EXHIBIT (c)(xvi)

Queensland’s Budget Papers for 2009-10

Exhibit (c)(xvi)

APPROPRIATION BILL 2009

(Second Reading Speech, 16 June 2009)

TREASURER

The Honourable Andrew Fraser MP

Treasurer and Minister for Employment

and Economic Development

APPROPRIATION BILL 2009

(Second Reading Speech, 16 June 2009)

TREASURER

The Honourable Andrew Fraser MP

Treasurer and Minister for Employment

and Economic Development

Mr Speaker,

I move that the bill be now read a second time.

“The scope and need for … development are obvious to all. In addition to creating assets of value to the community, the utilisation of funds for these purposes relieves unemployment in a most effective manner. Business is stimulated by the circulation of increased purchasing power which, in turn, augments demand for consumable goods.”

This statement in Treasurer Forgan Smith’s 1933 Budget Speech rings true more than 75 years later as the 2009–10 State Budget is introduced.

This is a Budget about the future.

It is not about tomorrow, but the future beyond.

It is the first Budget of a newly constituted government.

It is delivered at a time of immediate upheaval and uncertainty, but delivered with a focus on sustainability in the decades ahead.

It is a Budget that has a dual task—to support the economy during this time of need, and to chart a course for a new future beyond these dark hours.

ECONOMIC AND FISCAL OUTLOOK

Mr Speaker, there is almost universal acceptance that the globe is experiencing the most severe financial crisis since the 1930s.

The synchronised and rapid deterioration that swept the globe will see global output contract for the first time since the Second World War.

Twelve months ago Queensland’s major trading partners were forecast to grow by 3 1/2%, today they are forecast to contract by 3% in 2009.

Our major trading partner, Japan, has recorded four consecutive quarters of negative growth.

South Korea, Taiwan, the United States, the United Kingdom, the Netherlands and Brazil are all in our top ten trading nations … and all are in recession.

1

The International Monetary Fund (IMF) forecasts the average unemployment rate of advanced economies will reach 9.2% in 2010.

The synchronicity of the collapse in global demand has been countered by a synchronicity of effort by governments and central banks alike.

Significant fiscal stimulus in concert with monetary policy easing has sought to inject and invite demand.

Australia has been a stand out performer amongst our peers—before and since the global recession.

And Queensland has stayed ahead of the nation.

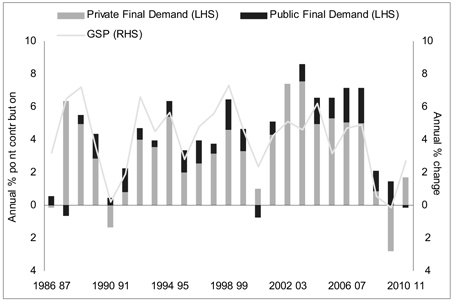

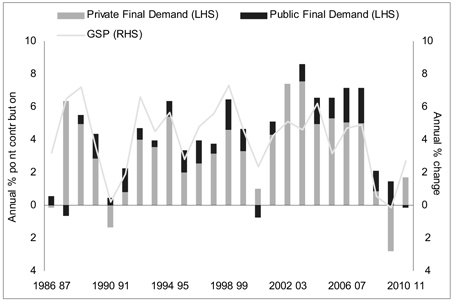

We have been out in front for 12 years, growing ahead of the nation and we are set to close off this most tumultuous of years with positive—albeit marginal—growth of 1/2%.

Just as the nation expects to enter into a sustained period of contraction next year, we expect to see the Queensland economy also experiencing negative growth.

The Queensland economy is forecast to contract by 1/4% in 2009–10. Once again, this forecast would see our economy outperforming the nation.

Our modern, diversified economy has provided capacity to absorb the full effects. Western Australia, which is more reliant on resources, is forecast to contract by 1 1/4%.

Growth in Queensland is forecast to return the following year, but remain below trend.

Our economy has been buffeted by the global recession, and the roughest seas remain ahead.

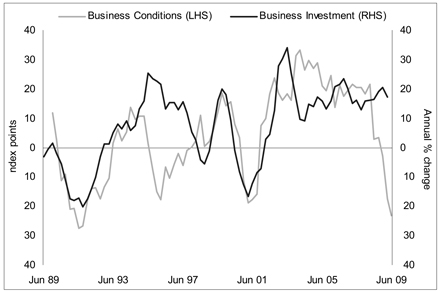

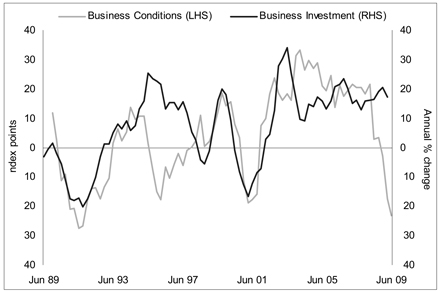

After tripling over the last eight years, business investment is expected to fall by 17% in 2009–10. The last echoes of the boom that have sustained the economy through most of this financial year are now fading.

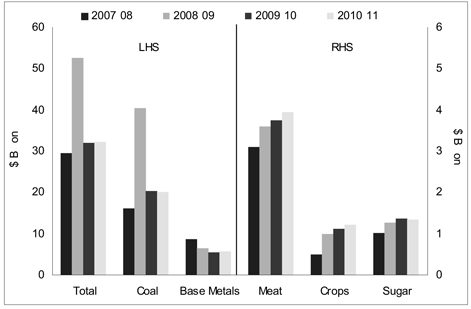

Apart from our agricultural sector, which has experienced the natural disaster and the natural wonder of flooding rains, our export outlook is challenging.

By far the starkest numbers in our economic outlook are those on forecast unemployment. The economy continues to shed jobs.

While our unemployment rate remains half a per cent better than the nation, unemployment is expected to rise, relentlessly and remorselessly … as it has through this year, as it will through next year.

Unemployment for 2008–09 is expected to remain in line with the forecast at February’s Economic and Fiscal Update of 4 1/4% for the year, and is now forecast to be 6 1/2% in 2009–10.

Unemployment is now expected to reach 7 1/4% the year after next, and is forecast to be at that rate through most of 2010–11.

2

In starker, human terms, we will see Queensland’s unemployment queue stretch to 175,000 people. That’s 175,000 individual tragedies … with impacts that extend beyond the individual to their families, their children.

It is our society that bears the human and financial cost, and we must fight against it.

These are the 175,000 reasons the Government does not resile from its commitment to funding a building program to generate demand and generate jobs—and build for the future.

Fiscal Outlook

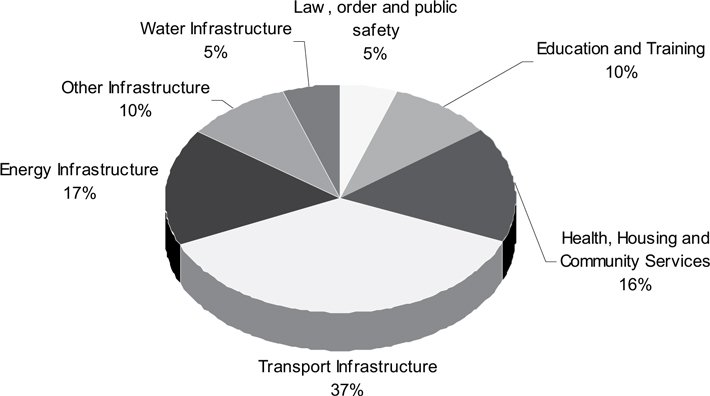

At the centre of this Budget and at the centre of the Government’s immediate economic strategy, is a massive $18.2 billion capital works program.

The program will be maintained against the colossal drop in forecast revenue of more than $15 billion across the forward estimates.

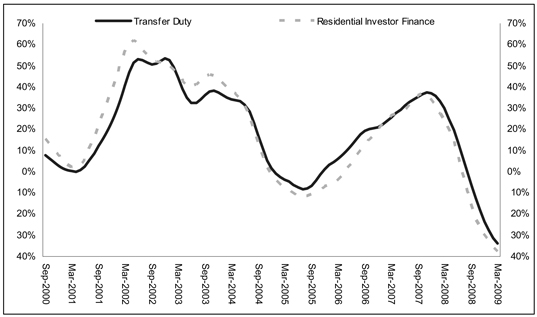

Our revenues from transfer duty, GST and royalties have taken a battering.

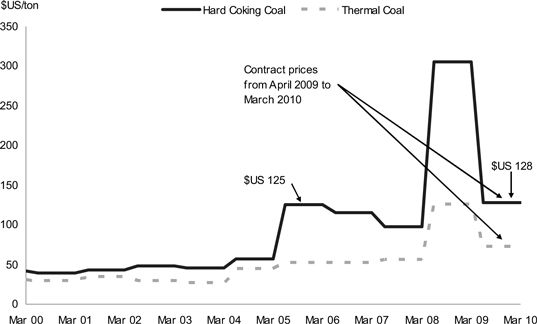

Royalty revenue, never forecast to stay at record highs, has been written down further as contracts have settled and the Australian dollar has appreciated.

As private sector investment evaporates it is this public investment, undertaken in partnership with the Federal Government that will provide support to the economy.

This is a deliberate strategy by the Government to support the economy and generate jobs. It is a deliberate strategy that recognises current economic circumstances.

The budgeted injection of $18.2 billion—when the economy needs it most—necessarily means we need to make longer-term decisions to provide stability to the State’s finances.

Our capital program will need to adjust in the future to match the economic circumstances of the future.

The Government is also adopting a deliberate strategy to return the budget to surplus.

It is Labor in government that has delivered surplus budgets, Labor in government that has overseen our economy outperform the nation, Labor in government that has driven unemployment down and kept it below the national rate.

With the revenue wipe-out, the Budget has been forced into deficit through the forward estimates.

The 2008–09 estimated actual balance is a deficit of $574 million, which is almost $1 billion better than forecast in February. The Budget forecasts a negative operating balance of $1.954 billion for the year ahead, around $1 billion better than that forecast in February.

3

Mr Speaker,

The 2009–10 Budget provides for $5.4 billion of measures that commence the turnaround of the State’s finances.

The abolition of the fuel subsidy contributes $2.4 billion.

While some measures have immediate impact, others are about long-term structural reform that will deliver benefits beyond the forward estimates and for years to come.

Under the new Financial Accountability Act 2009, the Government is required to adopt a Charter of Fiscal Responsibility, including the need to have Fiscal Principles.

This Budget not only adopts immediate measures, it sets out the framework that will return the Budget to surplus into the future.

Our 5-year Renewing Queensland Plan is central to our medium-term fiscal strategy.

The current and future balance sheet of the State will benefit from the proposed transactions.

Under the plan, whole-of-state balance sheet debt will be reduced, and the net proceeds will be applied in the General Government sector to assist in the future funding of service delivery infrastructure.

For the advancements in lifesaving medical treatments not yet imagined, for the educational technology not yet created and for the clean energy sources not yet developed, we need to look to the future and to move forward.

We need to move forward, beyond those things government currently does because it always has, to fund the priorities of the future.

The plan is central to our commitment to stabilise the State’s balance sheet, and the Government will move forward to legislate the plan with this Budget.

As part of our resolve, we also are adopting a commitment to contain future expenditure growth to real per capita levels. This is a fiscal discipline necessary to build the path back to balance and means expenditure growth beyond inflation and population growth will not be adopted.

The maintenance of a competitive tax regime is important in encouraging investment and in encouraging future growth and the Government reaffirms that commitment for the future.

We affirm this with our commitment to maintain the lowest payroll tax rate in the nation.

We affirm this with our commitment to exclude apprentice and trainee wages from payroll tax and extend a rebate of a further 25% on these wages. This measure will provide relief for the year ahead and assist businesses to keep apprentices and trainees during the tough times ahead.

4

I also announce further relief for business with the extension of the terms for land tax payments for 2009–10, paving the way for the introduction of an instalment payments regime the following year.

We are committed to returning the Budget to surplus by 2015–16. This Budget begins the task of delivering on that commitment.

It begins, but does not complete that task. This will be an ongoing quest.

The Budget also includes other important structural reforms.

An overhaul of local government subsidy programs will see future subsidies targeted at councils most in need. An additional $127 million is provided over the next two years to fund a program of significant works with a new capped scheme to be introduced from 1 July 2011.

Our farsighted local government reforms were implemented to make councils stronger, and this reform aligns future funding with future need.

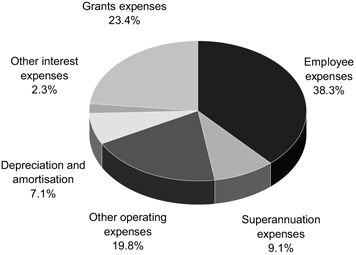

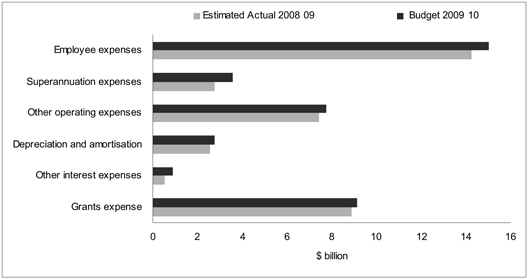

As essential service providers, state governments around the nation expend half their entire budget on employee costs: on teachers and school cleaners, nurses and orderlies, police and court wardens and land titles clerks.

$18.6 billion of the $39 billion allocated is required for wages, superannuation and other costs of the workforce that serves Queensland.

We are a Labor government—a government that will honour the agreements it has with its employees. We will honour wage agreements, reached in good faith.

We will also honour our commitment to lead by example in superannuation, because it is the right thing to do for the long term sustainability of our nation as we strive as a nation to fund secure retirement incomes for all Australians.

We will honour those commitments provided in the past, but it must be recognised that the future landscape has changed.

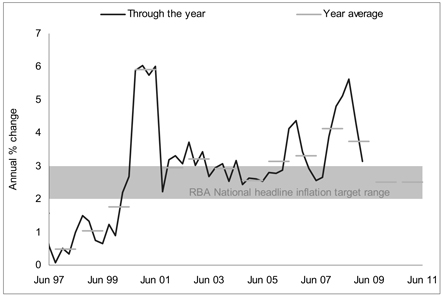

The Government will provide that for current year negotiations not agreed by 1 September, a new wages policy of 2.5% will apply—the mid-point of the Reserve Bank’s target band for inflation.

The policy will be resolutely applied and effective on 1 July for all senior public servants. The wages freeze for Members of Parliament remains in force.

Visiting a renewed discipline upon government is important in charting a course for budget sustainability.

5

The 2008–09 Budget set a $60 million efficiency dividend, due to rise to $180 million for 2009–10. The Budget I present today sees the Government bring forward a planned additional $100 million in targeted savings originally planned to commence from 2010–11.

Total savings of $280 million form part of the 2009–10 Budget—to garner the benefits from our overhaul of the Public Service structure. The savings are set across the board and represent a bringing forward of our target for 2010–11.

The reforms in this Budget set a course. It is a course that will require vigilance and further actions in the future. The reforms begin the task of returning the Budget to balance and improve our credit rating.

The immediate priority must be on funding a building program to support jobs and support our economy, when it needs it most.

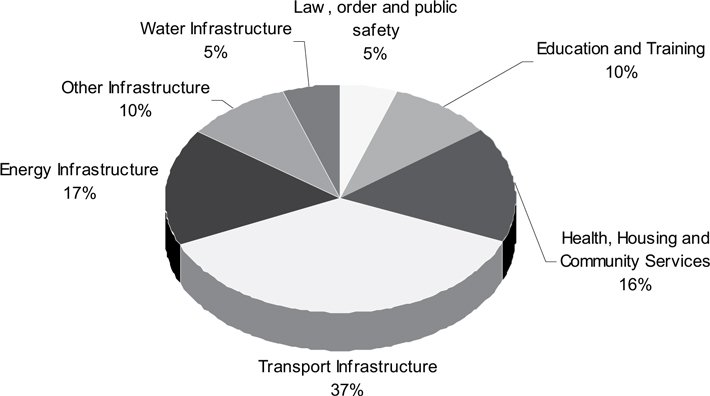

$18.2 BILLION BUILDING PROGRAM

Our capital program is doing the heavy lifting on infrastructure investment. It alone is more than the combined total of the infrastructure spend planned by Victoria, South Australia and Tasmania.

The Budget proposes a building program that will support 127,000 jobs across Queensland.

It is a building program that will create jobs, support demand and deliver the platform for future growth.

The program’s breadth is aimed at the full force of the downturn delivered unto us from the global recession.

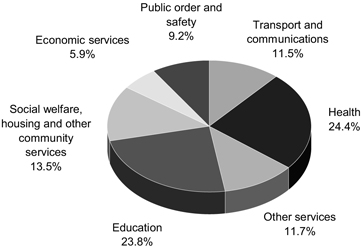

Health and Hospitals

It’s an $18.2 billion program that continues, not cuts, our hospital building program.

Investment in hospital and health facilities accounts for about $1.3 billion of capital works spend this year.

$155 million will be spent on the Gold Coast University Hospital as construction works will see it begin to take shape through the year, and an additional $80 million is allocated for a research facility to be built as part of the new Queensland Children’s Hospital.

The development of the Sunshine Coast University Hospital, proposed for development in partnership with the private sector, will commence with more public beds provided sooner than originally planned.

6

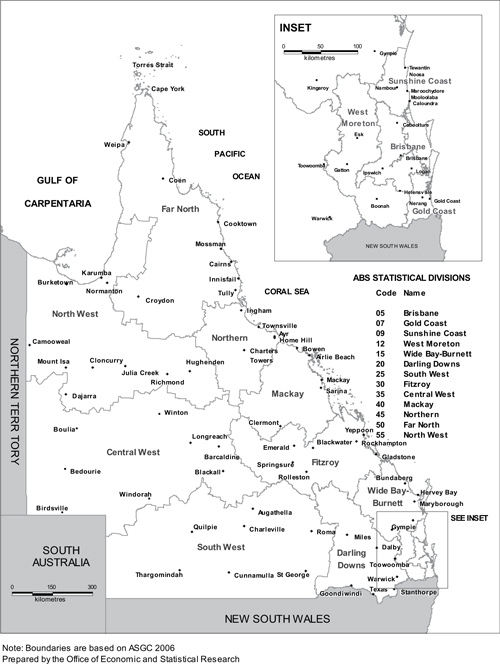

The new Mackay Hospital will begin to take shape this year with a spend of $61 million. We will move ahead on the upgrades of the Cairns and Mount Isa hospitals. The expansions of Townsville and Rockhampton hospitals are funded—and funded in partnership with a federal government that puts money into building hospitals.

Health capital works are underway across the State, including the expansions of Bundaberg Hospital and Robina Hospital, projects nearing completion at Ingham and Yeppoon hospitals and work commencing this year on the birthing centre at Toowoomba Hospital.

Roads and Transport

Our massive program of transport infrastructure capital works will also continue. The expansion of the coal terminal at Abbot Point continues under our commitment to business as usual with another $305 million in this Budget.

The Cairns cruise terminal facility has $11 million allocated by this Budget, as we deliver on our commitment to the people of Cairns and the tourism industry upon which they rely.

The long awaited Port Access Road—which will benefit Townsville residents and their economy alike—has $47.3 million allocated in 2009–10.

The Townsville Ring Road to Shaw Road has been finished and the Douglas Arterial duplication is to begin.

The $100 million Bundaberg Ring Road will be completed.

The State Budget will contribute $464 million to build the Gold Coast Rapid Transit project, with the Commonwealth providing $365 million and the Gold Coast City Council contributing $120 million.

We will also provide funding towards the Cooroy to Curra upgrade on the Bruce Highway—a notorious blackspot on the national highway.

The $315 million new Houghton Highway Bridge goes $125 million further across the bay this year, and the second Gateway Bridge goes $259 million higher above the river.

Roadworks on the Roma–Taroom Road, on the Aramac–Torrens Creek Road and on the Carnarvon Highway will be completed and $4.4 million is allocated to the widening of the Flinders Highway west of Charters Towers.

The realignment of the Dawson Highway at Calliope goes $36 million further and the widening of the Maryborough–Hervey Bay Road has $16 million allocated.

Fittingly, the duplication of the Forgan Bridge in Mackay has $37 million allocated as part of our record building program.

7

Construction of the $466 million Eastern Busway from Buranda to Coorparoo and the $735 million Northern Busway from Enoggera Creek to Kedron will continue as we build the public transport infrastructure to sustain our growth.

Essential Infrastructure—Delivering More Jobs

The $600 million Supreme and District Court complex, which will support almost 5,000 jobs in total, is allocated $152 million this year.

The expansion of Lotus Glen Correctional Centre in far North Queensland, which will provide on-site jobs for about 250 construction workers, and the new Gatton women’s prison will have a combined $363 million spent on construction this year.

The Cleveland Youth Detention Centre in North Queensland will generate jobs and demand in Townsville with a $74 million spend this year.

The $348 million Wyaralong Dam kicks off in earnest with $171 million of expenditure this year, while construction will continue on the $187 million Toowoomba to Wivenhoe pipeline.

Across the board the building program is delivering jobs today, and the platform for growth for the future.

Immediate jobs for long term prosperity.

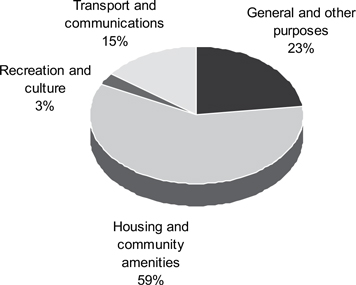

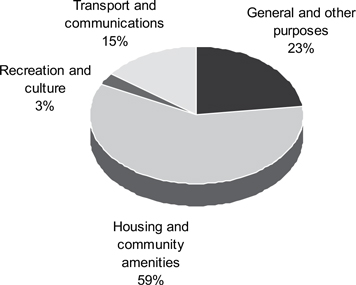

GENERATING JOBS IN HOUSING

Mr Speaker,

The single largest injection into public housing in the State’s history will be funded in this Budget including a $140 million allocation from the Future Growth Fund to support the Australian Government’s stimulus package.

This will add more than 4,000 to the housing stock in this State over the next three years.

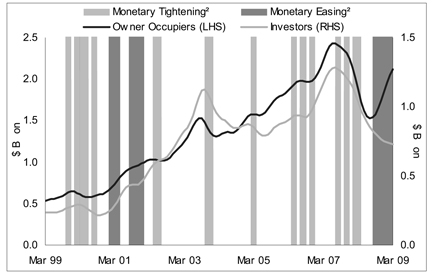

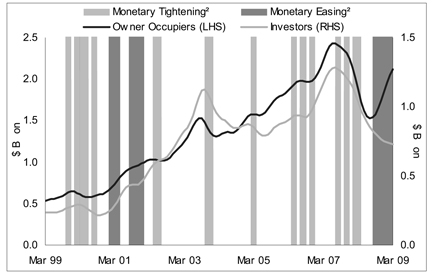

Boosts to the First Home Owner Grant and our nation-leading reforms abolishing stamp duty for first home buyers all the way to $500,000 have supported demand at the all important entry-level of the market.

States like Victoria and South Australia have implemented sleight of hand temporary boosts to the First Home Owner Grant.

These states still take more than they receive by whacking the first home owner with tens of thousands of dollars in stamp duty.

This Government has taken the lead—and we intend to stay there.

Today I announce we will continue on our quest to help young Queenslanders into their first homes.

8

We will abolish stamp duty for vacant land for first home buyers who purchase land to build their first home up to $250,000.

And we will extend the concession to land up to a value of $400,000—ensuring Queenslanders who choose to build their first home rather than buy will benefit.

This move will bring the cost of our stamp duty abolitions for first home buyers to around $250 million in 2009–10.

That’s $250 million that could be added back to the bottom line.

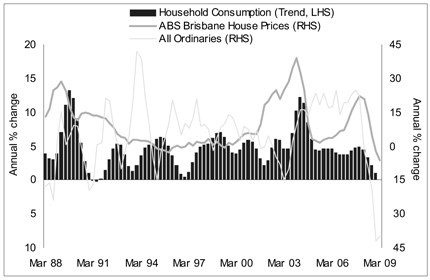

First home buyers today are the fastest growing proportion of the market—at around 30% of all home purchases—our reforms are directly aimed at stimulating the housing sector. And housing construction, means jobs, apprenticeships and traineeships.

Private dwelling investment was clubbed by the high interest rates of 2008 and the global recession has made sure it has stayed on the canvas.

Along with our continued quest to stimulate the market, we will oversee the $1.45 billion budgeted for construction and upgrades of social housing.

This unprecedented program will not only provide a roof over the heads of many of Queensland’s most needy, the work generated will help keep a roof over the heads of thousands of construction workers and their families.

FRONTLINE SERVICES FOR A GROWING POPULATION

Mr Speaker,

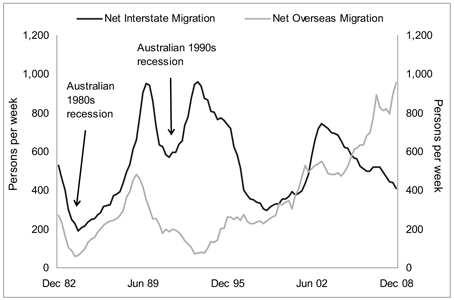

As we pause this year to celebrate our 150th year, the rush to join us continues.

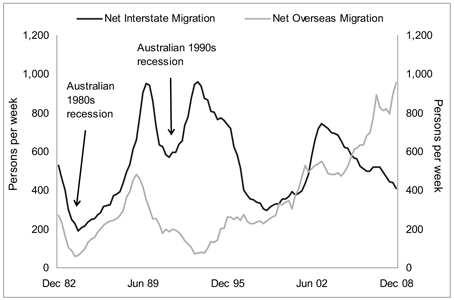

Data released this month confirmed that our population grew by more than 2,000 people per week on average over 2008.

Our population continues to swell as the State’s warm embrace captures more hearts.

These days we seek also to capture their minds. In fact, in the last decade, the number of researchers in Queensland has increased by 55%.

It is why we are investing in projects such as the Translational Research Institute at the Princess Alexandra Hospital. Our $100 million commitment, along with $140 million from the Australian Government, will establish an Australian first—a one-stop shop for the discovery, production and clinical testing of new biopharmaceuticals and treatments.

Population growth means we need more frontline workers, not fewer. It means we need more teachers, more police, more ambulance officers.

This Budget does just that—it provides for 350 more teachers and teacher aides, 203 more police and another 50 ambulance officers. It provides for 645 more doctors, nurses and health practitioners.

9

Seven new schools over the next three years are to be built to cater for growth in expanding communities, including on the Gold and Sunshine Coasts and in the booming western corridor.

We will increase teacher aide hours and dedicate $20 million to improve literacy and numeracy, with 80 dedicated coaches, summer schools and more resources for those in danger of falling behind.

A new Leadership Centre for school principals will be established, to provide our principals with the best chance to develop their skills and lift school performance.

The 203 additional police funded in this year’s Budget will expand the ranks of a police force which has grown to 10,000 to serve our growing State.

Only under Labor has our police-to-population ratio been brought to the national average and we intend to keep it there.

New stations will be completed at Carseldine, Crestmead, Reedy Creek/Robina, Sippy Downs and Springfield and works will commence or progress on replacement stations at Murgon, Lockhart River, Camp Hill/Carina, Fortitude Valley and Charleville.

As 20 ambulance stations will be constructed or redeveloped, so too will nine fire stations. One hundred and fifty new ambulance vehicles, 23 new fire trucks and 34 rural fire service vehicles are also funded.

Our rural fire service will gain more resources to improve safety as we honour our election commitment.

The Government wants to ensure the appropriate resourcing of our rural fire service in particular and will commence a review of rural fire service funding and the fire levy system this year.

We are also providing resources to some of our hardest working, and most important Queenslanders. Community sector workers who care and support some of our most vulnerable Queenslanders, the frail elderly, the disabled and the unwell, have recently had the value of their work recognised by the independent Queensland Industrial Relations Commission.

The single biggest allocation of additional resources in this Budget—some $414 million across four years—is provided to support the community sector to continue their essential work.

We will also assist older Queenslanders by increasing the subsidy available for electricity bills by 15.67% to assist with the increased cost of electricity. This increase is being funded by redirecting $6.7 million that was being paid to local governments to subsidise costs for street lighting.

Tough times mean choices have to be made. This Budget makes those choices.

10

FUNDING SET ASIDE—FOR THE FUTURE

Mr Speaker,

In recent years the Government has established a number of important funds, and prudently set aside money for priorities.

The Queensland Future Growth Fund was established with more than $3 billion and this Budget provides allocations not only to housing as outlined already, but to the development of clean coal technology vital to the future of our economy and our environment.

The Future Growth Fund will maintain a balance in excess of $1 billion as at 30 June 2010 and continues to earn interest for the benefit of future allocations.

The $50 million Renewable Energy Fund was established to support research and development for new forms of energy and today I announce a significant disbursement as we invest in the green energy solutions of the future:

| | • | | $9.3 million for a new geothermal power station at Birdsville and for mapping potential geothermal sites closer to the coast; |

| | • | | $9 million for the Mackay Sugar co-generation project; and, |

| | • | | $7.5 million for a project with CSIRO, subject to gaining an industry partner, for SolarGas One, the world’s first solar multi-tower array system using SolarGas technology. |

Along with implementing our Solar Hot Water program, these initiatives are directed firmly at providing cleaner, greener ways to power our future development.

The Climate Change Fund provides a funding stream of $30 million per annum to assist in meeting the other great challenge of our time—moving to a low carbon economy.

Today I announce a range of initiatives that will form part of our future agenda on dealing with, and adapting to, the reality of climate change.

We will build on the success of our ClimateSmart Home service with an allocation of $15 million over four years for the ClimateSmart Business Service.

The new service will be developed this year to assist small-to-medium sized Queensland businesses save energy and reduce their greenhouse gas emissions in the lead up to the planned introduction of a Carbon Pollution Reduction Scheme in 2011.

We will also invest $8 million over four years to increase the energy efficiency of government buildings and set aside $15.6 million for assisting with preparedness for natural disasters made more likely by climate change.

11

Last year I established a $70 million Prevention and Early Intervention Incentives Pool to drive innovative policy proposals aimed at preventing avoidable costs—human and financial.

Simply put, we must seek out new interventions to prevent the tragic cycles which are so unimaginably costly to individuals, families, communities and their government.

Today I announce a range of projects totalling $28.3 million over three years, which will trial, test and evaluate new ideas, new modes of service delivery and new approaches to some age-old problems.

Community-based housing for young people with a mental illness will seek to treat symptoms early before young people and their families are swept into a tragic spiral that can lead to a lifetime in and out of acute care at immense cost to the individual and to our health system.

A pilot program to intervene early in new domestic violence cases will seek to avoid the confronting reality that episodes are rarely a one-off.

Not only will families avoid the incalculable harm, we seek also to avoid the other costs—call outs with further demands on social, health and emergency services.

Two separate programs will seek to avoid the costs of the cycle of recidivism. Offenders with cognitive or developmental disorders who otherwise will likely cycle through the justice system regularly at immense cost, and without benefit, will be targeted along with juvenile offenders at risk of homelessness and a likely life of offending. Securing jobs for these young offenders will be the frontline task.

The largest allocation is for an $8.7 million program in the Logan area to improve literacy and numeracy outcomes at low socio-economic schools through new and innovative approaches, including supporting parents to improve their parenting skills and literacy and numeracy skills to help break the typical cycle.

Other projects seek to trial new ways of avoiding ongoing costs in the ambulance and health systems, in child protection and in disability services.

Not all will get the results we might hope. But through these pilots and these trials we seek not only to avoid the human costs of violence, neglect and lack of support but to avoid the inevitable cost to the public of dealing with the consequences.

If we can prevent and avoid the costs—human and financial—we will do a great service to many individuals and families but also the community that otherwise bears the costs of social intervention services.

The demands on government services have substantially increased over the last two decades in particular. This funding is about providing sustainable services for the future, not just picking up the pieces afterwards, and the bill.

12

These funds—the Future Growth Fund and the Renewable Energy Fund, the Climate Change Fund and the Prevention and Early Intervention Incentives Pool—make possible these investments at a time of fiscal rectitude.

By setting aside these funds for the future we have provided ourselves with the opportunity to fund initiatives to deal with the challenges of our future: environmentally, socially and economically.

They are the hallmark of a government determined to face up and confront our many challenges, as we look far ahead.

CONCLUSION

Mr Speaker,

The framework set down by this Budget and the bills I introduce today are the most significant structural reforms to the State’s finances since the Second World War.

Together the bills seek to address the ravages of a global recession not seen since the Great Depression.

This is a Budget that reinforces our determination to build Queensland’s future.

… our determination to build Queensland, to build the roads, the schools, the hospitals that our growing State needs.

… our determination to create jobs for Queenslanders with our record building program.

… our determination to keep pace with the essential services needed by a young and growing State with more nurses, more police, more teachers and frontline workers.

… our determination to apply fiscal discipline and make the tough decisions to put the State’s finances on the pathway to surplus.

… our determination to keep our eye firmly on the future as we deal with the immediate challenges.

This Budget lays the foundation stones for the path that lies ahead.

Paved with uncertainty, we should—indeed we must—be optimistic about the fundamental strengths of the ground on which we build.

We are building here for the future.

We are building now for the future.

Building upon our strengths.

For a time ahead, beyond the current hour, when the path is clearer and our bright future is forever the destination ahead.

I commend the Bill to the House.

13

2009–10 State Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

5. Service Delivery Statements

Budget Highlights

The suite of Budget Papers is similar to that published in 2008–09.

In March 2009, machinery-of-Government changes saw the creation of 13 departments reporting to 18 Ministers.

These new arrangements have required minor changes to how information is presented in some Budget Papers. In particular, Budget Paper No. 5—Service Delivery Statements is now presented on a departmental rather than a Ministerial basis.

The 2009–10 Budget Papers provide continuity of information between the previous departmental structure and the new arrangements. Future budget papers will present information, including financial statements, only from a whole-of-department point of view.

The Budget Papers are available online at www.budget.qld.gov.au or they can be purchased through The Queensland Government Bookshop, individually or as a set. Please phone (07) 3883 8700 (1800 801 123 for callers outside of Brisbane).

© Crown copyright

All rights reserved

Queensland Government 2009

Excerpts from this publication may be reproduced, with appropriate

acknowledgement, as permitted under the Copyright Act.

Budget Strategy and Outlook

Budget Paper No.2

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

STATE BUDGET

2009-10

BUDGET STRATEGY AND

OUTLOOK

Budget Paper No. 2

TABLE OF CONTENTS

| | | | |

| 1 | | Overview – Medium Term Fiscal Strategy | | 1 |

| | |

| | Fiscal Strategy | | 2 |

| | Path Back to Surplus | | 15 |

| | |

| 2 | | Economic Performance and Outlook | | 16 |

| | |

| | External Environment | | 17 |

| | The Queensland Economy | | 22 |

| | |

| 3 | | Budget Performance and Outlook | | 40 |

| | |

| | Summary of Key Financial Aggregates | | 41 |

| | Budget Outcomes 2008-09 | | 42 |

| | Budget 2009-10 and Outyear Projections | | 45 |

| | Reconciliation of Net Operating Balance | | 48 |

| | |

| 4 | | Economic Strategy | | 49 |

| | |

| | Framework for Sustaining Jobs and Positioning for Economic Recovery | | 49 |

| | Delivering Jobs for Queensland | | 50 |

| | Investing in Infrastructure | | 52 |

| | Investing in Skills and Innovation for the Future | | 54 |

| | Responding to Climate Change | | 57 |

| | The Smart Regulation Reform Agenda | | 61 |

| | |

| 5 | | Public Non-financial Corporations Sector | | 63 |

| | |

| | Net Flows to Government | | 65 |

| | Asset Sales Program | | 67 |

| | Capital Structure Review | | 69 |

| | Implementation of GOC Reforms | | 70 |

| | Transport Sector | | 72 |

| | Energy Sector | | 79 |

| | Water Sector | | 82 |

| | Forestry | | 84 |

| | | | |

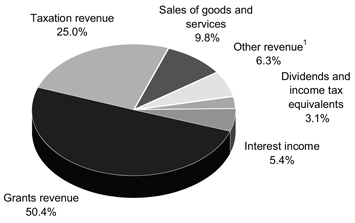

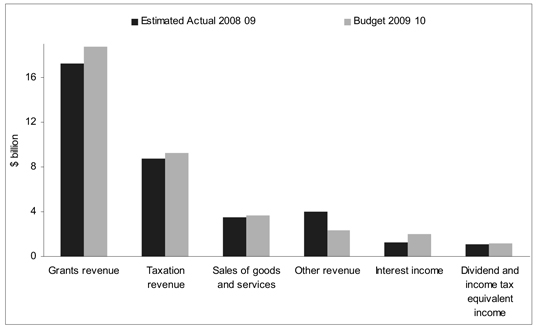

| 6 | | Revenue | | 85 |

| | |

| | Introduction | | 86 |

| | Reductions in Revenue Since the 2008-09 Budget | | 88 |

| | Revenue by Operating Statement Category | | 92 |

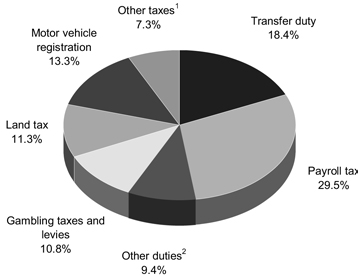

| | Taxation Revenue | | 94 |

| | Queensland’s Competitive Tax Status | | 102 |

| | Grants Revenue | | 105 |

| | Sales of Goods and Services | | 107 |

| | Interest Income | | 109 |

| | Dividend and Income Tax Equivalent Income | | 110 |

| | Other Revenue | | 111 |

| | |

| 7 | | Expenses | | 113 |

| | |

| | Introduction | | 113 |

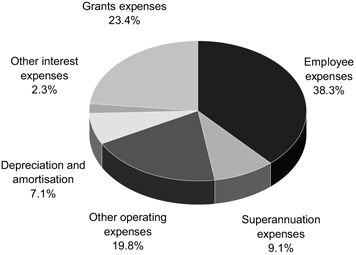

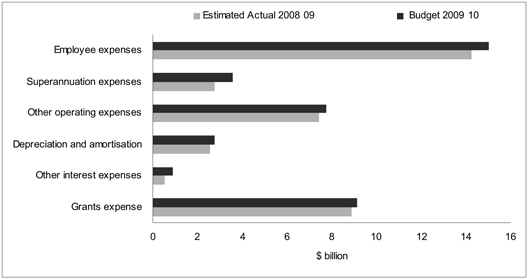

| | Expenses by Operating Statement Category | | 115 |

| | Details of Expenses | | 117 |

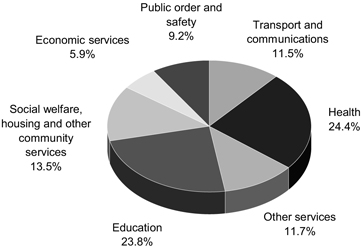

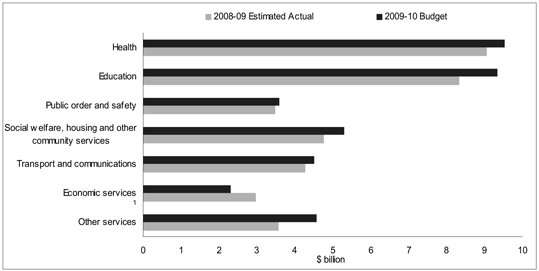

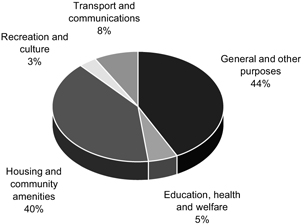

| | Operating Expenses by Purpose | | 120 |

| | Departmental Expenses | | 124 |

| | |

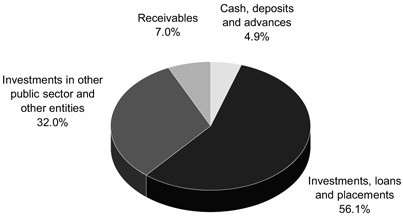

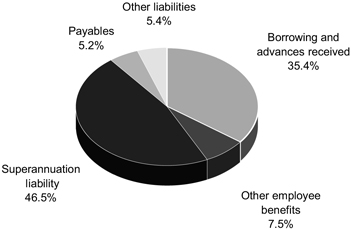

| 8 | | Balance Sheet and Cash Flows | | 127 |

| | |

| | Introduction | | 127 |

| | Balance Sheet | | 128 |

| | Cash Flows | | 134 |

| | Reconciliation of Operating Cash Flows to the Operating Statement | | 142 |

| | |

| 9 | | Intergovernmental Financial Relations | | 143 |

| | |

| | Federal Financial Arrangements | | 144 |

| | COAG Reform of Australian Government Payments | | 149 |

| | Nation Building and Jobs Plan | | 153 |

| | Payments for Specific Purposes by Function | | 153 |

| | GST Revenue Payments | | 156 |

| | Other Commonwealth Payments | | 162 |

| | Review of Australia’s Tax System | | 163 |

| | State-Local Government Financial Relations | | 164 |

| | | | |

| 10 | | Uniform Presentation Framework | | 167 |

| | |

| | Introduction | | 167 |

| | General Government Sector | | 167 |

| | Public Non-financial Corporations Sector | | 168 |

| | Uniform Presentation Framework Financial Information | | 171 |

| | Reconciliation of Net Operating Balance to Accounting Operating Result | | 181 |

| | General Government Time Series | | 182 |

| | Other General Government UPF Data | | 183 |

| | Contingent Liabilities | | 189 |

| | Background and Interpretation of Uniform Presentation Framework | | 190 |

| | Sector Classification | | 195 |

| | Reporting Entities | | 196 |

| |

Appendix A – Tax Expenditure Statement | | 199 |

| |

Appendix B – Concessions Statement | | 206 |

| 1 | OVERVIEW – MEDIUM TERM FISCAL STRATEGY |

Framing a budget in an environment of falling revenues and continuing uncertainty is challenging. Queensland, like other economies around the world and in Australia, has been significantly impacted by the global economic downturn. Since the 2008-09 Budget, this downturn has stripped $15 billion off the forward estimates of the State’s key revenue streams of royalties, taxes and GST. Understandably this has had a significantly negative impact on Queensland’s operating position, with the State

forecasting deficits across each of the Budget and forward estimate years.

While current economic conditions prevail, the Queensland Government’s objective is to continue to invest in infrastructure to sustain jobs. The 2009-10 Budget does this with a projected 2009-10 capital program of $18.2 billion which is forecast to support 127,000 full-time jobs.

However, the Government also recognises the need to ensure the health of the Queensland economy in the medium and longer term and is cognisant of the part played by sound financial management and fiscal sustainability in supporting this growth. As a result, the Government has implemented a number of measures that are aimed at improving Queensland’s fiscal position. Key initiatives in this Budget include:

| • | | revised fiscal principles including a commitment to return to surplus |

| • | | abolition of the Queensland Fuel Subsidy Scheme |

| • | | further public sector efficiency measures which leverage off savings from the recent machinery of government changes |

| • | | reform to local government grants and subsidy programs |

| • | | revision to the Government’s wages policy |

| • | | changes to procurement policy |

| • | | a comprehensive program of asset sales. |

These are in addition to the following measures, announced since the 2008-09 Budget:

| • | | Government-owned corporation reform |

| • | | closure of the defined benefits scheme |

| • | | taxation measures announced in December 2008. |

The total value of these initiatives, excluding asset sales, is around $5.4 billion over four years.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 1 |

FISCAL STRATEGY

Revised fiscal principles

The unprecedented economic and financial conditions arising from the global financial crisis have had significant adverse effects on the State’s financial position. In this environment, the Government has adopted a new fiscal strategy, setting out how it will restore Queensland’s traditionally strong financial position, while maintaining services and continuing to deliver its commitments to the community.

To ensure the fiscal strategy is transparent and credible, the Government introduced the Financial Accountability Act 2009 which, among other things, requires the Treasurer to prepare and table in the Legislative Assembly a Charter of Fiscal Responsibility giving

details of the Government’s fiscal objectives and the fiscal principles that support those objectives.

The Treasurer must report regularly to the Legislative Assembly on progress the Government has made against the outcomes stated in the Charter. This report will be tabled and published each year in the Budget papers, Mid Year Fiscal and Economic Review and Report on State Finances.

The fiscal principles of the Queensland Government are broadly based around three themes: fiscal sustainability; a competitive tax regime; and managing the State’s balance sheet.

Since the 2008-09 Budget, the Queensland Government has taken a number of measures, totalling some $5.4 billion over four years, to improve the State’s financial position, including measures to reduce:

| • | | the operating deficit, such as abolition of the fuel subsidy scheme, improving the efficiency of public sector service delivery and increasing revenue; and |

| • | | the level of debt, such as asset sales. |

In addition to these measures, the wages policy for public sector employees will restrict expenditure growth, particularly in the years beyond the forward estimates.

| | | | |

2 | | Budget Strategy and Outlook 2009-10 | | |

Fiscal sustainability

Governments must balance the cost of their activities with the revenues raised by taxation, royalties and income from business activities. It is not sustainable for governments to borrow to fund recurrent expenses, as the resultant interest costs and repayment of debt will be borne by future taxpayers, at the expense of other government services or through higher taxes.

On the other hand, capital investment benefits users and society more generally over the life of the asset. It is therefore appropriate to borrow to fund capital investment, so that the costs of the investment are paid over the same time frame as the benefits that are

realised.

|

Principle In the General Government sector, meet all operating expenses from operating revenue (where operating revenue is defined as total revenue from transactions and operating expenses are defined as total expenses from transactions less depreciation). |

In this financial environment, fiscal discipline is important. Until it achieves an operating surplus, growth in state own purpose expenses (that is, excluding Commonwealth related expenses) will be limited to inflation and population growth. This is projected to be 4.75% in 2009-10.

|

Principle Growth in own-purpose expenses in the General Government sector to not exceed real per capita growth. |

The approach to expenses growth, together with the impact of the large asset sale program not yet factored into the forward estimates, is aimed at achieving a net operating surplus in the General Government sector by 2015-16 and, depending on the strength of the recovery, possibly sooner.

Further details on expenses projections are contained in Chapter 7.

|

Principle Achieve a General Government net operating surplus as soon as possible, but no later than 2015-16. |

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 3 |

Competitive tax regime

One of the Queensland Government’s key fiscal objectives is to maintain a competitive tax environment. While the Government will raise sufficient revenue to meet the service and infrastructure needs of the people of Queensland, it is important that business has a

low cost environment, to promote economic development and jobs growth.

|

Principle Maintain a competitive tax environment for business. |

The competitiveness of a State’s tax system is usually assessed by using one of the following measures:

| • | | taxation revenue on a per capita basis |

| • | | taxation effort as assessed by the Commonwealth Grants Commission |

| • | | taxation revenue expressed as a percentage of gross state product (GSP). |

Queensland’s competitive tax position is confirmed on all three measures:

| • | | per capita tax collections in Queensland in 2009-10 are estimated at $2,087, compared with an estimated $2,487 for the average of the other states |

| • | | Commonwealth Grants Commission data indicate that Queensland’s taxation effort ratio was 85.6% of the standard for all states in 2007-08 |

| • | | Queensland’s tax collections were 4.46% of GSP in 2007-08, compared to 4.75% for the average of the other states. |

The 2009-10 Budget and the Mid Year Fiscal and Economic Review include changes to transfer duty, payroll tax, land tax, casino taxes and motor vehicle registration fees. Details of these changes and other revenue items are provided in Chapter 6.

| | | | |

4 | | Budget Strategy and Outlook 2009-10 | | |

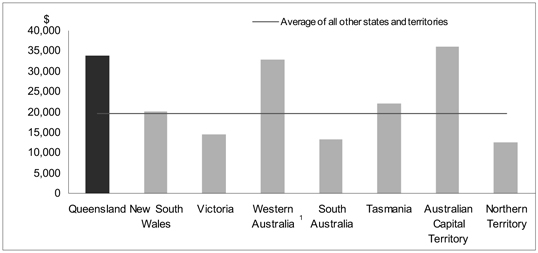

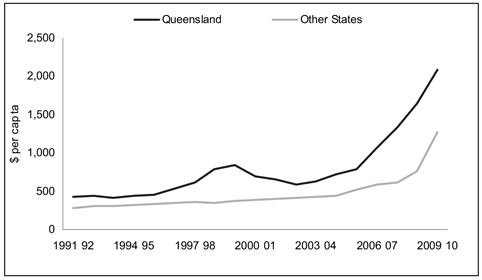

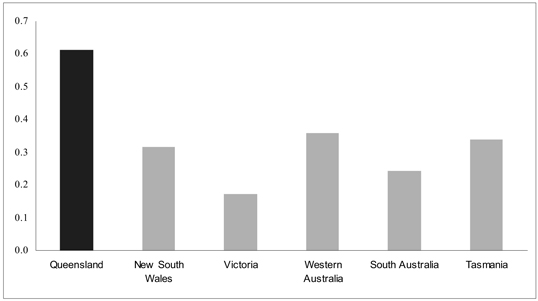

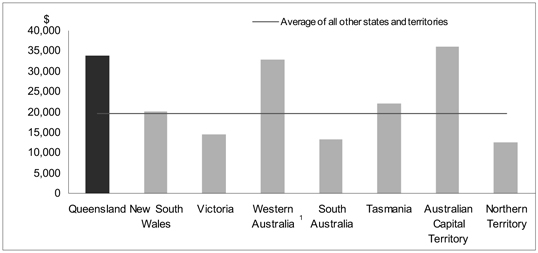

Managing the State’s balance sheet

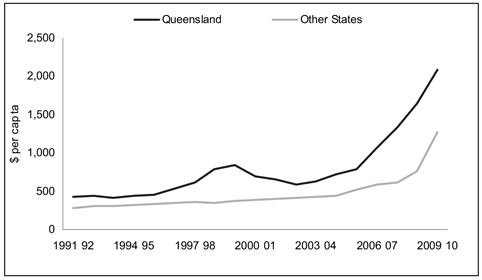

The provision of adequate levels of infrastructure is an ongoing challenge for a state such as Queensland that continues to experience higher levels of economic and population growth than the national average. In meeting this challenge, the Government funds capital expenditure well above the average of the other states and territories, in per capita terms.

As discussed above, Queensland funds its capital program primarily through borrowing, recognising the interest, operating and depreciation costs on the operating statement. It will also be necessary to borrow to fund operating deficits. While the balance sheet of

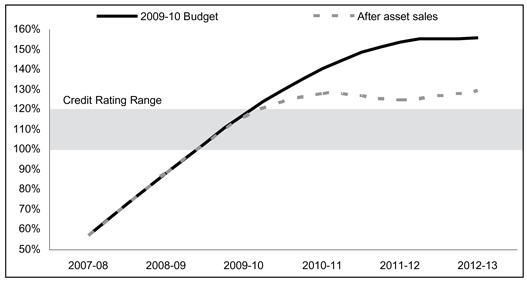

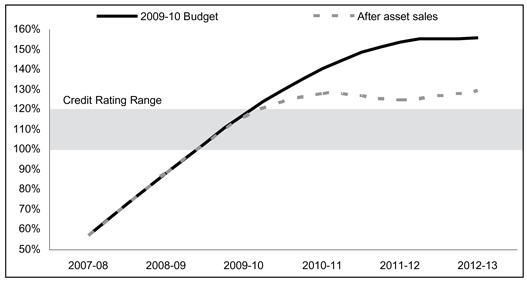

the Queensland Government remains strong, the increased borrowing, coupled with a significant fall in revenue arising as a result of the global financial crisis has led to an increase in the ratio of net financial liabilities1 to revenue, which is a measure used by financial markets to assess financial sustainability.

This ratio is expected to be 117% at the end of the 2009-10 financial year and to stabilise at below 130% after completion of the asset sales program.

|

Principle Stabilise net financial liabilities as a proportion of revenue in the Non-financial Public sector. |

Queensland has a long history of setting aside funds to accumulate financial assets sufficient to meet future liabilities, the largest being for future employee entitlements, in particular superannuation. Queensland is therefore far better placed than other state governments to meet future accruing liabilities, as most other jurisdictions have substantial unfunded superannuation liabilities.

The State’s policy of setting aside funds to meet future liabilities and reinvesting all earnings provides the capacity to manage cycles in investment markets without affecting the Government’s ability to fund services to the community.

|

Principle Target full funding of long-term liabilities such as superannuation in accordance with actuarial advice. |

Further information on balance sheet aggregates can be found in Chapter 8.

| 1 | Net financial liabilities in this context is the term used by Standard & Poor’s ratings agency and differs from that used in the Uniform Presentation Framework tables in Chapter 10. |

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 5 |

Table 1.1

The fiscal principles of the Queensland Government

| | | | | | | | | |

Principle | | Indicator | |

Fiscal sustainability | | | | | | | | | |

| | | | | Operating

Revenue1

($ million) | | | Operating expenses

less depreciation

($ million) | |

In the General Government sector, meet all operating expenses from operating revenue (where operating revenue is defined as total revenue from transactions and operating expenses are defined as total expenses from transactions less depreciation) | | 2009 10 | | 37,192 | | | | 36,373 | |

| | 2010 11 | | 37,029 | | | | 37,444 | |

| | 2011 12 | | 38,100 | | | | 38,930 | |

| | 2012 13 | | 40,431 | | | | 40,327 | |

| | | |

| | | Growth in: | | Own purpose

expense2 | | | Inflation plus

population | |

| | | | |

| | | | |

| Growth in own purpose expenses in the General Government sector to not exceed real per capita growth | | 2009 10 | | 5.04 | % | | | 4.75 | % |

| | 2010 11 | | 4.63 | % | | | 4.50 | % |

| | 2011 12 | | 3.85 | % | | | 4.50 | % |

| | 2012 13 | | 3.67 | % | | | 4.75 | % |

| | Avg over FEs | | 4.30 | % | | | 4.63 | % |

| |

| | | Net operating balance ($ million) | |

| Achieve a General Government net operating surplus as soon as possible, but no later than 2015 16 | | 2009 10 | | | | | | (1,954 | ) |

| | 2010 11 | | | | | | (3,459 | ) |

| | 2011 12 | | | | | | (4,090 | ) |

| | 2012 13 | | | | | | (3,290 | ) |

| | | |

Competitive tax regime | | | | | | | | | |

| |

| | | Taxation revenue per capita, 2009 10 | |

| Maintain a competitive tax environment for business | | Queensland: | | | $ | 2,087 | |

| | Average of other states and territories: | | | $ | 2,487 | |

| | | |

Managing the State’s balance sheet | | | | | | | | | |

| |

| | | Net Financial Liabilities/Revenue

Non financial Public Sector | |

| | | | | Before asset sales | | | After asset sales | |

| Stabilise net financial liabilities as a proportion of revenue in the Non Financial Public Sector | | 2009 10 | | 117 | % | | | 116 | % |

| | 2010 11 | | 141 | % | | | 128 | % |

| | 2011 12 | | 154 | % | | | 125 | % |

| | 2012 13 | | 156 | % | | | 130 | % |

| Target full funding of long term liabilities such as superannuation in accordance with actuarial advice | | As at last actuarial review (released June 2008), accruing superannuation liabilities were fully funded. The State Actuary reviews the scheme every 3 years. | |

Notes:

| 1. | The reduction in revenue in 2010-11 reflects additional Australian Government funding in 2009-10 associated with initiatives such as the Nation Building and Jobs Plan. |

| 2. | Superannuation interest costs have been normalised to reflect the assumed long run rate of return. |

| | | | |

6 | | Budget Strategy and Outlook 2009-10 | | |

Abolition of the Queensland Fuel Subsidy Scheme

The Government has decided to cease the Queensland Fuel Subsidy Scheme from 1 July 2009, saving around $2.4 billion over the next four years.

There are several compelling reasons to now abolish the fuel subsidy.

| • | | The State’s fiscal position makes the retention of the fuel subsidy scheme unsustainable. The Government would be required to borrow to continue to fund the fuel subsidy. To borrow for this purpose would run counter to the principle of intergenerational equity, as future generations would be required to fund the services consumed today. |

| • | | The Queensland Fuel Subsidy Scheme does not represent value for money to Queensland taxpayers. The scheme currently benefits interstate consumers and businesses purchasing retail fuel in Queensland or establishing a bulk end user fuel storage site in the State. The Pincus Inquiry into the effectiveness of the scheme, found that much of the diesel sold for commercial purposes is consumed outside the State. It also found that there was no practical way of preventing interstate businesses from benefiting from the fuel subsidy other than by abolishing it. |

| • | | The Pincus Inquiry recommended that the scheme be abolished if Government could not find a way to ensure the subsidy was being passed on. Evidence given to the Inquiry and an opinion from the Solicitor-General concluded that there is no perfect system to ensure that the subsidy is fully passed on. None of the submissions to the Inquiry or during public consultation identified workable options for improvement. |

Further details on the cessation of the Queensland Fuel Subsidy Scheme can be found in Budget Paper 4 - Measures.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 7 |

Further public sector efficiency measures

In the 2008-09 Budget, the Queensland Government announced a public sector efficiency target of $60 million in 2008-09, growing to $80 million from 2009-10. Given the savings to be derived from the recently announced machinery of government reforms as well as the savings being realised through efficiency and productivity improvements in the areas of corporate overheads, travel, publication, marketing and communication costs, these targets have been increased to a total of $280 million per year from 2009-10. These savings targets will not impact on front line service delivery.

Reform to local government grants and subsidy programs

In 2006-07, the Government announced a program of $700 million over five years for a suite of grants and subsidy programs to support local government to deliver the infrastructure for which they are responsible. To date, projects with a total subsidy value of $880.5 million have been approved for construction. Of this total, $388.5 million has already been paid to local governments.

Given the potential for efficiencies and savings being delivered through the Local Government Reform Program and the significant increase in grant and subsidy funding, the Government reviewed ongoing arrangements for funding of local government infrastructure.

As a result, the Government has decided to overhaul the current suite of local government grant and subsidy programs. The current programs will cease on 16 June 2009. Existing approved commitments will be met, subject to claims being lodged a maximum of three years from the date the application was approved.

Subsidy payments to local governments for street lighting will also cease. These funds are being redirected towards the increased funds allocated to the Pensioner Electricity Rebate Scheme.

A new $45 million per annum local government infrastructure program will be introduced which will be more targeted. Through introducing revised funding criteria, the Government will ensure that subsidies are delivered to those councils and communities that have infrastructure projects that are ready to be delivered and do not have the financial capability to deliver the projects without assistance.

The $2 million annual show subsidy scheme administered by the Department of Infrastructure and Planning will continue.

| | | | |

8 | | Budget Strategy and Outlook 2009-10 | | |

Taxation measures

As a result of tight fiscal conditions brought about by the downturn in the global economy, the Queensland Government has decided to implement a number of taxation measures to enable it to continue to fund services to the community and maintain the capital program.

Motor vehicle registration

The Government will increase motor vehicle registration fees commencing 1 July 2009. These increases were detailed in the Mid Year Fiscal and Economic Review which, in addition, stated motor vehicle registration costs from 1 July 2009 will incorporate adjustments for the Consumer Price Index and changes to Compulsory Third Party premiums.

Further detail on this initiative can be found in Budget Paper 4 – Measures and the Mid Year Fiscal and Economic Review.

Delay in abolition of transfer duty on core business assets

The Intergovernmental Agreement for the Reform of Commonwealth-State Financial Relations (IGA), agreed by the Australian Government and all state and territory governments in 1999, required the abolition and review of a number of state taxes.

Following the review of duties listed in the IGA, a timetable for the abolition of the majority of these duties was announced in the 2005-06 Budget.

To date, the Government has completed all of the duty abolitions listed in this timetable in accordance with the timeframes agreed under the scheduled.

It was intended to halve duty on the transfer of core business assets from 1 July 2010, with full abolition from 1 January 2011. The 2008-09 Mid Year Fiscal and Economic Review extended this timeframe to 1 July 2012.

In light of the tight fiscal conditions, the abolition of this duty will now occur by 1 July 2013, in accordance with the timeframe included in the new Intergovernmental Agreement on Federal Financial Relations.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 9 |

Casino gaming machines

In order to reduce the disparity that exists between the tax rates applicable to gaming machines in casinos and those applicable to large clubs and hotels, the tax rate on gaming machine win on casino gaming machines will increase by 10% from 1 July 2009, to 20% at the Breakwater Island (Jupiters Townsville) and Reef (Cairns) casinos and from 20% to 30% at the Conrad Jupiters (Gold Coast) and Conrad International Treasury (Brisbane) casinos. At the same time, the concessional tax rate applicable to premium play at the Breakwater Island and Reef casinos will be removed. This initiative was announced in the Mid Year Fiscal and Economic Review.

Land tax

As announced in the Mid Year Fiscal and Economic Review, from 1 July 2009, a 0.5% surcharge will apply where the aggregate value of all land (for land tax purposes) exceeds $5 million. The surcharge will apply only to the portion of the value exceeding $5 million. The surcharge is estimated to apply to around 2,000 of Queensland’s 53,000 land tax payers (around 3.7%).

Further details on this initiative can be found in Budget Paper 4 – Measures and the Mid Year Fiscal and Economic Review.

Wages policy

The Government is committed to maintaining wage increases as prescribed in the Memorandum of Understanding (MOU) with unions for all agreements covered by the MOU.

All other agreements that have expired or are due to expire by 31 December 2009, will have until 1 September 2009 to reach an agreement. Where an agreement is not reached by this date, and for agreements expiring after 31 December 2009, a new Government wages policy will apply which limits wage increases to 2.5% per annum until the Budget returns to surplus. The new policy will apply to Chief Executives, Senior Executives and Senior Officers and their equivalents from 1 July 2009.

Changes to procurement policy

The Government considers a range of procurement options for delivery of major capital projects, including construct-only; design and construct; design, construct and maintain; alliance contracting; managing contractor model; public-private partnerships; and hybrid delivery models. To achieve optimal project outcomes, the procurement approach must be appropriate for the risks and issues each project is likely to face in practice.

| | | | |

10 | | Budget Strategy and Outlook 2009-10 | | |

In recent years, alliance contracting, where Government and its alliance partners share the risks and responsibilities in delivery the construction phase of a project, has featured significantly in certain areas of infrastructure delivery. While the Government will continue to consider alliance contracting where appropriate, in selecting procurement approaches for each major project, the Government will be particularly focused on driving competitive, value for money project delivery outcomes which reflect current

market conditions.

Government-owned corporation reform

As outlined in the Mid Year Fiscal and Economic Review, the Government has been working with its Government-owned corporations (GOCs) to improve their efficiency, effectiveness and accountability. The aim has been to provide GOCs with appropriate organisational structures and incentive frameworks to allow them to operate to their full commercial potential.

More information on this initiative can be found in the Mid Year Fiscal and Economic Review and in Chapter 5.

Closure of the defined benefit scheme

Earlier this financial year the Government announced the closure of QSuper’s defined benefit account to new members, effective from the date of announcement.

Before the closure of the scheme, Queensland was the only Government in Australia that still had a broad based, open defined benefit scheme. Other states and the Commonwealth all stopped offering defined benefit schemes over the past 15 years.

This action was taken to protect the current entitlements of existing defined benefit members and to ensure that the scheme’s liabilities are not exposed to risks that flow from the decline in global equity markets.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 11 |

Asset sales

In order to protect the State’s capital program while maintaining a prudent fiscal approach, the Government announced, on 2 June 2009, a significant infrastructure assets reform and sale program.

This program will involve:

| • | | the sale of Forestry Plantations Queensland’s softwood business and possibly its hardwood plantations |

| • | | the sale of Queensland Motorways Limited’s (QML) business, incorporating a major upgrade of the Port of Brisbane Motorway |

| • | | the sale of the Port of Brisbane Corporation Limited’s (PBC) business and assets |

| • | | the sale of QR Limited’s (QR) above and below rail coal businesses and assets, along with Ports Corporation of Queensland Limited’s Abbot Point Coal Terminal |

| • | | the intention to instigate negotiations with the Australian Government over the potential sale of other parts of QR’s below rail network to the Australian Government-owned Australian Rail Track Corporation |

| • | | investigating options for the most appropriate way to offer the sale of Queensland Rail’s bulk freight, intermodal, retail and regional freight services to the market. |

In recognition of the complexity of the process and the need to undertake detailed planning in relation to appropriate sale structures, the Government envisages that the sales will be progressed in the market over the next three to five years. The sale program will deliver an estimated $15 billion in sale proceeds, and result in approximately $12 billion in required capital investment over the next five years being avoided. The staging of the asset sales will be influenced by the timing of the recovery in financial markets. The impact of the asset sales has not been factored into the Budget estimates.

Economic impact

The Government recognises the need to ensure that the Queensland economy emerges from the current economic conditions in a strong position to drive the future growth and job creation opportunities for both the State and national economies.

In this regard, the asset sales program has a strong export focus. The sale of QR’s coal businesses provides an opportunity to further integrate coal export chains. The inclusion of Abbot Point Coal Terminal in the sales package is expected to further facilitate the integration of rail-to-port networks, and ensure that the objectives of port and rail infrastructure providers are more closely aligned.

| | | | |

12 | | Budget Strategy and Outlook 2009-10 | | |

Similar opportunities exist in relation to export infrastructure in South East Queensland. The sale of PBC, in conjunction with QML, the operator of key road infrastructure servicing the Port of Brisbane and the southern Queensland road network more generally, is expected to facilitate the development of both the Port of Brisbane and surrounding infrastructure.

In combination, the asset sales package is designed to encourage the private sector to play a more active role in providing and funding the key economic infrastructure which is essential in promoting economic growth.

Financial considerations

The 2009-10 Budget focuses on supporting the continued delivery of key public infrastructure such as schools, hospitals and public transport, and the delivery of public services through these facilities.

The Government expects to forgo dividends and tax equivalent payments as a result of the asset sales. However, interest savings on sale proceeds and the additional capital expenditure of $12 billion avoided as a result of the sales will benefit the Budget.

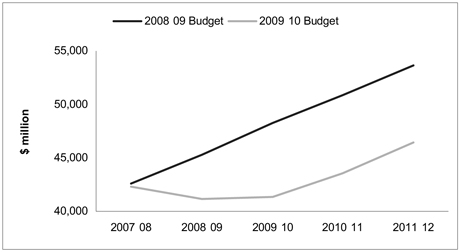

The following chart shows, on balance, the overall favourable impact the expected sale proceeds will have on one of the key credit rating ratios (net financial liabilities to revenue), after accounting for forgone revenue. Chart 1.1 indicates that the ratio stabilises at below 130% following these asset sales.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 13 |

Chart 1.1

Net financial liabilities to revenue ratio, before and after asset sales

Notes:

| 1. | The figures in this chart assume the sales are completed by 2012-13. |

| 2. | Based on a broad range for AAA rated states. |

The program of asset sales will play an important role in funding the Government’s infrastructure program, reducing State debt and encouraging private sector provision of infrastructure. The sales are designed to realise value, reduce risk and obviate the need to further fund the significant ongoing capital requirements of these businesses, where the private sector can fund those requirements.

This will go a long way toward reducing the current level of indebtedness of the State and demonstrate to ratings agencies and financial markets the Government’s willingness to reduce debt and return the State to a solid fiscal position. Post the current forward estimates, when the worst of the global economic crisis has passed, the Queensland Government will reduce the capital program to levels under $10 billion per year and look at further policy measures to improve revenue and reduce expenditure to assist in bringing the net financial liabilities to revenue ratio back within a range comparable to other larger states.

Further detail about the restructuring and disposal processes is provided in Chapter 5.

| | | | |

14 | | Budget Strategy and Outlook 2009-10 | | |

PATH BACK TO SURPLUS

Returning the Budget to surplus is a key element of the Government’s revised fiscal principles. A return to surplus depends on economic and population growth in the State as well as on the policy decisions of Government.

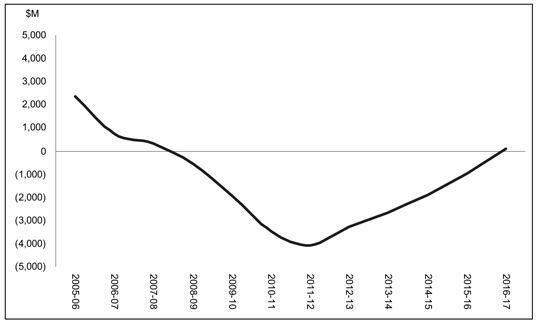

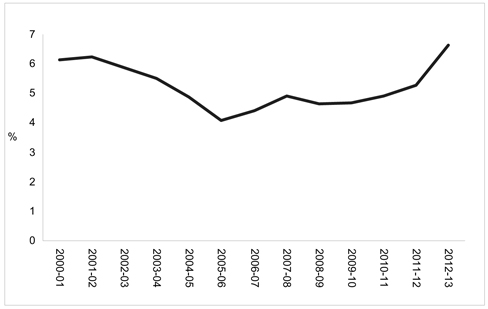

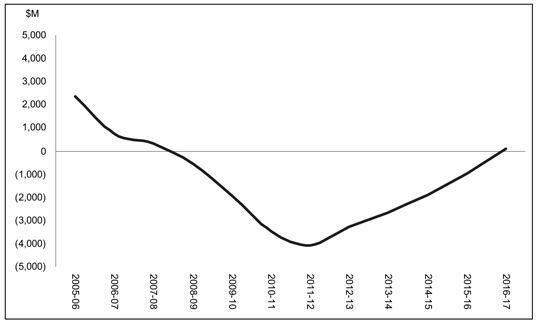

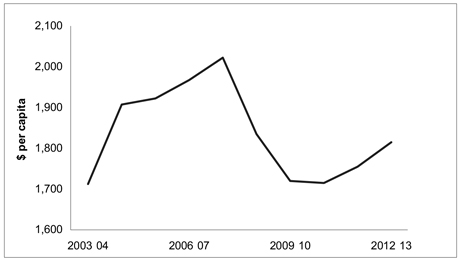

The revised fiscal principle relating to the General Government net operating balance requires the Government to achieve a General Government net operating surplus as soon as possible, but no later than 2015-16. While Chart 1.2 below notionally indicates a deficit position for Queensland until 2016-17 (a year after the Australian Government has forecast to return to surplus), it is expected that the significant program of asset sales, which are not factored into the forward estimates, will make a positive contribution to the General Government sector and will assist in meeting this fiscal principle.

There also remains a high degree of uncertainty about the pace and path of recovery. Queensland’s assumptions are for continuing deterioration in the fiscal position for a number of years before recovery in the final years of the forward estimates. While it is possible that the economy and hence fiscal position will deteriorate more dramatically than indicated in the chart below, Queensland’s revenue estimates are more conservative than those used by other Australian states. This provides Queensland with more upside should the turnaround occur earlier or more favourably than anticipated.

Chart 1.2

General Government Sector Net Operating Balance, 2005-06 to 2016-17

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 15 |

| 2 | ECONOMIC PERFORMANCE AND OUTLOOK |

FEATURES

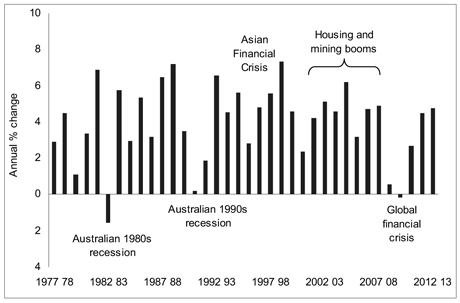

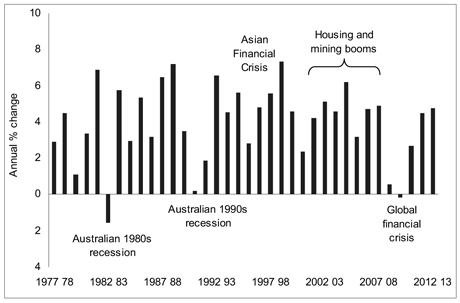

| • | | The global economy is experiencing its most severe financial crisis since the 1930s, with global GDP now widely expected to contract in 2009 for the first time in 60 years. Economic activity in Queensland’s major trading partners is expected to decline by 3% this calendar year. |

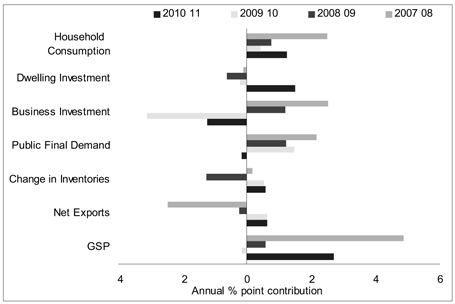

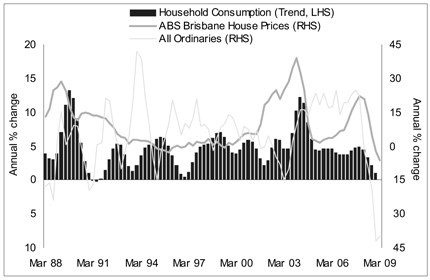

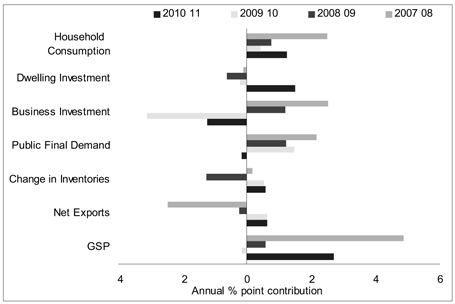

| • | | As a result, economic growth in Queensland is estimated to slow to 1/2% in 2008-09, with the economy forecast to contract marginally, by 1/4%, in 2009-10. In addition to a decline in exports, growth in consumption is forecast to ease due to lower household wealth. High interest rates for much of 2008, as well as weak investor confidence, are also forecast to lower dwelling investment. |

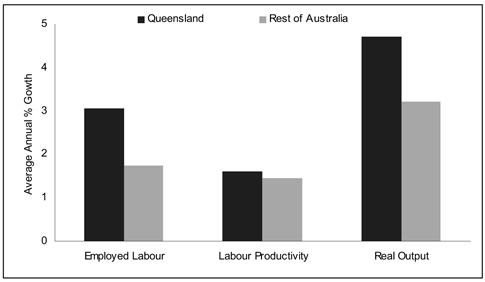

| • | | The slight fall in economic activity in 2009-10 reflects a peaking in the private investment cycle. After tripling over the past eight years, business investment is forecast to fall 17% in 2009-10, largely due to a scaling back in commercial and mining construction. Partly offsetting this, public infrastructure spending is forecast to rise sharply, reflecting State and Federal Government initiatives. Growth is forecast to return in 2010-11, albeit to a modest 2 3/4%. This would represent the third successive year of below-trend growth, as a slow global recovery initially tempers an upturn in exports. Growth in consumer spending is forecast to improve, as balance sheets are strengthened, while solid population growth should eventually drive a sharp rise in housing investment. |

| • | | Benefiting from significant investment in capacity in previous years, economic growth is projected to accelerate to 4 1/2% in 2011-12 and reach its decade average of 4 3/4% in 2012-13, as the global economic recovery gathers pace. |

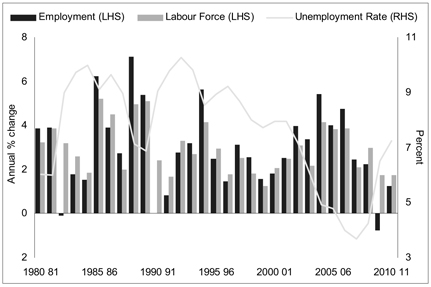

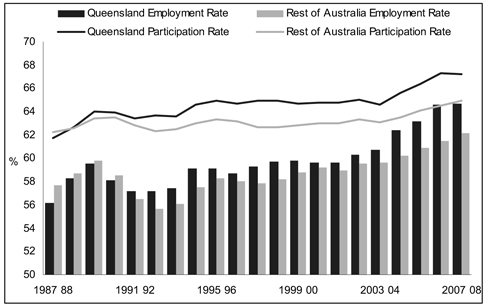

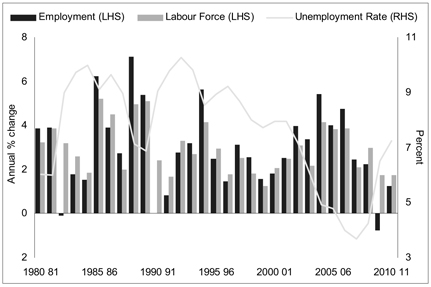

| • | | In line with subdued economic activity, employment is forecast to fall 3/4% in 2009-10 and recover by 1 1/4% in 2010-11. With labour force growth forecast to continue to exceed jobs growth, the year-average unemployment rate is forecast to rise to 6 1/2% in 2009-10 and peak at 7 1/4% in 2010-11. |

This chapter presents the economic context within which the 2009-10 State Budget has been prepared. It overviews developments in Queensland’s external environment in light of the financial crisis, including the contraction now expected in major trading partner economies and the national outlook. The chapter summarises the economic performance of, and outlook for, Queensland over 2008-09 to 2012-13, and provides detailed estimates for 2008-09 and forecasts for sectors of the economy in 2009-10. In line with the Australian Government, the chapter for the first time provides forecasts for an additional year, detailing the drivers of the economic recovery in 2010-11. The chapter also outlines key risks to economic growth over the forecast period.

| | | | |

16 | | Budget Strategy and Outlook 2009-10 | | |

EXTERNAL ENVIRONMENT

International conditions

The global economy is experiencing its most severe financial crisis since the 1930s. This has undermined activity throughout developed and developing economies with such severity and synchronicity that global gross domestic product (GDP) in 2009 is now widely expected to contract for the first time in 60 years. A negative feedback loop between credit markets and global economic activity is also evolving, raising considerable uncertainty regarding the depth of the recession, as well as the timing of an eventual recovery.

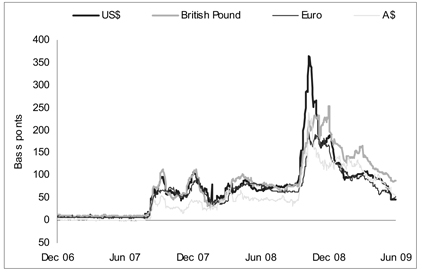

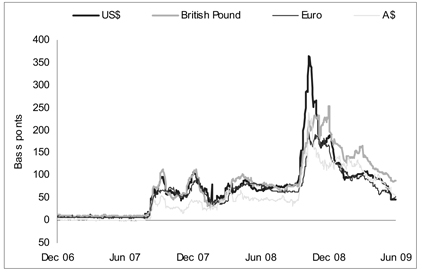

The global financial crisis intensified from mid-September 2008, when investment bank Lehman Brothers filed for bankruptcy. This led to a rapid escalation in perceived counterparty risk and thus a reluctance by the financial sector to lend funds. As a result, interbank interest rate spreads widened from already-elevated levels (see Chart 2.1). These developments also prompted an acute deterioration in consumer and business sentiment, as well as significant falls in equity and commodity prices.

Financial market conditions, equity values and commodity prices have all recovered somewhat since late 2008, aided by various policy responses from governments and central banks. However, ongoing concerns about further write downs across the banking sector and a deteriorating economic outlook continue to impair credit markets and overall sentiment. In its April 2009 Global Financial Stability Report, the International Monetary Fund (IMF) estimated total write downs to reach US$4.1 trillion, of which approximately US$1.9 trillion were yet to be realised by banks, while in its latest World Economic Outlook, the IMF forecast the global economy to contract 1.3% in 2009.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 17 |

Chart 2.1

Interbank interest rate spreads¹

Note:

| 1. | Three month London Interbank Offered Rate less three month Overnight Indexed Swap rate. |

Sources: Reuters, Bloomberg and Queensland Treasury.

A subdued outlook, combined with funding constraints, has led businesses globally to cut investment, run down inventories and scale down operations. This has been most pronounced in advanced economies in Europe and Asia. Industrial production over the year to April 2009 fell by more than 30% in Japan, around 20% in Taiwan, Germany and Spain and around 10% in the US and Korea, while over the year to March 2009, industrial production fell more than 20% in Italy and more than 10% in the UK.

Lower industrial activity in advanced economies has also affected large commodity exporters, with reduced demand suppressing both export volumes and prices. The resulting sharp contraction in international trade is widely expected to persist this year, with the IMF forecasting export volumes from developed and developing economies to fall 13.5% and 6.4% respectively in 2009.

Household wealth has fallen in many economies due to lower equity and house prices, while a deteriorating labour market has reduced job security, undermining sentiment and spending. As at early June 2009, stock markets in the US and UK remained 40% and 35% below their 2007 highs respectively, while house prices in these countries have fallen 31% and 18% from their peak. The US unemployment rate has risen from 4.4% in early 2007 to 9.4% in May 2009, while the IMF forecasts the average unemployment rate of advanced economies to rise 2.3 percentage points to 8.1% in 2009, and to 9.2% in 2010.

| | | | |

18 | | Budget Strategy and Outlook 2009-10 | | |

Queensland’s major trading partners’ GDP is forecast to contract by 3% in 2009, larger than the fall in world GDP expected by the IMF (see Table 2.1). This is partly due to the recession in Japan, which accounts for a larger share of the State’s exports relative to its weight in global GDP. Reflecting a reliance on export-led growth, Japan’s economy contracted by a record 3.8% in March quarter 2009, or by 8.4% over the year, while the Korean economy has shrunk by 5.0% since September quarter 2008. The US economy contracted by 3.1% over the two quarters to March quarter 2009, its largest six-month fall since 1958, while Eurozone GDP declined by a record 2.5% last quarter.

Table 2.1

Queensland major trading partner GDP outlook

(annual % change)

| | | | | | | | | | | | |

| | | Actual

2008 | | Forecasts |

| | | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 |

World¹ | | 3.2 | | 1.3 | | 1.9 | | 4.3 | | 4.8 | | 4.9 |

Major trading partners² | | 2 | | 3 | | 1 1/2 | | 3 3/4 | | 4 1/2 | | 4 1/2 |

Non Japan Asia³ | | 4 1/4 | | 3/4 | | 3 | | 5 3/4 | | 6 1/4 | | 6 1/4 |

Japan | | 3/4 | | 6 1/4 | | 1/2 | | 2 1/4 | | 3 1/4 | | 2 3/4 |

Europe4 | | 1 | | 4 1/4 | | 1/2 | | 1 1/2 | | 2 1/4 | | 2 1/4 |

US | | 1 | | 2 3/4 | | 0 | | 3 1/2 | | 3 3/4 | | 3 1/4 |

Notes:

| 1. | Sourced from the April 2009 IMF World Economic Outlook database. World GDP comprises 173 countries, weighted by purchasing power parity (PPP) GDP. |

| 2. | Queensland’s major trading partner output comprises 31 countries, weighted by their share of merchandise exports in the three years to 2007 08. Forecasts are sourced from IMF. |

| 4. | Includes United Kingdom. |

Sources: International Monetary Fund and Queensland Treasury.

A distinguishing characteristic of the current global recession compared with previous downturns has been the scale of wealth destruction caused by the financial crisis. This has seen a broad-based shift in consumer and business priorities toward repairing balance sheets. This de-leveraging process remains incomplete and is likely to prolong the current downturn, despite numerous monetary and fiscal policy efforts to stimulate activity and relieve credit market stresses.

| | | | |

| | | Budget Strategy and Outlook 2009-10 | | 19 |

Given a prerequisite for a sustainable economic recovery is the restoration of stability in the global financial system, substantial efforts have been made to increase liquidity, reduce borrowing costs and recapitalise the banking sector. Easing global inflation, as a result of lower commodity prices and excess capacity, has enabled central banks to loosen monetary policy considerably. Official interest rates are now at or near record lows in the US, Japan, UK and Eurozone. More unconventional efforts to promote financial stability have been adopted, including quantitative or credit easing by the US and UK central banks, as well as the US Treasury’s Troubled Asset Relief Program. Moreover, numerous governments have provided guarantees on private sector borrowing and purchased ‘toxic’ assets from the banking sector. Such efforts should help normalise financial markets, restore sentiment and stabilise economic activity by late 2009. As a result, global economic growth is forecast to re-emerge in the first half of 2010.

However, growth is forecast to be relatively more subdued compared with previous recoveries. Recoveries from recessions caused by financial crises tend to be weaker, given the protracted nature of the private sector de-leveraging process. The highly synchronised nature of the current global recession also reduces prospects for an export-led recovery. The cost of credit is likely to remain higher, and availability more restricted, than in the years preceding the crisis, reflecting a more rational pricing of risk. Further, current private sector de-leveraging will eventually transfer to the public sector. With governments globally becoming more indebted from necessary fiscal expansion and a deteriorating revenue base, public sector spending is unlikely to contribute as significantly to economic growth after the recession ends. Consequently, Queensland’s major trading partner economies are expected to expand at a below trend rate of 1 1/2% in 2010, with the peak in their combined economic output achieved in June quarter 2008 not expected to be reached again before the second half of 2011.

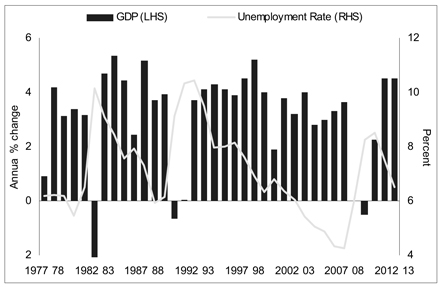

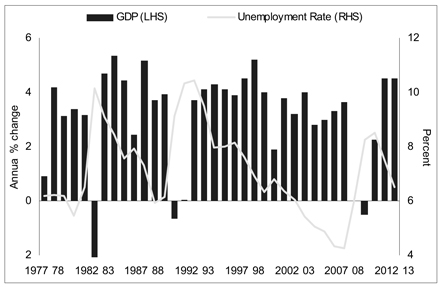

Australian economy

Reflecting the impact of the global recession on business confidence and export demand, the Australian Government forecasts GDP to be unchanged in 2008-09 and fall 1/2% in 2009-10. This would result in a recession of similar magnitude to that of the early 1990s (see Chart 2.2). The contraction in GDP in 2009-10 is expected to be driven by a sharp fall in business investment and exports, while a one-third decline in household net financial wealth in 2008 is forecast to drive a 1/4% fall in household consumption.

With the world economy expected to gradually recover during 2010, a turnaround in exports and strong growth in dwelling investment are anticipated to support a return to GDP growth of 2 1/4% in 2010-11. Households are forecast to continue to rebuild their balance sheets, resulting in below average consumption growth, while a modest recovery in business investment is based on an expectation that a number of high value resource projects scheduled to commence in 2010-11 will proceed.

| | | | |

20 | | Budget Strategy and Outlook 2009-10 | | |

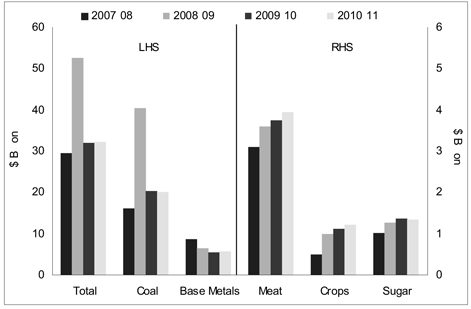

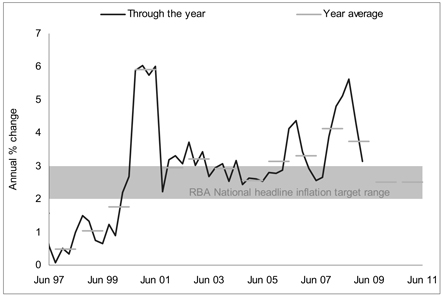

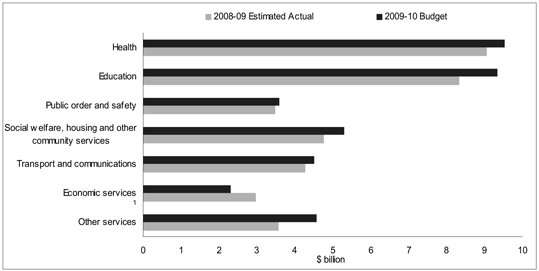

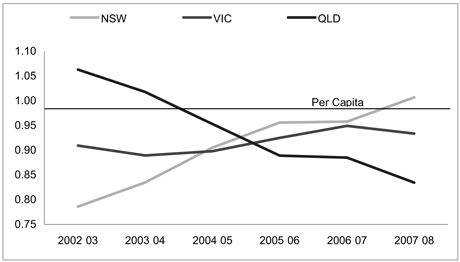

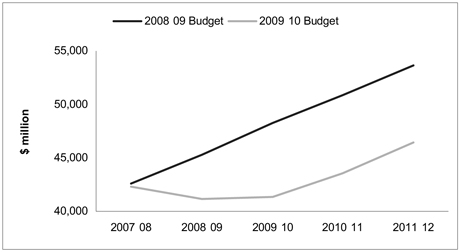

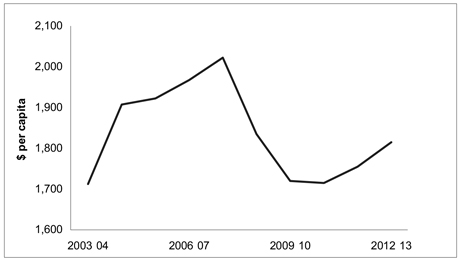

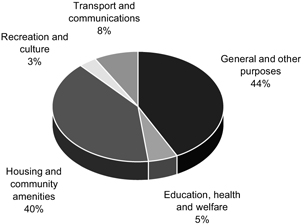

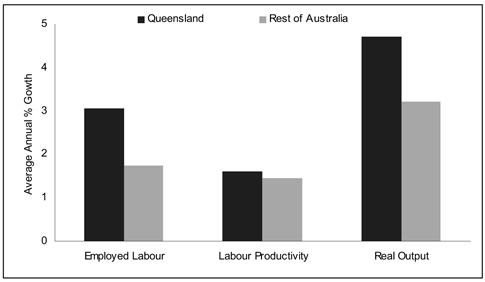

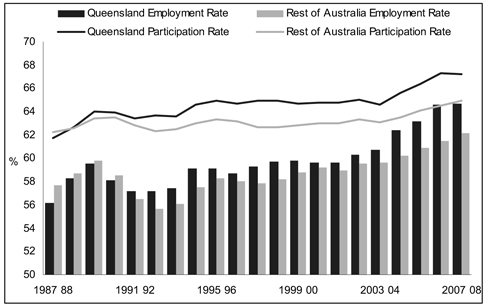

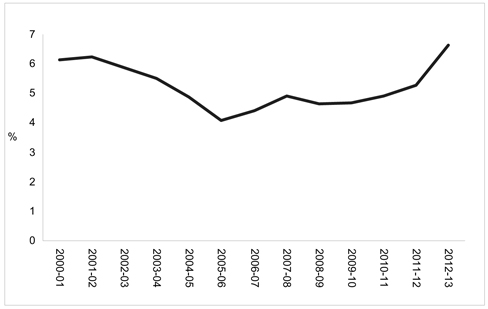

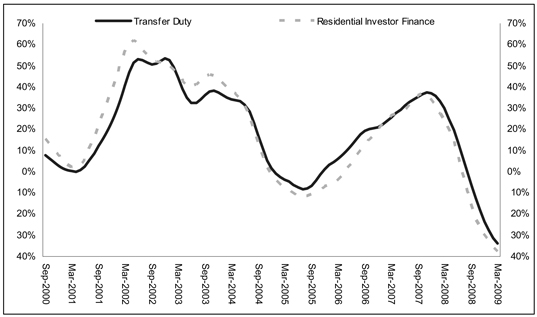

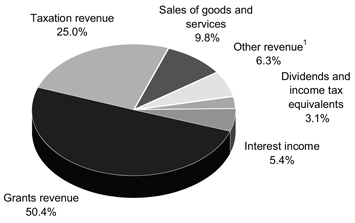

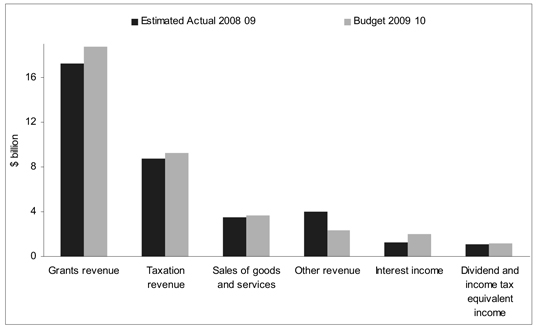

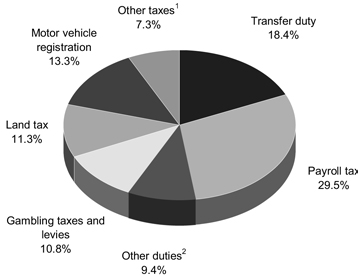

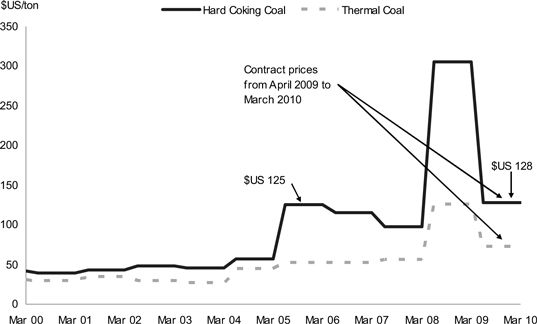

Employment is forecast to contract 1 1/2% over the year to June quarter 2010, causing the unemployment rate to rise to 8 1/4% in the quarter. With modest jobs growth in 2010-11 insufficient to absorb growth in the labour supply, the unemployment rate is forecast to peak at 8 1/2% in June quarter 2011, before declining over the following two years.