EXHIBIT (c)(viii)

Queensland’s Budget Papers for 2024-25

FORWARD-LOOKING STATEMENTS

This exhibit contains forward-looking statements. Statements that are not historical facts, including statements about the State of Queensland’s (the “State” or “Queensland”) beliefs and expectations, are forward-looking statements. These statements are based on current plans, budgets, estimates and projections and therefore you should not place undue reliance on them. The words “believe”, “may”, “will”, “should”, “estimate”, “continue”, “anticipate”, “intend”, “expect”, “forecast” and similar words are intended to identify forward-looking statements. Forward-looking statements speak only as of the date they are made, and neither the Queensland Treasury Corporation nor the State undertake any obligation to update publicly any of them in light of new information or future events.

Forward-looking statements are based on current plans, estimates and projections and, therefore, undue reliance should not be placed on them. Although the Queensland Treasury Corporation and the State believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such beliefs and expectations will prove to have been correct. Forward-looking statements involve inherent risks and uncertainties. We caution you that actual results may differ materially from those contained in any forward-looking statements.

A number of important factors could cause actual results to differ materially from those expressed in any forward-looking statement. Factors that could cause the actual outcomes to differ materially from those expressed or implied in forward-looking statements include:

| | • | | the international and Australian economies, and in particular the rates of growth (or contraction) of the State’s major trading partners; |

| | • | | the effects, both internationally and in Australia, of any economic downturn, as well as the effect of ongoing economic, banking and sovereign debt risk; |

| | • | | the effect of natural disasters, epidemics and geopolitical events, such as the Russian invasion of Ukraine and the Israel-Hamas conflict; |

| | • | | increases or decreases in international and Australian domestic interest rates; |

| | • | | changes in and increased volatility in currency exchange rates; |

| | • | | changes in the State’s domestic consumption; |

| | • | | changes in the State’s labor force participation and productivity; |

| | • | | downgrades in the credit ratings of the State or Australia; |

| | • | | changes in the rate of inflation in the State; |

| | • | | changes in environmental and other regulation; and |

| | • | | changes in the distribution of revenue from the Commonwealth of Australia Government to the State. |

(c)(viii)-1

| | |

DOING WHAT MATTERS FOR QUEENSLAND QUEENSLAND BUDGET 2024-25 | |  |

BUDGET SPEECH

BUDGET PAPER NO. 1

2024-25 Queensland Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

Service Delivery Statements

Appropriation Bills

Budget Overview

Regional Action Plans

First Nations acknowledgement

Queensland Treasury acknowledges Aboriginal peoples and Torres Strait Islander peoples as the Traditional Owners and custodians of the land. We recognise their connection to land, sea and community, and pay our respects to Elders past, present and emerging.

© The State of Queensland (Queensland Treasury) 2024

Copyright

This publication is protected by the Copyright Act 1968

Licence

This document is licensed by the State of Queensland (Queensland Treasury) under a Creative Commons Attribution (CC BY 4.0) International licence.

In essence, you are free to copy, communicate and adapt this publication, as long as you attribute the work to the State of Queensland (Queensland Treasury).

Attribution

Content from this publication should be attributed to:

© The State of Queensland (Queensland Treasury) - 2024–25 Queensland Budget

Translating and interpreting assistance

The Queensland Government is committed to providing accessible services to Queenslanders from all cultural and linguistic backgrounds. If you have difficulty in understanding this publication, you can contact us on telephone (07) 3035 3503 and we will arrange an interpreter to effectively communicate the report to you.

Budget Speech

Budget Paper No. 1

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

APPROPRIATION BILL 2024–25

THE HONOURABLE CAMERON DICK MP

DEPUTY PREMIER, TREASURER

MINISTER FOR TRADE AND INVESTMENT

INTRODUCTION

This first Budget of the Miles Labor Government is focused on doing what matters for Queenslanders.

And what matters for Queenslanders the most, is cost-of-living relief.

Queenslanders deserve the right to make choices about their lives.

But in recent times, many have been robbed of those choices by the ever-present constraints of global and national cost-of-living pressures.

For many Queenslanders, the only choice has been which bill to pay next.

But our Government is relentlessly focused on doing what matters for Queenslanders.

So our Government has made the choice to reduce that cost-of-living pressure on Queensland families.

We have chosen to deliver nation-leading cost-of-living relief that will give all Queenslanders more choice.

In doing so, we have made the deliberate choice to put our Budget into deficit, to help Queensland households keep their budgets in balance.

Delivering a deficit, spending more than the government collects in revenue, is not, and should never be an easy choice.

Page 1 of 24

But in a contest between the balance sheet and doing what matters for Queenslanders, the Miles Labor Government will always be on Queenslanders’ side.

Weak governments leave people to fend for themselves.

Strong governments make the choice to intervene and invest.

Weak Governments may offer the promise of lower taxes and lower debt, but they do so by delivering less services and cutting frontline jobs.

Strong Governments recognise that people are always more important than numbers on a balance sheet.

Strong Governments recognise that putting fiscal figures over families can lead to communities being ripped apart, in a way that takes decades to repair.

The Miles Labor Government is a strong Labor Government.

And our strong Budget addresses the short-term pressures being faced by families across Queensland.

At the same time, this strong Budget also seizes the long-term opportunities that only our state has, to plan and build for Queensland’s future prosperity.

COST OF LIVING

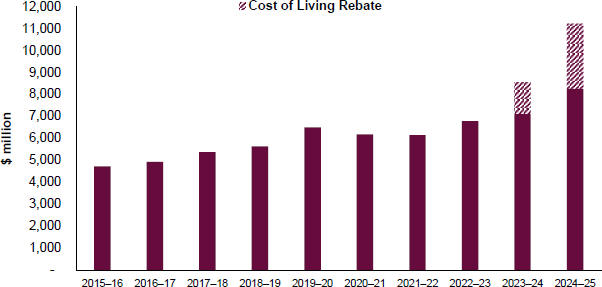

The total value of new and existing cost-of-living concessions available to Queenslanders rises by 31 per cent in this Budget, to a total of $11.2 billion.

This cost-of-living relief starts with electricity rebates.

Together with the Albanese Labor Government, our Government will deliver electricity rebates of $1,300 to every household in this state.

Page 2 of 24

And for vulnerable Queenslanders, we will go further, delivering a total electricity rebate of $1,672.

This means that some vulnerable Queensland households, those households struggling the most with cost-of-living pressures, will be able to avoid paying anything for electricity in the 2024–25 Budget year.

In total, our landmark power rebates will provide almost $3 billion in cost-of-living relief to Queensland households and businesses.

One of the Premier’s first acts upon being sworn in last December was to freeze the cost of vehicle registration.

Today, we go further.

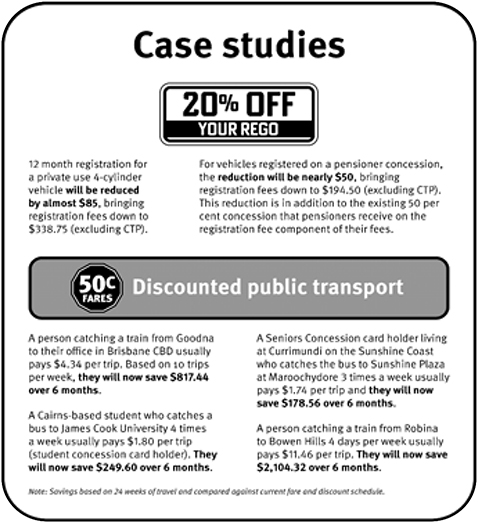

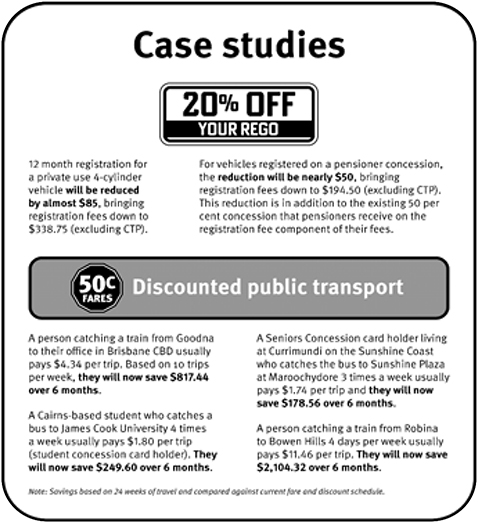

For 12 months, we will cut the cost of registration for all light vehicles by 20 per cent.

The total cost of this cost-of-living relief to Queenslanders will be $435 million.

That means a saving of $126 for a 6-cylinder ute, $85 for a 4-cylinder car, and $69 for an electric vehicle.

For 6 months, we will cut the cost of all Translink public transport fares across Queensland to almost nothing.

We will cut all Translink public transport fares across Queensland to a flat 50 cents, no matter where you live or how far you travel.

The total investment in this cost-of-living relief for Queenslanders will be $150 million.

And for the same period, we will halve the cost of travel on the Airtrain to and from Brisbane Airport, as we try to make the best of a dud deal that has dudded Queenslanders for decades.

Page 3 of 24

50 cent fares and half-price Airtrain travel will all take effect from 5 August this year, and our 20 per cent rego reduction will start to appear on renewal notices sent out from 5 August as well.

There is one important cost-of-living measure that does not appear in the Budget aggregates.

The people of Queensland will also pay no more when it comes to fees and charges.

For the 2024–25 financial year, the indexation for fees and charges in Queensland will be zero.

That means zero increase on the Emergency Management Levy introduced by the Newman Government, that appears on Council rates bills across Queensland.

And that means zero State Government impact on Council rates bills.

If Council rates bills rise, that is entirely a matter for those Councils.

INFLATION

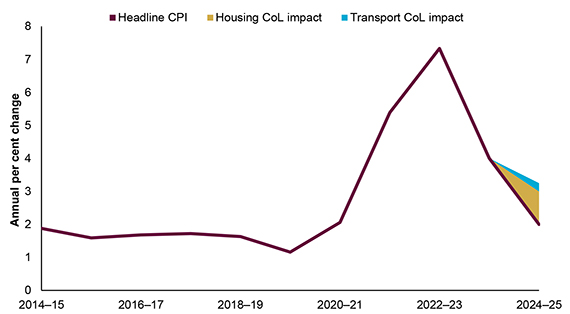

As we deliver these cost-of-living relief measures, we are mindful that we do so in a way that reduces inflationary pressures.

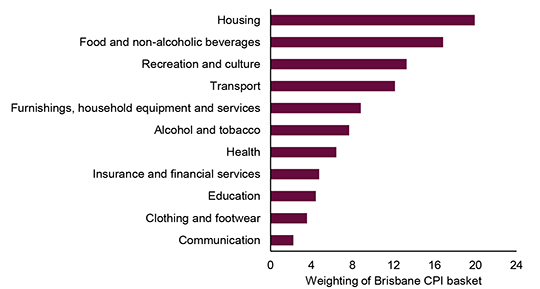

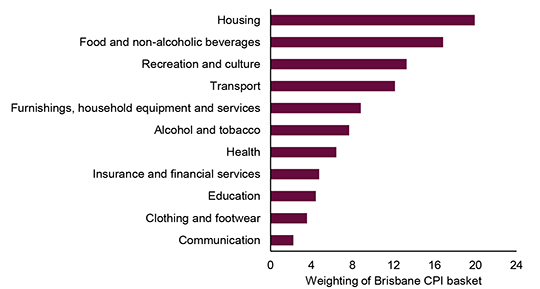

Within the Brisbane Consumer Price Index basket used by the Australian Bureau of Statistics, roughly one-third is comprised of the Transport and Housing groups, the latter of which includes energy costs.

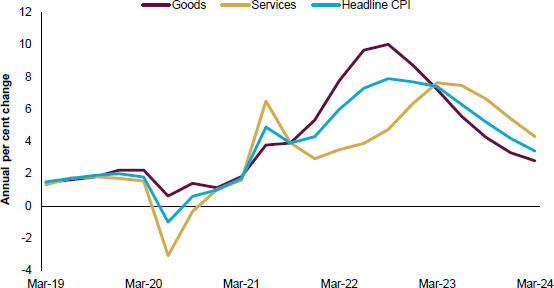

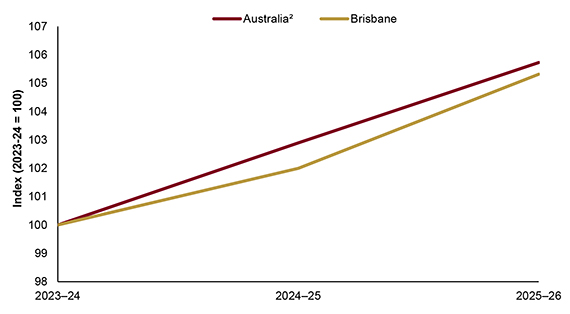

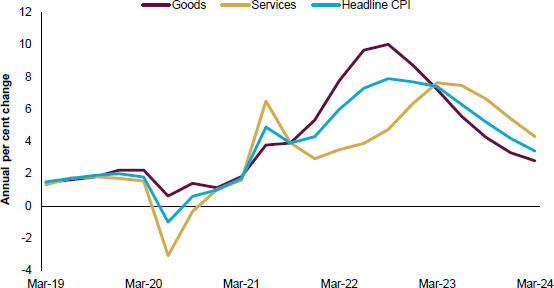

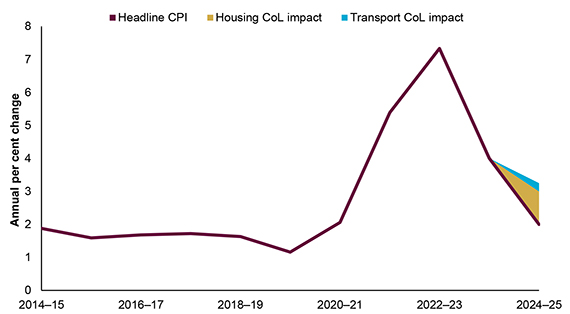

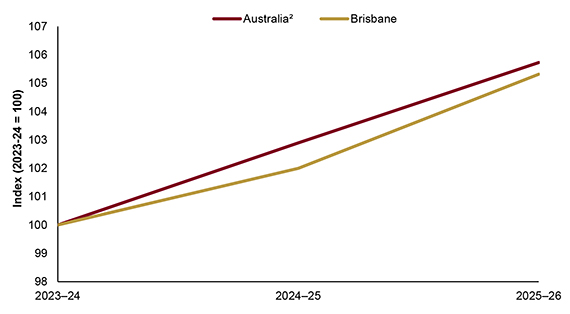

Queensland Treasury estimates the combined effect of cost-of-living measures from the Miles and Albanese Labor Governments will reduce Brisbane’s headline CPI growth in 2024–25 by around one and a quarter percentage points.

That is forecast to reduce Brisbane CPI growth for the year to just 2 per cent.

Page 4 of 24

HOUSING

The strong response of Queenslanders, and our Labor Government to COVID-19, meant we emerged from the pandemic in better shape than almost anywhere in the world.

But there was one unforeseeable impact of that time that continues to affect tens of thousands of Queenslanders every day.

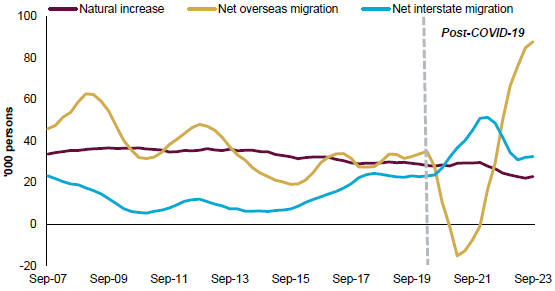

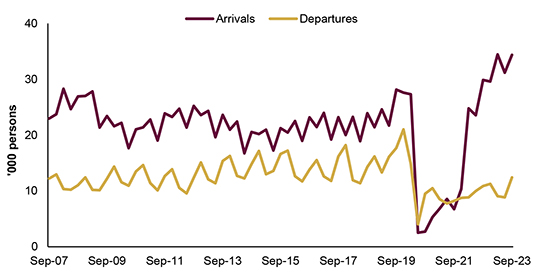

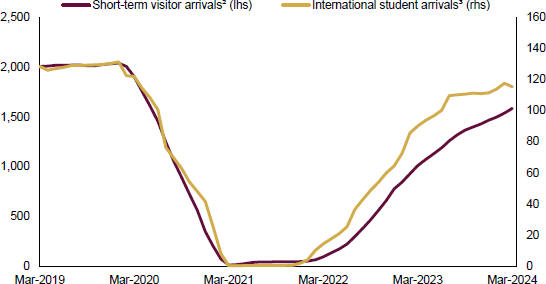

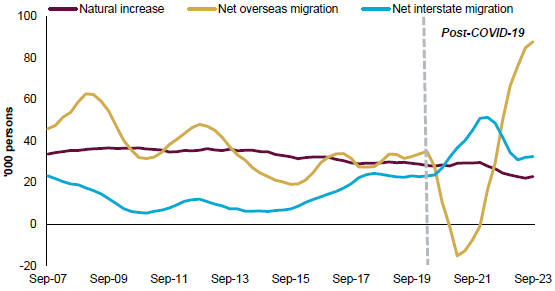

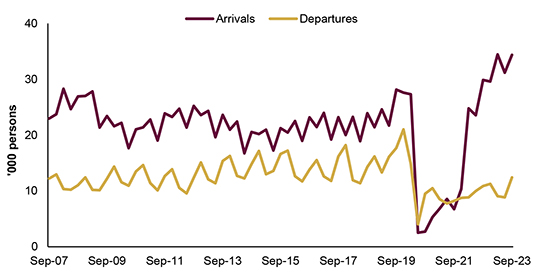

After international migration ground to a halt when international borders were closed, it has now roared back to life, at a pace that defies economists and statisticians.

As Secretary of the Federal Treasury, Dr Stephen Kennedy, observed last week, this stunning surge in temporary migration took Federal Treasury forecasters by surprise.

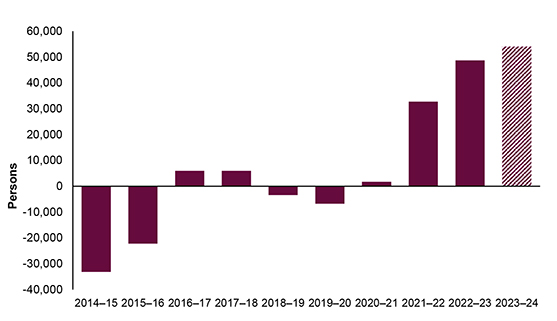

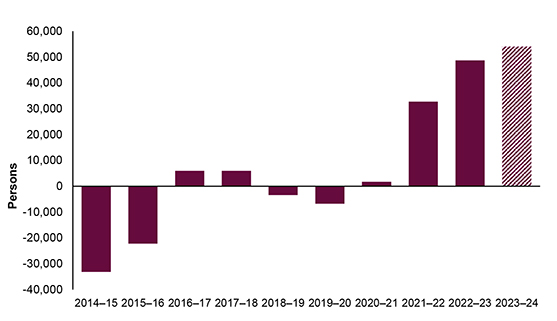

For Queensland, the increase in population in 2022–23 was 60 per cent higher than forecast.

This year, population growth is rising so fast that upward revisions are being revised again, almost as soon as they are published.

Those numbers represent tens of thousands more people who need somewhere to call home.

That is why the first Budget of the Miles Labor Government includes a record investment of $2.8 billion, to get more Queenslanders into their own home.

The Budget will provide more support for renters and those unable to find a home.

And as part of the Miles Government’s Homes for Queenslanders initiative, this Budget provides for an additional 600 modular homes.

Homes for Queenslanders is our vision for delivering one million new homes by 2046.

It is a real plan backed by real investment, a total of $3.1 billion over 5 years.

This includes the delivery of 53,500 social homes by 2046.

Page 5 of 24

Homes for Queenslanders includes a downpayment of $1.3 billion to contribute to the ramp up to more than 2,000 social homes on average, every year, from 2028, to reach this target.

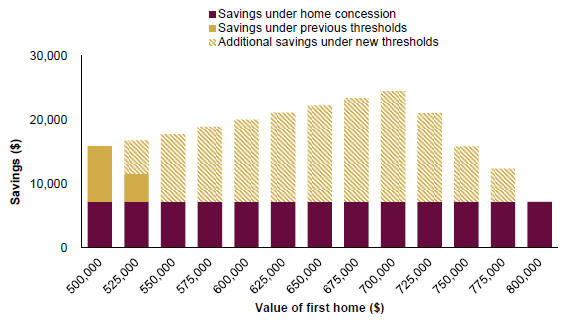

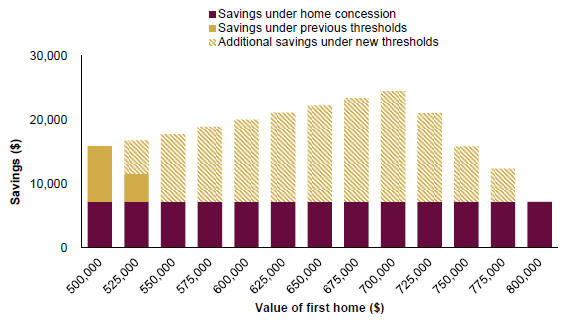

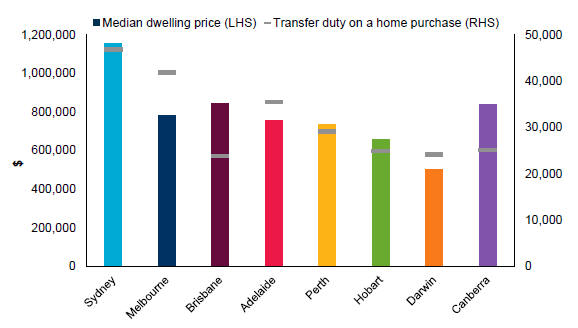

For Queenslanders looking to buy their first home, we have lifted the threshold for a full stamp duty concession with immediate effect.

The threshold is now $700,000, tapering to a new cap of $800,000.

While that threshold is still below the median house price in Brisbane, it provides more generous relief than the equivalent threshold in Sydney or Melbourne.

This is a thoughtful plan, a detailed plan, and a prudent plan to help young Queenslanders in particular, find a home that they can call their own.

And it is a plan that will not sacrifice the revenue that pays the wages of Queensland teachers, nurses and police officers.

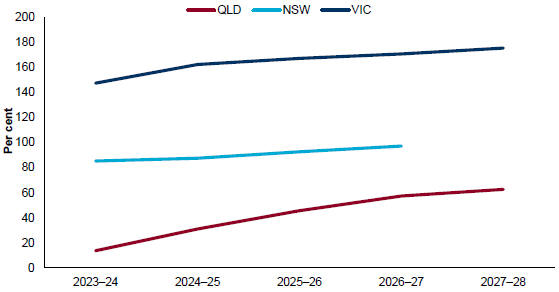

From 1 July, we will bring our foreign owner transfer duty surcharge into line with Victoria and New South Wales.

And we will raise our foreign owner land tax surcharge from 2 per cent to 3 per cent, still more generous than New South Wales and Victoria.

This plan will provide $360 million in cost-of-living relief to Queenslanders, while helping 40,000 Queensland families into their first home over the next 4 years.

A fully-costed, revenue neutral plan to help first home buyers, without pushing up prices, is a policy that Queenslanders would only see from a strong Labor Government.

This Budget also includes a temporary 20 per cent increase in funding for Specialist Homelessness Services, an investment of almost $390 million.

This will allow for the expansion of the Immediate Housing Response, to individuals and couples, and more temporary supported accommodation.

Page 6 of 24

HEALTH

Queenslanders know that they can always trust Labor Governments to do what matters when it comes to their health care.

Through this Budget, the Miles Labor Government will continue to invest in the health of all Queenslanders.

A strong health system supports a healthy population.

And a healthy population means higher labour productivity and stronger economic growth.

Even in a time of rising cost-of-living pressures, the cost of providing health care continues to rise faster than other expenses.

So this Budget will once again deliver a record investment in health.

Our hospital Capacity Expansion Program now totals $11 billion over 6 years.

That program will deliver around 2,200 additional overnight beds at facilities across the Queensland health system, including:

| | • | | The new Bundaberg Hospital |

| | • | | The new Coomera Hospital |

| | • | | The new Toowoomba Hospital |

| | • | | The new Queensland Cancer Centre |

| | • | | The Cairns Hospital expansion |

| | • | | The Hervey Bay Hospital expansion |

| | • | | The Ipswich Hospital expansion |

| | • | | The Logan Hospital expansion |

| | • | | The Mackay Hospital expansion |

| | • | | The Princess Alexandra Hospital expansion |

| | • | | The QEII Hospital expansion |

Page 7 of 24

| | • | | The Redcliffe Hospital expansion |

| | • | | The Robina Hospital expansion |

| | • | | The Prince Charles Hospital expansion |

| | • | | And the Townsville University Hospital expansion. |

Through the $943 million Building Rural and Remote Health Program, we are building a new hospital in Moranbah, and health care centre in locations as diverse as Tara, Camooweal, Doomadgee and Childers.

This Budget also allocates $200 million to redevelop the Cooktown Multi-Purpose Health Service facility, expanding inpatient beds, and adding an operating theatre.

Within our hospitals, and from our Capital Expansion Program, $1 billion will be allocated to optimise patient flow within hospitals, to reduce wait times and improve healthcare delivery.

The 10.6 per cent increase in operating funding for Queensland Health in this Budget is well above the historical average of 6.9 per cent.

This Budget will also support culturally appropriate models of care through the Torres and Cape Health Care Commissioning Fund, known as TORCH.

This Budget will deliver free meningococcal B vaccines for eligible infants, children and adolescents.

Speaker, for all those members who say they support this budget, they should be proud of the health budget, and the important social reforms that it is progressing.

This budget will support the Women and Girls’ Health Strategy 2032, delivering 34 new initiatives to address existing health inequities and provide enhanced gender and trauma informed care.

That includes $21 million to enhance the workforce for termination of pregnancy.

Page 8 of 24

This funding shows that, for our Government, decriminalising the termination of pregnancy is more than a legal reform.

For it to be a real social reform, that delivers for all Queensland women, then it needs funding, and that’s exactly what this budget delivers.

And this Budget will provide $18 million over 4 years to support the operational delivery of the Voluntary Assisted Dying scheme, including support for the Queensland Voluntary Assisted Dying Scheme Support and Pharmacy Service.

We will also provide ongoing support for our nation-leading pill testing and ketamine trials.

These are all Labor budget initiatives, and initiatives that, by definition, Members will support when they cast their vote in favour of the appropriation.

HEALTH WORKFORCE STRATEGY

Our Government continues to invest in our health workforce, to deliver the care our community needs.

The new Health Workforce Strategy for Queensland to 2032 is backed by a $1.7 billion investment.

It will deliver more than 700 extra doctors, more than 2,600 nurses and midwives, and more than 1,000 allied health staff.

This is a huge investment in our staff and the Queenslanders they help every day.

The funding will also ensure minimum midwife to post-natal patient ratios, providing patients and families with individually-tailored, culturally-appropriate maternity care.

We are also expanding and boosting our schemes to attract the health workforce needed across Queensland.

Page 9 of 24

Interstate and international doctors who make the decision to take up a job in regional and remote Queensland continue to be eligible for payments up to $70,000.

In addition, in a landmark investment, our Government will offer $40,000 to attract and retain GP trainees across Queensland.

These investments will help attract, retain, and support a homegrown health workforce that will deliver world-class healthcare across Queensland.

QUEENSLAND AMBULANCE SERVICE

For Queenslanders unfortunate enough to experience a health emergency, their first connection is often with the dedicated paramedics of the Queensland Ambulance Service.

In the last 6 years, ambulance demand from priority code one and code two patients has risen over 22 per cent.

In the next 6 years, that demand is forecast to rise a further 19 per cent.

This first Budget of the Miles Labor Government will provide investment for an additional 268 full-time equivalent personnel in the Queensland Ambulance Service, to sustainably meet growth in demand.

We will also invest $30 million in the QAS capital program, which includes replacing ageing ambulances and delivering additional new vehicles.

Across vast expanses of our state, the best method of delivering emergency care is often not by road, but by air.

To ensure all Queenslanders get the care they need, when they need it, the 2024–25 Budget is continuing to invest in vital aeromedical ambulance services, including:

| | • | | LifeFlight Australia, from its bases in Bundaberg, the Sunshine Coast, Toowoomba, Mount Isa and Brisbane; |

Page 10 of 24

| | • | | The Capricorn Helicopter Rescue Service and Central Queensland Rescue Service, which operate from bases in Rockhampton and Mackay; and |

| | • | | The Royal Flying Doctor Service, which provides inter-hospital transfer services across Queensland. |

FIRST NATIONS

In 2023, this Parliament voted to establish the Path to Treaty Act, to prepare a framework for treaty negotiations with First Nations Queenslanders.

In keeping with that decision, $40 million has been allocated over 4 years for the First Nations Treaty Institute.

The Miles Labor Government is also providing $56 million over 4 years for the Truth-telling and Healing Inquiry, which commences on 1 July 2024.

The Budget also provides extra funding of $18 million over 4 years to help community members tell their stories to the Inquiry, through access to extra specialist research and archival officers, and additional resources for Community and Personal Histories.

These are Budget measures I am sure this House will support now, and across the Forward Estimates.

COMMUNITY SAFETY

Queenslanders deserve to feel safe in their home, and safe on the streets of our state.

That’s why our Government invests in frontline police and crime prevention.

We do so, not because we want to win seats in parliament, quote, “off the back of crime,” but because Queenslanders deserve to be safe, and to feel safe.

Page 11 of 24

That’s why our Community Safety Plan for Queensland, announced by the Premier earlier this year, provides an extra $1.3 billion over 5 years for community safety measures across 5 key pillars:

| | • | | Delivering for our frontline; |

| | • | | Intervening when people offend; and |

| | • | | Preventing crime before it occurs. |

To help build safer communities, we are placing an increased focus on preventing domestic, family, and sexual violence.

We are placing an extra focus on the safety of women and girls and on dealing with young offenders.

The Community Safety Plan for Queensland builds on successful measures that have already helped to deliver a reduction in overall offences in the first quarter of 2024.

Our Government is determined to put more police officers on the frontline.

Like every employer, we have encountered extraordinary challenges in recruitment.

A low unemployment rate means a stronger economy, but it also means very high competition to attract employees.

Our Government will ensure that Queenslanders have the frontline police they deserve.

That’s why our Government has offered recruitment incentives of up to $40,000 for new police officers.

Our interventions have helped to turn the corner in police recruitment.

Page 12 of 24

I am advised by Queensland Police Service that the academy is full, with the largest number of recruits on record.

I am also advised that as those recruits graduate, by the end of this month, we will have achieved a net annual increase in the total number of police.

And that growth will continue as more recruits roll through, a significant achievement when unemployment is so low.

This Budget supports the recruitment of 900 additional police personnel, along with $48 million to upgrade police stations in Bundaberg and Hervey Bay.

This Budget provides additional equipment to increase community safety, including 3,000 wands for knife detection to support Jack’s Law, and 1,000 additional tasers.

To support more police boots on the ground, this Budget provides more police eyes in the sky.

To follow on from the resounding success of our Townsville-based police helicopter, Polair helicopter bases will be established in Far North Queensland, and on the Sunshine Coast and Wide Bay.

And this Budget will deliver a 20 per cent permanent uplift in funding for domestic, family and sexual violence service providers across the state.

Our Government is also investing $52 million to provide more resources and support for victims of crime, including:

| | • | | $16 million to expand the Victims of Crime Community Response Program; |

| | • | | $16 million to increase the capacity of Victims Assist Queensland to process financial assistance applications; and |

| | • | | $3 million to enhance the Victim Liaison Service to better connect victims and their families with prosecutors, while cases proceed through court. |

Locking up more offenders means more detention capacity is required.

Page 13 of 24

This Budget includes $628 million over 5 years for the new youth detention centre at the Woodford Correctional Precinct, and continues delivery of the $885 million Lockyer Valley Correctional Centre.

BIG BUILD

This Budget addresses the challenges Queensland families are facing today, but it also plans and delivers for our state’s future prosperity.

The record extraordinary population growth experienced by our state in the last 3 years – growth that was not predicted by anyone – means we must step up our investment.

This first Budget of the Miles Labor Government makes a deliberate choice to continue with the ambition of our Big Build, because it is our ambition for Queensland.

States like New South Wales and Victoria are putting major infrastructure projects on hold, because they lack Queensland’s balance sheet strength.

Those southern decisions to delay and cut may help their balance sheets today, but they will cause more expensive problems in the future.

With extraordinary and unforeseeable population growth, our Government will forge ahead with our Big Build, because ensuring the provision of essential infrastructure is what matters to Queenslanders.

In the 4 years to 2027–28, our Big Build will deliver $107 billion of investment in building projects across the length and breadth of our great state.

These are projects that will define Queensland’s future.

They will support our economic and energy transformation, while improving the access to essential services and utilities right across the state.

Page 14 of 24

This investment will drive generational change, creating more jobs, better communities and stronger regions.

Over the 13 years to 2027–28, our Government will have supported over $226 billion in infrastructure works.

In 2024–25, the government will invest a record $27 billion in building Queensland, directly supporting around 72,000 jobs.

This is the largest annual investment in capital works in Queensland’s history.

A record $19 billion, or almost 70 per cent of this capital program, will be invested outside of the Greater Brisbane region, supporting around 50,000 jobs.

Almost $10 billion in transport infrastructure will be delivered in 2024–25, including:

| | • | | $786 million towards the Queensland Train Manufacturing Program in Maryborough; |

| | • | | $650 million towards the construction of Stage 1 of the Coomera Connector; |

| | • | | $514 million to continue construction work on Cross River Rail; |

| | • | | $500 million towards the Logan and Gold Coast Faster Rail project; and |

| | • | | $308 million to continue Stage 3 of the Gold Coast Light Rail, a project our Government will not walk away from. |

And as is always the case in Labor Budgets delivered by our Labor Government, there is substantial ongoing investment to fund major upgrades to the Bruce Highway, and the M1.

CLEAN ENERGY

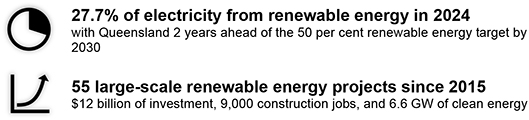

When it comes to renewable energy, Queensland has a global head start.

We have the sun, we have the wind, and we have the space to build industrial-scale generation.

Page 15 of 24

And most importantly of all, Queensland has the topography and rainfall to support deep storage pumped hydro.

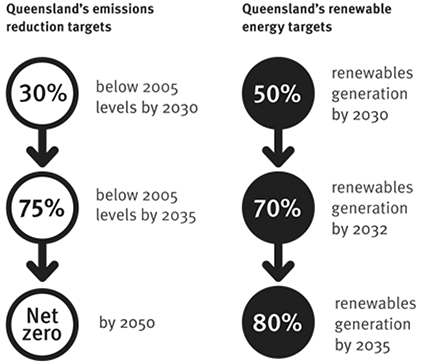

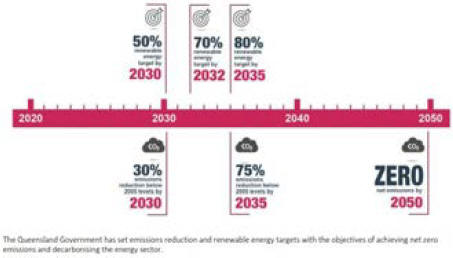

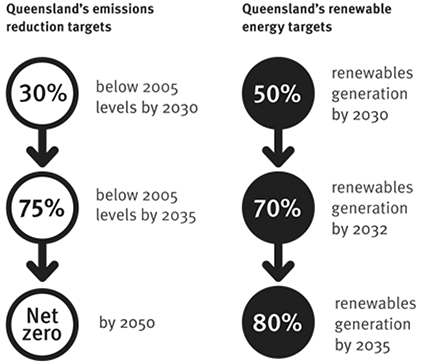

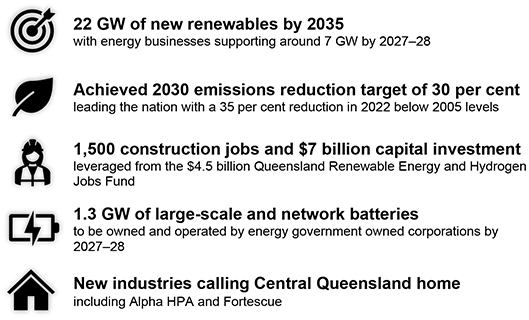

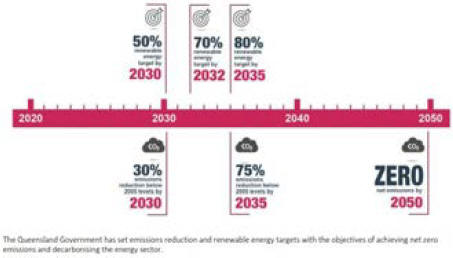

Very significantly, we have a target of 75 per cent emissions reduction by 2035, a target that has bipartisan political support at a state level.

But in order to ensure we capitalise on our natural advantages, we must press ahead to cement our place on the global stage for renewable energy and the industries it will support.

To continue the delivery of the Queensland Energy and Jobs Plan, the 2024–25 Queensland Budget includes a landmark capital investment of $26 billion over 4 years.

And our state’s energy transformation will continue to be driven by our other great advantage, Queensland’s publicly-owned energy companies.

In 2024–25, significant clean energy investments include:

| | • | | $712 million for CopperString 2032, connecting Mount Isa and the North West to the national electricity grid; |

| | • | | $801 million by Stanwell, for the Wambo and Tarong West Wind Farms; |

| | • | | $500 million for CS Energy’s Lotus Creek Wind Farm; |

| | • | | $275 million for CleanCo’s Swanbank Battery; |

| | • | | $936 million to progress the Borumba Pumped Hydro Energy Storage scheme; and |

| | • | | $38.5 million for early works at the Pioneer Burdekin Pumped Hydro Energy Storage scheme, with a $1 billion equity commitment across the forward estimates. |

That investment in the Pioneer-Burdekin Pumped Hydro Storage scheme is fully detailed in the budget papers, fully funded – and fully supported.

PORTS AND WATER

If Queensland is to take full advantage of the opportunities our renewable energy revolution presents, we must have the capacity to send more high-end, future-economy manufactured goods to the world.

Page 16 of 24

Major seaport projects in the Big Build that will be progressed in 2024–25 include:

| | • | | $251 million to complete the Port of Townsville Channel Capacity Upgrade; |

| | • | | $360 million for the ongoing expansion of the Cairns Marine Precinct; |

| | • | | $116 million for the Northern Land Expansion at the Port of Gladstone; and |

| | • | | initial works for North Queensland Bulk Ports to progress the Bowen Wharf replacement project. |

Major water investments in 2024–25 include:

| | • | | $311 million for the Fitzroy to Gladstone Water Pipeline; |

| | • | | $26 million for the Mount Crosby Flood Resilience Program; |

| | • | | $56 million towards the Toowoomba to Warwick Water Pipeline; and |

| | • | | $303 million towards improvement programs at dams including Paradise, Burdekin Falls, Somerset and Wivenhoe. |

PUTTING QUEENSLAND KIDS FIRST

Investing in the development and education of Queensland children is a direct investment in Queensland’s future prosperity.

Clinically-informed research makes it clear that investing in the first 7 years of a child’s life is the greatest opportunity open to us to contribute to their future wellbeing and success.

In order to give Queensland kids that opportunity, the Miles Labor Government is investing more than $500 million in our Putting Queensland Kids First strategy.

This program will stretch across education, health and communities to support Queensland children from birth onwards.

Putting Queensland Kids First encompasses everything from health development checks to extended free kindy for four-year-olds, particularly in discrete Aboriginal and Torres Strait

Page 17 of 24

Islander communities, as well as supporting behavioural specialists and health practitioners in state schools.

It is the most comprehensive package of measures to help children that Queensland has ever seen.

And it is a signature policy of the Miles Labor Government.

CHILDREN AND EDUCATION

As a further cost of living measure to allow more Queensland children to enjoy a healthy lifestyle, this Budget will lift the investment in our successful FairPlay vouchers to $40 million in 2024–25.

This additional investment will increase the total number of vouchers from 50,000 to 200,000, and increase the value of each voucher to $200 to address rising costs.

50,000 FairPlay vouchers will continue to be reserved for vulnerable households in the greatest need of support.

To ensure that Queensland children are able to get everything they can out of each day at school, this budget allocates $15 million for subsidised school breakfasts and lunches.

$15 million is a small price to pay to ensure Queensland children are ready to learn each day.

Decades from now, there will be a direct benefit to the health of our economy if we focus on the health and nutrition of school kids today.

With a record investment of nearly $21 billion in education, this Budget will improve the lives of young Queenslanders and set them up for the future.

Our investment of almost $1.3 billion in school infrastructure in 2024–25 includes:

| | • | | $342 million for new facilities at schools experiencing the fastest enrolment growth; |

Page 18 of 24

| | • | | $273 million to upgrade facilities at existing schools; |

| | • | | $167 million for the Building Future Schools program to deliver world-class learning environments for students; |

| | • | | $144 million as part of the strategic land acquisition fund, to acquire land for new and expanded schools; and |

| | • | | $117 million to continue the rollout of our successful School Halls Program. |

This Budget will deliver the schools, teachers and student supports, that matter to Queenslanders.

Importantly, this Budget allocates $1 billion over 5 years to deliver more teachers and teacher aides to help every student realise their potential, including priority cohorts such as students with a disability.

To help recruit teachers to remote and regional Queensland where housing pressures can be greater than they are in the South East, we are investing $45 million over 3 years to subsidise teacher accommodation.

TRAINING

Just as education can set a child up for life, training can set a young Queenslander up for their career.

In the biggest skills and training reform in almost a decade, the Miles Labor Government will fund one million training places for Queenslanders.

As our economy transitions and evolves, the ability to upskill and retrain, to take advantage of emerging opportunities, has never been more important.

The Good Jobs, Great Training: Queensland Skills Strategy 2024–2028 will invest an additional $203 million over 2 years, to address skills needs and workforce priorities across every region of Queensland.

Page 19 of 24

Working with the Albanese Labor Government, we will continue to offer Free TAFE for around 200 courses, a program that has already enrolled almost 82,000 Queenslanders.

Our 50 per cent payroll tax rebate for apprentices and trainees will be extended for a further 12 months to 30 June 2025.

And first year apprentices this year in the housing industry will have access to a $1,000 rebate on their work tools, through our $4 million Free Tools for First Years program.

2032 OLYMPIC AND PARALYMPIC GAMES

The forward estimates contained within this budget bring Queensland to just over 4 years from the 2032 Olympic and Paralympic Games.

Together with the Federal Government, we are providing for a total capital expenditure of $7.1 billion for the Brisbane Games, to be delivered by the Games Venue and Legacy Delivery Authority.

In keeping with our Government’s response to the Sport Venue Review, the venues infrastructure program includes the upgrading of the Queensland State Athletics Centre, the refurbishment of the Gabba and Suncorp Stadium, and the construction of the Brisbane Arena.

Through this Budget, over $560 million is allocated to works that are now in procurement, including $42 million for the Brisbane Aquatic Centre, and $142 million for the Sunshine Coast Indoor Sports Centre.

ECONOMIC AND FISCAL UPDATE

In the face of persistent inflation and an uncertain global outlook, the fundamental strengths of the Queensland economy endure.

Queensland’s economic growth is forecast to strengthen from 2.3 per cent in 2022–23 to 3 per cent in both 2023–24 and 2024–25.

Page 20 of 24

This growth will be driven by a rebound in exports as capacity constraints unwind and increased public final demand, reflecting our Government’s deliberate decision to continue to fund public infrastructure investment.

Once again, this Budget is about choices.

And the Miles Labor Government is choosing to stay the course, and to invest in Queensland’s future growth and prosperity.

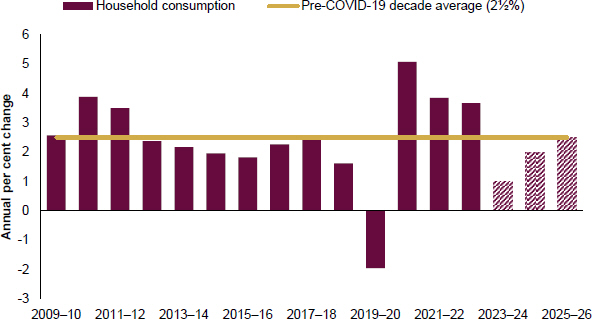

With inflation forecast to finally start easing, growth in consumption is expected to recover to around pre-pandemic averages in 2026–27.

Queensland’s economy is projected to continue to grow solidly at 21⁄2 per cent in 2025–26, sustained by continuing growth in domestic activity as household consumption regains its strength.

For the first time in Queensland’s history, Gross State Product has exceeded half a trillion dollars.

That means the Queensland economy is larger than that of Finland, of Portugal or of New Zealand.

As Australia’s growth state, Queensland has been the engine, driving employment growth across Australia.

As at April 2024, Queensland had recorded the largest employment growth of any state or territory since March 2020, a total of 366,900 people.

That employment growth is equivalent to the entire population of the Sunshine Coast.

With inflation moderating, real wage growth is expected to continue across the forward estimates, further helping Queensland families deal with cost-of-living pressures.

Page 21 of 24

Queensland’s place as the growth state of the Commonwealth has placed greater pressure on housing here than it has in any other jurisdiction.

That is the finding of Professor Hal Pawson from the University of New South Wales in his analysis done for the Queensland Council of Social Services.

Thankfully, the easing in the Commonwealth’s migration program is expected to take some pressure off housing supply in coming years.

FISCAL

After forecasting a deficit of almost $2.2 billion for the current 2023–24 financial year, the Miles Labor Government now expects to return an operating surplus of $564 million.

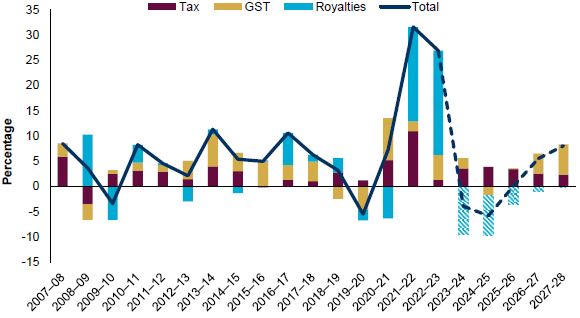

This surplus has been achieved through careful management of improved revenue, including royalties and taxes.

This estimated actual surplus represents Queensland’s third operating surplus in succession, but it is forecast to be the last in the current sequence.

For 2024–25, a deficit of $2.6 billion is forecast, a deficit that ensures we can help more Queensland families keep their budgets in balance.

If a deficit is the price to be paid to provide nation-leading cost-of-living relief, then that is a price we are willing to pay.

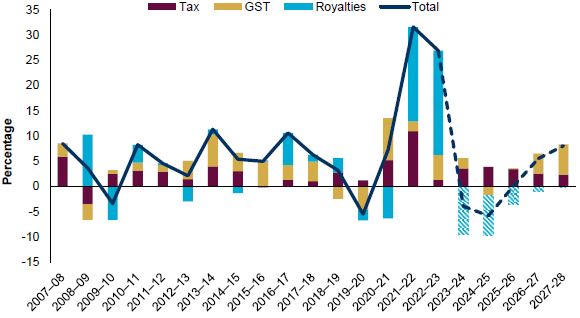

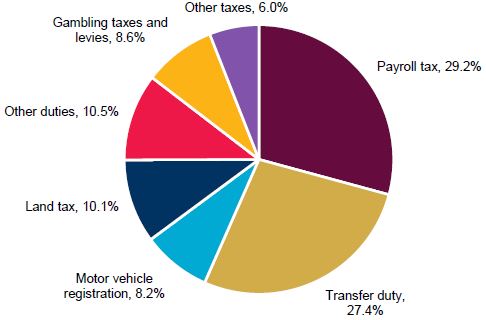

In 2024–25, growth in taxation revenue will be offset by an expected decline in royalties, and by expense measures including our record cost-of-living relief measures, and increased investments in housing, health and community safety.

The deficit is forecast to fall to $515 million in 2025–26.

A targeted $3 billion savings plan, over 4 years, to 2027–28, will be applied, to ensure returns to surplus from 2026–27.

Page 22 of 24

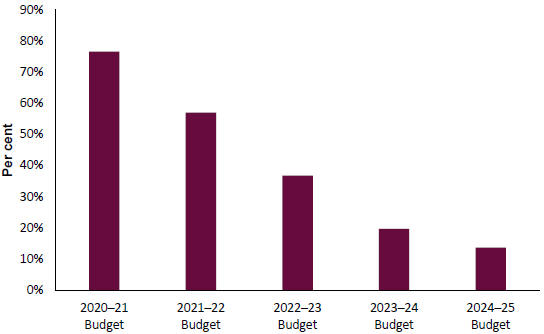

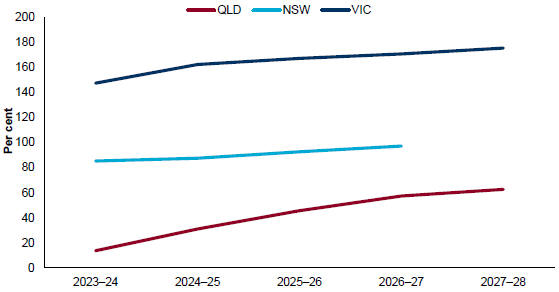

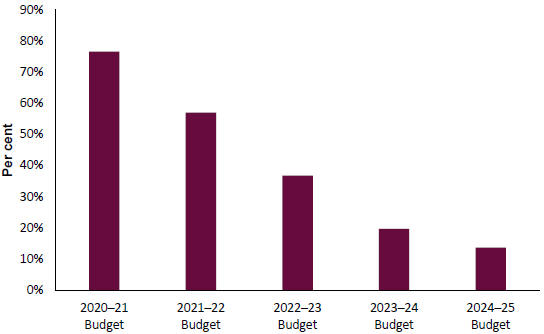

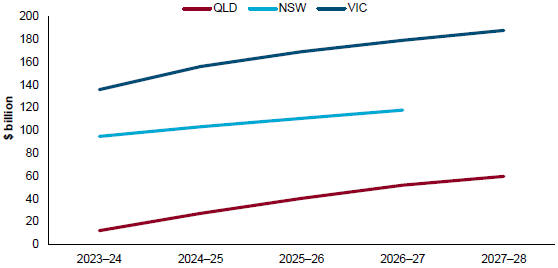

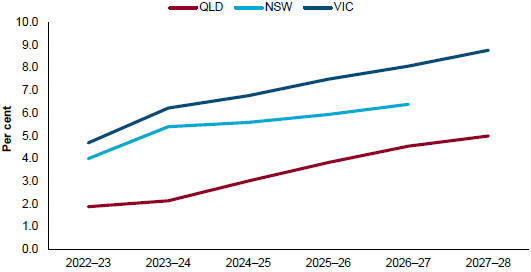

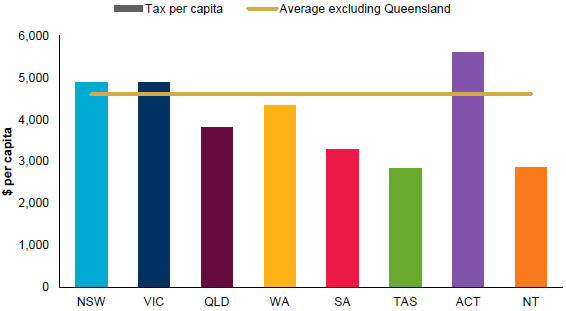

Despite these 2 forecasts deficits, Queensland remains well positioned compared to our peers, as the projected net debt to revenue metric for 2023–24 has fallen materially over recent budgets.

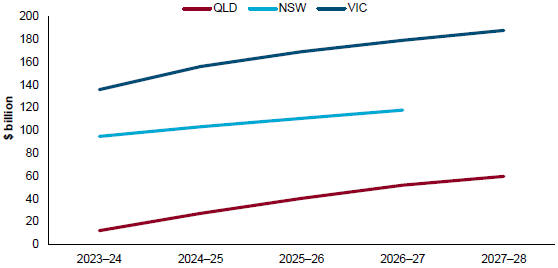

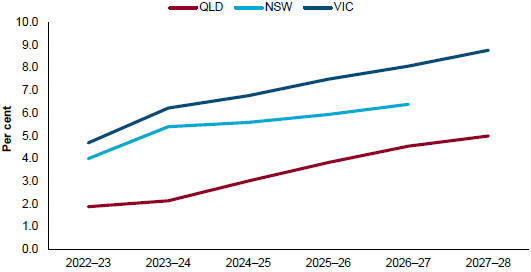

Queensland’s 2024–25 estimated net debt to revenue ratio of 31 per cent compares very favourably to our peers, given that the same ratio is 88 per cent for New South Wales and 163 per cent for Victoria.

Queensland’s credit ratings are all stable, with S&P Global and Fitch at AA+, and Moody’s at Aa1.

That stable outlook is the recognition by ratings agencies that Queensland, under the Miles Labor Government, will continue to be able to service its borrowings.

In the fiscal Olympics, as the 2032 host, Queensland holds a higher credit rating than this year’s host, France.

CONCLUSION

Speaker, this first Budget of the Miles Labor Government sets out our fully costed, fully detailed, and fully accountable plan for the next 4 years.

It delivers what Queenslanders deserve.

And Queenslanders deserve nothing less than unprecedented action on cost-of-living.

This Budget answers the questions about how our Government would proceed over the next 4 years.

As comprehensive as this Budget is, it is not the final word on what happens next to Queensland.

So let me end where I began.

Page 23 of 24

With the choice facing Queenslanders.

It is no secret that on 26 October, Queenslanders face a choice.

Queenslanders will be asked to make a choice about their future, not to express an opinion about the past.

This Budget makes clear the values and the plans that the Miles Labor Government will be putting forward, when Queenslanders are asked to make that choice.

Queenslanders deserve nothing less from anyone who seeks to lead our great state.

Page 24 of 24

Queensland Budget 2024–25 Budget Speech Budget Paper No.1

| | |

DOING WHAT MATTERS FOR QUEENSLAND QUEENSLAND BUDGET 2024-25 | |  |

BUDGET STRATEGY AND OUTLOOK

BUDGET PAPER NO. 2

2024-25 Queensland Budget Papers

1. Budget Speech

2. Budget Strategy and Outlook

3. Capital Statement

4. Budget Measures

Service Delivery Statements

Appropriation Bills

Budget Overview

Regional Action Plans

First Nations acknowledgement

Queensland Treasury acknowledges Aboriginal peoples and Torres Strait Islander peoples as the Traditional Owners and custodians of the land. We recognise their connection to land, sea and community, and pay our respects to Elders past, present and emerging.

© The State of Queensland (Queensland Treasury) 2024

Copyright

This publication is protected by the Copyright Act 1968

Licence

This document is licensed by the State of Queensland (Queensland Treasury) under a Creative Commons Attribution (CC BY 4.0) International licence.

In essence, you are free to copy, communicate and adapt this publication, as long as you attribute the work to the State of Queensland (Queensland Treasury).

Attribution

Content from this publication should be attributed to:

© The State of Queensland (Queensland Treasury) - 2024–25 Queensland Budget

Translating and interpreting assistance

The Queensland Government is committed to providing accessible services to Queenslanders from all cultural and linguistic backgrounds. If you have difficulty in understanding this publication, you can contact us on telephone (07) 3035 3503 and we will arrange an interpreter to effectively communicate the report to you.

Budget Strategy and Outlook

Budget Paper No. 2

ISSN 1445-4890 (Print)

ISSN 1445-4904 (Online)

Budget Strategy and Outlook 2024–25

State Budget

2024–25

Budget Strategy and Outlook

Budget Paper No. 2

Budget Strategy and Outlook 2024-25

Contents

| | | | | | |

Overview | | | 1 | |

Economic outlook | | | 3 | |

Fiscal outlook | | | 5 | |

| | |

1 | | Budget priorities and economic strategy | | | 8 | |

| | |

1.1 | | Our strong economy – laying a platform for growth and prosperity | | | 9 | |

1.2 | | Addressing cost-of-living challenges and delivering more homes for Queenslanders | | | 15 | |

1.3 | | Delivering better services and supporting stronger, safer communities | | | 23 | |

1.4 | | Foundations for future success | | | 24 | |

1.5 | | Delivering Queensland’s Big Build program | | | 26 | |

1.6 | | Investing in skills and training | | | 29 | |

| | |

2 | | Economic performance and outlook | | | 31 | |

| | |

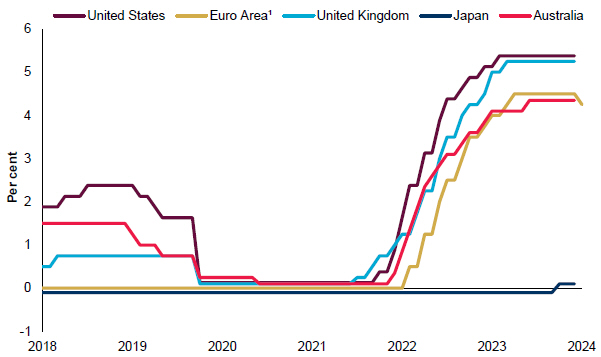

2.1 | | International conditions | | | 32 | |

2.2 | | National conditions | | | 35 | |

2.3 | | Key assumptions | | | 37 | |

2.4 | | Queensland conditions and outlook | | | 37 | |

2.5 | | Risks to the outlook | | | 66 | |

| | |

3 | | Fiscal strategy and outlook | | | 69 | |

| | |

3.1 | | Fiscal outlook | | | 70 | |

3.2 | | Key fiscal aggregates | | | 77 | |

| | |

4 | | Revenue | | | 92 | |

| | |

4.1 | | 2023–24 Estimated actual | | | 93 | |

4.2 | | 2024–25 Budget and outyears | | | 93 | |

Budget Strategy and Outlook 2024-25

| | | | | | |

4.3 | | Revenue initiatives | | | 97 | |

4.4 | | Revenue by operating statement category | | | 101 | |

| | |

5 | | Expenses | | | 132 | |

| | |

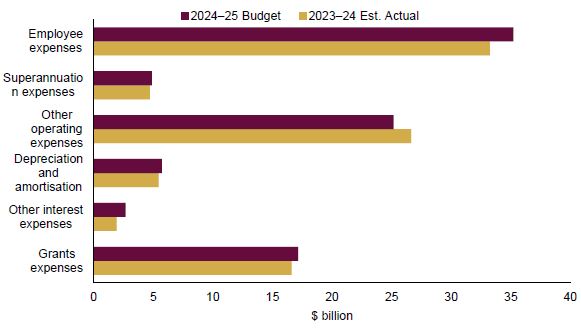

5.1 | | 2023–24 Estimated actual | | | 132 | |

5.2 | | 2024–25 Budget and outyears | | | 133 | |

5.3 | | Expenses by operating statement category | | | 134 | |

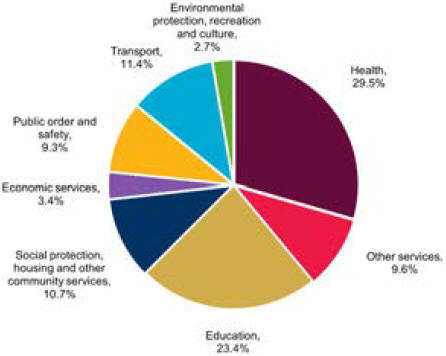

5.4 | | Operating expenses by purpose | | | 141 | |

| | |

6 | | Balance sheet and cash flows | | | 142 | |

| | |

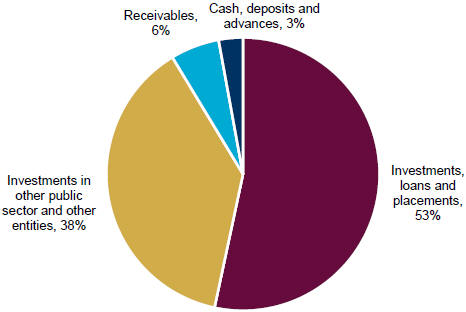

6.1 | | Overview | | | 143 | |

6.2 | | Balance sheet | | | 143 | |

6.3 | | Cash flows | | | 150 | |

| | |

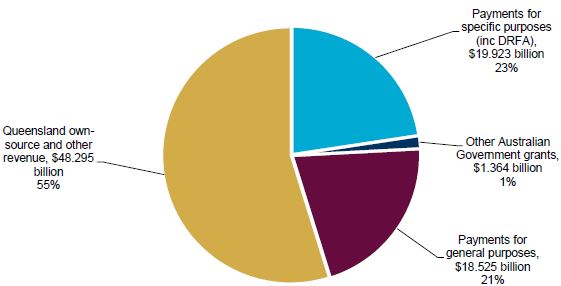

7 | | Intergovernmental financial relations | | | 151 | |

| | |

7.1 | | Federal financial arrangements | | | 151 | |

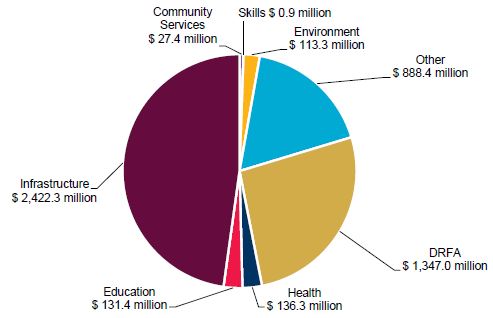

7.2 | | Australian Government funding to states and territories | | | 153 | |

7.3 | | Australian Government funding to Queensland | | | 155 | |

7.4 | | Payments to Queensland for specific purposes | | | 157 | |

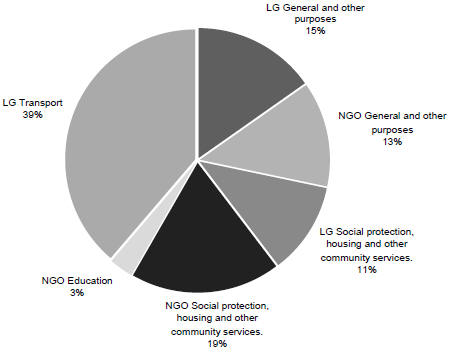

7.5 | | State-local government financial relations | | | 161 | |

| | |

8 | | Public Non-financial Corporations Sector | | | 165 | |

| | |

8.1 | | Context | | | 166 | |

8.2 | | Finances and performance | | | 174 | |

| | |

9 | | Uniform Presentation Framework | | | 182 | |

| | |

9.1 | | Context | | | 182 | |

9.2 | | Uniform Presentation Framework financial information | | | 182 | |

9.3 | | General Government Sector time series | | | 192 | |

Budget Strategy and Outlook 2024-25

| | | | | | |

9.4 | | Other General Government Sector Uniform Presentation Framework data | | | 194 | |

9.5 | | Contingent liabilities | | | 198 | |

9.6 | | Background and interpretation of Uniform Presentation Framework | | | 198 | |

9.7 | | Sector classification | | | 199 | |

9.8 | | Reporting entities | | | 200 | |

| |

Appendix A: Concessions statement | | | 204 | |

| |

Focus | | | 208 | |

Explanation of scope | | | 208 | |

A.1 Concessions summary | | | 209 | |

A.2 Concessions by agency | | | 210 | |

A.3 Concessions by government-owned corporation | | | 238 | |

| |

Appendix B: Tax expenditure statement | | | 240 | |

| |

Context | | | 240 | |

Methodology | | | 240 | |

The tax expenditure statement | | | 241 | |

Discussion of individual taxes | | | 244 | |

| |

Appendix C: Revenue and expense assumptions and sensitivity analysis | | | 249 | |

| |

Taxation revenue assumptions and revenue risks | | | 250 | |

Royalty assumptions and revenue risks | | | 251 | |

Parameters influencing Australian Government GST payments to Queensland | | | 252 | |

Sensitivity of expenditure estimates and expenditure risks | | | 252 | |

| |

Appendix D: Fiscal aggregates and indicators | | | 254 | |

Budget Strategy and Outlook 2024-25

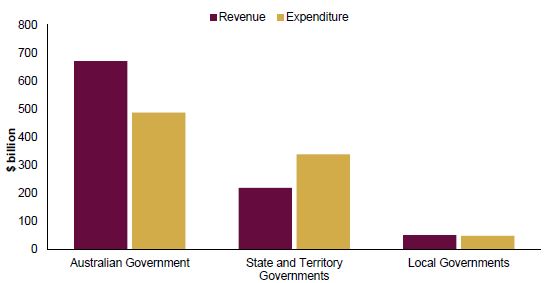

Overview

Queensland’s economic performance continues to be highlighted by stronger than national economic growth and nation-leading jobs growth, while challenged by an unprecedented increase in the population and global inflationary pressures.

The Queensland Government, through the 2024–25 Budget, is continuing to address immediate cost-of-living challenges facing Queenslanders, while also making significant additional investments to accommodate the rapid population growth and position the state for longer-term growth and prosperity.

This includes significant new and expanded cost-of-living relief for all Queensland households, and additional support for more vulnerable Queenslanders.

As population growth continues to drive demand for infrastructure and government services, the government is continuing to make substantial additional investments in essential services such as health and education, building stronger and safer communities, and strengthening the foundations that support positive life outcomes and the overall wellbeing of young Queenslanders across the state. Population growth has particularly challenged housing supply and affordability across the state, warranting a particular focus with a range of targeted initiatives and funding support.

Investments in productivity-enhancing infrastructure will continue to directly underpin Queensland’s economic growth opportunities while helping to increase overall living standards.

The government also continues to invest significantly in targeted skills and training initiatives to increase the capacity of the workforce to respond to future economic challenges.

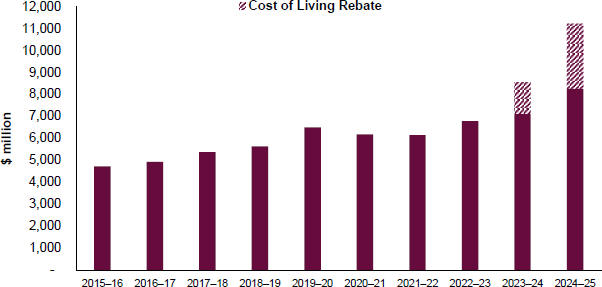

Addressing cost-of-living challenges and delivering more homes for Queenslanders

The 2024–25 Budget cost-of-living measures are responding to the pressures confronting Queensland households arising from a unique set of circumstances.

In 2024–25, the government is providing a record $11.218 billion in concessions, an increase of 31.1 per cent compared with 2023–24.

The government is providing $3.739 billion in new and expanded measures in 2024–25 to support Queenslanders in tackling cost-of-living challenges.

Through the Cheaper Power (Supplementary Appropriation) Bill 2024, the government resolved to provide $2.267 billion in urgent cost-of-living relief through electricity rebates.

The $1,300 Cost of Living Rebate will be automatically credited to electricity bills for all Queensland households in 2024–25, consisting of an upfront $1,000 Cost of Living Rebate from the Queensland Government and a $300 rebate paid in quarterly instalments from the Australian Government.

Around 205,000 eligible Queensland small businesses will also continue to receive $650 off their electricity bills in 2024–25, co-funded by the Queensland and Australian Governments.

These temporary elevated levels of assistance are helping households meet these immediate pressures. The cost-of-living pressures will ease as inflation falls, real wages continue to grow,

1

Budget Strategy and Outlook 2024-25

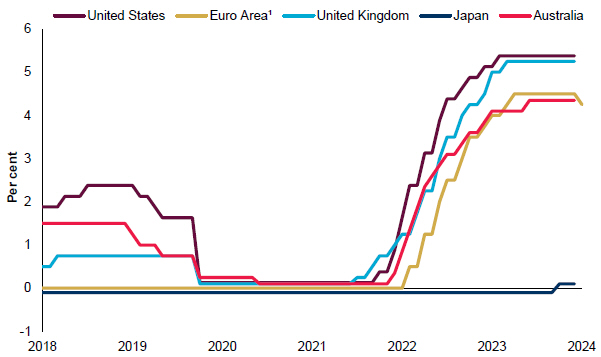

significant Australian Government income tax cuts are delivered from 1 July 2024, and interest rates in time begin to fall.

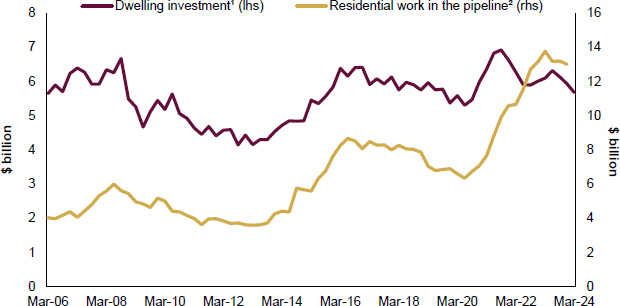

To address ongoing pressures in the state’s housing system, the government is implementing its housing plan, Homes for Queenslanders, backed by an investment of over $3 billion. This represents a significant uplift on top of the already major investment in social and affordable housing, with total investment by the government in social housing and infrastructure increasing to $1.125 billion in 2024–25.

Delivering better services and supporting stronger, safer communities

Unprecedented population growth is driving extraordinary demand for core government services. The 2024–25 Queensland Budget aims to support these services through substantial investments and additional funding in key areas such as health and community safety.

This includes a record Queensland Health total operating budget of $26.710 billion in 2024–25, as well as additional funding of $247.9 million over 5 years to improve women’s health outcomes and experience of the healthcare system under the $1 billion Queensland Women and Girls’ Health Strategy 2032.

The government’s evidence-based Community Safety Plan for Queensland commits an extra $1.28 billion over 5 years for community safety measures across 5 key pillars: supporting victims; delivering for our frontline; detaining offenders; intervening when people offend; and preventing crime before it occurs.

Foundations for future success

The Budget is investing in young Queenslanders and the state’s future workforce through significant investments in education and training, and prevention and early support initiatives.

This includes total funding of $22.801 billion for education and training in 2024–25, and the $502 million Putting Queensland Kids First package to support children from their earliest years of life. This funding will ensure every Queensland child and family has the best possible opportunities for a great life.

By supporting the education, development and growth of young Queenslanders, the government’s investments will help drive sustained economic participation, productivity and income growth, and increased standards of living over time.

Delivering Queensland’s Big Build program

The record increase in the population and driving diversification of the Queensland economy requires continued investments in critical social and economic infrastructure.

The government’s flagship Big Build Program is meeting the demand of the larger population, while supporting the state’s ongoing economic and energy transformation.

The government is investing $107.3 billion over the 4 years to 2027–28 in new and ongoing health, transport, education, housing and energy transformation projects. The Big Build is improving the sustainability and liveability of Queensland’s communities and regions.

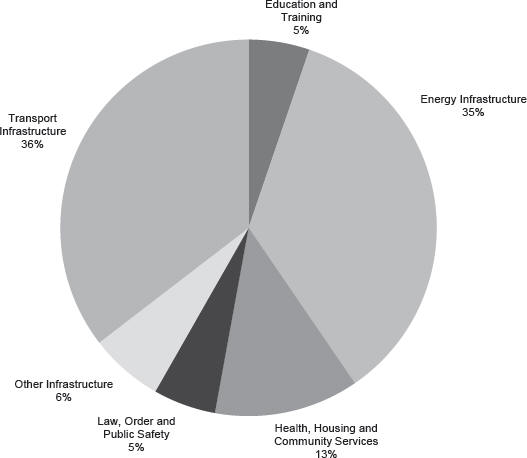

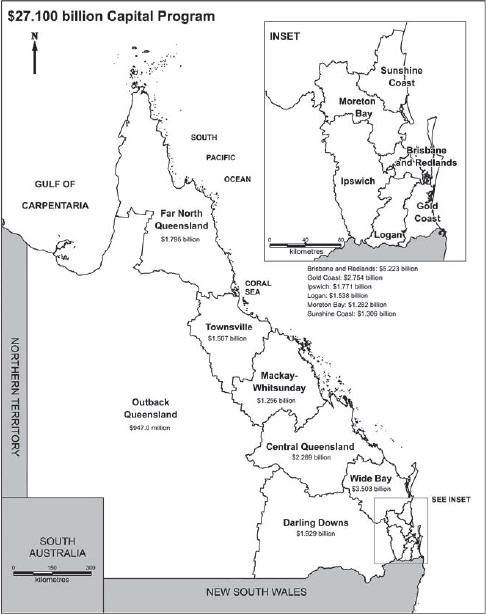

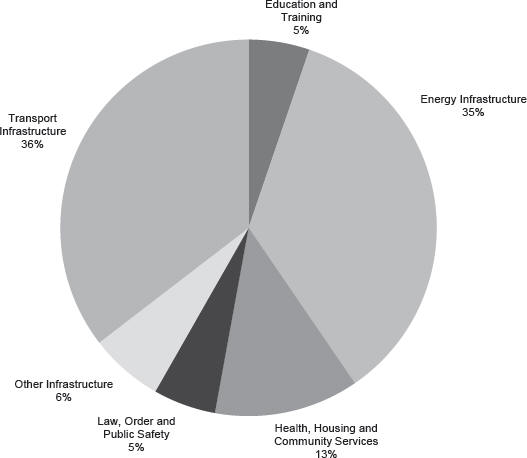

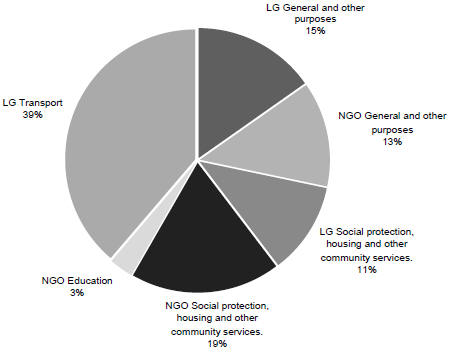

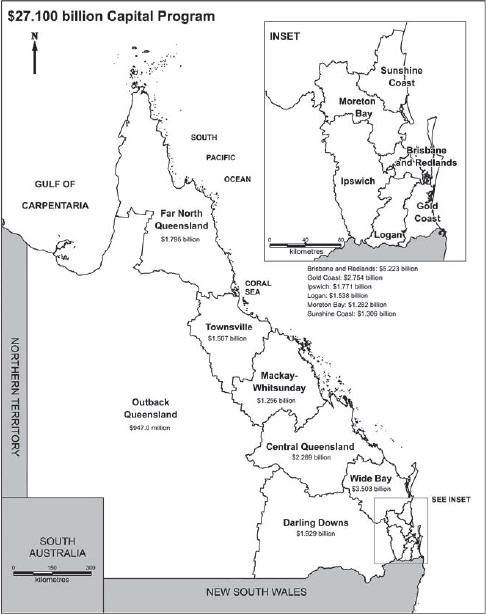

The Big Build, which includes $27.1 billion in 2024–25, is helping to drive the growth of Queensland’s traditional and emerging industries and create more jobs across the state. $18.568 billion or 68.5 per cent of the capital program is being invested outside the Greater

2

Budget Strategy and Outlook 2024-25

Brisbane region. The capital program is supporting around 72,000 direct jobs in 2024–25, with 50,000, or 69 per cent, of these jobs located outside of the Greater Brisbane region.

Delivery of productivity-enhancing economic and social infrastructure will help lower price pressures over the long term by reducing the cost of doing business and improving connectivity and labour mobility. In addition, the government’s Queensland Energy and Jobs Plan charts an infrastructure investment pathway to 2035 that will deliver clean, reliable, and affordable energy.

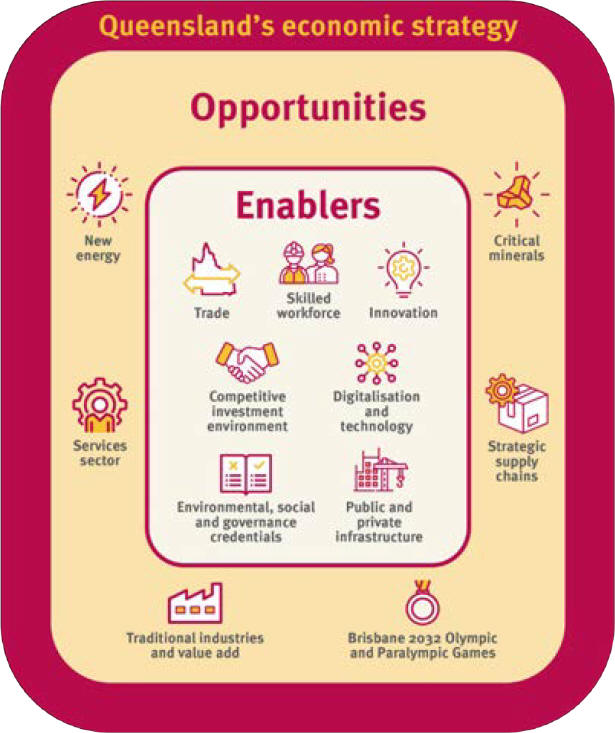

Economic strategy – laying the platform for growth and prosperity

By investing in the key enablers of growth, as outlined in the government’s overarching economic strategy, the Budget maintains the government’s focus on growing a more sustainable and diversified economy that is resilient, productive, competitive and able to respond to future opportunities and challenges.

The government’s investments in these key enablers of growth continue to support the ongoing transformation of the Queensland economy, as well as attracting new private sector investment opportunities across an increasingly diversified and decarbonised industrial base.

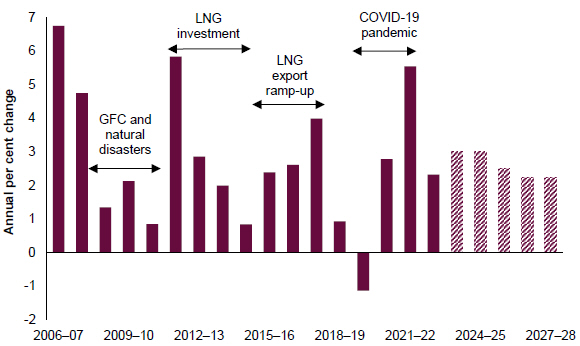

Economic outlook

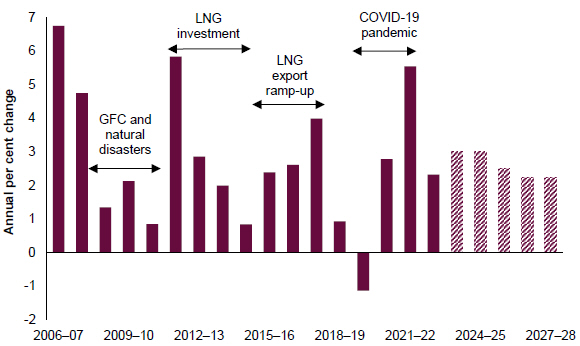

Queensland’s economic growth is forecast to strengthen from 2.3 per cent in 2022–23 to 3 per cent in both 2023–24 and 2024–25, driven by a substantial rebound in exports, in part due to an unwinding of capacity constraints, and continued strong growth in public infrastructure spending.

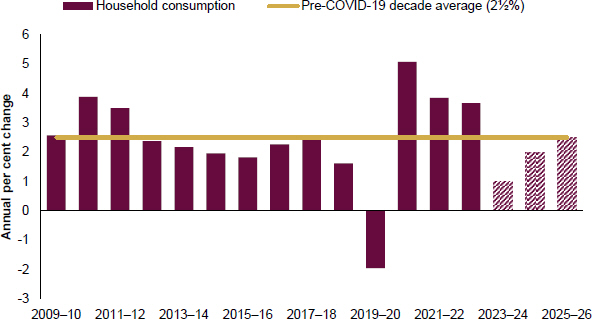

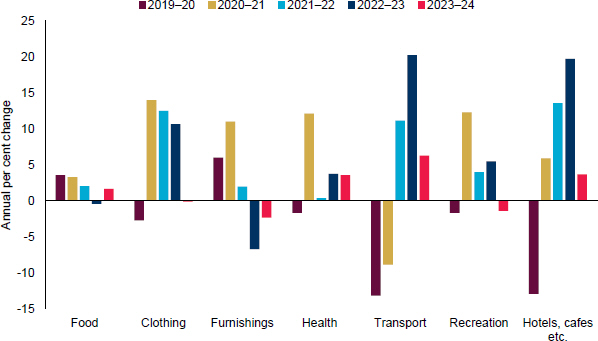

Household budgets continue to be constrained by higher mortgage rates and other cost-of-living pressures, which have resulted in slower consumption growth in 2023–24. However, growth in consumption is expected to recover to around pre-pandemic averages in 2025–26.

Queensland’s economy is projected to continue to grow solidly at 21⁄2 per cent in 2025–26, sustained by continuing growth in domestic activity as household consumption strengthens.

3

Budget Strategy and Outlook 2024-25

Overview Table 1 Queensland economic forecasts/projections1

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Actuals | | | Forecasts | | | Projections | |

| | | 2022–23 | | | 2023–24 | | | 2024–25 | | | 2025–26 | | | 2026–27 | | | 2027–28 | |

Gross state product2 | | | 2.3 | | | | 3 | | | | 3 | | | | 21⁄2 | | | | 21⁄4 | | | | 21⁄4 | |

Employment | | | 3.7 | | | | 23⁄4 | | | | 11⁄2 | | | | 1 | | | | 11⁄4 | | | | 11⁄2 | |

Unemployment rate3 | | | 3.7 | | | | 41⁄4 | | | | 41⁄2 | | | | 43⁄4 | | | | 43⁄4 | | | | 43⁄4 | |

Inflation4 | | | 7.3 | | | | 4 | | | | 2 | | | | 31⁄4 | | | | 21⁄2 | | | | 21⁄2 | |

Wage Price Index | | | 3.6 | | | | 43⁄4 | | | | 33⁄4 | | | | 31⁄2 | | | | 31⁄4 | | | | 3 | |

Population | | | 2.4 | | | | 21⁄2 | | | | 11⁄2 | | | | 11⁄2 | | | | 11⁄4 | | | | 11⁄4 | |

Notes:

| 1. | Unless otherwise stated, all figures are annual percentage changes. |

| 2. | Chain volume measure (CVM), 2021–22 reference year. |

| 3. | Per cent, year-average. |

| 4. | Brisbane, per cent, year-average. |

Sources: ABS Annual State Accounts, National, State and Territory Population, Labour Force, Wage Price Index, Consumer Price Index and Queensland Treasury.

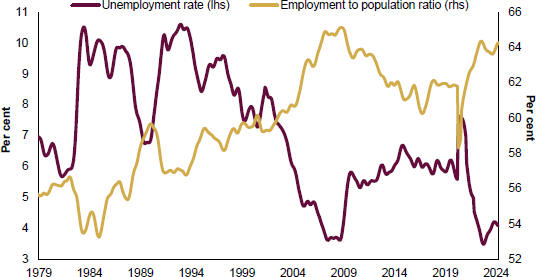

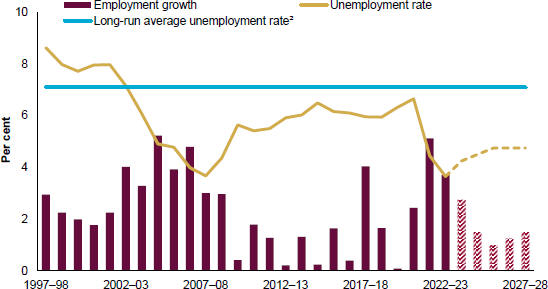

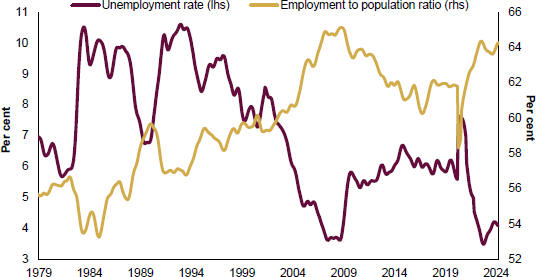

Queensland continues to enjoy exceptionally strong labour market conditions. As of April 2024, Queensland had recorded the largest employment growth of any state or territory since March 2020 at 366,900 persons.

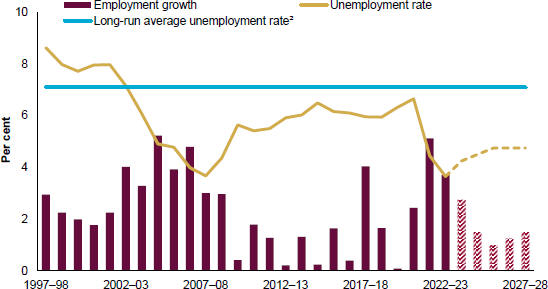

The state’s unemployment rate averaged 3.7 per cent in 2022–23, its lowest year-average unemployment rate since ABS monthly data began in 1978. As tightness in the labour market continues to unwind gradually, the unemployment rate is expected to edge slightly higher over the forward estimates period but remain low by historical standards.

Following strong wages growth in 2023–24, Queensland’s Wage Price Index is expected to continue to grow solidly, with ongoing real wage growth expected across the remaining years of the forecast period.

Inflationary pressures eased significantly during 2023. This has largely been due to a marked slowing in goods inflation, whereas services inflation has been more persistent.

Importantly, the Queensland Government’s substantial cost-of-living relief measures, when combined with the Australian Government measures, are estimated to cumulatively reduce Brisbane’s headline Consumer Price Index growth in 2024–25 by around 11⁄4 percentage points, reducing CPI growth to 2 per cent.

Population growth, after reaching unexpected highs in 2022–23 and 2023–24, is expected to moderate in line with a significant easing in the Australian Government’s overseas migration program. However, there remain backlogs in housing and infrastructure to catch up with this population increase.

Global geopolitical tensions remain a key risk to the economic outlook. This includes the ongoing war in Ukraine as well as the ongoing risk of an escalation in the conflict in the Middle East, which could impact on oil prices as well as threaten global trade routes.

4

Budget Strategy and Outlook 2024-25

Global supply chain disruptions have generally eased, but labour supply shortages remain a problem, especially in the construction industry, where the rate of company failures remains relatively elevated compared with other industries. Combined with the ongoing shortages of skilled labour, this poses risks in terms of the capacity of the construction industry to meet the expected demand for housing, business and public sector investment.

Fiscal outlook

Fiscal capacity is being deployed to support Queenslanders with additional spending measures responding to immediate, but temporary challenges. Investment is focussed on delivering cost-of-living relief, along with services and infrastructure to clear demand backlogs in the short term, with longer term investment in long-lived transformational recurrent and capital spending programs.

Since the 2023–24 Budget the net operating position for 2023–24 has improved from a $2.182 billion deficit to a surplus of $564 million. This is being delivered though careful management of revenue improvements, some of which has been prioritised to fund $2.267 billion of electricity bill support as part of a record $3.739 billion cost-of-living package for Queenslanders.

This surplus represents the third consecutive operating surplus and follows a record surplus of $13.9 billion in 2022–23.

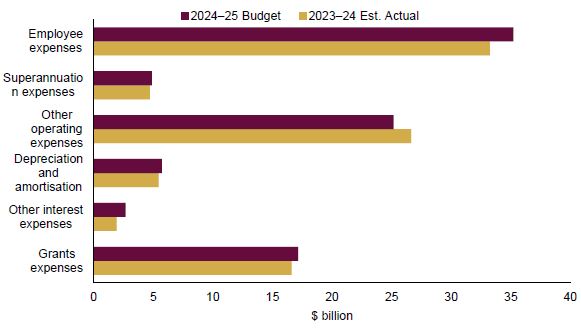

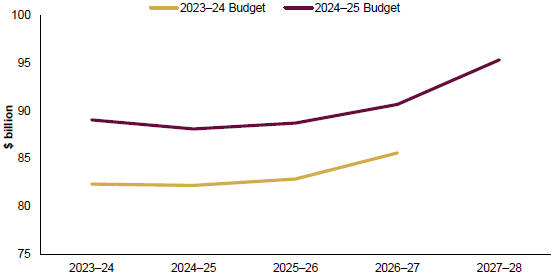

In 2024–25, a deficit of $2.631 billion is forecast, compared to a surplus of $135 million in the 2023–24 Budget. This change reflects a very significant response from government to prioritise the provision of elevated cost-of-living support when the community most needs it, as well as boosting health, housing and community safety measures in response to unprecedented and stronger than expected population growth.

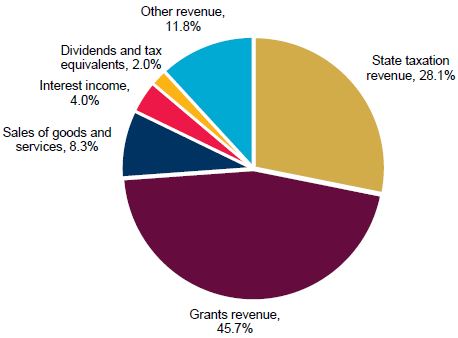

Revenue growth is forecast to remain relatively flat in 2025–26 as coal prices continue to unwind, before returning to solid growth in 2026–27 and 2027–28, driven by growth in taxation revenue and GST.

From 2025–26 as temporary relief measures are wound back, Queensland’s net operating position is expected to improve. Compared to 2024–25 the deficit improves to a forecast $515 million in 2025–26. Surpluses of $0.9 billion and $2 billion are then forecast for 2026–27 and 2027–28 as revenue growth returns and expenses are managed within available resources.

The recovery in the net operating balance profile is also underpinned by a commitment to savings of $3 billion over 4 years to 2027–28, which represents a renewal of the government’s successful 2020 Savings and Debt Plan.

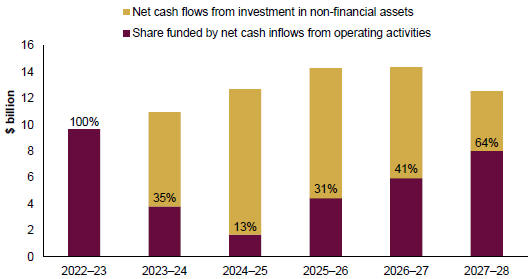

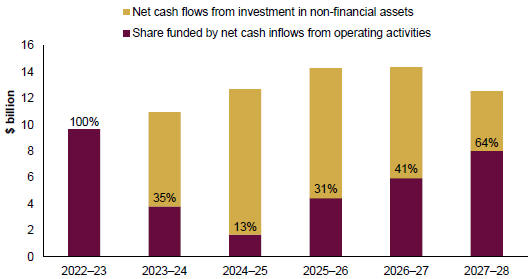

The capital program continues to respond to population growth and priority areas and strategically position Queensland to maintain a strong and diverse economy into the future and meet the needs of a growing population. This includes a large component of transformative infrastructure investment such as boosting health system capacity, decarbonisation of the state’s energy system, preparing for the Brisbane 2032 Olympic and Paralympic Games, Homes for Queenslanders, and major transport infrastructure investment such as Direct Sunshine Coast Rail.

5

Budget Strategy and Outlook 2024-25

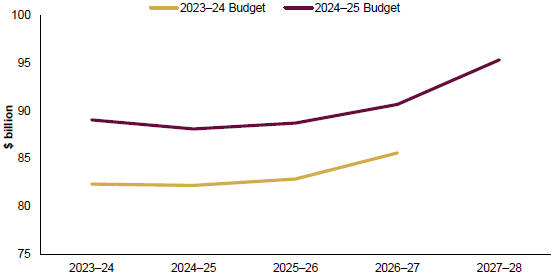

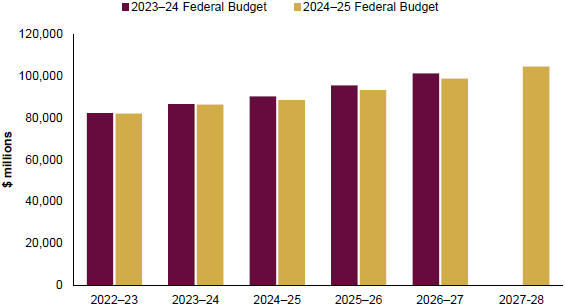

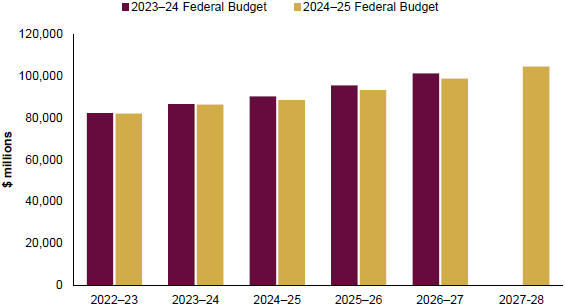

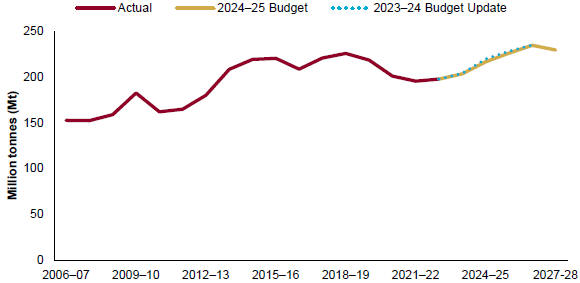

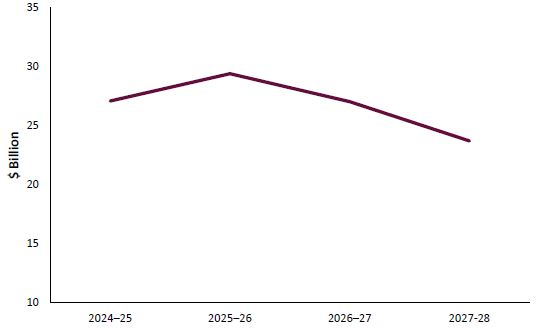

The total capital program is now projected to be $107.3 billion over the four years to 2027–28 compared to the projected $96.2 billion over the four years to 2026–27 at the 2023–24 Budget Update. However, the annual capital program is expected to peak in 2025–26 at $29.4 billion before moderating to $23.7 billion by 2027–28, representing a 19 per cent reduction over that period.

The moderation reflects several factors including the clearing of an infrastructure backlog that arose from unprecedented population growth. There is also a greater degree of flexibility with medium term capital scheduling given the spending profile of significant programs such as the hospital capital expansion program, the completion of large projects such as Cross River Rail and the decline in capital works being funded under the disaster recovery arrangements as projects are completed.

The total expenditure on Olympics venues over the forward estimates makes up just 3 per cent of the Big Build.

The increase in the four-year capital program means the government’s debt profile has shifted up since the 2023–24 Budget Update. General Government borrowings are now expected to reach around $103.2 billion in 2026–27, which is $6.5 billion higher than in the 2023–24 Budget Update. However, as the peak in capital spending in 2025–26 passes there is a clear moderation in the general government debt burden trajectory. This leaves Queensland well positioned relative to its peers.

6

Budget Strategy and Outlook 2024-25

| Overview Table 2 | Key fiscal aggregates1 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2022–23 | | | 2023–24 | | | 2023–24 | | | 2024–25 | | | 2025–26 | | | 2026–27 | | | 2027–28 | |

| | | Outcome | | | Budget | | | Est. Act. | | | Budget | | | Projection | | | Projection | | | Projection | |

| | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | | | $ million | |

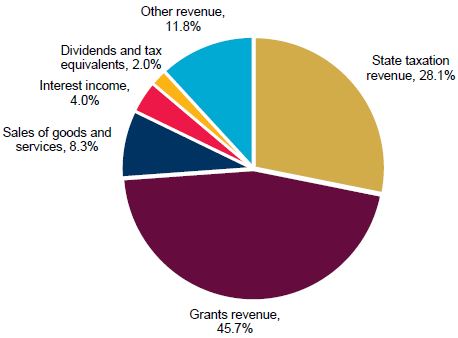

Revenue | | | 89,810 | | | | 82,079 | | | | 89,059 | | | | 88,107 | | | | 88,717 | | | | 90,670 | | | | 95,332 | |

Expenses | | | 75,880 | | | | 84,261 | | | | 88,495 | | | | 90,738 | | | | 89,232 | | | | 89,783 | | | | 93,305 | |

Net operating balance | | | 13,930 | | | | (2,182 | ) | | | 564 | | | | (2,631 | ) | | | (515 | ) | | | 887 | | | | 2,027 | |

PNFA2 | | | 9,899 | | | | 9,347 | | | | 11,061 | | | | 12,831 | | | | 14,485 | | | | 14,577 | | | | 12,763 | |

Fiscal balance | | | 8,092 | | | | (6,716 | ) | | | (5,717 | ) | | | (10,790 | ) | | | (9,547 | ) | | | (7,341 | ) | | | (4,054 | ) |

Borrowings3 | | | 53,726 | | | | 65,479 | | | | 61,958 | | | | 77,118 | | | | 91,507 | | | | 103,221 | | | | 111,383 | |

Net debt | | | 2,615 | | | | 16,190 | | | | 12,223 | | | | 27,407 | | | | 40,552 | | | | 52,076 | | | | 59,831 | |

Notes:

| 1. | Numbers may not add due to rounding. |

| 2. | PNFA: Purchases of non-financial assets. |

| 3. | Comprised of borrowing with QTC, leases and similar arrangements and securities and derivatives line items in the Balance Sheet. |

7

Budget Strategy and Outlook 2024-25

| 1 | Budget priorities and economic strategy |

Features

| • | | Queensland’s strong overall economic performance continues to be highlighted by stronger than national economic growth and nation-leading jobs growth. |

| • | | However, household budgets have come under significant pressure from escalating costs, especially for essentials such as housing and food. Queenslanders are also looking to the government to further enhance health services and improve community safety. |

| • | | A record and stronger than expected post-COVID-19 population increase has ramped up demand for housing and infrastructure, and government services such as health. |

| • | | A strong economy, positioned for the future, will provide the capacity to afford the improved services the community requires. |

| • | | The 2024–25 Queensland Budget is providing a record $11.218 billion in concessions in 2024–25, an increase of 31.1 per cent compared with 2023–24. The Budget is delivering substantial cost-of-living relief, including a $1,300 electricity bill rebate in 2024–25 for all Queensland households. This is part of the government’s commitment to $3.739 billion in new and expanded cost-of-living measures in 2024–25 to support Queenslanders in tackling cost-of-living challenges. |

| • | | To address record demand for new housing from unprecedented levels of population growth, the government is implementing its housing plan, Homes for Queenslanders, backed by an investment of over $3 billion, which represents a significant uplift on top of the already major investment in social and affordable housing. Total investment by the government for social and affordable housing infrastructure is $1.125 billion in 2024–25. |

| • | | The Budget further highlights the government’s strong commitment to support healthy, strong and safe communities, including record health funding of $26.710 billion in 2024–25, as well as over $1 billion in initiatives over the next 5 years for the Queensland Women and Girls’ Health Strategy 2032 to improve women’s health outcomes and experience of the healthcare system. |

| • | | The government’s evidence-based Community Safety Plan for Queensland commits an extra $1.28 billion over 5 years for community safety measures across 5 key pillars: supporting victims; delivering for our frontline; detaining offenders; intervening when people offend; and preventing crime before it occurs. |

| • | | The Budget is investing in young Queenslanders and the state’s future workforce though significant investments in education and training, and prevention and early support initiatives. This includes total funding of $22.801 billion in 2024–25 for education and training, and the $502 million Putting Queensland Kids First early support package to support children from their earliest years of life and direct resources, services and supports to give every Queensland child and family the best possible opportunities for a great life. |

| • | | The 2024–25 Budget also maintains the government’s focus on investing in the key enablers of economic growth, as identified in its overarching economic strategy, to support |

8

Budget Strategy and Outlook 2024-25

| | the state’s ongoing transformation to a more sustainable, diversified and low carbon economy that is resilient, productive, competitive and able to respond to future opportunities and challenges. |

| • | | The ongoing delivery of the government’s Big Build capital program, with investment of $107.3 billion over the 4 years to 2027–28, will continue to support Queensland’s energy and economic transformation, enhance productivity and competitiveness, and improve the sustainability and liveability of communities across the state. |

| • | | In 2024–25, the government will invest $27.1 billion in capital, directly supporting around 72,000 jobs. Of this capital program, $18.568 billion will be invested outside of the Greater Brisbane region, supporting around 50,000 jobs. |

| • | | The government also continues to invest in targeted skills and training initiatives to support a flexible and productive workforce both now and in the future. This includes funding of more than $1.5 billion in 2024–25, as well as the ongoing implementation of key actions under the Good people. Good Jobs: Queensland Workforce Strategy 2022–2032. |

| 1.1 | Our strong economy – laying a platform for growth and prosperity |

Against a backdrop of risks in terms of global economic conditions, Queensland’s strong economic performance since the COVID-19 pandemic is continuing to drive growth and employment opportunities across the state.

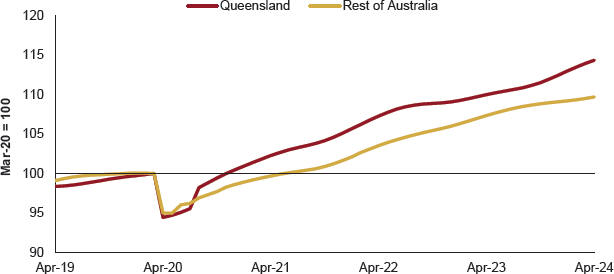

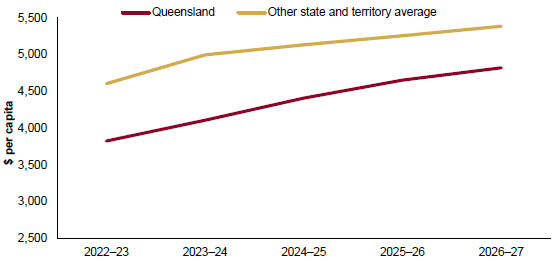

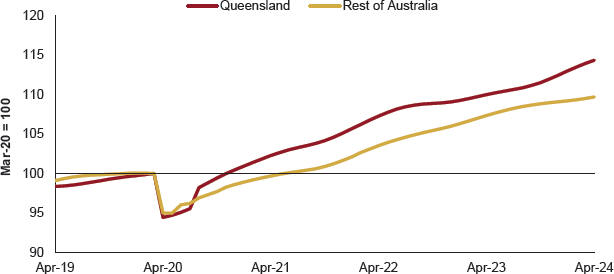

Chart 1.1 – Employment growth, Queensland and Rest of Australia1

Note:

Source: ABS Labour Force.

9

Budget Strategy and Outlook 2024-25

This is reflected in Queensland’s exceptionally strong labour market performance, which has resulted in employment growth in Queensland as of April 2024 of 14.3 per cent (or 366,900 persons) since March 2020, well above the growth in the rest of Australia (9.7 per cent) and the strongest of any state or territory over this period.

Queensland has also experienced historically low unemployment rates across the state, including in many areas of regional Queensland.

The state’s overall unemployment rate averaged 3.7 per cent in 2022–23, the lowest year-average unemployment rate since ABS monthly records began in 1978.

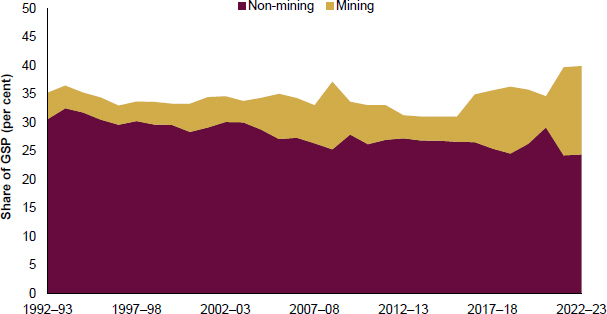

Queensland’s traditional export industries, including mining, agriculture and tourism, continue to be important contributors to the state’s economy and its regions.

The agriculture, forestry and fishing industry has performed strongly in recent years, with real output growing by an average of 17.0 per cent per annum over the past 3 years. In nominal terms, the industry contributed $12.9 billion to Queensland’s economy in 2022–23, while in the year ended March quarter 2024, there were 68,000 people employed in the industry, 14.4 per cent higher than the corresponding previous year.

Nominal agriculture exports rose by 7.3 per cent to $14.8 billion in 2023, driven by increased beef and sorghum exports. This follows strong growth in the previous year, where the value of agriculture exports rose by 26.5 per cent, driven by higher prices and favourable weather conditions which aided increased exports of cotton and crops.

The state’s tourism sector has also rebounded strongly from the impacts of the COVID-19 pandemic and related border closures. The latest data from Tourism Research Australia show direct tourism gross value added in Queensland was worth $14.2 billion in 2022–23, a 62 per cent increase on 2021–22 and 13 per cent above the pre-COVID-19 level in 2018–19.

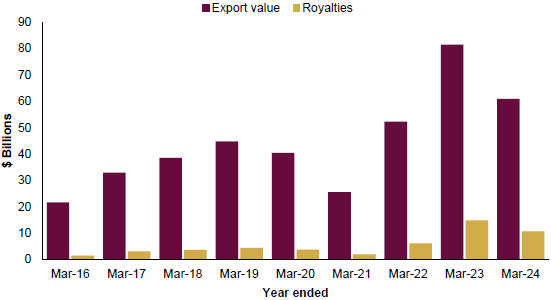

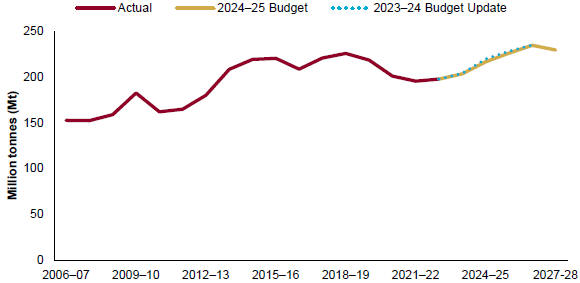

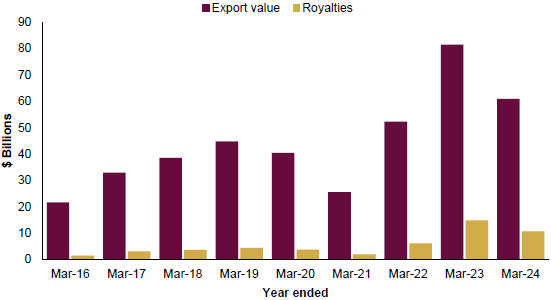

The Queensland resources sector is supporting strong labour market outcomes and driving ongoing economic growth, as it remains buoyed by elevated global commodity prices.

The elevated commodity prices seen in recent years, particularly for coal, have provided Queensland’s resources industry with a substantial boost in revenues and profitability. ABS data show that across the period from July 2021 to March 2024, Queensland’s coal industry benefitted from an additional $88 billion in export revenues compared with the same period just three years earlier (i.e. July 2018 to March 2021).

Queensland’s new progressive royalty tiers, announced in the 2022–23 Queensland Budget, are ensuring that Queenslanders are receiving a fair share of this windfall, reflecting an appropriate return on their valuable and non-renewable resources.

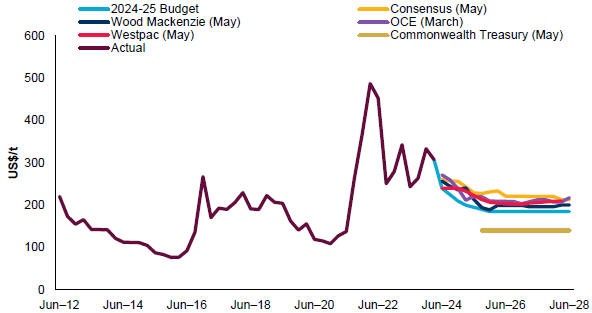

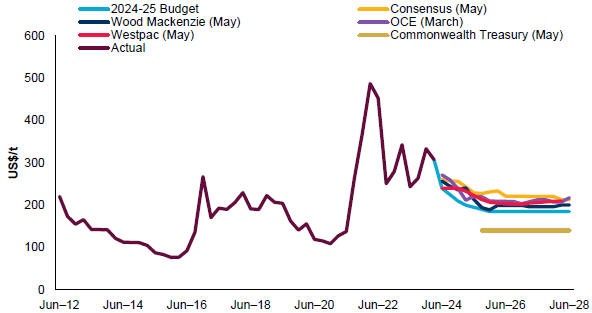

Coal prices are expected to continue to decline over the next 18 months. The premium hard coking coal spot price fell sharply in March 2024, from US$314 per tonne at the end of February to US$243 per tonne at the end of April. This reflected a decline in steel demand in China and India and improving supply conditions. Looking forward, as supply conditions continue to normalise, the hard coking coal spot price is expected to continue to moderate towards medium-term fundamentals.

10

Budget Strategy and Outlook 2024-25

Accordingly, the revenue raised from the new tiers — which only take effect during periods of high prices — will decline over time. However, their continuing operation will ensure Queenslanders share appropriately in the prosperity from any unforeseen spikes in coal prices into the future.

The 2024–25 Queensland Budget continues the government’s commitment to reinvest the additional revenue received from the high global prices for the state’s resources directly back into Queensland communities.

More specifically, the increased fiscal capacity provided by the new progressive royalty tiers has enabled the government to continue to address the immediate cost-of-living challenges facing Queenslanders and invest in the necessary foundations for long-term economic growth and prosperity, such as the Queensland Energy and Jobs Plan (QEJP).

In particular, this year’s Budget includes a commitment to $3.739 billion in new and expanded measures in 2024–25 to support Queenslanders in tackling cost-of-living challenges. This includes a $1,300 Cost of Living Rebate on electricity bills for all Queensland households in 2024–25, consisting of a $1,000 Cost of Living Rebate from the Queensland Government and a $300 rebate from the Australian Government.

The 2024–25 Budget cost-of-living measures are responding to the pressures confronting Queensland households arising from a unique set of circumstances. These pressures will ease as inflation falls, real wages continue to grow, significant Australian Government income tax cuts are delivered from 1 July 2024, and interest rates in time begin to fall. Further details on the government’s cost-of-living measures are included in Box 1.1.

The government has also committed to substantial additional investments to enhance delivery of essential services such as health and education and to build stronger, safer communities across the state. This includes implementation of government policies such as the Queensland Women and Girls’ Health Strategy 2032, the Community Safety Plan for Queensland, the Putting Queensland Kids First early support package, and the Free Kindy program.

This substantial support and investment will help ensure all Queenslanders can participate in, and benefit from, Queensland’s growing economy and enjoy enhanced quality of life delivered through increased economic and employment opportunities.

Through the ongoing implementation of the government’s economic strategy, the Budget maintains the government’s focus on growing a more sustainable and diversified economy that is resilient, productive, competitive and able to readily respond to future opportunities and challenges, including the ongoing decarbonisation of the global economy.

As well as underpinning Queensland’s recent economic success, the government’s investments in key enablers of growth continue to support the broader transformation of the Queensland economy. These investments are positioning the state as a highly dynamic and competitive investment location and attracting new private sector investment opportunities across an increasingly diversified and decarbonised industrial base.

Of note, this includes the ongoing implementation of industry and workforce strategies, including the QEJP, Queensland Resources Industry Development Plan, Queensland Critical Minerals Strategy, Queensland Trade and Investment Strategy 2022–2032, and the Queensland New-Industry Development Strategy.

11

Budget Strategy and Outlook 2024-25

The government also continues to invest in innovation and skills development to support ongoing growth, including through the Advance Queensland – Innovation for a Future Economy 2022–2032 Roadmap, Our Thriving Digital Future: Queensland’s Digital Economy Strategy, and the Good people. Good jobs: Queensland Workforce Strategy 2022–2032.

In line with the government’s focus on fostering innovation and skills, the Queensland and Australian Governments are investing approximately $465 million each to partner with PsiQuantum and make a major breakthrough in Australia’s quantum computing capabilities.

On the back of this investment, PsiQuantum will build the world’s first commercial-scale fault tolerant quantum computer, establish its Asia-Pacific headquarters and regional hub in Brisbane, and provide opportunities for advanced manufacturing, advanced technology supply chains and higher education to the Australian quantum ecosystem. With applications across health and pharmaceuticals, chemicals, energy, security, and food production, quantum computing will tackle some of the most urgent challenges faced by society.

The investment of $89.7 million over 5 years to develop and deliver the Quantum and Advanced Technologies Strategy, released in October 2023, and the Queensland Quantum Academy, has the potential to leverage billions of dollars in direct investment by the company and will create up to 400 new highly skilled ongoing jobs.

By delivering these ongoing and new initiatives, the government is facilitating the development of emerging industries that are anticipated to play an increasingly important role in the state’s economy, while also supporting traditional industries such as mining, agriculture and tourism, which will still continue to drive significant levels of economic activity and growth into the future.

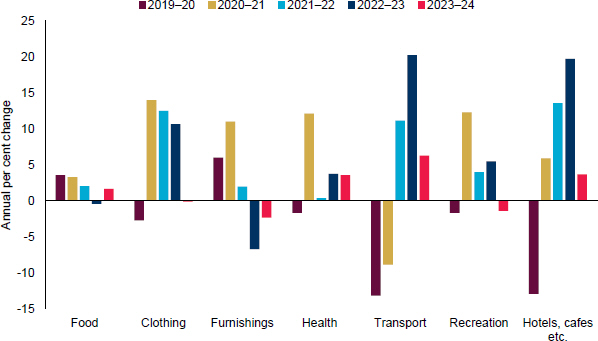

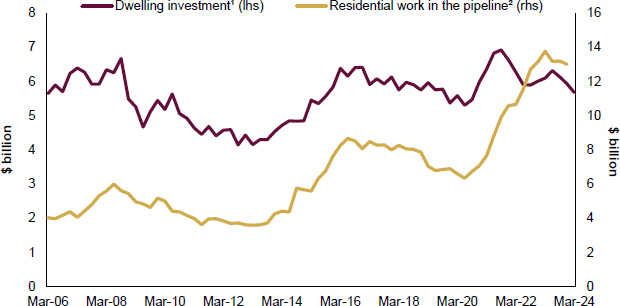

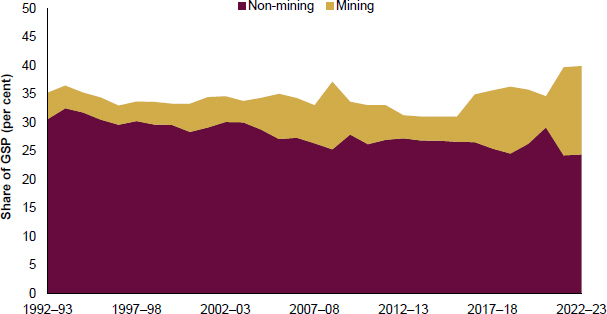

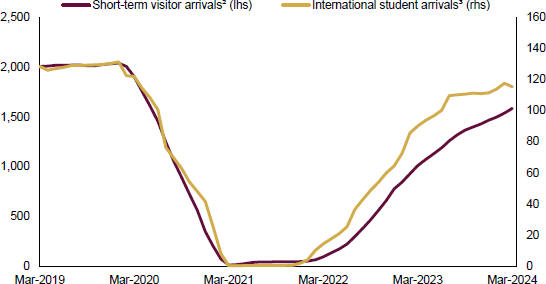

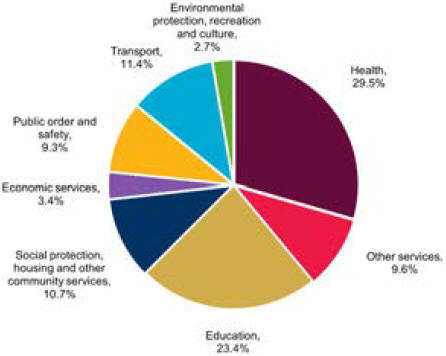

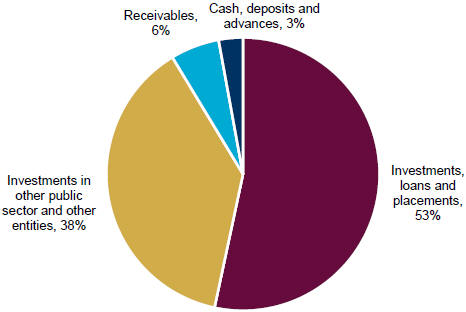

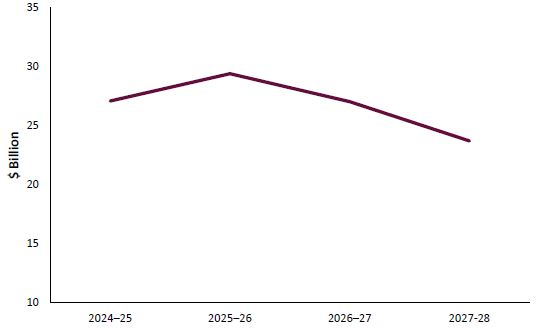

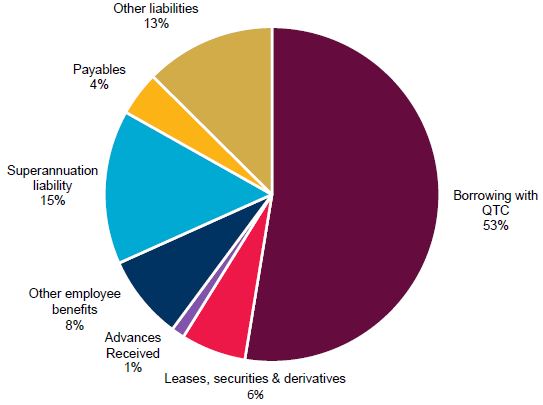

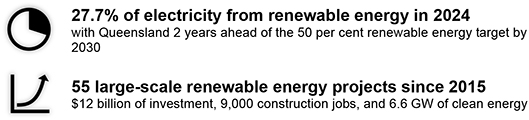

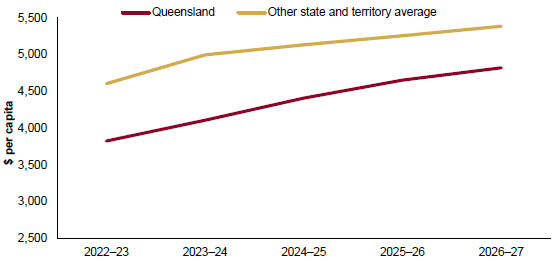

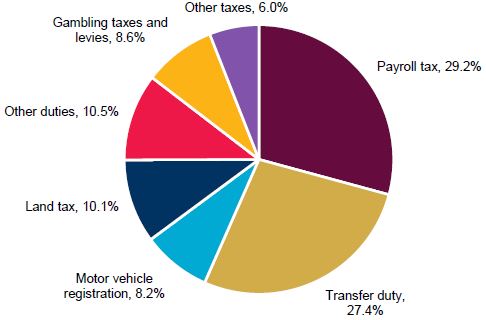

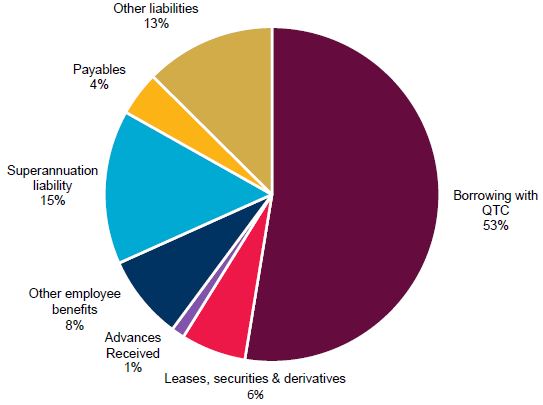

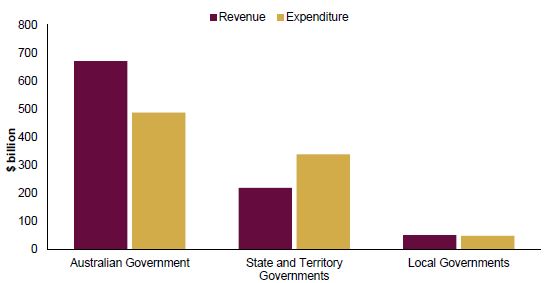

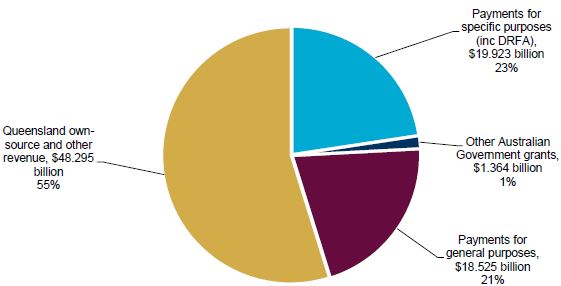

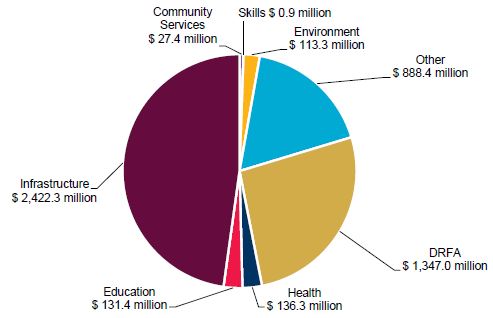

Underpinning the ongoing transformation of the Queensland economy to a clean future are the Clean Economy Jobs Act 2024 and Energy (Renewable Transformation and Jobs) Act 2024 which enshrines the changes to Queensland’s energy grid into law.