EXHIBIT (c)(vii)

The Queensland Treasury Corporation Half Yearly Report

for the half-year ended December 31, 2011

AUDAX AT FIDELIS

QUEENSLAND

TREASURY

CORPORATION

HALF-YEARLY

REPORT

DECEMBER 2011

VISION

PARTNERS IN FINANCIAL SUSTAINABILITY

MISSION

TO CREATE AND DELIVER UNIQUE AND RELEVANT VALUE FOR QUEENSLAND’S PUBLIC SECTOR

VALUES

WE ARE FOCUSED ON OUR CLIENTS

WE ARE PASSIONATE ABOUT QUEENSLAND

WE VALUE AND RESPECT OUR PEOPLE

WE ARE COLLABORATIVE AND SEEK CONTINUOUS IMPROVEMENT

ABOVE ALL ELSE,

WE VALUE INTEGRITY

Queensland Treasury Corporation is the Queensland Government’s central financing authority and corporate treasury services provider, with responsibility for:

sourcing and managing the debt funding to finance Queensland’s infrastructure requirements in the most cost-effective manner

providing financial and risk management advice to the Queensland Government and its public sector clients on financial risk issues, and

investing the State’s short- to medium-term cash surpluses, to maximise client returns through a conservative risk management framework.

QTC does not formulate Government policy, but works within the policy frameworks developed by the Government and Queensland Treasury.

Debt funding and management

QTC borrows funds in the domestic and international markets in a manner that minimises the State’s and QTC’s liquidity and refinancing risk. We then lend these funds to meet our clients’ debt requirements, for both new borrowings and the refinancing of existing debt. With responsibility for all of the State’s debt raising, QTC is able to capture significant economies of scale and scope in the issuance, management and administration of debt.

Financial advisory and risk management services

QTC works closely with its public sector clients to assist in managing their risk in financial transactions and achieve the best financial solutions for their organisations and for Queensland. In assisting clients, QTC does not provide advice that is contrary to the interests of the State. We encourage our clients and Queensland Treasury, our major stakeholder, to use our organisation as an extension of their resources, by:

providing access, on a cost recovery basis, to professional skills and resources to ensure that their financial risks are identified and managed on a consistent basis

acting as a central store of knowledge and expertise on financial structures and transactions, and the risks and benefits they encompass

providing Queensland Treasury with advice on matters of financial and commercial policy and risk relating to the State and its entities

working as a conduit between the Government and the private sector, and

using our economies of scale and scope to ensure that the best possible solutions are obtained.

Short- to medium-term investments

QTC uses its financial markets expertise, developed through strong relationships with the domestic and international markets, together with its understanding of debt management and the management of financial risk, to provide clients with investment solutions that achieve a high return within a conservative risk environment. Clients can choose from an overnight facility, a managed short-term fund or fixed-term facilities. Alternatively, we can assist them to source appropriate solutions from the marketplace.

QUEENSLAND

TREASURY

CORPORATION

CONTENTS

Queensland Treasury Corporation 1

Five-Year Business Summary 3 Chairman’s and

Chief Executive’s Report 4

Financial Statements 7

Appendices 25

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 1

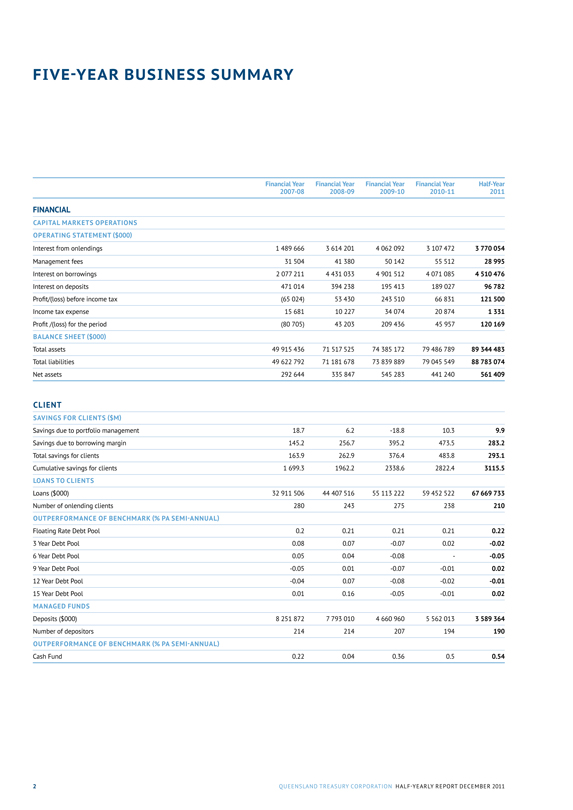

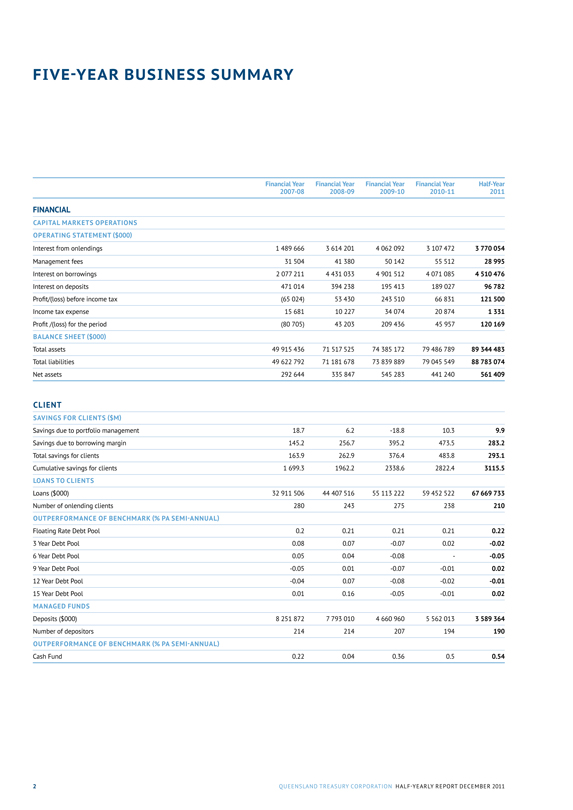

FIVE-YEAR BUSINESS SUMMARY

Financial Year Financial Year Financial Year Financial Year Half-Year

2007-08 2008-09 2009-10 2010-11 2011

FINANCIAL

CAPITAL MARKETS OPERATIONS

OPERATING STATEMENT ($000)

Interest from onlendings 1 489 666 3 614 201 4 062 092 3 107 472 3 770 054

Management fees 31 504 41 380 50 142 55 512 28 995

Interest on borrowings 2 077 211 4 431 033 4 901 512 4 071 085 4 510 476

Interest on deposits 471 014 394 238 195 413 189 027 96 782

Profit/(loss) before income tax (65 024) 53 430 243 510 66 831 121 500

Income tax expense 15 681 10 227 34 074 20 874 1 331

Profit/(loss) for the period (80 705) 43 203 209 436 45 957 120 169 BALANCE SHEET ($000)

Total assets 49 915 436 71 517 525 74 385 172 79 486 789 89 344 483

Total liabilities 49 622 792 71 181 678 73 839 889 79 045 549 88 783 074

Net assets 292 644 335 847 545 283 441 240 561 409

CLIENT

SAVINGS FOR CLIENTS ($M)

Savings due to portfolio management 18.7 6.2 -18.8 10.3 9.9

Savings due to borrowing margin 145.2 256.7 395.2 473.5 283.2

Total savings for clients 163.9 262.9 376.4 483.8 293.1

Cumulative savings for clients 1 699.3 1962.2 2338.6 2822.4 3115.5

LOANS TO CLIENTS

Loans ($000) 32 911 506 44 407 516 55 113 222 59 452 522 67 669 733

Number of onlending clients 280 243 275 238 210

OUTPERFORMANCE OF BENCHMARK (% PA SEMI-ANNUAL)

Floating Rate Debt Pool 0.2 0.21 0.21 0.21 0.22

3 Year Debt Pool 0.08 0.07 -0.07 0.02 -0.02

6 Year Debt Pool 0.05 0.04 -0.08 - -0.05

9 Year Debt Pool -0.05 0.01 -0.07 -0.01 0.02

12 Year Debt Pool -0.04 0.07 -0.08 -0.02 -0.01

15 Year Debt Pool 0.01 0.16 -0.05 -0.01 0.02

MANAGED FUNDS

Deposits ($000) 8 251 872 7 793 010 4 660 960 5 562 013 3 589 364

Number of depositors 214 214 207 194 190

OUTPERFORMANCE OF BENCHMARK (% PA SEMI-ANNUAL)

Cash Fund 0.22 0.04 0.36 0.5 0.54

2 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

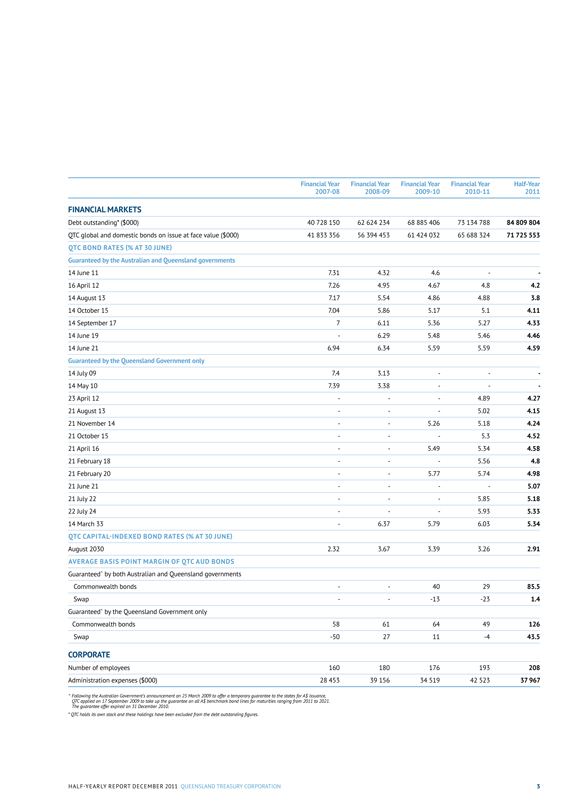

Financial Year Financial Year Financial Year Financial Year Half-Year

2007-08 2008-09 2009-10 2010-11 2011

FINANCIAL MARKETS

Debt outstanding* ($000) 40 728 150 62 624 234 68 885 406 73 134 788 84 809 804

QTC global and domestic bonds on issue at face value ($000) 41 833 356 56 394 453 61 424 032 65 688 324 71 725 553

QTC BOND RATES (% AT 30 JUNE)

Guaranteed by the Australian and Queensland governments

14 June 11 7.31 4.32 4.6

16 April 12 7.26 4.95 4.67 4.8 4.2

14 August 13 7.17 5.54 4.86 4.88 3.8

14 October 15 7.04 5.86 5.17 5.1 4.11

14 September 17 7 6.11 5.36 5.27 4.33

14 June 19 - 6.29 5.48 5.46 4.46

14 June 21 6.94 6.34 5.59 5.59 4.59

Guaranteed by the Queensland Government only

14 July 09 7.4 3.13

14 May 10 7.39 3.38

23 April 12 - - 4.89 4.27

21 August 13 - - 5.02 4.15

21 November 14 - - 5.26 5.18 4.24

21 October 15 - 5.3 4.52

21 April 16 - - 5.49 5.34 4.58

21 February 18 - - 5.56 4.8

21 February 20 - - 5.77 5.74 4.98

21 June 21 5.07

21 July 22 - - 5.85 5.18

22 July 24 - - 5.93 5.33

14 March 33 - 6.37 5.79 6.03 5.34

QTC CAPITAL-INDEXED BOND RATES (% AT 30 JUNE)

August 2030 2.32 3.67 3.39 3.26 2.91

AVERAGE BASIS POINT MARGIN OF QTC AUD BONDS

Guaranteed^ by both Australian and Queensland governments

Commonwealth bonds - - 40 29 85.5

Swap - -13 -23 1.4

Guaranteed^ by the Queensland Government only

Commonwealth bonds 58 61 64 49 126

Swap -50 27 11 -4 43.5

CORPORATE

Number of employees 160 180 176 193 208

Administration expenses ($000) 28 453 39 156 34 519 42 523 37967

^ Following the Australian Government’s announcement on 25 March 2009 to offer a temporary guarantee to the states for A$ issuance, QTC applied on 17 September 2009 to take up the guarantee on all A$ benchmark bond lines for maturities ranging from 2011 to 2021. The guarantee offer expired on 31 December 2010.

* QTC holds its own stock and these holdings have been excluded from the debt outstanding figures.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 3

CHAIRMAN’S & CHIEF EXECUTIVE’S REPORT

STEPHEN ROCHESTER

Chairman

In the first six months of the 2011-12 reporting period, Queensland Treasury Corporation (QTC) successfully raised approximately $13.7 billion towards its 2011-12 borrowing program, and achieved an operating profit from its capital markets operations of $120.2 million (2010: $24.6 million).

QTC also achieved quantifiable savings for clients and the State of $293.1 million (2010: $247.5 million), through its capital market activities and economies of scale that provided them with access to funding.

Separate from QTC’s capital markets operations, the long term assets segment recorded a loss of $526.8 million (2010: $915.0 million profit); however, since the beginning of 2012, the investment markets appear to be staging a recovery.

The long term assets segment is managed by QIC Limited and comprises the investments that fund the State’s defined-benefit superannuation and other long-term employee obligations. These investments were transferred to QTC by the State Government. In return, QTC has issued the State with fixed-rate notes that provide the State with a fixed rate of return, while QTC bears the impact of fluctuations in the value and returns on the asset portfolio. The accumulated losses incurred by this segment have no impact on QTC’s capacity to meet its obligations, as there is no cash flow effect for QTC.

A year of recovery

The joint Australian and state governments’ Natural Disaster Relief and Recovery Arrangements have been instrumental in Queensland’s solid recovery from the 2010-11 flooding and tropical cyclone disasters.

Through the arrangements’ provision of 75 per cent of the estimated $6.8 billion cost of reconstruction, significant progress has been made to repair the damage to public infrastructure, as the ongoing effort to support and rebuild damaged communities continues.

Challenging economic environment

Following the European sovereign debt concerns that beleaguered markets during the second half of 2011, and monetary policymakers’ aggressive action to minimise fall-out into the financial system, we (like many in the markets) anticipate that 2012 will again prove very challenging.

The significant repricing of semi-government, including QTC, credit spreads relative to the Commonwealth Government was a notable feature of this period.

However, while external developments are expected to have some impact on the Queensland economy, the State’s medium-term prospects remain strong given the large-scale industrialisation processes underway in many of its major trading partners in the fast-growing Asia Pacific region.

This is driving a structural increase in demand for resource and energy commodities from Queensland and is underpinning an unprecedented pipeline of investment in the State. The Queensland Government estimates that $146 billion will be invested in mineral and energy projects in the Central Queensland area alone between now and 2020, with the majority of projects due to begin by 2016.

It is these prospects, and the attractive yields on offer, that have seen continued demand for QTC bonds.

4 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT December 2011

Borrowing program revised

On 18 January 2012, having raised approximately $13.7 billion towards its 2011-12 borrowing program, QTC revised its estimated borrowing requirement for the 2011-12 financial year down from $22 billion to $19.2 billion. This decrease in the borrowing requirement results from Queensland’s lower capital spend in 2011-12, particularly in the energy and rail corporations, and advance payments received from the Australian Government relating to natural disaster works.

In July, QTC issued a $1.5 billion State Government guaranteed domestic benchmark bond, maturing in 2021, with positive uptake from investors.

Then, in October, in response to increasingly challenging market, QTC announced it was implementing a strategy of issuing bonds on a reverse- enquiry basis through its distribution group of 17 international banks.

To complete its borrowing program for 2011-12, QTC intends to maintain its reverse-enquiry issuance strategy, and take advantage of other term funding opportunities as they arise.

QTC’s approach to raising funds relies on its ability to attract and maintain a diverse range of wholesale investors from various global locations, and it remains committed to open and transparent communication with the market. As part of its annual domestic and offshore investor relations roadshow program, over the past six months, QTC representatives have met with key institutional investors, as well as representatives of its distribution group banks and other financial intermediaries.

Capital markets operations

QTC’s $120.2 million operating profit from its capital markets operations primarily represents unrealised accounting gains on investments held in advance of future lending requirements, and includes a $14.8 million write down in the value of software under development.

Greater efficiencies and enhanced teamwork

Within QTC, we look forward to greater efficiencies and enhanced teamwork as we co-locate all employees in one building, and our in-house resources implement upgraded business systems and processes to support both employees and our clients. These developments will enhance our capacity and our capabilities as we focus on delivering financial solutions to the State’s public sector.

On behalf of the Board and the senior management team, we thank our team of talented and dedicated employees, whose contributions to their clients’ businesses continue to build a better Queensland.

STEPHEN ROCHESTER

Chairman

PHILIP NOBLE

Chief Executive

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 5

PHILIP NOBLE

Chief Executive

6 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

AUDAX AT FIDELIS

QUEENSLAND

TREASURY

CORPORATION

FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

Contents

Statement of Comprehensive Income 8

Balance Sheet 9

Statement of Changes in Equity 10

Statement of Cash Flows 11

Notes to and forming part of the Financial Statements 12

Certificate of the Queensland Treasury Corporation 22

Independent Auditor’s Review Report 23

Management Report 24 7

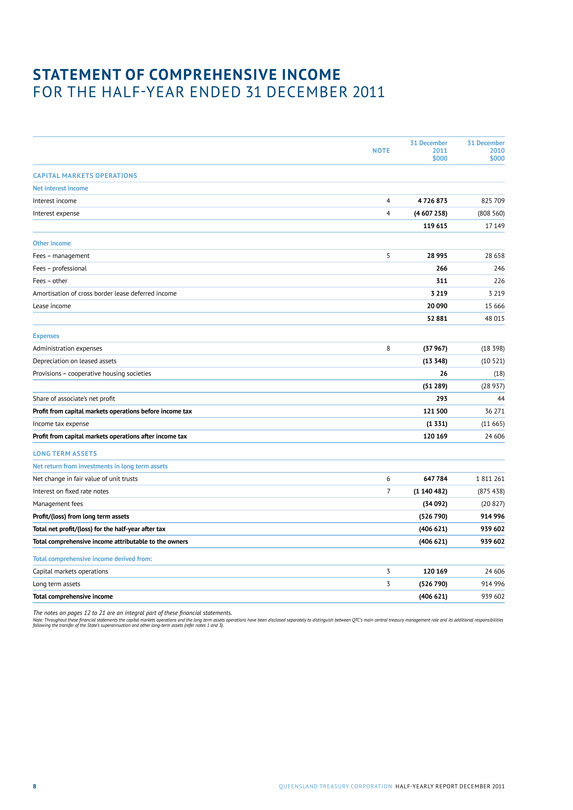

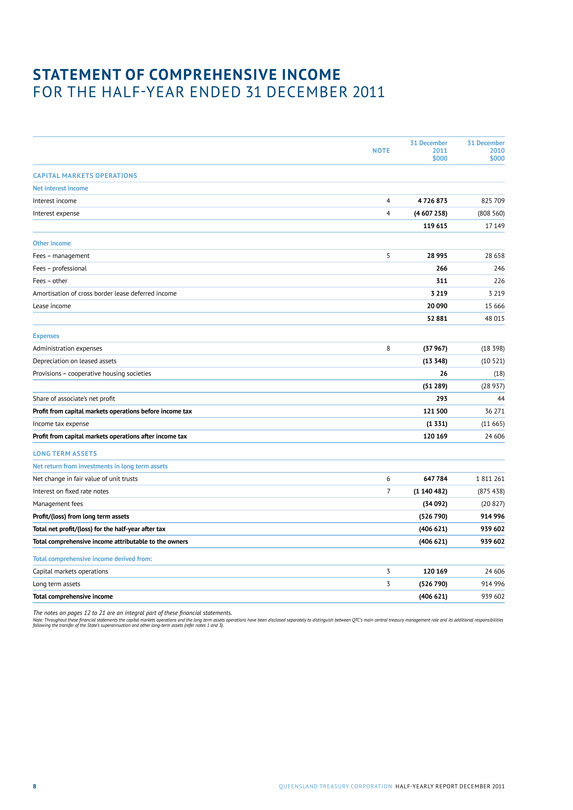

STATEMENT OF COMPREHENSIVE INCOME

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

NOTE

31 December 2011 $000

31 December 2010 $000

CAPITAL MARKETS OPERATIONS

Net interest income

Interest income 4 4 726 873 825 709

Interest expense 4 (4 607 258) (808 560)

119 615 17 149

Other income

Fees - management 5 28 995 28 658

Fees - professional 266 246

Fees - other 311 226

Amortisation of cross border lease deferred income 3 219 3 219

Lease income 20 090 15 666

52 881 48 015

Expenses

Administration expenses 8 (37 967) (18 398)

Depreciation on leased assets (13 348) (10 521)

Provisions - cooperative housing societies 26 (18)

(51 289) (28 937)

Share of associate’s net profit 293 44

Profit from capital markets operations before income tax 121 500 36 271

Income tax expense (1 331) (11 665)

Profit from capital markets operations after income tax 120 169 24 606

LONG TERM ASSETS

Net return from investments in long term assets

Net change in fair value of unit trusts 6 647 784 1 811 261

Interest on fixed rate notes 7 (1 140 482) (875 438)

Management fees (34 092) (20 827)

Profit/(loss) from long term assets (526 790) 914 996

Total net profit/(loss) for the half-year after tax (406 621) 939 602

Total comprehensive income attributable to the owners (406 621) 939 602

Total comprehensive income derived from:

Capital markets operations 3 120 169 24 606

Long term assets 3 (526 790) 914 996

Total comprehensive income (406 621) 939 602

The notes on pages 12 to 21 are an integral part of these financial statements.

Note: Throughout these financial statements the capital markets operations and the long term assets operations have been disclosed separately to distinguish between QTC’s main central treasury management role and its additional responsibilities following the transfer of the State’s superannuation and other long-term assets (refer notes 1 and 3).

8 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

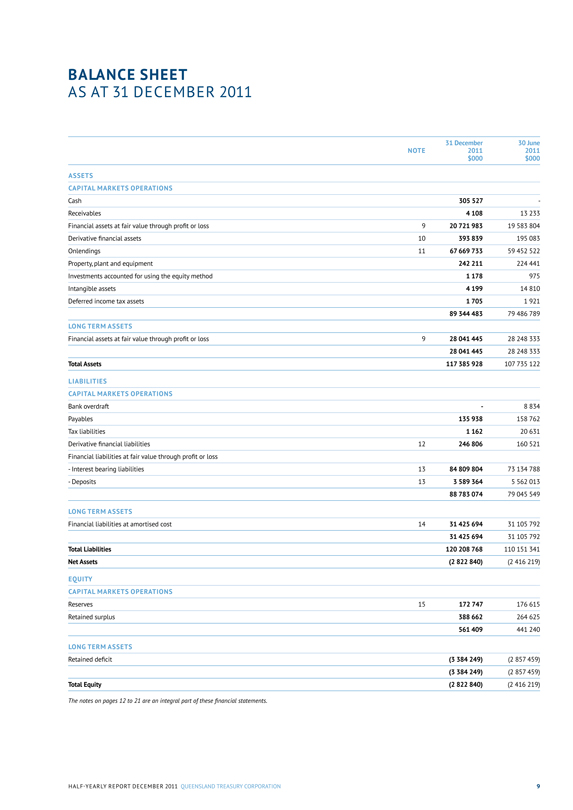

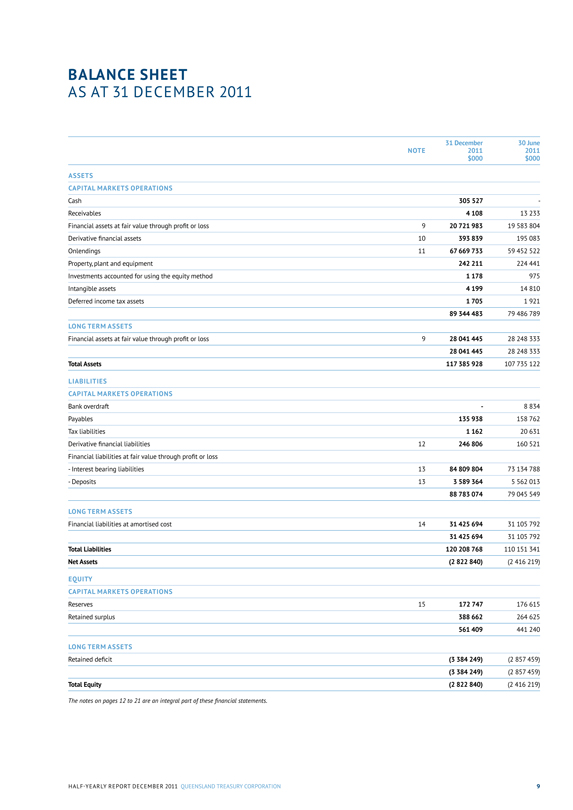

BALANCE SHEET

AS AT 31 DECEMBER 2011

NOTE

31 December 2011 $000

30 June 2011 $000

ASSETS

CAPITAL MARKETS OPERATIONS

Cash 305 527 -

Receivables 4 108 13 233

Financial assets at fair value through profit or loss 9 20 721 983 19 583 804

Derivative financial assets 10 393 839 195 083

Onlendings 11 67 669 733 59 452 522

Property, plant and equipment 242 211 224 441

Investments accounted for using the equity method 1 178 975

Intangible assets 4 199 14 810

Deferred income tax assets 1 705 1 921

89 344 483 79 486 789

LONG TERM ASSETS

Financial assets at fair value through profit or loss 9 28 041 445 28 248 333

28 041 445 28 248 333

Total Assets 117 385 928 107 735 122

LIABILITIES

CAPITAL MARKETS OPERATIONS

Bank overdraft - 8 834

Payables 135 938 158 762

Tax liabilities 1 162 20 631

Derivative financial liabilities 12 246 806 160 521

Financial liabilities at fair value through profit or loss

- Interest bearing liabilities 13 84 809 804 73 134 788

- Deposits 13 3 589 364 5 562 013

88 783 074 79 045 549

LONG TERM ASSETS

Financial liabilities at amortised cost 14 31 425 694 31 105 792

31 425 694 31 105 792

Total Liabilities 120 208 768 110 151 341

Net Assets (2 822 840) (2 416 219)

EQUITY CAPITAL MARKETS OPERATIONS

Reserves 15 172 747 176 615

Retained surplus 388 662 264 625

561 409 441 240

LONG TERM ASSETS

Retained deficit (3 384 249) (2 857 459)

(3 384 249) (2 857 459)

Total Equity (2 822 840) (2 416 219)

The notes on pages 12 to 21 are an integral part of these financial statements.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 9

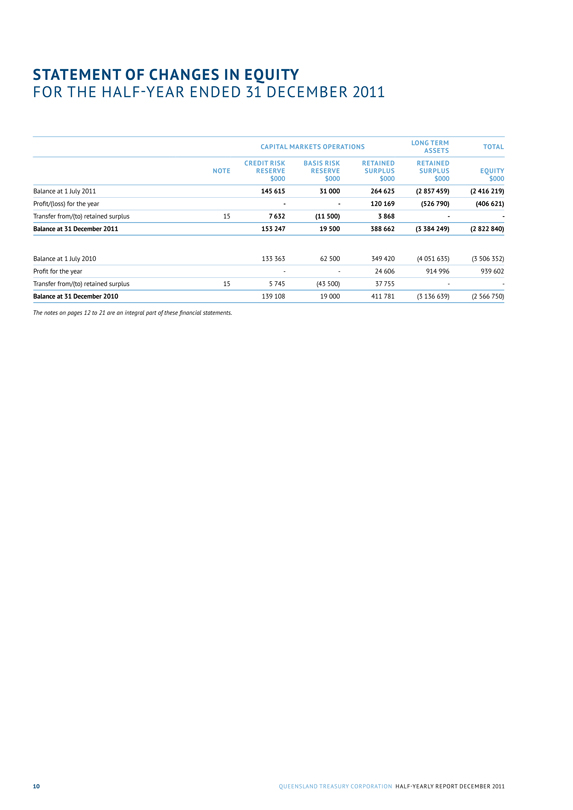

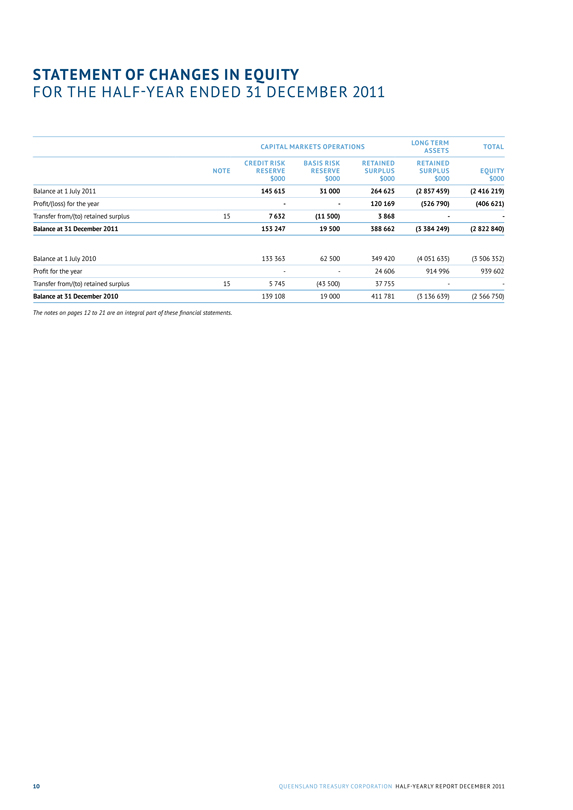

STATEMENT OF CHANGES IN EQUITY

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

CAPITAL MARKETS OPERATIONS

LONG TERM ASSETS

TOTAL

NOTE

CREDIT RISK RESERVE $000

BASIS RISK RESERVE $000

RETAINED SURPLUS $000

RETAINED SURPLUS $000

EQUITY $000

Balance at 1 July 2011 145 615 31 000 264 625 (2 857 459) (2 416 219)

Profit/(loss) for the year - - 120 169 (526 790) (406 621)

Transfer from/(to) retained surplus 15 7 632 (11 500) 3 868 - -

Balance at 31 December 2011 153 247 19 500 388 662 (3 384 249) (2 822 840)

Balance at 1 July 2010 133 363 62 500 349 420 (4 051 635) (3 506 352)

Profit for the year - - 24 606 914 996 939 602

Transfer from/(to) retained surplus 15 5 745 (43 500) 37 755 - -

Balance at 31 December 2010 139 108 19 000 411 781 (3 136 639) (2 566 750)

The notes on pages 12 to 21 are an integral part of these financial statements.

10 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

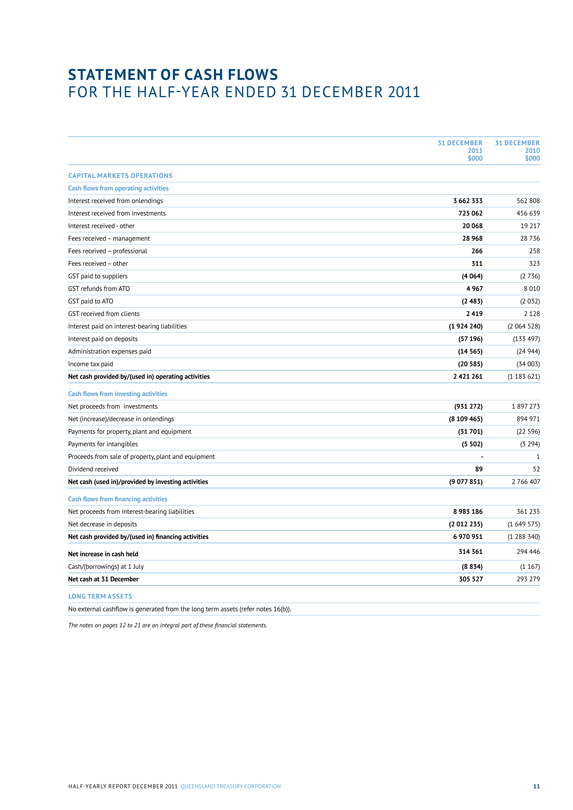

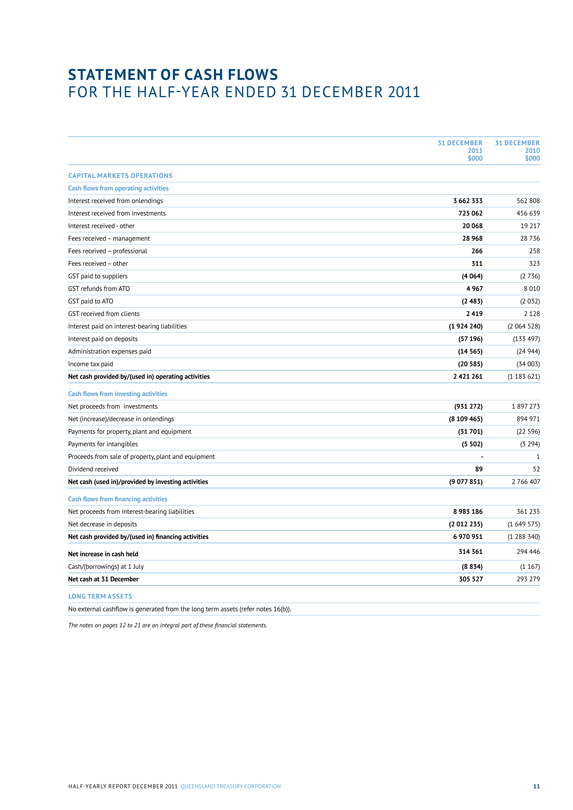

STATEMENT OF CASH FLOWS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

31 DECEMBER 2011 $000

31 DECEMBER 2010 $000

CAPITAL MARKETS OPERATIONS

Cash flows from operating activities

Interest received from onlendings 3 662 333 562 808

Interest received from investments 725 062 456 639

Interest received-other 20 068 19 217

Fees received - management 28 968 28 736

Fees received - professional 266 258

Fees received - other 311 323

GST paid to suppliers (4 064) (2 736)

GST refunds from ATO 4 967 8 010

GST paid to ATO (2 483) (2 032)

GST received from clients 2 419 2 128

Interest paid on interest-bearing liabilities (1 924 240) (2 064 528)

Interest paid on deposits (57 196) (133 497)

Administration expenses paid (14 565) (24 944)

Income tax paid (20 585) (34 003)

Net cash provided by/(used in) operating activities 2 421 261 (1 183 621)

Cash flows from investing activities

Net proceeds from investments (931 272) 1 897 273

Net (increase)/decrease in onlendings (8 109 465) 894 971

Payments for property, plant and equipment (31 701) (22 596)

Payments for intangibles (5 502) (3 294)

Proceeds from sale of property, plant and equipment - 1

Dividend received 89 52

Net cash (used in)/provided by investing activities (9 077 851) 2 766 407

Cash flows from financing activities

Net proceeds from interest-bearing liabilities 8 983 186 361 235

Net decrease in deposits (2 012 235) (1 649 575)

Net cash provided by/(used in) financing activities 6 970 951 (1 288 340)

Net increase in cash held 314 361 294 446

Cash/(borrowings) at 1 July (8 834) (1 167)

Net cash at 31 December 305 527 293 279

LONG TERM ASSETS

No external cashflow is generated from the long term assets (refer notes 16(b)).

The notes on pages 12 to 21 are an integral part of these financial statements.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 11

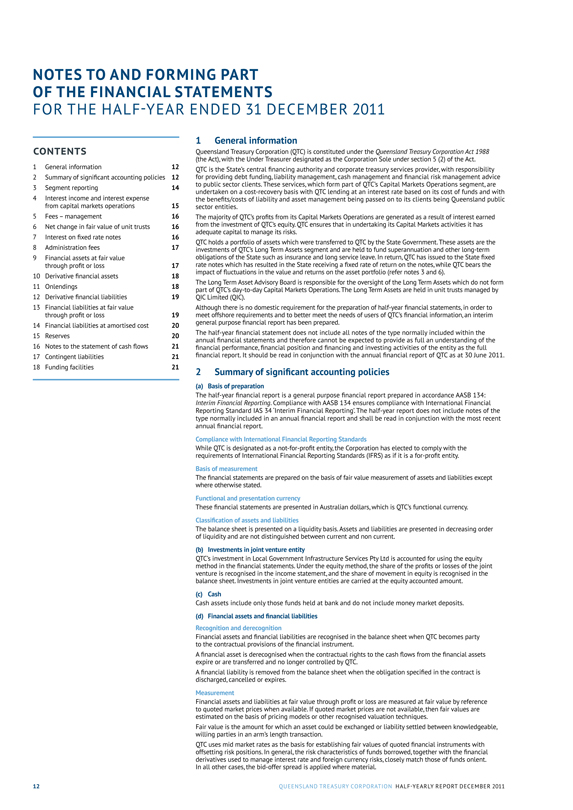

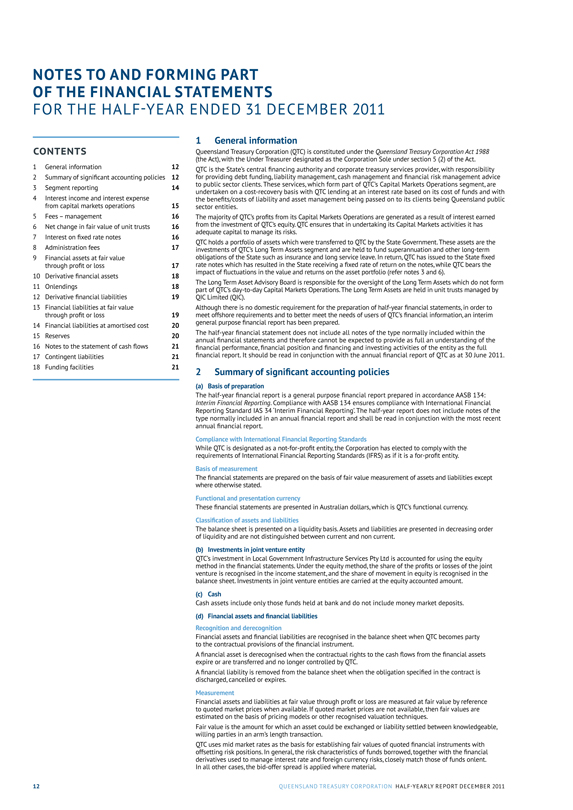

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

CONTENTS

1 General information 12

2 Summary of significant accounting policies 12

3 Segment reporting 14

4 Interest income and interest expense from capital markets operations 15

5 Fees - management 16

6 Net change in fair value of unit trusts 16

7 Interest on fixed rate notes 16

8 Administration fees 17

9 Financial assets at fair value through profit or loss 17

10 Derivative financial assets 18

11 Onlendings 18

12 Derivative financial liabilities 19

13 Financial liabilities at fair value through profit or loss 19

14 Financial liabilities at amortised cost 20

15 Reserves 20

16 Notes to the statement of cash flows 21

17 Contingent liabilities 21

18 Funding facilities 21

1 General information

Queensland Treasury Corporation (QTC) is constituted under the Queensland Treasury Corporation Act 1988 (the Act), with the Under Treasurer designated as the Corporation Sole under section 5 (2) of the Act.

QTC is the State’s central financing authority and corporate treasury services provider, with responsibility for providing debt funding, liability management, cash management and financial risk management advice to public sector clients. These services, which form part of QTC’s Capital Markets Operations segment, are undertaken on a cost-recovery basis with QTC lending at an interest rate based on its cost of funds and with the benefits/costs of liability and asset management being passed on to its clients being Queensland public sector entities.

The majority of QTC’s profits from its Capital Markets Operations are generated as a result of interest earned from the investment of QTC’s equity. QTC ensures that in undertaking its Capital Markets activities it has adequate capital to manage its risks.

QTC holds a portfolio of assets which were transferred to QTC by the State Government. These assets are the investments of QTC’s Long Term Assets segment and are held to fund superannuation and other long-term obligations of the State such as insurance and long service leave. In return, QTC has issued to the State fixed rate notes which has resulted in the State receiving a fixed rate of return on the notes, while QTC bears the impact of fluctuations in the value and returns on the asset portfolio (refer notes 3 and 6).

The Long Term Asset Advisory Board is responsible for the oversight of the Long Term Assets which do not form part of QTC’s day-to-day Capital Markets Operations. The Long Term Assets are held in unit trusts managed by QIC Limited (QIC).

Although there is no domestic requirement for the preparation of half-year financial statements, in order to meet offshore requirements and to better meet the needs of users of QTC’s financial information, an interim general purpose financial report has been prepared.

The half-year financial statement does not include all notes of the type normally included within the annual financial statements and therefore cannot be expected to provide as full an understanding of the financial performance, financial position and financing and investing activities of the entity as the full financial report. It should be read in conjunction with the annual financial report of QTC as at 30 June 2011.

2 Summary of significant accounting policies

(a) Basis of preparation

The half-year financial report is a general purpose financial report prepared in accordance AASB 134:

Interim Financial Reporting. Compliance with AASB 134 ensures compliance with International Financial Reporting Standard IAS 34 ‘Interim Financial Reporting’. The half-year report does not include notes of the type normally included in an annual financial report and shall be read in conjunction with the most recent annual financial report.

Compliance with International Financial Reporting Standards

While QTC is designated as a not-for-profit entity, the Corporation has elected to comply with the requirements of International Financial Reporting Standards (IFRS) as if it is a for-profit entity.

Basis of measurement

The financial statements are prepared on the basis of fair value measurement of assets and liabilities except where otherwise stated.

Functional and presentation currency

These financial statements are presented in Australian dollars, which is QTC’s functional currency.

Classification of assets and liabilities

The balance sheet is presented on a liquidity basis. Assets and liabilities are presented in decreasing order of liquidity and are not distinguished between current and non current.

(b) Investments in joint venture entity

QTC’s investment in Local Government Infrastructure Services Pty Ltd is accounted for using the equity method in the financial statements. Under the equity method, the share of the profits or losses of the joint venture is recognised in the income statement, and the share of movement in equity is recognised in the balance sheet. Investments in joint venture entities are carried at the equity accounted amount.

(c) Cash

Cash assets include only those funds held at bank and do not include money market deposits.

(d) Financial assets and financial liabilities Recognition and derecognition

Financial assets and financial liabilities are recognised in the balance sheet when QTC becomes party to the contractual provisions of the financial instrument.

A financial asset is derecognised when the contractual rights to the cash flows from the financial assets expire or are transferred and no longer controlled by QTC.

A financial liability is removed from the balance sheet when the obligation specified in the contract is discharged, cancelled or expires.

Measurement

Financial assets and liabilities at fair value through profit or loss are measured at fair value by reference to quoted market prices when available. If quoted market prices are not available, then fair values are estimated on the basis of pricing models or other recognised valuation techniques.

Fair value is the amount for which an asset could be exchanged or liability settled between knowledgeable, willing parties in an arm’s length transaction.

QTC uses mid market rates as the basis for establishing fair values of quoted financial instruments with offsetting risk positions. In general, the risk characteristics of funds borrowed, together with the financial derivatives used to manage interest rate and foreign currency risks, closely match those of funds onlent.

In all other cases, the bid-offer spread is applied where material.

12 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

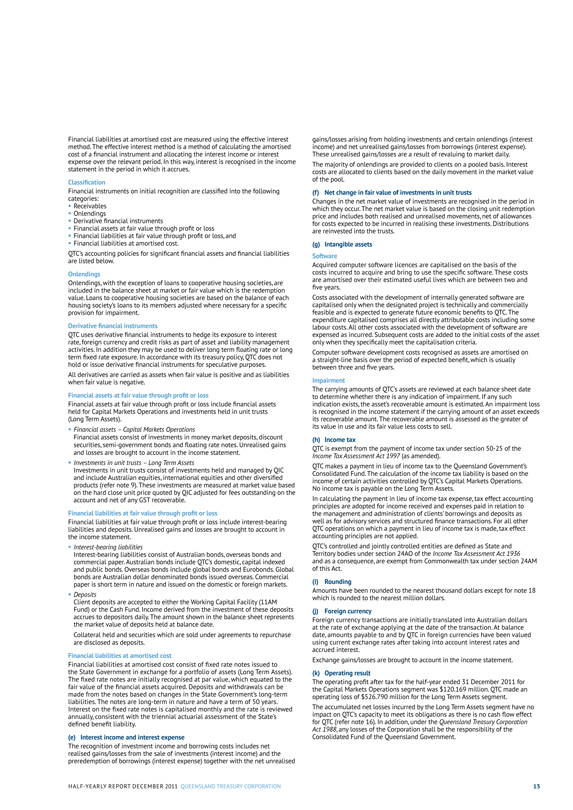

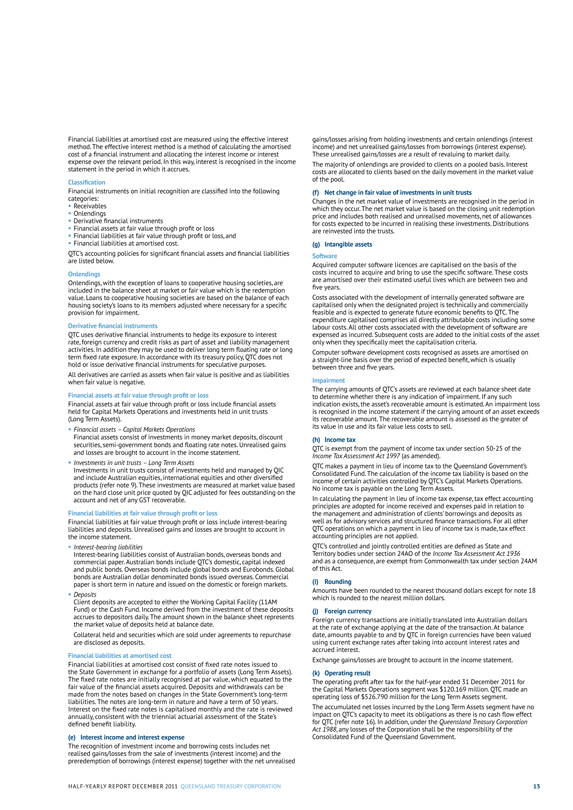

Financial liabilities at amortised cost are measured using the effective interest method. The effective interest method is a method of calculating the amortised cost of a financial instrument and allocating the interest income or interest expense over the relevant period. In this way, interest is recognised in the income statement in the period in which it accrues.

Classification

Financial instruments on initial recognition are classified into the following categories:

Receivables

Onlendings

Derivative financial instruments

Financial assets at fair value through profit or loss

Financial liabilities at fair value through profit or loss, and

Financial liabilities at amortised cost.

QTC’s accounting policies for significant financial assets and financial liabilities are listed below.

Onlendings

Onlendings, with the exception of loans to cooperative housing societies, are included in the balance sheet at market or fair value which is the redemption value. Loans to cooperative housing societies are based on the balance of each housing society’s loans to its members adjusted where necessary for a specific provision for impairment.

Derivative financial instruments

QTC uses derivative financial instruments to hedge its exposure to interest rate, foreign currency and credit risks as part of asset and liability management activities. In addition they may be used to deliver long term floating rate or long term fixed rate exposure. In accordance with its treasury policy, QTC does not hold or issue derivative financial instruments for speculative purposes.

All derivatives are carried as assets when fair value is positive and as liabilities when fair value is negative.

Financial assets at fair value through profit or loss

Financial assets at fair value through profit or loss include financial assets held for Capital Markets Operations and investments held in unit trusts (Long Term Assets).

Financial assets - Capital Markets Operations

Financial assets consist of investments in money market deposits, discount securities, semi-government bonds and floating rate notes. Unrealised gains and losses are brought to account in the income statement.

Investments in unit trusts - Long Term Assets

Investments in unit trusts consist of investments held and managed by QIC and include Australian equities, international equities and other diversified products (refer note 9). These investments are measured at market value based on the hard close unit price quoted by QIC adjusted for fees outstanding on the account and net of any GST recoverable.

Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss include interest-bearing liabilities and deposits. Unrealised gains and losses are brought to account in the income statement.

Interest-bearing liabilities

Interest-bearing liabilities consist of Australian bonds, overseas bonds and commercial paper. Australian bonds include QTC’s domestic, capital indexed and public bonds. Overseas bonds include global bonds and Eurobonds. Global bonds are Australian dollar denominated bonds issued overseas. Commercial paper is short term in nature and issued on the domestic or foreign markets.

Deposits

Client deposits are accepted to either the Working Capital Facility (11AM Fund) or the Cash Fund. Income derived from the investment of these deposits accrues to depositors daily. The amount shown in the balance sheet represents the market value of deposits held at balance date.

Collateral held and securities which are sold under agreements to repurchase are disclosed as deposits.

Financial liabilities at amortised cost

Financial liabilities at amortised cost consist of fixed rate notes issued to the State Government in exchange for a portfolio of assets (Long Term Assets). The fixed rate notes are initially recognised at par value, which equated to the fair value of the financial assets acquired. Deposits and withdrawals can be made from the notes based on changes in the State Government’s long-term liabilities. The notes are long-term in nature and have a term of 50 years. Interest on the fixed rate notes is capitalised monthly and the rate is reviewed annually, consistent with the triennial actuarial assessment of the State’s defined benefit liability.

(e) Interest income and interest expense

The recognition of investment income and borrowing costs includes net realised gains/losses from the sale of investments (interest income) and the preredemption of borrowings (interest expense) together with the net unrealised

gains/losses arising from holding investments and certain onlendings (interest income) and net unrealised gains/losses from borrowings (interest expense). These unrealised gains/losses are a result of revaluing to market daily.

The majority of onlendings are provided to clients on a pooled basis. Interest costs are allocated to clients based on the daily movement in the market value of the pool.

(f) Net change in fair value of investments in unit trusts

Changes in the net market value of investments are recognised in the period in which they occur. The net market value is based on the closing unit redemption price and includes both realised and unrealised movements, net of allowances for costs expected to be incurred in realising these investments. Distributions are reinvested into the trusts.

(g) Intangible assets

Software

Acquired computer software licences are capitalised on the basis of the costs incurred to acquire and bring to use the specific software. These costs are amortised over their estimated useful lives which are between two and five years.

Costs associated with the development of internally generated software are capitalised only when the designated project is technically and commercially feasible and is expected to generate future economic benefits to QTC. The expenditure capitalised comprises all directly attributable costs including some labour costs. All other costs associated with the development of software are expensed as incurred. Subsequent costs are added to the initial costs of the asset only when they specifically meet the capitalisation criteria.

Computer software development costs recognised as assets are amortised on a straight-line basis over the period of expected benefit, which is usually between three and five years.

Impairment

The carrying amounts of QTC’s assets are reviewed at each balance sheet date to determine whether there is any indication of impairment. If any such indication exists, the asset’s recoverable amount is estimated. An impairment loss is recognised in the income statement if the carrying amount of an asset exceeds its recoverable amount. The recoverable amount is assessed as the greater of its value in use and its fair value less costs to sell.

(h) Income tax

QTC is exempt from the payment of income tax under section 50-25 of the Income Tax Assessment Act 1997 (as amended).

QTC makes a payment in lieu of income tax to the Queensland Government’s Consolidated Fund. The calculation of the income tax liability is based on the income of certain activities controlled by QTC’s Capital Markets Operations.

No income tax is payable on the Long Term Assets.

In calculating the payment in lieu of income tax expense, tax effect accounting principles are adopted for income received and expenses paid in relation to the management and administration of clients’ borrowings and deposits as well as for advisory services and structured finance transactions. For all other QTC operations on which a payment in lieu of income tax is made, tax effect accounting principles are not applied.

QTC’s controlled and jointly controlled entities are defined as State and Territory bodies under section 24AO of the Income Tax Assessment Act 1936 and as a consequence, are exempt from Commonwealth tax under section 24AM of this Act.

(i) Rounding

Amounts have been rounded to the nearest thousand dollars except for note 18 which is rounded to the nearest million dollars.

(j) Foreign currency

Foreign currency transactions are initially translated into Australian dollars at the rate of exchange applying at the date of the transaction. At balance date, amounts payable to and by QTC in foreign currencies have been valued using current exchange rates after taking into account interest rates and accrued interest.

Exchange gains/losses are brought to account in the income statement.

(k) Operating result

The operating profit after tax for the half-year ended 31 December 2011 for the Capital Markets Operations segment was $120.169 million. QTC made an operating loss of $526.790 million for the Long Term Assets segment.

The accumulated net losses incurred by the Long Term Assets segment have no impact on QTC’s capacity to meet its obligations as there is no cash flow effect for QTC (refer note 16). In addition, under the Queensland Treasury Corporation Act 1988, any losses of the Corporation shall be the responsibility of the Consolidated Fund of the Queensland Government.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 13

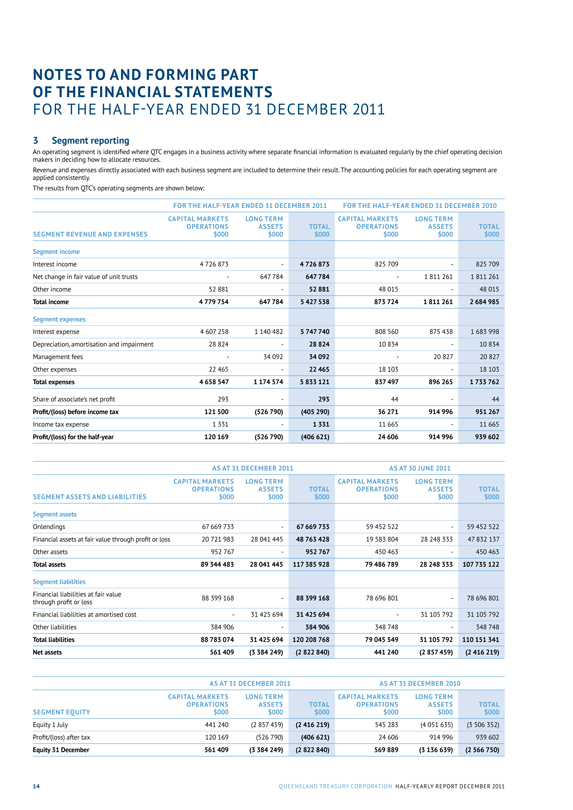

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

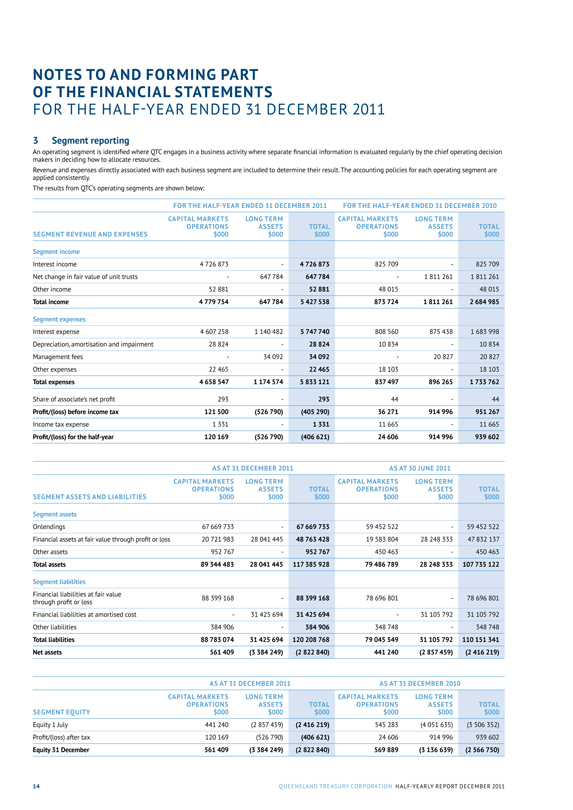

3 Segment reporting

An operating segment is identified where QTC engages in a business activity where separate financial information is evaluated regularly by the chief operating decision makers in deciding how to allocate resources.

Revenue and expenses directly associated with each business segment are included to determine their result. The accounting policies for each operating segment are applied consistently.

The results from QTCs operating segments are shown below:

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011 FOR THE HALF-YEAR ENDED 31 DECEMBER 2010

SEGMENT REVENUE AND EXPENSES

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

Segment income Interest income 4 726 873 - 4 726 873 825 709 - 825 709

Net change in fair value of unit trusts - 647 784 647 784 - 1 811 261 1 811 261

Other income 52 881 - 52 881 48 015 - 48 015

Total income 4 779 754 647 784 5 427 538 873 724 1 811 261 2 684 985

Segment expenses Interest expense 4 607 258 1 140 482 5 747 740 808 560 875 438 1 683 998

Depreciation, amortisation and impairment 28 824 - 28 824 10 834 - 10 834

Management fees - 34 092 34 092 - 20 827 20 827

Other expenses 22 465 - 22 465 18 103 - 18 103

Total expenses 4 658 547 1 174 574 5 833 121 837 497 896 265 1 733 762

Share of associate’s net profit 293 - 293 44 - 44

Profit/(loss) before income tax 121 500 (526 790) (405 290) 36 271 914 996 951 267

Income tax expense 1 331 - 1 331 11 665 - 11 665

Profit/(loss) for the half-year 120 169 (526 790) (406 621) 24 606 914 996 939 602

AS AT 31 DECEMBER 2011 AS AT 30 JUNE 2011

SEGMENT ASSETS AND LIABILITIES

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

Segment assets Onlendings 67 669 733 - 67 669 733 59 452 522 - 59 452 522

Financial assets at fair value through profit or loss 20 721 983 28 041 445 48 763 428 19 583 804 28 248 333 47 832 137

Other assets 952 767 - 952 767 450 463 - 450 463

Total assets 89 344 483 28 041 445 117 385 928 79 486 789 28 248 333 107 735 122

Segment liabilities Financial liabilities at fair value through profit or loss 88 399 168 - 88 399 168 78 696 801 - 78 696 801

Financial liabilities at amortised cost - 31 425 694 31 425 694 - 31 105 792 31 105 792

Other liabilities 384 906 - 384 906 348 748 - 348 748

Total liabilities 88 783 074 31 425 694 120 208 768 79 045 549 31 105 792 110 151 341

Net assets 561 409 (3 384 249) (2 822 840) 441 240 (2 857 459) (2 416 219)

AS AT 31 DECEMBER 2011 AS AT 31 DECEMBER 2010

SEGMENT EQUITY

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

CAPITAL MARKETS OPERATIONS $000

LONG TERM ASSETS $000

TOTAL $000

Equity 1 July 441 240 (2 857 459) (2 416 219) 545 283 (4 051 635) (3 506 352)

Profit/(loss) after tax 120 169 (526 790) (406 621) 24 606 914 996 939 602

Equity 31 December 561 409 (3 384 249) (2 822 840) 569 889 (3 136 639) (2 566 750)

14 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

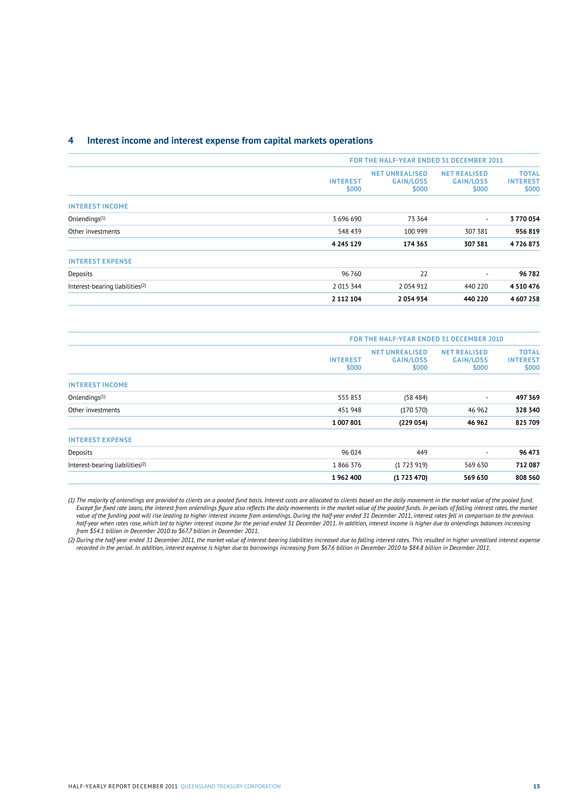

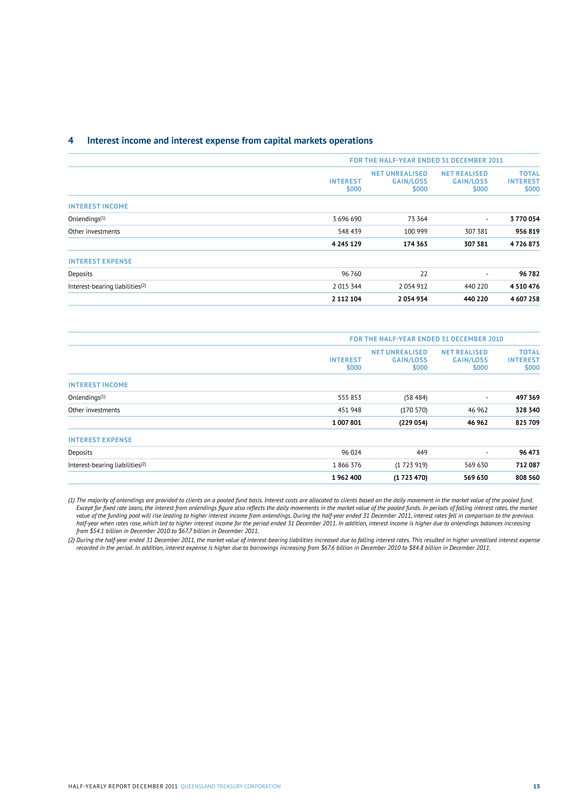

4 Interest income and interest expense from capital markets operations

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

INTEREST $000

NET UNREALISED GAIN /LOSS $000

NET REALISED GAIN /LOSS $000

TOTAL INTEREST $000

INTEREST INCOME Onlendings(1) 3 696 690 73 364 - 3 770 054

Other investments 548 439 100 999 307 381 956 819

4 245 129 174 363 307 381 4 726 873

INTEREST EXPENSE Deposits 96 760 22 - 96 782

Interest-bearing liabilities(2) 2 015 344 2 054 912 440 220 4 510 476

2 112 104 2 054 934 440 220 4 607 258

FOR THE HALF-YEAR ENDED 31 DECEMBER 2010

INTEREST $000

NET UNREALISED GAIN /LOSS $000

NET REALISED GAIN /LOSS $000

TOTAL INTEREST $000

INTEREST INCOME Onlendings(1) 555 853 (58 484) - 497 369

Other investments 451 948 (170 570) 46 962 328 340

1 007 801 (229 054) 46 962 825 709

INTEREST EXPENSE Deposits 96 024 449 - 96 473

Interest-bearing Liabilities(2) 1 866 376 (1 723 919) 569 630 712 087

1 962 400 (1 723 470) 569 630 808 560

(1) The majority of onlendings are provided to clients on a pooled fund basis. Interest costs are allocated to clients based on the daily movement in the market value of the pooled fund. Except for fixed rate loans, the interest from onlendings figure also reflects the daily movements in the market value of the pooled funds. In periods of falling interest rates, the market value of the funding pool will rise leading to higher interest income from onlendings. During the half-year ended 31 December 2011, interest rates fell in comparison to the previous half-year when rates rose, which led to higher interest income for the period ended 31 December 2011. In addition, interest income is higher due to onlendings balances increasing from $54.1 billion in December 2010 to $67.7 billion in December 2011.

(2) During the half-year ended 31 December 2011, the market value of interest-bearing liabilities increased due to falling interest rates. This resulted in higher unrealised interest expense recorded in the period. In addition, interest expense is higher due to borrowings increasing from $67.6 billion in December 2010 to $84.8 billion in December 2011.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 15

NOTES TO AND FORMING PART

OF THE FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

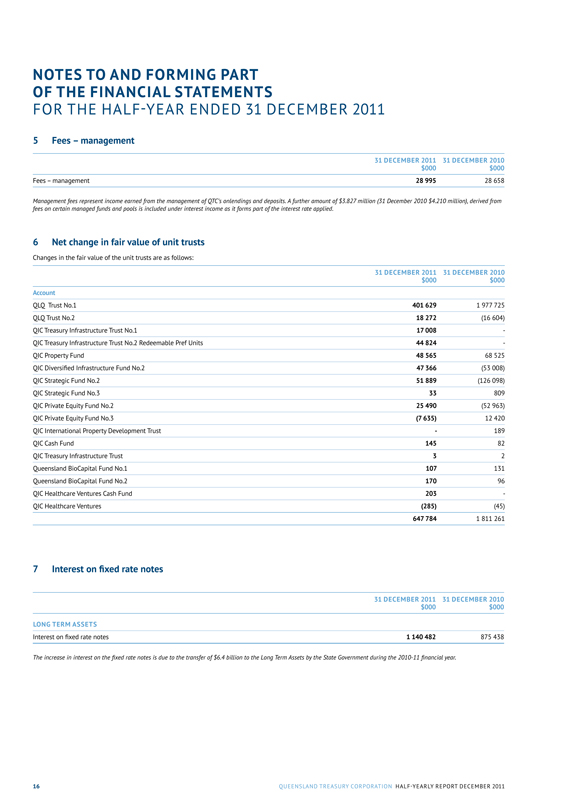

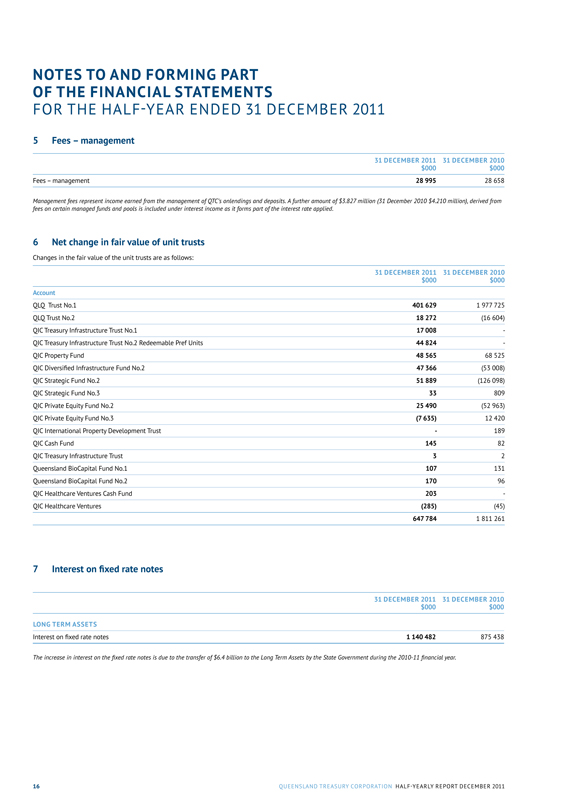

5 Fees - management

31 DECEMBER 2011 31 DECEMBER 2010 $000 $000

Fees - management 28 995 28 658

Management fees represent income earned from the management of QTC’s onlendings and deposits. A further amount of $3,827 million (31 December 2010 $4,210 million), derived from fees on certain managed funds and pools is included under interest income as it forms part of the interest rate applied.

6 Net change in fair value of unit trusts

Changes in the fair value of the unit trusts are as follows:

31 DECEMBER 2011 31 DECEMBER 2010

$000 $000

Account

QLQ Trust No.l 401 629 1 977 725

QLQ Trust No.2 18 272 (16 604)

QIC Treasury Infrastructure Trust No.l 17 008 -

QIC Treasury Infrastructure Trust No.2

Redeemable Pref Units 44 824 -

QIC Property Fund 48 565 68 525

QIC Diversified Infrastructure Fund No.2 47 366 (53 008)

QIC Strategic Fund No.2 51 889 (126 098)

QIC Strategic Fund No.3 33 809

QIC Private Equity Fund No.2 25 490 (52 963)

QIC Private Equity Fund No.3 (7 635) 12 420

QIC International Property Development Trust - 189

QIC Cash Fund 145 82

QIC Treasury Infrastructure Trust 3 2

Queensland BioCapital Fund No.l 107 131

Queensland BioCapital Fund No.2 170 96

QIC Healthcare Ventures Cash Fund 203 -

QIC Healthcare Ventures (285) (45)

647 784 1 811 261

7 Interest on fixed rate notes

31 DECEMBER 2011 31 DECEMBER 2010

$000 $000

LONG TERM ASSETS

Interest on fixed rate notes 1140 482 875 438

The increase in interest on the fixed rate notes is due to the transfer of $6.4 billion to the Long Term Assets by the State Government during the 2010-11 financial year.

16 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

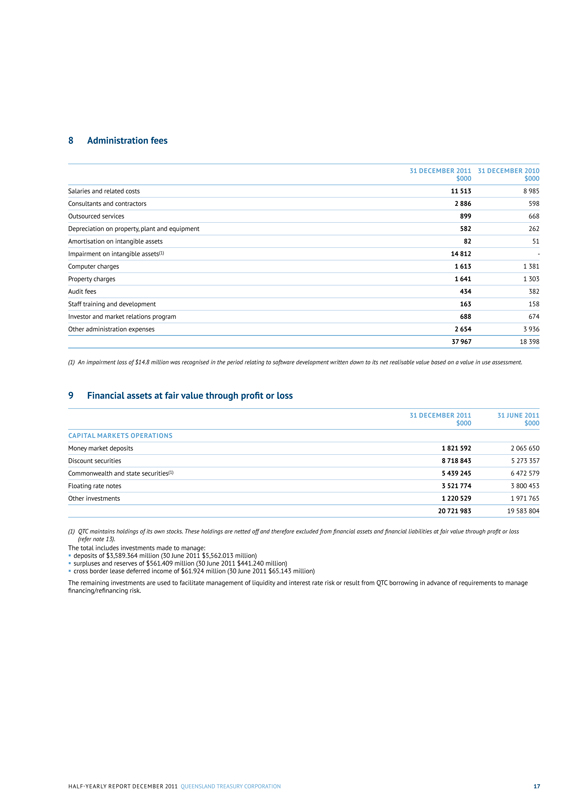

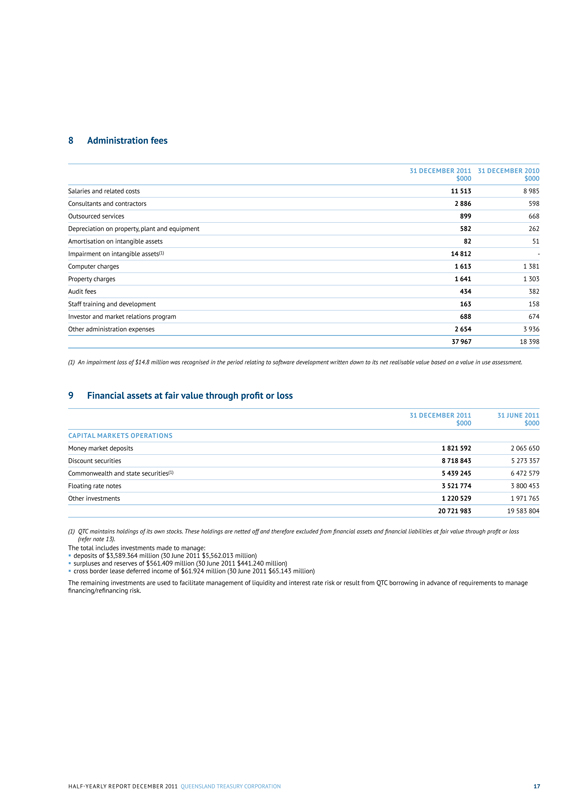

8 Administration fees

31 DECEMBER 2011 31 DECEMBER 2010 $000 $000

Salaries and related costs 11 513 8 985

Consultants and contractors 2 886 598

Outsourced services 899 668

Depreciation on property, plant and equipment 582 262

Amortisation on intangible assets 82 51

Impairment on intangible assets(1) 14 812 -

Computer charges 1 613 1 381

Property charges 1 641 1 303

Audit fees 434 382

Staff training and development 163 158

Investor and market relations program 688 674

Other administration expenses 2 654 3 936

37 967 18 398

(1) An impairment loss of $14.8 million was recognised in the period relating to software development written down to its net realisable value based on a value in use assessment.

9 Financial assets at fair value through profit or loss

31 DECEMBER 2011 31 JUNE 2011

$000 $000

CAPITAL MARKETS OPERATIONS

Money market deposits 1 821 592 2 065 650

Discount securities 8 718 843 5 273 357

Commonwealth and state securities(1) 5 439 245 6 472 579

Floating rate notes 3 521 774 3 800 453

Other investments 1 220 529 1 971 765

20 721 983 19 583 804

(1) QTC maintains holdings of its own stocks. These holdings are netted off and therefore excluded from financial assets and financial liabilities at fair value through profit or loss

(refer note 13).

The total includes investments made to manage:

* deposits of $3,589.364 million (30 June 2011 $5,562.013 million)

* surpluses and reserves of $561.409 million (30 June 2011 $441.240 million)

* cross border lease deferred income of $61.924 million (30 June 2011 $65.143 million)

The remaining investments are used to facilitate management of liquidity and interest rate risk or result from QTC borrowing in advance of requirements to manage financing/refinancing risk.

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 17

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

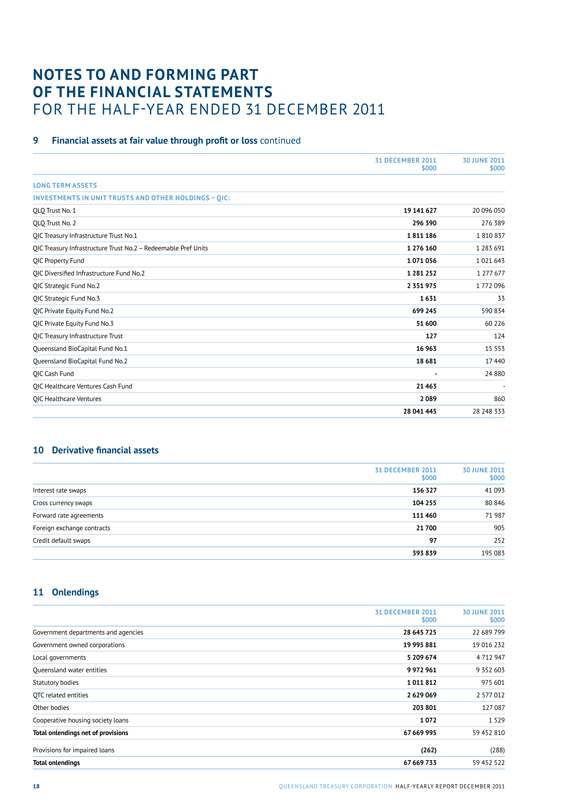

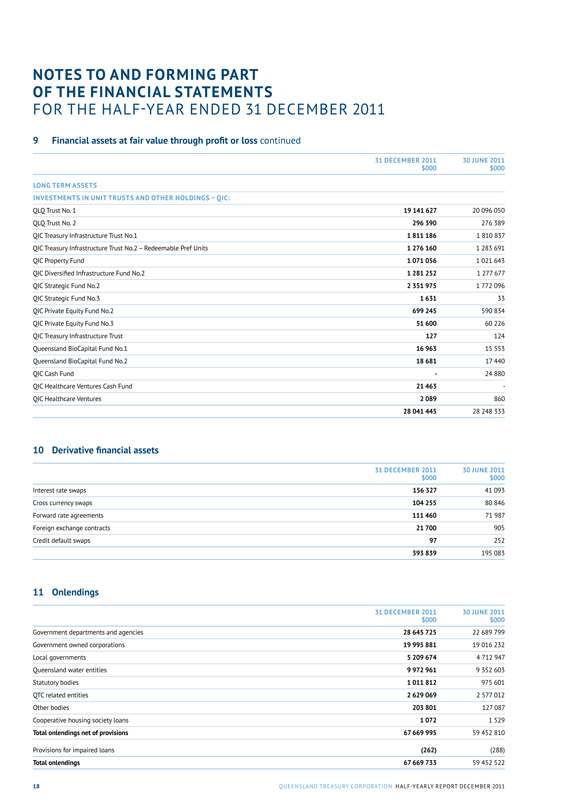

9 Financial assets at fair value through profit or loss continued

31 DECEMBER 2011 30 JUNE 2011

$000 $000

LONG TERM ASSETS

INVESTMENTS IN UNIT TRUSTS AND OTHER HOLDINGS - QIC:

QLQ Trust No. 1 19 141 627 20 096 050

QLQ Trust No. 2 296 390 276 389

QIC Treasury Infrastructure Trust No.1 1 811 186 1 810 837

QIC Treasury Infrastructure Trust No.2 - Redeemable Pref Units 1 276 160 1 283 691

QIC Property Fund 1 071 056 1 021 643

QIC Diversified Infrastructure Fund No.2 1 281 252 1 277 677

QIC Strategic Fund No.2 2 351 975 1 772 096

QIC Strategic Fund No.3 1 631 33

QIC Private Equity Fund No.2 699 245 590 834

QIC Private Equity Fund No.3 51 600 60 226

QIC Treasury Infrastructure Trust 127 124

Queensland BioCapital Fund No.1 16 963 15 553

Queensland BioCapital Fund No.2 18 681 17 440

QIC Cash Fund - 24 880

QIC Healthcare Ventures Cash Fund 21 463 -

QIC Healthcare Ventures 2 089 860

28 041 445 28 248 333

10 Derivative financial assets

31 DECEMBER 2011 30 JUNE 2011

$000 $000

Interest rate swaps 156 327 41 093

Cross currency swaps 104 255 80 846

Forward rate agreements 111 460 71 987

Foreign exchange contracts 21 700 905

Credit default swaps 97 252

393 839 195 083

11 Onlendings

31 DECEMBER 2011 30 JUNE 2011

$000 $000

Government departments and agencies 28 645 725 22 689 799

Government owned corporations 19 995 881 19 016 232

Local governments 5 209 674 4 712 947

Queensland water entities 9 972 961 9 352 603

Statutory bodies 1 011 812 975 601

QTC related entities 2 629 069 2 577 012

Other bodies 203 801 127 087

Cooperative housing society loans 1 072 1 529

Total onlendings net of provisions 67 669 995 59 452 810

Provisions for impaired loans (262) (288)

Total onlendings 67 669 733 59 452 522

18 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

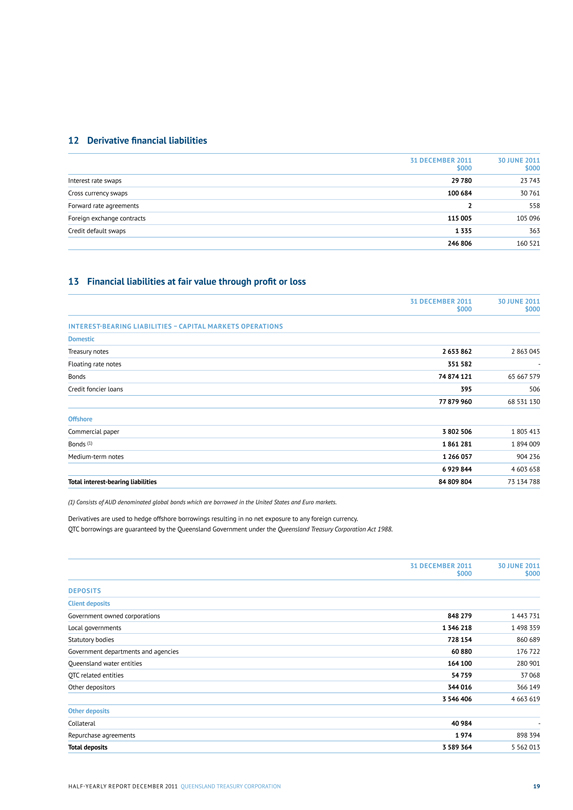

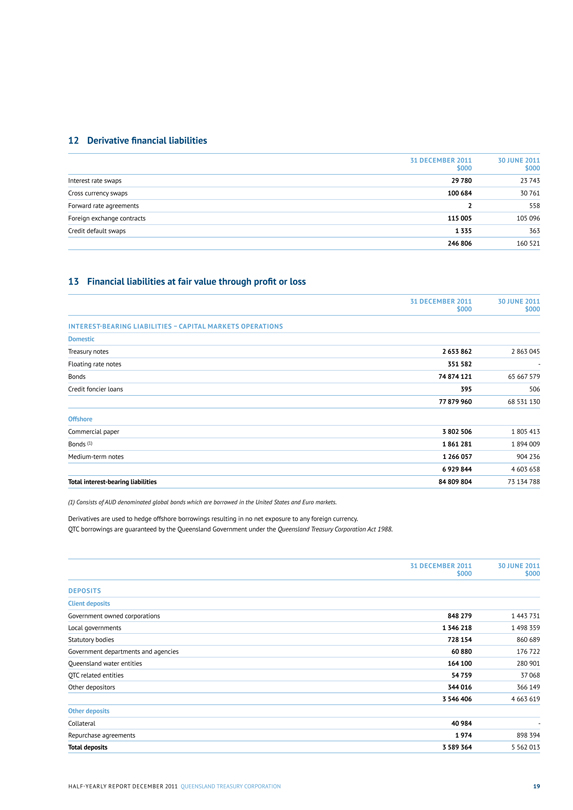

12 Derivative financial liabilities

31 DECEMBER 2011 30 JUNE 2011

$000 $000

Interest rate swaps 29 780 23 743

Cross currency swaps 100 684 30 761

Forward rate agreements 2 558

Foreign exchange contracts 115 005 105 096

Credit default swaps 1 335 363

246 806 160 521

13 Financial liabilities at fair value through profit or loss

31 DECEMBER 2011 30 JUNE 2011

$000 $000

INTEREST-BEARING LIABILITIES - CAPITAL MARKETS OPERATIONS

Domestic

Treasury notes 2 653 862 2 863 045

Floating rate notes 351 582 -

Bonds 74 874 121 65 667 579

Credit foncier loans 395 506

77 879 960 68 531 130

Offshore

Commercial paper 3 802 506 1 805 413

Bonds (1) 1 861 281 1 894 009

Medium-term notes 1 266 057 904 236

6 929 844 4 603 658

Total interest-bearing liabilities 84 809 804 73 134 788

(1) Consists of AUD denominated global bonds which are borrowed in the United States and Euro markets.

Derivatives are used to hedge offshore borrowings resulting in no net exposure to any foreign currency.

QTC borrowings are guaranteed by the Queensland Government under the Queensland Treasury Corporation Act 1988.

31 DECEMBER 2011 30 JUNE 2011

$000 $000

DEPOSITS

Client deposits

Government owned corporations 848 279 1 443 731

Local governments 1 346 218 1 498 359

Statutory bodies 728 154 860 689

Government departments and agencies 60 880 176 722

Queensland water entities 164 100 280 901

QTC related entities 54 759 37 068

Other depositors 344 016 366 149

3 546 406 4 663 619

Other deposits

Collateral 40 984 -

Repurchase agreements 1 974 898 394

Total deposits 3 589 364 5 562 013

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 19

NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

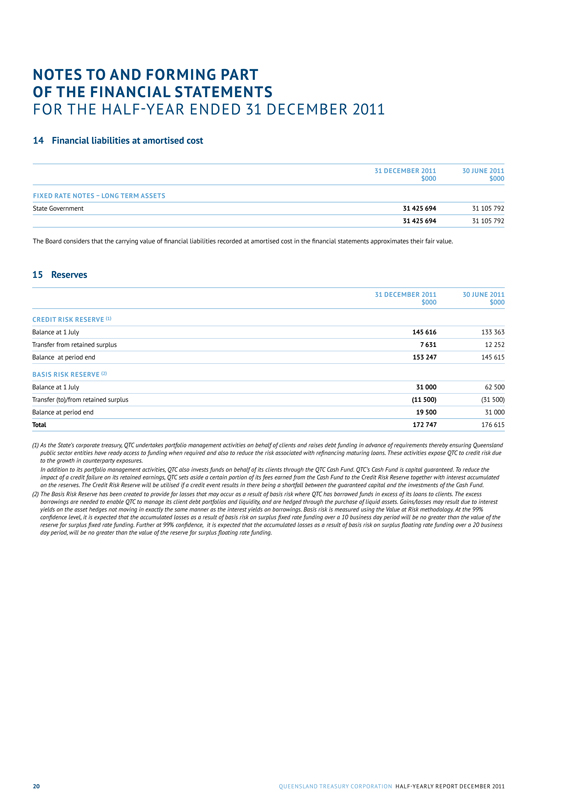

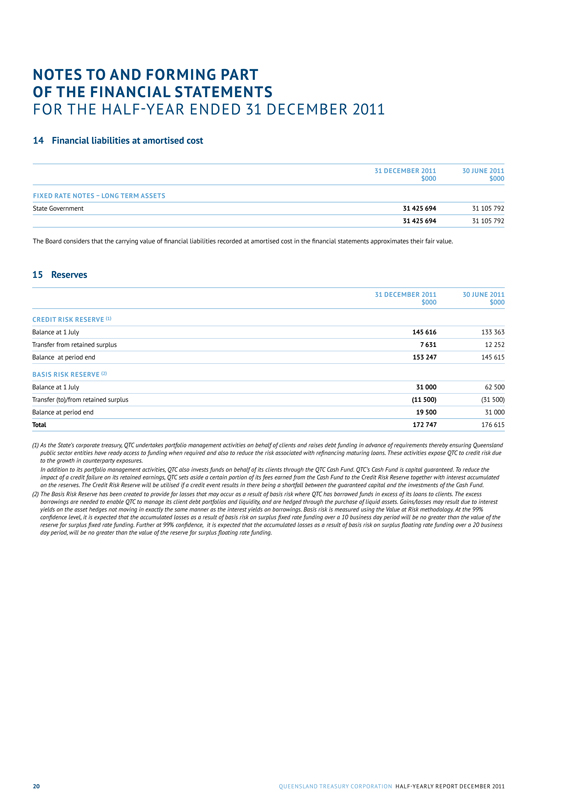

14 Financial liabilities at amortised cost

31 DECEMBER 2011 $000 30 JUNE 2011 $000

FIXED RATE NOTES - LONG TERM ASSETS State Government 31 425 694 31 105 792

31 425 694 31 105 792

The Board considers that the carrying value of financial liabilities recorded at amortised cost in the financial statements approximates their fair value.

15 Reserves

31 DECEMBER 2011 $000 30 JUNE 2011 $000

CREDIT RISK RESERVE (1) Balance at 1 July 145 616 133 363

Transfer from retained surplus 7 631 12 252

Balance at period end 153 247 145 615

BASIS RISK RESERVE(2) Balance at 1 July 31 000 62 500

Transfer (to)/from retained surplus (11 500) (31 500)

Balance at period end 19 500 31 000

Total 172 747 176 615

(1) As the State’s corporate treasury, QTC undertakes portfolio management activities on behalf of clients and raises debt funding in advance of requirements thereby ensuring Queensland public sector entities have ready access to funding when required and also to reduce the risk associated with refinancing maturing loans. These activities expose QTC to credit risk due to the growth in counterparty exposures.

In addition to its portfolio management activities, QTC also invests funds on behalf of its clients through the QTC Cash Fund. QTC’s Cash Fund is capital guaranteed. To reduce the impact of a credit failure on its retained earnings, QTC sets aside a certain portion of its fees earned from the Cash Fund to the Credit Risk Reserve together with interest accumulated on the reserves. The Credit Risk Reserve will be utilised if a credit event results in there being a shortfall between the guaranteed capital and the investments of the Cash Fund.

(2) The Basis Risk Reserve has been created to provide for losses that may occur as a result of basis risk where QTC has borrowed funds in excess of its loans to clients. The excess borrowings are needed to enable QTC to manage its client debt portfolios and liquidity, and are hedged through the purchase of liquid assets. Gains/losses may result due to interest yields on the asset hedges not moving in exactly the same manner as the interest yields on borrowings. Basis risk is measured using the Value at Risk methodology. At the 99% confidence level, it is expected that the accumulated losses as a result of basis risk on surplus fixed rate funding over a 10 business day period will be no greater than the value of the reserve for surplus fixed rate funding. Further at 99% confidence, it is expected that the accumulated losses as a result of basis risk on surplus floating rate funding over a 20 business day period, will be no greater than the value of the reserve for surplus floating rate funding.

20 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

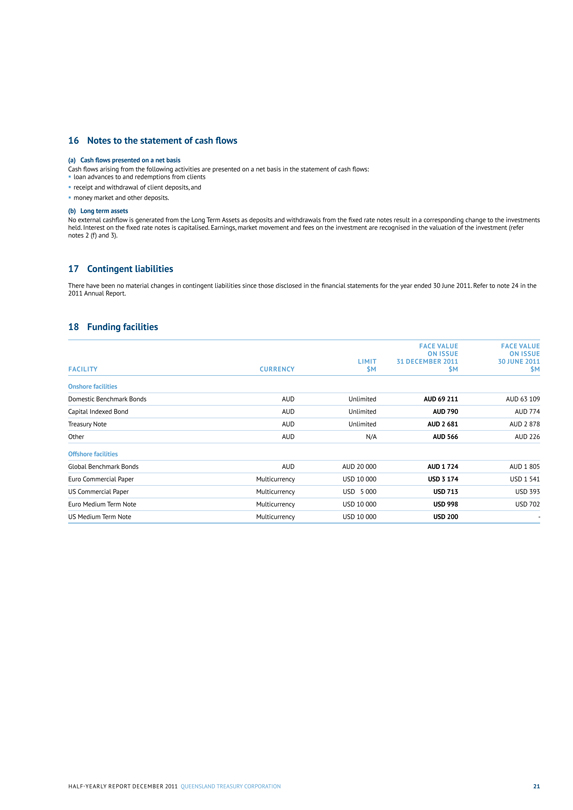

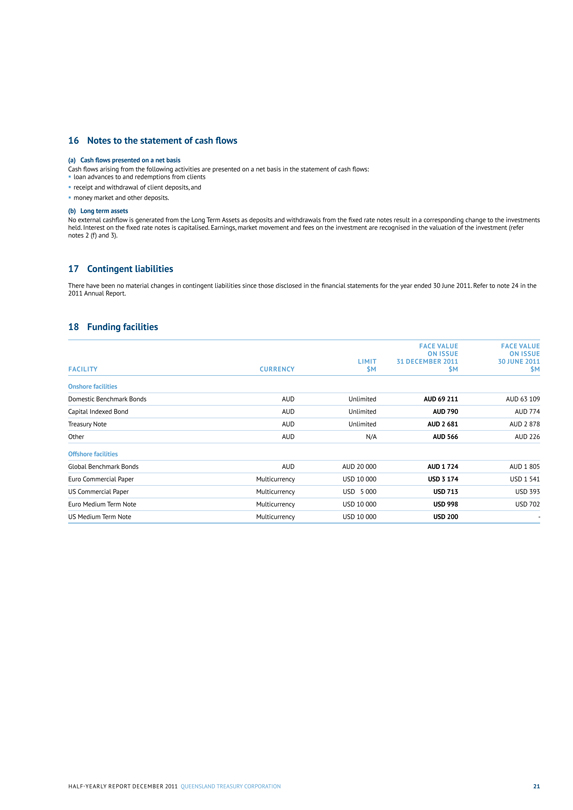

16 Notes to the statement of cash flows

(a) Cash flows presented on a net basis

Cash flows arising from the following activities are presented on a net basis in the statement of cash flows:

loan advances to and redemptions from clients

receipt and withdrawal of client deposits, and

money market and other deposits.

(b) Long term assets

No external cashflow is generated from the Long Term Assets as deposits and withdrawals from the fixed rate notes result in a corresponding change to the investments held. Interest on the fixed rate notes is capitalised. Earnings, market movement and fees on the investment are recognised in the valuation of the investment (refer notes 2 (f) and 3).

17 Contingent liabilities

There have been no material changes in contingent liabilities since those disclosed in the financial statements for the year ended 30 June 2011. Refer to note 24 in the 2011 Annual Report.

18 Funding facilities

FACILITY

CURRENCY

LIMIT $M

FACE VALUE ON ISSUE 31 DECEMBER 2011 $M

FACE VALUE ON ISSUE 30 JUNE 2011 $M

Onshore facilities Domestic Benchmark Bonds AUD Unlimited AUD 69 211 AUD 63 109

Capital Indexed Bond AUD Unlimited AUD 790 AUD 774

Treasury Note AUD Unlimited AUD 2 681 AUD 2 878

Other AUD N/A AUD 566 AUD 226

Offshore facilities Global Benchmark Bonds AUD AUD 20 000 AUD 1 724 AUD 1 805

Euro Commercial Paper Multicurrency USD 10 000 USD 3 174 USD 1 541

US Commercial Paper Multicurrency USD 5 000 USD 713 USD 393

Euro Medium Term Note Multicurrency USD 10 000 USD 998 USD 702

US Medium Term Note Multicurrency USD 10 000 USD 200 -

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 21

CERTIFICATE OF THE OUEENSLAND TREASURY CORPORATION

The foregoing general purpose financial statements have been prepared in accordance with the requirements of AASB 134: Interim Financial Reports. Compliance with AASB 134 ensures compliance with International Financial Reporting Standard IAS 34: Interim Financial Reporting.

We certify that in our opinion:

(i) the prescribed requirements for establishing and keeping the accounts have been complied with in all material respects

(ii) the foregoing half-year financial statements have been drawn up so as to present a true and fair view of Queensland Treasury Corporation’s assets and liabilities, financial position and financial performance for the half-year ended 31 December 2011, and

(iii) the interim management report includes a fair review of the information required under article 4(4) of the Law of January 11, 2008 on transparency requirements for issuers of securities on the Luxembourg Stock Exchange.

Signed in accordance with a resolution of the Directors.

G P BRADLEY

Corporation Sole

Queensland Treasury Corporation

P C NOBLE

Chief Executive

Brisbane

8 February 2012

22 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

INDEPENDENT AUDITOR’S REVIEW REPORT TO OUEENSLAND TREASURY CORPORATION

Review Report on the Half-year Financial Report

I have reviewed the accompanying half-year financial report of Queensland Treasury Corporation, which comprises the balance sheet as at 31 December 2011, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the half-year ended on that date, notes comprising a summary of significant accounting policies and other explanatory information, and the certificates given by the Under Treasurer - Queensland Treasury as the Corporation Sole and the Chief Executive.

The Corporation Sole’s responsibility for the Half-year Financial Report

The Corporation Sole is responsible for the preparation of the half-year financial report that gives a true and fair view in accordance with Australian Accounting Standards and for such internal control as the Corporation Sole determines is necessary to enable the preparation of the half-year financial report that is free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

My responsibility is to express a conclusion on the half-year financial report based on my review. The review was conducted in accordance with the Auditor-General of Queensland Auditing Standards and Auditing Standard on Review Engagements ASRE 2410 Review of Interim and Other Financial Reports Performed by the Independent Auditor of the Entity, in order to state whether, on the basis of the procedures described, I have become aware of any matter that makes me believe that the half-year financial report is not in accordance with Australian Accounting Standards, including: giving a true and fair view of Queensland Treasury Corporation’s financial position as at 31 December 2011 and its performance for the half-year ended on that date: and complying with Accounting Standard AASB 134 Interim Financial Reporting. As the auditor of Queensland Treasury Corporation, ASRE 2410 requires that I comply with the ethical requirements relevant to the audit of the annual financial report.

A review of a half-year financial report consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Australian Auditing Standards and consequently does not enable me to obtain assurance that I would become aware of all significant matters that might be identified in an audit. Accordingly, I do not express an audit opinion.

Independence

The Auditor-General Act 2009 promotes the independence of the Auditor General and all authorised auditors. The Auditor-General is the auditor of all Queensland public sector entities and can only be removed by Parliament.

The Auditor-General may conduct an audit in anyway considered appropriate and is not subject to direction by any person about the way in which audit powers are to be exercised. The Auditor General has for the purposes of conducting an audit, access to all documents and property and can report to Parliament matters which in the Auditor-General’s opinion are significant.

Conclusion

Based on my review, which is not an audit, I have not become aware of any matter that makes me believe that the half-year financial report of Queensland Treasury Corporation does not:

(a) present a true and fair view, in all material respects, of the financial position of Queensland Treasury Corporation as at 31 December 2011, and of its financial performance and its cash flows for the half-year ended on that date;

(b) comply with Australian Accounting Standard AASB 134 Interim Financial Reporting.

Other Matters - Electronic Presentation of the Reviewed Financial Report

This review report relates to the financial report of Queensland Treasury Corporation for the half-year ended 31 December 2011. Where the financial report is included on Queensland Treasury Corporation’s website, the Corporation is responsible for the integrity of Queensland Treasury Corporation’s website and I have not been engaged to report on the integrity of Queensland Treasury Corporation’s website. The review report refers only to the subject matter described above. It does not provide an opinion on any other information which may have been hyperlinked to/ from these statements or otherwise included with the financial report. If users of the financial report are concerned with the inherent risks arising from publication on a website, they are advised to refer to the hard copy of the reviewed financial report to confirm the information contained in this website version of the financial report.

These matters also relate to the presentation of the reviewed financial report in other electronic media including CD Rom.

AUDITOR GENERAL

10 FEB 2012

OF QUEENSLAND

A M GREAVES CA

Auditor-General of Queensland

Queensland Audit Office

Brisbane

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 23

MANAGEMENT REPORT

FOR THE HALF-YEAR ENDED 31 DECEMBER 2011

Review of Operations

QTC made an operating loss for the half-year ended 31 December 2011 of A$406.6 million consisting of the following operating segment results:

Capital Markets Operations

During the period from 1 July 2011 to 31 December 2011, QTC continued in its ordinary course of business as the State of Queensland’s central financing authority and corporate treasury services provider. The operating profit after tax for the half-year ended 31 December 2011 for the Capital Markets Operations segment was A$120.2 million. The profit is primarily due to unrealised accounting gains on investments held in advance of future lending commitments in excess of the market adjustments on the underlying borrowings.

Long Term Assets

QTC holds a portfolio of assets which were transferred to QTC by the State Government under an administrative arrangement. These assets are the investments of QTC’s Long Term Assets segment and were accumulated to fund superannuation and other long-term obligations of the State such as insurance and long service leave. In return, QTC issued to the State fixed rate notes which has resulted in the State receiving a fixed rate of return on the notes, while QTC bears the impact of fluctuations in the value and returns on the asset portfolio.

QTC made an operating loss after tax of A$526.8 million for the Long Term Assets segment. The accumulated net losses incurred by the Long Term Assets segment to date have no impact on QTC’s capacity to meet its obligations as there is no cash flow effect for QTC.

In addition, under the Queensland Treasury Corporation Act 1988, any losses of the Corporation shall be the responsibility of the Consolidated Fund of the Queensland Government.

Principal risks and uncertainties

In the second half of 2011, an escalation of sovereign debt concerns led to substantial volatility in financial markets. Sentiment surrounding the European banking system and liquidity conditions are not expected to improve in the short term. Financial market conditions in 2012 are again likely to be impacted by the actions of European policymakers. The ability for the European region to reach a solution to the region’s debt crisis will have far reaching implications on financial markets and the broader global economy.

G P BRADLEY

Corporation Sole

Queensland Treasury Corporation

Brisbane

8 February 2012

P C NOBLE

Chief Executive

24 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

AUDAX AT FIDELIS

QUEENSLAND

TREASURY

CORPORATION

APPENDICES

CONTENTS

Appendix A – Loans to clients 26

Appendix B – QTC’s 2011-12 indicative borrowing program 30

Appendix C – Glossary 31

Appendix D – Contacts 32

25

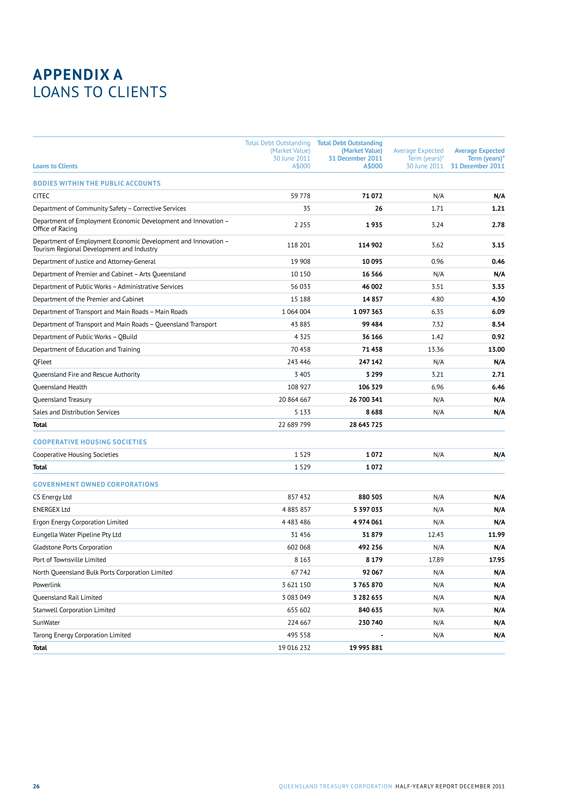

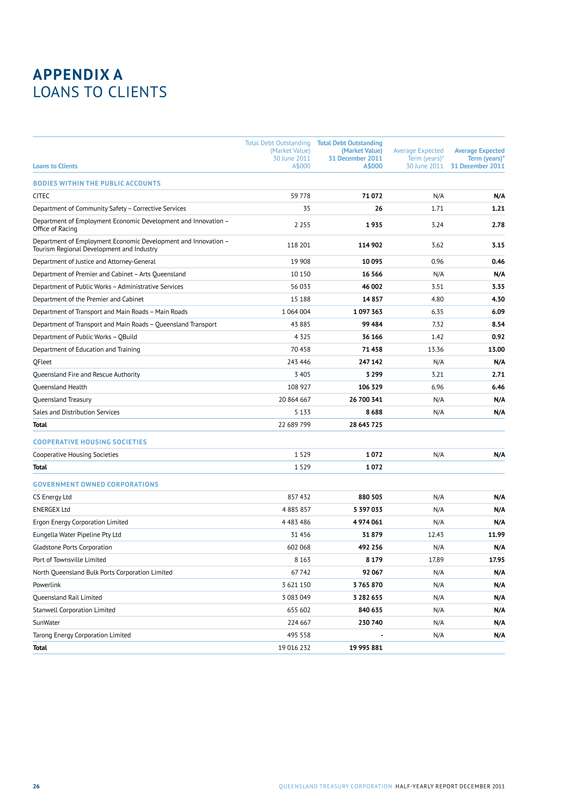

APPENDIX A

LOANS TO CLIENTS

Total Debt Outstanding Total Debt Outstanding

(Market Value) (Market Value) Average Expected Average Expected

30 June 2011 31 December 2011 Term (years)* Term (years)*

Loans to Clients A$000 A$000 30 June 2011 31 December 2011

BODIES WITHIN THE PUBLIC ACCOUNTS

CITEC 59 778 71 072 N/A N/A

Department of Community Safety – Corrective Services 35 26 1.71 1.21

Department of Employment Economic Development and Innovation – 2 255 1 935 3.24 2.78

Office of Racing

Department of Employment Economic Development and Innovation – 118 201 114 902 3.62 3.15

Tourism Regional Development and Industry

Department of Justice and Attorney-General 19 908 10 095 0.96 0.46

Department of Premier and Cabinet – Arts Queensland 10 150 16 566 N/A N/A

Department of Public Works – Administrative Services 56 033 46 002 3.51 3.35

Department of the Premier and Cabinet 15 188 14 857 4.80 4.30

Department of Transport and Main Roads – Main Roads 1 064 004 1 097 363 6.35 6.09

Department of Transport and Main Roads – Queensland Transport 43 885 99 484 7.32 8.54

Department of Public Works – QBuild 4 325 36 166 1.42 0.92

Department of Education and Training 70 458 71 458 13.36 13.00

QFleet 243 446 247 142 N/A N/A

Queensland Fire and Rescue Authority 3 405 3 299 3.21 2.71

Queensland Health 108 927 106 329 6.96 6.46

Queensland Treasury 20 864 667 26 700 341 N/A N/A

Sales and Distribution Services 5 133 8 688 N/A N/A

Total 22 689 799 28 645 725

COOPERATIVE HOUSING SOCIETIES

Cooperative Housing Societies 1 529 1 072 N/A N/A

Total 1 529 1 072

GOVERNMENT OWNED CORPORATIONS

CS Energy Ltd 857 432 880 505 N/A N/A

ENERGEX Ltd 4 885 857 5 397 033 N/A N/A

Ergon Energy Corporation Limited 4 483 486 4 974 061 N/A N/A

Eungella Water Pipeline Pty Ltd 31 456 31 879 12.43 11.99

Gladstone Ports Corporation 602 068 492 256 N/A N/A

Port of Townsville Limited 8 163 8 179 17.89 17.95

North Queensland Bulk Ports Corporation Limited 67 742 92 067 N/A N/A

Powerlink 3 621 150 3 765 870 N/A N/A

Queensland Rail Limited 3 083 049 3 282 655 N/A N/A

Stanwell Corporation Limited 655 602 840 635 N/A N/A

SunWater 224 667 230 740 N/A N/A

Tarong Energy Corporation Limited 495 558 - N/A N/A

Total 19 016 232 19 995 881

26 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

Loans to Clients

Total Debt Outstanding

(Market Value)

30 June 2011

A$000

Total Debt Outstanding

(Market Value)

31 December 2011

A$000

Average Expected

Term (years)*

30 June 2011

Average Expected

Term (years)*

31 December 2011

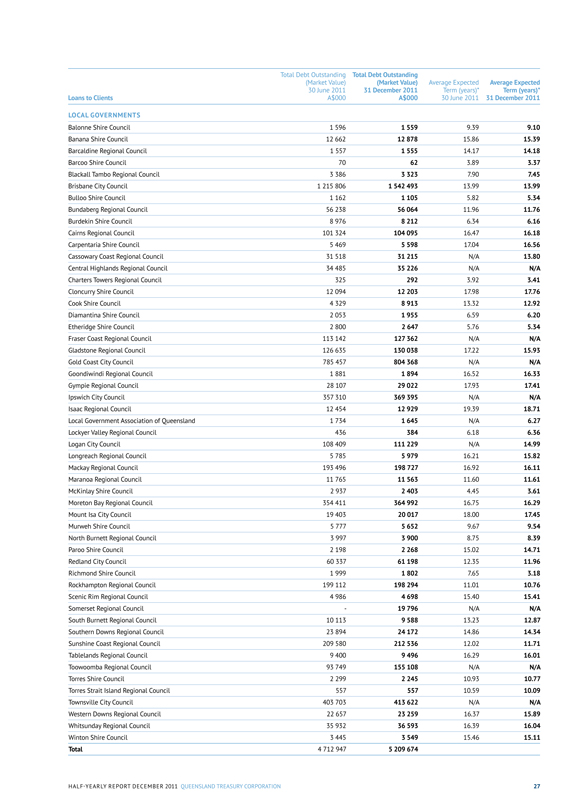

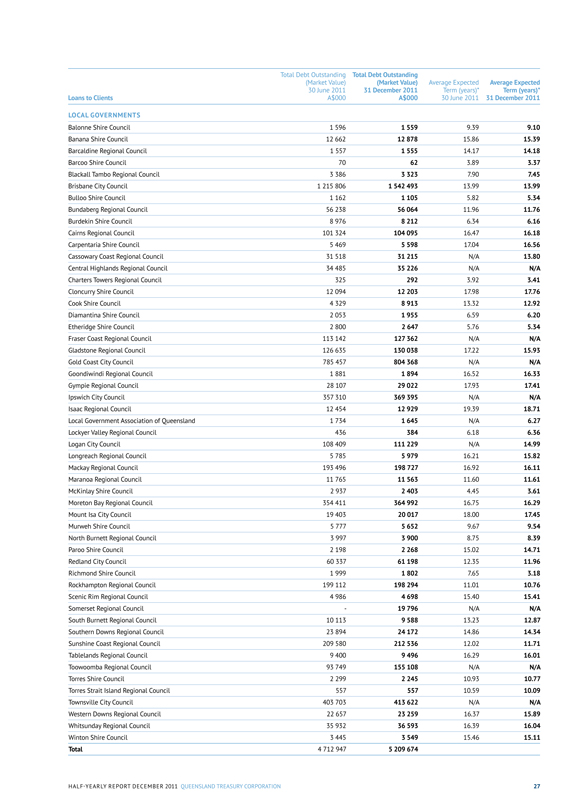

LOCAL GOVERNMENTS

Balonne Shire Council 1 596 1 559 9.39 9.10

Banana Shire Council 12 662 12 878 15.86 15.39

Barcaldine Regional Council 1 557 1 555 14.17 14.18

Barcoo Shire Council 70 62 3.89 3.37

Blackall Tambo Regional Council 3 386 3 323 7.90 7.45

Brisbane City Council 1 215 806 1 542 493 13.99 13.99

Bulloo Shire Council 1 162 1 105 5.82 5.34

Bundaberg Regional Council 56 238 56 064 11.96 11.76

Burdekin Shire Council 8 976 8 212 6.34 6.16

Cairns Regional Council 101 324 104 095 16.47 16.18

Carpentaria Shire Council 5 469 5 598 17.04 16.56

Cassowary Coast Regional Council 31 518 31 215 N/A 13.80

Central Highlands Regional Council 34 485 35 226 N/A N/A

Charters Towers Regional Council 325 292 3.92 3.41

Cloncurry Shire Council 12 094 12 203 17.98 17.76

Cook Shire Council 4 329 8 913 13.32 12.92

Diamantina Shire Council 2 053 1 955 6.59 6.20

Etheridge Shire Council 2 800 2 647 5.76 5.34

Fraser Coast Regional Council 113 142 127 362 N/A N/A

Gladstone Regional Council 126 635 130 038 17.22 15.93

Gold Coast City Council 785 457 804 368 N/A N/A

Goondiwindi Regional Council 1 881 1 894 16.52 16.33

Gympie Regional Council 28 107 29 022 17.93 17.41

Ipswich City Council 357 310 369 395 N/A N/A

Isaac Regional Council 12 454 12 929 19.39 18.71

Local Government Association of Queensland 1 734 1 645 N/A 6.27

Lockyer Valley Regional Council 436 384 6.18 6.36

Logan City Council 108 409 111 229 N/A 14.99

Longreach Regional Council 5 785 5 979 16.21 15.82

Mackay Regional Council 193 496 198 727 16.92 16.11

Maranoa Regional Council 11 765 11 563 11.60 11.61

McKinlay Shire Council 2 937 2 403 4.45 3.61

Moreton Bay Regional Council 354 411 364 992 16.75 16.29

Mount Isa City Council 19 403 20 017 18.00 17.45

Murweh Shire Council 5 777 5 652 9.67 9.54

North Burnett Regional Council 3 997 3 900 8.75 8.39

Paroo Shire Council 2 198 2 268 15.02 14.71

Redland City Council 60 337 61 198 12.35 11.96

Richmond Shire Council 1 999 1 802 7.65 3.18

Rockhampton Regional Council 199 112 198 294 11.01 10.76

Scenic Rim Regional Council 4 986 4 698 15.40 15.41

Somerset Regional Council - 19 796 N/A N/A

South Burnett Regional Council 10 113 9 588 13.23 12.87

Southern Downs Regional Council 23 894 24 172 14.86 14.34

Sunshine Coast Regional Council 209 580 212 536 12.02 11.71

Tablelands Regional Council 9 400 9 496 16.29 16.01

Toowoomba Regional Council 93 749 155 108 N/A N/A

Torres Shire Council 2 299 2 245 10.93 10.77

Torres Strait Island Regional Council 557 557 10.59 10.09

Townsville City Council 403 703 413 622 N/A N/A

Western Downs Regional Council 22 657 23 259 16.37 15.89

Whitsunday Regional Council 35 932 36 593 16.39 16.04

Winton Shire Council 3 445 3 549 15.46 15.11

Total 4 712 947 5 209 674

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 27

APPENDIX A

LOANS TO CLIENTS continued

Loans to Clients

Total Debt Outstanding

(Market Value)

30 June 2011

A$000

Total Debt Outstanding

(Market Value)

31 December 2011

A$000

Average Expected

Term (years)*

30 June 2011

Average Expected

Term (years)*

31 December 2011

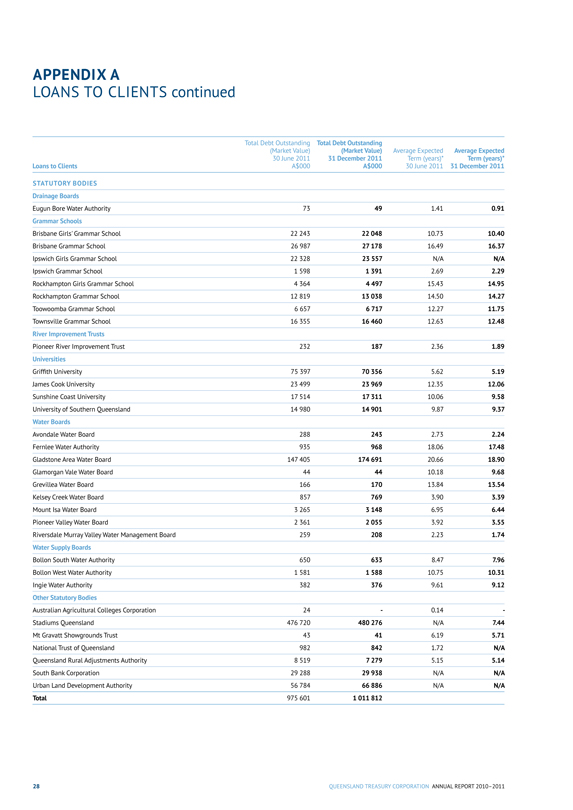

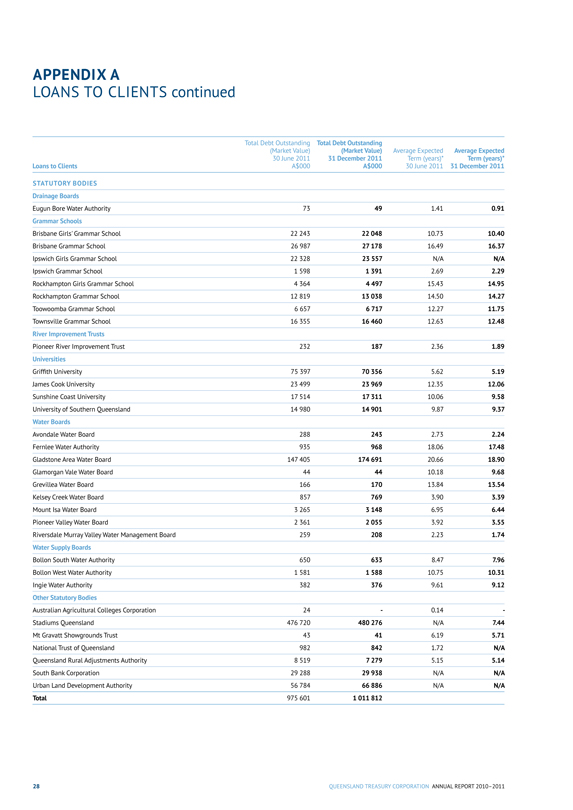

STATUTORY BODIES

Drainage Boards

Eugun Bore Water Authority 73 49 1.41 0.91

Grammar Schools

Brisbane Girls’ Grammar School 22 243 22 048 10.73 10.40

Brisbane Grammar School 26 987 27 178 16.49 16.37

Ipswich Girls Grammar School 22 328 23 557 N/A N/A

Ipswich Grammar School 1 598 1 391 2.69 2.29

Rockhampton Girls Grammar School 4 364 4 497 15.43 14.95

Rockhampton Grammar School 12 819 13 038 14.50 14.27

Toowoomba Grammar School 6 657 6 717 12.27 11.75

Townsville Grammar School 16 355 16 460 12.63 12.48

River Improvement Trusts

Pioneer River Improvement Trust 232 187 2.36 1.89

Universities

Griffith University 75 397 70 356 5.62 5.19

James Cook University 23 499 23 969 12.35 12.06

Sunshine Coast University 17 514 17 311 10.06 9.58

University of Southern Queensland 14 980 14 901 9.87 9.37

Water Boards

Avondale Water Board 288 243 2.73 2.24

Fernlee Water Authority 935 968 18.06 17.48

Gladstone Area Water Board 147 405 174 691 20.66 18.90

Glamorgan Vale Water Board 44 44 10.18 9.68

Grevillea Water Board 166 170 13.84 13.54

Kelsey Creek Water Board 857 769 3.90 3.39

Mount Isa Water Board 3 265 3 148 6.95 6.44

Pioneer Valley Water Board 2 361 2 055 3.92 3.55

Riversdale Murray Valley Water Management Board 259 208 2.23 1.74

Water Supply Boards

Bollon South Water Authority 650 633 8.47 7.96

Bollon West Water Authority 1 581 1 588 10.75 10.31

Ingie Water Authority 382 376 9.61 9.12

Other Statutory Bodies

Australian Agricultural Colleges Corporation 24 - 0.14 -

Stadiums Queensland 476 720 480 276 N/A 7.44

Mt Gravatt Showgrounds Trust 43 41 6.19 5.71

National Trust of Queensland 982 842 1.72 N/A

Queensland Rural Adjustments Authority 8 519 7 279 5.15 5.14

South Bank Corporation 29 288 29 938 N/A N/A

Urban Land Development Authority 56 784 66 886 N/A N/A

Total 975 601 1 011 812

28 QUEENSLAND TREASURY CORPORATION ANNUAL REPORT 2010–2011

Loans to Clients

Total Debt Outstanding

(Market Value)

30 June 2011

A$000

Total Debt Outstanding

(Market Value)

31 December 2011

A$000

Average Expected

Term (years)*

30 June 2011

Average Expected

Term (years)*

31 December 2011

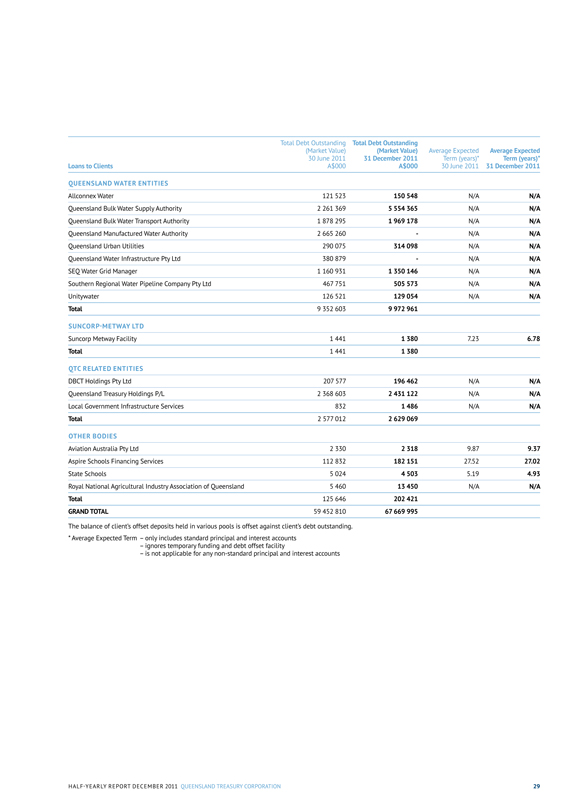

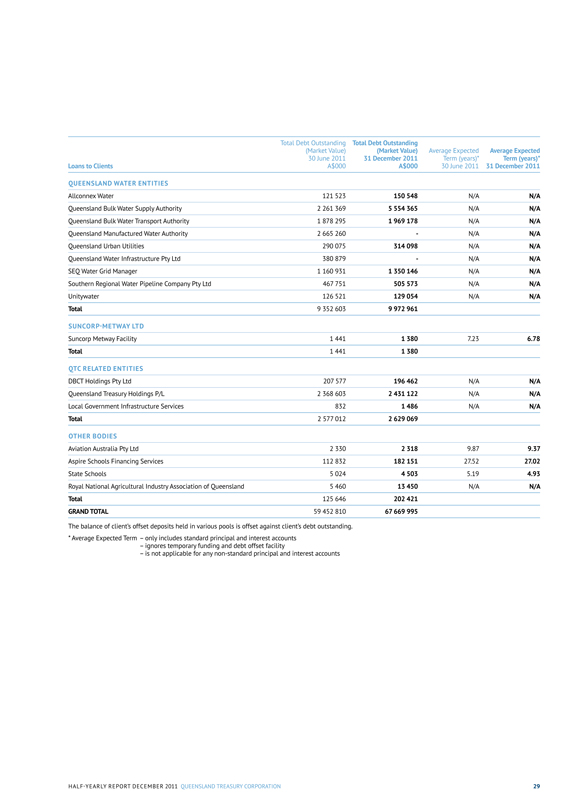

QUEENSLAND WATER ENTITIES

Allconnex Water 121 523 150 548 N/A N/A

Queensland Bulk Water Supply Authority 2 261 369 5 554 365 N/A N/A

Queensland Bulk Water Transport Authority 1 878 295 1 969 178 N/A N/A

Queensland Manufactured Water Authority 2 665 260 - N/A N/A

Queensland Urban Utilities 290 075 314 098 N/A N/A

Queensland Water Infrastructure Pty Ltd 380 879 - N/A N/A

SEQ Water Grid Manager 1 160 931 1 350 146 N/A N/A

Southern Regional Water Pipeline Company Pty Ltd 467 751 505 573 N/A N/A

Unitywater 126 521 129 054 N/A N/A

Total 9 352 603 9 972 961

SUNCORP-METWAY LTD

Suncorp Metway Facility 1 441 1 380 7.23 6.78

Total 1 441 1 380

QTC RELATED ENTITIES

DBCT Holdings Pty Ltd 207 577 196 462 N/A N/A

Queensland Treasury Holdings P/L 2 368 603 2 431 122 N/A N/A

Local Government Infrastructure Services 832 1 486 N/A N/A

Total 2 577 012 2 629 069

OTHER BODIES

Aviation Australia Pty Ltd 2 330 2 318 9.87 9.37

Aspire Schools Financing Services 112 832 182 151 27.52 27.02

State Schools 5 024 4 503 5.19 4.93

Royal National Agricultural Industry Association of Queensland 5 460 13 450 N/A N/A

Total 125 646 202 421

GRAND TOTAL 59 452 810 67 669 995

The balance of client’s offset deposits held in various pools is offset against client’s debt outstanding.

* Average Expected Term – only includes standard principal and interest accounts

– ignores temporary funding and debt offset facility

– is not applicable for any non-standard principal and interest accounts

HALF-YEARLY REPORT DECEMBER 2011 QUEENSLAND TREASURY CORPORATION 29

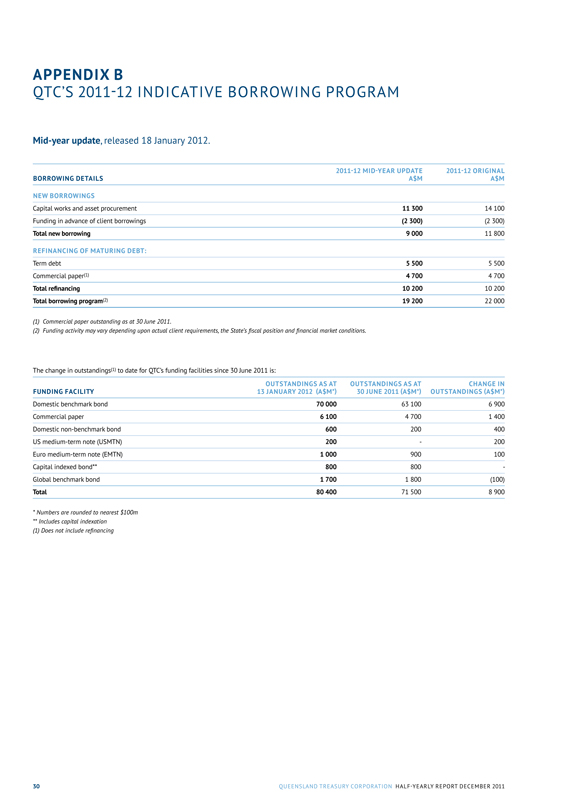

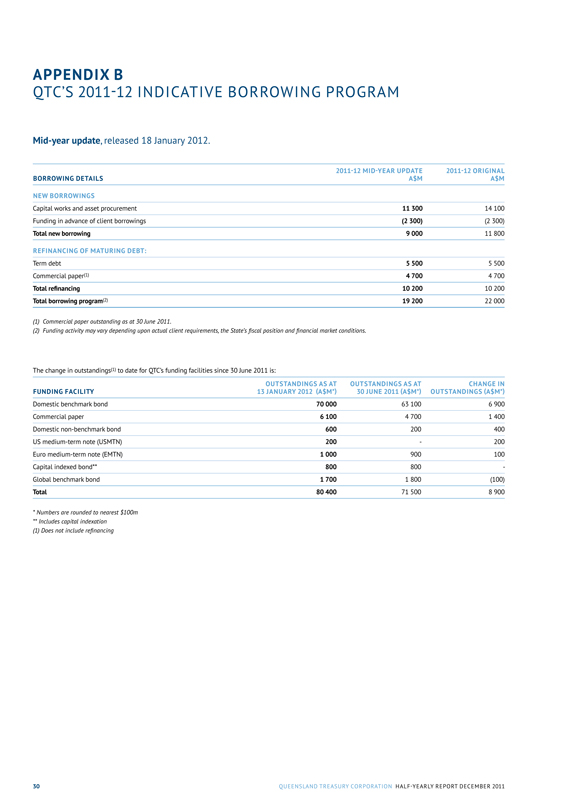

APPENDIX B

QTC’S 2011-12 INDICATIVE BORROWING PROGRAM

Mid-year update, released 18 January 2012.

2011-12 MID-YEAR UPDATE 2011-12 ORIGINAL

BORROWING DETAILS A$M A$M

NEW BORROWINGS

Capital works and asset procurement 11 300 14 100

Funding in advance of client borrowings (2 300) (2 300)

Total new borrowing 9 000 11 800

REFINANCING OF MATURING DEBT:

Term debt 5 500 5 500

Commercial paper(1) 4 700 4 700

Total refinancing 10 200 10 200

Total borrowing program(2) 19 200 22 000

(1) Commercial paper outstanding as at 30 June 2011.

(2) Funding activity may vary depending upon actual client requirements, the State’s fiscal position and financial market conditions.

The change in outstandings(1) to date for QTC’s funding facilities since 30 June 2011 is:

OUTSTANDINGS AS AT OUTSTANDINGS AS AT CHANGE IN

FUNDING FACILITY 13 JANUARY 2012 (A$M*) 30 JUNE 2011 (A$M*) OUTSTANDINGS (A$M*)

Domestic benchmark bond 70 000 63 100 6 900

Commercial paper 6 100 4 700 1 400

Domestic non-benchmark bond 600 200 400

US medium-term note (USMTN) 200 - 200

Euro medium-term note (EMTN) 1 000 900 100

Capital indexed bond** 800 800 -

Global benchmark bond 1 700 1 800 (100)

Total 80 400 71 500 8 900

* Numbers are rounded to nearest $100m

** Includes capital indexation

(1) Does not include refinancing

30 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2011

APPENDIX C

GLOSSARY

Australian Government Guarantee (AGG): Also known as the Commonwealth Government Guarantee. The Global Financial Crisis had an adverse effect on the state government bond market and threatened the capacity of state governments to deliver critical infrastructure projects. In response, on 25 March 2009, the Australian Government announced that it would provide a time limited, voluntary guarantee over Australian state and territory government borrowing, available for both existing and new issuances of securities over a range of maturities. On 16 June 2009, the Queensland Government announced it would take up the Australian Government’s offer of the guarantee on all existing AUD denominated benchmark bond lines (global and domestic) issued by QTC with a maturity date of between 12 months and 180 months (1-15 years). On 18 September 2009, the Reserve Bank of Australia (RBA) approved QTC’s application for the Australian Government Guarantee to be applied to selected AUD Domestic Benchmark bonds. On 11 December 2009, the RBA approved QTC’s application for the Australian Government Guarantee to be applied to selected AUD Global Benchmark bonds. The AGG was withdrawn for new borrowings after 31 December 2010.

Basis point: One hundredth of one per cent (0.01%).

Bond: A financial instrument whereby the borrower agrees to pay the investor a rate of interest for a fixed period of time. A typical bond will involve regular interest payments and a return of principal at maturity.

Commonwealth Government Guarantee (CGG): See Australian Government Guarantee above.

CP (commercial paper): A short term money market instrument issued at a discount with the full face value repaid at maturity.

CP can be issued in various currencies with a term to maturity of less than one year.