EXHIBIT (c)(xiii)

Government of Queensland State Accounts June Quarter 2011.

Queensland

State

Accounts

June Quarter 2011

Queensland Government

Office of Economic and Statistical Research

For further information

Office of Economic and Statistical Research

Level 8

33 Charlotte Street

Brisbane Q 4000

Telephone: (07) 3224 5326

Facsimile: (07) 3227 7437

E-mail qsa@treasury.qld.gov.au

Websites

www.oesr.qld.gov.au/releases/qsa

or

www.treasury.qld.gov.au

© The State of Queensland (Queensland Treasury) 2011

You are free to copy, communicate and adapt the work, as long as you attribute the authors,

This document is licensed under a Creative Commons Attribution 2.5 Australia license.

To view a copy of this license, visit http://creativecommons.org./license/by/2.5/au

To attribute this work cite Queensland State Accounts, Office of Economic and Statistical Research, Queensland Treasury

ISSN 1321-2338

| | |

| | Queensland State Accounts, June Quarter 2011 |

TABLE I

Percentage change in Gross State/Domestic Product

Chain volume measures (2008-09 prices)

| | | | | | | | | | | | |

| | | Queensland

(a) | | | Rest of

Australia

(a) | | | Australia

(b) | |

TREND | | | | | | | | | | | | |

Mar qtr 11 to Jun qtr 11 | | | -0.1 | | | | 0.3 | | | | 0.2 | |

Jun qtr 10 to Jun qtr 11 | | | -1.7 | | | | 1.8 | | | | 1.1 | |

ORIGINAL | | | | | | | | | | | | |

Year-average (c) | | | 0.2 | | | | 2.3 | | | | 1.9 | |

| (a) | Source: OESR Queensland State Accounts |

| (c) | Reference quarter and the three preceding quarters compared with the same period a year earlier |

June Quarter 2011 – Key Points

Quarterly Results

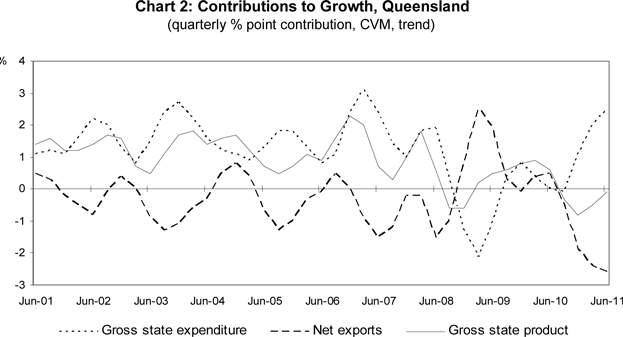

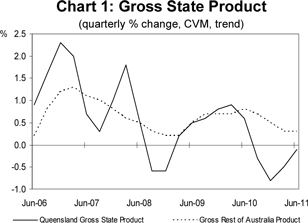

| • | | Queensland gross state product (GSP) declined 0.1 per cent in June quarter 2011, following a decline of 0.5 per cent in the March quarter 2011, to be 1.7 per cent lower over the year. In contrast, Rest of Australia recorded growth of 0.3 per cent in June quarter 2011. |

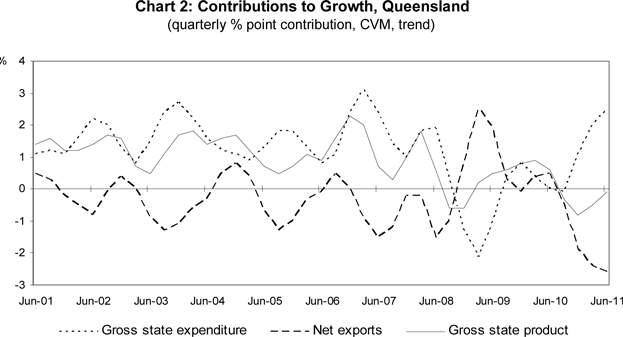

| • | | Gross state expenditure (a measure of domestic demand) strengthened further, rising 2.5 per cent in the June quarter, following an increase of 2.0 per cent in March quarter 2011. |

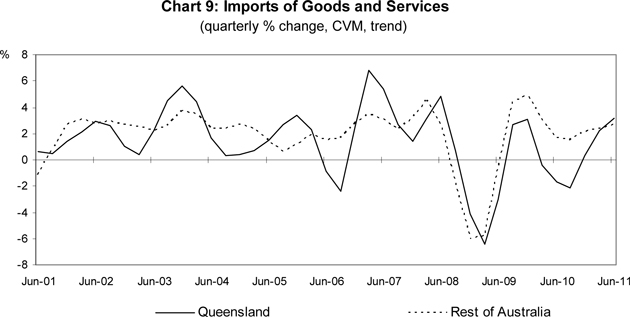

| • | | Offsetting the rise in domestic demand, the Queensland trade sector detracted 2.6 percentage points from economic growth in the June quarter. Both exports of goods and services (down 4.1 per cent) and imports of goods and services (up 3.2 per cent) detracted from Queensland’s growth. |

- 1 -

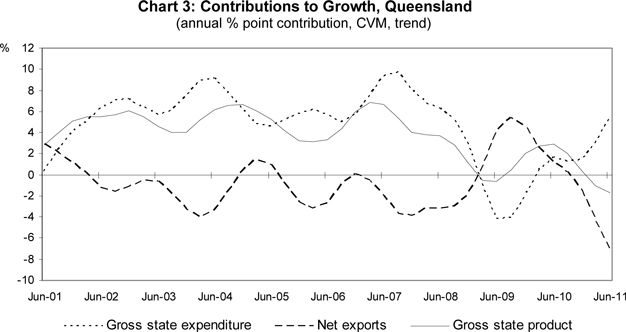

Annual Results

| • | | In real trend terms, GSP declined by 1.7 per cent over the year to June quarter 2011. This followed a decline of 1.0 per cent over the year to March quarter 2011. In contrast, gross Rest of Australia product grew by 1.8 per cent over the year to June quarter 2011. |

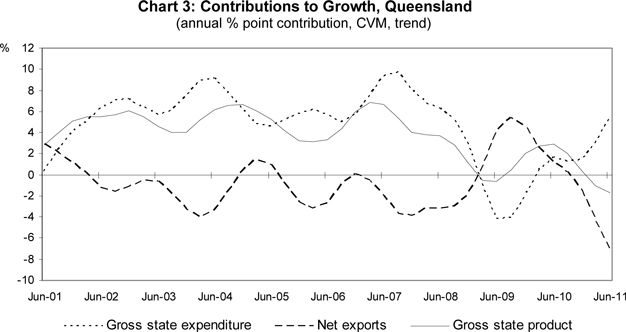

| • | | Gross state expenditure increased 5.7 per cent over the year to the June quarter. As a result, gross state expenditure contributed 5.5 percentage points to Queensland’s economic growth. The increase in domestic demand was mainly driven by higher business investment, household consumption and general government consumption, contributing 4.5, 1.3 and 0.7 percentage points respectively to Queensland GSP growth. |

| • | | Net exports detracted 7.2 percentage points from Queensland GSP growth over the year to the June quarter. Both exports of goods and services (down 15.4 per cent) and imports of goods and services (up 3.6 per cent) detracted from growth. |

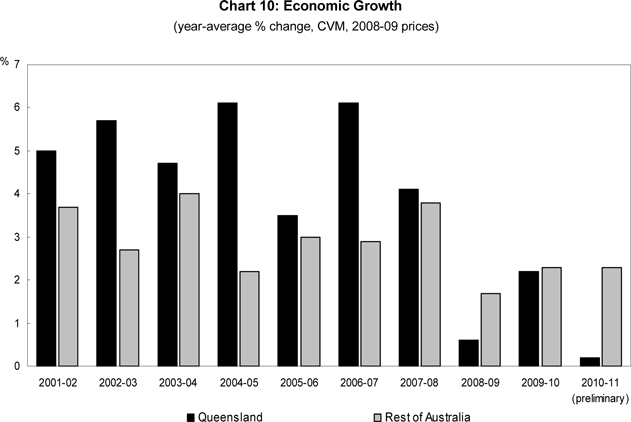

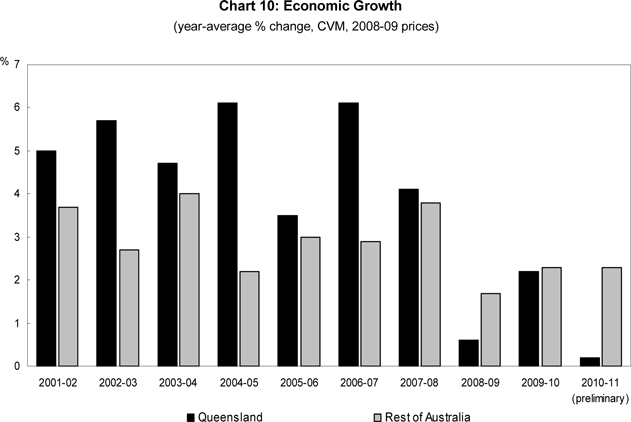

Preliminary 2010-11 Outcome

| • | | The Queensland economy recorded year-average growth of 0.2 per cent (preliminary) in 2010-11, following growth of 2.2 per cent in 2009-10 and 0.6 per cent in 2008-09. This modest growth was largely due to the adverse impacts of natural disasters in March quarter 2011. |

| • | | A rebound in domestic demand, which contributed 2.7 percentage points to Queensland’s economic growth in 2010-11, was partially offset by a detraction from the trade sector. |

| • | | This preliminary estimate for Queensland’s economic performance for 2010-11 may be subject to revision over the coming quarters as updated ABS data are incorporated into the Queensland State Accounts. |

- 2 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

Expenditure on GSP – Main Features

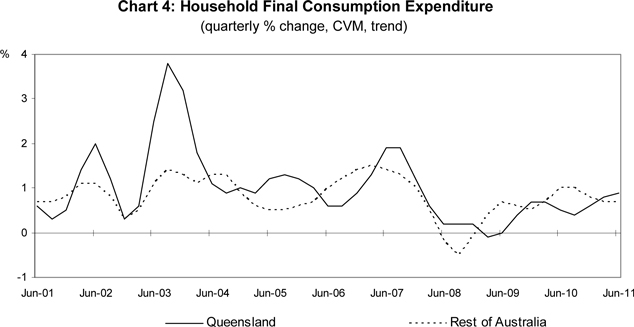

Household Final Consumption Expenditure

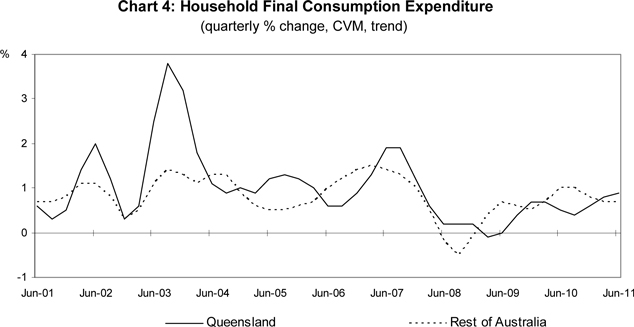

Quarterly Results (Trend, CVM)

| • | | Queensland household final consumption expenditure increased 0.9 per cent in real trend terms in June quarter 2011, contributing 0.5 percentage point to GSP growth. |

| • | | Growth in household consumption was mainly driven by expenditure on health, food and rent and other dwelling services. These increases were partially offset by a decline in expenditure on the purchases of vehicles, and insurance and other financial services. |

| • | | In comparison, household consumption in the Rest of Australia recorded growth of 0.7 per cent, contributing 0.4 percentage point to growth in the Rest of Australia in the June quarter. |

Annual Results (Trend, CVM)

| • | | Queensland recorded household consumption growth of 2.7 per cent over the year to June quarter 2011, contributing 1.3 percentage points to annual growth in GSP. |

| • | | For the Rest of Australia, household consumption rose 3.3 per cent over the year to June quarter 2011, contributing 1.8 percentage points to annual growth in gross Rest of Australia product. |

- 3 -

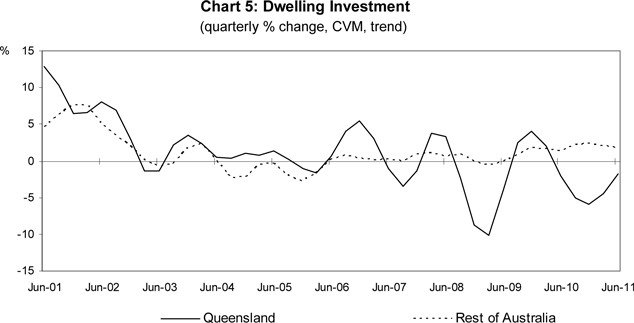

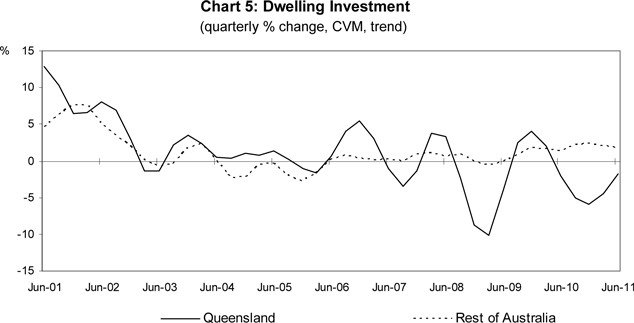

Dwelling Investment

Quarterly Results (Trend, CVM)

| • | | Queensland dwelling investment continued to decline, down 1.8 per cent in June quarter 2011, following a 4.5 per cent decrease in March quarter 2011. |

| • | | The decrease in dwelling investment was driven by declines in both new and used dwelling investment (down 3.0 per cent) and alterations and additions (down 0.5 per cent). |

| • | | In contrast, dwelling investment in the Rest of Australia increased 1.8 per cent in the June quarter, following an increase of 2.0 per cent in the previous quarter. |

Annual Results (Trend, CVM)

| • | | Queensland dwelling investment decreased 16.2 per cent over the year to June quarter 2011, following a decline of 16.4 per cent over the year to March quarter 2011. This is the fourth consecutive annual decline in dwelling investment. Dwelling investment detracted 1.1 percentage points from annual GSP growth in June quarter 2011. |

| • | | The annual decrease was driven by a 20.3 per cent decline in new and used dwellings investment and an 11.4 per cent decline in alterations and additions. |

| • | | In contrast, dwelling investment in the Rest of Australia increased 8.5 per cent over the year to June quarter 2011, following an increase of 8.0 per cent over the year to March quarter 2011. |

- 4 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

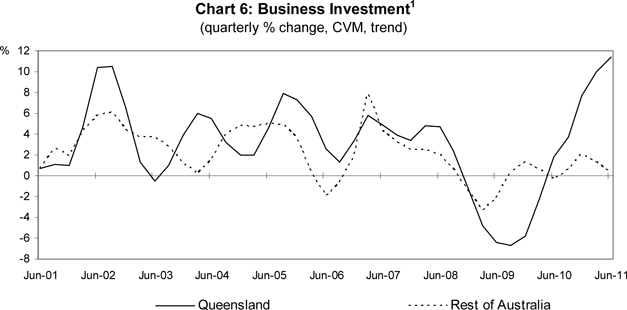

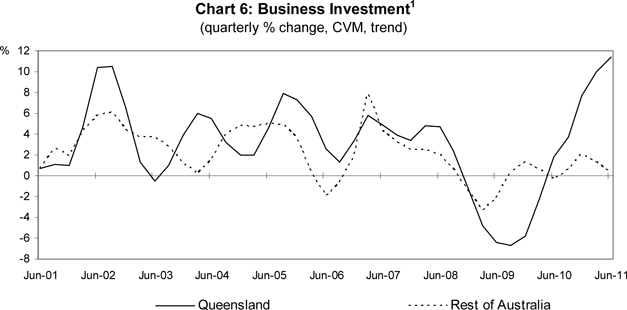

Business Investment

Quarterly Results (Trend, CVM)

| • | | Queensland business investment (comprised of non-dwelling construction and machinery and equipment) increased at a record high 11.4 per cent in June quarter 2011, contributing 1.7 percentage points to GSP growth. |

| • | | The increase in business investment was driven by higher investment in both non-dwelling construction and machinery and equipment, up 13.8 and 8.5 per cent respectively. |

| • | | Rest of Australia business investment increased 0.2 per cent in the June quarter, with higher investment in machinery and equipment (up 3.0 per cent) more than offsetting a decline in non-dwelling construction investment (down 2.5 per cent). |

Annual Results (Trend, CVM)

| • | | Queensland business investment2 increased by a record 36.9 per cent over the year to June quarter 2011, following a 25.1 per cent increase over the year to March quarter 2011. |

| • | | Investment rose in both non-dwelling construction (up 44.2 per cent) and machinery and equipment (up 28.6 per cent) resulting in business investment contributing 4.5 percentage points to Queensland GSP growth over the year to June quarter 2011. |

| • | | Business investment in the Rest of Australia increased 4.3 per cent over the year to June quarter 2011, following an increase of 3.7 per cent over the year to March quarter. |

| 1 | In 2009 Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. |

| 2 | In November 2010, the Queensland Government floated QR National and sold a 99-year lease on the Port of Brisbane. Users should interpret the trend estimate of business investment with caution around this period. |

- 5 -

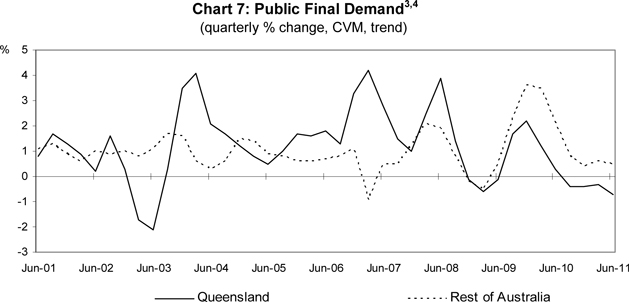

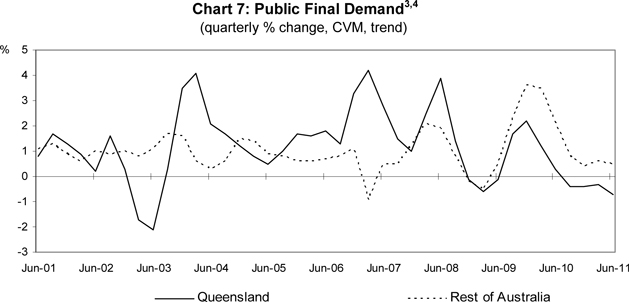

Public Final Demand

Quarterly Results (Trend, CVM)

| • | | Queensland public final demand (comprised of general government consumption and investment and public corporations investment), decreased 0.7 per cent in June quarter 2011, following an decrease of 0.3 per cent in the previous quarter. Public final demand detracted 0.2 percentage point from GSP growth in the June quarter. |

| • | | The decrease in public final demand was driven by decreases in both public corporations investment3 (down 11.7 per cent) and general government investment (down 0.1 per cent) together detracting 0.3 percentage point from GSP growth. This was partly offset by an increase in general government consumption of 0.5 per cent, contributing 0.1 percentage point to GSP growth. |

| • | | Public final demand in the Rest of Australia increased 0.5 per cent in the June quarter, following 0.6 per cent growth in the previous quarter. |

Annual Results (Trend, CVM)

| • | | Queensland public final demand decreased 1.8 per cent over the year to June quarter 2011, detracting 0.4 percentage point from GSP growth. This followed a decline of 0.8 per cent over the year to March quarter 2011. |

| • | | The decrease in public final demand was due to both lower general government investment (down 10.8 per cent) and lower public corporations investment (down 21.3 per cent) offsetting higher general government consumption (up 4.8 per cent). |

| • | | Public final demand in the Rest of Australia rose 2.3 per cent over the year to June quarter 2011, following growth of 3.9 per cent over the year to March quarter 2011. |

| 3 | In November 2010, the Queensland Government floated QR National and sold a 99-year lease on the Port of Brisbane. Users should interpret the trend estimate of public gross fixed capital formation, public corporations - state and local, with caution around this period. |

| 4 | Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. Additionally, quarterly growth estimates for Rest of Australia in March quarter 2007 are affected by a trend break resulting from the privatisation of Telstra. |

- 6 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

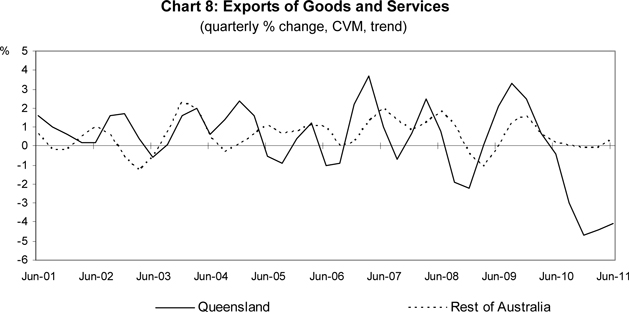

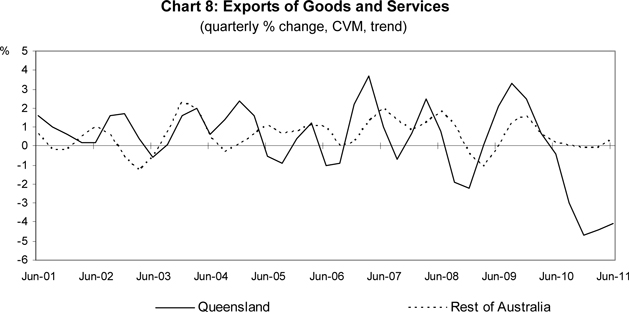

Exports of Goods and Services

Quarterly (Trend, CVM)

| • | | Queensland exports of goods and services declined 4.1 per cent in June quarter 2011, with overseas and interstate exports declining 4.6 per cent and 2.8 per cent respectively. |

| • | | The decrease in overseas exports of goods and services was largely driven by a decline in exports of goods (down 5.1 per cent), underpinned by a large decline in coal exports. |

| • | | Lower interstate exports of goods and services was driven by a decrease in both exports of goods (down 3.1 per cent) and exports of selected services (down 1.8 per cent). |

| • | | In comparison, Rest of Australia recorded an increase of 0.4 per cent in aggregate exports of goods and services. A decline in overseas exports (down 0.1 per cent) was more than offset by a rise in interstate exports (up 3.2 per cent). |

Annual (Trend, CVM)

| • | | In annual terms, Queensland exports of goods and services decreased 15.4 per cent over the year to June quarter 2011, detracting 6.0 percentage points from annual growth in GSP. The decrease in aggregate exports of goods and services was driven by declines in both overseas exports (down 18.2 per cent) and interstate exports (down 7.0 per cent). |

| • | | In contrast, exports of goods and services in the Rest of Australia increased 0.2 per cent over the year to June quarter 2011, after remaining unchanged over the year to March quarter 2011. |

- 7 -

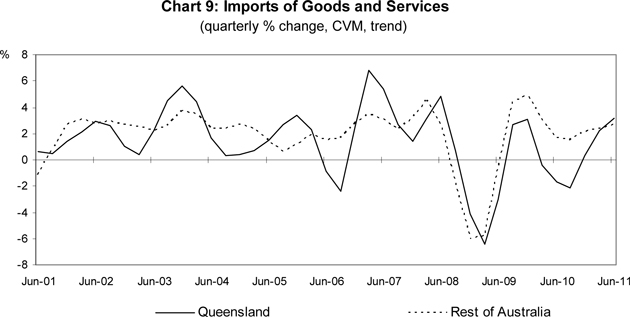

Imports of Goods and Services

Quarterly Results (Trend, CVM)

| • | | Imports of goods and services rose 3.2 per cent in June quarter 2011. A rise in overseas imports (up 3.1 per cent) was complemented by a rise in interstate imports (up 3.2 per cent). |

| • | | Within aggregate overseas imports, overseas goods imports rose 2.8 per cent and overseas services imports were 4.2 per cent higher in the June quarter. |

| • | | The increase in interstate imports was driven by higher imports of goods (up 3.5 per cent) with interstate imports of selected services remaining unchanged. |

| • | | In comparison, imports of goods and services to the Rest of Australia increased 2.7 per cent in the June quarter, following growth of 2.4 per cent in March quarter 2010. |

Annual Results (Trend, CVM)

| • | | In annual terms, Queensland imports of goods and services increased 3.6 per cent over the year to June quarter 2011, resulting in imports detracting 1.3 percentage points from annual GSP growth. |

| • | | In comparison, Rest of Australia imports of goods and services increased 9.0 per cent over the year to June quarter 2011, with an increase in overseas imports (up 10.6 per cent) more than offsetting a decline in interstate imports (down 7.0 per cent). |

- 8 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

Summary Tables

Table II

Changes and Contribution to Growth, Quarterly, Trend, Chain Volume Measures (a)

| | | | | | | | | | | | | | | | |

| | | Queensland | | | Rest of Australia (b) | |

| | | Quarterly

%

change

Mar-11

to Jun-11 | | | % point

contribution

to growth

in GSP

Mar-11 to

Jun-11 | | | Quarterly

%

change

Mar-11

to Jun-11 | | | % point

contribution

to growth

in GSP

Mar-11 to

Jun-11 | |

| | | | |

Household consumption | | | 0.9 | | | | 0.5 | | | | 0.7 | | | | 0.4 | |

| | | | |

Private investment | | | 7.0 | | | | 1.7 | | | | 0.7 | | | | 0.2 | |

Dwelling investment | | | -1.8 | | | | -0.1 | | | | 1.8 | | | | 0.1 | |

New and used | | | -3.0 | | | | -0.1 | | | | 1.4 | | | | 0.0 | |

Alterations and additions | | | -0.5 | | | | 0.0 | | | | 2.4 | | | | 0.1 | |

Business investment | | | 11.4 | | | | 1.7 | | | | 0.2 | | | | 0.0 | |

Non-dwelling construction | | | 13.8 | | | | 1.2 | | | | -2.5 | | | | -0.2 | |

Machinery and equipment | | | 8.5 | | | | 0.6 | | | | 3.0 | | | | 0.2 | |

| | | | |

Public final demand | | | -0.7 | | | | -0.2 | | | | 0.5 | | | | 0.1 | |

General government consumption | | | 0.5 | | | | 0.1 | | | | 0.7 | | | | 0.1 | |

Public corporations investment | | | -11.7 | | | | -0.3 | | | | 0.9 | | | | 0.0 | |

General government investment | | | -0.1 | | | | 0.0 | | | | -0.4 | | | | 0.0 | |

| | | | |

Changes in inventories | | | n.a. | | | | 0.6 | | | | n.a. | | | | 0.2 | |

| | | | |

Gross state expenditure | | | 2.5 | | | | 2.5 | | | | 1.0 | | | | 1.0 | |

| | | | |

Exports of goods and services | | | -4.1 | | | | -1.4 | | | | 0.4 | | | | 0.1 | |

Overseas | | | -4.6 | | | | -1.2 | | | | -0.1 | | | | 0.0 | |

Interstate | | | -2.8 | | | | -0.3 | | | | 3.2 | | | | 0.1 | |

| | | | |

less Imports of goods and services | | | 3.2 | | | | 1.1 | | | | 2.7 | | | | 0.8 | |

Overseas | | | 3.1 | | | | 0.6 | | | | 3.2 | | | | 0.8 | |

Interstate | | | 3.2 | | | | 0.5 | | | | -2.8 | | | | -0.1 | |

| | | | |

Gross state product (c) | | | -0.1 | | | | -0.1 | | | | 0.3 | | | | 0.3 | |

| (a) | Chain volume measure reference year 2008-09. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

n.a. not applicable

| (c) | Includes statistical discrepancy. |

With respect to the real trend quarterly changes and contributions to growth in June quarter 2011:

| • | | Household final consumption expenditure in Queensland increased 0.9 per cent and contributed 0.5 percentage point to overall growth. |

| • | | Dwelling investment decreased 1.8 per cent and detracted 0.1 percentage point from GSP growth, while business investment (comprised of non-dwelling construction, and machinery and equipment) increased 11.4 per cent and contributed 1.7 percentage points to GSP growth. |

| • | | Public final demand (comprised of general government consumption and investment, and public corporations investment) decreased 0.7 per cent. |

| • | | Net exports detracted 2.6 percentage points from economic growth. Both exports of goods and services (down 4.1 per cent) and imports of goods and services (up 3.2 per cent) detracted from Queensland’s growth. |

- 9 -

Table III

Changes and Contribution to Growth, Annual, Trend, Chain Volume Measures (a)

| | | | | | | | | | | | | | | | |

| | | Queensland | | | Rest of Australia (b) | |

| | | Annual

% change

Jun-10 to

Jun-11 | | | % point

contribution

to growth

in GSP

Jun-10 to

Jun-11 | | | Annual

% change

Jun-10 to

Jun-11 | | | % point

contribution

to growth

in GSP

Jun-10 to

Jun-11 | |

| | | | |

Household consumption | | | 2.7 | | | | 1.3 | | | | 3.3 | | | | 1.8 | |

| | | | |

Private investment | | | 16.0 | | | | 3.5 | | | | 4.0 | | | | 0.9 | |

Dwelling investment | | | -16.2 | | | | -1.1 | | | | 8.5 | | | | 0.5 | |

New and used | | | -20.3 | | | | -0.7 | | | | 11.2 | | | | 0.4 | |

Alterations and additions | | | -11.4 | | | | -0.3 | | | | 4.7 | | | | 0.1 | |

Business investment | | | 36.9 | | | | 4.5 | | | | 4.3 | | | | 0.5 | |

Non-dwelling construction | | | 44.2 | | | | 2.9 | | | | 0.7 | | | | 0.0 | |

Machinery and equipment | | | 28.6 | | | | 1.7 | | | | 8.0 | | | | 0.5 | |

| | | | |

Public final demand | | | -1.8 | | | | -0.4 | | | | 2.3 | | | | 0.6 | |

General government consumption | | | 4.8 | | | | 0.7 | | | | 3.0 | | | | 0.6 | |

Public corporations investment | | | -21.3 | | | | -0.5 | | | | -2.7 | | | | 0.0 | |

General government investment | | | -10.8 | | | | -0.7 | | | | 1.6 | | | | 0.1 | |

| | | | |

Changes in inventories | | | n.a. | | | | 1.1 | | | | n.a. | | | | 0.9 | |

| | | | |

Gross state expenditure | | | 5.7 | | | | 5.5 | | | | 4.2 | | | | 4.2 | |

| | | | |

Exports of goods and services | | | -15.4 | | | | -6.0 | | | | 0.2 | | | | 0.1 | |

Overseas | | | -18.2 | | | | -5.3 | | | | 0.8 | | | | 0.2 | |

Interstate | | | -7.0 | | | | -0.7 | | | | -2.7 | | | | -0.1 | |

| | | | |

less Imports of goods and services | | | 3.6 | | | | 1.3 | | | | 9.0 | | | | 2.4 | |

Overseas | | | 8.9 | | | | 1.7 | | | | 10.6 | | | | 2.6 | |

Interstate | | | -2.7 | | | | -0.4 | | | | -7.0 | | | | -0.2 | |

| | | | |

Gross state product (c) | | | -1.7 | | | | -1.7 | | | | 1.8 | | | | 1.8 | |

n.a. not applicable

| (a) | Chain volume measure reference year 2008-09. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

| (c) | Includes statistical discrepancy. |

With respect to the real trend annual changes and contributions to growth for Queensland over the year to June quarter 2011:

| • | | Household final consumption expenditure increased 2.7 per cent and contributed 1.3 percentage points to annual GSP growth. |

| • | | Dwelling investment in Queensland decreased 16.2 per cent, resulting in a 1.1 percentage points detraction from overall growth. |

| • | | Business investment (comprised of non-dwelling construction, and machinery and equipment) increased 36.9 per cent and contributed 4.5 percentage points to Queensland annual GSP growth. |

| • | | Public final demand (comprised of general government consumption and investment, and public corporations investment) decreased 1.8 per cent, resulting in a 0.4 percentage point detraction from overall growth. |

| • | | Net exports detracted 7.2 percentage points from Queensland’s annual economic growth. A 6.0 percentage points detraction from exports was complemented by a 1.3 percentage points detraction from imports. |

- 10 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

Table IV

Changes and Contribution to Growth, Quarterly, Trend, Current Prices

| | | | | | | | | | | | | | | | |

| | | Queensland | | | Rest of Australia (a) | |

| | | Quarterly

%

change

Mar-11

to Jun-11 | | | % point

contribution

to growth

in GSP

Mar-11 to

Jun-11 | | | Quarterly

%

change

Mar-11

to Jun-11 | | | % point

contribution

to growth

in GSP

Mar-11 to

Jun-11 | |

| | | | |

Compensation of employees | | | 1.8 | | | | 0.9 | | | | 2.1 | | | | 1.0 | |

Gross operating surplus and mixed income | | | 1.1 | | | | 0.5 | | | | 0.8 | | | | 0.3 | |

Gross state product at factor cost | | | 1.5 | | | | 1.3 | | | | 1.5 | | | | 1.4 | |

Taxes less subsidies on production and imports | | | 1.3 | | | | 0.1 | | | | 2.0 | | | | 0.2 | |

| | | | |

Gross state product (b) | | | 1.3 | | | | 1.3 | | | | 1.6 | | | | 1.6 | |

| | | | |

Household consumption | | | 1.7 | | | | 0.9 | | | | 1.2 | | | | 0.6 | |

| | | | |

Private investment | | | 6.6 | | | | 1.5 | | | | 0.4 | | | | 0.1 | |

Dwelling investment | | | -1.1 | | | | -0.1 | | | | 2.3 | | | | 0.1 | |

New and used | | | -2.3 | | | | -0.1 | | | | 1.8 | | | | 0.1 | |

Alterations and additions | | | 0.2 | | | | 0.0 | | | | 3.1 | | | | 0.1 | |

Business investment | | | 10.9 | | | | 1.5 | | | | -0.5 | | | | -0.1 | |

Non-dwelling construction | | | 14.4 | | | | 1.1 | | | | -2.2 | | | | -0.1 | |

Machinery and equipment | | | 6.5 | | | | 0.4 | | | | 1.4 | | | | 0.1 | |

| | | | |

Public final demand | | | -0.4 | | | | -0.1 | | | | 0.9 | | | | 0.2 | |

General government consumption | | | 0.7 | | | | 0.1 | | | | 1.1 | | | | 0.2 | |

Public corporations investment | | | -10.6 | | | | -0.2 | | | | 1.1 | | | | 0.0 | |

General government investment | | | 0.2 | | | | 0.0 | | | | -0.4 | | | | 0.0 | |

| | | | |

Changes in inventories | | | n.a. | | | | 0.4 | | | | n.a. | | | | 0.3 | |

| | | | |

Gross state expenditure | | | 2.7 | | | | 2.7 | | | | 1.4 | | | | 1.4 | |

| | | | |

Exports of goods and services | | | -0.9 | | | | -0.3 | | | | 2.5 | | | | 0.6 | |

Overseas | | | -0.6 | | | | -0.1 | | | | 2.4 | | | | 0.5 | |

Interstate | | | -1.8 | | | | -0.2 | | | | 2.9 | | | | 0.1 | |

| | | | |

less Imports of goods and services | | | 3.4 | | | | 1.1 | | | | 2.0 | | | | 0.5 | |

Overseas | | | 3.9 | | | | 0.7 | | | | 2.4 | | | | 0.5 | |

Interstate | | | 2.9 | | | | 0.4 | | | | -1.8 | | | | 0.0 | |

| | | | |

Gross state product (b) | | | 1.3 | | | | 1.3 | | | | 1.6 | | | | 1.6 | |

n.a. not applicable

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

| (b) | Includes statistical discrepancy. |

With respect to the current price trend quarterly changes and contributions to growth in June quarter 2011:

| • | | Compensation of employees increased 1.8 per cent in Queensland, compared with growth of 2.1 per cent for the Rest of Australia. |

| • | | Gross operating surplus and mixed income increased 1.1 per cent in Queensland in comparison to an increase of 0.8 per cent in the Rest of Australia. |

| • | | Household final consumption increased 1.7 per cent and contributed 0.9 percentage point to nominal GSP growth. |

| • | | In current price terms, Queensland overseas exports of goods and services decreased by 0.6 per cent in the quarter, with a decline in export volumes (down 4.6 per cent) offsetting higher prices (up 4.2 per cent). Overseas imports of goods and services increased 3.9 per cent in the June quarter, reflecting both increased import volumes (up 3.1 per cent) and increased prices (up 0.7 per cent). |

- 11 -

Table V

Changes and Contribution to Growth, Annual, Trend, Current Prices

| | | | | | | | | | | | | | | | |

| | | Queensland | | | Rest of Australia (a) | |

| | | Annual

% change

Jun-10 to

Jun-11 | | | % point

contribution

to growth

in GSP

Jun-10 to

Jun-11 | | | Annual

% change

Jun-10 to

Jun-11 | | | % point

contribution

to growth

in GSP

Jun-10 to

Jun-11 | |

| | | | |

Compensation of employees | | | 7.2 | | | | 3.4 | | | | 8.2 | | | | 3.9 | |

Gross operating surplus and mixed income | | | 0.4 | | | | 0.2 | | | | 3.8 | | | | 1.6 | |

Gross state product at factor cost | | | 3.9 | | | | 3.5 | | | | 7.0 | | | | 6.3 | |

Taxes less subsidies on production and imports | | | 5.3 | | | | 0.5 | | | | 7.1 | | | | 0.7 | |

Gross state product (b) | | | 3.8 | | | | 3.8 | | | | 7.0 | | | | 7.0 | |

| | | | |

Household consumption | | | 5.5 | | | | 2.8 | | | | 5.9 | | | | 3.1 | |

| | | | |

Private investment | | | 15.0 | | | | 3.2 | | | | 4.1 | | | | 0.9 | |

Dwelling investment | | | -14.4 | | | | -1.0 | | | | 11.2 | | | | 0.6 | |

New and used | | | -19.0 | | | | -0.7 | | | | 13.8 | | | | 0.4 | |

Alterations and additions | | | -9.2 | | | | -0.3 | | | | 7.5 | | | | 0.2 | |

Business investment | | | 34.7 | | | | 4.1 | | | | 2.5 | | | | 0.3 | |

Non-dwelling construction | | | 46.9 | | | | 3.0 | | | | 3.1 | | | | 0.2 | |

Machinery and equipment | | | 21.0 | | | | 1.2 | | | | 2.0 | | | | 0.1 | |

| | | | |

Public final demand | | | -1.5 | | | | -0.4 | | | | 4.0 | | | | 1.0 | |

General government consumption | | | 3.9 | | | | 0.7 | | | | 4.7 | | | | 0.9 | |

Public corporations investment | | | -17.4 | | | | -0.4 | | | | 0.3 | | | | 0.0 | |

General government investment | | | -10.7 | | | | -0.6 | | | | 2.7 | | �� | | 0.1 | |

| | | | |

Changes in inventories | | | n.a. | | | | 1.1 | | | | n.a. | | | | 1.0 | |

| | | | |

Gross state expenditure | | | 6.8 | | | | 6.7 | | | | 6.2 | | | | 6.2 | |

| | | | |

Exports of goods and services | | | -6.0 | | | | -2.0 | | | | 7.0 | | | | 1.7 | |

Overseas | | | -6.8 | | | | -1.6 | | | | 8.8 | | | | 1.9 | |

Interstate | | | -4.0 | | | | -0.4 | | | | -3.5 | | | | -0.1 | |

| | | | |

less Imports of goods and services | | | 3.0 | | | | 1.0 | | | | 5.5 | | | | 1.3 | |

Overseas | | | 8.9 | | | | 1.5 | | | | 6.6 | | | | 1.4 | |

Interstate | | | -3.5 | | | | -0.5 | | | | -4.0 | | | | -0.1 | |

| | | | |

Gross state product (b) | | | 3.8 | | | | 3.8 | | | | 7.0 | | | | 7.0 | |

n.a. not applicable

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

| (b) | Includes statistical discrepancy. |

With respect to the current price annual changes and contributions to growth over the year to June quarter 2011:

| • | | Compensation of employees increased 7.2 per cent in Queensland and contributed 3.4 percentage points to annual nominal GSP growth. |

| • | | Queensland gross operating surplus and mixed income increased 0.4 per cent, compared with a 3.8 per cent rise for Rest of Australia. |

| • | | Queensland exports of goods and services decreased 6.0 per cent in annual terms, driven by lower export volumes (down 15.4 per cent) partially offset by a 11.1 per cent rise in the price of exports. |

| • | | Queensland imports of goods and services rose 3.0 per cent, driven by a rise in import volumes (up 3.6 per cent) and a moderate decline in import prices (down 0.5 per cent). |

- 12 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

Performance of the Queensland Economy in 2010-11

This June quarter 2011 edition of the Queensland State Accounts contains the first preliminary estimate for the 2010-11 financial year and may be subject to revision.

The Queensland economy recorded year-average growth of 0.2 per cent in 2010-11 following growth of 2.2 per cent in 2009-10 and 0.6 per cent in 2008-09. This preliminary result was largely due to the adverse impacts of natural disasters in March quarter 2011. This compares with year-average growth in the Rest of Australia of 2.3 per cent in 2010-11.

A rebound in domestic demand, which contributed 2.7 percentage points to Queensland’s economic growth in 2010-11, was partially offset by a 2.8 percentage points detraction from the trade sector.

Household final consumption expenditure, up 2.4 per cent in 2010-11, contributed 1.2 percentage points to GSP in 2010-11.

Dwelling investment declined by 12.9 per cent, detracting 0.9 percentage point from GSP in 2010-11.

A strong rebound in business investment, up 20.0 per cent in 2010-11 following a decline of 19.3 per cent in 2009-10, contributed 2.5 percentage points to Queensland GSP growth. Both components of business investment rose. Non-dwelling construction increased 25.5 per cent, driven mainly by a resources-related surge in engineering construction, and machinery and equipment rose 14.1 per cent.

- 13 -

Public final demand declined 0.4 per cent in 2010-11, with growth in general government consumption more than offset by lower public corporations investment5 and general government investment. Public corporation investment declined by 13.7 per cent and detracted 0.4 percentage point from GSP growth in 2010-11. Following several years of very strong growth, general government investment declined 8.5 per cent, detracting 0.5 percentage point from Queensland’s economic growth in 2010-11.

The trade sector (net exports) detracted 2.8 percentage points from Queensland’s economic growth in 2010-11, a turnaround from a contribution of 3.6 percentage points in 2009-10. The adverse impact of natural disasters on commodity production and transportation resulted in a record decline in exports of goods and services (down 7.8 per cent), which more than offset a minor decline in imports of goods and services (down 0.7 per cent) in 2010-11.

Gross Rest of Australia product increased 2.3 per cent in 2010-11. Growth for the Rest of Australia was driven by domestic demand, which was partly offset by a detraction from net exports.

Table VI

Changes and Contribution to Growth, 2010-11, Year-Average, CVM (a)

| | | | | | | | | | | | | | | | |

| | | Queensland | | | Rest of Australia | |

| | | Year-average

% change

2009-10 to

2010-11 (p) | | | % point

contribution

to growth

in GSP

2009-10 to

2010-11 (p) | | | Year-average

% change

2009-10 to

2010-11 (p) | | | % point

contribution

to growth

in GSP

2009-10 to

2010-11 (p) | |

| | | | |

Household consumption | | | 2.4 | | | | 1.2 | | | | 3.5 | | | | 1.9 | |

| | | | |

Private investment | | | 6.3 | | | | 1.4 | | | | 3.5 | | | | 0.8 | |

Dwelling investment | | | -12.9 | | | | -0.9 | | | | 7.4 | | | | 0.4 | |

New and used | | | -17.9 | | | | -0.7 | | | | 11.5 | | | | 0.4 | |

Alterations and additions | | | -6.8 | | | | -0.2 | | | | 1.9 | | | | 0.0 | |

Business investment | | | 20.0 | | | | 2.5 | | | | 3.4 | | | | 0.4 | |

Non-dwelling construction | | | 25.5 | | | | 1.7 | | | | 6.9 | | | | 0.4 | |

Machinery and equipment | | | 14.1 | | | | 0.8 | | | | 0.0 | | | | 0.0 | |

| | | | |

Public final demand | | | -0.4 | | | | -0.1 | | | | 5.8 | | | | 1.4 | |

General government consumption | | | 5.0 | | | | 0.8 | | | | 4.0 | | | | 0.7 | |

Public corporations investment | | | -13.7 | | | | -0.4 | | | | -1.3 | | | | 0.0 | |

General government investment | | | -8.5 | | | | -0.5 | | | | 17.5 | | | | 0.7 | |

| | | | |

Changes in inventories | | | n.a. | | | | 0.2 | | | | n.a. | | | | 0.2 | |

| | | | |

Gross state expenditure | | | 2.8 | | | | 2.7 | | | | 4.2 | | | | 4.3 | |

| | | | |

Exports of goods and services | | | -7.8 | | | | -3.0 | | | | 0.2 | | | | 0.1 | |

Overseas | | | -6.6 | | | | -1.9 | | | | 2.3 | | | | 0.5 | |

Interstate | | | -11.0 | | | | -1.2 | | | | -10.5 | | | | -0.4 | |

| | | | |

less Imports of goods and services | | | -0.7 | | | | -0.2 | | | | 9.0 | | | | 2.4 | |

Overseas | | | 8.4 | | | | 1.5 | | | | 11.2 | | | | 2.7 | |

Interstate | | | -10.5 | | | | -1.8 | | | | -11.0 | | | | -0.3 | |

| | | | |

Gross state product (b) | | | 0.2 | | | | 0.2 | | | | 2.3 | | | | 2.3 | |

| (a) | Chain volume measure reference year 2008-09. |

n.a. not applicable

| (b) | Includes statistical discrepancy. |

| 5 | In November 2010, the Queensland Government floated QR National and sold a 99-year lease on the Port of Brisbane. Users should interpret the estimate of business investment and public gross fixed capital formation, public corporations - state and local, with caution around this period. |

- 14 -

| | |

| | Queensland State Accounts, June Quarter 2011 |

Queensland State Accounts - Tables

| | | | | | |

| Table | | Domestic Production Account – Queensland | | Page | |

| 1 | | Trend, chain volume measures, $m | | | 16 | |

| 2 | | Trend, chain volume measures, quarterly % change | | | 18 | |

| 3 | | Trend, chain volume measures, quarterly contribution to growth, % points | | | 20 | |

| 4 | | Trend, chain volume measures, annual % change | | | 22 | |

| 5 | | Trend, chain volume measures, annual contribution to growth, % points | | | 24 | |

Additional tables available on the Internet

URL: http://www.oesr.qld.gov.au/releases/qsatables

| | |

| Table | | Domestic Production Account – Queensland |

| |

| 6 | | Seasonally adjusted, chain volume measures, $m |

| 7 | | Seasonally adjusted, chain volume measures, quarterly % change |

| 8 | | Seasonally adjusted, chain volume measures, annual % change |

| 9 | | Original, chain volume measures, $m |

| 10 | | Original, chain volume measures, annual % change |

| 11 | | Trend, current prices, $m |

| 12 | | Trend, current prices, quarterly % change |

| 13 | | Trend, current prices, quarterly contribution to growth, % points |

| 14 | | Seasonally adjusted, current prices, $m |

| 15 | | Seasonally adjusted, current prices, quarterly % change |

| 16 | | Seasonally adjusted, current prices, quarterly contribution to growth, % points |

| 17 | | Original, current prices, $m |

| 18 | | Original, current prices, annual % change |

| 19 | | Trend, implicit price deflators, 2008-09 = 100 |

| 20 | | Original, implicit price deflators, 2008-09 = 100 |

| |

| Table | | Domestic Production Account - Rest of Australia |

| |

| 21 | | Trend, chain volume measures, $m |

| 22 | | Trend, chain volume measures, quarterly % change |

| 23 | | Seasonally adjusted, chain volume measures, $m |

| 24 | | Original, chain volume measures, $m |

| 25 | | Trend, current prices, $m |

| 26 | | Original, current prices, $m |

| 27 | | Trend, implicit price deflators, 2008-09 = 100 |

- 15 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 1 |

| (Trend, chain volume measure (a), $m) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007-08 | | | 2008-09 | | | 2009-10 | | | 2010-11 | |

| | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | |

| | | | | | | | | | | | | |

Final consumption expenditure | | | 41,347 | | | | 41,518 | | | | 41,658 | | | | 41,649 | | | | 41,641 | | | | 41,827 | | | | 42,148 | | | | 42,475 | | | | 42,731 | | | | 43,016 | | | | 43,379 | | | | 43,745 | | | | 44,088 | |

| | | | | | | | | | | | | |

Households | | | 31,640 | | | | 31,701 | | | | 31,774 | | | | 31,748 | | | | 31,747 | | | | 31,875 | | | | 32,113 | | | | 32,348 | | | | 32,514 | | | | 32,640 | | | | 32,840 | | | | 33,093 | | | | 33,382 | |

| | | | | | | | | | | | | |

General government | | | 9,708 | | | | 9,818 | | | | 9,884 | | | | 9,901 | | | | 9,895 | | | | 9,952 | | | | 10,034 | | | | 10,127 | | | | 10,218 | | | | 10,376 | | | | 10,539 | | | | 10,652 | | | | 10,706 | |

National | | | 3,057 | | | | 3,096 | | | | 3,125 | | | | 3,118 | | | | 3,081 | | | | 3,040 | | | | 2,994 | | | | 2,995 | | | | 3,067 | | | | 3,187 | | | | 3,287 | | | | 3,335 | | | | 3,349 | |

State and local | | | 6,646 | | | | 6,721 | | | | 6,759 | | | | 6,783 | | | | 6,813 | | | | 6,912 | | | | 7,040 | | | | 7,132 | | | | 7,151 | | | | 7,188 | | | | 7,252 | | | | 7,317 | | | | 7,357 | |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) (c) | | | 17,409 | | | | 17,374 | | | | 16,773 | | | | 15,871 | | | | 15,164 | | | | 14,736 | | | | 14,473 | | | | 14,354 | | | | 14,294 | | | | 14,287 | | | | 14,710 | | | | 15,487 | | | | 16,574 | |

| | | | | | | | | | | | | |

Dwellings | | | 5,214 | | | | 5,088 | | | | 4,645 | | | | 4,171 | | | | 4,009 | | | | 4,111 | | | | 4,279 | | | | 4,370 | | | | 4,283 | | | | 4,066 | | | | 3,827 | | | | 3,653 | | | | 3,588 | |

New and used | | | 3,113 | | | | 3,006 | | | | 2,730 | | | | 2,448 | | | | 2,342 | | | | 2,331 | | | | 2,357 | | | | 2,373 | | | | 2,309 | | | | 2,179 | | | | 2,022 | | | | 1,896 | | | | 1,840 | |

Alterations and additions | | | 2,101 | | | | 2,082 | | | | 1,915 | | | | 1,723 | | | | 1,667 | | | | 1,779 | | | | 1,922 | | | | 1,997 | | | | 1,974 | | | | 1,887 | | | | 1,805 | | | | 1,757 | | | | 1,748 | |

| | | | | | | | | | | | | |

Business Investment (b) (c) | | | 10,176 | | | | 10,416 | | | | 10,289 | | | | 9,799 | | | | 9,173 | | | | 8,557 | | | | 8,058 | | | | 7,875 | | | | 8,016 | | | | 8,314 | | | | 8,956 | | | | 9,853 | | | | 10,973 | |

Non-dwelling construction (b) | | | 4,696 | | | | 4,942 | | | | 5,035 | | | | 4,900 | | | | 4,620 | | | | 4,369 | | | | 4,169 | | | | 4,139 | | | | 4,231 | | | | 4,366 | | | | 4,754 | | | | 5,364 | | | | 6,103 | |

Machinery and equipment (b) | | | 5,480 | | | | 5,474 | | | | 5,254 | | | | 4,899 | | | | 4,552 | | | | 4,188 | | | | 3,890 | | | | 3,735 | | | | 3,786 | | | | 3,948 | | | | 4,202 | | | | 4,489 | | | | 4,870 | |

| | | | | | | | | | | | | |

Livestock and orchards | | | 194 | | | | 200 | | | | 206 | | | | 209 | | | | 213 | | | | 217 | | | | 222 | | | | 228 | | | | 235 | | | | 244 | | | | 249 | | | | 250 | | | | 248 | |

Intellectual property products | | | 900 | | | | 892 | | | | 878 | | | | 875 | | | | 899 | | | | 940 | | | | 979 | | | | 1,006 | | | | 1,016 | | | | 1,016 | | | | 1,024 | | | | 1,047 | | | | 1,082 | |

Ownership transfer costs | | | 923 | | | | 787 | | | | 721 | | | | 770 | | | | 860 | | | | 920 | | | | 902 | | | | 841 | | | | 761 | | | | 696 | | | | 643 | | | | 602 | | | | 556 | |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) (c) | | | 5,156 | | | | 5,284 | | | | 5,198 | | | | 5,085 | | | | 5,075 | | | | 5,275 | | | | 5,535 | | | | 5,627 | | | | 5,576 | | | | 5,360 | | | | 5,134 | | | | 4,974 | | | | 4,804 | |

| | | | | | | | | | | | | |

Public corporations (b) (c) | | | 2,181 | | | | 2,174 | | | | 2,082 | | | | 1,991 | | | | 1,898 | | | | 1,827 | | | | 1,711 | | | | 1,605 | | | | 1,604 | | | | 1,600 | | | | 1,542 | | | | 1,430 | | | | 1,263 | |

Commonwealth (b) | | | 52 | | | | 43 | | | | 43 | | | | 58 | | | | 82 | | | | 102 | | | | 102 | | | | 87 | | | | 72 | | | | 68 | | | | 78 | | | | 91 | | | | 105 | |

State and local (c) | | | 2,131 | | | | 2,131 | | | | 2,039 | | | | 1,933 | | | | 1,815 | | | | 1,725 | | | | 1,609 | | | | 1,518 | | | | 1,532 | | | | 1,532 | | | | 1,464 | | | | 1,338 | | | | 1,157 | |

| | | | | | | | | | | | | |

General government | | | 2,999 | | | | 3,110 | | | | 3,116 | | | | 3,095 | | | | 3,178 | | | | 3,448 | | | | 3,824 | | | | 4,022 | | | | 3,972 | | | | 3,760 | | | | 3,591 | | | | 3,545 | | | | 3,542 | |

National | | | 672 | | | | 705 | | | | 655 | | | | 584 | | | | 565 | | | | 617 | | | | 686 | | | | 738 | | | | 765 | | | | 766 | | | | 765 | | | | 770 | | | | 776 | |

State and local | | | 2,317 | | | | 2,405 | | | | 2,461 | | | | 2,511 | | | | 2,613 | | | | 2,831 | | | | 3,138 | | | | 3,285 | | | | 3,207 | | | | 2,994 | | | | 2,826 | | | | 2,775 | | | | 2,766 | |

| | | | | | | | | | | | | |

Change in inventories | | | 333 | | | | 292 | | | | 4 | | | | -272 | | | | -270 | | | | 26 | | | | 238 | | | | 203 | | | | 49 | | | | -65 | | | | 84 | | | | 375 | | | | 740 | |

| | | | | | | | | | | | | |

Gross state expenditure | | | 64,270 | | | | 64,468 | | | | 63,634 | | | | 62,333 | | | | 61,611 | | | | 61,864 | | | | 62,393 | | | | 62,659 | | | | 62,650 | | | | 62,597 | | | | 63,307 | | | | 64,581 | | | | 66,206 | |

- 16 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | | 24,272 | | | | 23,821 | | | | 23,292 | | | | 23,326 | | | | 23,827 | | | | 24,608 | | | | 25,233 | | | | 25,401 | | | | 25,302 | | | | 24,536 | | | | 23,375 | | | | 22,335 | | | | 21,412 | |

| | | | | | | | | | | | | |

Overseas | | | 17,355 | | | | 17,234 | | | | 17,118 | | | | 17,228 | | | | 17,309 | | | | 17,534 | | | | 18,061 | | | | 18,671 | | | | 19,010 | | | | 18,394 | | | | 17,266 | | | | 16,311 | | | | 15,557 | |

Goods | | | 14,441 | | | | 14,311 | | | | 14,216 | | | | 14,353 | | | | 14,496 | | | | 14,799 | | | | 15,398 | | | | 16,060 | | | | 16,387 | | | | 15,779 | | | | 14,683 | | | | 13,774 | | | | 13,074 | |

Services | | | 2,914 | | | | 2,924 | | | | 2,901 | | | | 2,875 | | | | 2,813 | | | | 2,735 | | | | 2,663 | | | | 2,610 | | | | 2,622 | | | | 2,615 | | | | 2,583 | | | | 2,537 | | | | 2,483 | |

| | | | | | | | | | | | | |

Interstate | | | 6,917 | | | | 6,587 | | | | 6,175 | | | | 6,098 | | | | 6,518 | | | | 7,074 | | | | 7,172 | | | | 6,730 | | | | 6,293 | | | | 6,142 | | | | 6,110 | | | | 6,023 | | | | 5,854 | |

Goods | | | 5,395 | | | | 5,156 | | | | 4,814 | | | | 4,749 | | | | 5,132 | | | | 5,651 | | | | 5,741 | | | | 5,303 | | | | 4,856 | | | | 4,696 | | | | 4,683 | | | | 4,630 | | | | 4,485 | |

Selected services | | | 1,522 | | | | 1,431 | | | | 1,360 | | | | 1,350 | | | | 1,386 | | | | 1,423 | | | | 1,431 | | | | 1,427 | | | | 1,436 | | | | 1,446 | | | | 1,427 | | | | 1,394 | | | | 1,369 | |

| | | | | | | | | | | | | |

less Imports of goods and services | | | 24,948 | | | | 25,135 | | | | 24,100 | | | | 22,560 | | | | 21,885 | | | | 22,485 | | | | 23,171 | | | | 23,083 | | | | 22,692 | | | | 22,220 | | | | 22,297 | | | | 22,785 | | | | 23,510 | |

| | | | | | | | | | | | | |

less Overseas | | | 12,363 | | | | 12,301 | | | | 11,601 | | | | 10,844 | | | | 10,660 | | | | 11,109 | | | | 11,779 | | | | 12,212 | | | | 12,418 | | | | 12,505 | | | | 12,735 | | | | 13,106 | | | | 13,517 | |

less Goods | | | 9,402 | | | | 9,403 | | | | 8,869 | | | | 8,240 | | | | 8,053 | | | | 8,410 | | | | 8,987 | | | | 9,333 | | | | 9,457 | | | | 9,469 | | | | 9,595 | | | | 9,844 | | | | 10,119 | |

less Services | | | 2,961 | | | | 2,898 | | | | 2,732 | | | | 2,603 | | | | 2,607 | | | | 2,699 | | | | 2,792 | | | | 2,879 | | | | 2,961 | | | | 3,035 | | | | 3,140 | | | | 3,262 | | | | 3,398 | |

| | | | | | | | | | | | | |

less Interstate | | | 12,585 | | | | 12,834 | | | | 12,499 | | | | 11,717 | | | | 11,225 | | | | 11,377 | | | | 11,392 | | | | 10,871 | | | | 10,274 | | | | 9,716 | | | | 9,562 | | | | 9,679 | | | | 9,993 | |

less Goods | | | 11,646 | | | | 11,922 | | | | 11,628 | | | | 10,888 | | | | 10,416 | | | | 10,523 | | | | 10,520 | | | | 9,972 | | | | 9,347 | | | | 8,814 | | | | 8,701 | | | | 8,846 | | | | 9,160 | |

less Selected services | | | 939 | | | | 912 | | | | 871 | | | | 829 | | | | 809 | | | | 853 | | | | 873 | | | | 899 | | | | 927 | | | | 901 | | | | 861 | | | | 833 | | | | 833 | |

| | | | | | | | | | | | | |

Statistical discrepancy (E) | | | 171 | | | | 228 | | | | 147 | | | | -17 | | | | -178 | | | | -258 | | | | -231 | | | | -176 | | | | -48 | | | | 76 | | | | 70 | | | | 31 | | | | -7 | |

| | | | | | | | | | | | | |

Gross state product | | | 63,765 | | | | 63,382 | | | | 62,974 | | | | 63,082 | | | | 63,375 | | | | 63,729 | | | | 64,224 | | | | 64,800 | | | | 65,212 | | | | 64,989 | | | | 64,455 | | | | 64,162 | | | | 64,101 | |

| (a) | Chain volume measure reference year 2008-09 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. Additionally, Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. |

| (c) | In November 2010, the Queensland Government floated QR National and sold a lease of the Port of Brisbane. Users should interpret the trend estimate of business investment and public gross fixed capital formation, public corporations - state and local, with caution around this period. |

TABLE 1

- 17 -

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 2 |

| (Trend, chain volume measure (a), quarterly percentage change, %) | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007-08 | | | 2008-09 | | | 2009-10 | | | 2010-11 | |

| | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | |

| | | | | | | | | | | | | |

Final consumption expenditure | | | 0.5 | | | | 0.4 | | | | 0.3 | | | | 0.0 | | | | 0.0 | | | | 0.4 | | | | 0.8 | | | | 0.8 | | | | 0.6 | | | | 0.7 | | | | 0.8 | | | | 0.8 | | | | 0.8 | |

| | | | | | | | | | | | | |

Households | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | -0.1 | | | | 0.0 | | | | 0.4 | | | | 0.7 | | | | 0.7 | | | | 0.5 | | | | 0.4 | | | | 0.6 | | | | 0.8 | | | | 0.9 | |

| | | | | | | | | | | | | |

General government | | | 1.5 | | | | 1.1 | | | | 0.7 | | | | 0.2 | | | | -0.1 | | | | 0.6 | | | | 0.8 | | | | 0.9 | | | | 0.9 | | | | 1.5 | | | | 1.6 | | | | 1.1 | | | | 0.5 | |

National | | | 1.5 | | | | 1.3 | | | | 0.9 | | | | -0.2 | | | | -1.2 | | | | -1.3 | | | | -1.5 | | | | 0.0 | | | | 2.4 | | | | 3.9 | | | | 3.1 | | | | 1.5 | | | | 0.4 | |

State and local | | | 1.4 | | | | 1.1 | | | | 0.6 | | | | 0.4 | | | | 0.4 | | | | 1.5 | | | | 1.9 | | | | 1.3 | | | | 0.3 | | | | 0.5 | | | | 0.9 | | | | 0.9 | | �� | | 0.5 | |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) (c) | | | 2.9 | | | | -0.2 | | | | -3.5 | | | | -5.4 | | | | -4.5 | | | | -2.8 | | | | -1.8 | | | | -0.8 | | | | -0.4 | | | | 0.0 | | | | 3.0 | | | | 5.3 | | | | 7.0 | |

| | | | | | | | | | | | | |

Dwellings | | | 3.3 | | | | -2.4 | | | | -8.7 | | | | -10.2 | | | | -3.9 | | | | 2.5 | | | | 4.1 | | | | 2.1 | | | | -2.0 | | | | -5.1 | | | | -5.9 | | | | -4.5 | | | | -1.8 | |

New and used | | | 2.8 | | | | -3.4 | | | | -9.2 | | | | -10.3 | | | | -4.3 | | | | -0.5 | | | | 1.1 | | | | 0.7 | | | | -2.7 | | | | -5.6 | | | | -7.2 | | | | -6.2 | | | | -3.0 | |

Alterations and additions | | | 4.2 | | | | -0.9 | | | | -8.0 | | | | -10.0 | | | | -3.3 | | | | 6.7 | | | | 8.0 | | | | 3.9 | | | | -1.2 | | | | -4.4 | | | | -4.3 | | | | -2.7 | | | | -0.5 | |

| | | | | | | | | | | | | |

Business Investment (b) (c) | | | 4.7 | | | | 2.4 | | | | -1.2 | | | | -4.8 | | | | -6.4 | | | | -6.7 | | | | -5.8 | | | | -2.3 | | | | 1.8 | | | | 3.7 | | | | 7.7 | | | | 10.0 | | | | 11.4 | |

Non-dwelling construction (b) | | | 7.2 | | | | 5.2 | | | | 1.9 | | | | -2.7 | | | | -5.7 | | | | -5.4 | | | | -4.6 | | | | -0.7 | | | | 2.2 | | | | 3.2 | | | | 8.9 | | | | 12.8 | | | | 13.8 | |

Machinery and equipment (b) | | | 2.7 | | | | -0.1 | | | | -4.0 | | | | -6.8 | | | | -7.1 | | | | -8.0 | | | | -7.1 | | | | -4.0 | | | | 1.4 | | | | 4.3 | | | | 6.4 | | | | 6.8 | | | | 8.5 | |

| | | | | | | | | | | | | |

Livestock and orchards | | | 4.3 | | | | 3.1 | | | | 3.0 | | | | 1.5 | | | | 1.9 | | | | 1.9 | | | | 2.3 | | | | 2.7 | | | | 3.1 | | | | 3.8 | | | | 2.0 | | | | 0.4 | | | | -0.8 | |

Intellectual property products | | | 0.6 | | | | -0.9 | | | | -1.6 | | | | -0.3 | | | | 2.7 | | | | 4.6 | | | | 4.1 | | | | 2.8 | | | | 1.0 | | | | 0.0 | | | | 0.8 | | | | 2.2 | | | | 3.3 | |

Ownership transfer costs | | | -13.6 | | | | -14.7 | | | | -8.4 | | | | 6.8 | | | | 11.7 | | | | 7.0 | | | | -2.0 | | | | -6.8 | | | | -9.5 | | | | -8.5 | | | | -7.6 | | | | -6.4 | | | | -7.6 | |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) (c) | | | 8.5 | | | | 2.5 | | | | -1.6 | | | | -2.2 | | | | -0.2 | | | | 3.9 | | | | 4.9 | | | | 1.7 | | | | -0.9 | | | | -3.9 | | | | -4.2 | | | | -3.1 | | | | -3.4 | |

| | | | | | | | | | | | | |

Public corporations | | | 6.3 | | | | -0.3 | | | | -4.2 | | | | -4.4 | | | | -4.7 | | | | -3.7 | | | | -6.3 | | | | -6.2 | | | | -0.1 | | | | -0.2 | | | | -3.6 | | | | -7.3 | | | | -11.7 | |

Commonwealth (b) | | | -8.8 | | | | -17.3 | | | | 0.0 | | | | 34.9 | | | | 41.4 | | | | 24.4 | | | | 0.0 | | | | -14.7 | | | | -17.2 | | | | -5.6 | | | | 14.7 | | | | 16.7 | | | | 15.4 | |

State and local (c) | | | 7.2 | | | | 0.0 | | | | -4.3 | | | | -5.2 | | | | -6.1 | | | | -5.0 | | | | -6.7 | | | | -5.7 | | | | 0.9 | | | | 0.0 | | | | -4.4 | | | | -8.6 | | | | -13.5 | |

| | | | | | | | | | | | | |

General government | | | 10.2 | | | | 3.7 | | | | 0.2 | | | | -0.7 | | | | 2.7 | | | | 8.5 | | | | 10.9 | | | | 5.2 | | | | -1.2 | | | | -5.3 | | | | -4.5 | | | | -1.3 | | | | -0.1 | |

National | | | 23.3 | | | | 4.9 | | | | -7.1 | | | | -10.8 | | | | -3.3 | | | | 9.2 | | | | 11.2 | | | | 7.6 | | | | 3.7 | | | | 0.1 | | | | -0.1 | | | | 0.7 | | | | 0.8 | |

State and local | | | 6.9 | | | | 3.8 | | | | 2.3 | | | | 2.0 | | | | 4.1 | | | | 8.3 | | | | 10.8 | | | | 4.7 | | | | -2.4 | | | | -6.6 | | | | -5.6 | | | | -1.8 | | | | -0.3 | |

| | | | | | | | | | | | | |

Gross state expenditure | | | 1.9 | | | | 0.3 | | | | -1.3 | | | | -2.0 | | | | -1.2 | | | | 0.4 | | | | 0.9 | | | | 0.4 | | | | 0.0 | | | | -0.1 | | | | 1.1 | | | | 2.0 | | | | 2.5 | |

- 18 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | | 0.8 | | | | -1.9 | | | | -2.2 | | | | 0.1 | | | | 2.1 | | | | 3.3 | | | | 2.5 | | | | 0.7 | | | | -0.4 | | | | -3.0 | | | | -4.7 | | | | -4.4 | | | | -4.1 | |

| | | | | | | | | | | | | |

Overseas | | | 1.7 | | | | -0.7 | | | | -0.7 | | | | 0.6 | | | | 0.5 | | | | 1.3 | | | | 3.0 | | | | 3.4 | | | | 1.8 | | | | -3.2 | | | | -6.1 | | | | -5.5 | | | | -4.6 | |

Goods | | | 1.7 | | | | -0.9 | | | | -0.7 | | | | 1.0 | | | | 1.0 | | | | 2.1 | | | | 4.0 | | | | 4.3 | | | | 2.0 | | | | -3.7 | | | | -6.9 | | | | -6.2 | | | | -5.1 | |

Services | | | 1.7 | | | | 0.3 | | | | -0.8 | | | | -0.9 | | | | -2.2 | | | | -2.8 | | | | -2.6 | | | | -2.0 | | | | 0.5 | | | | -0.3 | | | | -1.2 | | | | -1.8 | | | | -2.1 | |

| | | | | | | | | | | | | |

Interstate | | | -1.5 | | | | -4.8 | | | | -6.3 | | | | -1.2 | | | | 6.9 | | | | 8.5 | | | | 1.4 | | | | -6.2 | | | | -6.5 | | | | -2.4 | | | | -0.5 | | | | -1.4 | | | | -2.8 | |

Goods | | | -0.5 | | | | -4.4 | | | | -6.6 | | | | -1.4 | | | | 8.1 | | | | 10.1 | | | | 1.6 | | | | -7.6 | | | | -8.4 | | | | -3.3 | | | | -0.3 | | | | -1.1 | | | | -3.1 | |

Selected services | | | -5.0 | | | | -6.0 | | | | -5.0 | | | | -0.7 | | | | 2.7 | | | | 2.7 | | | | 0.6 | | | | -0.3 | | | | 0.6 | | | | 0.7 | | | | -1.3 | | | | -2.3 | | | | -1.8 | |

| | | | | | | | | | | | | |

less Imports of goods and services | | | 4.8 | | | | 0.7 | | | | -4.1 | | | | -6.4 | | | | -3.0 | | | | 2.7 | | | | 3.1 | | | | -0.4 | | | | -1.7 | | | | -2.1 | | | | 0.3 | | | | 2.2 | | | | 3.2 | |

| | | | | | | | | | | | | |

less Overseas | | | 5.1 | | | | -0.5 | | | | -5.7 | | | | -6.5 | | | | -1.7 | | | | 4.2 | | | | 6.0 | | | | 3.7 | | | | 1.7 | | | | 0.7 | | | | 1.8 | | | | 2.9 | | | | 3.1 | |

less Goods | | | 5.4 | | | | 0.0 | | | | -5.7 | | | | -7.1 | | | | -2.3 | | | | 4.4 | | | | 6.9 | | | | 3.9 | | | | 1.3 | | | | 0.1 | | | | 1.3 | | | | 2.6 | | | | 2.8 | |

less Services | | | 4.1 | | | | -2.1 | | | | -5.7 | | | | -4.7 | | | | 0.2 | | | | 3.5 | | | | 3.4 | | | | 3.1 | | | | 2.8 | | | | 2.5 | | | | 3.5 | | | | 3.9 | | | | 4.2 | |

| | | | | | | | | | | | | |

less Interstate | | | 4.5 | | | | 2.0 | | | | -2.6 | | | | -6.3 | | | | -4.2 | | | | 1.4 | | | | 0.1 | | | | -4.6 | | | | -5.5 | | | | -5.4 | | | | -1.6 | | | | 1.2 | | | | 3.2 | |

less Goods | | | 4.8 | | | | 2.4 | | | | -2.5 | | | | -6.4 | | | | -4.3 | | | | 1.0 | | | | 0.0 | | | | -5.2 | | | | -6.3 | | | | -5.7 | | | | -1.3 | | | | 1.7 | | | | 3.5 | |

less Selected services | | | 0.9 | | | | -2.9 | | | | -4.5 | | | | -4.8 | | | | -2.4 | | | | 5.4 | | | | 2.3 | | | | 3.0 | | | | 3.1 | | | | -2.8 | | | | -4.4 | | | | -3.3 | | | | 0.0 | |

| | | | | | | | | | | | | |

Gross state product (d) | | | 0.6 | | | | -0.6 | | | | -0.6 | | | | 0.2 | | | | 0.5 | | | | 0.6 | | | | 0.8 | | | | 0.9 | | | | 0.6 | | | | -0.3 | | | | -0.8 | | | | -0.5 | | | | -0.1 | |

| (a) | Chain volume measure reference year 2008-09 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. Additionally, Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. |

| (c) | In November 2010, the Queensland Government floated QR National and sold a lease of the Port of Brisbane. Users should interpret the trend estimate of business investment and public gross fixed capital formation, public corporations - state and local, with caution around this period. |

| (d) | Includes statistical discrepancy. |

TABLE 2

- 19 -

| | | | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | | TABLE 3 | |

| (Trend, chain volume measure (a), quarterly contribution to growth, % points) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007-08 | | | 2008-09 | | | 2009-10 | | | 2010-11 | |

| | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | |

| | | | | | | | | | | | | |

Final consumption expenditure | | | 0.3 | | | | 0.3 | | | | 0.2 | | | | 0.0 | | | | 0.0 | | | | 0.3 | | | | 0.5 | | | | 0.5 | | | | 0.4 | | | | 0.4 | | | | 0.6 | | | | 0.6 | | | | 0.5 | |

| | | | | | | | | | | | | |

Households | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.2 | | | | 0.4 | | | | 0.4 | | | | 0.3 | | | | 0.2 | | | | 0.3 | | | | 0.4 | | | | 0.5 | |

| | | | | | | | | | | | | |

General government | | | 0.2 | | | | 0.2 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.2 | | | | 0.3 | | | | 0.2 | | | | 0.1 | |

National | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | 0.0 | | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.1 | | | | 0.0 | |

State and local | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.2 | | | | 0.2 | | | | 0.1 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) (c) | | | 0.8 | | | | -0.1 | | | | -0.9 | | | | -1.4 | | | | -1.1 | | | | -0.7 | | | | -0.4 | | | | -0.2 | | | | -0.1 | | | | 0.0 | | | | 0.7 | | | | 1.2 | | | | 1.7 | |

| | | | | | | | | | | | | |

Dwellings | | | 0.3 | | | | -0.2 | | | | -0.7 | | | | -0.8 | | | | -0.3 | | | | 0.2 | | | | 0.3 | | | | 0.1 | | | | -0.1 | | | | -0.3 | | | | -0.4 | | | | -0.3 | | | | -0.1 | |

New and used | | | 0.1 | | | | -0.2 | | | | -0.4 | | | | -0.4 | | | | -0.2 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.2 | | | | -0.2 | | | | -0.2 | | | | -0.1 | |

Alterations and additions | | | 0.1 | | | | 0.0 | | | | -0.3 | | | | -0.3 | | | | -0.1 | | | | 0.2 | | | | 0.2 | | | | 0.1 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | 0.0 | |

| | | | | | | | | | | | | |

Business Investment (b) (c) | | | 0.7 | | | | 0.4 | | | | -0.2 | | | | -0.8 | | | | -1.0 | | | | -1.0 | | | | -0.8 | | | | -0.3 | | | | 0.2 | | | | 0.5 | | | | 1.0 | | | | 1.4 | | | | 1.7 | |

Non-dwelling construction (b) | | | 0.5 | | | | 0.4 | | | | 0.1 | | | | -0.2 | | | | -0.4 | | | | -0.4 | | | | -0.3 | | | | 0.0 | | | | 0.1 | | | | 0.2 | | | | 0.6 | | | | 0.9 | | | | 1.2 | |

Machinery and equipment (b) | | | 0.2 | | | | 0.0 | | | | -0.3 | | | | -0.6 | | | | -0.6 | | | | -0.6 | | | | -0.5 | | | | -0.2 | | | | 0.1 | | | | 0.2 | | | | 0.4 | | | | 0.4 | | | | 0.6 | |

| | | | | | | | | | | | | |

Livestock and orchards | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

Intellectual property products | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.1 | |

Ownership transfer costs | | | -0.2 | | | | -0.2 | | | | -0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.1 | |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) (c) | | | 0.6 | | | | 0.2 | | | | -0.1 | | | | -0.2 | | | | 0.0 | | | | 0.3 | | | | 0.4 | | | | 0.1 | | | | -0.1 | | | | -0.3 | | | | -0.3 | | | | -0.2 | | | | -0.3 | |

| | | | | | | | | | | | | |

Public corporations (b) (c) | | | 0.2 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.2 | | | | -0.2 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.2 | | | | -0.3 | |

Commonwealth (b) | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

State and local (c) | | | 0.2 | | | | 0.0 | | | | -0.1 | | | | -0.2 | | | | -0.2 | | | | -0.1 | | | | -0.2 | | | | -0.1 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.2 | | | | -0.3 | |

| | | | | | | | | | | | | |

General government | | | 0.4 | | | | 0.2 | | | | 0.0 | | | | 0.0 | | | | 0.1 | | | | 0.4 | | | | 0.6 | | | | 0.3 | | | | -0.1 | | | | -0.3 | | | | -0.3 | | | | -0.1 | | | | 0.0 | |

National | | | 0.2 | | | | 0.1 | | | | -0.1 | | | | -0.1 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

State and local | | | 0.2 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.2 | | | | 0.3 | | | | 0.5 | | | | 0.2 | | | | -0.1 | | | | -0.3 | | | | -0.3 | | | | -0.1 | | | | 0.0 | |

| | | | | | | | | | | | | |

Change in inventories | | | 0.2 | | | | -0.1 | | | | -0.5 | | | | -0.4 | | | | 0.0 | | | | 0.5 | | | | 0.3 | | | | -0.1 | | | | -0.2 | | | | -0.2 | | | | 0.2 | | | | 0.5 | | | | 0.6 | |

| | | | | | | | | | | | | |

Gross state expenditure | | | 1.9 | | | | 0.3 | | | | -1.3 | | | | -2.1 | | | | -1.1 | | | | 0.4 | | | | 0.8 | | | | 0.4 | | | | 0.0 | | | | -0.1 | | | | 1.1 | | | | 2.0 | | | | 2.5 | |

- 20 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | | 0.3 | | | | -0.7 | | | | -0.8 | | | | 0.1 | | | | 0.8 | | | | 1.2 | | | | 1.0 | | | | 0.3 | | | | -0.2 | | | | -1.2 | | | | -1.8 | | | | -1.6 | | | | -1.4 | |

| | | | | | | | | | | | | |

Overseas | | | 0.5 | | | | -0.2 | | | | -0.2 | | | | 0.2 | | | | 0.1 | | | | 0.4 | | | | 0.8 | | | | 0.9 | | | | 0.5 | | | | -0.9 | | | | -1.7 | | | | -1.5 | | | | -1.2 | |

Goods | | | 0.4 | | | | -0.2 | | | | -0.1 | | | | 0.2 | | | | 0.2 | | | | 0.5 | | | | 0.9 | | | | 1.0 | | | | 0.5 | | | | -0.9 | | | | -1.7 | | | | -1.4 | | | | -1.1 | |

Services | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.1 | |

| | | | | | | | | | | | | |

Interstate | | | -0.2 | | | | -0.5 | | | | -0.7 | | | | -0.1 | | | | 0.7 | | | | 0.9 | | | | 0.2 | | | | -0.7 | | | | -0.7 | | | | -0.2 | | | | 0.0 | | | | -0.1 | | | | -0.3 | |

Goods | | | 0.0 | | | | -0.4 | | | | -0.5 | | | | -0.1 | | | | 0.6 | | | | 0.8 | | | | 0.1 | | | | -0.7 | | | | -0.7 | | | | -0.2 | | | | 0.0 | | | | -0.1 | | | | -0.2 | |

Selected services | | | -0.1 | | | | -0.1 | | | | -0.1 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | 0.0 | |

| | | | | | | | | | | | | |

less Imports of goods and services | | | 1.8 | | | | 0.3 | | | | -1.6 | | | | -2.4 | | | | -1.1 | | | | 0.9 | | | | 1.1 | | | | -0.1 | | | | -0.6 | | | | -0.7 | | | | 0.1 | | | | 0.8 | | | | 1.1 | |

| | | | | | | | | | | | | |

less Overseas | | | 0.9 | | | | -0.1 | | | | -1.1 | | | | -1.2 | | | | -0.3 | | | | 0.7 | | | | 1.1 | | | | 0.7 | | | | 0.3 | | | | 0.1 | | | | 0.4 | | | | 0.6 | | | | 0.6 | |

less Goods | | | 0.8 | | | | 0.0 | | | | -0.8 | | | | -1.0 | | | | -0.3 | | | | 0.6 | | | | 0.9 | | | | 0.5 | | | | 0.2 | | | | 0.0 | | | | 0.2 | | | | 0.4 | | | | 0.4 | |

less Services | | | 0.2 | | | | -0.1 | | | | -0.3 | | | | -0.2 | | | | 0.0 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.2 | |

| | | | | | | | | | | | | |

less Interstate | | | 0.9 | | | | 0.4 | | | | -0.5 | | | | -1.2 | | | | -0.8 | | | | 0.2 | | | | 0.0 | | | | -0.8 | | | | -0.9 | | | | -0.9 | | | | -0.2 | | | | 0.2 | | | | 0.5 | |

less Goods | | | 0.8 | | | | 0.4 | | | | -0.5 | | | | -1.2 | | | | -0.7 | | | | 0.2 | | | | 0.0 | | | | -0.9 | | | | -1.0 | | | | -0.8 | | | | -0.2 | | | | 0.2 | | | | 0.5 | |

less Selected services | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | -0.1 | | | | 0.0 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | -0.1 | | | | 0.0 | | | | 0.0 | |

| | | | | | | | | | | | | |

Statistical discrepancy (E) | | | 0.2 | | | | 0.1 | | | | -0.1 | | | | -0.3 | | | | -0.3 | | | | -0.1 | | | | 0.0 | | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.0 | | | | -0.1 | | | | -0.1 | |

| | | | | | | | | | | | | |

Gross state product | | | 0.6 | | | | -0.6 | | | | -0.6 | | | | 0.2 | | | | 0.5 | | | | 0.6 | | | | 0.8 | | | | 0.9 | | | | 0.6 | | | | -0.3 | | | | -0.8 | | | | -0.5 | | | | -0.1 | |

| (a) | Chain volume measure reference year 2008-09 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. Additionally, Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. |

| (c) | In November 2010, the Queensland Government floated QR National and sold a lease of the Port of Brisbane. Users should interpret the trend estimate of business investment and public gross fixed capital formation, public corporations - state and local, with caution around this period. |

TABLE 3

- 21 -

| | | | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | | TABLE 4 | |

| (Trend, chain volume measure (a), annual percentage change, %) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007-08 | | | 2008-09 | | | 2009-10 | | | 2010-11 | |

| | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | |

| | | | | | | | | | | | | |

Final consumption expenditure | | | 4.4 | | | | 3.1 | | | | 2.1 | | | | 1.2 | | | | 0.7 | | | | 0.7 | | | | 1.2 | | | | 2.0 | | | | 2.6 | | | | 2.8 | | | | 2.9 | | | | 3.0 | | | | 3.2 | |

| | | | | | | | | | | | | |

Households | | | 3.9 | | | | 2.2 | | | | 1.2 | | | | 0.5 | | | | 0.3 | | | | 0.5 | | | | 1.1 | | | | 1.9 | | | | 2.4 | | | | 2.4 | | | | 2.3 | | | | 2.3 | | | | 2.7 | |

| | | | | | | | | | | | | |

General government | | | 6.1 | | | | 6.4 | | | | 5.4 | | | | 3.5 | | | | 1.9 | | | | 1.4 | | | | 1.5 | | | | 2.3 | | | | 3.3 | | | | 4.3 | | | | 5.0 | | | | 5.2 | | | | 4.8 | |

National | | | 4.4 | | | | 5.3 | | | | 5.3 | | | | 3.5 | | | | 0.8 | | | | -1.8 | | | | -4.2 | | | | -3.9 | | | | -0.5 | | | | 4.8 | | | | 9.8 | | | | 11.4 | | | | 9.2 | |

State and local | | | 7.0 | | | | 6.8 | | | | 5.4 | | | | 3.5 | | | | 2.5 | | | | 2.8 | | | | 4.2 | | | | 5.1 | | | | 5.0 | | | | 4.0 | | | | 3.0 | | | | 2.6 | | | | 2.9 | |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) (c) | | | 9.8 | | | | 8.1 | | | | 2.7 | | | | -6.2 | | | | -12.9 | | | | -15.2 | | | | -13.7 | | | | -9.6 | | | | -5.7 | | | | -3.0 | | | | 1.6 | | | | 7.9 | | | | 16.0 | |

| | | | | | | | | | | | | |

Dwellings | | | 2.3 | | | | 3.4 | | | | -4.4 | | | | -17.3 | | | | -23.1 | | | | -19.2 | | | | -7.9 | | | | 4.8 | | | | 6.8 | | | | -1.1 | | | | -10.6 | | | | -16.4 | | | | -16.2 | |

New and used | | | 3.3 | | | | 2.8 | | | | -6.0 | | | | -19.2 | | | | -24.8 | | | | -22.5 | | | | -13.7 | | | | -3.1 | | | | -1.4 | | | | -6.5 | | | | -14.2 | | | | -20.1 | | | | -20.3 | |

Alterations and additions | | | 0.9 | | | | 4.3 | | | | -2.0 | | | | -14.5 | | | | -20.7 | | | | -14.6 | | | | 0.4 | | | | 15.9 | | | | 18.4 | | | | 6.1 | | | | -6.1 | | | | -12.0 | | | | -11.4 | |

| | | | | | | | | | | | | |

Business Investment (b) (c) | | | 17.8 | | | | 16.1 | | | | 10.9 | | | | 0.8 | | | | -9.9 | | | | -17.8 | | | | -21.7 | | | | -19.6 | | | | -12.6 | | | | -2.8 | | | | 11.1 | | | | 25.1 | | | | 36.9 | |

Non-dwelling construction (b) | | | 19.1 | | | | 23.3 | | | | 21.8 | | | | 11.9 | | | | -1.6 | | | | -11.6 | | | | -17.2 | | | | -15.5 | | | | -8.4 | | | | -0.1 | | | | 14.0 | | | | 29.6 | | | | 44.2 | |

Machinery and equipment (b) | | | 16.7 | | | | 10.3 | | | | 2.2 | | | | -8.2 | | | | -16.9 | | | | -23.5 | | | | -26.0 | | | | -23.8 | | | | -16.8 | | | | -5.7 | | | | 8.0 | | | | 20.2 | | | | 28.6 | |

| | | | | | | | | | | | | |

Livestock and orchards | | | 9.6 | | | | 12.4 | | | | 13.8 | | | | 12.4 | | | | 9.8 | | | | 8.5 | | | | 7.8 | | | | 9.1 | | | | 10.3 | | | | 12.4 | | | | 12.2 | | | | 9.6 | | | | 5.5 | |

Intellectual property products | | | 8.3 | | | | 4.6 | | | | 0.2 | | | | -2.2 | | | | -0.1 | | | | 5.4 | | | | 11.5 | | | | 15.0 | | | | 13.0 | | | | 8.1 | | | | 4.6 | | | | 4.1 | | | | 6.5 | |

Ownership transfer costs | | | -24.4 | | | | -35.9 | | | | -38.2 | | | | -27.9 | | | | -6.8 | | | | 16.9 | | | | 25.1 | | | | 9.2 | | | | -11.5 | | | | -24.3 | | | | -28.7 | | | | -28.4 | | | | -26.9 | |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) (c) | | | 14.9 | | | | 14.1 | | | | 12.6 | | | | 7.1 | | | | -1.6 | | | | -0.2 | | | | 6.5 | | | | 10.7 | | | | 9.9 | | | | 1.6 | | | | -7.2 | | | | -11.6 | | | | -13.8 | |

| | | | | | | | | | | | | |

Public corporations (b) (c) | | | 8.6 | | | | 3.2 | | | | 0.4 | | | | -3.0 | | | | -13.0 | | | | -16.0 | | | | -17.8 | | | | -19.4 | | | | -15.5 | | | | -12.4 | | | | -9.9 | | | | -10.9 | | | | -21.3 | |

Commonwealth (b) | | | -5.5 | | | | -4.4 | | | | -25.9 | | | | 1.8 | | | | 57.7 | | | | 137.2 | | | | 137.2 | | | | 50.0 | | | | -12.2 | | | | -33.3 | | | | -23.5 | | | | 4.6 | | | | 45.8 | |

State and local (c) | | | 8.2 | | | | 2.9 | | | | 1.4 | | | | -2.7 | | | | -14.8 | | | | -19.1 | | | | -21.1 | | | | -21.5 | | | | -15.6 | | | | -11.2 | | | | -9.0 | | | | -11.9 | | | | -24.5 | |

| | | | | | | | | | | | | |

General government | | | 22.2 | | | | 24.4 | | | | 22.7 | | | | 13.7 | | | | 6.0 | | | | 10.9 | | | | 22.7 | | | | 30.0 | | | | 25.0 | | | | 9.0 | | | | -6.1 | | | | -11.9 | | | | -10.8 | |

National | | | 65.1 | | | | 80.3 | | | | 53.0 | | | | 7.2 | | | | -15.9 | | | | -12.5 | | | | 4.7 | | | | 26.4 | | | | 35.4 | | | | 24.1 | | | | 11.5 | | | | 4.3 | | | | 1.4 | |

State and local | | | 9.8 | | | | 12.3 | | | | 16.2 | | | | 15.8 | | | | 12.8 | | | | 17.7 | | | | 27.5 | | | | 30.8 | | | | 22.7 | | | | 5.8 | | | | -9.9 | | | | -15.5 | | | | -13.8 | |

| | | | | | | | | | | | | |

Gross state expenditure | | | 6.4 | | | | 5.2 | | | | 2.8 | | | | -1.1 | | | | -4.1 | | | | -4.0 | | | | -2.0 | | | | 0.5 | | | | 1.7 | | | | 1.2 | | | | 1.5 | | | | 3.1 | | | | 5.7 | |

- 22 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Exports of goods and services | | | 3.2 | | | | 2.1 | | | | -0.9 | | | | -3.2 | | | | -1.8 | | | | 3.3 | | | | 8.3 | | | | 8.9 | | | | 6.2 | | | | -0.3 | | | | -7.4 | | | | -12.1 | | | | -15.4 | |

| | | | | | | | | | | | | |

Overseas | | | 5.8 | | | | 6.1 | | | | 3.9 | | | | 0.9 | | | | -0.3 | | | | 1.7 | | | | 5.5 | | | | 8.4 | | | | 9.8 | | | | 4.9 | | | | -4.4 | | | | -12.6 | | | | -18.2 | |

Goods | | | 5.4 | | | | 6.3 | | | | 4.1 | | | | 1.1 | | | | 0.4 | | | | 3.4 | | | | 8.3 | | | | 11.9 | | | | 13.0 | | | | 6.6 | | | | -4.6 | | | | -14.2 | | | | -20.2 | |

Services | | | 8.3 | | | | 5.6 | | | | 2.4 | | | | 0.4 | | | | -3.5 | | | | -6.5 | | | | -8.2 | | | | -9.2 | | | | -6.8 | | | | -4.4 | | | | -3.0 | | | | -2.8 | | | | -5.3 | |

| | | | | | | | | | | | | |

Interstate | | | -2.8 | | | | -7.3 | | | | -12.0 | | | | -13.2 | | | | -5.8 | | | | 7.4 | | | | 16.1 | | | | 10.4 | | | | -3.5 | | | | -13.2 | | | | -14.8 | | | | -10.5 | | | | -7.0 | |

Goods | | | 1.1 | | | | -4.0 | | | | -10.0 | | | | -12.4 | | | | -4.9 | | | | 9.6 | | | | 19.3 | | | | 11.7 | | | | -5.4 | | | | -16.9 | | | | -18.4 | | | | -12.7 | | | | -7.6 | |

Selected services | | | -14.5 | | | | -17.3 | | | | -18.5 | | | | -15.7 | | | | -8.9 | | | | -0.6 | | | | 5.2 | | | | 5.7 | | | | 3.6 | | | | 1.6 | | | | -0.3 | | | | -2.3 | | | | -4.7 | |

| | | | | | | | | | | | | |

less Imports of goods and services | | | 12.4 | | | | 10.3 | | | | 4.3 | | | | -5.3 | | | | -12.3 | | | | -10.5 | | | | -3.9 | | | | 2.3 | | | | 3.7 | | | | -1.2 | | | | -3.8 | | | | -1.3 | | | | 3.6 | |

| | | | | | | | | | | | | |

less Overseas | | | 19.7 | | | | 16.0 | | | | 4.7 | | | | -7.8 | | | | -13.8 | | | | -9.7 | | | | 1.5 | | | | 12.6 | | | | 16.5 | | | | 12.6 | | | | 8.1 | | | | 7.3 | | | | 8.9 | |

less Goods | | | 18.2 | | | | 15.8 | | | | 5.1 | | | | -7.6 | | | | -14.3 | | | | -10.6 | | | | 1.3 | | | | 13.3 | | | | 17.4 | | | | 12.6 | | | | 6.8 | | | | 5.5 | | | | 7.0 | |

less Services | | | 24.8 | | | | 16.6 | | | | 3.4 | | | | -8.5 | | | | -12.0 | | | | -6.9 | | | | 2.2 | | | | 10.6 | | | | 13.6 | | | | 12.4 | | | | 12.5 | | | | 13.3 | | | | 14.8 | |

| | | | | | | | | | | | | |

less Interstate | | | 6.0 | | | | 5.3 | | | | 4.0 | | | | -2.7 | | | | -10.8 | | | | -11.4 | | | | -8.9 | | | | -7.2 | | | | -8.5 | | | | -14.6 | | | | -16.1 | | | | -11.0 | | | | -2.7 | |

less Goods | | | 7.7 | | | | 6.7 | | | | 5.0 | | | | -2.0 | | | | -10.6 | | | | -11.7 | | | | -9.5 | | | | -8.4 | | | | -10.3 | | | | -16.2 | | | | -17.3 | | | | -11.3 | | | | -2.0 | |

less Selected services | | | -10.7 | | | | -9.7 | | | | -8.1 | | | | -11.0 | | | | -13.8 | | | | -6.5 | | | | 0.2 | | | | 8.4 | | | | 14.6 | | | | 5.6 | | | | -1.4 | | | | -7.3 | | | | -10.1 | |

| | | | | | | | | | | | | |

Gross state product (d) | | | 3.7 | | | | 2.8 | | | | 1.1 | | | | -0.5 | | | | -0.6 | | | | 0.5 | | | | 2.0 | | | | 2.7 | | | | 2.9 | | | | 2.0 | | | | 0.4 | | | | -1.0 | | | | -1.7 | |

| (a) | Chain volume measure reference year 2008-09 |

| (b) | In March quarter 2007, there was a trend break due to the Commonwealth Government’s privatisation of Telstra and users should interpret the trend estimates around this period with caution. Additionally, Tarong Energy completed the acquisition of the remaining 50 per cent of Tarong North Power Station not already owned and this transaction has been excluded from the underlying trend estimate for December quarter 2009. |

| (c) | In November 2010, the Queensland Government floated QR National and sold a lease of the Port of Brisbane. Users should interpret the trend estimate of business investment and public gross fixed capital formation, public corporations - state and local, with caution around this period. |

| (d) | Includes statistical discrepancy. |

TABLE 4

- 23 -

| | | | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | | TABLE 5 | |

| (Trend, chain volume measure (a), annual contribution to growth, % points) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007-08 | | | 2008-09 | | | 2009-10 | | | 2010-11 | |

| | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | | | Sep | | | Dec | | | Mar | | | Jun | |

| | | | | | | | | | | | | |

Final consumption expenditure | | | 2.8 | | | | 2.0 | | | | 1.4 | | | | 0.8 | | | | 0.5 | | | | 0.5 | | | | 0.8 | | | | 1.3 | | | | 1.7 | | | | 1.9 | | | | 1.9 | | | | 2.0 | | | | 2.1 | |

| | | | | | | | | | | | | |

Households | | | 1.9 | | | | 1.1 | | | | 0.6 | | | | 0.3 | | | | 0.2 | | | | 0.3 | | | | 0.5 | | | | 1.0 | | | | 1.2 | | | | 1.2 | | | | 1.1 | | | | 1.1 | | | | 1.3 | |

| | | | | | | | | | | | | |

General government | | | 0.9 | | | | 1.0 | | | | 0.8 | | | | 0.5 | | | | 0.3 | | | | 0.2 | | | | 0.2 | | | | 0.4 | | | | 0.5 | | | | 0.7 | | | | 0.8 | | | | 0.8 | | | | 0.7 | |

National | | | 0.2 | | | | 0.3 | | | | 0.3 | | | | 0.2 | | | | 0.0 | | | | -0.1 | | | | -0.2 | | | | -0.2 | | | | 0.0 | | | | 0.2 | | | | 0.5 | | | | 0.5 | | | | 0.4 | |

State and local | | | 0.7 | | | | 0.7 | | | | 0.6 | | | | 0.4 | | | | 0.3 | | | | 0.3 | | | | 0.4 | | | | 0.6 | | | | 0.5 | | | | 0.4 | | | | 0.3 | | | | 0.3 | | | | 0.3 | |

| | | | | | | | | | | | | |

Private gross fixed capital formation (b) (c) | | | 2.5 | | | | 2.1 | | | | 0.7 | | | | -1.7 | | | | -3.5 | | | | -4.2 | | | | -3.7 | | | | -2.4 | | | | -1.4 | | | | -0.7 | | | | 0.4 | | | | 1.7 | | | | 3.5 | |

| | | | | | | | | | | | | |

Dwellings | | | 0.2 | | | | 0.3 | | | | -0.3 | | | | -1.4 | | | | -1.9 | | | | -1.5 | | | | -0.6 | | | | 0.3 | | | | 0.4 | | | | -0.1 | | | | -0.7 | | | | -1.1 | | | | -1.1 | |

New and used | | | 0.2 | | | | 0.1 | | | | -0.3 | | | | -0.9 | | | | -1.2 | | | | -1.1 | | | | -0.6 | | | | -0.1 | | | | -0.1 | | | | -0.2 | | | | -0.5 | | | | -0.7 | | | | -0.7 | |

Alterations and additions | | | 0.0 | | | | 0.1 | | | | -0.1 | | | | -0.5 | | | | -0.7 | | | | -0.5 | | | | 0.0 | | | | 0.4 | | | | 0.5 | | | | 0.2 | | | | -0.2 | | | | -0.4 | | | | -0.3 | |

| | | | | | | | | | | | | |

Business Investment (b) (c) | | | 2.5 | | | | 2.3 | | | | 1.6 | | | | 0.1 | | | | -1.6 | | | | -2.9 | | | | -3.5 | | | | -3.0 | | | | -1.8 | | | | -0.4 | | | | 1.4 | | | | 3.1 | | | | 4.5 | |

Non-dwelling construction (b) | | | 1.2 | | | | 1.5 | | | | 1.4 | | | | 0.8 | | | | -0.1 | | | | -0.9 | | | | -1.4 | | | | -1.2 | | | | -0.6 | | | | 0.0 | | | | 0.9 | | | | 1.9 | | | | 2.9 | |

Machinery and equipment (b) | | | 1.3 | | | | 0.8 | | | | 0.2 | | | | -0.7 | | | | -1.5 | | | | -2.0 | | | | -2.2 | | | | -1.8 | | | | -1.2 | | | | -0.4 | | | | 0.5 | | | | 1.2 | | | | 1.7 | |

| | | | | | | | | | | | | |

Livestock and orchards | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.0 | |

Intellectual property products | | | 0.1 | | | | 0.1 | | | | 0.0 | | | | 0.0 | | | | 0.0 | | | | 0.1 | | | | 0.2 | | | | 0.2 | | | | 0.2 | | | | 0.1 | | | | 0.1 | | | | 0.1 | | | | 0.1 | |

Ownership transfer costs | | | -0.5 | | | | -0.7 | | | | -0.7 | | | | -0.5 | | | | -0.1 | | | | 0.2 | | | | 0.3 | | | | 0.1 | | | | -0.2 | | | | -0.4 | | | | -0.4 | | | | -0.4 | | | | -0.3 | |

| | | | | | | | | | | | | |

Public gross fixed capital formation (b) (c) | | | 1.1 | | | | 1.1 | | | | 0.9 | | | | 0.5 | | | | -0.1 | | | | 0.0 | | | | 0.5 | | | | 0.9 | | | | 0.8 | | | | 0.1 | | | | -0.6 | | | | -1.0 | | | | -1.2 | |

| | | | | | | | | | | | | |