EXHIBIT (c)(xii)

Queensland State Accounts March Quarter 2010.

Queensland State Accounts

March Quarter 2010

Queensland Government

Office of Economic and Statistical Research

For further information

Office of Economic and Statistical Research

Level 8

33 Charlotte Street

Brisbane Q 4000

Telephone: (07) 3224 5326

Facsimile: (07) 3227 7437

E-mail qsa@treasury.qld.gov.au

Websites

www.oesr.qld.gov.au/releases/qsa

or

www.treasury.qld.gov.au

© The State of Queensland (Queensland Treasury) 2010

You are free to copy, communicate and adapt the work, as long as you attribute the authors.

This document is licensed under a Creative Commons Attribution 2.5 Australia licence.

To view a copy of this licence, visit http://creativecommons.org/licenses/by/2.5/au

To attribute this work cite Queensland State Accounts, Office of Economic and Statistical Research, Queensland Treasury

| | |

| | Queensland State Accounts, March Quarter 2010 |

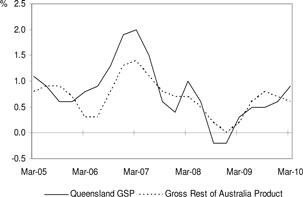

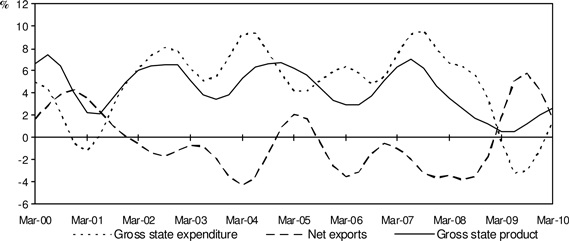

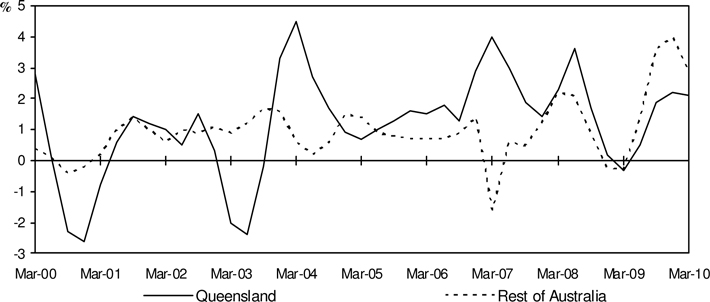

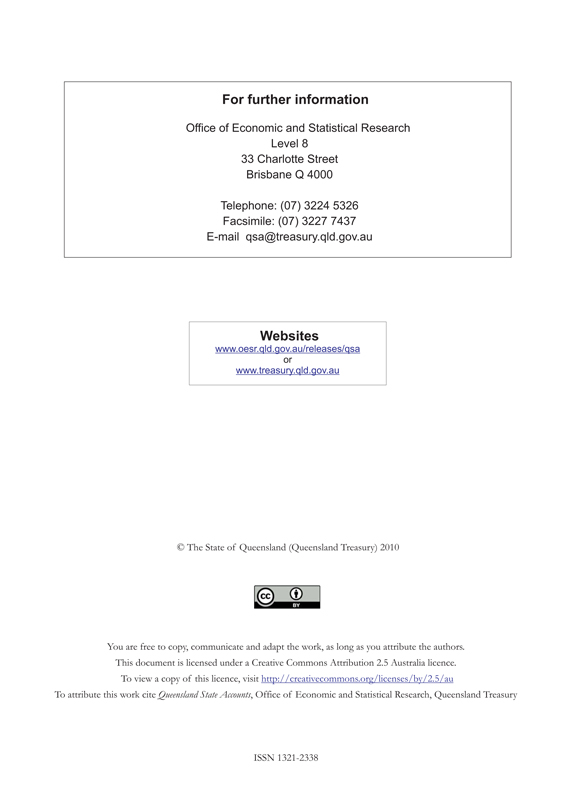

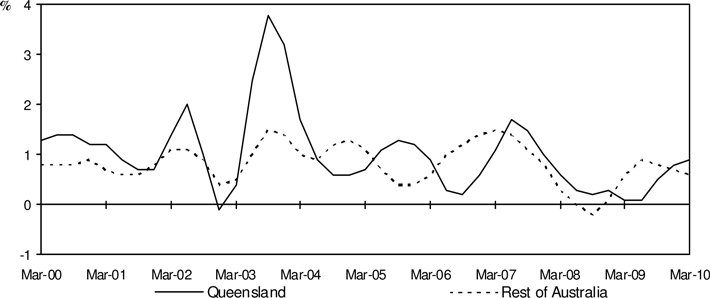

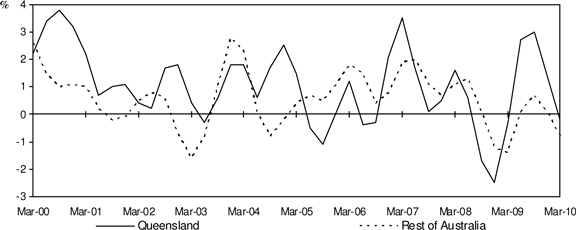

Chart 1: Gross State Product

(quarterly % change, CVM, trend)

TABLE I

Percentage change in Gross State/Domestic Product

Chain volume measures (2007-08 prices)

| | | | | | |

| | | Queensland

(a) | | Rest of

Australia

(a) | | Australia (b) |

TREND | | | | | | |

Dec qtr 09 to Mar qtr 10 | | 0.9 | | 0.6 | | 0.6 |

Mar qtr 09 to Mar qtr 10 | | 2.6 | | 2.7 | | 2.7 |

ORIGINAL | | | | | | |

Year-average (c) | | 1.6 | | 1.8 | | 1.7 |

| (a) | Source: OESR Queensland State Accounts |

| (c) | Reference quarter and the three preceding quarters compared with the same period a year earlier |

March Quarter 2010 - Key Points

Quarterly Results

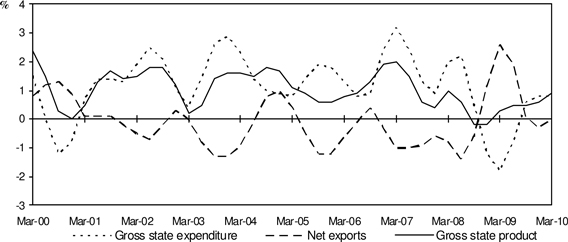

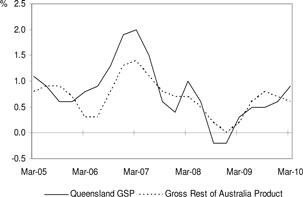

| • | | Queensland gross state product (GSP) rose 0.9 per cent in March quarter 2010, following a revised increase of 0.6 per cent in December quarter 2009. In comparison, gross Rest of Australia product increased by 0.6 per cent in March quarter 2010. |

| • | | Gross state expenditure (a measure of domestic demand) increased 0.7 per cent in the March quarter, following an increase of 0.8 per cent in the December quarter. Gross state expenditure contributed 0.8 percentage point to Queensland GSP growth in the March quarter. |

| • | | In contrast, the trade sector made no contribution to economic growth in the March quarter. Both imports of goods and services and exports of goods and services fell 0.2 per cent. |

- 1 -

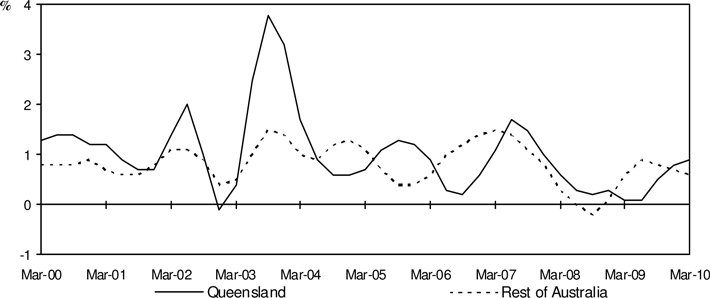

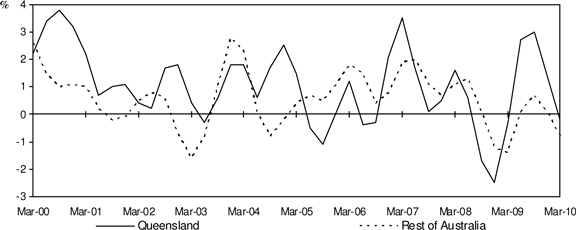

Chart 2: Contributions to Growth, Queensland

(quarterly % point contribution, CVM, trend)

Annual Results

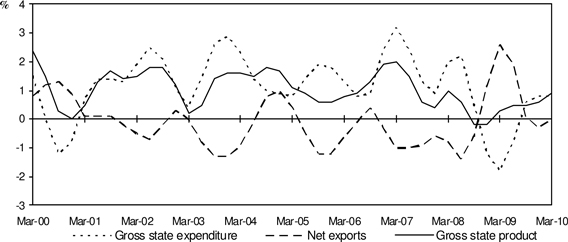

| | • | | In real trend terms, GSP rose by 2.6 per cent over the year to March quarter 2010 following growth of 2.0 per cent over the year to December quarter 2009. In comparison, gross Rest of Australia product grew by 2.7 per cent over the year to March quarter 2010. |

| | • | | Gross state expenditure increased 1.4 per cent over the year to the March quarter. As a result, gross state expenditure contributed 1.5 percentage points to Queensland’s economic growth. The increase in domestic demand was mainly driven by higher household consumption and the change in inventories, contributing 0.5 and 0.4 percentage point respectively to Queensland GSP. |

| | • | | Net exports contributed 1.7 percentage points to Queensland GSP growth over the year to the March quarter. A 7.0 per cent increase in exports of goods and services more than offset imports growth of 1.4 per cent. |

Chart 3: Contributions to Growth, Queensland

(annual % point contribution, CVM, trend)

- 2 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Expenditure on GSP - Main Features

Household Final Consumption Expenditure

Quarterly Results (Trend, CVM)

| • | | Household final consumption expenditure in Queensland increased 0.9 per cent in real trend terms in March quarter 2010, contributing 0.5 percentage point to GSP growth. |

| • | | Growth in the quarter was driven by increased expenditure on insurance and other financial services, rent and other dwelling services, as well as recreation and culture. This more than offset lower expenditure on operation of vehicles, health and electricity, gas and other fuel. |

| • | | Household consumption in the Rest of Australia recorded growth of 0.6 per cent and contributed 0.3 percentage point to the Rest of Australia growth in the March quarter. |

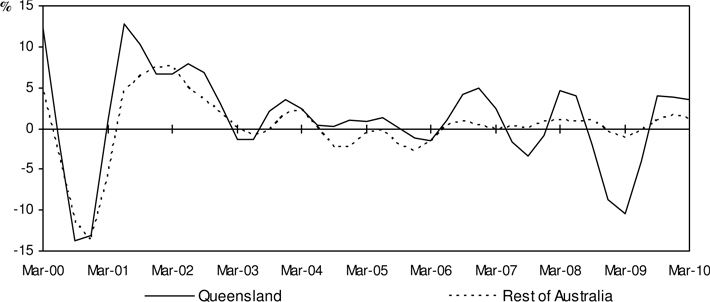

Chart 4: Household Final Consumption Expenditure

(quarterly % change, CVM, trend)

Annual Results (Trend, CVM)

| • | | Queensland recorded household consumption growth of 2.3 per cent over the year to the March quarter, contributing 1.2 percentage points to annual growth in GSP. |

| • | | For the Rest of Australia, household consumption rose 2.9 per cent over the year to the March quarter, following growth of 3.0 per cent over the year to the December quarter. |

- 3 -

Dwelling Investment

Quarterly Results (Trend, CVM)

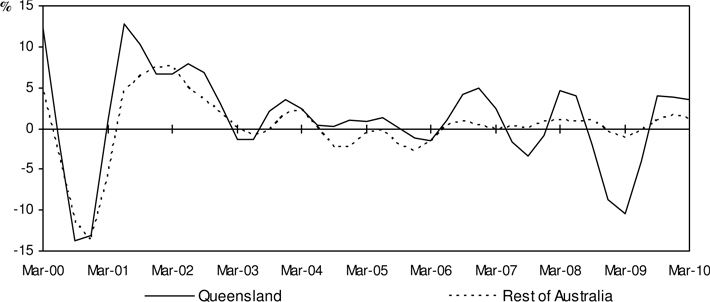

| • | | Queensland dwelling investment increased 3.6 per cent in March quarter 2010, following a 3.8 per cent increase in December quarter 2009. |

| • | | The increase in dwelling investment was driven by a 7.6 per cent rise in alterations and additions investment, offsetting a 0.4 per cent decline in new dwelling investment. |

| • | | Dwelling investment in the Rest of Australia increased 1.2 per cent in the March quarter, following an increase of 1.6 per cent in the previous quarter. |

Chart 5: Dwelling Investment

(quarterly % change, CVM, trend)

Annual Results (Trend, CVM)

| • | | Queensland dwelling investment increased 7.3 per cent over the year to March quarter 2010, a turnaround from the 7.2 per cent decline over the year to December quarter 2009. Dwelling investment contributed 0.5 percentage point to annual GSP growth in March quarter 2010. The increase in dwelling investment over the year to the March quarter follows five consecutive annual declines. |

| • | | The annual increase was driven by a 24.2 per cent rise in alterations and additions offsetting the 6.4 per cent fall in new dwellings. |

| • | | Dwelling investment in the Rest of Australia increased 3.6 per cent over the year to the March quarter, following an increase of 1.2 per cent over the year to the December quarter. |

- 4 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Business Investment

Quarterly Results (Trend, CVM)

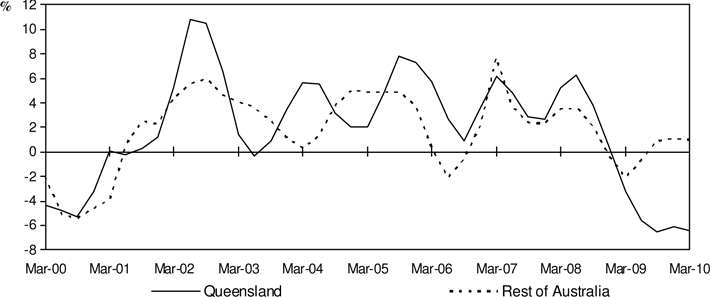

| • | | Queensland business investment (comprised of non-dwelling construction and machinery and equipment) declined 6.4 per cent in March quarter 2010 and detracted 0.9 percentage point from GSP growth. |

| • | | The decline in business investment was driven by declines in both machinery and equipment investment (-10.0 per cent) and non-dwelling construction investment (-3.0 per cent). |

| • | | Rest of Australia business investment increased 1.0 per cent in the March quarter, driven by higher investment in machinery and equipment (3.3 per cent) more than offsetting lower investment in non-dwelling construction (-1.8 per cent). |

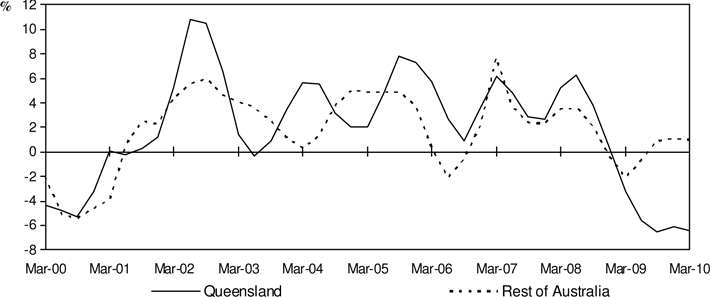

Chart 6: Business Investment1

(quarterly % change, CVM, trend)

Annual Results (Trend, CVM)

| • | | Queensland business investment fell 22.5 per cent over the year to March quarter 2010, following an annual decline of 19.8 per cent in December quarter 2009. |

| • | | A 29.9 per cent fall in machinery and equipment investment and a 14.6 per cent decline in non-dwelling construction investment resulted in business investment detracting 4.0 percentage points from Queensland growth over the year to March quarter 2010. |

| • | | Business investment in the Rest of Australia increased 2.3 per cent over the year to March quarter 2010, following an annual decline of 0.8 per cent over the year to December quarter 2009. |

| 1 | Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend in December quarter 2009. |

- 5 -

Public Final Demand

Quarterly Results (Trend, CVM)

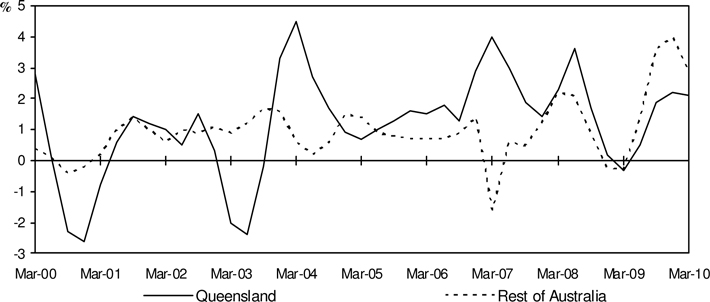

| • | | Queensland public final demand (comprised of general government final consumption and investment and public corporations investment), increased 2.1 per cent in March quarter 2010, following an increase of 2.2 per cent in the previous quarter. As a result, public final demand contributed 0.6 percentage point to GSP growth in the March quarter. |

| • | | The increase in public final demand was driven by higher general government consumption and investment, which offset a small decline in public corporations investment. General government consumption and investment rose 1.3 and 6.8 per cent respectively in the March quarter. In contrast, public corporations investment declined2 1.7 per cent. |

| • | | Public final demand in the Rest of Australia increased 2.9 per cent in the March quarter, following 4.0 per cent growth in the previous quarter. |

Chart 7: Public Final Demand3

(quarterly % change, CVM, trend)

Annual Results (Trend, CVM)

| • | | Queensland public final demand rose 6.8 per cent over the year to March quarter 2010, following annual growth of 4.3 per cent over the year to December quarter 2009. |

| • | | The increase in public final demand was driven by higher general government consumption (4.0 per cent) and general government investment (24.1 per cent). |

| • | | Public final demand in the Rest of Australia rose 12.3 per cent over the year to March quarter 2010, following growth of 8.7 per cent over the year to December quarter 2009. |

| 2 | Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend in December quarter 2009. |

| 3 | Quarterly growth estimates for Rest of Australia in March quarter 2007 are affected by a trend break resulting from the privatisation of Telstra. |

- 6 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Exports of Goods and Services

Quarterly (Trend, CVM)

| • | | Queensland exports of goods and services fell 0.2 per cent in March quarter 2010, with falls in both interstate exports (-0.3 per cent) and overseas exports (-0.2 per cent). |

| • | | The decline in overseas exports of goods and services was driven by a fall in exports of services (-1.4 per cent), which more than offset the 0.1 per cent growth in exports of goods. |

| • | | The decline in interstate exports of goods and services was driven by falls in interstate exports of goods (1.1 per cent) which more than offset higher exports of services (2.7 per cent). |

| • | | Rest of Australia recorded a decrease of 0.8 per cent in aggregate exports of goods and services, driven by lower interstate exports (-6.1 per cent) offsetting higher overseas exports (0.3 per cent). |

Chart 8: Exports of Goods and Services

(quarterly % change, CVM, trend)

Annual (Trend, CVM)

| • | | In annual terms, Queensland exports of goods and services increased 7.0 per cent over the year to March quarter 2010, contributing 2.2 percentage points to annual growth in GSP. |

| • | | The increase in aggregate exports of goods and services was driven by higher interstate exports (19.7 per cent) and to a lesser extent overseas exports (0.9 per cent). |

| • | | In comparison, exports of goods and services in the Rest of Australia increased 0.1 per cent over the year to March quarter 2010, following an annual fall of 0.6 per cent in December quarter 2009. |

- 7 -

Imports of Goods and Services

Quarterly Results (Trend, CVM)

| • | | Imports of goods and services fell 0.2 per cent in March quarter 2010 with lower interstate imports (-6.1 per cent) more than offsetting a 5.3 per cent rise in overseas imports. |

| • | | The decline in interstate imports was driven by lower imports of goods (-6.9 per cent), which more than offset higher imports of services interstate (2.0 per cent). |

| • | | Within aggregate overseas imports, overseas goods imports rose 5.3 per cent and overseas services imports were higher by 5.2 per cent in the March quarter. |

| • | | In comparison, imports of goods and services into the Rest of Australia recorded growth of 4.1 per cent, following growth of 5.1 per cent in December quarter 2009. |

Chart 9: Imports of Goods and Services

(quarterly % change, CVM, trend)

Annual Results (Trend, CVM)

| • | | In annual terms, Queensland imports of goods and services increased 1.4 per cent over the year to March quarter 2010, following four consecutive annual declines, resulting in imports detracting 0.5 percentage point from annual GSP growth. |

| • | | Overseas imports increased 13.8 per cent and more than offset a 10.5 per cent fall in interstate imports over the year to March quarter 2010. |

| • | | In comparison, Rest of Australia imports of goods and services increased 15.0 per cent over the year to March quarter 2010, with increases in both overseas imports (14.5 per cent) and interstate imports (19.7 per cent). |

- 8 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Summary Tables

Table II

| | | | | | | | |

Changes and Contribution to Growth, Quarterly, Trend, Chain Volume Measures (a) |

| | | Queensland | | Rest of Australia (b) |

| | | Quarterly

% change

Dec-09 to

Mar-10 | | % point

contribution to

growth in GSP

Dec-09 to Mar-10 | | Quarterly

% change

Dec-09 to

Mar-10 | | % point

contribution to

growth in GSP

Dec-09 to Mar-10 |

Household consumption | | 0.9 | | 0.5 | | 0.6 | | 0.3 |

| | | | |

Private investment | | -2.5 | | -0.6 | | 1.0 | | 0.2 |

Dwelling investment | | 3.6 | | 0.3 | | 1.2 | | 0.1 |

Business investment | | -6.4 | | -0.9 | | 1.0 | | 0.1 |

| | | | |

Public final demand | | 2.1 | | 0.6 | | 2.9 | | 0.7 |

General government consumption | | 1.3 | | 0.2 | | 1.1 | | 0.2 |

Public corporations investment | | -1.7 | | -0.1 | | 3.7 | | 0.1 |

General government investment | | 6.8 | | 0.4 | | 11.0 | | 0.4 |

| | | | |

Changes in inventories | | n.a. | | 0.4 | | n.a. | | 0.1 |

| | | | |

Gross state expenditure | | 0.7 | | 0.8 | | 1.6 | | 1.7 |

| | | | |

Exports of goods and services | | -0.2 | | -0.1 | | -0.8 | | -0.2 |

Overseas | | -0.2 | | 0.0 | | 0.3 | | 0.1 |

Interstate | | -0.3 | | 0.0 | | -6.1 | | -0.2 |

| | | | |

less Imports of goods and services | | -0.2 | | -0.1 | | 4.1 | | 1.0 |

Overseas | | 5.3 | | 1.0 | | 4.6 | | 1.0 |

Interstate | | -6.1 | | -1.0 | | -0.3 | | 0.0 |

| | | | |

Gross state product | | 0.9 | | 0.9 | | 0.6 | | 0.6 |

| (a) | Chain volume measure reference year 2007-08. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the real trend quarterly changes and contributions to growth in the March quarter 2010:

| • | | Household final consumption expenditure in Queensland increased 0.9 per cent and contributed 0.5 percentage point to overall growth. |

| • | | Dwelling investment increased 3.6 per cent and contributed 0.3 percentage point to GSP growth, while business investment4 (comprised of non-dwelling construction, and machinery and equipment) declined 6.4 per cent and detracted 0.9 percentage point from GSP growth. |

| • | | Public final demand (comprised of general government consumption and investment, and public corporations investment) increased 2.1 per cent. |

| • | | Both exports of goods and services and imports of goods and services contributed 0.1 percentage point respectively to GSP growth. |

| 4 | Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend in December quarter 2009. |

- 9 -

Table III

| | | | | | | | |

Changes and Contribution to Growth, Annual, Trend, Chain Volume Measures (a) |

| | | Queensland | | Rest of Australia (b) |

| | | Annual

% change

Mar-09 to

Mar-10 | | % point

contribution to

growth in GSP

Mar-09 to Mar-10 | | Annual

% change

Mar-09 to

Mar-10 | | % point

contribution to

growth in GSP

Mar-09 to Mar-10 |

Household consumption | | 2.3 | | 1.2 | | 2.9 | | 1.6 |

| | | | |

Private investment | | -10.6 | | -3.0 | | 3.4 | | 0.8 |

Dwelling investment | | 7.3 | | 0.5 | | 3.6 | | 0.2 |

Business investment | | -22.5 | | -4.0 | | 2.3 | | 0.3 |

| | | | |

Public final demand | | 6.8 | | 1.7 | | 12.3 | | 2.7 |

General government consumption | | 4.0 | | 0.7 | | 5.0 | | 0.9 |

Public corporations investment | | -4.6 | | -0.2 | | 22.8 | | 0.4 |

General government investment | | 24.1 | | 1.2 | | 52.9 | | 1.4 |

| | | | |

Changes in inventories | | n.a. | | 1.5 | | n.a. | | 1.2 |

| | | | |

Gross state expenditure | | 1.4 | | 1.5 | | 6.6 | | 6.6 |

| | | | |

Exports of goods and services | | 7.0 | | 2.2 | | 0.1 | | 0.0 |

Overseas | | 0.9 | | 0.2 | | 2.4 | | 0.5 |

Interstate | | 19.7 | | 2.0 | | -10.5 | | -0.4 |

| | | | |

less Imports of goods and services | | 1.4 | | 0.5 | | 15.0 | | 3.5 |

Overseas | | 13.8 | | 2.4 | | 14.5 | | 3.0 |

Interstate | | -10.5 | | -1.9 | | 19.7 | | 0.5 |

| | | | |

Gross state product | | 2.6 | | 2.6 | | 2.7 | | 2.7 |

| (a) | Chain volume measure reference year 2007-08. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the real trend annual changes and contributions to growth for Queensland over the year to March quarter 2010:

| • | | Household final consumption expenditure increased 2.3 per cent and contributed 1.2 percentage points to annual GSP growth. |

| • | | Dwelling investment in Queensland increased 7.3 per cent, resulting in a 0.5 percentage point contribution to overall growth. |

| • | | Business investment (comprised of non-dwelling construction, and machinery and equipment) fell 22.5 per cent and detracted 4.0 percentage points from Queensland annual GSP growth. |

| • | | Public final demand (comprised of general government consumption and investment, and public corporations investment) increased 6.8 per cent, resulting in a 1.7 percentage point contribution to overall growth. |

| • | | Net exports contributed 1.7 percentage points to Queensland annual economic growth. A 2.2 percentage point contribution by exports was partially offset by a 0.5 percentage point detraction from imports. |

- 10 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Table IV

| | | | | | | | |

Changes and Contribution to Growth, Quarterly, Trend, Current Prices5 |

| | | Queensland | | Rest of Australia (a) |

| | | Quarterly

% change

Dec-09 to

Mar-10 | | % point

contribution to

growth in GSP

Dec-09 to Mar-10 | | Quarterly

% change

Dec-09 to

Mar-10 | | % point

contribution to

growth in GSP

Dec-09 to Mar-10 |

Compensation of employees | | 1.1 | | 0.5 | | 1.0 | | 0.5 |

Gross operating surplus and mixed income | | 2.6 | | 1.1 | | 3.1 | | 1.3 |

Gross state product at factor cost | | 1.8 | | 1.6 | | 2.1 | | 1.8 |

Taxes less subsidies on production and imports | | 1.7 | | 0.2 | | 2.0 | | 0.2 |

Gross state product | | 1.9 | | 1.9 | | 2.1 | | 2.1 |

| | | | |

Household consumption | | 1.6 | | 0.9 | | 1.6 | | -0.2 |

| | | | |

Private investment | | -2.9 | | -0.7 | | 1.3 | | 0.3 |

Dwelling investment | | 3.9 | | 0.3 | | 2.1 | | 0.1 |

Business investment | | -7.3 | | -1.0 | | 0.3 | | 0.0 |

| | | | |

Public final demand | | 2.2 | | 0.6 | | 3.3 | | 0.8 |

General government consumption | | 1.7 | | 0.3 | | 2.3 | | 0.4 |

Public corporations investment | | -2.9 | | -0.1 | | 5.2 | | 0.1 |

General government investment | | 6.4 | | 0.3 | | 8.1 | | 0.3 |

| | | | |

Changes in inventories | | n.a. | | 0.2 | | n.a. | | 0.3 |

| | | | |

Gross state expenditure | | 0.9 | | 0.9 | | 2.3 | | 2.4 |

| | | | |

Exports of goods and services | | 0.4 | | 0.1 | | 0.1 | | 0.0 |

Overseas | | 0.5 | | 0.1 | | 1.9 | | 0.3 |

Interstate | | 0.2 | | 0.0 | | -8.1 | | -0.3 |

| | | | |

less Imports of goods and services | | -1.9 | | -0.6 | | 2.1 | | 0.5 |

Overseas | | 3.9 | | 0.7 | | 2.3 | | 0.5 |

Interstate | | -8.1 | | -1.3 | | 0.2 | | 0.0 |

| | | | |

Gross state product | | 1.9 | | 1.9 | | 2.1 | | 2.1 |

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the current price trend quarterly changes and contributions to growth in March quarter 2010:

| • | | Compensation of employees increased 1.1 per cent in Queensland, just above growth of 1.0 per cent for the Rest of Australia. |

| • | | Gross operating surplus and mixed income increased 2.6 per cent in Queensland compared with an increase of 3.1 per cent in the Rest of Australia. |

| • | | Household final consumption increased 1.6 per cent and contributed 0.9 percentage point to nominal GSP growth. |

| • | | In current price terms, Queensland exports of goods and services overseas increased by 0.4 per cent in the quarter, with rising prices (0.6 per cent) offsetting a 0.2 per cent decline in export volumes. Imports of goods and services overseas decreased 1.9 per cent in the March quarter, driven by both declining prices (-1.7 per cent) and declining import volumes (-0.2 per cent). |

| 5 | Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend in December quarter 2009. |

- 11 -

Table V

| | | | | | | | |

Changes and Contribution to Growth, Annual, Trend, Current Prices |

| | | Queensland | | Rest of Australia (a) |

| | | Annual

% change

Mar-09 to

Mar-10 | | % point

contribution to

growth in GSP

Mar-09 to Mar-10 | | Annual

% change

Mar-09 to

Mar-10 | | % point

contribution to

growth in GSP

Mar-09 to Mar-10 |

Compensation of employees | | 1.9 | | 0.9 | | 1.7 | | 0.9 |

Gross operating surplus and mixed income | | -5.9 | | -2.7 | | 8.9 | | 3.6 |

Gross state product at factor cost | | -2.0 | | -1.8 | | 5.1 | | 4.5 |

Taxes less subsidies on production and imports | | 6.8 | | 0.6 | | 6.0 | | 0.6 |

Gross state product | | -0.9 | | -0.9 | | 5.3 | | 5.3 |

| | | | |

Household consumption | | 5.5 | | 2.7 | | 5.5 | | -0.7 |

| | | | |

Private investment | | -13.1 | | -3.4 | | 3.0 | | 0.7 |

Dwelling investment | | 7.6 | | 0.5 | | 6.7 | | 0.3 |

Business investment | | -26.5 | | -4.4 | | -1.8 | | -0.2 |

| | | | |

Public final demand | | 5.8 | | 1.4 | | 12.0 | | 2.6 |

General government consumption | | 6.1 | | 1.0 | | 9.1 | | 1.6 |

Public corporations investment | | -13.6 | | -0.4 | | 19.6 | | 0.3 |

General government investment | | 17.7 | | 0.9 | | 26.5 | | 0.7 |

| | | | |

Changes in inventories | | n.a. | | 1.0 | | n.a. | | 1.3 |

| | | | |

Gross state expenditure | | 1.7 | | 1.7 | | 8.2 | | 8.3 |

| | | | |

Exports of goods and services | | -14.8 | | -5.5 | | -12.8 | | -3.3 |

Overseas | | -26.1 | | -7.1 | | -11.7 | | -2.5 |

Interstate | | 17.2 | | 1.7 | | -17.9 | | -0.8 |

| | | | |

less Imports of goods and services | | -9.5 | | -3.3 | | -2.3 | | -0.6 |

Overseas | | -1.1 | | -0.2 | | -4.4 | | -1.0 |

Interstate | | -17.9 | | -3.1 | | 17.2 | | 0.4 |

| | | | |

Gross state product | | -0.9 | | -0.9 | | 5.3 | | 5.3 |

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the current price annual changes and contributions to growth over the year to March quarter 2010:

| • | | Compensation of employees increased 1.9 per cent in Queensland and contributed 0.9 percentage point to annual nominal GSP growth. |

| • | | Queensland gross operating surplus and mixed income declined 5.9 per cent, in contrast to the 8.9 per cent rise for the Rest of Australia. This largely reflects a decline in mining gross operating surplus of 29 per cent (in original terms) due to a substantial decline in coal export prices from their exceptional high levels in March quarter 2009. |

| • | | Queensland exports of goods and services overseas declined 14.8 per cent in annual terms, with a 7.0 per cent rise in export volumes more than offset by a 20.4 per cent decline in the price of exports. This decline was largely due to a 51 per cent decline in coal export prices. |

| • | | Queensland imports of goods and services fell 9.5 per cent, with a moderate rise in import volumes (1.4 per cent) more than offset by declining import prices (-10.8 per cent). |

- 12 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Queensland State Accounts - Tables

| | | | |

| Table | | Domestic Production Accounts – Queensland | | Page |

| | |

| 1 | | Chain volume measures, trend, $m | | 14 |

| 2 | | Chain volume measures, trend, quarterly % change | | 16 |

| 3 | | Chain volume measures, trend, quarterly contribution to growth, % point | | 18 |

| 4 | | Chain volume measures, trend, annual % change | | 20 |

| 5 | | Chain volume measures, trend, annual contribution to growth, % point | | 22 |

Additional tables available on the Internet URL: http://www.oesr.qld.gov.au/releases/qsatables |

| Table | | Domestic Production Accounts – Queensland | | |

| | |

| 6 | | Seasonally adjusted, chain volume measures, $m | | |

| 7 | | Seasonally adjusted, chain volume measures, quarterly % change | | |

| 8 | | Seasonally adjusted, chain volume measures, annual % change | | |

| 9 | | Original, chain volume measures, $m | | |

| 10 | | Original, chain volume measures, annual % change | | |

| 11 | | Trend, current prices, $m | | |

| 12 | | Trend, current prices, quarterly % change | | |

| 13 | | Trend, current prices, quarterly contribution to growth, % point | | |

| 14 | | Seasonally adjusted, current prices, $m | | |

| 15 | | Seasonally adjusted, current prices, quarterly % change | | |

| 16 | | Seasonally adjusted, current prices, quarterly contribution to growth, % point | | |

| 17 | | Original, current prices, $m | | |

| 18 | | Original, current prices, annual % change | | |

| 19 | | Trend, implicit price deflators, 2007-08 = 100 | | |

| 20 | | Original, implicit price deflators, 2007-08 = 100 | | |

| | |

| Table | | Domestic Production Accounts - Rest of Australia | | |

| | |

| 21 | | Trend, chain volume measures, $m | | |

| 22 | | Trend, chain volume measures, quarterly % change | | |

| 23 | | Seasonally adjusted, chain volume measures, $m | | |

| 24 | | Original, chain volume measures, $m | | |

| 25 | | Trend, current prices, $m | | |

| 26 | | Original, current prices, $m | | |

| 27 | | Trend, implicit price deflators, 2007-08 = 100 | | |

- 13 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 1 |

| (Trend, chain volume measure (a) , $m) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Levels |

| | | 2006-07 | | 2007-08 | | 2008-09 | | 2009-10 |

| | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar |

| | | | | | | | | | | | | |

Final consumption expenditure | | 37,073 | | 37,621 | | 38,187 | | 38,626 | | 38,948 | | 39,155 | | 39,315 | | 39,450 | | 39,474 | | 39,539 | | 39,791 | | 40,147 | | 40,539 |

| | | | | | | | | | | | | |

Households | | 28,437 | | 28,914 | | 29,356 | | 29,642 | | 29,810 | | 29,887 | | 29,935 | | 30,010 | | 30,030 | | 30,069 | | 30,217 | | 30,445 | | 30,714 |

| | | | | | | | | | | | | |

General government | | 8,636 | | 8,707 | | 8,830 | | 8,984 | | 9,139 | | 9,268 | | 9,380 | | 9,440 | | 9,444 | | 9,470 | | 9,575 | | 9,702 | | 9,826 |

National | | 2,779 | | 2,813 | | 2,839 | | 2,865 | | 2,891 | | 2,918 | | 2,927 | | 2,913 | | 2,875 | | 2,871 | | 2,930 | | 3,007 | | 3,083 |

State and local | | 5,856 | | 5,894 | | 5,992 | | 6,119 | | 6,248 | | 6,350 | | 6,453 | | 6,526 | | 6,568 | | 6,599 | | 6,645 | | 6,694 | | 6,743 |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) | | 14,966 | | 15,365 | | 15,481 | | 15,630 | | 16,236 | | 16,902 | | 17,063 | | 16,636 | | 15,908 | | 15,307 | | 14,935 | | 14,585 | | 14,219 |

| | | | | | | | | | | | | |

Dwellings | | 4,803 | | 4,720 | | 4,561 | | 4,525 | | 4,734 | | 4,922 | | 4,826 | | 4,408 | | 3,951 | | 3,791 | | 3,941 | | 4,092 | | 4,238 |

New and used | | 2,579 | | 2,537 | | 2,482 | | 2,508 | | 2,670 | | 2,774 | | 2,690 | | 2,439 | | 2,188 | | 2,075 | | 2,074 | | 2,058 | | 2,049 |

Alterations and additions | | 2,223 | | 2,182 | | 2,079 | | 2,017 | | 2,064 | | 2,148 | | 2,136 | | 1,969 | | 1,763 | | 1,715 | | 1,866 | | 2,034 | | 2,189 |

| | | | | | | | | | | | | |

Business Investment (b) | | 8,063 | | 8,450 | | 8,698 | | 8,921 | | 9,386 | | 9,978 | | 10,354 | | 10,406 | | 10,078 | | 9,510 | | 8,892 | | 8,346 | | 7,811 |

Non-dwelling construction (b) | | 3,865 | | 3,961 | | 3,989 | | 4,055 | | 4,288 | | 4,623 | | 4,865 | | 4,984 | | 4,906 | | 4,701 | | 4,484 | | 4,319 | | 4,189 |

Machinery and equipment (b) | | 4,198 | | 4,490 | | 4,709 | | 4,866 | | 5,098 | | 5,355 | | 5,489 | | 5,421 | | 5,172 | | 4,808 | | 4,408 | | 4,027 | | 3,623 |

| | | | | | | | | | | | | |

Livestock and orchards | | 179 | | 178 | | 180 | | 183 | | 189 | | 196 | | 202 | | 207 | | 210 | | 214 | | 219 | | 224 | | 229 |

Intellectual property products | | 774 | | 799 | | 815 | | 836 | | 861 | | 884 | | 896 | | 896 | | 901 | | 934 | | 981 | | 1,025 | | 1,061 |

Ownership transfer costs | | 1,147 | | 1,218 | | 1,225 | | 1,165 | | 1,067 | | 923 | | 785 | | 720 | | 769 | | 859 | | 902 | | 898 | | 880 |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) | | 3,999 | | 4,309 | | 4,435 | | 4,467 | | 4,625 | | 4,992 | | 5,119 | | 5,093 | | 5,045 | | 5,087 | | 5,259 | | 5,454 | | 5,652 |

| | | | | | | | | | | | | |

Public corporations (b) | | 1,740 | | 1,961 | | 2,041 | | 2,003 | | 1,989 | | 2,153 | | 2,201 | | 2,159 | | 2,118 | | 2,082 | | 2,075 | | 2,056 | | 2,021 |

Commonwealth (b) | | 94 | | 53 | | 45 | | 58 | | 58 | | 58 | | 58 | | 58 | | 62 | | 73 | | 86 | | 94 | | 99 |

State and local | | 1,646 | | 1,908 | | 1,996 | | 1,945 | | 1,931 | | 2,095 | | 2,143 | | 2,101 | | 2,056 | | 2,009 | | 1,989 | | 1,962 | | 1,922 |

| | | | | | | | | | | | | |

General government | | 2,259 | | 2,349 | | 2,394 | | 2,463 | | 2,635 | | 2,839 | | 2,918 | | 2,934 | | 2,926 | | 3,005 | | 3,185 | | 3,398 | | 3,630 |

National | | 420 | | 408 | | 394 | | 417 | | 492 | | 568 | | 580 | | 538 | | 486 | | 480 | | 521 | | 581 | | 648 |

State and local | | 1,839 | | 1,941 | | 2,001 | | 2,047 | | 2,143 | | 2,271 | | 2,338 | | 2,396 | | 2,441 | | 2,525 | | 2,664 | | 2,817 | | 2,982 |

| | | | | | | | | | | | | |

Change in inventories | | 370 | | 455 | | 366 | | 270 | | 290 | | 292 | | 102 | | -238 | | -490 | | -429 | | -120 | | 153 | | 371 |

| | | | | | | | | | | | | |

Gross state expenditure | | 56,409 | | 57,750 | | 58,469 | | 58,992 | | 60,100 | | 61,342 | | 61,600 | | 60,941 | | 59,936 | | 59,505 | | 59,865 | | 60,339 | | 60,781 |

- 14 -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | 17,991 | | 18,299 | | 18,313 | | 18,409 | | 18,700 | | 18,810 | | 18,488 | | 18,025 | | 17,962 | | 18,448 | | 19,004 | | 19,262 | | 19,219 |

| | | | | | | | | | | | | |

Overseas | | 11,413 | | 11,520 | | 11,487 | | 11,639 | | 11,982 | | 12,221 | | 12,128 | | 12,030 | | 12,121 | | 12,228 | | 12,252 | | 12,249 | | 12,226 |

Goods | | 8,885 | | 8,899 | | 8,787 | | 8,872 | | 9,189 | | 9,393 | | 9,295 | | 9,221 | | 9,342 | | 9,511 | | 9,590 | | 9,619 | | 9,632 |

Services | | 2,528 | | 2,621 | | 2,700 | | 2,766 | | 2,792 | | 2,828 | | 2,833 | | 2,809 | | 2,779 | | 2,716 | | 2,662 | | 2,630 | | 2,594 |

| | | | | | | | | | | | | |

Interstate | | 6,578 | | 6,779 | | 6,826 | | 6,770 | | 6,718 | | 6,589 | | 6,360 | | 5,995 | | 5,841 | | 6,220 | | 6,752 | | 7,013 | | 6,993 |

Goods | | 4,873 | | 5,116 | | 5,114 | | 5,072 | | 5,149 | | 5,166 | | 4,944 | | 4,614 | | 4,521 | | 4,909 | | 5,342 | | 5,524 | | 5,464 |

Selected services | | 1,705 | | 1,663 | | 1,712 | | 1,698 | | 1,569 | | 1,423 | | 1,416 | | 1,381 | | 1,320 | | 1,311 | | 1,410 | | 1,489 | | 1,529 |

| | | | | | | | | | | | | |

less Imports of goods and services | | 19,359 | | 20,199 | | 20,698 | | 21,155 | | 21,921 | | 22,848 | | 22,861 | | 21,705 | | 20,176 | | 19,571 | | 20,047 | | 20,493 | | 20,458 |

| | | | | | | | | | | | | |

less Overseas | | 9,193 | | 9,487 | | 9,730 | | 10,170 | | 10,829 | | 11,370 | | 11,245 | | 10,551 | | 9,872 | | 9,703 | | 10,117 | | 10,675 | | 11,236 |

less Goods | | 7,059 | | 7,268 | | 7,412 | | 7,707 | | 8,178 | | 8,613 | | 8,548 | | 8,012 | | 7,465 | | 7,304 | | 7,621 | | 8,060 | | 8,484 |

less Services | | 2,134 | | 2,219 | | 2,319 | | 2,463 | | 2,651 | | 2,757 | | 2,697 | | 2,540 | | 2,408 | | 2,399 | | 2,496 | | 2,615 | | 2,752 |

| | | | | | | | | | | | | |

less Interstate | | 10,167 | | 10,711 | | 10,967 | | 10,985 | | 11,092 | | 11,478 | | 11,615 | | 11,154 | | 10,304 | | 9,868 | | 9,930 | | 9,818 | | 9,222 |

less Goods | | 9,151 | | 9,684 | | 9,971 | | 10,049 | | 10,183 | | 10,562 | | 10,707 | | 10,287 | | 9,499 | | 9,082 | | 9,084 | | 8,924 | | 8,312 |

less Selected services | | 1,015 | | 1,027 | | 996 | | 936 | | 909 | | 916 | | 908 | | 867 | | 804 | | 785 | | 846 | | 893 | | 911 |

| | | | | | | | | | | | | |

Statistical discrepancy (E) | | -77 | | -71 | | 49 | | 109 | | 29 | | -60 | | -115 | | -248 | | -532 | | -879 | | -1,014 | | -980 | | -886 |

| | | | | | | | | | | | | |

Gross state product | | 54,964 | | 55,780 | | 56,133 | | 56,354 | | 56,908 | | 57,244 | | 57,112 | | 57,012 | | 57,190 | | 57,503 | | 57,807 | | 58,127 | | 58,656 |

| (a) | Chain volume measure reference year 2007-08 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. |

TABLE 1

- 15 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 2 |

| (Trend, chain volume measure (a) , quarterly percentage change, %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Change from last quarter |

| | | 2006-07 | | 2007-08 | | 2008-09 | | 2009-10 |

| | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar |

| | | | | | | | | | | | | |

Final consumption expenditure | | 1.1 | | 1.5 | | 1.5 | | 1.1 | | 0.8 | | 0.5 | | 0.4 | | 0.3 | | 0.1 | | 0.2 | | 0.6 | | 0.9 | | 1.0 |

| | | | | | | | | | | | | |

Households | | 1.1 | | 1.7 | | 1.5 | | 1.0 | | 0.6 | | 0.3 | | 0.2 | | 0.3 | | 0.1 | | 0.1 | | 0.5 | | 0.8 | | 0.9 |

| | | | | | | | | | | | | |

General government | | 0.9 | | 0.8 | | 1.4 | | 1.7 | | 1.7 | | 1.4 | | 1.2 | | 0.6 | | 0.0 | | 0.3 | | 1.1 | | 1.3 | | 1.3 |

National | | 1.8 | | 1.2 | | 0.9 | | 0.9 | | 0.9 | | 0.9 | | 0.3 | | -0.5 | | -1.3 | | -0.1 | | 2.1 | | 2.6 | | 2.5 |

State and local | | 0.4 | | 0.6 | | 1.7 | | 2.1 | | 2.1 | | 1.6 | | 1.6 | | 1.1 | | 0.6 | | 0.5 | | 0.7 | | 0.7 | | 0.7 |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) | | 4.8 | | 2.7 | | 0.8 | | 1.0 | | 3.9 | | 4.1 | | 1.0 | | -2.5 | | -4.4 | | -3.8 | | -2.4 | | -2.3 | | -2.5 |

| | | | | | | | | | | | | |

Dwellings | | 2.4 | | -1.7 | | -3.4 | | -0.8 | | 4.6 | | 4.0 | | -2.0 | | -8.7 | | -10.4 | | -4.0 | | 4.0 | | 3.8 | | 3.6 |

New and used | | 1.3 | | -1.6 | | -2.2 | | 1.0 | | 6.5 | | 3.9 | | -3.0 | | -9.3 | | -10.3 | | -5.2 | | 0.0 | | -0.8 | | -0.4 |

Alterations and additions | | 3.6 | | -1.8 | | -4.7 | | -3.0 | | 2.3 | | 4.1 | | -0.6 | | -7.8 | | -10.5 | | -2.7 | | 8.8 | | 9.0 | | 7.6 |

| | | | | | | | | | | | | |

Business Investment (b) | | 6.2 | | 4.8 | | 2.9 | | 2.6 | | 5.2 | | 6.3 | | 3.8 | | 0.5 | | -3.2 | | -5.6 | | -6.5 | | -6.1 | | -6.4 |

Non-dwelling construction (b) | | 5.4 | | 2.5 | | 0.7 | | 1.7 | | 5.7 | | 7.8 | | 5.2 | | 2.4 | | -1.6 | | -4.2 | | -4.6 | | -3.7 | | -3.0 |

Machinery and equipment (b) | | 6.9 | | 7.0 | | 4.9 | | 3.3 | | 4.8 | | 5.0 | | 2.5 | | -1.2 | | -4.6 | | -7.0 | | -8.3 | | -8.6 | | -10.0 |

| | | | | | | | | | | | | |

Livestock and orchards | | -5.3 | | -0.6 | | 1.1 | | 1.7 | | 3.3 | | 3.7 | | 3.1 | | 2.5 | | 1.4 | | 1.9 | | 2.3 | | 2.3 | | 2.2 |

Intellectual property products | | 4.0 | | 3.2 | | 2.0 | | 2.6 | | 3.0 | | 2.7 | | 1.4 | | 0.0 | | 0.6 | | 3.7 | | 5.0 | | 4.5 | | 3.5 |

Ownership transfer costs | | 7.3 | | 6.2 | | 0.6 | | -4.9 | | -8.4 | | -13.5 | | -15.0 | | -8.3 | | 6.8 | | 11.7 | | 5.0 | | -0.4 | | -2.0 |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) | | 11.4 | | 7.8 | | 2.9 | | 0.7 | | 3.5 | | 7.9 | | 2.5 | | -0.5 | | -0.9 | | 0.8 | | 3.4 | | 3.7 | | 3.6 |

| | | | | | | | | | | | | |

Public corporations (b) | | 17.7 | | 12.7 | | 4.1 | | -1.9 | | -0.7 | | 8.2 | | 2.2 | | -1.9 | | -1.9 | | -1.7 | | -0.3 | | -0.9 | | -1.7 |

Commonwealth (b) | | -41.3 | | -43.6 | | -15.1 | | 28.9 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 6.9 | | 17.7 | | 17.8 | | 9.3 | | 5.3 |

State and local | | 24.9 | | 15.9 | | 4.6 | | -2.6 | | -0.7 | | 8.5 | | 2.3 | | -2.0 | | -2.1 | | -2.3 | | -1.0 | | -1.4 | | -2.0 |

| | | | | | | | | | | | | |

General government | | 7.0 | | 4.0 | | 1.9 | | 2.9 | | 7.0 | | 7.7 | | 2.8 | | 0.5 | | -0.3 | | 2.7 | | 6.0 | | 6.7 | | 6.8 |

National | | 0.0 | | -2.9 | | -3.4 | | 5.8 | | 18.0 | | 15.4 | | 2.1 | | -7.2 | | -9.7 | | -1.2 | | 8.5 | | 11.5 | | 11.5 |

State and local | | 8.7 | | 5.5 | | 3.1 | | 2.3 | | 4.7 | | 6.0 | | 3.0 | | 2.5 | | 1.9 | | 3.4 | | 5.5 | | 5.7 | | 5.9 |

| | | | | | | | | | | | | |

Gross state expenditure | | 3.2 | | 2.4 | | 1.2 | | 0.9 | | 1.9 | | 2.1 | | 0.4 | | -1.1 | | -1.6 | | -0.7 | | 0.6 | | 0.8 | | 0.7 |

- 16 -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | 3.5 | | 1.7 | | 0.1 | | 0.5 | | 1.6 | | 0.6 | | -1.7 | | -2.5 | | -0.3 | | 2.7 | | 3.0 | | 1.4 | | -0.2 |

| | | | | | | | | | | | | |

Overseas | | 3.0 | | 0.9 | | -0.3 | | 1.3 | | 2.9 | | 2.0 | | -0.8 | | -0.8 | | 0.8 | | 0.9 | | 0.2 | | 0.0 | | -0.2 |

Goods | | 2.9 | | 0.2 | | -1.3 | | 1.0 | | 3.6 | | 2.2 | | -1.0 | | -0.8 | | 1.3 | | 1.8 | | 0.8 | | 0.3 | | 0.1 |

Services | | 3.2 | | 3.7 | | 3.0 | | 2.4 | | 0.9 | | 1.3 | | 0.2 | | -0.8 | | -1.1 | | -2.3 | | -2.0 | | -1.2 | | -1.4 |

| | | | | | | | | | | | | |

Interstate | | 4.5 | | 3.1 | | 0.7 | | -0.8 | | -0.8 | | -1.9 | | -3.5 | | -5.7 | | -2.6 | | 6.5 | | 8.6 | | 3.9 | | -0.3 |

Goods | | 5.9 | | 5.0 | | 0.0 | | -0.8 | | 1.5 | | 0.3 | | -4.3 | | -6.7 | | -2.0 | | 8.6 | | 8.8 | | 3.4 | | -1.1 |

Selected services | | 0.8 | | -2.5 | | 2.9 | | -0.8 | | -7.6 | | -9.3 | | -0.5 | | -2.5 | | -4.4 | | -0.7 | | 7.6 | | 5.6 | | 2.7 |

| | | | | | | | | | | | | |

less Imports of goods and services | | 6.3 | | 4.3 | | 2.5 | | 2.2 | | 3.6 | | 4.2 | | 0.1 | | -5.1 | | -7.0 | | -3.0 | | 2.4 | | 2.2 | | -0.2 |

| | | | | | | | | | | | | |

less Overseas | | 4.5 | | 3.2 | | 2.6 | | 4.5 | | 6.5 | | 5.0 | | -1.1 | | -6.2 | | -6.4 | | -1.7 | | 4.3 | | 5.5 | | 5.3 |

less Goods | | 4.6 | | 3.0 | | 2.0 | | 4.0 | | 6.1 | | 5.3 | | -0.8 | | -6.3 | | -6.8 | | -2.2 | | 4.3 | | 5.8 | | 5.3 |

less Services | | 4.0 | | 4.0 | | 4.5 | | 6.2 | | 7.6 | | 4.0 | | -2.2 | | -5.8 | | -5.2 | | -0.4 | | 4.0 | | 4.8 | | 5.2 |

| | | | | | | | | | | | | |

less Interstate | | 8.1 | | 5.4 | | 2.4 | | 0.2 | | 1.0 | | 3.5 | | 1.2 | | -4.0 | | -7.6 | | -4.2 | | 0.6 | | -1.1 | | -6.1 |

less Goods | | 8.8 | | 5.8 | | 3.0 | | 0.8 | | 1.3 | | 3.7 | | 1.4 | | -3.9 | | -7.7 | | -4.4 | | 0.0 | | -1.8 | | -6.9 |

less Selected services | | 2.0 | | 1.2 | | -3.0 | | -6.0 | | -2.9 | | 0.8 | | -0.9 | | -4.5 | | -7.3 | | -2.4 | | 7.8 | | 5.6 | | 2.0 |

| | | | | | | | | | | | | |

Gross state product | | 2.0 | | 1.5 | | 0.6 | | 0.4 | | 1.0 | | 0.6 | | -0.2 | | -0.2 | | 0.3 | | 0.5 | | 0.5 | | 0.6 | | 0.9 |

| (a) | Chain volume measure reference year 2007-08 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. |

TABLE 2

- 17 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 3 |

| (Trend, chain volume measure (a) , quarterly contribution to growth, % points) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Contributions to growth from last quarter |

| | | 2006-07 | | 2007-08 | | 2008-09 | | 2009-10 |

| | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar |

| | | | | | | | | | | | | |

Final consumption expenditure | | 0.7 | | 1.0 | | 1.0 | | 0.8 | | 0.6 | | 0.4 | | 0.3 | | 0.2 | | 0.0 | | 0.1 | | 0.4 | | 0.6 | | 0.7 |

| | | | | | | | | | | | | |

Households | | 0.6 | | 0.9 | | 0.8 | | 0.5 | | 0.3 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.1 | | 0.3 | | 0.4 | | 0.5 |

| | | | | | | | | | | | | |

General government | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.3 | | 0.2 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.2 | | 0.2 | | 0.2 |

National | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | -0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

State and local | | 0.0 | | 0.1 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) | | 1.3 | | 0.7 | | 0.2 | | 0.3 | | 1.1 | | 1.2 | | 0.3 | | -0.7 | | -1.3 | | -1.1 | | -0.6 | | -0.6 | | -0.6 |

| | | | | | | | | | | | | |

Dwellings | | 0.2 | | -0.2 | | -0.3 | | -0.1 | | 0.4 | | 0.3 | | -0.2 | | -0.7 | | -0.8 | | -0.3 | | 0.3 | | 0.3 | | 0.3 |

New and used | | 0.1 | | -0.1 | | -0.1 | | 0.0 | | 0.3 | | 0.2 | | -0.1 | | -0.4 | | -0.4 | | -0.2 | | 0.0 | | 0.0 | | 0.0 |

Alterations and additions | | 0.1 | | -0.1 | | -0.2 | | -0.1 | | 0.1 | | 0.1 | | 0.0 | | -0.3 | | -0.4 | | -0.1 | | 0.3 | | 0.3 | | 0.3 |

| | | | | | | | | | | | | |

Business Investment (b) | | 0.9 | | 0.7 | | 0.4 | | 0.4 | | 0.8 | | 1.0 | | 0.7 | | 0.1 | | -0.6 | | -1.0 | | -1.1 | | -0.9 | | -0.9 |

Non-dwelling construction (b) | | 0.4 | | 0.2 | | 0.1 | | 0.1 | | 0.4 | | 0.6 | | 0.4 | | 0.2 | | -0.1 | | -0.4 | | -0.4 | | -0.3 | | -0.2 |

Machinery and equipment (b) | | 0.5 | | 0.5 | | 0.4 | | 0.3 | | 0.4 | | 0.5 | | 0.2 | | -0.1 | | -0.4 | | -0.6 | | -0.7 | | -0.7 | | -0.7 |

| | | | | | | | | | | | | |

Livestock and orchards | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Intellectual property products | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.1 |

Ownership transfer costs | | 0.1 | | 0.1 | | 0.0 | | -0.1 | | -0.2 | | -0.3 | | -0.2 | | -0.1 | | 0.1 | | 0.2 | | 0.1 | | 0.0 | | 0.0 |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) | | 0.8 | | 0.6 | | 0.2 | | 0.1 | | 0.3 | | 0.6 | | 0.2 | | 0.0 | | -0.1 | | 0.1 | | 0.3 | | 0.3 | | 0.3 |

| | | | | | | | | | | | | |

Public corporations (b) | | 0.5 | | 0.4 | | 0.1 | | -0.1 | | 0.0 | | 0.3 | | 0.1 | | -0.1 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | -0.1 |

Commonwealth (b) | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

State and local | | 0.6 | | 0.5 | | 0.2 | | -0.1 | | 0.0 | | 0.3 | | 0.1 | | -0.1 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | -0.1 |

| | | | | | | | | | | | | |

General government | | 0.3 | | 0.2 | | 0.1 | | 0.1 | | 0.3 | | 0.4 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.3 | | 0.4 | | 0.4 |

National | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

State and local | | 0.3 | | 0.2 | | 0.1 | | 0.1 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.3 |

| | | | | | | | | | | | | |

Change in inventories | | 0.5 | | 0.2 | | -0.2 | | -0.2 | | 0.0 | | 0.0 | | -0.3 | | -0.6 | | -0.4 | | 0.1 | | 0.5 | | 0.5 | | 0.4 |

| | | | | | | | | | | | | |

Gross state expenditure | | 3.2 | | 2.4 | | 1.3 | | 0.9 | | 2.0 | | 2.2 | | 0.5 | | -1.2 | | -1.8 | | -0.8 | | 0.6 | | 0.8 | | 0.8 |

- 18 -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | 1.1 | | 0.6 | | 0.0 | | 0.2 | | 0.5 | | 0.2 | | -0.6 | | -0.8 | | -0.1 | | 0.8 | | 1.0 | | 0.4 | | -0.1 |

| | | | | | | | | | | | | |

Overseas | | 0.6 | | 0.2 | | -0.1 | | 0.3 | | 0.6 | | 0.4 | | -0.2 | | -0.2 | | 0.2 | | 0.2 | | 0.0 | | 0.0 | | 0.0 |

Goods | | 0.5 | | 0.0 | | -0.2 | | 0.2 | | 0.6 | | 0.4 | | -0.2 | | -0.1 | | 0.2 | | 0.3 | | 0.1 | | 0.1 | | 0.0 |

Services | | 0.1 | | 0.2 | | 0.1 | | 0.1 | | 0.0 | | 0.1 | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | -0.1 | | -0.1 | | -0.1 |

| | | | | | | | | | | | | |

Interstate | | 0.5 | | 0.4 | | 0.1 | | -0.1 | | -0.1 | | -0.2 | | -0.4 | | -0.6 | | -0.3 | | 0.7 | | 0.9 | | 0.5 | | 0.0 |

Goods | | 0.5 | | 0.4 | | 0.0 | | -0.1 | | 0.1 | | 0.0 | | -0.4 | | -0.6 | | -0.2 | | 0.7 | | 0.8 | | 0.3 | | -0.1 |

Selected services | | 0.0 | | -0.1 | | 0.1 | | 0.0 | | -0.2 | | -0.3 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.2 | | 0.1 | | 0.1 |

| | | | | | | | | | | | | |

less Imports of goods and services | | 2.1 | | 1.5 | | 0.9 | | 0.8 | | 1.4 | | 1.6 | | 0.0 | | -2.0 | | -2.7 | | -1.1 | | 0.8 | | 0.8 | | -0.1 |

| | | | | | | | | | | | | |

less Overseas | | 0.7 | | 0.5 | | 0.4 | | 0.8 | | 1.2 | | 1.0 | | -0.2 | | -1.2 | | -1.2 | | -0.3 | | 0.7 | | 1.0 | | 1.0 |

less Goods | | 0.6 | | 0.4 | | 0.3 | | 0.5 | | 0.8 | | 0.8 | | -0.1 | | -0.9 | | -1.0 | | -0.3 | | 0.6 | | 0.8 | | 0.7 |

less Services | | 0.2 | | 0.2 | | 0.2 | | 0.3 | | 0.3 | | 0.2 | | -0.1 | | -0.3 | | -0.2 | | 0.0 | | 0.2 | | 0.2 | | 0.2 |

| | | | | | | | | | | | | |

less Interstate | | 1.4 | | 1.0 | | 0.5 | | 0.0 | | 0.2 | | 0.7 | | 0.2 | | -0.8 | | -1.5 | | -0.8 | | 0.1 | | -0.2 | | -1.0 |

less Goods | | 1.4 | | 1.0 | | 0.5 | | 0.1 | | 0.2 | | 0.7 | | 0.3 | | -0.7 | | -1.4 | | -0.7 | | 0.0 | | -0.3 | | -1.1 |

less Selected services | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.0 |

| | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Statistical discrepancy (E) | | -0.2 | | 0.0 | | 0.2 | | 0.1 | | -0.1 | | -0.2 | | -0.1 | | -0.2 | | -0.5 | | -0.6 | | -0.2 | | 0.1 | | 0.2 |

| | | | | | | | | | | | | |

Gross state product | | 2.0 | | 1.5 | | 0.6 | | 0.4 | | 1.0 | | 0.6 | | -0.2 | | -0.2 | | 0.3 | | 0.5 | | 0.5 | | 0.6 | | 0.9 |

| (a) | Chain volume measure reference year 2007-08 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. |

TABLE 3

- 19 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 4 |

| (Trend, chain volume measure (a) , annual percentage change, %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Change from same quarter last year |

| | | 2006-07 | | 2007-08 | | 2008-09 | | 2009-10 |

| | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar |

| | | | | | | | | | | | | |

Final consumption expenditure | | 2.9 | | 3.8 | | 4.9 | | 5.3 | | 5.1 | | 4.1 | | 3.0 | | 2.1 | | 1.4 | | 1.0 | | 1.2 | | 1.8 | | 2.7 |

| | | | | | | | | | | | | |

Households | | 2.3 | | 3.7 | | 5.1 | | 5.4 | | 4.8 | | 3.4 | | 2.0 | | 1.2 | | 0.7 | | 0.6 | | 0.9 | | 1.4 | | 2.3 |

| | | | | | | | | | | | | |

General government | | 4.8 | | 4.4 | | 4.4 | | 4.9 | | 5.8 | | 6.4 | | 6.2 | | 5.1 | | 3.3 | | 2.2 | | 2.1 | | 2.8 | | 4.0 |

National | | 8.2 | | 8.2 | | 6.9 | | 5.0 | | 4.0 | | 3.7 | | 3.1 | | 1.7 | | -0.6 | | -1.6 | | 0.1 | | 3.2 | | 7.2 |

State and local | | 3.2 | | 2.6 | | 3.3 | | 4.9 | | 6.7 | | 7.7 | | 7.7 | | 6.7 | | 5.1 | | 3.9 | | 3.0 | | 2.6 | | 2.7 |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) | | 12.7 | | 13.5 | | 12.4 | | 9.4 | | 8.5 | | 10.0 | | 10.2 | | 6.4 | | -2.0 | | -9.4 | | -12.5 | | -12.3 | | -10.6 |

| | | | | | | | | | | | | |

Dwellings | | 13.2 | | 10.1 | | 2.1 | | -3.5 | | -1.4 | | 4.3 | | 5.8 | | -2.6 | | -16.5 | | -23.0 | | -18.3 | | -7.2 | | 7.3 |

New and used | | 8.5 | | 6.3 | | 1.1 | | -1.5 | | 3.5 | | 9.3 | | 8.4 | | -2.8 | | -18.1 | | -25.2 | | -22.9 | | -15.6 | | -6.4 |

Alterations and additions | | 19.1 | | 14.9 | | 3.3 | | -6.0 | | -7.2 | | -1.6 | | 2.7 | | -2.4 | | -14.6 | | -20.2 | | -12.6 | | 3.3 | | 24.2 |

| | | | | | | | | | | | | |

Business Investment (b) | | 13.8 | | 16.2 | | 18.5 | | 17.5 | | 16.4 | | 18.1 | | 19.0 | | 16.6 | | 7.4 | | -4.7 | | -14.1 | | -19.8 | | -22.5 |

Non-dwelling construction (b) | | 19.3 | | 18.1 | | 15.1 | | 10.6 | | 10.9 | | 16.7 | | 22.0 | | 22.9 | | 14.4 | | 1.7 | | -7.8 | | -13.3 | | -14.6 |

Machinery and equipment (b) | | 9.1 | | 14.7 | | 21.6 | | 23.9 | | 21.4 | | 19.3 | | 16.6 | | 11.4 | | 1.5 | | -10.2 | | -19.7 | | -25.7 | | -29.9 |

| | | | | | | | | | | | | |

Livestock and orchards | | -32.7 | | -26.1 | | -14.7 | | -3.2 | | 5.6 | | 10.1 | | 12.2 | | 13.1 | | 11.1 | | 9.2 | | 8.4 | | 8.2 | | 9.0 |

Intellectual property products | | 18.7 | | 17.3 | | 14.5 | | 12.4 | | 11.2 | | 10.6 | | 9.9 | | 7.2 | | 4.6 | | 5.7 | | 9.5 | | 14.4 | | 17.8 |

Ownership transfer costs | | 10.7 | | 15.3 | | 16.8 | | 9.0 | | -7.0 | | -24.2 | | -35.9 | | -38.2 | | -27.9 | | -6.9 | | 14.9 | | 24.7 | | 14.4 |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) | | 24.7 | | 29.9 | | 32.3 | | 24.5 | | 15.7 | | 15.9 | | 15.4 | | 14.0 | | 9.1 | | 1.9 | | 2.7 | | 7.1 | | 12.0 |

| | | | | | | | | | | | | |

Public corporations (b) | | 28.3 | | 39.4 | | 47.6 | | 35.5 | | 14.3 | | 9.8 | | 7.8 | | 7.8 | | 6.5 | | -3.3 | | -5.7 | | -4.8 | | -4.6 |

Commonwealth (b) | | -60.2 | | -78.7 | | -80.0 | | -63.8 | | -38.3 | | 9.4 | | 28.9 | | 0.0 | | 6.9 | | 25.9 | | 48.3 | | 62.1 | | 59.7 |

State and local | | 47.1 | | 64.8 | | 72.4 | | 47.6 | | 17.3 | | 9.8 | | 7.4 | | 8.0 | | 6.5 | | -4.1 | | -7.2 | | -6.6 | | -6.5 |

| | | | | | | | | | | | | |

General government | | 22.0 | | 23.0 | | 21.6 | | 16.7 | | 16.6 | | 20.9 | | 21.9 | | 19.1 | | 11.0 | | 5.8 | | 9.2 | | 15.8 | | 24.1 |

National | | 7.1 | | 3.3 | | -2.7 | | -0.7 | | 17.1 | | 39.2 | | 47.2 | | 29.0 | | -1.2 | | -15.5 | | -10.2 | | 8.0 | | 33.3 |

State and local | | 26.0 | | 28.2 | | 27.9 | | 21.0 | | 16.5 | | 17.0 | | 16.8 | | 17.0 | | 13.9 | | 11.2 | | 13.9 | | 17.6 | | 22.2 |

| | | | | | | | | | | | | |

Gross state expenditure | | 7.4 | | 9.1 | | 9.5 | | 7.9 | | 6.5 | | 6.2 | | 5.4 | | 3.3 | | -0.3 | | -3.0 | | -2.8 | | -1.0 | | 1.4 |

- 20 -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | 5.0 | | 7.2 | | 7.6 | | 5.9 | | 3.9 | | 2.8 | | 1.0 | | -2.1 | | -3.9 | | -1.9 | | 2.8 | | 6.9 | | 7.0 |

| | | | | | | | | | | | | |

Overseas | | 4.7 | | 6.2 | | 5.9 | | 5.0 | | 5.0 | | 6.1 | | 5.6 | | 3.4 | | 1.2 | | 0.1 | | 1.0 | | 1.8 | | 0.9 |

Goods | | 2.9 | | 4.5 | | 4.1 | | 2.8 | | 3.4 | | 5.6 | | 5.8 | | 3.9 | | 1.7 | | 1.3 | | 3.2 | | 4.3 | | 3.1 |

Services | | 11.5 | | 12.3 | | 12.5 | | 12.9 | | 10.4 | | 7.9 | | 4.9 | | 1.6 | | -0.5 | | -4.0 | | -6.0 | | -6.4 | | -6.7 |

| | | | | | | | | | | | | |

Interstate | | 5.6 | | 9.0 | | 10.6 | | 7.6 | | 2.1 | | -2.8 | | -6.8 | | -11.4 | | -13.1 | | -5.6 | | 6.2 | | 17.0 | | 19.7 |

Goods | | 4.1 | | 8.8 | | 12.4 | | 10.2 | | 5.7 | | 1.0 | | -3.3 | | -9.0 | | -12.2 | | -5.0 | | 8.1 | | 19.7 | | 20.9 |

Selected services | | 9.9 | | 9.3 | | 5.5 | | 0.4 | | -8.0 | | -14.4 | | -17.3 | | -18.7 | | -15.9 | | -7.9 | | -0.4 | | 7.8 | | 15.8 |

| | | | | | | | | | | | | |

less Imports of goods and services | | 7.6 | | 12.5 | | 17.0 | | 16.2 | | 13.2 | | 13.1 | | 10.5 | | 2.6 | | -8.0 | | -14.3 | | -12.3 | | -5.6 | | 1.4 |

| | | | | | | | | | | | | |

less Overseas | | 9.7 | | 12.6 | | 14.3 | | 15.6 | | 17.8 | | 19.8 | | 15.6 | | 3.7 | | -8.8 | | -14.7 | | -10.0 | | 1.2 | | 13.8 |

less Goods | | 9.1 | | 12.1 | | 13.6 | | 14.2 | | 15.9 | | 18.5 | | 15.3 | | 4.0 | | -8.7 | | -15.2 | | -10.8 | | 0.6 | | 13.7 |

less Services | | 11.9 | | 14.5 | | 16.9 | | 20.0 | | 24.2 | | 24.2 | | 16.3 | | 3.1 | | -9.2 | | -13.0 | | -7.5 | | 3.0 | | 14.3 |

| | | | | | | | | | | | | |

less Interstate | | 5.7 | | 12.3 | | 19.4 | | 16.8 | | 9.1 | | 7.2 | | 5.9 | | 1.5 | | -7.1 | | -14.0 | | -14.5 | | -12.0 | | -10.5 |

less Goods | | 6.5 | | 14.2 | | 22.0 | | 19.5 | | 11.3 | | 9.1 | | 7.4 | | 2.4 | | -6.7 | | -14.0 | | -15.2 | | -13.2 | | -12.5 |

less Selected services | | -0.5 | | -2.8 | | -2.3 | | -5.9 | | -10.4 | | -10.8 | | -8.8 | | -7.4 | | -11.6 | | -14.3 | | -6.8 | | 3.0 | | 13.3 |

| | | | | | | | | | | | | |

Gross state product | | 6.3 | | 7.0 | | 6.2 | | 4.6 | | 3.5 | | 2.6 | | 1.7 | | 1.2 | | 0.5 | | 0.5 | | 1.2 | | 2.0 | | 2.6 |

| (a) | Chain volume measure reference year 2007-08 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. |

TABLE 4

- 21 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 5 |

| (Trend, chain volume measure (a) , annual contribution to growth, % points) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Contributions to growth from same quarter last year |

| | | 2006-07 | | 2007-08 | | 2008-09 | | 2009-10 |

| | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar |

| | | | | | | | | | | | | |

Final consumption expenditure | | 2.0 | | 2.7 | | 3.4 | | 3.6 | | 3.4 | | 2.8 | | 2.0 | | 1.5 | | 0.9 | | 0.7 | | 0.8 | | 1.2 | | 1.9 |

| | | | | | | | | | | | | |

Households | | 1.2 | | 2.0 | | 2.7 | | 2.8 | | 2.5 | | 1.7 | | 1.0 | | 0.7 | | 0.4 | | 0.3 | | 0.5 | | 0.8 | | 1.2 |

| | | | | | | | | | | | | |

General government | | 0.8 | | 0.7 | | 0.7 | | 0.8 | | 0.9 | | 1.0 | | 1.0 | | 0.8 | | 0.5 | | 0.4 | | 0.3 | | 0.5 | | 0.7 |

National | | 0.4 | | 0.4 | | 0.3 | | 0.3 | | 0.2 | | 0.2 | | 0.2 | | 0.1 | | 0.0 | | -0.1 | | 0.0 | | 0.2 | | 0.4 |

State and local | | 0.3 | | 0.3 | | 0.4 | | 0.5 | | 0.7 | | 0.8 | | 0.8 | | 0.7 | | 0.6 | | 0.4 | | 0.3 | | 0.3 | | 0.3 |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) | | 3.3 | | 3.5 | | 3.2 | | 2.5 | | 2.3 | | 2.8 | | 2.8 | | 1.8 | | -0.6 | | -2.8 | | -3.7 | | -3.6 | | -3.0 |

| | | | | | | | | | | | | |

Dwellings | | 1.1 | | 0.8 | | 0.2 | | -0.3 | | -0.1 | | 0.4 | | 0.5 | | -0.2 | | -1.4 | | -2.0 | | -1.5 | | -0.6 | | 0.5 |

New and used | | 0.4 | | 0.3 | | 0.1 | | -0.1 | | 0.2 | | 0.4 | | 0.4 | | -0.1 | | -0.8 | | -1.2 | | -1.1 | | -0.7 | | -0.2 |

Alterations and additions | | 0.7 | | 0.5 | | 0.1 | | -0.2 | | -0.3 | | -0.1 | | 0.1 | | -0.1 | | -0.5 | | -0.8 | | -0.5 | | 0.1 | | 0.7 |

| | | | | | | | | | | | | |

Business Investment (b) | | 1.9 | | 2.3 | | 2.6 | | 2.5 | | 2.4 | | 2.7 | | 3.0 | | 2.6 | | 1.2 | | -0.8 | | -2.6 | | -3.6 | | -4.0 |

Non-dwelling construction (b) | | 1.2 | | 1.2 | | 1.0 | | 0.7 | | 0.8 | | 1.2 | | 1.6 | | 1.6 | | 1.1 | | 0.1 | | -0.7 | | -1.2 | | -1.3 |

Machinery and equipment (b) | | 0.7 | | 1.1 | | 1.6 | | 1.7 | | 1.6 | | 1.6 | | 1.4 | | 1.0 | | 0.1 | | -1.0 | | -1.9 | | -2.4 | | -2.7 |

| | | | | | | | | | | | | |

Livestock and orchards | | -0.2 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Intellectual property products | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.2 | | 0.3 |

Ownership transfer costs | | 0.2 | | 0.3 | | 0.3 | | 0.2 | | -0.1 | | -0.5 | | -0.8 | | -0.8 | | -0.5 | | -0.1 | | 0.2 | | 0.3 | | 0.2 |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) | | 1.5 | | 1.9 | | 2.0 | | 1.6 | | 1.1 | | 1.2 | | 1.2 | | 1.1 | | 0.7 | | 0.2 | | 0.2 | | 0.6 | | 1.1 |

| | | | | | | | | | | | | |

Public corporations (b) | | 0.7 | | 1.1 | | 1.2 | | 1.0 | | 0.5 | | 0.3 | | 0.3 | | 0.3 | | 0.2 | | -0.1 | | -0.2 | | -0.2 | | -0.2 |

Commonwealth (b) | | -0.3 | | -0.4 | | -0.3 | | -0.2 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 |

State and local | | 1.0 | | 1.4 | | 1.6 | | 1.2 | | 0.5 | | 0.3 | | 0.3 | | 0.3 | | 0.2 | | -0.2 | | -0.3 | | -0.2 | | -0.2 |

| | | | | | | | | | | | | |

General government | | 0.8 | | 0.8 | | 0.8 | | 0.7 | | 0.7 | | 0.9 | | 0.9 | | 0.8 | | 0.5 | | 0.3 | | 0.5 | | 0.8 | | 1.2 |

National | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.3 | | 0.3 | | 0.2 | | 0.0 | | -0.2 | | -0.1 | | 0.1 | | 0.3 |

State and local | | 0.7 | | 0.8 | | 0.8 | | 0.7 | | 0.6 | | 0.6 | | 0.6 | | 0.6 | | 0.5 | | 0.4 | | 0.6 | | 0.7 | | 0.9 |

| | | | | | | | | | | | | |

Change in inventories | | 0.7 | | 1.2 | | 0.9 | | 0.3 | | -0.1 | | -0.3 | | -0.5 | | -0.9 | | -1.4 | | -1.3 | | -0.4 | | 0.7 | | 1.5 |

| | | | | | | | | | | | | |

Gross state expenditure | | 7.5 | | 9.3 | | 9.6 | | 8.0 | | 6.7 | | 6.4 | | 5.6 | | 3.5 | | -0.3 | | -3.2 | | -3.0 | | -1.1 | | 1.5 |

- 22 -

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | 1.7 | | 2.4 | | 2.5 | | 1.9 | | 1.3 | | 0.9 | | 0.3 | | -0.7 | | -1.3 | | -0.6 | | 0.9 | | 2.2 | | 2.2 |

| | | | | | | | | | | | | |

Overseas | | 1.0 | | 1.3 | | 1.2 | | 1.0 | | 1.0 | | 1.3 | | 1.1 | | 0.7 | | 0.2 | | 0.0 | | 0.2 | | 0.4 | | 0.2 |

Goods | | 0.5 | | 0.7 | | 0.7 | | 0.4 | | 0.6 | | 0.9 | | 0.9 | | 0.6 | | 0.3 | | 0.2 | | 0.5 | | 0.7 | | 0.5 |

Services | | 0.5 | | 0.6 | | 0.6 | | 0.6 | | 0.5 | | 0.4 | | 0.2 | | 0.1 | | 0.0 | | -0.2 | | -0.3 | | -0.3 | | -0.3 |

| | | | | | | | | | | | | |

Interstate | | 0.7 | | 1.1 | | 1.2 | | 0.9 | | 0.3 | | -0.3 | | -0.8 | | -1.4 | | -1.5 | | -0.6 | | 0.7 | | 1.8 | | 2.0 |

Goods | | 0.4 | | 0.8 | | 1.1 | | 0.9 | | 0.5 | | 0.1 | | -0.3 | | -0.8 | | -1.1 | | -0.4 | | 0.7 | | 1.6 | | 1.6 |

Selected services | | 0.3 | | 0.3 | | 0.2 | | 0.0 | | -0.2 | | -0.4 | | -0.5 | | -0.6 | | -0.4 | | -0.2 | | 0.0 | | 0.2 | | 0.4 |

| | | | | | | | | | | | | |

less Imports of goods and services | | 2.6 | | 4.3 | | 5.7 | | 5.5 | | 4.7 | | 4.7 | | 3.9 | | 1.0 | | -3.1 | | -5.7 | | -4.9 | | -2.1 | | 0.5 |

| | | | | | | | | | | | | |

less Overseas | | 1.6 | | 2.0 | | 2.3 | | 2.5 | | 3.0 | | 3.4 | | 2.7 | | 0.7 | | -1.7 | | -2.9 | | -2.0 | | 0.2 | | 2.4 |

less Goods | | 1.1 | | 1.5 | | 1.7 | | 1.8 | | 2.0 | | 2.4 | | 2.0 | | 0.5 | | -1.3 | | -2.3 | | -1.6 | | 0.1 | | 1.8 |

less Services | | 0.4 | | 0.5 | | 0.6 | | 0.8 | | 0.9 | | 1.0 | | 0.7 | | 0.1 | | -0.4 | | -0.6 | | -0.4 | | 0.1 | | 0.6 |

| | | | | | | | | | | | | |

less Interstate | | 1.1 | | 2.3 | | 3.4 | | 2.9 | | 1.7 | | 1.4 | | 1.2 | | 0.3 | | -1.4 | | -2.8 | | -3.0 | | -2.3 | | -1.9 |

less Goods | | 1.1 | | 2.3 | | 3.4 | | 3.0 | | 1.9 | | 1.6 | | 1.3 | | 0.4 | | -1.2 | | -2.6 | | -2.8 | | -2.4 | | -2.1 |

less Selected services | | 0.0 | | -0.1 | | 0.0 | | -0.1 | | -0.2 | | -0.2 | | -0.2 | | -0.1 | | -0.2 | | -0.2 | | -0.1 | | 0.0 | | 0.2 |

| | | | | | | | | | | | | |

Statistical discrepancy (E) | | -0.2 | | -0.4 | | -0.1 | | 0.2 | | 0.2 | | 0.0 | | -0.3 | | -0.6 | | -1.0 | | -1.4 | | -1.6 | | -1.3 | | -0.6 |

| | | | | | | | | | | | | |

Gross state product | | 6.3 | | 7.0 | | 6.2 | | 4.6 | | 3.5 | | 2.6 | | 1.7 | | 1.2 | | 0.5 | | 0.5 | | 1.2 | | 2.0 | | 2.6 |

| (a) | Chain volume measure reference year 2007-08 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. |

TABLE 5

- 23 -

Explanatory Notes

Overview

The Queensland State Accounts are compiled in accordance with the international standards contained in the System of National Accounts 2008 (SNA08).

Readers interested in more detailed information on the changes to national and state accounts are referred to the Australian Bureau of Statistics (ABS) Australian National Accounts: Concepts, Sources and Methods, 2000 (ABS 5216.0) and the following ABS information papers:

| • | | Australian National Accounts, Introduction of Chain Volume and Price Indexes, Sep 1997 (ABS 5248.0); and |

| • | | Product changes to Australian System of National Accounts following revisions to international standards, 2009 (ABS 5204.0.55.005). |

The broad structure of the Queensland State Accounts is that of a social accounting matrix comprising two regions: Queensland and the Rest of Australia. This enables the appropriate comparison to be made of the performance of Queensland with respect to the performance of the rest of the nation, rather than with Australia as a whole. This publication reports only on the domestic production accounts of these two regions.

The Queensland State Accounts are designed to allow consolidation of the two regions into the single region of Australia. The Australian National Accounts, produced by the ABS, form a clear national framework and set of estimates, with which the Queensland State Accounts is congruent.

The ABS also produces the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0). The Queensland State Accounts uses as much Queensland information contained in this ABS publication as is appropriate and relevant. However, since the purpose of the Queensland State Accounts is to measure the structure and performance of the Queensland economy as accurately and comprehensively as possible, it significantly extends the information contained in the Australian National Accounts, National Income, Expenditure and Product series. Since this extension is feasible in the case of a single State, especially one with the statistical resources of Queensland, the Queensland State Accounts is not necessarily bound to agree exactly with any ABS estimates. Nevertheless, the quality of the Australian National Accounts is such that the Queensland State Accounts estimates are generally and routinely benchmarked to them. In all cases, the ABS estimates are taken into strong initial consideration.

The major extension of the domestic production accounts in the Queensland State Accounts system is the addition of estimates of interstate trade in goods and trade in services. This enables the system to derive quarterly estimates of gross state product in volume terms. As well, this provides a more comprehensive understanding of Queensland’s overall trade performance, and replaces the more limited understanding provided by the common misperception of overseas State trade as total State trade.

- 24 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Methodology

The estimates in the Queensland State Accounts generally agree with those of the Australian Bureau of Statistics (ABS) Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0) when available, except in cases where the Office of Economic and Statistical Research (OESR) has improved on, or corrected, ABS estimates. These corrections generally arise from data confrontation exercises which involve alternative sources of evidence or information, and which often involve the input of further primary information.

Chain Volume Measures

The chain volume measures appearing in this issue are annually re-weighted chained Laspeyres indexes referenced to the current price in a reference year, currently 2007-08. Chained Laspeyres volume measures are compiled by linking together (compounding) movements in volumes, calculated by using the average prices of the previous financial year, and applying the compounded movements to the current price estimates of the reference year. Quarterly chain volume estimates are benchmarked to annual chain volume estimates, so that the quarterly estimates for a financial year sum to the corresponding annual estimate.

Chain volume measures are not generally additive. They do not sum in total, in the way original current price components do. To minimise this impact, the ABS uses the year preceding the last full financial year as the reference year. This approach means that the chain volume measures are additive in the reference year (currently 2007-08) and the quarters following the reference year. However, the chain volume measures are not additive in the quarters preceding the reference year.

Compensation of employees

The OESR estimate of compensation of employees (COE) differs from that published by the ABS in Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). As reported in the September quarter 1994 issue of the Queensland State Accounts, the OESR is of the opinion that the compensation of employees (COE) series published in the ABS 5206.0 substantially under-recorded COE from the period commencing September quarter 1993. As a result, in the period starting with September quarter 1993 and ending December quarter 2001, the average of the quarterly movements in average weekly earnings, and survey of employment and earnings is combined with the number of wage and salary earners to derive the COE series published in the Queensland State Accounts.

From March 2002 onwards, the OESR COE series is extrapolated using the quarterly movements in the compensation of employees series published in ABS Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0).

Gross operating surplus and gross mixed income

OESR uses indicators of activity to estimate Queensland’s share of the five components of Australia’s gross operating surplus and mixed income (GOS/MI). Since March quarter 2001, State data from the ABS publication Business Indicators: Australia (ABS 5276.0) has been used to estimate the share for private non-financial corporations. These estimates are benchmarked to the annual ABS estimates contained in Australian National Accounts, State Accounts (ABS 5220.0).

- 25 -

The OESR estimates of GOS/MI differ from that published by the ABS in Australian National Accounts, State Accounts, 2008-09 (ABS 5220.0) for 2008-09. This difference reflects the OESR using a different methodology to allocate the Australian estimates of industry GOS/MI between Queensland and the Rest of Australia.

Taxes less subsidies on production and imports

The quarterly Queensland State Accounts taxes less subsidies on production and imports (taxes) estimates are compiled using government finance statistics provided by the ABS to calculate State and local government taxes and estimates of Commonwealth taxes levied in Queensland.

Statistical discrepancy (I) and (E)

In line with the ABS practice, an explicit statistical discrepancy has been retained in the Queensland State Accounts. This discrepancy is allocated between the income and expenditure estimates to provide a unique measure of quarterly current gross state product. This is pro-rated from the national estimates to Queensland using gross state/domestic product.

Gross state product

The estimates of gross state product (GSP) are produced by summing the income components of gross state product: compensation of employees, gross operating surplus, gross mixed income, and taxes less subsidies on production and imports. Expenditure estimates of GSP comprise the summation of household and government consumption, capital formation, change in inventories and exports less imports. These are balanced against the income components of GSP (i.e. the income approach).

The method used to obtain chain volume estimates of GSP could be best described as ‘indirect’ as the only current price estimates of GSP available are obtained by aggregating the incomes accruing from production (i.e. the income approach). It is not possible to satisfactorily deflate such incomes to produce chain volume estimates because they do not comprise readily identifiable price and quantity elements. Consequently, the chain volume estimates of GSP are derived using the expenditure approach.

Household final consumption expenditure

The estimate of household final consumption expenditure is largely based on ABS estimates in Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0) supplemented with data contained in Tourism Research Australia (TRA) National Visitor Survey and International Visitor Survey, and the ABS Balance of Payments and International Investment Position (ABS 5302.0).

Differences between the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0) and the Queensland State Accounts are due primarily to differences in the estimates of net interstate and overseas expenditure by visitors.

- 26 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

General government final consumption expenditure

Estimates of these components are generally taken from the ABS estimates in the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0).

In some instances, particularly in the most recent quarters, there are differences between the Queensland State Accounts estimates of general government final consumption expenditure and those published by the ABS Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). In these cases, the OESR has incorporated additional information that has become available after the release of ABS estimates. No adjustments have been made for Australia.

In 1999-2000 the Queensland State Accounts current price estimate is different from the ABS by $1.1 billion due to different treatment of an abnormal return on QSuper trust assets.

Private gross fixed capital formation

This is formed by the addition of the components of private investment: dwellings, non-dwelling construction, machinery and equipment, livestock and orchards, intangible fixed assets and ownership transfer costs. Estimates of these components are generally taken from the ABS estimates in the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0).

Business investment

This is calculated by the addition of non-dwelling construction and machinery and equipment.

General government gross fixed capital formation

Estimates of general government investment, including Commonwealth and State and local general government investment, are generally taken from the ABS estimates in the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0).

In some instances, there are differences between the Queensland State Accounts estimates of general government final consumption expenditure and those published by the ABS Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). In these cases, the OESR has incorporated additional information that has become available after the release of ABS estimates. No adjustments have been made to Australia.

Public corporations gross fixed capital formation

Estimates of these components are generally taken from the ABS estimates in the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0). However, in some instances, there are differences between the Queensland State Accounts estimates of public corporations gross fixed capital formation and those published by the ABS Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). In these cases, the OESR has incorporated additional information that has become available after the release of ABS estimates. No adjustments have been made to Australia.

- 27 -

Changes in inventories

Estimates of these components are made by allocating the national inventory activity identified in the ABS estimates in the Australian National Accounts, National Income, Expenditure and Product (ABS 5206.0) to Queensland.

Gross state expenditure

The sum of household final consumption expenditure, general government final consumption expenditure, private gross fixed capital formation, public corporations gross fixed capital formation, general government gross fixed capital formation and change in inventories.

Exports of goods, overseas

Estimates are derived using data from ABS International Trade in Goods and Services (ABS 5368.0) at the two digit Standard International Trade Classification (SITC) level. The chain volume measure series is estimated using Queensland specific SITC implicit price deflators obtained from the ABS.

Exports of services, overseas

Estimates for Queensland are derived as a share from the ABS Balance of Payments and International Investment Position (ABS 5302.0). Data from the TRA International Visitor Survey and ABS Overseas Arrivals and Departures (ABS 3401.0) is also used.

Exports of goods, interstate

Estimated from the ABS Queensland Interstate Trade Survey in which interstate exports of goods are estimated by broad commodity group.

This Queensland Interstate Trade Survey was revised in June quarter 2008. The new survey was incorporated into the Queensland State Accounts in the September quarter 2008 edition, with series prior to June quarter 2008 re-estimated based on the differences in the levels of interstate exports between the old and the new surveys.

Exports of selected services, interstate

Exports of selected services are estimated using a combination of results from the TRA National Visitor Survey and the ABS Balance of Payments and International Investment Position (ABS 5302.0). Historical expenditure figures were derived using a combination of the above, Domestic Tourism Expenditure Surveys (1982, 1992), and Queensland Travel and Tourism Corporation’s Queensland Visitors Survey.

Imports of goods, overseas

The difference between the Queensland State Accounts estimates of Queensland imports of goods, overseas and those published by the ABS Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0) are due to different treatment of civil aircraft imports. Estimates are derived on a Balance of Payments Broad Economic Category (BOP BEC) basis, using unpublished data from the ABS Balance of Payments and International Investment Position (ABS 5302.0). Chain volume measures are derived using Queensland specific BOP BEC implicit price deflators.

- 28 -

| | |

| | Queensland State Accounts, March Quarter 2010 |

Imports of services, overseas

This is estimated for Queensland by calculating the State’s share from the ABS Balance of Payments and International Investment Position (ABS 5302.0).

Imports of goods, interstate

Estimated from the ABS Queensland Interstate Trade Survey in which interstate imports of goods are estimated by broad commodity group.

This Queensland Interstate Trade Survey was revised in June quarter 2008. The new survey was incorporated into the Queensland State Accounts in the September quarter 2008 edition, with series prior to June quarter 2008 re-estimated based on the differences in the levels of interstate imports between the old and the new surveys.

Imports of selected services, interstate

Selected services are estimated using a combination of results from the TRA National Visitor Survey and the ABS Balance of Payments and International Investment Position (ABS 5302.0). Historical expenditure figures were derived using a combination of the above, Domestic Tourism Expenditure Surveys (1982, 1992), and Queensland Travel and Tourism Corporation’s Queensland Visitors Survey.

Expenditure on gross state product

The sum of gross state expenditure, the statistical discrepancy (E), exports of goods and services, less imports of goods and services.

Seasonally adjusted estimates