EXHIBIT (c)(ii)

Consolidated Financial Statements of the Co-Registrant for the fiscal year ended June 30, 2020.

FORWARD-LOOKING STATEMENTS

This exhibit contains forward-looking statements. Statements that are not historical facts, including statements about the State of Queensland’s (the “State” or “Queensland”) beliefs and expectations, are forward-looking statements. These statements are based on current plans, budgets, estimates and projections and therefore you should not place undue reliance on them. The words “believe”, “may”, “will”, “should”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and neither the Queensland Treasury Corporation nor the State undertake any obligation to update publicly any of them in light of new information or future events.

Forward-looking statements are based on current plans, estimates and projections and, therefore, undue reliance should not be placed on them. Although the Queensland Treasury Corporation and the State believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such beliefs and expectations will prove to have been correct. Forward-looking statements involve inherent risks and uncertainties. We caution you that actual results may differ materially from those contained in any forward-looking statements.

A number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. Factors that could cause the actual outcomes to differ materially from those expressed or implied in forward-looking statements include:

| | • | | the international and Australian economies, and in particular the rates of growth (or contraction) of the State’s major trading partners; |

| | • | | the effects, both internationally and in Australia, of any subsequent economic downturn, as well as the effect of ongoing economic, banking and sovereign debt risk; |

| | • | | the effect of the ongoing novel coronavirus (COVID-19) pandemic; |

| | • | | increases or decreases in international and Australian domestic interest rates; |

| | • | | changes in and increased volatility in currency exchange rates; |

| | • | | changes in the State’s domestic consumption; |

| | • | | changes in the State’s labor force participation and productivity; |

| | • | | downgrades in the credit ratings of the State and Australia; |

| | • | | changes in the rate of inflation in the State; |

| | • | | changes in environmental and other regulation; and |

| | • | | changes in the distribution of revenue from the Commonwealth of Australia Government to the State. |

2019–20

Report on State Finances

of the Queensland Government – 30 June 2020

Incorporating the Outcomes Report and

the AASB 1049 Financial Statements

Contents

| | | | |

| | | Page | |

| |

Message from the Treasurer | | | 2 | |

| |

Outcomes Report - Uniform Presentation Framework | | | | |

| |

Overview and Analysis | | | 3-1 | |

| |

Operating Statement by Sector | | | 3-9 | |

| |

Balance Sheet by Sector | | | 3-10 | |

| |

Cash Flow Statement by Sector | | | 3-11 | |

| |

General Government Sector Taxes | | | 3-12 | |

| |

General Government Sector Dividend and Income Tax Equivalent Income | | | 3-12 | |

| |

General Government Sector Grants Revenue | | | 3-13 | |

| |

General Government Sector Grants Expenses | | | 3-13 | |

| |

General Government Sector Expenses by Function | | | 3-14 | |

| |

General Government Sector Purchases of Non-financial Assets by Function | | | 3-15 | |

| |

Certification of Outcomes Report | | | 3-16 | |

| |

AASB 1049 Financial Statements | | | | |

| |

Overview and Analysis | | | 4-1 | |

| |

Audited Financial Statements | | | | |

| |

Operating Statement | | | 5-1 | |

| |

Balance Sheet | | | 5-3 | |

| |

Statement of Changes in Net Assets (Equity) | | | 5-4 | |

| |

Cash Flow Statement | | | 5-8 | |

| |

Notes to the Financial Statements | | | 5-10 | |

| |

Certification of Queensland State Government Financial Statements | | | 5-119 | |

| |

Independent Auditor’s Report to the Treasurer of Queensland | | | 5-120 | |

| | | | |

| Report on State Finances 2019–20 – Queensland Government | | | 1 | |

Message from the Treasurer

I present Queensland’s 2019-20 Report on State Finances which includes the Outcomes Report and AASB 1049 Financial Statements.

The Queensland Government’s strong economic and fiscal position enabled it to respond swiftly to the global COVID-19 pandemic with the Government providing immediate stimulus to boost health system capacity and to support Queensland businesses, industry, communities and households and move towards a longer-term recovery plan.

The downturn in revenues and the Government’s increased expenditure in response to the pandemic has resulted in an operating deficit of $5.734 billion for 2019-20. Consistent with the impact of lower revenues and the support measures taken by the Government including maintaining the capital program, borrowings have increased.

The Outcomes Report

The Outcomes Report contains financial statements that are presented in accordance with the Uniform Presentation Framework (UPF) which provides comparable reporting of Commonwealth, State and Territory Governments’ financial information.

Queensland’s 2019-20 Budget was prepared in accordance with the UPF, The Outcomes Report compares the 2019-20 actual results with the COVID-19 Fiscal and Economic Review. The 2019-20 Mid-Year Fiscal and Economic Review (MYFER) included for context.

The UPF presentation is structured on a sectoral basis with a focus on the General Government and Public Non-financial Corporations Sectors.

AASB 1049 Financial Statements

The AASB 1049 Financial Statements outline the operations of the Queensland Government in accordance with Australian Accounting Standard AASB 1049 Whole of Government and General Government Sector Financial Reporting and other applicable standards and are audited.

These statements focus on the General Government Sector (GGS) and Total State Sector (TSS) and include detailed notes.

The statements include comparatives for the 2018-19 year, and there is also analysis of variances between original 2019-20 Budget and actuals.

AASB 1049 aims to harmonise the Government Finance Statistics (GFS) and Accounting Standard frameworks. The GFS reporting framework, developed by the Australian Bureau of Statistics (ABS), is based on international statistical standards and allows comprehensive assessments to be made of the economic impact of government.

I note the assurances of Treasury officials that both the Outcomes Report and the audited financial statements are presented on a true and fair basis and that the independent auditor’s report is unqualified.

In endorsing this report, I place on record my appreciation of the professionalism and co-operation extended to Queensland Treasury by agency personnel and of the Treasury staff involved in its preparation.

The Honourable Cameron Dick MP

Treasurer

Minister for Investment

Related Publications

This report complements other key publications relating to the financial performance of the Queensland Public Sector including:

| | – | | the 2019-20 Budget papers; |

| | – | | Budget updates including the COVID-19 Fiscal and Economic Review and Mid-Year Fiscal and Economic Review; |

| | – | | the Treasurer’s Consolidated Fund Financial Report; and |

| | – | | the annual reports of the various departments, statutory bodies, Government-owned corporations and other entities that comprise the Queensland Government. |

| | |

| 2 | | Report on State Finances 2019–20 – Queensland Government |

2019–20

Outcomes Report

Uniform Presentation Framework of the

Queensland Government – 30 June 2020

Outcomes Report - Overview and Analysis

Overview

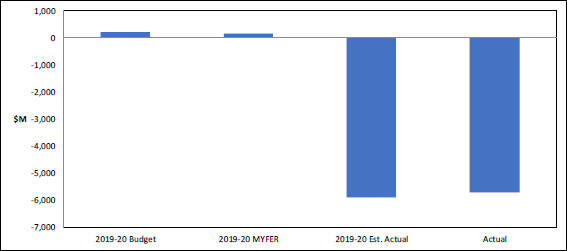

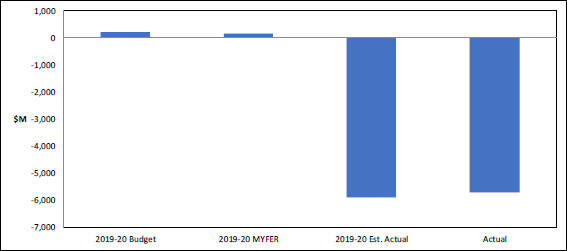

The General Government Sector (GGS) realised a Uniform Presentation Format (UPF) net operating deficit of $5.734 billion for 2019-20. The net operating balance is a small improvement over the COVID-19 Fiscal and Economic Review (C19-FER) estimated deficit of $5.898 billion reflecting slightly higher revenue and lower expenses.

The deterioration in the operating balance from the forecast surplus of $151 million at the time of the 2019-20 Mid-Year Fiscal and Economic Review (MYFER) and the operating surpluses achieved over the past six consecutive years, is primarily due to the impact of the global COVID-19 pandemic on GGS revenue sources and measures taken by the Queensland Government in response to the crisis.

In 2019-20, GGS revenue totalled $57.764 billion, a reduction of $2.623 billion from the original Budget estimate of $60.387 billion. Since the 2019-20 Budget, revenue has been significantly impacted by the COVID-19 crisis, with a decline across key revenue sources of taxation, GST and royalties. In its immediate response to the pandemic, the Government provided payroll tax and land tax relief measures to support businesses and jobs, directly impacting taxation revenue.

Conversely, expenses increased by $3.3 billion from the 2019-20 Budget to total $63.498 billion in 2019-20. Higher expenses were due to fiscal stimulus measures to support businesses, workers and households in the immediate wake of the COVID-19 crisis, provisioning for acknowledgement of historical serious child physical abuse claims, revision of expected costs of historical child sexual abuse claims and other litigation.

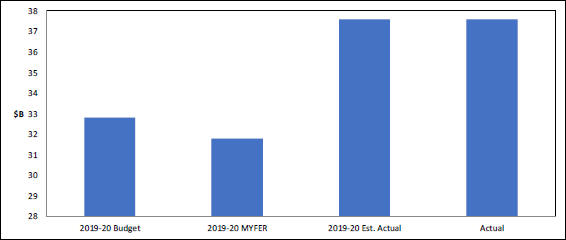

Chart 3.1: 2019-20 General Government Sector UPF net operating balance compared to budget forecasts

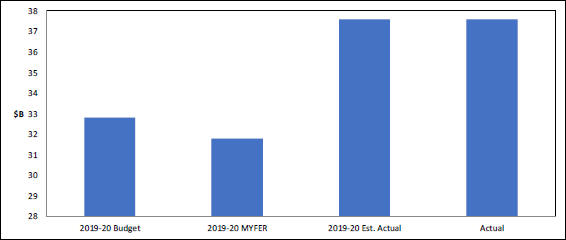

GGS borrowing with QTC at 30 June 2020 was $37.57 billion, $4.789 billion higher than the 2019-20 Budget estimate of $32.781 billion and in line with the C19-FER forecast. The higher borrowing is predominantly due to the impact of COVID-19 on key revenue sources, COVID-19 revenue and expense measures, as well as balance sheet measures such as the Jobs Support Loans Scheme. The Government’s decision not to proceed with the planned $1 billion repatriation of surplus defined benefit assets under the Debt Action Plan also contributed to higher borrowings with QTC than originally estimated.

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 1 | |

Outcomes Report - Overview and Analysis

Overview continued

Chart 3.2: 2019-20 General Government Sector borrowing with QTC compared to budget forecasts

Prior to COVID-19, the GGS debt to revenue ratio was estimated at 63% in the 2019-20 MYFER. Predominantly due to the COVID-19 economic downturn, this ratio has increased to 77%, with the reduction in revenues and the Government’s targeted expenditure in support of economic activity increasing borrowings in the latter part of the year. Key initiatives such as payroll tax and land tax relief measures, utility assistance packages for households, electricity rebates for small businesses and loans provided under the Jobs Support Loans Scheme contributed to higher borrowings. Previous balance sheet management actions taken by the Government under its Debt Action Plan have enabled it to leverage Queensland’s strong balance sheet position to absorb the sharp decline in revenues as well as provide fiscal stimulus to the Queensland economy. The 2019-20 debt to revenue ratio of 77% remains a considerable improvement from its peak in 2012-13 of 91%.

Non-financial Public Sector gross borrowing with QTC of $76.464 billion in 2019-20 was $4.51 billion higher than the forecast in the 2019-20 Budget. This increase is predominantly due to additional GGS borrowing with QTC. This outcome has resulted in an increase in the Non-financial Public Sector debt to revenue ratio from the Budget estimate of 115% to 128% but is still lower than the 2012-13 peak of 140%.

Fiscal principles

Impact of the COVID-19 pandemic on the Fiscal Principles

In keeping with the requirement to regularly report progress against the principles set out in the Charter of Fiscal Responsibility, the table on page 3-3 provides an overview of these fiscal principles and progress against them for the 2019-20 financial year.

The COVID-19 crisis has, in the near term, significantly impacted the Government’s ability to meet its fiscal principle targets, which were established prior to the pandemic. The Government has prioritised its economic and health response to the pandemic to ensure the State is well placed to commence its recovery.

Principle 1 - Target ongoing reductions in Queensland’s relative debt burden, as measured by the General Government debt to revenue ratio

In managing GGS debt, a debt to revenue ratio is a key measure of the sustainability of a jurisdiction’s debt levels. As mentioned above, Queensland’s debt to revenue ratio was 77% in 2019-20, in line with the C19-FER estimated actual but higher than the 63% projected pre-COVID-19 in the 2019-20 MYFER, predominantly due to the COVID-19 economic downturn. While the ratio is elevated above pre-COVID-19 estimates, the ratio of 77% remains below the peak of 91% in 2012-13.

In August 2020, the Government passed legislation to establish the Queensland Future Fund (QFF). The QFF is a long-term plan to alleviate the debt burden on future generations of Queenslanders. All assets within the QFF are ringfenced by legislation, which requires they only be used to reduce the State’s borrowings. This means for Credit Rating purposes, Queensland’s borrowings are considered net of assets held in the QFF.

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 2 | |

Outcomes Report - Overview and Analysis

Fiscal principles continued

Principle 2 - Target net operating surpluses that ensure any new capital investment in the General Government Sector is funded primarily through recurrent revenues rather than borrowing

The operating deficit of $5.734 billion, for the reasons mentioned, previously has resulted in all new capital investment within the year being funded from borrowings.

Principle 3 - The capital program will be managed to ensure a consistent flow of works to support jobs and the economy and reduce the risk of backlogs emerging

The capital program includes purchases of non-financial assets, capital grants and new finance leases and similar arrangements. The capital program for the State Non-financial Sector in 2019-20 was $12.482 billion, compared to $11.149 billion in 2018-19. The Government re-confirmed its commitment to a $51.8 billion capital program over four years in the C19-FER.

Principle 4 - Maintain competitive taxation by ensuring that General Government Sector own-source revenue remains at or below 8.5% of nominal gross state product, on average, across the forward estimates

Government has a clear role in providing an economic environment that supports business and jobs growth and does not place undue strain on households. In 2019-20, own-source revenue represented 8.3% of nominal gross state product, consistent with the Government’s fiscal principle.

Own source revenue is estimated to be 7.7% of gross state product in 2020-21 partly due to subdued economic activity following the global COVID-19 outbreak in 2019-20.

Principle 5 - Target full funding of long term liabilities such as superannuation and WorkCover in accordance with actuarial advice

Consistent with the long-standing practice of successive governments, the Queensland Government is committed to ensuring that the State sets aside assets, on an actuarially determined basis, to meet long term liabilities such as superannuation and WorkCover. The latest full actuarial review of the QSuper scheme was as at 30 June 2019 and was published in a report dated 4 December 2019. The report found the scheme to be fully funded.

As at 30 June 2020, WorkCover Queensland was fully funded.

Principle 6 - Maintain a sustainable public service by ensuring that overall growth in full-time equivalents (FTE) employees, on average over the forward estimates, does not exceed population growth

The Government has committed to providing high quality and appropriate frontline services that keep pace with growth in the population, while maintaining fiscally responsible and affordable levels of expenditure.

Departmental FTEs increased by 1.8% in 2019-20, compared with the original 2019-20 Budget estimate growth of 1.9%, with 89% of the growth attributable to health and education.

At the time of C19-FER, the average growth in FTEs over the two-year period to 2020-21 was estimated to be 2.2%. Average population growth over the two-year period to 2020-21 is estimated to be 11⁄4%, which is below recent rates of population growth. International and interstate travel restrictions implemented across Australia to combat the spread of COVID-19 has led to a fall in expected population growth.

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 3 | |

Outcomes Report - Overview and Analysis

Fiscal principles continued

| | | | |

| |

| The fiscal principles of the Queensland Government 2019-20 |

| | |

| Principle | | Indicator |

| | |

Target ongoing reductions in Queensland’s relative debt burden, as measured by the General Government debt to revenue ratio | | Debt to Revenue Ratio |

| | Est. Actual | | Outcome |

| | 77% | | 77% |

| | |

Target net operating surpluses that ensure any new capital investment in the General Government Sector is funded primarily through recurrent revenue rather than borrowings | | Net operating cash flows as a proportion of net investments in non-financial assets |

| | Est. Actual | | Outcome |

| | Operating cash flows are negative | | Operating cash flows are negative |

| | |

The capital program will be managed to ensure a consistent flow of works to support jobs and the economy and reduce the risk of backlogs emerging | | State Non-financial Sector capital program |

| | Est. Actual | | Outcome |

| | $12.428 billion | | $12.482 billion |

| | |

Maintain competitive taxation by ensuring that General Government Sector own-source revenue remains at or below 8.5% of nominal gross state product, on average, across the forward estimates | | Own-source revenue to gross state product ratio |

| | Est. Actual | | Outcome |

| | 8.2% | | 8.3% |

| | |

Target full funding of long-term liabilities such as superannuation and WorkCover in accordance with actuarial advice | | The latest actuarial review of the QSuper scheme as at 30 June 2019 found the scheme to be fully funded. The WorkCover scheme was fully funded as at 30 June 2020. |

| | |

Maintain a sustainable public service by ensuring that overall growth in full-time equivalent employees, on average over the forward estimates, does not exceed population growth | | Two-year average FTE growth to 2020-21 is 2.2%. Two-year average population growth to 2020-21 is 11/4% |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 4 | |

Outcomes Report - Overview and Analysis

Key UPF Financial Aggregates

Outlined in the table below are the key aggregates, by sector for 2019-20. The actual outcome for 2019-20 is compared to the estimated actual (Est. Actual) per the COVID-19 Fiscal and Economic Review.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public

Sector | |

| | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | |

| | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | |

| | | | | | | |

Revenue | | | 57,719 | | | | 57,764 | | | | 13,623 | | | | 13,589 | | | | 66,200 | | | | 66,156 | |

Expenses | | | 63,617 | | | | 63,498 | | | | 12,272 | | | | 12,662 | | | | 71,825 | | | | 72,049 | |

Net operating balance | | | (5,898 | ) | | | (5,734 | ) | | | 1,351 | | | | 927 | | | | (5,625 | ) | | | (5,893 | ) |

| | | | | | | |

Capital purchases | | | 6,305 | | | | 6,291 | | | | 3,142 | | | | 3,156 | | | | 9,447 | | | | 9,467 | |

| | | | | | | |

Fiscal balance | | | (9,318 | ) | | | (9,158 | ) | | | 719 | | | | 306 | | | | (9,678 | ) | | | (9,958 | ) |

| | | | | | | |

Borrowing with QTC | | | 37,574 | | | | 37,570 | | | | 38,904 | | | | 38,894 | | | | 76,478 | | | | 76,464 | |

Leases and similar arrangements | | | 6,454 | | | | 6,499 | | | | 491 | | | | 492 | | | | 6,945 | | | | 6,991 | |

Securities and derivatives | | | 198 | | | | 198 | | | | 1,315 | | | | 1,315 | | | | 1,513 | | | | 1,505 | |

| | | | | | | |

Notes: | | | | | | | | | | | | | | | | | | | | | | | | |

1. Numbers may not add due to rounding. | |

| | | | | | | | | | | | |

2. Non-financial Public Sector consolidates the General Government and Public Non-financial Corporations Sector and excludes inter-sector transactions and balances. |

General Government Sector

Revenue

| | | | | | | | | | | | |

| | | 2019-20 | | | 2019-20 | | | 2019-20 | |

| Revenue | | MYFER | | | Est. Actual | | | Outcome | |

| | | $ million | | | $ million | | | $ million | |

| | | | |

Taxation revenue | | | 15,145 | | | | 14,566 | | | | 14,585 | |

Grants revenue | | | 28,261 | | | | 27,569 | | | | 27,641 | |

Sales of goods and services | | | 6,107 | | | | 5,809 | | | | 5,618 | |

Interest income | | | 2,047 | | | | 2,020 | | | | 2,076 | |

Dividend and income tax equivalent income | | | 2,187 | | | | 1,895 | | | | 1,929 | |

Other revenue | | | 6,167 | | | | 5,859 | | | | 5,915 | |

| | | | |

Total Revenue | | | 59,914 | | | | 57,719 | | | | 57,764 | |

| | | | |

Note: | | | | | | | | | | | | |

1. Numbers may not add due to rounding. | |

Total GGS revenue of $57.764 billion was consistent with the C19-FER and $2.15 billion, or 3.6%, lower than the 2019-20 MYFER.

Since 2019-20 MYFER, the COVID-19 pandemic significantly impacted Queensland’s revenue with falls occurring across all categories of revenue. Taxation revenue declined $561 million largely reflecting the Government’s COVID-19 payroll tax and land tax relief measures resulting in revenue forgone and lower gambling machine tax revenue due to the closure of venues during the height of the crisis. GST revenue was also down, falling $1.251 billion from the 2019-20 MYFER estimate due to lower national GST collections resulting from subdued economic activity during the crisis. These falls in revenue were partially offset by the Australian Government funding for health services and the bring forward from 2020-21 grants for on-passing to non-State schools and Financial Assistance grants for local councils.

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 5 | |

Outcomes Report - Overview and Analysis

Key UPF Financial Aggregates continued

General Government Sector continued

Expenses

| | | | | | | | | | | | |

| | | 2019-20 | | | 2019-20 | | | 2019-20 | |

| Expenses | | MYFER | | | Est. Actual | | | Outcome | |

| | | $ million | | | $ million | | | $ million | |

| | | | |

Employee expenses | | | 25,511 | | | | 25,657 | | | | 25,660 | |

Superannuation expenses | | | | | | | | | | | | |

Superannuation interest cost | | | 346 | | | | 346 | | | | 354 | |

Other superannuation expenses | | | 3,097 | | | | 3,104 | | | | 3,183 | |

Other operating expenses | | | 15,176 | | | | 17,264 | | | | 17,087 | |

Depreciation and amortisation | | | 3,951 | | | | 4,033 | | | | 4,033 | |

Other interest expenses | | | 1,544 | | | | 1,508 | | | | 1,486 | |

Grants expenses | | | 10,139 | | | | 11,704 | | | | 11,695 | |

| | | | |

Total Expenses | | | 59,763 | | | | 63,617 | | | | 63,498 | |

| | | | |

Note: | | | | | | | | | | | | |

1. Numbers may not add due to rounding. | |

GGS expenses for 2019-20 totalled $63.498 million, $119 million lower than expected in the C19-FER and $3.734 billion, or 6.2%, higher than the 2019-20 MYFER estimate.

In response to the COVID-19 pandemic, the Government provided significant immediate stimulus with funding targeted at boosting health capacity, economic assistance to businesses through payroll and land tax relief refunds, electricity and water utility assistance to households, electricity rebates for small businesses and worker assistance. Expenses also grew relative to the 2019-20 MYFER due to the State providing for historical serious child physical abuse claims following the removal of the limitation periods and an increase in expected historical serious sexual abuse claims as well as other pending litigation.

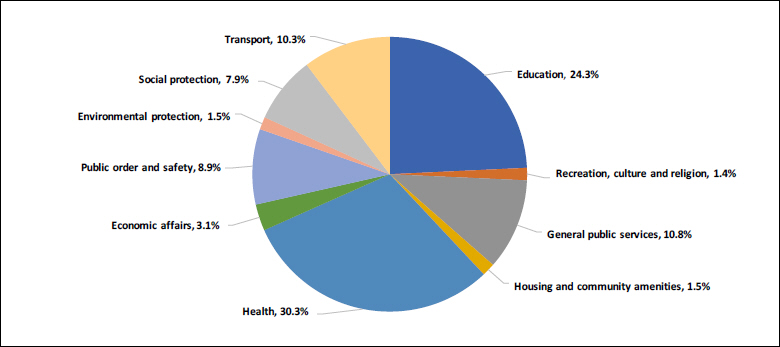

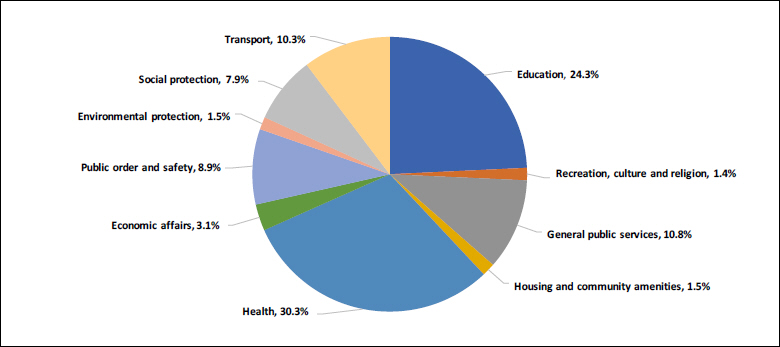

GGS expenditure is focused on the delivery of core services to the community. As shown in Chart 3.4 below, education and health account for over half of the total expenses, consistent with their share in other jurisdictions.

Chart 3.4: 2019-20 General Government Sector expenses by function1

| 1 | Refer to page 3-12 for further detail of expenses in each function. |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 6 | |

Outcomes Report - Overview and Analysis

Key UPF Financial Aggregates continued

General Government Sector continued

Net Operating Balance

The net operating balance is the net of revenue and expenses from transactions and was an operating deficit of $5.734 billion for 2019-20. This was a modest improvement on the $5.898 billion estimated actual in the C19-FER and a $5.885 billion deterioration from the 2019-20 MYFER estimated net operating balance of $151 million, for the reasons discussed above.

Capital Purchases

GGS purchases of non-financial assets are the actual cash outlays per the Cash Flow Statement and totalled $6.291 billion, which was $14 million lower than the C19-FER estimate.

Fiscal Balance

The fiscal deficit of $9.158 billion for 2019-20 was a modest improvement on the C19-FER projection of a $9.318 billion deficit. The deterioration of the fiscal balance since the 2019-20 MYFER is due to the impact of COVID-19 on the net operating balance, partly offset by lower than projected capital purchases.

Borrowing

Gross borrowing with QTC was $37.57 billion, compared to the 2019-20 MYFER projection of $31.774 billion, an increase of $5.796 billion. The increase reflects the reduction in cash flows from operating activities caused by lower revenues and rise in expenses as a result of the COVID-19 pandemic, COVID-19 balance sheet measures (including payroll tax and land tax deferrals and the Jobs Support Loan Scheme), and not proceeding with the planned $1 billion repatriation of surplus defined benefit assets. Offsetting this in part were lower capital purchases than projected at MYFER.

Leases and similar arrangements were $6.499 billion at year end, $428 million higher than estimated at 2019-20 MYFER. This increase is due to the timing of recognition on the Cross River Rail project and revision of estimates on transition to AASB 16 Leases.

Net Worth

The GGS net worth was $193.731 billion as at 30 June 2020, $2.224 billion lower than the estimated actual included in the C19-FER. The decrease related mainly to downwards valuation of the investment in public enterprises and an increase in the actuarial valuation of defined benefit superannuation liabilities.

Net Debt

Net debt is the sum of deposits held, advances received and borrowings (financial liabilities) less cash and deposits, advances paid and investments, loans and placements (financial assets). Financial liabilities exceeded financial assets in the GGS by $14.046 billion at 30 June 2020.

Net debt has increased since 2019-20 MYFER due to higher borrowing with QTC resulting from the impact of COVID-19 on net cash flows from operating activities, as well as a decrease in the valuation of investments, loans and placements.

Operating Result

The operating result measures the outcome for the State under the Accounting Standards framework, rather than the GFS framework. The GGS operating deficit of $10.749 billion differs from the net operating balance as it includes valuation adjustments such as gains and losses on financial and non-financial assets.

Comprehensive Result - Total Change in Net Worth

The comprehensive result includes the revaluation of assets taken to reserves and actuarial adjustments to defined benefit superannuation liabilities.

The decrease from the C19-FER estimated actual to the actual comprehensive result was due mainly to slightly lower revaluations of non-financial assets, downwards valuation of the investment in public enterprises and the actuarial valuation of defined benefit superannuation liabilities discussed above.

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 7 | |

2019 - 20 Operating Statement by Sector ($ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public Sector (b) | | | Public

Financial

Corporations

Sector (b) | | | State

Financial

Sector | |

| | | | | | | | | | |

| | | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Outcome (c) | | | Outcome (c) | |

Revenue from Transactions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Taxation revenue | | | 14,566 | | | | 14,585 | | | | - | | | | - | | | | 14,275 | | | | 14,254 | | | | - | | | | 14,146 | |

Grants revenue | | | 27,569 | | | | 27,641 | | | | 666 | | | | 646 | | | | 27,611 | | | | 27,674 | | | | 1 | | | | 27,571 | |

Sales of goods and services | | | 5,809 | | | | 5,618 | | | | 12,401 | | | | 12,359 | | | | 15,827 | | | | 15,596 | | | | 2,429 | | | | 17,674 | |

Interest income | | | 2,020 | | | | 2,076 | | | | 83 | | | | 87 | | | | 2,060 | | | | 2,140 | | | | 3,398 | | | | 935 | |

Dividend and income tax equivalent income | | | 1,895 | | | | 1,929 | | | | 13 | | | | 14 | | | | 152 | | | | 141 | | | | - | | | | 14 | |

Other revenue | | | 5,859 | | | | 5,915 | | | | 461 | | | | 482 | | | | 6,275 | | | | 6,351 | | | | 76 | | | | 6,425 | |

Total Revenue from Transactions | | | 57,719 | | | | 57,764 | | | | 13,623 | | | | 13,589 | | | | 66,200 | | | | 66,156 | | | | 5,904 | | | | 66,766 | |

| | | | | | | | | |

Expenses from Transactions | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Employee expenses | | | 25,657 | | | | 25,660 | | | | 2,113 | | | | 2,087 | | | | 27,651 | | | | 27,629 | | | | 371 | | | | 27,710 | |

Superannuation expenses | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Superannuation interest cost | | | 346 | | | | 354 | | | | - | | | | (5 | ) | | | 346 | | | | 349 | | | | - | | | | 349 | |

Other superannuation expenses | | | 3,104 | | | | 3,183 | | | | 214 | | | | 237 | | | | 3,318 | | | | 3,421 | | | | 26 | | | | 3,446 | |

Other operating expenses | | | 17,264 | | | | 17,087 | | | | 4,729 | | | | 5,129 | | | | 19,577 | | | | 19,768 | | | | 2,991 | | | | 22,751 | |

Depreciation and amortisation | | | 4,033 | | | | 4,033 | | | | 2,658 | | | | 2,719 | | | | 6,691 | | | | 6,752 | | | | 28 | | | | 6,779 | |

Other interest expenses | | | 1,508 | | | | 1,486 | | | | 1,842 | | | | 1,776 | | | | 3,144 | | | | 3,070 | | | | 5,564 | | | | 3,868 | |

Grants expenses | | | 11,704 | | | | 11,695 | | | | 17 | | | | (19 | ) | | | 11,097 | | | | 11,062 | | | | 103 | | | | 11,061 | |

Other property expenses | | | - | | | | - | | | | 699 | | | | 737 | | | | - | | | | - | | | | 32 | | | | - | |

Total Expenses from Transactions | | | 63,617 | | | | 63,498 | | | | 12,272 | | | | 12,662 | | | | 71,825 | | | | 72,049 | | | | 9,115 | | | | 75,965 | |

Net Operating Balance | | | (5,898 | ) | | | (5,734 | ) | | | 1,351 | | | | 927 | | | | (5,625 | ) | | | (5,893 | ) | | | (3,211 | ) | | | (9,199 | ) |

| | | | | | | | | |

Other economic flows - included in operating result | | | (4,283 | ) | | | (5,015 | ) | | | (1,008 | ) | | | (944 | ) | | | (5,361 | ) | | | (6,033 | ) | | | 2,503 | | | | (4,989 | ) |

| | | | | | | | | |

Operating Result | | | (10,181 | ) | | | (10,749 | ) | | | 343 | | | | (17 | ) | | | (10,986 | ) | | | (11,926 | ) | | | (709 | ) | | | (14,188 | ) |

| | | | | | | | | |

Other economic flows - other movements in equity | | | 4,632 | | | | 2,976 | | | | (464 | ) | | | (651 | ) | | | 5,437 | | | | 4,153 | | | | (111 | ) | | | 4,956 | |

| | | | | | | | | |

Comprehensive Result - Total Change in Net Worth (d) | | | (5,549 | ) | | | (7,773 | ) | | | (121 | ) | | | (668 | ) | | | (5,548 | ) | | | (7,773 | ) | | | (820 | ) | | | (9,232 | ) |

| | | | | | | | | |

KEY FISCAL AGGREGATES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Net Operating Balance | | | (5,898 | ) | | | (5,734 | ) | | | 1,351 | | | | 927 | | | | (5,625 | ) | | | (5,893 | ) | | | (3,211 | ) | | | (9,199 | ) |

| | | | | | | | | |

Net Acquisition/(Disposal) of Non-financial Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchases of non-financial assets | | | 6,305 | | | | 6,291 | | | | 3,142 | | | | 3,156 | | | | 9,447 | | | | 9,467 | | | | 17 | | | | 9,483 | |

Less | | Sales of non-financial assets | | | 228 | | | | 230 | | | | 45 | | | | 36 | | | | 272 | | | | 266 | | | | - | | | | 266 | |

Less | | Depreciation | | | 4,033 | | | | 4,033 | | | | 2,658 | | | | 2,719 | | | | 6,691 | | | | 6,752 | | | | 28 | | | | 6,779 | |

Plus | | Change in inventories | | | 54 | | | | 107 | | | | 40 | | | | 50 | | | | 94 | | | | 156 | | | | - | | | | 156 | |

Plus | | Other movements in non-financial assets | | | 1,323 | | | | 1,289 | | | | 153 | | | | 170 | | | | 1,476 | | | | 1,460 | | | | 4 | | | | 1,464 | |

Equals | | Total Net Acquisition of Non-financial Assets | | | 3,421 | | | | 3,424 | | | | 632 | | | | 621 | | | | 4,053 | | | | 4,065 | | | | (7 | ) | | | 4,057 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Balance | | | (9,318 | ) | | | (9,158 | ) | | | 719 | | | | 306 | | | | (9,678 | ) | | | (9,958 | ) | | | (3,204 | ) | | | (13,256 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| Notes: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

(a) Numbers may not add due to rounding and have been restated where necessary to ensure comparability. (b) The Non-financial Public Sector (NFP) consolidates the GGS and PNFC Sectors, eliminating inter-sector balances and transactions such as dividend and income tax equivalent income. The State Financial Sector consolidates the NFP and the PFC sectors. (c) In accordance with UPF requirements, estimates for Public Financial Corporations (PFC) and State Financial Sectors are not included in Budget documentation. (d) For GFS, the change in Net Worth is the change from the previous published outcome. This differs from the AASB 1049 statements where prior year adjustments are permitted under IFRS. | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 9 | |

2019 - 20 Balance Sheet by Sector ($ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public Sector (b) | | | Public

Financial

Corporations

Sector (b) | | | State

Financial

Sector | |

| | | | | | | | | |

| | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Outcome (c) | | | Outcome (c) | |

Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and deposits | | | 1,168 | | | | 1,205 | | | | 889 | | | | 889 | | | | 2,057 | | | | 2,094 | | | | 2,604 | | | | 3,045 | |

Advances paid | | | 1,269 | | | | 1,280 | | | | 1,491 | | | | 1,491 | | | | 1,263 | | | | 1,274 | | | | - | | | | 1,274 | |

Investments, loans and placements | | | 29,441 | | | | 29,580 | | | | 1,639 | | | | 1,787 | | | | 31,080 | | | | 31,366 | | | | 154,690 | | | | 72,160 | |

Receivables | | | 4,333 | | | | 4,490 | | | | 1,569 | | | | 1,484 | | | | 4,636 | | | | 4,669 | | | | 323 | | | | 4,781 | |

Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in other public sector entities | | | 22,108 | | | | 21,560 | | | | - | | | | - | | | | 2,592 | | | | 2,592 | | | | - | | | | - | |

Investments - other | | | 150 | | | | 163 | | | | 270 | | | | 279 | | | | 420 | | | | 442 | | | | - | | | | 442 | |

Total financial assets | | | 58,468 | | | | 58,278 | | | | 5,859 | | | | 5,930 | | | | 42,048 | | | | 42,438 | | | | 157,617 | | | | 81,703 | |

| | | | | | | | | |

Non-Financial Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Land and other fixed assets | | | 223,249 | | | | 223,280 | | | | 63,761 | | | | 63,522 | | | | 287,008 | | | | 286,800 | | | | 185 | | | | 286,985 | |

Other non-financial assets | | | 6,881 | | | | 6,928 | | | | 1,178 | | | | 1,388 | | | | 1,272 | | | | 1,236 | | | | 179 | | | | 1,220 | |

Total Non-financial Assets | | | 230,129 | | | | 230,207 | | | | 64,938 | | | | 64,910 | | | | 288,281 | | | | 288,037 | | | | 364 | | | | 288,205 | |

| | | | | | | | | |

Total assets | | | 288,597 | | | | 288,485 | | | | 70,798 | | | | 70,840 | | | | 330,329 | | | | 330,475 | | | | 157,981 | | | | 369,908 | |

| | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payables | | | 5,712 | | | | 5,729 | | | | 2,232 | | | | 2,210 | | | | 6,709 | | | | 6,676 | | | | 252 | | | | 6,743 | |

Superannuation liability | | | 26,859 | | | | 27,808 | | | | (172 | ) | | | (152 | ) | | | 26,687 | | | | 27,656 | | | | - | | | | 27,656 | |

Other employee benefits | | | 7,705 | | | | 8,327 | | | | 824 | | | | 911 | | | | 8,530 | | | | 9,238 | | | | 115 | | | | 9,353.07 | |

Deposits held | | | - | | | | - | | | | 15 | | | | 13 | | | | 15 | | | | 13 | | | | 8,826 | | | | 7,185 | |

Advances received | | | 1,844 | | | | 1,845 | | | | 6 | | | | 6 | | | | 353 | | | | 354 | | | | - | | | | 354 | |

Borrowing with QTC | | | 37,574 | | | | 37,570 | | | | 38,904 | | | | 38,894 | | | | 76,478 | | | | 76,464 | | | | - | | | | - | |

Leases and other similar arrangements | | | 6,454 | | | | 6,499 | | | | 491 | | | | 492 | | | | 6,945 | | | | 6,991 | | | | 405 | | | | 7,396 | |

Securities and derivatives | | | 198 | | | | 198 | | | | 1,315 | | | | 1,315 | | | | 1,513 | | | | 1,505 | | | | 139,739 | | | | 115,027 | |

Other liabilities | | | 6,295 | | | | 6,779 | | | | 7,665 | | | | 8,183 | | | | 7,143 | | | | 7,847 | | | | 6,053 | | | | 13,679 | |

Total liabilities | | | 92,641 | | | | 94,754 | | | | 51,281 | | | | 51,871 | | | | 134,373 | | | | 136,743 | | | | 155,389 | | | | 187,392 | |

| | | | | | | | | |

Net Worth | | | 195,956 | | | | 193,731 | | | | 19,516 | | | | 18,969 | | | | 195,956 | | | | 193,731 | | | | 2,592 | | | | 182,516 | |

| | | | | | | | | |

KEY FISCAL AGGREGATES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Net Financial Worth | | | (34,173 | ) | | | (36,476 | ) | | | (45,422 | ) | | | (45,941 | ) | | | (92,325 | ) | | | (94,305 | ) | | | 2,228 | | | | (105,689 | ) |

Net Financial Liabilities | | | 56,281 | | | | 58,036 | | | | NA | | | | NA | | | | 94,916 | | | | 96,897 | | | | NA | | | | 105,689 | |

Net Debt | | | 14,192 | | | | 14,046 | | | | 36,712 | | | | 36,552 | | | | 50,904 | | | | 50,592 | | | | (8,325 | ) | | | 53,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(a) Numbers may not add due to rounding and have been restated where necessary to ensure comparability. (b) The Non-financial Public Sector (NFP) consolidates the GGS and PNFC Sectors, eliminating inter-sector balances and transactions such as dividend and income tax equivalent income. The State Financial Sector consolidates the NFP and the PFC sectors. (c) In accordance with UPF requirements, estimates for Public Financial Corporations (PFC) and State Financial sectors are not included in Budget documentation. | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 10 | |

2019 - 20 Cash Flow Statement by Sector ($ million)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | General Government

Sector | | | Public Non-financial

Corporations Sector | | | Non-financial Public Sector (b) | | | Public

Financial

Corporations

Sector (b) | | | State

Financial

Sector | |

| | | | | | | | | |

| | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Est. Actual | | | Outcome | | | Outcome (c) | | | Outcome (c) | |

Cash Receipts from Operating Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Taxes received | | | 13,884 | | | | 13,870 | | | | - | | | | - | | | | 13,593 | | | | 13,543 | | | | - | | | | 13,460 | |

Grants and subsidies received | | | 28,587 | | | | 28,841 | | | | 649 | | | | 643 | | | | 28,612 | | | | 28,875 | | | | 1 | | | | 28,772 | |

Sales of goods and services | | | 6,129 | | | | 6,055 | | | | 14,748 | | | | 14,582 | | | | 18,124 | | | | 18,222 | | | | 2,667 | | | | 20,539 | |

Interest receipts | | | 1,942 | | | | 1,997 | | | | 83 | | | | 88 | | | | 1,982 | | | | 2,061 | | | | 3,398 | | | | 932 | |

Dividends and income tax equivalents | | | 2,791 | | | | 2,756 | | | | 13 | | | | 14 | | | | 172 | | | | 81 | | | | - | | | | 14 | |

Other receipts | | | 7,339 | | | | 7,048 | | | | 354 | | | | 373 | | | | 7,642 | | | | 7,441 | | | | 140 | | | | 7,579 | |

| | | | 60,672 | | | | 60,567 | | | | 15,847 | | | | 15,701 | | | | 70,125 | | | | 70,223 | | | | 6,206 | | | | 71,297 | |

Cash Payments for Operating Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Payments for employees | | | (29,490 | ) | | | (29,332 | ) | | | (2,328 | ) | | | (2,219 | ) | | | (31,699 | ) | | | (31,432 | ) | | | (420 | ) | | | (31,562 | ) |

Payments for goods and services | | | (19,095 | ) | | | (19,019 | ) | | | (6,438 | ) | | | (6,307 | ) | | | (22,741 | ) | | | (22,875 | ) | | | (1,764 | ) | | | (24,632 | ) |

Grants and subsidies | | | (10,897 | ) | | | (10,928 | ) | | | (268 | ) | | | (263 | ) | | | (10,541 | ) | | | (10,581 | ) | | | (103 | ) | | | (10,580 | ) |

Interest paid | | | (1,487 | ) | | | (1,460 | ) | | | (1,859 | ) | | | (1,771 | ) | | | (3,140 | ) | | | (3,041 | ) | | | (5,462 | ) | | | (3,840 | ) |

Other payments | | | - | | | | (8 | ) | | | (1,416 | ) | | | (1,471 | ) | | | (562 | ) | | | (571 | ) | | | (182 | ) | | | (796 | ) |

| | | | (60,970 | ) | | | (60,747 | ) | | | (12,309 | ) | | | (12,030 | ) | | | (68,683 | ) | | | (68,500 | ) | | | (7,931 | ) | | | (71,410 | ) |

| | | | | | | | | |

Net Cash Flows from Operating Activities | | | (297 | ) | | | (180 | ) | | | 3,538 | | | | 3,671 | | | | 1,442 | | | | 1,723 | | | | (1,725 | ) | | | (113 | ) |

| | | | | | | | | |

Cash Flows from Investing Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-financial Assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Purchases of non-financial assets | | | (6,305 | ) | | | (6,291 | ) | | | (3,142 | ) | | | (3,156 | ) | | | (9,447 | ) | | | (9,467 | ) | | | (17 | ) | | | (9,483 | ) |

Sales of non-financial assets | | | 228 | | | | 230 | | | | 45 | | | | 36 | | | | 272 | | | | 266 | | | | - | | | | 266 | |

| | | | (6,078 | ) | | | (6,061 | ) | | | (3,097 | ) | | | (3,120 | ) | | | (9,175 | ) | | | (9,201 | ) | | | (17 | ) | | | (9,217 | ) |

Financial Assets (Policy Purposes) | | | (939 | ) | | | (941 | ) | | | 707 | | | | 707 | | | | (907 | ) | | | (916 | ) | | | - | | | | (916 | ) |

| | | | | | | | | |

Financial Assets (Liquidity Purposes) | | | 4,505 | | | | 4,391 | | | | - | | | | (29 | ) | | | 4,505 | | | | 4,362 | | | | (2,959 | ) | | | 1,383 | |

| | | | | | | | | |

Net Cash Flows from Investing Activities | | | (2,512 | ) | | | (2,611 | ) | | | (2,390 | ) | | | (2,442 | ) | | | (5,576 | ) | | | (5,755 | ) | | | (2,975 | ) | | | (8,750 | ) |

| | | | | | | | | |

Net Cash Flows from Financing Activities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Advances received (net) | | | (866 | ) | | | (847 | ) | | | (1 | ) | | | 5 | | | | (88 | ) | | | (64 | ) | | | - | | | | (64 | ) |

Borrowing (net) | | | 2,975 | | | | 2,975 | | | | 742 | | | | 733 | | | | 3,717 | | | | 3,708 | | | | (5,203 | ) | | | (1,494 | ) |

Dividends paid | | | - | | | | - | | | | (1,799 | ) | | | (1,799 | ) | | | - | | | | - | | | | (109 | ) | | | - | |

Deposits received (net) | | | - | | | | - | | | | 1 | | | | (1 | ) | | | 1 | | | | (1 | ) | | | 1,652 | | | | 1,951 | |

Other financing (net) | | | - | | | | - | | | | 94 | | | | 19 | | | | (9 | ) | | | (88 | ) | | | 9,291 | | | | 9,223 | |

Net Cash Flows from Financing Activities | | | 2,109 | | | | 2,128 | | | | (963 | ) | | | (1,043 | ) | | | 3,620 | | | | 3,555 | | | | 5,631 | | | | 9,617 | |

| | | | | | | | | |

Net Increase/(Decrease) in Cash Held | | | (700 | ) | | | (663 | ) | | | 186 | | | | 186 | | | | (514 | ) | | | (477 | ) | | | 931 | | | | 754 | |

| | | | | | | | | |

KEY FISCAL AGGREGATES | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net cash from operating activities | | | (297 | ) | | | (180 | ) | | | 3,538 | | | | 3,671 | | | | 1,442 | | | | 1,723 | | | | (1,725 | ) | | | (113 | ) |

Net cash from investments in non-financial assets | | | (6,078 | ) | | | (6,061 | ) | | | (3,097 | ) | | | (3,120 | ) | | | (9,175 | ) | | | (9,201 | ) | | | (17 | ) | | | (9,217 | ) |

Dividends paid | | | - | | | | - | | | | (1,799 | ) | | | (1,799 | ) | | | - | | | | - | | | | (109 | ) | | | - | |

Cash Surplus/(Deficit) | | | (6,375 | ) | | | (6,241 | ) | | | (1,357 | ) | | | (1,248 | ) | | | (7,733 | ) | | | (7,478 | ) | | | (1,850 | ) | | | (9,330 | ) |

| | | | | | | | | |

Derivation of ABS GFS Cash Surplus/Deficit | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash surplus/(deficit) | | | (6,375 | ) | | | (6,241 | ) | | | (1,357 | ) | | | (1,248 | ) | | | (7,733 | ) | | | (7,478 | ) | | | (1,850 | ) | | | (9,330 | ) |

Acquisitions under finance leases and similar arrangements | | | (1,248 | ) | | | (1,263 | ) | | | (45 | ) | | | (54 | ) | | | (1,293 | ) | | | (1,316 | ) | | | (4 | ) | | | (1,320 | ) |

ABS GFS Cash Surplus/(Deficit) Including Finance Leases and Similar Arrangements | | | (7,623 | ) | | | (7,503 | ) | | | (1,402 | ) | | | (1,302 | ) | | | (9,025 | ) | | | (8,794 | ) | | | (1,854 | ) | | | (10,650 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Notes: | |

(a) Numbers may not add due to rounding and have been restated where necessary to ensure comparability. (b) The Non-financial Public Sector (NFP) consolidates the GGS and PNFC Sectors, eliminating inter-sector balances and transactions such as dividend and income tax equivalent income. The State Financial Sector consolidates the NFP and the PFC sectors. (c) In accordance with UPF requirements, estimates for Public Financial Corporations (PFC) and State Financial sectors are not included in Budget documentation. | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 11 | |

Outcomes Report - Other General Government UPF Data

Data in the following tables is presented in accordance with the Uniform Presentation Framework.

General Government Sector

| | | | |

| Taxes | | 2019-20

Outcome

$ million | |

| | |

Taxes on employers’ payroll and labour force | | | 4,211 | |

| | |

Taxes on property | | | | |

Land taxes | | | 1,406 | |

Other | | | 562 | |

| | |

Taxes on the provision of goods and services | | | | |

Stamp duties on financial and capital transactions | | | 3,075 | |

Financial Institutions’ transactions taxes | | | 272 | |

Taxes on gambling | | | 1,258 | |

Taxes on insurance | | | 1,060 | |

| | |

Taxes on use of goods and performance of activities | | | | |

Motor vehicle taxes | | | 2,443 | |

Other | | | 296 | |

| | |

Total Taxation Revenue | | | 14,585 | |

| | |

Note: | | | | |

1. Numbers may not add due to rounding. | | | | |

| | | | |

| Dividend and Income Tax Equivalent Income | | 2019-20

Outcome

$ million | |

| | |

Dividend and Income Tax Equivalent income from PNFC sector | | | 1,802 | |

Dividend and Income Tax Equivalent income from PFC sector | | | 127 | |

| | |

Total Dividend and Income Tax Equivalent income | | | 1,929 | |

| | |

Note: | | | | |

1. Numbers may not add due to rounding. | | | | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 12 | |

Outcomes Report - Other General Government UPF Data

General Government Sector continued

| | | | |

| Grants Revenue | | 2019-20

Outcome

$ million | |

| | |

Current grants revenue | | | | |

| | |

Current grants from the Commonwealth | | | | |

General purpose grants | | | 12,794 | |

Specific purpose grants | | | 9,018 | |

Specific purpose grants for on-passing | | | 3,658 | |

Total current grants from the Commonwealth | | | 25,470 | |

Other contributions and grants | | | 330 | |

Total current grants revenue | | | 25,800 | |

| | |

Capital grants revenue | | | | |

| | |

Capital grants from the Commonwealth | | | | |

General purpose grants | | | 2 | |

Specific purpose grants | | | 1,803 | |

Total capital grants from the Commonwealth | | | 1,805 | |

Other contributions and grants | | | 37 | |

Total capital grants revenue | | | 1,841 | |

| | |

Total grants revenue | | | 27,641 | |

| | |

Note: | | | | |

1. Numbers may not add due to rounding. | | | | |

| | | | |

| Grants Expenses | | 2019-20

Outcome

$ million | |

| | |

Current grants expenses | | | | |

| | |

Private and not-for-profit sector | | | 2,998 | |

Private and not-for-profit sector on-passing | | | 3,163 | |

Local Government | | | 193 | |

Local Government on-passing | | | 504 | |

Grants to other sectors of Government | | | 2,136 | |

Other | | | 969 | |

Total current grants expense | | | 9,963 | |

| | |

Capital grants expenses | | | | |

| | |

Private and not-for-profit sector | | | 529 | |

Local Government | | | 1,070 | |

Grants to other sectors of Government | | | 34 | |

Other | | | 98 | |

Total capital grants expenses | | | 1,732 | |

| | |

Total grants expenses | | | 11,695 | |

| | |

Note: | | | | |

1. Numbers may not add due to rounding. | | | | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 13 | |

Outcomes Report - Other General Government UPF Data

General Government Sector continued

| | | | | | | | | | |

Expenses by Function | | | | | | | |

| | | | 2019-20 | | | | | | 2019-20 | |

| | | | Outcome | | | | | | Outcome | |

| | | | $ million | | | | | | $ million | |

| | | | |

General Public Services | | | 6,829 | | | Health | | | 19,258 | |

Executive and legislative organs, financial and fiscal affairs, external affairs | | | | | | Outpatient services | | | 3,016 | |

| | | 1,148 | | | Hospital services | | | 10,794 | |

General services | | | 286 | | | Mental health institutions | | | 550 | |

Public debt transactions | | | 1,471 | | | Community health services | | | 3,847 | |

Transfers of a general character between level of government | | | 508 | | | Public health services | | | 384 | |

General public services n.e.c. | | | 3,417 | | | R&D - Health | | | 199 | |

| | | | | | | Health n.e.c. | | | 469 | |

Public Order and Safety | | | 5,635 | | | | | | | |

Police services | | | 2,313 | | | Recreation, Culture and Religion | | | 920 | |

Civil and fire protection services | | | 696 | | | Recreation and sporting services | | | 407 | |

Law courts | | | 891 | | | Cultural services | | | 365 | |

Prisons | | | 1,293 | | | Recreation, culture and religion n.e.c. | | | 149 | |

Public order and safety n.e.c. | | | 442 | | | | | | | |

| | | | | | | Education | | | 15,404 | |

Economic Affairs | | | 1,981 | | | Pre-primary and primary education | | | 7,512 | |

General economic, commercial and labour affairs | | | 319 | | | Secondary education | | | 5,073 | |

Agriculture, forestry, fishing and hunting | | | 470 | | | Tertiary education | | | 1,303 | |

Fuel and energy | | | 516 | | | Subsidiary services to education | | | 175 | |

Mining, manufacturing and construction | | | 269 | | | Education n.e.c. | | | 1,342 | |

R&D - Economic affairs | | | 187 | | | | | | | |

Other industries | | | 221 | | | Social Protection | | | 4,994 | |

| | | | | | | Sickness and disability | | | 1,741 | |

Environmental Protection | | | 939 | | | Old age | | | 12 | |

Waste water management | | | 12 | | | Family and children | | | 1,430 | |

Protection of biodiversity and landscape | | | 701 | | | Housing | | | 421 | |

Environmental protection n.e.c. | | | 226 | | | Social exclusion n.e.c. | | | 175 | |

| | | | | | | Social protection n.e.c. | | | 1,215 | |

Housing and Community Amenities | | | 983 | | | | | | | |

Housing development | | | 714 | | | Transport | | | 6,554 | |

Community development | | | 104 | | | Road transport | | | 2,967 | |

Water supply | | | 124 | | | Bus transport | | | 77 | |

Housing and community amenities n.e.c. | | | 41 | | | Water transport | | | 147 | |

| | | | | | | Railway transport | | | 1,973 | |

| | | | | | | Multi-mode urban transport | | | 874 | |

| | | | | | | Transport n.e.c. | | | 516 | |

| | | | | | | | | | | |

| | | | | | | Total | | | 63,498 | |

| | | | | | | | | | | |

| | | | |

Note: | | | | | | | | | | |

1. Numbers may not add due to rounding. | | | | | | | | | | |

| | | | | | | | | | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 14 | |

Outcomes Report - Other General Government UPF Data

General Government Sector continued

| | | | |

Purchases of Non-financial Assets by Function | |

| 2019-20

Outcome $ million |

|

| | |

General public services | | | 218 | |

Public order and safety | | | 501 | |

Economic affairs | | | 31 | |

Environmental protection | | | 66 | |

Housing and community amenities | | | 326 | |

Health | | | 706 | |

Recreation, culture and religion | | | 78 | |

Education | | | 1,177 | |

Social protection | | | 50 | |

Transport | | | 3,138 | |

Total | | | 6,291 | |

| | | | |

| | |

Note: | | | | |

1. Numbers may not add due to rounding. | | | | |

| | | | |

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 15 | |

Certification of Outcomes Report

Management Certification

The foregoing Outcomes Report contains financial statements for the Queensland State Government, prepared and presented in accordance with the Uniform Presentation Framework (UPF) agreed to at the 1991 Premiers’ Conference and revised in 2008 to align with AASB 1049 Whole of Government and General Government Sector Financial Reporting.

This report separately discloses outcomes for the General Government, Public Non-financial Corporations, Public Financial Corporations and State Financial Sectors within Queensland. Entities excluded from this report include local governments and universities. Queensland public sector entities consolidated for this report are listed in the AASB 1049 Financial Statements, taking into account intra and inter-agency eliminations.

Only those agencies considered material by virtue of their financial transactions and balances are consolidated in this report.

We certify that, in our opinion, the Outcomes Report has been properly drawn up, in accordance with UPF requirements, to present a true and fair view of:

| (i) | the Operating Statement and Cash Flows of the Queensland State Government for the financial year; and |

| (ii) | the Balance Sheet of the Government at 30 June 2020. |

At the date of certification of this report, we are not aware of any material circumstances that would render any particulars included in the Outcomes Report misleading or inaccurate.

| | |

William Ryan | | Rachel Hunter |

| |

Acting Head of Fiscal | | Under Treasurer |

| |

Queensland Treasury | | Queensland Treasury |

23 November 2020

| | | | |

| Report on State Finances 2019 – 20 - Queensland Government | | | 3 - 16 | |

2019–20

AASB 1049

Financial Statements

Overview and Analysis – 30 June 2020

AASB 1049 - Overview and Analysis

The following analysis compares current year General Government Sector (GGS) and Total State Sector (TSS) performance with last year’s balances, restated for changes in accounting policies, presentational and timing differences and errors.

AASB 1049 Whole of Government and General Government Sector Financial Reporting aims to harmonise the disclosure presentation to be consistent with the Uniform Presentation Framework disclosed in the Outcomes Report.

Summary of Key Financial Aggregates of the Consolidated Financial Statements

The table below provides aggregate information under AASB1049:

| | | | | | | | | | | | | | | | |

| | | General

Government | | | Total State | |

| | | Sector | | | Sector | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| | | $

million | | | $

million | | | $

million | | | $

million | |

| | | | | |

Taxation revenue | | | 14,585 | | | | 14,165 | | | | 14,146 | | | | 13,870 | |

Grants revenue | | | 27,641 | | | | 28,307 | | | | 27,571 | | | | 28,239 | |

Sales of goods and services | | | 5,618 | | | | 5,783 | | | | 17,674 | | | | 18,707 | |

Interest income | | | 2,076 | | | | 2,191 | | | | 935 | | | | 1,678 | |

Dividend and income tax equivalent income | | | 1,929 | | | | 2,784 | | | | 14 | | | | 13 | |

Other revenue | | | 5,915 | | | | 6,598 | | | | 6,425 | | | | 7,113 | |

Continuing Revenue from Transactions | | | 57,764 | | | | 59,828 | | | | 66,766 | | | | 69,621 | |

| | | | | |

Employee expenses | | | 25,660 | | | | 24,019 | | | | 27,710 | | | | 25,877 | |

Superannuation expenses | | | 3,537 | | | | 3,665 | | | | 3,795 | | | | 3,899 | |

Other operating expenses | | | 17,087 | | | | 16,480 | | | | 22,751 | | | | 21,611 | |

Depreciation and amortisation | | | 4,033 | | | | 3,451 | | | | 6,779 | | | | 6,051 | |

Other interest expense | | | 1,486 | | | | 1,581 | | | | 3,868 | | | | 4,177 | |

Grants expenses | | | 11,695 | | | | 9,647 | | | | 11,061 | | | | 9,098 | |

Continuing Expenses from Transactions | | | 63,498 | | | | 58,843 | | | | 75,965 | | | | 70,713 | |

Net Operating Balance | | | (5,734 | ) | | | 985 | | | | (9,199 | ) | | | (1,092 | ) |

| | | | | |

Other Economic Flows - Included in Operating Result | | | (5,015 | ) | | | (819 | ) | | | (4,989 | ) | | | (2,962 | ) |

| | | | | |

Operating Result | | | (10,749 | ) | | | 166 | | | | (14,188 | ) | | | (4,054 | ) |

| | | | | |

Other Economic Flows - Other Movements in Equity | | | 3,620 | | | | 5,657 | | | | 5,600 | | | | 5,694 | |

| | | | | |

Comprehensive Result 1 | | | (7,129 | ) | | | 5,823 | | | | (8,588 | ) | | | 1,640 | |

| | | | | |

Purchases of non-financial assets | | | 6,291 | | | | 5,764 | | | | 9,483 | | | | 8,485 | |

| | | | | |

Fiscal Balance | | | (9,158 | ) | | | (2,207 | ) | | | (13,256 | ) | | | (4,441 | ) |

| | | | | |

Borrowing with QTC | | | 37,570 | | | | 29,468 | | | | - | | | | - | |

Leases and other loans | | | 6,499 | | | | 2,612 | | | | 7,396 | | | | 2,965 | |

Securities and derivatives | | | 198 | | | | 121 | | | | 115,027 | | | | 102,786 | |

| | | | | |

Assets | | | 288,485 | | | | 280,950 | | | | 369,908 | | | | 355,725 | |

Liabilities | | | 94,754 | | | | 80,089 | | | | 187,392 | | | | 164,621 | |

Net Worth | | | 193,731 | | | | 200,861 | | | | 182,516 | | | | 191,104 | |

| | |

| |

| Note: |

| 1. | | Comprehensive result is different to the Outcomes Report as it reflects the movement from the 2020 recast position, rather than the 2020 |

| | | published position. |

| 2 | | Numbers may not add due to rounding. |

| | | | |

| Report on State Finances 2019–20 – Queensland Government | | | 4-1 | |

AASB 1049 - Overview and Analysis

Net Operating Balance

The GGS net operating balance was a deficit of $5.734 billion compared to a restated surplus of $985 million in 2018-19. The global COVID-19 pandemic had a profound negative impact on the 2019-20 net operating balance, with the combined effect of lower revenues due to the downturn in economic activity and a rise in GGS expenses to mitigate the effects of the crisis on businesses, households and industry.

GGS revenue fell by around 3% ($2.064 billion) while expenses grew by around 8% ($4.655 billion) over the year.

The Total State Sector (TSS) net operating balance showed a deficit of $9.199 billion compared to a restated deficit of $1.092 billion in 2018-19.

The variances are explained below.

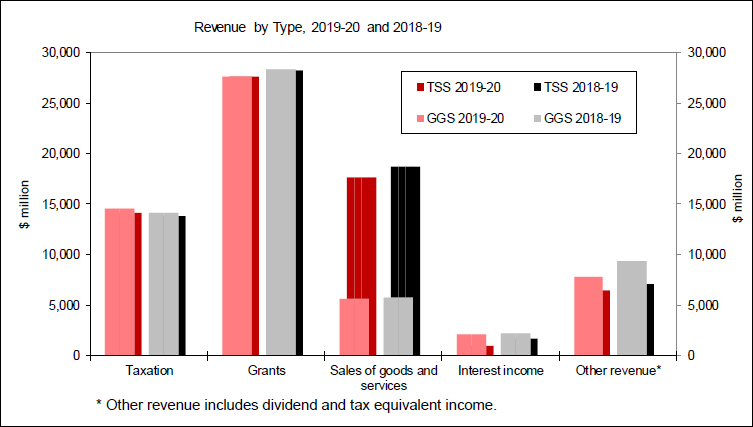

Revenue

Revenue from transactions declined from $59.828 billion in 2018-19 to be $57.764 billion in the GGS and totals $66.766 billion in the TSS, a fall of $2.855 billion over 2018-19.

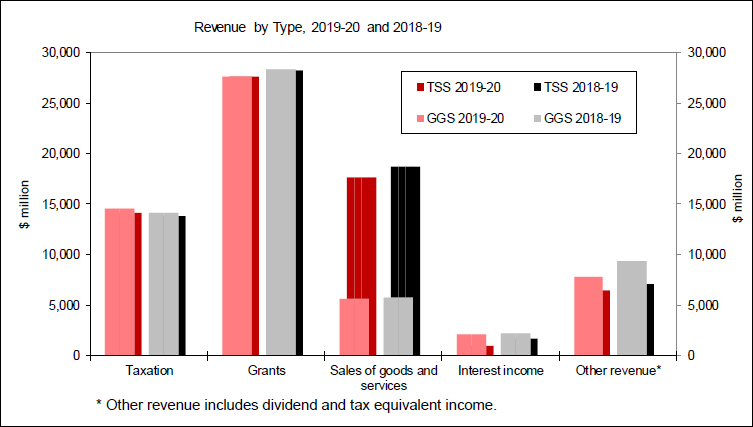

Revenues by type for the GGS and TSS are shown in the following chart:

Taxation revenue increased in 2019-20 by $420 million for GGS and $276 million for the TSS.

The increase in GGS taxation revenue was predominantly due to the introduction of a waste levy on landfill in Queensland from 1 July 2019 and guarantee fees from Queensland Investment Corporation. Besides these two tax streams, overall taxation revenue was lower in the second half of 2019-20 compared to the previous year driven by the pandemic-led economic downturn.

Stamp duties and gaming machine taxes and levies were respectively $153 million and $75 million lower than 2018-19, while payroll and land tax only showed modest increases compared to normal growth patterns, also affected by relief measures.

Commonwealth and other grants comprised 48% of GGS revenue and 41% of TSS revenue. Grant revenue decreased $666 million from 2019-20 for the GGS and $668 million for the TSS. The decrease was due to

| – | lower GST revenue of $1.571 billion driven by lower national GST collections following the COVID-19 economic downturn; and |

| – | National Partnership Payments were $190 million lower partly due to one-off funding for the Restocking, Replanting and On-farm Infrastructure grants program in 2018-19. |

| | |

| 4-2 | | Report on State Finances 2019–20 – Queensland Government |

AASB 1049 - Overview and Analysis

Revenue continued

These decreases were partly offset by higher Commonwealth Specific Purpose Payments of $721 million (including health COVID-19 funding and schools funding) and higher on-passing grants to non-state schools of $386 million.

TSS sales of goods and services were $1.033 billion lower than 2018-19 largely due to lower electricity prices.

Dividend and income tax equivalent revenue for the GGS decreased $855 million in comparison to 2018-19 mainly due to lower returns in the electricity sector from lower prices.

GGS other revenue was $683 million lower in 2019-20 than 2018-19 mainly due to the impact on royalties of weaker global demand during the COVID-19 pandemic. This increase flows through to the TSS.

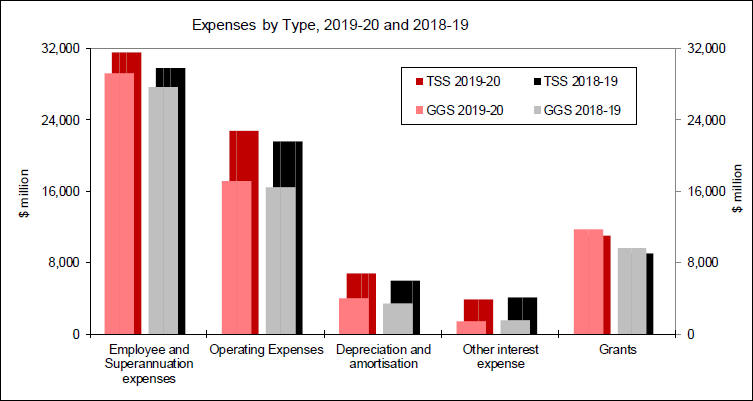

Expenses

Total expenses for 2019-20 were $63.498 billion for the GGS and $75.965 billion for the TSS, $4.655 billion and $5.251 billion more than the previous year respectively.

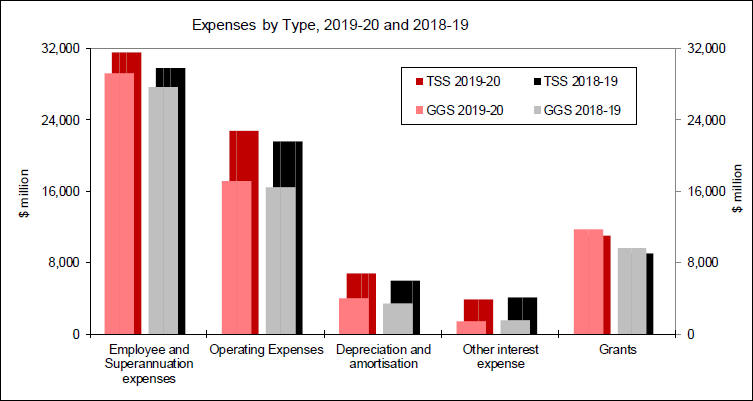

Expenses by type are shown in the following chart:

Employee and superannuation expenses were 5.5% higher in 2019-20, consistent with the estimate in the 2019-20 Budget. The increases are mainly in the areas of Health and Education, reflecting the Government’s commitment to revitalising frontline services.

Other operating expenses were $607 million higher than 2018-19 for the GGS. The increase was due to electricity rebates provided to households as COVID-19 measures and expected claims for civil child abuse, offset by reallocations of disability costs to grants under NDIS, and operating lease expenses to depreciation and interest on the adoption of AASB 16 Leases. In addition to these higher GGS expenses, additional claims costs, partly offset by lower costs in the electricity sector contributed to the $1.14 billion higher other operating expenses for TSS.

Depreciation and amortisation increased by $582 million for the GGS and $729 million for the TSS, mainly due to the adoption of AASB 16, which brings additional assets onto the State’s balance sheet and results in a reallocation from other operating expenses.

Interest costs decreased by $94 million to $1.486 billion for the GGS in 2019-20, due to lower interest rates on borrowing with QTC, partly offset by additional interest on finance leases following the adoption of AASB 16.

| | | | |

| Report on State Finances 2019–20 – Queensland Government | | | 4-3 | |

AASB 1049 - Overview and Analysis

Expenses continued

Grant expenses increased $2.048 billion in the GGS, mainly due to the transition of disability services to the NDIS ($499 million), increases in the on-passing of Commonwealth grants for non-state schools ($386 million) and payroll and land tax rebates and electricity subsidies to businesses ($550 million) in response to the COVID-19 crisis. Grants expense for the TSS were $1.963 billion higher than 2018-19.

Operating Result

The operating result is the surplus or deficit for the year under the Australian Accounting Standards framework. Valuation and other adjustments such as deferred tax, capital returns and market value interest are shown as other economic flows and are included in the operating result.

The GGS operating result for the 2019-20 year was a deficit of $10.749 billion, compared to a surplus of $166 million in 2018-19. The difference in the result compared to 2018-19 is mainly due to the lower net operating balance, discussed above, the market value adjustment to the fixed rate notes with QTC, and deferred tax adjustments for impairments and unrealised losses on investments.

The TSS operating result was a deficit of $14.188 billion compared to a deficit of $4.054 billion in 2018-19. The lower result in 2019-20 arose mainly from the lower net operating balance as well as the net effect of realised and unrealised market value adjustments to derivatives, investments, non-financial assets and borrowings.

Fiscal Balance

The GGS fiscal deficit was $9.158 billion for 2019-20 compared to a deficit of $2.207 billion for 2018-19. The TSS fiscal deficit was $13.256 billion for 2019-20 compared to a deficit of $4.441 billion for 2018-19. The changes are driven by the lower net operating balances and higher purchases of non-financial assets in each case.

Assets

Assets controlled by the GGS at 30 June 2020 totalled $288.485 billion, an increase of $7.535 billion on 2018-19, while assets controlled by the TSS at 30 June 2020 totalled $369.908 billion. This is an increase of $14.183 billion from the 2019 balance of $355.725 billion.

Financial assets in the GGS were $4.486 billion lower than 2018-19, with lower balances on the fixed rate notes and investments in public sector entities following market value adjustments and impairments. Decreases in cash balances were largely offset by increases in advances, mainly for the Jobs Support Loan package.

Financial assets of the State increased by $1.973 billion, reflecting higher cash balances of $754 million, mainly in QTC, Jobs Support loans, increased onlendings to Local Government, higher electricity derivative balances, and securities and bonds invested by QTC from forward funding and client deposits. These increases were offset by lower balances on QIC trusts following market value adjustments.

Non-financial assets increased by $12.021 billion in the GGS due to revaluations of land under roads, road infrastructure and schools, and the adoption of AASB 16, as well as capital purchases exceeding depreciation. The increase at the TSS level was $12.21 billion.

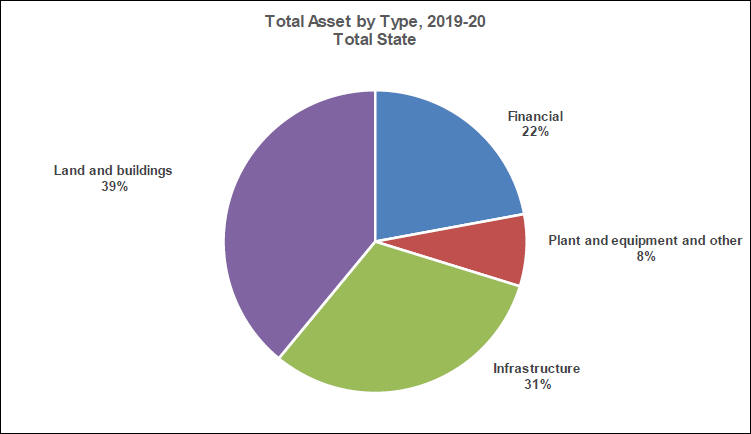

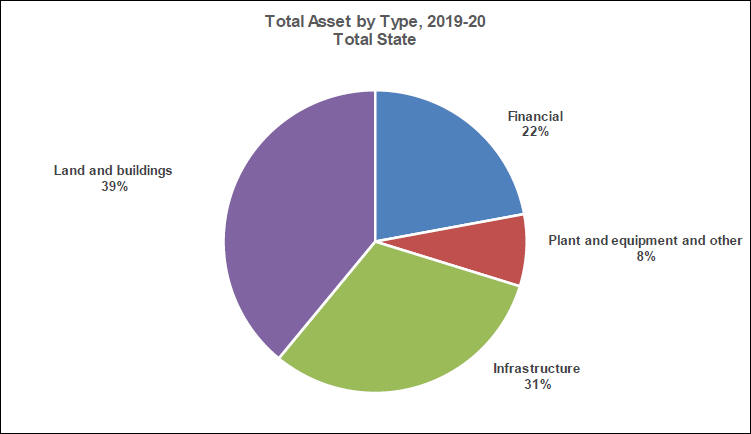

Of the TSS assets, GGS assets comprised 78%. Total assets are made up of:

| | | | | | | | |

| | | General

Government | | | Total State | |

| | |

| | | $M | | | $M | |

| | |

Financial | | | 58,278 | | | | 81,703 | |

| | |

Infrastructure | | | 62,116 | | | | 115,412 | |

| | |

Land and buildings | | | 139,936 | | | | 144,365 | |

| | |

Plant and equipment and other | | | 28,155 | | | | 28,428 | |

| | |

| | | | | | | | |

| | | 288,485 | | | | 369,908 | |

| | | | | | | | |

| | |

| 4-4 | | Report on State Finances 2019–20 – Queensland Government |

AASB 1049 - Overview and Analysis

Assets continued

The main types of assets owned by the State are detailed in the following chart:

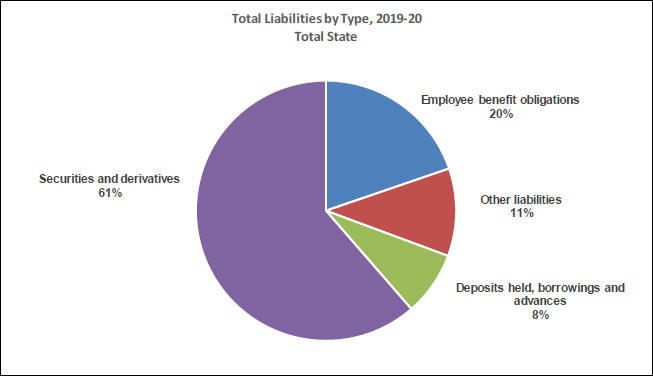

Liabilities

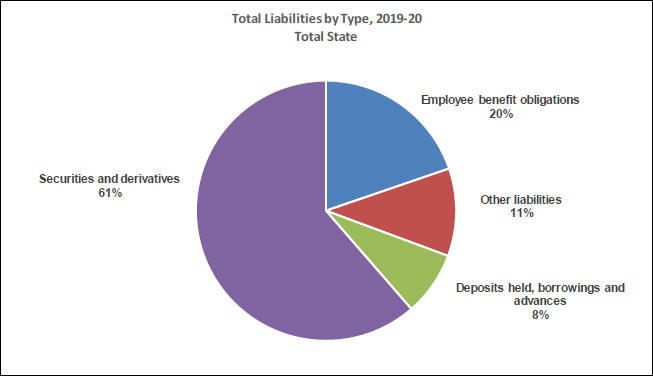

Liabilities at 30 June 2020 totalled $94.754 billion for the GGS and $187.392 billion for the TSS, an increase of $14.665 billion over 2018-19 for the GGS and an increase of $22.771 billion for the State.

The overall increase in liabilities for the GGS arose largely from GST overpaid by the Commonwealth, actuarial changes to long service leave liabilities, additional borrowing from QTC ($8.102 billion), increased leases and other loans ($3.887 billion) following the adoption of AASB 16, $546 million of additional deferred tax liabilities, and $1.3 billion in provisions mainly from civil child abuse and other litigation claims. Partly offsetting these increases were lower advances from GOCs.

For the TSS, securities and derivatives, largely held by QTC, have increased $12.241 billion, mainly to fund additional on-lending requirements as well as being impacted by market value adjustments. Following the adoption of AASB 16, the increase in leases and other loans is $4.432 billion. Provisions have increased by $2.816 billion, mainly for WorkCover and the National Injury Insurance Scheme and other claims, in addition to the increase in the GGS.

Of the TSS liabilities, GGS liabilities comprised 51%. Total liabilities are made up of:

| | | | | | | | |

| | | General

Government | | | Total State | |

| | |

| | | $M | | | $M | |

| | |

Securities and derivatives | | | 198 | | | | 115,027 | |

| | |

Deposits held, borrowings and advances | | | 45,913 | | | | 14,935 | |

| | |

Employee benefit obligations | | | 36,135 | | | | 37,009 | |

| | |

Other liabilities | | | 12,508 | | | | 20,422 | |

| | |

| | | | | | | | |

| | | 94,754 | | | | 187,392 | |

| | | | | | | | |

| | | | |

| Report on State Finances 2019–20 – Queensland Government | | | 4-5 | |

AASB 1049 - Overview and Analysis

Liabilities continued

The components of State liabilities are shown in the following chart:

Cash Flow Statement

The impact of COVID-19 and the Government’s response to the crisis have resulted in negative cash flows from operating activities for the GGS of $180 million. When this is added to the net investments in non-financial assets of $6.061 billion, the cash deficit totals $6.241 billion, compared to a cash surplus in 2019 of $302 million.

The TSS recorded net cash outflows from operating activities for the 2019-20 financial year of $113 million. After net investments in non-financial assets of $9.217 billion, the resulting cash deficit is $10.65 billion, compared to a $2.475 billion cash deficit for 2018-19.

| | |

| 4-6 | | Report on State Finances 2019–20 – Queensland Government |

2019–20

Audited Information

Queensland General Government and

Whole of Government Consolidated

Financial Statements

30 June 2020

Operating Statement for Queensland

for the Year Ended 30 June 2020

| | | | | | | | | | | | | | | | | | |

| | | | | General Government | | | Total State | |

| | | | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| | | Notes | | $M | | | $M | | | $M | | | $M | |

Continuing Operations | | | | | | | | | | | | | | | | | | |

Revenue from Transactions | | | | | | | | | | | | | | | | | | |

Taxation revenue | | 3 | | | 14,585 | | | | 14,165 | | | | 14,146 | | | | 13,870 | |

Grants revenue | | 4 | | | 27,641 | | | | 28,307 | | | | 27,571 | | | | 28,239 | |

Sales of goods and services | | 5 | | | 5,618 | | | | 5,783 | | | | 17,674 | | | | 18,707 | |

Interest income | | 6 | | | 2,076 | | | | 2,191 | | | | 935 | | | | 1,678 | |

Dividend and income tax equivalent income | | 7 | | | 1,929 | | | | 2,784 | | | | 14 | | | | 13 | |

Other revenue | | 8 | | | 5,915 | | | | 6,598 | | | | 6,425 | | | | 7,113 | |

Total Revenue from Transactions | | | | | 57,764 | | | | 59,828 | | | | 66,766 | | | | 69,621 | |

| | | | | |

Expenses from Transactions | | | | | | | | | | | | | | | | | | |

Employee expenses | | 9 | | | 25,660 | | | | 24,019 | | | | 27,710 | | | | 25,877 | |

Superannuation expenses | | | | | | | | | | | | | | | | | | |

Superannuation interest cost | | 48 | | | 354 | | | | 653 | | | | 349 | | | | 641 | |

Other superannuation expenses | | 10 | �� | | 3,183 | | | | 3,012 | | | | 3,446 | | | | 3,258 | |

Other operating expenses | | 11 | | | 17,087 | | | | 16,480 | | | | 22,751 | | | | 21,611 | |

Depreciation and amortisation | | 12 | | | 4,033 | | | | 3,451 | | | | 6,779 | | | | 6,051 | |

Other interest expense | | 13 | | | 1,486 | | | | 1,581 | | | | 3,868 | | | | 4,177 | |

Grants expenses | | 14 | | | 11,695 | | | | 9,647 | | | | 11,061 | | | | 9,098 | |

Total Expenses from Transactions | | | | | 63,498 | | | | 58,843 | | | | 75,965 | | | | 70,713 | |

| | | | | | | | | | | | | | | | | | |

Net Operating Balance from Continuing Operations | | | | | (5,734 | ) | | | 985 | | | | (9,199 | ) | | | (1,092 | ) |

| | | | | | | | | | | | | | | | | | |

Other Economic Flows - Included in Operating Result * | | | | | | | | | | | | | | | | | | |

Gains/(losses) on sale of assets/settlement of liabilities | | 15 | | | (22 | ) | | | 42 | | | | 916 | | | | 346 | |

Revaluation increments/(decrements) and impairment | | | | | | | | | | | | | | | | | | |

(losses)/reversals | | 16 | | | (3,385 | ) | | | (307 | ) | | | (3,157 | ) | | | 1,919 | |

Asset write-downs | | 17 | | | (253 | ) | | | (167 | ) | | | (265 | ) | | | (191 | ) |

Actuarial adjustments to liabilities | | 18 | | | (411 | ) | | | (398 | ) | | | (364 | ) | | | (687 | ) |

Deferred income tax equivalents | | | | | (809 | ) | | | (70 | ) | | | - | | | | - | |

Dividends and tax equivalents treated as capital returns | | 19 | | | 74 | | | | 102 | | | | - | | | | - | |

Other | | 20 | | | (209 | ) | | | (20 | ) | | | (2,119 | ) | | | (4,349 | ) |

Total Other Economic Flows - Included in Operating Result | | | | | (5,015 | ) | | | (819 | ) | | | (4,989 | ) | | | (2,962 | ) |

| | | | | |

Operating Result from Continuing Operations | | | | | (10,749 | ) | | | 166 | | | | (14,188 | ) | | | (4,054 | ) |

| | | | | |

Other Economic Flows - Other Movements in Equity ** | | | | | | | | | | | | | | | | | | |

Adjustments to opening balances *** | | | | | (94 | ) | | | (377 | ) | | | (94 | ) | | | (377 | ) |

Revaluations **** | | 21 | | | 3,714 | | | | 6,034 | | | | 5,694 | | | | 6,070 | |

Other **** | | 22 | | | - | | | | - | | | | - | | | | 1 | |

Total Other Economic Flows - Other Movements in Equity | | | | | 3,620 | | | | 5,657 | | | | 5,600 | | | | 5,694 | |

| | | | | |

Comprehensive Result/Total Change in Net Worth | | | | | (7,129 | ) | | | 5,823 | | | | (8,588 | ) | | | 1,640 | |

| | | | | |

KEY FISCAL AGGREGATES | | | | | | | | | | | | | | | | | | |

| | | | | |

Net Operating Balance | | | | | (5,734 | ) | | | 985 | | | | (9,199 | ) | | | (1,092 | ) |

| | | | | |

Net Acquisition/(Disposal) of Non-Financial Assets | | | | | | | | | | | | | | | | | | |