EXHIBIT (c)(vi)

The Queensland Treasury Corporation Half-Yearly Report for the half-year ended December 31, 2013

AUDAX AT FIDELIS

QUEENSLAND

TREASURY CORPORATION

HALF-YEARLY REPORT DECEMBER 2013

VISION

Securing Queensland’s financial success

MISSION

To deliver optimal financial outcomes through sound funding and financial risk management

VALUES

We are focused on our clients We are passionate about Queensland We value and respect our people We are collaborative and seek continuous improvement Above all else, we value integrity

As the Queensland Government’s central financing authority, Queensland Treasury Corporation (QTC) plays a pivotal role in securing the State’s financial success.

QTC provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, short- to medium-term cash management facilities, financial risk management advisory, and specialist public finance training.

Debt funding and management

QTC borrows funds in the domestic and global markets in the most cost-effective manner and in a way that minimises liquidity risk and refinancing risk. QTC achieves significant economies of scale and scope by issuing, managing and administering the State’s debt funding.

QTC works closely with Queensland’s public sector entities, including local governments, to assist them to most effectively manage their financial transactions, minimise their financial risk and achieve the best financial solutions for their organisation and the State.

Short- to medium-term cash management facilities

QTC assists the State’s public sector entities to make the best use of their short- to medium-term cash balances within a conservative risk management framework. It offers overnight and fixed-term facilities and a managed short-term fund.

Financial risk management advisory

QTC offers a range of financial risk management advisory services to clients, including:

n support to ensure financial risks are identified and effectively managed

n advice on financial and commercial considerations

n expertise in financial transactions and structures

n project management support to deliver key fiscal outcomes, and

n collaboration with the financial markets and private sector institutions.

Specialist public finance training

QTC offers a range of training courses that complement its products and advisory services and allow it to share its specialist financial, commercial, treasury management and risk management expertise with clients. Courses are developed and delivered by QTC’s experienced professionals and industry experts.

QUEENSLAND TREASURY CORPORATION

CONTENTS

Queensland Treasury Corporation

1

Update from the Chairman & Chief Executive

2

Financial Statements

3

Appendices

23

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION

1

UPDATE FROM THE CHAIRMAN & CHIEF EXECUTIVE

Borrowing program

In response to the State Government’s Mid-Year Fiscal and Economic Review, QTC released its mid-year update of its 2013-14 borrowing program on 19 December 2013. In this update, QTC’s borrowing task was reduced by $1 billion, as a result of better operating performance in the General Government sector, lower borrowing requirements across Government, and use of surplus liquidity.

The revised $11.1 billion borrowing program for 2013-14 consists of $6.1 billion of term debt, $3 billion of which had been raised by the end of the calendar year via:

n a syndicated $1.2 billion 2016 floating-rate note issue in September, which was QTC’s first issue of a floating-rate note since 2011

n a syndicated tap of its existing 2019 benchmark bond line, raising $1.1 billion and bringing this line to $4 billion, and

n an additional $500 million of its 2016 floating rate note via syndication in October.

In the period under review, QTC’s bond spreads contracted to those of the other Australian semi-government and Commonwealth issuers.

AUD benchmark bonds will remain QTC’s principal source of funding with other instruments, including floating rate notes, considered subject to funding requirements and investor preference. QTC also plans to maintain approximately $5 billion of short-term debt under its commercial paper and treasury-note programs.

Credit rating

In November, Standard & Poor’s affirmed Queensland and QTC’s credit rating at AA+/A-1+ with the outlook remaining stable, citing Australia’s strong institutional framework, together with Queensland’s strengthening economy, positive financial management and strong liquidity.

Whole-of-State benefits

QTC’s capital markets activities, together with its ability to leverage economies of scale, have delivered an estimated $162 million worth of benefits for clients in the six months to 31 December 2013. On the financial advisory side of its business, QTC is working with the State to deliver its wider fiscal priorities and support the Public Sector Commission’s implementation of the Commission of Audit recommendations.

Operating profit

For the half-year ended 31 December 2013, Queensland Treasury Corporation (QTC) achieved an operating profit from its capital markets operations of $97.9 million (HY2012: $225.4 million). In addition to these capital markets activities, QTC’s long-term assets operations recorded a $446.0 million profit (HY2012: $1,154.5 million)*.

G P BRADLEY

P C NOBLE

Chairman

Chief Executive

*Under an administrative arrangement, QTC on behalf of the State receives returns from investments held to meet the State’s long-term obligations, primarily superannuation, which are managed by QIC Limited. In return, QTC has issued to the State fixed-rate notes that provide a stable return. While QTC bears the fluctuations in the value of and returns on the long-term asset portfolio, there is no cash flow effect; any losses incurred would have no impact on QTC’s capital markets activities or its ability to meet its obligations.

2

QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

FINANCIAL STATEMENTS

FOR THE HALF-YEAR ENDED

31 DECEMBER 2013

CONTENTS

Statement of comprehensive income

4

Balance sheet

5

Statement of changes in equity

6

Statement of cash flows

7

Notes to and forming part of the Financial Statements

8

Certificate of the

Queensland Treasury Corporation

19

Independent Auditor’s review report

20

Management report

21

QUEENSLAND TREASURY CORPORATION

3

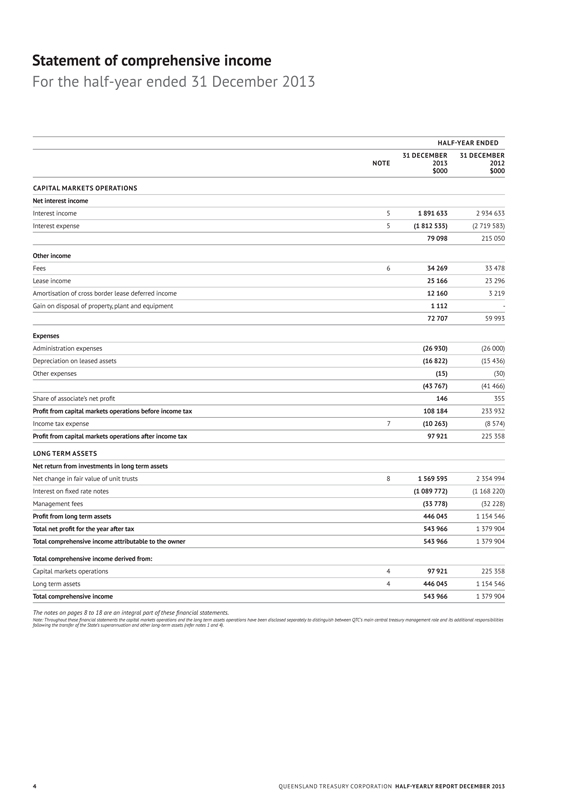

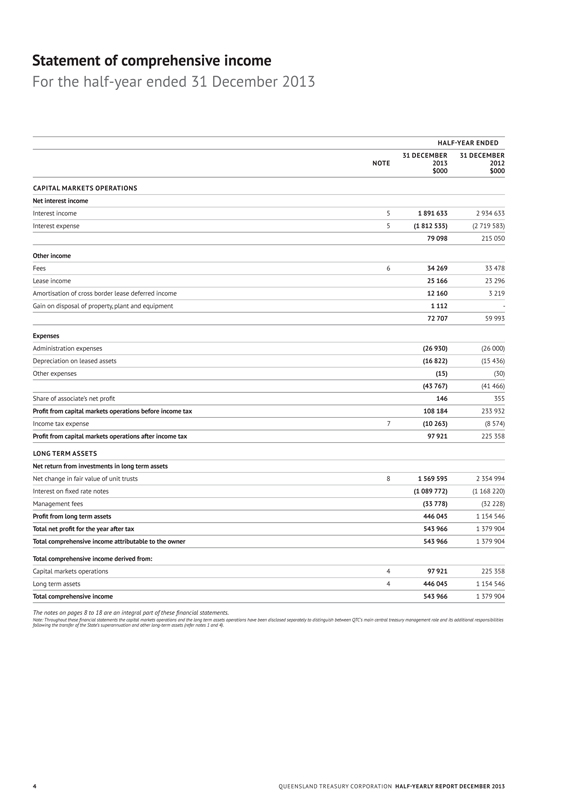

Statement of comprehensive income

For the half-year ended 31 December 2013

HALF-YEAR ENDED

NOTE

31 DECEMBER 2013 31 DECEMBER 2012

$000 $000

CAPITAL MARKETS OPERATIONS

Net interest income

Interest income 5 1 891 633 2 934 633

Interest expense 5 (1 812 535) (2 719 583)

79 098 215 050

Other income

Fees 6 34 269 33 478

Lease income 25 166 23 296

Amortisation of cross border lease deferred income 12 160 3 219

Gain on disposal of property, plant and equipment 1 112 —

72 707 59 993

Expenses

Administration expenses (26 930) (26 000)

Depreciation on leased assets (16 822) (15 436)

Other expenses (15) (30)

(43 767) (41 466)

Share of associate’s net profit 146 355

Profit from capital markets operations before income tax 108 184 233 932

Income tax expense 7 (10 263) (8 574)

Profit from capital markets operations after income tax 97 921 225 358

LONG TERM ASSETS

Net return from investments in long term assets

Net change in fair value of unit trusts 8 1 569 595 2 354 994

Interest on fixed rate notes (1 089 772) (1 168 220)

Management fees (33 778) (32 228)

Profit from long term assets 446 045 1 154 546

Total net profit for the year after tax 543 966 1 379 904

Total comprehensive income attributable to the owner 543 966 1 379 904

Total comprehensive income derived from:

Capital markets operations 4 97 921 225 358

Long term assets 4 446 045 1 154 546

Total comprehensive income 543 966 1 379 904

The notes on pages 8 to 18 are an integral part of these financial statements.

Note: Throughout these financial statements the capital markets operations and the long term assets operations have been disclosed separately to distinguish between QTC’s main central treasury management role and its additional responsibilities following the transfer of the State’s superannuation and other long-term assets (refer notes 1 and 4).

QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

4

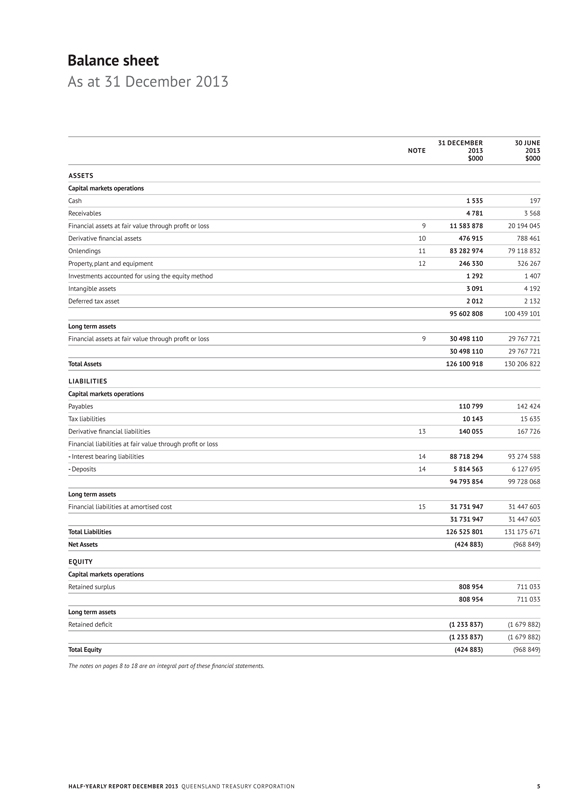

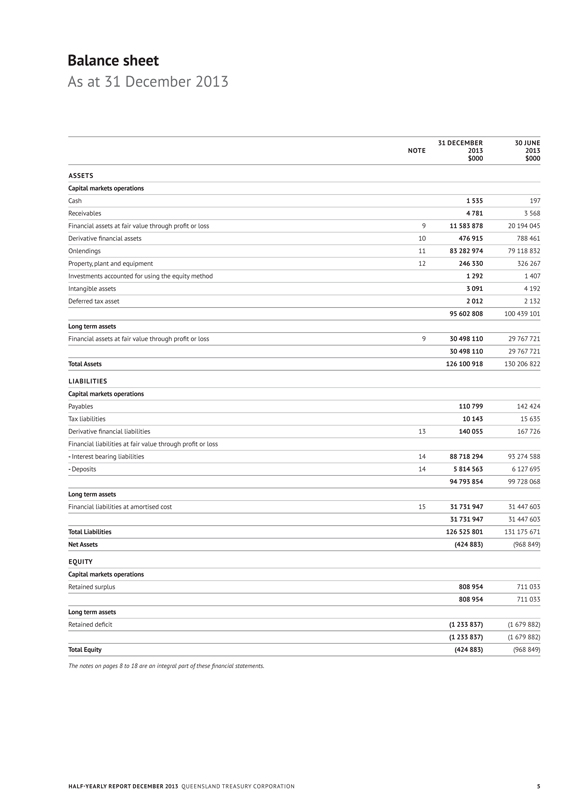

Balance sheet

As at 31 December 2013

NOTE

31 DECEMBER 2013 $000

30 JUNE 2013 $000

ASSETS

Capital markets operations

Cash 1 535 197

Receivables 4 781 3 568

Financial assets at fair value through profit or loss 9 11 583 878 20 194 045

Derivative financial assets 10 476 915 788 461

Onlendings 11 83 282 974 79 118 832

Property, plant and equipment 12 246 330 326 267

Investments accounted for using the equity method 1 292 1 407

Intangible assets 3 091 4 192

Deferred tax asset 2 012 2 132

95 602 808 100 439 101

Long term assets

Financial assets at fair value through profit or loss 9 30 498 110 29 767 721

30 498 110 29 767 721

Total Assets 126 100 918 130 206 822

LIABILITIES

Capital markets operations

Payables 110 799 142 424

Tax liabilities 10 143 15 635

Derivative financial liabilities 13 140 055 167 726

Financial liabilities at fair value through profit or loss

- Interest bearing liabilities 14 88 718 294 93 274 588

- Deposits 14 5 814 563 6 127 695

94 793 854 99 728 068

Long term assets

Financial liabilities at amortised cost 15 31 731 947 31 447 603

31 731 947 31 447 603

Total Liabilities 126 525 801 131 175 671

Net Assets (424 883) (968 849)

EQUITY

Capital markets operations

Retained surplus 808 954 711 033

808 954 711 033

Long term assets

Retained deficit (1 233 837) (1 679 882)

(1 233 837) (1 679 882)

Total Equity (424 883) (968 849)

The notes on pages 8 to 18 are an integral part of these financial statements.

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION

5

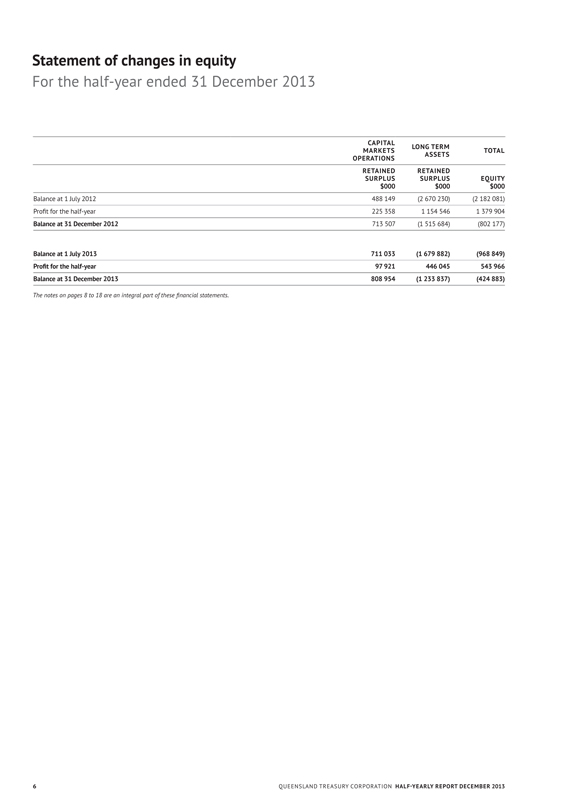

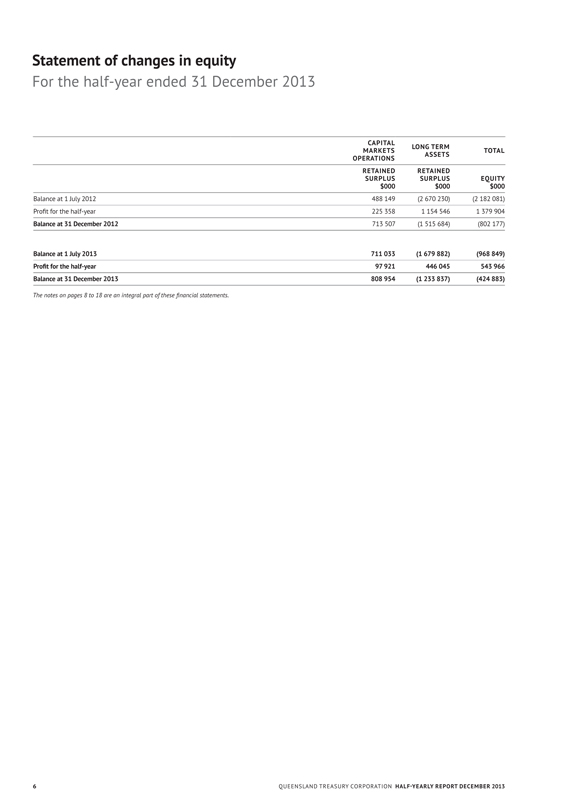

Statement of changes in equity

For the half-year ended 31 December 2013

CAPITAL MARKETS OPERATIONS

LONG TERM ASSETS

TOTAL

RETAINED SURPLUS $000

RETAINED SURPLUS $000

EQUITY $000

Balance at 1 July 2012

488 149

(2 670 230)

(2 182 081)

Profit for the half-year

225 358

1 154 546

1 379 904

Balance at 31 December 2012

713 507

(1 515 684)

(802 177)

Balance at 1 July 2013

711 033

(1 679 882)

(968 849)

Profit for the half-year

97 921

446 045

543 966

Balance at 31 December 2013

808 954

(1 233 837)

(424 883)

The notes on pages 8 to 18 are an integral part of these financial statements.

6

QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

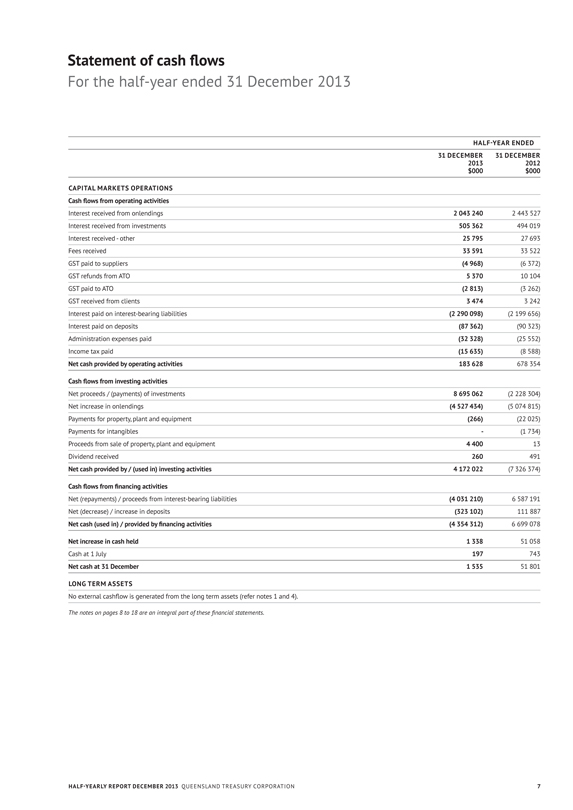

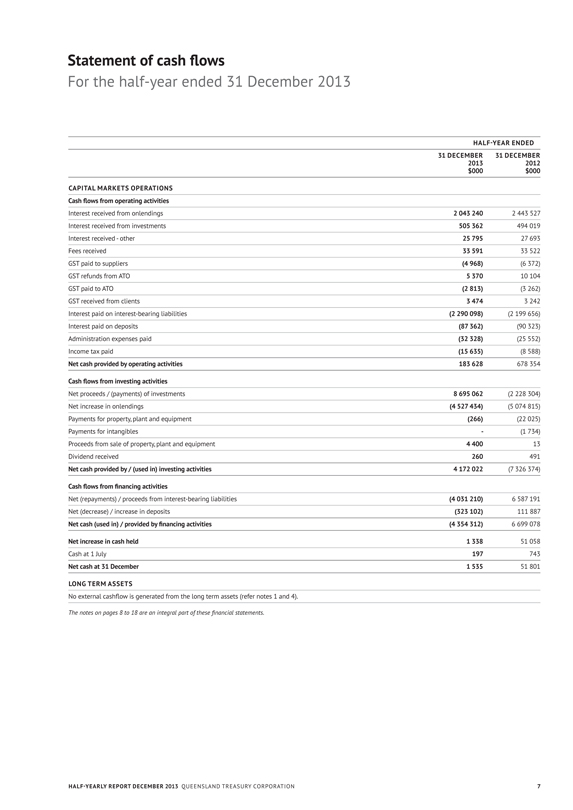

Statement of cash flows

For the half-year ended 31 December 2013

HALF-YEAR ENDED

31 DECEMBER 31 DECEMBER

2013 2012

$000 $000

CAPITAL MARKETS OPERATIONS

Cash flows from operating activities

Interest received from onlendings 2 043 240 2 443 527

Interest received from investments 505 362 494 019

Interest received - other 25 795 27 693

Fees received 33 591 33 522

GST paid to suppliers (4 968) (6 372)

GST refunds from ATO 5 370 10 104

GST paid to ATO (2 813) (3 262)

GST received from clients 3 474 3 242

Interest paid on interest-bearing liabilities (2 290 098) (2 199 656)

Interest paid on deposits (87 362) (90 323)

Administration expenses paid (32 328) (25 552)

Income tax paid (15 635) (8 588)

Net cash provided by operating activities 183 628 678 354

Cash flows from investing activities

Net proceeds / (payments) of investments 8 695 062 (2 228 304)

Net increase in onlendings (4 527 434) (5 074 815)

Payments for property, plant and equipment (266) (22 025)

Payments for intangibles — (1 734)

Proceeds from sale of property, plant and equipment 4 400 13

Dividend received 260 491

Net cash provided by / (used in) investing activities 4 172 022 (7 326 374)

Cash flows from financing activities

Net (repayments) / proceeds from interest-bearing liabilities (4 031 210) 6 587 191

Net (decrease) / increase in deposits (323 102) 111 887

Net cash (used in) / provided by financing activities (4 354 312) 6 699 078

Net increase in cash held 1 338 51 058

Cash at 1 July 197 743

Net cash at 31 December 1 535 51 801

LONG TERM ASSETS

No external cashflow is generated from the long term assets (refer notes 1 and 4).

The notes on pages 8 to 18 are an integral part of these financial statements.

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 7

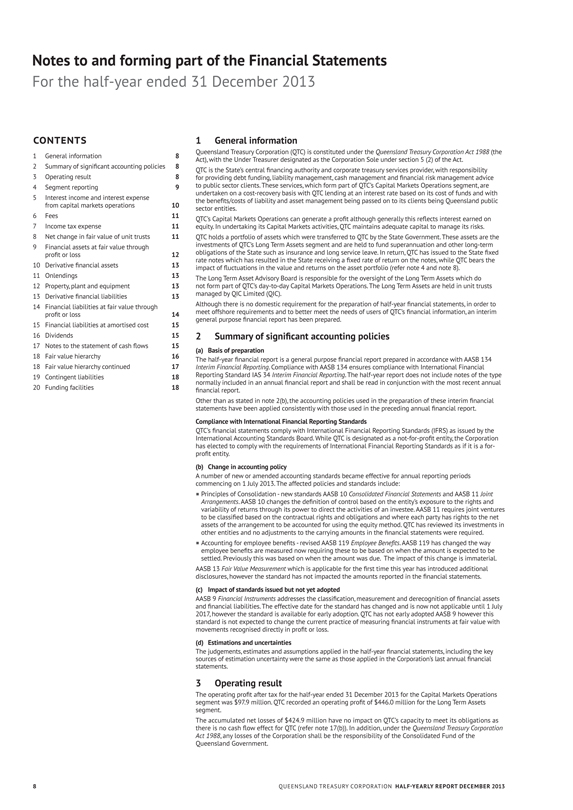

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

CONTENTS

1 General information 8

2 Summary of significant accounting policies 8

3 Operating result 8

4 Segment reporting 9

5 Interest income and interest expense from capital markets operations 10

6 Fees 11

7 Income tax expense 11

8 Net change in fair value of unit trusts 11

9 Financial assets at fair value through profit or loss 12

10 Derivative financial assets 13

11 Onlendings 13

12 Property, plant and equipment 13

13 Derivative financial liabilities 13

14 Financial liabilities at fair value through profit or loss 14

15 Financial liabilities at amortised cost 15

16 Dividends 15

17 Notes to the statement of cash flows 15

18 Fair value hierarchy 16

18 Fair value hierarchy continued 17

19 Contingent liabilities 18

20 Funding facilities 18

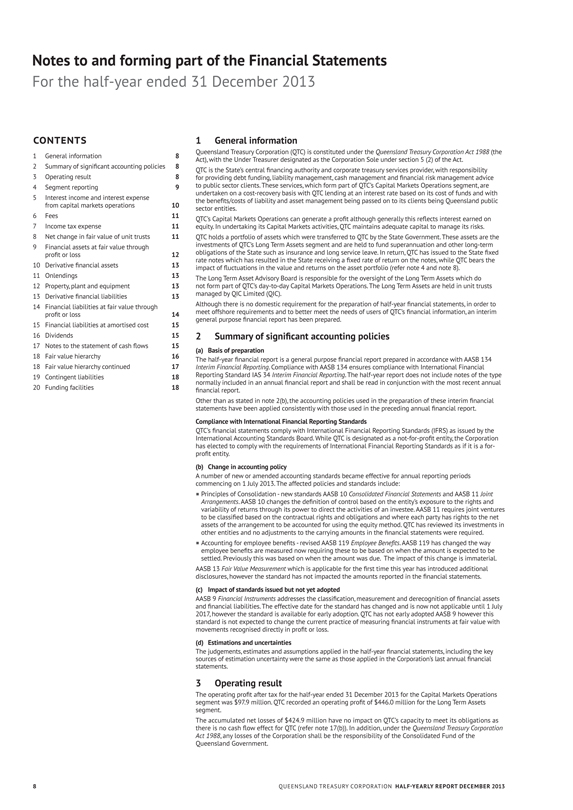

1 General information

Queensland Treasury Corporation (QTC) is constituted under the Queensland Treasury Corporation Act 1988 (the Act), with the Under Treasurer designated as the Corporation Sole under section 5 (2) of the Act. QTC is the State’s central financing authority and corporate treasury services provider, with responsibility for providing debt funding, liability management, cash management and financial risk management advice to public sector clients. These services, which form part of QTC’s Capital Markets Operations segment, are undertaken on a cost-recovery basis with QTC lending at an interest rate based on its cost of funds and with the benefits/costs of liability and asset management being passed on to its clients being Queensland public sector entities.

QTC’s Capital Markets Operations can generate a profit although generally this reflects interest earned on equity. In undertaking its Capital Markets activities, QTC maintains adequate capital to manage its risks. QTC holds a portfolio of assets which were transferred to QTC by the State Government. These assets are the investments of QTC’s Long Term Assets segment and are held to fund superannuation and other long-term obligations of the State such as insurance and long service leave. In return, QTC has issued to the State fixed rate notes which has resulted in the State receiving a fixed rate of return on the notes, while QTC bears the impact of fluctuations in the value and returns on the asset portfolio (refer note 4 and note 8).

The Long Term Asset Advisory Board is responsible for the oversight of the Long Term Assets which do not form part of QTC’s day-to-day Capital Markets Operations. The Long Term Assets are held in unit trusts managed by QIC Limited (QIC).

Although there is no domestic requirement for the preparation of half-year financial statements, in order to meet offshore requirements and to better meet the needs of users of QTC’s financial information, an interim general purpose financial report has been prepared.

2 Summary of significant accounting policies

(a) Basis of preparation

The half-year financial report is a general purpose financial report prepared in accordance with AASB 134 Interim Financial Reporting. Compliance with AASB 134 ensures compliance with International Financial Reporting Standard IAS 34 Interim Financial Reporting. The half-year report does not include notes of the type normally included in an annual financial report and shall be read in conjunction with the most recent annual financial report.

Other than as stated in note 2(b), the accounting policies used in the preparation of these interim financial statements have been applied consistently with those used in the preceding annual financial report.

Compliance with International Financial Reporting Standards

QTC’s financial statements comply with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. While QTC is designated as a not-for-profit entity, the Corporation has elected to comply with the requirements of International Financial Reporting Standards as if it is a for-profit entity.

(b) Change in accounting policy

A number of new or amended accounting standards became effective for annual reporting periods commencing on 1 July 2013. The affected policies and standards include:

¡ Principles of Consolidation - new standards AASB 10 Consolidated Financial Statements and AASB 11 Joint

Arrangements. AASB 10 changes the definition of control based on the entity’s exposure to the rights and variability of returns through its power to direct the activities of an investee. AASB 11 requires joint ventures to be classified based on the contractual rights and obligations and where each party has rights to the net assets of the arrangement to be accounted for using the equity method. QTC has reviewed its investments in other entities and no adjustments to the carrying amounts in the financial statements were required. ¡ Accounting for employee benefits - revised AASB 119 Employee Benefits. AASB 119 has changed the way employee benefits are measured now requiring these to be based on when the amount is expected to be settled. Previously this was based on when the amount was due. The impact of this change is immaterial. AASB 13 Fair Value Measurement which is applicable for the first time this year has introduced additional disclosures, however the standard has not impacted the amounts reported in the financial statements.

(c) Impact of standards issued but not yet adopted

AASB 9 Financial Instruments addresses the classification, measurement and derecognition of financial assets and financial liabilities. The effective date for the standard has changed and is now not applicable until 1 July 2017, however the standard is available for early adoption. QTC has not early adopted AASB 9 however this standard is not expected to change the current practice of measuring financial instruments at fair value with movements recognised directly in profit or loss.

(d) Estimations and uncertainties

The judgements, estimates and assumptions applied in the half-year financial statements, including the key sources of estimation uncertainty were the same as those applied in the Corporation’s last annual financial statements.

3 Operating result

The operating profit after tax for the half-year ended 31 December 2013 for the Capital Markets Operations segment was $97.9 million. QTC recorded an operating profit of $446.0 million for the Long Term Assets segment.

The accumulated net losses of $424.9 million have no impact on QTC’s capacity to meet its obligations as there is no cash flow effect for QTC (refer note 17(b)). In addition, under the Queensland Treasury Corporation Act 1988, any losses of the Corporation shall be the responsibility of the Consolidated Fund of the Queensland Government.

8 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

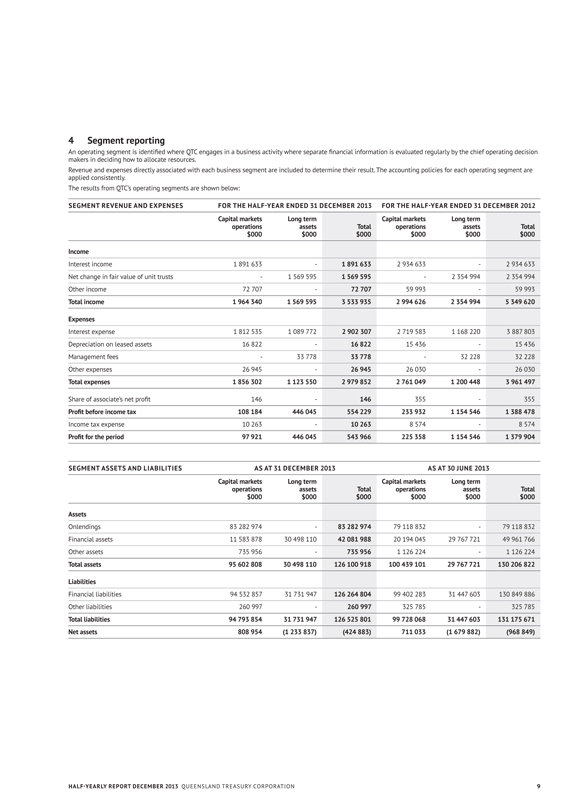

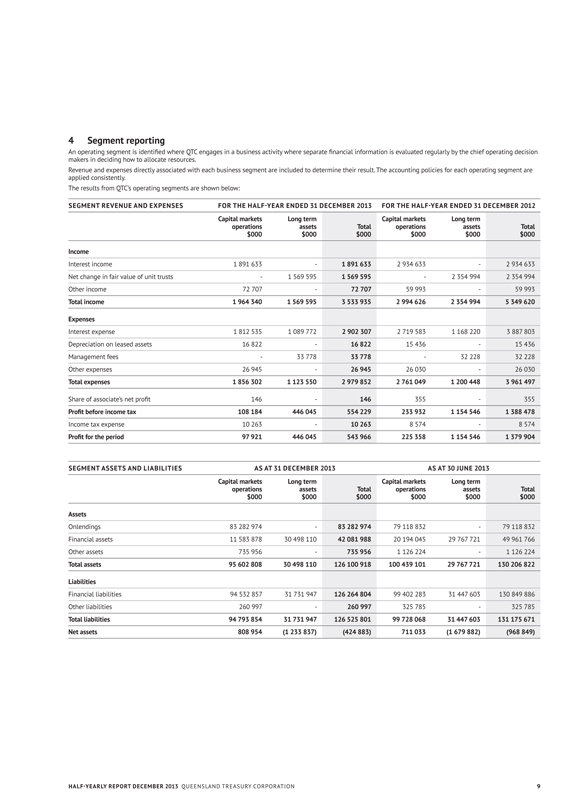

4 Segment reporting

An operating segment is identified where QTC engages in a business activity where separate financial information is evaluated regularly by the chief operating decision makers in deciding how to allocate resources.

Revenue and expenses directly associated with each business segment are included to determine their result. The accounting policies for each operating segment are applied consistently.

The results from QTC’s operating segments are shown below:

SEGMENT REVENUE AND EXPENSES FOR THE HALF-YEAR ENDED 31 DECEMBER 2013 FOR THE HALF-YEAR ENDED 31 DECEMBER 2012

Capital markets Long term Capital markets Long term operations assets Total operations assets Total

$000 $000 $000 $000 $000 $000

Income

Interest income 1 891 633 — 1 891 633 2 934 633 — 2 934 633

Net change in fair value of unit trusts — 1 569 595 1 569 595 — 2 354 994 2 354 994

Other income 72 707 — 72 707 59 993 — 59 993

Total income 1 964 340 1 569 595 3 533 935 2 994 626 2 354 994 5 349 620

Expenses

Interest expense 1 812 535 1 089 772 2 902 307 2 719 583 1 168 220 3 887 803

Depreciation on leased assets 16 822 — 16 822 15 436 — 15 436

Management fees — 33 778 33 778 — 32 228 32 228

Other expenses 26 945 — 26 945 26 030 — 26 030

Total expenses 1 856 302 1 123 550 2 979 852 2 761 049 1 200 448 3 961 497

Share of associate’s net profit 146 — 146 355 — 355

Profit before income tax 108 184 446 045 554 229 233 932 1 154 546 1 388 478

Income tax expense 10 263 — 10 263 8 574 — 8 574

Profit for the period 97 921 446 045 543 966 225 358 1 154 546 1 379 904

SEGMENT ASSETS AND LIABILITIES AS AT 31 DECEMBER 2013 AS AT 30 JUNE 2013

Capital markets Long term Capital markets Long term

operations assets Total operations assets Total

$000 $000 $000 $000 $000 $000

Assets

Onlendings 83 282 974 — 83 282 974 79 118 832 — 79 118 832

Financial assets 11 583 878 30 498 110 42 081 988 20 194 045 29 767 721 49 961 766

Other assets 735 956 — 735 956 1 126 224 — 1 126 224

Total assets 95 602 808 30 498 110 126 100 918 100 439 101 29 767 721 130 206 822

Liabilities

Financial liabilities 94 532 857 31 731 947 126 264 804 99 402 283 31 447 603 130 849 886

Other liabilities 260 997 — 260 997 325 785 — 325 785

Total liabilities 94 793 854 31 731 947 126 525 801 99 728 068 31 447 603 131 175 671

Net assets 808 954 (1 233 837) (424 883) 711 033 (1 679 882) (968 849)

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 9

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

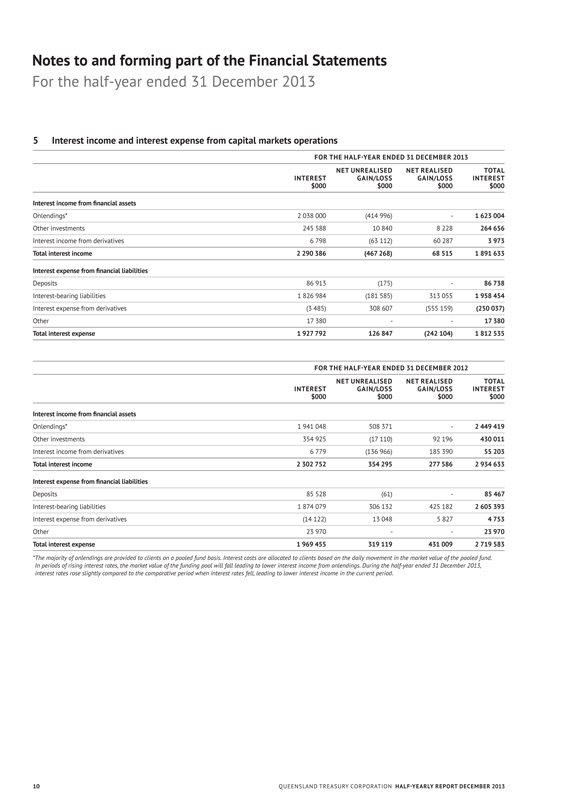

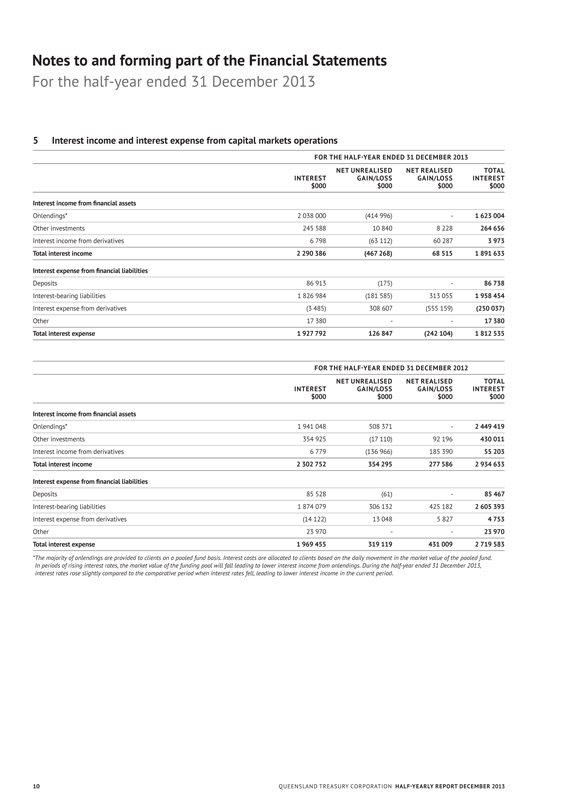

5 Interest income and interest expense from capital markets operations

FOR THE HALF-YEAR ENDED 31 DECEMBER 2013

NET UNREALISED NET REALISED TOTAL

INTEREST GAIN/LOSS GAIN/LOSS INTEREST

$000 $000 $000 $000

Interest income from financial assets

Onlendings* 2 038 000 (414 996) — 1 623 004

Other investments 245 588 10 840 8 228 264 656

Interest income from derivatives 6 798 (63 112) 60 287 3 973

Total interest income 2 290 386 (467 268) 68 515 1 891 633

Interest expense from financial liabilities

Deposits 86 913 (175) — 86 738

Interest-bearing liabilities 1 826 984 (181 585) 313 055 1 958 454

Interest expense from derivatives (3 485) 308 607 (555 159) (250 037)

Other 17 380 — — 17 380

Total interest expense 1 927 792 126 847 (242 104) 1 812 535

FOR THE HALF-YEAR ENDED 31 DECEMBER 2012

NET UNREALISED NET REALISED TOTAL

INTEREST GAIN/LOSS GAIN/LOSS INTEREST

$000 $000 $000 $000

Interest income from financial assets

Onlendings* 1 941 048 508 371 — 2 449 419

Other investments 354 925 (17 110) 92 196 430 011

Interest income from derivatives 6 779 (136 966) 185 390 55 203

Total interest income 2 302 752 354 295 277 586 2 934 633

Interest expense from financial liabilities

Deposits 85 528 (61) — 85 467

Interest-bearing liabilities 1 874 079 306 132 425 182 2 605 393

Interest expense from derivatives (14 122) 13 048 5 827 4 753

Other 23 970 — — 23 970

Total interest expense 1 969 455 319 119 431 009 2 719 583

*The majority of onlendings are provided to clients on a pooled fund basis. Interest costs are allocated to clients based on the daily movement in the market value of the pooled fund. In periods of rising interest rates, the market value of the funding pool will fall leading to lower interest income from onlendings. During the half-year ended 31 December 2013, interest rates rose slightly compared to the comparative period when interest rates fell, leading to lower interest income in the current period.

10 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

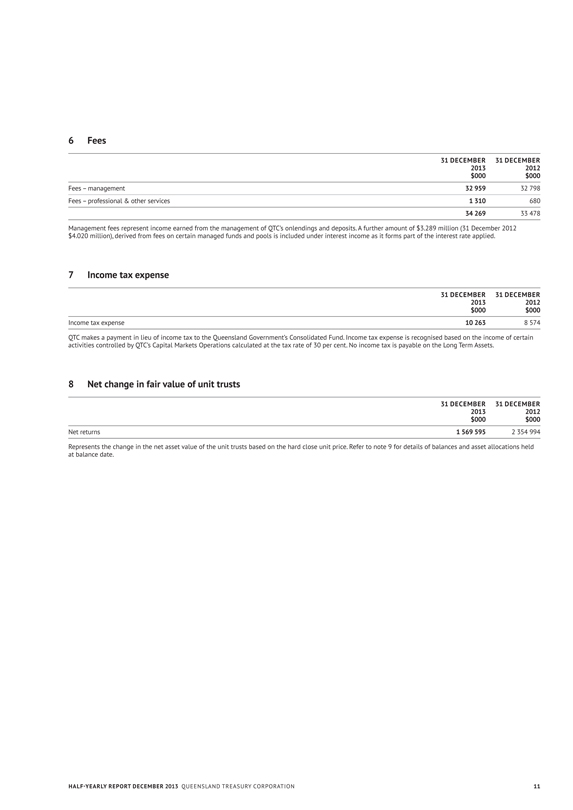

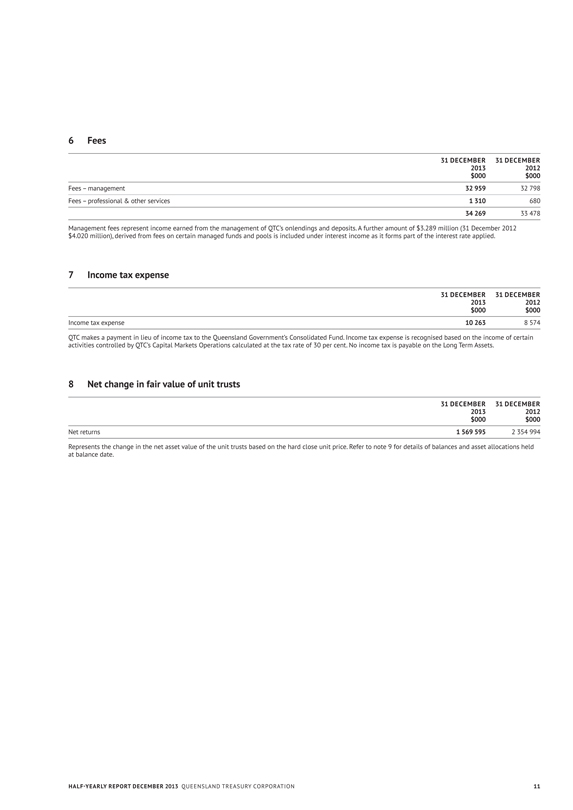

6 Fees

31 DECEMBER 31 DECEMBER

2013 2012

$000 $000

Fees – management 32 959 32 798

Fees – professional & other services 1 310 680

34 269 33 478

Management fees represent income earned from the management of QTC’s onlendings and deposits. A further amount of $3.289 million (31 December 2012 $4.020 million), derived from fees on certain managed funds and pools is included under interest income as it forms part of the interest rate applied.

7 Income tax expense

31 DECEMBER 31 DECEMBER

2013 2012

$000 $000

Income tax expense 10 263 8 574

QTC makes a payment in lieu of income tax to the Queensland Government’s Consolidated Fund. Income tax expense is recognised based on the income of certain activities controlled by QTC’s Capital Markets Operations calculated at the tax rate of 30 per cent. No income tax is payable on the Long Term Assets.

8 Net change in fair value of unit trusts

31 DECEMBER 31 DECEMBER

2013 2012

$000 $000

Net returns 1 569 595 2 354 994

Represents the change in the net asset value of the unit trusts based on the hard close unit price. Refer to note 9 for details of balances and asset allocations held at balance date.

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 11

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

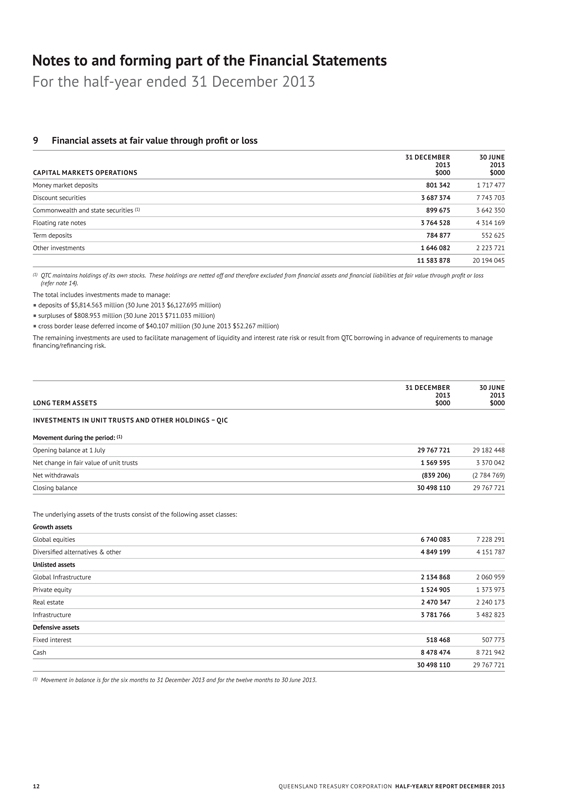

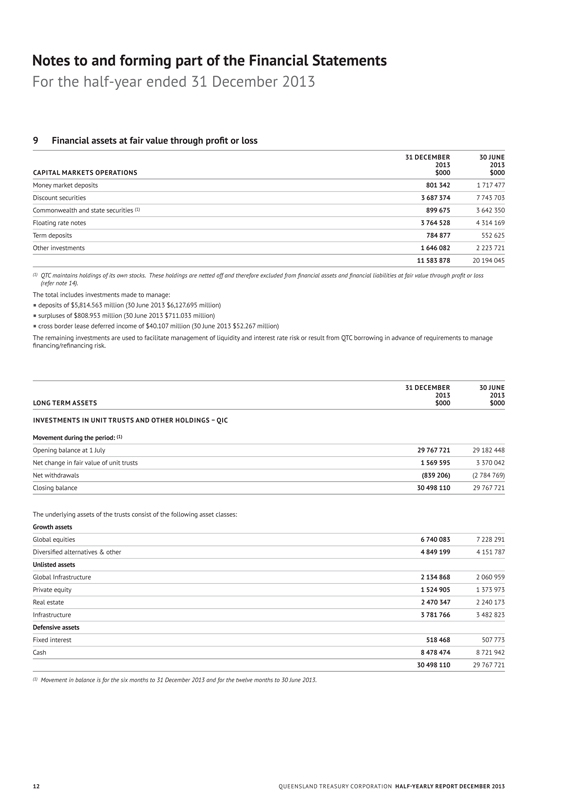

9 Financial assets at fair value through profit or loss

31 DECEMBER 30 JUNE

2013 2013

CAPITAL MARKETS OPERATIONS $000 $000

Money market deposits 801 342 1 717 477

Discount securities 3 687 374 7 743 703

Commonwealth and state securities (1) 899 675 3 642 350

Floating rate notes 3 764 528 4 314 169

Term deposits 784 877 552 625

Other investments 1 646 082 2 223 721

11 583 878 20 194 045

(1) QTC maintains holdings of its own stocks. These holdings are netted off and therefore excluded from financial assets and financial liabilities at fair value through profit or loss (refer note 14).

The total includes investments made to manage:

¡ deposits of $5,814.563 million (30 June 2013 $6,127.695 million)

¡ surpluses of $808.953 million (30 June 2013 $711.033 million)

¡ cross border lease deferred income of $40.107 million (30 June 2013 $52.267 million)

The remaining investments are used to facilitate management of liquidity and interest rate risk or result from QTC borrowing in advance of requirements to manage financing/refinancing risk.

31 DECEMBER 30 JUNE

2013 2013

LONG TERM ASSETS $000 $000

INVESTMENTS IN UNIT TRUSTS AND OTHER HOLDINGS – QIC

Movement during the period: (1)

Opening balance at 1 July 29 767 721 29 182 448

Net change in fair value of unit trusts 1 569 595 3 370 042

Net withdrawals (839 206) (2 784 769)

Closing balance 30 498 110 29 767 721

The underlying assets of the trusts consist of the following asset classes:

Growth assets

Global equities 6 740 083 7 228 291

Diversified alternatives & other 4 849 199 4 151 787

Unlisted assets

Global Infrastructure 2 134 868 2 060 959

Private equity 1 524 905 1 373 973

Real estate 2 470 347 2 240 173

Infrastructure 3 781 766 3 482 823

Defensive assets

Fixed interest 518 468 507 773

Cash 8 478 474 8 721 942

30 498 110 29 767 721

(1) Movement in balance is for the six months to 31 December 2013 and for the twelve months to 30 June 2013.

12 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

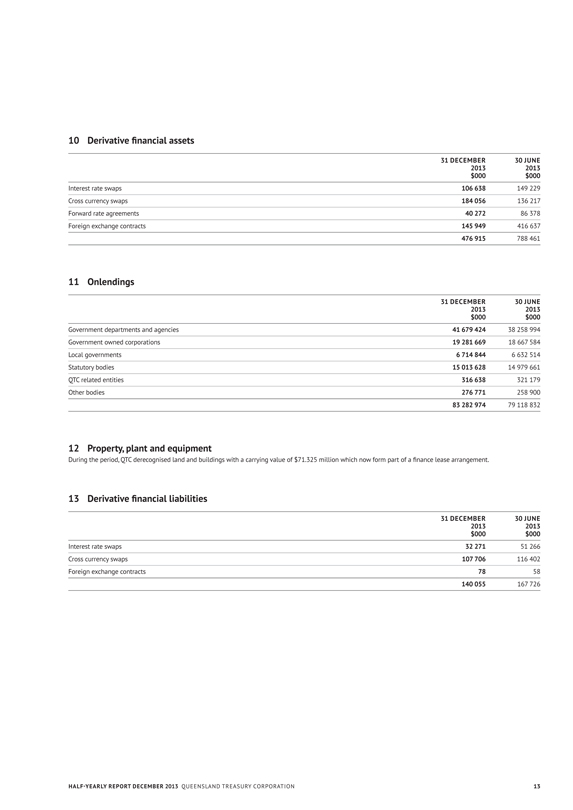

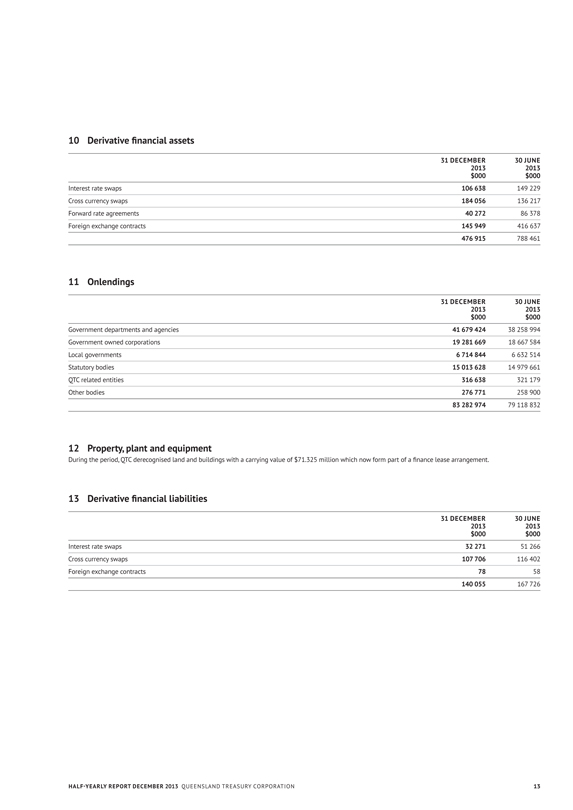

10 Derivative financial assets

31 DECEMBER 30 JUNE

2013 2013

$000 $000

Interest rate swaps 106 638 149 229

Cross currency swaps 184 056 136 217

Forward rate agreements 40 272 86 378

Foreign exchange contracts 145 949 416 637

476 915 788 461

11 Onlendings

31 DECEMBER 30 JUNE

2013 2013

$000 $000

Government departments and agencies 41 679 424 38 258 994

Government owned corporations 19 281 669 18 667 584

Local governments 6 714 844 6 632 514

Statutory bodies 15 013 628 14 979 661

QTC related entities 316 638 321 179

Other bodies 276 771 258 900

83 282 974 79 118 832

12 Property, plant and equipment

During the period, QTC derecognised land and buildings with a carrying value of $71.325 million which now form part of a finance lease arrangement.

13 Derivative financial liabilities

31 DECEMBER 30 JUNE

2013 2013

$000 $000

Interest rate swaps 32 271 51 266

Cross currency swaps 107 706 116 402

Foreign exchange contracts 78 58

140 055 167 726

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 13

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

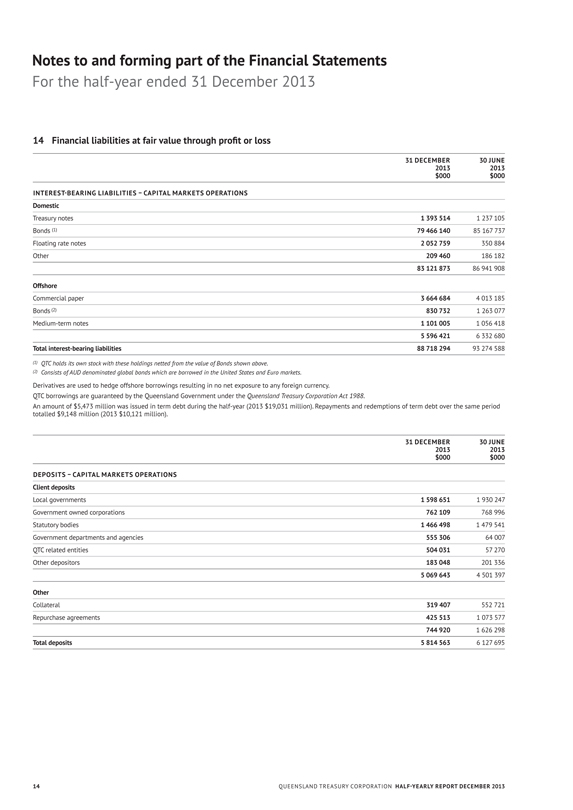

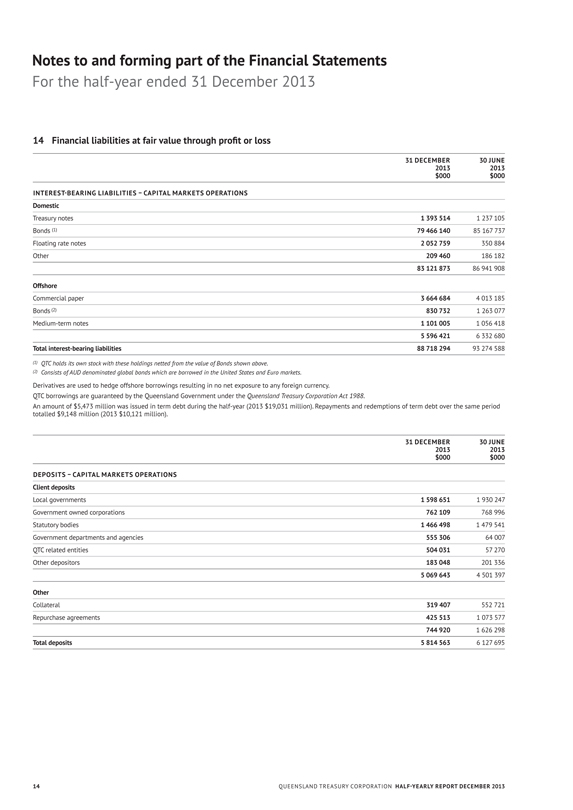

14 Financial liabilities at fair value through profit or loss

31 DECEMBER 30 JUNE

2013 2013

$000 $000

INTEREST-BEARING LIABILITIES – CAPITAL MARKETS OPERATIONS

Domestic

Treasury notes 1 393 514 1 237 105

Bonds (1) 79 466 140 85 167 737

Floating rate notes 2 052 759 350 884

Other 209 460 186 182

83 121 873 86 941 908

Offshore

Commercial paper 3 664 684 4 013 185

Bonds (2) 830 732 1 263 077

Medium-term notes 1 101 005 1 056 418

5 596 421 6 332 680

Total interest-bearing liabilities 88 718 294 93 274 588

(1) QTC holds its own stock with these holdings netted from the value of Bonds shown above.

(2) Consists of AUD denominated global bonds which are borrowed in the United States and Euro markets.

Derivatives are used to hedge offshore borrowings resulting in no net exposure to any foreign currency.

QTC borrowings are guaranteed by the Queensland Government under the Queensland Treasury Corporation Act 1988.

An amount of $5,473 million was issued in term debt during the half-year (2013 $19,031 million). Repayments and redemptions of term debt over the same period totalled $9,148 million (2013 $10,121 million).

31 DECEMBER 30 JUNE

2013 2013

$000 $000

DEPOSITS – CAPITAL MARKETS OPERATIONS

Client deposits

Local governments 1 598 651 1 930 247

Government owned corporations 762 109 768 996

Statutory bodies 1 466 498 1 479 541

Government departments and agencies 555 306 64 007

QTC related entities 504 031 57 270

Other depositors 183 048 201 336

5 069 643 4 501 397

Other

Collateral 319 407 552 721

Repurchase agreements 425 513 1 073 577

744 920 1 626 298

Total deposits 5 814 563 6 127 695

14 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

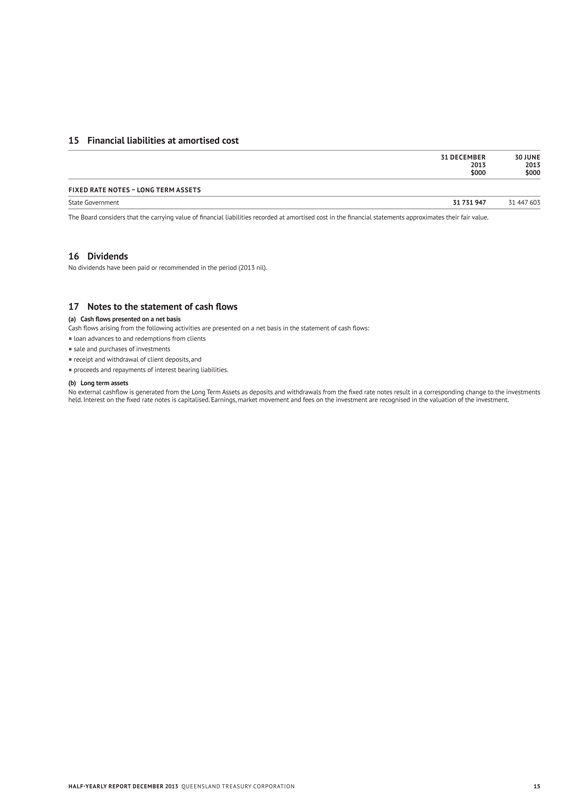

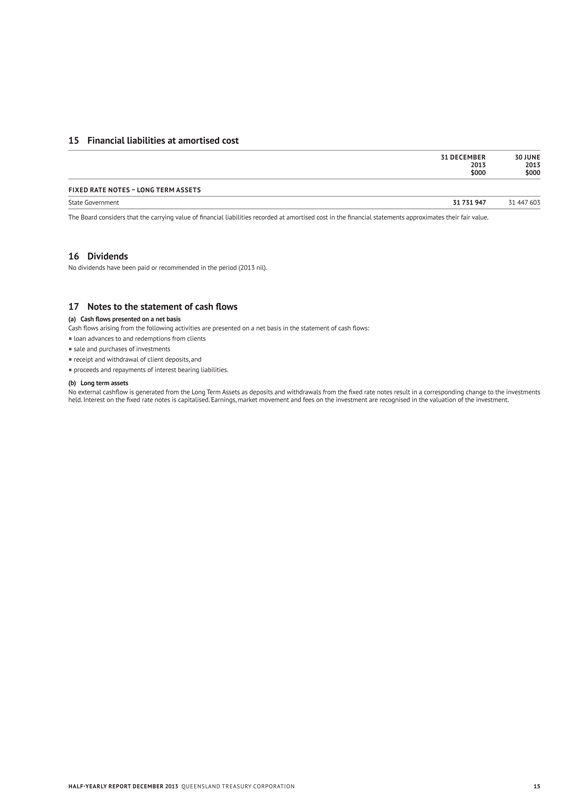

15 Financial liabilities at amortised cost

31 DECEMBER 30 JUNE

2013 2013

$000 $000

FIXED RATE NOTES – LONG TERM ASSETS

State Government 31 731 947 31 447 603

The Board considers that the carrying value of financial liabilities recorded at amortised cost in the financial statements approximates their fair value.

16 Dividends

No dividends have been paid or recommended in the period (2013 nil).

17 Notes to the statement of cash flows

(a) Cash flows presented on a net basis

Cash flows arising from the following activities are presented on a net basis in the statement of cash flows:

¡ loan advances to and redemptions from clients

¡ sale and purchases of investments

¡ receipt and withdrawal of client deposits, and

¡ proceeds and repayments of interest bearing liabilities.

(b) Long term assets

No external cashflow is generated from the Long Term Assets as deposits and withdrawals from the fixed rate notes result in a corresponding change to the investments held. Interest on the fixed rate notes is capitalised. Earnings, market movement and fees on the investment are recognised in the valuation of the investment.

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 15

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

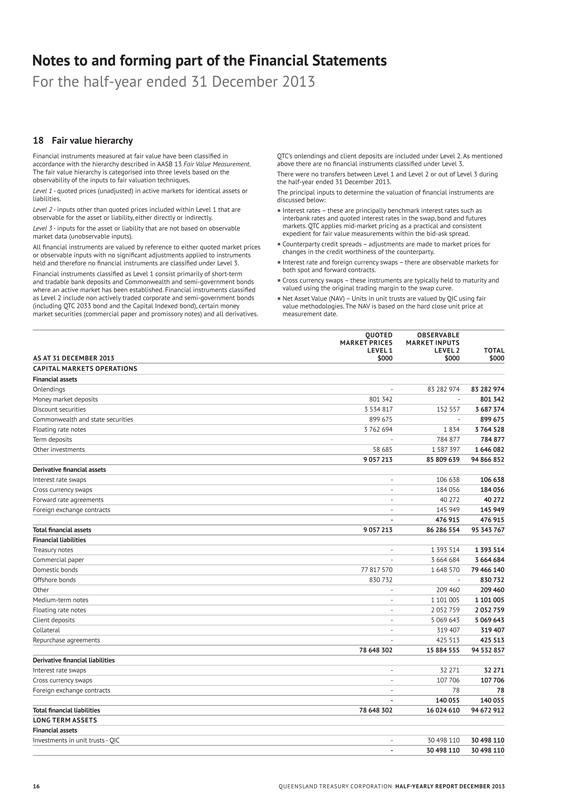

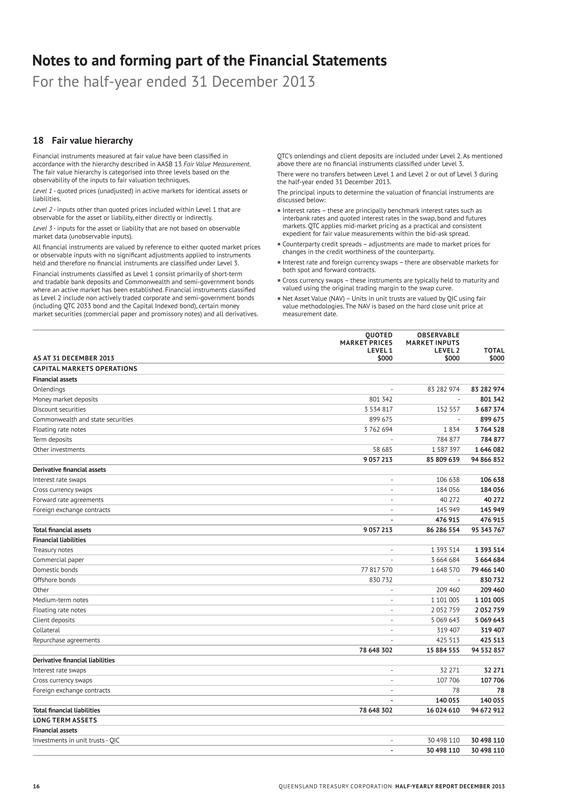

18 Fair value hierarchy

Financial instruments measured at fair value have been classified in accordance with the hierarchy described in AASB 13 Fair Value Measurement. The fair value hierarchy is categorised into three levels based on the observability of the inputs to fair valuation techniques.

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2 - inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

Level 3 - inputs for the asset or liability that are not based on observable market data (unobservable inputs).

All financial instruments are valued by reference to either quoted market prices or observable inputs with no significant adjustments applied to instruments held and therefore no financial instruments are classified under Level 3. Financial instruments classified as Level 1 consist primarily of short-term and tradable bank deposits and Commonwealth and semi-government bonds where an active market has been established. Financial instruments classified as Level 2 include non actively traded corporate and semi-government bonds (including QTC 2033 bond and the Capital Indexed bond), certain money market securities (commercial paper and promissory notes) and all derivatives.

QTC’s onlendings and client deposits are included under Level 2. As mentioned above there are no financial instruments classified under Level 3.

There were no transfers between Level 1 and Level 2 or out of Level 3 during the half-year ended 31 December 2013.

The principal inputs to determine the valuation of financial instruments are discussed below:

¡ Interest rates – these are principally benchmark interest rates such as interbank rates and quoted interest rates in the swap, bond and futures markets. QTC applies mid-market pricing as a practical and consistent expedient for fair value measurements within the bid-ask spread.

¡ Counterparty credit spreads – adjustments are made to market prices for changes in the credit worthiness of the counterparty.

¡ Interest rate and foreign currency swaps – there are observable markets for both spot and forward contracts.

¡ Cross currency swaps – these instruments are typically held to maturity and valued using the original trading margin to the swap curve.

¡ Net Asset Value (NAV) – Units in unit trusts are valued by QIC using fair value methodologies. The NAV is based on the hard close unit price at measurement date.

QUOTED OBSERVABLE

MARKET PRICES MARKET INPUTS

LEVEL 1 LEVEL 2 TOTAL

AS AT 31 DECEMBER 2013 $000 $000 $000

CAPITAL MARKETS OPERATIONS

Financial assets

Onlendings — 83 282 974 83 282 974

Money market deposits 801 342 — 801 342

Discount securities 3 534 817 152 557 3 687 374

Commonwealth and state securities 899 675 — 899 675

Floating rate notes 3 762 694 1 834 3 764 528

Term deposits — 784 877 784 877

Other investments 58 685 1 587 397 1 646 082

9 057 213 85 809 639 94 866 852

Derivative financial assets

Interest rate swaps — 106 638 106 638

Cross currency swaps — 184 056 184 056

Forward rate agreements — 40 272 40 272

Foreign exchange contracts — 145 949 145 949

— 476 915 476 915

Total financial assets 9 057 213 86 286 554 95 343 767

Financial liabilities

Treasury notes — 1 393 514 1 393 514

Commercial paper — 3 664 684 3 664 684

Domestic bonds 77 817 570 1 648 570 79 466 140

Offshore bonds 830 732 — 830 732

Other — 209 460 209 460

Medium-term notes — 1 101 005 1 101 005

Floating rate notes — 2 052 759 2 052 759

Client deposits — 5 069 643 5 069 643

Collateral — 319 407 319 407

Repurchase agreements — 425 513 425 513

78 648 302 15 884 555 94 532 857

Derivative financial liabilities

Interest rate swaps — 32 271 32 271

Cross currency swaps — 107 706 107 706

Foreign exchange contracts — 78 78

— 140 055 140 055

Total financial liabilities 78 648 302 16 024 610 94 672 912

LONG TERM ASSETS

Financial assets

Investments in unit trusts - QIC — 30 498 110 30 498 110

— 30 498 110 30 498 110

16 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

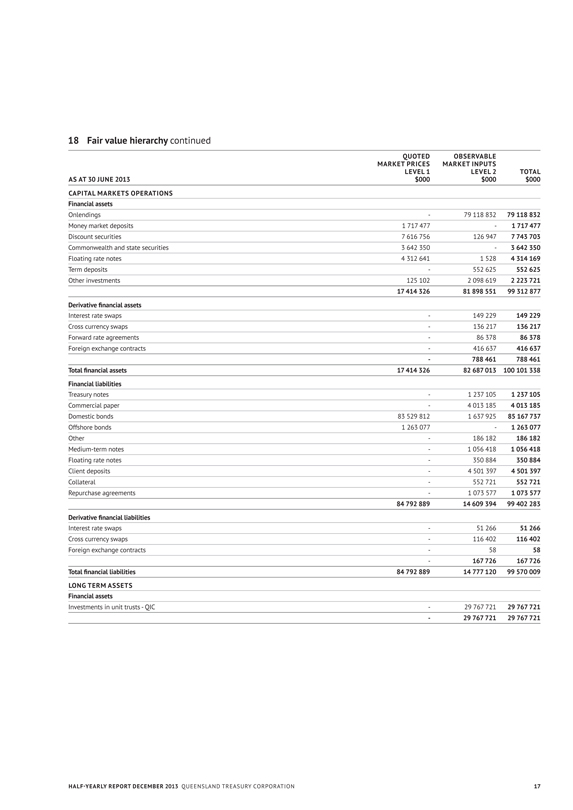

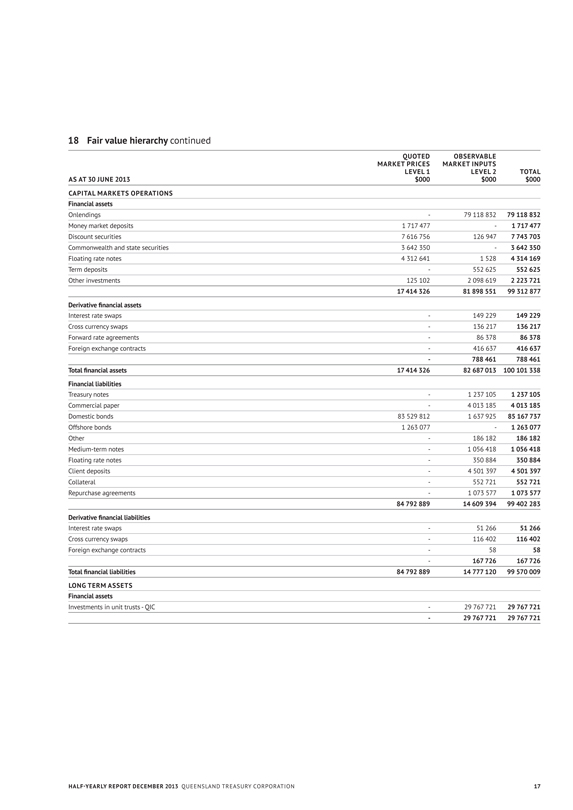

18 Fair value hierarchy continued

QUOTED OBSERVABLE

MARKET PRICES MARKET INPUTS

LEVEL 1 LEVEL 2 TOTAL

AS AT 30 JUNE 2013 $000 $000 $000

CAPITAL MARKETS OPERATIONS

Financial assets

Onlendings — 79 118 832 79 118 832

Money market deposits 1 717 477 — 1 717 477

Discount securities 7 616 756 126 947 7 743 703

Commonwealth and state securities 3 642 350 — 3 642 350

Floating rate notes 4 312 641 1 528 4 314 169

Term deposits — 552 625 552 625

Other investments 125 102 2 098 619 2 223 721

17 414 326 81 898 551 99 312 877

Derivative financial assets

Interest rate swaps — 149 229 149 229

Cross currency swaps — 136 217 136 217

Forward rate agreements — 86 378 86 378

Foreign exchange contracts — 416 637 416 637

— 788 461 788 461

Total financial assets 17 414 326 82 687 013 100 101 338

Financial liabilities

Treasury notes — 1 237 105 1 237 105

Commercial paper — 4 013 185 4 013 185

Domestic bonds 83 529 812 1 637 925 85 167 737

Offshore bonds 1 263 077 — 1 263 077

Other — 186 182 186 182

Medium-term notes — 1 056 418 1 056 418

Floating rate notes — 350 884 350 884

Client deposits — 4 501 397 4 501 397

Collateral — 552 721 552 721

Repurchase agreements — 1 073 577 1 073 577

84 792 889 14 609 394 99 402 283

Derivative financial liabilities

Interest rate swaps — 51 266 51 266

Cross currency swaps — 116 402 116 402

Foreign exchange contracts — 58 58

— 167 726 167 726

Total financial liabilities 84 792 889 14 777 120 99 570 009

LONG TERM ASSETS

Financial assets

Investments in unit trusts - QIC — 29 767 721 29 767 721

— 29 767 721 29 767 721

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 17

Notes to and forming part of the Financial Statements

For the half-year ended 31 December 2013

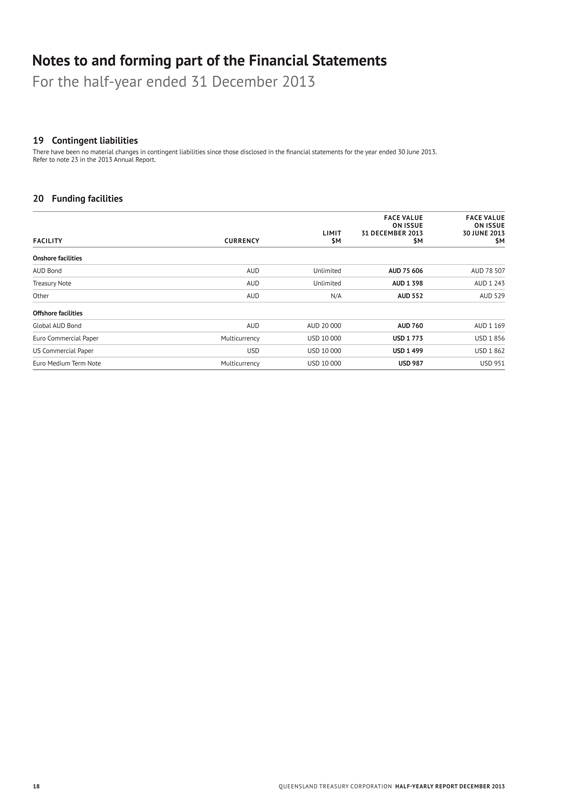

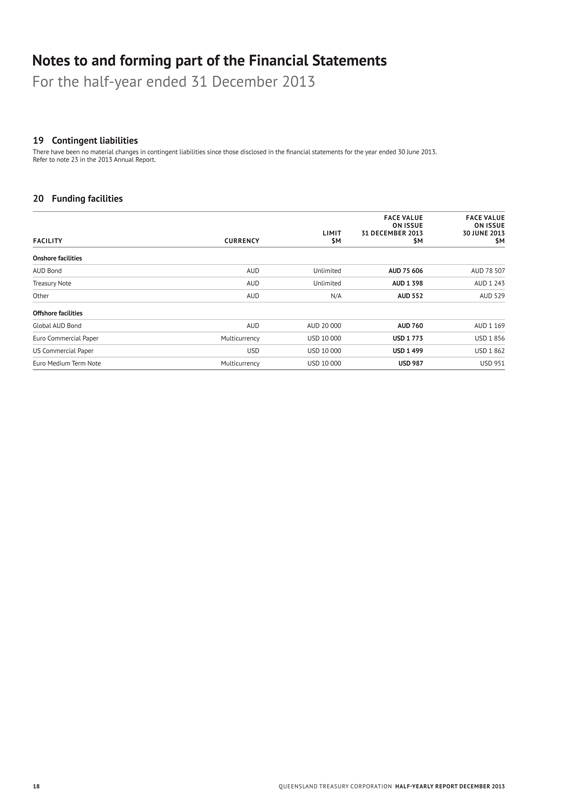

19 Contingent liabilities

There have been no material changes in contingent liabilities since those disclosed in the financial statements for the year ended 30 June 2013. Refer to note 23 in the 2013 Annual Report.

20 Funding facilities

FACE VALUE FACE VALUE

ON ISSUE ON ISSUE

LIMIT 31 DECEMBER 2013 30 JUNE 2013

FACILITY CURRENCY $M $M $M

Onshore facilities

AUD Bond AUD Unlimited AUD 75 606 AUD 78 507

Treasury Note AUD Unlimited AUD 1 398 AUD 1 243

Other AUD N/A AUD 552 AUD 529

Offshore facilities

Global AUD Bond AUD AUD 20 000 AUD 760 AUD 1 169

Euro Commercial Paper Multicurrency USD 10 000 USD 1 773 USD 1 856

US Commercial Paper USD USD 10 000 USD 1 499 USD 1 862

Euro Medium Term Note Multicurrency USD 10 000 USD 987 USD 951

18 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

Certificate of the Queensland Treasury Corporation

The foregoing general purpose financial statements have been prepared in accordance with the requirements of AASB 134: Interim Financial Reports. Compliance with AASB 134 ensures compliance with International Financial Reporting Standard

IAS 34: Interim Financial Reporting. We certify that in our opinion:

(i) the prescribed requirements for establishing and keeping the accounts have been complied with in all material respects

(ii) the foregoing half-year financial statements have been drawn up so as to present a true and fair view of Queensland Treasury Corporation’s assets and liabilities, financial position and financial performance for the half-year ended 31 December 2013, and

(iii) the interim management report includes a fair review of the information required under article 4(4) of the Law of January 11, 2008 on transparency requirements for issuers of securities on the Luxembourg Stock Exchange.

Signed in accordance with a resolution of the directors.

G P BRADLEY P C NOBLE

Chairman Chief Executive

Brisbane

12 February 2014

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 19

Independent Auditor’s review report

To the Capital Markets Board of Queensland Treasury Corporation

Review Report on the Half-year Financial Report

I have reviewed the accompanying half-year financial report of Queensland Treasury Corporation, which comprises the balance sheet as at 31 December 2013, and the statement of comprehensive income, statement of changes in equity and statement of cash flows for the half-year ended on that date, notes comprising a summary of significant accounting policies and other explanatory information, and the certificates given by the Chairman and Chief Executive.

The Corporation Sole’s responsibility for the Half-year Financial Report

The Corporation Sole is responsible for the preparation of the half-year financial report that gives a true and fair view in accordance with Australian Accounting Standards and for such internal control as the Corporation Sole determines is necessary to enable the preparation of the half-year financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

My responsibility is to express a conclusion on the half-year financial report based on my review. I conducted my review in accordance with the Auditor-General of Queensland Auditing Standards and Auditing Standard on Review Engagements ASRE 2410 Review of a Financial Report Performed by the Independent Auditor of the Entity, in order to state whether, on the basis of the procedures described, I have become aware of any matter that makes me believe that the half-year financial report is not in accordance with Australian Accounting Standards including: giving a true and fair view of Queensland Treasury Corporation’s financial position as at 31 December 2013 and its performance for the half-year ended on that date and complying with Accounting Standard AASB 134 Interim Financial Reporting. As the auditor of Queensland Treasury Corporation, ASRE 2410 requires that I comply with the ethical requirements relevant to the audit of the annual financial report.

A review of a half-year financial report consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Australian Auditing Standards and consequently does not enable me to obtain assurance that I would become aware of all significant matters that might be identified in an audit. Accordingly, I do not express an audit opinion.

Independence

The Auditor-General Act 2009 promotes the independence of the Auditor-General and all authorised auditors. The Auditor-General is the auditor of all Queensland public sector entities and can be removed only by Parliament.

The Auditor-General may conduct a review in any way considered appropriate and is not subject to direction by any person about the way in which audit powers are to be exercised. The Auditor-General has for the purposes of conducting a review, access to all documents and property and can report to Parliament matters which in the Auditor-General’s opinion are significant.

Conclusion

Based on my review, which is not an audit, I have not become aware of any matter that makes me believe that the half-year financial report of Queensland Treasury Corporation does not present a true and fair view, in all material respects, of the financial position of Queensland Treasury Corporation as at 31 December 2013 and of its financial performance for the half-year ended on that date; and comply with Australian Accounting Standard AASB 134 Interim Financial Reporting.

Other Matters – Electronic Presentation of the Reviewed Financial Report

Those viewing an electronic presentation of these financial statements should note that the review does not provide assurance on the integrity of the information presented electronically and does not provide an opinion on any information which may be hyperlinked to or from the financial statements. If users of the financial statements are concerned with the inherent risks arising from electronic presentation of information, they are advised to refer to the printed copy of the reviewed financial statements to confirm the accuracy of this electronically presented information.

A M GREAVES FCA FCPA

Auditor-General of Queensland

Queensland Audit Office

Brisbane

20 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

Management report for the half-year ended 31 December 2013

Review of operations

QTC made an operating profit after tax for the half-year ended 31 December 2013 of AUD544.0 million consisting of the following operating segment results:

n Capital Markets Operations

During the period from 1 July 2013 to 31 December 2013, QTC continued in its ordinary course of business as the State of Queensland’s central financing authority and corporate treasury services provider. The operating profit after tax for the half-year ended 31 December 2013 for the Capital Markets Operations segment was AUD97.9 million.

n Long Term Assets

QTC holds a portfolio of assets which were transferred to QTC by the State Government under an administrative arrangement. These assets are the investments of QTC’s Long Term Assets segment and were accumulated to fund superannuation and other long-term obligations of the State such as insurance and long service leave. In return, QTC issued to the State fixed rate notes which has resulted in the State receiving a fixed rate of return on the notes, while QTC bears the impact of fluctuations in the value and returns on the asset portfolio. The operating profit after tax for the Long Term Assets segment was AUD446.0 million. The accumulated net losses incurred by the Long Term Assets segment to date have no impact on QTC’s capacity to meet its obligations as there is no cash flow effect for QTC. In addition, under the Queensland Treasury Corporation Act 1988, any losses of the Corporation shall be the responsibility of the Consolidated Fund of the Queensland Government.

Principal risks and uncertainties

After some volatility in the latter part of 2012-13, financial market conditions were generally favourable during the first half of 2013-14.

The key risks and uncertainties over the remainder of the year include how smoothly US monetary policy is normalised and how effectively the Australian economy re-balances away from investment in the resource sector, neither of which are expected to impact on QTC’s performance or its ability to fund the State’s borrowing requirement.

G P BRADLEY

Chairman

P C NOBLE

Chief Executive

Brisbane

12 February 2014

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 21

22 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

APPENDICES

CONTENTS

Appendix A: Loans to clients 24

Appendix B: QTC’s 2013-14 indicative borrowing program 28

Appendix C: Contacts 29

AUDAX AT FIDELIS

QUEENSLAND TREASURY CORPORATION

23

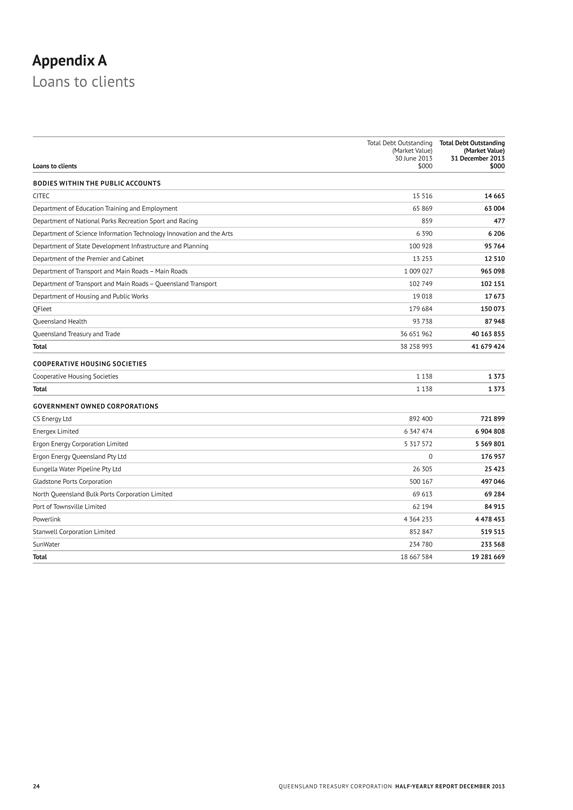

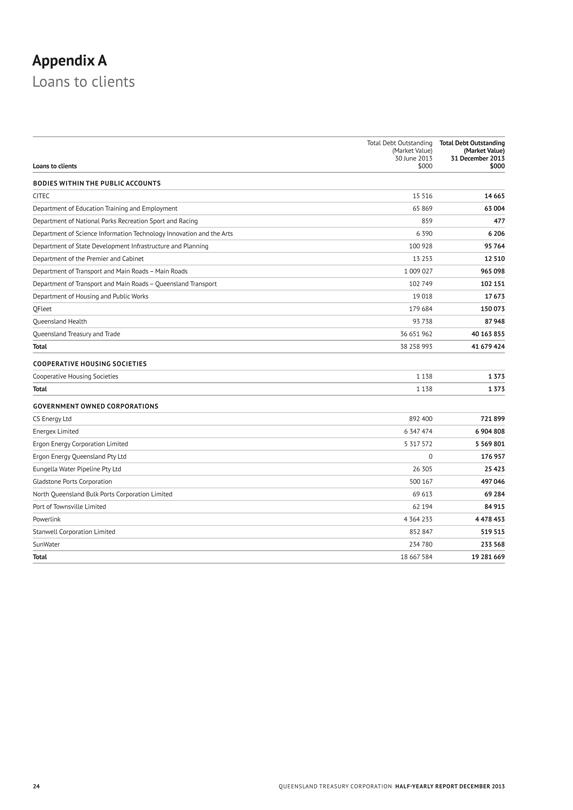

Appendix A

Loans to clients

Total Debt Outstanding (Market Value) 30 June 2013 $000

Total Debt Outstanding (Market Value) 31 December 2013 $000

Loans to clients

BODIES WITHIN THE PUBLIC ACCOUNTS

CITEC 15 516 14 665

Department of Education Training and Employment 65 869 63 004

Department of National Parks Recreation Sport and Racing 859 477

Department of Science Information Technology Innovation and the Arts 6 390 6 206

Department of State Development Infrastructure and Planning 100 928 95 764

Department of the Premier and Cabinet 13 253 12 510

Department of Transport and Main Roads – Main Roads 1 009 027 965 098

Department of Transport and Main Roads – Queensland Transport 102 749 102 151

Department of Housing and Public Works 19 018 17 673

QFleet 179 684 150 073

Queensland Health 93 738 87 948

Queensland Treasury and Trade 36 651 962 40 163 855

Total 38 258 993 41 679 424

COOPERATIVE HOUSING SOCIETIES

Cooperative Housing Societies 1 138 1 373

Total 1 138 1 373

GOVERNMENT OWNED CORPORATIONS

CS Energy Ltd 892 400 721 899

Energex Limited 6 347 474 6 904 808

Ergon Energy Corporation Limited 5 317 572 5 569 801

Ergon Energy Queensland Pty Ltd 0 176 957

Eungella Water Pipeline Pty Ltd 26 305 25 423

Gladstone Ports Corporation 500 167 497 046

North Queensland Bulk Ports Corporation Limited 69 613 69 284

Port of Townsville Limited 62 194 84 915

Powerlink 4 364 233 4 478 453

Stanwell Corporation Limited 852 847 519 515

SunWater 234 780 233 568

Total 18 667 584 19 281 669

24 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

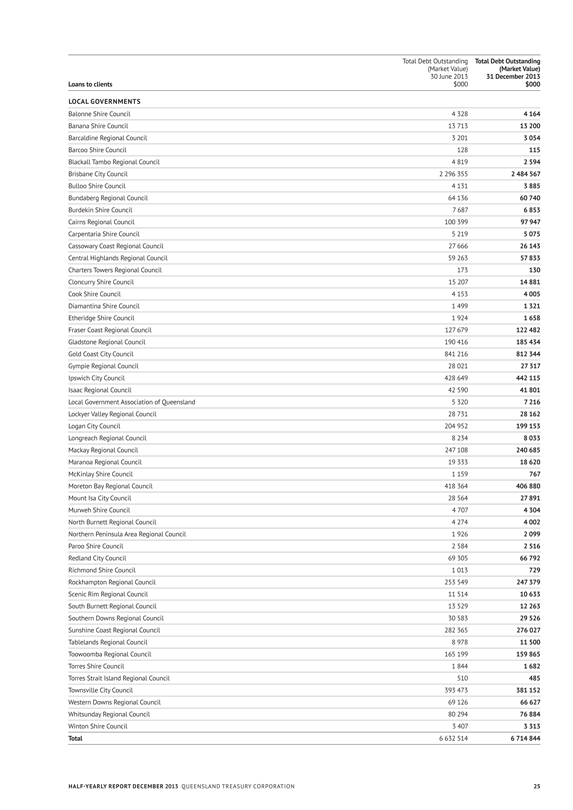

Total Debt Outstanding (Market Value) 30 June 2013

Total Debt Outstanding (Market Value) 31 December 2013

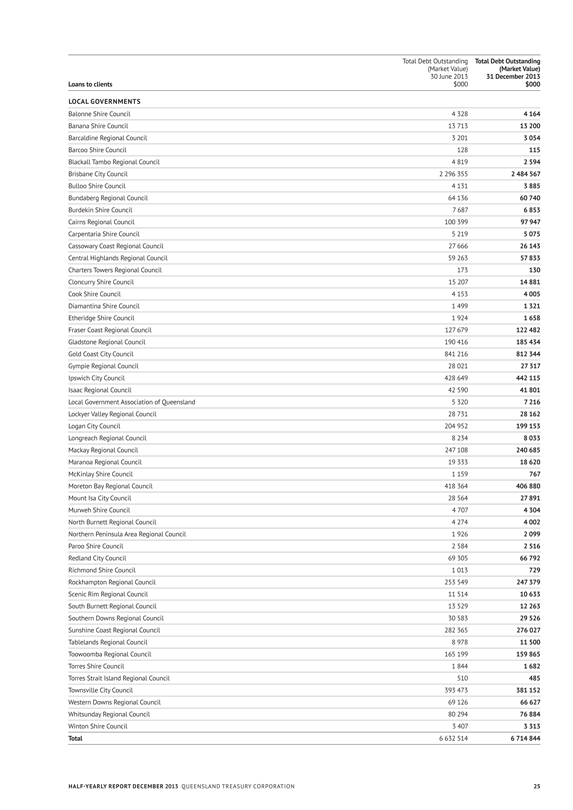

Loans to clients $000 $000

LOCAL GOVERNMENTS

Balonne Shire Council 4 328 4 164

Banana Shire Council 13 713 13 200

Barcaldine Regional Council 3 201 3 054

Barcoo Shire Council 128 115

Blackall Tambo Regional Council 4 819 2 594

Brisbane City Council 2 296 355 2 484 567

Bulloo Shire Council 4 131 3 885

Bundaberg Regional Council 64 136 60 740

Burdekin Shire Council 7 687 6 853

Cairns Regional Council 100 399 97 947

Carpentaria Shire Council 5 219 5 075

Cassowary Coast Regional Council 27 666 26 143

Central Highlands Regional Council 59 263 57 833

Charters Towers Regional Council 173 130

Cloncurry Shire Council 15 207 14 881

Cook Shire Council 4 153 4 005

Diamantina Shire Council 1 499 1 321

Etheridge Shire Council 1 924 1 658

Fraser Coast Regional Council 127 679 122 482

Gladstone Regional Council 190 416 185 434

Gold Coast City Council 841 216 812 344

Gympie Regional Council 28 021 27 317

Ipswich City Council 428 649 442 115

Isaac Regional Council 42 590 41 801

Local Government Association of Queensland 5 320 7 216

Lockyer Valley Regional Council 28 731 28 162

Logan City Council 204 952 199 153

Longreach Regional Council 8 234 8 033

Mackay Regional Council 247 108 240 685

Maranoa Regional Council 19 333 18 620

McKinlay Shire Council 1 159 767

Moreton Bay Regional Council 418 364 406 880

Mount Isa City Council 28 564 27 891

Murweh Shire Council 4 707 4 304

North Burnett Regional Council 4 274 4 002

Northern Peninsula Area Regional Council 1 926 2 099

Paroo Shire Council 2 584 2 516

Redland City Council 69 305 66 792

Richmond Shire Council 1 013 729

Rockhampton Regional Council 253 549 247 379

Scenic Rim Regional Council 11 514 10 633

South Burnett Regional Council 13 529 12 263

Southern Downs Regional Council 30 583 29 526

Sunshine Coast Regional Council 282 365 276 027

Tablelands Regional Council 8 978 11 500

Toowoomba Regional Council 165 199 159 865

Torres Shire Council 1 844 1 682

Torres Strait Island Regional Council 510 485

Townsville City Council 393 473 381 152

Western Downs Regional Council 69 126 66 627

Whitsunday Regional Council 80 294 76 884

Winton Shire Council 3 407 3 313

Total 6 632 514 6 714 844

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 25

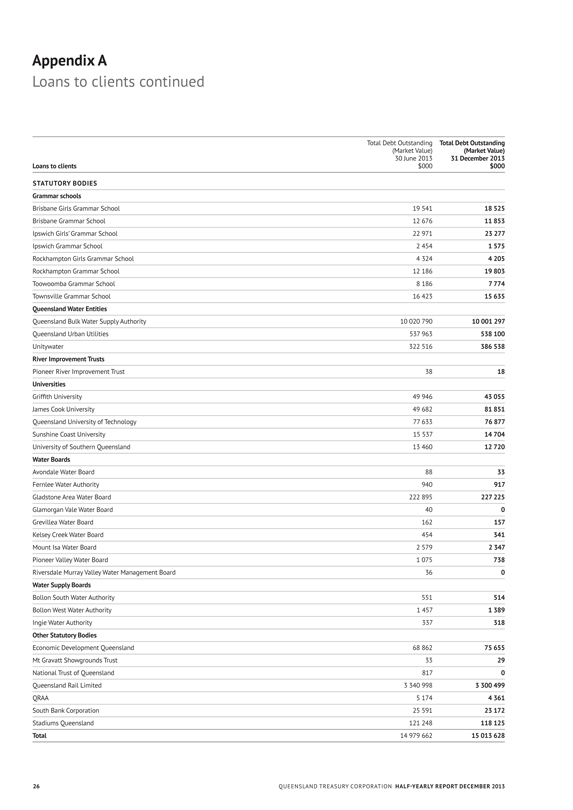

Appendix A

Loans to clients continued

Total Debt Outstanding (Market Value) 30 June 2013

Total Debt Outstanding (Market Value) 31 December 2013

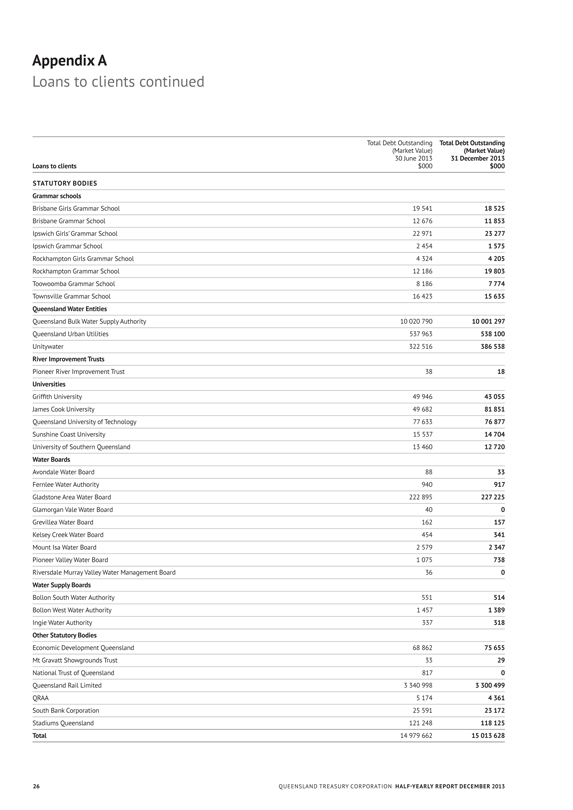

Loans to clients $000 $000

STATUTORY BODIES

Grammar schools

Brisbane Girls Grammar School 19 541 18 525

Brisbane Grammar School 12 676 11 853

Ipswich Girls’ Grammar School 22 971 23 277

Ipswich Grammar School 2 454 1 575

Rockhampton Girls Grammar School 4 324 4 205

Rockhampton Grammar School 12 186 19 803

Toowoomba Grammar School 8 186 7 774

Townsville Grammar School 16 423 15 635

Queensland Water Entities

Queensland Bulk Water Supply Authority 10 020 790 10 001 297

Queensland Urban Utilities 537 963 538 100

Unitywater 322 516 386 538

River Improvement Trusts

Pioneer River Improvement Trust 38 18

Universities

Griffith University 49 946 43 055

James Cook University 49 682 81 851

Queensland University of Technology 77 633 76 877

Sunshine Coast University 15 537 14 704

University of Southern Queensland 13 460 12 720

Water Boards

Avondale Water Board 88 33

Fernlee Water Authority 940 917

Gladstone Area Water Board 222 895 227 225

Glamorgan Vale Water Board 40 0

Grevillea Water Board 162 157

Kelsey Creek Water Board 454 341

Mount Isa Water Board 2 579 2 347

Pioneer Valley Water Board 1 075 738

Riversdale Murray Valley Water Management Board 36 0

Water Supply Boards

Bollon South Water Authority 551 514

Bollon West Water Authority 1 457 1 389

Ingie Water Authority 337 318

Other Statutory Bodies

Economic Development Queensland 68 862 75 655

Mt Gravatt Showgrounds Trust 33 29

National Trust of Queensland 817 0

Queensland Rail Limited 3 340 998 3 300 499

QRAA 5 174 4 361

South Bank Corporation 25 591 23 172

Stadiums Queensland 121 248 118 125

Total 14 979 662 15 013 628

26 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

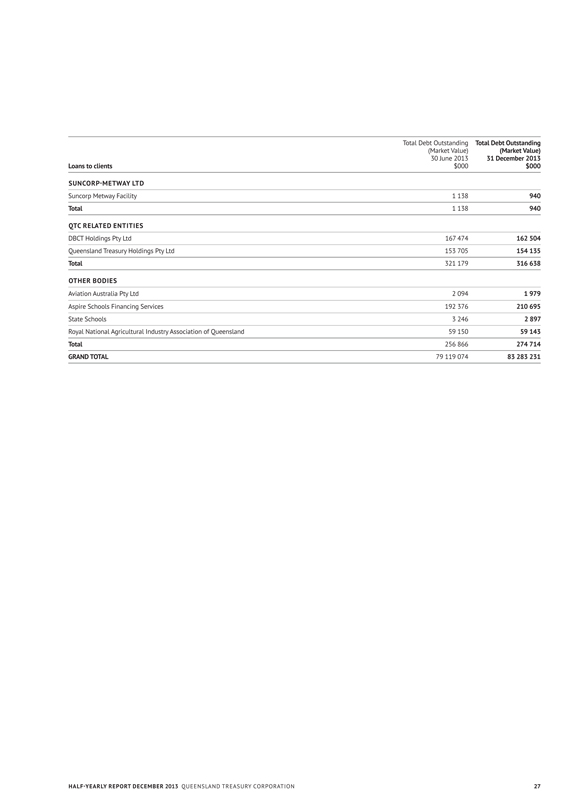

Total Debt Outstanding (Market Value) 30 June 2013

Total Debt Outstanding (Market Value) 31 December 2013

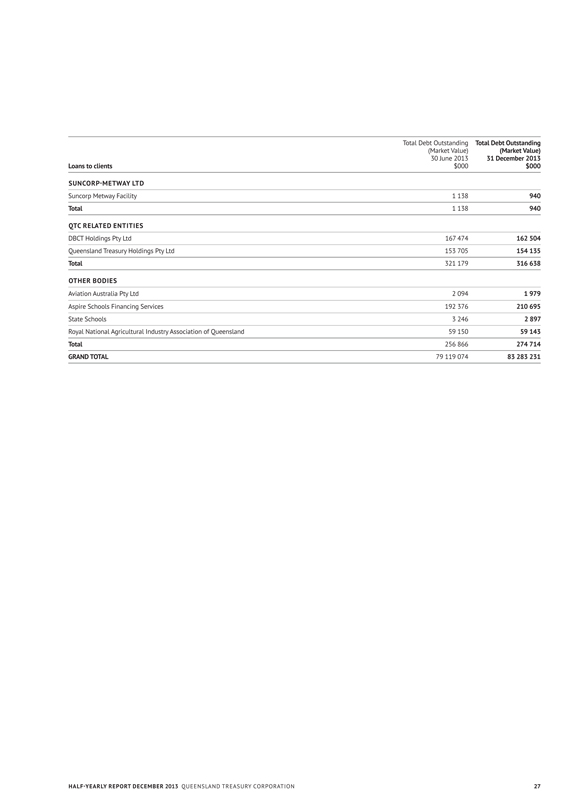

Loans to clients $000 $000

SUNCORP-METWAY LTD

Suncorp Metway Facility 1 138 940

Total 1 138 940

QTC RELATED ENTITIES

DBCT Holdings Pty Ltd 167 474 162 504

Queensland Treasury Holdings Pty Ltd 153 705 154 135

Total 321 179 316 638

OTHER BODIES

Aviation Australia Pty Ltd 2 094 1 979

Aspire Schools Financing Services 192 376 210 695

State Schools 3 246 2 897

Royal National Agricultural Industry Association of Queensland 59 150 59 143

Total 256 866 274 714

GRAND TOTAL 79 119 074 83 283 231

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 27

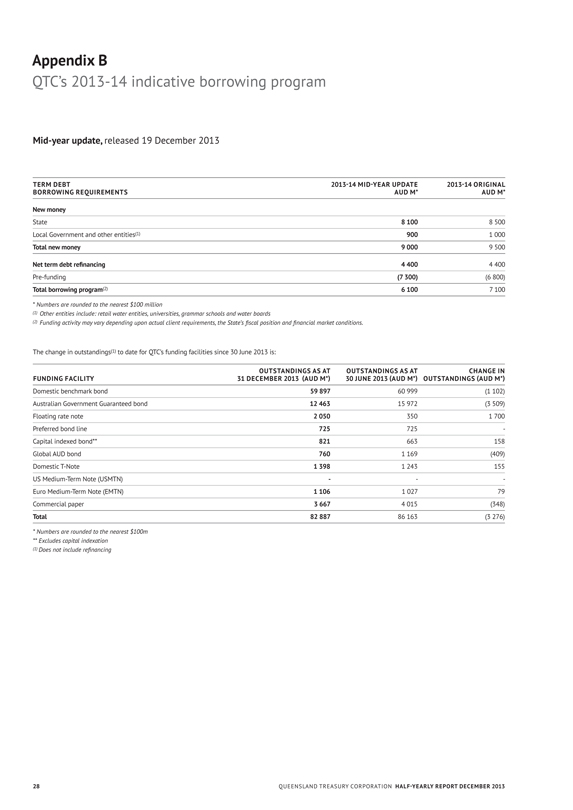

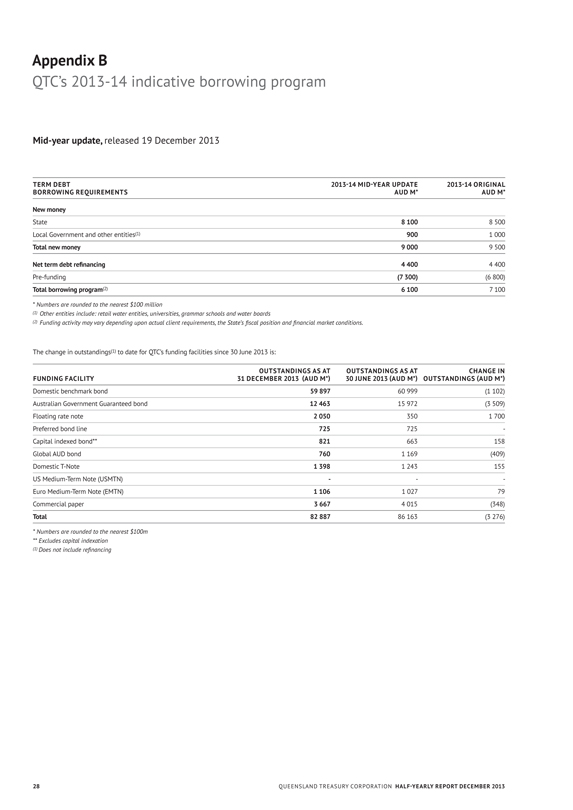

Appendix B

QTC’s 2013-14 indicative borrowing program

Mid-year update, released 19 December 2013

TERM DEBT 2013-14 MID-YEAR UPDATE 2013-14 ORIGINAL

BORROWING REQUIREMENTS AUD M* AUD M*

New money

State 8 100 8 500

Local Government and other entities(1) 900 1 000

Total new money 9 000 9 500

Net term debt refinancing 4 400 4 400

Pre-funding (7 300) (6 800)

Total borrowing program(2) 6 100 7 100

* Numbers are rounded to the nearest $100 million

(1) Other entities include: retail water entities, universities, grammar schools and water boards

(2) Funding activity may vary depending upon actual client requirements, the State’s fiscal position and financial market conditions.

The change in outstandings(1) to date for QTC’s funding facilities since 30 June 2013 is:

FUNDING FACILITY

OUTSTANDINGS AS AT 31 DECEMBER 2013 (AUD M*)

OUTSTANDINGS AS AT 30 JUNE 2013 (AUD M*)

CHANGE IN OUTSTANDINGS (AUD M*)

Domestic benchmark bond 59 897 60 999 (1 102)

Australian Government Guaranteed bond 12 463 15 972 (3 509)

Floating rate note 2 050 350 1 700

Preferred bond line 725 725 —

Capital indexed bond** 821 663 158

Global AUD bond 760 1 169 (409)

Domestic T-Note 1 398 1 243 155

US Medium-Term Note (USMTN) — — —

Euro Medium-Term Note (EMTN) 1 106 1 027 79

Commercial paper 3 667 4 015 (348)

Total 82 887 86 163 (3 276)

* Numbers are rounded to the nearest $100m

** Excludes capital indexation (1) Does not include refinancing

28 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

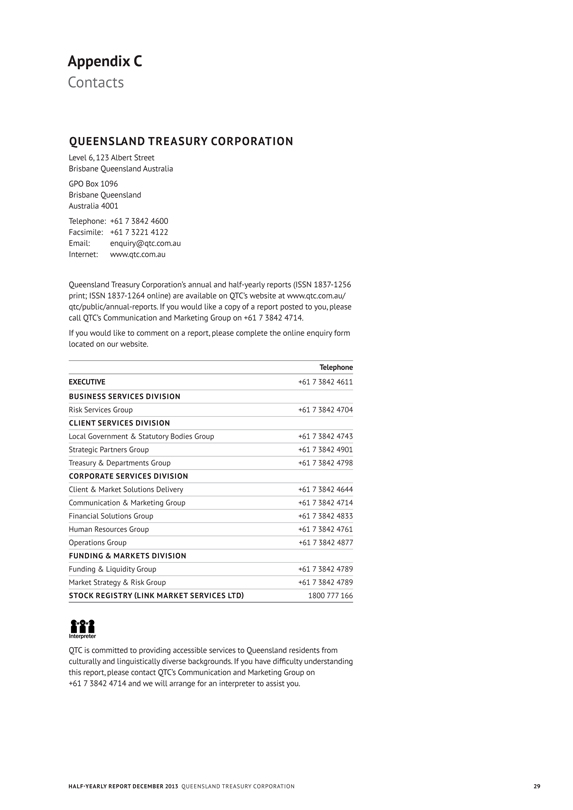

Appendix C

Contacts

QUEENSLAND TREASURY CORPORATION

Level 6, 123 Albert Street

Brisbane Queensland Australia

GPO Box 1096

Brisbane Queensland Australia 4001

Telephone: +61 7 3842 4600 Facsimile: +61 7 3221 4122 Email: enquiry@qtc.com.au Internet: www.qtc.com.au

Queensland Treasury Corporation’s annual and half-yearly reports (ISSN 1837-1256 print; ISSN 1837-1264 online) are available on QTC’s website at www.qtc.com.au/ qtc/public/annual-reports. If you would like a copy of a report posted to you, please call QTC’s Communication and Marketing Group on +61 7 3842 4714.

If you would like to comment on a report, please complete the online enquiry form located on our website.

Telephone

EXECUTIVE +61 7 3842 4611

BUSINESS SERVICES DIVISION

Risk Services Group +61 7 3842 4704

CLIENT SERVICES DIVISION

Local Government & Statutory Bodies Group +61 7 3842 4743

Strategic Partners Group +61 7 3842 4901

Treasury & Departments Group +61 7 3842 4798

CORPORATE SERVICES DIVISION

Client & Market Solutions Delivery +61 7 3842 4644

Communication & Marketing Group +61 7 3842 4714

Financial Solutions Group +61 7 3842 4833

Human Resources Group +61 7 3842 4761

Operations Group +61 7 3842 4877

FUNDING & MARKETS DIVISION

Funding & Liquidity Group +61 7 3842 4789

Market Strategy & Risk Group +61 7 3842 4789

STOCK REGISTRY (LINK MARKET SERVICES LTD) 1800 777 166

Interpreter

QTC is committed to providing accessible services to Queensland residents from culturally and linguistically diverse backgrounds. If you have difficulty understanding this report, please contact QTC’s Communication and Marketing Group on

+61 7 3842 4714 and we will arrange for an interpreter to assist you.

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 29

Appendix C

Contacts continued

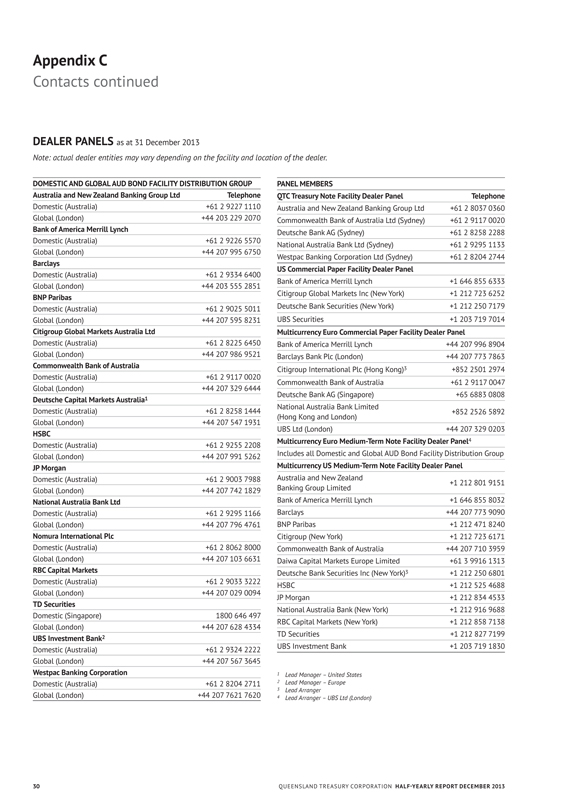

DEALER PANELS as at 31 December 2013

Note: actual dealer entities may vary depending on the facility and location of the dealer.

DOMESTIC AND GLOBAL AUD BOND FACILITY DISTRIBUTION GROUP

Australia and New Zealand Banking Group Ltd Telephone

Domestic (Australia) +61 2 9227 1110

Global (London) +44 203 229 2070

Bank of America Merrill Lynch

Domestic (Australia) +61 2 9226 5570

Global (London) +44 207 995 6750

Barclays

Domestic (Australia) +61 2 9334 6400

Global (London) +44 203 555 2851

BNP Paribas

Domestic (Australia) +61 2 9025 5011

Global (London) +44 207 595 8231

Citigroup Global Markets Australia Ltd

Domestic (Australia) +61 2 8225 6450

Global (London) +44 207 986 9521

Commonwealth Bank of Australia

Domestic (Australia) +61 2 9117 0020

Global (London) +44 207 329 6444

Deutsche Capital Markets Australia1

Domestic (Australia) +61 2 8258 1444

Global (London) +44 207 547 1931

HSBC

Domestic (Australia) +61 2 9255 2208

Global (London) +44 207 991 5262

JP Morgan

Domestic (Australia) +61 2 9003 7988

Global (London) +44 207 742 1829

National Australia Bank Ltd

Domestic (Australia) +61 2 9295 1166

Global (London) +44 207 796 4761

Nomura International Plc

Domestic (Australia) +61 2 8062 8000

Global (London) +44 207 103 6631

RBC Capital Markets

Domestic (Australia) +61 2 9033 3222

Global (London) +44 207 029 0094

TD Securities

Domestic (Singapore) 1800 646 497

Global (London) +44 207 628 4334

UBS Investment Bank2

Domestic (Australia) +61 2 9324 2222

Global (London) +44 207 567 3645

Westpac Banking Corporation

Domestic (Australia) +61 2 8204 2711

Global (London) +44 207 7621 7620

PANEL MEMBERS

QTC Treasury Note Facility Dealer Panel Telephone

Australia and New Zealand Banking Group Ltd +61 2 8037 0360

Commonwealth Bank of Australia Ltd (Sydney) +61 2 9117 0020

Deutsche Bank AG (Sydney) +61 2 8258 2288

National Australia Bank Ltd (Sydney) +61 2 9295 1133

Westpac Banking Corporation Ltd (Sydney) +61 2 8204 2744

US Commercial Paper Facility Dealer Panel

Bank of America Merrill Lynch +1 646 855 6333

Citigroup Global Markets Inc (New York) +1 212 723 6252

Deutsche Bank Securities (New York) +1 212 250 7179

UBS Securities +1 203 719 7014

Multicurrency Euro Commercial Paper Facility Dealer Panel

Bank of America Merrill Lynch +44 207 996 8904

Barclays Bank Plc (London) +44 207 773 7863

Citigroup International Plc (Hong Kong)3 +852 2501 2974

Commonwealth Bank of Australia +61 2 9117 0047

Deutsche Bank AG (Singapore) +65 6883 0808

National Australia Bank Limited +852 2526 5892

(Hong Kong and London)

UBS Ltd (London) +44 207 329 0203

Multicurrency Euro Medium-Term Note Facility Dealer Panel4

Includes all Domestic and Global AUD Bond Facility Distribution Group

Multicurrency US Medium-Term Note Facility Dealer Panel

Australia and New Zealand +1 212 801 9151

Banking Group Limited

Bank of America Merrill Lynch +1 646 855 8032

Barclays +44 207 773 9090

BNP Paribas +1 212 471 8240

Citigroup (New York) +1 212 723 6171

Commonwealth Bank of Australia +44 207 710 3959

Daiwa Capital Markets Europe Limited +61 3 9916 1313

Deutsche Bank Securities Inc (New York)3 +1 212 250 6801

HSBC +1 212 525 4688

JP Morgan +1 212 834 4533

National Australia Bank (New York) +1 212 916 9688

RBC Capital Markets (New York) +1 212 858 7138

TD Securities +1 212 827 7199

UBS Investment Bank +1 203 719 1830

1 Lead Manager – United States

2 Lead Manager – Europe

3 Lead Arranger

4 Lead Arranger – UBS Ltd (London)

30 QUEENSLAND TREASURY CORPORATION HALF-YEARLY REPORT DECEMBER 2013

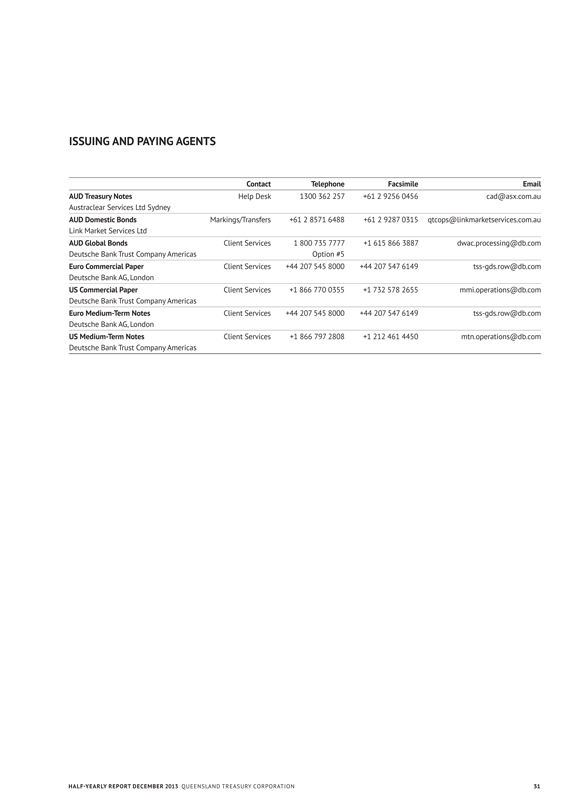

ISSUING AND PAYING AGENTS

Contact Telephone Facsimile Email

AUD Treasury Notes Help Desk 1300 362 257 +61 2 9256 0456 cad@asx.com.au

Austraclear Services Ltd Sydney

AUD Domestic Bonds Markings/Transfers +61 2 8571 6488 +61 2 9287 0315 qtcops@linkmarketservices.com.au

Link Market Services Ltd

AUD Global Bonds Client Services 1 800 735 7777 +1 615 866 3887 dwac.processing@db.com

Deutsche Bank Trust Company Americas

Option #5

Euro Commercial Paper Client Services +44 207 545 8000 +44 207 547 6149 tss-gds.row@db.com

Deutsche Bank AG, London

US Commercial Paper Client Services +1 866 770 0355 +1 732 578 2655 mmi.operations@db.com

Deutsche Bank Trust Company Americas

Euro Medium-Term Notes Client Services +44 207 545 8000 +44 207 547 6149 tss-gds.row@db.com

Deutsche Bank AG, London

US Medium-Term Notes Client Services +1 866 797 2808 +1 212 461 4450 mtn.operations@db.com

Deutsche Bank Trust Company Americas

HALF-YEARLY REPORT DECEMBER 2013 QUEENSLAND TREASURY CORPORATION 31

AUDAX AT FIDELIS

QUEENSLAND TREASURY CORPORATION

Level 6 123 Albert Street Brisbane GPO Box 1096 Brisbane

Queensland Australia 4001

Telephone: +61 7 3842 4600

Facsimile: +61 7 3221 4122 www.qtc.com.au

© Queensland Treasury Corporation 2014