| 20 | Key management personnel | |

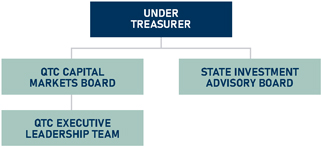

Key management personnel are defined as those persons having authority and responsibility for planning, directing and controlling the activities of QTC, being members of the Board and the Executive Leadership Team.

QTC has delegated its powers to its two boards, the CMB and SIAB. Both boards are appointed by the Governor in Council, pursuant to section 10(2) of the Act. The CMB has been delegated the governance role over QTC by the Under Treasurer.

| (b) | Remuneration principles | |

Capital Markets Board - Directors

Any changes to Board remuneration require consideration by Queensland Treasury and the Department of the Premier and Cabinet to ensure remuneration is commensurate with government policy. Cabinet endorsement of any changes is required prior to approval by the Governor in Council. Remuneration was last increased effective 21 September 2023.

State Investment Advisory Board - Directors

When the Long Term Asset Advisory Board was renamed and reconstituted as SIAB on 4 July 2019, external Board members were appointed who were entitled to remuneration. Remuneration for the external Board members was set by Queensland Treasury in consultation with the Department of the Premier and Cabinet prior to approval by the Governor in Council.

Executives and employees

QTC employees (including the Executive Leadership Team) are employed on individual contracts and are appointed pursuant to the Act. As the majority of QTC’s employees are sourced from the financial markets in which it operates, QTC’s employment practices are competitive with these markets. The remuneration framework comprises both fixed and variable remuneration (in the form of an annual short-term incentive (STI) opportunity), which are approved by the QTC Board annually. The fixed remuneration component is market-competitive and the variable remuneration component is linked to individual and corporate performance.

Remuneration governance

The Human Resources Committee of the Board is responsible for governance of remuneration practices and arrangements, with the Board maintaining ultimate responsibility and decision making for remuneration matters. QTC receives annual industry benchmarking data from the Financial Institutions Remuneration Group (FIRG) and Aon Hewitt, where applicable, which captures remuneration data from organisations within the financial services industry. Analysis and advice are obtained from external consultants to ensure that QTC continues to align roles to the market.

Total compensation

The total compensation fixed remuneration for QTC employees is reviewed each year and is benchmarked against the FIRG remuneration data and Aon Hewitt, where applicable. Total compensation levels were set around the FIRG market median position of a relevant sub-set of the FIRG database. Role scope and complexity, knowledge experience, skills and performance were considered when determining the remuneration level of each employee.

Variable remuneration - short-term incentives for employees

QTC’s variable remuneration framework provides an annual Short-Term Incentive (STI) opportunity for eligible employees, aligned to financial year individual and corporate performance. This opportunity is designed to differentiate and reward performance. It also aims to ensure market competitiveness, with ‘target’ STI outcomes aligned to the relevant market position of the FIRG database (i.e. the median incentive potential for FIRG members within QTC’s peer group) and approved at Board level each year. For the year ended 30 June 2024, STI payments will be made to eligible staff in September 2024.

Subject to meeting certain criteria, the STI of eligible employees may be deferred.

Variable remuneration - short term incentives for the Executive Leadership Team

Members of the Executive Leadership Team (ELT), excluding members on secondment to QTC, are eligible for an STI if their performance meets or exceeds corporate and individual key performance indicators. STIs are at risk with no payment made for underperformance and additional premiums of up to 30% of the target paid for above expected performance.

STI payments are based on a percentage of individual total fixed remuneration with the STI ‘target’ range for permanent ELT members of between 40% and 50%. The total STI entitlement for the ELT includes the STI deferral between 25% and 40%, which is to be paid over 24 months comprising two deferral periods:

| ∎ | | 50% of the deferred amount paid out at the conclusion of 12 months after the original STI was determined, and | |

| ∎ | | 50% of the deferred amount paid out at the conclusion of 24 months after the original STI was determined. | |

Payment of the deferred STI will be subject to satisfying the criteria outlined in the Risk Gateway, which is defined in the QTC Remuneration Framework. At the end of each deferral period, a report prepared on the criteria in the Risk Gateway will be assessed by the Board to determine whether the deferred STI will vest.

QTC’s overall performance for 2023-24, documented in the annual performance assessment reviewed and approved by QTC’s Board, was assessed as exceeding the benchmark. This reflects the performance achieved across QTC’s whole-of-State, client, funding, and operational activities. This performance assessment led to individual STIs for the Executive Leadership Team of between 40% and 60% of fixed remuneration.

The STI deferral has been fully expensed in 2023-24 and recognised as a long-term employee benefit.