Exhibit (c)(xi)

Announcement Entitled “QTC’s A$ Benchmark Bond Programs—

Impact of Changes to Australian Interest Withholding Tax (IWT) Laws”

QTC’S A$ BENCHMARK BOND PROGRAMS—IMPACT OF CHANGES TO AUSTRALIAN GOVERNMENT INTEREST WITHHOLDING TAX (IWT) LAWS

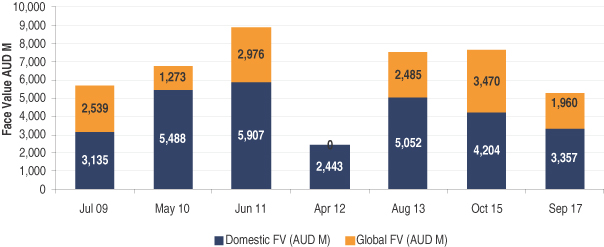

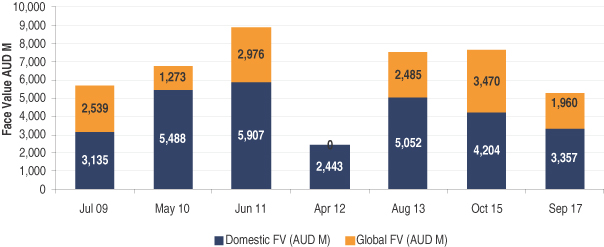

To date, QTC has maintained separate Domestic and Global Benchmark bond programs principally because the ‘public offer test’ IWT exemption did not previously apply to domestic bonds issued in Australia by semi-government authorities. The Global program, where bonds are issued outside of Australia in compliance with the public offer test, therefore enabled offshore investors to invest in QTC Global Benchmark bonds on an IWT exempt basis. The attached chart details QTC Domestic and Global Benchmark bonds on issue as at the end of October 2008.

The new legislative changes to IWT (which is levied by the Australian Government) have now been passed by the Australian parliament. The effect of these changes means that Domestic Benchmark bonds issued by QTC are now eligible for IWT exemption, including those issued to offshore investors.

The new IWT changes will take effect from the date on which the legislation receives Royal Assent from the Governor General and will therefore apply to all Domestic Benchmark bond coupon payments from this date.

Having considered the legislative changes:

| | • | | QTC will continue to maintain its existing Domestic and Global Benchmark bond programs. |

| | • | | QTC confirms that its existing Domestic Benchmark bonds have been issued in a manner that complies with the new IWT law and as such, will be IWT exempt for all types of investors regardless of their residency and tax status. Likewise, new Domestic Benchmark bonds will also be issued in a manner that complies with the new IWT law. |

| | • | | Global Benchmark bonds will continue to be available to QTC’s Fixed Interest Distribution Group (bank intermediaries) on a reverse enquiry basis. Pricing however will be adjusted so that all new issuance will be priced flat (i.e. at par) to QTC Domestic Benchmark bonds of identical maturity and coupon, effective immediately. This pricing is despite the fact that QTC will continue to incur additional costs to maintain its Global program. |

As has previously been the case, Global bonds will continue to be transferable for Domestic bonds (of identical maturity and coupon) by completing an election form and following the transfer procedures set out in QTC’s Global bond prospectus.

QTC has also in the past been approached on a reverse enquiry basis through its Fixed Interest Distribution Group to facilitate switches of bonds (of identical maturity and coupon) between the Global and Domestic Benchmark bond programs. Given that QTC will continue to maintain the Global and Domestic programs following the IWT changes, QTC intends that past practice will continue.

QUEENSLAND TREASURY CORPORATION — LEVEL 14, 61 MARY STREET BRISBANE QLD 4000 — T: +61 7 3842 4600 — F: +61 7 3221 4122 — www.qtc.qld.gov.au

It is QTC’s intention that its funding facilities continue to have maximum appeal to its broad on- and off-shore investor base. QTC believes that the above modifications arising from changes to Australian IWT legislation are consistent with this intention.

In summary:

| | • | | QTC will continue to maintain both Global and Domestic Benchmark bond programs. |

| | • | | Under the new IWT law (taking effect from Royal Assent), all existing and future Benchmark bond issuance under both programs will be exempt from Australian IWT. |

| | • | | New issue pricing will be identical under both programs, effective immediately. |

| | • | | No change to past practice in relation to transferring or switching Benchmark bonds between the two programs. |

Enquiries

Please direct any questions or comments to:

Richard Jackson, General Manager Financial Markets

Phone: +61 7 3842 4770

rjackson@qtc.com.au

Mike Gibson, Senior Portfolio Manager

Phone: +61 7 3842 4775

mgibson@qtc.com.au

Regards,

Richard Jackson

General Manager, Financial Markets

Not an Offer of Securities for Sale in the United States

This announcement is not an offer of securities for sale in the United States. Securities may not be offered or sold in the United States absent registration under the U.S. Securities Act of 1933 (as amended) or an exemption from registration. Any public offering of securities in the United States will be made by means of a prospectus that contains detailed information about QTC and its management, as well as financial statements.

QUEENSLAND TREASURY CORPORATION — LEVEL 14, 61 MARY STREET BRISBANE QLD 4000 — T: +61 7 3842 4600 — F: +61 7 3221 4122 — www.qtc.qld.gov.au

Attachment:

|

| QTC A$ Benchmark Bond Outstandings as at 31 October 2008 |

|

|

QUEENSLAND TREASURY CORPORATION — LEVEL 14, 61 MARY STREET BRISBANE QLD 4000 — T: +61 7 3842 4600 — F: +61 7 3221 4122 — www.qtc.qld.gov.au