EXHIBIT (c)(ix)

Queensland Treasury Corporation Annual Report for the Year Ended June 30, 2017.

FORWARD-LOOKING STATEMENTS

This exhibit contains forward-looking statements. Statements that are not historical facts, including statements about the State of Queensland’s (the “State” or “Queensland”) beliefs and expectations, are forward-looking statements. These statements are based on current plans, budgets, estimates and projections and therefore you should not place undue reliance on them. The words “believe”, “may”, “will”, “should”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and neither the Queensland Treasury Corporation nor the State undertake any obligation to update publicly any of them in light of new information or future events.

Forward-looking statements are based on current plans, estimates and projections and, therefore, undue reliance should not be placed on them. Although the Queensland Treasury Corporation and the State believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such beliefs and expectations will prove to have been correct. Forward-looking statements involve inherent risks and uncertainties. We caution you that actual results may differ materially from those contained in any forward-looking statements.

A number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. Factors that could cause the actual outcomes to differ materially from those expressed or implied in forward-looking statements include:

| | • | | the international and Australian economies, and in particular the rates of growth (or contraction) of the State’s major trading partners; |

| | • | | the effects, both internationally and in Australia, of any subsequent economic downturn, ongoing economic, banking and sovereign debt crisis in Europe and any stalling of the protracted United States recovery; |

| | • | | increases or decreases in international and Australian domestic interest rates; |

| | • | | changes in the State’s domestic consumption; |

| | • | | changes in the State’s labor force participation and productivity; |

| | • | | downgrades in the credit ratings of the State and Australia; |

| | • | | changes in the rate of inflation in the State; |

| | • | | changes in environmental and other regulation; and |

| | • | | changes in the distribution of revenue from the Commonwealth of Australia Government to the State. |

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Contents

| | | | |

Queensland Treasury Corporation | | | 2 | |

| |

Role and responsibilities | | | 3 | |

| |

Chairman’s and Chief Executive’s report | | | 4 | |

| |

Creating value for the State and clients | | | 6 | |

| |

Achieving sustainable access to funding | | | 8 | |

| |

Realising operational excellence | | | 10 | |

| |

Ensuring corporate governance | | | 12 | |

| |

Financial Statements | | | 17 | |

| |

Appendices | | | 51 | |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

| | |

| 25 September 2017 | |  |

The Honourable Curtis Pitt MP

Treasurer and Minister for Trade and Investment

GPO Box 611

Brisbane QLD 4001

Dear Treasurer

I am pleased to present the Annual Report 2016-17 for Queensland Treasury Corporation.

I certify that this Annual Report complies with:

| • | | the prescribed requirements of the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2009, and |

| • | | the detailed requirements set out in the Annual report requirements for Queensland Government agencies. |

A checklist outlining the annual reporting requirements can be found at page 54 of this report or accessed at www.qtc.com.au.

Sincerely

Gerard Bradley

Chairman

LEVEL 31, 111 EAGLE STREET, BRISBANE QUEENSLAND AUSTRALIA 4000

GPO BOX 1096, BRISBANE QUEENSLAND AUSTRALIA 4001

T: 07 3842 4600 • F: 07 3221 4122 • QTC.COM. AU

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Queensland Treasury Corporation

Queensland Treasury Corporation (QTC) has a statutory responsibility to advance the financial position of the State, and a mandate to manage and minimise financial risk in the public sector and provide value-adding financial solutions to its public sector clients. Established under the Queensland Treasury Corporation Act 1988, QTC is a corporation sole, reporting through the Under Treasurer to the Treasurer and Queensland Parliament.

| | |

| | Vision Securing Queensland’s financial success |

| |

| | Mission To deliver optimal financial outcomes through sound funding and financial risk management |

| |

| | Values Client focus We build strong partnerships with our clients to deliver simple and well-designed solutions that achieve quality outcomes for Queensland. Team spirit We work as one team, taking joint responsibility for achieving our vision and collaborating to achieve outstanding performance. Excellence We aim for excellence using flexible and agile processes to continuously improve. Respect We show respect by recognising contributions, welcoming ideas, acting with honesty, being inclusive and embracing diversity. Integrity We inspire trust and confidence in our colleagues, clients, stakeholders and investors by upholding strong professional and ethical standards. |

| |

| | 2017-20 Strategic Goals |

| | 1 State and client value |

| | 2 Sustainable funding |

| | 3 Organisational excellence |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Queensland Treasury Corporation

ROLE AND RESPONSIBILITIES

As the Queensland Government’s central financing authority, Queensland Treasury Corporation plays a pivotal role in securing the State’s financial success.

With a focus on whole-of-State outcomes, QTC provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, cash management facilities and financial risk management advisory services.

| | |

| | Debt funding and management QTC borrows funds in the domestic and global markets in the most cost-effective manner and in a way that minimises liquidity risk and refinancing risk. QTC achieves significant economies of scale and scope by issuing, managing and administering the State’s debt funding. |

| | QTC works closely with Queensland’s public sector entities, including local governments, to assist them to effectively manage their financial transactions, minimise their financial risk and achieve the best financial solutions for their organisation and the State. |

| | Financial risk management advisory services |

| | QTC offers a range of financial risk management advisory services to clients, including: |

| | • support to ensure financial risks are identified and effectively managed |

| | • advice on financial and commercial considerations |

| | • expertise in financial transactions and structures |

| | • project management support to deliver key fiscal outcomes, and |

| | • collaboration with the financial markets and private sector institutions. |

| | Cash management facilities |

| | QTC assists the State’s public sector entities to make the best |

| | use of their surplus cash balances within a conservative risk |

| | management framework. It offers overnight and fixed-term |

| | facilities and a managed cash fund. |

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Chairman’s and Chief Executive’s report

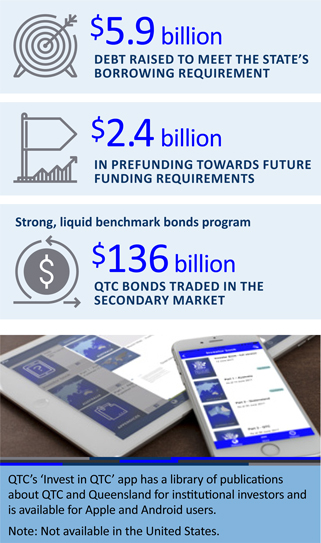

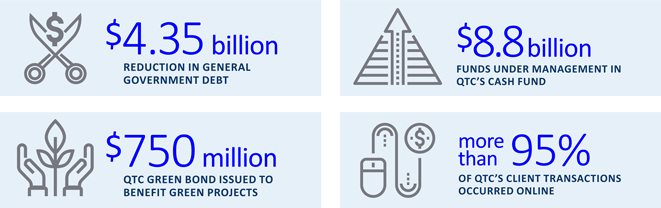

In 2016-17, Queensland Treasury Corporation delivered significant whole-of-State and client benefits, successfully funded the State’s $5.9 billion borrowing program, and realised an operating profit of $353.8 million. These results were achieved following the activation of QTC’s new business operating model, including the successful implementation of new enterprise IT platforms.

| | |

| | Operational excellence drives a successful year Solid investor demand for QTC’s AUD benchmark bonds provided the foundation of the successful execution of the $5.9 billion 2016-17 borrowing program. Despite a backdrop of improved global economic conditions, the operating environment remained challenging, with uncertainty led by geopolitical tensions and questions over monetary and fiscal policy in major economies. In addition, the Queensland economy continues to adjust following a period of significant mining investment. QTC experienced another successful year with a range of milestone events highlighting the value created for Queensland. These include: • Successful early completion of the 2016-17 term debt borrowing program and prefunding of $2.4 billion for future borrowing programs, a total of $8.3 billion. • Smoothed and extended QTC’s bond maturity profile through $2.5 billion 2027 Benchmark bond issue. • Issued 30 year bonds. • Successfully piloted a ‘virtual bond’ using a blockchain platform. • Completed $750 million issue of QTC’s first Green Bond, the largest Green Bond issue by an Australian issuer at the time. • Repatriation to Treasury of $500 million in past surpluses. Long-term assets |

| |

| | Separate from QTC’s capital markets operations, QTC’s long-term assets, which comprises the investments set aside primarily to support the State’s defined benefit superannuation, recorded an after tax operating profit of $224.6 million (2015-16: $908.6 million loss). Managed by QIC, these assets were transferred to QTC by the Queensland Government under an administrative arrangement in 2008; in return, QTC issued fixed-rate notes to the State that provide a fixed rate of return. While QTC bears the fluctuations in the value and returns on the asset portfolio, there is no cash flow effect for QTC. Any losses incurred by this segment have no impact on QTC’s capital markets activities or its ability to meet its obligations. |

| | Credit ratings |

| | Moody’s Investor Service rating outlook for Queensland was revised to stable from negative in April 2017. QTC is rated AA+/A-1+/Stable and Aa1/P-1/Stable from Standard & Poor’s and Moody’s respectively. |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

QTC’s advice benefits State

The 2016-17 financial year saw the Client Services Division continue to create significant value for the State, with a wide range of advisory projects reaping dividends for QTC’s public sector clients, including:

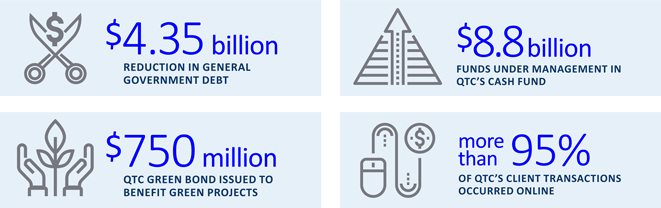

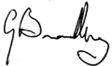

| • | | Facilitation of $4.35 billion in General Government debt reduction over the forward estimate through advice and improved cashflow management. |

| • | | Financial Assurance Review completed that identified close to $8 billion worth of liability for Government in mining rehabilitation. |

| • | | More than $600 million in new funds attracted to QTC’s cash fund as a result of repayment and investment advice. |

| • | | Structured net debt solution delivered resulting in $2.2 billion debt reduction in FY17 for the State. |

| • | | Forecasting models developed that cover 55 per cent of the State’s expenditure to better manage State finances. |

| • | | Financial Education partnership with established University of Queensland offering public sector clients the opportunity to gain the knowledge required to better manage their finances. |

Benefits realised from revitalised systems and processes

The simplification of systems and processes, the move to industry-standard software platforms and targeted recruitment has significantly increased productivity across the business. For example, more than 95 per cent of QTC’s client transactions now occur online via the QTC Link portal.

These positive results have led to increased value for our clients, and increased the overall value to the State generated by QTC.

Changes to Board membership

Stephen Roberts was appointed to QTC’s Capital Markets Board on 8 June 2017, with tenure to 30 June 2020. He brings extensive investment banking, leadership and governance expertise, developed across his career in global financial markets. Mr Roberts replaced Bill Shields who resigned on 31 December 2016.

Mr Shields made a significant contribution to QTC’s success during his 11 year tenure, bringing the benefit of his extensive experience in the banking and finance industry, government policy advice and specialisation in economics. On behalf of the Board, I thank him for his dedication and contribution.

It’s also my pleasure to again acknowledge the hard work of QTC’s employees, who have delivered significant value to the State over the 2016-17 financial year.

Looking to the future

QTC will continue to focus on fulfilling its responsibility to advance the financial position of the State, while helping manage and minimise financial risk in the public sector. QTC’s ability to cost-effectively raise funds to support the State’s borrowing program remains the cornerstone of our business. Further opportunities to help QTC’s public sector clients through the provision of advice will continue to be realised over time.

QTC’s results in the 2016-17 financial year were strong and, as the benefits continue to flow from our revitalised business model and increased capability, we anticipate another solid year of performance in 2017-18.

| | |

| |  |

G P BRADLEY | | P C NOBLE |

| Chairman | | Chief Executive |

| 25 September 2017 | | 25 September 2017 |

Supplementary update: QTC wins prestigious industry awards

In July 2017, QTC won two awards for Operational Excellence at the International Quality and Productivity Centre Awards in:

| • | | Customer Centricity and Experience, and |

| • | | Cultural Transformation. |

Both award submissions focused on QTC’s successful Strategic Change Program, and the awards were an acknowledgement of the hard work of employees and the strong results achieved by the Program in the 2016-17 financial year.

In addition to these awards, QTC also took out the Australian HR Team of the Year (<1,000 employees) at The Australian HR Awards announced in September 2017.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Creating value for the State and clients

In 2016-17, QTC contributed significant, positive financial results for the State and its public sector entities through the delivery of debt funding and management, cash management, financial advisory, and specialist public finance education services. QTC’s continued focus on delivering whole-of-State outcomes by providing advice and initiatives that enable clients to make better business decisions and improve revenues has been integral to this success.

Financial advice for the State’s public sector

In the year under review, QTC completed a broad range of financial advisory assignments to assist its clients and the State to address financial and risk management issues.

More than 200 major client advisory assignments were delivered, equivalent to $25 million in client service hours. QTC assisted clients to deliver budget savings, improve revenue and mitigate financial risks. Assignments included:

| • | | high-level, business forward planning for major Government entities |

| • | | financial assurance reviews to reduce risk and avoid cost |

| • | | surplus cash management strategies |

| • | | business sustainability and credit related advice across a range of QTC’s clients |

| • | | developing industry-specific financial modelling tools to improve clients’ business practices |

| • | | business case and project evaluation for infrastructure and assets of all sizes, and |

| • | | procurement and tender evaluation, including contract reviews and market sounding proposals. |

QTC developed forecasting models that account for 55 per cent of the State’s expenditure to support:

| • | | eight out of 16 hospital and health services |

| • | | housing, homelessness and youth justice |

| • | | the criminal justice system, and |

| • | | the Department of Education and Training. |

Delivering on the debt action plan

Working closely with Queensland Treasury, QTC facilitated the design and delivery of a number of initiatives from the review of the State’s balance sheet and implementation of the Government’s Debt Action Plan, including the:

| • | | facilitation of $4.35 billion in General Government debt reduction over the forward estimate through advice and improved cashflow management |

| • | | structuring of a net debt solution resulting in a reduction in the debt to revenue ratio of 60 per cent, and |

| • | | lengthening of the duration of core debt from 5.25 years to 5.75 years. |

Fostering strong relationships with local governments

Throughout the year, we have worked closely with our local government clients and provided a broad range of advice ranging from structural options for major council-owned assets and project evaluation to business case assessment for new council infrastructure.

Facilitating innovative funding

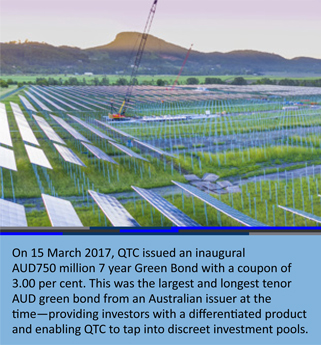

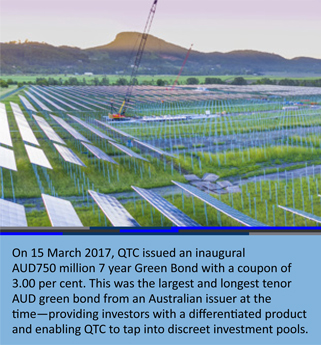

On 15 March 2017, QTC issued an inaugural AUD750 million seven year Green Bond with a coupon of 3.00 per cent. This was the largest and longest tenor AUD green bond from an Australian issuer at the time. QTC Green Bonds are guaranteed by the Queensland State Government, issued under the AUD Bond Program with 144A capability and certified by the Climate Bonds Initiative.

High quality debt and cash management products

QTC continued to provide low-cost loans and high-performing investment facilities throughout 2016-17.

Debt management

QTC has continued to successfully deliver its core mandate of providing clients with a lower cost of funds—by capturing the significant economies of scale and scope in the issuance, management and administration of the State’s debt.

Cash management

QTC offers cash management products that enable its clients to maximise the value of their surplus funds. In 2016-17, QTC’s Capital Guaranteed Cash Fund provided strong returns and outperformed its benchmark, the Bloomberg AusBond Bank Bill Index, by 79 basis points. During the year, QTC’s Cash Fund attracted new clients and, on 30 September 2016, it reached a milestone with more than $10 billion of funds under management—the highest amount in its history. At the end of the 2016-17 financial year it remained one of the largest managed funds in Australia with $8.8 billion under management.

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Client access website portal

In 2016-17, QTC made significant progress with the implementation of QTC Link—a new client portal as part of the organisation’s online offering to clients. QTC Link, through its industry-standard transaction platform, enabled 96 per cent of QTC’s client transactions to take place online.

Education program

QTC’s role in equipping clients with specialist financial knowledge and capabilities has continued. From July 2016 until May 2017, more than 600 clients attended QTC-delivered courses with a post-course satisfaction evaluation of 9 out of 10.

In May 2017, QTC partnered with The University of Queensland to develop and deliver a new enhanced and expanded education program tailored specifically to public sector clients. The partnership model has enabled QTC to deliver a new accredited program, the Graduate Certificate in Business Leadership (Public Sector Finance). As a result, the number of workshops available to Queensland public sector clients has expanded to 16 with more under consideration.

Loans to clients

| | | | | | | | |

| | | TOTAL DEBT OUTSTANDING | | | TOTAL DEBT OUTSTANDING | |

| | | (MARKET VALUE) | | | (MARKET VALUE) | |

| | | 30 JUNE 17 | | | 30 JUNE 16 | |

| | | A$000 | | | A$000 | |

Government General* | | | 33 655 316 | | | | 38 394 707 | |

Energy | | | 24 999 435 | | | | 25 970 955 | |

Water | | | 13 994 598 | | | | 14 597 305 | |

Local governments | | | 6 449 434 | | | | 6 507 397 | |

Transport | | | 4 891 024 | | | | 4 276 921 | |

Education | | | 710 367 | | | | 706 016 | |

Other | | | 402 234 | | | | 369 726 | |

| | | | | | | | |

Total | | | 85 102 408 | | | | 90 823 027 | |

| | | | | | | | |

* Government General includes the following State Government departments: Education and Training, Housing and Public Works, State Development, Transport and Main Roads, Health and Treasury.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

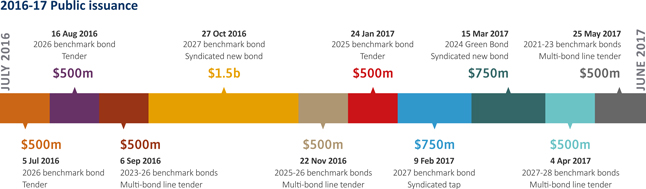

Achieving sustainable access to funding

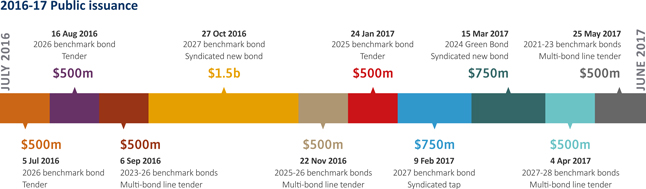

In 2016-17, QTC raised $5.9 billion of term debt to meet its clients’ annual funding requirements and refinance debt maturities. QTC also undertook an additional $2.4 billion pre-funding, reducing future borrowing programs. New strategic initiatives were implemented to further diversify QTC’s investor base, including a QTC Green Bond—the largest AUD green bond issue from an Australian issuer at the time.

Meeting the State’s funding requirements

QTC continued to demonstrate its reputation as a premium issuer with its investors, through the high-quality execution of term debt issuance. Using the strength of its AA+ credit rating, QTC provided the market with diverse, liquid lines that resulted in $8.3 billion being successfully raised for the State’s borrowing and refinancing requirement.

The original estimated term debt requirement for 2016-17 was $7.3 billion. This was revised down to $5.9 billion following the Government’s Mid-Year Fiscal and Economic Review, released in December 2016.

QTC undertook a range of activities to complete its annual borrowing program and support its bonds in the market, including:

| • | | completing the term debt requirement of $5.9 billion |

| • | | prefunding $2.4 billion towards the future funding requirements |

| • | | issuing $5.75 billion of benchmark bonds via public issuance, including two syndicated transactions for $2.25 billion and seven tenders for $3.5 billion |

| • | | issuing one new benchmark bond maturing in 2027 |

| • | | issuing a new 2024 green bond—the largest by an Australian issuer at the time—of $750 million by syndication, and |

| • | | issuing $615 million equivalent of new 30 year Euro and AUD bonds. |

QTC maintained its focus on providing its Fixed Income Distribution Group and investor base with greater flexibility and improved transparency.

On 14 June 2017, QTC announced its $6.8 billion term debt borrowing requirement for the 2017-18 fiscal year.

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Funding facilities

As at 30 June 2017

QTC has a diverse range of funding facilities in a variety of markets and currencies. The majority of QTC’s funding is

sourced through long-term debt facilities, with QTC’s AUD benchmark bonds comprising the principal source of funding.

| | | | | | | | |

OVERVIEW AS AT 30 JUNE 2017 | | SIZE ($M) | | MATURITIES | | CURRENCIES |

| | Domestic T-Note | | Unlimited | | 7–365 days | | AUD |

| Short-term | | Euro CP | | USD10,000 | | 1–364 days | | Multi-currency |

| | US CP | | USD10,000 | | 1–270 days | | USD |

| | AUD Bond | | Unlimited | | 13 benchmark lines: 2017-2028, 2033 | | AUD |

| | | | 3 AGG* lines: 2017-2021 | | AUD |

| | | | 1 QTC Green Bond: 2024 | | AUD |

| | | | 1 floating rate note: 2018 | | |

| Long-term | | | | | | 1 capital indexed bond: 2030 | | AUD |

| | | | | | 1 preferred line: 2047 | | |

| | Global AUD Bond | | AUD20,000 | | AGG* line: 2017 (transferable to domestic bonds) | | AUD |

| | Euro MTN | | USD10,000 | | Any maturity subject to market regulations | | Multi-currency |

| | US MTN | | USD10,000 | | 9 months - 30 years | | Multi-currency |

*AGG – Australian Government Guaranteed

Funding performance

QTC’s proactive management of the borrowing program and the management of its client funding and balance sheet activities helped to smooth and extend its maturity profile and support QTC’s bond spreads. Management of QTC’s liquid assets, funding execution, QTC’s Cash Fund, client debt transactions and debt rebalancing provided significant savings during 2016-17, while QTC’s total debt outstanding at year end was approximately $90 billion.

QTC’s issuance strategy continues to support its commitment to a diverse range of funding sources to complement its core AUD benchmark bond program. This diversity has seen it utilise a variety of instruments in the past year including green bonds, bond maturities out to 30 years and non-Australian dollar denominated bonds, as well as its AUD benchmark bond program. There was strong investor demand for each of QTC’s public issuances.

In 2017-18, QTC proactively managed its bond maturity profile to reduce refinancing risk by achieving more even maturities across the curve. This included reducing 2017 and 2018 maturities by $3 billion to reduce refinancing risk, improve credit metrics and smooth and extend the maturity profile. The issuance of $2.5 billion in a new 2027 benchmark bond also contributed to smoothing and extending QTC’s maturity profile.

QTC continued to focus on activities to expand its investor base, delivering an enhanced and effective domestic and global intermediary relationship program during the year. In partnership with Commonwealth Bank of Australia, QTC delivered a successful North Queensland investor conference. Open and transparent communication with the market remains a key focus. QTC continues to regularly engage with both its Fixed Income Distribution Group and investors through annual roadshow activities.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Realising operational excellence

QTC is committed to maintaining high organisational standards to provide an environment where corporate goals can be achieved and organisational risks are actively monitored and addressed. QTC’s Strategic Change Program delivered significantly over and above the targeted benefits this financial year.

Operational excellence

In 2016-17, QTC activated its new business operating model and a range of new technologies that enhanced its financial and risk management systems and processes.

The successful implementation of new IT platforms automated many formerly manual processes, leading to significant productivity gains across the organisation. In addition, QTC’s ability to create value for clients has been substantially enhanced following the creation of new roles and the recruitment of a significant number of new people. Highlights include:

| • | | transition from 250 applications to four core software platforms |

| • | | 96 per cent of client transactions completed online – more than 50 per cent in excess of target |

| • | | reduction in time spent rebalancing portfolios from approximately 120 hours to approximately 6 hours per month |

| • | | employee productivity increased, and reduced employee induction times |

| • | | 76 per cent employee engagement – a 33 per cent increase in 12 months |

| • | | 73 per cent reduction in the number of policy documents, and |

| • | | new employees rate recruitment satisfaction at 88 per cent. Our focus on achieving operational excellence continues, with more gains to be made as we continue to incrementally improve our systems, processes and our approach to the attraction and retention of high calibre employees. |

Corporate risk management and efficiency

QTC manages its risks within an enterprise-wide risk management framework. The framework supports the achievement of QTC’s corporate objectives by providing assurance that QTC’s risks are identified, assessed and adequately and appropriately managed.

QTC produces a risk appetite statement that establishes clear boundaries in which QTC’s material risks should be managed.

The framework identifies key internal controls, and through periodic attestation by control owners, assurance is given to management and the Board that these controls are operating effectively.

Throughout 2016-17, QTC managed its portfolio market risk exposures, including interest rate, foreign exchange and counterparty risk, within its Board-approved risk management framework. QTC continues to hold a portfolio of diverse, liquid financial securities to meet the State’s liquidity requirements, consistent with its internal and external policies.

High performance workforce

QTC recruits from the global financial industry to attract and retain its high calibre of employees. Pursuant to the Queensland Treasury Corporation Act 1988, QTC employees are hired on individual contracts, with employment practices aligned to the financial markets in which QTC operates.

QTC’s Board regularly reviews QTC’s remuneration framework, which comprises fixed and variable remuneration. The reviews are benchmarked against remuneration data from the Financial Institutions Remuneration Group (FIRG) that provides salary survey data for the Australian finance industry. QTC’s variable remuneration framework provides an opportunity for an annual short-term incentive for eligible employees designed to ensure market competitiveness and reward outstanding organisational, group and individual performance. The QTC Board approves the entitlement to, and the quantum of, the annual review of fixed remuneration and variable short-term incentives.

To realise the intent and benefits of QTC’s organisational transformation, this year’s focus areas have been on recruitment and induction of new employees aligned to the new business operating model and organisational structure, and on delivering the anticipated ‘end state’ organisational culture—agile, energised, outperforming and engaged.

Key initiatives to support these focus areas included targeted recruitment, leadership development, talent management and succession planning programs, professional development initiatives, and culture and diversity programs. Culture transformation has been supported by a series of organisation-wide and team-based culture development programs. An employee engagement and culture survey, held during the Strategic Change Program, measured an employee engagement rate of 76 per cent.

Leadership development continues to be an area of organisational priority. In the year under review, focus has included a foundational leadership program for QTC’s emerging leaders, and leadership coaching refreshers for QTC’s senior leaders.

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

A focus on diversity and wellbeing

QTC’s Strategic Change Program identified a range of opportunities in workforce composition, flexible work arrangements and employee wellbeing.

QTC’s Diversity and Inclusion Strategy recognises that diversity of perspective and experience improves performance, manages risk, and improves decision-making. Under the strategy’s three priority streams of culture, disability and gender, a number of initiatives were implemented, including:

| • | | activities to celebrate the 26 nationalities represented in QTC’s workforce |

| • | | two partnerships with external organisations to provide employment opportunities for people with a disability, and |

| • | | targeted mentoring for women in non-traditional roles. |

The focus on diversity has resulted in a continued increase of women in senior leadership roles, with females now comprising 44 per cent of Managing Directors and Executive Directors. This improvement compares favourably to the gender mix in senior leadership roles when compared to 2012, when only 20 per cent of these roles were held by women.

The implementation of the Strategic Change Program resulted in changes to the workforce profile. At the end of the 2016-17 financial year, there were 183 full-time equivalent employees (including fixed-term employees). The separation rate for the year was 38.6 per cent.

QTC’s policies support flexible working, where flexibility will contribute to QTC achieving its corporate objectives. Flexible working arrangements in place at QTC during the reporting period included part-time work, job share, purchased annual leave, phased retirement and flexible hours of work.

QTC has a corporate health and wellbeing program that provides activities to promote physical and mental wellbeing. Activities for the 2016-17 financial year have included flu vaccinations, health assessments, skin checks, team sports, healthy eating seminars, and mental health and resilience sessions.

QTC continued its practice of regularly reviewing and updating its policies and procedures to comply with changes in the legislative and regulatory environment and to ensure employees have access to avenues through which to raise concerns, including an internal grievance process.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Ensuring corporate governance

QTC is committed to maintaining high standards of corporate governance to support its strong market reputation and ensure that organisational goals are met and risks are monitored and appropriately addressed. QTC’s corporate governance practices are continually reviewed and updated in line with industry guidelines and standards.

QTC and its Boards

QTC was established by the Queensland Treasury Corporation Act 1988 (the QTC Act) as a corporation sole (ie, a corporation that consists solely of a nominated office holder). The Under Treasurer of Queensland is QTC’s nominated office holder. QTC has delegated its powers to its two boards:

| • | | the Queensland Treasury Corporation Capital Markets Board (the Board), which was established in 1991 and manages all of QTC’s operations except those relating to certain superannuation and other long-term assets, and |

| • | | the Long Term Asset Advisory Board, which was established in July 2008 and advises in relation to certain superannuation and other long-term assets that were transferred to QTC from Queensland Treasury on 1 July 2008. |

QTC Capital Markets Board

QTC and the Capital Markets Board have agreed the terms and administrative arrangements for the exercise of the powers that have been delegated to the Board by QTC (as the corporation sole).

The Board operates in accordance with its charter, which sets out its commitment to various corporate governance principles and standards, the roles and responsibilities of the Board and its members (based on its delegated powers), and the conduct of meetings. The charter provides that the role and functions of the Board include:

| • | | overseeing QTC’s operations, including its control and accountability systems |

| • | | approving the strategic direction of QTC and significant corporate strategic initiatives |

| • | | approving key policies and corporate performance objectives |

| • | | setting the risk appetite within which management is expected to operate |

| • | | approving the annual budget as proposed by management |

| • | | approving financial and other reporting to the market and stakeholders |

| • | | approving the remuneration framework |

| • | | monitoring of financial, operational and corporate performance against agreed outcomes |

| • | | monitoring and measuring the performance of QTC’s management and implementation of strategy and policies, including assessing whether appropriate resources are available |

| • | | reviewing and monitoring systems of risk management and internal compliance and controls, and |

| • | | monitoring compliance with all relevant legal, tax and regulatory obligations. |

The Board typically holds monthly meetings (except in January, April and November) and may, whenever necessary, hold additional meetings.

Board appointments

The Board comprises board members who are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act, with consideration given to each Board member’s qualifications, experience, skills, strategic ability and commitment to contribute to QTC’s performance and achievement of its corporate objectives. QTC’s Board is entirely constituted of non-executive directors.

Conflict of interest

Board members are required to monitor and disclose any actual or potential conflicts of interest. Unless the Board determines otherwise, a conflicted Board member may not receive any Board papers, attend any meetings or take part in any decisions relating to declared interests.

Performance and remuneration

To ensure continuous improvement and to enhance overall effectiveness, the Board conducts an annual assessment of its performance as a whole. Board members’ remuneration is determined by the Governor-in-Council (details are disclosed in QTC’s financial statements).

Board committees

The Board has established three committees, each with its own terms of reference, to assist it in overseeing and governing various QTC activities.

Accounts and Audit Committee

The Accounts and Audit Committee has responsibility for the:

| • | | adequacy and effectiveness of internal controls, including for the prevention of fraud |

| • | | integrity of financial statements |

| • | | adequacy and effectiveness of compliance monitoring, and |

The Accounts and Audit Committee must have at least three members and meet at least four times a year.

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

During the year the Accounts and Audit Committee recommended the adoption of the half year and annual financial statements, reviewed external and internal audit reports and the progress in implementing the recommendations from those reports, and reviewed the Queensland Audit Office’s Client Service Plan and QTC’s Internal Audit Plan.

As required by the Audit Committee Guidelines: Improving Accountability and Performance issued by Queensland Treasury, QTC’s Accounts and Audit Committee has observed its terms of reference and has had due regard to the Audit Committee Guidelines.

Human Resources Committee

The Human Resources Committee has responsibility for:

| • | | the appropriateness of any new or amended human resources policy |

| • | | the framework for, and review of, employee remuneration and performance, and |

| • | | employment terms and conditions. |

The Human Resources Committee must have at least three members and meet at least three times a year. The Human Resources Committee has observed its terms of reference.

Funding and Markets Committee

The core responsibilities of the Funding and Markets Committee is to assist the Board by making recommendations about the policy to enhance the performance and management of risk in the areas of funding accessibility (including liquidity) and balance sheet management, and to support QTC’s risk appetite with a focus on effectiveness and performance.

The Committee must have at least three members and meet at least four times a year. The Funding and Markets Committee has observed its terms of reference.

| | | | | | | | | | | | | | | | |

| | | BOARD | | | ACCOUNTS

& AUDIT

COMMITTEE | | | FUNDING &

MARKETS

COMMITTEE | | | HUMAN

RESOURCES

COMMITTEE | |

Meetings held | | | 10 | | | | 4 | | | | 4 | | | | 3 | |

Gerard Bradley | | | 10 | | | | 2 | † | | | 4 | | | | 3 | |

Warwick Agnew | | | 9 | | | | 4 | | | | — | | | | — | |

Tonianne Dwyer | | | 10 | | | | — | | | | — | | | | 3 | |

Anne Parkin | | | 10 | | | | 4 | | | | — | | | | 2 | |

Stephen Roberts^ | | | 1 | | | | — | | | | 0 | | | | — | |

Bill Shields* | | | 4 | | | | — | | | | 1 | | | | — | |

Jim Stening | | | 9 | | | | — | | | | 4 | | | | — | |

Karen Smith-Pomeroy§ | | | 10 | | | | 4 | | | | 4 | | | | — | |

| * | Mr Shields resigned from the Board effective 31 December 2016. He attended four Board meetings out of five held during the period. He also attended one Funding and Markets Committee meeting held out of two during the period. |

| ^ | Mr Roberts joined the Board on 8 June 2017. He attended one Board meeting out of one held during the period. Mr Roberts was appointed to the Funding and Markets Committee on 15 June 2017, however no Committee meetings were held during the period. |

| † | Mr Bradley attended two meetings as the Chairman of the Board. |

| § | Ms Smith-Pomeroy was a Funding and Markets Committee member until 15 June 2017. |

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

QTC’s Capital Markets Board as at 30 June 2017

Board members are appointed by the Governor-in-Council, pursuant to section 10(2) of the Queensland Treasury Corporation Act 1988 on the recommendation of the Treasurer and in consultation with the Under Treasurer. Members are chosen on their ability and commitment to contribute to QTC’s performance and achievement of its stated objectives.

| | | | |

| | GERARD BRADLEY BCOM, DIPADVACC, FCA, FCPA, FAICD, FIML Chair Appointed 10 May 2012 with tenure to 30 June 2019 Board Committees • Member, Human Resources Committee • Member, Funding and Markets Committee | | Prior to his appointment as the Chair of QTC’s Board, Mr Bradley was the Under Treasurer and Under Secretary of the Queensland Treasury Department, a position he held from 1998 to 2012. He was also a QTC Board member from 2000-2007. Mr Bradley has extensive experience in public sector finance gained in both the Queensland and South Australian treasury departments. He was Under Treasurer of the South Australian Department of Treasury and Finance from 1996 to 1998, and of Queensland’s Treasury Department from 1995 to 1996. Mr Bradley held various positions in Queensland Treasury from 1976 to 1995, with responsibility for the preparation and management of the State Budget and the fiscal and economic development of Queensland. He is currently a Non-Executive Director and Chairman of Queensland Treasury Holdings Pty Ltd and related companies, and a Non-Executive Director of Star Entertainment Group Ltd, Pinnacle Investment Management Group Limited and the Winston Churchill Memorial Trust. |

| | |

| | WARWICK AGNEW BECON, MSOCSC (ECON), MAPPFIN GRADUATE OF AUSTRALIAN INSTITUTE OF COMPANY DIRECTORS Appointed 13 November 2014 with tenure to 30 June 2020 Board Committee • Member, Accounts and Audit Committee | | Warwick Agnew is Queensland Treasury’s Deputy Under Treasurer, Agency Performance and Investment, previously holding the positions of Deputy Under Treasurer, Commercial Advisory and prior the department’s Chief Operating Officer. Throughout his career, Mr Agnew has held senior leadership positions across both public and private sector organisations including roles with Queensland Treasury and Trade, Queensland Treasury Corporation and ASX-listed entities, Macquarie Capital and Transfield Services. Mr Agnew’s extensive experience has seen him undertake senior roles involving social and economic infrastructure projects, economic analysis and policy, financial and commercial procurement, corporate finance advisory services, and operations and maintenance services at a national level. Mr Agnew represents Queensland Treasury on the Long Term Asset Advisory Board and holds a Director position on the Queensland Rural and Industry Development Authority Board and the Public Trustee Investment Board. Mr Agnew is an Independent Director on the Board of Surf Lifesaving Queensland. |

| | |

| | TONIANNE DWYER BJURIS (HONS), LLB (HONS), GAICD Appointed 14 February 2013 with tenure to 30 June 2020 Board Committee • Chair, Human Resources Committee | | Tonianne Dwyer is a lawyer by profession with a career of more than 25 years in international investment banking and finance in both executive management and board positions. Ms Dwyer’s executive experience covered a broad range of sectors, including real estate investment and development, financial services, health and aged care, education, research and development, and media. She held senior roles with Hambros Bank Limited, Societe Generale and Quintain Estates & Development PLC including a role with the finance division of the UK Department of Health. Over her executive career she had experience in the UK, Europe and Wall Street. Ms Dwyer currently holds directorships with Metcash Limited, DEXUS Property Group, DEXUS Wholesale Property Fund, ALS Limited and Oz Minerals Limited. She is also a Senator and Deputy Chancellor of the University of Queensland. |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

| | | | |

| | ANNE PARKIN B SCIENCE (HONS), DIP. ED, GRAD DIP SEC, MBA, MAICD, F FIN Appointed 1 July 2016 with tenure to 30 June 2019 Board Committees • Member, Accounts and Audit Committee • Member, Human Resources Committee | | Anne Parkin has more than 25 years’ of international management and board level experience across Asia-Pacific banking and financial services. Ms Parkin has held diverse leadership roles in domestic and global broking and banking, superannuation administration, retail management and education in both the public and private sectors. At an executive level, Anne has experience operating in highly regulated businesses including banking with Credit Suisse, UBS, and in Australian superannuation. Ms Parkin is Chairman of Eco Fuels Innovations and previously, was a Non-Executive Director of both Credit Suisse Securities in Malaysia and the Philippines. As an Executive Director, she was a member of the Hong Kong Control Committee responsible for oversight of operational risk for Credit Suisse Hong Kong and its affiliates, while as Operations Executive, she was accountable for operational matters with local regulators including the Hong Kong Monetary Authority and Hong Kong Securities & Futures Commission. In recognition of her expertise in the Asia-Pacific, Ms Parkin was invited to participate in the Asia Securities Industry & Financial Markets Association (ASIFMA). |

| | |

| | STEPHEN ROBERTS BECON Appointed 8 June 2017 with tenure to 20 June 2020 Board Committee • Member, Funding and Markets Committee | | Stephen Roberts brings extensive investment banking, leadership and governance expertise, developed across his career in the global financial markets. He is the former Chief Executive and Chief Country Officer of Citigroup Australia, where he was responsible for the Citi franchise in Australia and New Zealand. Prior to that, Mr Roberts was the Managing Director, Institutional Business, Citigroup Australia, with responsibility for the institutional business, including corporate and investment banking, markets, and transaction services. He has also held senior roles with Salomon Brothers/Citigroup Hong Kong, Lehman Brothers in Hong Kong, Salomon Brothers in London, Melbourne, Sydney and New York. Mr Roberts is a current Director of the Great Barrier Reef Foundation, a Director of the Bradman Foundation, and an Adjunct Professor of Finance, Sydney University. |

| | |

| | KAREN SMITH- POMEROY ADIP (ACCOUNTING), GAICD, FIPA, FFIN Appointed 9 July 2015 with tenure to 8 July 2019 Board Committee • Chair, Accounts and Audit Committee | | Karen Smith-Pomeroy is an experienced financial services senior executive with a specialty in risk and governance. She held senior executive roles with Suncorp Group Limited from1997 to 2014, including Executive Director, Suncorp Group subsidiary entities from 2009 to 2014. She has also held positions on a number of Boards and committees including Queensland Department of Local Government, Community Recovery and Resilience, CS Energy Limited and Tarong Energy Corporation Limited. Ms Smith-Pomeroy is a Non-Executive Director of National Affordable Housing Consortium Limited, Stanwell Corporation Limited, InFocus Limited and Kina Securities Limited. She is a Queensland Advisory Board member of Australian Super and is also an Independent Audit Committee member of the Queensland Department of Infrastructure, Local Government and Planning, and South Bank Corporation. |

| | |

| | JIM STENING DIPFINSERV, FAICD Appointed 13 November 2014 with tenure to 30 June 2020 Board Committee • Chair, Funding and Markets Committee | | Jim Stening has more than 30 years’ experience in financial markets in the fixed income asset class, including hands-on trading and investing in Australian and global capital markets. Mr Stening has extensive experience in debt markets, business development, executive management and corporate governance across a diverse range of economic cycles. He has held senior roles at NAB, Merrill Lynch and Banco Santander in addition to his role as founder and Managing Director of FIIG Securities Limited, Australia’s largest specialist fixed-income firm. Mr Stening is the Managing Director of FIIG Securities Limited (and related companies) and Chairman of OzFish Unlimited. |

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Long Term Asset Advisory Board

The Long Term Asset Advisory Board (LTAAB) was established in July 2008, following the transfer of certain superannuation and other long-term assets from Treasury to QTC (primarily for reasons relating to market volatility).

The LTAAB has power delegated from QTC to:

| • | | manage the sufficiency of the funding of the long-term assets |

| • | | set investment objectives and strategies for the long-term assets |

| • | | set the appropriate investment structure for the long-term assets, and |

| • | | monitor investment performance of the long-term assets. |

The LTAAB holds meetings at least four times per year and held six in the year under review.

The LTAAB members are appointed by the Governor-in-Council, pursuant to section 10(2) of the QTC Act.

The members of LTAAB are:

| | |

Name | | Position |

| Jim Murphy, Under Treasurer | | Chairperson |

| Philip Noble, Chief Executive, QTC | | Member |

| Wayne Cannon, State Actuary | | Member |

| Dennis Molloy, Deputy Under Treasurer (Economics and Fiscal) | | Member |

| Warwick Agnew, Deputy Under Treasurer (Agency Performance and Investment) | | Member |

The LTAAB has observed its terms of reference.

Auditors

In accordance with the provisions of the Auditor-General Act 2009, the Queensland Audit Office is the external auditor for QTC. The Queensland Audit Office has the responsibility for providing Queensland’s Parliament with assurances as to the adequacy of QTC’s discharge of its financial and administrative obligations.

The Financial and Performance Management Standard 2009 (Qld) (Standard) governs the operation of QTC’s internal audit function. QTC outsourced its independent internal audit function to Ernst and Young (EY) for the 2016-17 financial year. Internal audit reports to the Accounts and Audit Committee and is conducted under an Internal Audit Policy,

consistent with the relevant audit and ethical standards. The role of internal audit is to support QTC’s corporate governance framework by providing the Board (through the Accounts and Audit Committee) with:

| • | | assurance that QTC has effective, efficient and economical internal controls in place to support the achievement of its objectives, including the management of risk, and |

| • | | advice with respect to QTC’s internal controls and business processes. |

Internal audit is responsible for:

| • | | developing an annual audit plan, based on the assessment of financial and business risks (based on QTC’s approved significant risks and internal workshops) aligned with QTC’s strategic goals and objectives, and approved by the Accounts and Audit Committee |

| • | | providing regular audit reports and periodic program management reports to the management team and the Accounts and Audit Committee, and |

| • | | working constructively with QTC’s management team to challenge and improve established and proposed practices and to put forward ideas for process improvement. |

In the year under review, EY completed its internal audits in accordance with the approved annual audit plan.

QTC has had due regard to Treasury’s Audit Committee guidelines, in establishing and supervising its outsourced internal audit function and, together with the Accounts and Audit Committee, in overseeing and monitoring the internal audit function.

Management team

The responsibility for the day-to-day operation and administration of QTC is delegated by the Board to the Chief Executive and the Executive Management Team. The Chief Executive is appointed by the Board. Executives are appointed by the Chief Executive. As with the Board, Executive Management Team appointments are made on the basis of qualifications, experience, skills, strategic ability, and commitment to contribute to QTC’s performance and achievement of its corporate objectives

QTC’s Executive Management Team as at 30 June 2017

| | |

| Philip Noble | | Chief Executive |

| Grant Bush | | Deputy Chief Executive and Managing Director, Funding and Markets |

| Mark Girard | | Managing Director, Client Advisory |

| Rupert Haywood | | Managing Director, Risk and Financial Operations |

| Jane Keating | | Managing Director, Corporate Services |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Financial Statements

For the year ended 30 June 2017

| | | | |

Statement of comprehensive income | | | 18 | |

| |

Balance sheet | | | 19 | |

| |

Statement of changes in equity | | | 20 | |

| |

Statement of cash flows | | | 21 | |

| |

Notes to the Financial Statements | | | 22 | |

| |

∎ Capital Markets Operations | | | 24 | |

| |

∎ Long Term Assets | | | 39 | |

| |

∎ Other information | | | 41 | |

| |

Certificate of the Queensland Treasury Corporation | | | 45 | |

| |

Independent Auditor’s report | | | 46 | |

| |

Management report | | | 50 | |

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Statement of comprehensive income

For the year ended 30 June 2017

| | | | | | | | | | | | |

| | | NOTE | | | 2017

$000 | | | 2016

$000 | |

| | | |

CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

| | | |

Net income on financial instruments at fair value through profit or loss | | | | | | | | | | | | |

Gain on financial assets | | | 3 | | | | 574 993 | | | | 8 380 795 | |

Loss on financial liabilities | | | 3 | | | | (476 872 | ) | | | (8 341 333 | ) |

| | | | | | | 98 121 | | | | 39 462 | |

| | | |

Other income | | | | | | | | | | | | |

Fee income | | | | | | | 82 135 | | | | 79 603 | |

Lease income | | | | | | | 37 218 | | | | 46 272 | |

Amortisation of cross border lease deferred income | | | | | | | 29 298 | | | | 4 324 | |

| | | | | | | 148 651 | | | | 130 199 | |

| | | |

Expenses | | | | | | | | | | | | |

Administration expenses | | | 4 | | | | (73 575 | ) | | | (75 713 | ) |

Depreciation on leased assets | | | 13 | | | | (29 813 | ) | | | (37 754 | ) |

| | | | | | | (103 388 | ) | | | (113 467 | ) |

Profit from capital markets operations before income tax | | | | | | | 143 384 | | | | 56 194 | |

Income tax expense | | | 5 | | | | (14 200 | ) | | | (9 310 | ) |

Profit from capital markets operations after income tax | | | | | | | 129 184 | | | | 46 884 | |

| | | |

LONG TERM ASSETS | | | | | | | | | | | | |

| | | |

Net return from investments in long term assets | | | | | | | | | | | | |

Net change in fair value of unit trusts | | | | | | | 2 382 036 | | | | 1 441 186 | |

Interest on fixed rate notes | | | | | | | (2 065 828 | ) | | | (2 245 946 | ) |

Management fees | | | | | | | (91 617 | ) | | | (103 870 | ) |

Profit/(loss) from long term assets | | | | | | | 224 591 | | | | (908 630 | ) |

| | | | | | | | | | | | |

Total net profit/(loss) for the year after tax | | | | | | | 353 775 | | | | (861 746 | ) |

| | | | | | | | | | | | |

Total comprehensive income/(loss) attributable to the owner | | | | | | | 353 775 | | | | (861 746 | ) |

| | | | | | | | | | | | |

Total comprehensive income/(loss) derived from: | | | | | | | | | | | | |

Capital Markets Operations | | | | | | | 129 184 | | | | 46 884 | |

Long Term Assets | | | | | | | 224 591 | | | | (908 630 | ) |

| | | | | | | | | | | | |

Total comprehensive income/(loss) | | | | | | | 353 775 | | | | (861 746 | ) |

| | | | | | | | | | | | |

The notes on pages 22 to 44 are an integral part of these financial statements.

Note: Throughout these financial statements the Capital Markets Operations and the Long Term Assets operations have been disclosed separately to distinguish between QTC’s main central treasury management role and its additional responsibilities following the transfer of the State’s superannuation and other long term assets (refer note 1).

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Balance sheet

As at 30 June 2017

| | | | | | | | | | | | |

| | | NOTE | | | 2017

$000 | | | 2016

$000 | |

| | | |

ASSETS – CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

Cash and cash equivalents | | | 6 | | | | 2 124 768 | | | | 1 141 617 | |

Receivables | | | | | | | 4 018 | | | | 11 326 | |

Financial assets at fair value through profit or loss | | | 7 | | | | 19 268 151 | | | | 16 516 449 | |

Derivative financial assets | | | 8 | | | | 337 559 | | | | 224 989 | |

Onlendings | | | 9 | | | | 85 101 958 | | | | 90 822 729 | |

Property, plant and equipment | | | 13 | | | | 96 584 | | | | 134 649 | |

Intangible assets | | | | | | | 19 189 | | | | 17 557 | |

Deferred tax asset | | | | | | | 2 710 | | | | 3 372 | |

| | | | | | | 106 954 937 | | | | 108 872 688 | |

| | | |

ASSETS – LONG TERM ASSETS | | | | | | | | | | | | |

Financial assets at fair value through profit or loss | | | 15 | | | | 31 714 458 | | | | 31 076 084 | |

| | | | | | | 31 714 458 | | | | 31 076 084 | |

| | | | | | | | | | | | |

Total Assets | | | | | | | 138 669 395 | | | | 139 948 772 | |

| | | |

LIABILITIES – CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

Payables | | | | | | | 34 948 | | | | 33 448 | |

Derivative financial liabilities | | | 8 | | | | 175 192 | | | | 524 002 | |

Financial liabilities at fair value through profit or loss | | | | | | | | | | | | |

- Interest-bearing liabilities | | | 10 | (a) | | | 98 462 982 | | | | 100 679 305 | |

- Deposits | | | 10 | (b) | | | 7 428 891 | | | | 6 844 876 | |

Provision for dividend | | | 23 | | | | 500 000 | | | | 47 000 | |

Other liabilities | | | | | | | 13 322 | | | | 33 640 | |

| | | | | | | 106 615 335 | | | | 108 162 271 | |

| | | |

LIABILITIES – LONG TERM ASSETS | | | | | | | | | | | | |

Financial liabilities at amortised cost | | | | | | | 30 799 145 | | | | 30 385 361 | |

| | | | | | | 30 799 145 | | | | 30 385 361 | |

| | | | | | | | | | | | |

Total Liabilities | | | | | | | 137 414 480 | | | | 138 547 632 | |

| | | | | | | | | | | | |

| | | |

NET ASSETS | | | | | | | 1 254 915 | | | | 1 401 140 | |

| | | |

EQUITY – CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

Retained surplus | | | | | | | 339 601 | | | | 710 417 | |

| | | | | | | 339 601 | | | | 710 417 | |

| | | |

EQUITY – LONG TERM ASSETS | | | | | | | | | | | | |

Retained surplus | | | | | | | 915 314 | | | | 690 723 | |

| | | | | | | 915 314 | | | | 690 723 | |

| | | | | | | | | | | | |

Total Equity | | | | | | | 1 254 915 | | | | 1 401 140 | |

| | | | | | | | | | | | |

The notes on pages 22 to 44 are an integral part of these financial statements.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Statement of changes in equity

For the year ended 30 June 2017

| | | | | | | | | | | | | | | | |

| | | NOTE | | | CAPITAL

MARKETS

OPERATIONS | | | LONG TERM

ASSETS | | | | |

| | | | | | RETAINED

SURPLUS

$000 | | | RETAINED

SURPLUS

$000 | | | TOTAL

EQUITY

$000 | |

Balance at 1 July 2015 | | | | | | | 710 533 | | | | 1 599 353 | | | | 2 309 886 | |

Profit/(loss) for the year | | | | | | | 46 884 | | | | (908 630 | ) | | | (861 746 | ) |

Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | |

Dividends provided for or paid | | | 23 | | | | (47 000 | ) | | | — | | | | (47 000 | ) |

Balance at 30 June 2016 | | | | | | | 710 417 | | | | 690 723 | | | | 1 401 140 | |

| | | | |

Balance at 1 July 2016 | | | | | | | 710 417 | | | | 690 723 | | | | 1 401 140 | |

Profit for the year | | | | | | | 129 184 | | | | 224 591 | | | | 353 775 | |

Transactions with owners in their capacity as owners: | | | | | | | | | | | | | | | | |

Repatriation dividend provided for or paid | | | 23 | | | | (500 000 | ) | | | — | | | | (500 000 | ) |

Balance at 30 June 2017 | | | | | | | 339 601 | | | | 915 314 | | | | 1 254 915 | |

The notes on pages 22 to 44 are an integral part of these financial statements.

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Statement of cash flows

For the year ended 30 June 2017

| | | | | | | | | | | | |

| | | NOTE | | | 2017

$000 | | | 2016

$000 | |

| | | |

CAPITAL MARKETS OPERATIONS | | | | | | | | | | | | |

| | | |

Cash flows from operating activities | | | | | | | | | | | | |

Interest received from onlendings | | | | | | | 4 000 692 | | | | 4 162 623 | |

Interest received from investments and other sources | | | | | | | 595 279 | | | | 571 729 | |

Fees received | | | | | | | 81 667 | | | | 69 306 | |

Net GST | | | | | | | 317 | | | | (4 352 | ) |

Interest paid on interest-bearing liabilities | | | | | | | (4 609 029 | ) | | | (5 124 544 | ) |

Interest paid on deposits | | | | | | | (183 508 | ) | | | (216 203 | ) |

Administration expenses paid | | | | | | | (67 596 | ) | | | (70 121 | ) |

Income tax paid | | | | | | | (9 654 | ) | | | (9 678 | ) |

Net cash used in operating activities | | | 14 | | | | (191 832 | ) | | | (621 240 | ) |

| | | |

Cash flows from investing activities | | | | | | | | | | | | |

Proceeds from sale of investments | | | | | | | 30 801 805 | | | | 35 637 771 | |

Payments for investments | | | | | | | (33 662 640 | ) | | | (33 750 857 | ) |

Net onlendings | | | | | | | 1 868 187 | | | | 2 864 368 | |

Payments for intangibles | | | | | | | (3 390 | ) | | | (15 501 | ) |

Proceeds from sale of property, plant and equipment | | | | | | | 10 471 | | | | 6 756 | |

Payments for property, plant and equipment | | | | | | | (3 905 | ) | | | — | |

Net cash (used in)/provided by investing activities | | | | | | | (989 472 | ) | | | 4 742 537 | |

| | | |

Cash flows from financing activities | | | | | | | | | | | | |

Proceeds from interest-bearing liabilities | | | | | | | 50 575 339 | | | | 40 140 535 | |

Repayment of interest-bearing liabilities | | | | | | | (48 937 845 | ) | | | (44 316 271 | ) |

Net deposits | | | | | | | 573 961 | | | | (879 586 | ) |

Dividends paid | | | | | | | (47 000 | ) | | | (41 000 | ) |

Net cash provided/(used in) financing activities | | | | | | | 2 164 455 | | | | (5 096 322 | ) |

| | | |

Net increase/(decrease) cash and cash equivalents held | | | | | | | 983 151 | | | | (975 025 | ) |

Cash and cash equivalents at 1 July | | | | | | | 1 141 617 | | | | 2 116 642 | |

Cash and cash equivalents at 30 June | | | 6 | | | | 2 124 768 | | | | 1 141 617 | |

| | | |

LONG TERM ASSETS | | | | | | | | | | | | |

No external cash flow is generated from the long term assets (refer note 1). | | | | | | | | | | | | |

The notes on pages 22 to 44 are an integral part of these financial statements.

| | | | |

| ANNUAL | | QUEENSLAND TREASURY CORPORATION | | |

| REPORT 2016-17 | | | | |

Notes to the Financial Statements

For the year ended 30 June 2017

Contents

| | | | | | |

| 1 | | General information | | | 22 | |

| | |

| 2 | | Significant accounting policies and other explanatory information | | | 22 | |

| |

Capital Markets Operations | | | | |

| | |

| 3 | | Net income on financial instruments at fair value through profit or loss | | | 24 | |

| | |

| 4 | | Administration expenses | | | 24 | |

| | |

| 5 | | Income tax expense | | | 25 | |

| | |

| 6 | | Cash and cash equivalents | | | 25 | |

| | |

| 7 | | Financial assets at fair value through profit or loss | | | 26 | |

| | |

| 8 | | Derivative financial assets and derivative financial liabilities | | | 26 | |

| | |

| 9 | | Onlendings | | | 27 | |

| | |

| 10 | | Financial liabilities at fair value through profit or loss | | | 27 | |

| | |

| 11 | | Financial risk management | | | 30 | |

| | |

| 12 | | Fair value hierarchy | | | 36 | |

| | |

| 13 | | Property, plant and equipment | | | 37 | |

| | |

| 14 | | Notes to the statement of cash flows | | | 38 | |

| |

Long Term Assets | | | | |

| | |

| 15 | | Financial assets at fair value through profit or loss | | | 39 | |

| | |

| 16 | | Financial risk management | | | 40 | |

| | |

| 17 | | Fair value hierarchy | | | 40 | |

| |

Other information | | | | |

| | |

| 18 | | Contingent liabilities | | | 41 | |

| | |

| 19 | | Related party transactions | | | 41 | |

| | |

| 20 | | Key management personnel | | | 41 | |

| | |

| 21 | | Auditor’s remuneration | | | 43 | |

| | |

| 22 | | Investments in companies | | | 44 | |

| | |

| 23 | | Dividends | | | 44 | |

| | |

| 24 | | Events subsequent to balance date | | | 44 | |

Queensland Treasury Corporation (QTC) is constituted under the Queensland Treasury Corporation Act 1988 (the Act), with the Under Treasurer designated as the Corporation Sole under section 5 (2) of the Act. QTC is domiciled in Queensland, Australia, with its principal place of business being 111 Eagle Street, Brisbane, Queensland. QTC’s ultimate parent is the State of Queensland.

QTC is the Queensland Government’s central financing authority. QTC also provides a range of financial services to the State and its public sector entities, including local governments. These services include debt funding and management, cash management facilities, financial risk management advisory services, and specialist public finance education.

These services, which form part of QTC’s Capital Markets Operations segment, are undertaken on a cost-recovery basis with QTC lending at an interest rate based on its cost of funds and with the benefits/costs of liability and asset management being passed on to its clients being Queensland public sector entities. QTC’s Capital Markets Operations can generate a profit largely reflecting the interest earned from investments held for capital and liquidity purposes. In undertaking its Capital Markets activities, QTC maintains adequate capital to manage its risks.

QTC holds a portfolio of assets which were transferred to QTC by the State Government. These assets are the investments of QTC’s Long Term Assets segment and are held to fund superannuation and other long-term obligations of the State. In return, QTC has issued to the State fixed rate notes with an interest rate of 7.0 per cent which is the expected long term average rate of return on the portfolio. This has resulted in the State receiving a fixed rate of return on the notes, while QTC absorbs the impact of fluctuations in the value and returns on the asset portfolio.

The Long Term Asset Advisory Board (LTAAB) is responsible for the oversight of the Long Term Assets which do not form part of QTC’s day-to-day Capital Markets Operations. The Long Term Assets are held in unit trusts managed by QIC Limited (QIC).

The principal accounting policies adopted in the preparation of the financial report are set out below and in the relevant notes to the financial statements.

| 2 | Significant accounting policies and other explanatory information |

These general purpose financial statements for the year ended 30 June 2017 have been prepared in accordance with Australian Accounting Standards (AASBs) and interpretations adopted by the Australian Accounting Standards Board, the requirements of the Financial Accountability Act 2009, the Financial and Performance Management Standard 2009, and the Financial reporting requirements for Queensland Government Agencies (as applicable to statutory bodies).

Compliance with International Financial Reporting Standards

QTC’s financial statements comply with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board. While QTC is designated as a not-for-profit entity, the Corporation has elected to comply with the requirements of IFRS as if it is a for-profit entity. Reporting as a for-profit entity does materially change the financial statements of the Corporation.

Changes in accounting policy, disclosures, standards and interpretations

The accounting policies adopted are consistent with those of the previous financial year.

New accounting standards: All new and amended accounting standards effective for the financial year were adopted. While these new and amended standards may have resulted in disclosure changes, there has been no change to the amounts recognised in these statements.

Standards and interpretations not yet adopted: Certain new accounting standards have been issued that are not mandatory for the current reporting period. The Corporation’s assessment of the impact of material changes from these standards and interpretations are set out below.

Effective for annual reporting periods beginning on or after 1 January 2017:

| • | | AASB 2016-2: Amendments to Australian Accounting Standards – Disclosure Initiative: Amendments to AASB 107 will introduce additional disclosures to include a breakdown of movements in borrowing showing cash flows, such as drawdowns and repayment of borrowings, and non-cash changes, such as acquisitions, disposals and unrealised exchange differences. |

Effective for annual periods beginning on or after 1 January 2018:

| • | | AASB 9 Financial Instruments will replace AASB 139 Financial Instruments: Recognition and measurement. The new standard specifies new classification and measurement requirements for financial assets and financial liabilities within the scope of AASB 139. The amendments require financial assets to be measured at fair value through profit or loss unless they meet the criteria for amortised cost measurement. For financial liabilities, AASB 9 has largely adopted the classification and measurement criteria currently contained in AASB 139. Under the revised standard, any change in fair value attributable to an entity’s own credit risk is to be shown in other comprehensive income, not as part of profit or loss. An exemption applies to entities which have offsetting risk profiles which allows QTC to measure both financial assets and financial liabilities at fair value through profit or loss. Therefore the new standard is not expected to change the current practice of measuring changes in fair value movements of financial instruments through profit or loss. |

| • | | AASB 15 Revenue from contracts with customers will replace AASB 118 Revenue. The new standard is based on the principle that revenue is recognised when control of a good or service transfers to a customer with the control model replacing one of risk and rewards. This is not expected to impact QTC’s recognition of revenue which primarily relates to earnings on financial instruments and fees charged on the outstanding balance of debt and investment products. |

| | | | |

| | QUEENSLAND TREASURY CORPORATION | | ANNUAL |

| | | | REPORT 2016-17 |

Effective for annual periods beginning on or after 1 January 2019:

| • | | AASB 16 Leases will change the accounting by lessees and result in the recognition of almost all leases on the balance sheet. The standard requires the recognition of a right to use asset and the liability for the present value of future lease commitments. This standard removes the current distinction between operating and financing leases. This standard will result in a lease for QTC’s principal office and associated obligations being recognised on balance sheet. |

Other than as noted above, the adoption of various Australian Accounting Standards and Interpretations on issue but not yet effective is not expected to have a material impact on the financial statements of the Corporation. However, the pronouncements may result in minor changes to how information is currently disclosed.

Basis of measurement

The financial statements are prepared on the basis of fair value measurement of assets and liabilities except where otherwise stated. Fair value is the amount for which an asset could be exchanged or liability settled between knowledgeable, willing parties in an arm’s length transaction.

Functional and presentation currency: These financial statements are presented in Australian dollars which is QTC’s functional currency.

Classification of assets and liabilities: The balance sheet is presented on a liquidity basis. Assets and liabilities are presented in decreasing order of liquidity and are not distinguished between current and non-current.

Foreign currency transactions are initially translated into Australian dollars at the rate of exchange applying at the date of the transaction. At balance date, amounts payable to and by QTC in foreign currencies have been valued using current exchange rates after taking into account interest rates and accrued interest.

Exchange gains/losses are brought to account in the statement of comprehensive income.

QTC enters into a range of transactions with counterparties which require the lodgement of collateral subject to agreed market thresholds. Where these thresholds are exceeded, QTC may be required to either pledge assets to, or be entitled to receive pledged assets from, the counterparty to secure these transactions. The assets pledged or received are primarily in the form of cash.

| (d) | Offsetting financial instruments |

QTC offsets financial assets and liabilities where there is a legally enforceable right to set-off, and there is an intention to settle on a net basis or to realise the asset and settle the liability simultaneously (refer note 11 (c) (iv)).

Securities sold under agreements to repurchase at an agreed price are retained within the financial assets at fair value through profit or loss category while the obligation to repurchase is disclosed as a deposit.

Lease income from operating leases where QTC is the lessor is recognised as income on a straight line basis over the lease term.

| (g) | Cross border leases - income recognition |

Income received on cross border leases is deferred and amortised over the term of the lease or when the obligations under the lease is expired. During the financial year, QTC terminated all remaining cross border leases and recognised any remaining deferred revenue.

Fee income includes:

| • | | Management fee income which represents income earned from the management of QTC’s onlendings and deposits recognised on an accrual basis when the service has been provided; and |

| • | | Professional fees are recognised to the extent that it is probable that the economic benefits will flow to QTC and can be measured reliably. |

| • | | Revenue on financial guarantees are recognised at inception and on an ongoing basis over the contract term. As the probability of default is extremely low due to counter indemnities the revenue receivable is reflective of fair value. |

Unless otherwise determined by the Governor in Council, the Queensland Treasury Corporation Act 1988 requires that all profits shall accrue to the benefit of the State Consolidated Fund and all losses shall be the responsibility of the State Consolidated Fund. Dividends are provided for following approval by the Board after considering QTC’s capital requirements.

Acquired computer software licences and development costs are capitalised on the basis of the costs incurred to acquire and bring to use the specific software. These assets are amortised on a straight-line basis over the period of expected benefit, which is usually between three and ten years.