GOVERNMENT FISCAL PRINCIPLES

Principle 1 – Target ongoing reductions in Queensland’s relative debt burden, as measured by the General Government debt to revenue ratio

A primary fiscal focus for the Government is managing the debt of the General Government sector and servicing this debt from within the General Government sector through tax revenue, charges and royalties. Targeting ongoing reductions in the debt to revenue ratio enables the Government to improve the state’s fiscal sustainability.

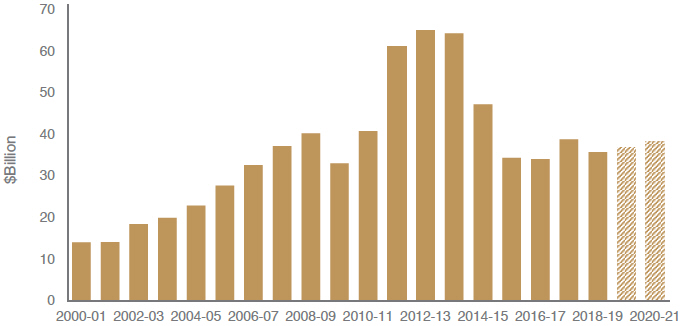

The General Government sector’s debt to revenue ratio has fallen substantially from a peak of 91% in 2012-13 to 63% in the 2019-20 MYFER, which is slightly lower than forecast at the 2019-20 Budget.

As outlined in the 2019-20 Budget Paper 2, AASB 16 Leases, applies to all government and private sector reporting entities. This means operating leases that previously were not recognised on the balance sheet are included as lease liabilities and lease assets. There is no material change to the state’s underlying financial sustainability.

Principle 2 – Target net operating surpluses that ensure any new capital investment in the General Government sector is funded primarily through recurrent revenues rather than borrowing

The actual outcome in 2018-19 demonstrates that new capital investment was funded from recurrent revenues in that year. Across the forward estimates, more than half of the General Government sector’s capital investment is expected to be funded from net operating cashflows.

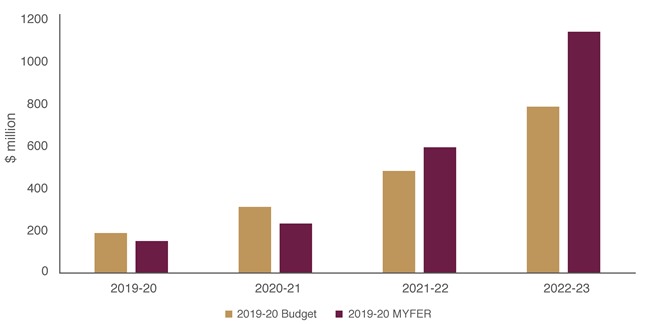

Principle 3 – The capital program will be managed to ensure a consistent flow of works to support jobs and the economy and reduce the risk of backlogs emerging

The 2019-20 MYFER sees Non-Financial Public Sector purchases of non-financial assets (capital purchases) increase from $8.46 billion in 2018-19 to $10.727 billion in 2019-20. Capital purchases over the next three years (2020-21 to 2022-23) average $10.5 billion per annum.

Principle 4 – Maintain competitive taxation by ensuring that General Government sector own–source revenue remains at or below 8.5% as a proportion of nominal gross state product, on average, across the forward estimates

General Government own-source revenue is forecast to be 8.5% of nominal gross state product (GSP) in 2019-20 and an average of 8.2% across the forward estimates. This ensures the Government’s revenue efforts do not constrain economic activity or place undue burden on households. Tax revenue will remain below the ten-year peak of 4.3% of GSP observed in 2014-15.

Principle 5 – Target full funding of long-term liabilities such as superannuation and WorkCover in accordance with actuarial advice

Consistent with the long-standing practice of successive governments, the Palaszczuk Government is committed to ensuring the state sets aside assets, on an actuarially determined basis, to meet long term liabilities such as superannuation and WorkCover.

The latest full actuarial review of the QSuper scheme, as at 30 June 2018 found the scheme to be fully funded. WorkCover is also fully funded as at 30 June 2019.

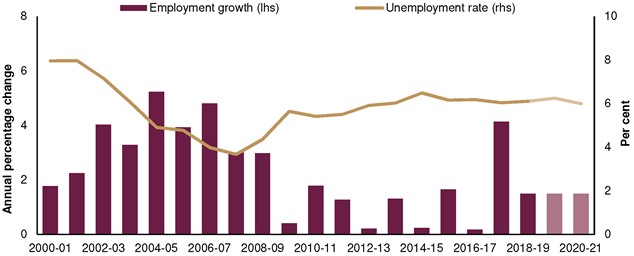

Principle 6 – Maintain a sustainable public service by ensuring that overall growth in full-time equivalent (FTE) employees, on average over the forward estimates, does not exceed population growth

Across the forward estimates, average growth in full-time equivalent employees is 1.7%, in line with expected population growth.

23