UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement | o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| o | Definitive Proxy Statement | |||||

| þ | Definitive Additional Materials | |||||

| o | Soliciting Material Pursuant to §240.14a-12 |

Denny’s Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Denny’s Corporation

Response to

Dissident Arguments

Response to

Dissident Arguments

In its letter dated April 30, 2010, the dissident group

continues to misrepresent the facts and make false

allegations. The following slides are intended to

address those latest claims and correct the

misrepresentations they contain.

continues to misrepresent the facts and make false

allegations. The following slides are intended to

address those latest claims and correct the

misrepresentations they contain.

1

5/1/2010

2

Dissident Arguments:

a. Company is reducing franchise fees on

Flying J units

Flying J units

* THERE IS NO REDUCTION OF ANYTHING *

Facts:

§ Denny’s is NOT reducing any fees on the Flying J units

§ Denny’s has partnered with franchisees to establish two programs that will

enable for the rapid conversion of the Flying J restaurant sites:

enable for the rapid conversion of the Flying J restaurant sites:

§ Denny’s has coordinated third party financing

§ Denny’s will allow franchisees who are opening multiple sites to pay their

front end fees over six to twelve months

front end fees over six to twelve months

Dissidents Misrepresent the Facts

b. Denny’s has given a false impression of its

Free Cash Flow

Free Cash Flow

§ Denny’s has been consistent and transparent in how we present our EBITDA and

Free Cash Flow metrics

Free Cash Flow metrics

§ Our reported EBITDA metric is explicitly defined in our credit facility and therefore

of importance to investors as they evaluate our covenant requirements

of importance to investors as they evaluate our covenant requirements

§ The GAAP measure of Cash Flow from Operations includes the negative cash flow

impact from balance sheet runoff associated with the sale of restaurants without

the positive benefit of the restaurant sale proceeds; in our measure both are

excluded and reflect the ongoing cash flow of our new business model

impact from balance sheet runoff associated with the sale of restaurants without

the positive benefit of the restaurant sale proceeds; in our measure both are

excluded and reflect the ongoing cash flow of our new business model

§ In fact, it is the dissidents’ selective use of 2001 and 2002 as part of their

measuring period that distorts the fact that Denny’s has been a strong cash flow

generator, regardless of which methodology one uses

measuring period that distorts the fact that Denny’s has been a strong cash flow

generator, regardless of which methodology one uses

* IT’S THE DEFINITION WE’VE USED IN ALL

OUR PUBLIC RELEASES SINCE 2005 *

OUR PUBLIC RELEASES SINCE 2005 *

Correcting the Facts

5/1/2010

3

Dissident Arguments:

Facts:

d. Denny’s management has rebuffed

attempts for dialogue and cancelled a

meeting with one of the Committee

members at the Stifel Nicolaus

Conference in March

attempts for dialogue and cancelled a

meeting with one of the Committee

members at the Stifel Nicolaus

Conference in March

c. Dissident activity has been the sole driver

of our recent Stock Price appreciation

of our recent Stock Price appreciation

§ See attached pages in the appendix from our previously filed stockholder and

proxy advisory presentations which highlight the positive trend following the

Flying J announcement and our fourth quarter 2009 earnings release

proxy advisory presentations which highlight the positive trend following the

Flying J announcement and our fourth quarter 2009 earnings release

§ Denny’s did not attend the Stifel Nicolaus Conference where it was scheduled to

meet with dissident group member, Soundpost Partners:

meet with dissident group member, Soundpost Partners:

§ Denny’s promptly sent a letter to Soundpost asking to reschedule and the

following week management had a conference call with Jaime Lester of

Soundpost Partners, a Committee member

following week management had a conference call with Jaime Lester of

Soundpost Partners, a Committee member

§ The conversation focused on the Denny’s IR presentation, with the

exception of Mr. Lester asking if a change in control would trigger any

debt covenants or executive compensation payment

exception of Mr. Lester asking if a change in control would trigger any

debt covenants or executive compensation payment

§ Denny’s management also returned Mr. Dash’s 3/31/10 call and offered to set up a

time to speak; but he never responded

time to speak; but he never responded

Dissidents Misrepresent the Facts

* MAJORITY OF APPRECIATION OCCURRED

AFTER FLYING J ANNOUNCEMENT AND Q4

2009 EARNINGS RELEASE *

AFTER FLYING J ANNOUNCEMENT AND Q4

2009 EARNINGS RELEASE *

* WE ARE STILL WAITING FOR MR.

DASH TO CALL US BACK *

DASH TO CALL US BACK *

e. The dissidents criticize the fact that Mr.

Langford serves as a paid consultant to

Denny’s

Langford serves as a paid consultant to

Denny’s

§ Mr. Langford’s work as a paid consultant to Denny’s is well known by the

franchisee community and had the consent of the DFA Board

franchisee community and had the consent of the DFA Board

§ The agreement is strongly supported by franchisees and is a direct outcome of

the conversations that the Company and its franchisees had over the course of

2009

the conversations that the Company and its franchisees had over the course of

2009

§ Mr. Langford has exceptional experience in restaurant operations and

marketing and has been instrumental in helping address system-wide issues

and improve communications and partnership between the Company and

franchisees

marketing and has been instrumental in helping address system-wide issues

and improve communications and partnership between the Company and

franchisees

* THE FRANCHISEES WANTED THIS

ARRANGEMENT AND IT HAS WORKED

VERY WELL FOR THEM AND THE

COMPANY *

ARRANGEMENT AND IT HAS WORKED

VERY WELL FOR THEM AND THE

COMPANY *

Correcting the Facts

4

Dissident Arguments:

Facts:

Dissidents Misrepresent the Facts

5/1/2010

f. The Chairman of the Denny’s Franchisee

Association (DFA) is not speaking on

behalf of all franchisees

Association (DFA) is not speaking on

behalf of all franchisees

§ The Company and its franchisees have worked in a collaborative fashion to

revitalize the Denny's brand and both parties agree that significant progress has

been made

revitalize the Denny's brand and both parties agree that significant progress has

been made

§ The dissidents continued misunderstanding of and lack of respect for the DFA

demonstrates that they are ill-suited to serve on the Board of a company with a

franchise-based business model

demonstrates that they are ill-suited to serve on the Board of a company with a

franchise-based business model

§ As with any association, it will never represent the exact views of every single

member at every point in time, but it absolutely speaks on behalf of the Denny’s

franchisee community

member at every point in time, but it absolutely speaks on behalf of the Denny’s

franchisee community

* THE CHAIRMAN OF THE DFA, AND ITS

12 MEMBERS, REPRESENT 85% OF ALL

FRANCHISED RESTAURANTS *

12 MEMBERS, REPRESENT 85% OF ALL

FRANCHISED RESTAURANTS *

g. Mr. Marchioli and Mr. Barber have an

agreement in the works for Mr. Barber to

take over the supply chain purchasing

arm of Denny’s

agreement in the works for Mr. Barber to

take over the supply chain purchasing

arm of Denny’s

§ This is patently false and inaccurate and further illustrates the dissidents’

disruptive efforts to promote dissension among the Company’s franchisees

and their lack of understanding about how a heavily franchised business

model works

disruptive efforts to promote dissension among the Company’s franchisees

and their lack of understanding about how a heavily franchised business

model works

§ The concept of a Purchasing Cooperative is a standard one within a

franchised business and is always on the table as a viable option and it will be

considered and implemented if and when it proves to be in the best interest of

the company, its franchisees, and its shareholders

franchised business and is always on the table as a viable option and it will be

considered and implemented if and when it proves to be in the best interest of

the company, its franchisees, and its shareholders

§ Absolutely no decisions have been made regarding the Company’s

purchasing program and none will be made in the context of this proxy

contest

purchasing program and none will be made in the context of this proxy

contest

§ Any decision regarding a Purchasing Cooperative would be made by the

Company in the normal course of business

Company in the normal course of business

* NO SUCH AGREEMENT EXISTS *

Correcting the Facts

History of “Creeping Control” and

Misrepresenting Intentions

Misrepresenting Intentions

Source: Company filings and publicly available information as of April 30, 2010. (1) Incorporated by reference to original 13-D.

Biglari Holdings

(f.k.a. Steak n Shake)

Western Sizzlin

“[Dissidents] are not seeking control

of the Board of Directors at the

Annual Meeting”

of the Board of Directors at the

Annual Meeting”

-Definitive Proxy Filing, 2/11/2008

- Addt’l Solicitation material 2/21/2008

“[Dissidents are] seeking Board

representation. Except as set

forth above, the Reporting

Persons have no present plans

or intentions that would result

in…any change in the present

board of directors or

management of the issuer.”(1)

representation. Except as set

forth above, the Reporting

Persons have no present plans

or intentions that would result

in…any change in the present

board of directors or

management of the issuer.”(1)

- 11/10/2005 13-D

Denny’s

“[Dissidents] are not seeking

control of Denny’s. In fact, as

clearly disclosed in our proxy

statement, we are only seeking

minority representation on the

board.”

control of Denny’s. In fact, as

clearly disclosed in our proxy

statement, we are only seeking

minority representation on the

board.”

- 4/30/2010 Fight Letter

?

Ø Only 1 of 9 original directors still on

Board 2 years after Biglari

nominated

Board 2 years after Biglari

nominated

Ø Biglari assumed Chair, CEO and

President roles within 5 months of

joining Board; eventually renamed

the Company after himself

President roles within 5 months of

joining Board; eventually renamed

the Company after himself

Ø Premium paid for control = 0%

Ø 6 of 9 directors resign on Biglari’s

nomination to the Board

nomination to the Board

Ø Dash appointed to the Board within a

month

month

Ø In less than a year, Biglari usurps full

control of all investment decisions

control of all investment decisions

Ø Premium paid for control = 0%

Appendix

7

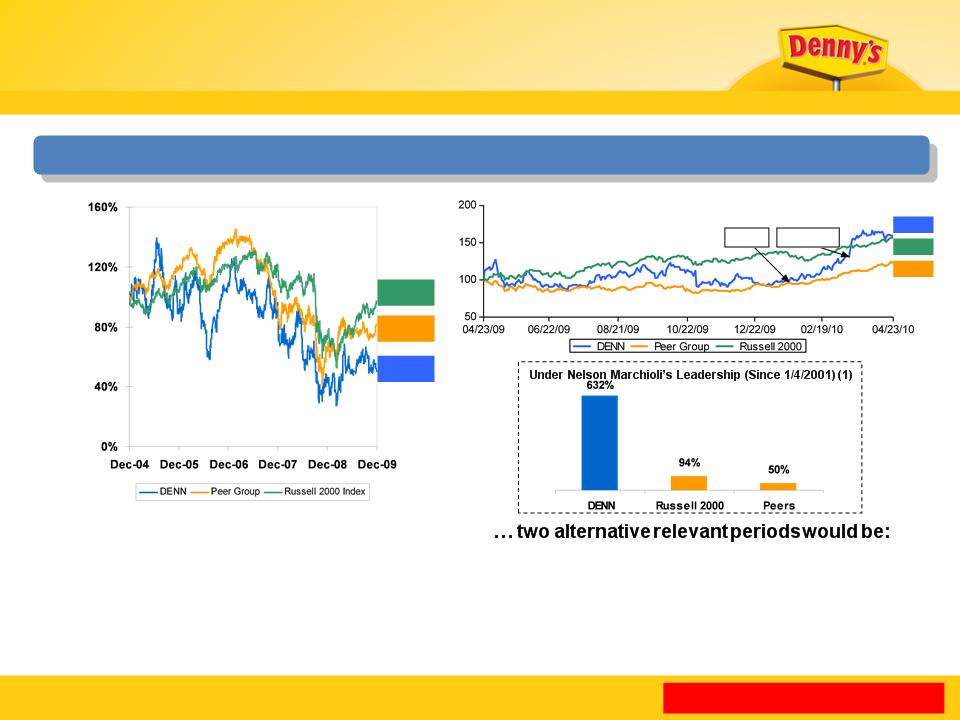

Dissident Claims About Stock Price Performance are Misleading

Share Price Performance

Dissidents focused on 5-year period

ending Dec. 2009 when arguably…

ending Dec. 2009 when arguably…

Note: Peer group consists of Burger King, Bob Evans Farms, Buffalo Wild Wings, Cracker Barrel,

O’Charley’s, CKE Restaurants, California Pizza Kitchen, Domino’s Pizza, Darden Restaurants, Brinker

International, DineEquity, Jack in the Box, Panera Bread Company, Papa John’s, Red Robin Gourmet

Burgers, Ruby Tuesday, Steak n’ Shake, Sonic, Texas Roadhouse and Wendy’s/Arby’s Group.

O’Charley’s, CKE Restaurants, California Pizza Kitchen, Domino’s Pizza, Darden Restaurants, Brinker

International, DineEquity, Jack in the Box, Panera Bread Company, Papa John’s, Red Robin Gourmet

Burgers, Ruby Tuesday, Steak n’ Shake, Sonic, Texas Roadhouse and Wendy’s/Arby’s Group.

(1) As of 4/23/2010. Does not include reinvestment of dividends.

§ Last twelve months (April 2009 - April 2010); or

§ Since Nelson Marchioli appointed CEO (1/4/01)

In either case, DENN has significantly

outperformed peers and overall market

outperformed peers and overall market

3%

(7%)

(51%)

Last Twelve Months (April 2009 - April 2010) (1)

Dissidents Misrepresent the Facts

57%

24%

61%

Flying J

Announcement

13-D Filed

5/1/2010

8

Source: Factset, Company filings and Wall Street equity research as of April 23, 2010.

Price

Volume

(‘000s)

(‘000s)

Stock Price Performance

Last Twelve Months

61%

5/1/2010

9

Timeline of Dissident Events

8/26/2009

Walsh calls

Denny’s; typical

investor call

Denny’s; typical

investor call

4/14/2010

Denny’s 1st

Fight Letter

released

Fight Letter

released

3/16/2010

Dissidents

release letter

outlining

arguments

against current

Denny’s Board

release letter

outlining

arguments

against current

Denny’s Board

1/21/2010

Dissidents file

first 13-D

first 13-D

3/2/2010

Dissidents

announce intent

to nominate 3

directors

announce intent

to nominate 3

directors

8/27/2009

Oak Street and

Walsh begin to

accumulate

shares

Walsh begin to

accumulate

shares

January 2010

February

April

March

Dec.

Nov.

Oct.

Sept.

Aug.

2009

2009

11/25/2009

Lyrical begins to

accumulate

shares

accumulate

shares

12/15/2009

Soundpost begins

to accumulate

shares

to accumulate

shares

12/21/2009

Dash begins

to accumulate

shares

to accumulate

shares

1/13/2010

Arbor begins

to accumulate

shares

to accumulate

shares

9/2009

Walsh calls several more

times with questions; asks

to speak with CEO (1)

times with questions; asks

to speak with CEO (1)

(1) Denny’s IR leadership used the same criteria in determining that the IR director, not the CEO, would remain the main point of contact with Oak Street.

10/2009

David Makula

leaves voicemail

asking to speak to

CEO. Denny’s

follow-up not

returned

leaves voicemail

asking to speak to

CEO. Denny’s

follow-up not

returned

3/16/2010

Denny’s sends

letter to Oak

Street to open the

door for

conversation; no

response

letter to Oak

Street to open the

door for

conversation; no

response

3/19/2010

Denny’s has

conference call with

Jaime Lester of

Soundpost, who

asked if a change in

control would trigger

any executive

compensation or debt

covenants

conference call with

Jaime Lester of

Soundpost, who

asked if a change in

control would trigger

any executive

compensation or debt

covenants

3/31/2010

Jonathan Dash calls

Rob Marks; call is

returned by IR

leadership and CFO,

but no response from

Dash

Rob Marks; call is

returned by IR

leadership and CFO,

but no response from

Dash

For Over 5 Months (October to March) the Dissidents Did Not Reach Out And When They Did, It

Was With Their Fight Letter

Was With Their Fight Letter

Our Attendance at 5 Conferences and Roadshows in 6 Cities From June 2009 Through January

2010 Demonstrate That We Have Been Active and Accessible

2010 Demonstrate That We Have Been Active and Accessible

5/1/2010

10

Denny’s Corporation urges caution in considering its current trends and any outlook on earnings disclosed in this

presentation. In addition, certain matters discussed may constitute forward-looking statements. These forward-looking

statements involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its

subsidiaries and underlying restaurants to be materially different from the performance indicated or implied by such

statements. Words such as “expects”, “anticipates”, “believes”, “intends”, “plans”, “hopes”, and variations of such words

and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the

Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances

after the date of this presentation or to reflect the occurrence of unanticipated events. Factors that could cause actual

performance to differ materially from the performance indicated by these forward-looking statements include, among others:

the competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives,

advertising and promotional efforts; adverse publicity; changes in business strategy or development plans; terms and

availability of capital; regional weather conditions; overall changes in the general economy, particularly at the retail level;

political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC

reports, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item

1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 30, 2009.

presentation. In addition, certain matters discussed may constitute forward-looking statements. These forward-looking

statements involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its

subsidiaries and underlying restaurants to be materially different from the performance indicated or implied by such

statements. Words such as “expects”, “anticipates”, “believes”, “intends”, “plans”, “hopes”, and variations of such words

and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the

Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances

after the date of this presentation or to reflect the occurrence of unanticipated events. Factors that could cause actual

performance to differ materially from the performance indicated by these forward-looking statements include, among others:

the competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives,

advertising and promotional efforts; adverse publicity; changes in business strategy or development plans; terms and

availability of capital; regional weather conditions; overall changes in the general economy, particularly at the retail level;

political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC

reports, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item

1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 30, 2009.

The Company has filed with the Securities and Exchange Commission ("SEC") and mailed to its stockholders a definitive

proxy statement in connection with its 2010 Annual Meeting of Stockholders. Stockholders are strongly advised to read the

Company's definitive proxy statement and the accompanying WHITE proxy card before making any voting decisions.

Stockholders may obtain copies of the Company's definitive proxy statement, any amendments or supplements to the proxy

statement and other documents filed by the Company with the SEC in connection with its 2010 Annual Meeting of

Stockholders free of charge at the SEC’s website at www.sec.gov, or on the Company's website at www.dennys.com. The

Company, its directors and officers and certain employees may be deemed to be participants in the solicitation of proxies from

stockholders in connection with the Company’s 2010 Annual Meeting of Stockholders. Information concerning persons who

may be considered participants in the solicitation of the Company's stockholders under the rules of the SEC is set forth in the

Company's definitive proxy statement filed with the SEC on April 8, 2010.

proxy statement in connection with its 2010 Annual Meeting of Stockholders. Stockholders are strongly advised to read the

Company's definitive proxy statement and the accompanying WHITE proxy card before making any voting decisions.

Stockholders may obtain copies of the Company's definitive proxy statement, any amendments or supplements to the proxy

statement and other documents filed by the Company with the SEC in connection with its 2010 Annual Meeting of

Stockholders free of charge at the SEC’s website at www.sec.gov, or on the Company's website at www.dennys.com. The

Company, its directors and officers and certain employees may be deemed to be participants in the solicitation of proxies from

stockholders in connection with the Company’s 2010 Annual Meeting of Stockholders. Information concerning persons who

may be considered participants in the solicitation of the Company's stockholders under the rules of the SEC is set forth in the

Company's definitive proxy statement filed with the SEC on April 8, 2010.

Forward Looking Statements &

Solicitation Materials

Solicitation Materials

5/1/2010