performance of Queensland’s labour and housing markets in 2024–25, with flow on impacts expected on the revenue base and growth of these key taxes across the forward estimates period.

Beyond 2024–25, total taxation revenue is expected to grow by around 5.7 per cent per annum on average over the three years to 2027–28, but with the annual rate of growth easing over the period. In addition to the ongoing strength of payroll tax and transfer duty, this solid growth also reflects broad-based growth across most other key taxes in line with the expected performance of the Queensland economy and labour market.

The revised outlook for taxation also incorporates the impact of the Government’s election commitments to provide targeted tax exemptions to first home buyers and patients visiting their GP.

Royalties

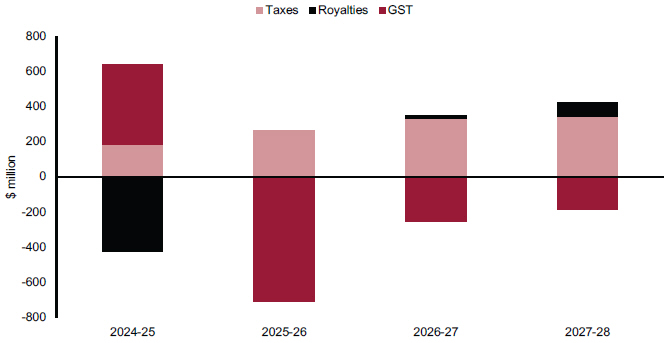

Royalty revenue is expected to total $7.984 billion in 2024–25, $4.787 billion (37.5 per cent) lower than in 2023–24 and $421.4 million (5.0 per cent) lower than forecast at the 2024–25 Budget. The downward revision is largely driven by lower than anticipated coal export volumes combined with a faster-than-expected decline in hard coking coal prices, which were only partly offset by a weaker Australian dollar.

Beyond 2024–25, the outlook for total royalties is broadly unchanged compared to the 2024–25 Budget, with further declines in royalty revenue still expected in coming years as commodity prices continue to normalise, before royalty revenue broadly stabilises from 2027–28.

GST

Queensland’s GST revenue is estimated to total $18.979 billion in 2024–25, $304.4 million (1.6 per cent) lower than in 2023–24, and up $453.6 million compared with the outlook at the time of the 2024–25 Budget.

As outlined in the Budget, the expected decline from 2023–24 reflects the Commonwealth Grants Commission’s recommendation in its 2024 Update report that Queensland receive a smaller share of the GST pool in 2024–25 compared with 2023–24. This impact has only partially been offset by impacts of the Australian Government’s upgrades to the national GST pool in 2024–25, as outlined in the Commonwealth MYEFO.

Reflecting a range of factors that present downside risks to Queensland’s GST, Queensland’s GST revenue is forecast to decline again in 2025–26 by 5.6 per cent. Following this, GST revenue is forecast to grow strongly, by 13.9 per cent in 2026–27 and then 16.3 per cent in 2027–28. These increases are driven by anticipated ongoing growth in the national GST pool and the expectation that the impacts of the higher coal royalties on Queensland’s share of GST will continue to reduce as coal prices continue to moderate.

The Australian Government’s MYEFO forecast an increase in the national GST pool across all years of the forward estimates compared with their previous 2024–25 Budget forecasts. However, there is ongoing uncertainty around the speed of recovery in national consumption in the context of ongoing risks to national and global economic growth.

Further, there are a range of other factors influencing Queensland’s GST share in the short term and across the forecast period, including the ongoing impacts of previous high royalties on Queensland’s GST share and uncertainty around the potential outcomes of the Commonwealth Grants Commission’s 2025 Methodology Review.

A range of other parameters impacting Queensland’s GST revenue outlook have also been updated to reflect outcomes from other state and territory 2024–25 Budgets.