May 14 & 15, 2014 Investor Presentation

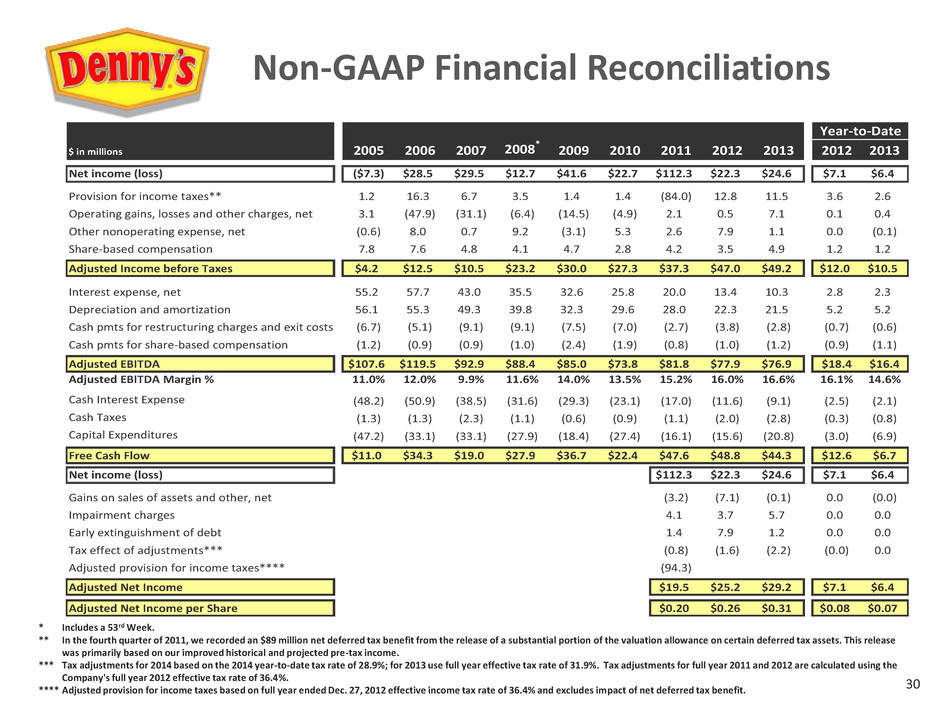

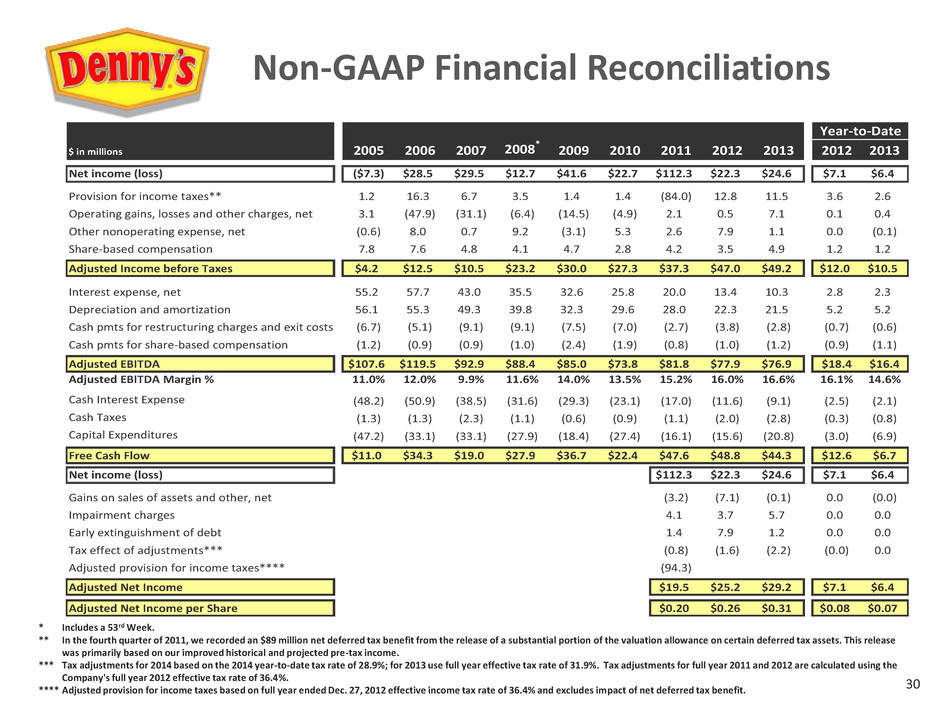

2 Forward-Looking Statements and Non-GAAP Financial Measures Denny’s Corporation urges caution in considering its current trends and any outlook on earnings disclosed in this presentation. In addition, certain matters discussed may constitute forward-looking statements. These forward-looking statements, which reflect the Company’s best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expects”, “anticipates”, “believes”, “intends”, “plans”, “hopes”, and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: the competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives, advertising and promotional efforts; adverse publicity; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy, particularly at the retail level; political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 25, 2013 (and in the Company’s subsequent quarterly reports on Form 10-Q). The presentation includes references to the Company’s non-GAAP financials measures. The Company believes that, in addition to other financial measures, Adjusted Income Before Taxes, Adjusted EBITDA, Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share are appropriate indicators to assist in the evaluation of its operating performance on a period-to-period basis. The Company also uses Adjusted Income, Adjusted EBITDA and Free Cash Flow internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including bonuses for certain employees. Adjusted EBITDA is also used to evaluate its ability to service debt because the excluded charges do not have an impact on its prospective debt servicing capability and these adjustments are contemplated in its credit facility for the computation of its debt covenant ratios. Free Cash Flow, defined as Adjusted EBITDA less cash portion of interest expense net of interest income, capital expenditures, and cash taxes, is used to evaluate operating effectiveness and decisions regarding the allocation of resources. However, Adjusted Income, Adjusted EBITDA, Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share should be considered as a supplement to, not a substitute for, operating income, net income or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations.

3 Denny’s Investment Highlights Iconic brand with 96% brand awareness in the U.S.* and approximately 1,700 restaurants in all 50 states in the U.S. and 11 countries & U.S. territories * Source: Denny’s BrandTracker, Year End 2013. ** See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share (also called Earnings per Share) and Free Cash Flow. Franchised-focused business that is 90% franchised provides lower risk profile with upside from owning meaningful base of high volume restaurants Strong balance sheet enables brand investments while returning of cash to shareholders Growing Earnings per Share** with significant Free Cash Flow** Unlocking long-term growth through brand revitalization and growing number of domestic and international locations in both traditional and non-traditional distribution points

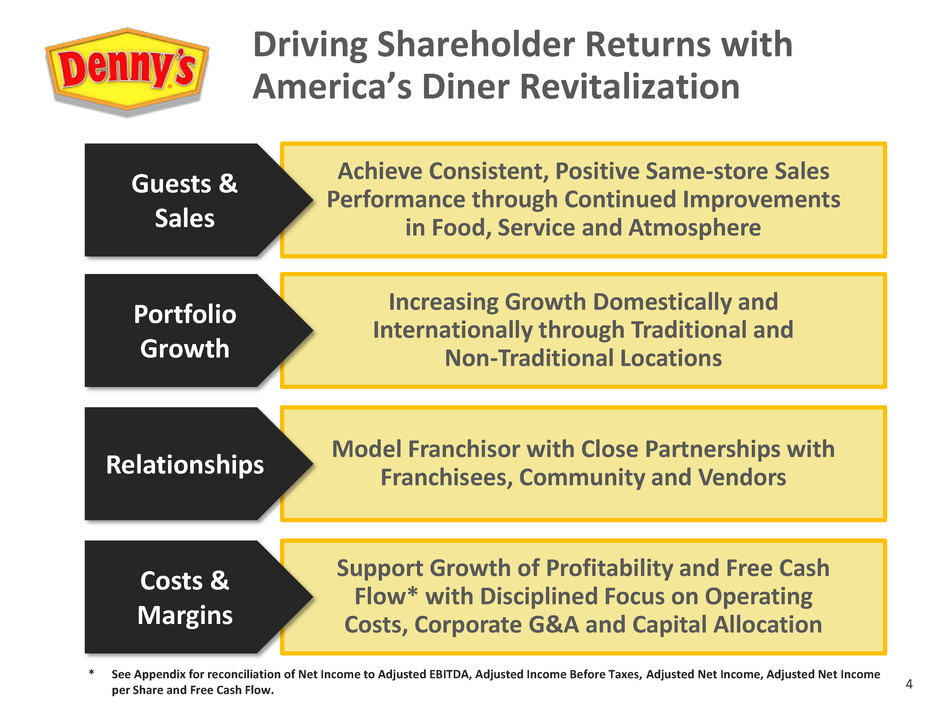

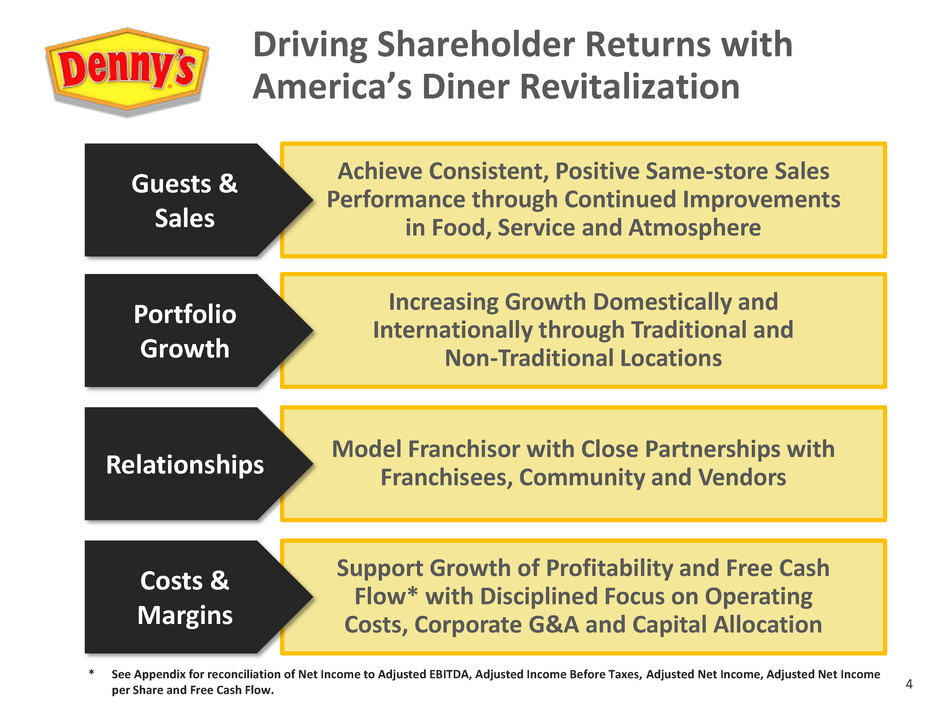

4 Achieve Consistent, Positive Same-store Sales Performance through Continued Improvements in Food, Service and Atmosphere Driving Shareholder Returns with America’s Diner Revitalization Guests & Sales * See Appendix for reconciliation of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share and Free Cash Flow. Increasing Growth Domestically and Internationally through Traditional and Non-Traditional Locations Portfolio Growth Model Franchisor with Close Partnerships with Franchisees, Community and Vendors Relationships Support Growth of Profitability and Free Cash Flow* with Disciplined Focus on Operating Costs, Corporate G&A and Capital Allocation Costs & Margins

5 Driving Guest Traffic with America’s Diner Strategy

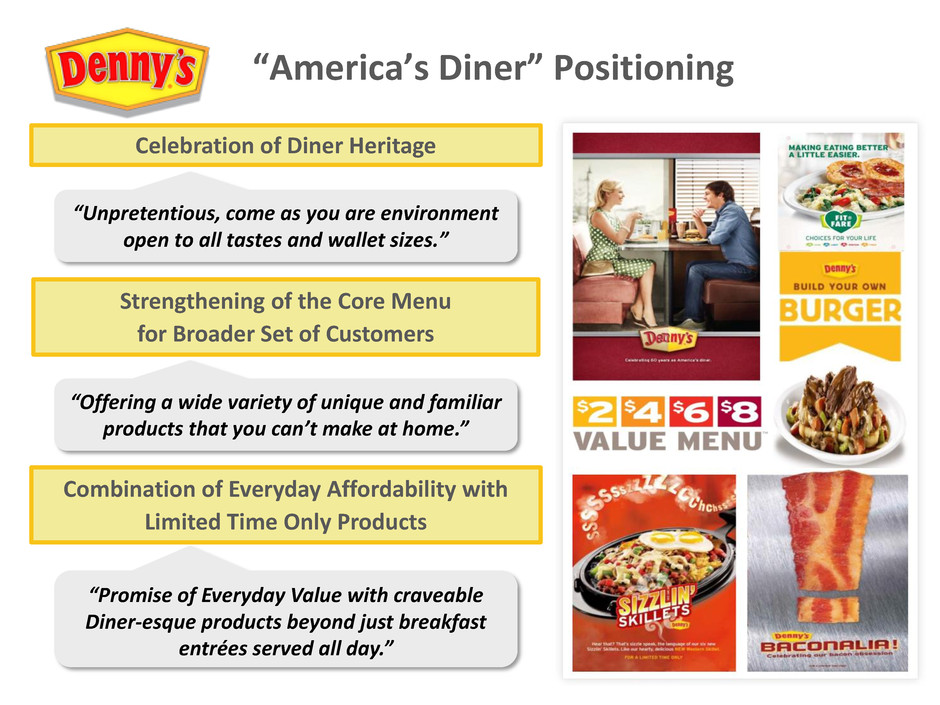

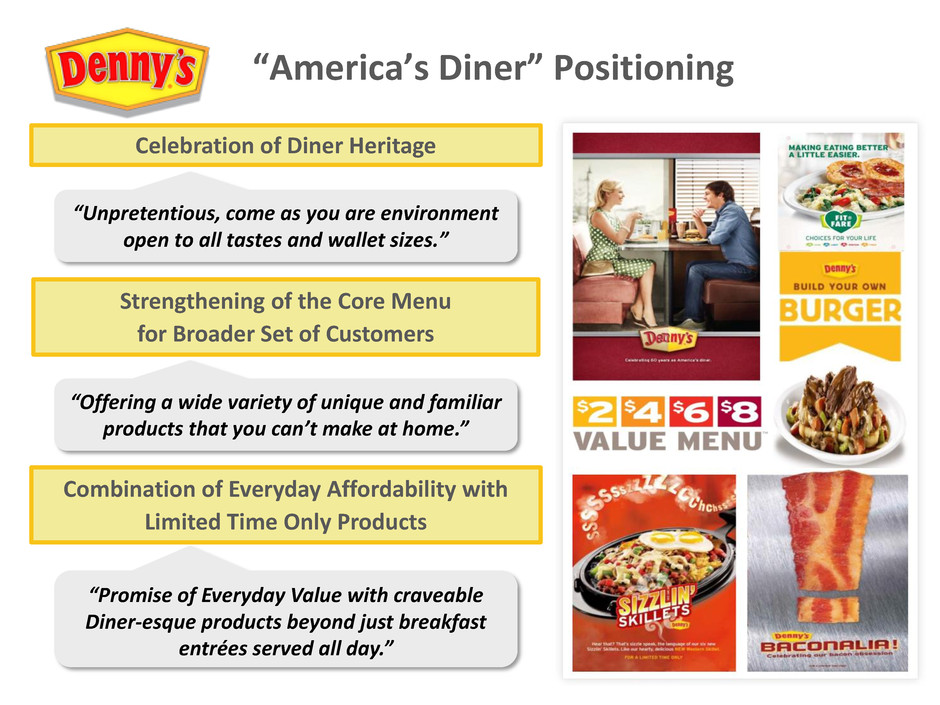

6 “America’s Diner” Positioning “Unpretentious, come as you are environment open to all tastes and wallet sizes.” Celebration of Diner Heritage “Offering a wide variety of unique and familiar products that you can’t make at home.” “Promise of Everyday Value with craveable Diner-esque products beyond just breakfast entrées served all day.” Combination of Everyday Affordability with Limited Time Only Products Strengthening of the Core Menu for Broader Set of Customers

7 Continuous Improvement of Core Menu with Craveable and Unique Products Rolled Out in 2014 Rolled Out in 2011, 2012 & 2013 New Core Menu

8 Leading Everyday Value Platform Provides attractive price points for customers at all dayparts helping drive 1 in 5 visits Achieved over 75% brand awareness with average incidence rate in 19% to 21% range since national launch Consistently refresh some products and utilize local and national media targeting popular products like $4 Everyday Value Slam

9 Strong and Consistent Pipeline of Limited Time Only Products High quality offerings for breakfast, lunch and dinner providing tiered pricing approach combining everyday value and premium offerings

10 50% 55% 60% 65% 70% 75% 80% 2010 2011 2012 2013 Overall Satisfaction (“OSAT”)* Commitment to deliver consistent, reliable service throughout the brand Driving improvements in guest satisfaction measurements (Speed, Taste, Attentiveness, Restaurant Atmosphere) Guest satisfaction scores improved by almost 10 ppts. over the past three years * End of period data (December) from Denny’s STAR Guest Satisfaction Program managed by Service Management Group. Improving Guest Service

11 New Heritage Remodel Program Common Exterior Look for Older Restaurants

12 New Heritage Remodel Program Common Interior Look for Older Restaurants

13 New Heritage Remodel Program

14 New Heritage Remodel Program

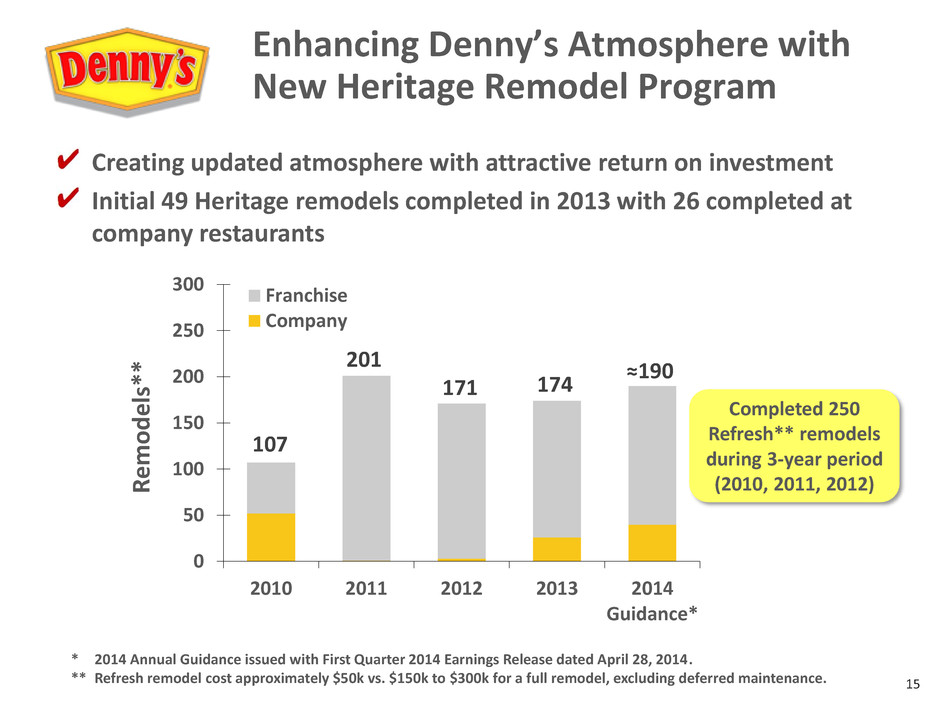

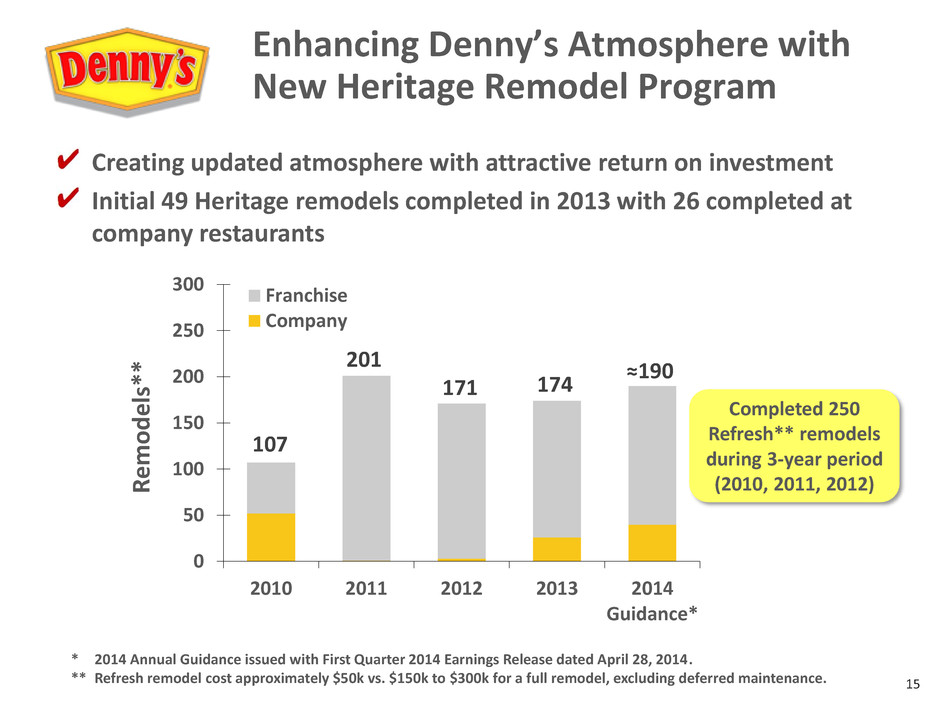

15 Enhancing Denny’s Atmosphere with New Heritage Remodel Program Creating updated atmosphere with attractive return on investment Initial 49 Heritage remodels completed in 2013 with 26 completed at company restaurants 0 50 100 150 200 250 300 2010 2011 2012 2013 2014 Guidance* R emo d els* * Franchise Company * 2014 Annual Guidance issued with First Quarter 2014 Earnings Release dated April 28, 2014. ** Refresh remodel cost approximately $50k vs. $150k to $300k for a full remodel, excluding deferred maintenance. Completed 250 Refresh** remodels during 3-year period (2010, 2011, 2012) 174 201 171 107 ≈190

16 New Restaurant with Heritage Image

17 Redevelopment of location by landlord provides opportunity to rebuild Denny’s highest volume restaurant Rebuilding Denny’s Casino Royale Restaurant in Las Vegas

18 Growing group of 274 franchisees with 37 owning more than 10 restaurants, or 53% of system Utilizing Brand Advisory Councils and Denny’s Franchisee Association (DFA) to drive improvements Leading full-service franchisor providing support through a number of avenues: • In-house purchasing group contracts for the entire system with no product mark-ups • Credit card program utilized in more than 90% of the domestic system to collect fees providing lower risk franchise revenue stream • Short-term loans to franchisees for new coffee equipment and installation of Denny’s POS system • Work closely with third-party lenders by providing limited loan guarantees for new development programs (Flying J, New & Emerging Markets, Heritage Remodel Program) Continue to Grow and Energize Franchise System

19 (12.0%) (10.0%) (8.0%) (6.0%) (4.0%) (2.0%) 0.0% 2.0% 4.0% Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011 Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Denny's System-wide Same-Store Sales (Domestic) Denny's 2-year Same-Store Sales Improving Same-store Sales Driven by Revitalization Strategy * 2014 Annual Guidance issued with First Quarter 2014 Earnings Release dated April 28, 2014. 2014 Annual Guidance* Company Same-Store Sales 2% to 3% Domestic Franchised Same-Store Sales 1% to 2%

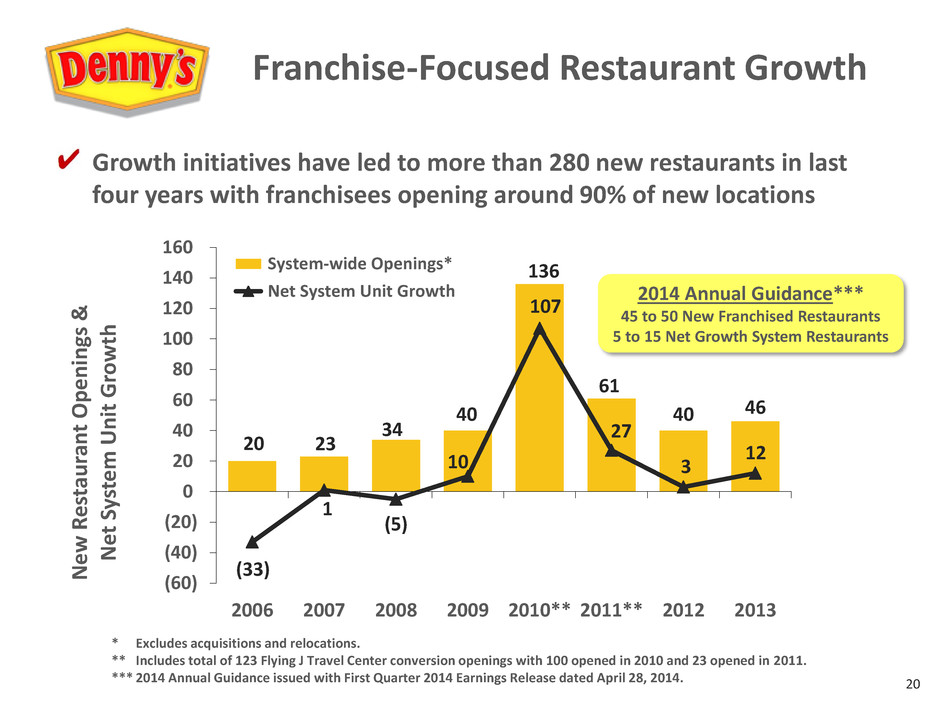

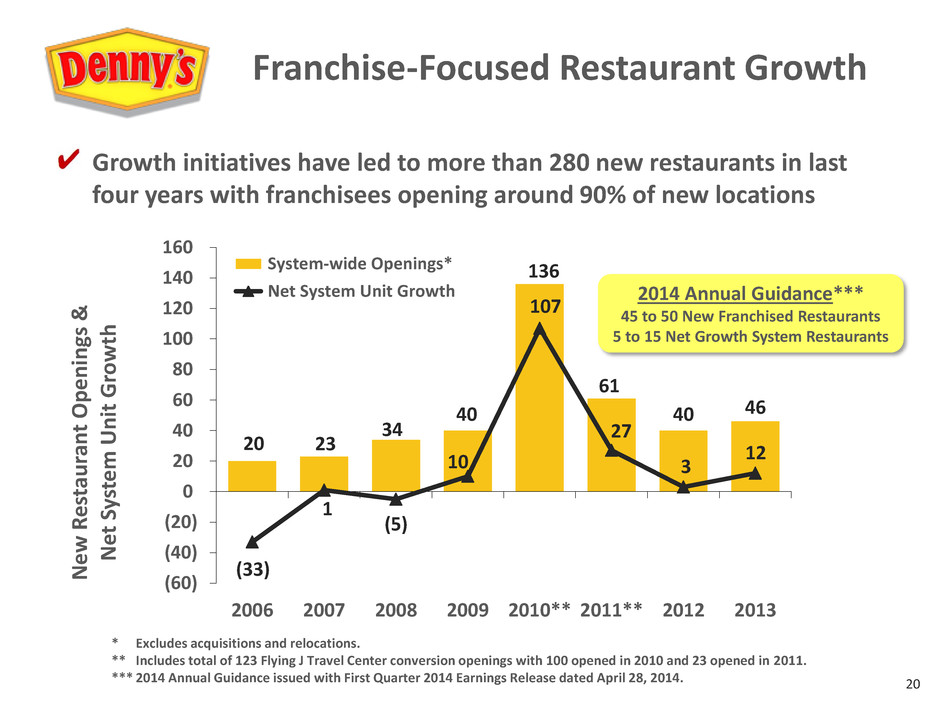

20 20 23 34 40 136 61 40 46 (33) 1 (5) 10 107 27 3 12 (60) (40) (20) 0 20 40 60 80 100 120 140 160 2006 2007 2008 2009 2010** 2011** 2012 2013 New R e st au ra n t Op e n in gs & Net Sy st e m U n it G ro w th System-wide Openings* Net System Unit Growth * Excludes acquisitions and relocations. ** Includes total of 123 Flying J Travel Center conversion openings with 100 opened in 2010 and 23 opened in 2011. *** 2014 Annual Guidance issued with First Quarter 2014 Earnings Release dated April 28, 2014. Franchise-Focused Restaurant Growth Growth initiatives have led to more than 280 new restaurants in last four years with franchisees opening around 90% of new locations 2014 Annual Guidance*** 45 to 50 New Franchised Restaurants 5 to 15 Net Growth System Restaurants

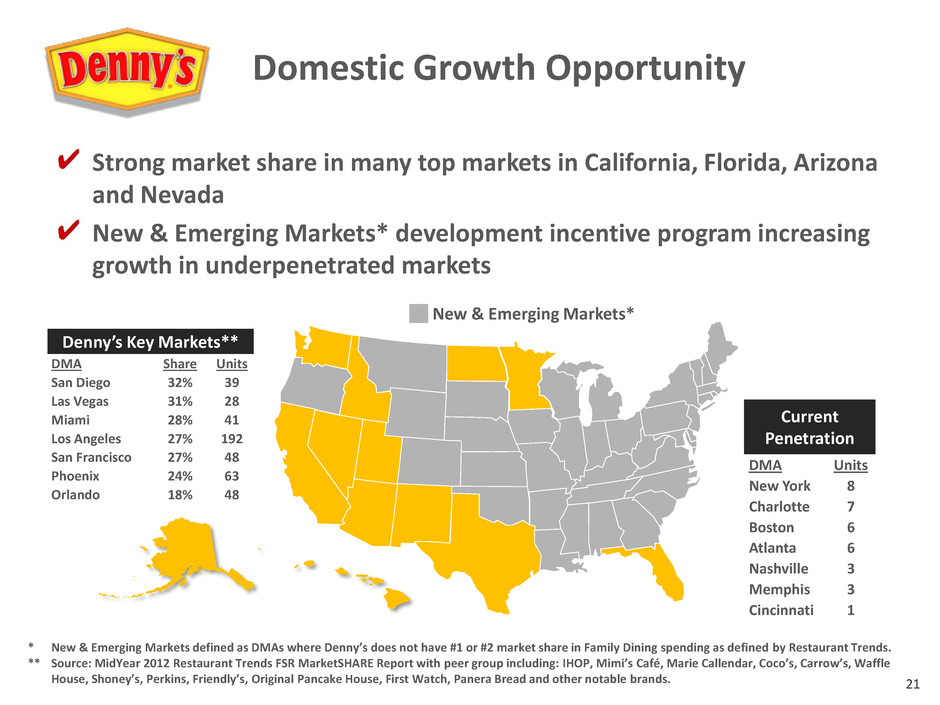

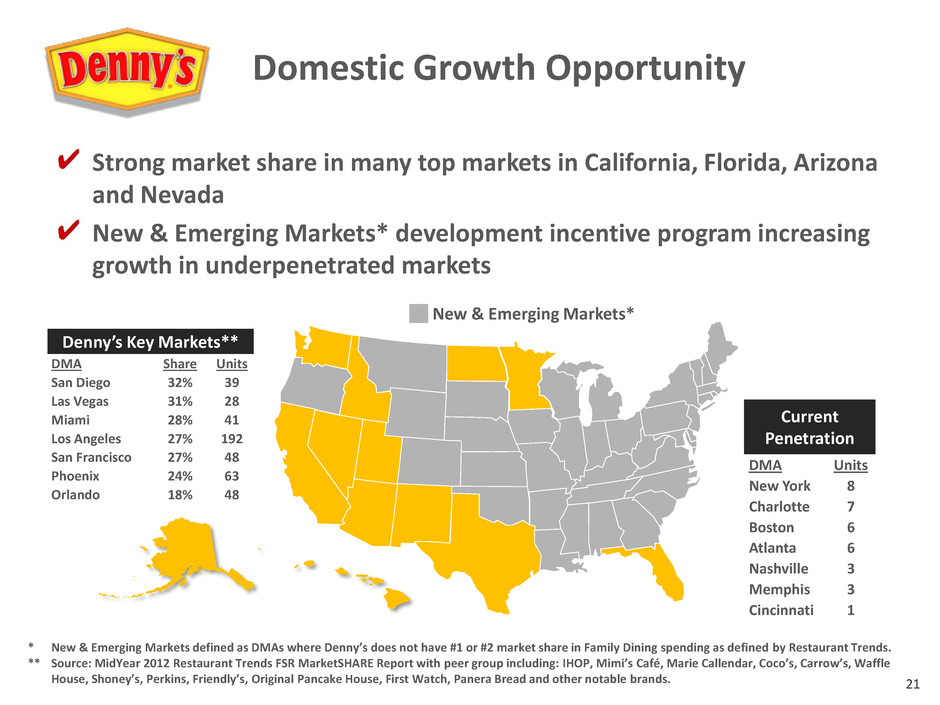

21 Strong market share in many top markets in California, Florida, Arizona and Nevada New & Emerging Markets* development incentive program increasing growth in underpenetrated markets Denny’s Key Markets** DMA Share Units San Diego 32% 39 Las Vegas 31% 28 Miami 28% 41 Los Angeles 27% 192 San Francisco 27% 48 Phoenix 24% 63 Orlando 18% 48 Current Penetration DMA Units New York 8 Charlotte 7 Boston 6 Atlanta 6 Nashville 3 Memphis 3 Cincinnati 1 * New & Emerging Markets defined as DMAs where Denny’s does not have #1 or #2 market share in Family Dining spending as defined by Restaurant Trends. ** Source: MidYear 2012 Restaurant Trends FSR MarketSHARE Report with peer group including: IHOP, Mimi’s Café, Marie Callendar, Coco’s, Carrow’s, Waffle House, Shoney’s, Perkins, Friendly’s, Original Pancake House, First Watch, Panera Bread and other notable brands. New & Emerging Markets* Domestic Growth Opportunity

22 * Although there are approximately 400 Denny’s restaurants in Japan, Denny’s sold all of the rights to the country of Japan in 1984. United States (1,594) Canada (65) Puerto Rico (12) New Zealand (7) Mexico (6) Costa Rica (3) Honduras (3) Guam (2) Curaçao (1) Dominican Republic (1) El Salvador (1) Chile (1) * Growing International Footprint Announced development agreement for Middle East on January 7, 2014 Currently have 102 international restaurants with 16 opened in past three years

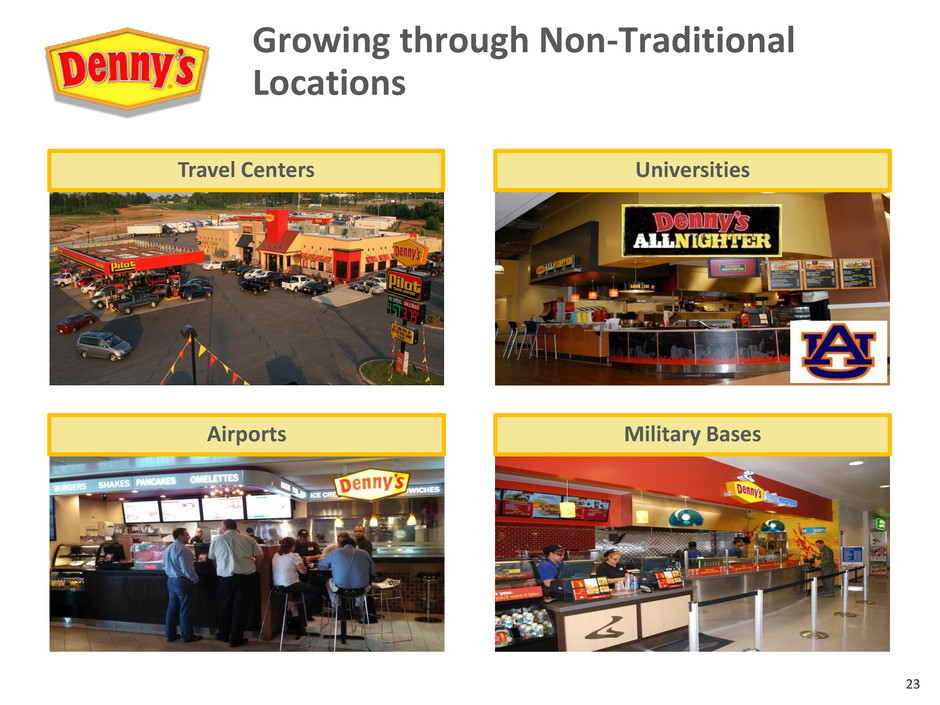

23 Growing through Non-Traditional Locations Travel Centers Airports Universities Military Bases

24 $0.20 $0.26 $0.31 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 2011 2012 2013 A d ju st ed N et In co me * ($ in Mil lio n s) A d ju st ed N et In co me p er Sha re * Adjusted Net Income* Adjusted Net Income per Share* * See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share (also called Earnings per Share) and Free Cash Flow. Franchise-focused business model that is 90% franchised provides lower risk with upside from base of high volume restaurants Growing Adjusted Earnings per Share*

25 $108 $120 $93 $88 $85 $74 $82 $78 $77 $11 $34 $19 $28 $37 $22 $48 $49 $44 $0 $200 $400 $600 $800 $1,000 $1,200 $0 $20 $40 $60 $80 $100 $120 $140 2005 2006 2007 2008 2009 2010** 2011 2012 2013 To tal Op e ra ti n g R ev e n u e ($ in Mil lio n s) $ in M ill io n s Total Operating Revenue Adjusted EBITDA* Free Cash Flow* Franchise-focused business model generating stronger profitability and free cash flow Franchised-Focused Business Model with Strong Free Cash Flow* Characteristics * See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share and Free Cash Flow. ** Includes new construction capital expenditures for 21 Flying J conversion units. *** 2014 Annual Guidance issued with First Quarter 2014 Earnings Release dated April 28, 2014. 2014 Annual Guidance*** Adjusted EBITDA* $77 to $79 Million Free Cash Flow* $44 to $47 Million

26 Strong Balance Sheet with Significant Flexibility $554 $175 5.1 x 2.3 x 0.0 x 1.0 x 2.0 x 3.0 x 4.0 x 5.0 x 6.0 x 2005 Q1 '14 $0 $100 $200 $300 $400 $500 $600 To ta l Ou ts tan d ing De b t* / A d ju st ed E B IT D A * R ati o To ta l Ou ts tan d ing De b t* ($ M ) Total debt has decreased almost 70% with current leverage ratio of 2.3x Enhanced flexibility provides ability to minimize debt repayment enabling brand investments while returning cash to shareholders * Total Outstanding Debt is Gross Debt including Capital Lease Obligations. See Appendix for non-GAAP financial reconciliations of Net Income to Adjusted EBITDA, Adjusted Income Before Taxes, Adjusted Net Income, Adjusted Net Income per Share and Free Cash Flow.

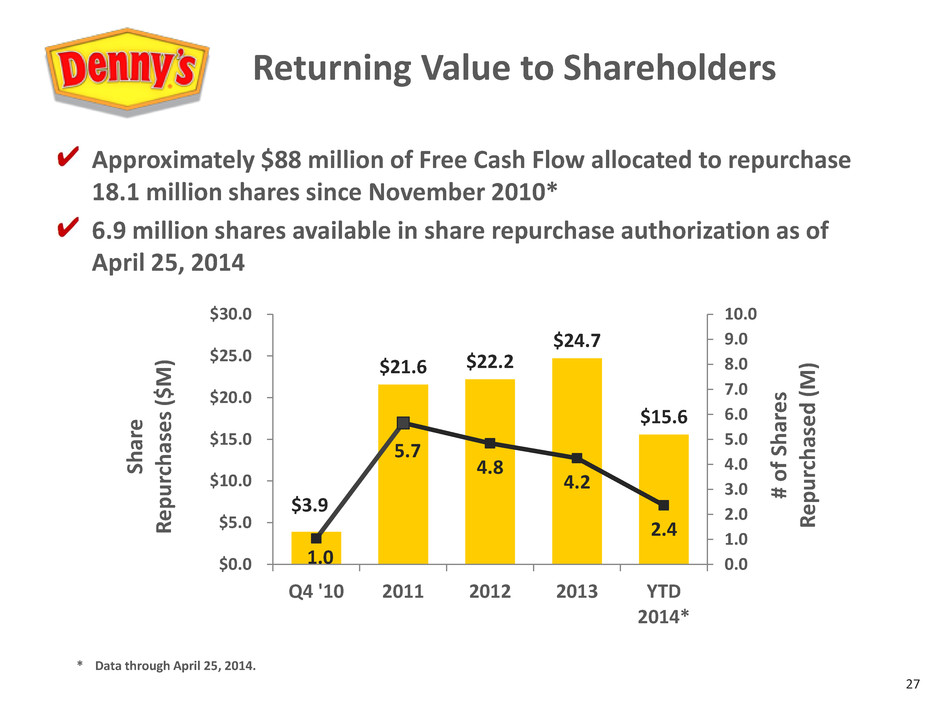

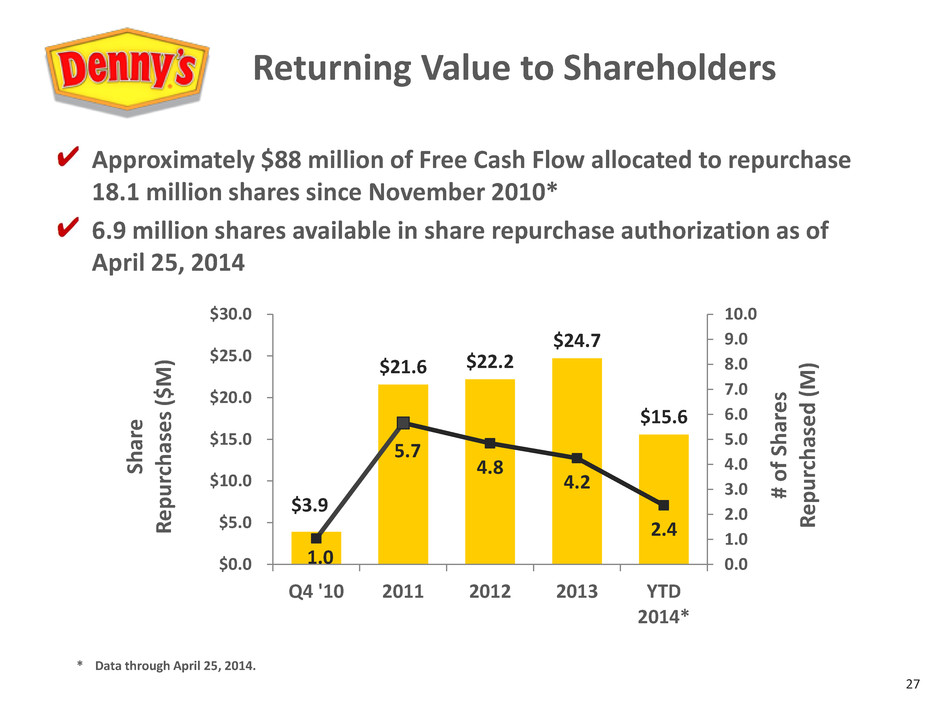

27 $3.9 $21.6 $22.2 $24.7 $15.6 1.0 5.7 4.8 4.2 2.4 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 Q4 '10 2011 2012 2013 YTD 2014* $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 # o f Sha re s R e p u rc h as e d (M ) Sha re R e p u rc h as e s ($M ) Approximately $88 million of Free Cash Flow allocated to repurchase 18.1 million shares since November 2010* 6.9 million shares available in share repurchase authorization as of April 25, 2014 * Data through April 25, 2014. Returning Value to Shareholders

APPENDIX

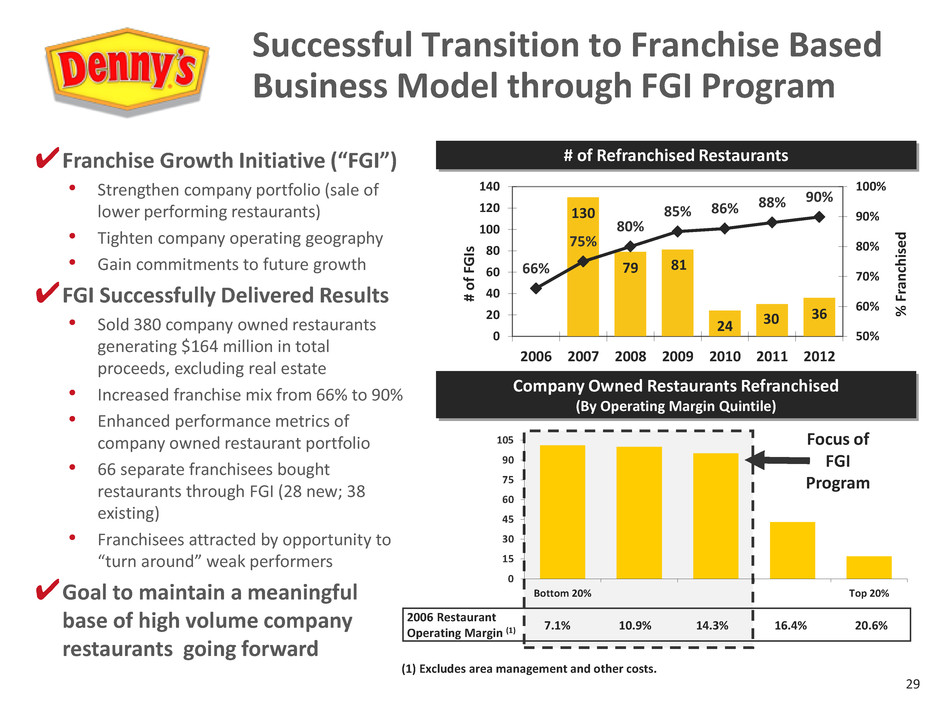

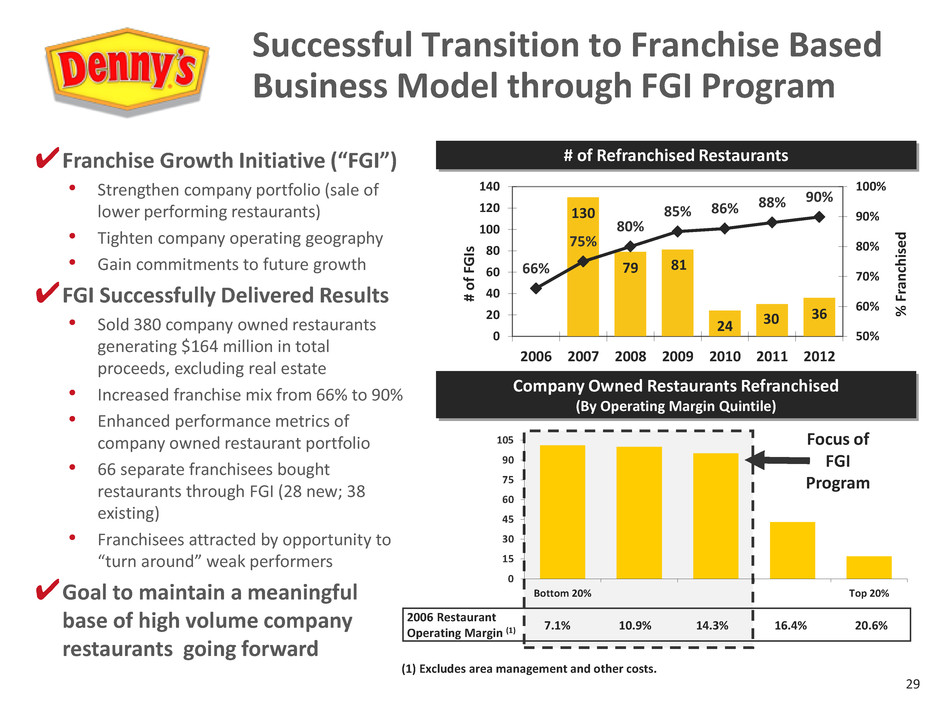

29 Company Owned Restaurants Refranchised (By Operating Margin Quintile) # of Refranchised Restaurants 130 79 81 24 30 36 66% 75% 80% 85% 86% 88% 90% 50% 60% 70% 80% 90% 100% 0 20 40 60 80 100 120 140 2006 2007 2008 2009 2010 2011 2012 % F ra n ch ise d # o f FG Is 0 15 30 45 60 75 90 105 Bottom 20% Top 20% 7.1% 10.9% 14.3% 16.4% 20.6% 2006 Restaurant Operating Margin (1) Focus of FGI Program (1) Excludes area management and other costs. Successful Transition to Franchise Based Business Model through FGI Program ✔Franchise Growth Initiative (“FGI”) • Strengthen company portfolio (sale of lower performing restaurants) • Tighten company operating geography • Gain commitments to future growth ✔FGI Successfully Delivered Results • Sold 380 company owned restaurants generating $164 million in total proceeds, excluding real estate • Increased franchise mix from 66% to 90% • Enhanced performance metrics of company owned restaurant portfolio • 66 separate franchisees bought restaurants through FGI (28 new; 38 existing) • Franchisees attracted by opportunity to “turn around” weak performers ✔Goal to maintain a meaningful base of high volume company restaurants going forward

30 * Includes a 53rd Week. ** In the fourth quarter of 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre-tax income. *** Tax adjustments for 2014 based on the 2014 year-to-date tax rate of 28.9%; for 2013 use full year effective tax rate of 31.9%. Tax adjustments for full year 2011 and 2012 are calculated using the Company's full year 2012 effective tax rate of 36.4%. **** Adjusted provision for income taxes based on full year ended Dec. 27, 2012 effective income tax rate of 36.4% and excludes impact of net deferred tax benefit. Non-GAAP Financial Reconciliations $ in millions 2005 2006 2007 2008 * 2009 2010 2011 2012 2013 2012 2013 Net income (loss) ($7.3) $28.5 $29.5 $12.7 $41.6 $22.7 $112.3 $22.3 $24.6 $7.1 $6.4 Provision for income taxes** 1.2 16.3 6.7 3.5 1.4 1.4 (84.0) 12.8 11.5 3.6 2.6 Operating gains, losses and other charges, net 3.1 (47.9) (31.1) (6.4) (14.5) (4.9) 2.1 0.5 7.1 0.1 0.4 Other nonoperating expense, net (0.6) 8.0 0.7 9.2 (3.1) 5.3 2.6 7.9 1.1 0.0 (0.1) Share-based compensation 7.8 7.6 4.8 4.1 4.7 2.8 4.2 3.5 4.9 1.2 1.2 Adjusted Income before Taxes $4.2 $12.5 $10.5 $23.2 $30.0 $27.3 $37.3 $47.0 $49.2 $12.0 $10.5 Interest expense, net 55.2 57.7 43.0 35.5 32.6 25.8 20.0 13.4 10.3 2.8 2.3 Depreciation and amortization 56.1 55.3 49.3 39.8 32.3 29.6 28.0 22.3 21.5 5.2 5.2 Cash pmts for restructuring charges and exit costs (6.7) (5.1) (9.1) (9.1) (7.5) (7.0) (2.7) (3.8) (2.8) (0.7) (0.6) Cash pmts for share-based compensation (1.2) (0.9) (0.9) (1.0) (2.4) (1.9) (0.8) (1.0) (1.2) (0.9) (1.1) Adjusted EBITDA $107.6 $119.5 $92.9 $88.4 $85.0 $73.8 $81.8 $77.9 $76.9 $18.4 $16.4 Adjusted EBITDA Margin % 11.0% 12.0% 9.9% 11.6% 14.0% 13.5% 15.2% 16.0% 16.6% 16.1% 14.6% Cash Interest Expense (48.2) (50.9) (38.5) (31.6) (29.3) (23.1) (17.0) (11.6) (9.1) (2.5) (2.1) Cash Taxes (1.3) (1.3) (2.3) (1.1) (0.6) (0.9) (1.1) (2.0) (2.8) (0.3) (0.8) Capital Expenditures (47.2) (33.1) (33.1) (27.9) (18.4) (27.4) (16.1) (15.6) (20.8) (3.0) (6.9) Free Cash Flow $11.0 $34.3 $19.0 $27.9 $36.7 $22.4 $47.6 $48.8 $44.3 $12.6 $6.7 Net income (loss) $112.3 $22.3 $24.6 $7.1 $6.4 Gains on sales of assets and other, net (3.2) (7.1) (0.1) 0.0 (0.0) Impairment charges 4.1 3.7 5.7 0.0 0.0 Early extinguishment of debt 1.4 7.9 1.2 0.0 0.0 Tax effect of adjustments*** (0.8) (1.6) (2.2) (0.0) 0.0 Adjusted provision for income taxes**** (94.3) Adjusted Net Income $19.5 $25.2 $29.2 $7.1 $6.4 Adjusted Net Income per Share $0.20 $0.26 $0.31 $0.08 $0.07 Year-to-Date