INVESTOR PRESENTATION Third Quarter 2022 Results

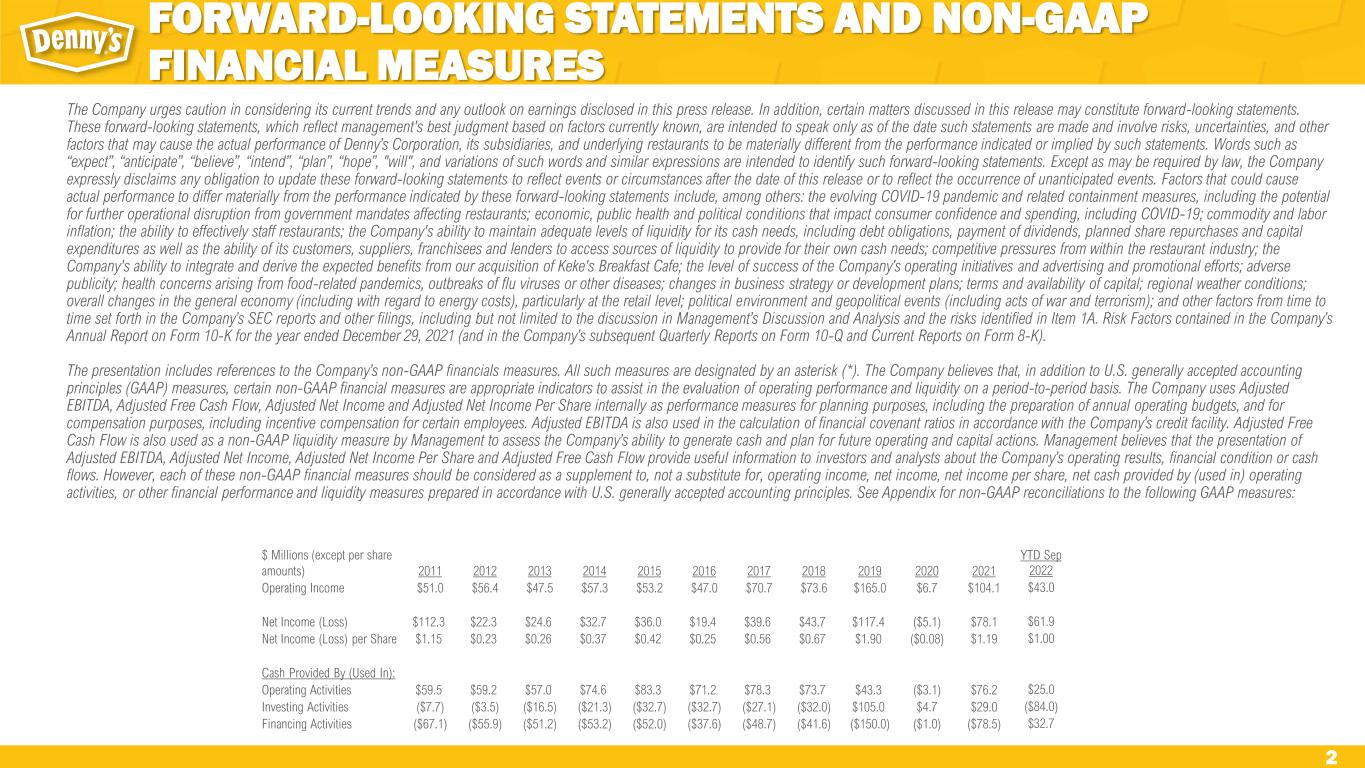

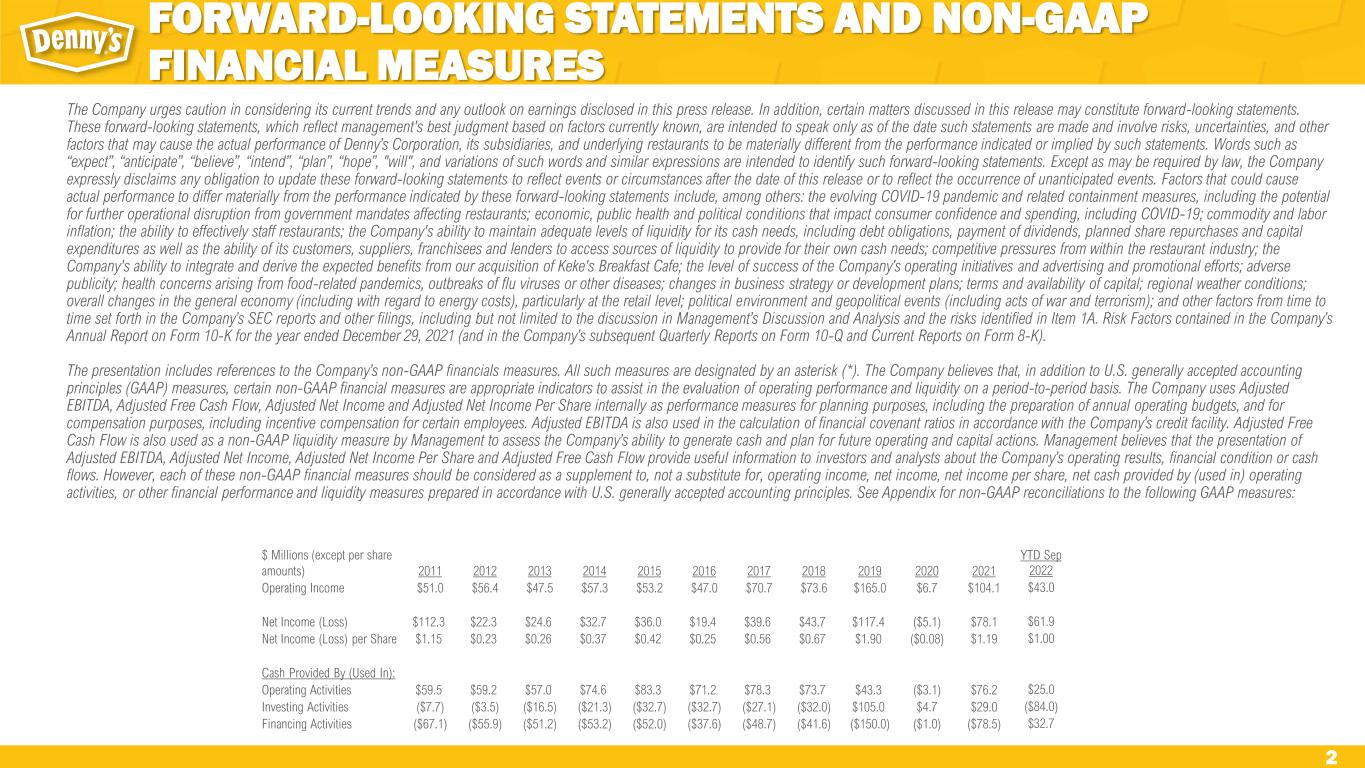

2 The Company urges caution in considering its current trends and any outlook on earnings disclosed in this press release. In addition, certain matters discussed in this release may constitute forward-looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: the evolving COVID-19 pandemic and related containment measures, including the potential for further operational disruption from government mandates affecting restaurants; economic, public health and political conditions that impact consumer confidence and spending, including COVID-19; commodity and labor inflation; the ability to effectively staff restaurants; the Company's ability to maintain adequate levels of liquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers, suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the Company's ability to integrate and derive the expected benefits from our acquisition of Keke's Breakfast Cafe; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 29, 2021 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to U.S. generally accepted accounting principles (GAAP) measures, certain non-GAAP financial measures are appropriate indicators to assist in the evaluation of operating performance and liquidity on a period-to-period basis. The Company uses Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. Adjusted EBITDA is also used in the calculation of financial covenant ratios in accordance with the Company’s credit facility. Adjusted Free Cash Flow is also used as a non-GAAP liquidity measure by Management to assess the Company’s ability to generate cash and plan for future operating and capital actions. Management believes that the presentation of Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income Per Share and Adjusted Free Cash Flow provide useful information to investors and analysts about the Company’s operating results, financial condition or cash flows. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income, net income per share, net cash provided by (used in) operating activities, or other financial performance and liquidity measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations to the following GAAP measures: FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES $ Millions (except per share amounts) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 YTD Sep 2022 Operating Income $51.0 $56.4 $47.5 $57.3 $53.2 $47.0 $70.7 $73.6 $165.0 $6.7 $104.1 $43.0 Net Income (Loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $117.4 ($5.1) $78.1 $61.9 Net Income (Loss) per Share $1.15 $0.23 $0.26 $0.37 $0.42 $0.25 $0.56 $0.67 $1.90 ($0.08) $1.19 $1.00 Cash Provided By (Used In): Operating Activities $59.5 $59.2 $57.0 $74.6 $83.3 $71.2 $78.3 $73.7 $43.3 ($3.1) $76.2 $25.0 Investing Activities ($7.7) ($3.5) ($16.5) ($21.3) ($32.7) ($32.7) ($27.1) ($32.0) $105.0 $4.7 $29.0 ($84.0) Financing Activities ($67.1) ($55.9) ($51.2) ($53.2) ($52.0) ($37.6) ($48.7) ($41.6) ($150.0) ($1.0) ($78.5) $32.7

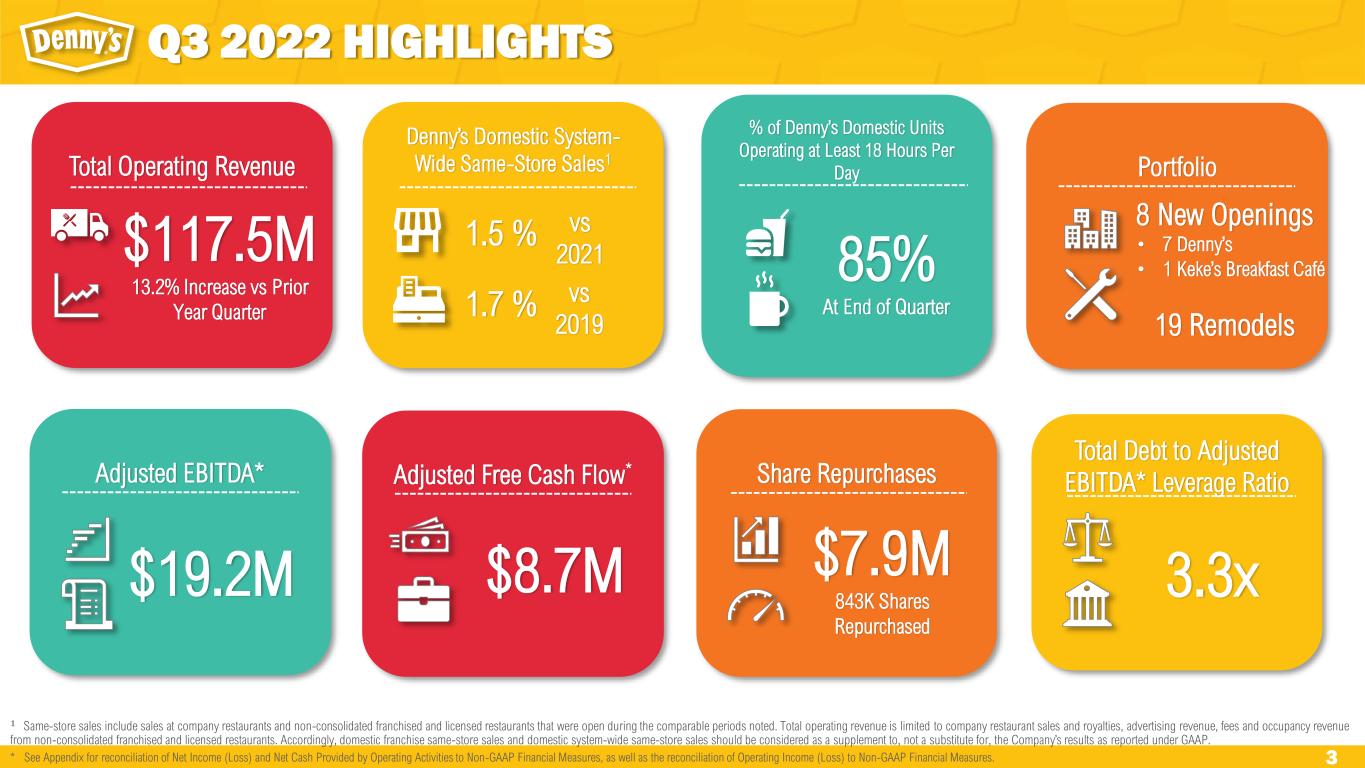

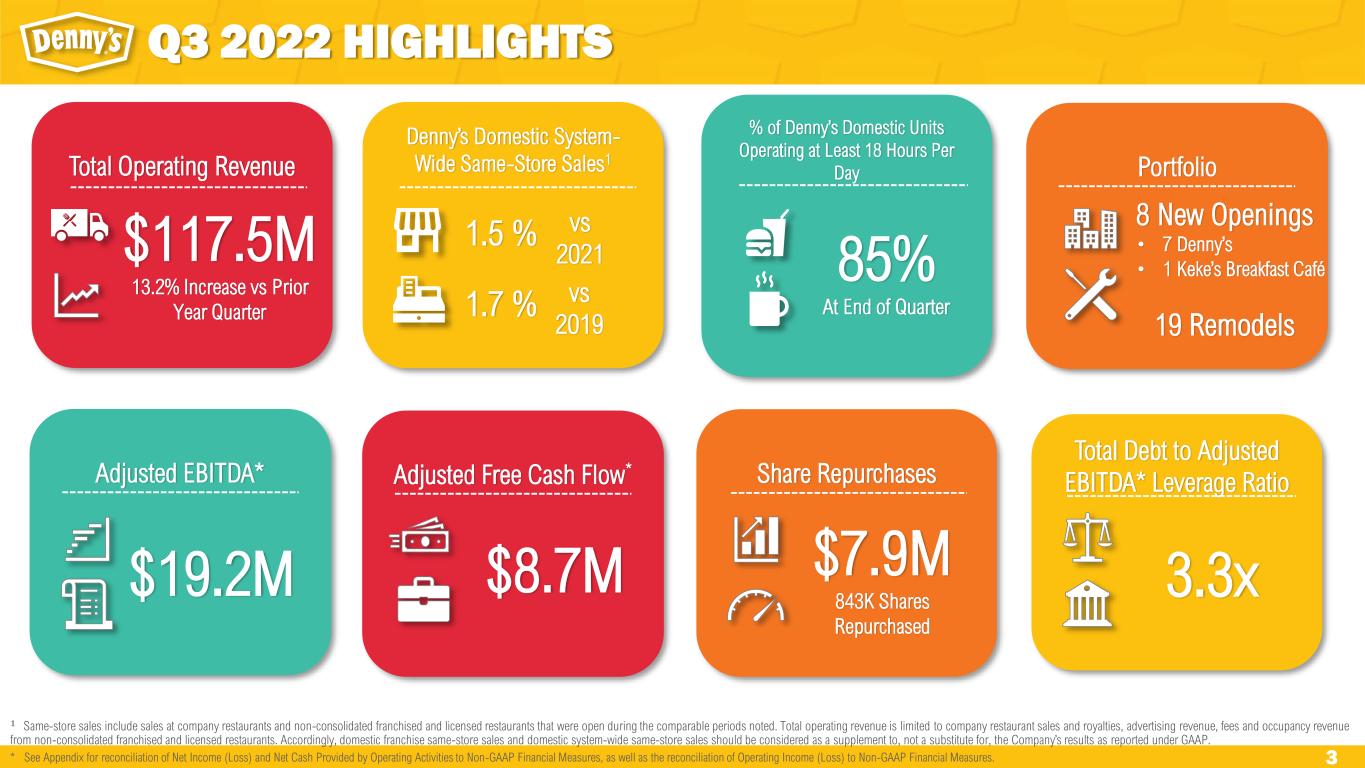

3 Total Operating Revenue Q3 2022 HIGHLIGHTS 𝟏 Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures. Denny’s Domestic System- Wide Same-Store Sales1 Adjusted Free Cash Flow* $8.7M Share Repurchases $7.9M 843K Shares Repurchased % of Denny’s Domestic Units Operating at Least 18 Hours Per Day 85% At End of Quarter Portfolio 8 New Openings • 7 Denny’s • 1 Keke’s Breakfast Café 19 Remodels $117.5M 13.2% Increase vs Prior Year Quarter Total Debt to Adjusted EBITDA* Leverage Ratio 3.3x Adjusted EBITDA* $19.2M 1.5 % vs 2021 1.7 % vs 2019

4 DENNY’S DOMESTIC AVERAGE WEEKLY SALES & SAME-STORE SALES1 $4.0 $4.0 $3.8 $4.1 $4.2 $8.4 $8.0 $7.9 $8.8 $8.1 $7.0 $7.2 $7.0 $6.5 $6.1 $0.4 $1.1 $1.0 $1.0 $0.9 $0.9 $0.9 $28.7 $30.1 $29.7 $30.0 $26.5 $6.4 $14.4 $15.4 $17.3 $25.3 $26.2 $27.0 $25.2 $28.3 $28.1 $32.7 $34.0 $33.6 $34.1 $30.8 $14.9 $22.4 $23.3 $26.6 $34.5 $34.3 $35.2 $33.1 $35.7 $35.1 1% 4% 1% 2% -6% -57% -34% -33% -20% -1% 0% 1% -2% 2% 2% -70% -50% -30% -10% 10% 30% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 D om es tic S ys te m -W id e S am e- S to re S al es 1 A ve ra ge W ee kl y S al es ( $0 00 s) Denny's Off-Premise Sales Virtual Brands Off-Premise Sales Denny's On-Premise Sales Denny's Total Sales Denny's Domestic System-Wide Same-Store Sales 𝟏 Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 𝟐 2021 and 2022 Denny’s domestic system-wide same-store sales1 are versus 2019. Denny’s Q3 2022 Domestic Average Weekly Sales Outperformed Q3 2021 by ~2.5% and Q3 2019 by ~5.0% 1,2

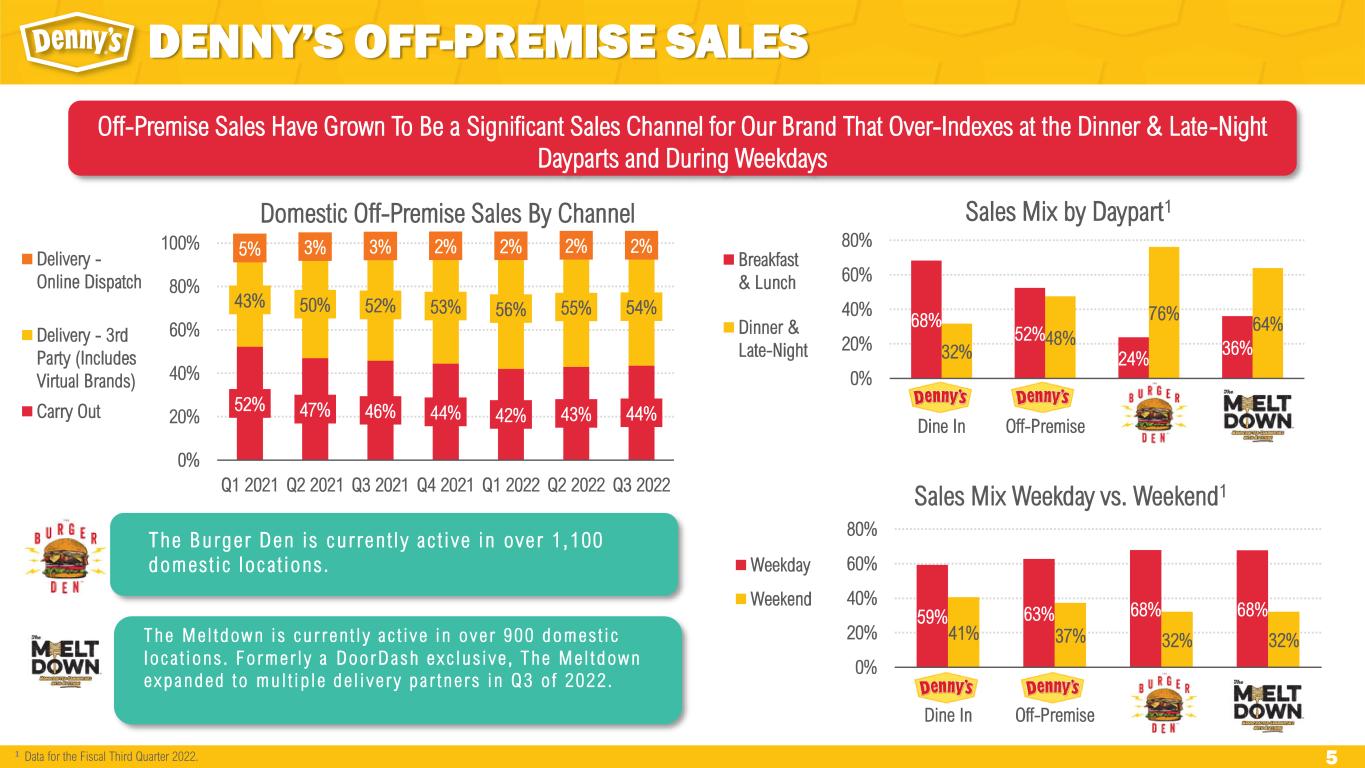

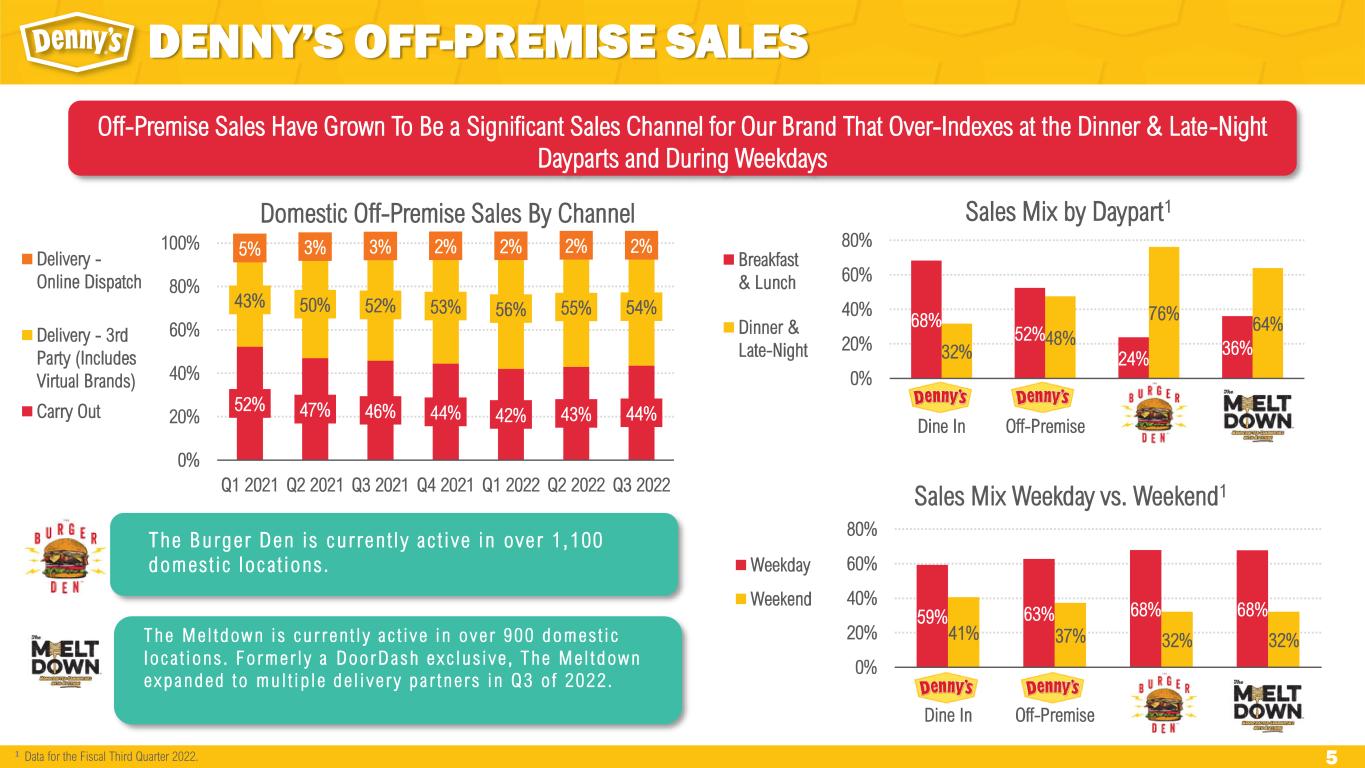

5 59% 63% 68% 68% 41% 37% 32% 32% 0% 20% 40% 60% 80% Dine In Off-Premise The Burger Den The Meltdown Sales Mix Weekday vs. Weekend1 Weekday Weekend 52% 47% 46% 44% 42% 43% 44% 43% 50% 52% 53% 56% 55% 54% 5% 3% 3% 2% 2% 2% 2% 0% 20% 40% 60% 80% 100% Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Domestic Off-Premise Sales By Channel Delivery - Online Dispatch Delivery - 3rd Party (Includes Virtual Brands) Carry Out DENNY’S OFF-PREMISE SALES Off-Premise Sales Have Grown To Be a Significant Sales Channel for Our Brand That Over-Indexes at the Dinner & Late-Night Dayparts and During Weekdays 68% 52% 24% 36%32% 48% 76% 64% 0% 20% 40% 60% 80% Dine In Off-Premise The Burger Den The Meltdown Sales Mix by Daypart1 Breakfast & Lunch Dinner & Late-Night 𝟏 Data for the Fiscal Third Quarter 2022. The Burge r Den i s cu r ren t l y ac t i ve in ove r 1 ,100 domes t i c loca t ions . The Me l t down i s cu r r en t l y a c t i v e i n o v e r 900 domes t i c l o c a t i ons . Fo rme r l y a Doo rDash exc l u s i v e , The Me l t down expanded t o mu l t i p l e de l i v e r y p a r t ne r s i n Q3 o f 2022 .

6 BARBELL MENU STRATEGY Recent ly Launched our A l l Day Diner Deals Value Promot ion Which is Dr iv ing Encouraging Traf f ic Trends Continue to In t roduce New and Innovat ive LTOs Featur ing Socia l Media In f luencers

7 DENNY’S DOMESTIC FOOTPRINT Tota l of 1,459 Restaurants in the U.S. wi th Strongest Presence in Cal i fornia, Texas, Flor ida, and Ar izona 1 Top 10 U.S. Markets1 DMA Units Los Angeles 170 Phoenix 66 Houston 64 Dallas/Ft. Worth 53 Sacramento/Stockton 46 Orlando/Daytona 40 San Francisco/Oakland 40 San Diego 38 Miami/Ft. Lauderdale 35 Las Vegas 33 % of Domestic System 40% 𝟏 Data as of the end of the Third Fiscal Quarter 2022. 3 24 2 7 6 6 6 1

8 DENNY’S INTERNATIONAL FOOTPRINT International Presence of 154 Restaurants in 13 Countries and U.S. Territories has Grown by ~77% Since Year End 20101 Footprint1 Country Units United States 1,459 Canada 85 Puerto Rico 15 Mexico 13 Philippines 10 New Zealand 7 Honduras 6 United Arab Emirates 5 Costa Rica 3 Guatemala 3 El Salvador 2 Guam 2 Indonesia 2 United Kingdom 1 Total 1,613 𝟏 Data as of the end of the Third Fiscal Quarter 2022.

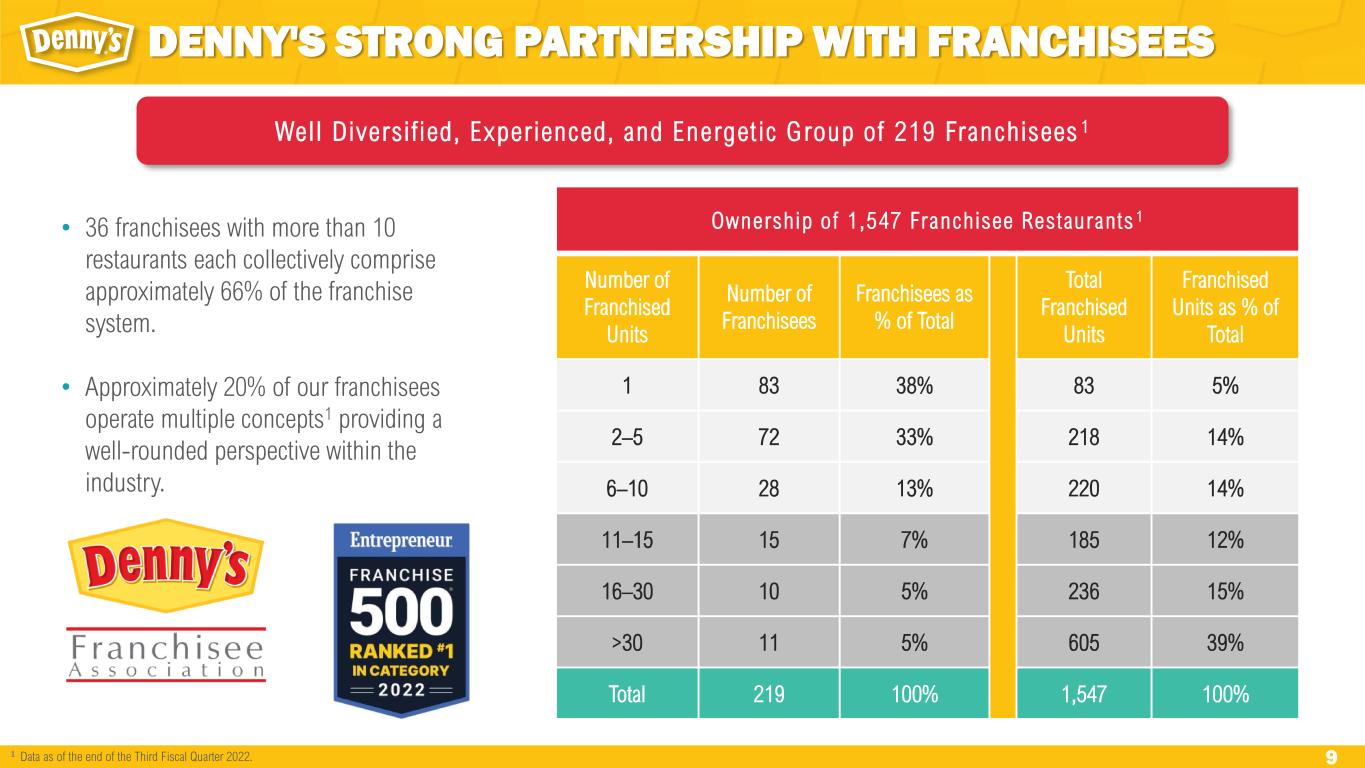

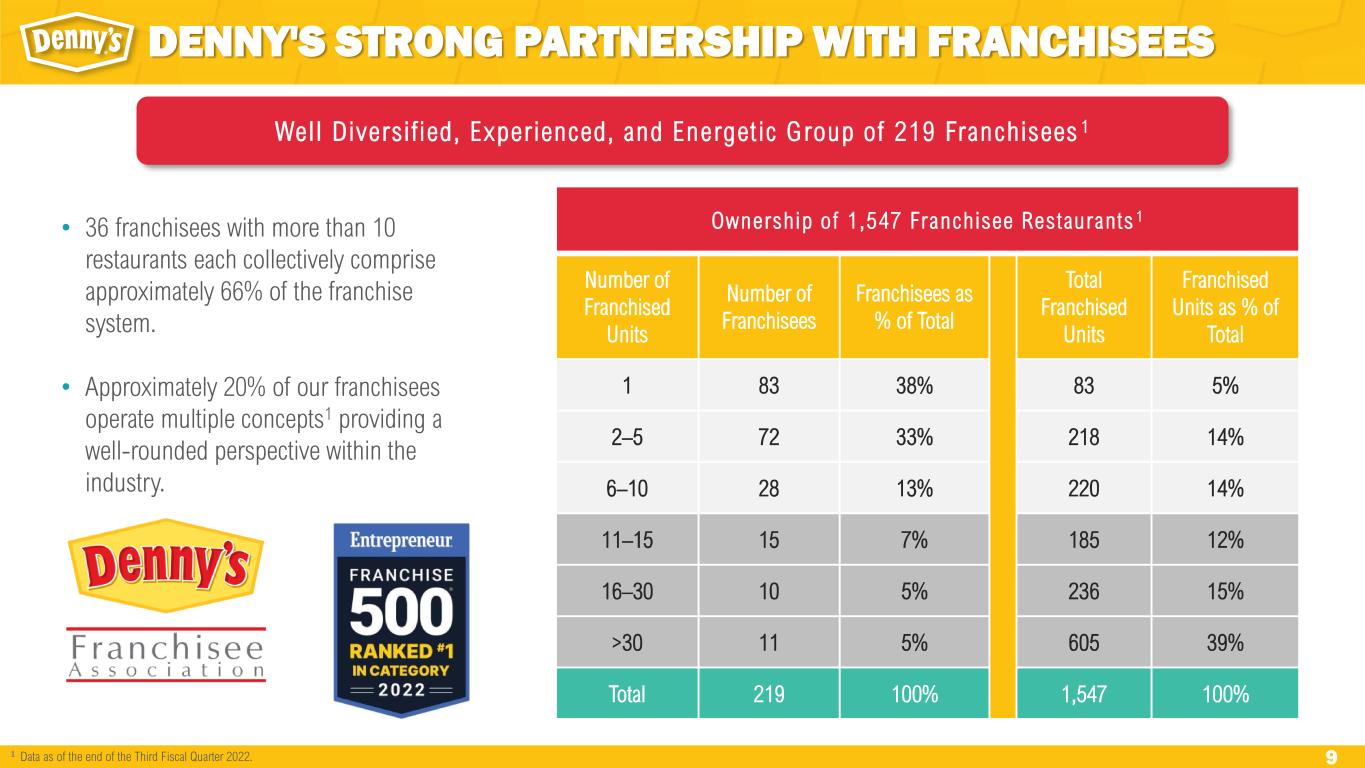

9 Well Diversi f ied, Exper ienced, and Energet ic Group of 219 Franchisees 1 • 36 franchisees with more than 10 restaurants each collectively comprise approximately 66% of the franchise system. • Approximately 20% of our franchisees operate multiple concepts1 providing a well-rounded perspective within the industry. DENNY'S STRONG PARTNERSHIP WITH FRANCHISEES Ownership o f 1 ,547 Franchisee Res taurants 1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 83 38% 83 5% 2–5 72 33% 218 14% 6–10 28 13% 220 14% 11–15 15 7% 185 12% 16–30 10 5% 236 15% >30 11 5% 605 39% Total 219 100% 1,547 100% 𝟏 Data as of the end of the Third Fiscal Quarter 2022.

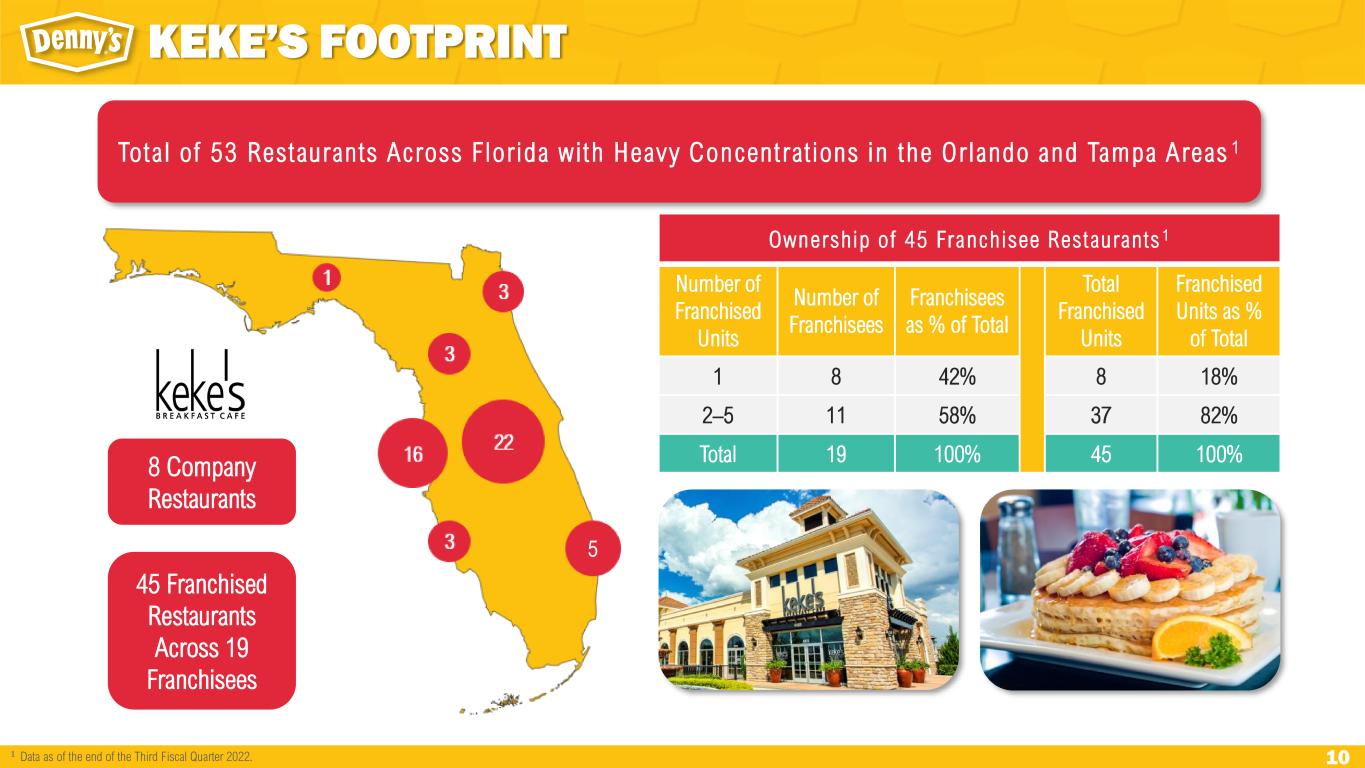

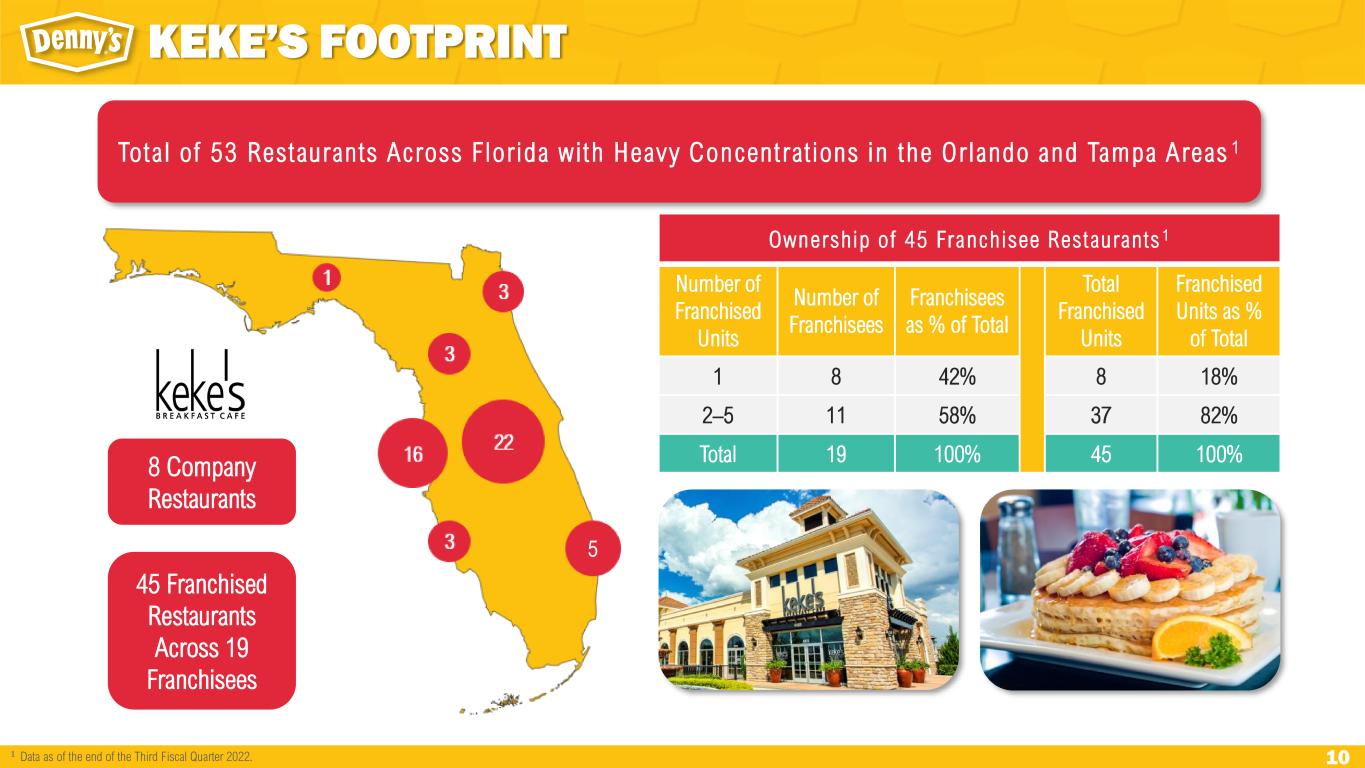

10 5 KEKE’S FOOTPRINT Tota l of 53 Restaurants Across Flor ida wi th Heavy Concentrat ions in the Orlando and Tampa Areas 1 8 Company Restaurants 45 Franchised Restaurants Across 19 Franchisees 𝟏 Data as of the end of the Third Fiscal Quarter 2022. Ownership o f 45 Franchisee Res taurants 1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 8 42% 8 18% 2–5 11 58% 37 82% Total 19 100% 45 100%

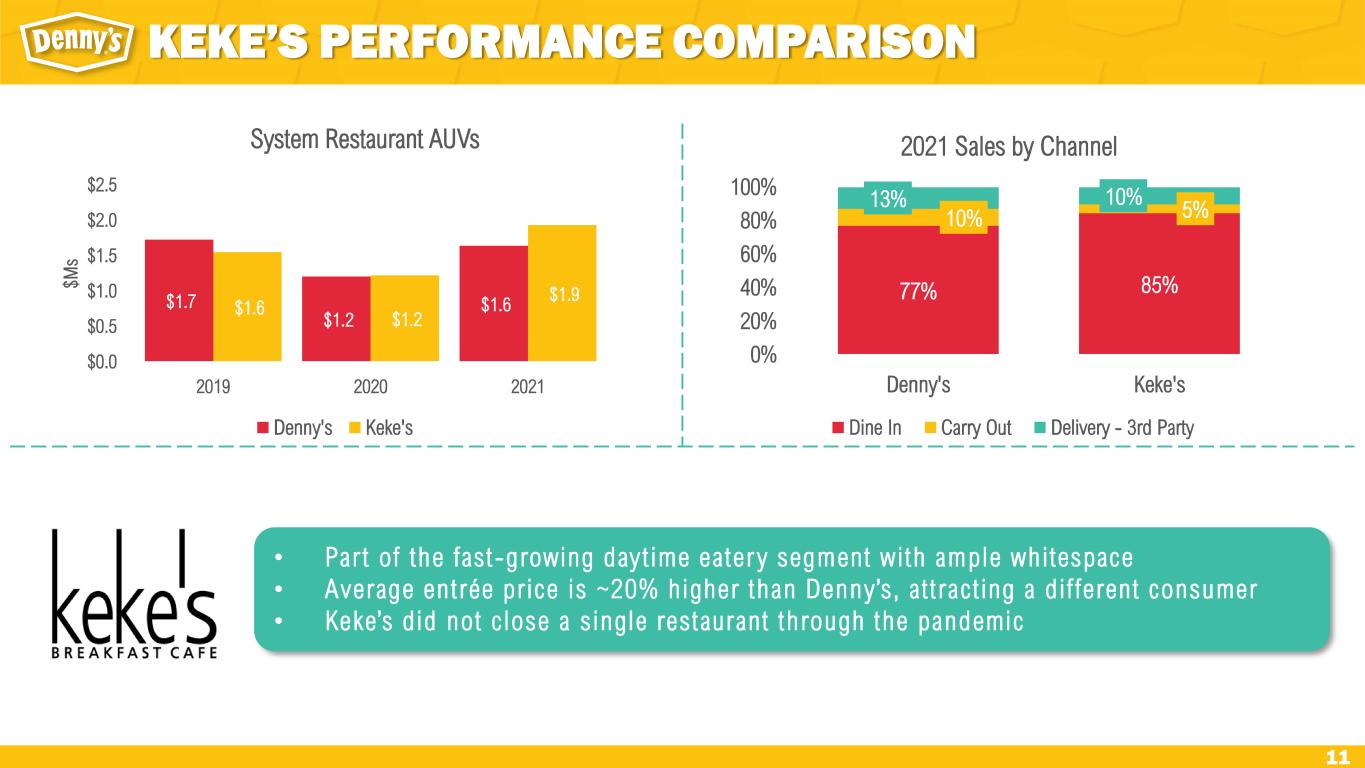

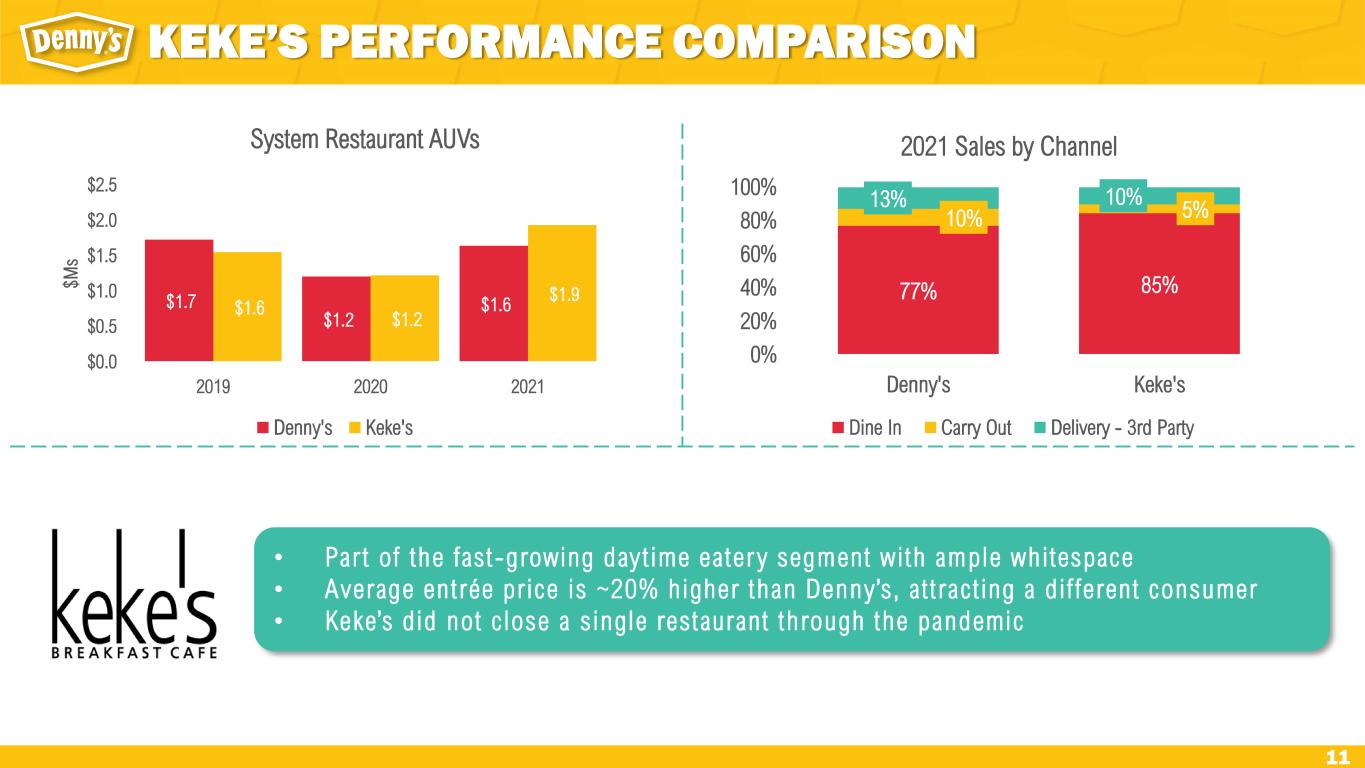

11 KEKE’S PERFORMANCE COMPARISON $1.7 $1.2 $1.6 $1.6 $1.2 $1.9 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 2019 2020 2021 $M s System Restaurant AUVs Denny's Keke's 77% 85% 10% 5% 13% 10% 0% 20% 40% 60% 80% 100% Denny's Keke's 2021 Sales by Channel Dine In Carry Out Delivery - 3rd Party • Par t of the fast -growing day t ime eater y segment wi th ample whi tespace • Average entrée pr ice is ~20% higher than Denny’s, a t t ract ing a di f ferent consumer • Keke’s did not c lose a s ingle restaurant through the pandemic

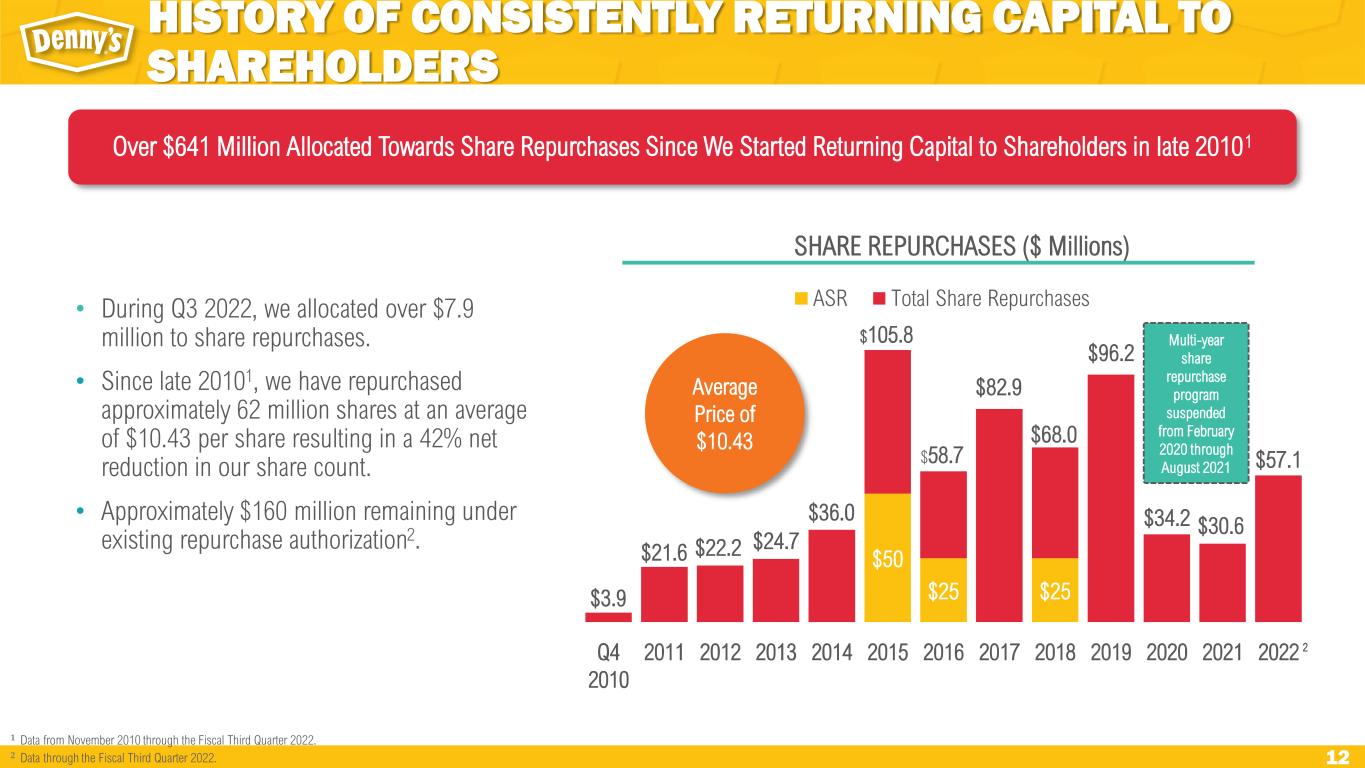

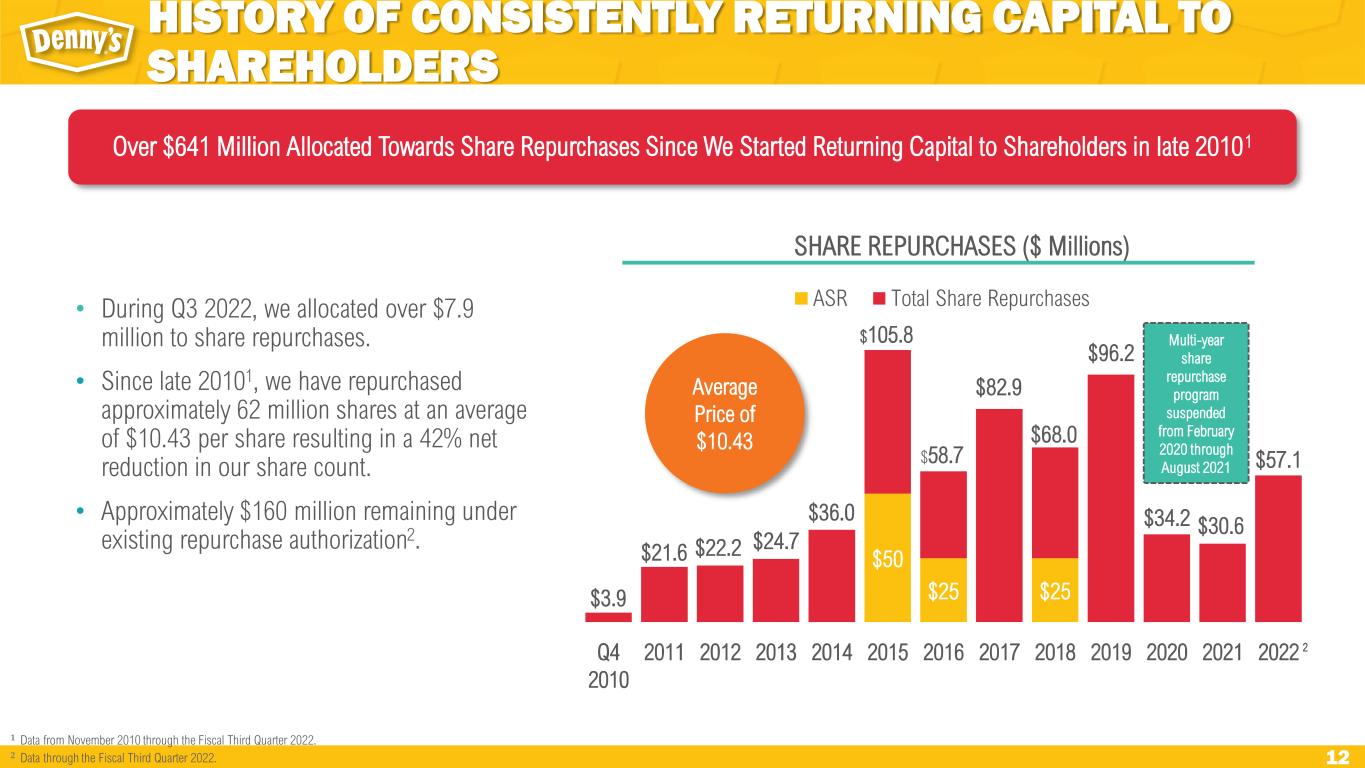

12 $50 $25 $25 $3.9 $21.6 $22.2 $24.7 $36.0 $82.9 $96.2 $34.2 $30.6 $57.1 Q4 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 ASR Total Share Repurchases• During Q3 2022, we allocated over $7.9 million to share repurchases. • Since late 20101, we have repurchased approximately 62 million shares at an average of $10.43 per share resulting in a 42% net reduction in our share count. • Approximately $160 million remaining under existing repurchase authorization2. SHARE REPURCHASES ($ Millions) $105.8 $58.7 $68.0 Average Price of $10.43 Over $641 Million Allocated Towards Share Repurchases Since We Started Returning Capital to Shareholders in late 20101 2 HISTORY OF CONSISTENTLY RETURNING CAPITAL TO SHAREHOLDERS 𝟏 Data from November 2010 through the Fiscal Third Quarter 2022. 𝟐 Data through the Fiscal Third Quarter 2022. Multi-year share repurchase program suspended from February 2020 through August 2021

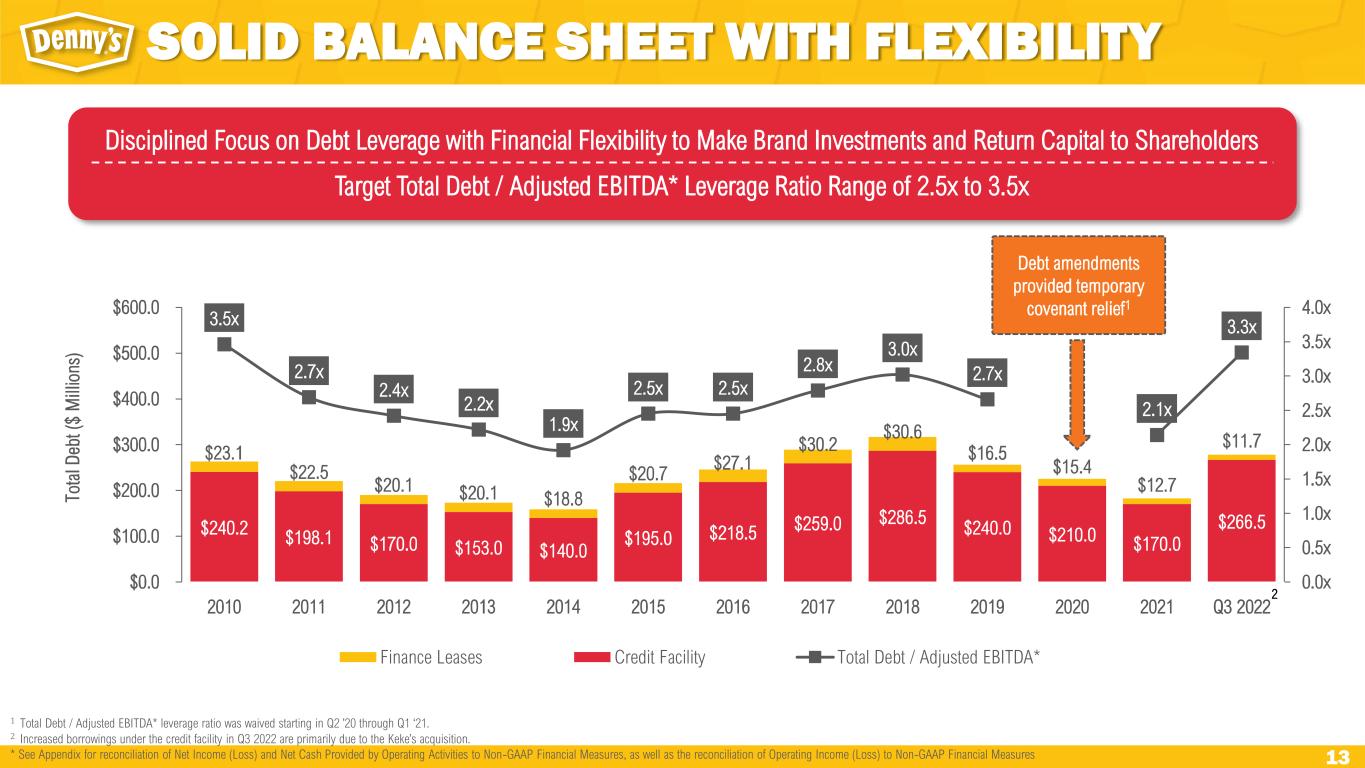

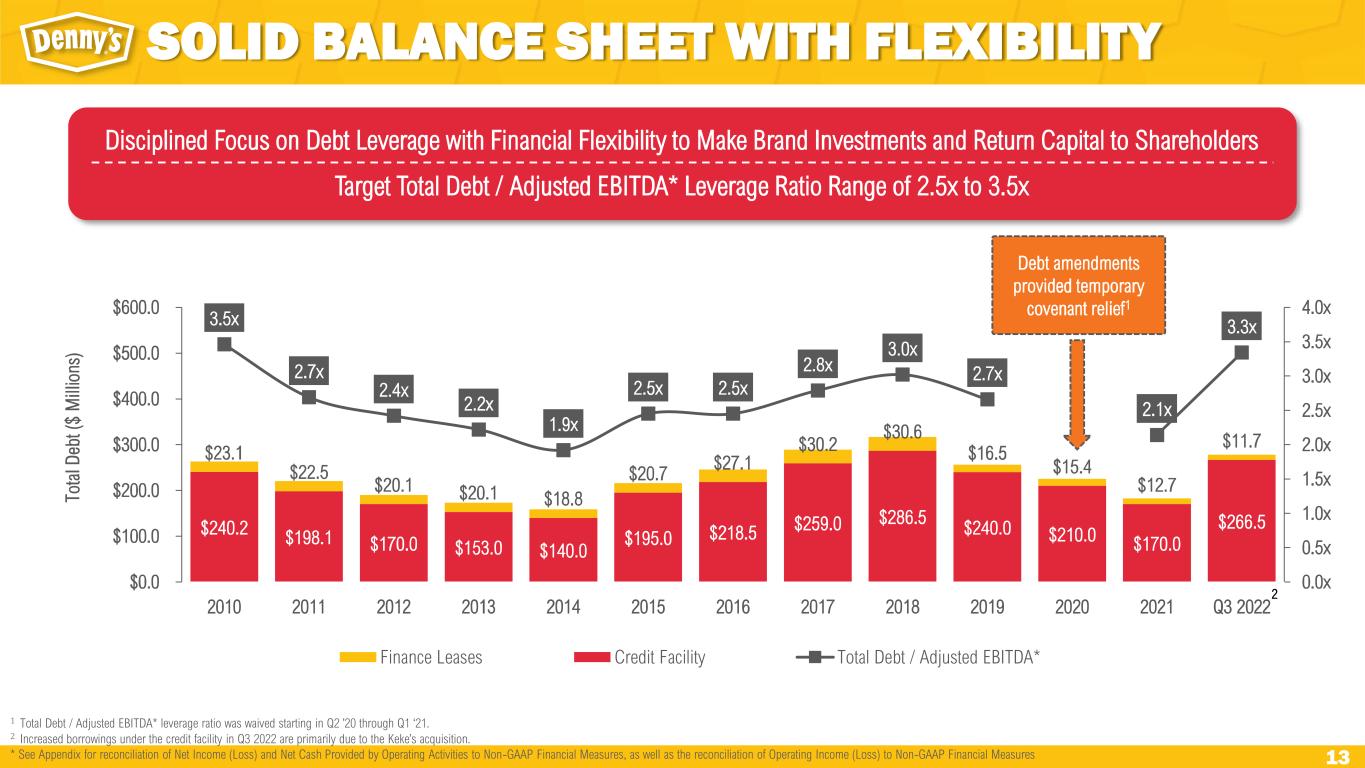

13 Disciplined Focus on Debt Leverage with Financial Flexibility to Make Brand Investments and Return Capital to Shareholders Target Total Debt / Adjusted EBITDA* Leverage Ratio Range of 2.5x to 3.5x 1 Total Debt / Adjusted EBITDA* leverage ratio was waived starting in Q2 ’20 through Q1 ‘21. 2 Increased borrowings under the credit facility in Q3 2022 are primarily due to the Keke’s acquisition. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures $240.2 $198.1 $170.0 $153.0 $140.0 $195.0 $218.5 $259.0 $286.5 $240.0 $210.0 $170.0 $266.5 $23.1 $22.5 $20.1 $20.1 $18.8 $20.7 $27.1 $30.2 $30.6 $16.5 $15.4 $12.7 $11.7 3.5x 2.7x 2.4x 2.2x 1.9x 2.5x 2.5x 2.8x 3.0x 2.7x 2.1x 3.3x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Q3 2022 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 To ta l D eb t ( $ M ill io ns ) Finance Leases Credit Facility Total Debt / Adjusted EBITDA* 2 SOLID BALANCE SHEET WITH FLEXIBILITY Debt amendments provided temporary covenant relief1

14 OPPORTUNITIES ON THE HORIZON Ex tend ing Opera t ing Hours Wi th Improved S ta f f ing Leve ls A p p r o x i m a t e l y 8 5 % o f d o m e s t i c u n i t s o p e r a t i n g a t l e a s t 1 8 h o u r s p e r d a y 1 1 Data as of the end of the Third Fiscal Quarter 2022. 2 Data as of the end of Fiscal 2021. Leveraging Va lue Messaging To Dr ive Transact ions R e n e w e d f o c u s o n r e l a t i v e v a l u e o f f e r i n g s t o d r i v e t r a f f i c g r o w t h E leva t ing the Gues t Exper ience Through Robust Remodels R e m o d e l p r o g r a m d e l i v e r i n g m i d - s i n g l e d i g i t s a l e s l i f t Growing the Co l lec t ive Geographic Reach o f Denny 's and Keke’s Loca t ions D e n n y ’ s e x i s t i n g g l o b a l p i p e l i n e o f o v e r 2 0 0 c o m m i t m en t s 2 Enhancing Ef f i c iency and Upgrading Products Through New Ki t chen Equ ipment N e w k i t c h e n e q u i p m e n t r o l l o u t t o b e s u b s t a n t i a l l y c o m p l e t e b y e n d o f 2 0 2 2 Crea t ing a More Seamless Digi t a l Exper ience Through Res taurant Technology Upgrades N e w c l o u d - b a s e d t e c h n o l o g y i s c u r r e n t l y i n t h e B e t a t e s t i n g p h a s e

15 1 Same-store sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-store sales and domestic system-wide same-store sales should be considered as a supplement to, not a substitute for, our results as reported under GAAP. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures. • Consistent same-store sales1 growth through brand revitalization strategies to enhance food, service, and atmosphere • Global footprint with seasoned franchisees supported by a strong domestic presence, a pipeline of Denny’s development commitments and additional opportunities to expand through Keke’s • Strong Adjusted Free Cash Flow* and shareholder returns supported by solid balance sheet with flexibility to support brand investments and a focus on highly accretive and shareholder friendly allocations of Adjusted Free Cash Flow* • Durable and agile business focused on the future with a highly-franchised business model supported by proven revitalization strategies, a sustained record of consistent financial performance and strong balance sheet DENNY’S INVESTMENT HIGHLIGHTS

APPENDIX

17 $1.8 $1.9 $2.0 $2.1 $2.2 $2.3 $2.3 $2.3 $2.5 $1.8 $2.7 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Denny’s Company Restaurant AUVs History of Steady Growth in Franchised and Company Average Unit Volumes Refranchising Strategy Benefited AUVs at Both Franchised and Company Restaurants in 2019 $M s $1.4 $1.4 $1.4 $1.5 $1.6 $1.6 $1.6 $1.6 $1.7 $1.2 $1.6 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Denny’s Franchised Restaurant AUVs $M s FRANCHISED AND COMPANY RESTAURANT SALES

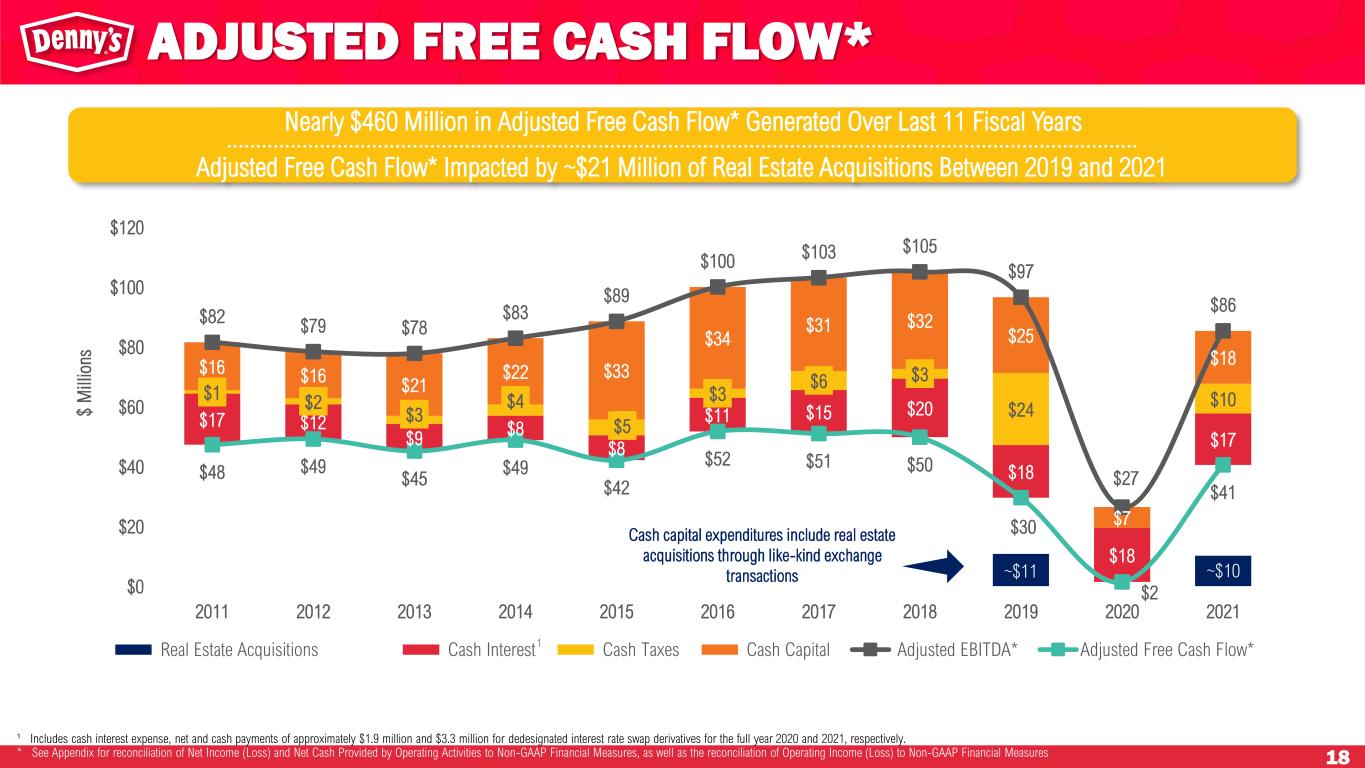

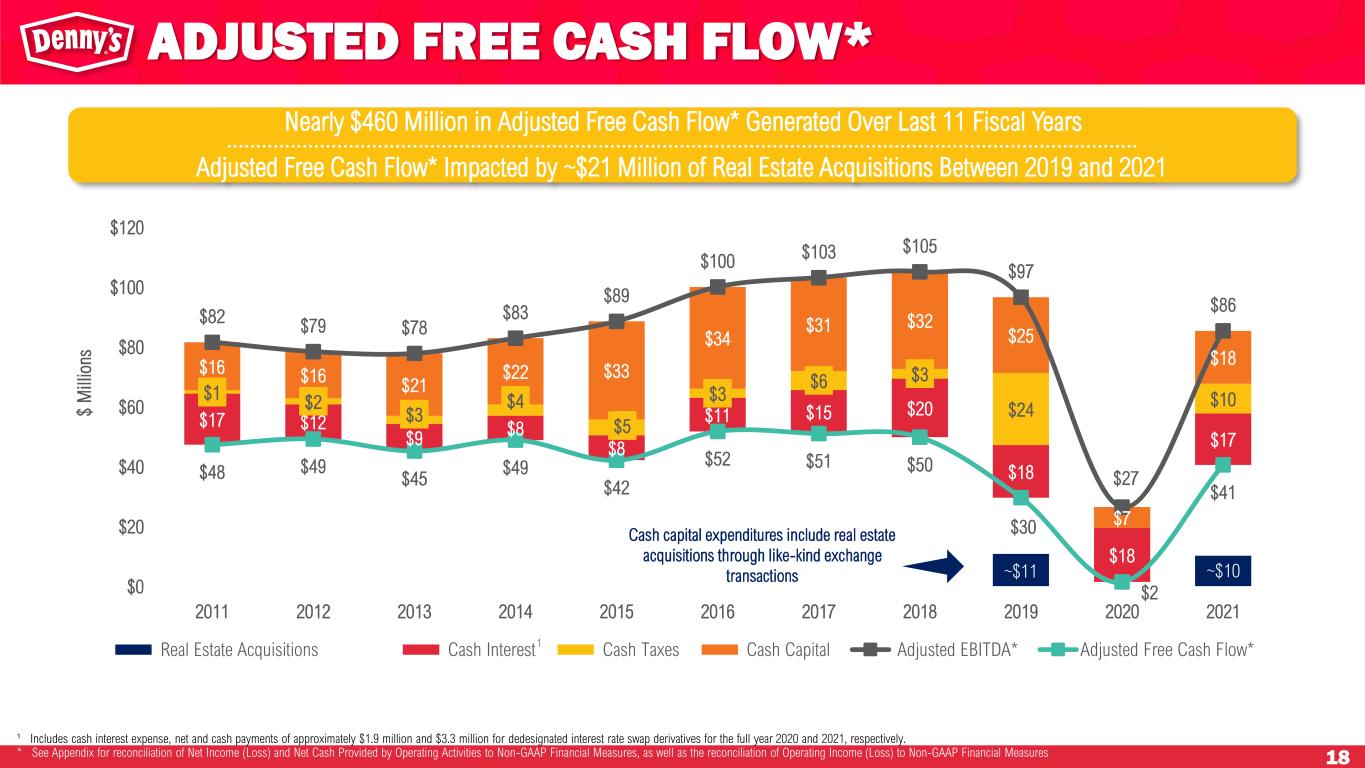

18 ~$11 ~$10 $17 $12 $9 $8 $8 $11 $15 $20 $18 $18 $17 $1 $2 $3 $4 $5 $3 $6 $3 $24 $10 $16 $16 $21 $22 $33 $34 $31 $32 $25 $7 $18 $82 $79 $78 $83 $89 $100 $103 $105 $97 $27 $86 $48 $49 $45 $49 $42 $52 $51 $50 $30 $2 $41 $0 $20 $40 $60 $80 $100 $120 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 $ M ill io ns Real Estate Acquisitions Cash Interest Cash Taxes Cash Capital Adjusted EBITDA* Adjusted Free Cash Flow* Cash capital expenditures include real estate acquisitions through like-kind exchange transactions Over $418 Million in Adjusted Free Cash Flow* Generated Over Last 10 Fiscal Years Adjusted Free Cash Flow* Impacted by ~$11 Million of Real Estate Acquisitions in 2019 ADJUSTED FREE CASH FLOW* Nearly $460 Million in Adjusted Fr e Cash Flow* Generated r t 1 i al r Adjusted Free Cash Flow* Impacted by ~$21 Million of Real Estate Acquisitions Between 2019 and 2021 ¹ Includes cash interest expense, net and cash payments of approximately $1.9 million and $3.3 million for dedesignated interest rate swap derivatives for the full year 2020 and 2021, respectively. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures. 1

19 Michael L. Furlow, Executive Vice President, Chief Information Officer. Prior to joining Denny’s in 2017, served as Chief Information Officer and Senior Vice President of IT at Red Robin Gourmet Burgers and CEC Entertainment, Inc. (an operator and franchisor of Chuck E. Cheese’s and Peter Piper Pizza). EXPERIENCED AND COMMITTED LEADERSHIP TEAM Jay C. Gilmore, Senior Vice President, Chief Accounting Officer and Corporate Controller. Joined Denny’s in 1999 as Director of Accounting and Assistant Corporate Controller and was named Senior Vice President, Chief Accounting Officer and Corporate Controller in 2021. Prior experience includes serving as a Senior Manager with KPMG LLP. John W. Dillon, Executive Vice President, Chief Brand Officer. Prior to joining Denny’s in 2007, held multiple marketing leadership positions with various organizations, including 10 years with YUM! Brands/Pizza Hut and was Vice President of Marketing for the National Basketball Association’s Houston Rockets. Robert P. Verostek, Executive Vice President, Chief Financial Officer. Joined Denny’s in 1999 and served in numerous leadersh ip positions across the Finance and Accounting teams. Named Vice President of Financial Planning and Analysis in 2012 and Chief Financial Officer is 2020. Prior experience includes various accounting roles for Insignia Financial Group. Kelli A. Valade, Chief Executive Officer and President. Prior to joining Denny's in June 2022, served as CEO of Red Lobster, CEO of Black Box Intelligence, and held various management positions at Chili’s including Brand President, Chief Operating Officer and Senior Vice President of Human Resources. Gail S. Myers, Executive Vice President, Chief Legal Officer, Chief People Officer and Secretary. Prior to joining Denny’s in 2020, served as Executive Vice President, General Counsel, Secretary and Chief Compliance Officer for American Tire Distributors, Inc., Senior Vice President, Deputy General Counsel and Chief Compliance Counsel at U.S. Foods and Senior Vice President, General Counsel and Secretary at Snyder's-Lance, Inc. David P. Schmidt, President of Keke’s Breakfast Café. Prior to joining Keke’s in September 2022, served as CFO of Red Lobster and worked for Bloomin’ Brands where he held various leadership roles throughout his tenure including Group Vice President and CFO of Bloomin’ Brand’s Casual Dining. Stephen C. Dunn, Executive Vice President, Chief Global Development Officer. Prior to joining Denny’s in 2004, held executive-level positions with Church's Chicken, El Pollo Loco, Mr. Gatti's, and TCBY. Earned the distinction of Certified Franchise Executive by the International Franchise Association Educational Foundation. Served as an Infantry Officer in the United States Army.

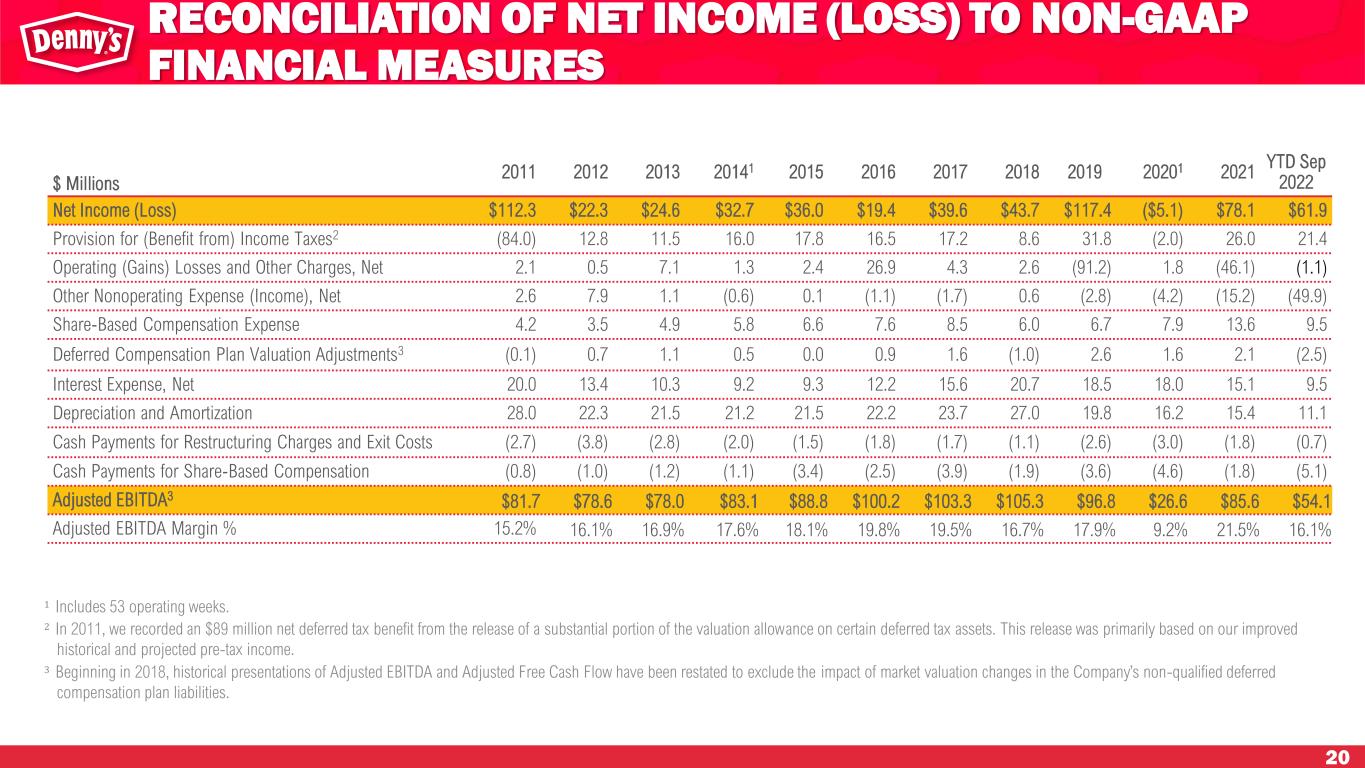

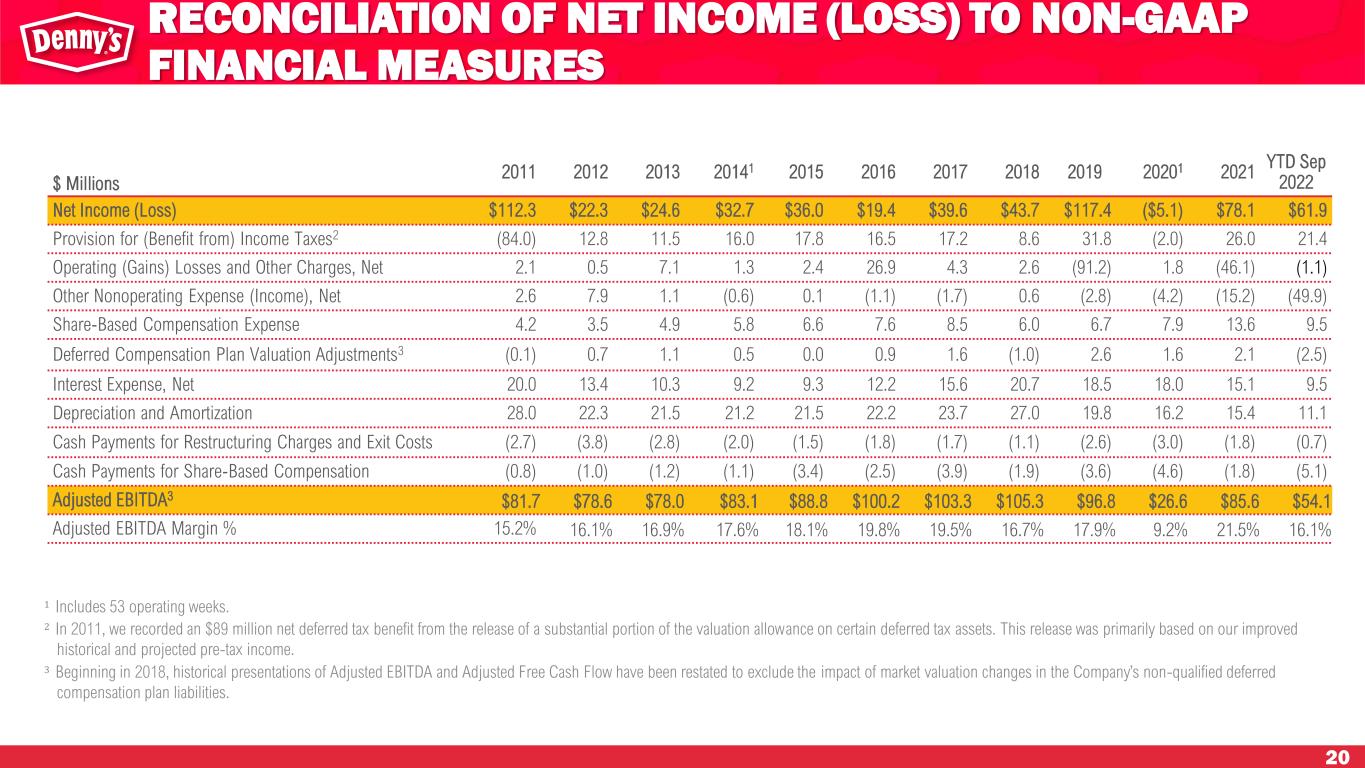

20 RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP FINANCIAL MEASURES $ Millions 2011 2012 2013 20141 2015 2016 2017 2018 2019 20201 2021 YTD Sep 2022 Net Income (Loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $117.4 ($5.1) $78.1 $61.9 Provision for (Benefit from) Income Taxes2 (84.0) 12.8 11.5 16.0 17.8 16.5 17.2 8.6 31.8 (2.0) 26.0 21.4 Operating (Gains) Losses and Other Charges, Net 2.1 0.5 7.1 1.3 2.4 26.9 4.3 2.6 (91.2) 1.8 (46.1) (1.1) Other Nonoperating Expense (Income), Net 2.6 7.9 1.1 (0.6) 0.1 (1.1) (1.7) 0.6 (2.8) (4.2) (15.2) (49.9) Share‐Based Compensation Expense 4.2 3.5 4.9 5.8 6.6 7.6 8.5 6.0 6.7 7.9 13.6 9.5 Deferred Compensation Plan Valuation Adjustments3 (0.1) 0.7 1.1 0.5 0.0 0.9 1.6 (1.0) 2.6 1.6 2.1 (2.5) Interest Expense, Net 20.0 13.4 10.3 9.2 9.3 12.2 15.6 20.7 18.5 18.0 15.1 9.5 Depreciation and Amortization 28.0 22.3 21.5 21.2 21.5 22.2 23.7 27.0 19.8 16.2 15.4 11.1 Cash Payments for Restructuring Charges and Exit Costs (2.7) (3.8) (2.8) (2.0) (1.5) (1.8) (1.7) (1.1) (2.6) (3.0) (1.8) (0.7) Cash Payments for Share‐Based Compensation (0.8) (1.0) (1.2) (1.1) (3.4) (2.5) (3.9) (1.9) (3.6) (4.6) (1.8) (5.1) Adjusted EBITDA3 $81.7 $78.6 $78.0 $83.1 $88.8 $100.2 $103.3 $105.3 $96.8 $26.6 $85.6 $54.1 Adjusted EBITDA Margin % 15.2% 16.1% 16.9% 17.6% 18.1% 19.8% 19.5% 16.7% 17.9% 9.2% 21.5% 16.1% 1 Includes 53 operating weeks. 2 In 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre-tax income. 3 Beginning in 2018, historical presentations of Adjusted EBITDA and Adjusted Free Cash Flow have been restated to exclude the impact of market valuation changes in the Company’s non-qualified deferred compensation plan liabilities.

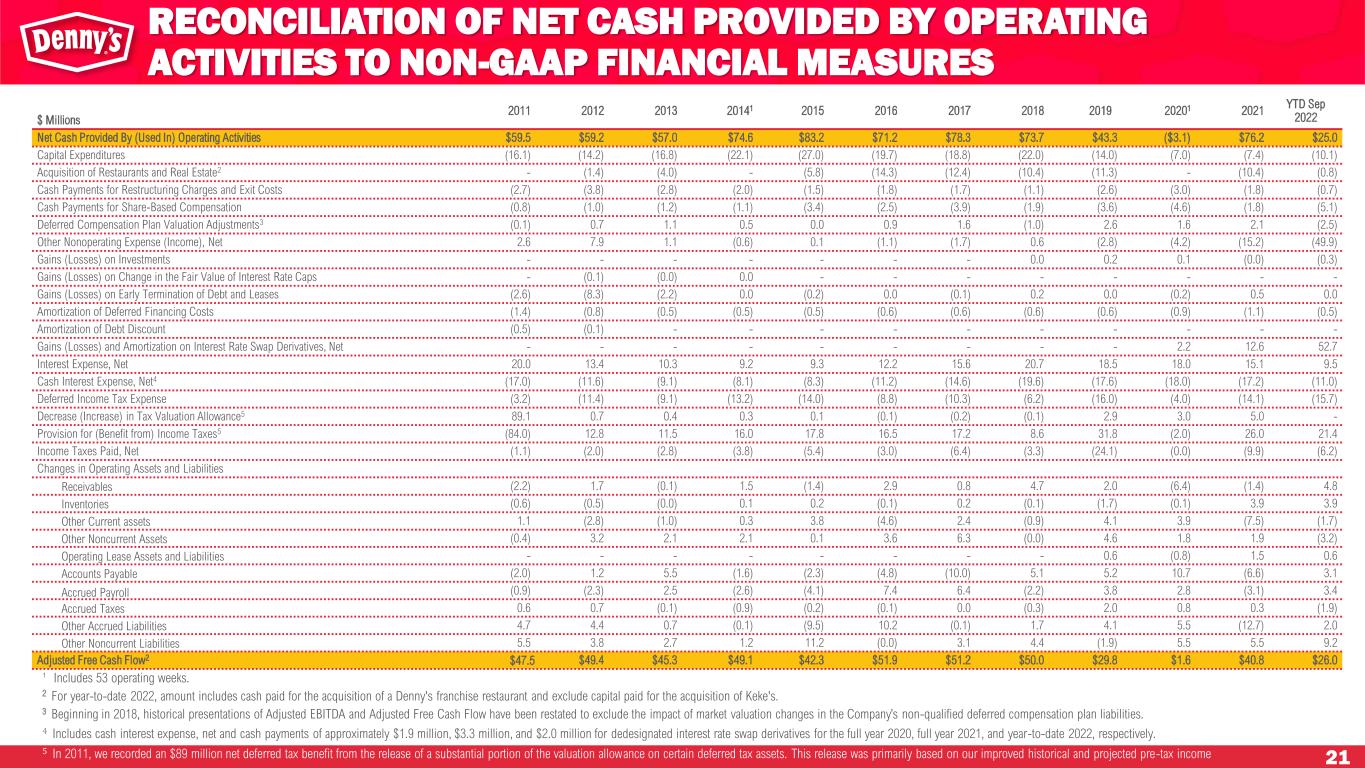

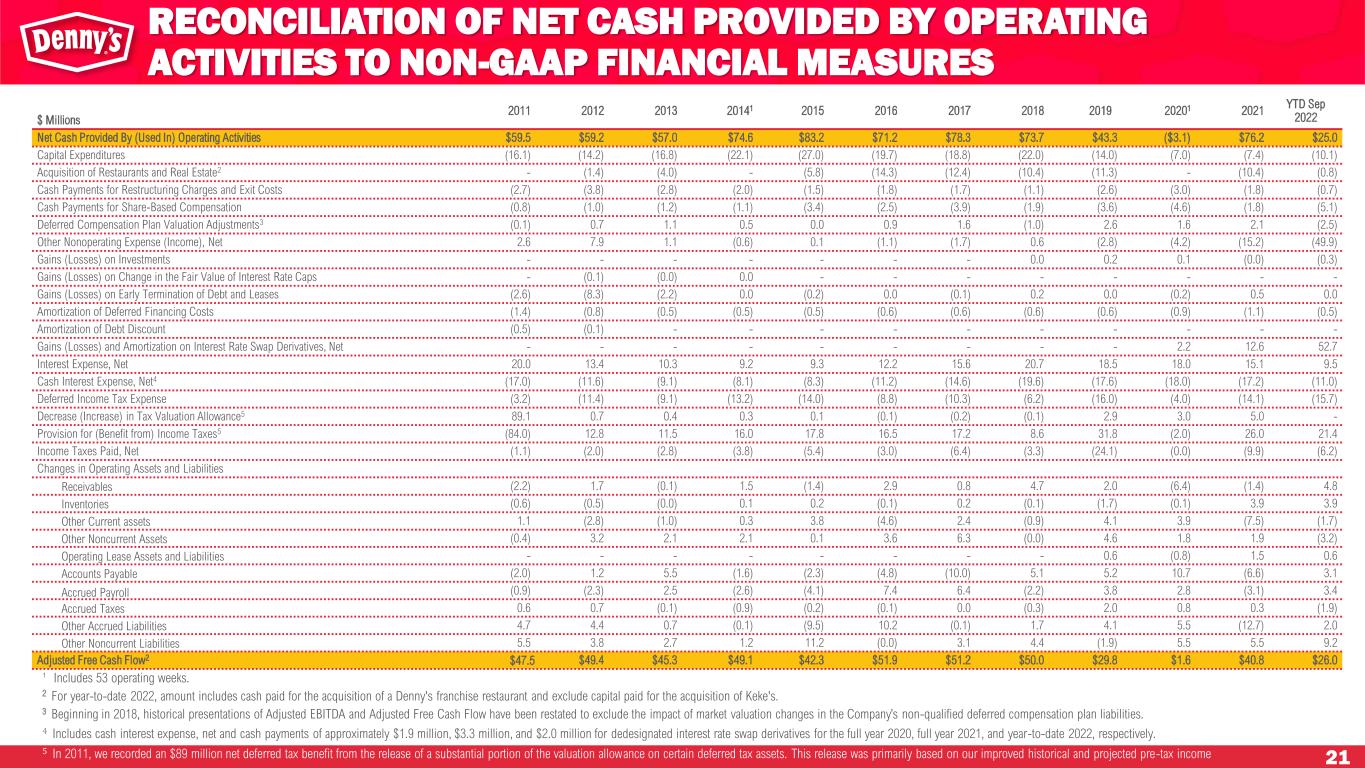

21 ¹ Includes 53 operating weeks. 2 For year-to-date 2022, amount includes cash paid for the acquisition of a Denny's franchise restaurant and exclude capital paid for the acquisition of Keke's. 3 Beginning in 2018, historical presentations of Adjusted EBITDA and Adjusted Free Cash Flow have been restated to exclude the impact of market valuation changes in the Company’s non-qualified deferred compensation plan liabilities. 4 Includes cash interest expense, net and cash payments of approximately $1.9 million, $3.3 million, and $2.0 million for dedesignated interest rate swap derivatives for the full year 2020, full year 2021, and year-to-date 2022, respectively. 5 In 2011, we recorded an $89 million net deferred tax benefit from the release of a substantial portion of the valuation allowance on certain deferred tax assets. This release was primarily based on our improved historical and projected pre-tax income. RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO NON-GAAP FINANCIAL MEASURES $ Millions 2011 2012 2013 20141 2015 2016 2017 2018 2019 20201 2021 YTD Sep 2022 Net Cash Provided By (Used In) Operating Activities $59.5 $59.2 $57.0 $74.6 $83.2 $71.2 $78.3 $73.7 $43.3 ($3.1) $76.2 $25.0 Capital Expenditures (16.1) (14.2) (16.8) (22.1) (27.0) (19.7) (18.8) (22.0) (14.0) (7.0) (7.4) (10.1) Acquisition of Restaurants and Real Estate2 - (1.4) (4.0) - (5.8) (14.3) (12.4) (10.4) (11.3) - (10.4) (0.8) Cash Payments for Restructuring Charges and Exit Costs (2.7) (3.8) (2.8) (2.0) (1.5) (1.8) (1.7) (1.1) (2.6) (3.0) (1.8) (0.7) Cash Payments for Share‐Based Compensation (0.8) (1.0) (1.2) (1.1) (3.4) (2.5) (3.9) (1.9) (3.6) (4.6) (1.8) (5.1) Deferred Compensation Plan Valuation Adjustments3 (0.1) 0.7 1.1 0.5 0.0 0.9 1.6 (1.0) 2.6 1.6 2.1 (2.5) Other Nonoperating Expense (Income), Net 2.6 7.9 1.1 (0.6) 0.1 (1.1) (1.7) 0.6 (2.8) (4.2) (15.2) (49.9) Gains (Losses) on Investments - - - - - - - 0.0 0.2 0.1 (0.0) (0.3) Gains (Losses) on Change in the Fair Value of Interest Rate Caps - (0.1) (0.0) 0.0 - - - - - - - - Gains (Losses) on Early Termination of Debt and Leases (2.6) (8.3) (2.2) 0.0 (0.2) 0.0 (0.1) 0.2 0.0 (0.2) 0.5 0.0 Amortization of Deferred Financing Costs (1.4) (0.8) (0.5) (0.5) (0.5) (0.6) (0.6) (0.6) (0.6) (0.9) (1.1) (0.5) Amortization of Debt Discount (0.5) (0.1) - - - - - - - - - - Gains (Losses) and Amortization on Interest Rate Swap Derivatives, Net - - - - - - - - - 2.2 12.6 52.7 Interest Expense, Net 20.0 13.4 10.3 9.2 9.3 12.2 15.6 20.7 18.5 18.0 15.1 9.5 Cash Interest Expense, Net4 (17.0) (11.6) (9.1) (8.1) (8.3) (11.2) (14.6) (19.6) (17.6) (18.0) (17.2) (11.0) Deferred Income Tax Expense (3.2) (11.4) (9.1) (13.2) (14.0) (8.8) (10.3) (6.2) (16.0) (4.0) (14.1) (15.7) Decrease (Increase) in Tax Valuation Allowance5 89.1 0.7 0.4 0.3 0.1 (0.1) (0.2) (0.1) 2.9 3.0 5.0 - Provision for (Benefit from) Income Taxes5 (84.0) 12.8 11.5 16.0 17.8 16.5 17.2 8.6 31.8 (2.0) 26.0 21.4 Income Taxes Paid, Net (1.1) (2.0) (2.8) (3.8) (5.4) (3.0) (6.4) (3.3) (24.1) (0.0) (9.9) (6.2) Changes in Operating Assets and Liabilities Receivables (2.2) 1.7 (0.1) 1.5 (1.4) 2.9 0.8 4.7 2.0 (6.4) (1.4) 4.8 Inventories (0.6) (0.5) (0.0) 0.1 0.2 (0.1) 0.2 (0.1) (1.7) (0.1) 3.9 3.9 Other Current assets 1.1 (2.8) (1.0) 0.3 3.8 (4.6) 2.4 (0.9) 4.1 3.9 (7.5) (1.7) Other Noncurrent Assets (0.4) 3.2 2.1 2.1 0.1 3.6 6.3 (0.0) 4.6 1.8 1.9 (3.2) Operating Lease Assets and Liabilities - - - - - - - - 0.6 (0.8) 1.5 0.6 Accounts Payable (2.0) 1.2 5.5 (1.6) (2.3) (4.8) (10.0) 5.1 5.2 10.7 (6.6) 3.1 Accrued Payroll (0.9) (2.3) 2.5 (2.6) (4.1) 7.4 6.4 (2.2) 3.8 2.8 (3.1) 3.4 Accrued Taxes 0.6 0.7 (0.1) (0.9) (0.2) (0.1) 0.0 (0.3) 2.0 0.8 0.3 (1.9) Other Accrued Liabilities 4.7 4.4 0.7 (0.1) (9.5) 10.2 (0.1) 1.7 4.1 5.5 (12.7) 2.0 Other Noncurrent Liabilities 5.5 3.8 2.7 1.2 11.2 (0.0) 3.1 4.4 (1.9) 5.5 5.5 9.2 Adjusted Free Cash Flow2 $47.5 $49.4 $45.3 $49.1 $42.3 $51.9 $51.2 $50.0 $29.8 $1.6 $40.8 $26.0

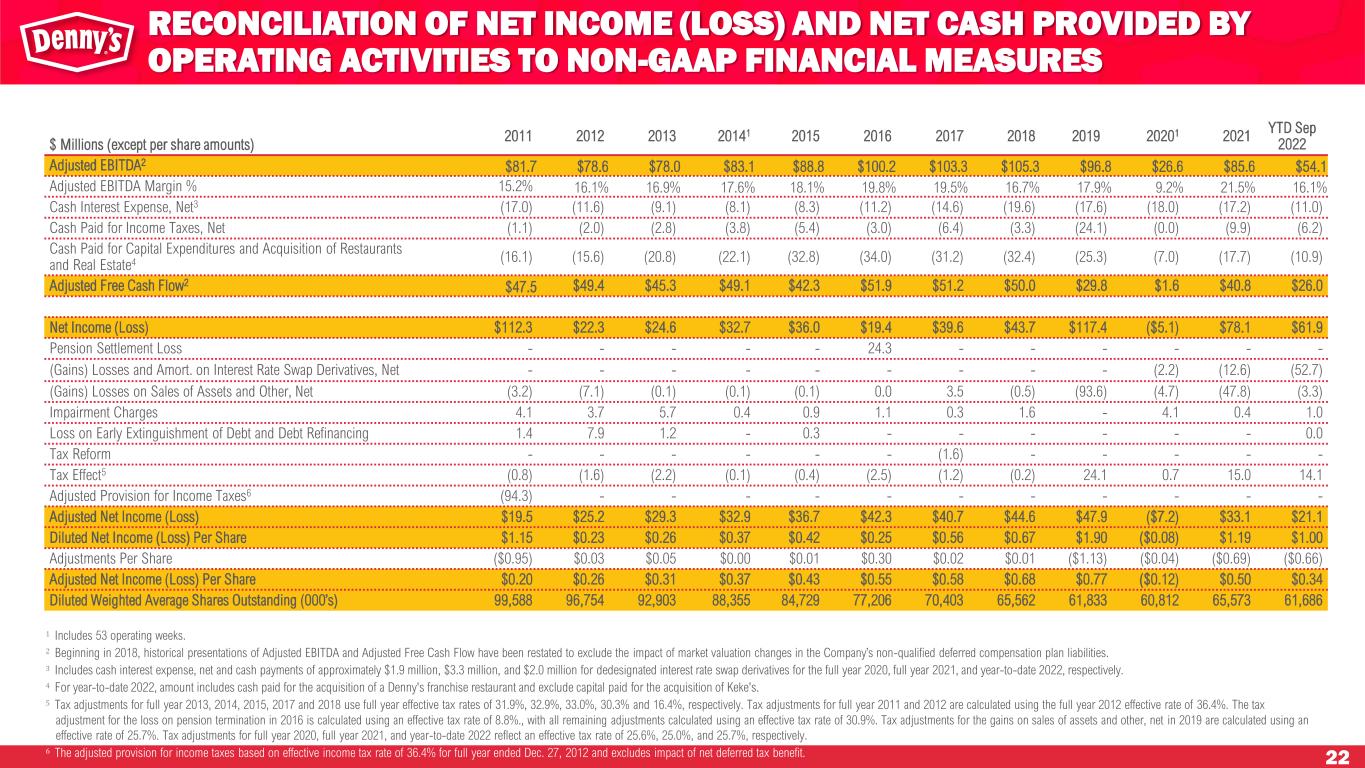

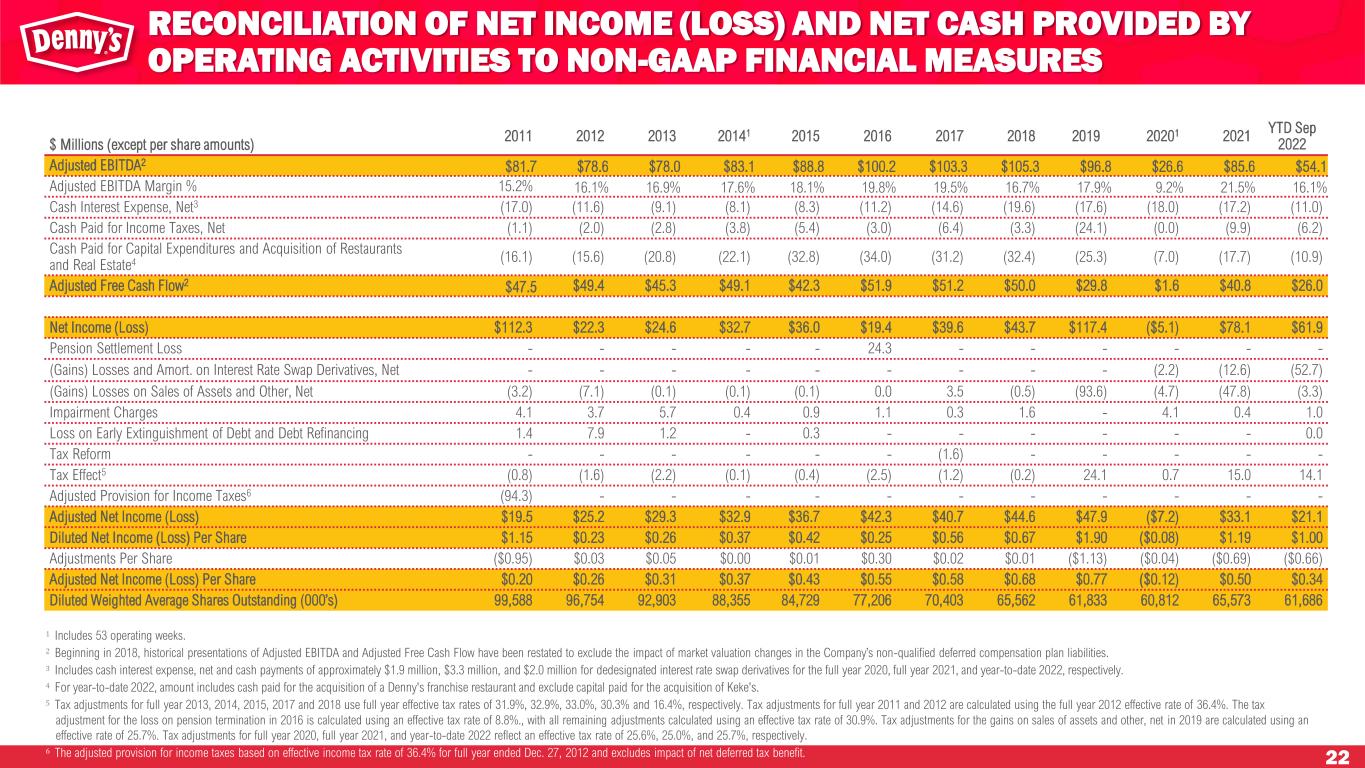

22 1 Includes 53 operating weeks. 2 Beginning in 2018, historical presentations of Adjusted EBITDA and Adjusted Free Cash Flow have been restated to exclude the impact of market valuation changes in the Company’s non-qualified deferred compensation plan liabilities. 3 Includes cash interest expense, net and cash payments of approximately $1.9 million, $3.3 million, and $2.0 million for dedesignated interest rate swap derivatives for the full year 2020, full year 2021, and year-to-date 2022, respectively. 4 For year-to-date 2022, amount includes cash paid for the acquisition of a Denny's franchise restaurant and exclude capital paid for the acquisition of Keke's. 5 Tax adjustments for full year 2013, 2014, 2015, 2017 and 2018 use full year effective tax rates of 31.9%, 32.9%, 33.0%, 30.3% and 16.4%, respectively. Tax adjustments for full year 2011 and 2012 are calculated using the full year 2012 effective rate of 36.4%. The tax adjustment for the loss on pension termination in 2016 is calculated using an effective tax rate of 8.8%., with all remaining adjustments calculated using an effective tax rate of 30.9%. Tax adjustments for the gains on sales of assets and other, net in 2019 are calculated using an effective rate of 25.7%. Tax adjustments for full year 2020, full year 2021, and year-to-date 2022 reflect an effective tax rate of 25.6%, 25.0%, and 25.7%, respectively. 6 The adjusted provision for income taxes based on effective income tax rate of 36.4% for full year ended Dec. 27, 2012 and excludes impact of net deferred tax benefit. RECONCILIATION OF NET INCOME (LOSS) AND NET CASH PROVIDED BY OPERATING ACTIVITIES TO NON-GAAP FINANCIAL MEASURES $ Millions (except per share amounts) 2011 2012 2013 20141 2015 2016 2017 2018 2019 20201 2021 YTD Sep 2022 Adjusted EBITDA2 $81.7 $78.6 $78.0 $83.1 $88.8 $100.2 $103.3 $105.3 $96.8 $26.6 $85.6 $54.1 Adjusted EBITDA Margin % 15.2% 16.1% 16.9% 17.6% 18.1% 19.8% 19.5% 16.7% 17.9% 9.2% 21.5% 16.1% Cash Interest Expense, Net3 (17.0) (11.6) (9.1) (8.1) (8.3) (11.2) (14.6) (19.6) (17.6) (18.0) (17.2) (11.0) Cash Paid for Income Taxes, Net (1.1) (2.0) (2.8) (3.8) (5.4) (3.0) (6.4) (3.3) (24.1) (0.0) (9.9) (6.2) Cash Paid for Capital Expenditures and Acquisition of Restaurants and Real Estate4 (16.1) (15.6) (20.8) (22.1) (32.8) (34.0) (31.2) (32.4) (25.3) (7.0) (17.7) (10.9) Adjusted Free Cash Flow2 $47.5 $49.4 $45.3 $49.1 $42.3 $51.9 $51.2 $50.0 $29.8 $1.6 $40.8 $26.0 Net Income (Loss) $112.3 $22.3 $24.6 $32.7 $36.0 $19.4 $39.6 $43.7 $117.4 ($5.1) $78.1 $61.9 Pension Settlement Loss - - - - - 24.3 - - - - - - (Gains) Losses and Amort. on Interest Rate Swap Derivatives, Net - - - - - - - - - (2.2) (12.6) (52.7) (Gains) Losses on Sales of Assets and Other, Net (3.2) (7.1) (0.1) (0.1) (0.1) 0.0 3.5 (0.5) (93.6) (4.7) (47.8) (3.3) Impairment Charges 4.1 3.7 5.7 0.4 0.9 1.1 0.3 1.6 - 4.1 0.4 1.0 Loss on Early Extinguishment of Debt and Debt Refinancing 1.4 7.9 1.2 - 0.3 - - - - - - 0.0 Tax Reform - - - - - - (1.6) - - - - - Tax Effect5 (0.8) (1.6) (2.2) (0.1) (0.4) (2.5) (1.2) (0.2) 24.1 0.7 15.0 14.1 Adjusted Provision for Income Taxes6 (94.3) - - - - - - - - - - - Adjusted Net Income (Loss) $19.5 $25.2 $29.3 $32.9 $36.7 $42.3 $40.7 $44.6 $47.9 ($7.2) $33.1 $21.1 Diluted Net Income (Loss) Per Share $1.15 $0.23 $0.26 $0.37 $0.42 $0.25 $0.56 $0.67 $1.90 ($0.08) $1.19 $1.00 Adjustments Per Share ($0.95) $0.03 $0.05 $0.00 $0.01 $0.30 $0.02 $0.01 ($1.13) ($0.04) ($0.69) ($0.66) Adjusted Net Income (Loss) Per Share $0.20 $0.26 $0.31 $0.37 $0.43 $0.55 $0.58 $0.68 $0.77 ($0.12) $0.50 $0.34 Diluted Weighted Average Shares Outstanding (000’s) 99,588 96,754 92,903 88,355 84,729 77,206 70,403 65,562 61,833 60,812 65,573 61,686

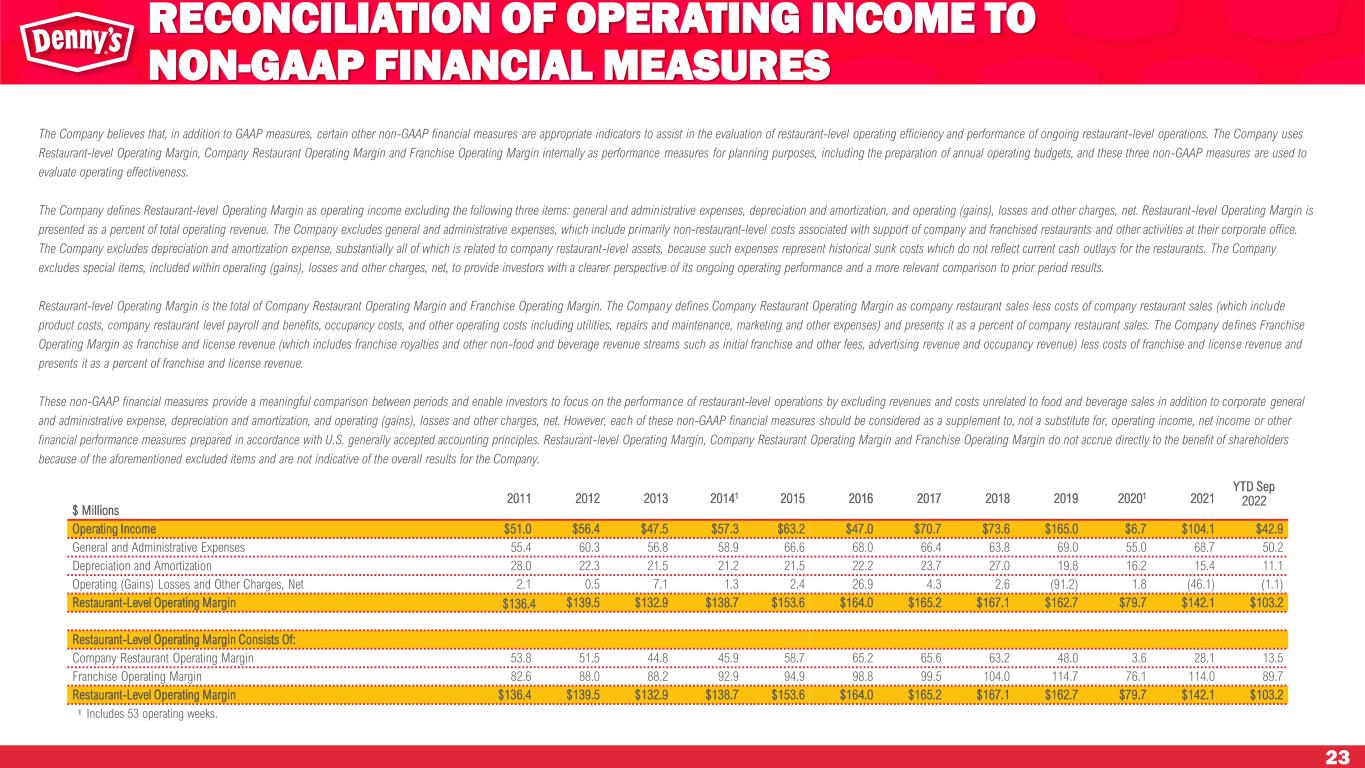

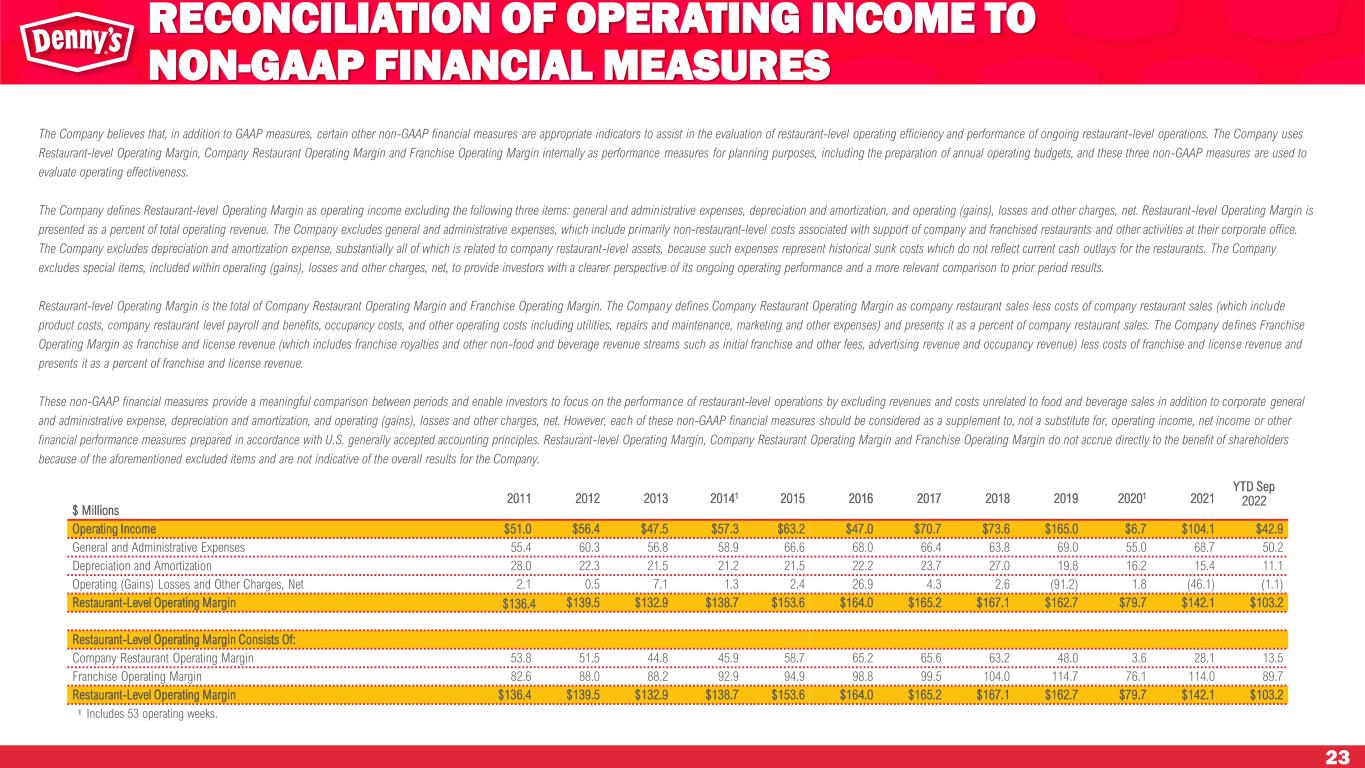

23 $ Millions 2011 2012 2013 20141 2015 2016 2017 2018 2019 20201 2021 YTD Sep 2022 Operating Income $51.0 $56.4 $47.5 $57.3 $63.2 $47.0 $70.7 $73.6 $165.0 $6.7 $104.1 $42.9 General and Administrative Expenses 55.4 60.3 56.8 58.9 66.6 68.0 66.4 63.8 69.0 55.0 68.7 50.2 Depreciation and Amortization 28.0 22.3 21.5 21.2 21.5 22.2 23.7 27.0 19.8 16.2 15.4 11.1 Operating (Gains) Losses and Other Charges, Net 2.1 0.5 7.1 1.3 2.4 26.9 4.3 2.6 (91.2) 1.8 (46.1) (1.1) Restaurant-Level Operating Margin $136.4 $139.5 $132.9 $138.7 $153.6 $164.0 $165.2 $167.1 $162.7 $79.7 $142.1 $103.2 Restaurant-Level Operating Margin Consists Of: Company Restaurant Operating Margin 53.8 51.5 44.8 45.9 58.7 65.2 65.6 63.2 48.0 3.6 28.1 13.5 Franchise Operating Margin 82.6 88.0 88.2 92.9 94.9 98.8 99.5 104.0 114.7 76.1 114.0 89.7 Restaurant-Level Operating Margin $136.4 $139.5 $132.9 $138.7 $153.6 $164.0 $165.2 $167.1 $162.7 $79.7 $142.1 $103.2 𝟏 Includes 53 operating weeks. The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are appropriate indicators to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. The Company uses Restaurant-level Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and these three non-GAAP measures are used to evaluate operating effectiveness. The Company defines Restaurant-level Operating Margin as operating income excluding the following three items: general and administrative expenses, depreciation and amortization, and operating (gains), losses and other charges, net. Restaurant-level Operating Margin is presented as a percent of total operating revenue. The Company excludes general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office. The Company excludes depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants. The Company excludes special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results. Restaurant-level Operating Margin is the total of Company Restaurant Operating Margin and Franchise Operating Margin. The Company defines Company Restaurant Operating Margin as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and presents it as a percent of company restaurant sales. The Company defines Franchise Operating Margin as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise and other fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and presents it as a percent of franchise and license revenue. These non-GAAP financial measures provide a meaningful comparison between periods and enable investors to focus on the performance of restaurant-level operations by excluding revenues and costs unrelated to food and beverage sales in addition to corporate general and administrative expense, depreciation and amortization, and operating (gains), losses and other charges, net. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income or other financial performance measures prepared in accordance with U.S. generally accepted accounting principles. Restaurant-level Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin do not accrue directly to the benefit of shareholders because of the aforementioned excluded items and are not indicative of the overall results for the Company. RECONCILIATION OF OPERATING INCOME TO NON-GAAP FINANCIAL MEASURES