EXHIBIT (c)(ix)

Queensland Treasury Corporation’s 2011-12 Indicative Borrowing Program Update

MEDIA RELEASE

QUEENSLAND TREASURY CORPORATION

4 July 2011

QTC announces Indicative Borrowing Program for 2011–12

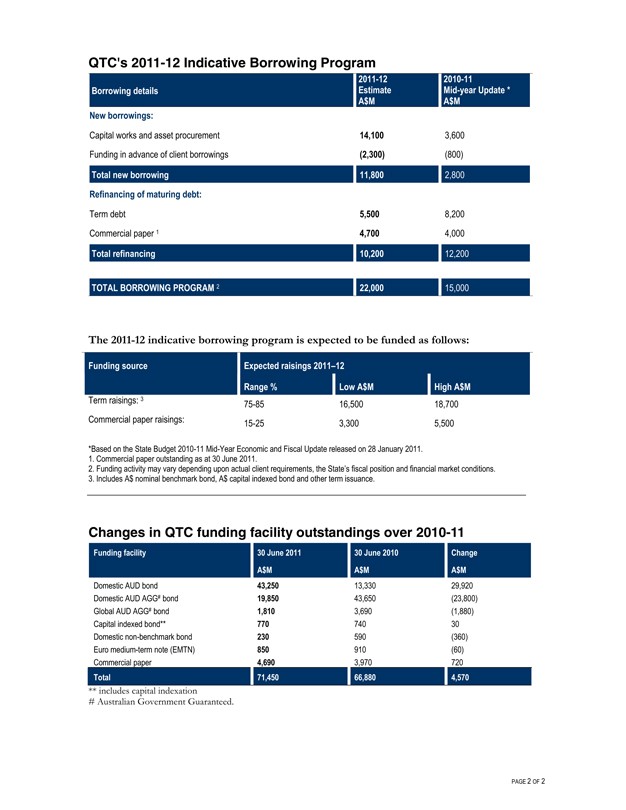

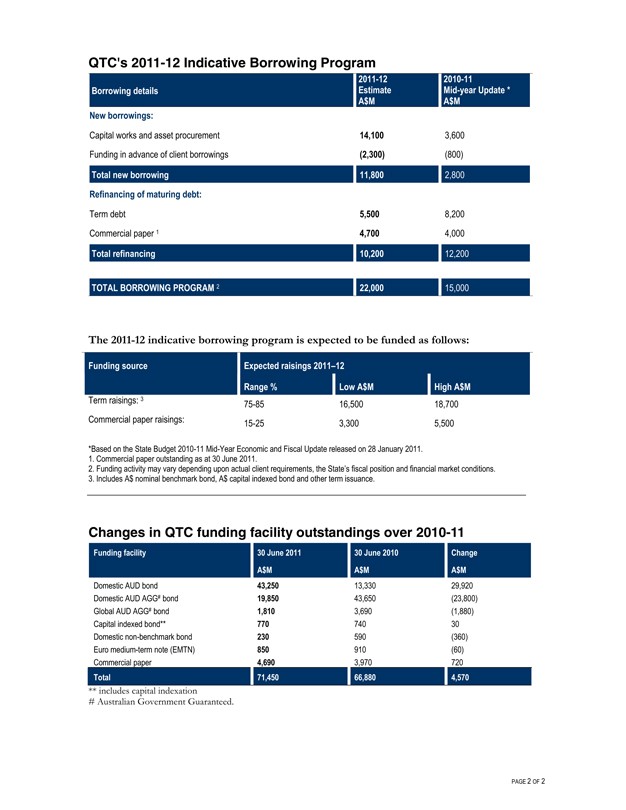

Queensland Treasury Corporation (QTC), the Queensland Government’s central financing authority and financial risk management adviser, estimates its borrowing requirement for the 2011-12 financial year to be $22 billion, following the release of the Queensland State Budget on 14 June 2011 (www.treasury.qld.gov.au).

This borrowing estimate includes $14 billion in new funding to meet the capital works and asset procurement requirements of the Queensland public sector, plus $10 billion to refinance maturing debt. Funding will be sourced through term debt and commercial paper issuance. A total of $2.3 billion has been funded in advance of requirements. (See over page for further details.)

Review of 2010–11 funding activity

In light of the withdrawal of the Australian Government guarantee (AGG) for new State debt issuance from 1 January 2011, QTC’s funding focus during 2010-11 was to establish liquid A$ benchmark bond lines guaranteed solely by the Queensland State Government. Through new raisings and consolidations from existing AGG bond lines, QTC established seven new State Government guaranteed (SGG) A$ benchmark bond lines to complement existing AGG maturities across the yield curve.

Funds raised totalled $17 billion including funding for bond and commercial paper maturities (see over page for change in facility outstandings).

Next review of QTC’s borrowing requirements

The mid-year update of QTC’s borrowing requirement for 2011-12 is scheduled for release in January 2012.

ENDS

For further enquiries, please contact:

Richard Jackson, General Manager, Funding & Markets. Ph: +61 7 3842 4770

Mike Gibson, Director, Funding & Markets. Ph: +61 7 3842 4775

GPO BOX 1096, BRISBANE QLD AUSTRALIA 4001

T 07 3842 4600 • F 07 3221 4122 • WWW.QTC.QLD.GOV.AU

PAGE 1 OF 2

QTC’s 2011-12 Indicative Borrowing Program

Borrowing details 2011-12 Estimate A$M 2010-11 Mid-year Update * A$M

New borrowings:

Capital works and asset procurement 14,100 3,600

Funding in advance of client borrowings (2,300) (800)

Total new borrowing 11,800 2,800

Refinancing of maturing debt:

Term debt 5,500 8,200

Commercial paper 1 4,700 4,000

Total refinancing 10,200 12,200

TOTAL BORROWING PROGRAM 2 22,000 15,000

The 2011-12 indicative borrowing program is expected to be funded as follows:

Funding source Expected raisings 2011–12 Range % Low A$M High A$M

Term raisings: 3 75-85 16,500 18,700

Commercial paper raisings: 15-25 3,300 5,500

*Based on the State Budget 2010-11 Mid-Year Economic and Fiscal Update released on 28 January 2011.

1. Commercial paper outstanding as at 30 June 2011.

2. Funding activity may vary depending upon actual client requirements, the State’s fiscal position and financial market conditions.

3. Includes A$ nominal benchmark bond, A$ capital indexed bond and other term issuance.

Changes in QTC funding facility outstandings over 2010-11

Funding facility 30 June 2011 A$M 30 June 2010 A$M Change A$M

Domestic AUD bond 43,250 13,330 29,920

Domestic AUD AGG# bond 19,850 43,650 (23,800)

Global AUD AGG# bond 1,810 3,690 (1,880)

Capital indexed bond** 770 740 30

Domestic non-benchmark bond 230 590 (360)

Euro medium-term note (EMTN) 850 910 (60)

Commercial paper 4,690 3,970 720

Total 71,450 66,880 4,570

** includes capital indexation

# Australian Government Guaranteed.

PAGE 2 OF 2