INVESTOR PRESENTATION November and December 2020

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES Denny’s Corporation urges caution in considering its current trends and any outlook on earnings disclosed in this press release. In addition, certain matters discussed in this release may constitute forward-looking statements. These forward-looking statements, which reflect management’s best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, “will”, and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: the rapidly evolving COVID-19 pandemic and related containment measures, including the potential for further operational disruption from government mandates affecting restaurants; economic, public health, social and political conditions that impact consumer confidence and spending with respect to social unrest and the COVID-19 pandemic; competitive pressures from within the restaurant industry; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 25, 2019 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to other financial measures, Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share are appropriate indicators to assist in the evaluation of its operating performance on a period-to-period basis. The Company also uses Adjusted EBITDA and Adjusted Free Cash Flow internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including bonuses for certain employees. Adjusted EBITDA is also used to evaluate its ability to service debt because the excluded charges do not have an impact on its prospective debt servicing capability and these adjustments are contemplated in its credit facility for the computation of its debt covenant ratios. The Company defines Adjusted Free Cash Flow for a given period as Adjusted EBITDA less the cash portion of interest expense net of interest income, capital expenditures, and cash taxes. Management believes that the presentation of Adjusted Free Cash Flow provides useful information to investors because it represents a liquidity measure used to evaluate, among other things, operating effectiveness and is used in decisions regarding the allocation of resources. However, Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income (Loss) and Adjusted Net Income (Loss) Per Share should be considered as a supplement to, not a substitute for, operating income, net income (loss) or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations. INVESTOR PRESENTATION 2

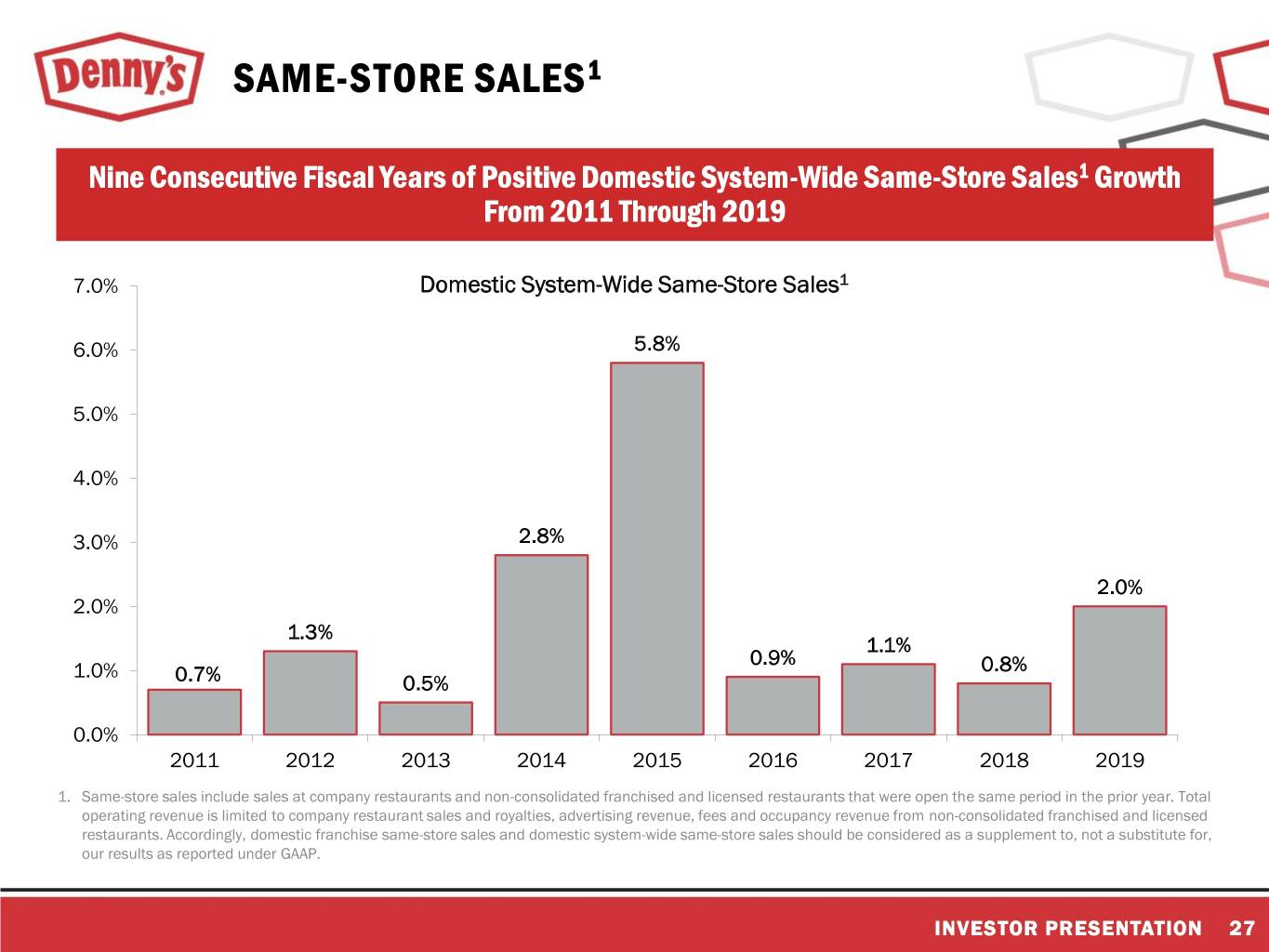

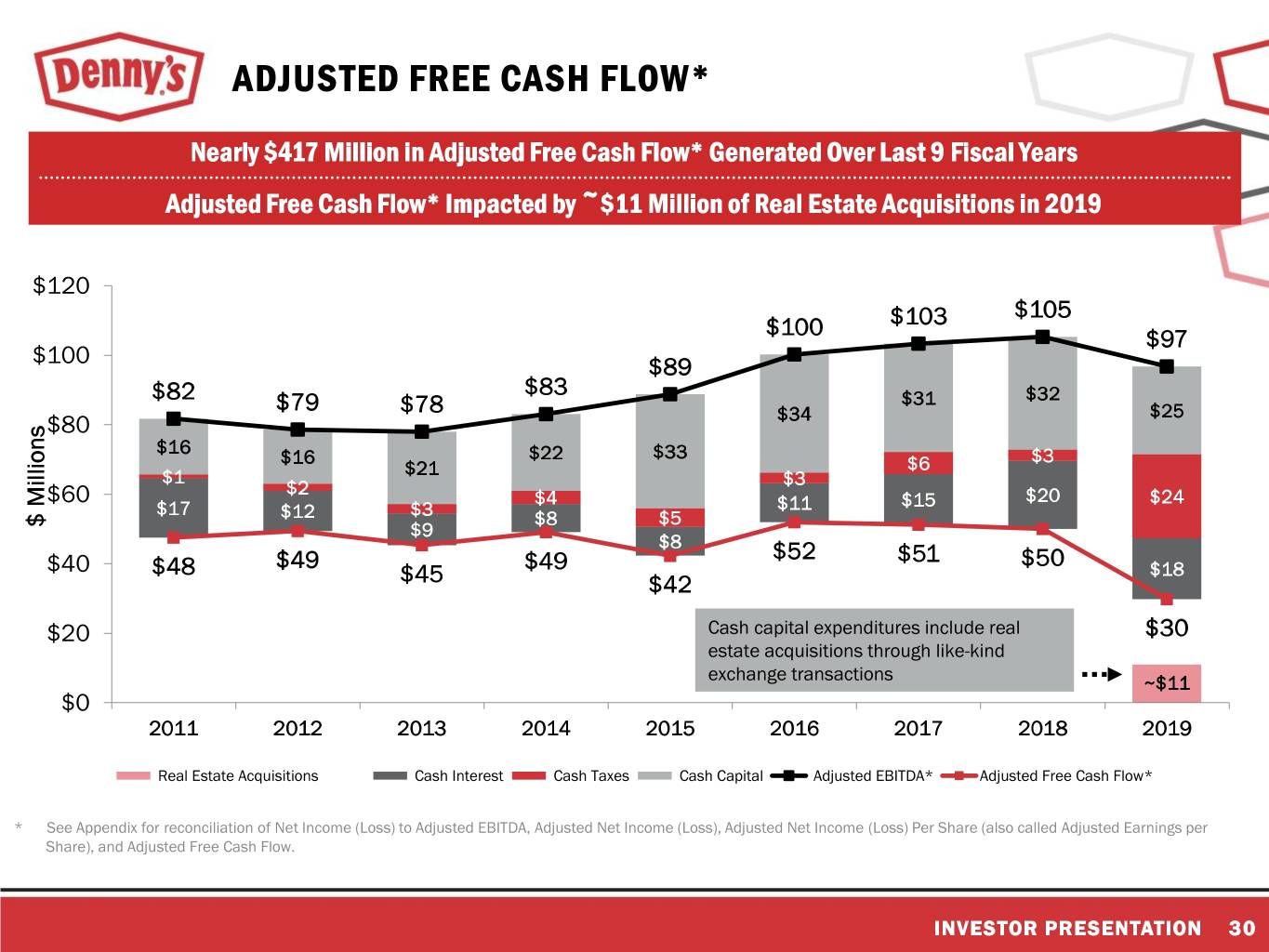

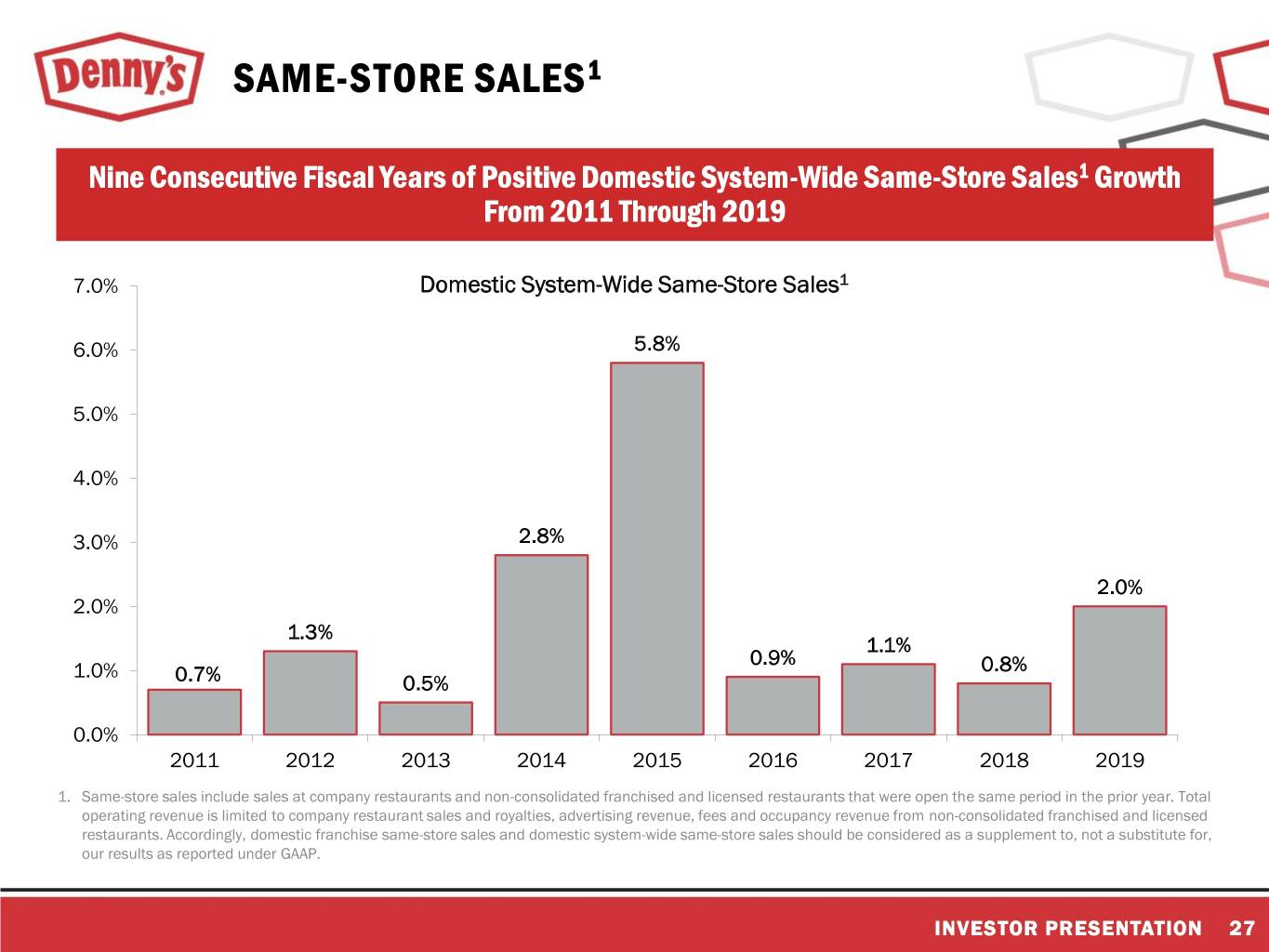

DENNY’S INVESTMENT HIGHLIGHTS • Nine consecutive fiscal years of domestic system-wide same-store sales1 CONSISTENT SAME -S T ORE growth2 SALES 1 GROWTH • Strong same-store sales1 performance relative to peers • 1,664 restaurants around the globe, including 1,519 domestic locations3 GLOBAL FOOTPRINT • 145 international locations across 13 countries and U.S. territories3 • 228 well diversified, experienced and energetic franchisees3 STRONG ADJUSTED FREE • Generated nearly $417M in Adjusted Free Cash Flow* over the last 9 fiscal years2 C ASH F L OW * A N D • Includes approximately $11M in real estate acquisitions2 SHAREHOLDER RETURN • Approximately $554M allocated to share repurchase program since November 20104 DURABLE BUSINESS • Sustained record of consistent financial performance FOCUSED ON THE FUTURE • Recent transition to a more highly franchised model with reduced business risk • Established revitalization strategies to continue propelling the brand forward * See Appendix for reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) Per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 2. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. 3. Data as of September 23, 2020 the end of Fiscal Third Quarter 2020. 4. Data as of February 27, 2020 (date the Company suspended share repurchases). INVESTOR PRESENTATION 3

COVID-19 BUSINESS UPDATE

SALES INNOVATIONS IN RESPONSE TO COVID-19 INVESTOR PRESENTATION 5

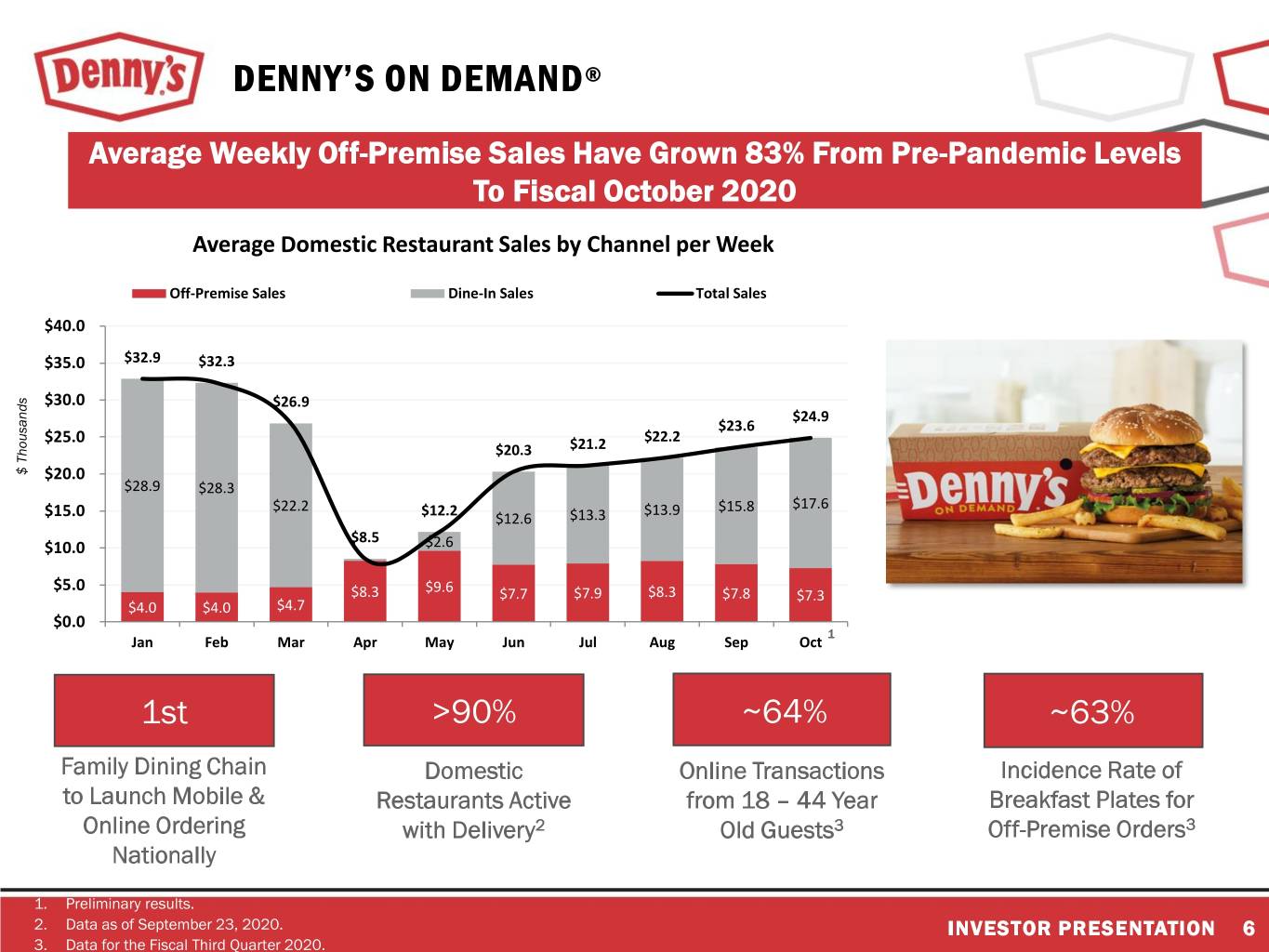

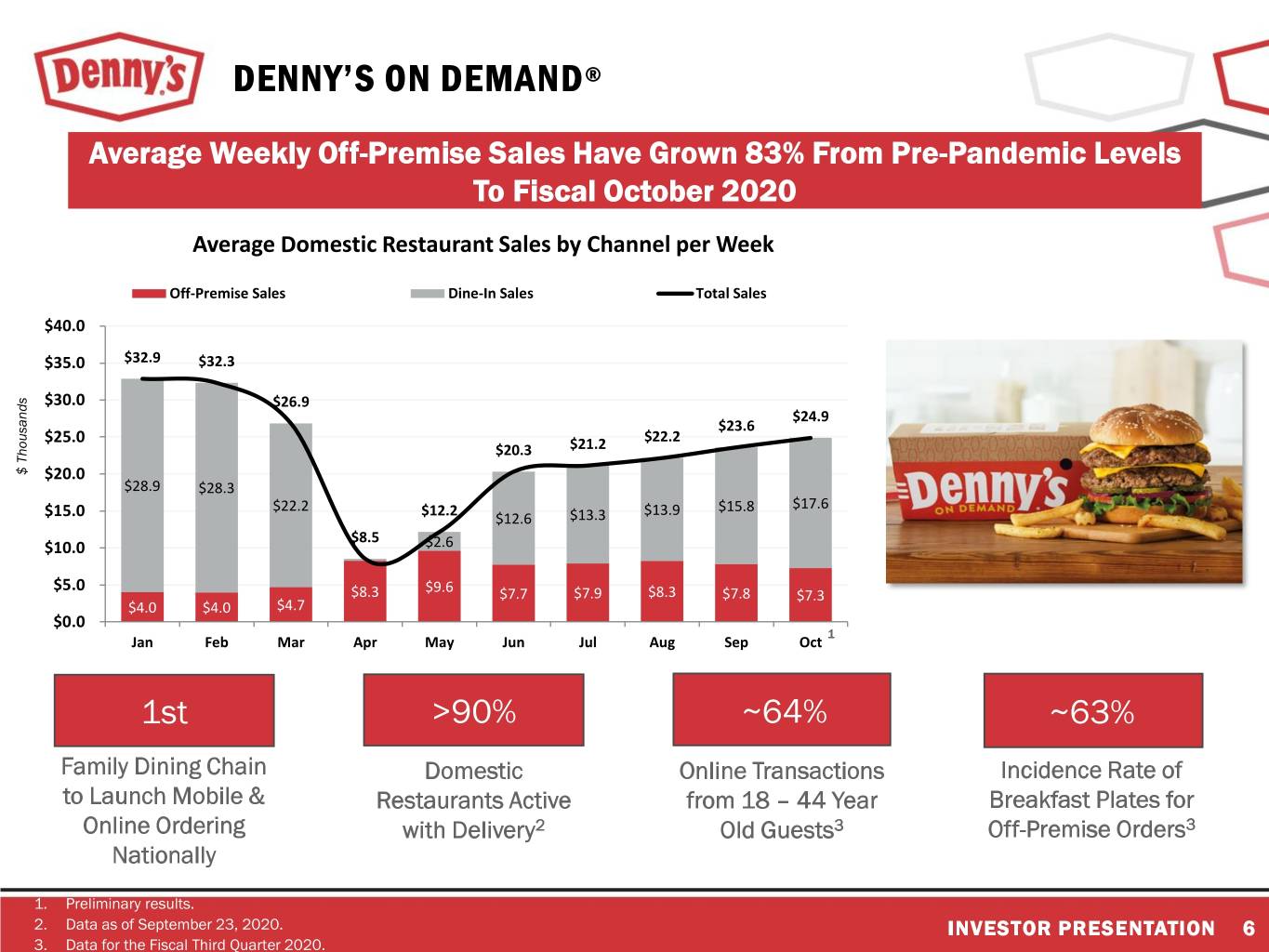

DENNY’S ON DEMAND® Average Weekly Off-Premise Sales Have Grown 83% From Pre-Pandemic Levels To Fiscal October 2020 Average Domestic Restaurant Sales by Channel per Week Off-Premise Sales Dine-In Sales Total Sales $40.0 $35.0 $32.9 $32.3 $30.0 $26.9 $24.9 $23.6 $25.0 $22.2 $20.3 $21.2 $ Thousands $ $20.0 $28.9 $28.3 $22.2 $12.2 $13.9 $15.8 $17.6 $15.0 $12.6 $13.3 $8.5 $10.0 $2.6 $5.0 $9.6 $8.3 $7.7 $7.9 $8.3 $7.8 $7.3 $4.0 $4.0 $4.7 $0.0 1 Jan Feb Mar Apr May Jun Jul Aug Sep Oct 1st >90% ~64% ~63% Family Dining Chain Domestic Online Transactions Incidence Rate of to Launch Mobile & Restaurants Active from 18 – 44 Year Breakfast Plates for Online Ordering with Delivery2 Old Guests3 Off-Premise Orders3 Nationally 1. Preliminary results. 2. Data as of September 23, 2020. INVESTOR PRESENTATION 6 3. Data for the Fiscal Third Quarter 2020.

HEALTH AND SAFTEY PROTOCOLS We Remain Focused on the Safety and Wellbeing of Our Guests, Restaurant Teams, Franchisees, Employees and Suppliers • Enhanced training materials and communications distributed to entire system of restaurants • Reinforcing strict food safety procedures, handwashing and personal hygiene standards, and enhanced daily deep cleaning protocols • Remain in close contact with public health officials and government agencies to ensure all public health concerns are addressed INVESTOR PRESENTATION 7

CONSUMER COMMUNICATION INVESTOR PRESENTATION 8

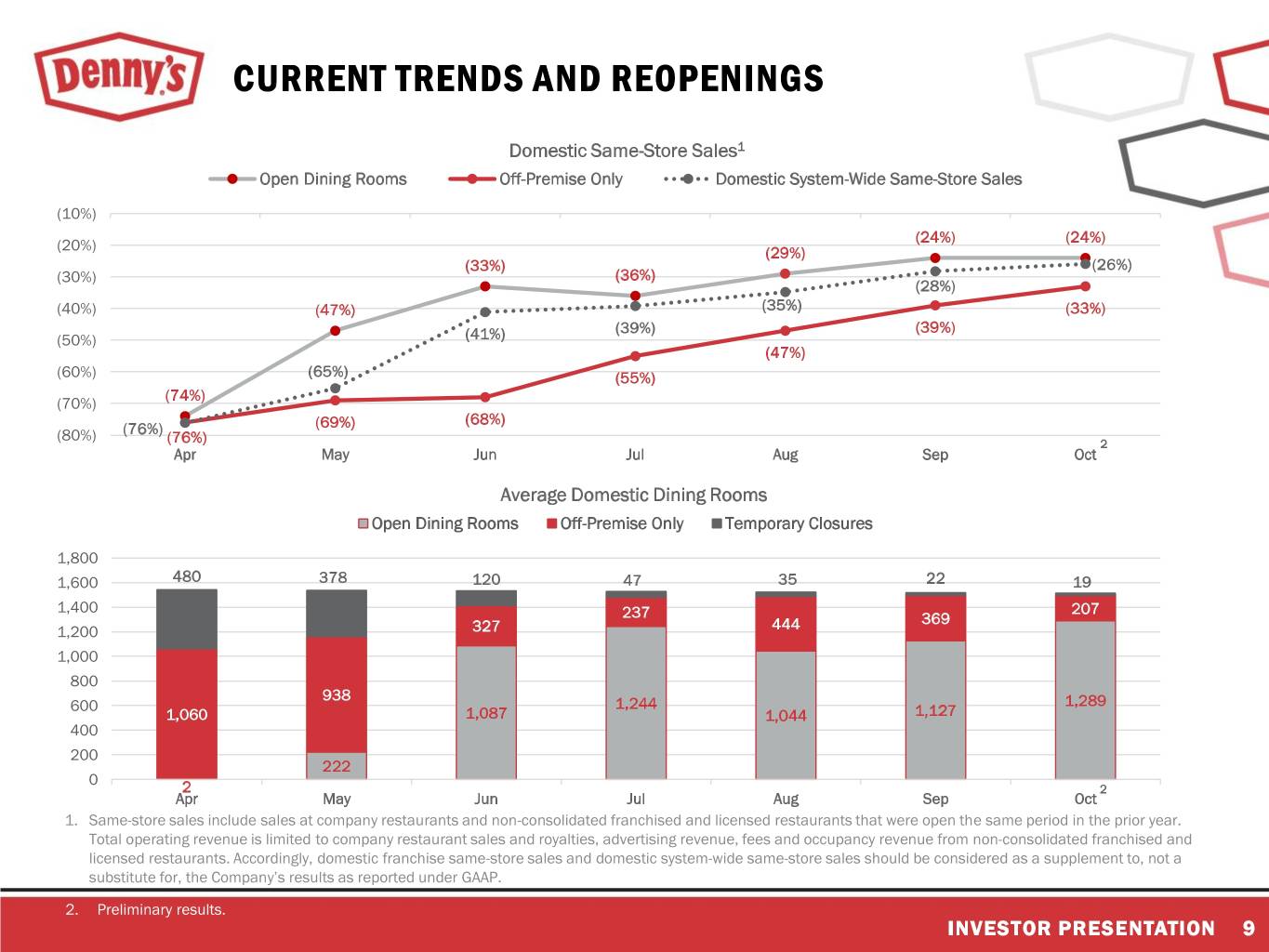

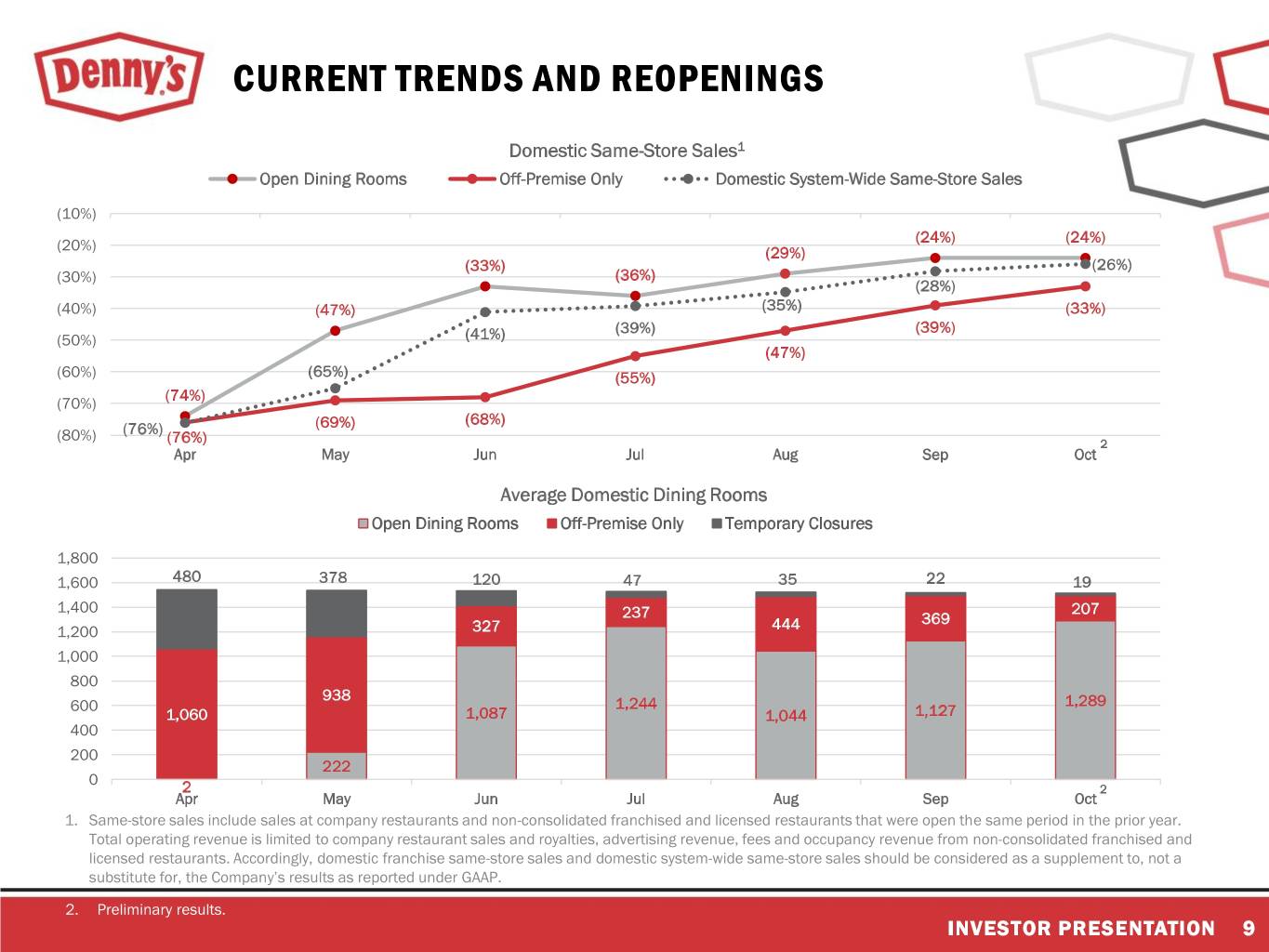

CURRENT TRENDS AND REOPENINGS Domestic Same-Store Sales1 Open Dining Rooms Off-Premise Only Domestic System-Wide Same-Store Sales (10%) (24%) (24%) (20%) (29%) (33%) (26%) (30%) (36%) (28%) (40%) (47%) (35%) (33%) (39%) (39%) (50%) (41%) (47%) (60%) (65%) (55%) (74%) (70%) (69%) (68%) (80%) (76%) (76%) 2 Apr May Jun Jul Aug Sep Oct Average Domestic Dining Rooms Open Dining Rooms Off-Premise Only Temporary Closures 1,800 1,600 480 378 120 47 35 22 19 1,400 207 237 369 1,200 327 444 1,000 800 938 600 1,244 1,289 1,060 1,087 1,044 1,127 400 200 222 0 2 2 Apr May Jun Jul Aug Sep Oct 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 2. Preliminary results. INVESTOR PRESENTATION 9

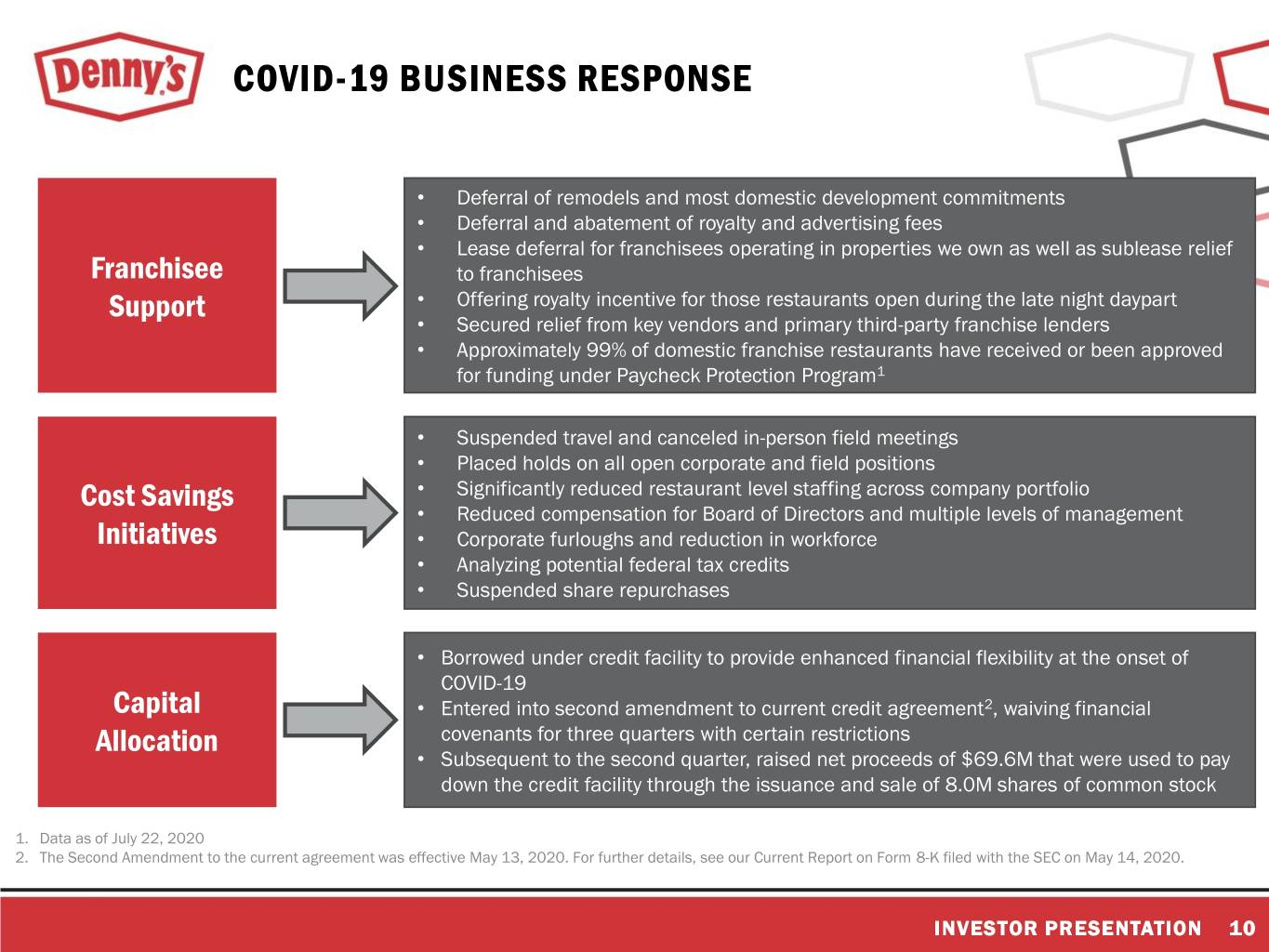

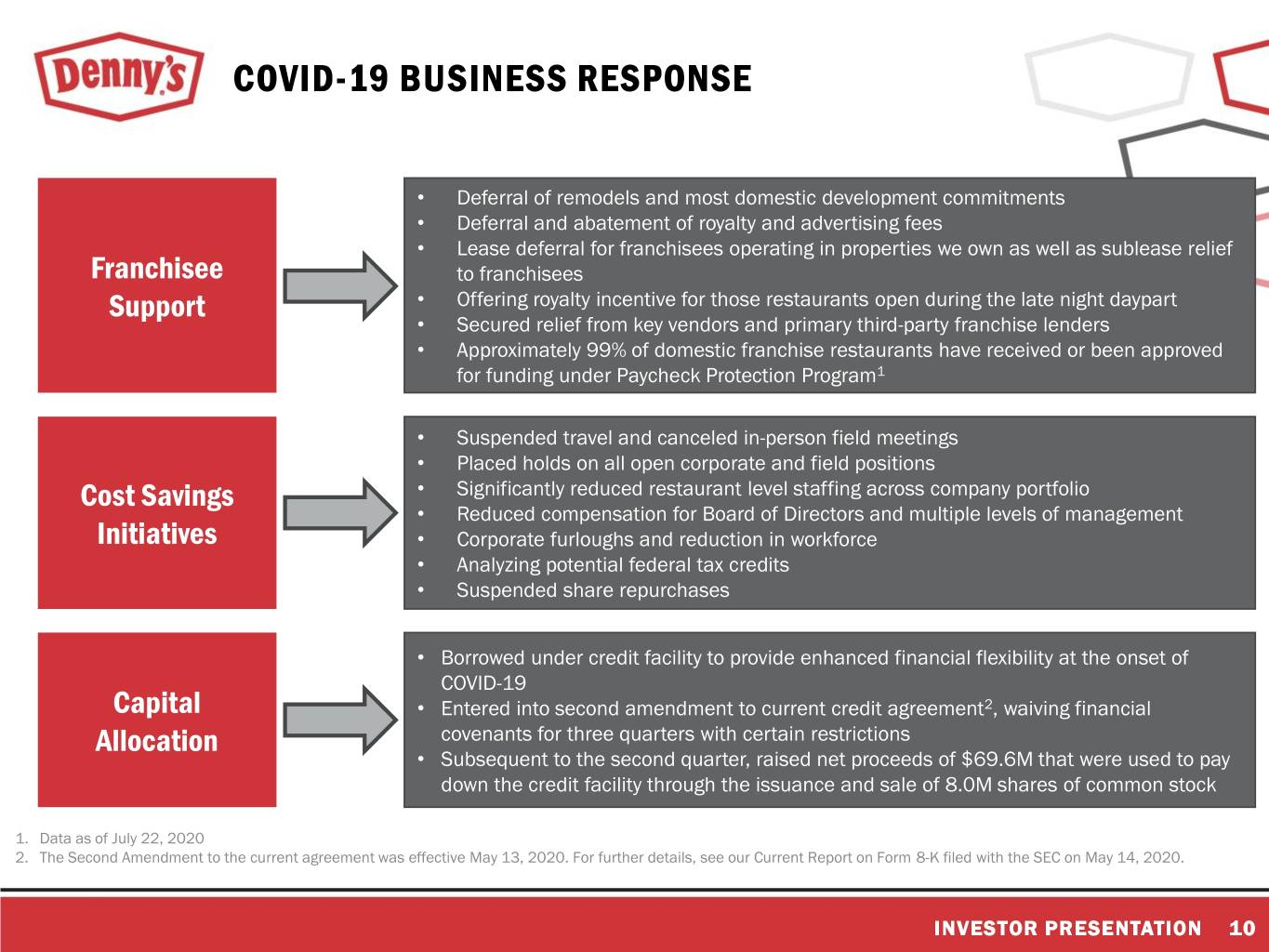

COVID-19 BUSINESS RESPONSE • Deferral of remodels and most domestic development commitments • Deferral and abatement of royalty and advertising fees • Lease deferral for franchisees operating in properties we own as well as sublease relief Franchisee to franchisees Support • Offering royalty incentive for those restaurants open during the late night daypart • Secured relief from key vendors and primary third-party franchise lenders • Approximately 99% of domestic franchise restaurants have received or been approved for funding under Paycheck Protection Program1 • Suspended travel and canceled in-person field meetings • Placed holds on all open corporate and field positions Cost Savings • Significantly reduced restaurant level staffing across company portfolio • Reduced compensation for Board of Directors and multiple levels of management Initiatives • Corporate furloughs and reduction in workforce • Analyzing potential federal tax credits • Suspended share repurchases • Borrowed under credit facility to provide enhanced financial flexibility at the onset of COVID-19 Capital • Entered into second amendment to current credit agreement2, waiving financial Allocation covenants for three quarters with certain restrictions • Subsequent to the second quarter, raised net proceeds of $69.6M that were used to pay down the credit facility through the issuance and sale of 8.0M shares of common stock 1. Data as of July 22, 2020 2. The Second Amendment to the current agreement was effective May 13, 2020. For further details, see our Current Report on Form 8-K filed with the SEC on May 14, 2020. INVESTOR PRESENTATION 10

DENNY’S BRAND

EXECUTION OF BRAND REVITALIZATION STRATEGY DRIVING RESULTS “Become the World’s Largest, Most Admired and Beloved Family of Local Restaurants” Deliver a Consistently Drive Grow Differentiated Operate Profitable the Global and Relevant Great Growth for All Franchise Brand Restaurants Stakeholders Enabled Through Technology and Training + Close Collaboration with Franchise Partners INVESTOR PRESENTATION 12

DELIVERING A DIFFERENTIATED AND RELEVANT BRAND Welcome to America’s Diner where we serve classic, comforting food at a fair price around the clock for unpretentious, everyday occasions. Food Service Atmosphere INVESTOR PRESENTATION 13

FOCUS ON BETTER QUALITY, MORE CRAVEABLE PRODUCTS Approximately 80% of Core Menu Entrées Changed or Improved Since Our Revitalization Began Leading to Significant Improvement in Taste and Quality Scores and Sales Growth INVESTOR PRESENTATION 14

EVERYDAY VALUE HELPING TO DRIVE TRAFFIC High awareness as 1 in 5 guests say they visit Denny’s because of $2468 Value Menu® Utilize local and national media targeting popular products like the Everyday Value Slam® A positive guest response to new LTO value entrées in 2019, resulted in total value incidence rate of over 19%, including a $2468 incidence rate of approximately 14% In Q3 2020, total value incidence rate of over 21%, including $2468 of approximately 18% INVESTOR PRESENTATION 15

THE MODERN AMERICAN FAMILY Who they are: Largely identify as part of the Millennial generation Have a family-first focus and are increasingly becoming multi-generational (especially amongst Hispanics) Are time-pressed, have multiple demands on family schedule Have a multi-screen approach to life, moving to streaming audio and video through mobile devices and Smart TVs How we are connecting with them: TV Digital Video Content Digital & Social Data & Tech Search INVESTOR PRESENTATION 16

REMODELS KEY TO REVITALIZING LEGACY BRAND Heritage2.0 Heritage LegacyDenny’s INVESTOR PRESENTATION 17

FOCUS ON CONSISTENTLY OPERATING GREAT RESTAURANTS LEADING TO SUSTAINED IMPROVEMENT • Investments in training talent, tools, and strategies, such as Ignite E-Learning and our latest Delight & Make It Right service programs, driving improvements in service scores • Denny’s Pride Review Program used to evaluate and share best practices • Close collaboration with franchisees to drive improvements in speed of service and margins INVESTOR PRESENTATION 18

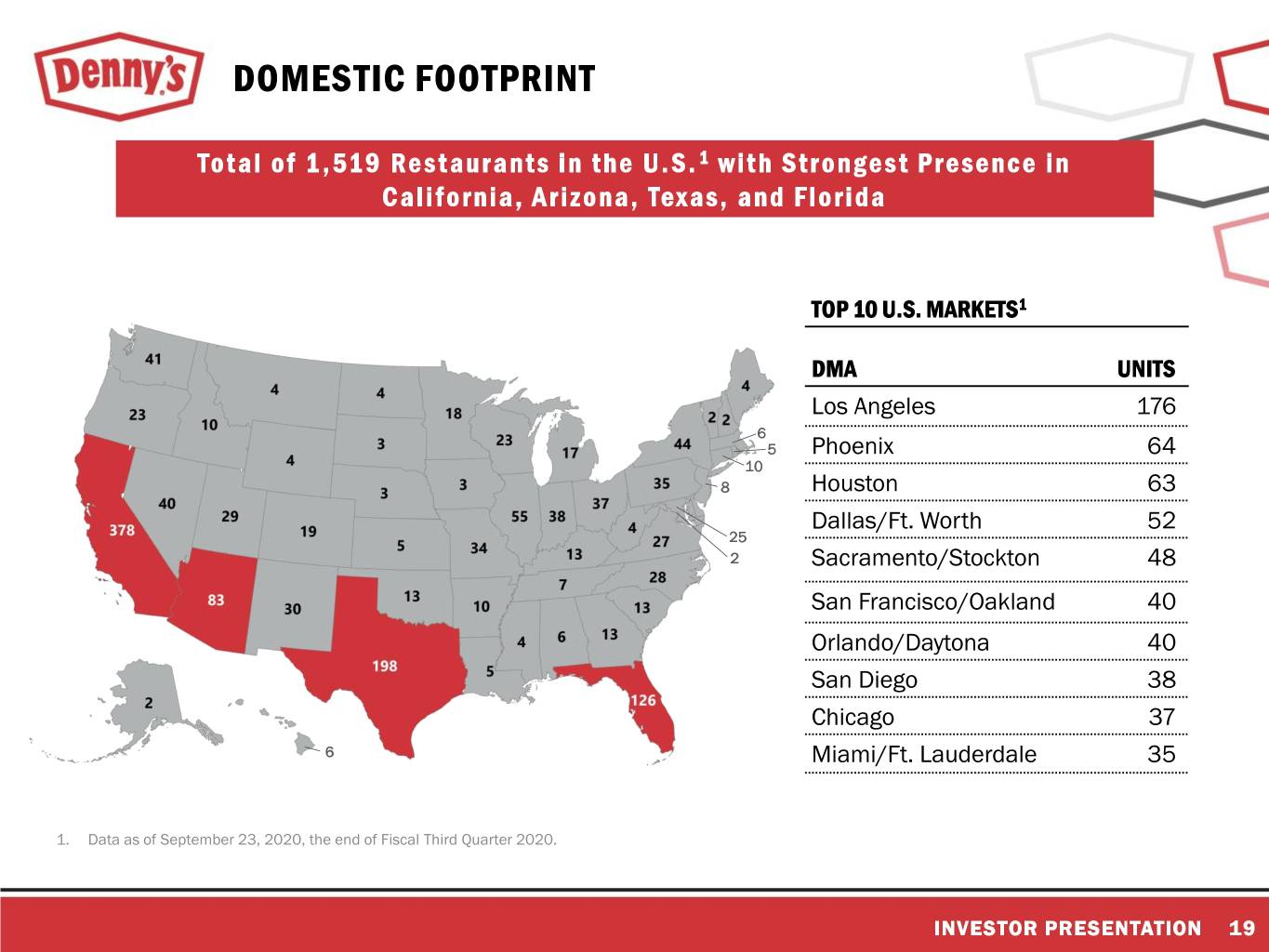

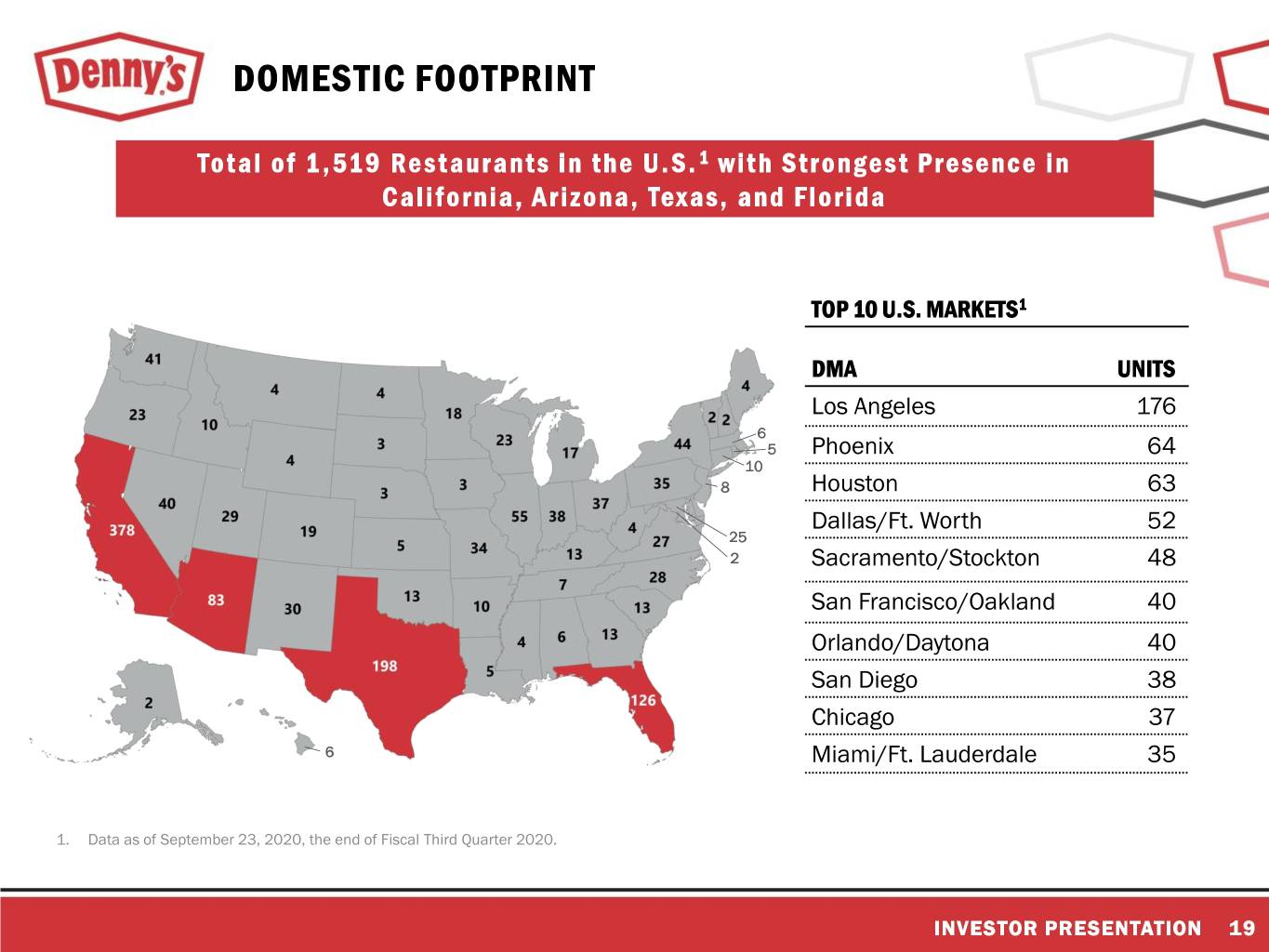

DOMESTIC FOOTPRINT Total of 1,519 Restaurants in the U.S. 1 with Strongest Presence in California, Arizona, Texas, and Florida TOP 10 U.S. MARKETS1 DMA UNITS Los Angeles 176 6 5 Phoenix 64 10 8 Houston 63 Dallas/Ft. Worth 52 25 2 Sacramento/Stockton 48 San Francisco/Oakland 40 Orlando/Daytona 40 San Diego 38 Chicago 37 6 Miami/Ft. Lauderdale 35 1. Data as of September 23, 2020, the end of Fiscal Third Quarter 2020. INVESTOR PRESENTATION 19

INTERNATIONAL FOOTPRINT International Presence of 145 Restaurants in 13 Countries and U.S. Territories has Grown by Over 65% Since Year End 2010 1 United States 1,519 Canada 77 Puerto Rico 15 Mexico 12 Philippines 10 New Zealand 7 Honduras Guatemala City Honduras 6 United Arab Emirates 6 Costa Rica 3 El Salvador 2 Guam 2 Guatemala 2 Indonesia 2 United Kingdom 1 Ontario Philippines 1. Data as of September 23, 2020, the end of Fiscal Third Quarter 2020. INVESTOR PRESENTATION 20

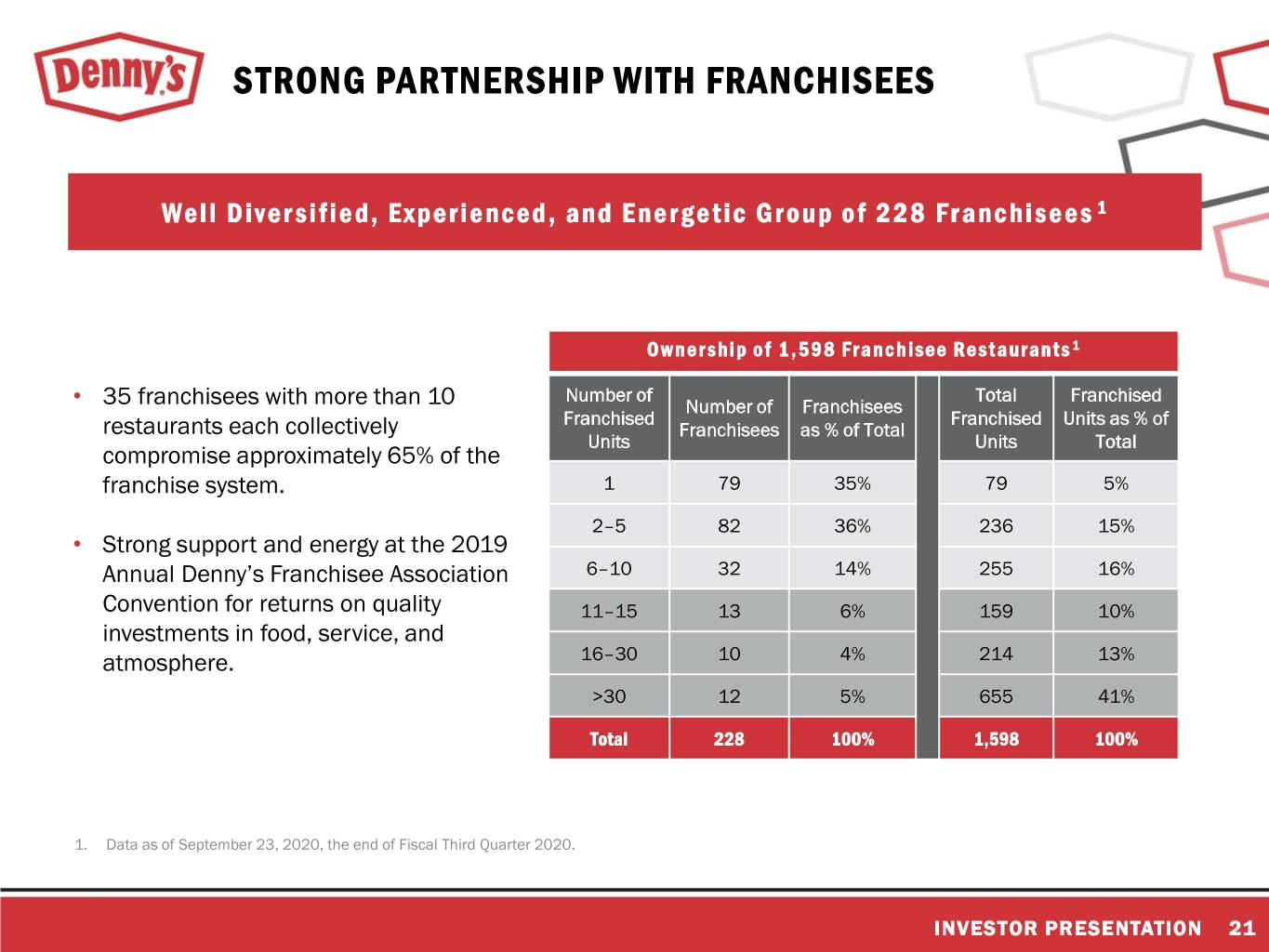

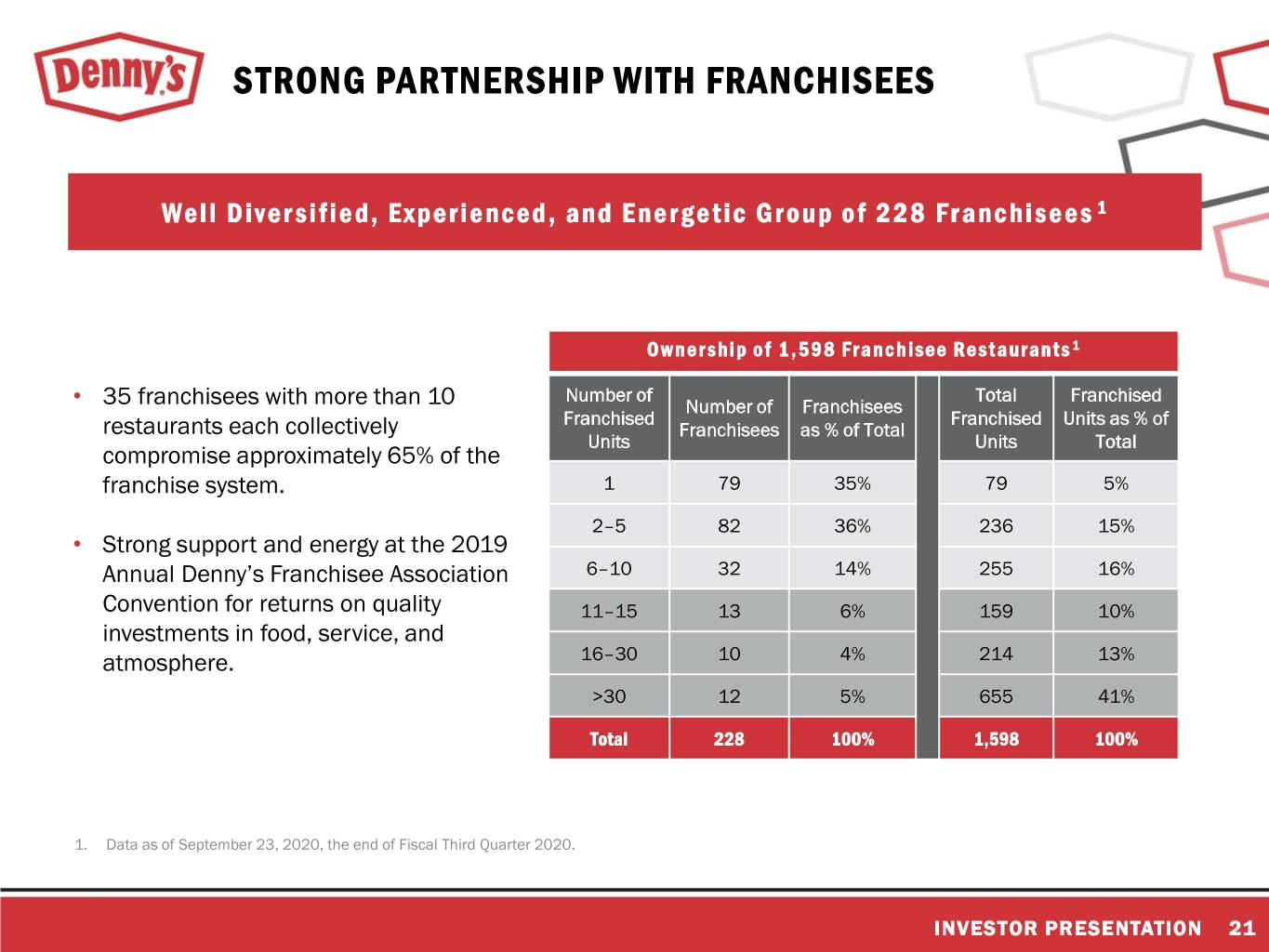

STRONG PARTNERSHIP WITH FRANCHISEES Well Diversified, Experienced, and Energetic Group of 228 Franchisees 1 Ownership of 1,598 Franchisee Restaurants 1 Number of Total Franchised • 35 franchisees with more than 10 Number of Franchisees Franchised Franchised Units as % of restaurants each collectively Franchisees as % of Total Units Units Total compromise approximately 65% of the franchise system. 1 79 35% 79 5% 2–5 82 36% 236 15% • Strong support and energy at the 2019 Annual Denny’s Franchisee Association 6–10 32 14% 255 16% Convention for returns on quality 11–15 13 6% 159 10% investments in food, service, and atmosphere. 16–30 10 4% 214 13% >30 12 5% 655 41% Total 228 100% 1,598 100% 1. Data as of September 23, 2020, the end of Fiscal Third Quarter 2020. INVESTOR PRESENTATION 21

STRONG COLLABORATION WITH FRANCHISEES Denny’s Franchisee Marketing Brand Advisory Operations Brand Advisory Association Council Council Annual Convention Menu Innovation Training Initiatives Steering Committee Meetings Media Support Pride Reviews Joint Board Meetings Product Testing Operations Support Supply Chain Oversight Development Brand Advisory Technology Brand Advisory Committee Council Council Purchase Product for System Successful Heritage Remodels Customer Facing Technology Outperformed PPI by Avg of ~1ppt Prototype Development Denny’s On Demand Each Year Over the Last Decade Lease & Asset Management Common POS Platform INVESTOR PRESENTATION 22

RECENT PERFORMANCE

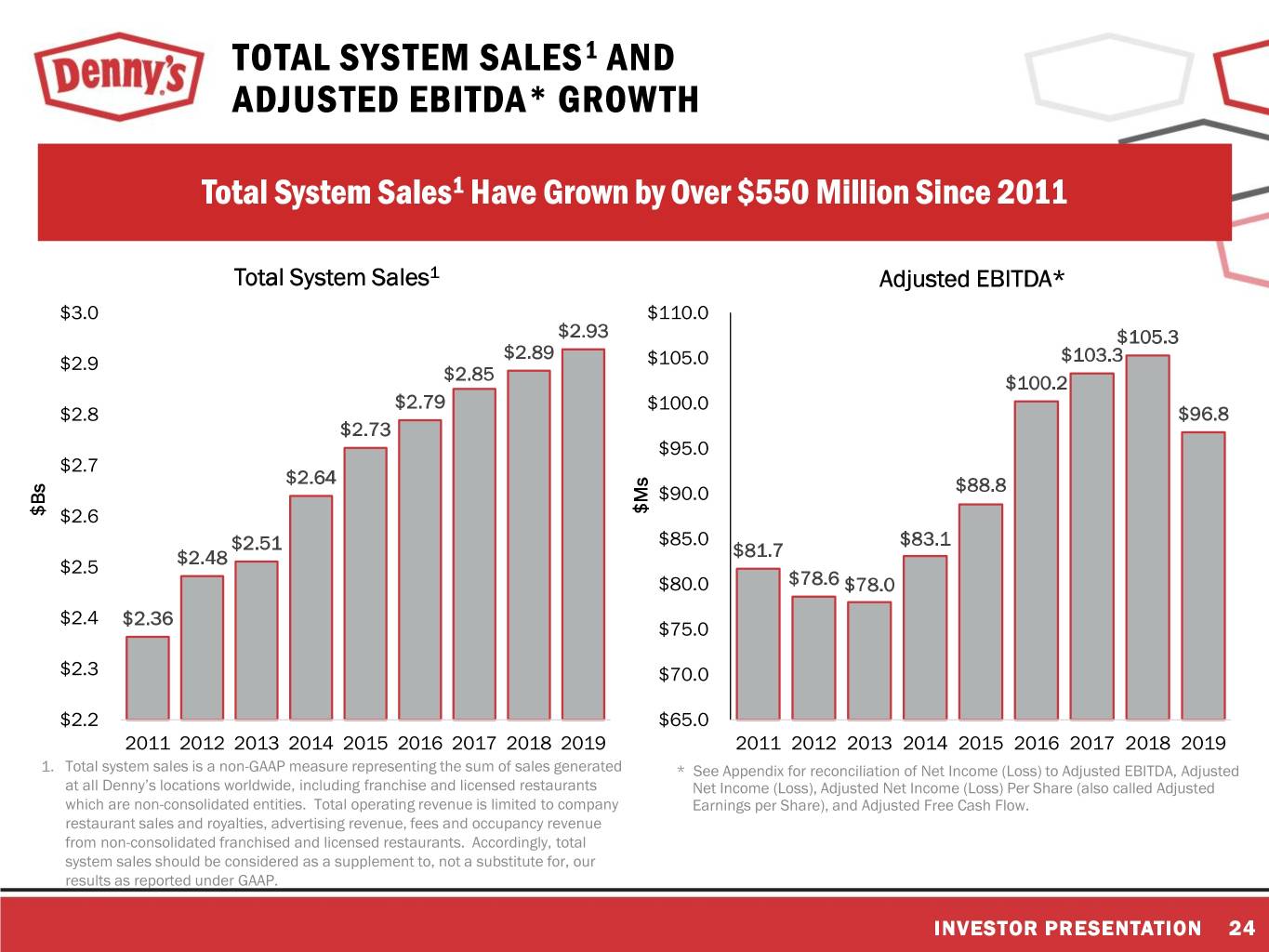

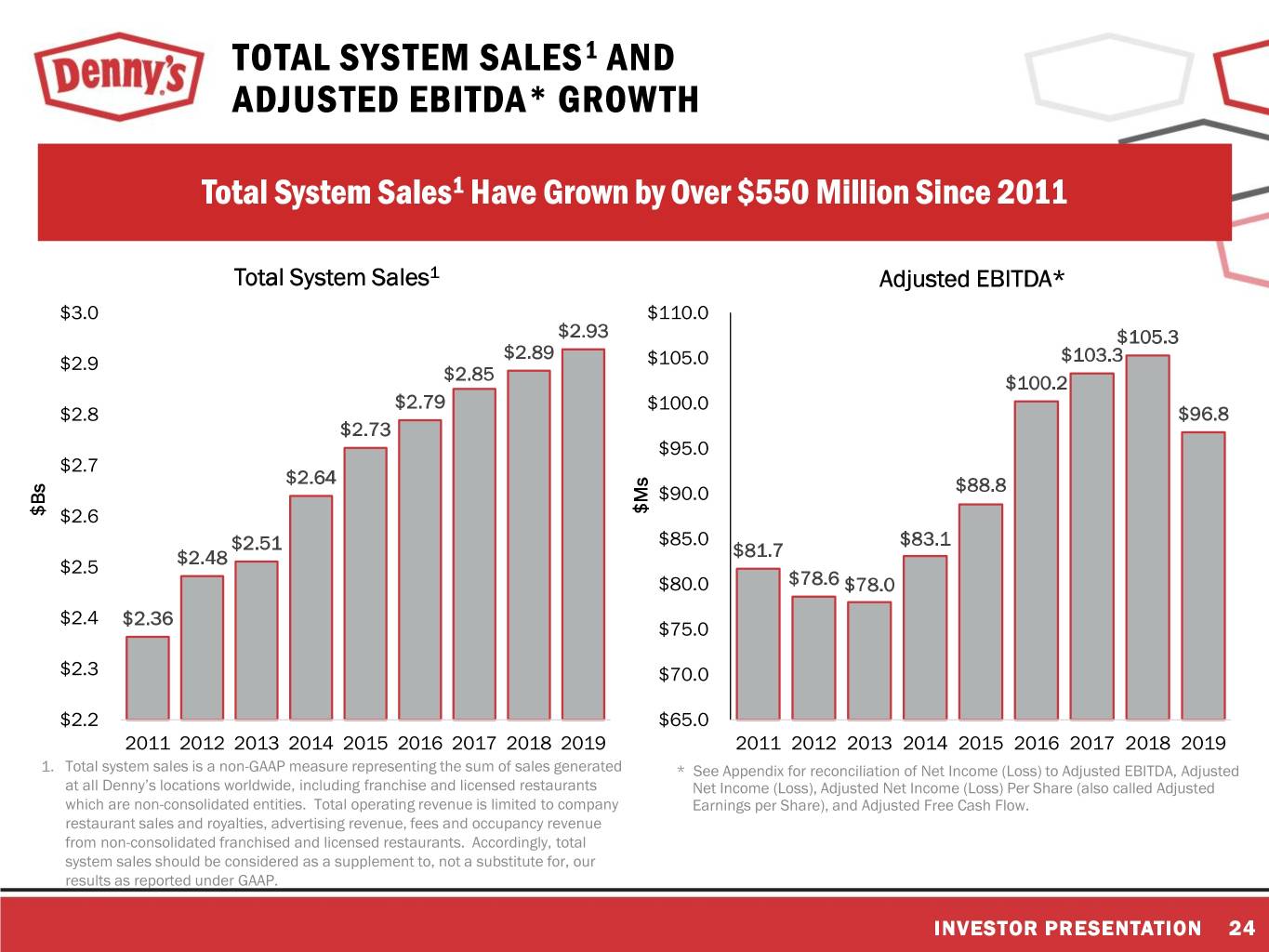

TOTAL SYSTEM SALES1 AND ADJUSTED EBITDA* GROWTH Total System Sales1 Have Grown by Over $550 Million Since 2011 Total System Sales1 Adjusted EBITDA* $3.0 $110.0 $2.93 $105.3 $2.89 $2.9 $105.0 $103.3 $2.85 $100.2 $2.79 $100.0 $2.8 $96.8 $2.73 $95.0 $2.7 $2.64 $90.0 $88.8 $Ms $Bs $2.6 $85.0 $83.1 $2.51 $81.7 $2.5 $2.48 $80.0 $78.6 $78.0 $2.4 $2.36 $75.0 $2.3 $70.0 $2.2 $65.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2011 2012 2013 2014 2015 2016 2017 2018 2019 1. Total system sales is a non-GAAP measure representing the sum of sales generated * See Appendix for reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted at all Denny’s locations worldwide, including franchise and licensed restaurants Net Income (Loss), Adjusted Net Income (Loss) Per Share (also called Adjusted which are non-consolidated entities. Total operating revenue is limited to company Earnings per Share), and Adjusted Free Cash Flow. restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, total system sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. INVESTOR PRESENTATION 24

FRANCHISED AND COMPANY RESTAURANT SALES History of Steady Growth in Franchised and Company Average Unit Volumes Refranchising Strategy Benefited AUVs at Both Franchised and Company Restaurants in 2019 Franchised Restaurant AUVs Company Restaurant AUVs $3.0 $3.0 $2.8 $2.8 $2.6 $2.6 $2.5 $2.4 $2.3 $2.4 $2.2 $2.3 $2.3 $2.2 $2.2 $2.1 $1.9 $2.0 $2.0 $2.0 $1.8 $1.8 $1.6 $1.6 $1.7 $1.8 $Ms $Ms $1.5 $1.6 $1.6 $1.6 $1.4 $1.4 $1.4 $1.6 $1.4 $1.4 $1.2 $1.2 $1.0 $1.0 $0.8 $0.8 $0.6 $0.6 $0.4 $0.4 $0.2 $0.2 $0.0 $0.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2011 2012 2013 2014 2015 2016 2017 2018 2019 INVESTOR PRESENTATION 25

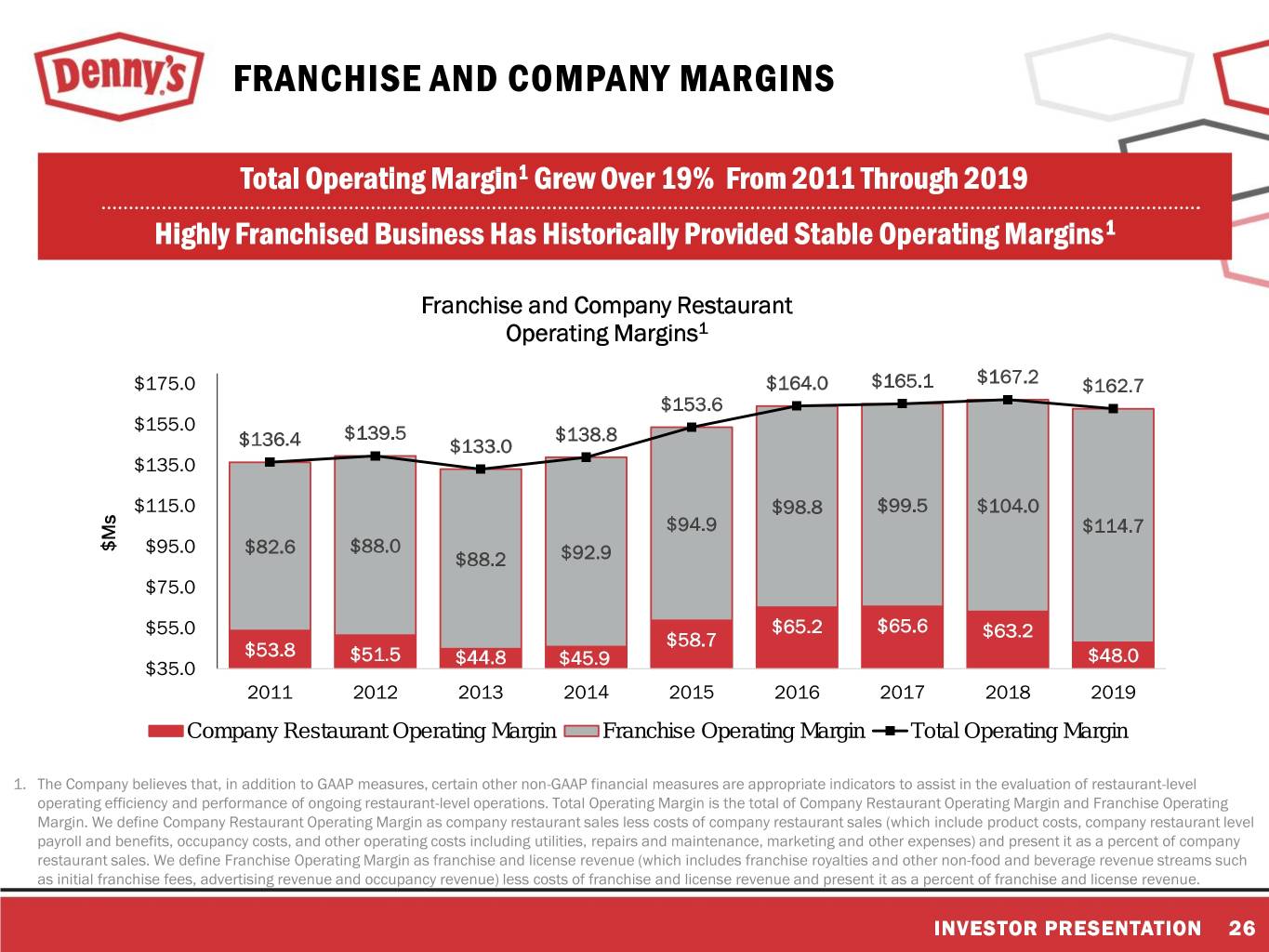

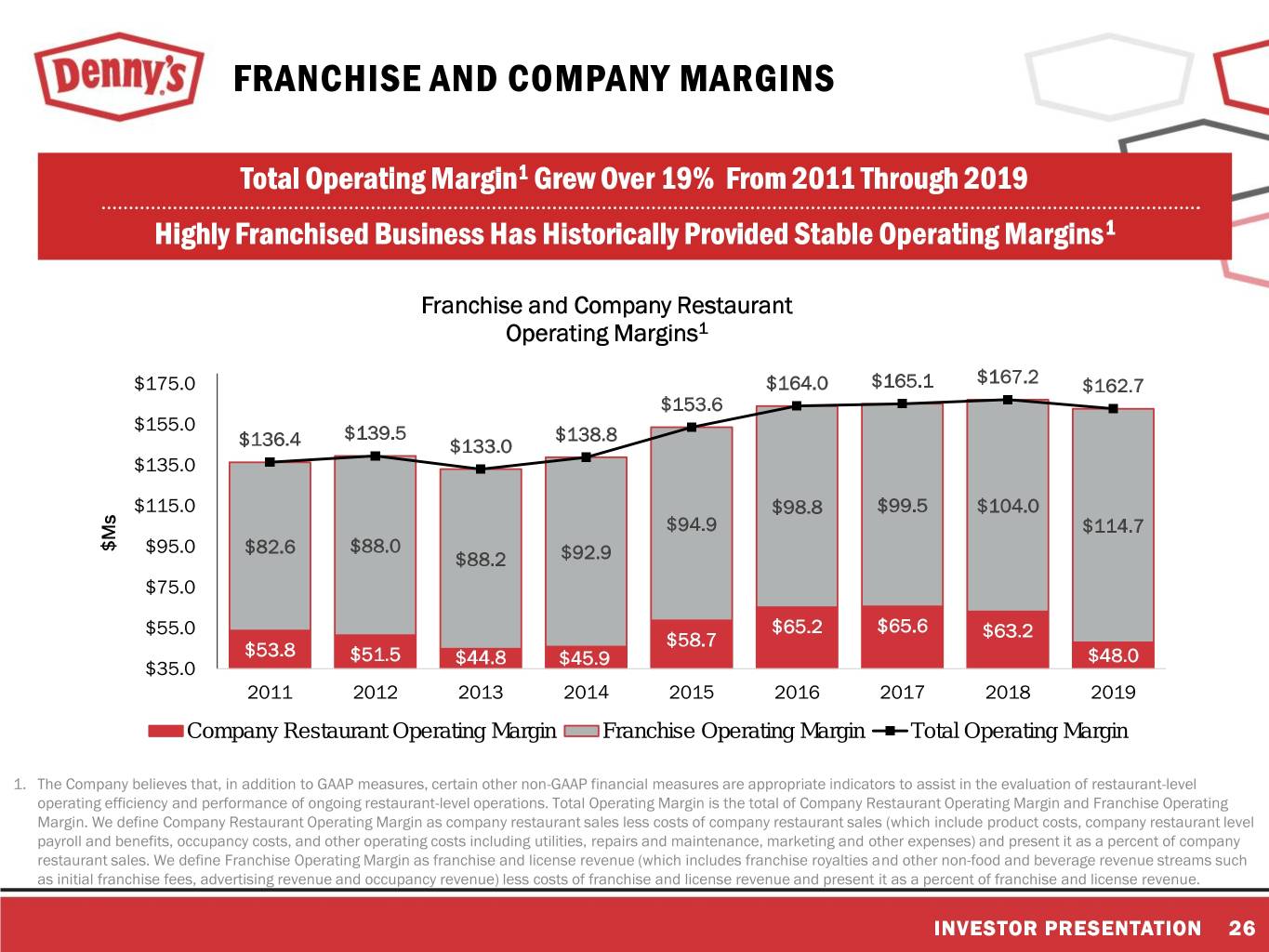

FRANCHISE AND COMPANY MARGINS Total Operating Margin1 Grew Over 19% From 2011 Through 2019 Highly Franchised Business Has Historically Provided Stable Operating Margins1 Franchise and Company Restaurant Operating Margins1 $175.0 $164.0 $165.1 $167.2 $162.7 $153.6 $155.0 $139.5 $138.8 $136.4 $133.0 $135.0 $115.0 $98.8 $99.5 $104.0 $94.9 $114.7 $Ms $95.0 $82.6 $88.0 $88.2 $92.9 $75.0 $55.0 $65.2 $65.6 $58.7 $63.2 $53.8 $51.5 $44.8 $45.9 $48.0 $35.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Company Restaurant Operating Margin Franchise Operating Margin Total Operating Margin 1. The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are appropriate indicators to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. Total Operating Margin is the total of Company Restaurant Operating Margin and Franchise Operating Margin. We define Company Restaurant Operating Margin as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and present it as a percent of company restaurant sales. We define Franchise Operating Margin as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and present it as a percent of franchise and license revenue. INVESTOR PRESENTATION 26

SAME-STORE SALES1 Nine Consecutive Fiscal Years of Positive Domestic System-Wide Same-Store Sales1 Growth From 2011 Through 2019 7.0% Domestic System-Wide Same-Store Sales1 6.0% 5.8% 5.0% 4.0% 3.0% 2.8% 2.0% 2.0% 1.3% 1.1% 0.9% 1.0% 0.8% 0.7% 0.5% 0.0% 2011 2012 2013 2014 2015 2016 2017 2018 2019 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. INVESTOR PRESENTATION 27

GLOBAL DEVELOPMENT Growth Initiatives Enabled Approximately 380 New Restaurant Openings Since 2011 With 95% Opened by Franchisees 1 70 61 60 5 50 50 46 45 40 5 14 39 40 38 8 6 6 7 30 30 30 56 9 14 41 20 37 36 34 32 32 21 10 16 0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Domestic Openings International Openings System Openings 1. Data as of December 25, 2019, the end of Fiscal Fourth Quarter 2019. INVESTOR PRESENTATION 28

ADJUSTED NET INCOME PER SHARE* Growth in Adjusted Net Income Per Share* Between 2011 and 2019 Driven by Successful Revitalization Initiatives and Share Repurchase Program $0.80 $0.77 $60.0 $0.68 $0.70 $50.0 $0.58 Adjusted Net Income* $0.60 $0.55 $40.0 ($ Millions) $0.50 $0.43 $0.37 $0.40 $0.31 $30.0 per Share*per $0.26 $0.30 $0.20 $44.6 $47.9 Adjusted Net IncomeNet Adjusted $42.3 $40.7 $36.7 $20.0 $32.9 $0.20 $29.3 $25.2 $19.5 $10.0 $0.10 $0.00 $0.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Adjusted Net Income* Adjusted Net Income Per Share* * See Appendix for reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) Per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 29

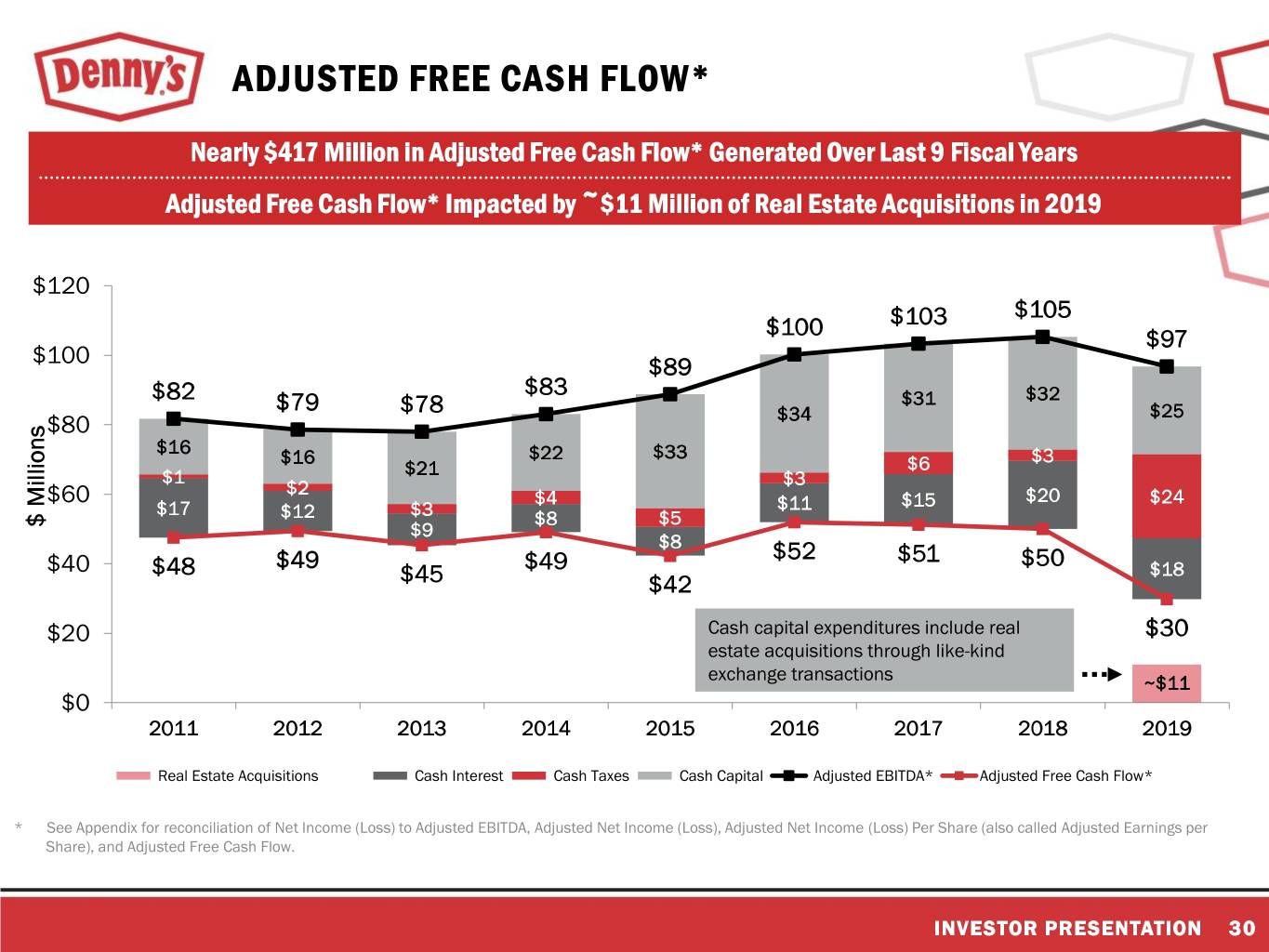

ADJUSTED FREE CASH FLOW* Nearly $417 Million in Adjusted Free Cash Flow* Generated Over Last 9 Fiscal Years Adjusted Free Cash Flow* Impacted by ~$11 Million of Real Estate Acquisitions in 2019 $120 $103 $105 $100 $97 $100 $89 $82 $83 $31 $32 $79 $78 $25 $80 $34 $16 $22 $33 $16 $6 $3 $1 $21 $2 $3 $60 $4 $15 $20 $24 $17 $12 $3 $11 $ Millions$ $8 $5 $9 $8 $52 $51 $40 $48 $49 $49 $50 $18 $45 $42 $20 Cash capital expenditures include real $30 estate acquisitions through like-kind exchange transactions ~$11 $0 2011 2012 2013 2014 2015 2016 2017 2018 2019 Real Estate Acquisitions Cash Interest Cash Taxes Cash Capital Adjusted EBITDA* Adjusted Free Cash Flow* * See Appendix for reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) Per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 30

SOLID BALANCE SHEET WITH FLEXIBILITY Subsequent to the Recent Follow On Equity Offering, Total Debt is Slightly Lower Than YE 2019, and Total Available Liquidity is Approximately $104 Million1 $600 $500 $400 $317.1 ($ Millions)($ $289.2 * $263.3 $300 $245.6 $256.5 $245.8 $220.6 $215.7 $190.1 $200 $173.1 $158.8 Total Debt Total $100 $0 1 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Total Debt 1. On May 13, 2020, we entered into an amendment to our credit agreement which temporarily waives certain financial covenants, increases the interest rate to LIBOR plus 3.00%, prohibits us from paying dividends and making stock repurchases and other general investments, restricts capital expenditures to $10 million in the aggregate through March 31, 2020, and adds a monthly minimum liquidity covenant, defined as the sum of unrestricted cash and revolver availability, ranging from $60 million to $70 million through May 26, 2021. Subsequent to the Second Quarter ended June 24, 2020, we raised $69.6 million in net proceeds from a public offering of common stock which we then utilized to paid down on the credit facility. As of September 23, 2020, the end of Fiscal Third Quarter 2020, we had $11.2 million cash on hand and $230.0 million outstanding on the credit facility yielding approximately $104 million of total available liquidity after considering the liquidity covenant. INVESTOR PRESENTATION 31

HISTORY OF CONSISTENTLY RETURNING EXCESS CAPITAL TO SHAREHOLDERS Approximately $554 Million Allocated Towards Share Repurchases Since We Started to Return Excess Capital to Shareholders in Late 20101 SHARE REPURCHASES ($ Millions) • Allocated $34.2 million toward share repurchases during Q1 2020 before suspending share repurchases as of ASR Total Share Repurchases February 27, 2020 $105.8 $96.2 • Terminated 10b5-1 trading plan on March 16, 2020 $82.9 • Paid an average of $10.26 per share to $68.0 $58.7 repurchase approximately $54 million shares resulting in a 44% net reduction in our share count since late 2010 $36.0 $34.2 $24.7 • On May 13, 2020, we entered into an $21.6 $22.2 $50 amendment to our credit agreement $25 $25 which, among other things, temporarily $3.9 prohibits us from paying dividends and Q4 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 making stock repurchases 2010 YTD1 1. Data as of February 27, 2020 (date the Company suspended share repurchases). INVESTOR PRESENTATION 32

(100%) 100% 200% 300% 400% 500% 600% 0% Between Between 2010 Stock Denny’s Price Rose to October the 2020, 187% and 23, Compared Dec-10 Index 125% of 600 Cap Small S&P Index and 266% of Restaurants 600 Cap Small S&P Mar-11 Denny’s Brand Revitalization Beginning of Beginning of Jun-11 2011 The Sep-11 S&P S&P 600 Cap Small 125% Index Up S&P 600 Cap Small Restaurants Index Up 266% DENN Up187% Dec-11 PERFORMANCE PRICE STOCK Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17 Dec-17 INVESTOR PRESENTATION PRESENTATION INVESTOR Mar-18 Jun-18 Sep-18 Refranchising Announcement Dec-18 Mar-19 Jun-19 Sep-19 Dec-19 COVID-19 Mar-20 Pandemic Jun-20 Sep-20 33

DENNY’S INVESTMENT HIGHLIGHTS • Consistent same-store sales1 growth through brand revitalization strategies to enhance food, service, and atmosphere • Global footprint supported by strong domestic presence and expanding international locations • Strong Adjusted Free Cash Flow* and shareholder return supported by solid balance sheet with flexibility to support brand investments and a focus on highly accretive and shareholder friendly allocations of Adjusted Free Cash Flow* • Durable business focused on the future with a lower risk, highly-franchised business model supported by established revitalization strategies and a sustained record of consistent financial performance 1. Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open the same period in the prior year. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. *See Appendix for reconciliation of Net Income (Loss) to Adjusted EBITDA, Adjusted Net Income (Loss), Adjusted Net Income (Loss) Per Share (also called Adjusted Earnings per Share), and Adjusted Free Cash Flow. INVESTOR PRESENTATION 34

APPENDIX

EXPERIENCED AND COMMITTED LEADERSHIP TEAM John C. Miller, Chief Executive Officer joined Denny’s in 2011 with over 30 years experience in restaurant operations and management. Prior to joining Denny’s, served as President of Taco Bueno and spent 17 years with Brinker International where positions held included President of Romano’s Macaroni Grill and President of Brinker’s Mexican Concepts. F. Mark Wolfinger, President joined Denny’s in 2005 as Chief Financial Officer. Previous roles include Chief Financial Officer of Danka Business Systems and senior financial positions with Hollywood Entertainment, Metromedia Restaurant Group (operators of Bennigans, Ponderosa Steakhouse, and Steak & Ale), and the Grand Metropolitan. Christopher D. Bode, Senior Vice President, Chief Operating Officer. Prior to joining Denny’s in 2011, served as Chief Operating Officer of QSR Management, LLC (a franchisee of Dunkin’ Donuts) and Vice President of Development & Construction of Dunkin’ Brands, Inc. Before joining the restaurant industry, served as a United States Navy Communications Specialist. John W. Dillon, Executive Vice President, Chief Brand Officer. Prior to joining Denny’s in 2007, held multiple marketing leadership positions with various organizations, including 10 years with YUM! Brands/Pizza Hut, and was Vice President of Marketing for the National Basketball Association’s Houston Rockets. Stephen C. Dunn, Senior Vice President, Chief Global Development Officer. Prior to joining Denny’s in 2004, held executive-level positions with Church's Chicken, El Pollo Loco, Mr. Gatti's, and TCBY. Earned the distinction of Certified Franchise Executive by the International Franchise Association Educational Foundation. Served as an Infantry Officer in the United States Army. Michael L. Furlow, Senior Vice President, Chief Information Officer. Prior to joining Denny’s in 2017, served as Chief Information Officer and Senior Vice President of IT at Red Robin Gourmet Burgers and CEC Entertainment, Inc. (an operator and franchisor of Chuck E. Cheese’s and Peter Piper Pizza). Gail S. Myers, Senior Vice President, General Counsel. Prior to joining Denny’s in 2020, served as Executive Vice President, General Counsel, Secretary and Chief Compliance Officer for American Tire Distributors, Inc., Senior Vice President, Deputy General Counsel and Chief Compliance Counsel at U.S. Foods and Senior Vice President, General Counsel and Secretary at Snyder's-Lance, Inc. Robert P. Verostek, Senior Vice President, Chief Financial Officer. Joined Denny’s in 1999 and served in numerous leadership positions across the Finance and Accounting teams. Named Vice President of Financial Planning and Analysis in 2012 and Chief Financial Officer is 2020. Prior experience includes various accounting roles for Insignia Financial Group. INVESTOR PRESENTATION 36

RECONCILIATION OF NET INCOME (LOSS) TO NON- GAAP FINANCIAL MEASURES 2020 Q3 2011 2012 2013 20141 2015 2016 2017 2018 2019 $ Millions (except per share amounts) YTD 1,2 Net Income (Loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $117.4 ($7.5) Provision for (Benefit from) Income Taxes3 (84.0) 12.8 11.5 16.0 17.8 16.5 17.2 8.6 31.8 (1.9) Operating (Gains) Losses and Other Charges, Net 2.1 0.5 7.1 1.3 2.4 26.9 4.3 2.6 (91.2) 2.3 Other Nonoperating Expense (Income), Net 2.6 7.9 1.1 (0.6) 0.1 (1.1) (1.7) 0.6 (2.8) 3.9 Share‐Based Compensation 4.2 3.5 4.9 5.8 6.6 7.6 8.5 6.0 6.7 2.0 Deferred Compensation Plan Valuation Adjustments4 (0.1) 0.7 1.1 0.5 0.0 0.9 1.6 (1.0) 2.6 0.0 Interest Expense, Net 20.0 13.4 10.3 9.2 9.3 12.2 15.6 20.7 18.5 13.3 Depreciation and Amortization 28.0 22.3 21.5 21.2 21.5 22.2 23.7 27.0 19.8 12.3 Cash Payments for Restructuring Charges & Exit Costs (2.7) (3.8) (2.8) (2.0) (1.5) (1.8) (1.7) (1.1) (2.6) (2.4) Cash Payments for Share‐Based Compensation (0.8) (1.0) (1.2) (1.1) (3.4) (2.5) (3.9) (1.9) (3.6) (3.2) Adjusted EBITDA4 $81.7 $78.6 $78.0 $83.1 $88.8 $100.2 $103.3 $105.3 $96.8 $18.7 Adjusted EBITDA Margin % 15.2% 16.1% 16.9% 17.6% 18.1% 19.8% 19.5% 16.7% 17.9% 9.0% Cash Interest Expense, Net7 (17.0) (11.6) (9.1) (8.1) (8.3) (11.2) (14.6) (19.6) (17.6) (13.1) Cash Paid for Income Taxes, Net (1.1) (2.0) (2.8) (3.8) (5.4) (3.0) (6.4) (3.3) (24.1) (0.5) Cash Paid for Capital Expenditures (16.1) (15.6) (20.8) (22.1) (32.8) (34.0) (31.2) (32.4) (25.3) (5.5) Adjusted Free Cash Flow4 4$47.5 $49.4 $45.3 $49.1 $42.3 $51.9 $51.2 $50.0 $29.8 ($0.5) Net Income (Loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $117.4 ($7.5) Pension Settlement Loss 0.0 0.0 0.0 0.0 0.0 24.3 0.0 0.0 0.0 0.0 (Gains) Losses on Interest Rate Swap Derivatives 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 4.2 (Gains) Losses on Sales of Assets and Other, Net (3.2) (7.1) (0.1) (0.1) (0.1) 0.0 3.5 (0.5) (93.6) (2.3) Impairment Charges 4.1 3.7 5.7 0.4 0.9 1.1 0.3 1.6 0.0 2.5 Early Extinguishment of Debt 1.4 7.9 1.2 0.0 0.3 0.0 0.0 0.0 0.0 0.0 Tax Reform 0.0 0.0 0.0 0.0 0.0 0.0 (1.6) 0.0 0.0 0.0 Tax Effect5 (0.8) (1.6) (2.2) (0.1) (0.4) (2.5) (1.2) (0.2) 24.1 (1.1) Adjusted Provision for Income Taxes6 (94.3) 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 Adjusted Net Income (Loss) $19.5 $25.2 $29.3 $32.9 $36.7 $42.3 $40.7 $44.6 $47.9 ($4.2) Diluted Net Income (Loss) Per Share $1.15 $0.23 $0.26 $0.37 $0.42 $0.25 $0.56 $0.67 $1.90 ($0.13) Adjustments Per Share ($0.95) $0.03 $0.05 $0.00 $0.01 $0.30 $0.02 $0.01 ($1.13) $0.06 Adjusted Net Income (Loss) Per Share $0.20 $0.26 $0.31 $0.37 $0.43 $0.55 $0.58 $0.68 $0.77 ($0.07) Diluted Weighted Average Shares Outstanding (000’s) 99,588 96,754 92,903 88,355 84,729 77,206 70,403 65,562 61,833 59,350 1. Full year includes 53 operating weeks. 2. Data for the three fiscal quarters ended September 23, 2020. 3. In 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre-tax income. 4. Beginning in 2018, historical presentations of Adjusted EBITDA and Adjusted Free Cash Flow have been restated to exclude the impact of market valuation changes in the Company’s non-qualified deferred compensation plan liabilities. 5. Tax adjustments for full year 2013, 2014, 2015, 2017 and 2018 use full year effective tax rates of 31.9%, 32.9%, 33.0%, 30.3% and 16.4%, respectively. Tax adjustments for full year 2011 and 2012 are calculated using the full year 2012 effective rate of 36.4%. The tax adjustment for the loss on pension termination in 2016 is calculated using an effective tax rate of 8.8%., with all remaining adjustments calculated using an effective tax rate of 30.9%. Tax adjustments for the gains on sales of assets and other, net in 2019 are calculated using an effective rate of 25.7%. For the three quarters ended September 23, 2020, the tax adjustments are calculated using an effective tax rate of 25.7%. 6. The Adjusted provision for income taxes based on effective income tax rate of 36.4% for full year ended Dec. 27, 2012 and excludes impact of net deferred tax benefit. 7. Includes cash interest expense, net and cash payments of approximately $1.1 million for dedesignated interest rate swap derivatives for year-to-date period ended September 23, 2020. INVESTOR PRESENTATION 37

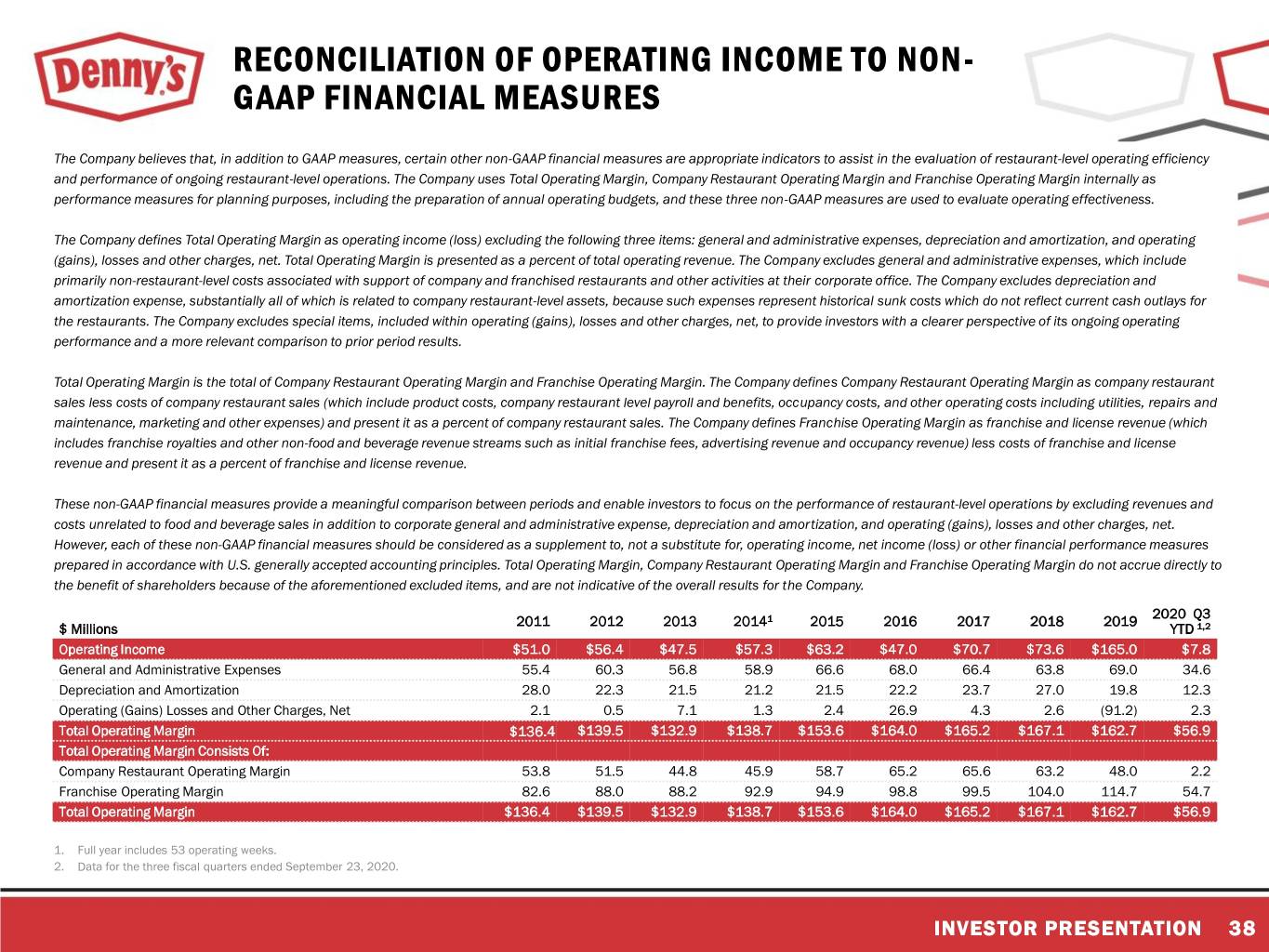

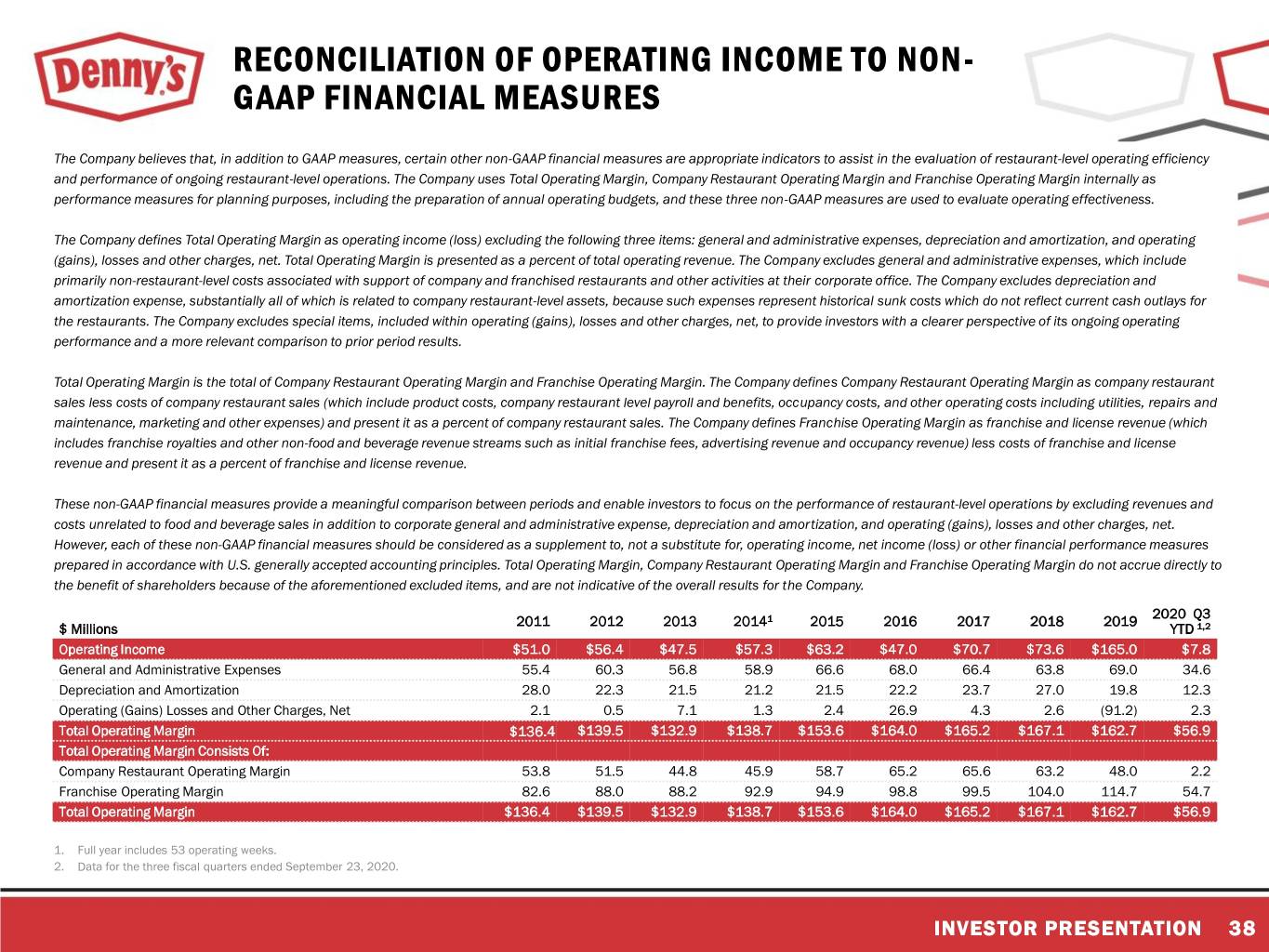

RECONCILIATION OF OPERATING INCOME TO NON- GAAP FINANCIAL MEASURES The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are appropriate indicators to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. The Company uses Total Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and these three non-GAAP measures are used to evaluate operating effectiveness. The Company defines Total Operating Margin as operating income (loss) excluding the following three items: general and administrative expenses, depreciation and amortization, and operating (gains), losses and other charges, net. Total Operating Margin is presented as a percent of total operating revenue. The Company excludes general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office. The Company excludes depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants. The Company excludes special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results. Total Operating Margin is the total of Company Restaurant Operating Margin and Franchise Operating Margin. The Company defines Company Restaurant Operating Margin as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and present it as a percent of company restaurant sales. The Company defines Franchise Operating Margin as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and present it as a percent of franchise and license revenue. These non-GAAP financial measures provide a meaningful comparison between periods and enable investors to focus on the performance of restaurant-level operations by excluding revenues and costs unrelated to food and beverage sales in addition to corporate general and administrative expense, depreciation and amortization, and operating (gains), losses and other charges, net. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income (loss) or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. Total Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin do not accrue directly to the benefit of shareholders because of the aforementioned excluded items, and are not indicative of the overall results for the Company. 2020 Q3 2011 2012 2013 20141 2015 2016 2017 2018 2019 $ Millions YTD 1,2 Operating Income $51.0 $56.4 $47.5 $57.3 $63.2 $47.0 $70.7 $73.6 $165.0 $7.8 General and Administrative Expenses 55.4 60.3 56.8 58.9 66.6 68.0 66.4 63.8 69.0 34.6 Depreciation and Amortization 28.0 22.3 21.5 21.2 21.5 22.2 23.7 27.0 19.8 12.3 Operating (Gains) Losses and Other Charges, Net 2.1 0.5 7.1 1.3 2.4 26.9 4.3 2.6 (91.2) 2.3 Total Operating Margin $136.4 $139.5 $132.9 $138.7 $153.6 $164.0 $165.2 $167.1 $162.7 $56.9 Total Operating Margin Consists Of: Company Restaurant Operating Margin 53.8 51.5 44.8 45.9 58.7 65.2 65.6 63.2 48.0 2.2 Franchise Operating Margin 82.6 88.0 88.2 92.9 94.9 98.8 99.5 104.0 114.7 54.7 Total Operating Margin $136.4 $139.5 $132.9 $138.7 $153.6 $164.0 $165.2 $167.1 $162.7 $56.9 1. Full year includes 53 operating weeks. 2. Data for the three fiscal quarters ended September 23, 2020. INVESTOR PRESENTATION 38