EXHIBIT (c)(v)

Queensland’s Budget Papers for 2019-20.

FORWARD-LOOKING STATEMENTS

This exhibit contains forward-looking statements. Statements that are not historical facts, including statements about the State of Queensland’s (the “State” or “Queensland”) beliefs and expectations, are forward-looking statements. These statements are based on current plans, budgets, estimates and projections and therefore you should not place undue reliance on them. The words “believe”, “may”, “will”, “should”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and neither the Queensland Treasury Corporation nor the State undertake any obligation to update publicly any of them in light of new information or future events.

Forward-looking statements are based on current plans, estimates and projections and, therefore, undue reliance should not be placed on them. Although the Queensland Treasury Corporation and the State believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such beliefs and expectations will prove to have been correct. Forward-looking statements involve inherent risks and uncertainties. We caution you that actual results may differ materially from those contained in any forward-looking statements.

A number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. Factors that could cause the actual outcomes to differ materially from those expressed or implied in forward-looking statements include:

| | • | | the international and Australian economies, and in particular the rates of growth (or contraction) of the State’s major trading partners; |

| | • | | the effects, both internationally and in Australia, of any subsequent economic downturn, the effect of ongoing economic, banking and sovereign debt risk, and any stalling of the protracted United States recovery; |

| | • | | increases or decreases in international and Australian domestic interest rates; |

| | • | | changes in the State’s domestic consumption; |

| | • | | changes in the State’s labor force participation and productivity; |

| | • | | downgrades in the credit ratings of the State and Australia; |

| | • | | changes in the rate of inflation in the State; |

| | • | | changes in environmental and other regulation; and |

| | • | | changes in the distribution of revenue from the Commonwealth of Australia Government to the State. |

QUEENSLAND BUDGET 2019-20

Budget Speech

Budget Paper No.1

budget.qld.gov.au

2019-20 Queensland Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

5. Service Delivery Statements

Appropriation Bills

Budget Highlights

The Budget Papers are available online at budget.qld.gov.au

© The State of Queensland (Queensland Treasury) 2019

Copyright

This publication is protected by the Copyright Act 1968

Licence

This document is licensed by the State of Queensland (Queensland Treasury) under a Creative Commons Attribution (CC BY 4.0) International licence.

In essence, you are free to copy, communicate and adapt this publication, as long as you attribute the work to the State of Queensland (Queensland Treasury). To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/

Attribution

Content from this publication should be attributed to:

© The State of Queensland (Queensland Treasury) - 2019-20 Queensland Budget

Translating and interpreting assistance

The Queensland Government is committed to providing accessible services to Queenslanders from all cultural and linguistic backgrounds. If you have difficulty in understanding this publication, you can contact us on telephone (07) 3035 3503 and we will arrange an interpreter to effectively communicate the report to you.

Budget Speech

Budget Paper No. 1

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

Appropriation Bill 2019

(First reading speech, 11 June 2019)

The Honourable Jackie Trad MP

Deputy Premier

Treasurer

Minister for Aboriginal and Torres Strait Islander Partnerships

Mr Speaker,

I move that the Bill be now read a first time.

Today I deliver a Queensland Budget unashamedly focussed on our regions.

I do so because Queensland is the most decentralised state in the federation.

1

A state that relies – more than any other – on the strength of its regional cities and towns.

On the prosperity of its regional economies.

And on the character and resilience of its regional communities.

Mr Speaker, our regions define who we are as Queenslanders.

When our regions do well, all of Queensland does well.

And so in shaping this Budget, it is regional Queenslanders who have been at the forefront of our thoughts.

Mr Speaker, this is a Budget for regional Queensland.

Our tourism regions. Our agricultural regions. And our coal and resource regions.

And it builds on a significant ongoing commitment by the Palaszczuk Government to regional Queensland.

Since 2015, the Palaszczuk Government has invested $29 billion in infrastructure outside of Greater Brisbane.

That’s almost 70 per cent of our entire capital spend – to strengthen our regional economies and improve hospitals and schools.

2

Mr Speaker, the list of projects completed or underway is too long to mention in detail, but the investment across our state includes:

| | • | | The Smithfield Bypass in Far North Queensland |

| | • | | The Berth 4 upgrade at the Port of Townsville |

| | • | | The Rockhampton Ring Road |

| | • | | The Capricornia Correctional Centre expansion |

| | • | | Major upgrades to the Bruce Highway |

| | • | | The Sunshine Coast University Hospital |

| | • | | The Gold Coast Light Rail extension; and |

| | • | | The Kingaroy and Roma Hospital redevelopments. |

And Mr Speaker

We’re not about to stop investing in regional Queensland.

Staying the Course

Budgets are about choices.

Today, through this Budget, the Palaszczuk Government is choosing to stay the course.

We choose to continue our strategy of investing in jobs and in front line services to meet the needs of a growing state.

3

We choose to support business, particularly small and medium sized business, to create jobs.

We choose to prepare our state for the future by investing in new industries and skills.

We choose not to cut, sack and sell.

And we make these choices because our economic plan is working to create jobs.

The proof is in the numbers.

Since 2015, 199,000 jobs have been created.

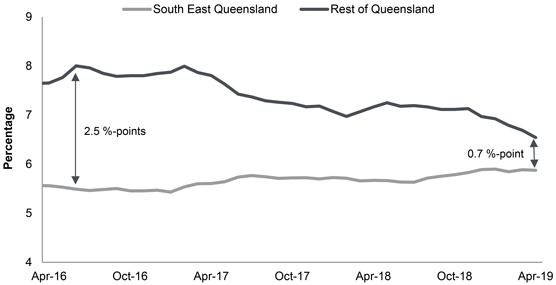

And the gap between unemployment in the regions and SEQ is narrowing.

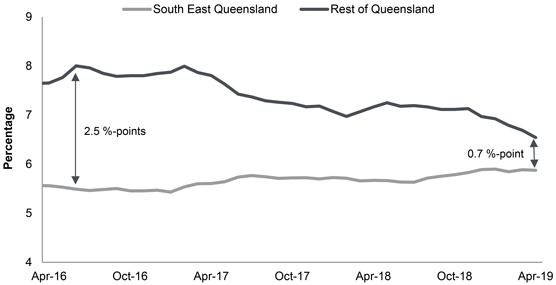

Because of this Government’s focus on delivering infrastructure and creating jobs, in recent years this gap has fallen from 2.5 per cent to just 0.7 per cent.

In fact, in the last year alone in regional Queensland jobs are being created twice as fast as the population is growing.

Infrastructure

Mr Speaker,

These outcomes are no coincidence.

4

They have been achieved as a result of the Palaszczuk Government’s focus on our number one priority – jobs for Queenslanders.

And in this Budget, we stay the course.

We continue our focus on job generating infrastructure with an investment of $49.5 billion over four years.

This year the capital program will invest almost $13 billion in job generating infrastructure, directly supporting more than 40,000 jobs.

And more than 25,000 or 63 per cent of those jobs will be in regions outside of Greater Brisbane.

This contrasts sharply with the Federal Government’s Northern Australia Infrastructure Facility, which is yet to spend a single cent – or deliver a single new job – in regional Queensland.

Here’s a sample of what our Government is delivering right across Queensland:

| | • | | Continuing the work on the Mackay Ring Road |

| | • | | Expanding the Townsville Port |

| | • | | Upgrading to the RG Tanna Coal Terminal in Gladstone |

| | • | | Upgrading the M1 at key congestion points including the Pacific and Gateway Motorway merge |

5

| | • | | Improving regional roads including the Kennedy Development Road and the Barkly Highway from Mt Isa to Cloncurry |

| | • | | Delivering Cross River Rail to double our rail network capacity across the river meaning more trains from the Gold Coast and the Sunshine Coast |

| | • | | Building the new North Queensland Stadium due to open ahead of the NRL Premiership Season next year |

| | • | | Making a multi–million dollar investment in train manufacturing jobs in Maryborough at Downer EDI |

| | • | | Developing a new export hub for regional Queensland |

| | • | | Building a new counter-terrorism training facility at Wacol |

And so much more.

In this Budget we are investing another $70 million in the Building our Regions Program bringing our total commitment in this job generating program to $515 million.

Building infrastructure creates good jobs in construction.

But it also builds our economic capacity, attracting new industry and private investment.

6

Our Economy Today

That’s why, Mr Speaker, now is not the time to change course.

Despite the challenges of natural disasters, Canberra’s cuts and an unfair GST distribution – it’s not the time to diminish our investment in Queensland’s economic prosperity.

Our commitment to keep building job-generating infrastructure and capital projects will see our borrowing with Queensland Treasury Corporation remain at affordable levels – $72 billion in 2019-20.

Mr Speaker, Queensland can afford this continued investment.

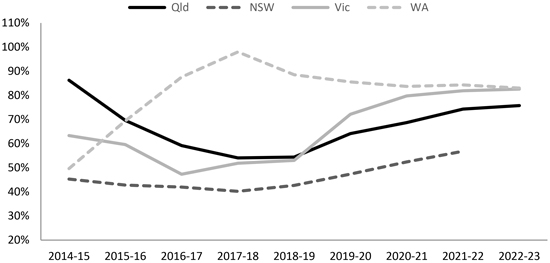

The General Government debt-to-revenue ratio is a key measure of our capacity to sustain our investment.

The Government’s careful management of borrowings means that this ratio will remain lower than any other major state except New South Wales.

And it is only lower in New South Wales because they have chosen to privatise assets.

Mr Speaker, Queensland’s economy – and our Budget – are strong.

7

Counting the total value of everything we produce, Queensland is a $350 billion economy – three times what it was in 1990.

And Queensland’s economic growth is forecast to strengthen next financial year to 3 per cent and then 2 and three-quarter per cent for the following three years.

In fact, 2019-20 is expected to be the third year in a row that Queensland’s growth rate outperforms national growth.

We will achieve surpluses in every year of the forward estimates period.

And this will see revenue growth outpace expenses growth over the forward estimate period.

We will continue to see the net worth of the state grow.

And by 2021, for the first time, the state’s net worth will be more than $200 billion.

Sectors & innovation

Mr Speaker,

As our economy grows, we also need to underpin its strength through diversification.

8

That’s why the Palaszczuk Government is committed to developing new industries.

Advanced Manufacturing

Queensland is emerging as an advanced manufacturing state – creating new products for a new decade.

For example, together with industry and the community, we won the $5.2 billion Land 400 contract with Rheinmettall at Ipswich.

This will see advanced manufacturing activity never before undertaken in Queensland.

With new skills and new capabilities contributing to a more diverse economy.

Energy

As well, Queensland is at the forefront of the global energy revolution – another opportunity to diversify our economy.

No state has more to gain from gas and hydrogen, solar and wind.

We lead the nation when it comes to energy supply and reform.

9

We power the nation with our energy exports to the national grid.

We help to power the globe with Queensland’s coal and now our LNG exports which total $15 billion a year.

All thanks to a Labor Government with the foresight more than a decade ago to create an entirely new resource industry for our state.

And now we have the opportunity to do it again with hydrogen.

Global demand for hydrogen is increasing, with the market expected to reach an astonishing US$155 billion by 2022 – only three years away.

We want Queensland to be the home of this new industry. In the same way as we’ve become a key player in LNG.

Our renewable resources of solar and wind, combined with the existing gas pipeline infrastructure and port facilities gives us a competitive edge for the future production and export of hydrogen.

That’s why this Budget provides $19 million to help kick start the hydrogen industry in Queensland.

10

Innovation

Mr Speaker, this Government continues to support the entrepreneurs who are helping to diversify our economy.

Like the entrepreneurs from RedEarth Energy Storage at Darra who have developed battery systems which can store excess electricity for use after the sun goes down.

Like the social entrepreneurs who founded Orange Sky in Brisbane.

This enterprise has now expanded to 29 services across the country. Each week their vans do 10 tonnes of laundry and provide 122 showers for people in need.

Like the home-grown start-up company, Didgigo – based in Cairns and delivering new and exciting bespoke solutions in the tourism industry.

And the amazing work of Immunologist Professor Ian Frazer – who is investigating the use of a new therapeutic vaccine he invented to treat head and neck cancers.

Our $175 million Jobs and Regional Growth Fund is helping Queensland to be at the forefront of a developing biofuels industry.

11

For example, the latest biorefinery pilot project in the Gladstone region will target production of four tonnes of renewable diesel and jet fuel daily, creating an estimated 50 jobs.

Resources

Mr Speaker, our efforts to build innovative new industries rests on the shoulders of Queensland’s continuing traditional strengths.

Queensland is a resources state.

In the past four years we have attracted more than $20 billion worth of new investment in resources and created more than 7,000 jobs.

And we will continue to innovate in mining and exploration.

The North West Minerals Province contains approximately 75 per cent of Queensland’s base metal and mineral endowment, including copper, lead, zinc, silver, gold and phosphate deposits.

These are the very resources the world’s new economy is demanding.

We want to unlock this potential.

12

That’s why this Budget invests in new initiatives to promote exploration, mining and exports in the North West Minerals Province.

This includes common-user facilities at the Port of Townsville – open for use by any above-rail operator.

It means that wagons of mineral concentrate that are destined for the world’s markets will no longer have to be unloaded more than 12 kilometres away and transported by truck through Townsville to the Port.

Our investment also includes a reduction in rail access charges on the Mt Isa line.

This means our resources will get from pit to port in the most competitive and cost-effective way.

This is a clear signal to global markets that we are serious about opening up the North West Minerals Province to the world and we’ve backed it with a half-a-billion-dollar investment in this year’s Budget.

Agriculture

Mr Speaker,

Queensland is an agricultural state.

13

And we are meeting the rising demand for clean and green food from the growing Asian middle class.

This has helped us set trade records – with total exports rising more than 16 per cent to $85 billion in the year to April 2019, including almost $10 billion of rural exports.

In the face of instability and uncertainty in international markets we have worked with the agricultural sector to secure jobs and opportunities.

For example, this Budget dedicates $14 million towards securing an international investor in Mackay Sugar Limited to secure more than 800 jobs on top of the proposed private investment of $120 million.

Tourism

Mr Speaker,

Queensland is a tourism state.

Tourism numbers in our state are at an all-time high. We have seen record highs in international visitor numbers, with nearly 2.8 million visitors spending $6 billion in Queensland.

14

Queensland’s tourism is thriving by offering new experiences – and more visitors than ever have fallen in love with our natural beauty and cherished lifestyle.

That’s how we have created thousands of tourism jobs, investing in direct flights from key locations in Asia whose people want to come straight to Queensland.

Our Budget again invests in a wide range of initiatives to attract tourists to Queensland and support jobs.

From the South East Corner, to the Outback we have our plan for jobs in tourism, backing it in with a more than $600 million investment in major events, programs and projects, including:

| | • | | Completing the Wangetti Trail |

| | • | | The rejuvenation of Great Barrier Reef Island Resorts |

| | • | | Outback tourism infrastructure, including an investment in a new glass bridge spanning the Cobbold Gorge |

| | • | | The rejuvenation of Airlie Beach |

| | • | | Infrastructure for Great Keppel Island |

| | • | | Premium ecotourism facilities on Whitsunday Island |

| | • | | The continuation of the World Science Festival; and |

| | • | | Funding for exclusive Queensland blockbuster exhibitions. |

15

Payroll tax relief

Mr Speaker,

Queensland is the place to do business.

What we have achieved as a state – in our emerging and traditional industries – we have achieved in partnership with business.

We know that the private sector creates most jobs in our economy.

And more than four in ten private sector workers in the state work in small and medium businesses. These businesses are the beating heart of our economy.

Small and medium-sized enterprises make up more than 99 per cent of all businesses in this state.

And if even one in five of them was able to employ just one extra person, that would be more than 80,000 new jobs.

That is why a centrepiece of this Budget is help for small and medium sized businesses, especially in the regions.

Today, I announce a payroll tax relief package worth $885 million to assist small and medium sized businesses to create jobs for Queenslanders.

16

From July, the exemption threshold for payroll tax will be increased for all Queensland businesses from $1.1 million to $1.3 million.

This will mean 1,500 additional businesses will no longer pay any payroll tax.

Queensland’s new tax-free threshold for business is double Victoria’s.

This means a business in Queensland can employ twice as many people – and operate at twice the size of a business in Victoria – before paying a single dollar in payroll tax.

As well, regional business who employ 85 per cent or more local workers will receive a payroll tax discount of 1 per cent off the set rate.

Our combined payroll tax threshold increase and the regional discount will mean an estimated 13,000 businesses are better off.

This demonstrates our continued determination to create jobs in regional communities.

17

Mr Speaker,

We will also keep our Back to Work incentive program which has provided support to more than 9,000 Queensland businesses who have been able to take on 19,000 previously unemployed Queenslanders.

And to further help address youth unemployment, the 50 per cent payroll tax rebate for apprentices and trainees – due to expire on June 30 – will be extended to June 2021.

Since the scheme started in 2015, more than 5,300 businesses have claimed a total of $76 million.

In addition to payroll tax relief and Back to Work programs, we are driving down electricity costs for regional businesses.

The latest Queensland Competition Authority decision will see energy prices drop by almost 6 per cent for regional small businesses and 4.4 per cent for regional households.

This is a direct result of this Governments facilitation of renewable energy generation into the grid right across our state.

18

Health

Mr Speaker,

As I have said, budgets are about choices.

We have chosen to stay the course on our economic plan to create jobs.

And we are staying the course on building – not cutting – our frontline services.

In 2015 Queenslanders made the choice to stop the LNP’s cuts and we have rebuilt the services the previous Government stripped away.

In health we have employed almost 6,000 nurses, more than 2,000 doctors and 500 ambulance officers to provide frontline health services for Queenslanders across the state.

This Budget provides a more-than $18 billion operating budget for Queensland Health and more than $770 million in capital investments to help keep Queenslanders healthy.

Regional hospitals in Roma and Gladstone will receive $78 million for redevelopments that support local jobs and improve healthcare for our regions.

19

Community helicopter providers like CareFlight will receive more than $58 million to help rapidly transport our most critically ill patients.

There will be even better mental health care at Hervey Bay and Maryborough Hospitals, along with new MRI and CT scanning equipment for Redcliffe Hospital.

And this Budget commits $80 million over four years for a range of initiatives under the Shifting Minds Suicide Prevention Flagship program.

Mr Speaker, tragically, too many young Indigenous Queenslanders are taking their own lives.

Of this $80 million investment, the Palaszczuk Government will direct almost $7 million toward the specific circumstances of Indigenous mental health and wellbeing.

Education and training

Mr Speaker,

Good education and training transforms lives by unlocking opportunity.

And it transforms the economy by creating a future-ready workforce.

20

The Palaszczuk Government has:

| | • | | mandated that apprentices or trainees make up at least 15 per cent of the workforce on large-scale Government projects. |

| | • | | provided a payroll tax rebate for businesses that take on apprentices |

Never forget those four words:

Labor. Made. TAFE. Free.

And we have restored education services previously cut.

In this Budget we again deliver a record investment in education and training.

We are increasing our investment in education infrastructure by a massive 80 per cent on last year’s budget.

This means better and new schools, with world class learning environments and facilities.

We have committed an additional $30 million over two years to support universal access for kindergarten in the year before school.

21

Mr Speaker, we know that early intervention can make all the difference to how a life is led.

That’s why this Budget continues our commitment to vulnerable youth.

In addition to our historic $330 million youth justice package, we will support at-risk young people through the expansion of our FlexiSpace program.

This program provides support to keep at-risk young people engaged in learning. Our $17 million investment over coming years will see this program expanded to up to 52 state schools across the state.

Mr Speaker, it’s hard to learn on an empty stomach. That’s why we will fund Foodbank to expand their proven school breakfast program to an additional 70 schools throughout our state.

Climate change, natural disasters, renewable energy

Mr Speaker,

This has been another tough year for Queenslanders enduring extreme weather events.

In the long term, there is no greater threat to job creation than climate change.

22

And it is places like Queensland – where regional jobs matter so much – that stand to lose the most.

You only have to look at the natural disasters that have hit our communities and our Budget over the past year to see the very real impact we are facing.

The bushfires in Central Queensland in November last year.

The unprecedented February flood events in Townsville and the North.

We think of our farmers in areas like Cloncurry, Normanton and Julia Creek, who battled drought for years to keep their farms productive.

And how their happiness at the first sight of rain turned to devastation as their stock was wiped out by the deluge.

We remember Cyclone Trevor hitting our communities in the Cape York Peninsula hard.

Then crossing the coast further south as a low-pressure system, flooding our communities in Central and Western Queensland.

Communities like Barcaldine, Tambo and Longreach.

23

As Queenslanders we take pride in the fact that we band together in times like this – we lend a helping hand to those in need.

And Queenslanders know better than anyone how these events devastate the economy and damage the Budget bottom line.

All told, 84 disasters in the past decade have now caused more than $15 billion in damage to public infrastructure.

Including an estimated $1.3 billion in damage since November 2018 alone.

So that is reality today. Extreme weather events already cost us through direct government expenditure, lost revenue and lost production.

We are paying the price of climate change right now. And it will only grow over time.

So because of the environmental emergency unfolding over decades, the Government has an immediate economic responsibility.

We must act to mitigate the climate risk to the state’s economy and the livelihoods of Queenslanders.

24

We must heed calls from business leaders within our economy – from energy and mining to retail, insurance and finance.

We must not ignore warnings from the Reserve Bank of Australia.

In March, Deputy Governor of the RBA, Guy Debelle, warned of the serious consequences of climate change to our economy when he said:

“… the physical impact of climate change and the transition are likely to have first-order economic effects … [including] … challenges for financial stability…”.

Mr Speaker,

In short, if we don’t act now, climate change will cut jobs and growth, lift prices and inflation, and destabilise our insurance and banking systems.

The problem is environmental and economic, urgent and important.

In response, our leadership must be global and local.

25

And that’s why we are pursuing a range of initiatives to lower emissions and create more renewable energy.

For example, next financial year, the Government’s renewable and low-emissions electricity generator – CleanCo – will begin operating and trading in the national electricity market.

CleanCo will assist in the provision of a cleaner, more affordable, sustainable and secure energy supply for Queensland.

Alongside the Government’s existing generation businesses, CleanCo will play a key role in the Government’s commitment to generate 50 per cent of the state’s energy from renewable sources by 2030.

As always, Queensland will carry its weight.

We will do our part.

Canberra

And Mr Speaker,

That’s what makes Canberra’s treatment of Queensland all the more disappointing.

26

As we struggle with natural disasters and the challenges of funding the needs of a growing state, the Federal Government is intent on being a ball and chain around our ankle.

Mr Speaker, this Government was not counting on a federal Labor win at the recent election.

But we cannot underestimate the impact of what another term of a Morrison LNP Government means for our state.

Less investment in Queensland’s infrastructure.

Less for our schools and hospitals and other services.

And less revenue from GST.

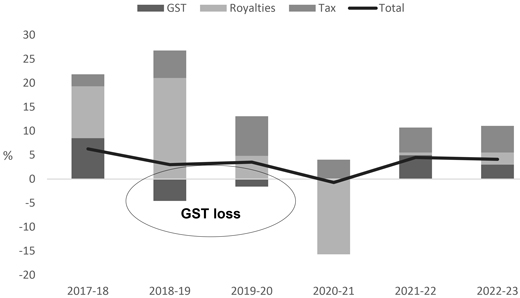

Let’s take the GST distribution, for example.

The Federal Government earlier this year announced a new approach to distributing GST revenues to the states.

As a result of these changes – and Mr Frydenberg’s directions to the Grants Commission – Queensland will be the only state to receive less in GST revenue next year than last year.

In fact, Queensland’s share of the GST has been slashed by $866 million as a direct result of interference by Canberra.

27

As a result of Canberra’s cuts, there will be an increase in land tax rates for companies and trusts of 0.25 per cent.

This change is forecast to raise $238 million over the forward estimates and apply only to land holdings over the value of $5 million.

Land tax rates for individuals will not change.

We will also bring the land tax absentee surcharge adjustment in line with NSW and Victoria. This will see an increase in the surcharge from 1.5 per cent to 2 per cent, along with a widening of the definition to include foreign companies and trusts.

The estimated revenue for this measure is $540 million over the forward estimates.

The measures will help buffer Queenslanders from Canberra’s rip-off.

Mr Speaker, the Government makes these land tax changes reluctantly.

And so I make this commitment.

28

If Canberra fixes the current bias in their GST calculations and returns what we are owed, we will repeal these land tax measures.

I urge Queensland business to lobby their State and Federal LNP Members of Parliament.

Demand they return Queensland’s fair share of GST.

Petroleum Royalty

Mr Speaker, earlier I spoke of the achievement of creating an entire LNG industry from scratch.

This relatively new industry is providing jobs and economic prosperity for regional Queensland.

However, the current royalty regime has been in place essentially since the industry commenced operations 10 years ago.

A feature of the arrangements is that different organisations are operating under separately struck royalty arrangements.

We intend to review royalty arrangements with a view to levelling the playing field.

In the process we will also increase royalties overall by 2.5 per cent – to 12.5 per cent for petroleum.

29

This is still a very fair outcome for a global industry operating in an international market in circumstances where other royalty rates, for example Canada, are as high as 30 per cent.

We will bring industry and producers together to work out a new scheme which is fair for all and will get us the best outcome.

These resources are from our regions and it’s only fair that Queenslanders get a dividend. Our petroleum resources are in high demand, internationally and domestically.

The petroleum dividend returned to Queenslanders for their resources will be $476 million over the forward estimates.

CONCLUSION

Mr Speaker,

Let me conclude where I began.

Budgets are about choices.

The Palaszczuk Labor Government chooses to stay the course.

We do so because all of the evidence points to the fact our economic plan is working.

Our promise to Queenslanders was that we would not cut, sack and sell.

30

This Budget delivers on that promise.

We will continue our plan to back Queensland jobs and stand by our communities.

To invest in our regions and build critical infrastructure.

To grow and diversify our economy.

To encourage small and medium businesses to grow.

To deliver the frontline services Queenslanders rely upon.

And to never shy away from the tough challenges.

Mr Speaker, this is a Budget for all Queenslanders.

But particularly, this is a Budget for Queensland’s regions.

I commend the Bill to the House.

31

Queensland Budget 2019-20 Budget Speech Budget Paper No.1

Queensland Budget 2019-20

Budget Speech Budget Paper No.1

budget.qld.gov.au

QUEENSLAND BUDGET 2019–20

Budget Strategy and Outlook

Budget Paper No.2

budget.qld.gov.au

2019-20 Queensland Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

5. Service Delivery Statements

Appropriation Bills

Budget Highlights

The Budget Papers are available online at budget.qld.gov.au

© The State of Queensland (Queensland Treasury) 2019

Copyright

This publication is protected by the Copyright Act 1968

Licence

This document is licensed by the State of Queensland (Queensland Treasury) under a Creative Commons Attribution (CC BY 4.0) International licence.

In essence, you are free to copy, communicate and adapt this publication, as long as you attribute the work to the State of Queensland (Queensland Treasury). To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/

Attribution

Content from this publication should be attributed to:

© The State of Queensland (Queensland Treasury) - 2019-20 Queensland Budget

Translating and interpreting assistance

Translating and interpreting assistance

The Queensland Government is committed to providing accessible services to Queenslanders from all cultural and linguistic backgrounds. If you have difficulty in understanding this publication, you can contact us on telephone (07) 3035 3503 and we will arrange an interpreter to effectively communicate the report to you.

Budget Strategy and Outlook

Budget Paper No. 2

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

Budget Strategy and Outlook 2019-20

State Budget

2019-20

Budget Strategy and Outlook

Budget Paper No. 2

Budget Strategy and Outlook 2019-20

Contents

| | | | | | |

Overview | | | 1 | |

| | |

1 | | Economic Plan – Backing Queensland Jobs | | | 11 | |

| | |

1.1 | | A plan to create jobs and drive economic growth across Queensland’s regions | | | 12 | |

1.2 | | Backing Queensland Jobs – key focus areas of the economic plan | | | 21 | |

| | |

2 | | Economic performance and outlook | | | 30 | |

| | |

2.1 | | International conditions | | | 31 | |

2.2 | | National conditions | | | 32 | |

2.3 | | Queensland conditions and outlook | | | 33 | |

2.4 | | Risks to the outlook | | | 43 | |

| | |

3 | | Fiscal strategy and outlook | | | 46 | |

| | |

3.1 | | Context | | | 47 | |

3.2 | | Key fiscal aggregates | | | 48 | |

3.3 | | Fiscal strategies | | | 52 | |

3.4 | | Achievement of fiscal principles | | | 64 | |

| | |

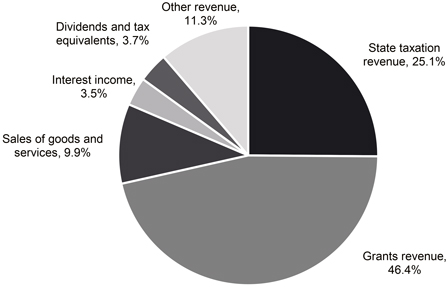

4 | | Revenue | | | 66 | |

| | |

4.1 | | Queensland Revenue Outlook | | | 67 | |

4.2 | | 2018-19 estimated actual | | | 69 | |

4.3 | | 2019-20 revenue by category | | | 70 | |

4.4 | | 2019-20 Budget initiatives | | | 71 | |

4.5 | | Queensland’s revenue trends | | | 74 | |

4.6 | | Taxation revenue | | | 77 | |

4.7 | | Grants | | | 84 | |

Budget Strategy and Outlook 2019-20

| | | | | | |

4.8 | | Royalty revenue | | | 85 | |

4.9 | | Sales of goods and services | | | 89 | |

4.10 | | Interest income | | | 90 | |

4.11 | | Dividend and income tax equivalent income | | | 90 | |

4.12 | | Other revenue | | | 91 | |

| | |

5 | | Expenses | | | 92 | |

| | |

5.1 | | 2018-19 estimated actual | | | 93 | |

5.2 | | 2019-20 Budget and out-years | | | 93 | |

5.3 | | Expenses by operating statement category | | | 94 | |

5.4 | | Operating expenses by purpose | | | 105 | |

5.5 | | Departmental expenses | | | 106 | |

| | |

6 | | Balance sheet and cash flows | | | 108 | |

| | |

6.1 | | Context | | | 109 | |

6.2 | | Balance Sheet | | | 110 | |

6.3 | | Cash flows | | | 116 | |

| | |

7 | | Intergovernmental financial relations | | | 117 | |

| | |

7.1 | | Federal financial arrangements | | | 118 | |

7.2 | | Australian Government funding to the states | | | 119 | |

7.3 | | Australian Government funding to Queensland | | | 120 | |

7.4 | | GST revenue | | | 120 | |

7.5 | | Payments to Queensland for specific purposes | | | 124 | |

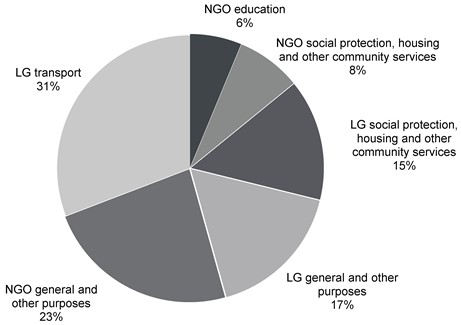

7.6 | | State-local government financial relations | | | 130 | |

| | |

8 | | Public Non-Financial Corporations Sector | | | 134 | |

| | |

8.1 | | Context | | | 135 | |

8.2 | | Finances and Performance | | | 142 | |

Budget Strategy and Outlook 2019-20

| | | | | | |

| | |

9 | | Uniform Presentation Framework | | | 150 | |

| | |

9.1 | | Context | | | 150 | |

9.2 | | Uniform Presentation Framework financial information | | | 150 | |

9.3 | | Reconciliation of net operating balance to accounting operating result | | | 160 | |

9.4 | | General Government Sector time series | | | 160 | |

9.5 | | Other General Government uniform presentation framework data | | | 162 | |

9.6 | | Contingent liabilities | | | 166 | |

9.7 | | Background and interpretation of uniform presentation framework | | | 166 | |

9.8 | | Sector classification | | | 168 | |

9.9 | | Reporting entities | | | 169 | |

| |

Appendix A: Concessions statement | | | 173 | |

| |

Context | | | 173 | |

Focus | | | 173 | |

Explanation of scope | | | 174 | |

A.1 Concessions summary | | | 175 | |

A.2 Concessions by agency | | | 176 | |

A.3 Concessions by entity – Government-owned corporations | | | 201 | |

| |

Appendix B: Tax expenditure statement | | | 203 | |

| |

Context | | | 203 | |

Methodology | | | 203 | |

The Tax Expenditure Statement | | | 204 | |

Discussion of individual taxes | | | 206 | |

| |

Appendix C: Revenue and expense assumptions and sensitivity analysis | | | 210 | |

| |

Taxation revenue assumptions and revenue risks | | | 211 | |

Royalty assumptions and revenue risks | | | 212 | |

Budget Strategy and Outlook 2019-20

| | | | | | |

Parameters influencing Australian Government GST payments to Queensland | | | 213 | |

Sensitivity of expenditure estimates and expenditure risks | | | 213 | |

| |

Appendix D: Fiscal Aggregates and Indicators | | | 214 | |

Budget Strategy and Outlook 2019-20

Overview

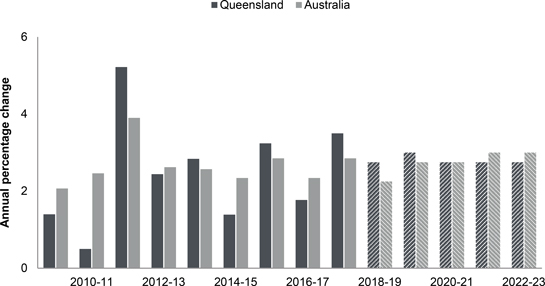

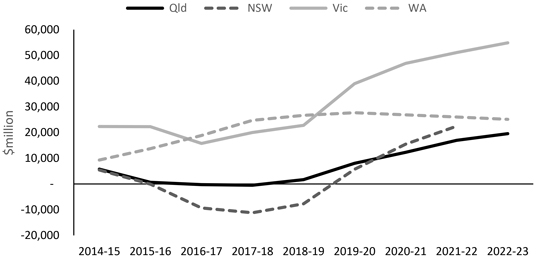

The latest National Accounts show the Queensland Economy leads the mainland states and territories in terms of domestic economic growth in March quarter 2019, while Queensland’s 2¾% forecast growth in gross state product (GSP) in 2018-19 is expected to outpace forecast national gross domestic product (GDP) growth of 2¼%.

The underlying performance of the State’s economy has been strong due to the unwavering commitment and focus by the Government to drive own-source revenue, focus on jobs and deliver the infrastructure necessary to support private sector investment.

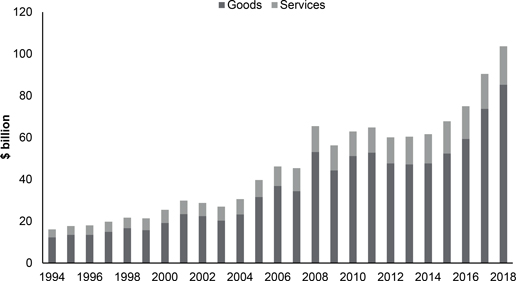

Queensland has a dynamic, diversified export economy. The Government has built a strong, sustainable and growing export capability which has delivered 13 consecutive months of record annual export totals, with the 12 months to April 2019 topping $85 billion. This is more than the total overseas goods exports of NSW and Victoria combined over the same period.

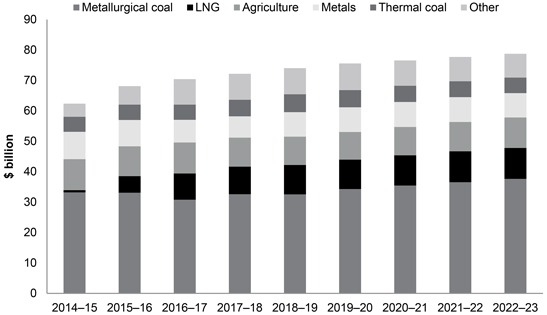

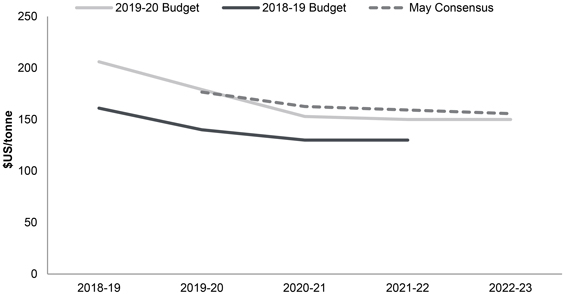

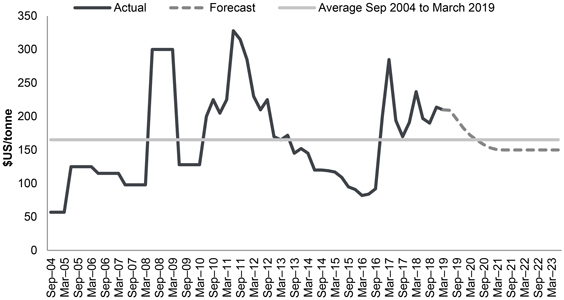

The top two export commodities in total export value were metallurgical coal ($37.4 billion) and liquefied natural gas (LNG, $15.2 billion). The LNG industry, which did not even exist in Queensland a decade ago, recorded more than twice the export value of thermal coal.

The 2019-20 Budget forecasts continuing strong growth for the coming financial year, with GSP forecast to grow by 3%.

However, in the face of this performance, national and global economic conditions have continued to deteriorate since late 2018 and forecasts indicate there will be a further weakening in global conditions. This uncertain external environment provides context for GSP growth to moderate to 23⁄4% over the forward estimates period beyond the 2019-20 financial year.

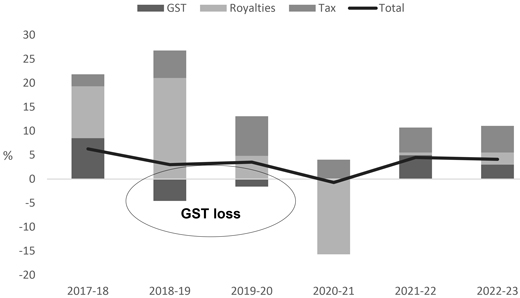

The Queensland Government will continue to use all levers at its disposal to drive economic growth and maintain a strong economy despite the loss of revenue due to the continual erosion of the State’s share of GST.

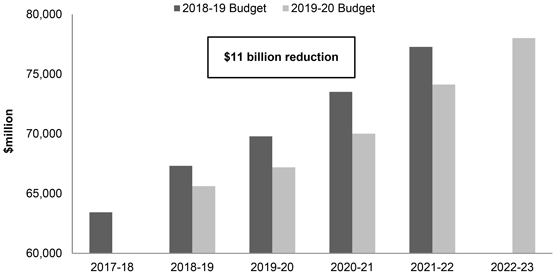

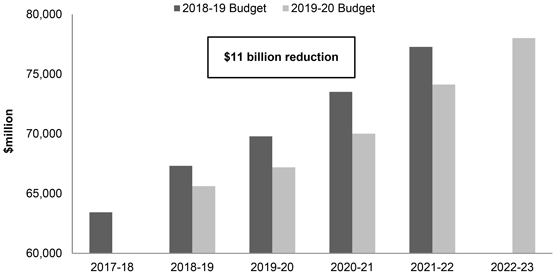

The impact of the Commonwealth’s GST reductions since the Mid Year Fiscal and Economic Review (MYFER) is taking $1.5 billion out of Queenslander’s pockets over the forward estimates. The actions taken by the Commonwealth Government have meant that Queensland is the only jurisdiction in the Commonwealth that will receive less GST revenue in 2019-20 than in the previous year. These challenges are in addition to the budget impact of natural disasters which occurred in the 2018-19 year with a total cost of $1.3 billion over the forward estimates.

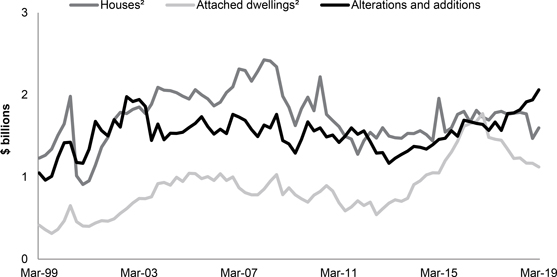

While Queensland is unique in receiving less GST revenue, the impact of subdued activity in the housing market nationally has delivered a revenue reduction across many jurisdictions. In Queensland, transfer duties have been revised down by $1 billion since the Mid Year Fiscal and Economic Review over the forward estimates period. Despite facing these headwinds, segments of the State’s dwelling construction industry have held up well, with labour-intensive additions and alterations activity hitting a record high in March quarter 2019.

1

Budget Strategy and Outlook 2019-20

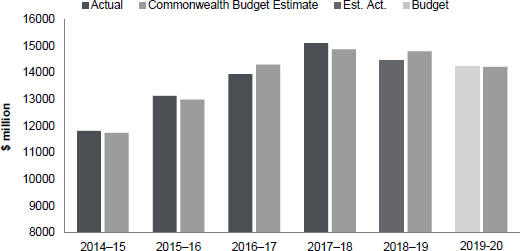

The net operating surplus for this year is almost $700 million higher than forecast in the 2018-19 Budget. The State has conservatively budgeted revenue outcomes and this trend has been replicated for the past three budget years.

Over the preceding three budgets, revenues have exceeded original budget forecasts by $7.3 billion. A continuation of this trend, of exceeding the 2019-20 Budget forecasts by 4%, would see an additional $2.4 billion in actual revenues above the level currently forecast for 2019-20.

The 2019-20 Budget maintains its consistently prudent approach to forecasting revenue growth and delivering on the fiscal principles of the Queensland Government.

Building on the successful strategies, initiatives and substantial investment implemented in the Government’s four previous budgets, the 2019-20 State Budget will continue to drive sustainable economic growth and create secure, well-paid jobs across all regions of Queensland.

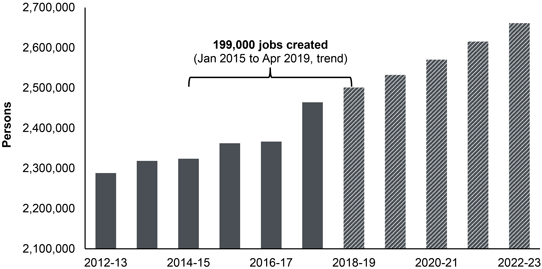

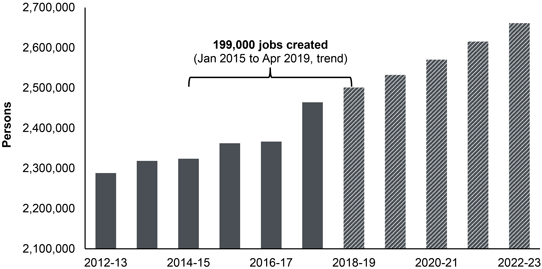

Following the strong economic growth and 199,000 jobs created since 2015, ongoing solid jobs growth is forecast in Queensland over the four years to 2022-23.

In the face of a changing global landscape, Queensland’s businesses, industries, communities and regions continue to grow and adapt as the State successfully transitions to a more resilient and diversified economy.

As Queensland’s economy continues to evolve and grow, the 2019-20 Budget and the Government’s economic plan will help create jobs across all regions of the State through an enhanced focus on:

| • | | supporting businesses and business-led growth |

| • | | delivering sustainable investment in productive infrastructure and essential services |

| • | | fostering the next wave of innovation and investing in ideas |

| • | | investing in skills and training for current and future generations of Queenslanders. |

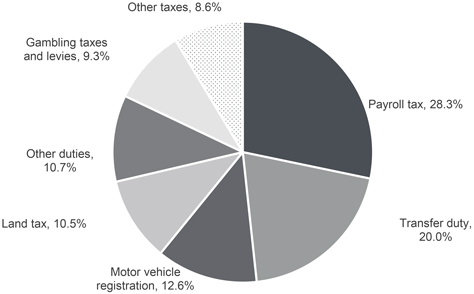

Payroll tax initiatives – Supporting Queensland business and backing jobs

Queensland’s small, medium and growing businesses across all regions will benefit from a $885 million package of targeted payroll tax initiatives, making it easier for businesses to grow, invest and employ more Queenslanders.

Key elements of the package to be implemented in 2019-20 include:

| • | | an increased exemption threshold – rising from $1.1 million to $1.3 million, which will benefit employers with annual wages up to $6.5 million |

| • | | regional payroll tax discount – from 1 July 2019, a 1% payroll tax discount will apply for eligible employers with 85% of their employees outside of South East Queensland |

| • | | employment growth rebate – for two years from 1 July 2019, employers that have increased their number of full-time employees will be eligible for a rebate on the payroll tax paid on these additional employees |

2

Budget Strategy and Outlook 2019-20

| • | | extension of apprentice and trainee rebate – the Government is also extending the successful 50% payroll tax rebate for apprentices and trainees until 30 June 2021. Since the introduction of the rebate in 2015-16, over 5,300 businesses have claimed a total of $76 million in rebates. |

Growing our regions

The Queensland Government continues its commitment to building stronger regional economies by investing in transformative infrastructure to encourage industry development, investment, innovation, and creating secure and well paid regional jobs.

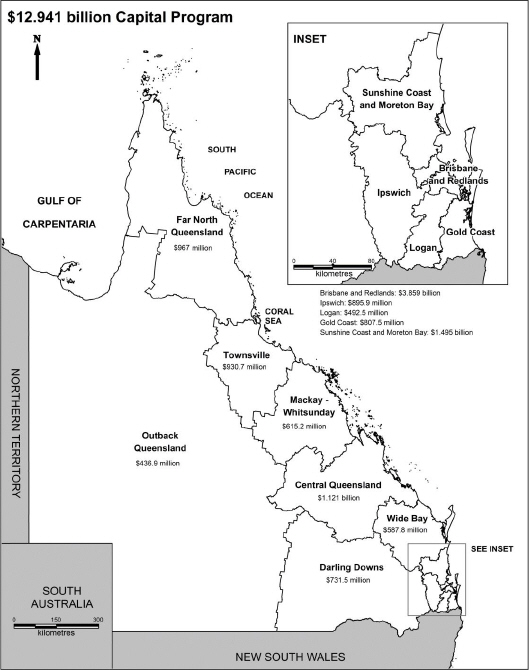

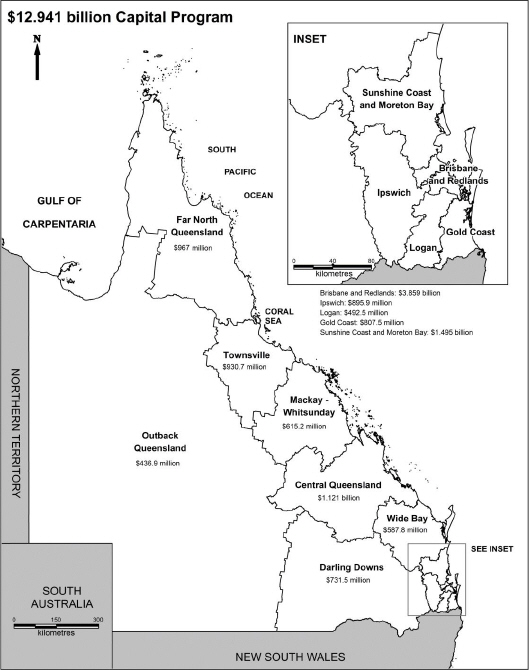

Close to 60% of the $12.9 billion capital works program in 2019-20 is to be delivered in regions outside of the Greater Brisbane area, supporting 25,500 jobs in those regions.

Other key initiatives in the 2019-20 Budget supporting economic growth and jobs across regional Queensland include:

| • | | ongoing funding of the $600 million Works for Queensland program to support job-creating maintenance and minor infrastructure works across regional Queensland |

| • | | transformative regional tourism infrastructure projects such as $41.4 million to develop the Wangetti Trail ecotourism walk from Palm Cove north to Port Douglas; and $25 million to help industry rejuvenate the Great Barrier Reef Island resorts |

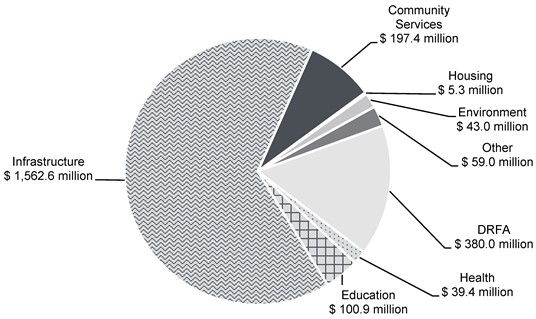

| • | | $110 million over four years from 2019-20 to provide further support for the North West Minerals Province and to promote mining exploration and investment in the region; and the $193.5 million Townsville Port channel capacity upgrade |

| • | | a $70 million boost to Building our Regions, bringing total funding for the program to $515 million, of which $365 million is administered by the Department of State Development, Manufacturing, Infrastructure and Planning and $150 million is administered by the Department of Transport and Main Roads through their Transport Infrastructure Development Scheme |

| • | | an increased commitment of $25 million to the Jobs and Regional Growth Fund, bringing the total funding of this program to $175 million, to assist businesses and projects that will generate ongoing economic development and employment opportunities in regional Queensland. |

Investing in infrastructure

The $49.5 billion capital works program over four years outlined in the Budget will directly support private sector jobs, with the $12.9 billion capital works program in 2019-20 estimated to directly support 40,500 jobs across the State.

To further enhance the productive capacity of the State’s businesses, industries, communities and regions, the Government will deliver a $5.6 billion investment in transformative transport infrastructure in 2019-20. In addition, the energy and water portfolios will invest $2.7 billion in infrastructure in 2019-20 to support the ongoing delivery of safe, secure, reliable and cost-effective energy and water across the State.

3

Budget Strategy and Outlook 2019-20

Capital expenditure across the health portfolio is $777.7 million in 2019-20, including $78.6 million as part of the Enhancing Regional Hospitals program and $40.7 million as part of the Rural and Regional Infrastructure package. The Government’s Building Better Hospitals commitment includes projects at three major south-east Queensland hospitals with a combined value of $956.9 million.

The education portfolio’s capital expenditure totals $1.2 billion in 2019-20. This includes an additional $272.8 million for new schools and classrooms, and air-conditioning. The 2019-20 Budget includes increased funding of $532.6 million over seven years from 2018-19 to expand the Building Future Schools Fund to a total of $1.3 billion to deliver world class learning environments for children, including new primary, secondary and special schools opening in 2020 and 2021.

Other highlights of the Government’s capital works program include:

| • | | ongoing construction of the transformative Cross River Rail project, which will ease congestion, improve network reliability and increase heavy rail accessibility to the Brisbane CBD for all South East Queensland regions. The State Government has allocated $5.409 billion to the Cross River Rail, which will mean more trains, more often and turn-up-and-go transport for South East Queensland commuters |

| • | | major projects on the M1 Pacific Motorway, including the Varsity Lakes to Tugun and Eight Mile Plains to Daisy Hill projects, as well delivery of the Pacific Motorway/Gateway Motorway merge project, due for completion in 2020 |

| • | | several key projects on the Bruce Highway, aimed at improving safety, flood resilience and capacity along its 1,700km length. These projects, being delivered in partnership with the Australian Government, will also continue to support construction jobs across regional Queensland |

| • | | several major infrastructure projects to support the Government’s commitment to preventing offending and reoffending, and keeping young people out of courts and custody |

| • | | construction of the $152 million Smithfield Bypass project to improve safety and traffic flow for road users around the northern beaches of Cairns |

| • | | a $930.7 million investment in Townsville in 2019-20, contributing to the delivery of a number of significant productivity enhancing and job creating infrastructure projects in the region over the coming years, including: |

| | • | | $225 million Townsville water security project to address long-term water security needs |

| | • | | $193.5 million Stage 1 of the Townsville Port Expansion Project, to upgrade capacity of the Townsville Channel to allow access by larger vessels and boost trade at the Port of Townsville |

| | • | | completion of the $290 million North Queensland Stadium, a 25,000-seat stadium in Townsville, in time for the 2020 National Rugby League Premiership Season |

| | • | | $31.9 million Townsville (Pimlico) TAFE project to refurbish and expand training facilities |

| | • | | $25 million to help industry rejuvenate the Great Barrier Reef Island resorts and offer world-class experiences to visitors |

4

Budget Strategy and Outlook 2019-20

| | • | | $7.3 million in 2019-20 out of a $45.4 million total spend to rehabilitate and widen various sections of the Gregory Development Road for freight and productivity gains |

| | • | | $6.7 million in 2019-20 out of a $44.4 million total spend to complete construction of the new North Shore State School. |

Increasing frontline services

To ensure all Queenslanders have access to world-class essential services, no matter where they live across the State, the Government continues to maintain record spending on delivery of health and education and training services.

The 2019-20 Budget allocates a record $18.5 billion for the provision of health services.

The 2019-20 Budget allocates a record $14.9 billion for education and training services.

An additional $847.9 million has been provided over five years for both capital investments and service provision in the justice system to keep Queensland’s communities safe.

The Budget also outlines the Government’s substantial ongoing investment in keeping our communities safe, protecting our environment for the future, supporting our Aboriginal and Torres Strait Islander communities and lowering the cost of living.

Investing in ideas and fostering the next wave of innovation

In the face of a changing global landscape, the Government is supporting businesses throughout the State to develop and adopt innovative approaches and seize new opportunities.

Advance Queensland, the Queensland Government’s $755 million flagship innovation program, continues to play a key role throughout the State in unlocking new opportunities to sustain and grow traditional industries while also helping to shape the development of emerging industries by fostering and supporting innovative ideas, research and technologies.

Highlights of the 2019-20 Budget that will foster and support adoption of the next wave of innovation by Queensland businesses and communities include:

| • | | additional funding of $19 million to establish an agenda for renewable hydrogen industry attraction and incentivisation to drive job creation, regional growth, and increased innovation and development, with Gladstone being a focus point for hydrogen development |

| • | | additional funding of $8.6 million over two years is provided for FibreCo to potentially make high speed and low-cost internet available to regional Queensland, with substantial additional funding provided for a range of other key telecommunications infrastructure to enhance community connectivity across regional Queensland. |

Skilling current and future generations of Queenslanders

With the number of employed persons in Queensland projected to surpass 2.6 million by 2022, the Palaszczuk Government is focused on providing people with the education, training and skills to access employment opportunities, including the jobs of the future.

5

Budget Strategy and Outlook 2019-20

The Budget includes several initiatives to support pre-school education and learning, including increased funding of $63.6 million over four years and $18.7 million ongoing to continue the provision of Early Childhood Development Programs, as well as $30.4 million over two years for the continued provision of universal access to kindergarten for children in the year before school.

The Government is providing increased funding of approximately $1.4 billion over calendar years 2019 to 2023 for Queensland state schools, as part of the five-year school funding agreement reached with the Australian Government in December 2018.

Further, significant commitments are made in the 2019-20 Budget to improve Queensland’s state schools, including $532.6 million over seven years to expand the Building Future Schools Fund and $251.3 million over three years for additional facilities at existing state schools experiencing enrolment growth.

The 2019-20 Budget also builds on the Government’s substantial existing investment in training and skills, through innovative initiatives such as the Micro-Credentialing Pilot and a Higher Level Apprenticeship Pilot to provide modern and flexible pathways to address current, emerging and future skills needs. Further targeted support is provided to disadvantaged groups, including mature-age jobseekers, through the $420 million Skilling Queenslanders for Work initiative to help them re-enter and stay in the workforce.

Since the Free TAFE initiative launched in August 2018, more than 6,000 students have started a new qualification, subject or module as part of their vocational education.

Further, the Government is continuing to deliver Free TAFE to help Year 12 graduates gain the training they need to develop skills in growing industry areas by covering the full cost of training in one of 160 high priority qualifications to ensure they get the skills to start their career.

Building the resilience of our communities impacted by natural disasters

The Government remains committed to rebuilding regional communities impacted by the North Queensland floods and other recent natural disasters. Key elements of the Government’s investment focused on improving existing infrastructure to improve the resilience of the State’s communities (with partial funding provided by the Australian Government) include:

| • | | a $242 million disaster funding package following the North and Far North Queensland Monsoon Trough |

| • | | ongoing funding as part of the Queensland Government’s $110 million commitment for extraordinary recovery and reconstruction projects following Severe Tropical Cyclone Debbie |

| • | | supporting drought-affected communities through continuation of the Drought Assistance Package by providing up to $74.6 million over four years. |

Economic Outlook

Queensland’s economy has continued to grow solidly. However, a range of global, national and local factors are expected to see Queensland’s Gross State Product (GSP) growth ease to 2¾% in 2018-19.

6

Budget Strategy and Outlook 2019-20

Global economic conditions have deteriorated substantially since early 2018, with a slowdown in China’s domestic economy, escalation of global trade tensions and uncertainty related to Brexit resulting in a slowing of global growth in late 2018. These trends have intensified in early 2019.

Nationally, the weaker global outlook and sharper than expected slowdown in the housing sector have led to an easing in domestic economic growth. Recent ABS National Accounts data confirmed this trend, with national GDP growing by only 0.4% (seasonally adjusted) in March quarter 2019, while Queensland recorded the strongest growth in state final demand (SFD) of all the mainland states and territories at 0.5% (seasonally-adjusted) for the same period.

An ongoing moderation in dwelling investment and the associated flow-on to consumption spending, as well as a moderation in business investment, are all contributing to the easing of growth in 2018-19.

The easing growth in 2018-19 also reflects the impact of the flooding event in North Queensland, which impacted many local communities. Losses in economic output from the floods are estimated to be around 1⁄4 percentage point of GSP, spread across 2018-19 and 2019-20.

GSP growth is forecast to strengthen to 3% in 2019-20, underpinned by a pick-up in domestic activity as business investment strengthens. From 2020-21 onwards, economic growth is expected to remain solid, at around 23⁄4% per annum, consistent with its longer-term capacity and with a more balanced contribution from all major components across the economy.

As reflected in the fiscal revenue forecasts, the softer global and national outlook, a sharper than expected slowdown in the housing sector and the moderation in employment growth are expected to have impacts on the growth in key Queensland government revenues, including GST, transfer duty and payroll tax.

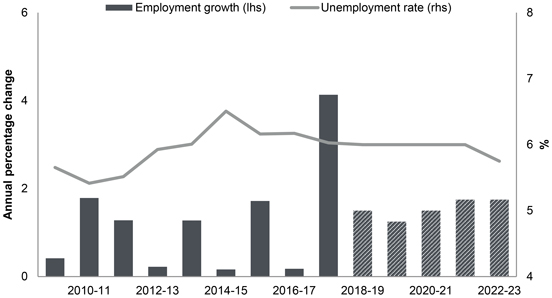

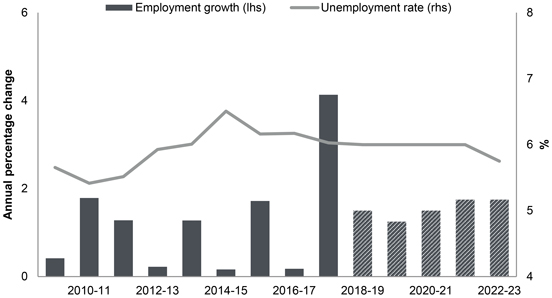

The strong GSP growth in 2017-18 was accompanied by exceptional employment growth of 4.1%, the strongest growth in more than a decade and the largest annual rise (97,700 persons) in the State’s history. However, in line with more subdued domestic activity, employment is still expected to grow, but at more moderate rates of 1½% in 2018-19 and 1¼% in 2019-20.

As employment growth eases, the participation rate is expected to decline, and the unemployment rate is forecast to stabilise at around 6% in both years.

Beyond 2019-20, as domestic activity strengthens, jobs growth is expected to pick up to around 13⁄4%, while the unemployment rate is expected to edge lower to 53⁄4% by the end of the projection period.

7

Budget Strategy and Outlook 2019-20

| Overview Table 1 | Queensland economic forecasts/projections1 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actual | | | Est. Act. | | | Forecasts | | | Projections | |

| | | 2017-18 | | | 2018-19 | | | 2019-20 | | | 2020-21 | | | 2021-22 | | | 2022-23 | |

Gross state product2 | | | 3.5 | | | | 23⁄4 | | | | 3 | | | | 23⁄4 | | | | 23⁄4 | | | | 23⁄4 | |

Nominal gross state product | | | 5.7 | | | | 6 | | | | 31⁄4 | | | | 31⁄2 | | | | 41⁄2 | | | | 43⁄4 | |

Employment3 | | | 4.1 | | | | 11⁄2 | | | | 11⁄4 | | | | 11⁄2 | | | | 13⁄4 | | | | 13⁄4 | |

Unemployment rate4 | | | 6.0 | | | | 6 | | | | 6 | | | | 6 | | | | 6 | | | | 53⁄4 | |

Inflation3 | | | 1.7 | | | | 13⁄4 | | | | 2 | | | | 21⁄4 | | | | 21⁄2 | | | | 21⁄2 | |

Wage Price Index3 | | | 2.2 | | | | 21⁄4 | | | | 21⁄4 | | | | 21⁄2 | | | | 21⁄2 | | | | 23⁄4 | |

Population3 | | | 1.7 | | | | 13⁄4 | | | | 13⁄4 | | | | 13⁄4 | | | | 13⁄4 | | | | 13⁄4 | |

Notes:

| 1. | Unless otherwise stated, all figures are annual percentage changes. |

| 2. | Chain volume measure (CVM), 2016-17 reference year. |

| 3. | Annual percentage change, year-average. |

| 4. | Per cent, year-average. |

Sources: ABS 3101.0, 6202.0, 6345.0, 6401.0 and Queensland Treasury.

8

Budget Strategy and Outlook 2019-20

Fiscal Outlook

The 2019-20 Budget demonstrates the Government’s commitment to supporting job creation, investing in the regions and delivering the infrastructure and frontline services Queensland needs, in a financially sustainable manner.

Net operating surpluses are projected in each year of the forward estimates. This is being achieved despite a reduction in Queensland’s share of GST revenue and downward revisions to transfer duty revenue. Across the forward estimates, the net operating balance is expected to improve as revenue growth outpaces expense growth with the gap widening each year from 2020-21 onwards.

A $49.5 billion capital program over four years will deliver infrastructure that supports economic growth across Queensland, enhances frontline services and provides employment opportunities. This level of investment will be partly funded through borrowings.

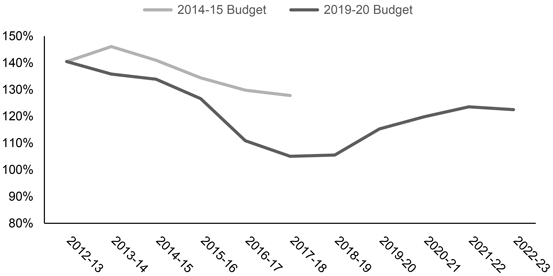

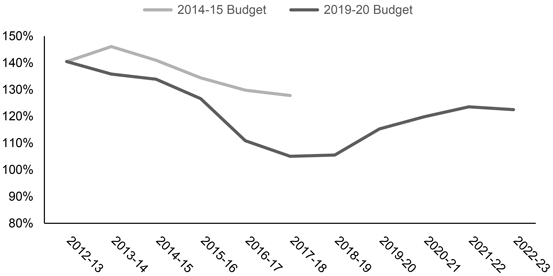

Even so, General Government borrowings as a share of revenue are expected to remain substantially below the peak level reached in 2012-13. The Government will continue to fund infrastructure investment while managing debt. This is being achieved while retaining strategic assets, such as electricity and water businesses, in public ownership.

In the Non-financial Public sector, which also includes the government-owned corporations, borrowings are expected to peak as a share of revenue in 2021-22, before declining in 2022-23.

9

Budget Strategy and Outlook 2019-20

The 2019-20 Budget incorporates adoption of a new accounting standard, which requires operating leases, such as office accommodation leases, to be recognised on the balance sheet as liabilities, despite there being no change in the State’s financial commitments. This new accounting standard has added $2.2 billion to lease liabilities, and therefore net debt, in the General Government Sector in 2019-20. For the Non-financial Public sector, the new accounting standard has increased liabilities and net debt, by $2.6 billion on adoption.

| Overview Table 2 | Key fiscal aggregates1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2017-18

Actual2

$ million | | | 2018-19

MYFER

$ million | | | 2018-19

Est. Act.

$ million | | | 2019-20

Budget

$ million | | | 2020-21

Projection

$ million | | | 2021-22

Projection

$ million | | | 2022-23

Projection

$ million | |

General Government Sector | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue | | | 58,087 | | | | 59,002 | | | | 60,068 | | | | 60,387 | | | | 61,729 | | | | 63,583 | | | | 65,540 | |

Expenses | | | 56,335 | | | | 58,478 | | | | 59,226 | | | | 60,198 | | | | 61,416 | | | | 63,101 | | | | 64,753 | |

Net operating balance | | | 1,753 | | | | 524 | | | | 841 | | | | 189 | | | | 313 | | | | 483 | | | | 787 | |

PNFA3 | | | 5,127 | | | | 5,981 | | | | 6,060 | | | | 6,727 | | | | 7,125 | | | | 7,963 | | | | 6,179 | |

Fiscal balance | | | (586 | ) | | | (2,632 | ) | | | (2,677 | ) | | | (3,527 | ) | | | (3,667 | ) | | | (4,280 | ) | | | (1,731 | ) |

Borrowing with QTC4 | | | 29,256 | | | | 30,610 | | | | 29,933 | | | | 32,781 | | | | 35,218 | | | | 40,174 | | | | 42,589 | |

Leases and similar arrangements5 | | | 2,152 | | | | 2,557 | | | | 2,623 | | | | 5,824 | | | | 7,071 | | | | 6,943 | | | | 6,966 | |

Securities and Derivatives | | | 122 | | | | 75 | | | | 122 | | | | 122 | | | | 122 | | | | 122 | | | | 122 | |

Non-financial Public Sector Borrowing with QTC | | | 66,964 | | | | 68,774 | | | | 68,141 | | | | 71,954 | | | | 75,413 | | | | 80,645 | | | | 82,972 | |

Leases and similar arrangements | | | 2,152 | | | | 2,557 | | | | 2,623 | | | | 6,217 | | | | 7,430 | | | | 7,266 | | | | 7,254 | |

Securities and Derivatives | | | 405 | | | | 278 | | | | 671 | | | | 544 | | | | 502 | | | | 492 | | | | 492 | |

Notes:

| 1. | Numbers may not add due to rounding. Bracketed numbers represent negative amounts. |

| 2. | Reflects published actuals. |

| 3. | PNFA: Purchases of non-financial assets. |

| 4. | Queensland Treasury Corporation. |

| 5. | This includes adoption of new accounting standard AASB 16 Leases. |

10

Budget Strategy and Outlook 2019-20

| 1 | Economic Plan – Backing Queensland Jobs |

Features

| • | | Queensland’s businesses, industries, communities and regions continue to grow and adapt as the State successfully transitions to a more resilient, diversified economy in the face of a changing global landscape. |

| • | | Queensland is not immune from the global forces shaping our economy – from technology to climate change to the changing nature of work in the future. This is what businesses in the private sector – from mining to agriculture, to financial services – are already adapting to: so too must the State’s economic strategy. |

| • | | Jobs and growth in the future will require our economy to: |

| | • | | diversify more and embed technologies better |

| | • | | train our people in new skills and in different ways |

| | • | | tailor our products and services to better meet the demands of Australian and global consumers. |

| • | | As the State’s economy continues to evolve and grow, creating jobs now and into the future remains at the heart of the Government’s economic plan – a plan that will ensure all Queenslanders, across all regions, benefit from the opportunities that current and future economic and jobs growth will deliver. |

| • | | Leveraging off the successful initiatives and investment in the Government’s four previous budgets, the 2019-20 Budget will continue to create secure, well-paid jobs and drive sustainable economic growth across all the State’s regions through an enhanced focus on: |

Supporting businesses and business-led growth Delivering sustainable investment in productive infrastructure and essential services Fostering the next wave of innovation and investing in ideas Investing in skills and training for current and future generations of Queenslanders.

| • | | Building on the 199,000 jobs created since 2015, ongoing solid jobs growth in Queensland is forecast over the four years to 2022-23. This growth is underpinned by the Government’s commitment to provide Queensland’s businesses with the confidence they need to grow, invest, innovate, export and employ. |

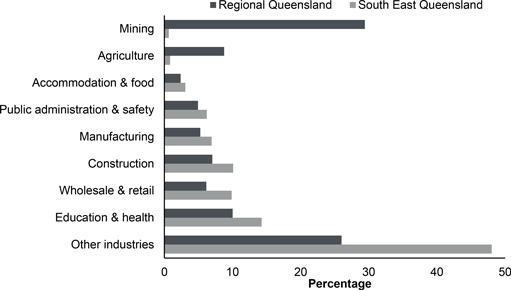

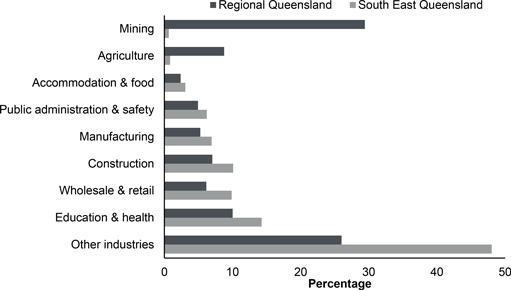

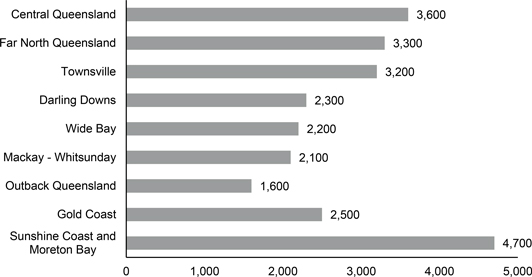

| • | | The gap between the regional and South East Queensland unemployment rates has continued to narrow, from 2.5 percentage points in mid-2016 to 0.7 percentage points over the year to April 2019. The Budget builds on this with further incentives and investments to drive jobs growth across Queensland, especially in regional Queensland. |

| • | | The 2019-20 Budget will see thousands of businesses across all areas of the State benefit from a $885 million payroll tax package, a boost to the Back to Work jobs program, increased funding for key business attraction and investment programs and a range of other initiatives to promote growth in key industries and priority sectors. |

11

Budget Strategy and Outlook 2019-20

| • | | Queensland remains highly competitive in terms of payroll tax and in terms of taxation per capita – in order to attract business and skilled people to our State. |

| • | | The Budget features a $49.5 billion investment in productivity-enhancing capital works over four years, delivering critical economic and social infrastructure and jobs across all regions. The $12.9 billion capital works program in 2019-20 will directly support 40,500 jobs across the State, with close to 60% of the 2019-20 capital works, estimated to support 25,500 jobs, to be delivered in regions outside of the Greater Brisbane area. |

| • | | The Budget also outlines ongoing and increased funding for a range of programs to support tens of thousands of jobs in key regional industries, including mining, agriculture, tourism, and emerging sectors supporting regional jobs. |

| • | | Record spending on health and education, and ongoing investment in schools, hospitals and other social infrastructure will ensure provision of world-class health, education and training services, as well as the justice services needed to keep communities safe and protect Queenslanders. This investment will help Queenslanders in all regions access secure, well-paid jobs and enjoy an improved quality of life. |

| 1.1 | A plan to create jobs and drive economic growth across Queensland’s regions |

A range of economic, social, demographic and environmental factors continue to impact the global economy, including: technological advancements; growth of knowledge-based industries; demographic change including ageing of the population; increased environmental concerns, including the impacts of severe weather events; and instability and uncertainty in global markets.

In the face of this changing global landscape, Queensland’s businesses, industries, communities and regions continue to grow and adapt as the State continues to successfully transition to a more resilient, diversified economy.

To continue the State’s growth and create jobs into the future, the Queensland Government understands the need to diversify the economy to meet the changing needs of the global economy and equip people with the skills they need.

The Queensland Government’s economic plan (see Figure 1.1 below), including the key initiatives outlined in the 2019-20 Budget, will continue to create secure, well-paid jobs and drive sustainable economic growth, including the ongoing growth of the State’s regional economies, through an enhanced focus on four key objectives:

| • | | Supporting businesses and business-led growth – to attract more businesses and private sector activity, and embed new technologies to meet changing consumer and investor needs |

| • | | Delivering sustainable investment in productive infrastructure and essential services – to improve our wellbeing and lower the transaction costs of doing business |

12

Budget Strategy and Outlook 2019-20

| • | | Fostering the next wave of innovation and investing in ideas – to modernise our businesses and create the next wave of businesses engaging in new markets |

| • | | Investing in skills and training for current and future generations of Queenslanders - to boost employment and incomes. |

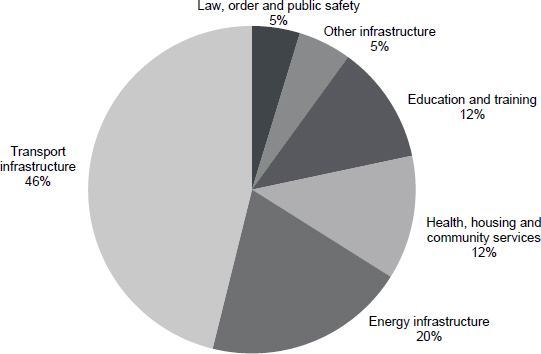

| Figure 1.1 | Backing Queensland Jobs |

| 1.1.1 | Creating secure, well paid jobs |

Since January 2015, the Queensland Government’s priority has been creating jobs and improving labour market outcomes across all regions of Queensland, including for the State’s young people and disadvantaged jobseekers.

Over this period, 199,000 new jobs have been created across the State in trend terms, while the State’s unemployment rate has improved, from 6.6% in January 2015 to 5.9% in April 2019. This is despite a slowdown in the national economy which has seen annual GDP growth slow to only 1.8% (seasonally adjusted) in the year to March quarter 2019 and prompted the Reserve Bank of Australia to cut the cash rate for the first time in almost three years.

Importantly, labour market conditions in many key regions have strengthened over recent years. As highlighted in Chapter 2, Chart 2.5, the gap between unemployment rates in regional Queensland and South East Queensland has narrowed significantly over the last two years.

13

Budget Strategy and Outlook 2019-20

In line with the Government’s focus on creating jobs for the future, youth employment has also grown steadily over recent years, with 17,900 youth jobs created and the State’s youth unemployment rate falling by 1.5 percentage points since January 2015.

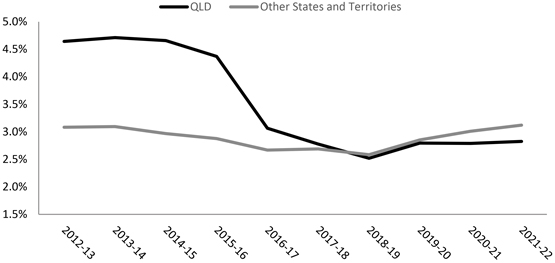

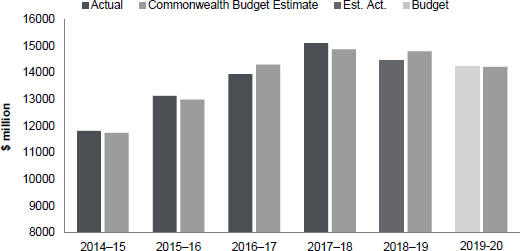

Building on the Government’s strong track record of job creation, ongoing solid jobs growth in Queensland is forecast over the four years to 2022-23 (see Chart 1.1 below).

| Chart 1.1 | Total employment, Queensland1 |

Note:

| 1. | 2018-19 to 2020-21 are forecasts; 2021-22 and 2022-23 are projections. Bars are in year average terms. Trend jobs growth and forecast jobs are not directly comparable. Jobs created reflects net additional jobs. |

Sources: ABS 6202.0 and Queensland Treasury.

Key Palaszczuk Government initiatives are directly assisting Queenslanders secure well paid jobs. For example, the Jobs and Regional Growth Fund and Advance Queensland Industry Attraction Fund, which has successfully attracted the multimillion-dollar Qantas pilot training academy to Toowoomba, are attracting and supporting businesses and projects that are creating ongoing jobs across the State, including in our regional economies.

To maintain this momentum, the 2019-20 Budget includes a suite of new initiatives and increased funding to support business growth and create additional job opportunities, as well as investing in the skills and training needed to ensure jobseekers can capitalise on those opportunities.

Queensland’s small, medium and growing businesses across all regions will benefit from the $885 million payroll tax package, making it easier for businesses to grow, invest and employ more Queenslanders.

14

Budget Strategy and Outlook 2019-20

The $49.5 billion capital works program over four years outlined in the Budget will directly support many tens of thousands of private sector jobs across the State. The $12.9 billion capital works program in 2019-20 alone is estimated to directly support 40,500 jobs, with 25,500 of these jobs in regions outside the Greater Brisbane area.

The Queensland Government’s Our Future State: Advancing Queensland Priorities, identified Creating jobs in a strong economy as one of its six priorities and highlighted the importance of supporting jobs across the State through key Budget initiatives.

| 1.1.2 | Driving sustainable economic growth |

Sustainable economic growth is essential to increase and maintain secure long-term employment opportunities, thereby increasing prosperity, incomes and living standards.

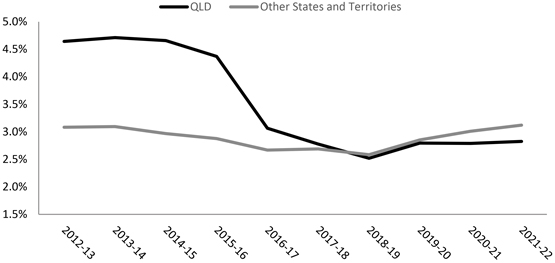

Aligned with the State’s strong jobs growth since 2015 and the Government’s ongoing focus on supporting growth across all sectors and regions, the State’s economy grew by 2.7% per year on average over the four years to 2018. This is stronger than the 2.6% per annum growth in the rest of Australia over the same period.

Queensland’s strong economic performance has been underpinned by a range of factors, including the State’s trade sector, with the value of the State’s overseas merchandise and services exports growing strongly and reaching record levels.

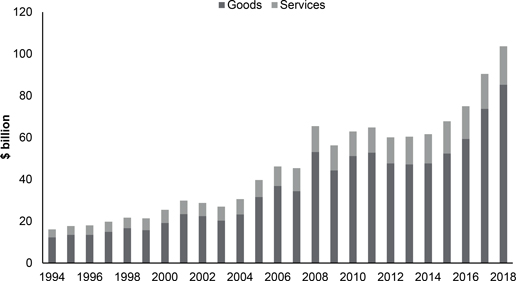

| Box 1.1 | Queensland exports at record levels |

The value of Queensland’s total overseas goods and services exports exceeded $100 billion in 2018, with the value of both overseas goods and overseas services exports reaching record levels over the last year.

Queensland exported a record $85.2 billion worth of goods overseas in the 12 months to April 2019, a rise of $12 billion over the previous 12 months. This increase was driven primarily by higher prices and increased volumes of LNG and hard coking (metallurgical) coal exports.

This was the 13th consecutive record breaking month for annual Queensland exports and was more than the value of goods exported overseas from New South Wales and Victoria combined over the same period.

Further, Queensland’s key services exports such as tourism, education and business services, also continue to grow, with the latest Queensland State Accounts showing the value of overseas services exports totalled a record $18.5 billion in 2018.

Driven by key regionally-important industries including mining, agriculture and manufacturing, around 80 per cent of Queensland’s goods exports are shipped from the State’s regional ports.

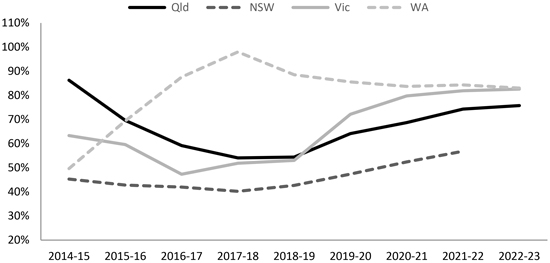

The exceptional performance of Queensland’s goods and services exports over recent years is highlighted in Chart 1.2 below.

15

Budget Strategy and Outlook 2019-20

| Chart 1.2 | Overseas exports, Queensland, nominal |

Source: Queensland Treasury (Queensland State Accounts).

In order to maintain this momentum and continue to drive sustainable growth across all regions, a key element of the Government’s focus is to optimise the use of Queensland’s natural resources.

By building on existing strengths and unlocking new opportunities, the resources sector will continue to deliver economic and social benefits for present and future generations, as well as supporting thousands of regional jobs.

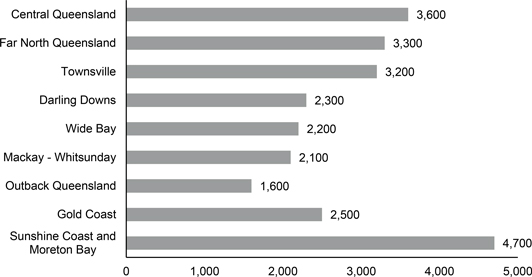

The sustainable use and protection of the State’s natural environment is also critical to support ongoing growth in other key regional industries such as tourism. In 2018, the Tropical North Queensland and the Whitsundays regions alone attracted around 3.6 million international and domestic overnight visitors, injecting over $4.4 billion into the State’s economy. This is helping support around 53,000 tourism jobs more broadly across regional Queensland.

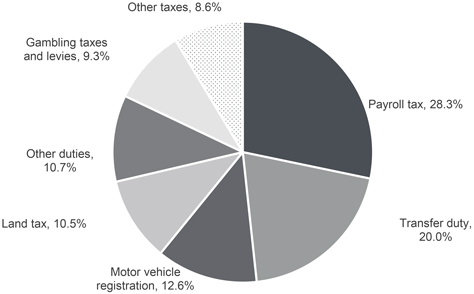

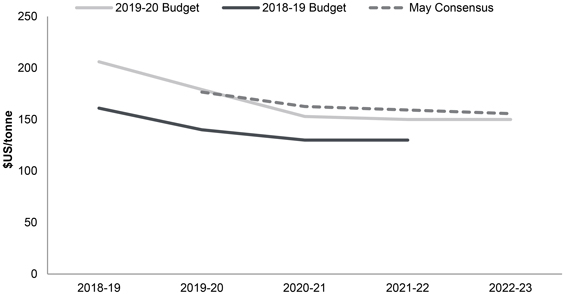

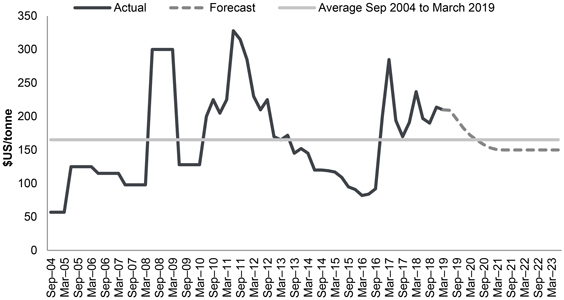

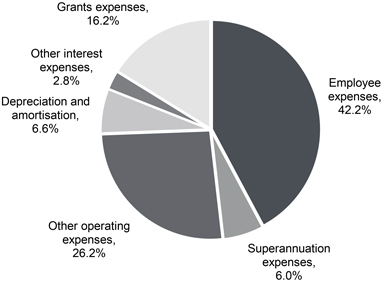

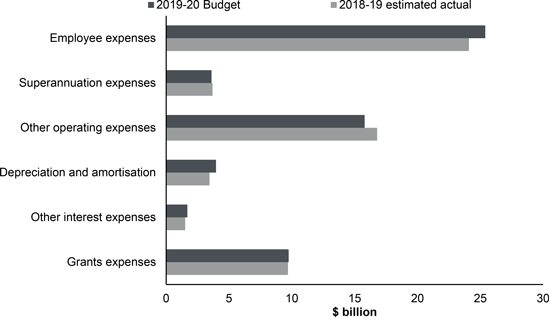

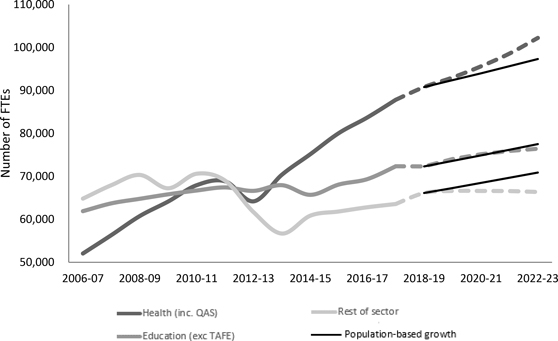

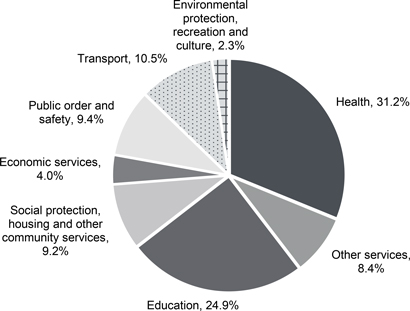

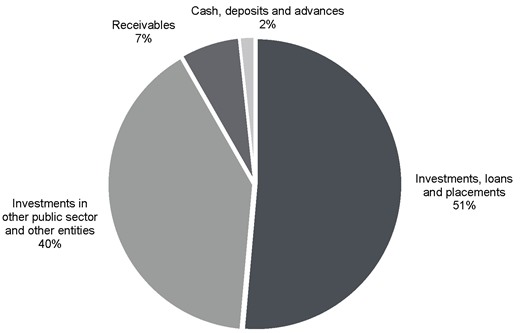

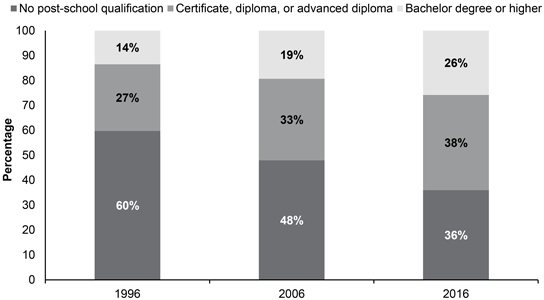

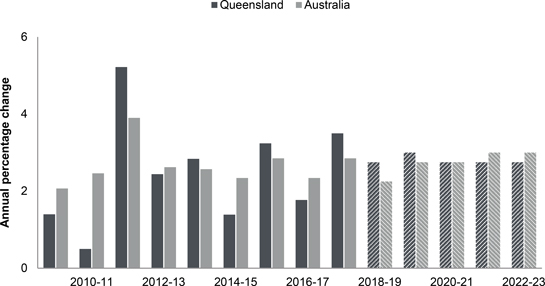

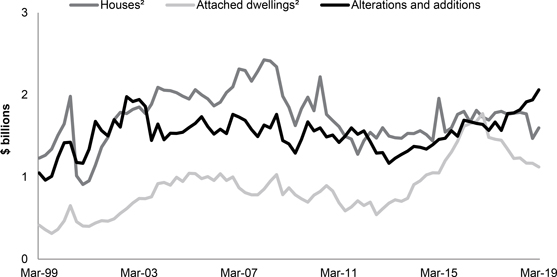

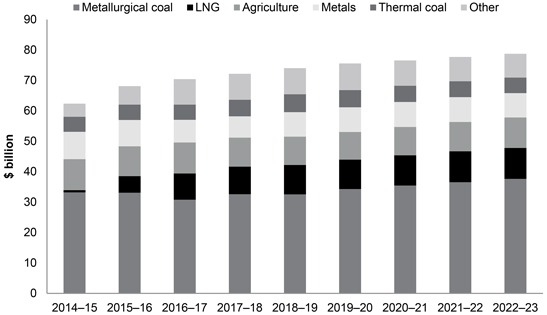

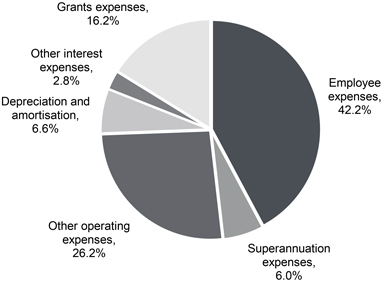

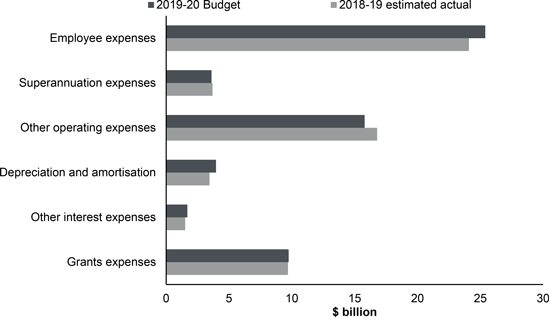

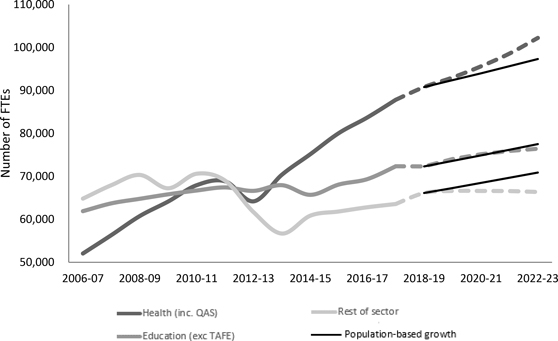

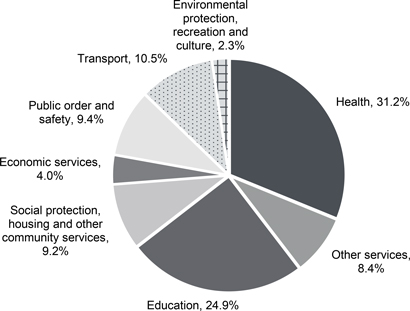

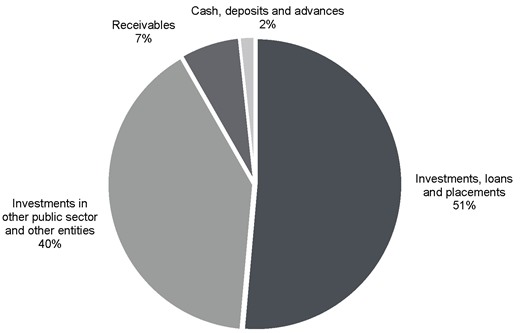

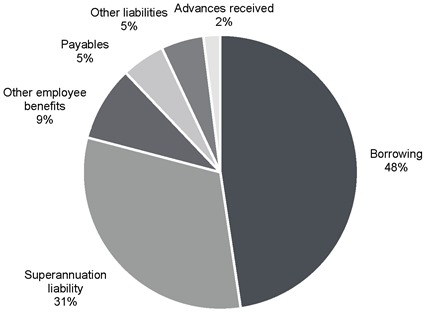

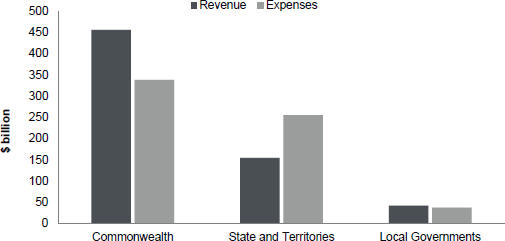

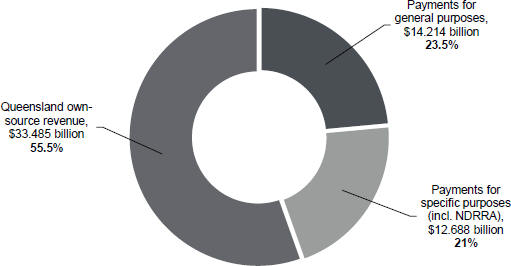

Importantly, the Government has implemented a number of key measures to protect the State’s world-renowned natural environment, including Queensland’s land, vegetation, waterways and the iconic Great Barrier Reef. The sustainability of our environment will deliver benefits for Queenslanders and the entire global community, as well as attracting millions of tourists from around the globe and generating tourism-related jobs for decades and generations to come.