing portfolio securities, a few days prior to the Closing Date of the Reorganization in order to facilitate the transfer of its portfolio securities to the Federated Fund as part of the Reorganization.

The Hilliard Board was also informed that, concurrently with the Reorganization transaction, the Hilliard Adviser and its affiliates would be seeking the consent of shareholders of other sweep accounts maintained by the Hilliard Adviser or its affiliates that provide for the automatic investment of net cash balances into shares of money market funds (other than the Hilliard Fund or the Federated Fund), and the automatic redemption of such shares to pay obligations incurred by such accounts. These consents would be sought in order to obtain the authority to transfer the cash balances invested in such other sweep accounts to the Federated Fund or to another money market mutual fund for which the Federated Adviser or its affiliates serves as investment adviser. As permitted under the rules of the Financial Industry Regulatory Authority (“FINRA”), such consents may be obtained by using negative consent letters. After the consents are obtained (for example, after the expiration of the period specified in such negative consent letters for an account holder to elect out of the transfers contemplated in such letters), the Hilliard Adviser or its affiliates will enter the redemption and purchase orders, and take any other commercially reasonably actions, necessary or appropriate to effect the transfers of the assets from such other sweep accounts to the Federated Fund or to another money market mutual fund for which the Federated Adviser or its affiliates serves as investment adviser on or before the Closing Date.

At its March 18, 2010 regular meeting, the Hilliard Board discussed the information it had received at its December 16, 2009 regular meeting and updates to the information. Representatives of the Hilliard Adviser also presented updated information relating to the Reorganization. The Hilliard Board discussed various factors in considering the Reorganization as further described below.

In light of the above rationale and considerations, in considering the proposed Reorganization, the Hilliard Board took into account a number of factors, including:

| · | The Hilliard Board considered, in particular, that the Hilliard Adviser has determined to discontinue its sponsorship of the Hilliard Fund. The Hilliard Board also considered the concerns about the ability of the Hilliard Fund to continue to operate at current expense levels, and about the continued overall viability of the Hilliard Fund, given the relatively small average shareholder account size. |

| · | That the Reorganization provides to Hilliard Fund shareholders the opportunity to participate in a significantly larger overall fund family and in the Federated Fund with a similar investment objective and substantially similar strategy. The Hilliard Board noted that Federated, one of the largest investment management firms in the United States, had advisory subsidiaries with assets under management as of December 31, 2010, that totaled approximately $389.3 billion, with approximately 145 funds, including approximately 50 money market funds (nearly all of which were managed by the Federated Adviser), and a variety of separately managed account options. For information regarding Federated, please see the section entitled “Summary – Investment Adviser” in this Prospectus/Information Statement. |

| · | Federated’s commitment to the mutual fund business, including growing its money market fund business, and broad distribution capacity. The Hilliard Board noted the qualifications and stability of the investment personnel and management for the Federated Adviser and Federated Fund, including the security selection process. The Hilliard Board noted the additional cash management services available to Hilliard Fund shareholders after the Reorganization is consummated, as further described in “Investment Advisory Fees and Other Expenses—Redemptions and Exchanges” below. The Hilliard Board also noted the level of resources and enterprise commitment of the Federated Adviser to compliance and risk management functions. The Board also noted Federated’s distribution capabilities. For additional information regarding Federated, please see the section entitled “Summary – Investment Adviser” in this Prospectus/Information Statement. |

| · | The similar investment objectives of the Hilliard Fund and the Federated Fund, and the substantially similar investment strategies, with some exceptions, of the Hilliard Fund and the Federated Fund, as described above. For a comparison of the investment objectives, policies, limitations and risks of the Hilliard Fund and the Federated Fund, see the section entitled “Summary – Comparison of Investment Objectives, Policies, Limitations and Risks” in this Prospectus/Information Statement. |

| · | The expense ratio and performance of the Federated Fund, and the discussion at the December 16, 2009 Hilliard Board meeting related thereto, as described above. For additional information regarding fees, expenses and performance of each of the Fund, see the sections entitled “Summary – Comparative Fee Tables”, “Summary – Comparison Of Potential Risks And Rewards; Performance Information” and “Summary – Investment Advisory Fees and Other Fees/Expenses” in this Prospectus/Information Statement. |

| · | The intended tax-free status of the Reorganization. The Hilliard Board considered that the Hilliard Fund’s shareholders will be receiving shares of the Federated Fund in a Reorganization that is intended to be a tax-free reorganization under Section 368(a) of the Code and that, in the opinion of the Hilliard Adviser, the Reorganization would generally provide a more preferable tax result for shareholders as compared to liquidating the Hilliard Fund (which generally would result in taxable redemptions). For additional information on the tax consequences of the Reorganization, see the sections entitled “Summary – Tax Consequences” and “Information About the Reorganization – Federal Income Tax Consequences” in this Prospectus/Information Statement. The Hilliard Board also recognized the Hilliard Adviser’s point that the Reorganization is preferable to other methods of transferring shareholder accounts to other money market funds from a portfolio management perspective because it does not involve a liquidation of Hilliard Fund assets. |

| · | That the Hilliard Fund and Federated Fund would not bear any expenses associated with their participation in the Reorganization, and that all expenses associated with the Reorganization would be borne by the Hilliard Adviser and Federated Adviser, or their affiliates, as mutually agreed between them, except the Federated Fund may bear expenses associated with the qualification of the Federated Fund’s shares on an as incurred basis and the Funds may incur transaction expenses associated with the purchase and/or sale of portfolio securities to the extent that any transition of portfolio securities is required in connection with the Reorganization. For additional information regarding the cost of the Reorganization, see the section titled “Information about the Reorganization – Costs of the Reorganization” in this Prospectus/Information Statement. |

| · | The Hilliard Adviser’s belief that the Reorganization will result in shareholders of the Hilliard Fund receiving shares in a compatible, larger and thus more viable combined money market fund, and that the benefits to Hilliard Fund shareholders of investing in a competitive Federated Fund with greater long-term viability as part of a larger mutual fund complex justify a determination that the Reorganization is in the best interests of Hilliard Fund shareholders. |

| · | That the Hilliard Adviser and Federated have entered into the Purchase Agreement regarding the sale by the Hilliard Adviser of certain assets to Federated, which contains provisions intended to address the requirements of Section 15(f) of the 1940 Act and provides that the Hilliard Adviser will assume any liabilities of the Hilliard Fund that have not been discharged by the Hilliard Fund on or prior to the date on which the Reorganization is consummated. The Board also considered the anticipated distribution, servicing and supplemental fees that the Hilliard Adviser and its affiliates may be eligible to receive, and noted that such fees would be paid for bona fide services to be provided by the Hilliard Adviser or its affiliates after the Reorganization is consummated. |

| · | The anticipated benefits to the Federated Adviser, such as increased advisory revenues and administration services revenue due to increased assets. |

Given the above factors, the Hilliard Adviser recommended to the Hilliard Board, and the Hilliard Board concluded, that when considering the totality of the factors, the Reorganization is in the best interests of the shareholders of the Hilliard Fund and that the dissolution of the Hilliard Fund is advisable.

Based on the foregoing, at its March 18, 2010 regular meeting, the Hilliard Board, including a majority of the directors who are not “interested persons,” through an exercise of its business judgment, approved the Plan for the Reorganization on behalf of the Hilliard Fund and determined that the Reorganization is in the best interests of the shareholders of the Hilliard Fund and that the dissolution of the Hilliard Fund is advisable.

The Federated Adviser also recommended the Reorganization to the Federated Board primarily because, in the opinion of the Federated Adviser, the Federated Fund’s shareholders will benefit from the increase in the Federated Fund’s assets resulting from the Reorganization. After the Reorganization is consummated, as a result of the increase in assets, it is expected that the pro forma gross expenses of the Federated Fund would decrease from 1.36% to 1.31%. See “Summary – Comparative Fee Tables – Fees and Expenses” below in this Prospectus/Information Statement for more information. After the Reorganization, it is anticipated that the Federated Fund’s portfolio will contain additional securities, and certain of these securities will likely be attractively priced relative to direct market alternatives. Given the shorter-term nature of certain other securities, it also is anticipated that the Federated Fund will likely have additional liquidity to pursue reinvestment opportunities. Based on these factors, although no guarantee can be provided, the Federated Board was also informed by the Federated Adviser that the increase in the Federated Fund’s assets may benefit the Federated Fund’s performance over time. As of March 31, 2010, the Hilliard Fund had $1,849,714,535 in total net assets and the Federated Fund had $748,181,021 in total net assets. After considering a number of factors, including the opinion of the Federated Adviser and the factors identified in the preceding sentences, the Federated Adviser recommended to the Federated Board, and the Federated Board concluded, that when considering the totality of the factors, the Reorganization is in the best interests of the shareholders of the Federated Fund. Based on the foregoing, at the Federated Board’s meeting held on February 11, 2010, the Federated Board, including a majority of the directors who are not “interested persons,” through an exercise of its business judgment, approved the Plan for the Reorganization on behalf of the Federated Fund and determined that the Reorganization is in the best interests of the shareholders of the Federated Fund.

Tax Consequences

Tax-Free Reorganization under Internal Revenue Code of 1986, as amended

The Reorganization is expected to qualify as a tax-free reorganization under Section 368(a) of the Code. As a condition to the Reorganization, the Hilliard Fund and the Federated Fund will receive an opinion of counsel that the Reorganization will be considered a tax-free “reorganization” under applicable provisions of the Code, so that no gain or loss will be recognized directly as a result of the Reorganization by the Hilliard Fund or the Federated Fund or the shareholders of the Hilliard Fund. The aggregate tax basis of the Federated Fund shares received by the shareholders of the Hilliard Fund will be the same as the aggregate tax basis of their shares in the Hilliard Fund. The holding period of the Federated Fund shares received by each shareholder of the Hilliard Fund will include the period during which the Hilliard Fund shares exchanged therefor were held by such shareholder (provided the Hilliard Fund shares are held as capital assets at the time of the Reorganization).

Distributions and Capital Loss Carryforwards and Unrealized Losses

Shareholders generally will not incur gains or losses on the exchange of shares of the Hilliard Fund for shares of the Federated Fund as a result of the Reorganization. Shareholders will be responsible for tax obligations associated with monthly, periodic or other dividend or capital gains distributions that occur prior to and after the Reorganization. For example, shareholders may have tax obligations in connection with taxable distributions, if any, by the Hilliard Fund immediately before the Closing Date. These distributions may include, for example, capital gains realized on dispositions of portfolio securities in connection with the Reorganization. Prior to the Reorganization being consummated, the Hilliard Adviser may sell from the portfolio of the Hilliard Fund certain securities to better align the portfolios of the Hilliard Fund and the Federated Fund. Promptly after the Hilliard Board’s March 18, 2010 regular meeting, the Hilliard Fund filed a supplement to its registration statement informing shareholders of the proposed Reorganization. Based on feedback from certain financial intermediaries since the supplement was filed, it is likely that certain shareholders will redeem, or be redeemed by their financial intermediaries, from the Hilliard Fund prior to the Reorganization. Any redemption requests may require the Hilliard Adviser to sell securities of the Hilliard Fund to meet such redemption requests. For more information on the disposition of certain portfolio securities, see the section entitled “Summary – Comparison of Investment Objectives, Policies, Limitations and Risks” in this Prospectus/Proxy Statement. It is not intended that these sales of portfolio securities will affect the Reorganization’s expected qualification as a tax-free reorganization under Section 368(a) of the Code.

The Federated Fund did not have a capital loss carryforward as of the end of its most recent fiscal year, May 31, 2009. The Hilliard Fund did not have a capital loss carryforward as of the end of its most recent fiscal year, August 31, 2009. To the extent that the Hilliard Fund would be in a net capital gain position prior to the Reorganization, the Hilliard Fund would make distributions of the capital gains (as well as any other required distributions) prior to the Reorganization being consummated. The Purchase Agreement between Federated and the Hilliard Adviser contains provisions under which the Hilliard Adviser is required to reimburse the Hilliard Fund for the full amount of any accumulated net realized loss as reflected in the Hilliard Fund’s audited Statement of Assets and Liabilities as of August 31, 2009, as adjusted for all net gains and losses realized by the Hilliard Fund after August 31, 2009, through the Closing Date (or any transaction that has caused a permanent impairment). See the section entitled “Information About the Reorganization - Agreement between Federated and the Hilliard Adviser” for more information about the Purchase Agreement.

State Taxes

As an open-end management investment company incorporated in the State of Maryland but domiciled in the Commonwealth of Pennsylvania, the Federated Fund is subject to the Pennsylvania Franchise Tax. This franchise tax is assessed annually on the value of the Federated Fund, as represented by average net assets for the tax year.

According to the Hilliard Adviser, the Hilliard Fund has historically sought to invest, as much as possible, in securities whose income and dividends were exempt from state and local taxes, and historically income and dividends on Hilliard Fund shares generally have not been subject to state and local income taxes. The Federated Fund has historically been managed without regard to state taxation.

Shareholders of the Hilliard Fund should consult their tax advisors regarding the federal, state and local tax treatment and implications of the Reorganization in light of their individual circumstances. See the section entitled “Information About the Reorganization – Federated Income Tax Consequences” in this Prospectus/Information Statement for further information.

This summary of the tax consequences of the Reorganization is based on Federal income (and, with respect to the Pennsylvania Franchise Tax, state franchise) tax laws, regulations, rulings and decisions in effect as of the date of the Prospectus/Information Statement, all of which are subject to change (retroactively or prospectively) and to differing interpretations.

Comparison of Investment Objectives, Policies, Limitations and Risks

This section will help you compare the investment objectives, policies, limitations and risks of the Hilliard Fund and the Federated Fund. Overall, the investment objectives and strategies of each of the Funds are similar, except that: (i) for fixed-rate Treasury or agency securities, the Federated Fund invests primarily in a portfolio of U.S. Treasury and government agency securities maturing in 397 days or less whereas the Hilliard Fund typically invests in fixed-rate U.S. Treasury and government agency securities maturing in six months or less; (ii) the Federated Fund uses repurchase agreements with counterparties believed to be of high quality as a means of managing liquidity and as a foundation for a barbelled portfolio structure, whereas the Hilliard Fund utilizes a short-term ladder of Treasury or agency securities to meet liquidity needs; (iii) the Hilliard Fund invests in securities issued by certain financial institutions participating in the Temporary Liquidity Guarantee Program adopted by the FDIC whereas the Federated Fund is able to but has not yet participated in these offerings; (iv) the Federated Fund may invest in callable agency securities, in which the Hilliard Fund does not invest; and (v) the Federated Fund may invest its assets in securities of other investment companies, including the securities of affiliated money market funds, as an efficient means of implementing its investment strategies and/or investing its uninvested cash. The differences in the Funds’ investment policies/limitations and risks also are discussed below. Please be aware that the foregoing is only a summary, and this section is only a brief discussion. More complete information may be found in the Prospectuses of the Hilliard Fund and the Federated Fund.

Investment Objectives and Strategies

The investment objective of the Federated Fund is to seek current income consistent with the stability of principal and liquidity. The investment objective of the Hilliard Fund is to seek preservation of capital, liquidity and the highest possible level of current income consistent with these objectives. Each Fund also is a money market fund that seeks to maintain a stable NAV of $1.00 per share. There is no guarantee that either Fund’s objectives will be attained.

Both Funds invest primarily in a portfolio of short-term U.S. Treasury and government agency securities. These investments include repurchase agreements collateralized fully by U.S. Treasury and government agency securities. Both Funds will have a dollar-weighted average portfolio maturity of 90 days or less. The Funds invest in the securities of U.S. government-sponsored entities (“GSEs”), including GSE securities that are not backed by the full faith and credit of the U.S. government, such as those issued by the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association and the Federal Home Loan Bank System. These entities are, however, supported through federal subsidies, loans or other benefits. The Funds may also invest in GSE securities that are supported by the full faith and credit of the U.S. government, such as those issued by the Government National Mortgage Association. Finally, both Funds may invest in GSE securities that have no explicit financial support, but which are regarded as having implied support because the federal government sponsors their activities. Such securities include those issued by the Farm Credit System and the Financing Corporation.

The Hilliard Fund and the Federated Fund differ in certain respects. The Federated Fund invests in fixed-rate Treasury and agency securities maturing in 397 days or less whereas the Hilliard Fund invests in fixed-rated Treasury and agency securities maturing in six months or less. However, both portfolios make use of agency floating rate securities that may have maturities that exceed 397 days as long as those securities reset at least as frequently as 397 days. Although both Funds are permitted to invest in repurchase agreements by their prospectuses, the Hilliard Fund has not used repurchase agreements recently in its investment strategy. The Hilliard Fund also will not enter into repurchase agreements having a duration of more than seven business days if, as a result, more than 10% of the value of its assets would be so invested. The Hilliard Board was informed as to the operational, legal, and credit procedures in place for the Federated Fund’s use of repurchase agreement transactions, as well as the potential yield and liquidity benefits of using such investments in the management of the Federated Fund. The Hilliard Fund invests in securities of certain financial institutions participating in the Temporary Liquidity Guarantee Program adopted by the FDIC, including longer-dated floating rate securities, whereas the Federated Fund has the ability to but has not yet invested in such offerings. The Federated Fund may invest in callable agency securities which the Hilliard Fund does not invest in. The Federated Fund also may invest its assets in securities of other investment companies, including the securities of affiliated money market funds, as an efficient means of implementing its investment strategies and/or investing its uninvested cash.

According to the Hilliard Adviser, the Hilliard Fund has historically sought to invest, as much as possible, in securities whose income and dividends were exempt from state and local taxes, and historically income and dividends on Hilliard Fund shares generally have not been subject to state and local income taxes. The Federated Fund has historically been managed without regard to state taxation.

Because the Federated Fund refers to government securities in its name, the SEC requires the Federated Fund to notify shareholders at least 60 days in advance of any change in its investment policies that would enable the Federated Fund to normally invest less than 80% of its assets in government securities.

Both Funds are money market mutual funds that are subject to Rule 2a-7 under the 1940 Act, the regulation which governs money market mutual funds. On February 23, 2010, the SEC published amendments to Rule 2a-7 that are intended to tighten certain risk-limiting requirements/conditions of Rule 2a-7 by, among other things, requiring money market mutual funds (including the Funds) to maintain a portion of their portfolios in instruments that can be readily converted to cash, reducing the maximum weighted average maturity of portfolio holdings, and improving the quality of portfolio securities. These amendments to Rule 2a-7 are effective May 5, 2010, and the dates by which money market mutual funds (including the Funds) are required to comply with these amendments are staggered over a period from May 5, 2010, through October 31, 2011.

For example, under these amendments to Rule 2a-7, by May 28, 2010, among certain other requirements: (1) each Fund must hold securities that are sufficiently liquid to meet reasonably foreseeable shareholder redemptions in light of the Fund’s redemption obligations under the 1940 Act and any commitments the Fund has made to shareholders; (2) each Fund would be prohibited from acquiring any illiquid security (i.e., a security that cannot be sold or disposed of in the ordinary course of business within seven days at approximately the value ascribed to the security by the Fund) if, immediately after the acquisition, the Fund would have invested more than five percent of its total assets in illiquid securities; (3) each Fund must hold at least 10 percent of its total assets in daily liquid assets (i.e., cash, direct obligations of the U.S. Government, or securities that will mature or are subject to a demand feature that is exercisable and payable in one business day) and at least 30 percent of its total assets in weekly liquid assets (i.e., cash, direct obligations of the U.S. Government, certain other government securities that are issued at a discount and have remaining maturities of 60 days or less, and securities that will mature or are subject to a demand feature that is exercisable and payable within five business days); (4) each Fund’s Board or its delegate must have evaluated the creditworthiness of repurchase agreement counterparties separate and apart from the value of the collateral supporting the counterparties’ obligations under the repurchase agreements; and (5) the Board of each Fund must adopt procedures that include periodic testing, at such intervals as each Board determines appropriate and reasonable in light of current market conditions, of its Fund’s ability to maintain a stable net asset value per share based upon certain specified hypothetical events (e.g., an increase in short-term interest rates, an increase in shareholder redemptions, a downgrade or default on portfolio securities, and widening or narrowing of spreads between yields on an appropriate benchmark selected by the Fund for overnight interest rates and commercial paper and other types of securities held by the Fund). By June 30, 2010: (A) each Fund must maintain a dollar-weighted average portfolio maturity (or “WAM”) appropriate to its objective of maintaining a stable net asset value or price per share, but in no case greater than 60 days; and (B) each Fund’s portfolio must have a dollar-weighted average life to maturity of no more than 120 days.

These amendments to Rule 2a-7 may affect the securities in which the Funds invest and may require the Funds to dispose of certain portfolio securities and purchase replacement securities. As a money market mutual fund that is required to comply with Rule 2a-7, the Hilliard Fund intends to comply with the amendments to Rule 2a-7 for which compliance is required prior to the consummation of the Reorganization in a manner that is consistent with its investment objective. As a money market mutual fund that is required to comply with Rule 2a-7, the Federated Fund also intends to comply with the amendments to Rule 2a-7 by the time compliance with such amendments is required pursuant to Rule 2a-7, as amended, in a manner consistent with its investment objective.

Investment Limitations

The Hilliard Fund and the Federated Fund each have fundamental investment policies which may not be changed without shareholder approval as well as non-fundamental policies which may be changed by the Fund’s Board without shareholder approval. As discussed above, the Federated Fund and the Hilliard Fund are managed using substantially similar investment strategies. Nonetheless, there are differences in the investment policies or limitations of the Funds which are attributable primarily to the fact that the Federated Fund is part of the Federated “family” of funds, and, therefore, has policies that are consistent with other funds in the Federated family of mutual funds. For example, the following policies/limitations of the Federated Fund are non-fundamental, and may be changed by the Federated Fund’s Board without shareholder approval, whereas corresponding Hilliard Fund policies/limitations are fundamental, and may not be changed without shareholder approval: (a) pledging assets, (b) purchases on margin, and (c) illiquid securities and restricted securities. The Hilliard Fund also has several policies/limitations that the Federated Fund does not have. The following table compares the investment policies/limitations of the Hilliard Fund and the Federated Fund:

| INVESTMENT LIMITATIONS |

| Hilliard Fund | Federated Fund |

Diversification of Investments (fundamental) The Fund may not purchase a security if, as a result, more than 5% of the value of the Fund’s total assets would be invested in the securities of a single issuer, except securities issued or guaranteed by the U.S. Government, or any of its agencies or instrumentalities, and repurchase agreements collateralized by such securities. The Fund will not purchase a security if, as a result, 10% or more of the outstanding securities of any class of any issuer would be held by the Fund (for this purpose, all indebtedness of an issuer is deemed to be of a single class), except securities issued or guaranteed by the U.S. Government, or any of its agencies or instrumentalities, and repurchase agreements collateralized by such securities. | Diversification of Investments (fundamental) With respect to securities comprising 75% of the value of its total assets, the Fund will not purchase securities of any one issuer (other than cash, cash items, securities issued or guaranteed by the government of the United States or its agencies or instrumentalities and repurchase agreements collateralized by such U.S. government securities, and securities of other investment companies) if, as a result, more than 5% of the value of its total assets would be invested in the securities of that issuer, or the Fund would own more than 10% of the outstanding voting securities of that issuer. |

Borrowing Money and Issuing Senior Securities (fundamental) The Fund may not borrow money, except as a temporary measure for extraordinary or emergency purposes, and then only from banks in amounts not exceeding the lesser of 10% of its total assets valued at cost or 5% of its total assets valued at market. The Fund will not borrow in order to increase income (leveraging), but only to facilitate redemption requests which might otherwise require untimely disposition of portfolio securities. Accordingly, the Fund will not purchase securities while borrowings are outstanding. | Borrowing Money and Issuing Senior Securities (fundamental) The Fund may borrow money, directly or indirectly, and issue senior securities to the maximum extent permitted under the 1940 Act. |

Investing in Real Estate (fundamental) The Fund may not purchase or sell real-estate (although it may purchase money market securities secured by real estate or interests therein, or issued by companies which invest in real estate or invests therein). | Investing in Real Estate (fundamental) The Fund may not purchase or sell real estate, provided that this restriction does not prevent the Fund from investing in issuers which invest, deal, or otherwise engage in transactions in real estate or interests therein, or investing in securities that are secured by real estate or interests therein. The Fund may exercise its rights under agreements relating to such securities, including the right to enforce security interests and to hold real estate acquired by reason of such enforcement until that real estate can be liquidated in an orderly manner. |

Investing in Commodities (fundamental) The Fund may not purchase or sell commodities or commodity contracts. | Investing in Commodities (fundamental) The Fund may not purchase or sell physical commodities, provided that the Fund may purchase securities of companies that deal in commodities. |

Underwriting (fundamental) The Fund may not underwrite securities issued by other persons. | Underwriting (fundamental) The Fund may not underwrite the securities of other issuers, except that the Fund may engage in transactions involving the acquisition, disposition or resale of its portfolio securities, under circumstances where it may be considered to be an underwriter under the Securities Act of 1933. |

Lending (fundamental) The Fund may not make loans although it may purchase money market securities and enter into repurchase agreements. | Lending (fundamental) The Fund may not make loans, provided that this restriction does not prevent the Fund from purchasing debt obligations, entering into repurchase agreements, lending its assets to broker/dealers or institutional investors and investing in loans, including assignments and participation interests. |

Concentration of Investments (fundamental) The Fund may not purchase a security if, as a result, 25% or more of the value of the Fund’s total assets would be invested in the securities of issuers having their principal business activities in the same industry, provided that this limitation does not apply to obligations issued or guaranteed by the U.S. government, or its agencies or instrumentalities, or to repurchase agreements collateralized by such securities, or to certificates of deposit or domestic bankers’ acceptances. | Concentration of Investments (fundamental) The Fund will not make investments that will result in the concentration of its investments in the securities of issuers primarily engaged in the same industry. Government securities, municipal securities and bank instruments will not be deemed to constitute an industry. |

Pledging Assets (fundamental) The Fund may not mortgage, pledge, hypothecate, or in any other manner transfer as security for indebtedness any security owned by the Fund, except as may be necessary in connection with permissible borrowings mentioned in connection with the borrowing money policy above, and then such mortgaging, pledging, or hypothecating may not exceed 15% of the Fund’s assets, taken at cost; provided, however, that as a matter of non-fundamental operating policy, the Fund will limit any such mortgaging, pledging or hypotheticating to 10% of its assets, taken at market. | Pledging Assets (non-fundamental) The Fund will not mortgage, pledge or hypothecate any of its assets, provided that this shall not apply to the transfer of securities in connection with any permissible borrowing or to collateral arrangements in connection with permissible activities. |

Purchase on Margin (fundamental) The Fund may not purchase securities on margin, except for use of short-term credit necessary for clearance of purchases of portfolio securities. | Purchase on Margin (non-fundamental) The Fund will not purchase securities on margin, provided that the Fund may obtain short-term credits necessary for the clearance of purchases and sales of securities. |

Illiquid Securities and Restricted Securities (fundamental) The Fund may not purchase securities with legal or contractual restrictions on resale (except repurchase agreements) or securities which are otherwise not readily marketable. | Illiquid Securities and Restricted Securities (non-fundamental) The Fund will not purchase securities for which there is no readily available market, or enter into repurchase agreements or purchase time deposits that the Fund cannot dispose of within seven days, if immediately after and as a result, the value of such securities would exceed, in the aggregate, 10% of the Fund’s net assets. The Fund may invest in securities subject to restrictions on resale under federal securities law. |

Invest in Start-up Companies (fundamental) The Fund may not purchase a security, if as a result more than 5% of the value of the Fund’s total assets would be invested in the securities (taken at cost) of issuers which, at the time of purchase, had been in operation less than three years, including predecessors and unconditional guarantors, except investments in obligations issued or guaranteed by the U.S. Government, or any of its agencies or instrumentalities, and repurchase agreements collateralized by such securities. | There is no corresponding Federated Fund policy. |

Non-controlling (fundamental) The Fund may not invest in companies for the purpose of exercising control. | There is no corresponding Federated Fund policy. |

Equity Investments (fundamental) The Fund may not purchase any common stock or other equity securities, or securities convertible into equity securities. | There is no corresponding Federated Fund policy. |

Investing in Securities of Other Investment Companies (fundamental) The Fund may not purchase securities of other investment companies, except in connection with a merger, consolidation, acquisition, or reorganization. | There is no corresponding Federated Fund policy. |

Oil, Gas or Mineral (fundamental) The Fund may not purchase participations or other direct interests in oil, gas, or other mineral exploration or development programs. | There is no corresponding Federated Fund policy. |

Beneficial Interest (fundamental) The Fund may not purchase or retain the securities of any issuer if, to the knowledge of the Fund’s management, those officers and directors of the Fund, and of its investment adviser, each of whom owns beneficially more than .5% of the outstanding securities of such issuer, together own beneficially more than 5% of such securities. | There is no corresponding Federated Fund policy. |

Derivatives (fundamental) The Fund may not invest in puts, calls, straddles, spreads or any combination thereof. | There is no corresponding Federated Fund policy. |

Certain Explanatory Language

The Federated Fund’s SAI includes the following explanatory language concerning its fundamental and non-fundamental investment limitations:

“For purposes of the diversification restriction, the Fund considers certificates of deposit and demand and time deposits issued by a U.S. branch of a domestic bank or savings association having capital, surplus, and undivided profits in excess of $100,000,000 at the time of investment to be “cash items.”

“Except with respect to borrowing money, if a percentage limitation is adhered to at the time of investment, a later increase or decrease in percentage resulting from any change in value or net assets will not result in a violation of such limitation.”

The Hilliard Fund’s SAI includes the following explanatory language concerning its fundamental and non-fundamental investment limitations:

“Operating policies are subject to change by the Board of Directors without shareholder approval. However, the operating policy of investing exclusively in securities issued or guaranteed by the U.S. Government, its agencies or instrumentalities and repurchase agreements collateralized by such securities, which securities (except those covered by repurchase agreements) will mature in six months or less, may be changed by the Board of Directors only if 30 days’ written notice is forwarded to shareholders. Likewise, such notice must be given if the Fund is to change its policy of investing not more than 10% of its total assets in repurchase agreements maturing in more than seven business days.”

“Should the yield differential between the securities in which the Fund invests and other high quality, short-term instruments widen to in excess of 1¾%, J.J.B. Hilliard, W.L. Lyons, LLC (the “Adviser” or “Hilliard-Lyons”) may recommend to the Fund’s Board of Directors that it consider authorizing investments in securities other than those issued or guaranteed by the U.S. Government, its agencies or instrumentalities, or in repurchase agreements collateralized by such securities. The Board of Directors may, at its discretion, but only after 30 days’ written notice to shareholders, authorize this change in investment policy, provided such investments are not prohibited by the Fund’s investment restrictions or by applicable law. If such policy is changed (after 30 days’ written notice to shareholders) the Fund will only invest in the following:

| | (i) | short-term (maturing in one year or less) debt obligations which are payable in dollars, issued or guaranteed by the Federal government, Federal governmental agencies or instrumentalities, or certain banks, savings and loan associations, and corporations; |

| | (ii) | certificates of deposit issued by domestic banks (but not foreign branches thereof) and savings and loan associations which have total assets in excess of $1 billion; |

| | (iii) | bankers’ acceptances or letters of credit guaranteed by U.S. commercial banks having total assets in excess of $1 billion; |

| | (iv) | commercial paper which is rated A-2 or higher by Standard & Poor’s Corporation (“Standard & Poor’s”) or rated P-2 or higher by Moody’s Investors Service, Inc. (“Moody’s”) or, if not rated, will be issued by a corporation having an existing debt security rated AA or higher by Standard & Poor’s or Aa or higher by Moody’s; |

| | (v) | other debt instruments (including bonds) issued by domestic corporations which either mature within one year or have been called for redemption by the issuer, with such redemption to be effective within one year, and which are rated AA or higher by Standard & Poor’s or Aa or higher by Moody’s; |

| | (vi) | obligations issued by other entities, if the obligation is accompanied by a guarantee of principal and interest of a bank or corporation whose certificates of deposit or commercial paper may otherwise be purchased by the Fund; and |

| (vii) | repurchase agreements collateralized by any of the foregoing types of securities. Although securities underlying the repurchase agreements may have maturities longer than one year, no repurchase agreements will be entered into with a duration of more than seven business days, if as a result more than 10% of the Fund’s total assets would be so invested. The Fund has no present plans to change its policy with regard to the types or maturities of the securities in which it invests, and the Fund’s Prospectus will be supplemented to give further information should the Fund’s Board of Directors authorize such a change.” |

Comparison of Risks

All mutual funds take investment risks. Therefore, even though the Funds are money market funds that seek to maintain a stable NAV, it is possible to lose money by investing in either Fund. An investment in the Fund is not insured or guaranteed by the FDIC or any other government agency. Although each Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Funds.

The principal risks of the Funds are substantially the same. As mentioned above, since the Federated Fund may invest in callable securities, it also is subject to call risks. The Prospectus for the Federated Fund also discloses risks associated with investing share purchase proceeds as a principal risk factor for the Federated Fund. The Prospectus for the Hilliard Fund also discloses redemption risk as a principal risk factor for the Hilliard Fund.

The following summarizes the principal risk factors relating to the Funds (which risk factors may reduce the Funds’ performance or affect the Funds’ NAV):

Interest Rate Risks (Hilliard Fund and Federated Fund)